Attached files

| file | filename |

|---|---|

| EX-31.1 - CENVEO, INC | ex31p1.htm |

| EX-23.2 - CENVEO, INC | ex23p2.htm |

| EX-32.1 - CENVEO, INC | ex32p1.htm |

| EX-32.2 - CENVEO, INC | ex32p2.htm |

| EX-4.28 - CENVEO, INC | ex4p28.htm |

| EX-21.1 - CENVEO, INC | ex21p1.htm |

| EX-23.1 - CENVEO, INC | ex23p1.htm |

| EX-4.29 - CENVEO, INC | ex4p29.htm |

| EX-31.2 - CENVEO, INC | ex31p2.htm |

| EX-10.20 - CENVEO, INC | ex10p20.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the fiscal year ended January 2, 2010

Commission

file number 1-12551

CENVEO,

INC.

(Exact

name of Registrant as specified in its charter.)

|

COLORADO

|

84-1250533

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer Identification No.)

|

|

ONE

CANTERBURY GREEN

201

BROAD STREET

|

|

|

STAMFORD,

CT

|

06901

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

203-595-3000

|

|

|

(Registrant’s

telephone number, including area

code)

|

|

Securities

Registered Pursuant to Section 12(b) of the Act:

|

Title of Each

Class

|

Name of Each Exchange on Which

Registered

|

|

Common

Stock, par value $0.01 per share

|

New

York Stock Exchange

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the Registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of

the Exchange Act. Large accelerated filer o Accelerated

filer x Non-accelerated

filer o Smaller reporting

company o

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes o No x

As of

June 27, 2009, the aggregate market value of the registrant’s common stock held

by non-affiliates of the registrant was $220,623,115 based on the closing sale

price as reported on the New York Stock Exchange.

As of

March 1, 2010, the registrant had 62,152,220 shares of common stock, par value

$0.01 per share, outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

Certain

information required by Part II (Item 5) and Part III of this form (Items 11,

12, 13 and 14, and part of Item 10) is incorporated by reference from the

Registrant’s Proxy Statement to be filed pursuant to Regulation 14A with respect

to the Registrant’s Annual Meeting of Shareholders to be held on or about May 5,

2010.

TABLE

OF CONTENTS

|

PART

I

|

|||

|

PAGE

|

|||

|

1

|

|||

|

7

|

|||

|

11

|

|||

|

11

|

|||

|

11

|

|||

|

PART

II

|

|||

|

12

|

|||

|

14

|

|||

|

15

|

|||

|

29

|

|||

|

30

|

|||

|

82

|

|||

|

82

|

|||

|

84

|

|||

|

PART

III

|

|||

|

84

|

|||

|

84

|

|||

|

84

|

|||

|

84

|

|||

|

84

|

|||

|

PART

IV

|

|||

|

84

|

PART

I

The

Company

Overview

We are

one of the largest diversified printing companies in North America, according to

the December 2009 Printing Impressions 400 report. Our broad portfolio of

products includes forms and labels manufacturing, packaging and publisher

offerings, envelope production and commercial printing. We operate a global

network of strategically located printing and manufacturing, fulfillment and

distribution facilities, which we refer to as manufacturing facilities, serving

a diverse base of over 100,000 customers. Since 2005, when current senior

management joined the Company, we have significantly improved profitability by

consolidating and closing plants, centralizing and leveraging our purchasing

spend, seeking operational efficiencies, and reducing corporate and field staff.

In addition, we have made investments in our businesses through acquisitions of

highly complementary companies and capital expenditures, while also divesting

non-strategic businesses. We are the successor to Mail-Well, Inc. and

were re-incorporated in Colorado in 1997.

We

operate our business in two complementary segments: envelopes, forms and labels

and commercial printing.

Envelopes,

Forms and Labels

Our

envelopes, forms and labels segment operates 35 manufacturing facilities in

North America. In 2009, we added to our envelopes, forms and labels business

with the acquisition of Nashua Corporation, which we refer to as Nashua.

Envelopes, forms and labels had net sales of $819.4 million, $916.1 million and

$897.7 million and operating income (loss) of $77.2 million, $(41.0) million and

$117.3 million, in 2009, 2008 and 2007, respectively. Total assets for

envelopes, forms and labels were $689.5 million, $624.8 million and $833.3

million, as of January 2, 2010, January 3, 2009 and December 29, 2007,

respectively.

On

September 15, 2009, we acquired all of the stock of Nashua, a manufacturer,

converter and marketer of labels and specialty papers, whose primary products

include pressure-sensitive labels, tags, transaction and financial receipts,

thermal and other coated papers, and wide-format papers. Prior to our

acquisition, Nashua had annual revenues of approximately $265 million. The total

consideration in connection with the Nashua acquisition, net of cash acquired of

$1.0 million, was $49.7 million, comprised of cash consideration of $4.2 million

and non-cash consideration of $45.5 million, primarily relating to the issuance

of approximately 7.0 million shares of Cenveo common stock, which closed on the

New York Stock Exchange at $6.53 on the date of acquisition. The combined

company is one of the largest manufacturers of pharmaceutical and scale labels

in North America, serving customers in the pharmacy, retail, and grocery

markets, as well as a leader in the point of sale and wide-format printing

markets.

Commercial

Printing

Our

commercial printing segment operates 35 manufacturing facilities in the United

States, Canada, Latin America and Asia. In 2008, we expanded our commercial

printing business with the acquisition of Rex Corporation and its manufacturing

facility, which we refer to as Rex. Commercial printing had net sales of $895.2

million, $1.2 billion and $1.1 billion and operating income (loss) of $(6.4)

million, $(136.8) million and $55.1 million in 2009, 2008 and 2007,

respectively. Total assets for commercial printing were $776.6 million, $863.2

million and $1.1 billion, as of January 2, 2010, January 3, 2009 and December

29, 2007, respectively.

Our

Products and Services

Segment

Overview

Envelopes, Forms and

Labels. We are the

largest North American prescription labels manufacturer for retail pharmacy

chains, a leading forms and labels provider, and one of the largest North

American envelope manufacturers. Our envelopes, forms and labels segment

represented approximately 48% of our net sales for the year ended January 2,

2010, primarily specializing in the design, manufacturing and printing

of:

1

|

|

·

|

Custom

labels and specialty forms;

|

|

|

·

|

Stock

envelopes, labels and business forms;

and

|

|

|

·

|

Direct

mail and customized envelopes developed for advertising, billing and

remittance.

|

Our

envelopes, forms and labels segment serves customers ranging from Fortune 50

companies to middle market and small companies serving niche markets. We produce

pressure-sensitive prescription labels for the retail pharmacy chain market. We

print a diverse line of custom labels and specialty forms for a broad range of

industries including manufacturing, warehousing, packaging, food and beverage,

and health and beauty, which we sell through extensive networks within the

resale channels. We supply a diverse line of custom products for our

small and mid-size business forms and labels customers, including both

traditional and specialty forms and labels for use with desktop PCs and laser

printers. We also provide direct mail and overnight packaging labels, food and

beverage labels, and shelf and scale labels for national and regional customer

accounts. Our printed office products include business documents, specialty

documents and short-run secondary labels, which are made of paper or film,

affixed with pressure sensitive adhesive and are used for mailing, messaging,

bar coding and other applications by large through smaller-sized customers

across a wide spectrum of industries. We produce a broad line of stock

envelopes, labels and traditional business forms that are sold through

independent distributors, contract stationers, national catalogs for the office

products market, office products superstores and quick printers. We also offer

direct mail products used for customer solicitations and custom envelopes used

for billing and remittance by end users including banks, brokerage firms and

credit card companies in addition to a broad group of other customers in various

industries.

Commercial Printing. We are one of the leading

commercial printing companies in North America and one of the largest providers

of end-to-end, content management solutions to scientific, technical and medical

journals, which we refer to as STM journals. Our commercial printing segment

represented approximately 52% of our net sales for the year ended January 2,

2010, providing one-stop print, design, content management fulfillment and

distribution offerings, including:

|

|

·

|

Specialty

packaging and high quality promotional materials for multinational

consumer products companies;

|

|

|

·

|

STM

journals, special interest and trade magazines for not-for-profit

organizations, educational institutions and specialty

publishers;

|

|

|

·

|

High-end

color printing of a wide range of premium products for major national and

regional customers; and

|

|

|

·

|

General

commercial printing products for regional and local

customers.

|

Our

commercial printing segment primarily caters to the consumer products,

pharmaceutical, financial services, publishing, and telecommunications

industries, with customers ranging from Fortune 50 companies to middle market

and small companies operating in niche markets. We provide a wide

array of commercial print offerings to our customers including electronic

prepress, digital asset archiving, direct-to-plate technology, high-quality

color printing on web and sheet-fed presses and digital printing. The broad

selection of commercial printing products we produce also includes specialty

packaging, journals and specialized periodicals, annual reports, car brochures,

direct mail products, advertising literature, corporate identity materials,

financial printing, books, directories, calendars, brand marketing materials,

catalogs, and maps. In our journal and specialty magazine business,

we offer complete solutions, including editing, content processing, content

management, electronic peer review, production, distribution and reprint

marketing. Our primary customers for our specialty packaging and promotional

products are pharmaceutical, apparel, tobacco and other large multi-national

consumer product companies.

The

primary methods of distribution of the principal products for our two segments

are by direct shipment via express mail, the U.S. postal system and freight

carriers.

Our

Business Strategy

Our goals

are to improve on profitability and pursue disciplined growth. The principal

features of our strategy are:

Improve our Cost Structure and

Profitability. We

regularly assess our operations with a view toward eliminating operations that

are not aligned with our core United States operations or are underperforming.

In September 2005, we established a goal of reducing annual operating expenses

through, among other things, consolidating our purchasing activities and

manufacturing platform, reducing corporate and field human resources,

streamlining information technology infrastructure and eliminating discretionary

spending. We achieved our cost-savings goal, which we refer to as our 2005 Plan,

before the end of 2007. In 2007 we initiated activities, which we refer to as

the 2007 Plan, in connection with our 2007 acquisitions of Commercial Envelope

Manufacturing Co. Inc., which we refer to as Commercial Envelope, Madison/Graham

ColorGraphics, Inc., which we refer to as ColorGraphics, Cadmus Communications

Corporation, which we refer to as

2

Cadmus,

and PC Ink Corp., which we refer to as Printegra and collectively with

Commercial Envelope, ColorGraphics and Cadmus, which we refer to as the 2007

Acquisitions. Under the 2007 Plan, we closed seven manufacturing facilities and

integrated those operations into acquired and existing operations.

In the

first quarter of 2009, we implemented our 2009 cost savings and restructuring

plan, which we refer to as the 2009 Plan, to reduce our operating costs and

realign our manufacturing platform in order to compete effectively during the

current economic downturn. In connection with the 2009 Plan, we implemented cost

savings initiatives throughout our operations by closing three envelope plants,

one journal printing plant, one content facility, two commercial printing plants

and a forms plant and consolidating them into existing operations while

continuing the consolidation of certain back office functions into specific

centralized locations. As a result of these 2009 actions, we reduced our

headcount by approximately 1,700. We expect to have substantially completed

these cost savings initiatives by the end of the first quarter of 2010. In

total, we took actions that resulted in significant cost savings in 2009 that

have aided us in weathering the recession and positioning us better for the

future. We expect further initiatives to improve our profitability including

additional cost-savings in connection with ongoing operations, completed

acquisitions and any future acquisitions. We continue to evaluate the sale or

closure of manufacturing facilities that do not align with our strategic goals

or meet our performance targets.

Capitalize on Scale

Advantages. We

believe there are significant advantages to being a large competitor in a highly

fragmented industry. We seek to capitalize on our size, geographic footprint and

broad product lines to offer one-stop shopping and enhance our overall value to

our customers. As we grow in scale and increase our operating leverage, we seek

to realize better profit margins through operational improvements in our

manufacturing platform.

Enhance the Supply Chain. We

continue to work with our core suppliers to improve all aspects of our

purchasing spend and other logistical capabilities as well as to ensure a stable

source of supply. We seek to lower costs through more favorable pricing and

payment terms, more effective inventory management and improved communications

with vendors. We continue to consolidate our suppliers of key production inputs

such as paper and ink, and believe that significant opportunities exist in

optimizing the rest of our supply chain. Such opportunities that still exist

include, but are not limited to: (i) consolidating our packaging suppliers,

specifically carton, film and tape, to maximize our purchasing spend with a

smaller supplier base, (ii) reducing warehousing-related costs through

better inventory management, and (iii) increasing operating results through

better waste by-product capture and return to recycling vendors.

Seek Product and Processing

Improvements. We

conduct regular reviews of our product offerings, manufacturing processes and

distribution methods to ensure that we take advantage of new technology when

practical and meet the changing needs of our customers and the demands of a

global economy. We actively explore potential new product opportunities for

expansion, particularly in market sectors that are expected to grow at a faster

pace than the broader commercial printing industry. We also strive to enter into

new markets in which we may have competitive advantages based on our existing

infrastructure, operating expertise and customer relationships. Pharmaceutical

labels, direct mail and specialty packaging are examples of product niche

markets with opportunities for faster growth into which we recently expanded or

entered. We are also investing in promising digital and variable print

technology as we see demand from our customers increasing. By expanding our

products offerings, we intend to increase cross-selling opportunities to our

existing customer base and mitigate the impact of any decline in a given

market.

Pursue Strategic

Acquisitions. We

continue to selectively review opportunities to expand within growing niche

markets, broaden our product offerings and increase our economies of scale

through acquisitions. We intend to continue practicing acquisition disciplines

and pursuing opportunities for greater expected profitability and cash flow or

improved operating efficiencies, such as increased utilization of our

manufacturing assets. Since July 2006, we have completed eight acquisitions that

we believe have and will continue to enhance our operating margins and deliver

economies of scale. We believe our acquisition strategy will allow us to both

realize increased revenue and cost-saving synergies, and apply our management

expertise to improve the operations of acquired entities. For example, our

acquisition of Nashua built upon our acquisition of Rx Technology Corporation,

which we refer to as Rx Technology. In July 2006, Rx Technology gave us entry

into and a leading market position in the pharmaceutical labels business. Nashua

further strengthened our position in the pharmaceutical labels market, while

giving us access to new shelf label market customers and allowing us to further

enhance our raw material purchasing power and rationalize our manufacturing

platform.

Our

Industry

The

United States printing industry is large and highly fragmented with just over

34,100 participants as reported in the second quarter 2009 United States

Department of Labor Quarterly Census of Employment and Wages. This is down from

approximately 36,100 participants in the second quarter of 2007. The Printing

Industries of America estimated 2008 aggregate shipment revenues for the

printing industry were in excess of $165 billion. The industry consists of a few

large companies with sales in excess of $1 billion, several mid-sized companies

with sales in excess of $100 million and thousands of smaller operations. These

printing businesses operate in a broad range of sectors, including commercial

printing,

3

envelopes,

forms and labels, specialty printing, trade publishing, and specialty packaging

among others. We estimate that in 2008 the ten largest North American commercial

printers by revenue, as reported in the Printing Impressions 400, represented

approximately 19% of total industry sales, while the market sectors in which we

primarily compete, as categorized in the 2008 PIA/GATF Print Market Atlas,

comprised approximately 70% of total industry sales.

Raw

Materials

The

primary materials used in our businesses are paper, ink, film, offset plates,

chemicals and cartons, with paper accounting for the majority of total material

costs. We purchase these materials from a number of key suppliers and

have not experienced any significant difficulties in obtaining the raw materials

necessary for our operations, though, in times of limited supply, we have

occasionally experienced minor delays in delivery. We believe that we

purchase our materials and supplies at competitive prices primarily due to the

size and scope of our purchasing power.

The

printing industry continues to experience pricing pressure related to increases

in the cost of materials used in the manufacture of our

products. Industry prices for most of the raw materials we use in our

business decreased during 2009 from 2008 pricing levels, primarily due to the

general economic downturn. We believe raw material pricing will increase in 2010

as we have received notifications of price increases in the fourth quarter of

2009 and in the first quarter of 2010.

While we

expect to continue to be able to pass along to our customers a substantial

portion of the raw material price increases, any price increase passed along

carries the risk of an offsetting decrease in demand for our

products.

Patents,

Trademarks and Trade Names

We market

products under a number of trademarks and trade names. We also hold or have

rights to use various patents relating to our businesses. Our patents

expire between 2011 and 2023 and our trademarks expire between 2010 and 2020.

Our sales do not materially depend upon any single patent or group of related

patents.

Competition

In

selling our printed labels and business forms products, we compete with other

label and document print manufacturers with nationwide locations, and regional

and local printers that typically sell within a 100- to 300-mile radius of their

plants. Printed labels and business forms competition is based mainly on

quick-turn customization quality of products and customer service levels. In

selling our envelope products, we compete with a few multi-plant and many

single-plant companies that primarily service regional and local markets. The

state of the U.S. and global economy affect the needs and buying capacity of our

customers that in turn influence our sales volume. We also face competition from

alternative sources of communication and information transfer such as electronic

mail, the internet, interactive video disks, interactive television, electronic

retailing and facsimile machines. Although these sources of communication and

advertising may eliminate some domestic envelope sales in the future, we believe

that we will experience continued demand for envelope products due to: (i) the

ability of our customers to obtain a relatively low-cost information delivery

vehicle that may be customized with text, color, graphics and action devices to

achieve the desired presentation effect; (ii) the ability of our direct mail

customers to penetrate desired markets as a result of the widespread delivery of

mail to residences and businesses through the U.S. Postal Service; and (iii) the

ability of our direct mail customers to include return materials inside their

mailings. Principal competitive factors in the envelope business are quality,

service and price. Although all three are equally important, various customers

may emphasize one or more over the others.

Our

commercial printing segment provides offerings designed to give customers

complete solutions for communicating their messages to targeted audiences. The

commercial printing industry continues to have excess capacity and is highly

competitive in most of our product categories and geographic regions, while also

influenced by the current U.S. and global economic conditions. Competition is

based largely on price, quality and servicing the special needs of customers.

The additional excess capacity resulted in a competitive pricing environment, in

which companies have focused on reducing costs in order to preserve operating

margins. We believe this environment will continue to lead to more consolidation

within the commercial print industry as companies seek economies of scale,

broader customer relationships, geographic coverage and product breadth to

overcome or offset excess industry capacity and pricing pressures.

4

Seasonality

Our

general labels business has historically experienced a seasonal increase during

the first and second quarters of the year primarily resulting from the release

of our product catalogs to the trade channel customers and our customers’ spring

advertising campaigns. Our prescription label business has historically

experienced seasonality in its sales due to cold and flu seasons generally

concentrated in the fourth and first quarters of the year. Our documents

businesses have historically experienced higher volume in the fourth quarter,

primarily resulting from tax forms and related documents. Our envelopes market

and certain segments of the direct mail market have historically experienced

seasonality with a higher percentage of volume of products sold to these markets

occurring during the fourth quarter of the year related to holiday purchases. As

a result of these seasonal variations, some of our envelopes, forms and labels

operations operate at or near capacity at certain times throughout the

year.

Our

commercial printing plants also experience seasonal variations. Revenues from

annual reports are generally concentrated from February through

April. Revenues associated with consumer publications, such as

holiday catalogs and automobile brochures; tend to be concentrated from July

through October. Revenues associated with the educational and scholarly market

and promotional materials tend to decline in the summer. As a result of these

seasonal variations, some of our commercial printing operations operate at or

near capacity at certain times throughout the year.

Backlog

At

January 2, 2010 and January 3, 2009, the backlog of customer orders to be

produced or shipped was approximately $87.1 million and $89.9 million,

respectively.

Employees

We

employed approximately 8,700 people worldwide as of January 2, 2010,

approximately 13% of whom were members of various local labor unions. Collective

bargaining agreements, each of which cover the workers at a particular facility,

expire from time to time and are negotiated separately. Accordingly, we believe

that no single collective bargaining agreement is material to our operations as

a whole.

Environmental

Regulations

Our

operations are subject to federal, state, local and foreign environmental laws

and regulations including those relating to air emissions; waste generation,

handling, management and disposal, and remediation of contaminated sites. We

have implemented environmental programs designed to ensure that we operate in

compliance with the applicable laws and regulations governing environmental

protection. Our policy is that management at all levels be aware of the

environmental impact of operations and direct such operations in compliance with

applicable standards. We believe that we are in substantial compliance with

applicable laws and regulations relating to environmental protection. We do not

anticipate that material capital expenditures will be required to achieve or

maintain compliance with environmental laws and regulations. However, there can

be no assurance that newly discovered conditions, or new laws and regulations or

stricter interpretations of existing laws and regulations, could result in

increased compliance or remediation costs.

Prior to

the acquisition, Nashua was involved in certain environmental matters and was

designated by the Environmental Protection Agency, which we refer to as the EPA,

as a potentially responsible party for certain hazardous waste sites. In

addition, Nashua had been notified by certain state environmental agencies that

Nashua may bear responsibility for remedial action at other sites which have not

been addressed by the EPA. The sites at which Nashua may have remedial

responsibilities are in various stages of investigation and remediation. Due to

the unique physical characteristics of each site, the remedial technology

employed, the extended timeframes of each remediation, the interpretation of

applicable laws and regulations and the financial viability of other potential

participants, our ultimate cost of remediation is an estimate and is contingent

on these factors. As of January 2, 2010, the liability relating to Nashua’s

environmental matters was $3.6 million and is included in other long-term

liabilities on our consolidated balance sheet. Based on information currently

available, we believe that Nashua’s remediation expense, if any, is not likely

to have a material adverse effect on our consolidated financial position or

results of operations. In an effort to mitigate any pre-acquisition

environmental matters related to Nashua, we purchased an environmental insurance

policy providing coverage for a ten year period subsequent to the date of

acquisition.

5

Executive

Officers

The

following presents a list of our executive officers, their age, prior and

present positions, the year elected to their present position and other

positions they have held during the past five years. No family

relationships exist among any of the executive officers named, nor is there any

undisclosed arrangement or understanding pursuant to which any person was

selected as an officer. This information is presented as of the date of the Form

10-K filing.

|

Name

|

|

Age

|

Position

|

|

Year

Elected

to

Present

Position

|

|

| Robert G. Burton, Sr. |

69

|

Chairman

and Chief Executive Officer

|

2005

|

|||

|

Mark

S. Hiltwein

|

46

|

Chief

Financial Officer

|

2007

|

|||

|

Dean

Cherry

|

49

|

President,

Envelope Operations

|

2008

|

|||

|

Harry

Vinson

|

49

|

President,

Publisher Services, Commercial Print and Packaging

Operations

|

2007

|

|||

|

Timothy

M. Davis

|

55

|

Senior

Vice President, General Counsel and Secretary

|

2006

|

|||

Robert G.

Burton, Sr. Mr. Burton, 69,

has been Cenveo’s Chairman and Chief Executive Officer since September 2005. In

January 2003, he formed Burton Capital Management, LLC, a company that invests

in manufacturing companies, and has been its Chairman, Chief Executive Officer

and sole managing member since its formation. From December 2000 through

December 2002, Mr. Burton was the Chairman, President and Chief Executive

Officer of Moore Corporation Limited, a leading printing company with over $2.0

billion in revenue for fiscal year 2002. Preceding his employment at

Moore, Mr. Burton was Chairman, President, and Chief Executive Officer of Walter

Industries, Inc., a diversified holding company. From April 1991

through October 1999, he was the Chairman, President and Chief Executive Officer

of World Color Press, Inc., a $3.0 billion diversified printing company. From

1981 through 1991, he held a series of senior executive positions at Capital

Cities/ABC, including President of ABC Publishing. Mr. Burton was

also employed for 10 years as a senior executive of SRA, the publishing division

of IBM.

Mark S.

Hiltwein Mr. Hiltwein, 46, has served as Cenveo’s Chief Financial Officer

since December 2009 and was Chief Financial Officer from July 2007 to June

2009. From June 2009 to December 2009, Mr. Hiltwein served as

Cenveo’s President and Field Sales Manager. From July 2005 to July

2007, he was President of Smartshipper.com, an online third party logistics

company. From February 2002 through July 2005, Mr. Hiltwein was

Executive Vice President and Chief Financial Officer of Moore Wallace

Incorporated, a $3.5 billion printing company. Prior to that, he

served as Senior Vice President and Controller from December 2000 to February

2002. Mr. Hiltwein has served in a number of financial positions from

1992 through 2000 with L.P. Thebault Company, a commercial printing company,

including Chief Financial Officer from 1997 through 2000. Mr.

Hiltwein began his career at Mortenson and Associates, a regional public

accounting firm where he held various positions in the audit department. He is a

CPA.

Dean E.

Cherry Mr. Cherry, 49, reassumed the position of Cenveo’s President

Envelope Operations in February 2010. From June 2009 through January 2010, he

served as Executive Vice President. From June 2008 through June 2009, Mr. Cherry

served as President of our Envelope, Commercial Print and Packaging Operations.

From February 1, 2008 to June 1, 2008, he was our President of Envelope

Operations. Since October 2006, Mr. Cherry was a private investor in

Renovatio Ventures, LLC. From 2004 to 2006, he was Group President of

Short-Run Commercial, and Group President of Integrated Print Communications and

Global Solutions, a $4.5 billion division of RR Donnelley & Sons, Inc. In

this position, Mr. Cherry had global P&L responsibility for Direct Mail,

Commercial Print, Global Capital Markets, Business Communication Services, Forms

and Labels, Astron (outsourcing) and Latin America. From 2001 to

2004, he held the positions of President, International and Subsidiary

Operations and President, Commercial and Subsidiary Operations, for Moore

Corporation Limited, a division of RR Donnelley. From 1991 to 1998 he held the

following positions at World Color Press, Inc.: 1991 to 1993 Vice

President, Operations; 1993 to 1994 Vice President, Regional Plant Manager; 1994

to 1996 Executive Vice President and Senior Vice President, Operations; 1997 to

1998 Executive Vice President, Investor Relations and Corporate

Communications. From 1985 to 1991, he held various financial

positions at Capital Cities/ABC Publishing division including Vice President,

Finance and Operations. Mr. Cherry is a member of University’s Dean’s

Advisory Council for the College of Business of Murray State University, and a

Trustee for the Murray State University Foundation.

Harry R.

Vinson Mr. Vinson, 49, has served as Cenveo’s President

Commercial Print, Packaging and Cadmus Publisher Services Group since October of

2009. Most recently, in October of 2009, he took on the added

responsibility of Cenveo’s Commercial Print Group after having the Global

Packaging Group responsibility added in December of 2008. From March

to December of 2007, Mr. Vinson was Cenveo’s Executive Vice President of the

Cadmus Publisher Services Group. Prior to his role at Cadmus

Publisher Services Group, Mr. Vinson was Cenveo’s Senior Vice President,

Purchasing and Logistics from September 2005 to March 2007. From

October 2003 until September 2005, he was the General Manager of

Central Region Sheetfed Operations of MAN Roland, a printing press

manufacturer. From February 2002 until July 2003, Mr. Vinson served

as Senior Vice President and General Manager of the Publication and Directory

Group at Moore Wallace (formerly Moore Corporation Limited). From

February 1990 until February 2002, he served in various senior sales positions

at Quebecor World (formerly World Color Press).

6

Timothy M.

Davis Mr. Davis, 55, has served as Cenveo’s Senior Vice

President, General Counsel and Secretary since January 2006. From July 1989

until he joined the Company, he was Senior Vice President, General Counsel and

Secretary of American Color Graphics, Inc., a commercial printing

company.

Cautionary

Statements

Certain

statements in this report, particularly statements found in “Risk Factors,”

“Business” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” may constitute “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. In addition, we

or our representatives have made or continue to make forward-looking statements,

orally or in writing, in other contexts. These forward-looking statements

generally can be identified by the use of terminology such as “may,” “will,”

“expect,” “intend,” “estimate,” “anticipate,” “plan,” “foresee,” “believe” or

“continue” and similar expressions, or as other statements that do not relate

solely to historical facts. These statements are not guarantees of future

performance and involve risks, uncertainties and assumptions that are difficult

to predict or quantify. Management believes these statements to be reasonable

when made. However, actual outcomes and results may differ materially from what

is expressed or forecasted in these forward-looking statements. As a result,

these statements speak only as of the date they were made. We undertake no

obligation to publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise. In view of such

uncertainties, investors should not place undue reliance on our forward-looking

statements.

Such

forward-looking statements involve known and unknown risks, including, but not

limited to, those identified in Item 1A. Risk Factors along with changes in

general economic, business and labor conditions. More information regarding

these and other risks can be found below under “Risk Factors,” “Business,”

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and other sections of this report.

Available

Information

Our

Internet address is: www.cenveo.com. References to our website address do not

constitute incorporation by reference of the information contained on the

website, and the information contained on the website is not part of this

document. We make available free of charge through our website our annual report

on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and

amendments to those reports filed pursuant to Section 13(a) or 15(d) of the

Exchange Act as soon as reasonably practicable after such documents are filed

electronically with the Securities and Exchange Commission, which we refer to as

the SEC. Our Code of Business Conduct and Ethics is also posted on our website.

In addition, our earnings conference calls are archived for replay on our

website, and presentations to securities analysts are also included on our

website. In June 2009, we submitted to the New York Stock Exchange a certificate

of our Chief Executive Officer certifying that he is not aware of any violation

by us of New York Stock Exchange corporate governance listing standards. We also

filed as exhibits to our annual reports on Form 10-K and Form 10-K/A for the

fiscal year ended January 3, 2009 certificates of the Chief Executive Officer

and Chief Financial Officer as required under Section 302 of the Sarbanes-Oxley

Act.

The

public may read and copy any materials we file with the SEC at the SEC’s Public

Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may

obtain information about the operation of the Public Reference Room by calling

the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy

and information statements and other information regarding issuers that file

electronically with the SEC.

Many of

the factors that affect our business and operations involve risks and

uncertainties. The factors described below are some of the risks that could

materially harm our business, financial conditions, results of operations or

prospects.

The

recent U.S. and global economic conditions have adversely affected us and could

continue to do so.

The

current U.S. and global economic conditions have affected and, most likely, will

continue to affect our results of operations and financial position. A

significant part of our business relies on our customers’ printing spend. A

prolonged downturn in the U.S. and global economy and an uncertain economic

outlook has reduced the demand for printed materials and related offerings that

we provide our customers. Consequently, the reductions and delays in our

customers’ spending have adversely impacted and could continue to adversely

impact our results of operations, financial position and cash flows. We believe

the current economic downturn will result in decreased net sales, operating

income and earnings while also impacting our ability to manage our inventory and

customer receivables. The downturn may also result in increased restructuring

and related charges, impairments relating to goodwill, intangible assets and

other long-lived assets, and write-offs associated with inventories or customer

receivables. These uncertainties about future economic conditions in a very

challenging environment also make it difficult for us to forecast our operating

results and make timely decisions about future investments.

7

Our

substantial level of indebtedness could impair our financial condition and

prevent us from fulfilling our business obligations.

We

currently have a substantial amount of debt, which requires significant

principal and interest payments. As of January 2, 2010, our total

indebtedness was approximately $1.2 billion. Our level of

indebtedness could affect our future operations, for example by:

|

|

·

|

requiring

a substantial portion of our cash flow from operations to be dedicated to

the payment of principal and interest on indebtedness instead of funding

working capital, capital expenditures, acquisitions and other business

purposes;

|

|

|

·

|

making

it more difficult for us to satisfy all of our debt obligations, thereby

increasing the risk of triggering a cross-default

provision;

|

|

|

·

|

increasing

our vulnerability to economic downturns or other adverse developments

relative to less leveraged

competitors;

|

|

|

·

|

limiting

our ability to obtain additional financing for working capital, capital

expenditures, acquisitions or other corporate purposes in the future;

and

|

|

|

·

|

increasing

our cost of borrowing to satisfy business

needs.

|

We

may be unable to service or refinance our debt.

Our

ability to make scheduled payments on, or to reduce or refinance, our

indebtedness will depend on our future financial and operating performance, and

prevailing market conditions. Our future performance will be affected by the

impact of general economic, financial, competitive and other factors beyond our

control, including the availability of financing in the banking and capital

markets. We cannot be certain that our business will generate sufficient cash

flow from operations in an amount necessary to service our debt. If

we are unable to meet our debt obligations or to fund our other liquidity needs,

we will be required to restructure or refinance all or a portion of our debt to

avoid defaulting on our debt obligations or to meet other business

needs. Such a refinancing of our indebtedness could result in higher

interest rates, could require us to comply with more onerous covenants that

further restrict our business operations, could be restricted by another of our

debt instruments outstanding, or refinancing opportunities may not be available

at all.

The

terms of our indebtedness impose significant restrictions on our operating and

financial flexibility.

Our

senior subordinated and senior note indentures, and our recent senior second

lien note indenture, along with our senior secured credit facility agreement

contain various covenants that limit our ability to, among other

things:

|

|

·

|

incur

or guarantee additional

indebtedness;

|

|

|

·

|

make

restricted payments, including dividends and prepaying

indebtedness;

|

|

|

·

|

create

or permit certain liens;

|

|

|

·

|

enter

into business combinations and asset sale

transactions;

|

|

|

·

|

make

investments, including capital

expenditures;

|

|

|

·

|

amend

organizational documents and change accounting

methods;

|

|

|

·

|

enter

into transactions with affiliates;

and

|

|

|

·

|

enter

into new businesses.

|

These

restrictions could limit our ability to obtain future financing, make

acquisitions or incur needed capital expenditures, withstand a future downturn

in our business or the economy in general, conduct operations or otherwise take

advantage of business opportunities that may arise. Our senior secured credit

facility also contains a schedule of financial ratios including a minimum

interest coverage ratio that we must comply with on a quarterly basis, and

maximum first lien leverage and total leverage financial ratio that we must be

in compliance with at all times. Our ability to meet these financial ratios may

be affected by events beyond our control, such as further deterioration in

general economic conditions. We are also required to provide certain financial

information on a quarterly basis. Our failure to maintain applicable financial

ratios, in certain circumstances, or effective internal controls would prevent

us from borrowing additional amounts, and could result in a default under our

senior secured credit facility. A default could cause the indebtedness

outstanding under the senior secured credit facility and, by reason of

cross-acceleration or cross-default provisions, the senior subordinated, senior

and senior second lien notes and any other indebtedness we may then have, to

become immediately due and payable. If we are unable to repay those amounts, the

lenders under our senior secured credit facility and senior second lien

indenture could initiate a bankruptcy proceeding or liquidation proceeding, or

proceed against the collateral granted to them which secures that indebtedness.

If the lenders under our senior secured credit facility agreement and/or our

senior second lien indenture were to accelerate the repayment of outstanding

borrowings, we might not have sufficient assets to repay our

indebtedness.

8

There

are additional borrowings available to us that could further exacerbate our risk

exposure from debt.

Despite

current indebtedness levels, we may incur substantial additional indebtedness in

the future. Our senior secured credit facility and senior

subordinated, senior and senior second lien notes indentures and our other debt

instruments limit, but do not prohibit us from doing so. If we

incur additional debt above our current outstanding levels, the risks associated

with our substantial leverage would increase.

To

the extent that we make select acquisitions, we may not be able to successfully

integrate the acquired businesses into our business.

In the

past, we have grown rapidly through acquisitions. We intend to continue to

pursue select acquisition opportunities within the printing

industry. To the extent that we seek to pursue additional

acquisitions, we cannot be certain that target businesses will be available on

favorable terms or that, if we are able to acquire businesses on favorable

terms, we will be able to successfully integrate or profitably manage

them. Successfully integrating an acquisition involves minimizing

disruptions and efficiently managing substantial changes, some of which may be

beyond our control. An acquisition always carries the risk that such

changes, including to facility and equipment location, management and employee

base, policies, philosophies and procedures, could have unanticipated effects,

could require more resources than intended and could cause customers to

temporarily or permanently seek alternate suppliers. A failure to

realize acquisition synergies and savings could negatively impact the results of

both our acquired and existing operations.

A

decline in our consolidated expected profitability or profitability within one

of our individual reporting units could result in the impairment of assets,

including goodwill, other long-lived assets and deferred tax

assets.

We have

material amounts of goodwill, other long-lived assets and deferred tax assets on

our consolidated balance sheet. A decline in expected profitability,

particularly the impact of a continued decline in the U.S. and global economies,

could call into question the recoverability of our related goodwill, other

long-lived assets, or deferred tax assets and require us to write down or

write-off these assets or, in the case of deferred tax assets, recognize a

valuation allowance through a charge to income tax expense.

The

SEC has made informal requests for information from us and we cannot predict

whether the SEC will commence a formal investigation or take any other

action.

As

previously disclosed by us, during the fourth quarter of 2007, senior management

became aware of unsupported accounting entries that were recorded by a plant

controller who had responsibility for two of our envelope plants. As a result,

our audit committee initiated an internal review conducted by outside counsel

under the direction of the audit committee. The review concluded that the

accounting irregularities were isolated to those two envelope plants. As a

result, we recorded adjustments to restate our historical consolidated financial

statements for the year ended December 30, 2006 and interim periods in

2007, which decreased operating income in 2006 by approximately $2.3 million and

approximately $4.4 million in the first nine months of 2007. In connection with

these restatements and management’s evaluation of internal control over

financial reporting for 2007, we identified several internal control matters

that we believe were remediated. In connection with an informal inquiry,

commencing in September 2008, we briefed the staff of the SEC regarding the

facts surrounding our restatements and other matters. We cannot be sure of the

scope of or predict whether the SEC will take any action in connection with its

informal inquiry, and regardless of whether it ultimately leads to a formal SEC

investigation or action against us or any current or former employees, our

business (including our ability to complete financing transactions) or the

trading price of our securities may be adversely impacted.

Our

industry is highly competitive.

The

printing industry in which we compete is extremely fragmented and highly

competitive. In the commercial printing market, we compete against a

few large, diversified and financially stronger printing companies, as well as

smaller regional and local commercial printers, many of which are capable of

competing with us on volume, price and production quality. In the

envelope market, we compete primarily with a few multi-plant and many

single-plant companies servicing regional and local markets. In the

printed office products market, we compete primarily with document printers with

nationwide manufacturing locations and regional or local printers. We

believe there currently is excess capacity in the printing industry, which has

resulted in substantial price competition that may continue as customers put

product work out for competitive bid. We are constantly seeking ways

to reduce our costs, become more efficient and attract customers. We

cannot, however, be certain that these efforts will be successful, or that our

competitors will not be more successful in their similar efforts. If

we fail to reduce costs and increase productivity, or to meet customer demand

for new value-added products, services or technologies, we may face decreased

revenues and profit margins in markets where we encounter price competition,

which in turn could reduce our cash flow and profitability.

9

The

printing business we compete in generally does not have long-term customer

agreements, and our printing operations may be subject to quarterly and cyclical

fluctuations.

The

printing industry in which we compete is generally characterized by individual

orders from customers or short-term contracts. A significant portion

of our customers are not contractually obligated to purchase products or

services from us. Most customer orders are for specific printing

jobs, and repeat business largely depends on our customers’ satisfaction with

our work product. Although our business does not depend on any one

customer or group of customers, we cannot be sure that any particular customer

will continue to do business with us for any period of time. In addition, the

timing of particular jobs or types of jobs at particular times of year may cause

significant fluctuations in the operating results of our various printing

operations in any given quarter. We depend to some extent on sales to

certain industries, such as the financial services, advertising, pharmaceutical,

automotive and office products industries. To the extent these

industries experience downturns; the results of our operations may be adversely

affected.

Factors

affecting the U.S. Postal Service can impact demand for our

products.

Historically,

increases in postal rates have resulted in reductions in the volume of mail

sent, including direct mail, which is a meaningful portion of our envelope

volume. The U.S. Postal Service enacted such increases in May 2007,

May 2008 and 2009. As postal rate increases in the U.S. are outside our control,

we can provide no assurance that any future increases in U.S. postal rates will

not have a negative effect on the level of mail sent or the volume of envelopes

purchased. If such events were to occur, we may experience a decrease

in revenues and profitability.

The U.S.

Postal Service has also indicated the potential need to reduce delivery days

from six to five. We can provide no assurance that such a change

would not impact our customers’ decisions to use direct mail products, which may

in turn cause a decrease in our revenues and profitability.

Factors

other than postal rates that affect the volume of mail sent through the U.S.

postal system may also negatively affect our business. Congress enacted a

federal “Do Not Call” registry in response to consumer backlash against

telemarketers and is contemplating enacting so-called “anti-spam” legislation in

response to consumer complaints about unsolicited e-mail

advertisements. If similar legislation becomes enacted for direct

mail advertisers, our business could be adversely affected.

The

availability of the internet and other electronic media may adversely affect our

business.

Our

business is highly dependent upon the demand for envelopes sent through the

mail. Such demand comes from utility companies, banks and other

financial institutions, among other companies. Our printing business

also depends upon demand for printed advertising and business forms, among other

products. Consumers increasingly use the internet and other

electronic media to purchase goods and services, and for other purposes such as

paying utility and credit card bills. Advertisers use the internet

and other electronic media for targeted campaigns directed at specific

electronic user groups. Large and small businesses use electronic

media to conduct business, send invoices and collect bills. In

addition, companies have begun to deliver annual reports electronically rather

than in printed form, which could reduce demand for our high impact color

printing. Although other trends, such as the current growth of

targeted direct mail campaigns based upon mailing lists generated by electronic

purchases, may offset these declines in whole or in part, we cannot be certain

that the acceleration of the trend towards electronic media will not cause a

decrease in the demand for our products. If demand for our products

decreases, our cash flow or profitability could materially

decrease.

Increases

in paper costs and any decreases in the availability of paper could have a

material adverse effect on our business.

Paper

costs represent a significant portion of our cost of materials. Changes in paper

pricing generally do not affect the operating margins of our commercial printing

business because the transactional nature of the business allows us to pass on

most announced increases in paper prices to our customers. However, our ability

to pass on increases in paper price is dependent upon the competitive

environment at any given time. Paper pricing also affects the operating margins

of our envelopes, forms and labels business. We have historically been less

successful in immediately passing on such paper price increases due to several

factors, including contractual restrictions in certain cases, and the inability

to quickly update catalog prices in other instances. Moreover, rising paper

costs and their consequent impact on our pricing could lead to a decrease in

demand for our products.

10

We depend

on the availability of paper in manufacturing most of our

products. During periods of tight paper supply, many paper producers

allocate shipments of paper based on the historical purchase levels of

customers. In the past, we have occasionally experienced minor delays

in delivery. Any future delay in availability could negatively impact

our cash flow and profitability.

We

depend on good labor relations.

As of

January 2, 2010, we have approximately 8,700 employees worldwide, of which

approximately 13% of our employees are members of various local labor

unions. If our unionized employees were to engage in a concerted

strike or other work stoppage, or if other employees were to become unionized,

we could experience a disruption of operations, higher labor costs or

both. A lengthy strike could result in a material decrease in our

cash flow or profitability.

Environmental

laws may affect our business.

Our

operations are subject to federal, state, local and foreign environmental laws

and regulations, including those relating to air emissions, wastewater

discharge, waste generation, handling, management and disposal, and remediation

of contaminated sites. Currently unknown environmental conditions or

matters at our existing and prior facilities, new laws and regulations, or

stricter interpretations of existing laws and regulations could result in

increased compliance or remediation costs that, if substantial, could have a

material adverse effect on our business or operations in the

future.

We

are dependent on key management personnel.

Our

success will depend to a significant degree on our executive officers and other

key management personnel. We cannot be certain that we will be able

to retain our executive officers and key personnel, or attract additional

qualified management in the future. In addition, the success of any

acquisitions we may pursue may depend, in part, on our ability to retain

management personnel of the acquired companies. We do not carry key

person insurance on any of our managerial personnel.

None

We

currently occupy approximately 70 printing and manufacturing facilities,

primarily in North America, of which 23 are owned and 47 are leased. In addition

to on-site storage at these facilities, we store products in seven warehouses,

all of which are leased, and we have six leased sales offices. In 2009, we

ceased operations in nine facilities; two of which are available for sublease,

four of which were terminated, one is currently being sublet, one was sold and

one will be for sale. We lease 46,474 square feet of office space in Stamford,

Connecticut for our corporate headquarters. We believe that we have adequate

facilities for the conduct of our current and future operations.

From time

to time we may be involved in claims or lawsuits that arise in the ordinary

course of business. Accruals for claims or lawsuits have been provided for to

the extent that losses are deemed probable and estimable. Although the ultimate

outcome of these claims or lawsuits cannot be ascertained, on the basis of

present information and advice received from counsel, it is our opinion that the

disposition or ultimate determination of such claims or lawsuits will not have a

material adverse effect on our consolidated financial statements. In the case of

administrative proceedings related to environmental matters involving

governmental authorities, we do not believe that any imposition of monetary

damages or fines would be material.

11

PART

II

Cenveo’s

certificate of incorporation provides that the total authorized capital stock of

the Company is 100 million (100,000,000) shares of common stock, $0.01 par

value per share, which we refer to as Common Stock. Each share of voting Common

Stock is entitled to one vote in respect of each share of Cenveo voting Common

Stock held of record on all matters submitted to a vote of

stockholders.

Our

Common Stock is traded on the New York Stock Exchange, which we refer to as NYSE

under the symbol “CVO.” As of February 12, 2010, there were 491 shareholders of

record and, as of that date, we estimate that there were approximately 7,231

beneficial owners holding stock in nominee or “street” name. The following table

sets forth, for the periods indicated, the range of the intraday high and low

sales prices for our Common Stock as reported by the NYSE:

|

2009

|

High

|

Low

|

|||

|

First

Quarter

|

$

|

5.48

|

$

|

1.54

|

|

|

Second

Quarter

|

5.56

|

2.76

|

|||

|

Third

Quarter

|

7.20

|

3.60

|

|||

|

Fourth

Quarter

|

9.42

|

6.56

|

|||

|

2008

|

High

|

Low

|

|||

|

First

Quarter

|

$

|

18.16

|

$

|

9.66

|

|

|

Second

Quarter

|

13.04

|

9.21

|

|||

|

Third

Quarter

|

10.67

|

7.50

|

|||

|

Fourth

Quarter

|

7.76

|

2.24

|

|||

We have

not paid a dividend on our Common Stock since our incorporation and do not

anticipate paying dividends in the foreseeable future as the instruments

governing a significant portion of our debt obligations limit our ability to pay

Common Stock dividends.

See Note

11 to our consolidated financial statements included in Item 8 of this

Annual Report on Form 10-K for information regarding the Company’s stock

compensation plans. Compensation information required by Item II will be

presented in the Company’s 2010 definitive proxy statement, which is

incorporated herein by reference.

12

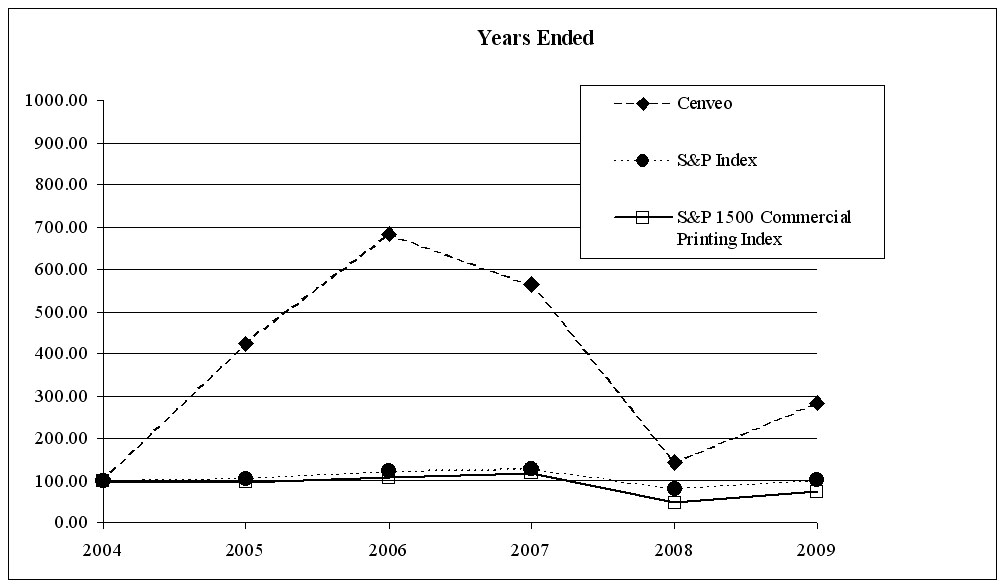

The graph

below compares five-year returns of our Common Stock with those of the S&P

500 Index, and the S&P 1500 Commercial Printing Index. The graph assumes

that $100 was invested as of December 2004 in each of our Common Stock, the

S&P 500 Index, and the S&P 1500 Commercial Printing Index and that all

dividends were reinvested. The S&P 1500 Commercial Printing Index is a

capitalization weighted index designed to measure the performance of all

NASDAQ-traded stocks in the commercial printing sector.

|

Years ended

|

|||||||

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

||

|

Cenveo

|

100.00

|

424.52

|

683.87

|

563.55

|

143.55

|

282.26

|

|

|

S&P

500 Index

|

100.00

|

104.83

|

121.20

|

127.87

|

81.12

|

102.15

|

|

|

S&P

1500 Commercial Printing Index

|

100.00

|

96.97

|

107.24

|

116.08

|

47.83

|

73.04

|

|

13

The

following table sets forth our selected financial and operating data for the

years ended January 2, 2010, January 3, 2009, December 29, 2007, December 30,

2006 and December 31, 2005.

The following consolidated selected financial data has been derived from, and should be read in conjunction with, the related consolidated financial statements, either elsewhere in this report or in reports we have previously filed with the SEC.

CENVEO,

INC. AND SUBSIDIARIES

(in

thousands, except per share data)

|

Years

Ended

|

||||||||||||||||

|

Statement

of Operations:

|

January

2,

2010

|

January

3,

2009

|

December

29, 2007

|

December

30, 2006

|

December

31, 2005

|

|||||||||||

|

Net

sales

|

$

|

1,714,631

|

$

|

2,098,694

|

$

|

2,046,716

|

$

|

1,511,224

|

$

|

1,594,781

|

||||||

|

Restructuring,

impairment and other

charges

|

68,034

|

399,066

|

(1)

|

40,086

|

41,096

|

77,254

|

||||||||||

|

Operating

income (loss)

|

32,188

|

(223,546

|

)

(1)

|

137,550

|

63,395

|

(26,310

|

)

|

|||||||||

|

(Gain)

loss on early extinguishment of

debt

|

(16,917

|

)

|

(14,642

|

)

|

9,256

|

32,744

|

—

|

|||||||||

|

Income

(loss) from continuing operations

|

(39,837

|

)

|

(296,976

|

)(2)

|

23,985

|

(11,148

|

)

|

(148,101

|

)

|

|||||||

|

Income

(loss) from discontinued operations,

net of taxes

|

8,898

|

(1,051

|

)

|

16,796

|

(3)

|

126,519

|

(4)

|

13,049

|

||||||||

|

Net

income (loss)

|

(30,939

|

)

|

(298,027

|

)(2)

|

40,781

|

(3)

|

115,371

|

(4)

|

(135,052

|

)

|

||||||

|

Income

(loss) per share from continuing operations:

|

||||||||||||||||

|

Basic

|

(0.70

|

)

|

(5.51

|

)

|

0.45

|

(0.21

|

)

|

(2.96

|

)

|

|||||||

|

Diluted

|

(0.70

|

)

|

(5.51

|

)

|

0.44

|

(0.21

|

)

|

(2.96

|

)

|

|||||||

|

Income

(loss) per share from discontinued operations:

|

||||||||||||||||

|

Basic

|

0.16

|

(0.02

|

)

|

0.31

|

2.38

|

0.26

|

||||||||||

|

Diluted

|

0.16

|

(0.02

|

)

|

0.31

|

2.38

|

0.26

|

||||||||||

|

Net

income (loss) per share:

|

||||||||||||||||

|

Basic

|

(0.54

|

)

|

(5.53

|

)

|

0.76

|

2.17

|

(2.70

|

)

|

||||||||

|

Diluted

|

(0.54

|

)

|

(5.53

|

)

|

0.75

|

2.17

|

(2.70

|

)

|

||||||||

|

Balance

Sheet data:

|

||||||||||||||||

|

Total

assets

|

1,525,773

|

1,552,114

|

2,002,722

|

999,892

|

1,079,564

|

|||||||||||

|

Total

long-term debt, including current maturities

|

1,233,917

|

1,306,355

|

1,444,637

|

675,295

|

812,136

|

|||||||||||

|

|

(1) Includes

$372.8 million pre-tax goodwill impairment

charges.

|

|

|

(2) Includes

$330.7 million goodwill impairment charges, net of tax benefit of $42.1

million.

|

|

|

(3) Includes

a $17.0 million gain on a disposal of discontinued operations, net of

taxes of $8.4 million.

|

|

|

(4) Includes

a $113.5 million gain on a disposal of discontinued operations, net of

taxes of $22.5 million.

|

14

This

Management’s Discussion and Analysis of Financial Condition and Results of

Operations, which we refer to as MD&A, of Cenveo, Inc. and its subsidiaries,

which we refer to as Cenveo, should be read in conjunction with our consolidated

financial statements included in Item 8 of this Annual Report on Form 10-K,

which we refer to as the Form 10-K. Certain statements we make under this Item 7

constitute forward-looking statements under the Private Securities Litigation

Reform Act of 1995. See Cautionary Statements regarding forward-looking

statements in Item 1 and Risk Factors in Item 1A.

Introduction

and Executive Overview

We are

one of the largest diversified printing companies in North America, according to

the December 2009 Printing Impressions 400 report. Our broad portfolio of

products includes forms and labels manufacturing, packaging and publisher

offerings, envelope production and commercial printing. We operate a global

network of strategically located printing and manufacturing, fulfillment and

distribution facilities, which we refer to as manufacturing facilities, serving

a diverse base of over 100,000 customers. Since 2005, when current senior

management joined the Company, we have significantly improved profitability by

consolidating and closing plants, centralizing and leveraging our purchasing

spend, seeking operational efficiencies, and reducing corporate and field staff.

In addition, we have made investments in our businesses through acquisitions of

highly complementary companies and capital expenditures, while also divesting

non-strategic businesses.

Our

management team is primarily focused on two main areas affecting our business:

(i) printing industry challenges, primarily pricing pressures experienced

throughout our operations and overcapacity in certain of the markets that we

operate in, and (ii) financial flexibility, which includes servicing our current

debt level, investing in our business through strategic acquisitions and capital

expenditures, and increasing our economies of scale to help improve the

performance of our current operations.

The

United States printing industry is highly fragmented, with a broad range of

sectors, including commercial printing and labels, envelopes and forms among