Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - INDUS REALTY TRUST, INC. | grif-20180531ex3227c8227.htm |

| EX-32.1 - EX-32.1 - INDUS REALTY TRUST, INC. | grif-20180531ex321b15edb.htm |

| EX-31.2 - EX-31.2 - INDUS REALTY TRUST, INC. | grif-20180531ex312acd020.htm |

| EX-31.1 - EX-31.1 - INDUS REALTY TRUST, INC. | grif-20180531ex311f60c84.htm |

| EX-10.63 - EX-10.63 - INDUS REALTY TRUST, INC. | grif-20180531ex10637af04.htm |

| EX-10.62 - EX-10.62 - INDUS REALTY TRUST, INC. | grif-20180531ex10622d665.htm |

| 10-Q - 10-Q - INDUS REALTY TRUST, INC. | grif-20180531x10q.htm |

Exhibit 10.64

CONSTRUCTION LOAN AGREEMENT

dated March 29, 2018

by and between

STATE FARM LIFE INSURANCE COMPANY ("State Farm")

and

TRADEPORT DEVELOPMENT VI, LLC ("Borrower")

Table of Contents

Page

|

ARTICLE 1 |

DEFINITIONS AND USE OF TERMS |

1 |

|

Section 1.1 |

Terms Defined Above |

1 |

|

Section 1.2 |

Certain Definitions |

1 |

|

Section 1.3 |

Definition of Other Terms |

10 |

|

ARTICLE 2 |

THE LOAN |

10 |

|

Section 2.1 |

Commitment to Lend |

10 |

|

Section 2.2 |

The Note |

10 |

|

Section 2.3 |

Advances |

10 |

|

Section 2.4 |

Conditions to the First Advance |

11 |

|

Section 2.5 |

Conditions to Subsequent Advances |

12 |

|

Section 2.6 |

Conditions to Final Advance |

13 |

|

Section 2.7 |

Budget |

14 |

|

Section 2.8 |

Budget Amendments |

14 |

|

Section 2.9 |

Borrower's Deposit |

14 |

|

Section 2.10 |

Funding |

15 |

|

Section 2.11 |

Application of Advances |

15 |

|

Section 2.12 |

Direct Disbursement and Application by State Farm |

15 |

|

Section 2.13 |

No Waiver |

15 |

|

Section 2.14 |

Conditions Precedent for the Benefit of State Farm |

15 |

|

Section 2.15 |

Subordination |

16 |

|

Section 2.16 |

Conversion |

16 |

|

ARTICLE 3 |

REPRESENTATIONS AND WARRANTIES OF BORROWER |

18 |

|

Section 3.1 |

Financial Statements |

18 |

|

Section 3.2 |

Suits, Actions, Etc. |

18 |

|

Section 3.3 |

Status of Borrower; Valid and Binding Obligation |

18 |

|

Section 3.4 |

Title to the Secured Property |

19 |

|

Section 3.5 |

Construction |

19 |

|

Section 3.6 |

Disclosure |

19 |

|

Section 3.7 |

System Compliance |

19 |

|

Section 3.8 |

Utility and Access Availability |

19 |

|

Section 3.9 |

Taxes |

19 |

|

Section 3.10 |

Plans |

19 |

|

Section 3.11 |

Violations |

20 |

|

Section 3.12 |

Compliance with Restrictions and Agreements |

20 |

|

Section 3.13 |

Inducement to State Farm |

20 |

i

Table of Contents

(continued)

Page

|

ARTICLE 4 |

COVENANTS AND AGREEMENTS OF BORROWER |

20 |

|

Section 4.1 |

Compliance of Plans and Secured Property |

20 |

|

Section 4.2 |

Contracts |

20 |

|

Section 4.3 |

Construction and Completion of the Improvements |

21 |

|

Section 4.4 |

Correction of Defects |

21 |

|

Section 4.5 |

Storage of Materials |

21 |

|

Section 4.6 |

Inspection of the Secured Property |

21 |

|

Section 4.7 |

Insurance |

21 |

|

Section 4.8 |

Notice to State Farm |

21 |

|

Section 4.9 |

Costs and Expenses |

22 |

|

Section 4.10 |

Further Assurances |

22 |

|

Section 4.11 |

Inspection of Books and Records |

22 |

|

Section 4.12 |

No Liability of State Farm |

22 |

|

Section 4.13 |

No Conditional Sale Contracts, Etc. |

23 |

|

Section 4.14 |

Defense of Actions |

23 |

|

Section 4.15 |

Prohibition on Assignment of Borrower's Interest |

23 |

|

Section 4.16 |

Payment of Claims |

23 |

|

Section 4.17 |

Restrictions and Annexation |

23 |

|

Section 4.18 |

Advertising by State Farm |

23 |

|

Section 4.19 |

Current Financial Statements |

23 |

|

Section 4.20 |

Guarantor Financial Statements |

24 |

|

Section 4.21 |

Loan Participation/Syndication |

24 |

|

Section 4.22 |

Inspections |

24 |

|

Section 4.23 |

Indemnification |

25 |

|

Section 4.24 |

State Farm's Action for its Own Protection Only |

25 |

|

Section 4.25 |

Appraisals |

26 |

|

Section 4.26 |

Foundation Survey |

26 |

|

Section 4.27 |

Security Deposits |

26 |

|

Section 4.28 |

Management Contracts |

26 |

|

Section 4.29 |

Assignment of Construction Contract |

26 |

|

Section 4.30 |

Assignment of Architectural Contract, Engineering Contract and Plans |

27 |

|

ARTICLE 5 |

DEFAULT AND REMEDIES |

28 |

|

Section 5.1 |

Events of Default |

28 |

|

Section 5.2 |

Certain Remedies |

29 |

|

Section 5.3 |

Completion of Construction, Etc. |

30 |

|

Section 5.4 |

Performance by State Farm on Borrower's Behalf |

30 |

|

Section 5.5 |

Remedies Cumulative |

31 |

ii

Table of Contents

(continued)

Page

|

ARTICLE 6 |

LEASING AND TENANT MATTERS |

31 |

|

Section 6.1 |

Leases |

31 |

|

Section 6.2 |

Approval of Leases Prior to Conversion |

31 |

|

Section 6.3 |

Cash Flow Sweep Escrow |

31 |

|

Section 6.4 |

Tenant Expansion Option; Right of First Offer; Subordinate Financing |

32 |

|

ARTICLE 7 |

GENERAL TERMS AND CONDITIONS |

34 |

|

Section 7.1 |

Notices, Consents and Approvals |

34 |

|

Section 7.2 |

Modifications |

36 |

|

Section 7.3 |

Severability |

36 |

|

Section 7.4 |

Election of Remedies |

36 |

|

Section 7.5 |

Form and Substance |

36 |

|

Section 7.6 |

Controlling Agreement |

36 |

|

Section 7.7 |

No Third Party Beneficiary |

36 |

|

Section 7.8 |

Number and Gender |

36 |

|

Section 7.9 |

Captions |

36 |

|

Section 7.10 |

Applicable Law |

36 |

|

Section 7.11 |

Relationship of the Parties |

37 |

|

Section 7.12 |

WAIVER OF JURY TRIAL |

37 |

|

Section 7.13 |

Consent to Jurisdiction |

37 |

|

Section 7.14 |

Limitation of Liability |

38 |

|

Section 7.15 |

Negotiation |

40 |

|

Section 7.16 |

Conflicting Terms |

40 |

|

Section 7.17 |

Substitute Guarantor |

40 |

|

Section 7.18 |

Entire Agreement |

41 |

|

Section 7.19 |

Counterparts |

41 |

|

Section 7.20 |

PREJUDGMENT REMEDY WAIVER |

41 |

iii

|

Exhibits |

|

|

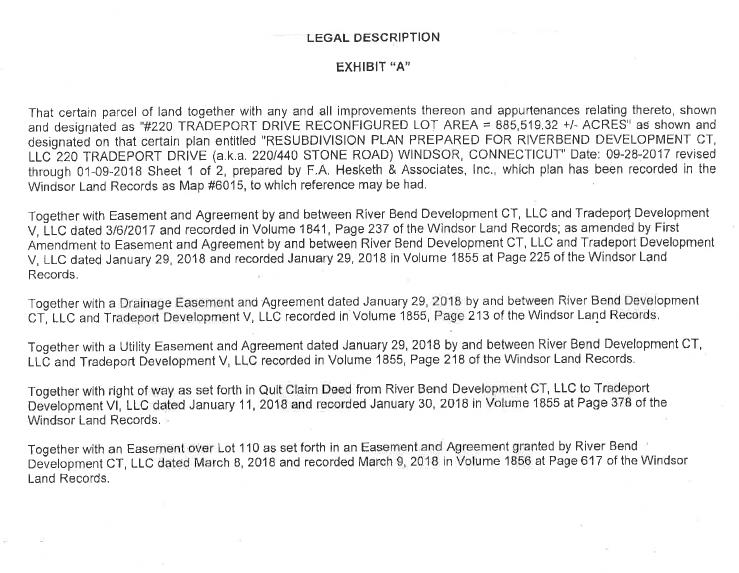

Exhibit "A" |

Legal Description |

|

Exhibit "B" |

Conditions to First Advance |

|

Exhibit "C" |

Budget |

|

Exhibit "D" |

ALTA/ASCM Title Survey Requirements |

|

Exhibit "E" |

Description of the Plans |

|

Exhibit "F" |

Form of Subordination, Non-Disturbance and Attornment Agreement |

|

Exhibit "G" |

Form of Tenant Estoppel Certificate |

|

Exhibit "H" |

Loan Title Policy Requirements |

|

Exhibit "I" |

Insurance Requirements |

|

Exhibit "J" |

Architect's Certificate |

|

Exhibit "K" |

Architect’s Certificate of Completion |

|

Exhibit "L" |

Phase I Environmental Report Requirements |

|

Exhibit "M" |

Form of Tax and Insurance Escrow Waiver Letter |

|

Exhibit "N" |

Form of Cash Flow Escrow Agreement |

|

Exhibit "O" |

Construction Contracts Approved by State Farm |

iv

CONSTRUCTION LOAN AGREEMENT

This CONSTRUCTION LOAN AGREEMENT is made and executed as of the 29th day of March, 2018, by and between STATE FARM LIFE INSURANCE COMPANY, an Illinois corporation ("State Farm"), and TRADEPORT DEVELOPMENT VI, LLC ("Borrower"), in respect of a loan in the maximum aggregate principal amount of up to Fourteen Million Two Hundred Eighty Seven Thousand Five Hundred and 00/100 Dollars ($14,287,500.00). For good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties agree as follows:

ARTICLE 1 -- DEFINITIONS AND USE OF TERMS

Section 1.1 Terms Defined Above. As used in this Agreement, the terms "State Farm" and "Borrower" shall have the meanings respectively indicated in the opening recital hereof.

Section 1.2 Certain Definitions. As used in this Agreement, the following terms shall have the following meanings, unless the context otherwise requires:

"Additional Funding Amount" shall mean an amount equal to the least of the following: (i) $487,500; (ii) an amount equal to 65% of the actual cost (including building fees, construction management fees and other soft costs) of implementing the Improvement Upgrades (such costs being the “Improvement Upgrade Costs”); or (c) an amount that would result in the Loan to Value Ratio not exceeding 65% based upon the Additional Funding Appraisal.

"Additional Funding Appraisal" shall mean an appraisal of the Secured Property, which shall (a) be prepared at Borrower’s expense by a licensed, independent third party appraiser holding an M.A.I. designation satisfactory to State Farm; (b) indicate an Appraised Value of the Secured Property in an amount sufficient to satisfy the Loan to Value Requirement; (c) be certified to State Farm; (d) include, without limitation, the income, cost and sales comparison approach to value; and (e) be otherwise satisfactory to State Farm in its sole discretion.

"Additional State Farm Financing" shall have the meaning set forth in Section 6.4.

"Additional State Farm Financing Loan Documents" shall mean any documents executed now or in the future by Borrower and/or Guarantor which evidence and/or secure the Additional State Farm Financing.

"Advance" means a disbursement by State Farm of any of the proceeds of the Loan and/or the Borrower's Deposit.

"Affidavit of Borrower" means a sworn affidavit of Borrower (and such other parties as State Farm may require) before a notary public to the effect that all statements, invoices, bills and other expenses incident to the Project incurred to a specified date, whether or not specified in the Budget, have been paid in full, except for (a) amounts retained pursuant to a Construction Contract; and (b) items to be paid from the proceeds of an Advance then being requested or in another manner satisfactory to State Farm.

1

"Agreement" means this Construction Loan Agreement, as from time to time amended or supplemented.

"Application for Advance" means a written application by Borrower and the applicable Contractor (and such other parties as State Farm may require) to State Farm on a form approved by State Farm specifying by name, current address and amount all parties to whom Borrower is obligated for labor, materials or services supplied for the Project by such Contractor and all other expenses incident to the Loan, the Secured Property and the construction of the Improvements for which an Advance is requested for the payment of such items, containing an Affidavit of Borrower, accompanied by such schedules, affidavits, releases, waivers, subordinations, statements, invoices, bills and other documents as State Farm (or the Inspecting Architects/Engineers) may reasonably request including, without limitation: (a) a Standard AIA Form G702 and G703 or other form reasonably acceptable to State Farm, including any change orders and invoices for any "soft costs" which shall be for costs consistent with the current Budget attached hereto as Exhibit C (as it may be revised from time to time with State Farm’s approval), certified by Borrower and the applicable Contractor and approved in writing by the Architect or Engineer; (b) subordinations of liens/lien waivers from Contractors (and subcontractors if requested by State Farm) in the respective sum received by each such Contractor for all of Borrower's preceding draw requests with respect to work, services or materials by such Contractor; and (c) an endorsement to the existing Title Insurance, as of the date of the requested Advance, reflecting the amount of such Advance and the total amount advanced, showing no additional liens or encumbrances upon the Secured Property (and in any event there shall be no exception for mechanic’s liens or other liens).

“Appraised Value” means the fair market value of the Secured Property as established by the Initial Appraisal, the Final Appraisal or, if any subsequent appraisal shall have been obtained by State Farm pursuant to Section 4.25, the latest subsequent appraisal obtained by State Farm pursuant to Section 4.25.

"Architect" means any architect or architectural firm as may be selected by Borrower and approved by State Farm.

“Architect’s Certificate” means the certificate of Borrower’s Architect in the form attached hereto as Exhibit J.

“Architect’s Consent” has the meaning set forth in Section 4.30.

"Architectural Contract" means a written agreement between Borrower and Architect for architectural and/or engineering services pertaining to construction of the Improvements.

"Assignment of Rents and Leases" means that certain Assignment of Rents and Leases of even date herewith executed by Borrower in favor of State Farm.

"Borrower's Deposit" means such cash sums, in addition to the proceeds of the Loan, as State Farm may deem necessary, payable by Borrower from time to time pursuant to Section 2.9 below until the Loan is paid in full, for the payment of the costs of labor, materials and services required for the construction of the Improvements, other costs and expenses specified in the Budget and other costs and expenses required to be paid in connection with the construction of the Improvements in accordance with the Plans, any Governmental Requirements and the requirements of any Lease, if applicable.

“Borrower’s Knowledge” or words of similar import shall mean solely the actual knowledge of (i) Michael S. Gamzon, President of GI, (ii) Anthony J. Galici, Vice President of GI, (iii) Thomas M. Lescalleet, Senior Vice President of GI, or (iv) Scott Bosco, Vice President of GI, who have been active in the management of the Property and the Borrower.

2

"Budget" means a schedule prepared and certified by Borrower in form, scope and substance satisfactory to State Farm, which reflects the cost of each item of work or material required to construct the Improvements pursuant to the Plans, together with all other costs and expenses, including interest and professional fees, and the dates (i.e. a Construction timeline) upon which Borrower expects to require Advances from State Farm for such costs and expenses. A copy of the current Budget is attached hereto as Exhibit C.

"Business Day" means a day other than a Saturday, Sunday or other day on which national banks in Bloomington, Illinois are authorized or required to be closed.

"Cash Flow Escrow Agreement" means that certain Cash Flow Escrow Agreement in the form of Exhibit N attached hereto, to be entered into among Borrower, State Farm and Escrow Agent if required pursuant to Section 6.3 of this Agreement.

"Closing" means the closing of the Loan, which shall be deemed to occur upon recordation of the Mortgage in the Land Records of Windsor, Connecticut pursuant to State Farm’s written direction.

"Code Compliance Report" shall have the meaning set forth on Exhibit B attached hereto.

"Completion" means the date on which all of the items required for the final Advance under Section 2.6 of this Agreement have been delivered to State Farm.

"Completion Date" means the date of Completion as confirmed in a written notice from State Farm to Borrower, which date shall be no later than the earliest of (i) October 31, 2018, (ii) six (6) months prior to expiration of the Construction Loan Period, or (iii) the date required under any Lease.

"Completion Guaranty" means the performance and completion guaranty executed by Guarantor of even date herewith guaranteeing the completion of construction of the Improvements under and pursuant to the Loan Documents.

"Construction or construction" means the construction and equipping of the Improvements in accordance with the Plans and the Leases and the installation of all personal property, fixtures and equipment required for the operation of the Project.

"Construction Contract" means each construction contract executed by Borrower and a Contractor for the construction of the Improvements.

"Construction Disbursement Agreement" means, if required by State Farm following an Event of Default, a construction disbursement agreement by and among the Title Company, Borrower and State Farm setting forth the terms and conditions pursuant to which Borrower will, from time to time as required to make advances, deposit its equity contribution for the Project with the Title Company (including Borrower’s Deposit) and request advances from the Title Company for costs of construction of the Improvements in accordance with the terms of this Agreement, which agreement shall be in form and substance acceptable to State Farm (including, without limitation, the Title Company's selection of the financial institution that will hold the escrowed funds).

"Construction Loan Fee" means the $34,500 nonrefundable construction loan fee, to be paid to State Farm concurrently herewith in consideration of the commitment of State Farm to administer the Loan prior to Conversion.

3

“Construction Loan Period” means sixteen (16) months after the Closing (or, at Borrower’s written election, may mature earlier if the Conversion Conditions have been achieved).

"Contractor" means each person with whom Borrower makes a Construction Contract.

"Contractor's Consent" has the meaning set forth in Section 4.29.

"Conversion" has the meaning set forth in Section 2.16.

"Conversion Conditions" has the meaning set forth in Section 2.16.

"Conversion Date" means the date on which all conditions precedent to conversion of the Loan from interim to permanent as set forth in Section 2.16 have been satisfied in accordance with such Section.

"Converted Maturity Date" shall mean April 1, 2034 (if applicable). Any extension of the Initial Maturity Date shall not extend the Converted Maturity Date and in no event shall the full term of the Loan exceed one hundred ninety-two (192) months. If, pursuant to Section 2.16, Conversion occurs prior to sixteen (16) months after the date of this Agreement, the term of the permanent portion of the Loan shall be extended to be more than one hundred seventy-six (176) months such that the full term of the Loan shall equal one hundred ninety-two (192) months.

"Debtor Relief Laws" means any applicable liquidation, conservatorship, bankruptcy, moratorium, rearrangement, insolvency, reorganization or similar laws, domestic or foreign including, without limitation, those in Title 11 of the United States Code, affecting the rights or remedies of creditors generally, as in effect from time to time.

"Debt Service Coverage Ratio" means for any relevant period, the ratio of (a) the Annualized Net Operating Income of the Secured Property; to (b) the Total Annual Debt Service, all as determined by State Farm and based on a twenty-five (25) year amortization. Calculation of the Debt Service Coverage Ratio shall be made by State Farm based on rent rolls and operating statements provided and certified by Borrower, and shall be conclusive.

"Debt Yield" means Net Operating Income of the Secured Property divided by the amount of the Loan, the Additional Funding Amount, if applicable, the Additional State Farm Financing or Secondary Financing (as defined herein), as the case may be. Calculation of the Debt Yield shall be made by State Farm based on rent rolls and operating statements provided and certified by Borrower, and shall be conclusive.

"Deposit Balance" means $20,000 of the $276,000 deposit paid by Borrower to State Farm pursuant to that certain Term Sheet dated November 9, 2017 between Borrower and State Farm.

"Disbursement Account" has the meaning set forth in Section 2.10.

"Engineer" means any engineer or engineering firm as may be selected by Borrower and approved by State Farm.

"Engineering Contract" means a written agreement between Borrower and Engineer for engineering services pertaining to the construction of the Improvements.

"Engineer’s Consent" has the meaning set forth in Section 4.30.

4

"Environmental Indemnification Agreement" means that certain Environmental Indemnification Agreement dated of even date herewith executed by Borrower and Guarantor, jointly and severally, for the benefit of State Farm.

"Escrow Agent" shall mean CBRE Capital Markets, Inc., a Texas corporation, or such other entity as may be acceptable to State Farm.

"Event of Default or event of default " has the meaning set forth in Section 5.1.

"Exculpated Party" and "Exculpated Parties" have the meanings set forth in Section 7.14.

"Expenses" mean, for the relevant period (but based on annualized amounts), the greater of (a) the actual annualized costs and expenses of owning, operating, managing and maintaining the Secured Property during such period incurred by Borrower, determined on a cash basis (except for real and personal property taxes and insurance premiums, which shall be determined on an accrual basis); or (b) the annualized amount of such costs and expenses assuming one hundred percent (100%) occupancy of the Secured Property.

Expenses will include, without limitation, utilities, insurance, cleaning, landscaping, security, repairs, maintenance, monthly management fees, administrative expenses (excluding items chargeable to Borrower’s management company per the management contract), reserves for replacements (reserves shall not be less than $.05 per square feet, real estate and property taxes and assessments (calculated at full assessment even if currently charged less, and excluding federal, state and other income taxes)), and any other expenses reasonably projected to recur annually.

Expenses will be subject to State Farm adjustment to reflect (a) commercially reasonable expenses and reserves for properties comparable in type and location to the Secured Property; and (b) the Expenses that would have been incurred at a one hundred percent (100%) occupancy level, even if actual occupancy is less at the time of determination of Expenses.

Expenses shall not include: (a) listed expenses not expected to recur annually; (b) actual expenditures for capital improvements and replacements; (c) actual expenditures or reserves for tenant improvements and leasing commissions; (d) debt service payments; (e) depreciation, amortization or similar non-cash items; or (f) expenses that are reimbursed by tenants (however, expenses reimbursed by tenants may be included if the related reimbursements are included in Gross Operating Income).

Expenses that occur only occasionally during a year, such as property taxes, if necessary to fairly present the impact of such Expenses, will be adjusted by State Farm for purposes of calculating Expenses by averaging those Expenses over a one-year period and using the monthly average for those Expenses rather than the actual Expenses paid for those items in the month being measured.

"Final Appraisal" means an appraisal of the Secured Property, which shall (a) be prepared at Borrower’s expense by a licensed, independent third party appraiser holding an M.A.I. designation satisfactory to State Farm; (b) indicate an Appraised Value of the Secured Property upon completion of construction in an amount sufficient to satisfy the Loan to Value Requirement; (c) be certified to State Farm; (d) include, without limitation, the income, cost and sales comparison approach to value; and (e) be otherwise satisfactory to State Farm in its sole discretion.

"Financial Statements" means such balance sheets, income and expense statements, and other financial information of Borrower and Guarantor as shall reasonably be required by State Farm, from time to time, or as required under any Loan Document, which statements shall be certified as true and correct in all material respects by the party submitting such statements.

5

"Financing Statements" means the Uniform Commercial Code financing statements filed by State Farm to perfect its security interest in fixtures and in certain personal property and other rights of Borrower included as part of the Secured Property.

"First Draw Deadline" means the date that is one hundred fifty (150) days after the Closing.

“Ford Major Lease” shall have the meaning set forth in Section 2.16.

“Ford Major Tenant” shall have the meaning set forth in Section 2.16.

"Governmental Authority" means the United States, the state, the county, the city or any other political subdivision in which the Secured Property is located and any court or political subdivision, agency or instrumentality having or exercising jurisdiction over Borrower, Guarantor or the Secured Property.

"Governmental Requirements" means all laws, ordinances, codes, rules, regulations, orders, writs, injunctions or decrees of any Governmental Authority applicable to Borrower, Guarantor or the Secured Property.

"Gross Operating Income" means annualized actual in place gross operating income from the Leases of the Secured Property for the relevant period; provided, however, that in no event shall Gross Operating Income include: (a) prepaid items; (b) reimbursements to Borrower for utilities and other expenses except to the extent such reimbursements are included in Expenses; (c) any loan proceeds; (d) proceeds or payments under insurance policies (except proceeds of rental interruption insurance and business income and expense insurance); (e) condemnation proceeds; (f) any security deposits received from tenants in the Project, unless and until the same are applied to rent or other obligations in accordance with the tenant's Lease; (g) lease termination fees; or (h) any other extraordinary items as determined, in State Farm's reasonable discretion. In addition, if any Lease contains a concession such as free or reduced rent and if State Farm deems such an adjustment necessary to fairly present the impact of the concession, State Farm will adjust the rental income for purposes of calculating Gross Operating Income spreading the concession over the term of that Lease.

"Guarantor" means Griffin Industrial Realty, Inc.

"Guaranty" means that certain Guaranty Agreement executed by Guarantor of even date herewith guaranteeing the Obligations of Borrower under the Loan Documents including, without limitation, the obligations and liabilities set forth in Section 7.14 and, prior to satisfaction of the Personal Liability Reduction Conditions in accordance with the terms of the Loan Documents, full recourse personal liability for all Obligations.

“Improvement Upgrades” means those additional leasehold improvements which the Ford Major Tenant is permitted to request that Borrower construct pursuant to the Ford Major Lease having an aggregate cost of up to $750,000.

"Improvements" means the improvements to be constructed on the Land comprising the Secured Property in accordance with the Plans as provided herein and contemplated hereby. The Improvements will be comprised of the following: approximately 234,000 rentable square foot pre-cast concrete panel industrial warehouse and distribution building with 36’ clear height, twenty-five (25) loading docks and two (2) drive-in doors and approximately 9,800 square feet of office and ancillary space, plus approximately 120 employee parking spaces and approximately 60 semi-trailer parking spaces and landscaped grounds, together with all buildings, structures and other improvements now or hereafter constructed, erected, installed, placed or situated upon the Land.

6

"Indebtedness" means (a) the indebtedness evidenced by the Note, including principal, interest, late charges and prepayment fee, if any; and (b) all other sums which may at any time be due, owing or required to be paid under the Note, the Mortgage, this Agreement and the other Loan Documents including, without limitation, sums owing from or required to be paid by Borrower as a result of the breach or non-performance of any of the Obligations, regardless of whether Borrower is personally liable for any such payment.

"Initial Appraisal" means the appraisal dated December 12, 2017 which was performed by CBRE Valuation and Advisory Services; such appraisal has been completed and accepted by State Farm.

"Initial Maturity Date" means August 1, 2019.

"Inspecting Architects/Engineers" mean such employees, representatives and agents of State Farm or third parties retained by State Farm at Borrower’s expense, who may, from time to time, perform architectural, engineering or inspection services related to the Secured Property including, without limitation, review of the Plans and all proposed changes in them, inspection of construction work for conformity with the Plans and this Agreement and review of Applications for Advances (the initial Inspecting Architects/Engineers shall be Lender’s Quality Assurance).

"Land" means approximately 19.6 acres of real estate described in Exhibit A.

“Lease” and “Leases” have the meanings defined in the Mortgage.

“Leverage Ratio” means the ratio of total secured debt to total assets.

“Liable Party” and “Liable Parties” have the meanings set forth in Section 7.14.

“Liquid Assets” means assets in the form of cash, cash equivalents, obligations of (or fully guaranteed as to principal and interest by) the United States or any agency or instrumentality thereof (provided the full faith and credit of the United States supports such obligation or guarantee), certificates of deposit issued by a commercial bank, and repurchase agreements entered into with commercial banks, in each case acceptable to Lender, having net assets of not less than $500 million, securities listed and traded on a recognized stock exchange or traded over the counter and listed in the National Association of Securities Dealers Automatic Quotations, or liquid debt instruments that have a readily ascertainable value and are regularly traded in a recognized financial market.

"Loan" means the loan to be made by State Farm to Borrower in the maximum amount of up to $14,287,500.00 in accordance with this Agreement and as evidenced by the Note, the final principal amount of which is subject to adjustment in accordance with Section 2.1.

"Loan Documents" means this Agreement, the Mortgage, the Note, the Guaranty, the Completion Guaranty, the Assignment of Rents and Leases, the Financing Statements, the SNDA’s, the Construction Disbursement Agreement (if any), the Cash Flow Escrow Agreement and such other documents evidencing, securing or pertaining to the Loan as shall, from time to time, be executed and delivered to State Farm by Borrower, Guarantor or any other party pursuant to this Agreement including, without limitation, each Affidavit of Borrower, each Application for Advance, the Budget and any future amendments or supplements to the Budget.

"Loan Investigation Fee" means the $7,500.00 non-refundable loan investigation fee which has been previously paid by Borrower to State Farm in consideration of the agreement by State Farm to review the information and materials submitted to State Farm in connection with the Loan.

7

"Loan to Value Requirement" means the requirement that the ratio of the aggregate of all amounts advanced under the Loan (including without limitation, the Additional Funding Amount) together with the amounts to be advanced in connection with the advance for which the Loan to Value Requirement is being tested, to the final market value (the “Loan to Value Ratio”) as stated in the Final Appraisal, or Additional Funding Appraisal, as applicable, ordered by State Farm at Borrower's expense, acceptable to State Farm, is not more than 65.0%.

"Losses" has the meaning set forth in Section 7.14.

"Mortgage" means that certain Open-End Construction Mortgage Deed and Security Agreement of even date herewith, granted by Borrower for the benefit of State Farm, securing the payment of the Indebtedness and the payment and performance of all Obligations specified in the Mortgage, this Agreement and the other Loan Documents and evidencing a valid and enforceable first priority lien, security interest and assignment of rents and proceeds covering the Secured Property, as it may from time to time be renewed, extended, amended or supplemented.

"Net Operating Income" means for any relevant period (a) Gross Operating Income; less (b) Expenses.

"Net Worth" means, as of a given date, (x) the total assets of any person or entity as of such date less (y) such person’s total liabilities as of such date, determined in accordance with generally accepted accounting principles, consistently applied.

"Note" means that certain Promissory Note evidencing the Loan of even date herewith made by Borrower and payable to the order of State Farm in the maximum principal amount of $14,287,500.00 as it may from time to time be renewed, extended, amended or supplemented.

"Obligations" means (a) the payment of the Indebtedness; and (b) the performance of any of the terms, provisions, covenants, agreements, representations, warranties, certifications and obligations contained in this Agreement or under the other Loan Documents.

"Personal Liability Reduction Conditions" has the meaning set forth in Section 7.14.

"Permanent Loan Period" means that provided the Conversion Conditions have been satisfied, the permanent portion of the loan shall commence on the Conversion Date and mature one hundred ninety two (192) months after the Closing.

"Plans" means the plans and specifications for the construction of the Improvements, as altered, modified or changed from time to time, prepared by the Architect and/or Engineer, as approved by State Farm (including the final plans and specifications for segments of such work).

"Project" means the Land, the construction of the Improvements thereon and the leasing and operation of the Improvements.

“Ratio Adjustment Payment” means a payment of principal of the Loan so the outstanding principal balance of the Loan does not exceed the lesser of (i) 75% of the actual acquisition and construction costs of the Project or (ii) 65% of the Appraisal Value.

"Required Upfront Equity" means an amount no less than 32.02% of the total approved cost of the Project, approximately $6,500,000.00, prior to the First Draw Deadline, as determined by State Farm. The

8

Required Upfront Equity will be a combination of cash and Land value. The Land value shall be deemed to be $2,800,000.00.

"Retainage" means ten percent (10%) of the "hard costs" (as set forth in Exhibit C attached hereto) contained in each requested Advance (i.e., the total amount then due the various Contractors, subcontractors and material suppliers for costs of construction).

"Secondary Financing" shall have the meaning set forth in Section 6.4.

"Secured Property" means the Land, the Improvements and all other property constituting the Secured Property as defined in the Mortgage or subject to a right, lien or security interest to secure the Loan pursuant to any other Loan Document.

"SNDA" means a subordination, non-disturbance and attornment agreement in the form attached hereto as Exhibit F.

"Survey" means a current certified survey of the Secured Property satisfying the requirements set forth in Exhibit D attached hereto.

"Tenant Estoppel Certificate" means a tenant estoppel certificate in the form attached hereto as Exhibit G.

"Title Company" means Chicago Title Insurance Company.

"Title Insurance" means one or more title insurance commitments and policies as State Farm may require issued by the Title Company in the maximum amount of the Loan, insuring or committing to insure that the Mortgage constitutes a valid lien covering the Land and all improvements thereon having a first lien priority required by State Farm and subject only to the “Permitted Encumbrances” (as defined in the Mortgage) and otherwise in accordance with State Farm's Title Insurance Requirements set forth on Exhibit H.

"Total Annual Debt Service" means the sum of:

(a) the aggregate of debt service payments for the relevant period on the maximum principal amount of the Loan, including any Additional Funding Amount, if applicable, and Additional State Farm Financing, assuming (i) an interest rate equal to the fixed rate per annum in effect for the relevant period; and (ii) monthly payments of principal and interest calculated upon the shorter of (x) an assumed twenty-five (25) year amortization schedule; or (y) the actual amortization schedule used in the Note (or other document evidencing the Additional Funding Amount and Additional State Farm Financing, as applicable); and

(b) the aggregate debt service payments (including principal and interest) on all other indebtedness secured by a lien on all or part of the Secured Property for the applicable period of time (this subsection (b) is not authorization for Borrower to incur any such other indebtedness secured by a lien upon the Secured Property).

Calculation of Total Annual Debt Service will be based upon: (i) the maximum possible Loan balance as if all Advances have been made, even if all such Advances have not yet been made at the time of the calculation (unless, at the time of such calculation no further Advances can be made under the Loan Documents, in which event the then outstanding principal Loan balance shall be used); (ii) the principal and interest payment that would be applicable after the end of an interest-only period under the Note, even

9

if the calculation is being made during an interest only period; and (iii) the average interest rate over the term of the Loan, if multiple rates apply.

Section 1.3 Definition of Other Terms. Capitalized terms not otherwise defined herein shall have the definitions and meanings ascribed to such terms in this Agreement and in the other Loan Documents.

Section 2.1 Commitment to Lend. Subject to and upon the terms, covenants and conditions of this Agreement, State Farm will make the Loan in Advances to Borrower in accordance with this Agreement in an aggregate amount (not including the amount of Borrower’s Deposit) not to exceed the principal face amount of the Note. State Farm's commitment to make Advances hereunder (a) shall expire and terminate on the earlier of the Initial Maturity Date or the date on which Conversion occurs; (b) may be terminated by State Farm by notice to Borrower if all conditions to the first Advance have not been satisfied on or before First Draw Deadline or if any Event of Default occurs hereunder; and (c) shall automatically terminate if the Note is prepaid in full. The Loan is not revolving; an amount repaid may not be reborrowed. Notwithstanding anything in this Agreement to the contrary, the Loan shall not exceed the lower of: (i) $14,287,500; (ii) sixty-five percent (65%) of the Appraised Value determined pursuant to Section 4.25; and (iii) seventy-five percent (75%) of the actual cost of the acquisition and construction of the Project to be initially determined based upon the Budget (the “Project Cost”), provided that after acquisition and during construction of the Project, such costs shall be determined on the actual costs incurred to date and State Farm's estimate of additional costs needed to complete construction of the Improvements as contemplated by the Budget.

Section 2.2 The Note. The Loan is evidenced by the Note. Interest on the Loan, at the rate or rates specified in the Note, shall be (a) computed on the unpaid principal balance which exists from time to time and shall be computed with respect to each Advance only from the date of such Advance (as to the portion of each Advance not constituting a portion of Borrower's Deposit); and (b) due and payable monthly as it accrues as more particularly set forth in the Note. Upon Conversion, principal and interest under the Note shall be due and payable in monthly installments as and when required under the Note. In any case and notwithstanding anything to the contrary, on the Converted Maturity Date, all then outstanding principal under the Note, plus all accrued but unpaid interest, the Prepayment Fee (as defined in the Note), if applicable, and other amounts payable pursuant to the Note and the other Loan Documents shall be due and payable in full.

(a) From time to time, Borrower shall submit an Application for Advance to State Farm requesting an Advance for the payment of costs of labor, materials and services supplied for the construction of the Improvements or for the payment of other costs and expenses incident to the Loan, the acquisition of the Secured Property or the construction of the Improvements and specified in the Budget. Advances for the payment of costs of labor, materials and services supplied for the construction of the Improvements and the other items shown in the Budget shall be made by State Farm, not more frequently than once per month, upon compliance by Borrower with this Agreement after actual commencement of construction of the Improvements for work actually done since the previous Advance. State Farm shall require an inspection of and an acceptable report on the Improvements by the Inspecting Architects/Engineers prior to making any Advance. Advances for payment of costs of construction of the Improvements and the other items shown in the Budget shall be limited to the amounts shown in the Budget and not exceed (i) the costs of labor, materials and services incorporated into the Improvements in a manner acceptable to State Farm (no Advances shall be made for uninstalled materials to be utilized in the construction of the

10

Improvements); less (ii) Retainage; and less (iii) all prior Advances for payment of costs of labor, materials and services for the construction of the Improvements. Each Application for Advance shall be submitted by Borrower to State Farm at a reasonable time (but not less than ten (10) days) prior to the date on which an Advance is desired by Borrower. The Retainage shall be held until completion of the Improvements and disbursed only at the time of the final disbursement of Loan; provided, however, upon the satisfactory completion of one hundred percent (100%) of the work with respect to any individual Contractor or subcontractor or the delivery of all materials by a materials supplier pursuant to a purchase order in accordance with the Plans as certified by the Inspecting Architects/Engineers, and further provided that the Loan remains "in balance" (as provided in Section 2.9), State Farm shall permit Retainages with respect to such Contractor or subcontractor or material supplier to be disbursed to Borrower upon receipt by State Farm of evidence of (A) the full completion of all work to be performed by the applicable subcontractor or delivery of materials by the applicable material supplier with respect to the Improvements as determined by State Farm, including the report of the Inspecting Architects/Engineers; (B) the passage of thirty (30) days following the date on which such Contractor or subcontractor last provided work or such material supplier last supplied materials to the Project, such date to be evidenced by an affidavit of such Contractor or subcontractor or material supplier; and (C) the submission of a full and final lien waiver executed by such Contractor or subcontractor or material supplier conditioned only upon payment of the Retainage attributable to such Contractor or subcontractor or material supplier.

(b) (if applicable) The Budget contains a line item for accrued interest on the Loan and the parties hereto acknowledge that Borrower hereby requests draws that will timely pay the interest on the Loan by Advances under such line item. Any such Advance to pay interest shall be subject to the conditions to Advances set forth in this Agreement. Whether or not a separate Application for Advance has been submitted for each such interest Advance, Borrower shall be deemed to represent that all of the conditions to an Advance hereunder have been satisfied in connection with such interest Advance unless Borrower sends State Farm written notice to the contrary prior to such Advance.

Section 2.4 Conditions to the First Advance; Failure to Satisfy First Advance; Required Upfront Equity.

(a) As conditions precedent to the first Advance hereunder (a) there shall then exist no Event of Default nor shall there have occurred any event which with the giving of notice or the lapse of time, or both, could become an Event of Default; (b) the representations and warranties made in this Agreement and the other Loan Documents shall be true and correct on and as of the date of the first Advance, with the same effect as if made on that date; (c) Borrower shall deliver an Application for Advance to State Farm; (d) State Farm has received evidence satisfactory to State Farm that Borrower has contributed the Required Upfront Equity and evidence that all Required Upfront Equity was advanced to pay for costs of the Project as set forth in the Budget; (e) Borrower must satisfy the conditions required hereby and execute and deliver to, procure for and deposit with, and pay to State Farm and, if appropriate, record in the proper records with all filing and recording fees paid, the documents, certificates, agreements and other items listed in Exhibit "B" that are noted by "(X)", together with such other documents, certificates, agreements and other items as State Farm may reasonably require so that the Closing shall have occurred; (f) State Farm has received, at Borrower’s expense, an updated feasibility report in form and substance satisfactory to State Farm, together with deliveries required in connection therewith, including, without limitation, an updated Budget and final Plans, all in form and substance satisfactory to State Farm; and (g) State Farm has received evidence satisfactory to State Farm that the Target

11

Approval Date has been met in accordance with the terms of the Ford Major Lease and that Ford Major Tenant does not have a termination right under the Ford Major Lease.

(b) Failure of Borrower to satisfy all conditions to the first Advance post-Closing for hard costs on or before the First Draw Deadline shall be an Event of Default under this Agreement.

Section 2.5 Subsequent Advances; Additional Funding.

(a) Conditions to Subsequent Advances. As a condition precedent to each Advance other than the first Advance, in addition to all other requirements herein, Borrower must satisfy the following requirements and, if required by State Farm, deliver to State Farm evidence of such satisfaction:

(i) All conditions precedent to the first Advance, if any, that were not satisfied at the time of the first Advance as consented to by State Farm shall have been satisfied and such conditions precedent to the first Advance that were satisfied at the time of the first Advance shall remain satisfied including, without limitation, the satisfaction of all items listed on Exhibit "B" regardless of how noted;

(ii) There shall then exist no Event of Default and no event or condition which with notice or lapse of time (or both) would constitute an Event of Default;

(iii) The representations and warranties made in this Agreement and the other Loan Documents shall be true and correct on and as of the date of each Advance, with the same effect as if made on that date;

(iv) Borrower shall deliver an Application for Advance to State Farm;

(v) The Improvements shall not have been damaged by fire or other casualty unless State Farm has determined that State Farm will receive insurance proceeds and/or Borrower’s Deposit sufficient in State Farm’s judgment to effect the satisfactory restoration of the Improvements and to permit the completion of the Improvements prior to the Completion Date; and

(vi) The Title Insurance shall be endorsed and extended, if available under local rules, to cover each Advance with no additional title exception objectionable to State Farm (and in any event there shall be no exceptions for mechanics liens or other liens).

(b) Conditions to Advance of Additional Funding Amount. As a condition precedent to funding the Additional Funding Amount, in addition to all other requirements herein, Borrower must satisfy the following requirements and, if required by State Farm, deliver to State Farm evidence of such satisfaction:

(i) All conditions precedent to the first Advance, if any, that were not satisfied at the time of the first Advance as consented to by State Farm shall have been satisfied and such conditions precedent to the first Advance that were satisfied at the time of the first Advance shall remain satisfied including, without limitation, the satisfaction of all items listed on Exhibit "B" regardless of how noted;

(ii) There shall then exist no Event of Default and no event or condition which with notice or lapse of time (or both) would constitute an Event of Default;

12

(iii) The representations and warranties made in this Agreement and the other Loan Documents shall be true and correct on and as of the date of each Advance, with the same effect as if made on that date;

(iv) Borrower shall send written notice of its desire to obtain the Additional Funding Amount to State Farm no later than 60 days before the Conversion Date;

(v) The Ford Major Tenant shall provide an updated estoppel certificate evidencing acceptance of the Improvement Upgrades and of the Supplemental Agreement (as defined in the Ford Major Lease) modifying rent payable by the Ford Major Tenant pursuant to Section 1(F) of the Ford Major Lease;

(vi) State Farm shall receive an endorsement to the Title Insurance Policy insuring the Mortgage, in the amount of the Additional Funding Amount dated as of the date of disbursement of the Additional Funding Amount with no added exceptions to the Title Insurance Policy obtained at the initial Loan closing, other than permitted exceptions acceptable to State Farm.

If the Borrower fails to satisfy the Additional Funding Requirements on or before the Conversion Date, then State Farm shall have no further obligation to fund the Additional Funding Amount.

All costs associated with the Additional Funding Amount (whether or not such Additional Funding Amount is advanced), including, but not limited to, appraisal fees, title search fees, recording fees, document taxes, recording costs, escrow fees, and reasonable attorneys’ fees and out‑of‑pocket expenses of State Farm’s outside counsel shall be paid by Borrower.

Section 2.6 Conditions to Final Advance.

(a) The final Advance, including all remaining Retainage, will not be made until State Farm has received the following, all in form and substance reasonably satisfactory to State Farm: (a) evidence that all Governmental Requirements have been satisfied including, without limitation, delivery to State Farm of certificates of occupancy (or the equivalent if the applicable Governmental Authorities do not issue certificates of occupancy) issued by the applicable Governmental Authorities permitting the Improvements to be legally occupied; (b) evidence that no mechanic's or materialman's lien or other encumbrance has been filed and remains in effect against the Secured Property; (c) an affidavit and final lien releases or waivers (including a conditional final waiver and release if the final payment has not been made) by the Architect, each Contractor and all subcontractors, materialman and other parties who have supplied labor, materials or services for the construction of the Improvements or who otherwise might be entitled to claim a contractual, statutory or constitutional lien against the Secured Property; (d) a Certificate of Substantial Completion in AIA form G704 executed by the Architect and each Contractor with respect to the work, services and materials under its Construction Contract (verified by the Inspecting Architects/Engineers through an inspection of and an acceptable report on the Improvements) certifying that the Project has been completed in accordance with the Plans; (e) an Architect’s/Engineer’s Certificate of Completion in the form attached hereto as Exhibit K; (f) a final "as-built" ALTA/ASCM survey of the Land with the Improvements located thereon, satisfying the requirements set forth in Exhibit D; (g) an endorsement to and extension of the Title Insurance to acknowledge completion of construction of the Improvements without any encroachment and in compliance with all applicable matters of public record and Governmental Requirements and deleting any exception relating to completion of the Improvements and other exceptions specified by State Farm that may be deleted pursuant to applicable regulations, with no additional exception objectionable to State Farm (and in any event there shall be no exceptions for mechanic’s liens or other liens); (h) an updated Code Compliance Report; and (i) evidence of the satisfaction by Borrower of all other

13

conditions precedent to the final Advance under this Agreement including, without limitation the conditions in Section 2.5.

(b) The final Advance shall also include an amount necessary so that the aggregate of all amounts advanced to Borrower equals (i) if no portion of the Additional Funding Amount has been, or is to be, advanced to Borrower hereunder, then the least of (I) $13,800,000 (not including the Additional Funding Amount); (II) 75% of the actual acquisition and construction costs of the Project, and (III) 65% of the Appraisal Value, and (ii) if any portion of the Additional Funding Amount has been, or is to be, advanced to Borrower as provided herein, then the least of (I) $13,800,000 plus so much of the Additional Funding Amount which has been, or is to be, advanced to Borrower as provided herein; (II) 75% of the actual acquisition and construction costs of the Project, and (III) 65% of the Appraisal Value.

Section 2.7 Budget. The Loan funds are allocated for the costs of the Project shown in the Budget attached hereto as Exhibit C. The Budget has been prepared by Borrower and Borrower hereby represents to State Farm that, except with respect to amendments which may need to be made with respect to Improvement Upgrades to be funded with any portion of the Additional Funding Amount, the Budget represents the total costs and expenses anticipated by Borrower incident to the Loan, the Secured Property and the Project after taking into account the requirements of this Agreement. State Farm shall not be required to make any Advance for any Project cost or any other purpose that is not set forth in the Budget. In addition, except as provided in the 2nd sentence of Section 2.8, State Farm shall not be required to make any Advance for any line item in the Budget in an amount which when added to the sum of all prior Advances for that line item would exceed the sum allocated in the Budget for that line item.

Section 2.8 Budget Amendments. State Farm reserves and shall have the right to make Advances which are allocated to any line items in the Budget for such other purposes or in such different proportions as State Farm may, in its sole discretion, deem necessary or advisable. Borrower shall have no right whatsoever to reallocate Loan funds from one Budget line item to another or otherwise to amend the Budget without the prior written consent of State Farm, which State Farm may grant or withhold in its sole discretion; provided, however, Borrower may adjust any line item, including a contingency or reserve line item, one or more times prior to the Initial Maturity Date so long as: (a) the aggregate of all such adjustments to all line items shall not exceed five (5) changes; (b) the amount of such amendment individually does not exceed $50,000.00; (c) the Budget is in balance prior to, and after giving effect to, any such adjustment; (d) no Event of Default has occurred and no event has occurred which with the passing of time, giving of notice or both shall constitute an Event of Default; (e) the total amount of the Budget is not increased by any such adjustment; (f) no adjustment may be made to (i) increase the amount allocated for the acquisition of the Land or any developer's fee or other fee payable to Borrower or any affiliate of Borrower; or (ii) decrease any interest reserve, taxes or fees or reimbursements payable to State Farm; and (g) no adjustment may be made to decrease the combined aggregate amount of funds set aside for soft costs, hard costs and contingency as set forth in Exhibit C attached hereto.

Section 2.9 Borrower's Deposit. If State Farm determines in its sole judgement at any time that the Loan is not "in balance", which means that the unadvanced portion of the Loan will be insufficient for payment in full of (a) costs of labor, materials and services required for the construction of the Improvements; (b) other costs and expenses specified in the Budget; (c) interest from time to time owing or to become owing on the Loan; and (d) other costs and expenses required to be paid in connection with the construction of the Improvements in accordance with the Plans, any Governmental Requirements or the requirements of any Lease, if applicable, then Borrower shall, within ten (10) days of the written request of State Farm, make a Borrower's Deposit with State Farm. The Loan shall be deemed to be "in balance" prior to the time that State Farm requests a Borrower’s Deposit and thereafter upon delivery of such deposit to State Farm, until such time as State Farm requests an additional Borrower’s Deposit. State Farm shall not be required to pay interest on such Borrower's Deposit. State Farm shall advance the Borrower's Deposit

14

prior to any portion of any of the Loan proceeds. Borrower shall promptly notify State Farm in writing if and when the cost of the construction of the Improvements exceeds, or appears likely to exceed, the amount of the unadvanced portion of the Loan and the unadvanced portion of any then existing Borrower's Deposit.

Section 2.10 Funding. Borrower shall establish and maintain a special account (the "Disbursement Account") for funding by State Farm into which Advances funded directly to Borrower (but no other funds), and excluding direct disbursements made to or by State Farm pursuant to this Agreement, shall be deposited by Borrower and against which checks shall be drawn only for the payment of (a) costs of labor, materials and services supplied for the construction of the Improvements specified in the Budget; and (b) other costs and expenses incident to the Loan and the Project specified in the Budget. Borrower shall assign such account to State Farm as additional security for its obligations evidenced hereunder and in the other Loan Documents and at State Farm's request Borrower shall deliver an executed deposit account control agreement in form and substance acceptable to State Farm. In addition, the depository bank must be acceptable to State Farm and State Farm shall have the right, from time to time, to require Borrower to change depository banks.

Section 2.11 Application of Advances. Borrower shall disburse all Advances for payment of costs and expenses specified in the Budget and for no other purpose.

Section 2.12 Direct Disbursement and Application by State Farm. Upon the occurrence of an Event of Default, State Farm shall have the right, but not the obligation, to disburse and directly apply the proceeds of any Advance to the satisfaction of any of Borrower's obligations hereunder or under any of the other Loan Documents (including, without limitation, the payment of any amounts claimed to be due by Contractors). Any Advance by State Farm for such purpose, except the Borrower's Deposit, shall be part of the Loan and shall be secured by the Loan Documents. Borrower hereby authorizes State Farm, upon the occurrence of an Event of Default, to hold, use, disburse and apply the Loan and the Borrower's Deposit for payment of costs of construction of the Improvements, expenses incident to the Loan and the Secured Property and the payment or performance of any Obligation of Borrower hereunder or under any of the other Loan Documents. Borrower hereby assigns and pledges the proceeds of the Loan and the Borrower's Deposit to State Farm for such purposes. Upon the occurrence of an Event of Default, State Farm may advance and incur such expenses as State Farm deems necessary for the completion of construction of the Improvements and to preserve the Secured Property and any other security for the Loan and such expenses, even though in excess of the amount of the Loan, shall be secured by the Loan Documents and payable to State Farm. State Farm may disburse any portion of any Advance at any time, and from time to time, to persons other than Borrower for the purposes specified in this Section 2.12 irrespective of the provisions of Section 2.3 hereof, and the amount of Advances to which Borrower shall thereafter be entitled shall be correspondingly reduced.

Section 2.13 No Waiver. No Advance shall constitute a waiver of any condition precedent to the obligation of State Farm to make any further Advance or preclude State Farm from thereafter declaring the failure of Borrower to satisfy such condition precedent to be an Event of Default.

Section 2.14 Conditions Precedent for the Benefit of State Farm. All conditions precedent to the obligation of State Farm to make any Advance are imposed hereby solely for the benefit of State Farm and no other party may require satisfaction of any such condition precedent or be entitled to assume that State Farm will refuse to make any Advance in the absence of strict compliance with such conditions precedent. All requirements of this Agreement may be waived by State Farm, in whole or in part, at any time.

Section 2.15 Subordination. State Farm shall not be obligated to make, nor shall Borrower be entitled to, any Advance until such time as State Farm shall have received subordination agreements from the Architect, the Contractor and all other persons furnishing labor, materials or services for the design or

15

construction of the Improvements, subordinating to the provisions of the Mortgage any lien, claim or charge they may have against Borrower or the Secured Property.

(a) On or before the Initial Maturity Date, Borrower shall satisfy all of the conditions set forth in paragraph (b) below. Upon satisfaction of all such conditions on or before the Initial Maturity Date in accordance herewith, the Loan shall convert from an interim construction loan to a permanent loan (the "Conversion") and the Initial Maturity Date shall be extended to the Converted Maturity Date. The terms and provisions of this Section 2.16 (and any extension of the Initial Maturity Date pursuant hereto) shall not constitute a waiver of the requirement that any modification of the Note or any of the Loan Documents shall be subject to the express written approval of State Farm, no such approval (either expressed or implied) having been given as of the date hereof.

(b) The Initial Maturity Date shall be extended to the Converted Maturity Date, provided that Borrower shall have satisfied the following conditions (the “Conversion Conditions”) on or before the Initial Maturity Date:

(i) Each of the following events shall have occurred: (A) Completion; (B) the Secured Property shall be one hundred percent (100%) occupied pursuant to the Ford Major Lease (as defined herein) with the Ford Major Tenant (as defined herein) (I) taken possession and accepted its leased premises with no defaults of Borrower under the Ford Major Lease; and (II) commenced payment of annual base rent in amount not less than $1,345,000 pursuant to the Ford Major Lease;

(ii) Execution of an extension agreement and such other documentation as State Farm may reasonably require in connection therewith, all of which shall be in form and substance acceptable to State Farm;

(iii) There shall exist no uncured Event of Default or any event which, with the passage of time or the giving of notice, would constitute an Event of Default;

(iv) Delivery to State Farm of an endorsement of any existing Title Insurance issued in connection herewith shall be obtained and delivered by Borrower to State Farm, stating that the coverage afforded thereby, or the agreements thereunder, and the first lien priority of State Farm's mortgage lien on the Secured Property, shall not be affected because of such extension and shall otherwise be in accordance with Section 2.6(g), and the obtainment of an abstractor’s certificate or other title evidence showing no liens, encumbrances or other exceptions to the title of the Secured Property other than those previously approved in writing by State Farm (and in any event there shall be no exception for mechanic’s liens or other liens);

(v) Execution by the tenants under the Leases and delivery to State Farm of current Tenant Estoppel Certificates in the form attached hereto as Exhibit G and if not previously received by State Farm, SNDA’s in the form attached hereto as Exhibit F;

(vi) Delivery to State Farm of evidence of permanent insurance in accordance with Exhibit I attached hereto;

(vii) Delivery to State Farm of the Final Appraisal, at State Farm's option and request;

16

(viii) Delivery to State Farm of a certified rent roll for the Secured Property in substance acceptable to State Farm and form reasonably acceptable to State Farm and identifying all tenants of the Secured Property;

(ix) Delivery to State Farm of a collateral assignment and subordination of management agreement executed by the manager of the Secured Property in substance acceptable to State Farm and form reasonably acceptable to State Farm, if a property manager is engaged by Borrower;

(x) Delivery to State Farm of a final “as-built” ALTA/ASCM survey of the Land with the Improvements located thereon in accordance with the requirements set forth in Exhibit D;

(xi) Delivery to State Farm of an updated Code Compliance Report in substance acceptable to State Farm and form reasonably acceptable to State Farm;

(xii) No material adverse change shall have occurred with respect to the Secured Property or the financial condition of Borrower or Guarantor, as of the date not earlier than fifteen (15) days prior to Conversion, as evidenced (in the case of the financial condition of Borrower and Guarantor) by current Financial Statements of Borrower and Guarantor delivered to State Farm not later than five (5) business days prior to the Conversion;

(xiii) Borrower shall pay all reasonable expenses including, without limitation, attorneys' fees and legal expenses, incurred by State Farm in connection with determining whether the conditions to Conversion set forth in this Agreement are fully satisfied and in connection with the preparation, negotiation and execution of any documentation for the Conversion;

(xiv) All payments to be made by Borrower to State Farm in connection with the Conversion (including, without limitation, the expenses described in subparagraph (xiii) above, if applicable) shall be made in good and immediately available funds to State Farm, and shall be payable as otherwise provided in the Note for principal or interest payments; and

(xv) Rent commencement with respect to that certain Indenture of Lease, dated October 18, 2017 (the “Ford Major Lease”), between River Bend Development CT, LLC, as landlord, and Ford Motor Company, as Tenant (the “Ford Major Tenant”), evidenced by a confirmatory Tenant Estoppel Certificate from the Ford Major Tenant in form and substance satisfactory to State Farm.

(c) Upon satisfaction of the Conversion Conditions by Borrower on or before the Initial Maturity Date in accordance herewith, State Farm shall return the Deposit Balance. If Conversion does not occur on or before the Initial Maturity Date, in addition to any other remedies that State Farm may exercise, the Deposit Balance shall be retained by State Farm and shall not thereafter be returnable to Borrower.

(d) Notwithstanding anything to the contrary set forth herein, if Borrower shall be unable to satisfy the Conversion Conditions, Conversion shall not occur and the Loan will be payable in full upon the expiration of the Construction Loan Period. However, State Farm, in its sole and absolute discretion, shall have the right, exercisable by delivery of written notice thereof to Borrower, to either (i) cause Conversion to occur regardless of the extent of Borrower’s satisfaction or non-satisfaction of the Conversion Conditions and regardless of any desire of Borrower to stop the Conversion (provided that such Conversion shall not be a waiver of Loan Document requirements with regard to matters referenced in the Conversion Conditions such as lien releases), or (ii) extend the Conversion Date to a specified date (the effect of which shall be to

17

lengthen the Construction Loan Period and shorten the permanent portion of the Loan). The Conversion Date will not automatically extend in the event State Farm approves extension of the permitted Completion Date. If State Farm causes Conversion to take place notwithstanding that all of the Conversion Conditions have not been satisfied, then Guarantor’s liability under Section 3A of the Guaranty (and Borrower’s full recourse liability under the Note) shall continue to exist until satisfaction of all Conversion Conditions (other than the condition that State Farm enter into a written agreement pursuant to Section 2.10(b)(ii) which condition shall be deemed waived by State Farm). However, if all of the Conversion Conditions have not been satisfied on or before twelve (12) months after Conversion, then Guarantor’s liability under Section 3A of the Guaranty (and Borrower’s full recourse liability) shall continue to exist until the Loan is repaid in full, and there will be no future opportunity for Guarantor or Borrower to reduce such liability.

ARTICLE 3 -- REPRESENTATIONS AND WARRANTIES OF BORROWER

To induce State Farm to make the Loan, Borrower hereby represents and warrants to State Farm (which representations and warranties shall survive the execution and delivery of the Note and the making of the Advances) that:

Section 3.1 Financial Statements. The Financial Statements are true, correct, and complete in all material aspects as of the dates specified therein and fully and accurately present the financial condition of Borrower and Guarantor as of the dates specified. No material adverse change has occurred in the condition, financial or otherwise, of Borrower or Guarantor since the dates of the Financial Statements. Each of Borrower and Guarantor is solvent after giving effect to all borrowings contemplated in this Agreement.

Section 3.2 Suits, Actions, Etc. There are no actions, suits, investigations or proceedings pending or, to Borrower’s knowledge, threatened in any court or before or by any Governmental Authority against or affecting Borrower, Guarantor or the Secured Property or involving the validity, enforceability or priority of any of the Loan Documents, at law or in equity. The consummation of the transactions contemplated hereby and the performance of the terms and conditions hereof and of the other Loan Documents will not cause Borrower or Guarantor to be in violation of, or in default with respect to, any Governmental Requirement, or result in a breach of, or constitute a default under, any note, lease, contract, deed of trust, agreement or other undertaking or restriction to which Borrower or Guarantor is a party or by which Borrower or Guarantor may be bound or affected. Neither Borrower nor Guarantor is in default under the terms of any order of any court or any requirement of any Governmental Authority. Borrower is not in default under the terms of any indebtedness or obligation and Guarantor is not in default under the terms of any indebtedness or obligation.

Section 3.3 Status of Borrower; Valid and Binding Obligation. Borrower is (a) a Connecticut limited liability company duly organized and validly existing under the laws of the state of its organization; and (b) possessed of all power and authority necessary to own the Secured Property and to construct and operate the Improvements, to enter into and perform its obligations under the Loan Documents to which it is a party and to make the borrowings contemplated hereby. All of the Loan Documents and all other documents referred to herein to which Borrower is a party, upon execution and delivery, will constitute legal, valid and binding obligations of Borrower enforceable against Borrower in accordance with their terms, except as the enforcement thereof may be limited by Debtor Relief Laws. The Guaranty and all other documents referred to herein to which Guarantor is a party, upon execution and delivery, will constitute legal, valid and binding obligations of Guarantor enforceable against Guarantor in accordance with their terms, except as the enforcement thereof may be limited by Debtor Relief Laws.

18

Section 3.4 Title to the Secured Property. Borrower holds full legal and equitable title to the Secured Property in fee simple absolute, subject only to the "Permitted Encumbrances" (as defined in the Mortgage).

Section 3.5 Construction. Prior to the recordation of the Mortgage (a) no work of any kind (including the destruction or removal of any existing improvements, site work, clearing, grading, grubbing, draining or fencing of the Land) shall have commenced or shall have been performed on the Land for which the amounts owed in connection therewith are delinquent or have not otherwise been paid in accordance with their terms and for which a lien against the Secured Property may be filed, unless those parties having such lien rights have entered into subordination agreements subordinating their lien rights to the Mortgage; (b) no equipment or material shall have been delivered to or upon the Land for any purpose whatsoever for which the amounts owed in connection therewith are delinquent or have not otherwise been paid in accordance with their terms and for which a lien against the Secured Property may be filed, unless those parties having such lien rights have entered into subordination agreements subordinating their lien rights to the Mortgage; and (c) no contract (or memorandum or affidavit thereof) for the supplying of labor, materials or services for the construction of the Improvements nor any affidavit of commencement of construction of the Improvements, shall have been executed or recorded in the mechanic's lien or other public records in the town where the Land is located, unless those parties having such lien rights have entered into subordination agreements subordinating their lien rights to the Mortgage.

Section 3.6 Disclosure. There is no fact that Borrower has not disclosed to State Farm in writing that could materially and adversely affect the Secured Property or the business or financial condition of Borrower, Guarantor or the Secured Property.

Section 3.7 System Compliance. (a) the storm and sanitary sewer system, water system, all mechanical systems of the Secured Property and other parts of the Improvements when completed in accordance with the Plans will comply with all Governmental Requirements; and (b) all Governmental Authorities have issued all necessary permits, licenses or other authorizations for the construction of the Improvements (specifically including the named systems).

Section 3.8 Utility and Access Availability. (a) all utility and municipal services required for the construction, occupancy and operation of the Improvements including, without limitation, water supply, storm and sanitary sewer systems, gas, electric and telephone facilities, are available for use and tap-on at the boundaries of the Secured Property and available in sufficient amounts for the normal and intended use of the Improvements; and (b) Borrower has obtained written acknowledgments from the applicable utility companies or municipalities of their willingness to connect the Improvements into each of said services.

Section 3.9 Taxes. Borrower has filed all necessary tax returns and reports and has paid all taxes and governmental charges thereby shown to be owing except any such taxes or charges that are being contested in good faith by appropriate proceedings which have been disclosed to State Farm in writing prior to the date of this Agreement and for which adequate reserves have been set aside on Borrower's books in accordance with generally accepted accounting principles.