Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Simulations Plus, Inc. | simulations_8k.htm |

| EX-99.1 - PRESS RELEASE - Simulations Plus, Inc. | simulations_8k-ex9901.htm |

Exhibit 99.2

(NASDAQ:SLP) Investor Conference Call April 9, 2018

2 With the exception of historical information, the matters discussed in this presentation are forward - looking statements that involve a number of risks and uncertainties . The actual results of the Company could differ significantly from those statements . Factors that could cause or contribute to such differences include, but are not limited to : continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity . Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission . Safe Harbor Statement

3 Highlights Walter S. Woltosz CEO and Chairman

4 • 2QFY18 • Revenues up $1.7 million (28.9%) to $7.4 million • Income from operations up $622,000 (34.7%) to $2.4 million • Net income up $2.3 million (190.6%) to $3.5 million, includes one time, non - cash $1.5M deferred tax adjustment • Diluted earnings per share increased to 19¢ per share up 13¢ • Software renewal rates: 89% (accounts); 94%(fees) • 15 new software clients added • 6MoFY18 • Revenues up $3.3 million (29.7%) to $14.4 million • Income from operations up $1.3 million (33.8%) to $5.0 million • Net income up $2.6 million (103%) to $5.2 million, includes one time, non - cash $1.5M deferred tax adjustment • Diluted earnings per share increased to 29¢ per share, up 14¢ • Software renewal rates: 85% (accounts); 91%(fees) • 36 new software clients added • Significant consulting pipeline resulted in significant increase in revenues Overview

5 Financial Overview John Kneisel Chief Financial Officer

6 Income Statement: 2QFY18 Versus 2QFY17 (in millions) Lancaster Buffalo North Carolina (ACQ. 6/01/17) 2QFY18 2QFY17 Diff % chg Net sales $ 4.6 $ 1.9 $ 0.9 $ 7.4 $ 5.7 $ 1.7 29.0% Gross profit 3.7 1.0 0.5 5.2 4.2 1.1 26.3% Gross profit margin 81.7% 53.5% 55.9% 71.2% 72.8% - 1.5% - 2.1% SG&A $ 1.4 $ 0.6 $ 0.3 $ 2.3 $ 1.9 $ 0.4 20.1% R&D 0.4 0.0 0.0 0.5 0.4 0.1 18.6% Total operating expenses 1.8 0.7 0.3 2.8 2.4 0.5 19.8% Income from operations 1.9 0.3 0.2 2.4 1.8 0.6 34.7% Other income (expense) 0.0 0.0 0.0 0.0 0.0 0.0 270.0% Income before income taxes 1.9 0.3 0.2 2.4 1.8 0.6 33.6% Net income $ 3.1 $ 0.2 $ 0.1 $ 3.5 $ 1.2 $ 2.3 190.6% Diluted earnings per share (in dollars) $ 0.19 $ 0.07 $ 0.13 183.8% EBITDA $ 2.3 $ 0.4 $ 0.3 $ 3.1 $ 2.3 $ 0.8 33.5%

7 Income Statement: 6MoFY18 Vs. 6MoFY17 (in millions) Lancaster Buffalo North Carolina (ACQ. 6/01/17) 6mo FY18 6mo FY17 Diff % chg Net sales $ 8.6 $ 3.8 $ 2.1 $ 14.4 $ 11.1 $ 3.3 29.7% Gross profit 7.0 2.2 1.3 10.6 8.2 2.3 28.4% Gross profit margin 82.0% 58.4% 64.2% 73.3% 74.0% - 0.7% - 1.0% SG&A $ 2.8 $ 1.3 $ 6 $ 4.7 $ 3.8 $ 0.9 24.6% R&D 0.7 0.0 0.1 0.8 0.7 0.1 21.0% Total operating expenses 3.5 1.4 0.7 5.6 4.5 1.1 24.0% Income from operations 3.5 0.8 0.6 5.0 3.7 1.3 33.8% Other income (expense) (0.1) 0.0 0.0 (0.1) $ 0.0 (0.1) - 372.4% Income before income taxes 3.4 0.8 0.6 4.9 3.8 1.1 30.6% Net income $ 4.2 $ 0.6 $ 0.4 $ 5.2 $ 2.6 $ 2.6 103.0% Diluted earnings per share (in dollars) $ 0.29 $ 0.15 $ 0.14 98.2% EBITDA $ 4.3 $ 1.0 $ 0.9 $ 6.2 $ 4.8 $ 1.4 30.2%

8 Consolidated Revenues: Fiscal Quarter ( in millions) $4.0 $4.6 $5.9 $3.7 $4.8 $5.2 $6.0 $4.0 $5.4 $5.7 $6.8 $6.3 $7.1 $7.4 $0 $1 $2 $3 $4 $5 $6 $7 $8 Q1 Q2 Q3 Q4 2015 2016 2017 2018

9 Consolidated Income from Operations by Fiscal Quarter (in millions) $0.7 $1.5 $2.9 $0.8 $1.7 $1.7 $2.8 $1.0 $1.9 $1.8 $3.1 $1.4 $2.6 $2.4 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 Q1 Q2 Q3 Q4 2015 2016 2017 2018 Note: 2Q18 $0.08 tax benefit of deferred tax adjustment

10 $0.5 $1.0 $1.9 $0.5 $1.1 $1.2 $1.9 $0.8 $1.4 $1.2 $2.1 $1.2 $1.7 $3.5 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 Q1 Q2 Q3 Q4 2015 2016 2017 2018 $2.0 Consolidated Net Income: Fiscal Quarter (in millions) Note: 2Q18 $1.5M tax benefit of deferred tax adjustment

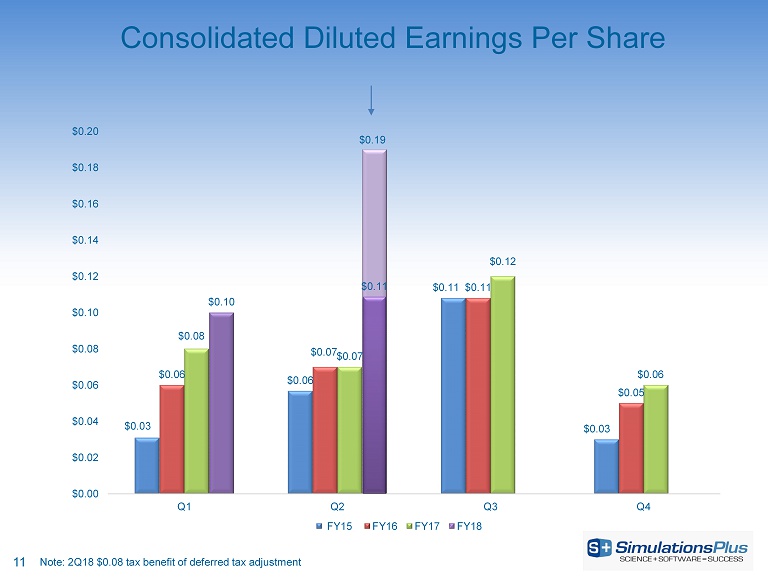

11 Consolidated Diluted Earnings Per Share $0.03 $0.06 $0.11 $0.03 $0.06 $0.07 $0.11 $0.05 $0.08 $0.07 $0.12 $0.06 $0.10 $0.19 $0.00 $0.02 $0.04 $0.06 $0.08 $0.10 $0.12 $0.14 $0.16 $0.18 $0.20 Q1 Q2 Q3 Q4 FY15 FY16 FY17 FY18 $0.11 Note: 2Q18 $0.08 tax benefit of deferred tax adjustment

12 Consolidated EBITDA: Fiscal Quarter (in millions) $1.2 $2.0 $3.3 $1.2 $2.2 $2.2 $3.3 $1.5 $2.5 $2.3 $3.6 $2.0 $3.2 $3.1 $0 $1 $2 $3 $4 Q1 Q2 Q3 Q4 2015 2016 2017 2018

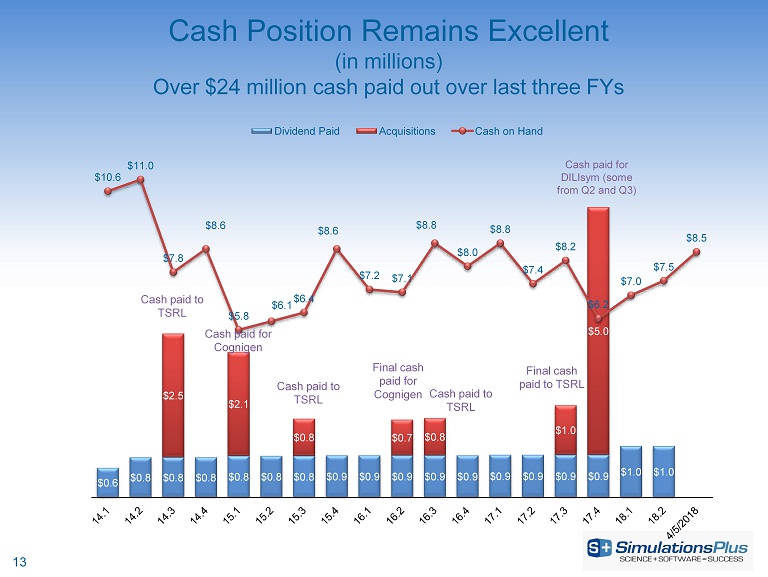

13 Cash Position Remains Excellent (in millions) Over $24 million cash paid out over last three FYs $0.6 $0.8 $0.8 $0.8 $0.8 $0.8 $0.8 $0.9 $0.9 $0.9 $0.9 $0.9 $0.9 $0.9 $0.9 $0.9 $1.0 $1.0 $2.5 $2.1 $0.8 $0.7 $0.8 $1.0 $5.0 $10.6 $11.0 $7.8 $8.6 $5.8 $6.1 $6.4 $8.6 $7.2 $7.1 $8.8 $8.0 $8.8 $7.4 $8.2 $6.2 $7.0 $7.5 $8.5 Dividend Paid Acquisitions Cash on Hand Cash paid to TSRL Cash paid for Cognigen Final cash paid for Cognigen Cash paid for DILIsym (some from Q2 and Q3) Cash paid to TSRL Cash paid to TSRL Final cash paid to TSRL

14 Selected Consolidated Balance Sheet Items (in millions, except where indicated) February 28, 2018 August 31, 2017 Cash and cash equivalents $ 6.9* $ 6.2* Cash per share ( in Dollars ) $ 0.40 $ 0.36 Total current assets 15.3 12.6 Total assets 41.0 38.5 Total current liabilities 5.5 2.0 Total liabilities 11.6 12.7 Current ratio 2.78x 6.20x Shareholders’ equity 29.4 25.8 Total liabilities and shareholders’ equity 41.0 38.5 Shareholders’ equity per diluted share ( in Dollars ) $1.650 $1.473 * Cash as of April 5, 2018 ~$8.5 million.

15 Lancaster Division Walt Woltosz CEO and Chairman

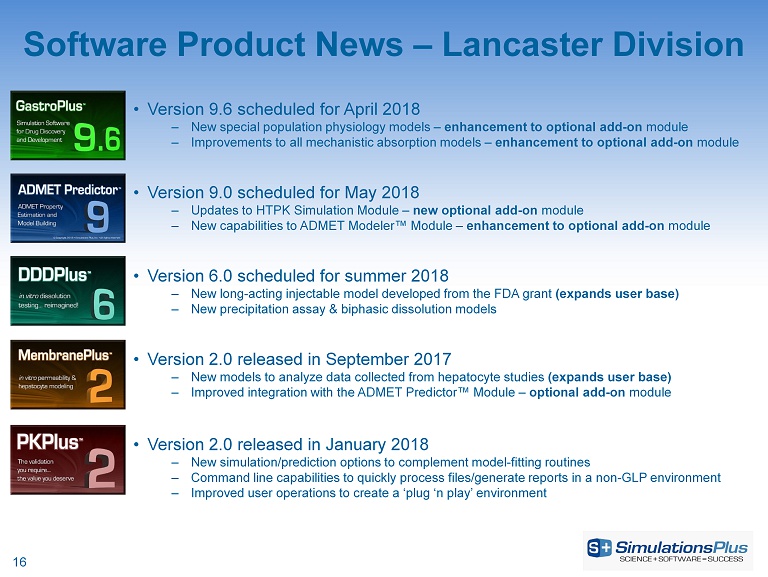

16 • Version 9.6 scheduled for April 2018 ‒ New special population physiology models – enhancement to optional add - on module ‒ Improvements to all mechanistic absorption models – enhancement to optional add - on module • Version 9.0 scheduled for May 2018 ‒ Updates to HTPK Simulation Module – new optional add - on module ‒ New capabilities to ADMET Modeler™ Module – enhancement to optional add - on module Software Product News – Lancaster Division • Version 6.0 scheduled for summer 2018 ‒ New long - acting injectable model developed from the FDA grant (expands user base) ‒ New precipitation assay & biphasic dissolution models • Version 2.0 released in September 2017 ‒ New models to analyze data collected from hepatocyte studies (expands user base) ‒ Improved integration with the ADMET Predictor™ Module – optional add - on module • Version 2.0 released in January 2018 ‒ New simulation/prediction options to complement model - fitting routines ‒ Command line capabilities to quickly process files/generate reports in a non - GLP environment ‒ Improved user operations to create a ‘plug ‘n play’ environment

2QFY18 Sales Review – Lancaster Division • Revenue +12.6% vs. 2QFY17 • Highlights: – Software revenue +7% • 89% renewal rate (accounts) • 94% renewal rate (fees) • 8% increase in license units • 8 new commercial companies • 7 new nonprofit groups – Consulting & training revenue +83% • Projects with 26 companies + 2 FDA funded collaborations 75% 12% 12% 1% Revenue Breakdown Renewal New Consulting Training 150 174 225 157 194 201 199 181 190 211 238 195 198 228 Q1 Q2 Q3 Q4 Software License Units/Quarter FY15 FY16 FY17 FY18 17

6MoFY18 Sales Review – Lancaster Division • Revenue +11% vs. 6MoFY17 • Highlights: – Software revenue +5% • 85% renewal rate (accounts) • 91% renewal rate (fees) • 6% increase in license units • 19 new commercial companies • 17 new nonprofit groups – Consulting & training revenue +74% • Projects with 30 companies + 2 FDA funded collaborations 72% 14% 13% 1% Revenue Breakdown Renewal New Consulting Training 150 174 225 157 194 201 199 181 190 211 238 195 198 228 Q1 Q2 Q3 Q4 Software License Units/Quarter FY15 FY16 FY17 FY18 18

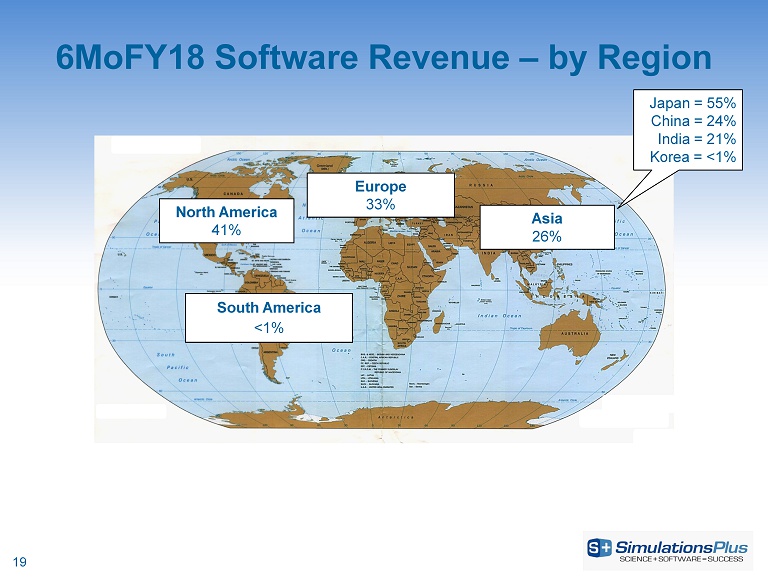

6MoFY18 Software Revenue – by Region Europe 33% North America 41% Asia 26% South America <1% Japan = 55% China = 24% India = 21% Korea = <1% 19

2QFY18 Marketing Activities Website Content • Increased production of video content for promotional/branding purposes • Increased focus on SEO performance • Continued migration of content from different division sites to main Simulations Plus domain Workshops and Conferences • PBPK workshop held at University of Maryland • Hosted 6 onsite trainings at individual companies • Attended 2 scientific conferences; delivered 3 poster/podium presentations Strategic Digital Marketing Initiatives • Hosted 3 webinars on modeling & simulation applications • Continued with active social media campaigns – Twitter/LinkedIn/YouTube followers have increased 20% vs. February 2017 – GastroPlus User Group membership increased 8% vs. February 2017 20

21 Earnings Call Update April 9 th , 2018 Ted Grasela, PharmD , Ph.D. President, Cognigen

22 Cognigen Status Report Pharmacometric Services • In FY2018 relationships with 25 companies on 38 drugs, 62 projects – 2 new companies in FY2018 – 19 new projects in FY2018 – 11 projects expanded scope in FY2018 – 3 projects with reduced scope – 41 outstanding proposals with 28 different companies • In FY2018 presented 7 posters, and 5 peer - reviewed publications – Modeling & Simulation Poster won Blue Ribbon at ASCPT conference – Working on 20 publications and 5 conference abstracts • Presenting two posters on KIWI at the PAGE conference in May – Pharmacometric Specific Data Repository Adds to Science - based Collaborations – Visualization tools added for dynamic representation of complex data • Most common therapeutic area is oncology, followed by neurology, endocrinology, and infectious disease – ~45% of projects result directly in regulatory interaction.

23 • Increased Marketing and Sales activities • Ongoing recruitment of new scientific talent • Pharmacometric services continue to expand ‒ Healthy pipeline of new projects, including global health initiative projects ‒ Bridging global regulatory filings ‒ Embedded client partner opportunities from first - in - human to commercialization of new medicines • Cross - selling opportunities with Simulations Plus and DILIsym ‒ Creating broader spectrum business models with clients ‒ Expanding scientific synergies across company scientists • KIWI™ Pharmacometric Communication Platform design and deployment accelerating Cognigen Summary

24 Drug - Induced Liver Injury and Liver Diseases Brett A. Howell, President DILIsym Services, Research Triangle Park, NC

DILIsym Services, Inc. – Our Vision 25 • DILIsym Services, Inc. offers comprehensive program services: – DILIsym software licensing, training, development (DILI - sim Initiative) – DILIsym and NAFLDsym simulation consulting projects – Consulting and data interpretation – in vitro assay experimental design and management “Our vision is safer, effective, more affordable medicines for patients through modeling and simulation.” DILIsym ®

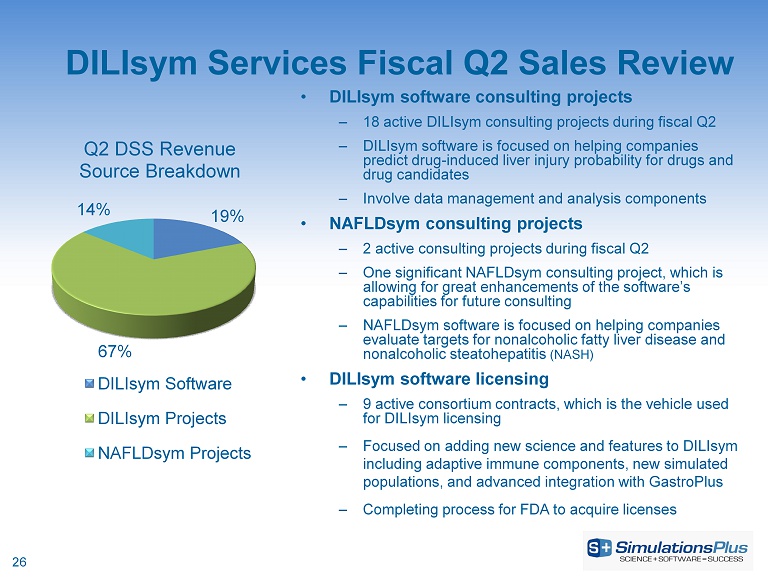

DILIsym Services Fiscal Q2 Sales Review • DILIsym software consulting projects – 18 active DILIsym consulting projects during fiscal Q2 – DILIsym software is focused on helping companies predict drug - induced liver injury probability for drugs and drug candidates – Involve data management and analysis components • NAFLDsym consulting projects – 2 active consulting projects during fiscal Q2 – One significant NAFLDsym consulting project, which is allowing for great enhancements of the software’s capabilities for future consulting – NAFLDsym software is focused on helping companies evaluate targets for nonalcoholic fatty liver disease and nonalcoholic steatohepatitis (NASH) • DILIsym software licensing – 9 active consortium contracts, which is the vehicle used for DILIsym licensing – Focused on adding new science and features to DILIsym including adaptive immune components, new simulated populations, and advanced integration with GastroPlus – Completing process for FDA to acquire licenses 26 19% 67% 14% Q2 DSS Revenue Source Breakdown DILIsym Software DILIsym Projects NAFLDsym Projects

DILIsym Services Software Product News • DILIsym version 7A is running smoothly by all accounts – Includes large number of expanded features and exemplar drugs – Version 8A development is well underway – release in early 2019 • DILIsym refactoring (recoding) in progress for improved use and tight integration with GastroPlus • NAFLDsym development continues through large pharma company sponsorships – Addition of fibrosis and inflammation pathways and additional simulated patients – Available towards end of 2018 for internal consulting use • Government grant proposal for development of software focused on drug - induced kidney injury was submitted; awaiting final funding decision 27 DILIsym ®

DILIsym Services Marketing and Event Updates • Successfully completed first 3 day DILIsym training workshop in San Diego in March • Great interest in DILIsym software use at March 2018 professional meetings including the annual Society of Toxicology meeting in San Antonio – Conducted a co - marketing lunch and learn session in collaboration with Simulations Plus Lancaster to a packed audience; presented GastroPlus + DILIsym • Website revisions are progressing nicely and should be complete in next 3 months; will lead to a clean look and feel for potential clients of all 3 divisions 28

DILIsym Services Summary • Latest version of DILIsym is working well • Active development across multiple products for expanded applications, including possible kidney injury product • Continuing to work with Simulations Plus Lancaster and Cognigen on integrative marketing and other synergies • Number of consulting clients continues to grow; now well over 30 companies • Number of DILIsym licensees continues to grow; now 19 major pharmaceutical companies have licensed DILIsym at some point in the history of the consortium, as well as FDA 29

30 Final Summary Walter S. Woltosz CEO and Chairman

31 • 2QFY18 • Revenues up $1.7 million (28.9%) to $7.4 million • Income from operations up $622,000 (34.7%) to $2.4 million • Net income up $2.3 million (190.6%) to $3.5 million, includes one time, non - cash $1.5M deferred tax adjustment • 6MoFY18 • Revenues up $3.3 million (29.7%) to $14.4 million • Income from operations up $1.3 million (33.8%) to $5.0 million • Net income up $2.6 million (103%) to $5.2 million, includes one time, non - cash $1.5M deferred tax adjustment • Diluted earnings per increased to 29¢ per share up 14¢ • California, Buffalo, and North Carolina divisions all performing well • Expected synergies being realized • Addressing regulatory agency focus on applying PBPK modeling in clinical pharmacology & safety research • New guidance documents issued by FDA and EMA helping drive interest • We believe Simulations Plus continues to lead the trend toward greater use of modeling and simulation in research & development Summary

32 Thank you! http://www.simulations - plus.com https://www.linkedin.com/company/95827/ https://www.linkedin.com/company/46152/