Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - ENNIS, INC. | ebf-ex322_36.htm |

| EX-32.1 - EX-32.1 - ENNIS, INC. | ebf-ex321_37.htm |

| EX-31.2 - EX-31.2 - ENNIS, INC. | ebf-ex312_39.htm |

| EX-31.1 - EX-31.1 - ENNIS, INC. | ebf-ex311_38.htm |

| EX-23 - EX-23 - ENNIS, INC. | ebf-ex23_40.htm |

| EX-21 - EX-21 - ENNIS, INC. | ebf-ex21_41.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended February 28, 2018

OR

|

☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from __________ to __________

Commission File Number 1-5807

ENNIS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Texas |

|

75-0256410 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

2441 Presidential Pkwy., Midlothian, Texas |

|

76065 |

|

(Address of Principal Executive Offices) |

|

(Zip code) |

(Registrant’s Telephone Number, Including Area Code) (972) 775-9801

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $2.50 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one).

|

Large accelerated Filer |

☐ |

|

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

☐ |

|

Emerging growth company. |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant as of August 31, 2017 was approximately $467 million. Shares of voting stock held by executive officers, directors and holders of more than 10% of the outstanding voting stock have been excluded from this calculation because such persons may be deemed to be affiliates. Exclusion of such shares should not be construed to indicate that any of such persons possesses the power, direct or indirect, to control the Registrant, or that any such person is controlled by or under common control with the Registrant.

The number of shares of the Registrant’s Common Stock, par value $2.50, outstanding at April 30, 2018 was 25,489,502.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2018 Annual Meeting of Shareholders are incorporated by reference into Part III of this Report.

FORM 10-K

FOR THE PERIOD ENDED FEBRUARY 28, 2018

TABLE OF CONTENTS

|

|

|

|

|

Item 1 |

4 |

|

|

Item 1A |

7 |

|

|

Item 1B |

12 |

|

|

Item 2 |

12 |

|

|

Item 3 |

13 |

|

|

Item 4 |

13 |

|

|

|

|

|

|

|

|

|

|

Item 5 |

14 |

|

|

Item 6 |

17 |

|

|

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

|

Item 7A |

27 |

|

|

Item 8 |

27 |

|

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

27 |

|

Item 9A |

27 |

|

|

Item 9B |

28 |

|

|

|

|

|

|

|

|

|

|

Item 10 |

29 |

|

|

Item 11 |

29 |

|

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related |

29 |

|

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

29 |

|

Item 14 |

29 |

|

|

|

|

|

|

|

|

|

|

Item 15 |

30 |

|

|

|

32 |

2

Cautionary Statements Regarding Forward-Looking Statements

All of the statements in this Annual Report on Form 10-K, other than historical facts, are forward-looking statements, including, without limitation, the statements made in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” particularly under the caption “Overview.” As a general matter, forward-looking statements are those focused upon anticipated events or trends, expectations, and beliefs relating to matters that are not historical in nature. The words “could,” “should,” “feel,” “anticipate,” “aim,” “preliminary,” “expect,” “believe,” “estimate,” “intend,” “intent,” “plan,” “will,” “foresee,” “project,” “forecast,” or the negative thereof or variations thereon, and similar expressions identify forward-looking statements.

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for these forward-looking statements. In order to comply with the terms of the safe harbor, Ennis, Inc. notes that forward-looking statements are subject to known and unknown risks, uncertainties and other factors relating to its operations and business environment, all of which are difficult to predict and many of which are beyond the control of Ennis, Inc. These known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those matters expressed in, anticipated by or implied by such forward-looking statements.

These statements reflect the current views and assumptions of management with respect to future events. Ennis, Inc. does not undertake, and hereby disclaims, any duty to update these forward-looking statements, even though its situation and circumstances may change in the future. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this report. The inclusion of any statement in this report does not constitute an admission by Ennis, Inc. or any other person that the events or circumstances described in such statement are material.

We believe these forward-looking statements are based upon reasonable assumptions. All such statements involve risks and uncertainties, and as a result, actual results could differ materially from those projected, anticipated or implied by these statements. Such forward-looking statements involve known and unknown risks, including but not limited to, general economic, business and labor conditions and the potential impact on our operations; our ability to implement our strategic initiatives and control our operational costs; dependence on a limited number of key suppliers; our ability to recover the rising cost of raw materials and other costs (i.e., energy, freight, labor, benefit costs, etc.) in markets that are highly price competitive and volatile; our ability to timely or adequately respond to technological changes in the industry; the impact of the Internet and other electronic media on the demand for forms and printed materials; the impact of foreign competition, tariffs, trade regulations and import restrictions; customer credit risk; competitors’ pricing strategies; a decline in business volume and profitability could result in an impairment in our reported goodwill negatively impacting our operational results; our ability to retain key management personnel; our ability to identify, manage or integrate acquisitions; and changes in government regulations.

3

Overview

Ennis, Inc. (“we” or the “Company”) was organized under the laws of Texas in 1909. The Company and its subsidiaries print and manufacture a broad line of business forms and other business products. We distribute business products and forms throughout the United States primarily through independent dealers. This distributor channel encompasses independent print distributors, commercial printers, direct mail, fulfillment companies, payroll and accounts payable software companies, and advertising agencies, among others. We also sell products to many of our competitors to satisfy their customers’ needs.

On April 30, 2018, we acquired the assets of a tag and label operation located in New York for $4.75 million in cash plus the assumption of trade payables. On July 7, 2017, we acquired the assets of a tag operation located in Ohio, for $1.4 million in cash plus the assumption of certain accrued liabilities. Management considers both of these acquisitions immaterial.

On January 27, 2017, we completed the acquisition of Independent Printing Company, Inc. and its related entities (collectively “Independent”) for $17.7 million in cash consideration, in a stock purchase transaction. Independent’s main facility located in DePere, Wisconsin. The business produces presentation folders, checks, wide format and commercial print. Independent operates under its brand name and generated approximately $37.0 million in sales during the 2016 calendar year. Independent sells mainly through distributors and resellers. We now have four folder facilities located in Michigan, Kansas, California and Wisconsin, as well as wide format capabilities in Colorado and Wisconsin.

On May 25, 2016 the Company sold its apparel business, consisting of Alstyle Apparel, LLC and its subsidiaries (the “Apparel Segment”) to Gildan Activewear Inc. (“Gildan”) for an all-cash purchase price of $110.0 million, subject to a working capital adjustment, customary indemnification arrangements, and the other terms of the Unit Purchase Agreement dated May 4, 2016. In connection with the sale of the Apparel Segment to Gildan, the Company was required to place $2.0 million of the purchase price in escrow as a source of funds to pay any liabilities that arose post-closing from an employment contract with a former officer of the Company. The Company believed in good faith, based on consultation with its advisors, that no liability existed with respect to the employment contract, and as such, recorded a receivable for the full amount of the funds held in escrow. In January 2017, the purchaser, without notice to the Company, voluntarily paid $2.0 million to the former officer of the Company and requested that all of the escrowed funds be released to it as reimbursement. The Company denied the request, due in part because of the purchaser’s failure to provide the Company prior notice and a right to defend as the Company believes was contractually required. In February 2018 an arbitrator ruled in favor of Gildan but did not authorize the release of the escrow funds, as his opinion was appealable. Although the Company has filed a complaint to vacate the arbitrator’s opinion, in the fourth quarter of fiscal year 2018 the Company wrote off the full amount of the receivable.

During the fourth quarter of fiscal year 2016, we moved our folder operations from Omaha, Nebraska to Columbus, Kansas, due to the landlord’s desire to sell the facility. The move and inefficiencies associated with starting-up and training new employees had a negative impact on revenues and operational margins over the first half of fiscal year 2017. However, during the second half of fiscal year 2017 we saw a turnaround and the operations were marginally profitable. This momentum largely carried over into the 2018 fiscal year. In addition, our medical claims during fiscal year 2017 exceeded historical levels, which resulted in us incurring an additional $4.3 million in increased medical charges that had a negative impact on our earnings. To mitigate further medical charges, we implemented a new cost reimbursement program, as well as other changes to our health plan, as of the start of the calendar year 2017. At the completion of the first year of this program, we are encouraged with the results.

4

Business Overview

Our management believes we are the largest provider of business forms, pressure-seal forms, labels, tags, envelopes, and presentation folders to independent distributors in the United States.

We are in the business of manufacturing, designing and selling business forms and other printed business products primarily to distributors located in the United States. We operate 56 manufacturing plants throughout the United States in 20 strategically located states. Approximately 95% of the business products manufactured are custom and semi-custom products, constructed in a wide variety of sizes, colors, number of parts and quantities on an individual job basis, depending upon the customers’ specifications.

The products sold include snap sets, continuous forms, laser cut sheets, tags, labels, envelopes, integrated products, jumbo rolls and pressure sensitive products in short, medium and long runs under the following labels: Ennis®, Royal Business Forms®, Block Graphics®, Specialized Printed Forms®, 360º Custom LabelsSM, ColorWorx®, Enfusion®, Uncompromised Check Solutions®, VersaSeal®, Ad ConceptsSM, FormSource LimitedSM, Star Award Ribbon Company®, Witt Printing®, B&D Litho®, Genforms®, PrintGraphicsSM, Calibrated Forms®, PrintXcelSM, Printegra®, Curtis Business FormsSM, Falcon Business FormsSM, Forms ManufacturersSM, Mutual GraphicsSM, TRI-C Business FormsSM, Major Business SystemsSM, Independent PrintingSM, Hoosier Data Forms®, and Hayes Graphics®. We also sell the Adams McClure® brand (which provides Point of Purchase advertising for large franchise and fast food chains as well as kitting and fulfillment); the Admore®, Folder Express®, and Independent Folders® brands (which provide presentation folders and document folders); Ennis Tag & LabelSM (which provides custom printed, high performance labels and custom and stock tags); Atlas Tag & Label®, Kay Toledo Tag® and Special Service Partners® (SSP) (which provides custom and stock tags and labels); Trade Envelopes®, Block Graphics®, Wisco® and National Imprint Corporation® (which provide custom and imprinted envelopes) and Northstar® and General Financial Supply® (which provide financial and security documents).

We sell predominantly through private printers and independent distributors, as well as to many of our competitors. Northstar Computer Forms, Inc., our wholly-owned subsidiary, also sells direct to a small number of customers, generally large banking organizations (where a distributor is not acceptable or available to the end-user). Adams McClure, LP, a wholly-owned subsidiary, also sells direct to a small number of customers, where sales are generally through advertising agencies.

The printing industry generally sells its products either predominantly to end users, a market dominated by a few large manufacturers, such as R.R. Donnelley and Sons, Staples, Inc., Standard Register Co. (a subsidiary of Taylor Corporation), and Cenveo, Inc., or, like the Company, through a variety of independent distributors and distributor groups. While it is not possible, because of the lack of adequate public statistical information, to determine the Company’s share of the total business products market, management believes the Company is the largest producer of business forms, pressure-seal forms, labels, tags, envelopes, and presentation folders in the United States distributing primarily through independent dealers.

There are a number of competitors that operate in this segment, ranging in size from single employee-owned operations to multi-plant organizations. We believe our strategic locations and buying power permit us to compete on a favorable basis within the distributor market on competitive factors, such as service, quality, and price.

Distribution of business forms and other business products throughout the United States is primarily done through independent dealers, including business forms distributors, resellers, direct mail, commercial printers, payroll and accounts payable software companies, and advertising agencies.

Raw materials principally consist of a wide variety of weights, widths, colors, sizes, and qualities of paper for business products purchased from generally one major supplier at favorable prices based on the volume of business.

Business products usage in the printing industry is generally not seasonal. General economic conditions and contraction of the traditional business forms industry are the predominant factors in quarterly volume fluctuations.

5

Patents, Licenses, Franchises and Concessions

Outside of the patent for our VersaSeal® product, we do not have any significant patents, licenses, franchises, or concessions.

Intellectual Property

We market our products under a number of trademarks and trade names. The protection of our trademarks is important to our business. We believe that our registered and common law trademarks have significant value and these trademarks are important to our ability to create and sustain demand for our products. We have registered trademarks in the United States for Ennis®, EnnisOnlineSM, B&D Litho of AZ®, B&D Litho®, ACR®, Block Graphics®, Enfusion®, 360º Custom LabelsSM, Admore®, CashManagementSupply.comSM, Securestar®, Northstar®, MICRLink®, MICR ConnectionTM, Ennisstores.comTM, General Financial Supply®, Calibrated Forms®, PrintXcelSM, Printegra®, Trade Envelopes®, Witt Printing®, Genforms®, Royal Business Forms®, Crabar/GBFSM, BF&SSM, Adams McClure®, Advertising ConceptsTM, ColorWorx®, Atlas Tag & Label®, PrintgraphicsSM, Uncompromised Check Solutions®, VersaSeal®, VersaSeal SecureX®, Folder Express®, Wisco®, National Imprint Corporation®, Star Award Ribbon®, Kay Toledo Tag®, Curtis Business FormsSM, Falcon Business FormsSM, Forms ManufacturersSM, Mutual GraphicsSM, TRI-C Business FormsSM, SSP®, EOSTouchpoint®, Printersmall®, Check Guard®, Envirofolder®, Independent®, Independent Checks®, Independent Folders®, Independent Large Format Solutions®, and variations of these brands as well as other trademarks. We have similar trademark registrations internationally.

Customers

No single customer accounts for as much as five percent of our consolidated net sales or accounts receivable.

Backlog

At February 28, 2018, our backlog of orders was approximately $17.4 million, as compared to approximately $14.9 million at February 28, 2017.

Research and Development

While we seek new products to sell through our distribution channel, there have been no material amounts spent on research and development in fiscal years 2018, 2017 or 2016.

Environment

We are subject to various federal, state, and local environmental laws and regulations concerning, among other things, wastewater discharges, air emissions and solid waste disposal. Our manufacturing processes do not emit substantial foreign substances into the environment. We do not believe that our compliance with federal, state, or local statutes or regulations relating to the protection of the environment has any material effect upon capital expenditures, earnings or our competitive position. There can be no assurance, however, that future changes in federal, state, or local regulations, interpretations of existing regulations or the discovery of currently unknown problems or conditions will not require substantial additional expenditures. Similarly, the extent of our liability, if any, for past failures to comply with laws, regulations, and permits applicable to our operations cannot be determined.

Employees

At February 28, 2018, we had 2,183 employees. 210 employees are represented by labor unions under collective bargaining agreements, which are subject to periodic negotiations.

6

Available Information

We make our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 available free of charge under the Investors Relations page on our website, www.ennis.com, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). Information on our website is not included as a part of, or incorporated by reference into, this report. Our SEC filings are also available through the SEC’s website, www.sec.gov. In addition, the public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. Information regarding the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

You should carefully consider the risks described below, as well as the other information included or incorporated by reference in this Annual Report on Form 10-K, before making an investment in our common stock. The risks described below are not the only ones we face in our business. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also impair our business operations. If any of the following risks occur, our business, financial condition or operating results could be materially harmed. In such an event, our common stock could decline in price and you may lose all or part of your investment.

Our results and financial condition are affected by global and local market conditions, and competitors’ pricing strategies, which can adversely affect our sales, margins, and net income.

Our results of operations can be affected by local, national and worldwide market conditions. The consequences of domestic and international economic uncertainty or instability, volatility in commodity markets, and domestic or international policy uncertainty, all of which we have seen in the past, can all impact economic activity. Unfavorable conditions can depress the demand for our products and thus sales in a given market and may prompt competitor’s pricing strategies that adversely affect our margins or constrain our operating flexibility. Certain macroeconomic events, such as the past crisis in the financial markets, could have a more wide-ranging and prolonged impact on the general business environment, which could also adversely affect us. Whether we can manage these risks effectively depends mainly on the following:

|

• |

Our ability to manage movements in commodity prices and the impact of government actions to manage national economic conditions such as consumer spending, inflation rates and unemployment levels, particularly given the past volatility in the global financial markets; and |

|

• |

The impact on our margins of labor costs given our labor-intensive business model, the trend toward higher wages in both mature and developing markets and the potential impact of union organizing efforts on day-to-day operations of our manufacturing facilities. |

The terms and conditions of our credit facility impose certain restrictions on our operations. We may not be able to raise additional capital, if needed, for proposed expansion projects.

The terms and conditions of our credit facility impose certain restrictions on our ability to incur additional debt, make capital expenditures, acquisitions and asset dispositions, as well as impose other customary covenants, such as requiring that our fixed charge coverage ratio not be less than 1.25:1.00 and our total leverage ratio not exceed 3.00:1:00. Our ability to comply with the covenants may be affected by events beyond our control, such as distressed and volatile financial and/or consumer markets, etc. A breach of any of these covenants could result in a default under our credit facility. In the event of a default, the bank could elect to declare the outstanding principal amount of our credit facility, all interest thereon, and all other amounts payable under our credit facility to be immediately due and payable. As of February 28, 2018, we were in compliance with all terms and conditions of our credit facility, which matures on August 11, 2020, and have cash on hand in excess of 3.2 times our current outstanding debt level.

7

Declining financial market conditions and continued decline in long-term interest rates could adversely impact the funded status of our pension plan.

We maintain a noncontributory defined benefit retirement plan (the “Pension Plan”) covering approximately 20% of our employees. Included in our financial results are Pension Plan costs that are measured using actuarial valuations. The actuarial assumptions used may differ from actual results. In addition, as our Pension Plan assets are invested in marketable securities, severe fluctuations in market values could potentially negatively impact our funded status, recorded pension liability, and future required minimum contribution levels. A decline in long-term debt interest rates puts downward pressure on the discount rate used by plan sponsors to determine their pension liabilities. Each 10 basis point change in the discount rate impacts our computed liability by about $900,000. Similar to fluctuations in market values, a drop in the discount rate could potentially negatively impact our funded status, recorded pension liability and future contribution levels. Also, continued changes in the mortality tables could potentially impact our funded status. As of February 28, 2018, our pension plan was 98.7% funded on a projected benefit obligation (PBO) basis and 106.8% on an accumulated benefit obligation (ABO) basis.

We may be unable to identify or to complete acquisitions or to successfully integrate the businesses we acquire.

We have evaluated, and may continue to evaluate, potential acquisition transactions. We attempt to address the potential risks inherent in assessing the attractiveness of acquisition candidates, as well as other challenges such as retaining the employees and integrating the operations of the businesses we acquire. Integrating acquired operations, such as our acquisition of Independent, involves significant risks and uncertainties, including maintenance of uniform standards, controls, policies and procedures; diversion of management’s attention from normal business operations during the integration process; unplanned expenses associated with integration efforts; and unidentified issues not discovered in due diligence, including legal contingencies. Due to these risks and others, there can be no guarantee that the businesses we acquire will lead to the cost savings or increases in net sales that we expect or desire. Additionally, there can be no assurance that suitable acquisition opportunities will be available in the future, which could harm our business plan.

We may be required to write down goodwill and other intangible assets, which could cause our financial condition and results of operations to be negatively affected in the future.

When we acquire a business, a portion of the purchase price of the acquisition may be allocated to goodwill and other identifiable intangible assets. The amount of the purchase price which is allocated to goodwill and other intangible assets is the excess of the purchase price over the net identifiable tangible assets acquired. The annual impairment test is based on several factors requiring judgment. An impairment may be caused by any number of factors outside our control, such as a decline in market conditions caused by a recession, or protracted recovery there-from, or other factors like competitor’s pricing strategies, which may be tied to such economic events. Though to date, we have not been required to take an impairment charge relating to our print business, continued sale-side pressures due to technology transference, competitor pricing pressures, and economic uncertainties could result in a determination that a portion of the recorded value of goodwill and intangible assets may be required to be written down. Although such a charge would be a non-cash expense, it would impact our reported operating results and financial position. At February 28, 2018, our consolidated goodwill and other intangible assets were approximately $70.6 million and $49.3 million, respectively.

Digital technologies will continue to erode the demand for our printed business documents.

The increasing sophistication of software, internet technologies, and digital equipment combined with our customers’ general preference, as well as governmental influences for paperless business environments will continue to reduce the number of traditional printed documents sold. Moreover, the documents that will continue to coexist with software applications will likely contain less value-added print content.

Many of our custom-printed documents help companies control their internal business processes and facilitate the flow of information. These applications will increasingly be conducted over the internet or through other

8

electronic payment systems. The predominant method of our customers’ communication to their customers is by printed information. As their customers become more accepting of internet communications, our clients may increasingly opt for what is perceived to be less costly electronic option, which would reduce our revenue. The pace of these trends is difficult to predict. These factors will tend to reduce the industry-wide demand for printed documents and require us to gain market share to maintain or increase our current level of print-based revenue which could place pressure on our operating margins.

In response to the gradual obsolescence of our standardized forms business, we continue to develop our capability to provide custom and full-color products. If new printing capabilities and new product introductions do not continue to offset the obsolescence of our standardized business forms products, and we aren’t able to increase our market share, our sales and profits will be affected. Decreases in sales of our standardized business forms and products due to obsolescence could also reduce our gross margins or impact the value of our recorded goodwill and intangible assets. This reduction could in turn adversely impact our profits, unless we are able to offset the reduction through the introduction of new high margin products and services or realize cost savings in other areas.

Our distributor customers may be acquired by other manufacturers who redirect business within their plants.

Some of our customers are being absorbed by the distribution channels of some of our manufacturing competitors. However, we do not believe this will significantly impact our business model. We have continued to sell to some of these customers even after they were absorbed by our competition because of the breadth of our product line and our geographic diversity.

Our distributors face increased competition from various sources, such as office supply superstores. Increased competition may require us to reduce prices or to offer other incentives in order to enable our distributors to attract new customers and retain existing customers.

Low price, high value office supply chain stores offer standardized business forms, checks and related products. Because of their size, these superstores have the buying power to offer many of these products at competitive prices. These superstores also offer the convenience of “one-stop” shopping for a broad array of office supplies that our distributors do not offer. In addition, superstores have the financial strength to reduce prices or increase promotional discounts to expand market share. This could result in us reducing our prices or offering incentives in order to enable our distributors to attract new customers and retain existing customers, which could reduce our profits.

Technological improvements may reduce our competitive advantage over some of our competitors, which could reduce our profits.

Improvements in the cost and quality of printing technology are enabling some of our competitors to gain access to products of complex design and functionality at competitive costs. Increased competition from these competitors could force us to reduce our prices in order to attract and retain customers, which could reduce our profits.

We could experience labor disputes that could disrupt our business in the future.

As of February 28, 2018, approximately 10% of our employees are represented by labor unions under collective bargaining agreements, which are subject to periodic negotiations. While we feel we have a good working relationship with all of the unions, there can be no assurance that any future labor negotiations will prove successful, which may result in a significant increase in the cost of labor, or may break down and result in the disruption of our business or operations.

We obtain our raw materials from a limited number of suppliers, and any disruption in our relationships with these suppliers, or any substantial increase in the price of raw materials or material shortages could have a material adverse effect on us.

We purchase our paper products from a limited number of sources, which meet stringent quality and on-time delivery standards under long-term contracts. However, fluctuations in the quality of our paper, unexpected price changes or other factors that relate to our paper products could have a material adverse effect on our operating results.

9

Paper is a commodity that is subject to periodic increases or decreases in price, which are sometimes quite significant. There is no effective market of derivative instruments to cost-effectively insulate us against unexpected changes in price of paper, and corporate negotiated purchase contracts provide only limited protection against price increases. Generally, when paper prices are increased, we attempt to recover the higher costs by raising the prices of our products to our customers. In the price-competitive marketplaces in which we operate, we may not always be able to pass through any or all of the higher costs. As such, any significant increase in the price of paper or shortages in its availability, could have a material adverse effect on our results of operations. Lately, paper pricing has been increasing due to higher pulp prices and reduced domestic capacity, which has been caused by capacity being taken off-line (planned or unplanned) or transferred to different paper types coupled with the impact of a cheaper dollar on foreign imports. Fewer imports and less domestic capacity may cause higher prices and in some cases imposed allocations, which tends to put pressure on our selling prices and operating margins.

We face intense competition to gain market share, which may lead some competitors to sell substantial amounts of goods at prices against which we cannot profitably compete.

Our marketing strategy is to differentiate ourselves by providing quality service and quality products to our customers. Even if this strategy is successful, the results may be offset by reductions in demand or price declines due to competitors’ pricing strategies or other micro or macro-economic factors. We face the risk of our competition following a strategy of selling its products at or below cost in order to cover some amount of fixed costs, especially in stressed economic times.

Environmental regulations may impact our future operating results.

We are subject to extensive and changing federal, state and foreign laws and regulations establishing health and environmental quality standards, concerning, among other things, wastewater discharges, air emissions and solid waste disposal, and may be subject to liability or penalties for violations of those standards. We are also subject to laws and regulations governing remediation of contamination at facilities currently or formerly owned or operated by us or to which we have sent hazardous substances or wastes for treatment, recycling or disposal. We may be subject to future liabilities or obligations as a result of new or more stringent interpretations of existing laws and regulations. In addition, we may have liabilities or obligations in the future if we discover any environmental contamination or liability at any of our facilities, or at facilities we may acquire.

We are subject to taxation related risks.

Tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are applied. On December 22, 2017, the U.S. government enacted the Tax Cuts and Jobs Act (the "Tax Act"). The Tax Act includes significant changes to the U.S. corporate income tax system including, among other things, a federal corporate rate reduction from 35% to 21%; limitations on the deductibility of interest expense and executive compensation and the transition of U.S. international taxation from a worldwide tax system to a modified territorial tax system. In the future, we may be subject to increased taxes under the Tax Act, including possible significant limitations on deductions for certain items, such as interest on debt, executive compensation, etc. Also, we may be required to make material adjustments to provisional items recorded. In addition, there can be no assurance that U.S. tax laws, including the corporate income tax rate, which the Tax Act lowered to 21%, would not undergo additional changes in the future. The final impact of the Tax Act on the Company may differ from the estimates reported, possibly materially, due to such factors as changes in interpretations and assumptions made, additional guidance that may be issued, and actions taken by the Company as a result of the Tax Act, among others. All of these factors and uncertainties may adversely affect our results of operations, financial position and cash flows.

We are exposed to the risk of non-payment by our customers on a significant amount of our sales.

Our extension of credit involves considerable judgment and is based on an evaluation of each customer’s financial condition and payment history. We monitor our credit risk exposure by periodically obtaining credit reports and updated financials on our customers. We generally see a heightened amount of bankruptcies by our customers during economic downturns. While we maintain an allowance for doubtful receivables for potential credit losses based upon our historical trends and other available information, in times of economic turmoil, there is heightened risk that our historical indicators may prove to be inaccurate. The inability to collect on sales to significant customers or a group of customers could have a material adverse effect on our results of operations.

10

Our business incurs significant freight and transportation costs.

We incur transportation expenses to ship our products to our customers. Significant increases in the costs of freight and transportation could have a material adverse effect on our results of operations, as there can be no assurance that we could pass on these increased costs to our customers. Recently, due to imposed government regulations, the availability of drivers has become a significant challenge in the industry. Costs to employ drivers have increased and transportation shortages have become more prevalent.

We depend upon the talents and contributions of a limited number of individuals, many of whom would be difficult to replace.

The loss or interruption of the services of our Chief Executive Officer, Executive Vice President or Chief Financial Officer could have a material adverse effect on our business, financial condition or results of operations. Although we maintain employment agreements with these individuals, it cannot be assured that the services of such individuals will continue.

If our internal controls are found to be ineffective, our financial results or our stock price could be adversely affected.

We believe that we currently have adequate internal control procedures in place. However, increased risk of internal control breakdowns generally exists in a business environment that is decentralized. In addition, if our internal control over financial reporting is found to be ineffective, investors may lose confidence in the reliability of our financial statements, which may adversely affect our stock price.

Our services depend on the reliability of computer systems we and our vendors maintain. If these systems fail, our operations may be adversely affected.

We depend on information technology and data processing systems to operate our business, and a significant malfunction or disruption in the operation of our systems may disrupt our business and adversely affect our ability to operate and compete in the markets we serve. These systems include systems that we own and operate, as well as systems of our vendors. Such systems are susceptible to malfunctions and interruptions. We also periodically upgrade and install new systems, which if installed or programmed incorrectly, may cause significant disruptions. The disruptions could interrupt our operations and adversely affect our results of operations, financial condition and cash flows.

We may suffer a data breach of sensitive information, which may result in significant costs to investigate and remediate the breach, litigation expenses and government enforcement actions and penalties, all of which could have an adverse effect on our operations and reputation.

It is critically important for us to maintain the confidentiality, integrity and availability of our systems, software and solutions. Many of our clients provide us with information they consider confidential or sensitive, and many of our client’s industries have established standards for safeguarding the confidentiality, integrity and availability of information relating to their businesses and customers. Confidential and sensitive information stored in our systems or available through web portals are susceptible to cybercrime or intentional disruption, which generally have increased across all industries in terms of sophistication and frequency. Disclosure of confidential information maintained on our systems or available through web portals due to human error, breach of our systems through cybercrime, a leak of confidential information due to employee misconduct or similar events may damage our reputation, subject us to regulatory enforcement action and cause significant reputational harm for our clients. Any of these outcomes may adversely affect our results of operations, financial condition and cash flows.

Increases in the cost of employee benefits could impact our financial results and cash flow.

Our expenses relating to employee health benefits are significant. Unfavorable changes in the cost of such benefits could impact our financial results and cash flow. Healthcare costs have risen significantly in recent years,

11

and recent legislative and private sector initiatives regarding healthcare reform could result in significant changes to the U.S. healthcare system. While the Company has various cost controls measures in place and employs outsight and outside cost reviews on larger claims, this has been and is expected to continue to be a significant cost to the Company. As seen during the fiscal year 2017, the Company incurred significant additional medical costs in excess of what we anticipated. As such, effective with the start of calendar year 2017, the Company made changes to its medical reimbursement program. Indications through the current fiscal year were positive with medical claims now trending more in line with historical levels. Even so, medical costs are and will continue to be a significant expense to the Company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved SEC staff comments.

Our corporate headquarters are located in Midlothian, Texas. We operate manufacturing facilities throughout the United States. See the table below for additional information on our locations.

All of the properties are used for the production, warehousing and shipping of the following: business forms, flexographic printing, advertising specialties and Post-it® Notes (Wolfe City, Texas); presentation products (Macomb, Michigan and Anaheim, California); printed and electronic promotional media (Denver, Colorado); envelopes (Portland, Oregon; Columbus, Kansas and Tullahoma, Tennessee); financial forms (Minneapolis/St. Paul, Minnesota; Nevada, Iowa and Bridgewater, Virginia) and other business products.

Our plants are operated at production levels required to meet our forecasted customer demands. Production levels fluctuate with market demands and depend upon the product mix at any given point in time. Equipment is added as existing machinery becomes obsolete or not repairable, and as new equipment becomes necessary to meet market demands; however, at any given time, these additions and replacements are not considered to be material additions to property, plant and equipment, although such additions or replacements may increase a plant’s efficiency or capacity.

All of the foregoing facilities are considered to be in good condition. We do not anticipate that substantial expansion, refurbishing, or re-equipping will be required in the near future.

All of the rented property is held under leases with original terms of one or more years, expiring at various times through October 2024. No difficulties are presently foreseen in maintaining or renewing leases as they expire.

The accompanying list contains each of our owned and leased locations:

|

|

|

|

|

Approximate Square Footage |

|

|||||

|

Location |

|

General Use |

|

Owned |

|

|

Leased |

|

||

|

Ennis, Texas |

|

Three Manufacturing Facilities * |

|

|

325,118 |

|

|

|

— |

|

|

Chatham, Virginia |

|

Two Manufacturing Facilities |

|

|

127,956 |

|

|

|

— |

|

|

Paso Robles, California |

|

Manufacturing |

|

|

94,120 |

|

|

|

— |

|

|

DeWitt, Iowa |

|

Two Manufacturing Facilities |

|

|

95,000 |

|

|

|

— |

|

|

Ft. Scott, Kansas |

|

Manufacturing |

|

|

86,660 |

|

|

|

— |

|

|

Portland, Oregon |

|

Manufacturing |

|

|

— |

|

|

|

103,402 |

|

|

Wolfe City, Texas |

|

Two Manufacturing Facilities |

|

|

119,259 |

|

|

|

— |

|

|

Moultrie, Georgia |

|

Held for Sale |

|

|

25,000 |

|

|

|

— |

|

|

Coshocton, Ohio |

|

Manufacturing |

|

|

24,750 |

|

|

|

— |

|

|

Macomb, Michigan |

|

Manufacturing |

|

|

56,350 |

|

|

|

— |

|

|

Denver, Colorado |

|

Four Manufacturing Facilities |

|

|

60,000 |

|

|

|

117,575 |

|

|

Brooklyn Park, Minnesota |

|

Manufacturing |

|

|

94,800 |

|

|

|

— |

|

|

Coon Rapids, Minnesota |

|

Warehouse |

|

|

— |

|

|

|

4,800 |

|

|

Roseville, Minnesota |

|

Manufacturing |

|

|

— |

|

|

|

41,300 |

|

|

Nevada, Iowa |

|

Two Manufacturing Facilities |

|

|

232,000 |

|

|

|

— |

|

|

Nevada, Iowa |

|

Held for Sale |

|

|

58,752 |

|

|

|

— |

|

|

Bridgewater, Virginia |

|

Manufacturing |

|

|

— |

|

|

|

27,000 |

|

12

|

|

|

|

|

Approximate Square Footage |

|

|||||

|

Location |

|

General Use |

|

Owned |

|

|

Leased |

|

||

|

|

Two Manufacturing Facilities and Warehouse |

|

|

174,089 |

|

|

|

— |

|

|

|

Leipsic, Ohio |

|

Manufacturing |

|

|

83,216 |

|

|

|

— |

|

|

El Dorado Springs, Missouri |

|

Manufacturing |

|

|

70,894 |

|

|

|

— |

|

|

Princeton, Illinois |

|

Manufacturing |

|

|

— |

|

|

|

44,190 |

|

|

Arlington, Texas |

|

Two Manufacturing Facilities |

|

|

69,935 |

|

|

|

— |

|

|

Tullahoma, Tennessee |

|

Two Manufacturing Facilities |

|

|

142,061 |

|

|

|

— |

|

|

Caledonia, New York |

|

Manufacturing |

|

|

138,730 |

|

|

|

— |

|

|

Sun City, California |

|

Manufacturing |

|

|

52,617 |

|

|

|

— |

|

|

Livermore, California |

|

Sales Office |

|

|

— |

|

|

|

650 |

|

|

Perris, California |

|

Warehouse |

|

|

— |

|

|

|

6,788 |

|

|

Phoenix, Arizona |

|

Manufacturing and Warehouse |

|

|

— |

|

|

|

59,000 |

|

|

Neenah, Wisconsin |

|

Two Manufacturing Facilities & One Warehouse |

|

|

72,354 |

|

|

|

97,161 |

|

|

West Chester, Pennsylvania |

|

Sales Office |

|

|

— |

|

|

|

1,150 |

|

|

Claysburg, Pennsylvania |

|

Manufacturing |

|

|

— |

|

|

|

69,000 |

|

|

Vandalia, Ohio |

|

Held for Sale |

|

|

47,820 |

|

|

|

— |

|

|

Fairport, New York |

|

Two Manufacturing Facilities |

|

|

— |

|

|

|

40,800 |

|

|

Indianapolis, Indiana |

|

Two Manufacturing Facilities |

|

|

— |

|

|

|

38,000 |

|

|

Smyrna, Georgia |

|

Manufacturing |

|

|

— |

|

|

|

65,000 |

|

|

Clarksville, Tennessee |

|

Manufacturing |

|

|

51,900 |

|

|

|

— |

|

|

Fairhope, Alabama |

|

Manufacturing |

|

|

65,000 |

|

|

|

— |

|

|

Toledo, Ohio |

|

Three Manufacturing Facilities |

|

|

120,947 |

|

|

|

— |

|

|

Visalia, California |

|

Manufacturing |

|

|

— |

|

|

|

56,000 |

|

|

Corsicana, Texas |

|

Manufacturing |

|

|

39,685 |

|

|

|

— |

|

|

Girard, Kansas |

|

Manufacturing |

|

|

69,474 |

|

|

|

— |

|

|

Powell, Tennessee |

|

Manufacturing |

|

|

43,968 |

|

|

|

— |

|

|

Houston, Texas |

|

Manufacturing |

|

|

— |

|

|

|

29,668 |

|

|

DePere, Wisconsin |

|

Manufacturing & Two Warehouses |

|

|

— |

|

|

|

171,847 |

|

|

Mosinee, Wisconsin |

|

Manufacturing & Warehouse |

|

|

— |

|

|

|

20,940 |

|

|

|

|

|

|

|

2,642,455 |

|

|

|

994,271 |

|

|

Corporate Offices |

|

|

|

|

|

|

|

|

|

|

|

Ennis, Texas |

|

Administrative Offices |

|

|

9,300 |

|

|

|

— |

|

|

Midlothian, Texas |

|

Executive and Administrative Offices |

|

|

28,000 |

|

|

|

— |

|

|

|

|

|

|

|

37,300 |

|

|

|

— |

|

|

|

|

Totals |

|

|

2,679,755 |

|

|

|

994,271 |

|

|

* |

7,000 square feet of Ennis, Texas location leased |

From time to time we are involved in various litigation matters arising in the ordinary course of our business. We do not believe the disposition of any current matter will have a material adverse effect on our consolidated financial position or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

13

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on the New York Stock Exchange (“NYSE”) under the trading symbol “EBF”. The following table sets forth the high and low sales prices, the common stock trading volume as reported by the New York Stock Exchange and dividends per share paid by the Company for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Dividends |

|

||

|

|

|

|

|

|

|

|

|

|

|

Trading Volume |

|

|

per share of |

|

||

|

|

|

Common Stock Price Range |

|

|

(number of shares |

|

|

Common |

|

|||||||

|

|

|

High |

|

|

Low |

|

|

in thousands) |

|

|

Stock |

|

||||

|

Fiscal Year Ended February 28, 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

$ |

17.90 |

|

|

$ |

15.20 |

|

|

|

1,514 |

|

|

$ |

0.175 |

|

|

Second Quarter |

|

|

19.80 |

|

|

|

15.95 |

|

|

|

1,420 |

|

|

$ |

0.200 |

|

|

Third Quarter |

|

|

21.45 |

|

|

|

18.70 |

|

|

|

1,188 |

|

|

$ |

0.200 |

|

|

Fourth Quarter |

|

|

21.30 |

|

|

|

19.15 |

|

|

|

1,265 |

|

|

$ |

0.300 |

|

|

Fiscal Year Ended February 28, 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

$ |

21.53 |

|

|

$ |

17.25 |

|

|

|

3,081 |

|

|

$ |

0.175 |

|

|

Second Quarter |

|

|

20.40 |

|

|

|

15.99 |

|

|

|

3,438 |

|

|

$ |

1.675 |

|

|

Third Quarter |

|

|

17.53 |

|

|

|

14.45 |

|

|

|

2,293 |

|

|

$ |

0.175 |

|

|

Fourth Quarter |

|

|

18.05 |

|

|

|

16.10 |

|

|

|

1,827 |

|

|

$ |

0.175 |

|

Dividends paid in the fourth quarter of fiscal year 2018 included a special one-time cash dividend of $0.10 per share of common stock in response to the signing of the Tax Act. Dividends paid in the second quarter of 2017 included a special one-time cash dividend of $1.50 per share of common stock as a result of the Company’s sale of the Apparel Segment.

The last reported sale price of our common stock on NYSE on April 30, 2018 was $17.90. As of that date, there were approximately 716 shareholders of record of our common stock. Cash dividends may be paid or repurchases of our common stock may be made from time to time, as our Board of Directors deems appropriate, after considering our growth rate, operating results, financial condition, cash requirements, restrictive lending covenants, and such other factors as the Board of Directors may deem appropriate.

14

In the 2016 calendar year, the Board authorized the repurchase of up to an aggregate of $40.0 million of the Company’s stock through the Company’s stock repurchase program. Under the repurchase program, share purchases may be made from time to time in the open market or through privately negotiated transactions depending on market conditions, share price, trading volume and other factors. Such purchases, if any, will be made in accordance with applicable insider trading and other securities laws and regulations. These repurchases may be commenced or suspended at any time or from time to time without prior notice. During our fiscal year ended February 28, 2018, the Company, under the program, repurchased 191,033 shares of common stock at an average price of $17.33 per share. Since the program’s inception in October 2008, there have been 1,442,236 common shares repurchased at an average price of $14.99 per share. As of February 28, 2018 there was $18.4 million available to repurchase shares of the Company’s common stock under the program. Unrelated to the stock repurchase program, the Company purchased 145 shares of its common stock during the fiscal year ended February 28, 2018.

The following table details shares of stock repurchased during the three months ended February 28, 2018 and the remaining amount available to repurchase additional shares of the Company’s stock under the program.

|

|

|

|

|

|

|

|

|

|

|

Total Number |

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

of Shares |

|

|

Maximum Amount |

|

|||

|

|

|

Number |

|

|

Average |

|

|

Purchased as |

|

|

that May Yet Be Used |

|

||||

|

|

|

of Shares |

|

|

Price Paid |

|

|

Part of Publicly |

|

|

to Purchase Shares |

|

||||

|

Period |

|

Purchased |

|

|

per Share |

|

|

Announced Programs |

|

|

Under the Program |

|

||||

|

December 1, 2017 - December 31, 2017 |

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

18,377,146 |

|

|

January 1, 2018 - January 27, 2018 |

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

18,377,146 |

|

|

January 28, 2018 - February 28, 2018 |

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

18,377,146 |

|

|

Total |

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

18,377,146 |

|

15

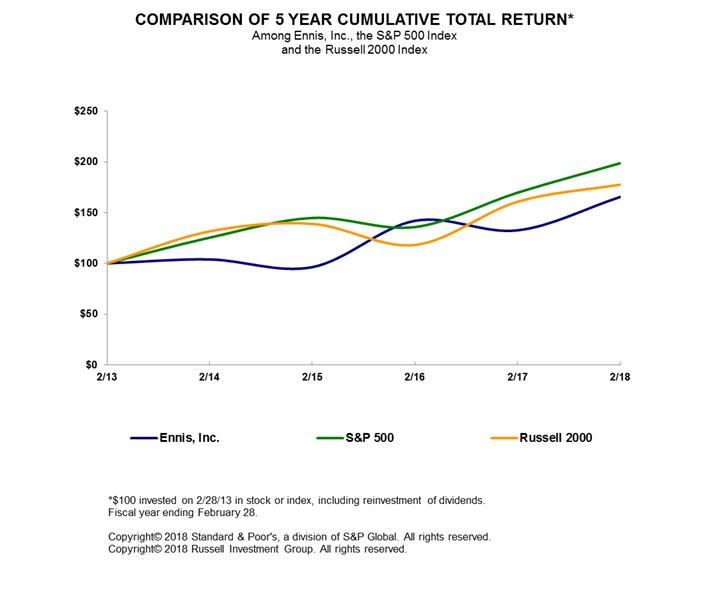

The graph below matches our cumulative 5-year total shareholder return on common stock with the cumulative total returns of the S&P 500 Index and the Russell 2000 Index. The graph tracks the performance of a $100 investment in our common stock and in each of the indexes (with the reinvestment of all dividends) from February 28, 2013 to February 28, 2018.

|

|

|

|

2013 |

|

|

2014 |

|

|

2015 |

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|||||

|

Ennis, Inc. |

|

$ |

100.00 |

|

|

$ |

103.90 |

|

|

$ |

96.30 |

|

|

$ |

142.02 |

|

|

$ |

132.59 |

|

|

$ |

165.54 |

|

|

S&P 500 |

|

|

100.00 |

|

|

|

125.37 |

|

|

|

144.81 |

|

|

|

135.85 |

|

|

|

169.78 |

|

|

|

198.81 |

|

|

Russell 2000 |

|

|

100.00 |

|

|

|

131.56 |

|

|

|

138.97 |

|

|

|

118.16 |

|

|

|

160.83 |

|

|

|

177.74 |

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

16

ITEM 6. SELECTED FINANCIAL DATA

The following tables set forth key operating metrics as of and for the periods indicated and have been derived from our audited historical consolidated financial statements for the four years ended February 28, 2018. The selected financial data for the year ended February 28, 2014, was derived from audited financial statements with certain adjustments to reflect discontinued operations. Our consolidated financial statements and notes thereto as of February 28, 2018, February 28, 2017, and for the three years in the period ended February 28, 2018, and the reports of Grant Thornton LLP are included in Item 15 of this Report. The selected financial data should be read in conjunction with Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes thereto included in Item 15 of this Report.

|

|

|

Fiscal Years Ended |

|

|||||||||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|||||

|

|

|

(Dollars and shares in thousands, except per share and ratio amounts) |

|

|||||||||||||||||

|

Operating results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

370,171 |

|

|

$ |

356,888 |

|

|

$ |

385,946 |

|

|

$ |

380,379 |

|

|

$ |

339,347 |

|

|

Gross profit margin |

|

|

116,914 |

|

|

|

103,950 |

|

|

|

116,310 |

|

|

|

115,071 |

|

|

|

101,040 |

|

|

Selling, general and administrative expenses |

|

|

69,451 |

|

|

|

63,147 |

|

|

|

65,743 |

|

|

|

60,661 |

|

|

|

57,032 |

|

|

Earnings from continuing operations |

|

|

32,758 |

|

|

|

26,417 |

|

|

|

32,258 |

|

|

|

34,470 |

|

|

|

29,005 |

|

|

Earnings (loss) from discontinued operations, net of tax |

|

|

147 |

|

|

|

(24,637 |

) |

|

|

3,478 |

|

|

|

(79,003 |

) |

|

|

(15,816 |

) |

|

Net earnings (loss) |

|

$ |

32,905 |

|

|

$ |

1,780 |

|

|

$ |

35,736 |

|

|

$ |

(44,533 |

) |

|

$ |

13,189 |

|

|

Earnings (loss) and dividends per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

1.29 |

|

|

$ |

1.03 |

|

|

$ |

1.25 |

|

|

$ |

1.33 |

|

|

$ |

1.11 |

|

|

Discontinued operations |

|

|

0.01 |

|

|

|

(0.96 |

) |

|

|

0.14 |

|

|

|

(3.05 |

) |

|

|

(0.61 |

) |

|

Net earnings (loss) |

|

$ |

1.30 |

|

|

$ |

0.07 |

|

|

$ |

1.39 |

|

|

$ |

(1.72 |

) |

|

$ |

0.50 |

|

|

Dividends |

|

$ |

0.875 |

|

(1) |

$ |

2.20 |

|

(1) |

$ |

0.70 |

|

|

$ |

0.70 |

|

|

$ |

0.53 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

25,392 |

|

|

|

25,735 |

|

|

|

25,688 |

|

|

|

25,864 |

|

|

|

26,125 |

|

|

Diluted |

|

|

25,417 |

|

|

|

25,749 |

|

|

|

25,722 |

|

|

|

25,864 |

|

|

|

26,146 |

|

|

Financial Position: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital |

|

$ |

133,773 |

|

|

$ |

119,282 |

|

|

$ |

135,441 |

|

|

$ |

170,023 |

|

|

$ |

166,004 |

|

|

Current assets |

|

|

163,344 |

|

|

|

149,250 |

|

|

|

175,841 |

|

|

|

210,270 |

|

|

|

207,881 |

|

|

Total assets |

|

|

329,439 |

|

|

|

324,285 |

|

|

|

390,044 |

|

|

|

446,990 |

|

|

|

530,085 |

|

|

Current liabilities |

|

|

29,571 |

|

|

|

29,968 |

|

|

|

40,400 |

|

|

|

40,247 |

|

|

|

41,877 |

|

|

Long-term debt |

|

|

30,000 |

|

|

|

30,000 |

|

|

|

40,000 |

|

|

|

106,500 |

|

|

|

105,500 |

|

|

Total liabilities |

|

|

67,735 |

|

|

|

72,930 |

|

|

|

91,498 |

|

|

|

162,310 |

|

|

|

167,150 |

|

|

Shareholders' equity |

|

|

261,704 |

|

|

|

251,355 |

|

|

|

298,546 |

|

|

|

284,680 |

|

|

|

362,935 |

|

|

Current ratio |

|

5.52 to 1.0 |

|

|

4.98 to 1.0 |

|

|

4.35 to 1.0 |

|

|

5.22 to 1.0 |

|

|

4.96 to 1.0 |

|

|||||

|

Long-term debt to equity ratio |

|

0.11 to 1.0 |

|

|

0.12 to 1.0 |

|

|

0.13 to 1.0 |

|

|

0.37 to 1.0 |

|

|

0.29 to 1.0 |

|

|||||

(1) Fiscal year 2018 included a special one-time cash dividend of $0.10 per share of common stock in response to the signing of the Tax Act. Fiscal year 2017 included a special one-time cash dividend of $1.50 per share of common stock as a result of the Company’s sale of the Apparel Segment.

17

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management’s Discussion and Analysis provides material historical and prospective disclosures intended to enable investors and other users to assess our financial condition and results of operations. Statements that are not historical are forward-looking and involve risk and uncertainties, including those discussed under the caption “Risk Factors” in Item 1A starting on page 7 of this Annual Report on Form 10-K and elsewhere in this Report. You should read this discussion and analysis in conjunction with our Consolidated Financial Statements and the related notes appearing elsewhere in this Report. The words “anticipate,” “preliminary,” “expect,” “believe,” “intend” and similar expressions identify forward-looking statements. We believe these forward-looking statements are based upon reasonable assumptions. All such statements involve risks and uncertainties, and as a result, actual results could differ materially from those projected, anticipated, or implied by these statements.

In view of such uncertainties, investors should not place undue reliance on our forward-looking statements since such statements may prove to be inaccurate and speak only as of the date when made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This Management’s Discussion and Analysis includes the following sections and is for the continuing operations of the Company, which is comprised of the production and sale of business forms and other business products, and excludes the discontinued operations of the Apparel Segment:

|

|

• |

Overview – An overall discussion on our Company, the business challenges and opportunities we believe are key to our success, and our plans for facing these challenges relating to our continuing operations. |

|

|

• |

Critical Accounting Policies and Estimates – A discussion of the accounting policies that require our most critical judgments and estimates relating to our continuing operations. This discussion provides insight into the level of subjectivity, quality, and variability involved in these judgments and estimates. This section also provides a summary of recently adopted and recently issued accounting pronouncements that have or may materially affect our business. |

|

|

• |

Results of Operations – An analysis of our consolidated results of operations and segment results for the three years presented in our consolidated financial statements. This analysis discusses material trends within our continuing business and provides important information necessary for an understanding of our continuing operating results. |

|

|

• |

Liquidity and Capital Resources - An analysis of our cash flows and a discussion of our financial condition and contractual obligations. This section provides information necessary to evaluate our ability to generate cash and to meet existing and known future cash requirements over both the short and long term. |

References to 2018, 2017 and 2016 refer to the fiscal years ended February 28, 2018, February 28, 2017 and February 29, 2016, respectively.

18

The Company – Our management believes we are the largest provider of business forms, pressure-seal forms, labels, tags, envelopes, and presentation folders to independent distributors in the United States.

Our Business Challenges - We are engaged in an industry experiencing consolidation of some of our traditional channels, product obsolescence, paper supplier capacity adjustments, and increased pricing and potential supply allocations due to demand/supply curve imbalance. Technology advances have made electronic distribution of documents, internet hosting, digital printing and print-on-demand valid, cost-effective alternatives to traditional custom-printed documents and customer communications. Improved equipment has become more accessible to our competitors due to the continued low interest rate environment. We face highly competitive conditions throughout the supply chain in an already over-supplied, price-competitive print industry. The challenges of our business include the following:

Transformation of our portfolio of products – While traditional business documents are essential in order to conduct business, many are being replaced through the use of cheaper paper grades or imported paper, or devalued with advances in digital technologies, causing steady declines in demand for a portion of our current product line. Transforming our product offerings in order to continue to provide innovative, valuable solutions through lower labor and fixed charges to our customers on a proactive basis will require us to make investments in new and existing technology and to develop key strategic business relationships, such as print-on-demand services and product offerings that assist customers in their transition to digital business environments. In addition, we will continue to look for new market opportunities and niches through acquisitions, such as the addition of our envelope offerings, tag offerings, folder offerings, healthcare wristbands, secure document solutions, innovative in-mold label offerings and long-run integrated products with high color web printing, which provide us with an opportunity for growth and differentiate us from our competition.