Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - Simulations Plus, Inc. | slp_10k-ex2301.htm |

| EX-31.2 - CERTIFICATION - Simulations Plus, Inc. | slp_10k-ex3102.htm |

| EX-32 - CERTIFICATION - Simulations Plus, Inc. | slp_10k-ex3200.htm |

| EX-31.1 - CERTIFICATION - Simulations Plus, Inc. | slp_10k-ex3101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| S | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended August 31, 2012 |

or

| £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _________ to _________ | |

Commission file number: 001-32046

Simulations Plus, Inc.

(Exact name of registrant as specified in its charter)

|

California (State or other jurisdiction of incorporation or organization)

|

95-4595609 (I.R.S. Employer Identification No.)

|

|

42505 Tenth Street West Lancaster, CA 93534-7059 (Address of principal executive offices including zip code) |

(661) 723-7723 (Registrant’s telephone number, including area code)

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

Title of Each Class Common Stock, par value $0.001 per share |

Name of Each Exchange on Which Registered NASDAQ Stock Market LLC |

SECURITIES REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes £ No S

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes £ No S

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filings requirements for the past 90 days.

Yes S No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes S No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| £ Large accelerated filer | £ Accelerated filer |

| £ Non-accelerated filer (Do not check if a smaller reporting company) | S Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No S

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of February 29, 2012, based upon the closing price of the common stock as reported by The Nasdaq Stock Market on such date, was approximately $38,035,604. This calculation does not reflect a determination that persons are affiliates for any other purposes.

As of November 13, 2012, 15,927,806 shares of the registrant’s common stock, par value $0.001 per share were outstanding, and no shares of preferred stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the definitive Proxy Statement to be delivered to shareholders in connection with the 2013 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year covered by this annual report.

The Exhibit Index (Item 15) lists several documents incorporated by reference.

Simulations Plus, Inc.

FORM 10-K

For the Fiscal Year Ended August 31, 2012

Table of Contents

| Page | ||

| PART I | ||

| Item 1 | Business | 1 |

| Item 1A | Risk Factors | 8 |

| Item 1B | Unresolved Staff Comments | 8 |

| Item 2 | Properties | 8 |

| Item 3 | Legal Proceedings | 9 |

| Item 4 | Mine Safety Disclosures | 9 |

| PART II | ||

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 9 |

| Item 6 | Selected Financial Data | 10 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 11 |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 20 |

| Item 8 | Financial Statements and Supplementary Data | 20 |

| Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 20 |

| Item 9A | Controls and Procedures | 20 |

| Item 9B | Other Information | 21 |

| PART III | ||

| Item 10 | Directors, Executive Officers and Corporate Governance | 21 |

| Item 11 | Executive Compensation | 22 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 22 |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 22 |

| Item 14 | Principal Accounting Fees and Services | 22 |

| PART IV | ||

| Item 15 | Exhibits, Financial Statement Schedules | 22 |

| Signatures | 24 | |

| i |

Forward-Looking Statements

This document and the documents incorporated in this document by reference contain forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact contained in this document and the materials accompanying this document are forward-looking statements.

The forward-looking statements are based on the beliefs of our management, as well as assumptions made by, and information currently available to, our management. Frequently, but not always, forward-looking statements are identified by the use of the future tense and by words such as “believes,” expects,” “anticipates,” “intends,” “will,” “may,” “could,” “would,” “projects,” “continues,” “estimates” or similar expressions. Forward-looking statements are not guarantees of future performance and actual results could differ materially from those indicated by the forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements.

The forward-looking statements contained or incorporated by reference in this document are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These statements include declarations regarding our plans, intentions, beliefs or current expectations.

Among the important factors that could cause actual results to differ materially from those indicated by forward-looking statements are the risks and uncertainties described under “Risk Factors” in our other filings with the Securities and Exchange Commission (“SEC”).

Forward-looking statements are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and we do not undertake any obligation to update forward-looking statements to reflect new information, subsequent events or otherwise.

PART I

Item 1 –Business

OVerview

Simulations Plus, Inc. (“Simulations Plus” or the “Company,” “us,” “we,” or “our”), which was incorporated in California in 1996, develops and produces software for use in pharmaceutical research and for education, and provides consulting and contract research services to the pharmaceutical industry. Simulations Plus also assumed responsibility for producing a personal productivity software program called Abbreviate!, originally spun out of products for the disabled created by our former subsidiary, Words+, for the retail market. Words+, founded in 1981, produces computer software and specialized hardware for use by persons with disabilities. During the first quarter of our fiscal year ended August 31, 2012, Words+ continued to refine its products for the disabled. We sold Words+, pursuant to that certain stock purchase agreement with the Prentke Romich Company of Wooster, Ohio, effective as of November 30, 2011. Words+ is now a wholly-owned subsidiary of the Prentke Romich Company. As a result of this sale, Words+ is treated as “discontinued operations” in our financial statements attached hereto. For more information regarding the Stock Purchase Agreement, please see the full text of such document filed as Exhibit 10.50 to this Annual Report on Form 10-K, which is incorporated herein by reference. Also see Note 12 under the Notes to the Financial Statements included in this Annual Report on Form 10-K for more information. The discussion in this Annual Report on Form 10-K will therefore focus on our ongoing operations for pharmaceutical software and services.

| 1 |

Products

We currently offer five software products for pharmaceutical research: ADMET Predictor™, MedChem Designer™, MedChem Studio™, DDDPlus™, and GastroPlus™. We call the combination of ADMET Predictor, MedChem Studio, and MedChem Designer our ADMET Design Suite™.

ADMET Predictor™

ADMET (Absorption, Distribution, Metabolism, Excretion and Toxicity) Predictor is a computer program that takes molecular structures as inputs and predicts over 140 different properties for them at the rate of about 200,000 compounds per hour on a laptop computer. This capability means that a pharmaceutical scientist can screen a very large number of molecules in a very short time using ADMET Predictor. The current state-of-the-art of this type of software allows identifying molecules that are sure to fail as potential drug candidates without the need to synthesize and test them. Millions of “virtual” compounds can now be created and screened in a day, compared to potentially months of work to synthesize and test a few hundred actual compounds. The ability to quickly eliminate obviously poor compounds in this manner enables chemists to investigate a much larger “chemical space” in their search for new medicines.

Pharmaceutical companies spend enormous amounts of money conducting a wide variety of experiments on new molecules each year, resulting in large databases of experimental data. Using this proprietary data to build predictive models can provide a second return on their investment; however, model building has traditionally been a tedious activity performed by specialists. The ADMET Modeler subprogram that is integrated into ADMET Predictor enables scientists without model-building experience to use their own experimental data to quickly create high-quality, proprietary predictive models using the same powerful modeling methods we use to build our top-ranked property predictions.

We released Version 6.0 of ADMET Predictor in April 2012. This new version incorporates a new feature that enables users to generate likely metabolites for any molecule using an embedded version of our MedChem Designer™ program. It also increases the number of predictive models for metabolism and toxicity, and refines many of our earlier predictions, which had already been top-rated in almost every published independent comparison study. In March 2010, we entered into the a royalty agreement with Enslein Research pursuant to which royalties were paid to Enslein Research from revenues on each license for the Enslein Metabolism Module. On February 28, 2012, we agreed to buyout this royalty agreement from Enslein Research. This buyout gave us sole ownership of the intellectual property rights used in the Enslein Metabolism Module and allowed us to merge the former Enslein Metabolism Module and our Metabolite Module into a single Metabolism Module, making it easier for customers to realize the value in the combined capabilities of the two separate functions. We are also progressing with curating the scientific literature for a much larger data set for certain enzymes known as the cytochrome P450 (“CYP”) family to further enhance our predictive capabilities for metabolism. These improvements to metabolism and metabolite prediction are now also available via MedChem Designer and MedChem Studio for customers who also license ADMET Predictor.

MedChem Designer™

MedChem Designer was launched in February 2011. It was initially a molecule drawing program, or “sketcher”, but now has capabilities beyond those of other molecule drawing programs because of its integration with both MedChem Studio and ADMET Predictor. We provide MedChem Designer for free because we believe that in the long run it will help to increase demand for ADMET Predictor and MedChem Studio. Most other existing molecule drawing programs are also free. The free version includes a small set of ADMET Predictor property predictions, allowing the chemist to modify molecular structures and then see a few key properties very quickly. The chemist also sees that with a paid ADMET Predictor license, over 140 predictions would be available.

| 2 |

When coupled with a license for ADMET Predictor, MedChem Designer becomes a de novo design tool for medicinal chemists. With it, they can draw one or more molecular structures, then click on the ADMET Predictor icon and have over 140 properties for each structure calculated in seconds, including our proprietary ADMET Risk™ index. ADMET Risk provides a single number that tells the chemist how many threshold values for more than 20 predicted properties were crossed (or violated) by each structure. Thus, in a single number, the chemist can instantly compare how different structural changes affect a variety of predicted properties. As chemists attempt to modify structures to improve one property, they often cause others to become unacceptable. Without ADMET Risk, the chemist would have to separately examine many key properties for each new molecule to check whether any became unacceptable as a result of changing the structure. Thus, ADMET Risk lets them “see” in many dimensions at once. We believe this provides a novel and unequaled capability for new molecule design. In addition to affecting the therapeutic target, there are many properties that are required for a molecule to become a drug, and ADMET Predictor can predict a large number of such properties.

We released MedChem Designer 2.0 in May 2012 with its new capabilities that show the most likely metabolites that would be produced from a parent molecule by the most dominant CYP enzymes. With this capability, the chemist can not only see predicted likely metabolites, but can also use ADMET Predictor to assess whether any of the predicted metabolites would be likely to result in unacceptable adverse effects. It is often the case that a molecule that could have been a good medicine is converted into a toxic metabolite that renders the original molecule dangerous or useless. This ability to predict metabolites and their properties is another way to reduce the number of molecules that are taken forward into development only to fail at a later stage after considerable time and money have been expended.

MedChem Studio™

Over the past several years, MedChem Studio updates have resulted in a better tool for medicinal and computational chemists for both data mining and for designing new drug-like molecules.

MedChem Designer can be used to refine a small number of molecules; however, refining a very large number of molecules down to a few promising lead candidates is the primary function of MedChem Studio (with ADMET Predictor). MedChem Studio has features that enable it to generate very large numbers of new molecular structures using a variety of de novo design methods. Coupled with ADMET Predictor, we believe the two programs provide an unmatched capability for chemists to search through large libraries of compounds that have undergone high-throughput screening experiments to find the most promising classes and molecules that are active against a particular target. In addition, MedChem Studio with ADMET Predictor can take an interesting (but not acceptable) molecule and very quickly generate many thousands of high quality analogs (i.e., similar new molecules) using a variety of design algorithms to generate new molecules that are predicted to be both active against the target as well as acceptable in a variety of ADMET properties. MedChem Designer (see above) is also a part of MedChem Studio, so the user can click on the MedChem Designer icon and bring up the drawing window to investigate how further modifications to the structures of molecules generated by MedChem Studio can improve their properties.

MedChem Studio version 3.0 was released in May 2012.

NCE Project

In March 2011, we initiated our own program of designing and making new molecules (NCEs, or New Chemical Entities) using the ADMET Design Suite (MedChem Studio/MedChem Designer/ADMET Predictor) based on our belief in the suite’s capabilities. We selected as a target the malaria parasite Plasmodium falciparum, both because there is an unmet need for a very low-cost cure, and because we believed that external funding opportunities might exist if we were successful in generating high-quality lead compounds using our software. We completed the design process early in the first quarter of fiscal year 2012 and in September 2012 we announced that we had requested quotations from chemical synthesis companies for the cost and time to make a small set of molecules. Five molecules of our own design were synthesized and tested for inhibition of the parasite at the University of California at Riverside. We were hoping that at least one would show inhibition of the growth cycle of the parasite.

| 3 |

Every molecule showed activity against the parasite at less than micromolar concentrations, with two showing activity at less than 100 nanomolar concentration (high potency) against the drug-sensitive strain of the parasite. They were then tested against the drug-resistant strain of the malaria parasite, and again potency was observed, with two molecules showing nanomolar activity. Several of these molecules were sent to another outside laboratory for additional experiments to measure a few key properties to compare the values versus our ADMET Predictor predictions. Our predictions for solubility, ionization constants (pKa), and lipophilicity were all well within accepted tolerances. Metabolism by human liver microsomes was much faster than predicted, probably due to metabolism by pathways our models do not yet predict. These molecules were only expected to be good lead molecules, not to be final drug molecules, so further structural changes would be expected to meet all requirements for an approved drug.

Our goal for this project was not actually to cure malaria. Rather, our goal was to demonstrate that a method of using our software tools to quickly and efficiently analyze high-throughput data, to generate new molecular structures, and to assess their qualities via ADMET Predictor, could result in high-quality lead candidates in a fraction of the time and cost usually required to reach that stage of drug development. We accomplished that and we have been presenting our results in scientific meetings and in webinars to a worldwide audience. We expect to pursue at least one more therapeutic target in the coming months.

DDDPlus

DDDPlus simulates in vitro laboratory experiments used to measure the rate of dissolution of the drug and sometimes the additives (excipients) contained in tablets and capsules under a variety of experimental conditions. This software program is used by formulation scientists in industry and the U.S. Food and Drug Administration (FDA) to (1) understand the physical mechanisms affecting the dissolution rate for various formulations, (2) reduce the number of cut-and-try attempts to design new drug formulations, and (3) to design in vitro dissolution experiments to better mimic in vivo conditions.

During fiscal year 2011, improvements were added to further enhance the value of this product, including numerous user convenience features, as well as more sophisticated handling of dosage forms that incorporate multiple polymers for controlled-release formulations. The FDA and a growing number of companies use DDDPlus in their work.

Development efforts for DDDPlus during fiscal year 2012 were limited because of priorities on other programs.

GastroPlus

Our flagship product and largest source of revenues is GastroPlus. GastroPlus simulates the absorption, pharmacokinetics, and pharmacodynamics of drugs administered to humans and animals, and is currently in use at numerous pharmaceutical companies, the FDA, the U.S. National Institutes of Health (NIH), and other government agencies in the U.S. and other countries. Because of GastroPlus, we were invited to joint the European Innovative Medicines Initiative (IMI) program for Oral Bioavailibility Tools (“OrBiTo”). We were the only non-European company invited to participate. OrBiTo is a collaboration among 27 industry, academic, and government organizations working in the area of oral absorption of pharmaceutical products. Because we are outside of Europe, our participation in this project is at our own expense, while other members are compensated for their work; however, we are a full member with access to all of the data and discussions of any other members. We believe participation in this initiative will enable us to benefit from and to contribute to advancing the prediction of human oral absorption from preclinical data.

| 4 |

We released version 8.0 of GastroPlus in April 2012. This new version added many new features, including:

| (1) | extending the predictive capabilities for ocular and nasal/pulmonary dosing; |

| (2) | adding a paracellular permeability capability that distinguishes between how some drug molecules permeate the intestinal membrane by moving through gaps between the epithelial cells from the diffusion through the cells; |

| (3) | enhancing the PDPlus™ pharmacodynamic module to incorporate a tumor compartment model and to better deal with multiple metabolites; and |

| (4) | providing enhanced graphical outputs and reporting capabilities requested by customers. |

We are expecting to release version 8.5 of GastroPlus before the end of calendar year 2012. This interim release adds several new capabilities requested by customers.

Contract Research and Consulting Services

Our expertise in oral absorption and pharmacokinetics is evidenced by the fact that our staff members have been speakers or presenters at over 80 prestigious scientific meetings worldwide in the past four years. We frequently conduct contracted studies for large customers (including top 5 pharmaceutical companies) who have particularly difficult problems and who recognize our expertise in solving them, as well as for smaller customers who prefer to have studies run by our scientists rather than to license our software and train someone to use it. The demand for our consulting services has been steady. Long-term collaborations and shorter-term consulting contracts serve both to showcase our technologies and to build and strengthen customer relationships.

During fiscal year 2012 we continued to work on our 5-year collaboration agreement with the Center for Food Safety and Applied Nutrition (CFSAN) of the FDA using ADMET Predictor/Modeler to build predictive models for likely toxicities of food additives and contaminants. During this first year of the collaboration, we analyzed FDA databases and worked with FDA scientists to ensure that the FDA data to be used for building new predictive models is as accurate as we can reasonably make it. Both FDA scientists and our scientists are building a series of models to classify new compounds as toxic or nontoxic from FDA datasets. Included in this effort was a special modification to ADMET Predictor to allow the user to set a minimum value for specificity or sensitivity when building a model. Sensitivity refers to how well a model identifies toxic (or any other property) compounds. A model that determined all compounds are toxic would have 100% sensitivity, because all toxic compounds would be labeled as such; however, all nontoxic compounds would also be labeled toxic. Specificity refers to how well a model distinguishes between toxic and nontoxic compounds. Increasing one usually results in decreasing the other. Depending on the purpose of the model, some scientists will prefer to train models that emphasize one statistic over the other.

Product Development

Development of our software is focused on expanding product lines, designing enhancements to our core technology and integrating existing and new products into our principal software architecture and platform technology. We intend to offer regular updates to our products and to continue to look for opportunities to expand our existing product suite.

| 5 |

We develop all of our products internally. We have also licensed products or have otherwise acquired products, or portions of our products, from other organizations. These arrangements sometimes require the payment of royalties by us. We intend to continue to license or otherwise acquire technology or products from third parties. We currently have two royalty agreements, one with TSRL, Inc. (“TSRL”) and another with Symyx Technologies (“Symyx”). In July 1997, we entered into a royalty agreement with TSRL pursuant to which royalties were paid to TSRL from revenues on each license for GastroPlus basic software. In March 2010, we entered into a royalty agreement with Symyx, which was merged with Accelrys, Inc., pursuant to which royalties were paid to Symyx from revenues on each license for Metabolite module. After we made a buyout agreement with Enslein Research, we combined Metabolism module and Metabolite module, and currently we pay royalties to Symyx from the sale of a new Metabolism module.

Marketing and Distribution

We market our pharmaceutical software and consulting services through attendance and presentations at scientific meetings, exhibits at trade shows, seminars at pharmaceutical companies and government agencies, through our web pages on the Internet, and using various communication media to our compiled database of prospects and customer names. At the American Association of Pharmaceutical Scientists (AAPS) conference in Chicago in October 2012, there were numerous different presentations and posters presented in which the research that was reported was done using our software. Many of those were from industry and FDA scientists, seven were from our staff.

During fiscal year 2012 we added one full-time salesperson. We have one independent distributor in Japan and two independent representatives in China; however, our scientific team is also the majority of our sales and marketing team, assisting our Vice President of Marketing and Sales and his staff with trade shows, seminars, and customer training both via Internet and on-site. We believe that this is more effective than a completely separate sales team for several reasons: (1) customers appreciate talking directly with developers who can answer a wide range of technical questions about methods and features in depth; (2) our scientists benefit from direct customer contact by gaining an appreciation for the environment and problems of the customer; and (3) the relationships we build through scientist-to-scientist contact are stronger than through salesperson-to-scientist contacts.

We use the Internet to provide product information and software updates, and as a forum for user feedback and information exchange. We have cultivated market share in North America, South America, Europe, Japan, Australia, New Zealand, Singapore, and the People’s Republic of China. Internet and e-mail technologies have had a positive influence on our ability to communicate with existing and potential customers worldwide.

Production

Our pharmaceutical software products are designed and developed entirely by our development team in California, with locations in Lancaster, Petaluma, San Jose, and San Diego. The principal materials and components used in the manufacture of simulation software products include CD-ROMs and instruction manuals, which are also produced in-house and through outside contractors. In-house graphic art and engineering talent enables us to accomplish this production in a cost-efficient manner.

Competition

In our pharmaceutical software and services business, we compete against a number of established companies that provide screening, testing and research services, and products that are not based on simulation software. There are also software companies whose products do not compete directly, but are sometimes closely related, to ours. Our competitors in this field include some companies with financial, personnel, research and marketing resources that are greater than ours. Management believes there is currently no significant competitive threat to GastroPlus or DDDPlus, however, one could be developed over time. MedChem Studio, MedChem Designer, and ADMET Predictor/ADMET Modeler operate in a more competitive environment. Several other companies presently offer simulation or modeling software, or simulation-software-based services, to the pharmaceutical industry.

| 6 |

Major pharmaceutical companies conduct drug discovery and development efforts through their internal development staffs and through outsourcing some of this work. Smaller companies generally need to outsource a greater percentage of this research. Thus, we compete not only with other software suppliers, but also with the in-house development teams at some of the larger pharmaceutical companies.

Although competitive products exist, both new licenses and license renewals for GastroPlus have continued to grow in spite of this competition. We believe that we enjoy a dominant market share in this segment. We believe that the success of our recent NCE project in which we designed, had synthesized, and tested a number of new molecules to treat malaria has cultivated strong interest in our ADMET Design Suite (ADMET Predictor/ MedChem Studio/ MedChem Designer). Presentations in the U.S., Japan, and Europe over the past several months since the results were released have been well received and companies have requested evaluation copies of the software to determine whether it can increase their productivity.

We believe the key factors in competing in this field are our ability to develop industry-leading simulation and modeling software and related products and services to effectively predict activities and ADMET-related behaviors of new drug-like compounds, to design new molecules with acceptable activity and ADMET properties, to develop and maintain a proprietary database of results of physical experiments that will serve as a basis for simulated studies and empirical models, to attract and retain a highly skilled scientific and engineering team, and to develop and maintain relationships with research and development departments of pharmaceutical companies, universities and government agencies.

We are actively seeking acquisitions to expand the pharmaceutical software and services business. Earlier attempts to acquire other companies have not been successful either in arriving at mutually agreeable terms and conditions, or because of adverse conditions discovered during our due diligence process.

TRAINING AND TECHNICAL SUPPORT

Customer training and technical support are important factors in customer satisfaction for our pharmaceutical products, and we believe we are an industry leader in providing customer training and technical support in our business areas. We provide in-house seminars at customers’, and potential customers’, sites. These seminars often serve as initial training in the event the potential customer decides to license or evaluate our software. Technical support is provided after the sale of any software in the form of on-site training (at the customer’s expense), web meetings, telephone, fax, and e-mail assistance to the customer’s users during the customer’s license period. We have used Internet meetings extensively to provide demonstrations and customer assistance, resulting in rapid response to requests worldwide and reducing our travel time and expenses.

Technical support for pharmaceutical software is provided by our life sciences team and our inside sales and support staff based at our headquarters facilities in Lancaster, California. We provide free telephone support offering toll-free numbers in the U.S. and Canada, and e-mail and web-based support for all of our pharmaceutical software products worldwide. Technical support for pharmaceutical software products is minimal, averaging a few person-hours per month.

RESEARCH AND DEVELOPMENT

We believe that our ability to grow and remain competitive in our markets is strongly dependent on investment into research and development (“R&D”). R&D activities include both enhancement of existing products and development of new products. Development of new products and adding functionality to existing products are capitalized in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 985-20, “Costs of Software to Be Sold Leased, or Marketed”. R&D expenditures, which primarily relate to both capitalized and expensed salaries, R&D supplies, laboratory testing, and R&D consulting, were approximately $1,900,000 during fiscal year 2012, of which $952,000 was capitalized. R&D expenditures during fiscal year 2011 were approximately $1,261,000, of which $797,000 was capitalized.

| 7 |

Our pharmaceutical business R&D activities during fiscal year 2012 were focused on improving our ADMET Predictor/ADMET Modeler, MedChem Studio, MedChem Designer and GastroPlus products.

EMPLOYEES

As of August 31, 2012, we employed 25 full-time employees and no part-time employees, including 17 in research and development, 4 in marketing and sales, 4 in administration and accounting. Currently 15 employees hold Ph.D.s and 1 is a Ph.D. candidate in their respective science or engineering disciplines. Additionally, 4 employees hold one or more Master’s degrees. Most of the senior management team and the members of our Board of Directors hold graduate degrees. We believe that our future success will depend, in part, on our ability to continue to attract, hire and retain qualified personnel. We continue to seek additions to our life sciences team although the competition for such personnel in the pharmaceutical industry is intense. None of our employees is represented by a labor union, and we have never experienced a work stoppage. We believe that our relations with our employees are good.

Intellectual Property and Other Proprietary Rights

We own two patents that were acquired as part of our acquisition of certain assets of Bioreason, Inc. in November 2005. We primarily protect our intellectual property through copyrights and trade secrecy. Our intellectual property consists primarily of source code for computer programs and data files for various applications of those programs in the pharmaceutical software businesses. The expertise of our staff is a considerable asset closely related to intellectual property, and attracting and retaining highly qualified scientists and engineers is essential to our business.

EFFECT OF GOVERNMENT REGULATIONS

Our pharmaceutical software products are tools used in research and development and are neither approved nor approvable by the FDA or other government agencies.

Item 1A – risk factors

Not applicable because we are a smaller reporting company.

Item 1B – UNRESOLVED STAFF COMMENTS

Not applicable.

Item 2 –propertIES

We lease approximately 13,500 square feet of space in Lancaster, California. The original agreement had a five-year term with two (2), three (3)-year options to extend. Since the original five-year term expired in February 2011, we have exercised the first of the two (2), three (3)-year options. The base rent started at the rate of $18,445 per month plus common area maintenance fees. The base rental rate increases at 4% annually and it is currently $23,339 per month, plus common area maintenance fees. We believe that this facility is sufficient for our current needs and growth for the foreseeable future.

After the sale of our subsidiary, Words+, we entered into a sublease agreement under which Words+ pays 20%of the monthly rent we pay to our landlord, plus 20% of facility-related operating expenses. This sublease is on a month-to-month basis commencing on January 1, 2012. We report all of our lease expense under Selling, General and Administrative expense; however, the payments received from Words+ are reported under Other Income. Also see Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 4 under the Notes to the Financial Statements included in this Annual Report on Form 10-K for more information.

| 8 |

Item 3 – LEGAL PROCEEDINGS

We are not a party to any legal proceedings and are not aware of any pending legal proceedings of any kind.

Item 4 – MINE SAFETY DISCLOSURES.

Not applicable.

PART II

Item 5 – MARKET for Registrant’s Common Equity and Related Stockholder Matters AND ISSUER PURCHASES OF EQUITY SECURITIES

There is currently no share repurchase program pending, and the Company made no repurchases of its securities within the fourth quarter of the fiscal year 2012.

The following table shows low and high sales price for the Company’s common stock for the last eight fiscal quarters.

| Low Sales Price | High Sales Price | |||||||

| FY11: | ||||||||

| Quarter ended August 31, 2012 | 3.76 | 4.46 | ||||||

| Quarter ended May 31, 2012 | 3.66 | 4.61 | ||||||

| Quarter ended February 29, 2012 | 2.91 | 4.25 | ||||||

| Quarter ended November 30, 2011 | 2.97 | 3.24 | ||||||

| FY10: | ||||||||

| Quarter ended August 31, 2011 | 2.76 | 3.47 | ||||||

| Quarter ended May 31, 2011 | 2.68 | 3.27 | ||||||

| Quarter ended February 28, 2011 | 2.42 | 3.69 | ||||||

| Quarter ended November 30, 2010 | 2.40 | 3.50 | ||||||

COMPANY STOCK PRICE PERFORMANCE

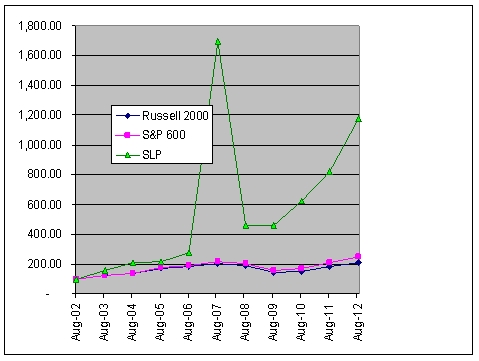

The stock price performance graph below and stock price tables above are not required by the SEC and shall not be deemed to be incorporated by reference by any general statement incorporating by reference this Annual Report on Form 10-K into any filing under the Securities Act or under the Exchange Act except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed soliciting material or filed under such the Securities Act or the Exchange Act.

| 9 |

The graph below compares the cumulative total shareholder return on the common stock of the Company from the last day of the first month of trading of the Company’s common stock from August 31, 2002 to August 31, 2012 with the cumulative total return on the Russell 2000 Index, and the S&P 600 Small Cap Index (assuming the investment of $100 in the Company’s common stock and in each of the indices on August 31, 2002, and reinvestment of all dividends). The stock price performance on the graph is not necessarily indicative of future stock price performance.

The graph above was plotted using the following data:

| Russell 2000 | S&P 600 | SLP | ||||||||||||||||||||||

| 30-Aug-02 | $ | 390.96 | 100.00 | $ | 30.35 | 100.00 | $ | 0.38 | 100.00 | |||||||||||||||

| 29-Aug-03 | $ | 497.42 | 127.23 | $ | 37.29 | 122.87 | $ | 0.61 | 160.53 | |||||||||||||||

| 31-Aug-04 | $ | 547.93 | 140.15 | $ | 42.80 | 141.02 | $ | 0.80 | 210.53 | |||||||||||||||

| 31-Aug-05 | $ | 666.51 | 170.48 | $ | 54.07 | 178.15 | $ | 0.82 | 215.79 | |||||||||||||||

| 31-Aug-06 | $ | 720.53 | 184.30 | $ | 57.63 | 189.88 | $ | 1.06 | 278.95 | |||||||||||||||

| 31-Aug-07 | $ | 792.86 | 202.80 | $ | 65.33 | 215.26 | $ | 6.44 | 1,694.74 | |||||||||||||||

| 29-Aug-08 | $ | 739.50 | 189.15 | $ | 61.01 | 201.02 | $ | 1.75 | 460.53 | |||||||||||||||

| 31-Aug-09 | $ | 572.07 | 146.32 | $ | 48.21 | 158.85 | $ | 1.74 | 457.89 | |||||||||||||||

| 31-Aug-10 | $ | 602.06 | 154.00 | $ | 51.82 | 170.74 | $ | 2.37 | 623.68 | |||||||||||||||

| 31-Aug-11 | $ | 726.81 | 185.90 | $ | 64.43 | 212.29 | $ | 3.12 | 821.05 | |||||||||||||||

| 31-Aug-12 | $ | 812.09 | 207.72 | $ | 75.33 | 248.20 | $ | 4.46 | 1,173.68 | |||||||||||||||

* Close price adjusted for dividends and splits.

Item 6 – SELECTED FINANCIAL DATA

Not applicable because we are a smaller reporting company.

| 10 |

Item 7 – Management’s Discussion and Analysis oF FINANCIAL CONDITION AND RESULTS of OperationS

The following discussion and analysis should be read in conjunction with the Financial Statements and related notes included in this Annual Report on Form 10-K.

Management Overview

Fiscal year 2012 highlights:

| · | We signed two funded collaboration agreements with top-5 pharmaceutical companies to extend the capabilities of our flagship GastroPlus™ software with an enhanced oral cavity absorption model and to add the ability to simulate dosing through the skin. |

| · | We successfully completed the first year of our five-year renewable collaboration with the Center for Food Safety and Nutrition of the FDA to develop predictive toxicity models for food additives and contaminants |

| · | On November 30, 2011, we completed the sale of Words+, Inc. for $1,973,000 in cash. Words+ operations are now presented as discontinued operations in this Form 10K |

| · | We completed a drug design process targeting the malaria parasite, including data mining of a large public domain database, design of new molecular structures, synthesizing a selected set of molecules, and testing them against the parasite. Every molecule we designed and synthesized inhibited the growth of the parasite. |

| · | We attempted to acquire certain assets of Entelos through their bankruptcy proceeding. We were unsuccessful in that offering. |

| · | We expanded our technical staff, adding three new Ph.D. scientists to the Life Sciences department and one new scientist to our marketing and sales department. |

| · | We reinitiated the development of the MembranePlus™ software program for simulation of in vitro permeability experiments. This project had begin in 2004 but was postponed for more pressing activities. With our expanded scientific staff, we have now been able to continue the development of this new product. We expect to release it during calendar year 2013. |

| · | The Board of Directors declared an ongoing quarterly cash dividend of $0.05 per share ($0.20 per year). We made dividend distributions in March, May, and August and the board declared the next distribution for November 13, 2012, which is in fiscal year 2013. The total cash distribution each quarter is just below $800,000, so we paid out approximately $2.4 million in dividends in fiscal year 2012. |

| · | Our cash position remained strong, with cash at the end of the fiscal year of $12.7 million, compared to $10.2 million at the end of fiscal year 2011. |

Fiscal year 2012 Financial Summary:

| · | Gross revenues increased 8.1% to $9,449,000 from $8,739,000 in fiscal year 2011 |

| · | Selling, General and Administrative expenses increased 6.1% to $3,379,000 from $3,186,000 in fiscal year 2011 |

| · | Research and Development expenditures increased 50.7% to $1,900,000 from $1,261,000 in fiscal year 2011. Approximately $140,000 of this increase was for outside services to synthesize and test the new molecules we designed to inhibit the growth of the malaria parasite. |

| · | Income from continuing operations increased 5.6% to $2,812,000 from $2,663,000 in fiscal year 2011 |

| 11 |

Strategy Going Forward:

| · | Continue to advance our software offerings through both our in-house developments and our funded and unfunded collaborations with our industry and government customers |

| · | Continue to seek acquisition and partnership possibilities to broaden our offerings of products and services |

| · | Continue our aggressive marketing and sales campaign including attending and exhibiting at numerous scientific conferences and meetings, expanded use of social media, and expanded advertising |

| · | Increase our marketing and sales efforts with respect our consulting services in both pharmacokinetics and in small molecule design |

| · | Seek partners for our malaria new chemical initiative to take it further into development |

| · | Select a new target and repeat our drug design, synthesis, and test activities as we did for malaria to further demonstrate the capabilities of our ADMET Design Suite to generate high-quality lead compounds in a fraction of the time and cost normally required |

Fiscal year 2012 was a record year comprised of four record quarters. We believe the continued growth of our pharmaceutical software and services business segment is the result of increasing adoption of simulation and modeling software tools such as those we produce, as well as the expertise we offer as consultants to assist companies involved in the research and development of new medicines, which has resulted in a continuing series of study contracts with pharmaceutical companies ranging from several of the largest in the world to a number of medium-sized and smaller companies in the U.S. and Europe.

During fiscal year 2012 we released upgrades to three of our five pharmaceutical software offerings, as well as to our software product called MedChem Designer. Our financial performance enabled us to continue to increase our cash deposits, remain debt-free, and continue to invest in the marketing and sales activities we began in early 2009 in order to reach a wider customer base.

We have not been successful in identifying and completing any acquisitions during this reporting period in spite of a number of investigations and due diligence activities. In every case, either our due diligence activities revealed undesirable aspects of the potential acquisition, or terms and conditions agreeable to both sides were not able to be reached. It is our intent to continue to search for acquisition opportunities that would be compatible with our current businesses and that would be accretive, i.e., adding to both revenues and earnings.

In the past, we have used some of our cash to repurchase shares of our common stock because we believe that reducing the number of fully diluted shares provides greater value to our shareholders than receiving a low interest rate on our cash deposits, and because we believe that our cash deposits after such repurchases remain sufficient to accomplish any reasonable potential acquisitions as well as to maintain sufficient cash reserves to ensure meeting operational needs for the foreseeable future. Although there are no stock repurchase programs pending, the board of directors may consider additional repurchases at any time at prices and under conditions set by the board.

Results of Operations

The following sets forth selected items from our statements of operations (in thousands) and the percentages that such items bear to net sales for the fiscal years ended August 31, 2012 (“FY12”) and August 31, 2011 (“FY11”).

| 12 |

| Fiscal years ended | ||||||||||||||||

| 8/31/12 | 8/31/11 | |||||||||||||||

| Net sales | $ | 9,449 | 100% | $ | 8,739 | 100% | ||||||||||

| Cost of sales | 1,510 | 16.0 | 1,559 | * | 17.8 | |||||||||||

| Gross profit | 7,939 | 84.0 | 7,180 | 82.2 | ||||||||||||

| Selling, general and administrative | 3,379 | 35.8 | 3,186 | * | 36.5 | |||||||||||

| Research and development | 948 | 10.0 | 464 | * | 5.3 | |||||||||||

| Total operating expenses | 4,327 | 45.8 | 3,650 | 41.8 | ||||||||||||

| Income from operations | 3,612 | 38.2 | 3,530 | 40.4 | ||||||||||||

| Other income | 343 | 3.6 | 168 | 1.9 | ||||||||||||

| Net income before taxes | 3,955 | 41.9 | 3,698 | 42.3 | ||||||||||||

| (Provision) for income taxes | (1,143 | ) | (12.1 | ) | (1,035 | ) | (11.8 | ) | ||||||||

| Income from continuing operations | 2,812 | 29.8% | 2,663 | 30.5 | ||||||||||||

| Results of discontinued operations, net of tax | 216 | 2.3 | 52 | 0.6 | ||||||||||||

| Net income | $ | 3,028 | 32.1% | $ | 2,715 | 31.1% | ||||||||||

* Numbers in the prior year have been reclassified to conform to the current year’s presentation.

FY12 Compared with FY11

Net Sales

Net sales increased $710,000, or 8.1%, to $9,449,000 in fiscal year 2012 from $8,739,000 in FY11. We attribute the increase in pharmaceutical software sales to increases in the number of licenses with new and existing customers, as well as licensing of new modules to existing customers, especially for our GastroPlus line of products because it has more modules than other products we offer. In addition, in the 4th quarter we began two funded collaborations that will expand the capabilities of our GastroPlus software.

Those increases outweighed the decreases in net sales from previously large funded collaborations and analytical studies (large collaboration contracts were completed by August 2010), workshops, and a Small Business Innovation Research Grant (2-year grant from NIH ended in March 2011.)

The revenue from software licenses resulted in an increase of $8,002,000, or 12.4%, while the revenue from services, such as funded collaborations contracts, grant, and analytical study contracts, resulted in a decrease of $281,000, or 38.2%.

Cost of Sales

Cost of sales decreased $49,000, or 3.1%, to $1,510,000 in FY12 from $1,559,000 in FY11. As a percentage of net sales, cost of sales also decreased by 1.8%.

A significant portion of cost of sales is the systematic amortization of capitalized software development costs, which is an independent fixed cost rather than a variable cost related to sales. This amortization cost increased approximately $7,000, or 1%, in FY12 compared with FY11.

Royalty expense, a variable cost related to sales of our GastroPlus core program as well as royalties from the agreement with Accelrys, Inc. (the original agreement was with Symyx Technologies which merged with Accelrys, Inc. in 2010) Metabolite/Metabolism, decreased approximately $26,000, or 5%, in FY12 compared with FY11. We also incurred royalty expense on the Enslein Metabolism Module; however, we signed an agreement to buy out this royalty agreement from Enslein Research of Rochester, New York on February 28, 2012 for $75,000, and as a result, we no longer had this royalty expense beginning March 2012.

| 13 |

Service cost, such as labor costs for trainings/workshops, analytical studies, and technical support, decreased approximately $85,000, or 26%, in FY12 compared with FY11 as a result of a lesser number of person-hours allocated to those services during FY12 compared with FY11.

Gross Profit

Gross profit increased $759,000, or 10.6%, to $7,939,000 in FY12 from $7,180,000 in FY11. We attribute this increase to the increased sales of pharmaceutical software and a decrease in the cost of goods sold.

Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses increased $193,000, or 6.1% to $3,379,000 in FY12, compared to $3,186,000 in FY11; however, as a percentage of sales, SG&A decreased to approximately 35.8% in FY12 from approximately 36.5% in FY11. The increase in SG&A expenses is due to an increase in the amount of our office rent to $293,000 from $144,000, because we now pay the entire office lease following the sale of our former subsidiary, Words+, on November 30, 2011. Although we continue to sublease approximately 20% of the office space to Words+, the income from the sublease is recorded as Other Income and so does not directly offset the increase in SG&A. Other increases in SG&A expense were due to increases in the costs associated with advertising, trade shows, marketing and labor, as we attended more trade shows and conferences in FY12, we also contracted additional labor, were subject to a new tax on sales generated in India which the Indian government regulates, and had additional payroll-related expenses, such as payroll taxes, 401k and insurances. These increases outweighed decreased consulting fees, equipment rental, and recruiting costs.

Research and Development

We incurred approximately $1,900,000 of research and development costs during FY12. Of this amount, $952,000 was capitalized and $948,000 was expensed. In FY11, we incurred $1,261,000 of research and development costs, of which $797,000 was capitalized and $464,000 was expensed. The increase of $639,000, or 50.7%, in total research and development expenditures from FY11 to FY12 was due to laboratory experimental costs of $140,000 for our NCE (new chemical entity) malaria project, staff increases, and salary increases for existing staff.

Income from operations

During FY12, we generated income from operations of $3,612,000, as compared to $3,530,000 for FY11, an increase of 2.3%. We attribute this increase to increases in gross profit and decreases in the cost of goods sold which outweighed increases in SG&A expense and research and development expenses.

Other Income and (Expense)

Net other income (expense) increased by $175,000, or 104.2%, to $343,000 in FY12 from $168,000 in FY11. This is due to gains from Japanese Yen and Chinese Yuan currency exchanges and sublease payments we received from Words+ for their rented space.

Provision for Income Taxes

Provision for income taxes for FY12 increased by $108,000, or 10.4%, to $1,143,000, compared to $1,035,000 for FY11 due to the increase in net income. The tax rate used in this report is lower than the standard rate because of various tax credits generated during the reporting period for this Annual Report on Form 10-K.

| 14 |

Income from Continuing Operations

Net income from continuing operations for FY12 increased by $149,000, or 5.6%, to $2,812,000, compared to $2,663,000 for FY11. We attribute this increase in net income to increased gross profit and other income, which outweighed increases in SG&A expenses and taxes.

Seasonality

Sales in our business segment exhibit some seasonal fluctuations, with the fourth fiscal quarter (June-August) generally having the lowest sales over the past three fiscal years because of summer vacations and reduced activities at our customers’ sites. This unaudited net sales information has been prepared on the same basis as the annual information presented elsewhere in this Annual Report on Form 10-K and, in the opinion of management, reflects all adjustments (consisting of normal recurring entries) necessary for a fair presentation of the information presented. Net sales for any quarter are not necessarily indicative of sales for any future period; however, because our pharmaceutical software is licensed on an annual basis, renewals are generally within the same quarter year after year.

| Net Sales (in thousands) | ||||||||||||||||||||

| FY | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | Total | |||||||||||||||

| 2012 | 2,248 | 2,789 | 2,772 | 1,640 | 9,449 | |||||||||||||||

| 2011 | 2,050 | 2,622 | 2,640 | 1,427 | 8,739 | |||||||||||||||

| 2010 | 1,735 | 2,227 | 2,325 | 1,334 | 7,621 | |||||||||||||||

| 2009 | 1,430 | 1,779 | 1,985 | 1,107 | 6,301 | |||||||||||||||

| 2008 | 1,438 | 1,550 | 1,975 | 1,092 | 6,055 | |||||||||||||||

| 2007 | 824 | 1,808 | 1,659 | 1,465 | 5,756 | |||||||||||||||

| 2006 | 199 | 884 | 1,096 | 1,007 | 3,186 | |||||||||||||||

| 2005 | 524 | 410 | 662 | 473 | 2,069 | |||||||||||||||

| 2004 | 642 | 742 | 603 | 869 | 2,856 | |||||||||||||||

| 2003 | 507 | 582 | 614 | 1,403 | 3,106 | |||||||||||||||

| 2002 | 390 | 554 | 504 | 595 | 2,043 | |||||||||||||||

| 2001 | 221 | 373 | 305 | 282 | 1,181 | |||||||||||||||

| 2000 | 151 | 467 | 143 | 174 | 935 | |||||||||||||||

| 1999 | 87 | 93 | 117 | 164 | 461 | |||||||||||||||

| 1998 | 11 | 11 | 13 | 27 | 62 | |||||||||||||||

Liquidity and Capital Resources

Our principal source of capital has been cash flow from our operations. We have achieved continuous positive operating cash flow over the last nine fiscal years. We believe that our existing capital and anticipated funds from operations will be sufficient to meet our anticipated cash needs for working capital and capital expenditures for the foreseeable future. Thereafter, if cash generated from operations is insufficient to satisfy our capital requirements, we may open a revolving line of credit with a bank, or we may have to sell additional equity or debt securities or obtain expanded credit facilities. In the event such financing is needed in the future, there can be no assurance that such financing will be available to us, or, if available, that it will be in amounts and on terms acceptable to us.

We are not aware of any trends or demands, commitments, or uncertainties that are reasonably likely to result in a decrease in liquidity of our assets. The trend over the last ten years has been increasing cash deposits from our operating cash flows, and we expect that trend to continue for the foreseeable future. We have no material commitments for capital expenditures as of the end of the latest fiscal period.

| 15 |

We continue to seek opportunities for strategic acquisitions. If one or more such acquisition is identified, a substantial portion of our cash reserves may be required to complete it; however, we intend to maintain sufficient cash reserves after any acquisition to provide reasonable assurance that outside financing will not be necessary to continue operations. If we identify an attractive acquisition that would require more cash to complete than we are willing or able to use from our cash reserves, we will consider financing options to complete the acquisition, including obtaining loans and issuing additional securities.

Because we have not been able to find suitable acquisitions for several years, the board of directors decided to distribute a portion of our cash reserves to our shareholders, declaring an ongoing $0.05 per share per quarter cash dividend beginning with the second quarter of FY12. Quarterly dividend payments were made on March 1, May 8, and August 10, 2012 during FY12. There can be no assurances that our Board of Directors will continue the dividend distributions for any specified number of quarters; however, there is no current plan to discontinue the quarterly dividend distributions.

UNUSUAL OR INFREQUENT EVENTS

On November 30, 2011, we sold our entire interest in our former wholly-owned subsidiary, Words+, an augmentative and alternative communication device manufacturer, for aggregate gross proceeds of $1.97 million. We recognized a gain of approximately $465,820, net of tax, from the sale of Words+, which is included in discontinued operations in our statement of operations for the fiscal year ended August 31, 2012. The difference between the sales price and the net gain is a result of adjustments to net working capital from August 31, 2011, until the closing on November 30, 2011, legal fees, auditing fees, tax specialist’s fees, and severance compensation for terminated employees.

KNOWN TRENDS OR UNCERTAINTIES

Although we have not seen any significant reduction in revenues to date, we have seen consolidation in the pharmaceutical industry during the current economic downturn. This trend has not had a negative effect on our total sales to that industry; however, these consolidations and downsizing in the industry could have an impact on our revenues and earnings going forward.

We believe that the need for improved productivity in the research and development activities directed toward developing new medicines will continue to result in increasing adoption of simulation and modeling tools such as those we produce. New product developments in the pharmaceutical business segments could result in increased revenues and earnings if they are accepted by our markets; however, there can be no assurances that new products will result in significant improvements to revenues or earnings. For competitive reasons, we do not disclose all of our new product development activities.

Our continued quest for acquisitions in the pharmaceutical business segment could result in a significant change to revenues and earnings if one or more such acquisitions are completed.

INFLATION

We have not been affected materially by inflation during the periods presented, and no material effect is expected in the near future.

OFF-BALANCE SHEET ARRANGEMENTS

As of August 31, 2012, we did not have any relationships with unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special purpose entities, which would have been established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purposes. As such, we are not materially exposed to any financing, liquidity, market or credit risk that could arise if we had engaged in such relationships.

| 16 |

We do not have relationships or transactions with persons or entities that derive benefits from their non-independent relationship with us or our related parties.

RECENTLY ISSUED or Newly adopted ACCOUNTING STANDARDS

In September 2009, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2009-14 which amends Statement of Position (“SOP”) 97-2, “Software Revenue Recognition”, to exclude tangible products containing software components and non-software components that function together to deliver the product’s essential functionality. ASU 2009-14 applies to revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010, with early application permitted with EITF 08-1 (as defined below). We adopted this standard in the first quarter of fiscal 2011. We believe adoption did not have a material effect on our financial statements.

In September 2009, the FASB issued ASU 2009-13, “Revenue Arrangements with Multiple Deliverables” (“EITF 08-1”). EITF 08-1 amends Emerging Issues Task Force (“EITF”) 00-21, “Revenue Arrangements with Multiple Deliverables”, to require an entity to use an estimated selling price when vendor-specific objective evidence or acceptable third-party evidence does not exist for any products or services included in a multiple element arrangement. The arrangement consideration should be allocated among the products and services based upon their relative selling prices, thus eliminating the use of the residual method of allocation. EITF 08-1 also requires expanded qualitative and quantitative disclosures regarding significant judgments made and changes in applying the guidance. EITF 08-1 applies to fiscal years beginning after June 15, 2010, with early application permitted. We adopted this standard in the first quarter of fiscal 2011. We believe adoption did not have a material effect on our financial statements.

In May 2011, the FASB issued ASU 2011-04, Fair Value Measurement (“ASU 2011-04”), which amended Accounting Standard Codification (“ASC”) 820, Fair Value Measurements (“ASC 820”), providing a consistent definition and measurement of fair value, as well as similar disclosure requirements between U.S. generally accepted account principals and International Financial Reporting Standards. ASU 2011-04 changes certain fair value measurement principles, clarifies the application of existing fair value measurement and expands the disclosure requirements. We adopted this standard in the first quarter of 2012. We believe adoption did not have a material effect on our financial statements.

In June 2011, the FASB issued ASU 2011-05, Presentation of Comprehensive Income (“ASU 2011-05”). ASU 2011-05 requires the presentation of comprehensive income in either (1) a continuous statement of comprehensive income or (2) two separate but consecutive statements. We adopted this standard in the first quarter of 2012. We believe adoption did not have a material effect on our financial statements.

In September 2011, the FASB issued ASU 2011-08, Testing Goodwill for Impairment (“ASU 2011-08”), which amends the guidance in ASC 350-20, Intangibles—Goodwill and Other – Goodwill. ASU 2011-08 provides entities with the option of performing a qualitative assessment before calculating the fair value of the reporting unit when testing goodwill for impairment. If the fair value of the reporting unit is determined, based on qualitative factors, to be more likely than not less than the carrying amount of the reporting unit, the entities are required to perform a two-step goodwill impairment test. We adopted this standard in the first quarter of 2012. We believe adoption did not have a material effect on our financial statements.

| 17 |

In December 2011, the FASB issued ASU No. 2011-11, “Disclosures about Offsetting Assets and Liabilities.” The amendments in this update require enhanced disclosures around financial instruments and derivative instruments that are either (1) offset in accordance with either ASC 210-20-45 or ASC 815-10-45 or (2) subject to an enforceable master netting arrangement or similar agreement, irrespective of whether they are offset in accordance with either ASC 210-20-45 or ASC 815-10-45. An entity should provide the disclosures required by those amendments retrospectively for all comparative periods presented. The amendments are effective during interim and annual periods beginning after February 28, 2012. We adopted this standard in the third quarter of 2012. We believe adoption did not have a material effect on our financial statements.

In July 2012, the FASB issued ASU 2012-02, “Testing Indefinite-Lived Intangible Assets for Impairment”, which amended the guidance in ASU 2011-08 to simplify the testing of indefinite-lived intangible assets other than goodwill for impairment. ASU 2012-02 becomes effective for annual and interim impairment tests performed for fiscal years beginning on or after September 15, 2012 and earlier adoption is permitted. We adopted this standard in the first quarter of fiscal year 2013. We believe adoption did not have a material effect on our financial statements.

Revenue Recognition

We recognize revenues related to software licenses and software maintenance in accordance with the FASB ASC 985-605, “Software – Revenue Recognition”. Software products revenue is recorded when the following conditions are met: 1) evidence of arrangement exists; 2) delivery has been made; 3) the amount is fixed; and 4) collectability is probable. Post-contract customer support (“PCS”) obligations are insignificant; therefore, revenue for PCS is recognized at the same time as the licensing fee, and the costs of providing such support services are accrued and amortized over the obligation period.

As a byproduct of ongoing improvements and upgrades for the new programs and new modules of software, some modifications are provided to our customers who have already purchased software at no additional charge. Other software modifications result in new, additional cost modules that expand the functionality of the software. These are licensed separately. We consider the modifications that are provided without charge to be minimal, as they do not significantly change the basic functionality or utility of the software, but rather add convenience, such as being able to plot some additional variable on a graph in addition to the numerous variables that had been available before, or adding some additional calculations to supplement the information provided from running the software. Such software modifications for any single product have typically occurred once or twice per year, sometimes more, sometimes less. Thus, they are infrequent. The Company provides, for a fee, additional training and service calls to its customers and recognizes revenue at the time the training or service call is provided.

Generally, we enter into one-year license agreements with customers for the use of our pharmaceutical software products. We recognize revenue on these contracts when all the criteria are met.

Most license agreements have a term of one year; however, from time to time, we enter into multi-year license agreements. We generally unlock and invoice software one year at a time for multi-year licenses. Therefore, revenue is recognized one year at a time.

We recognize the revenue from collaboration research and the revenue from grants equally over their terms. However, we recognize the contract study revenue using the percentage of completion method, depending upon how the contract studies are engaged, in accordance with FASB ASC 605-35, “Revenue Recognition – Construction-Type and Production-Type Contracts”. To recognize revenue using the percentage of completion method, we must determine whether we meet the following criteria: 1) there is a long-term, legally enforceable contract and 2) it is possible to reasonably estimate the total project costs, and 3) it is possible to reasonably estimate the extent of progress toward completion.

| 18 |

Capitalized Computer Software Development Costs

Software development costs are capitalized in accordance with FASB ASC 985-20, “Costs of Software to Be Sold Leased, or Marketed”. Capitalization of software development costs begins upon the establishment of technological feasibility and is discontinued when the product is available for sale.

The establishment of technological feasibility and the ongoing assessment for recoverability of capitalized software development costs require considerable judgment by management with respect to certain external factors including, but not limited to, technological feasibility, anticipated future gross revenues, estimated economic life, and changes in software and hardware technologies. Capitalized computer software development costs are comprised primarily of salaries and direct payroll-related costs and the purchase of existing software to be used in the Company’s software products.

Amortization of capitalized computer software development costs is provided on a product-by-product basis on the straight-line method over the estimated economic life of the products (not to exceed five years). Amortization of software development costs amounted to $668,021 and $660,893 for the years ended August 31, 2012 and 2011, respectively. We expect future amortization expense to vary due to increases in capitalized computer software development costs.

We test capitalized computer software development costs for recoverability whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

Income Taxes

We utilize FASB ASC 740-10, “Income Taxes”, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns.

Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized. The provision for income taxes represents the tax payable for the period and the change during the period in deferred tax assets and liabilities.

Stock-Based Compensation

We account for stock options using the modified prospective method in accordance with FASB ASC 718-10, “Compensation-Stock Compensation”. Under this method, compensation costs include: (1) compensation cost for all share-based payments granted prior to, but not yet vested as of September 1, 2006, based on the grant-date fair value estimated in accordance with the original provisions of Statement of Financial Accounting Standards No. 123 amortized over the options’ vesting period, and (2) compensation cost for all share-based payments granted subsequent to September 1, 2006, based on the grant-date fair value estimated in accordance with the provisions of FASB ASC 718-10, amortized on a straight-line basis over the options’ vesting period. Stock-based compensation was $181,520 and $155,252 for the fiscal years ended August 31, 2012 and 2011, respectively, and is included in the consolidated statements of operations as Consulting, Salaries, and Research and Development expense.

Estimates

Our consolidated financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. Actual results could differ from those estimates. Significant accounting policies for us include revenue recognition, accounting for capitalized software development costs, and accounting for income taxes.

| 19 |

Item 7a – QUANTITATIVE AND QUALitaTiVe DISCLOSURES ABOUT MARKET RISK

Not applicable because we are a smaller reporting company.

Item 8 - Financial Statements AND SUPPLEMENTARY DATA

The responses to this item are included elsewhere in this Form 10-K (see pages F1 – F23) and incorporated herein by reference.

Item 9 – Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

There have been no changes to our public accountants during the past two years.

ITEM 9A – CONTROLS AND PROCEDURES

We are responsible for maintaining disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange. Disclosure controls and procedures are controls and other procedures designed to provide reasonable assurance that the information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. In designing and evaluating disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Based on our management’s evaluation (with the participation of our principal executive officer and principal financial officer) of our disclosure controls and procedures as required by Rule 13a-15(b) and 15d-15(b) under the Exchange Act, our principal executive officer and principal financial officer have concluded that our disclosure controls and procedures were effective as of August 31, 2012, the end of the fiscal year covered by this report.

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal controls over financial reporting, as defined in Exchange Act Rules 13a-15(f) and 15d-15(f). Our internal controls over financial reporting are designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting principles.

| 20 |

Under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of our internal controls over financial reporting based on the framework established by the Committee of Sponsoring Organizations of the Treadway Commission. Based on our evaluation under such framework, including the completion and review of internal review assessment forms and the completion and review of financial reporting information systems and controls checklists in the framework, our management concluded that our internal control over financial reporting was effective as of August 31, 2012.

No changes were made in our internal controls over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act) during the quarter ended August 31, 2012, that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.