Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - UNITED BANKSHARES INC/WV | d583201dex991.htm |

| 8-K - FORM 8-K - UNITED BANKSHARES INC/WV | d583201d8k.htm |

United Bankshares, Inc. Second Quarter 2018 Earnings Review July 26, 2018 Exhibit 99.2

Forward-Looking Statements This presentation and statements made by United Bankshares, Inc. (“United”) and its management may contain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts and often use the words “projects”, “targets”, “intends”, “plans”, “believes,” “expects,” “anticipates” or similar expressions or future or conditional verbs such as “will”, “may”, “might”, “should”, “would” and “could”. These forward-looking statements involve certain risks and uncertainties. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: competitive pressures among depository institutions increase significantly; changes in interest rate environment may adversely affect net interest income; gain on sale margins; loan accretion; prepayment speeds, loan sale volumes, charge-offs and loan loss provisions; general economic conditions, either national or in the states in which United does business, are less favorable than expected; changes in the securities markets; continued diversification of assets and adverse changes to credit quality; any economic slowdown that could adversely affect credit quality and loan originations. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the caption “Risk Factors” of United’s Annual Report on Form 10-K for the year ended December 31, 2017, as filed with the SEC. July 2018

2Q18 HIGHLIGHTS Record Net Income of $66.3 million with diluted earnings per share of $0.63 Generated return on average assets of 1.42%, return on equity of 8.11%, and return on tangible equity* of 15.14% Quarterly dividend of $0.34 per share equates to a yield of 3.7% based upon recent stock price Strong expense control with an efficiency ratio of 50.5% Asset quality and capital position remain sound, with Non Performing Assets decreasing 4.2% LQ Repurchased 962,500 shares of common stock during Q2 *Non GAAP measure. Refer to appendix.

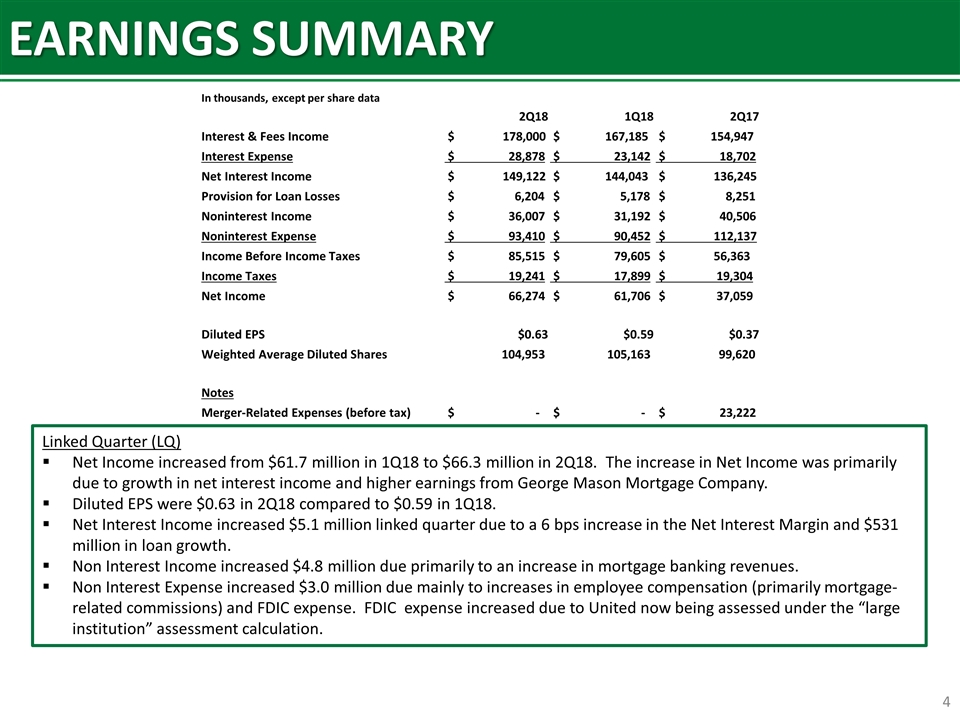

EARNINGS SUMMARY Linked Quarter (LQ) Net Income increased from $61.7 million in 1Q18 to $66.3 million in 2Q18. The increase in Net Income was primarily due to growth in net interest income and higher earnings from George Mason Mortgage Company. Diluted EPS were $0.63 in 2Q18 compared to $0.59 in 1Q18. Net Interest Income increased $5.1 million linked quarter due to a 6 bps increase in the Net Interest Margin and $531 million in loan growth. Non Interest Income increased $4.8 million due primarily to an increase in mortgage banking revenues. Non Interest Expense increased $3.0 million due mainly to increases in employee compensation (primarily mortgage-related commissions) and FDIC expense. FDIC expense increased due to United now being assessed under the “large institution” assessment calculation. In thousands, except per share data 2Q18 1Q18 2Q17 Interest & Fees Income $ 178,000 $ 167,185 $ 154,947 Interest Expense $ 28,878 $ 23,142 $ 18,702 Net Interest Income $ 149,122 $ 144,043 $ 136,245 Provision for Loan Losses $ 6,204 $ 5,178 $ 8,251 Noninterest Income $ 36,007 $ 31,192 $ 40,506 Noninterest Expense $ 93,410 $ 90,452 $ 112,137 Income Before Income Taxes $ 85,515 $ 79,605 $ 56,363 Income Taxes $ 19,241 $ 17,899 $ 19,304 Net Income $ 66,274 $ 61,706 $ 37,059 Diluted EPS $0.63 $0.59 $0.37 Weighted Average Diluted Shares 104,953 105,163 99,620 Notes Merger-Related Expenses (before tax) $ - $ - $ 23,222

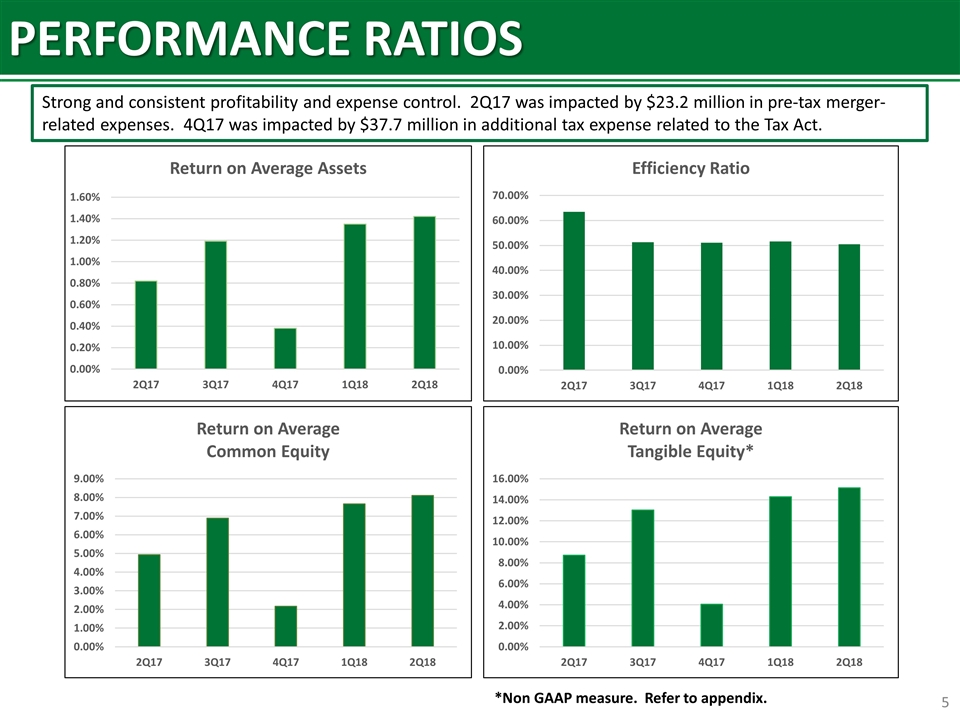

PERFORMANCE RATIOS Strong and consistent profitability and expense control. 2Q17 was impacted by $23.2 million in pre-tax merger-related expenses. 4Q17 was impacted by $37.7 million in additional tax expense related to the Tax Act. *Non GAAP measure. Refer to appendix.

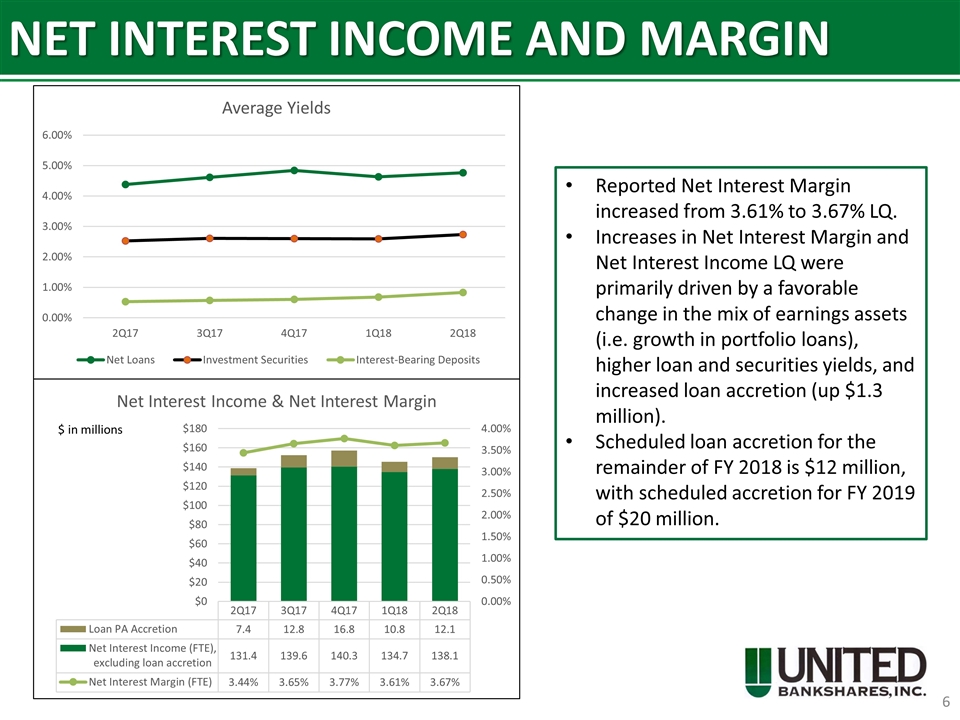

NET INTEREST INCOME AND MARGIN Reported Net Interest Margin increased from 3.61% to 3.67% LQ. Increases in Net Interest Margin and Net Interest Income LQ were primarily driven by a favorable change in the mix of earnings assets (i.e. growth in portfolio loans), higher loan and securities yields, and increased loan accretion (up $1.3 million). Scheduled loan accretion for the remainder of FY 2018 is $12 million, with scheduled accretion for FY 2019 of $20 million. $ in millions

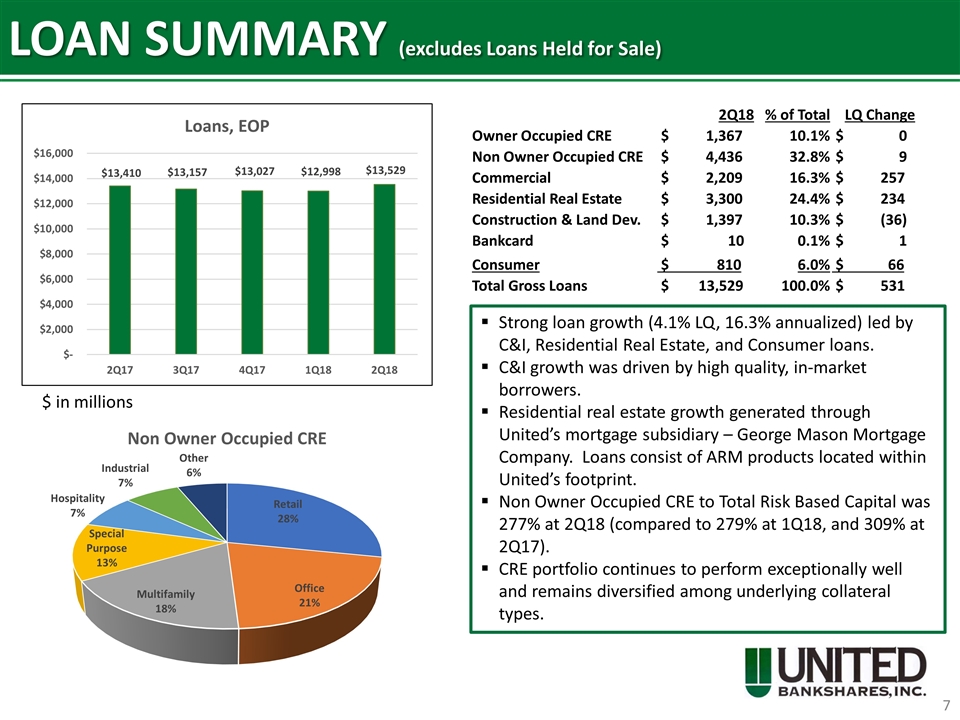

LOAN SUMMARY (excludes Loans Held for Sale) Strong loan growth (4.1% LQ, 16.3% annualized) led by C&I, Residential Real Estate, and Consumer loans. C&I growth was driven by high quality, in-market borrowers. Residential real estate growth generated through United’s mortgage subsidiary – George Mason Mortgage Company. Loans consist of ARM products located within United’s footprint. Non Owner Occupied CRE to Total Risk Based Capital was 277% at 2Q18 (compared to 279% at 1Q18, and 309% at 2Q17). CRE portfolio continues to perform exceptionally well and remains diversified among underlying collateral types. $ in millions 2Q18 % of Total LQ Change Owner Occupied CRE $ 1,367 10.1% $ 0 Non Owner Occupied CRE $ 4,436 32.8% $ 9 Commercial $ 2,209 16.3% $ 257 Residential Real Estate $ 3,300 24.4% $ 234 Construction & Land Dev. $ 1,397 10.3% $ (36) Bankcard $ 10 0.1% $ 1 Consumer $ 810 6.0% $ 66 Total Gross Loans $ 13,529 100.0% $ 531

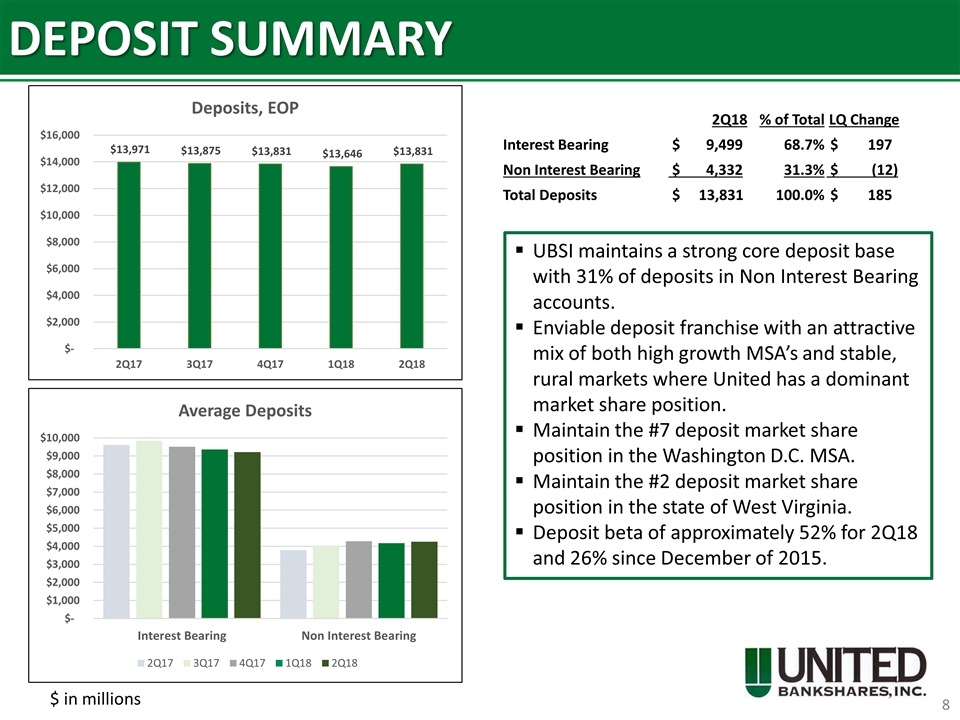

DEPOSIT SUMMARY UBSI maintains a strong core deposit base with 31% of deposits in Non Interest Bearing accounts. Enviable deposit franchise with an attractive mix of both high growth MSA’s and stable, rural markets where United has a dominant market share position. Maintain the #7 deposit market share position in the Washington D.C. MSA. Maintain the #2 deposit market share position in the state of West Virginia. Deposit beta of approximately 52% for 2Q18 and 26% since December of 2015. $ in millions 2Q18 % of Total LQ Change Interest Bearing $ 9,499 68.7% $ 197 Non Interest Bearing $ 4,332 31.3% $ (12) Total Deposits $ 13,831 100.0% $ 185

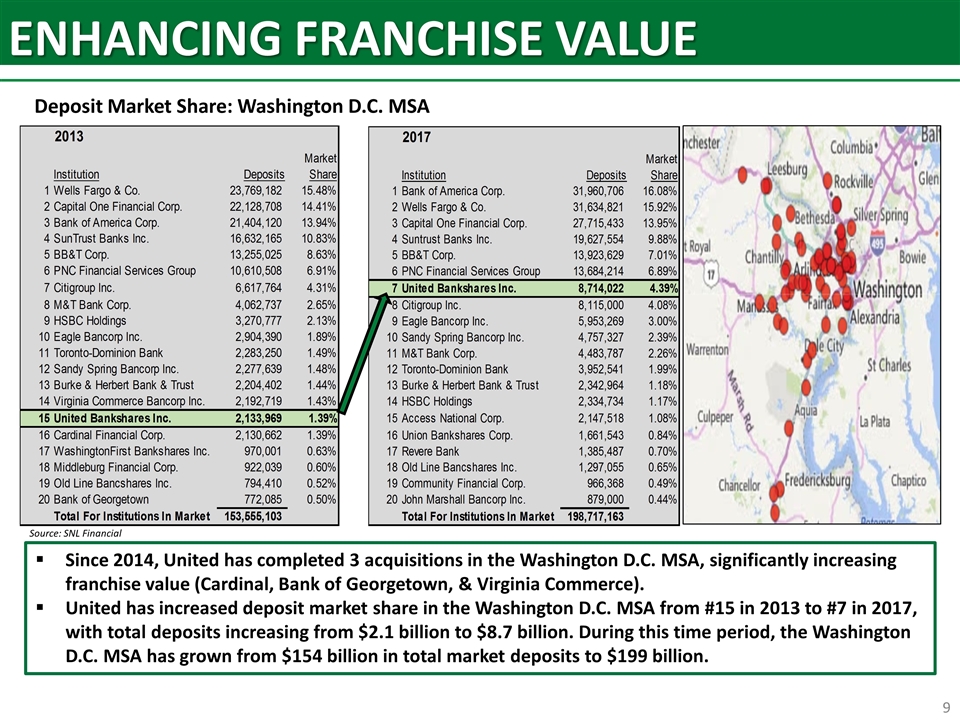

ENHANCING FRANCHISE VALUE Deposit Market Share: Washington D.C. MSA Since 2014, United has completed 3 acquisitions in the Washington D.C. MSA, significantly increasing franchise value (Cardinal, Bank of Georgetown, & Virginia Commerce). United has increased deposit market share in the Washington D.C. MSA from #15 in 2013 to #7 in 2017, with total deposits increasing from $2.1 billion to $8.7 billion. During this time period, the Washington D.C. MSA has grown from $154 billion in total market deposits to $199 billion. Source: SNL Financial

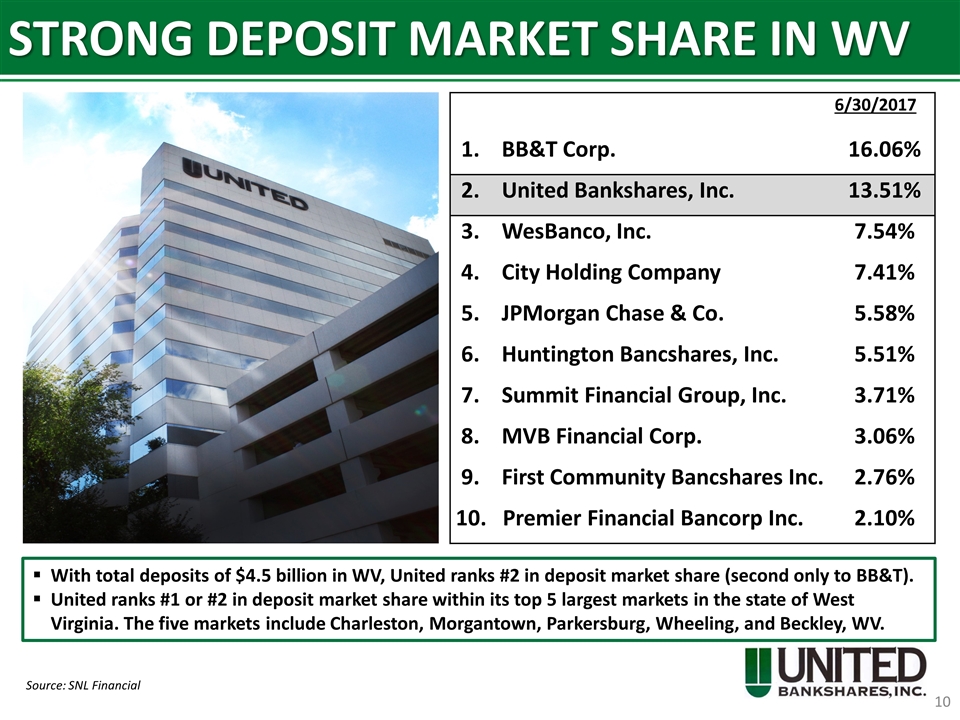

STRONG DEPOSIT MARKET SHARE IN WV Source: SNL Financial 6/30/2017 1. BB&T Corp. 16.06% 2. United Bankshares, Inc. 13.51% 3. WesBanco, Inc. 7.54% 4. City Holding Company 7.41% 5. JPMorgan Chase & Co. 5.58% 6. Huntington Bancshares, Inc. 5.51% 7. Summit Financial Group, Inc. 3.71% 8. MVB Financial Corp. 3.06% 9. First Community Bancshares Inc. 2.76% 10. Premier Financial Bancorp Inc. 2.10% With total deposits of $4.5 billion in WV, United ranks #2 in deposit market share (second only to BB&T). United ranks #1 or #2 in deposit market share within its top 5 largest markets in the state of West Virginia. The five markets include Charleston, Morgantown, Parkersburg, Wheeling, and Beckley, WV.

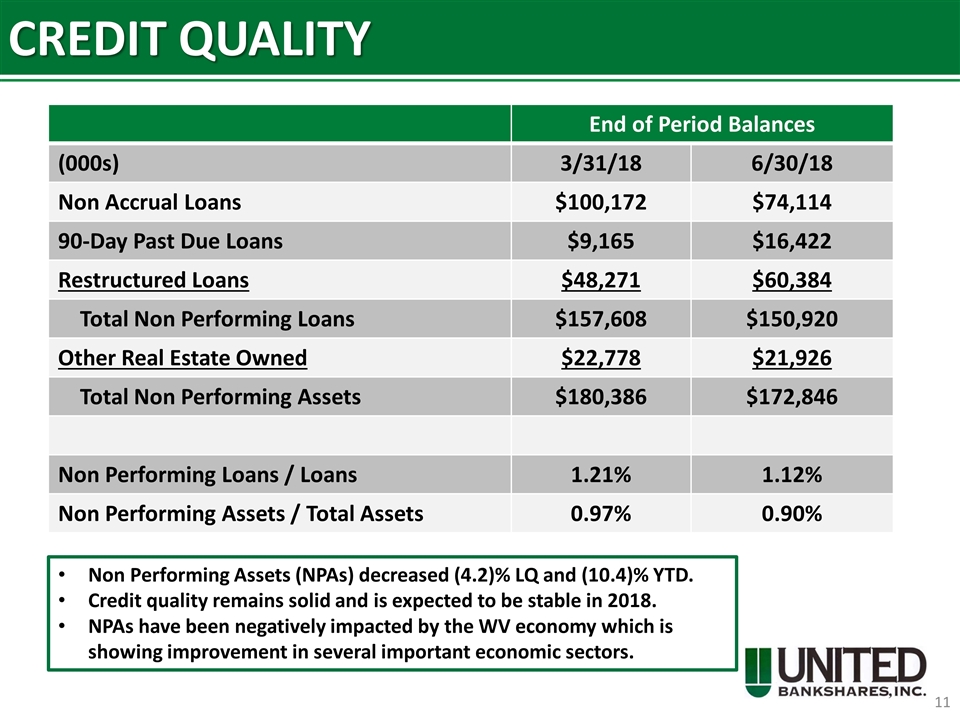

CREDIT QUALITY End of Period Balances (000s) 3/31/18 6/30/18 Non Accrual Loans $100,172 $74,114 90-Day Past Due Loans $9,165 $16,422 Restructured Loans $48,271 $60,384 Total Non Performing Loans $157,608 $150,920 Other Real Estate Owned $22,778 $21,926 Total Non Performing Assets $180,386 $172,846 Non Performing Loans / Loans 1.21% 1.12% Non Performing Assets / Total Assets 0.97% 0.90% Non Performing Assets (NPAs) decreased (4.2)% LQ and (10.4)% YTD. Credit quality remains solid and is expected to be stable in 2018. NPAs have been negatively impacted by the WV economy which is showing improvement in several important economic sectors.

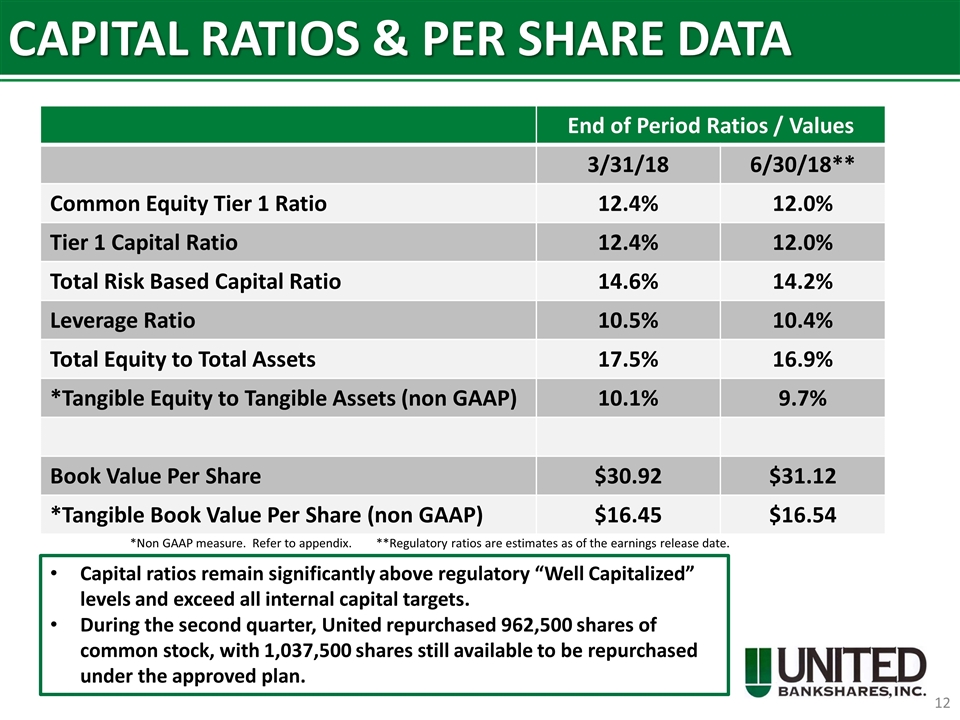

CAPITAL RATIOS & PER SHARE DATA End of Period Ratios / Values 3/31/18 6/30/18** Common Equity Tier 1 Ratio 12.4% 12.0% Tier 1 Capital Ratio 12.4% 12.0% Total Risk Based Capital Ratio 14.6% 14.2% Leverage Ratio 10.5% 10.4% Total Equity to Total Assets 17.5% 16.9% *Tangible Equity to Tangible Assets (non GAAP) 10.1% 9.7% Book Value Per Share $30.92 $31.12 *Tangible Book Value Per Share (non GAAP) $16.45 $16.54 Capital ratios remain significantly above regulatory “Well Capitalized” levels and exceed all internal capital targets. During the second quarter, United repurchased 962,500 shares of common stock, with 1,037,500 shares still available to be repurchased under the approved plan. *Non GAAP measure. Refer to appendix. **Regulatory ratios are estimates as of the earnings release date.

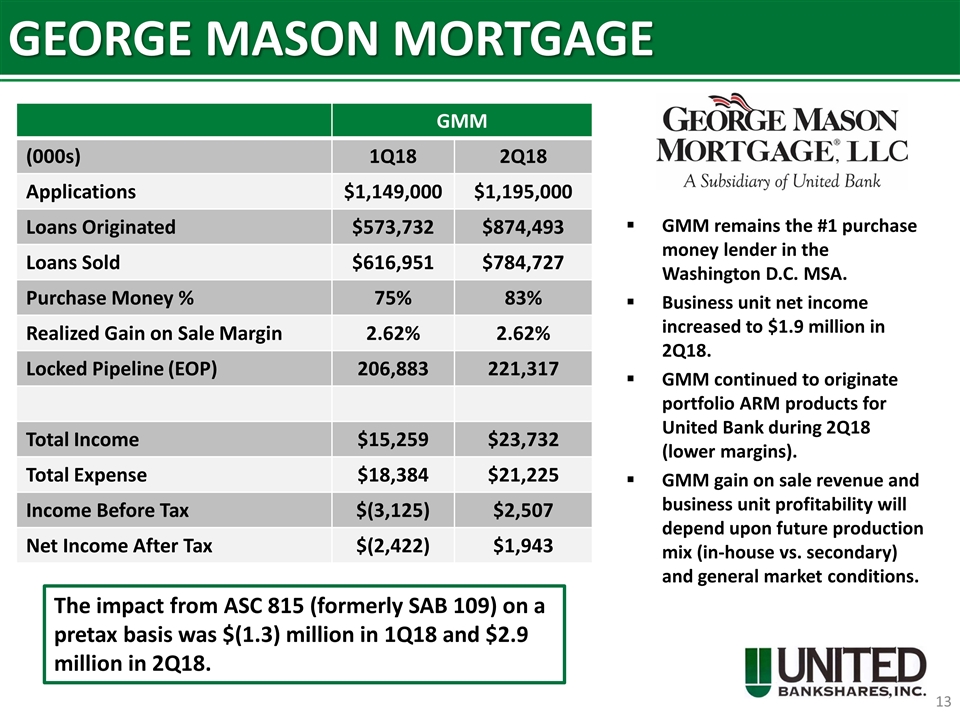

GEORGE MASON MORTGAGE GMM remains the #1 purchase money lender in the Washington D.C. MSA. Business unit net income increased to $1.9 million in 2Q18. GMM continued to originate portfolio ARM products for United Bank during 2Q18 (lower margins). GMM gain on sale revenue and business unit profitability will depend upon future production mix (in-house vs. secondary) and general market conditions. GMM (000s) 1Q18 2Q18 Applications $1,149,000 $1,195,000 Loans Originated $573,732 $874,493 Loans Sold $616,951 $784,727 Purchase Money % 75% 83% Realized Gain on Sale Margin 2.62% 2.62% Locked Pipeline (EOP) 206,883 221,317 Total Income $15,259 $23,732 Total Expense $18,384 $21,225 Income Before Tax $(3,125) $2,507 Net Income After Tax $(2,422) $1,943 The impact from ASC 815 (formerly SAB 109) on a pretax basis was $(1.3) million in 1Q18 and $2.9 million in 2Q18.

2018 OUTLOOK Loans & Deposits: Loan and deposit growth rates expected in the low to mid single digits for the remainder of 2018. Net Interest Margin: Stable core NIM (excluding purchase accounting related loan accretion). Asset Quality: Stable asset quality metrics (following improvement in 1Q18 & 2Q18). Non Interest Income: NII growth, excluding George Mason Mortgage Company and net loss on investments, is estimated in the low single digits (compared to 2Q18 annualized). Non Interest Expense: NIE growth, excluding George Mason Mortgage Company, is estimated to be flat (compared to 2Q18 annualized). Tax Rate: 2018 Tax Rate estimated at approximately 22.5%-23.0%. The outlook below reflects a continuation of the current economic climate and interest rate environment. Our outlook may change if the expectations for these items vary from current expectations.

UBSI INVESTMENT THESIS Excellent franchise with strong growth prospects Experienced management team with a proven track record of execution High level of insider ownership High-performance bank with a low-risk profile 44 consecutive years of dividend increases evidences United’s strong profitability, solid asset quality, and sound capital management over a very long period of time Attractive valuation with a current Price-to-Earnings Ratio of 14.2x (based upon median 2019 street consensus estimate of $2.57, per Bloomberg) and a dividend yield of 3.7% (based upon recent prices)

THE CHALLENGE TO BE THE BEST NEVER ENDS www.ubsi-inc.com

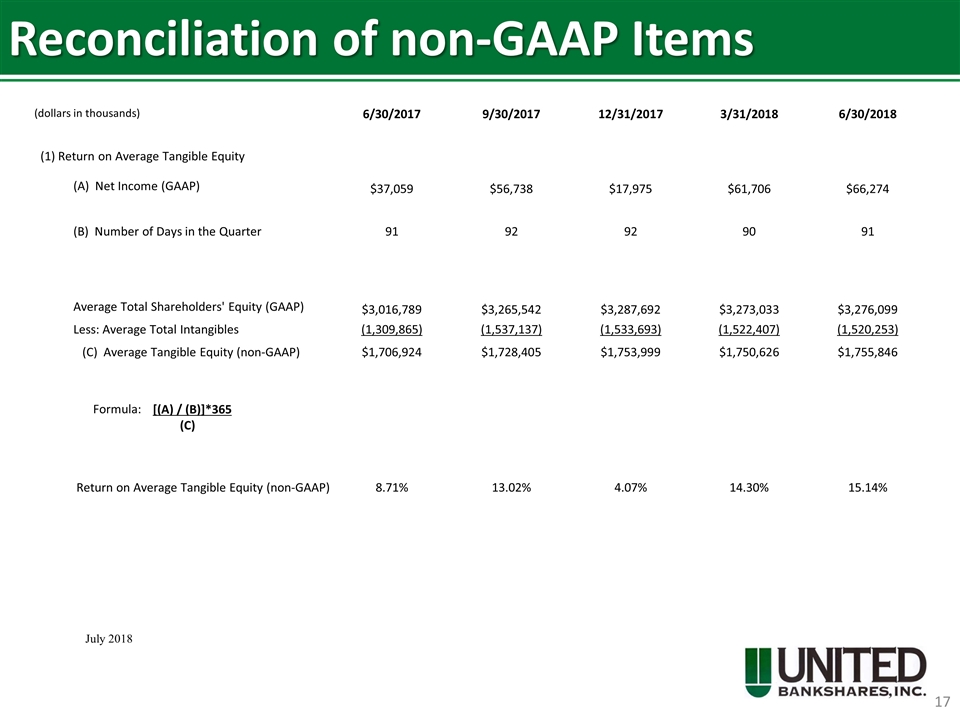

Reconciliation of non-GAAP Items July 2018 (dollars in thousands) 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 (1) Return on Average Tangible Equity (A) Net Income (GAAP) $37,059 $56,738 $17,975 $61,706 $66,274 (B) Number of Days in the Quarter 91 92 92 90 91 Average Total Shareholders' Equity (GAAP) $3,016,789 $3,265,542 $3,287,692 $3,273,033 $3,276,099 Less: Average Total Intangibles (1,309,865) (1,537,137) (1,533,693) (1,522,407) (1,520,253) (C) Average Tangible Equity (non-GAAP) $1,706,924 $1,728,405 $1,753,999 $1,750,626 $1,755,846 Formula: [(A) / (B)]*365 (C) Return on Average Tangible Equity (non-GAAP) 8.71% 13.02% 4.07% 14.30% 15.14%

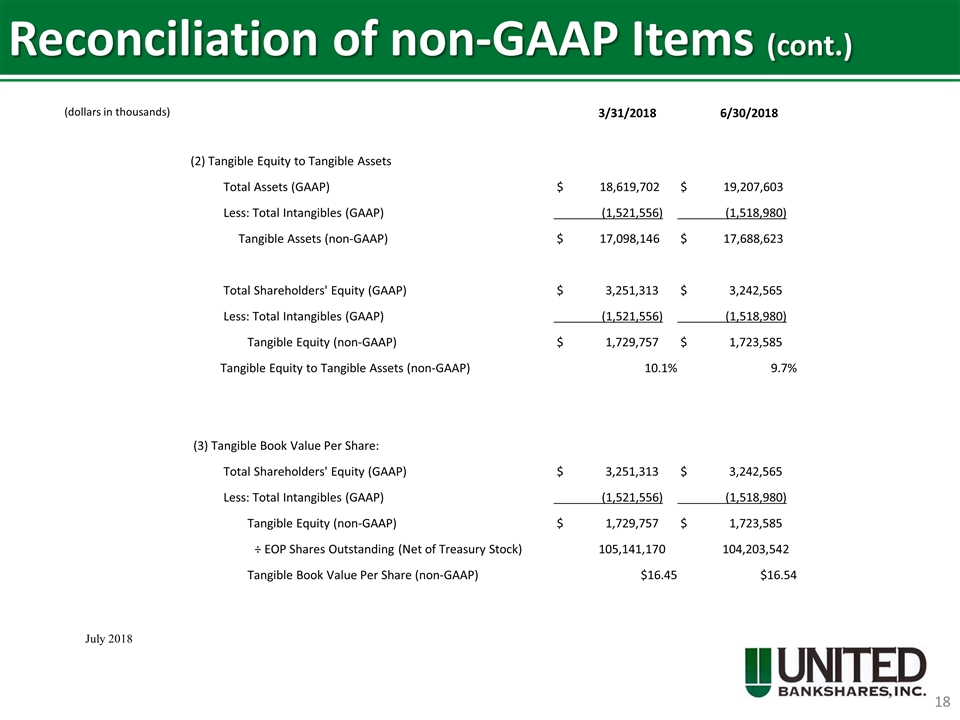

Reconciliation of non-GAAP Items (cont.) July 2018 (dollars in thousands) 3/31/2018 6/30/2018 (2) Tangible Equity to Tangible Assets Total Assets (GAAP) $ 18,619,702 $ 19,207,603 Less: Total Intangibles (GAAP) (1,521,556) (1,518,980) Tangible Assets (non-GAAP) $ 17,098,146 $ 17,688,623 Total Shareholders' Equity (GAAP) $ 3,251,313 $ 3,242,565 Less: Total Intangibles (GAAP) (1,521,556) (1,518,980) Tangible Equity (non-GAAP) $ 1,729,757 $ 1,723,585 Tangible Equity to Tangible Assets (non-GAAP) 10.1% 9.7% (3) Tangible Book Value Per Share: Total Shareholders' Equity (GAAP) $ 3,251,313 $ 3,242,565 Less: Total Intangibles (GAAP) (1,521,556) (1,518,980) Tangible Equity (non-GAAP) $ 1,729,757 $ 1,723,585 ÷ EOP Shares Outstanding (Net of Treasury Stock) 105,141,170 104,203,542 Tangible Book Value Per Share (non-GAAP) $16.45 $16.54