Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - PGT Innovations, Inc. | Financial_Report.xls |

| EX-21.1 - LIST OF SUBSIDIARIES - PGT Innovations, Inc. | d847691dex211.htm |

| EX-32.2 - CERTIFICATION - PGT Innovations, Inc. | d847691dex322.htm |

| EX-31.2 - CERTIFICATION - PGT Innovations, Inc. | d847691dex312.htm |

| EX-23.2 - CONSENT - PGT Innovations, Inc. | d847691dex232.htm |

| EX-32.1 - CERTIFICATION - PGT Innovations, Inc. | d847691dex321.htm |

| EX-23.1 - CONSENT - PGT Innovations, Inc. | d847691dex231.htm |

| EX-31.1 - CERTIFICATION - PGT Innovations, Inc. | d847691dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 3, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-52059

PGT, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-0634715 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1070 Technology Drive North Venice, Florida |

34275 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (941) 480-1600

Former name, former address and former fiscal year, if changed since last report: Not applicable

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Exchange on Which Registered | |

| Common stock, par value $0.01 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12 (g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 27, 2014 was approximately $380,136,516 based on the closing price per share on that date of $8.57 as reported on the NASDAQ Global Market.

The number of shares of the registrant’s common stock, par value $0.01, outstanding as of February 28, 2015, was 47,707,270.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the Company’s 2015 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Table of Contents to Form 10-K

| Page | ||||||

| PART I | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

7 | |||||

| Item 1B. |

11 | |||||

| Item 2. |

11 | |||||

| Item 3. |

11 | |||||

| Item 4. |

11 | |||||

| PART II | ||||||

| Item 5. |

12 | |||||

| Item 6. |

14 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | ||||

| Item 7A. |

32 | |||||

| Item 8. |

33 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

72 | ||||

| Item 9A. |

72 | |||||

| Item 9B. |

73 | |||||

| PART III | ||||||

| Item 10. |

74 | |||||

| Item 11. |

75 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

75 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

76 | ||||

| Item 14. |

76 | |||||

| PART IV | ||||||

| Item 15. |

77 | |||||

| Subsidiaries |

||||||

| Consent of KPMG LLP |

||||||

| Consent of Ernst & Young LLP |

||||||

| Written Statement Pursuant to Section 302 |

||||||

| Written Statement Pursuant to Section 302 |

||||||

| Written Statement Pursuant to Section 906 |

||||||

| Written Statement Pursuant to Section 906 |

||||||

- 2 -

Table of Contents

| Item 1. | BUSINESS |

GENERAL DEVELOPMENT OF BUSINESS

Description of the Company

We are the leading U.S. manufacturer and supplier of residential impact-resistant windows and doors and pioneered the U.S. impact-resistant window and door industry. Our impact-resistant products, which are marketed under the WinGuard®, PremierVue ™, PGT Architectural Systems and PGT Commercial Storefront System brand names, combine heavy-duty aluminum or vinyl frames with laminated glass to provide protection from hurricane-force winds and wind-borne debris by maintaining their structural integrity and preventing penetration by impacting objects. Impact-resistant windows and doors satisfy stringent building codes in hurricane-prone coastal states and provide an attractive alternative to shutters and other “active” forms of hurricane protection that require installation and removal before and after each storm. Combining the impact resistance of WinGuard, PremierVue ™ , PGT Architectural Systems, and PGT Commercial Storefront System with our insulating glass creates energy efficient windows that can significantly reduce cooling and heating costs. We also manufacture non-impact resistant products in both aluminum and vinyl frames including our SpectraGuard ™ line of products. Our current market share in Florida, which is the largest U.S. impact-resistant window and door market, is significantly greater than that of any of our competitors.

Our manufacturing facility in North Venice, Florida, produces fully-customized windows and doors. We are vertically integrated with glass insulating, tempering and laminating facilities, which provide us with a consistent source of impact-resistant laminated and insulating glass, shorter lead times, and lower costs relative to third-party sourcing.

On September 22, 2014, we completed the acquisition of CGI Windows and Doors Holdings, Inc. (CGI) which became a wholly-owned subsidiary of PGT Industries, Inc. CGI was established in 1992 and has consistently built a reputation based on designing and manufacturing quality impact resistant products that meet or exceed the stringent Miami-Dade County impact standards. CGI has over 200 employees at its manufacturing plant in Miami, Florida. Today, CGI continues to lead as an innovator in product craftsmanship, strength and style, and its brands are highly recognized and respected by the architectural community. CGI product lines include the Estate Collection, Sentinel by CGI, Estate Entrances, Commercial Series and Targa by CGI.

The geographic regions in which we currently conduct business include the Southeastern U.S., Gulf Coast, Coastal mid-Atlantic, the Caribbean, Central America, and Canada. We distribute our products through multiple channels, including approximately 1,100 window distributors, building supply distributors, window replacement dealers and enclosure contractors. This broad distribution network provides us with the flexibility to meet demand as it shifts between the residential new construction and repair and remodeling end markets.

History

Our subsidiary, PGT Industries, Inc., a Florida Corporation, was founded in 1980 as Vinyl Tech, Inc. The PGT brand was established in 1987, and we introduced our WinGuard branded product line in the aftermath of Hurricane Andrew in 1992. CGI became a wholly-owned subsidiary of PGT Industries, Inc. on September 22, 2014.

PGT, Inc. is a Delaware corporation formed on December 16, 2003, and on June 27, 2006, we became a publicly listed company on the NASDAQ Global Market under the symbol “PGTI”.

FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS

We operate as one segment, the manufacture and sale of windows and doors. Additional required information is included in Item 8.

NARRATIVE DESCRIPTION OF BUSINESS

Our Products

We manufacture complete lines of premium, fully customizable aluminum and vinyl windows and doors and porch enclosure products targeting both the residential new construction and repair and remodeling end markets. All of our PGT products carry the PGT brand, and our consumer-oriented PGT products carry an additional, trademarked product name, including WinGuard, Eze-Breeze, SpectraGuard, PremierVue, WinGuard Vinyl and EnergyVue. CGI’s products carry the CGI brand and carry the trademarked product names of Estate Collection, Sentinel by CGI, Estate Entrances, Commercial Series and Targa by CGI.

- 3 -

Table of Contents

Window and door products

Impact window and door products

WinGuard. WinGuard is an impact-resistant product line and combines heavy-duty aluminum or vinyl frames with laminated glass to provide protection from hurricane-force winds and wind-borne debris that satisfy increasingly stringent building codes and primarily target hurricane-prone coastal states in the U.S., as well as the Caribbean and Central America. Combining the impact resistance of WinGuard with our insulating glass creates energy efficient windows that can significantly reduce cooling and heating costs. In the first quarter of 2015, we announced the launch of our new WinGuard Vinyl line of windows and doors, our all-new impact-resistant vinyl window designed to offer some of the highest design pressures available on impact-resistant windows and doors even stronger and in an attractive modern profile, with larger sizes capable of handling the toughest hurricane codes in the country. It also protects against flying debris, intruders, outside noise and UV rays making it a top choice for customers seeking an impact-resistant window.

PremierVue. PremierVue is a complete line of impact-resistant vinyl window and door products that are tailored for the mid- to high-end of the replacement market, primarily targeting single and multi-family homes and low to mid-rise condominiums in Florida and other coastal regions of the Southeastern U.S. Combining structural strength and energy efficiency, these products are designed for flexibility in today’s market, offering both laminated and laminated-insulated impact-resistant glass options which are Energy Star rated. PremierVue’s large test sizes and high design pressures, combined with vinyl’s inherent thermal efficiency, make these products truly unique in the window and door industry.

Architectural Systems. Similar to WinGuard, Architectural Systems products are impact-resistant, offering protection from hurricane-force winds and wind-borne debris for mid- and high-rise buildings rather than single family homes.

Estate Collection. Our Estate Collection of windows and doors is CGI’s premium, high-end aluminum impact-resistant product line. These windows and doors can be found in elegant homes, prestigious resorts, hotels, schools and office buildings. Our Estate Collection combines best-in-class performance against hurricane force damage with architectural-grade quality, handcrafted details and superior engineering. Similar to WinGuard, Estate windows and doors protect and insulate against every imaginable external event, from hurricanes to UV protection, outside noise and forced entry. Estate’s aluminum frames are up to 100% thicker than many of our competitors making it an excellent choice for any coastal area prone to hurricanes.

Sentinel. Sentinel is a complete line of aluminum impact-resistant windows and doors from CGI that provide exceptional quality, craftsmanship, energy efficiency and durability at an affordable price. Sentinel windows and doors are manufactured to enhance the aesthetics of the home while delivering protection from the most extreme coastal conditions. Sentinel is custom manufactured to exact sizes within our wide range of design parameters, therefore, reducing on-site construction costs. In addition, Sentinel’s frame depth is designed for both new construction and replacement applications resulting in faster, less intrusive installations.

Targa. Targa is CGI’s line of vinyl energy-efficient, impact-resistant windows designed specifically to exceed the Florida Impact codes, the most stringent impact standards in the U.S. Targa windows enhance the aesthetics of a home and are low maintenance windows with long-term durability, and environmental compatibility.

Other window and door products

Aluminum. We offer a complete line of fully customizable, non-impact-resistant aluminum frame windows and doors. These products primarily target regions with warmer climates, where aluminum is often preferred due to its ability to withstand higher structural loads. Adding our insulating glass creates energy-efficient windows that can significantly reduce cooling and heating costs.

Vinyl. We offer a complete line of fully customizable, non-impact-resistant vinyl frame windows and doors where the energy-efficient characteristics of vinyl frames are critical. It includes a line of energy-efficient vinyl windows for new construction with wood-like aesthetics, such as brick-mould frames, wood-like trim detail and simulated divided lights. Also, part of this line is vinyl replacement windows with the same superior energy performance and wood-like detail and branded the product lines as SpectraGuard. All of our vinyl product lines possess options to meet the needs of the Florida market and are Energy Star rated.

- 4 -

Table of Contents

Eze-Breeze. Eze-Breeze non-glass vertical and horizontal sliding panels for porch enclosures are vinyl-glazed, aluminum-framed products used for enclosing screened-in porches that provide protection from inclement weather. This line was completed with the addition of a cabana door.

PGT Commercial Storefront System. PGT’s Commercial Storefront window system and entry doors, launched in 2013, are engineered to provide a flexible yet economical solution for a variety of applications. Our system provides easy fabrication and assembly, while also reducing installation time and challenges.

EnergyVue. EnergyVue is our all new non-impact vinyl window featuring energy-efficient insulating glass and multi-chambered frames that meet or exceed ENERGY STAR® standards in all climate zones to help save consumers on energy costs. The new design has a refined modern profile combined with robust construction to make larger sizes and higher design pressures an unparalleled offering. We rounded out the line with one of the industry’s most extensive selection of frame colors and a variety of hardware finishes, glass tints, grid styles and patterns for their customers. We announced the launch of EnergyVue in the first quarter of 2015.

Sales and Marketing

Our sales strategy primarily focuses on attracting and retaining distributors and dealers by consistently providing exceptional customer service, leading product designs and quality, and competitive pricing all using our advanced knowledge of building code requirements and technical expertise.

Our marketing strategy is designed to reinforce the high quality of our products and focuses on both coastal and inland markets. We support our markets through print and web-based advertising, consumer, dealer, and builder promotions, and selling and collateral materials. We also work with our dealers and distributors to educate architects, building officials, consumers and homebuilders on the advantages of using impact-resistant and energy-efficient products. We market our products based on quality, building code compliance, outstanding service, shorter lead times, and on-time delivery using our fleet of trucks and trailers.

Our Customers

We have a highly diversified customer base that is comprised of approximately 1,100 window distributors, building supply distributors, window replacement dealers and enclosure contractors. Our largest customer accounts for approximately 4% of net sales and our top ten customers account for approximately 20% of net sales. Our sales are comprised of residential new construction and home repair and remodeling end markets, which represented approximately 38% and 62% of our sales, respectively, during 2014. This compares to 32% and 68%, respectively, in 2013.

We do not supply our products directly to homebuilders, but believe demand for our products is also a function of our relationships with a number of national homebuilders, which we believe are strong.

- 5 -

Table of Contents

Materials and Supplier Relationships

Our primary manufacturing materials include aluminum and vinyl extrusions, glass, ionoplast, and polyvinyl butyral. Although in many instances we have agreements with our suppliers, these agreements are generally terminable by either party on limited notice. All of our materials are typically readily available from other sources. Aluminum and vinyl extrusions accounted for approximately 37% of our material purchases during fiscal year 2014. Sheet glass, which is sourced from two major national suppliers, accounted for approximately 17% of our material purchases during fiscal year 2014. Sheet glass that we purchase comes in various sizes, tints, and thermal properties. From the sheet glass purchased, we produce most of our own laminated glass needs. However, in 2014 due to some temporary capacity constraints, we did purchase the remaining amounts of our laminated glass needs from one major national supplier. This finished laminated glass made up approximately 9% of our material purchases in fiscal year 2014. Polyvinyl butyral and ionoplast, which are both used as inner layer in laminated glass, accounted for approximately 13% of our material purchases during fiscal year 2014.

Backlog

As of January 3, 2015, our backlog was $28.0 million, which includes CGI’s backlog of $3.4 million, compared to PGT’s backlog of $17.6 million at December 28, 2013. Our backlog consists of orders that we have received from customers that have not yet shipped, and we expect that substantially all of our current backlog will be recognized as sales in the first quarter of 2015, due in part to our lead times which range from one to five weeks.

Intellectual Property

We own and have registered trademarks in the United States. In addition, we own several patents and patent applications concerning various aspects of window assembly and related processes. We are not aware of any circumstances that would have a material adverse effect on our ability to use our trademarks and patents. As long as we continue to renew our trademarks when necessary, the trademark protection provided by them is perpetual.

Manufacturing

Our manufacturing facilities are located in Florida where we produce fully-customized products. The manufacturing process typically begins in our glass plant where we cut, temper, laminate, and insulate sheet glass to meet specific requirements of our customers’ orders.

Glass is transported to our window and door assembly lines in a make-to-order sequence where it is combined with an aluminum or vinyl frame. These frames are also fabricated to order. We start with a piece of extruded material which is cut and shaped into a frame that fits the customers’ specifications. Once complete, product is immediately staged for delivery and generally shipped on our trucking fleet within 48 hours of completion.

Competition

The window and door industry is highly fragmented, and the competitive landscape is based on geographic scope. The competition falls into one of two categories.

Local and Regional Window and Door Manufacturers: This group of competitors consists of numerous local job shops and small manufacturing facilities that tend to focus on selling products to local or regional dealers and wholesalers. Competitors in this group typically lack marketing support and the service levels and quality controls demanded by larger distributors, as well as the ability to offer a full complement of products.

National Window and Door Manufacturers: This group of competitors tends to focus on selling branded products nationally to dealers and wholesalers and has multiple locations.

Active Protection: This group of competitors consists of manufactures that produce shutters and plywood, both of which are used to actively protect openings. Our impact windows and doors represent passive protection, meaning, once installed, no activity is required to protect a home from storm related hazards.

The principal methods of competition in the window and door industry are the development of long-term relationships with window and door dealers and distributors, and the retention of customers by delivering a full range of high-quality products on time while offering competitive pricing and flexibility in transaction processing. Trade professionals such as contractors, homebuilders, architects and engineers also engage in direct interaction and look to the manufacturer for training and education of product and code.

- 6 -

Table of Contents

Although some of our competitors may have greater geographic scope and access to greater resources and economies of scale than do we, our leading position in the U.S. impact-resistant window and door market, and the award winning designs and high quality of our products, position us well to meet the needs of our customers.

Environmental Considerations

Although our business and facilities are subject to federal, state, and local environmental regulation, environmental regulation does not have a material impact on our operations, and we believe that our facilities are in material compliance with such laws and regulations.

Employees

As of March 10, 2015, we employed approximately 1,900 people, including approximately 200 people at CGI, none of whom were represented by a collective bargaining unit. We believe we have good relations with our employees.

FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

Our domestic and international net sales for each of the three years ended January 3, 2015, December 28, 2013, and December 29, 2012, are as follows (in millions):

| Year Ended | ||||||||||||

| January 3, 2015 |

December 28, 2013 |

December 29, 2012 |

||||||||||

| Domestic |

$ | 295.8 | $ | 232.7 | $ | 166.9 | ||||||

| International |

10.6 | 6.6 | 7.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total net sales |

$ | 306.4 | $ | 239.3 | $ | 174.5 | ||||||

|

|

|

|

|

|

|

|||||||

AVAILABLE INFORMATION

Our Internet address is www.pgtindustries.com. Through our Internet website under “Financial Information” in the Investors section, we make available free of charge, as soon as reasonably practical after such information has been filed with the SEC, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act. Also available through our Internet website under “Corporate Governance” in the Investors section are our Code of Business Conduct and Ethics and our supplemental Code of Ethics for Senior Officers. We are not including this or any other information on our website as a part of, nor incorporating it by reference into this Form 10-K, or any of our other SEC filings. The SEC maintains an Internet site that contains our reports, proxy and information statements, and other information that we file electronically with the SEC at www.sec.gov.

| Item 1A. | RISK FACTORS |

We are subject to regional and national economic conditions. The economy in Florida and throughout the United States could negatively impact demand for our products as it has in the past, and macroeconomic forces such as employment rates and the availability of credit could have an adverse effect on our sales and results of operations.

New home construction while improving, remains below average. Also repair and remodeling markets are subject to many economic factors. Accordingly, either market could decline and lower the demand for, and the pricing of, our products, which could adversely affect our results. The window and door industry is subject to the cyclical market pressures of the larger new construction and repair and remodeling markets. In turn, these changes may be affected by adverse changes in economic conditions such as demographic trends, employment levels, interest rates, and consumer confidence. A decline in the economic environment or new home construction could negatively impact our sales and earnings.

Economic and credit market conditions impact our ability to collect receivables. Economic and credit conditions negatively impacted our bad debt expense in the years 2007-2011, which adversely impacted our results of operations. If these conditions return, our results of operations may again be adversely impacted by bad debts.

We are subject to fluctuations in the prices of our raw materials. We experience significant fluctuations in the cost of our raw materials, including aluminum extrusion, polyvinyl butyral and glass. A variety of factors over which we have no control, including

- 7 -

Table of Contents

global demand for aluminum, fluctuations in oil prices, speculation in commodities futures and the creation of new laminates or other products based on new technologies impact the cost of raw materials which we purchase for the manufacture of our products. While we attempt to minimize our risk from severe price fluctuations by entering into aluminum forward contracts to hedge these fluctuations in the purchase price of aluminum extrusion we use in production, substantial, prolonged upward trends in aluminum prices could significantly increase the cost of the unhedged portions of our aluminum needs and have an adverse impact on our results of operations. We anticipate that these fluctuations will continue in the future. While we have entered into a two-year supply agreement through December 2016 with a major producer of ionoplast inter layer that we believe provides us with a reliable, single source for ionoplast with stable pricing on favorable terms, if one or both parties to the agreement do not satisfy the terms of the agreement it may be terminated which could result in our inability to obtain ionoplast on commercially reasonable terms having an adverse impact on our results of operations. While historically we have to some extent been able to pass on significant cost increases to our customers, our results between periods may be negatively impacted by a delay between the cost increases and price increases in our products.

We depend on third-party suppliers for our raw materials. Our ability to offer a wide variety of products to our customers depends on receipt of adequate material supplies from manufacturers and other suppliers. Generally, our raw materials and supplies are obtainable from various sources and in sufficient quantities. However, it is possible that our competitors or other suppliers may create laminates or products based on new technologies that are not available to us or are more effective than our products at surviving hurricane-force winds and wind-borne debris or that they may have access to products of a similar quality at lower prices. Although in many instances we have agreements with our suppliers, these agreements are generally terminable by either party on limited notice. Moreover, other than with our suppliers of polyvinyl butyral and aluminum, we do not have long-term contracts with the suppliers of our raw materials.

Transportation costs represent a significant part of our cost structure. Fuel prices decreased significantly in the second half of 2014 but have increased in early 2015, and remain volatile. A rapid and prolonged increase in fuel prices may significantly increase our costs and have an adverse impact on our results of operations.

The home building industry and the home repair and remodeling sector are regulated. The homebuilding industry and the home repair and remodeling sector are subject to various local, state, and federal statutes, ordinances, rules, and regulations concerning zoning, building design and safety, construction, and similar matters, including regulations that impose restrictive zoning and density requirements in order to limit the number of homes that can be built within the boundaries of a particular area. Increased regulatory restrictions could limit demand for new homes and home repair and remodeling products and could negatively affect our sales and results of operations.

Our operating results are substantially dependent on sales of our branded impact-resistant products. A majority of our net sales are, and are expected to continue to be, derived from the sales of our branded impact-resistant products. Accordingly, our future operating results will depend on the demand for our impact-resistant products by current and future customers, including additions to this product line that are subsequently introduced. If our competitors release new products that are superior to our impact-resistant products in performance or price, or if we fail to update our impact-resistant products with any technological advances that are developed by us or our competitors or introduce new products in a timely manner, demand for our products may decline. A decline in demand for our impact-resistant products as a result of competition, technological change or other factors could have a material adverse effect on our ability to generate sales, which would negatively affect results of operations.

In 2015, we are launching a new line of vinyl impact-resistant and non-impact energy saving windows. In January 2015, we unveiled our new Vinyl WinGuard and EnergyVue line of vinyl windows which we will begin taking orders for in April 2015. Our intent in launching this new line of vinyl products is that it will ultimately replace various existing lines of vinyl impact-resistant and energy saving windows. We designed these products to exceed the most stringent impact-resistance and energy-saving codes in the country, and they have been well received by the industry. However, if these products fail to gain acceptance with our customers as replacements of our currently successful lines of vinyl windows, we could lose market share to our competitors that produce similar products, which could have a material impact on our sales and negatively affect results of operations.

Changes in building codes could lower the demand for our impact-resistant windows and doors. The market for our impact-resistant windows and doors depends in large part on our ability to satisfy state and local building codes that require protection from wind-borne debris. If the standards in such building codes are raised, we may not be able to meet their requirements, and demand for our products could decline. Conversely, if the standards in such building codes are lowered or are not enforced in certain areas, demand for our impact-resistant products may decrease. Further, if states and regions that are affected by hurricanes but do not currently have such building codes fail to adopt and enforce hurricane protection building codes; our ability to expand our business in such markets may be limited.

- 8 -

Table of Contents

Our industry is competitive, and competition may increase as our markets grow or as more states adopt or enforce building codes that require impact-resistant products. The window and door industry is highly competitive. We face significant competition from numerous small, regional producers, as well as certain national producers. Any of these competitors may (i) foresee the course of market development more accurately than do we, (ii) develop products that are superior to our products, (iii) have the ability to produce similar products at a lower cost, or (iv) adapt more quickly to new technologies or evolving customer requirements than do we. Additionally, new competitors may enter our industry, and larger existing competitors may increase their efforts and devote substantially more resources to expand their presence in the impact-resistant market. If we are unable to compete effectively, demand for our products may decline. In addition, while we are skilled at creating finished impact-resistant and other window and door products, the materials we use can be purchased by any existing or potential competitor. New competitors can enter our industry, and existing competitors may increase their efforts in the impact-resistant market. Furthermore, if the market for impact-resistant windows and doors continues to expand, larger competitors could enter or expand their presence in the market and may be able to compete more effectively. Finally, we may not be able to maintain our costs at a level for us to compete effectively. If we are unable to compete effectively, demand for our products and our profitability may decline.

Our business is currently concentrated in one state. Our business is concentrated geographically in Florida. In fiscal year 2014, approximately 88% of our sales were generated in Florida, a state in which new single family housing permits remain below average. Focusing operations into manufacturing locations in Florida optimizes manufacturing efficiencies and logistics, and we believe that a focused approach to growing our share within our core wind-borne debris markets in Florida, from the Gulf Coast to the mid-Atlantic, and certain international markets, will maximize value and return. However, such a focus further concentrates our business, and another prolonged decline in the economy of the state of Florida or of certain coastal regions, a change in state and local building code requirements for hurricane protection, or any other adverse condition in the state or certain coastal regions, could cause a decline in the demand for our products, which could have an adverse impact on our sales and results of operations.

We may incur additional indebtedness. We may incur additional indebtedness under our credit facilities, which provide for up to $35 million of revolving credit borrowings. In addition, we and our subsidiaries may incur additional indebtedness in the future. If new debt is added to our current debt levels, certain risks which we currently do not consider significant could intensify.

Our debt instruments contain various covenants that limit our ability to operate our business. Our credit facility contains various provisions that limit our ability to, among other things, transfer or sell assets, including the equity interests of our subsidiaries, or use asset sale proceeds; pay dividends or distributions on our capital stock, make certain restricted payments or investments; create liens to secure debt; enter into transactions with affiliates; merge or consolidate with another company; and engage in unrelated business activities.

In addition, our credit facilities require us to meet specified financial ratios. These covenants may restrict our ability to expand or fully pursue our business strategies. Our ability to comply with these and other provisions of our credit facilities may be affected by changes in our operating and financial performance, changes in general business and economic conditions, adverse regulatory developments, or other events beyond our control. The breach of any of these covenants, including those contained in our credit facilities, could result in a default under our indebtedness, which could cause those and other obligations to become due and payable. If any of our indebtedness is accelerated, we may not be able to repay it.

We may be adversely affected by any disruption in our information technology systems. Our operations are dependent upon our information technology systems, which encompass all of our major business functions. A disruption in our information technology systems for any prolonged period could result in delays in receiving inventory and supplies or filling customer orders and adversely affect our customer service and relationships.

During the second quarter of fiscal year 2012, we started the implementation of our new Enterprise Resource Planning (“ERP”) System. In order to maintain our leadership position in the market and efficiently process increased business volume, we are making a significant upgrade to our computer hardware, software and our ERP System. The ERP implementation was substantially completed by the end of 2014, with shipments in our new system expected to increase significantly through the second quarter of 2015. Although significant testing of the new ERP system has taken place, inefficiencies could result from the conversion and our ability to maintain and grow the business could be hindered, and our operations and financial results could be adversely impacted.

We may be adversely affected by any disruptions to our manufacturing facilities or disruptions to our customer, supplier, or employee base. Any disruption to our facilities resulting from hurricanes and other weather-related events, fire, an act of terrorism, or any other cause could damage a significant portion of our inventory, affect our distribution of products, and materially impair our ability to distribute our products to customers. We could incur significantly higher costs and longer lead times associated with distributing our products to our customers during the time that it takes for us to reopen or replace a damaged facility. In addition, if there are disruptions to our customer and supplier base or to our employees caused by hurricanes, our business could be temporarily adversely affected by higher costs for materials, increased shipping and storage costs, increased labor costs, increased absentee rates,

- 9 -

Table of Contents

and scheduling issues. Furthermore, some of our direct and indirect suppliers have unionized work forces, and strikes, work stoppages, or slowdowns experienced by these suppliers could result in slowdowns or closures of their facilities. Any interruption in the production or delivery of our supplies could reduce sales of our products and increase our costs.

The nature of our business exposes us to product liability and warranty claims. We are, from time to time, involved in product liability and product warranty claims relating to the products we manufacture and distribute that, if adversely determined, could adversely affect our financial condition, results of operations, and cash flows. In addition, we may be exposed to potential claims arising from the conduct of homebuilders and home remodelers and their sub-contractors. Although we currently maintain what we believe to be suitable and adequate insurance in excess of our self-insured amounts, we may not be able to maintain such insurance on acceptable terms or such insurance may not provide adequate protection against potential liabilities. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for significant periods, regardless of the ultimate outcome. Claims of this nature could also have a negative impact on customer confidence in our products and our company.

We are subject to potential exposure to environmental liabilities and are subject to environmental regulation. We are subject to various federal, state, and local environmental laws, ordinances, and regulations. Although we believe that our facilities are in material compliance with such laws, ordinances, and regulations, as owners and lessees of real property, we can be held liable for the investigation or remediation of contamination on such properties, in some circumstances, without regard to whether we knew of or were responsible for such contamination. Remediation may be required in the future as a result of spills or releases of petroleum products or hazardous substances, the discovery of unknown environmental conditions, or more stringent standards regarding existing residual contamination. More burdensome environmental regulatory requirements may increase our general and administrative costs and may increase the risk that we may incur fines or penalties or be held liable for violations of such regulatory requirements.

We conduct all of our operations through our subsidiaries, and rely on payments from our subsidiaries to meet all of our obligations. We are a holding company and derive all of our operating income from our subsidiary, PGT Industries, Inc., and its subsidiary, CGI Windows and Doors, Inc. All of our assets are held by our subsidiaries, and we rely on the earnings and cash flows of our subsidiaries to meet our obligations. The ability of our subsidiaries to make payments to us will depend on their respective operating results and may be restricted by, among other things, the laws of their jurisdictions of organization (which may limit the amount of funds available for distributions to us), the terms of existing and future indebtedness and other agreements of our subsidiaries, including our credit facilities, and the covenants of any future outstanding indebtedness we or our subsidiaries incur.

We are exposed to risks relating to evaluations of controls required by Section 404 of the Sarbanes-Oxley Act of 2002. We are required to comply with Section 404 of the Sarbanes-Oxley Act of 2002. While we have concluded that at January 3, 2015, we have no material weaknesses in our internal controls over financial reporting, we cannot assure you that we will not have a material weakness in the future. A “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. If we fail to maintain a system of internal controls over financial reporting that meets the requirements of Section 404, we might be subject to sanctions or investigation by regulatory authorities such as the SEC or by the NASDAQ Global Market LLC. Additionally, failure to comply with Section 404 or the report by us of a material weakness may cause investors to lose confidence in our financial statements and our stock price may be adversely affected. If we fail to remedy any material weakness, our financial statements may be inaccurate, we may not have access to the capital markets, and our stock price may be adversely affected.

We are exposed to risks relating to building of our new glass facility. We expanded our glass processing capacity with the completion of a new multi-million dollar facility, and are proceeding with the second phase of this expansion with the purchase of additional laminating and insulating equipment. While the second phase of the plant expansion is progressing with no anticipated issues, there is always the potential risk of a delay in completion and of cost over-runs. Should a serious delay in the second phase of this project take place, or if this project negatively impacted our operational efficiencies, this would impact the cost savings we expect to achieve during 2015 which could negatively affect our future results.

We may be adversely impacted by the loss of sales or market share from being unable to keep up with demand. We are currently experiencing growth through higher sales volume and growth in market share. To meet the increased demand, we have been hiring and training new employees for direct and indirect support, and adding to our glass capacity. However, should we be unable to find and retain quality employees to meet demand, or should there be disruptions to the increase in capacity, we may be unable to keep up with our higher sales demand. If our lag time on delivery falls behind, or we are unable to meet customer timing demands, we could lose market share to competitors.

We made a significant acquisition late in the third quarter of 2014 of a company that sells products similar to PGT’s own impact-resistant line of products in PGT’s primary market of Florida. Late in the third quarter of 2014, we acquired CGI Windows and Doors, Inc. CGI produces the Estate, Sentinel and Targa lines of impact-resistant branded products which are very similar to our

- 10 -

Table of Contents

WinGuard line of impact-resistant branded products. Nearly all of CGI’s sales are in Florida, PGT’s primary market. We believe that adding CGI’s branded products and presence in Florida to PGT’s already successful, established line of branded products in Florida will benefit PGT through higher sales and market share. However, no assurances can be given that the combination of these branded products within a single company will not result in dilution of these brands, resulting in loss of market share and demand for these products.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

We have the following properties as of January 3, 2015:

| Manufacturing | Support | Storage | ||||||||||

| (in square feet) | ||||||||||||

| Owned: |

||||||||||||

| Main Plant and Corporate Office, North Venice, FL |

348,000 | 15,000 | — | |||||||||

| Glass tempering and laminating, North Venice, FL |

80,000 | — | — | |||||||||

| New glass facility, North Venice, FL |

96,000 | — | — | |||||||||

| Insulated Glass, North Venice, FL |

42,000 | — | — | |||||||||

| PGT Wellness Center, North Venice, FL |

— | 3,600 | — | |||||||||

| Leased: |

||||||||||||

| James Street Storage, Venice, FL |

15,000 | — | — | |||||||||

| Center Court, Venice, FL |

19,600 | 15,400 | — | |||||||||

| Endeavor Court, Nokomis, FL |

— | 2,300 | — | |||||||||

| Endeavor Court, Nokomis, FL |

— | 6,100 | — | |||||||||

| Technology Park, Nokomis, FL |

— | 1,800 | — | |||||||||

| Sarasota Warehouse, Bradenton, FL |

— | — | 48,000 | |||||||||

| Plant and Administrative Offices, Miami, FL |

90,000 | 17,000 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total square feet |

690,600 | 61,200 | 48,000 | |||||||||

|

|

|

|

|

|

|

|||||||

On August 16, 2013, we purchased land to build our new glass operations plant. We officially broke ground on January 9, 2014, and completed construction during 2014. The new glass plant became operational late in the third quarter of 2014. This new facility adds 96,000 square foot to our current glass cutting, tempering and laminating process. We also own three additional parcels of land available for future growth.

Our leases listed above expire between December 2015 and September 2016. Each of the leases provides for a fixed annual rent. The leases require us to pay taxes, insurance and common area maintenance expenses associated with the properties.

All of our owned properties secure borrowings under our credit agreement. We believe all of these operating facilities are adequate in capacity and condition to service existing customer needs.

| Item 3. | LEGAL PROCEEDINGS |

We are involved in various claims and lawsuits incidental to the conduct of our business in the ordinary course. We carry insurance coverage in such amounts in excess of our self-insured retention as we believe to be reasonable under the circumstances and that may or may not cover any or all of our liabilities in respect of claims and lawsuits. We do not believe that the ultimate resolution of these matters will have a material adverse impact on our financial position, cash flows or results of operations.

| Item 4. | MINE SAFETY DISCLOSURES |

Not Applicable

- 11 -

Table of Contents

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our Common Stock is traded on the NASDAQ Global Market ® under the symbol “PGTI”. On March 10, 2015, the closing price of our Common Stock was $10.71 as reported on the NASDAQ Global Market. The approximate number of stockholders of record of our Common Stock on that date was 50, although we believe that the number of beneficial owners of our Common Stock is substantially greater.

The table below sets forth the price range of our Common Stock during the periods indicated:

| High | Low | |||||||

| 2014 |

||||||||

| 1st Quarter |

$ | 12.61 | $ | 9.75 | ||||

| 2nd Quarter |

$ | 11.93 | $ | 7.87 | ||||

| 3rd Quarter |

$ | 10.97 | $ | 7.34 | ||||

| 4th Quarter |

$ | 10.26 | $ | 8.25 | ||||

| High | Low | |||||||

| 2013 |

||||||||

| 1st Quarter |

$ | 8.22 | $ | 4.22 | ||||

| 2nd Quarter |

$ | 9.25 | $ | 6.23 | ||||

| 3rd Quarter |

$ | 11.69 | $ | 8.58 | ||||

| 4th Quarter |

$ | 11.00 | $ | 8.84 | ||||

Dividends

We do not pay a regular dividend. Any determination relating to dividend policy will be made at the discretion of our Board of Directors. The terms of our credit facility currently restrict our ability to pay dividends.

Securities Authorized for Issuance under Equity Compensation Plans

The information required by this item appears in our definitive proxy statement for our annual meeting of stockholders under the caption “Security Ownership of Certain Beneficial Owners and Management” and “Equity Compensation Plan Information,” which information is incorporated herein by reference.

Unregistered Sales of Equity Securities

None.

Issuer Purchases of Equity Securities

On November 15, 2012, the Board of Directors authorized and approved a share repurchase program of up to $20 million. All share repurchases were made in accordance with Rule 10b5-1 and Rule 10b-18, as applicable, of the Securities Exchange Act of 1934 as to the timing, pricing, and volume of such transactions. During 2014, we acquired 93,081 shares of our common stock at a cost of approximately $1.0 million, bringing our total shares acquired to 2,089,853 at a total cost of $11.1 million. These shares were placed in treasury. During the second quarter of fiscal 2013, we repurchased 6,791,171 shares of our common stock from JLL Partners Fund IV, L.P. We purchased these shares at a price per share of $7.36, which represented the offering price to the public in a concurrent secondary offering, less the underwriting discounts and commissions. These shares were cancelled and retired.

- 12 -

Table of Contents

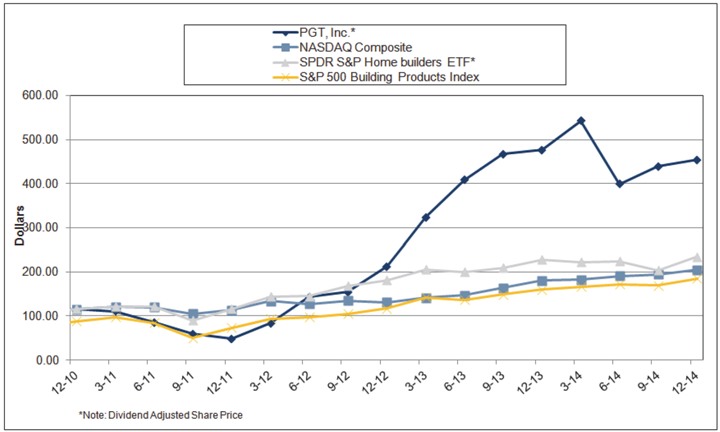

Performance Graph

The following graphs compare the percentage change in PGT, Inc.’s cumulative total stockholder return on its Common Stock with the cumulative total stockholder return of the Standard & Poor’s Building Products Index and the NASDAQ Composite Index over the period from January 2, 2010, to January 3, 2015.

COMPARISON OF 60 MONTH CUMULATIVE TOTAL RETURN*

AMONG PGT, INC., THE NASDAQ COMPOSITE INDEX,

AND THE S&P BUILDING PRODUCTS INDEX

| * | $100 invested on January 2, 2010 in stock or in index-including reinvestment of dividends for 60 months ending January 3, 2015. |

- 13 -

Table of Contents

| Item 6. | SELECTED FINANCIAL DATA |

The following table sets forth selected historical consolidated financial information and other data as of and for the periods indicated and have been derived from our audited consolidated financial statements.

All information included in the following tables should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in Item 7, and with the consolidated financial statements and related notes in Item 8. All years presented consisted of 52 weeks, except for the year ended January 3, 2015, which consisted of 53 weeks.

| Selected Consolidated Financial Data |

Year Ended January 3, 2015 |

Year Ended December 28, 2013 |

Year Ended December 29, 2012 |

Year Ended December 31, 2011 |

Year Ended January 1, 2011 |

|||||||||||||||

| Net sales |

$ | 306,388 | $ | 239,303 | $ | 174,540 | $ | 167,276 | $ | 175,741 | ||||||||||

| Cost of sales |

213,596 | 159,169 | 114,872 | 128,171 | 125,615 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

92,792 | 80,134 | 59,668 | 39,105 | 50,126 | |||||||||||||||

| Impairment charges (1) |

— | — | — | 5,959 | 5,561 | |||||||||||||||

| Gain on sale of assets held (2) |

— | (2,195 | ) | — | — | — | ||||||||||||||

| Selling, general and administrative expenses |

56,377 | 54,594 | 47,094 | 48,619 | 53,879 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from operations |

36,415 | 27,735 | 12,574 | (15,473 | ) | (9,314 | ) | |||||||||||||

| Interest expense |

5,960 | 3,520 | 3,437 | 4,168 | 5,123 | |||||||||||||||

| Debt extinguishment costs |

2,625 | 333 | — | — | — | |||||||||||||||

| Other expense (income), net (3) |

1,750 | 437 | 72 | (419 | ) | (19 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

26,080 | 23,445 | 9,065 | (19,222 | ) | (14,418 | ) | |||||||||||||

| Income tax expense (benefit) |

9,675 | (3,374 | ) | 110 | (2,324 | ) | 77 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 16,405 | $ | 26,819 | $ | 8,955 | $ | (16,898 | ) | $ | (14,495 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per common share: |

||||||||||||||||||||

| Basic |

$ | 0.35 | $ | 0.55 | $ | 0.17 | $ | (0.31 | ) | $ | (0.29 | ) | ||||||||

| Diluted |

$ | 0.33 | $ | 0.51 | $ | 0.16 | $ | (0.31 | ) | $ | (0.29 | ) | ||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic |

47,376 | 48,881 | 53,620 | 53,659 | 50,174 | |||||||||||||||

| Diluted |

49,777 | 52,211 | 55,262 | 53,659 | 50,174 | |||||||||||||||

| Other financial data: |

||||||||||||||||||||

| Depreciation |

$ | 4,534 | $ | 4,622 | $ | 5,731 | $ | 7,590 | $ | 9,180 | ||||||||||

| Amortization |

1,446 | 6,458 | 6,502 | 6,502 | 6,028 | |||||||||||||||

| As Of January 3, 2015 (4) |

As Of December 28, 2013 |

As Of December 29, 2012 |

As Of December 31, 2011 |

As Of January 1, 2011 |

||||||||||||||||

| Balance Sheet data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 42,469 | $ | 30,204 | $ | 18,743 | $ | 10,940 | $ | 22,012 | ||||||||||

| Total assets |

311,749 | 156,632 | 141,317 | 142,835 | 169,119 | |||||||||||||||

| Total debt, including current portion |

193,754 | 77,255 | 37,500 | 45,550 | 50,163 | |||||||||||||||

| Shareholders’ equity |

73,976 | 49,075 | 74,210 | 67,362 | 83,042 | |||||||||||||||

| (1) | In 2011, amounts relate to intangible asset impairment charges. In 2010, amount relates to write-down of the value of our Salisbury, NC property, and certain other equipment of the Company. See Notes 2 and 8 in Item 8. |

| (2) | Relates to the sale of the Salisbury, NC facility. The net selling price of the facility was approximately $7.5 million and the carrying value of the asset at the time of sale was $5.3 million. |

| (3) | In 2014 and 2013, this relates to a combination of derivative financial instruments and deferred financing costs. |

| (4) | Late in the third quarter of 2014, we acquired CGI. See Note 4 in Item 8. |

- 14 -

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) should be read in conjunction with our Consolidated Financial Statements and related Notes included in Item 8. We also advise you read the risk factors in Item 1A. Our MD&A is presented in seven sections:

| • | Executive Overview; |

| • | Results of Operations; |

| • | Liquidity and Capital Resources; |

| • | Disclosures of Contractual Obligations and Commercial Commitments; |

| • | Critical Accounting Estimates; |

| • | Recently Issued Accounting Standards; and |

| • | Forward Outlook |

EXECUTIVE OVERVIEW

Sales and Operations

On February 25, 2015, we issued a press release and on February 26, 2015, we held a conference call to review the results of operations for our fourth quarter and fiscal year ended January 3, 2015. During the call, we also discussed current market conditions and progress made regarding certain of our initiatives. The overview and estimates contained in this report are consistent with those given in our press release and discussed on the call. We are neither updating nor confirming that information.

Resulting from the improvement in the housing market as well our marketing programs focused on taking market share with our WinGuard products, our sales grew 28.0% to $306.4 million, our highest net sales since 2007. Gross profit increased 15.8% and we continued to leverage selling, general and administrative expenses which, as a percent of sales, decreased to 18.4%, compared to 22.8% in 2013. However, our net income was $16.4 million, a decrease of $10.4 million when compared to 2013’s net income of $26.8 million. The decrease in net income was primarily the result of the reversal of the valuation allowance on deferred tax assets in 2013, which resulted in an income tax benefit of $3.4 million for 2013 compared to an income tax expense of $9.7 million in 2014, a factor that caused net income to decrease by $13.1 million.

In terms of sales strategies, we continued our strategic focus of concentrating our resources in our core market, Florida, and implemented promotional activities to gain market share. We also established programs and partnerships with national accounts to increase our sales presence. As a result of our efforts and the improving macro-economic conditions, specifically in Florida, sales during 2014 increased $67.1 million, or 28.0%, compared to 2013. New construction sales increased $39.5 million, or 52.2%, while repair and remodel sales increased by $27.6 million, or 16.8%. CGI sales in 2014 include $5.0 million of new construction sales and $8.3 million of repair and remodeling sales. By region, our sales in Florida increased $56.9 million, or 26.6%, including $12.0 million of sales in Florida from CGI, and sales in the out of state markets increased $6.2 million, or 33.2%. Sales in the international markets increased $4.0 million, or 60.6%, including $1.3 million of international sales from CGI.

By product category, sales in our impact lines increased $56.9 million, or 31.0%, including $13.3 million from CGI. All of CGI’s products are impact-resistant. This increase was driven by our WinGuard products which increased $38.5 million, or 22.4%. Within WinGuard, Vinyl WinGuard products increased $11.7 million, or 31.4%, and Aluminum WinGuard products increased $26.8 million, or 19.9%. Sales in our Architectural System line increased by $11.6 million, while sales in our Storefront product introduced last year increased $1.5 million. Our PremierVue product sales increased $2.0 million. Sales of our other non-impact products increased by $10.2 million overall, including a $1.8 million increase in Eze-Breeze product sales. CGI’s sales of impact products of $13.3 million included $6.8 million from their Estate Collection products, $5.7 million from its Sentinel line, and $0.8 million of Targa products.

Looking at 2015 and beyond, we completed our new glass facility late in the third quarter of 2014. This new glass facility increases our internal capacities for glass processing which reduces our reliance on outsourced finished glass products. We are currently in the second phase of this project, which includes adding laminating and insulating equipment to our new facility. Moody’s forecast for 2015 suggests a 14% increase in new single family home construction,

- 15 -

Table of Contents

while the repair and remodeling market is expected to record a slow but steady improvement. While we expect continued sales growth driven by the improving new construction market, we will continue to make investments to gain market share in both the new construction and repair and remodeling markets.

Liquidity and Cash Flow

During 2014, we generated $22.3 million in cash flow from operations, which was used to fund working capital needs, service our long-term debt, and capital expenditures of $19.3 million, including the construction of our new glass processing facility. Late in the third quarter of 2014, we entered into a new senior secured credit facility which includes a $200 million term loan and $35 million revolving line of credit. This new facility increased our outstanding debt to $200 million, the proceeds from which we used to acquire CGI, including the payment of financing costs, and to repay existing long-term debt which at that time was $79 million which was the result of a debt refinancing we consummated in May 2013. The proceeds from the 2013 refinancing was used to fund our stock repurchase from JLL Partners.

RESULTS OF OPERATIONS

Analysis of Selected Items from our Consolidated Statements of Operations

| Year Ended | Percent Change | |||||||||||||||||||

| January 3, 2015 |

December 28, 2013 |

December 29, 2012 |

Increase / (Decrease) | |||||||||||||||||

| (in thousands, except per share amounts) | 2014-2013 | 2013-2012 | ||||||||||||||||||

| Net sales |

$ | 306,388 | $ | 239,303 | $ | 174,540 | 28.0 | % | 37.1 | % | ||||||||||

| Cost of sales |

213,596 | 159,169 | 114,872 | 34.2 | % | 38.6 | % | |||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Gross profit |

92,792 | 80,134 | 59,668 | 15.8 | % | 34.3 | % | |||||||||||||

| Gross margin |

30.3 | % | 33.5 | % | 34.2 | % | ||||||||||||||

| Gain on sale of assets held |

— | (2,195 | ) | — | ||||||||||||||||

| SG&A expenses |

56,377 | 54,594 | 47,094 | 3.3 | % | 15.9 | % | |||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| SG&A expenses as a percentage of sales |

18.4 | % | 22.8 | % | 27.0 | % | ||||||||||||||

| Income from operations |

36,415 | 27,735 | 12,574 | |||||||||||||||||

| Interest expense, net |

5,960 | 3,520 | 3,437 | |||||||||||||||||

| Debt extinguishment costs |

2,625 | 333 | — | |||||||||||||||||

| Other expenses, net |

1,750 | 437 | 72 | |||||||||||||||||

| Income tax expense (benefit) |

9,675 | (3,374 | ) | 110 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

$ | 16,405 | $ | 26,819 | $ | 8,955 | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net income per common share: |

||||||||||||||||||||

| Basic |

$ | 0.35 | $ | 0.55 | $ | 0.17 | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Diluted |

$ | 0.33 | $ | 0.51 | $ | 0.16 | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

2014 Compared with 2013

Net sales

Net sales for 2014 were $306.4 million, a $67.1 million, or 28.0%, increase in sales from $239.3 million in the prior year.

- 16 -

Table of Contents

The following table shows net sales classified by major product category (in millions, except percentages):

| Year Ended | ||||||||||||||||||||

| January 3, 2015 | December 28, 2013 | |||||||||||||||||||

| Sales | % of sales | Sales | % of sales | % change | ||||||||||||||||

| Product category: |

||||||||||||||||||||

| Impact window and door products |

$ | 240.3 | 78.4 | % | $ | 183.4 | 76.6 | % | 31.0 | % | ||||||||||

| Other window and door products |

66.1 | 21.6 | % | 55.9 | 23.4 | % | 18.2 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total net sales |

$ | 306.4 | 100.0 | % | $ | 239.3 | 100.0 | % | 28.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Net sales of our impact window and door products, which include our WinGuard, Architectural Systems, Storefront and PremierVue products, as well as sales of $13.3 million from CGI, were $240.3 million in 2014, an increase of $56.9 million, or 31.0%, from $183.4 million in the prior year. This increase was driven mainly by our WinGuard products, which increased $38.5 million, or 22.4%, due to the improved new construction housing market, and our promotional and marketing activities. Within our WinGuard products, Vinyl WinGuard grew $11.7 million, or 31.4%, and Aluminum WinGuard grew $26.8 million, or 19.9%. Also contributing to our overall increased sales was an increase in our Architectural System products, up $1.6 million, our Storefront product, which grew $1.5 million, and our PremierVue products, which grew $2.0 million.

Net sales of other window and door products, which includes aluminum and vinyl non-impact, and Eze-Breeze, were $66.1 million in 2014, an increase of $10.2 million, or 18.2%, from $55.9 million for the prior year. Sales of our aluminum products increased $3.1 million, or 12.9%, and sales of our Vinyl products increased $5.3 million, or 30.5%, due in large part to the increased new construction activity and our ability to provide customers with one stop shopping for all window and door needs. The Eze-Breeze line increased sales by $1.8 million due to improvement in market conditions and a new agreement with a large mid-western retailer.

Gross profit and gross margin

Gross profit was $92.8 million in 2014, an increase of $12.7 million, or 15.8%, from $80.1 million in the prior year. The gross margin percentage was 30.3% in 2014 compared to 33.5% in the prior year, a decrease of 3.2%. Gross margin was negatively impacted by 1.5% due to excess labor and overhead costs resulting from the hiring and training of new manufacturing employees to meet the increased demand for our products. In addition, gross margin was negatively impacted by 1.3% due to increased material costs due to an increase in aluminum prices during 2014 as well as our need to purchase finished glass from outside suppliers due to certain internal capacity constraints. In response to these constraints, during 2014, we completed the construction of a new glass processing facility which became operational late in the third quarter of 2014 but for which gross margin was negatively impacted by 0.5% due to start-up costs of the new glass facility. Our gross margin was also negatively impacted by 0.5% due to pricing and product mix, including pricing and mix on certain large projects done during 2014. Lastly, 2014 was a 53-week year which included an extra week of fixed costs in the fourth quarter during which we had no sales activity. The fixed costs from this extra week resulted in a negative impact to gross margin of 0.3%. These items were offset by leverage on higher sales volume of 0.6% and the addition of CGI, which benefited gross margin by 0.3%.

Selling, general and administrative expenses

Selling, general and administrative expenses were $56.4 million, an increase of $1.8 million, or 3.3%, from $54.6 million in the prior year. As a percentage, we leveraged these costs to 18.4%, a decrease of 4.4% from 22.8% from fiscal year 2013. Selling, general, and administrative expenses includes $3.0 million related to CGI. Excluding CGI, selling, general and administrative costs decreased $1.2 million. Contributing to the decrease was a decrease of $6.0 million in intangible assets amortization expense due to our amortizable intangible assets, not including those acquired with the acquisition of CGI, becoming fully amortized early in 2014. There was also a $0.3 million decrease in depreciation expense and a $0.2 million decrease in professional, consulting and public company fees and costs. Offsetting these decreases, was a $5.3 million increase in selling and distribution costs as the result of an increase in volume.

Interest expense

Interest expense was $6.0 million in 2014, an increase of nearly $2.5 million from $3.5 million in the prior year. During 2014, concurrent with the acquisition of CGI late in the third quarter of 2014, we refinanced our then existing credit agreement into a new $200 million senior secured credit facility which increased our outstanding debt balance to $200 million, up from $79.0 million at the end of 2013. The increase in interest expense was due primarily to the increase in outstanding debt under the new credit facility and resulting increase in average outstanding debt balance during 2014 compared to 2013.

- 17 -

Table of Contents

Debt extinguishment costs

In 2014, there were write-offs of deferred financing costs of $2.6 million relating to the debt refinancing resulting from entering into the 2014 Credit Agreement. In 2013, the write-off of deferred financing costs relating to the debt refinancing resulting from entering into the 2013 Credit Agreement totaled $0.3 million.

Other expenses, net

Other expenses, net were $1.8 million and $0.4 million in 2014 and 2013, respectively. In 2014, other expenses includes expenses related to termination of our interest rate swap agreement of $1.5 million and the ineffective portion of our aluminum hedging activity of $0.2 million. There was other expense of less than $0.1 million in 2014 relating to the interest rate cap. In 2013, the expense relates to the ineffective portion of our aluminum hedging activity.

Income tax expense (benefit)

Our income tax expense was $9.7 million for 2014, representing an effective tax rate of 37.1%, slightly lower than our combined statutory federal and state tax rate of 38.8% as the result of the section 199 domestic manufacturing deduction. In 2013, we had a tax benefit of $3.4 million as we released our valuation allowances on deferred tax assets as we were no longer in a cumulative loss position and we concluded that it was more likely than not that our deferred tax assets will be realized. Excluding the impact of the 2013 reversal of the valuation allowance, our effective tax rate would have been 40.7% in 2013.

2013 Compared with 2012

Net sales

Net sales for 2013 were $239.3 million, a $64.8 million, or 37.1%, increase in sales from $174.5 million in the prior year.

The following table shows net sales classified by major product category (in millions, except percentages):

| Year Ended | ||||||||||||||||||||

| December 28, 2013 | December 29, 2012 | |||||||||||||||||||

| Sales | % of sales | Sales | % of sales | % change | ||||||||||||||||

| Product category: |

||||||||||||||||||||

| Impact window and door products |

$ | 183.4 | 76.6 | % | $ | 130.1 | 74.5 | % | 41.0 | % | ||||||||||

| Other window and door products |

55.9 | 23.4 | % | 44.4 | 25.5 | % | 25.9 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total net sales |

$ | 239.3 | 100.0 | % | $ | 174.5 | 100.0 | % | 37.1 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Net sales of our impact window and door products, which include our WinGuard, Architectural Systems, Storefront and PremierVue products were $183.4 million in 2013, an increase of $53.3 million, or 41.0%, from $130.1 million in the prior year. This increase was driven mainly by our WinGuard products, which increased $49.5 million, or 40.4%, due to the improved new construction housing market, and our promotional and marketing activities. Within our WinGuard products, Vinyl WinGuard grew $14.1 million, or 60.8%, and Aluminum WinGuard grew $35.4 million, or 35.8%. Also contributing to our overall increased sales was an increase in our Architectural System products, up $2.3 million, and our new product Storefront with sales of $0.7 million.

Net sales of other window and door products, which include aluminum and vinyl non-impact, and Eze-Breeze, were $55.9 million in 2013, an increase of $11.5 million, or 25.9%, from $44.4 million for the prior year. Sales of our aluminum products increased $4.7 million, or 24.2%, and sales of our Vinyl products increased $5.1 million, or 41.5%, due in large part to the increased new construction activity and our ability to provide customer with one stop shopping for all window and door needs. The Eze-Breeze line increased sales by $2.4 million due to improvement in market conditions and a new agreement with a large mid-western retailer.

Gross profit and gross margin

Gross profit was $80.1 million in 2013, an increase of $20.5 million, or 34.3%, from $59.7 million in the prior year. The gross margin percentage was 33.5% in 2013 compared to 34.2% in the prior year. Cost of goods sold was negatively impacted by $4.2 million, or 1.7%, in excess material and labor costs resulting from the hiring and training of over 300 new manufacturing employees to meet the increased demand for our products. In addition, due to certain internal capacity constraints, cost of goods sold was negatively impacted as a result of purchasing finished glass and other material from outside suppliers by $2.6 million, or 1.1%. Lastly, we were negatively impacted by a mix change resulting in a decrease of $1.5 million, or 0.6%. These items were offset by leverage on higher sales volume of 2.5%, and a product price increase effective in the fourth quarter which impacted margins 0.2%.

- 18 -

Table of Contents

Gain on sale of assets held

In 2013, we sold the North Carolina plant for a gain of $2.2 million. The $2.2 million represents the net selling price of approximately $7.5 million less the asset’s carrying value at the time of the sale of approximately $5.3 million.

Selling, general and administrative expenses

Selling, general and administrative expenses were $54.6 million, an increase of $7.5 million, or 15.9%, from $47.1 million in the prior year. As a percentage, we leveraged these costs to 22.8%, a decrease of 4.2% from 27.0% from fiscal year 2012. In terms of dollars, selling, general and administrative expenses includes increased charges related to employee compensation and insurance costs of $4.4 million. Also contributing to the increase was additional charges for trade promotions and marketing materials of $1.7 million, and credit card fees of $0.7 million resulting from increased sales. Offsetting these increased costs was a $0.7 million decrease due to improved quality control of finished products and enhanced quality control procedures before shipping.

Interest expense

Interest expense was $3.5 million in 2013, a slight increase of $0.1 million from $3.4 million in the prior year. During 2013, we entered into a new debt agreement which increased our balance to $80 million in the second quarter of 2013, up from a $37.5 million debt balance at the end of 2012. Our interest expense increased slightly from prior year due to the increased debt balance, while offset by decreased interest rates from the new agreement, and decreased deferred financing costs.

Debt extinguishment costs

In 2013, the write-off of deferred financing costs relating to the debt refinancing resulting from entering into the 2013 Credit Agreement totaled $0.3 million.

Other expenses, net

Other expenses, net were $0.4 million and $0.1 million in 2013 and 2012, respectively. In both 2013 and 2012, the expense related to the ineffective portion of our aluminum hedging activity.

Income tax (benefit) expense

Our income tax benefit was $3.4 million for the year ended December 28, 2013. As we released our valuation allowances on deferred tax assets, we released our valuation allowance as we are no longer in a cumulative loss position and it is more likely than not, that our deferred tax assets will be realized.

Excluding the impact of the 2013 reversal of the valuation allowance, as well as the impact of the valuation allowance in 2012, our 2013 and 2012 effective tax rates would have been 40.7% and 40.3% for each year, respectively.

LIQUIDITY AND CAPITAL RESOURCES