Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - CENVEO, INC | d596058dex993.htm |

| 8-K - 8-K - CENVEO, INC | d596058d8k.htm |

| EX-99.1 - EX-99.1 - CENVEO, INC | d596058dex991.htm |

Single-Employer Pension Plans: Cleansing Materials Highly Confidential / Attorney-Client Communication / Attorney Work Product Exhibit 99.2

Overview of Pension Plans The Cenveo Corporation Pension Plan (the “Cenveo Pension Plan”) and the Lancaster Press Pressmen and Bindery Workers Pension Plan (the “Lancaster Pension Plan,” together with the Cenveo Pension Plan, the “Pension Plans") are qualified single-employer defined benefit pension plans. The Cenveo Pension Plan The Cenveo Pension Plan consists of several legacy pension plans acquired through various strategic transactions and provide benefits to approximately 609 active employees and 5,499 retirees. The Cenveo Pension Plan provides benefits to employees who are or were members of the following unions: (i) GCC/IBT in Clackamas, Oregon; (ii) United Steel, Paper and Forestry Workers in Indianapolis, Indiana, Jersey City, New Jersey, and Williamsburg, Pennsylvania; (iii) International Association of Machinist and Aerospace Workers in Cleveland, Ohio; and (iv) Hawaii Teamsters and Allied Workers in Honolulu, Hawaii. The Cenveo Pension Plan also provides benefits to unrepresented salaried employees. The Cenveo Pension Plan is frozen; consequently, there are no new participants and benefits do not accrue. The Lancaster Pension Plan Provides benefits to approximately 125 active employees and approximately 201 retired participants. The Lancaster Pension Plan provides benefits employees who are represented by the GCC/IBT in Lancaster, Pennsylvania. The Lancaster Pension Plan is frozen; consequently, there are no new participants and benefits do not accrue. Highly Confidential / Attorney-Client Communication / Attorney Work Product

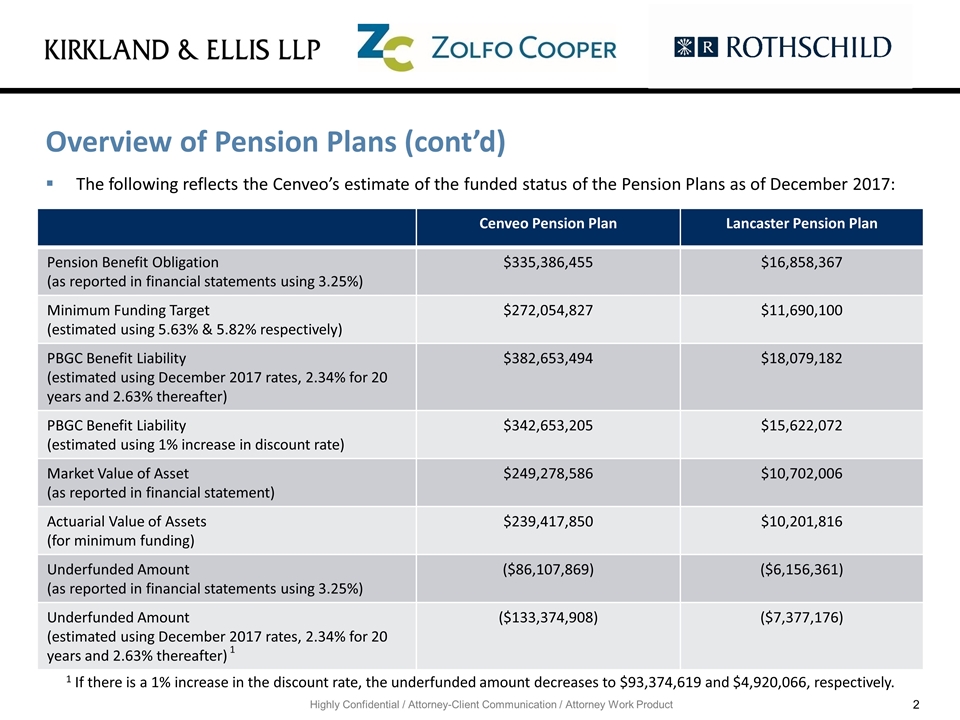

Overview of Pension Plans (cont’d) The following reflects the Cenveo’s estimate of the funded status of the Pension Plans as of December 2017: Highly Confidential / Attorney-Client Communication / Attorney Work Product Cenveo Pension Plan Lancaster Pension Plan Pension Benefit Obligation (as reported in financial statements using 3.25%) $335,386,455 $16,858,367 Minimum Funding Target (estimated using 5.63% & 5.82% respectively) $272,054,827 $11,690,100 PBGC Benefit Liability (estimated using December 2017 rates, 2.34% for 20 years and 2.63% thereafter) $382,653,494 $18,079,182 PBGC Benefit Liability (estimated using 1% increase in discount rate) $342,653,205 $15,622,072 Market Value of Asset (as reported in financial statement) $249,278,586 $10,702,006 Actuarial Value of Assets (for minimum funding) $239,417,850 $10,201,816 Underfunded Amount (as reported in financial statements using 3.25%) ($86,107,869) ($6,156,361) Underfunded Amount (estimated using December 2017 rates, 2.34% for 20 years and 2.63% thereafter) 1 ($133,374,908) ($7,377,176) 1 If there is a 1% increase in the discount rate, the underfunded amount decreases to $93,374,619 and $4,920,066, respectively.

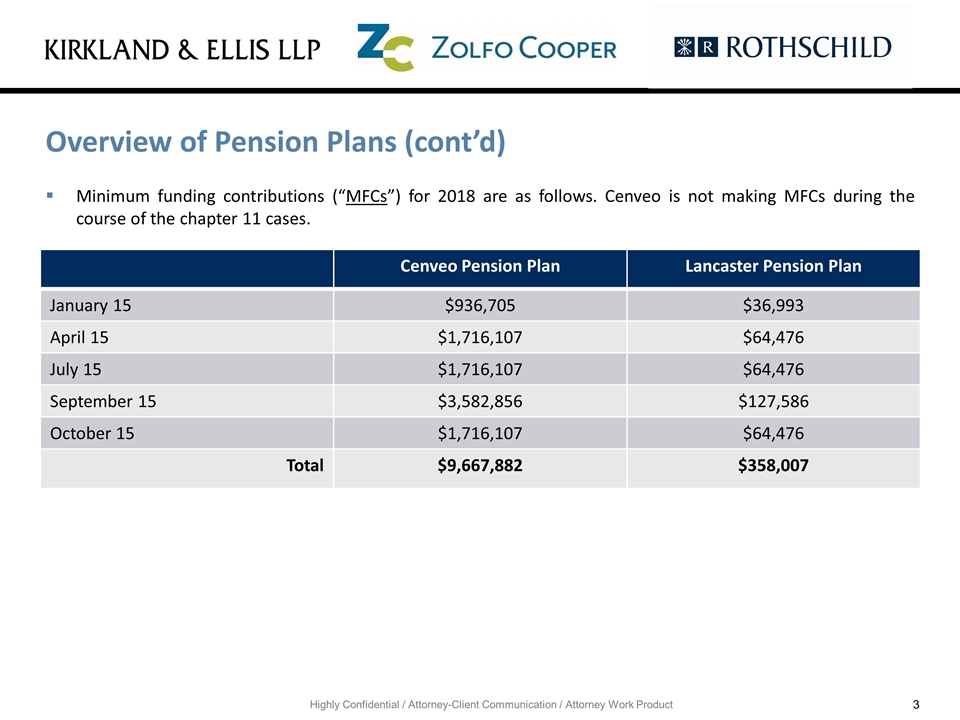

Overview of Pension Plans (cont’d) Minimum funding contributions (“MFCs”) for 2018 are as follows. Cenveo is not making MFCs during the course of the chapter 11 cases. Highly Confidential / Attorney-Client Communication / Attorney Work Product Cenveo Pension Plan Lancaster Pension Plan January 15 $936,705 $36,993 April 15 $1,716,107 $64,476 July 15 $1,716,107 $64,476 September 15 $3,582,856 $127,586 October 15 $1,716,107 $64,476 Total $9,667,882 $358,007

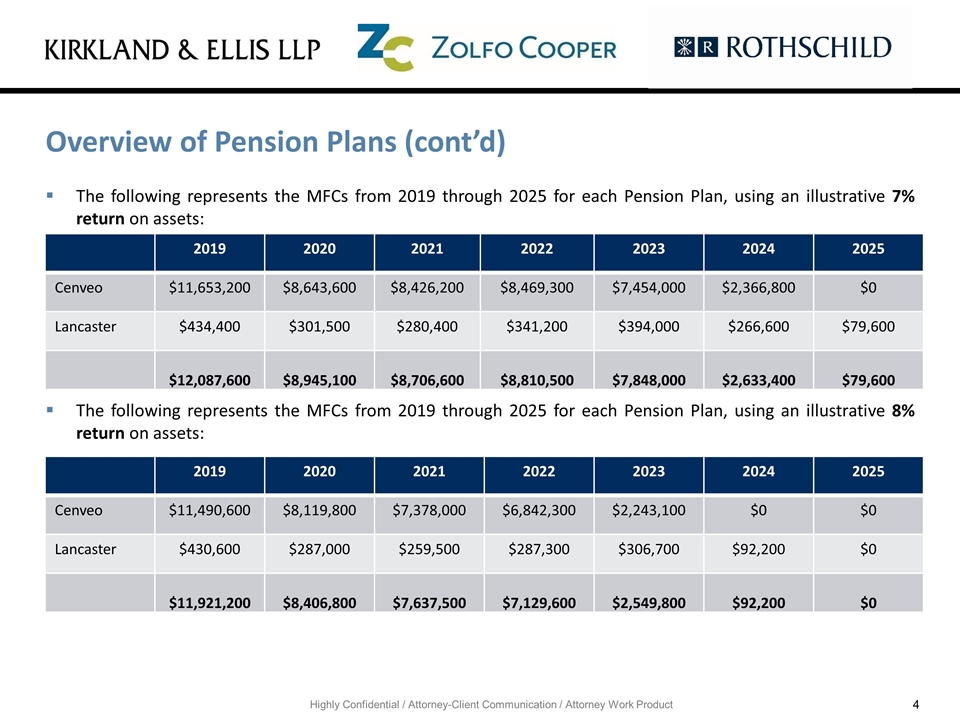

Overview of Pension Plans (cont’d) The following represents the MFCs from 2019 through 2025 for each Pension Plan, using an illustrative 7% return on assets: The following represents the MFCs from 2019 through 2025 for each Pension Plan, using an illustrative 8% return on assets: Highly Confidential / Attorney-Client Communication / Attorney Work Product 2019 2020 2021 2022 2023 2024 2025 Cenveo $11,653,200 $8,643,600 $8,426,200 $8,469,300 $7,454,000 $2,366,800 $0 Lancaster $434,400 $301,500 $280,400 $341,200 $394,000 $266,600 $79,600 $12,087,600 $8,945,100 $8,706,600 $8,810,500 $7,848,000 $2,633,400 $79,600 2019 2020 2021 2022 2023 2024 2025 Cenveo $11,490,600 $8,119,800 $7,378,000 $6,842,300 $2,243,100 $0 $0 Lancaster $430,600 $287,000 $259,500 $287,300 $306,700 $92,200 $0 $11,921,200 $8,406,800 $7,637,500 $7,129,600 $2,549,800 $92,200 $0

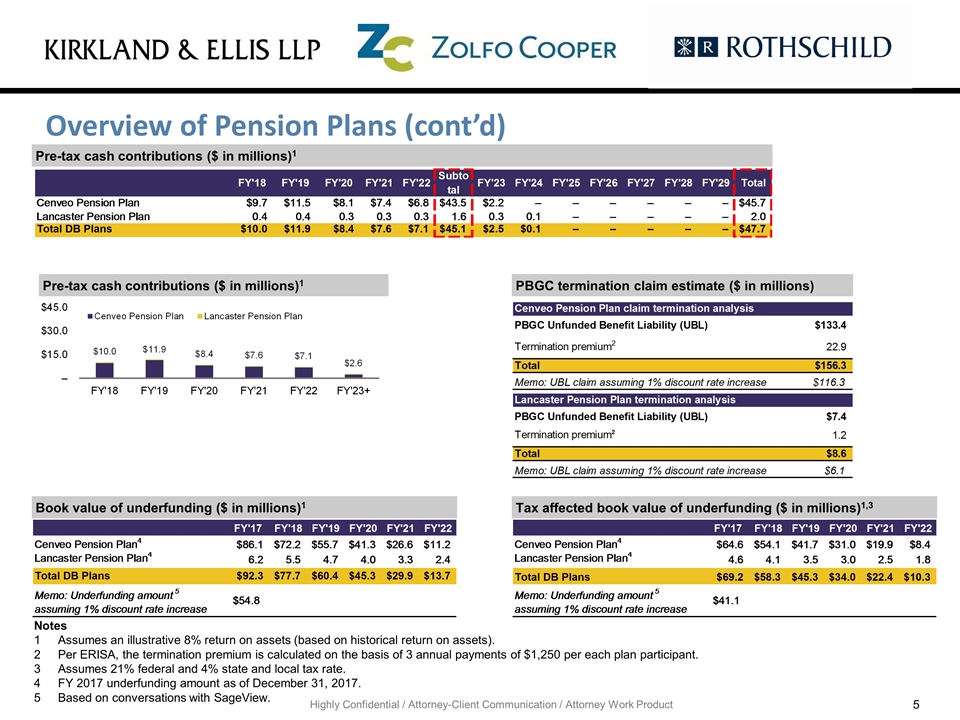

Overview of Pension Plans (cont’d) Highly Confidential / Attorney-Client Communication / Attorney Work Product Pre-tax cash contributions ($ in millions)1 Pre-tax cash contributions ($ in millions)1 Tax affected book value of underfunding ($ in millions)1,3 PBGC termination claim estimate ($ in millions) Notes Assumes an illustrative 8% return on assets (based on historical return on assets). Per ERISA, the termination premium is calculated on the basis of 3 annual payments of $1,250 per each plan participant. Assumes 21% federal and 4% state and local tax rate. FY 2017 underfunding amount as of December 31, 2017. Based on conversations with SageView. Book value of underfunding ($ in millions)1

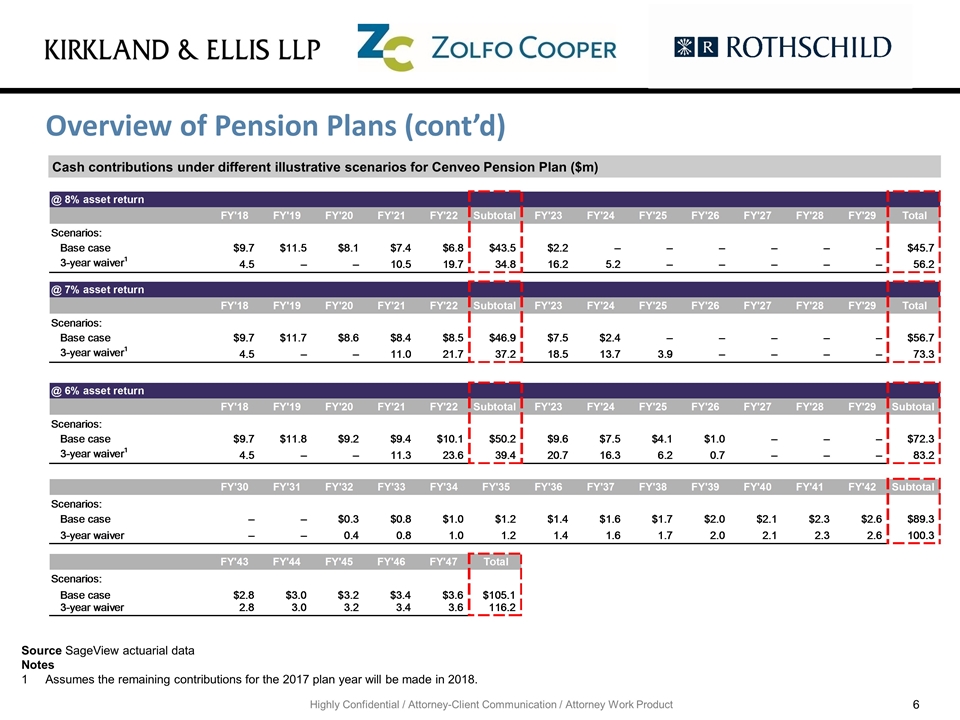

Overview of Pension Plans (cont’d) Highly Confidential / Attorney-Client Communication / Attorney Work Product Cash contributions under different illustrative scenarios for Cenveo Pension Plan ($m) Source SageView actuarial data Notes Assumes the remaining contributions for the 2017 plan year will be made in 2018.

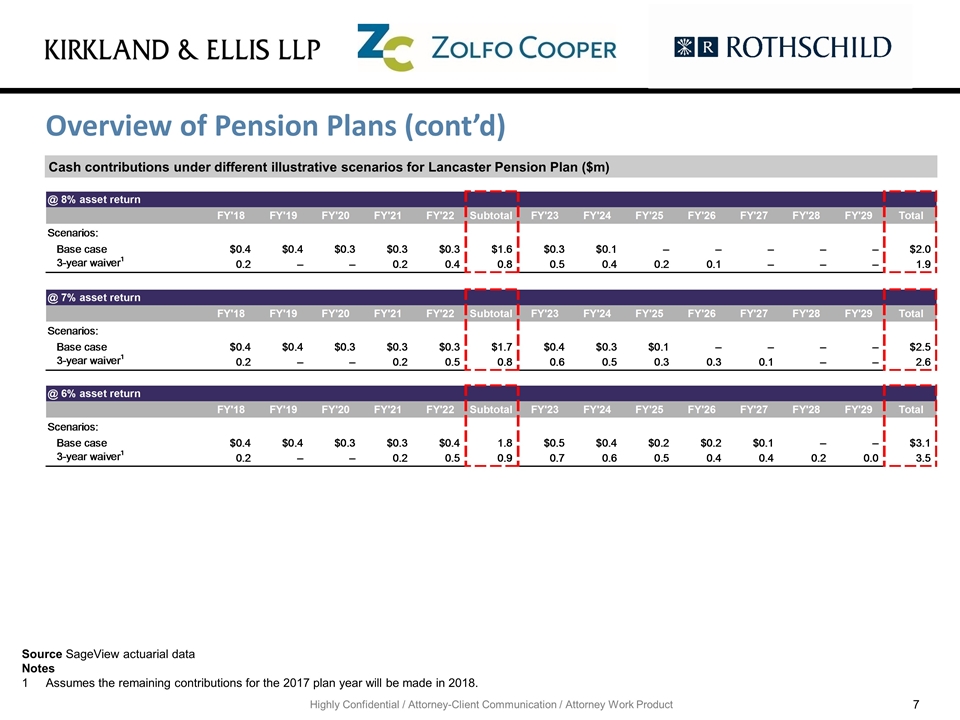

Overview of Pension Plans (cont’d) Highly Confidential / Attorney-Client Communication / Attorney Work Product 1 Cash contributions under different illustrative scenarios for Lancaster Pension Plan ($m) Source SageView actuarial data Notes Assumes the remaining contributions for the 2017 plan year will be made in 2018.

Upon termination, PBGC will likely assert four claims in the event of a termination: unfunded benefit liability claim; unpaid MFCs; unpaid insurance premiums; and Deficit Reduction Act Termination Premiums (“DRA Termination Premiums”), which is $1,250 per plan participant, payable every year for three years after the debtor’s emergence from chapter 11.1 Cenveo Pension Plan: $7,635,000 annually for three years (approximately $22,905,000 total) Lancaster Pension Plan: $407,500 annually for three years (approximately $1,222,500 total) Highly Confidential / Attorney-Client Communication / Attorney Work Product 1 See 29 U.S.C. § 1306(a)(7)(A).

Disclaimer Nothing contained in these materials is intended or should be construed as an admission or stipulation of the validity or treatment of any claim against the Company, any assertion made therein or herein, or a waiver of the Company's rights to dispute any claim or assert any cause of action or defense against any party. The Company’s security holders are cautioned that trading in debt or other securities of the Company during the pendency of the chapter 11 Cases will be highly speculative and will pose substantial risks. It is possible some or all of the Company’s currently outstanding debt or other securities may be cancelled and extinguished upon confirmation of a restructuring plan by the Bankruptcy Court. In such an event, the Company’s security holders would not be entitled to receive or retain any cash, debt or other securities or other property on account of their cancelled debt or other securities. Trading prices for the Company’s debt or other securities may bear little or no relation to actual recovery, if any, by holders thereof in the Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its debt or other securities. Certain statements included in this presentation are not historical facts but are forward-looking statements. Forward-looking statements generally are accompanied by words such as “may”, “should”, “would”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “seem”, “seek”, “continue”, “future”, “will”, “expect”, “outlook” or other similar words, phrases or expressions. These forward-looking statements include statements regarding future events and other statements that are not historical facts. These statements are based on the current expectations of the company and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding the company’s business, and actual results may differ materially. These risks and uncertainties include and those factors discussed under the heading “Risk Factors” in the company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 23, 2017. In addition, forward-looking statements provide the company’s expectations, plans or forecasts of future events and views as of the date of this communication. The company anticipates that subsequent events and developments may cause its assessments to change. These forward-looking statements should not be relied upon as representing the company’s assessments as of any date subsequent to the date of this presentation. Highly Confidential / Attorney-Client Communication / Attorney Work Product