Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENB Financial Corp | form8k-20254_enbf.htm |

ENB Financial Corp 2018 Annual Shareholders Meeting May 8, 2018

» Welcome » Reading of the Minutes » Certify Voting Activity » Vote on Matters of the Proxy Statement » Discussion of Company Condition • President’s Remarks • Financial Review » Questions & Answers » Voting Results » Adjournment Agenda

» Aaron L. Groff, Jr. • President, CEO and Board Chairman – ENB Financial Corp and Ephrata National Bank » Barry W. Harting • Vice President and Corporate Secretary – ENB Financial Corp • Senior Vice President and Chief Risk Officer – Ephrata National Bank » Scott E. Lied • Treasurer – ENB Financial Corp • Senior Vice President and Chief Financial Officer – Ephrata National Bank Presenters

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Meeting Certification

Matters of Proxy Proxy Holders 1. Elect three (3) Class B directors to serve a 3 - year term 2. Transact other business

1. Elect three (3) Class B directors to serve a 3 - year term Matters of Proxy Election of Directors – Class B Willis R. Lefever Donald Z. Musser Judith A. Weaver

Current Directors Continuing Directors – Class A Aaron L. Groff, Jr. Dr. Brian K. Reed Paul M. Zimmerman, Jr. Continuing Directors – Class C Joshua E. Hoffman Susan Y. Nicholas Mark C. Wagner Paul W. Wenger

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Voting Process

Voting Process Proxy Holders » Janice S. Eaby » John H. Shuey Judges of Election » Paul W. Wenger » Roger S. Kline » John L. Weber

Presented by: Aaron L. Groff, Jr. President & CEO - ENB Financial Corp President’s Remarks

To remain an independent community bank of undisputed integrity, serving the communities of Lancaster County and beyond. To offer state - of - the - art financial products and services of high quality and value at an affordable price. To provide unsurpassed personal service, delivered by a highly dedicated professional team. Mission Statement

To help clients achieve financial success as defined by them by discovering their goals and dreams in order to provide helpful advice. Vision Statement

Growth

Market Expansion - Branches

Market Expansion - Mortgage

Market Expansion - CRE

Market Expansion – Ag Banking

Community Support

Easier Access

Easier Access

Easier Access

Easier Access

Focus on our Future

Presented by: Scott E. Lied Treasurer - ENB Financial Corp Financial Condition

Unaudited Financial Information » Some of the following slides do present financial information that is unaudited. Therefore, this information is subject to adjustments that could be necessary upon completion of the annual audit. Forward Looking Statements » Some of the material and/or language used in this presentation would be considered as a forward looking statement. Management is not obligated to update these forward looking statements. Disclosures

Net Income

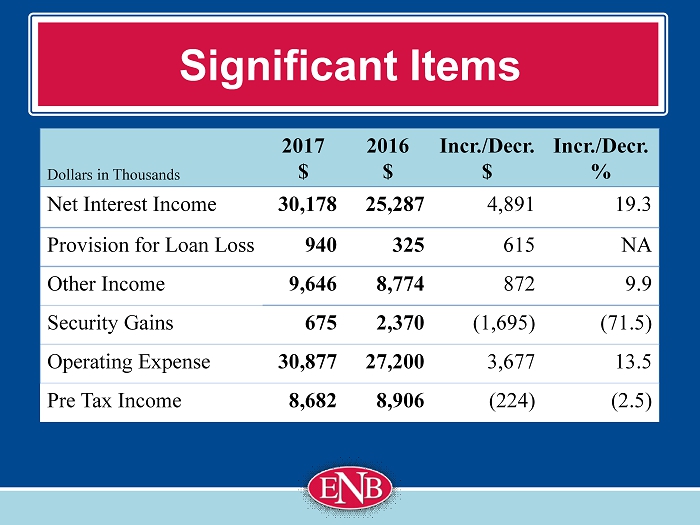

Significant Items Dollars in Thousands 2017 $ 2016 $ Incr./ Decr . $ Incr./ Decr . % Net Interest Income 30,178 25,287 4,891 19.3 Provision for Loan Loss 940 325 615 NA Other Income 9,646 8,774 872 9.9 Security Gains 675 2,370 (1,695) (71.5) Operating Expense 30,877 27,200 3,677 13.5 Pre Tax Income 8,682 8,906 (224) (2.5)

0 200 400 600 800 1000 1200 1400 1600 1800 2015 2016 2017 Dollars In Thousands Annual Revenue Non Dep Inv Prod Trust ENB Money Management Group

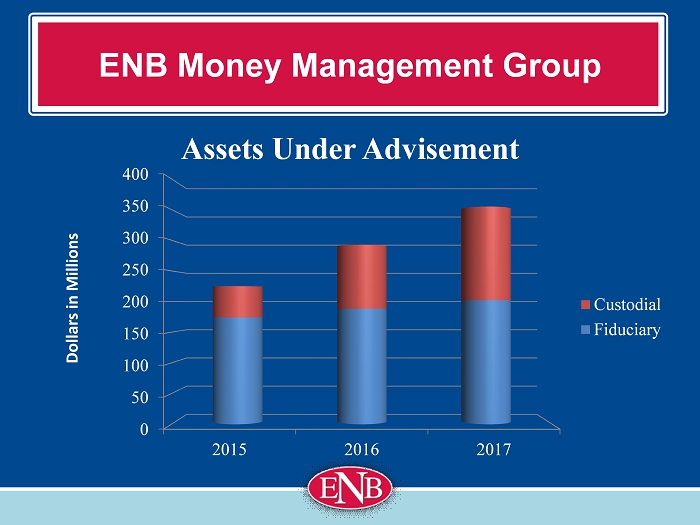

0 50 100 150 200 250 300 350 400 2015 2016 2017 Dollars in Millions Assets Under Advisement Custodial Fiduciary ENB Money Management Group

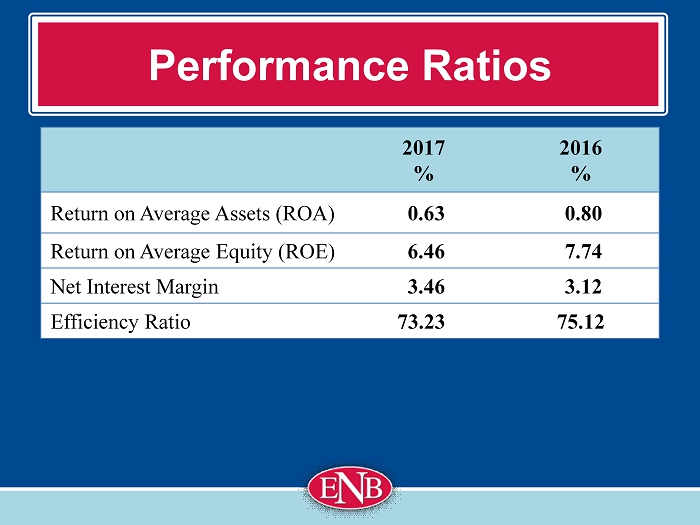

Performance Ratios 2017 % 2016 % Return on Average Assets (ROA) 0.63 0.80 Return on Average Equity (ROE) 6.46 7.74 Net Interest Margin 3.46 3.12 Efficiency Ratio 73.23 75.12

Per Share Data 2017 2016 Earnings Per Share $2.23 $2.65 Dividends Per Share $1.12 $1.09 Dividend Payout Ratio 50.22% 41.13%

2017 Peer Analysis Measurement ENBP % PA Bank Peer* % Return of Average Assets 0.63 0.74 Return on Average Equity 6.5 7.5 Price to Earnings 15.5 17.7 Price to Tangible Book 98.8 146.4 Dividend Yield 3.27 2.46 *Data as of December 31, 2017 from Boenning & Scattergood, Inc., 1 st Qtr. 2018 Mid - Atlantic Regional Bank & Thrift Revie w

2017 Peer Analysis Measurement ENBP % PA Bank Peer* % Tangible Capital to Assets 9.7 8.9 Tier 1 Capital Ratio 13.8 12.8 Total Risk Based Capital 15.0 14.2 Non - Performing Assets/Total Assets 0.10 0.70 Allowance for Loan Losses/Total Loans 1.38 1.05 *Data as of December 31, 2017 from Boenning & Scattergood, Inc., 1 st Qtr. 2018 Mid - Atlantic Regional Bank & Thrift Revie w

2017 Balance Sheet Growth » Total Assets up $49.4 million + 5.0% » Total Loans up $26.0 million + 4.5% » Total Deposits up $49.0 million + 6.0% » Total Capital up $4.8 million + 5.1%

First Quarter 2018 Results (Unaudited) » Earnings: $2.82 million, 54.4% increase » Net Interest Income: Up $470,000, 6.5% increase » Provision for Loan Losses: $190,000 vs. $90,000 » BOLI Income: $1.1 million vs. $173,000 » Mortgage Gains: $235,000 vs. $355,000 » Operating Expenses: Up $366,000, 4.9% increase

2018 Strategic Initiatives » Loan to Deposit Ratio » Mortgage geographic expansion » Leverage resources » Improve efficiency

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Voting Results

Communication

Questions & Answers

Adjournment Thank you!