Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K DATED MAY 1, 2018 - PGT Innovations, Inc. | form8k_05012018.htm |

| EX-99.1 - PRESS RELEASE DATED MAY 1, 2018 - PGT Innovations, Inc. | ex991q12018.htm |

EXHIBIT 99.2

PGT Innovations, inc.First Quarter 2018FINANCIAL RESULTSmarch 31, 2018

- 1 -

2 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Statements in this presentation regarding our business that are not historical facts are “forward-looking statements” that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “may,” “expect,” “expectations,” “outlook,” “forecast,” “guidance,” “intend,” “believe,” “could,” “project,” “estimate,” “anticipate,” “should” and similar terminology. These risks and uncertainties include factors such as:• unfavorable changes in new home starts and home remodeling trends, especially in Florida, where the substantial portion of our sales are generated;• unfavorable changes in the economy in the United States in general and in Florida, where the substantial portion of our sales are generated;• increases in our cost of raw materials, including aluminum, glass and vinyl, including, without limitation, price increases due to the implementation of tariffs and other trade-related restrictions;• our dependence on a limited number of suppliers for certain of our key materials;• increases in our transportation costs;• our level of indebtedness;• our dependence on our impact-resistant product lines;• our ability to successfully integrate businesses we may acquire;• product liability and warranty claims brought against us;• federal, state and local laws and regulations, including unfavorable changes in local building codes; • our dependence on a limited number of manufacturing facilities;• the continuing post-storm impact of Hurricane Irma on our customers and markets, demand for our products, and our financial and operational performance related thereto; • risks associated with our information technology systems, including cybersecurity-related risks, such as unauthorized intrusions into our systems by “hackers” and theft of data and information from our systems; and,• other risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 30, 2017, filed with the SEC.Statements in this presentation that are forward-looking statements include, without limitation, our expectations regarding: (1) demand for our products going forward, including the demand for our products from homeowners who are preparing for the 2018 and future hurricane seasons; (2) our ability to continue to leverage fixed costs in a favorable manner; (3) the heightened awareness brought by Hurricane Irma and our post-Irma advertising initiatives about the benefits of impact-resistant window and door products; (4) the favorable impact that the increase in our product prices may have on our performance, and our ability to take future price increases to offset further increases in our costs; (5) the amount of the decrease in our cash interests costs going forward; (6) the Company’s ability to capture a meaningful share of any increased demand for impact-resistant products; and (7) our financial and operational performance for our 2018 fiscal year, including our “Fiscal Year 2018 Outlook” set forth in this press release. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances from the date of this presentation. Forward-Looking Statements

- 2 -

3 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Management Presenters Jeff Jackson Chief Executive Officer and President Business and Market Overview Brad West Chief Financial Office and Sr. V.P. Financial Results

- 3 -

4 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Business and Market Overview Q1 2018 sales of $140M, increased $28M, or 24% over Q1 2017.Factors driving increased sales in Q1 2018 compared to last year include increasing demand in both new construction and repair and remodeling (R&R) markets. We continued to execute on our strategy of investing in marketing and advertising, to leverage heightened awareness of the benefits of impact-resistant products from active 2017 hurricane season, which included Hurricane Irma: the most powerful storm ever recorded in the Atlantic; first to hit Florida coast in 12 years.Q1 2018 sales included 63% into the R&R market, increasing 32% compared to Q1 2017. We continue to demonstrate our ability to gain share in the R&R market, driving a favorable shift in mix to higher-margin R&R sales.Q1 2018 adjusted EBITDA was $22M, increasing 42% compared to $15M in Q1 2017. Q1 2018 adjusted EBITDA margin of 15.5% was up 2 full percentage points versus Q1 2017, as gains from sales growth and improved operations were partially offset by increased incentive costs and marketing investments.Q1 2018 adjusted diluted EPS of 19 cents for Q1 2018, was up 12 cents compared with Q1 2017.Vinyl WinGuard sales grew 44% in Q1 2018, compared to Q1 2017. Since 2014, vinyl WinGuard sales have grown at an annual compound rate of nearly 35%. Aluminum WinGuard sales grew 20% in Q1 2018, compared to Q1 2017.

- 4 -

5 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Business and Market Overview Florida was recently ranked No. 1 for its residential building codes by the Insurance Institute for Business and Home Safety, rating them as the safest residential building codes in the country.Experts are forecasting another active hurricane season in 2018, which begins June 1 and goes through the end of November.We believe homeowners are choosing our impact-resistant products at an increasing rate for their R&R projects, because of the benefits that our impact-resistant products provide, and to comply with Florida’s building codes.We successfully completed another strategic initiative with the move into our new, 330,000 square foot leased production facility. This move was well-planned by our team, and well-executed. Production began in this new facility in March and we were fully operational by mid-April.Increasing our production capacity in the Miami area allows us to continue to meet the demand for impact-resistant products across Florida. Additional capacity to accommodate CGI’s new Slim Front Commercial Product, and its new Sparta line, was critical. The Sparta launch is our first value-custom impact-resistant window product line, a solution with an emphasis on affordability that makes it easier for homeowners to upgrade from cumbersome plywood and shutters to protect their families and homes from the next big storm.We refinanced our credit facility in Q1 2018. The refinancing lowered our interest rate margin by 125 basis points, significantly improving our cost of capital. Combined with the 100 basis-point decrease in the Q1 2017 refinancing, and $40 million of voluntary prepayments in 2017, we expect cash debt service costs over the facility’s remaining term will be significantly reduced.

- 5 -

6 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Business and Market Overview Florida is the third most populous and second fastest growing state in the U.S.:Population expansion (estimated increase 336,000 in 2017; approaching 21M)Job creation (2.1M jobs added since a low of 8.1M in December 2009; now 10.2M employed)Declining unemployment (reached a high of 11.2% in December 2009; now just 3.9%)Demand continues to be strong in both the new construction and R&R sectors of our business, with sales into both sectors continuing to grow compared to last year.Florida is our primary market, which represents approximately 90% of our sales. Our focus has been on increasing awareness in Florida of our impact-resistant brands through advertising.Florida’s southern region is our key market, which continues to see steady increases in population and wealth, especially in our key southern coastal markets.We are confident that Florida’s economic factors that impact our business are positive and expect that those factors will continue to be favorable to our business for the remainder of 2018.Inflationary conditions from the second half of 2017 continued into Q1 2018, pressuring our margins from rising costs of aluminum, glass, fuel, and wages. We were able to offset the impacts of these costs through the strength of our Q1 2018 operating results, and through a previously announced price increase.We have built a durable, competitive advantage that we believe enables us to raise prices to cover inflationary impacts, if needed, while still gaining share.

- 6 -

7 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Business and Market Overview PGT Innovations is well-positioned to capture and gain share of the increased demand for impact-resistant products in one of America’s strongest markets…Florida.We have anticipated what we think will be a long period of growth and instituted four strategic pillars of focus from which we expect to create long-term customer and shareholder value:Building Brand Through Customer Loyalty - we believe that being loyal to our customers builds our brands and we do this by positioning our brands in the marketplace through our investments in advertising, by developing new, innovative products, and by offering customer sales initiatives and homeowner rebate programs. We believe this loyalty to our customers results in the close relationships we have with our customers that we are known for.Leading Through Talent - we focus on attracting talented, hardworking, leaders to the PGT Innovations’ family. We believe that leading through talent is a key ingredient to success in our business. We offer benefits, various bonuses, child care and scholarship and leadership and workforce development programs.Operations Engineered to Deliver – we believe that expanding our operations to meet increasing demand is an important strategic pillar. Besides expanding our operations, we are adding more automation to our manufacturing processes, which gives our manufacturing leaders and team members more time to focus on maintaining and increasing the quality of our products.Disciplined Capital Allocation – because resources are not limitless, we have a strategic focus on allocating our capital generated from our free cash flow in a way that supports our strong Florida growth, and enables us to consider potential out-of-state acquisitions in the future.

- 7 -

8 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Financial Overview

- 8 -

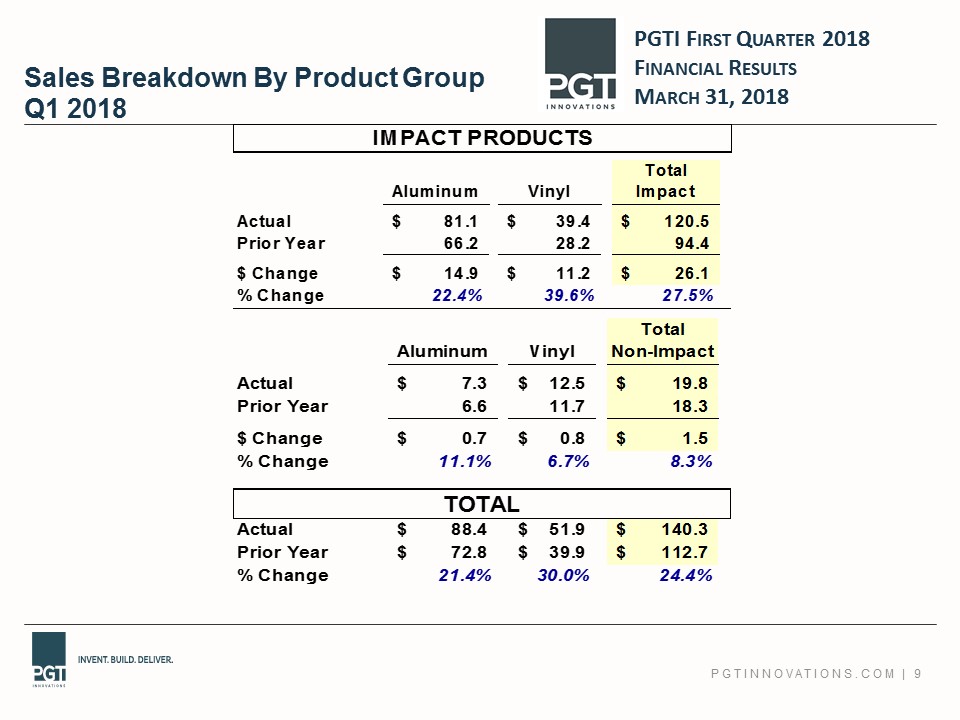

9 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Sales Breakdown By Product GroupQ1 2018

- 9 -

10 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Income Statements Q1 2018 & 2017

- 10 -

11 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 Balance Sheets

- 11 -

12 PGTI First Quarter 2018 Financial ResultsMarch 31, 2018 2018 Outlook Housing starts are growing steadily. We expect single-family housing starts in Florida will continue to increase at a rate of at least 10% for the remainder of 2018.On our 2017 Year-End earnings call in February, we provided guidance for 2018. Based on our top-line performance and operating results for the quarter, we expect to finish at the high end of those ranges in 2018. Those ranges are:Net sales to be between $550M and $575M, representing an increase of between 8 and 13 percent.Adjusted EBITDA of between $95M and $105M, representing an increase of between 10 and 22 percent. Adjusted EBITDA in 2018 and all prior comparison periods will include stock-based compensation expense.Net income per diluted share of $0.81 to $0.98, which assumes 52M weighted-average diluted shares outstanding, andFree cash flow of $59M to $67M reflecting our expectations for solid growth for the remainder of 2018 and disciplined capital spending. This includes a total of $25M of cash proceeds we expect to receive in 2018 from finalizing the sale of certain glass-plant assets, $10M of which we received in January 2018.Our free cash flow target for 2018 includes the impact of a $9M estimated tax payment made in January 2018.We expect our effective tax rate for 2018 to be approximately 26%, benefitting from the Tax Cuts and Jobs Act of 2017.

- 12 -