Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | form8-k4q2018earnings.htm |

| EX-99.3 - EXHIBIT 99.3 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex993earningssupplement4.htm |

| EX-99.1 - EXHIBIT 99.1 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex991earningsrelease4q2018.htm |

EXHIBIT 99.2 Earnings Webcast & Conference Call Fourth Quarter and Fiscal Year 2018 © 2017 | 1

Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge" or the "Company") may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2019 Guidance” section are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2018 (the “2018 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2018 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; a material security breach or cybersecurity attack affecting the information of Broadridge's clients; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; the failure of Broadridge's key service providers to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. © 2018 | 2

Use of Non-GAAP Financial Measures Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company’s results in this presentation are presented in accordance with U.S. generally accepted accounting principles ("GAAP") except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non- GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, and Free cash flow. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes its Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate the Company's ongoing operations, for internal planning and forecasting purposes and in the calculation of performance-based compensation. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing its business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings per Share These Non-GAAP measures reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing operating performance. These adjusted measures exclude the impact of: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs, (iii) Tax Act items, (iv) the Gain on Sale of Securities and (v) the Message Automation Limited ("MAL") investment gain. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company's acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. Tax Act items represent the net impact of a U.S. federal transition tax on earnings of certain foreign subsidiaries, foreign jurisdiction withholding taxes and certain benefits related to the remeasurement of the Company's net U.S. federal and state deferred tax liabilities attributable to the Tax Cuts and Jobs Act (the "Tax Act"). The Gain on Sale of Securities represents a non- operating gain on the sale of securities associated with the Company's retirement plan obligations. The MAL investment gain represents a non- cash, nontaxable gain on investment from the Company’s acquisition of MAL in March 2017. The Company excludes Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, Tax Act items, the Gain on Sale of Securities and the MAL investment gain from our earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and these items do not reflect ordinary operations or earnings. Management believes these adjusted measures may be useful to an investor in evaluating the underlying operating performance of our business. © 2018 | 3

Use of Non-GAAP Financial Measures Free Cash Flow In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities less Capital expenditures as well as Software purchases and capitalized internal use software. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. © 2018 | 4

Highlights . Strong fiscal year 2018 financial results • Recurring fee revenues rose 6% and Event-driven revenues up 30% • Diluted EPS growth of 32% and Adjusted EPS growth of 34% . 33% dividend increase emphasizes commitment to long-term shareholder value creation and balanced capital allocation • Seventh consecutive year of double-digit dividend growth • Additional $225 million returned to shareholders in fiscal 2018 via share buybacks . Closed Sales up 14% to $215 million across governance, capital markets and wealth management • $115 million in Closed Sales in 4Q 2018 • Strong pipeline © 2018 | 5

Outlook and Fiscal Year 2019 Guidance . Broadridge firmly positioned to capitalize on long-term opportunities • Evolution in financial services driving need to mutualize costs and integrate new technologies • Recent SEC announcements on mutual fund communications and proxy process an opportunity for Broadridge to enable enhanced content and ⦁ increased shareholder engagement Broadridge investments and technology very well aligned with SEC goals . Fiscal year 2019 guidance calls for continued solid organic growth, margin expansion, and EPS growth • Building on fiscal year 2018 momentum • Recurring revenue growth of 5 - 7% • Continued margin expansion and Adjusted EPS growth of 9 - 13% • Closed sales of $185 - $225 million . Well positioned to achieve three year financial objectives set out at Investor Day last December © 2018 | 6

Business Update . Strong Closed sales reflect momentum across Governance, Capital markets and Wealth management . ICS benefiting from continued growth in recurring revenues • Strong stock and interim record growth fueled strength in core governance • Data and analytics also contributing to growth • Event-driven revenues down in quarter but up 30% for fiscal year 2018 . Continued strong performance in GTO • Client on-boardings biggest driver of growth • Internal growth balanced across trade and non-trade services . Investing across both segments • Enhancing digital capabilities and growing data and analytics capabilities • New fixed income and wealth capabilities also a focus © 2018 | 7

Executing Against Investor Day Themes Extend Governance Drive Capital Markets Build Wealth Management • Driving next-gen • Extending global post • Continued strong interest regulatory communications trade technology platform from key clients in 30e-3 and Enhanced Continued progress integrated Wealth Content opportunities onboarding major clients platform Strengthening digital New client wins further • Continuing to drive products to enhance extend international reach penetration of existing regulatory and other • Developing new products products communications to drive network value in New back office platform Blockchain proxy fixed income market wins driving growth in U.S. capability for North and Canada American market • Successfully tested blockchain proof of 9% revenue growth in • Growing data & analytics concept for repo market front-office Advisor suite Solutions • Broadening corporate issuer solution set • Building omni-channel communications © 2018 | 8

Fourth Quarter 2018 Revenue Growth Drivers ▪ Fourth Quarter 2018 Total revenues declined 2% to $1.3 billion +4% 0% -2% -2% $1,346M -4% $1,320M ▪ Fourth Quarter 2018 Recurring fee revenues grew 7% to $862 million Organic Growth: 6% +7% +5% +3% +1% $862M $806M - 2% Note: Amounts may not sum due to rounding © 2018 | 9

Fiscal Year 2018 Revenue Growth Drivers ▪ Fiscal Year 2018 Total revenues grew 5% to $4.3 billion +2% +4% 0% +5% -1% $4,330M $ 4,143M ▪ Fiscal Year 2018 Recurring fee revenues grew 6% to $2.6 billion Organic Growth: 5% +1% +6% +6% -3% +2% $2,610M $2,451M Note: Amounts may not sum due to rounding © 2018 | 10

Fourth Quarter 2018 GAAP and Adjusted Operating Income and Adjusted EPS $ in millions, except per share amounts Year-over-Year Change in Operating Income Year-over-Year Change in EPS and and Adjusted Operating Income Adjusted EPS +9% +10% -10% -11% © 2018 | 11

Fiscal Year 2018 GAAP and Adjusted Operating Income and Adjusted EPS $ in millions, except per share amounts Year-over-Year Change in Operating Income Year-over-Year Change in EPS and and Adjusted Operating Income Adjusted EPS +10% +34% +32% +12% © 2018 | 12

Segment Results ($ in millions) Investor Communication Solutions ("ICS") 4Q Fiscal Year 2017 2018 Change 2017 2018 Change Recurring fee revenues $589 $628 7% $1,626 $1,699 5% Event-driven fee revenues 91 61 (33)% 219 284 30% Distribution revenues 476 423 (11)% 1,554 1,513 (3)% Total revenues $1,156 $1,112 (4)% $3,399 $3,496 3% Earnings before income taxes $298 $284 (5)% $428 $495 16% Pre-tax margins 25.8% 25.5% 12.6% 14.1% Global Technology and Operations ("GTO") 4Q Fiscal Year 2017 2018 Change 2017 2018 Change Total revenues $217 $234 8% $825 $912 10% Earnings before income taxes $39 $46 18% $162 $199 23% Pre-tax margins 18.0% 19.8% 19.7% 21.9% Note: Amounts may not sum due to rounding © 2018 | 13

Capital Allocation and Summary Balance Sheet $ in millions Select Uses of Cash in Free Cash Flow FY18 (a) FY18 Free cash flow includes $41 million from excess tax benefits from stock-based compensation (b) Includes purchase of intellectual property assets (c) Purchases of Treasury stock, net of proceeds from exercise of stock options © 2018 | 14

Record Sales Building Revenue Backlog $ in millions Year-over-Year Closed Sales Recurring Revenue Backlog as of Performance1 June 301,2 Total ~$295 +14% (1) Closed sales and Recurring Revenue Backlog are Broadridge estimates and subject to revision. (2) Recurring Revenue Backlog represents an estimate of first year revenues from Closed sales that have not yet been recognized and are expected to be recognized. Not Yet Live represents the subset of the Backlog where none of the first year revenues from Closed sales have been recognized but are expected to be recognized. Live represents the subset of the Backlog where a portion of the first year revenues from Closed sales have been recognized in previous periods. © 2018 | 15

Fiscal Year 2019 Guidance Recurring fee revenue growth 5 - 7% Total revenue growth 3 - 5% Operating income margin - GAAP ~14.5% Adjusted Operating income margin - Non-GAAP ~16.5% Diluted earnings per share growth 12 - 16% Adjusted earnings per share growth - Non-GAAP 9 - 13% Free cash flow - Non-GAAP $565 - $615M Closed sales $185 - $225M Note: Fiscal year 2019 guidance includes $25 million of excess tax benefits related to stock-based compensation, down from $41 million in fiscal year 2018. © 2018 | 16

Closing Summary . Strong fiscal year 2018 results • Recurring revenues up 6% • Diluted EPS and Adjusted EPS rose 32% and 34%, respectively • Record Closed sales . Strong fourth quarter finish to fiscal year 2018 • Recurring revenues up 7% • Closed sales of $115 million . Broadridge enters fiscal year 2019 with momentum • Guidance for continued growth in recurring revenue and EPS • Well positioned to achieve three year financial objectives . Broadridge remains focused on sustainable, long-term growth • Executing on the strategy laid out at Investor Day last December © 2018 | 17

Appendix © 2018 | 18

Tax Act Impact to Broadridge 2017 2018 2019 FY FY FY $ in millions Indicative Effective Tax Rate (GAAP) 33.1% 23.7% ~20% Net Tax Charges1 - ($15) - Tax Rate Excluding Non-Recurring Gains & Charges2 33.7% 21.0% ~20% Effective Tax Rate (GAAP) 33.1% 23.7% ~20% Net Tax Charges1 - ($15) - Excess Tax Benefits from stock-based compensation - $41 ~$25 Tax Rate Excluding ETB and Non-Recurring Gains & Charges2 33.7% 28.3% ~24% (1) Net charges of $15 million in FY2018 related to the change in U.S. tax law. (2) FY17 GAAP Tax rate was impacted by the recognition of the non-cash, nontaxable $9.3 million investment gain. Excluding that gain the tax rate would have been 33.7%. © 2018 | 19

Annual Excess Tax Benefits: FY14-FY18 © 2018 | 20

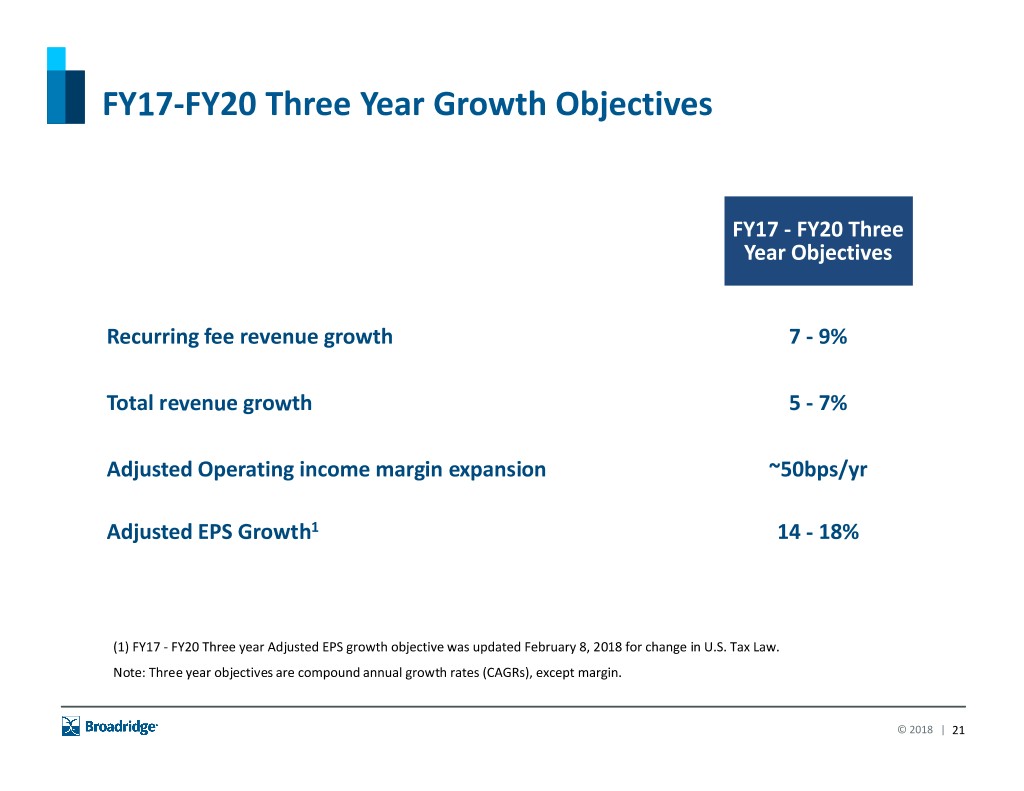

FY17-FY20 Three Year Growth Objectives FY17 - FY20 Three Year Objectives Recurring fee revenue growth 7 - 9% Total revenue growth 5 - 7% Adjusted Operating income margin expansion ~50bps/yr Adjusted EPS Growth1 14 - 18% (1) FY17 - FY20 Three year Adjusted EPS growth objective was updated February 8, 2018 for change in U.S. Tax Law. Note: Three year objectives are compound annual growth rates (CAGRs), except margin. © 2018 | 21

Reconciliation of GAAP to Non-GAAP Measures (Unaudited - Note: Amounts may not sum due to rounding) $ in millions, except per share amounts Three Months Ended June 30, Fiscal Year 2018 2017 2018 2017 Operating income (GAAP) $ 265.4 $ 297.0 $ 594.9 $ 531.6 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 22.1 19.7 81.4 72.6 Acquisition and Integration Costs 2.8 7.1 8.8 19.1 Adjusted Operating income (Non-GAAP) $ 290.2 $ 323.9 $ 685.1 $ 623.3 Operating income margin (GAAP) 20.1% 22.1% 13.7% 12.8% Adjusted Operating income margin (Non-GAAP) 22.0% 24.1% 15.8% 15.0% Three Months Ended June 30, Fiscal Year 2018 2017 2018 2017 Net earnings (GAAP) $ 206.9 $ 187.1 $ 427.9 $ 326.8 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 22.1 19.7 81.4 72.6 Acquisition and Integration Costs 2.8 7.1 8.8 19.1 Gain on Sale of Securities — — (5.5) — Taxable adjustments 24.8 26.9 84.7 91.7 Tax Act items (0.7) — 15.4 — MAL investment gain — — — (9.3) Tax impact of adjustments (a) (7.3) (9.6) (23.9) (30.9) Adjusted Net earnings (Non-GAAP) $ 223.7 $ 204.3 $ 504.1 $ 378.3 (a) Calculated using the GAAP effective tax rate, adjusted to exclude the net $0.7 million benefits and $15.4 million charges associated with the Tax Act, as well as $22.3 million and $40.9 million of excess tax benefits associated with stock-based compensation for the three months and fiscal year ended June 30, 2018, respectively. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. © 2018 | 22

Reconciliation of GAAP to Non-GAAP Measures (Unaudited - Note: Amounts may not sum due to rounding) Three Months Ended June 30, Fiscal Year 2018 2017 2018 2017 Diluted earnings per share (GAAP) $ 1.72 $ 1.57 $ 3.56 $ 2.70 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 0.18 0.17 0.68 0.60 Acquisition and Integration Costs 0.02 0.06 0.07 0.16 Gain on Sale of Securities — — (0.05) — Taxable adjustments 0.21 0.22 0.70 0.76 Tax Act items (0.01) — 0.13 — MAL investment gain — — — (0.08) Tax impact of adjustments (a) (0.06) (0.08) (0.20) (0.26) Adjusted earnings per share (Non-GAAP) $ 1.86 $ 1.71 $ 4.19 $ 3.13 Fiscal Year 2018 2017 Net cash flows provided by operating activities (GAAP) $ 693.6 $ 515.9 Capital expenditures and Software purchases and capitalized internal use software (97.9) (113.7) Free cash flow (Non-GAAP) $ 595.7 $ 402.2 (a) Calculated using the GAAP effective tax rate, adjusted to exclude the net $0.7 million benefits and $15.4 million charges associated with the Tax Act, as well as $22.3 million and $40.9 million of excess tax benefits associated with stock-based compensation for the three months and fiscal year ended June 30, 2018, respectively. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. © 2018 | 23

Reconciliation of GAAP to Non-GAAP Measures - FY19 Guidance (Unaudited) Adjusted Earnings Per Share Growth Rate (1) Diluted earnings per share (GAAP) 12% - 16% Adjusted earnings per share (Non-GAAP) 9% - 13% Adjusted Operating Income Margin (2) Operating income margin % (GAAP) ~14.5% Adjusted Operating income margin % (Non-GAAP) ~16.5% Free Cash Flow Net cash flows provided by operating activities (GAAP) $660 - $730 million Capital expenditures and Software purchases and capitalized internal use software (95) - (115) million Free cash flow (Non-GAAP) $565 - $615 million (1) Adjusted earnings per share growth (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, and is calculated using diluted shares outstanding. Fiscal year 2019 Non-GAAP Adjusted earnings per share guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, net of taxes, of approximately $0.60 per share. (2) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs. Fiscal year 2019 Non-GAAP Adjusted Operating income margin guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs of approximately $94 million. © 2018 | 24

Broadridge Investor Relations W. Edings Thibault Investor Relations Tel: 516-472-5129 Email: edings.thibault@broadridge.com © 2018 | 25