Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PIONEER ENERGY SERVICES CORP | a8kinvpres3-27x18.htm |

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

SCOTIA HOWARD WEIL 2018 ENERGY CONFERENCE

March 27th, 2018

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

Forward-looking Statements

This presentation contains various forward-looking statements and information that are based on management’s current expectations and assumptions about

future events. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “expect,” “anticipate,” “plan,”

“intend,” “seek,” “will,” “should,” “goal” and other words that convey the uncertainty of future events and outcomes. Forward-looking information includes,

among other matters, statements regarding the Company’s anticipated performance, quality of assets, rig utilization rate, capital spending by oil and gas

companies, and the Company's international operations.

Although the Company believes that the expectations and assumptions reflected in such forward-looking statements are reasonable, it can give no assurance

that such expectations and assumptions will prove to have been correct. Such statements are subject to certain risks, uncertainties and assumptions, including

general economic and business conditions and industry trends, levels and volatility of oil and gas prices, the continued demand for drilling services or

production services in the geographic areas where we operate, decisions about exploration and development projects to be made by oil and gas exploration

and production companies, the highly competitive nature of our business, technological advancements and trends in our industry and improvements in our

competitors’ equipment, the loss of one or more of our major clients or a decrease in their demand for our services, future compliance with covenants under

debt agreements, including our senior secured revolving asset-based credit facility, our term loan and our senior notes, operating hazards inherent in our

operations, the supply of marketable drilling rigs, well servicing rigs, coiled tubing and wireline units within the industry, the continued availability of new

components for drilling rigs, well servicing rigs, coiled tubing units and wireline units, the continued availability of qualified personnel, the success or failure of

our acquisition strategy, including our ability to finance acquisitions, manage growth and effectively integrate acquisitions, the political, economic, regulatory

and other uncertainties encountered by our operations, and changes in, or our failure or inability to comply with, governmental regulations, including those

relating to the environment.

Should one or more of these risks, contingencies or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary

materially from those expected. Many of these factors have been discussed in more detail in the Company's annual report on Form 10-K for the fiscal year

ended December 31, 2016. Other unpredictable or unknown factors that the Company has not discussed in this presentation or in its filings with the Securities

and Exchange Commission could also have material adverse effects on actual results of matters that are the subject of the forward-looking statements. All

forward-looking statements speak only as the date on which they are made and the Company undertakes no duty to update or revise any forward-looking

statements. We advise investors to use caution and common sense when considering our forward-looking statements.

2

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

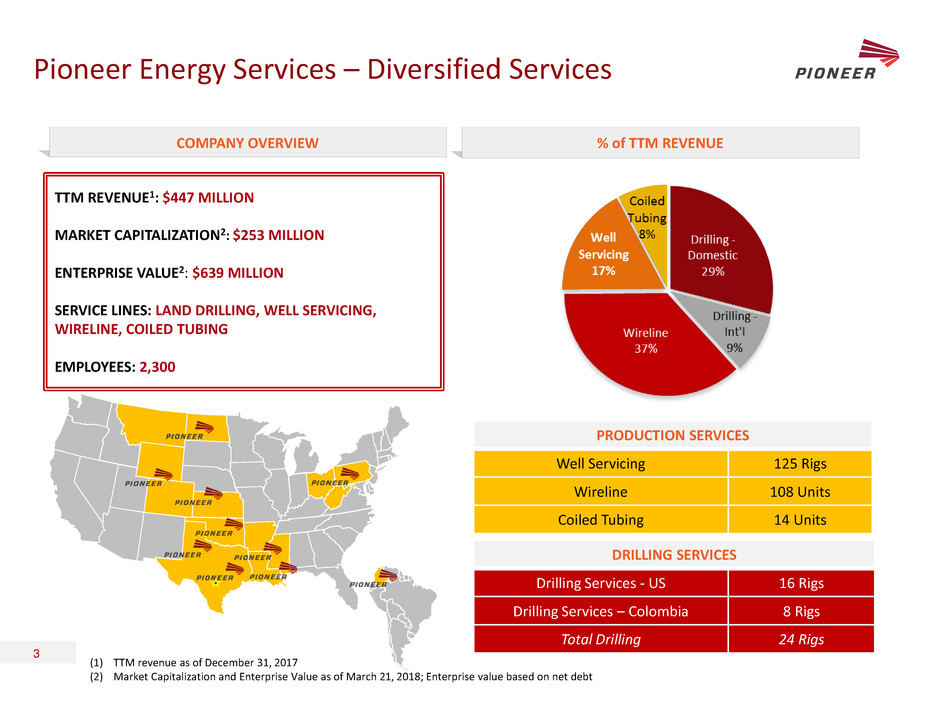

Pioneer Energy Services – Diversified Services

% of TTM REVENUE

(1) TTM revenue as of December 31, 2017

(2) Market Capitalization and Enterprise Value as of March 21, 2018; Enterprise value based on net debt

DRILLING SERVICES

Drilling Services - US 16 Rigs

Drilling Services – Colombia 8 Rigs

Total Drilling 24 Rigs

PRODUCTION SERVICES

Well Servicing 125 Rigs

Wireline 108 Units

Coiled Tubing 14 Units

3

TTM REVENUE1: $447 MILLION

MARKET CAPITALIZATION2: $253 MILLION

ENTERPRISE VALUE2: $639 MILLION

SERVICE LINES: LAND DRILLING, WELL SERVICING,

WIRELINE, COILED TUBING

EMPLOYEES: 2,300

COMPANY OVERVIEW

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

Premium Shale-Oriented Assets

4

US DRILLING SERVICES PRODUCTION SERVICES

• 100% pad-capable AC rigs

• Framework of a super-spec rig:

• 7,500psi mud systems

• Integrated top drives

• Rapid rig moves

• Greater racking capacity

• Ability to walk over wellheads

• Ability to run four engines and three mud pumps

• Premium shale-capable equipment

• High horsepower and tall-masted well

servicing rigs capable of servicing

laterals of any length

• Emphasis on large-diameter coiled

tubing services

• Completion-weighted services (56%)

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

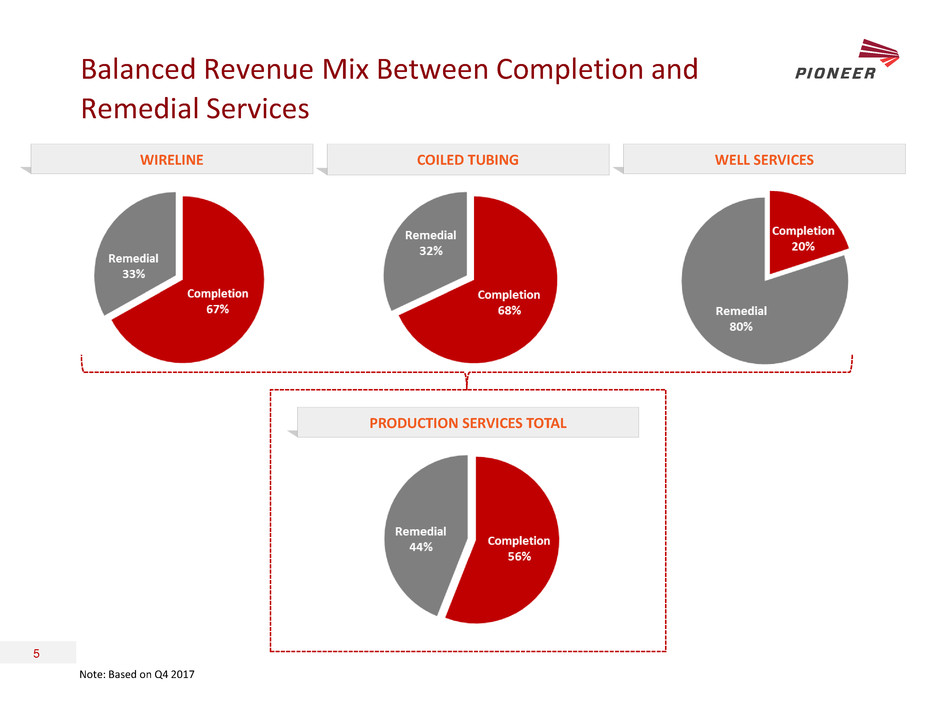

Balanced Revenue Mix Between Completion and

Remedial Services

5

COILED TUBING WIRELINE WELL SERVICES

PRODUCTION SERVICES TOTAL

Note: Based on Q4 2017

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

Established Customer Base with Premier Customers

KEY CUSTOMERS

6

• Long-standing, high quality client relationships with a diverse group of large independent oil and gas

exploration and production companies

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

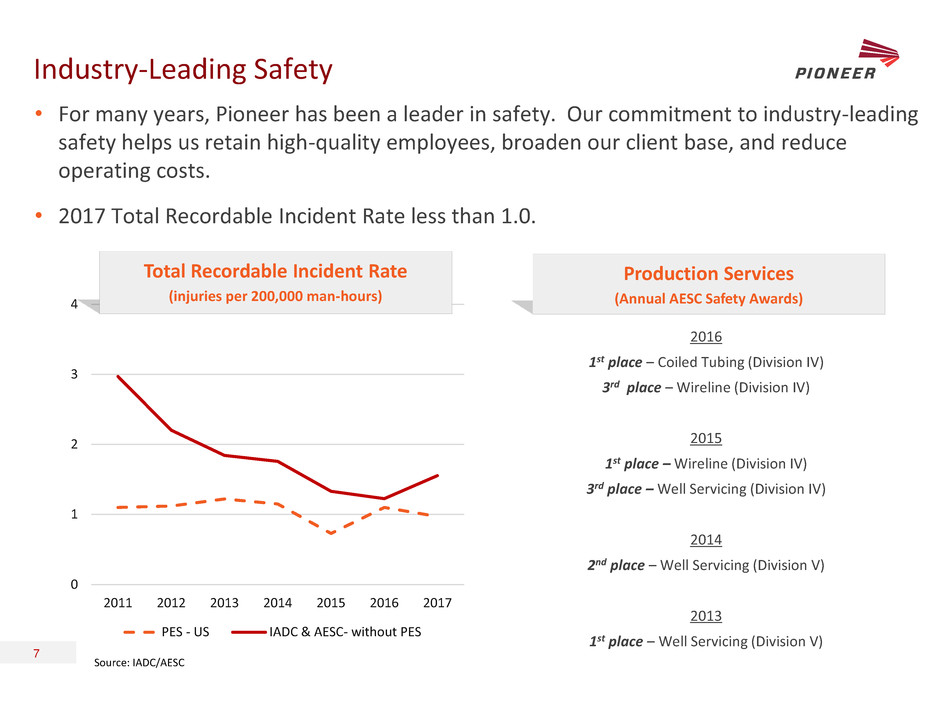

Industry-Leading Safety

• For many years, Pioneer has been a leader in safety. Our commitment to industry-leading

safety helps us retain high-quality employees, broaden our client base, and reduce

operating costs.

• 2017 Total Recordable Incident Rate less than 1.0.

0

1

2

3

4

2011 2012 2013 2014 2015 2016 2017

PES - US IADC & AESC- without PES

Total Recordable Incident Rate

(injuries per 200,000 man-hours)

7

Source: IADC/AESC

Production Services

(Annual AESC Safety Awards)

2016

1st place – Coiled Tubing (Division IV)

3rd place – Wireline (Division IV)

2015

1st place – Wireline (Division IV)

3rd place – Well Servicing (Division IV)

2014

2nd place – Well Servicing (Division V)

2013

1st place – Well Servicing (Division V)

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

PRODUCTION

SERVICES

8

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

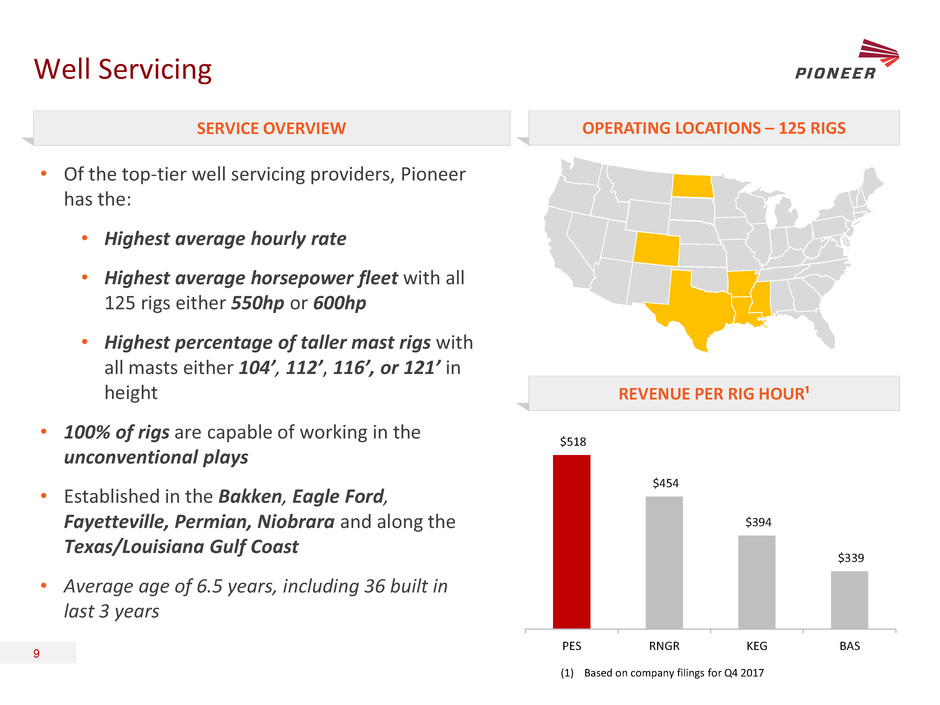

Well Servicing

• Of the top-tier well servicing providers, Pioneer

has the:

• Highest average hourly rate

• Highest average horsepower fleet with all

125 rigs either 550hp or 600hp

• Highest percentage of taller mast rigs with

all masts either 104’, 112’, 116’, or 121’ in

height

• 100% of rigs are capable of working in the

unconventional plays

• Established in the Bakken, Eagle Ford,

Fayetteville, Permian, Niobrara and along the

Texas/Louisiana Gulf Coast

• Average age of 6.5 years, including 36 built in

last 3 years

SERVICE OVERVIEW OPERATING LOCATIONS – 125 RIGS

REVENUE PER RIG HOUR¹

9

(1) Based on company filings for Q4 2017

$518

$454

$394

$339

PES RNGR KEG BAS

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

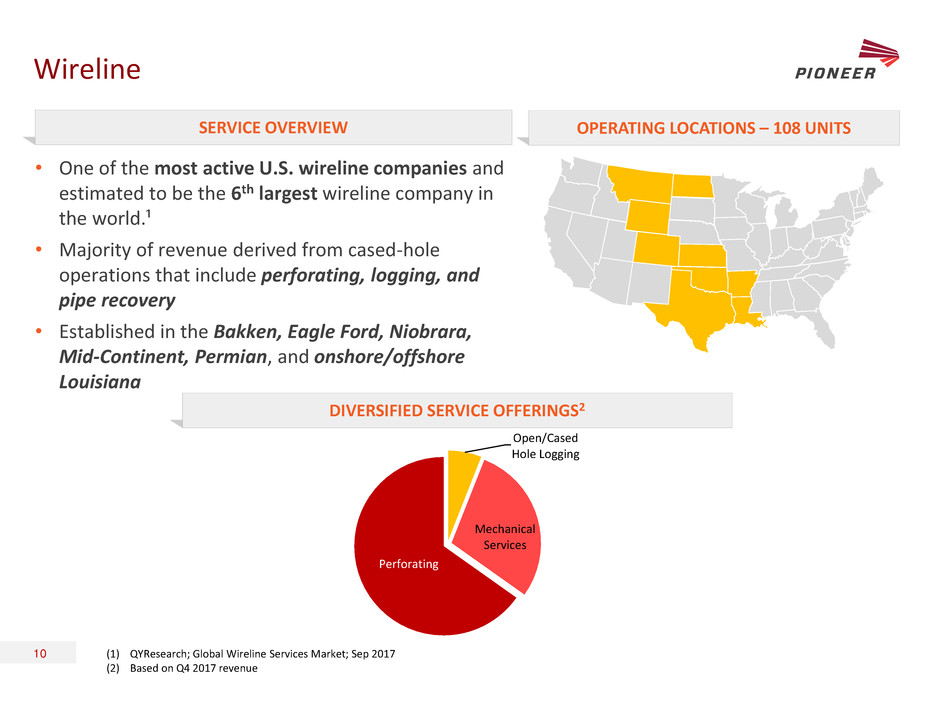

Wireline

• One of the most active U.S. wireline companies and

estimated to be the 6th largest wireline company in

the world.¹

• Majority of revenue derived from cased-hole

operations that include perforating, logging, and

pipe recovery

• Established in the Bakken, Eagle Ford, Niobrara,

Mid-Continent, Permian, and onshore/offshore

Louisiana

(1) QYResearch; Global Wireline Services Market; Sep 2017

(2) Based on Q4 2017 revenue

SERVICE OVERVIEW OPERATING LOCATIONS – 108 UNITS

DIVERSIFIED SERVICE OFFERINGS2

10

Open/Cased

Hole Logging

Mechanical

Services

Perforating

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

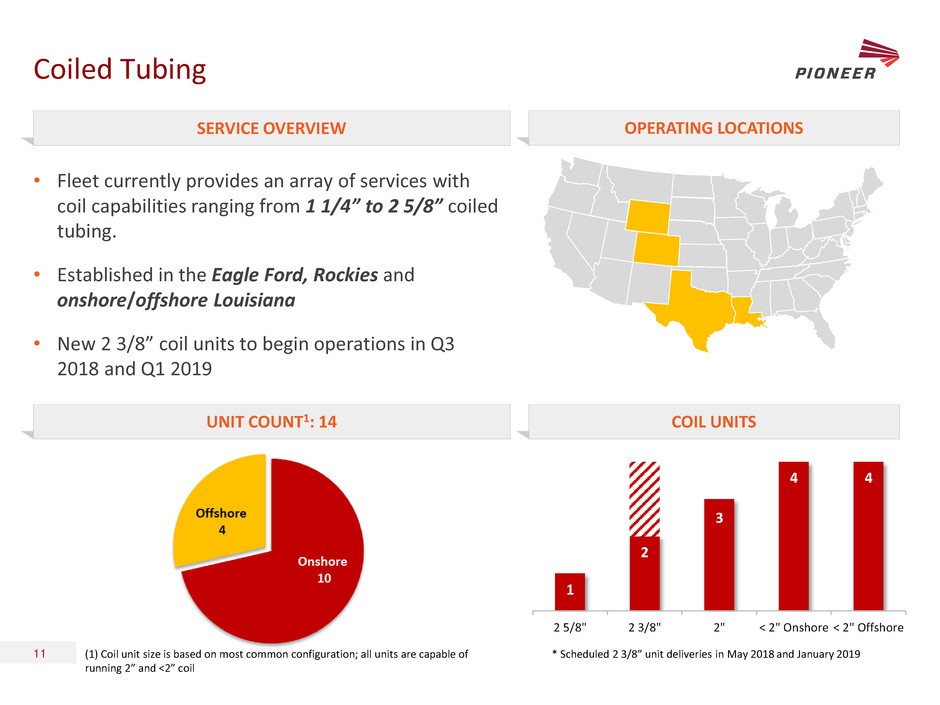

Coiled Tubing

• Fleet currently provides an array of services with

coil capabilities ranging from 1 1/4” to 2 5/8” coiled

tubing.

• Established in the Eagle Ford, Rockies and

onshore/offshore Louisiana

• New 2 3/8” coil units to begin operations in Q3

2018 and Q1 2019

SERVICE OVERVIEW OPERATING LOCATIONS

UNIT COUNT1: 14 COIL UNITS

(1) Coil unit size is based on most common configuration; all units are capable of

running 2” and <2” coil

11

1

2

3

4 4

2 5/8" 2 3/8" 2" < 2" Onshore < 2" Offshore

* Scheduled 2 3/8” unit deliveries in May 2018 and January 2019

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

DRILLING

SERVICES

12

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

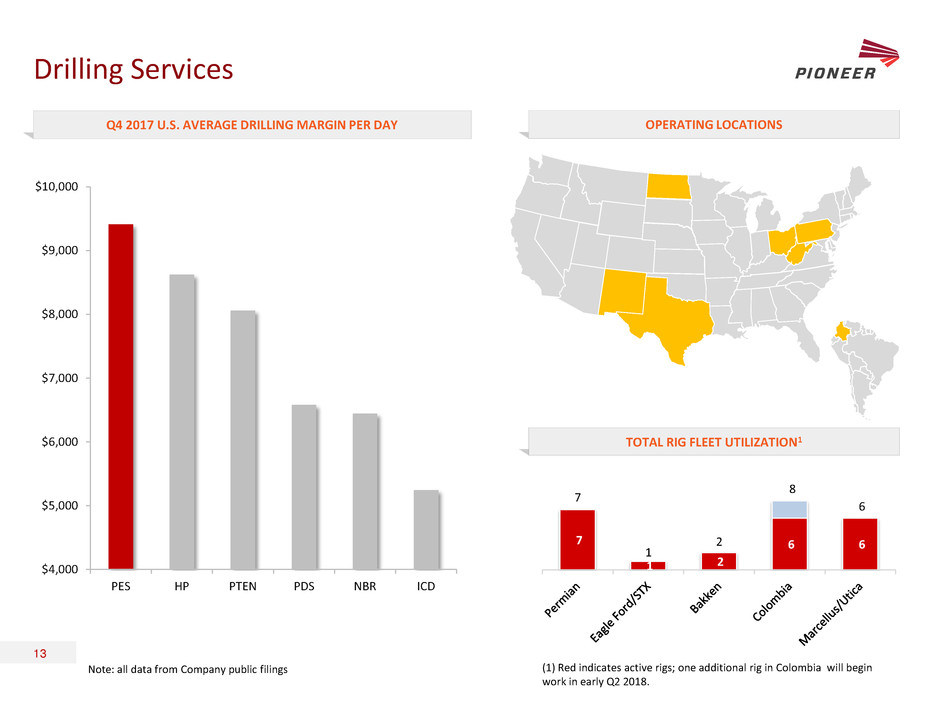

Drilling Services

Q4 2017 U.S. AVERAGE DRILLING MARGIN PER DAY OPERATING LOCATIONS

TOTAL RIG FLEET UTILIZATION1

13

(1) Red indicates active rigs; one additional rig in Colombia will begin

work in early Q2 2018.

Note: all data from Company public filings

7

1 2

6 6

7

1

2

8

6

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

PES HP PTEN PDS NBR ICD

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

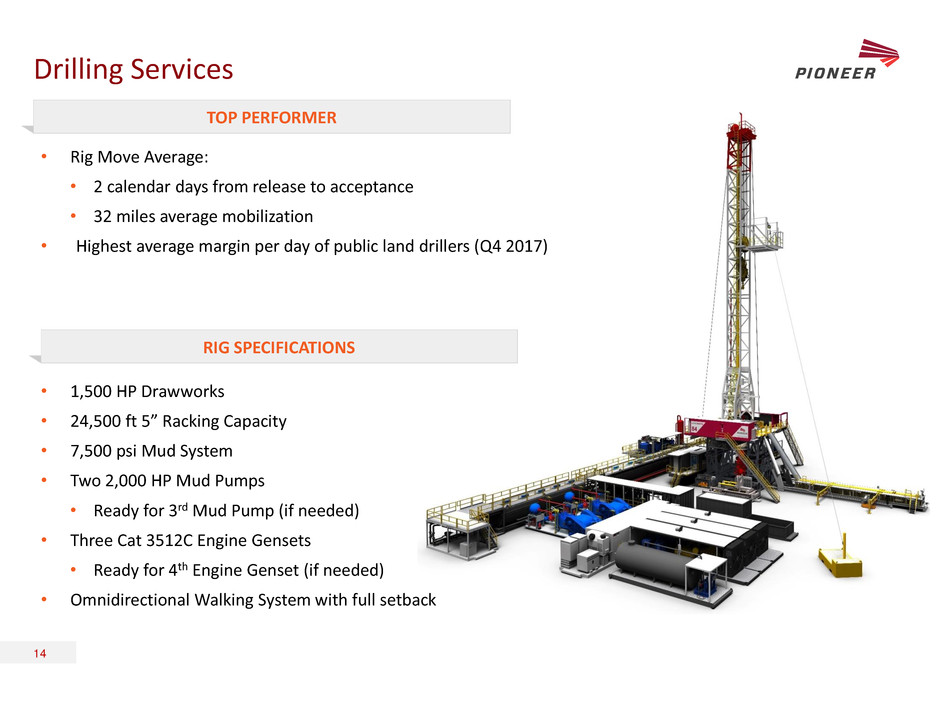

• Rig Move Average:

• 2 calendar days from release to acceptance

• 32 miles average mobilization

• Highest average margin per day of public land drillers (Q4 2017)

Drilling Services

14

TOP PERFORMER

• 1,500 HP Drawworks

• 24,500 ft 5” Racking Capacity

• 7,500 psi Mud System

• Two 2,000 HP Mud Pumps

• Ready for 3rd Mud Pump (if needed)

• Three Cat 3512C Engine Gensets

• Ready for 4th Engine Genset (if needed)

• Omnidirectional Walking System with full setback

RIG SPECIFICATIONS

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

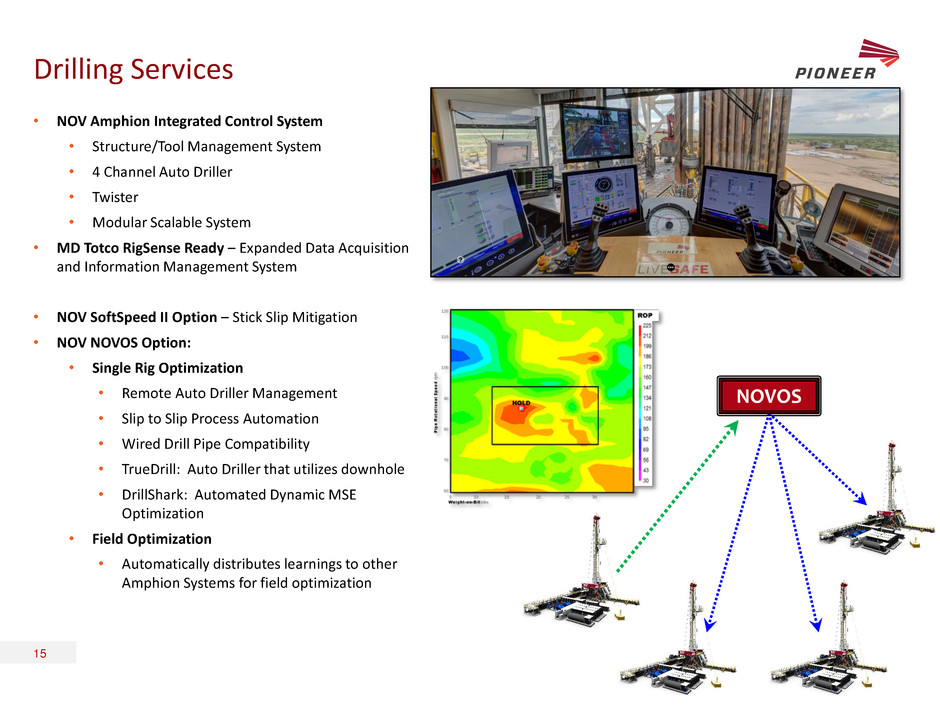

Drilling Services

15

• NOV Amphion Integrated Control System

• Structure/Tool Management System

• 4 Channel Auto Driller

• Twister

• Modular Scalable System

• MD Totco RigSense Ready – Expanded Data Acquisition

and Information Management System

• NOV SoftSpeed II Option – Stick Slip Mitigation

• NOV NOVOS Option:

• Single Rig Optimization

• Remote Auto Driller Management

• Slip to Slip Process Automation

• Wired Drill Pipe Compatibility

• TrueDrill: Auto Driller that utilizes downhole

• DrillShark: Automated Dynamic MSE

Optimization

• Field Optimization

• Automatically distributes learnings to other

Amphion Systems for field optimization

NOVOS

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

16

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

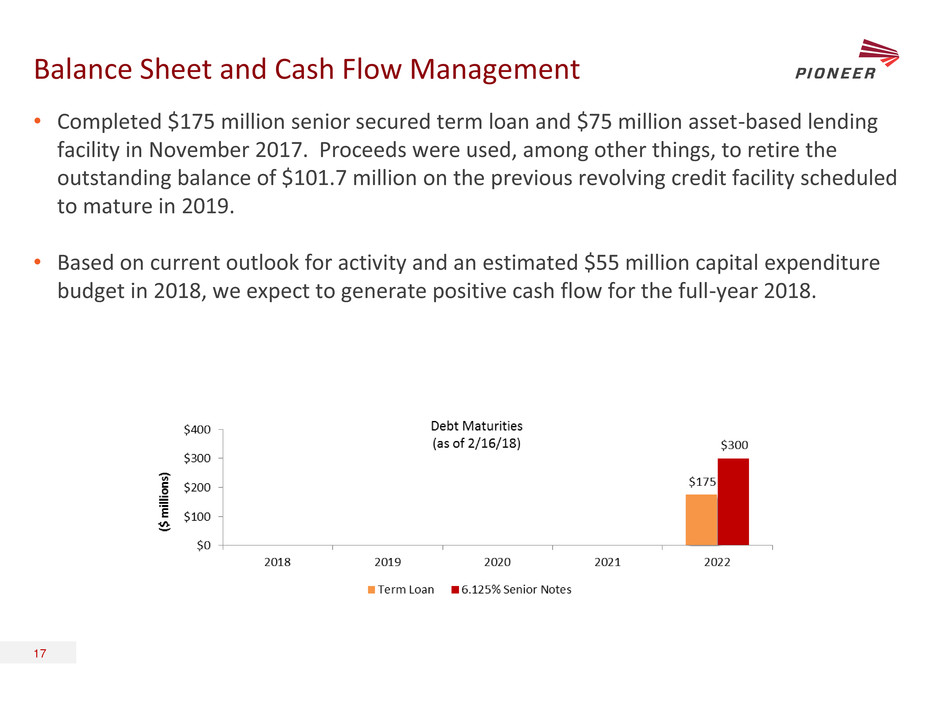

Balance Sheet and Cash Flow Management

• Completed $175 million senior secured term loan and $75 million asset-based lending

facility in November 2017. Proceeds were used, among other things, to retire the

outstanding balance of $101.7 million on the previous revolving credit facility scheduled

to mature in 2019.

• Based on current outlook for activity and an estimated $55 million capital expenditure

budget in 2018, we expect to generate positive cash flow for the full-year 2018.

17

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

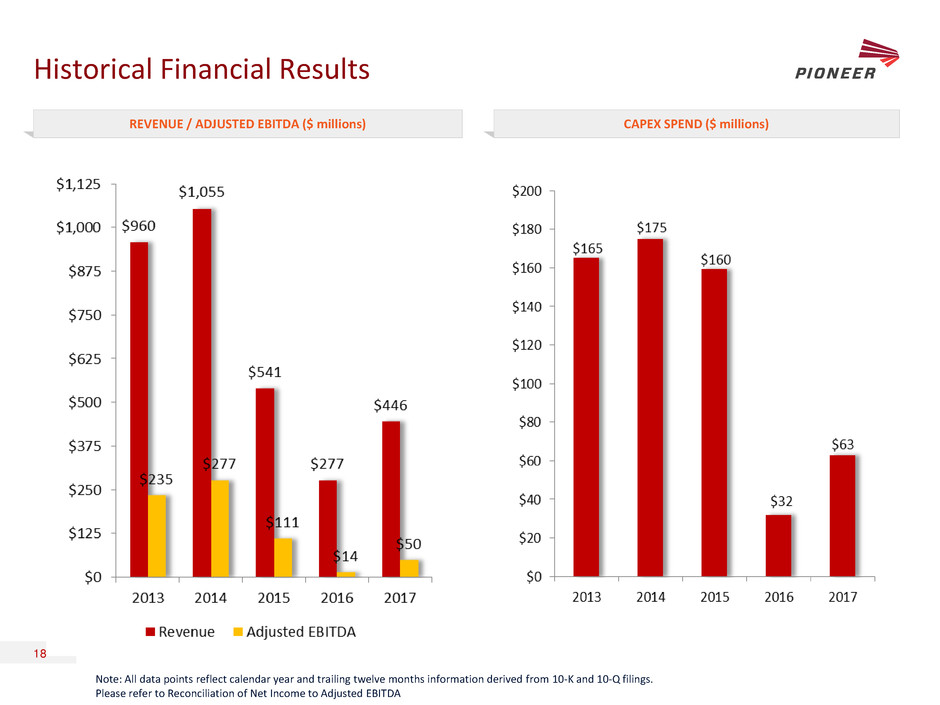

Historical Financial Results

REVENUE / ADJUSTED EBITDA ($ millions) CAPEX SPEND ($ millions)

Note: All data points reflect calendar year and trailing twelve months information derived from 10-K and 10-Q filings.

Please refer to Reconciliation of Net Income to Adjusted EBITDA

18

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

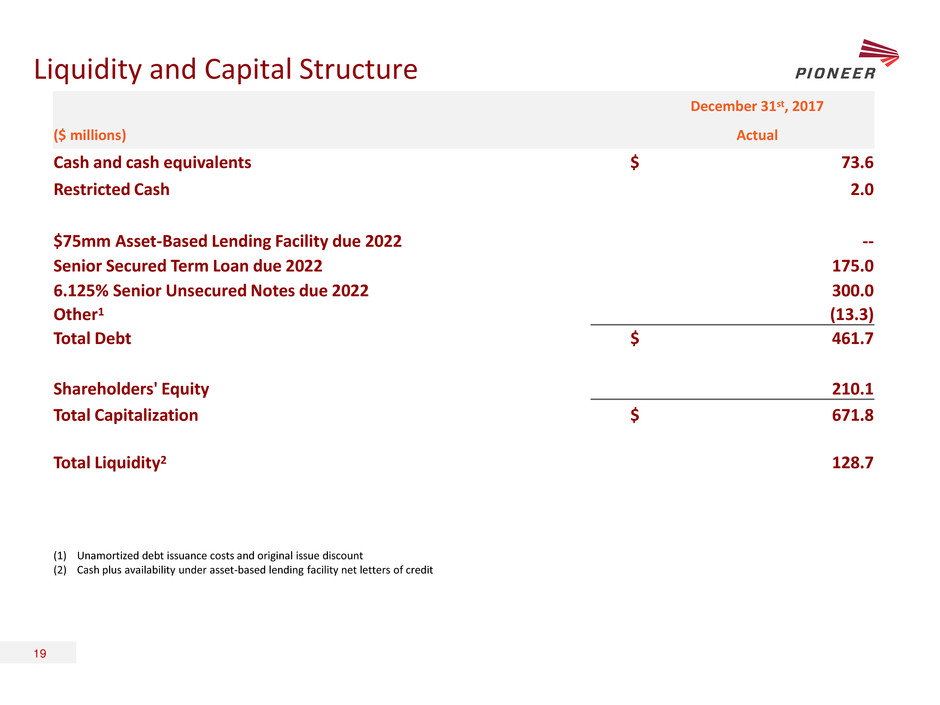

Liquidity and Capital Structure

December 31st, 2017

($ millions) Actual

Cash and cash equivalents $ 73.6

Restricted Cash 2.0

$75mm Asset-Based Lending Facility due 2022 --

Senior Secured Term Loan due 2022 175.0

6.125% Senior Unsecured Notes due 2022 300.0

Other1 (13.3)

Total Debt $ 461.7

Shareholders' Equity 210.1

Total Capitalization $ 671.8

Total Liquidity2 128.7

(1) Unamortized debt issuance costs and original issue discount

(2) Cash plus availability under asset-based lending facility net letters of credit

19

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx

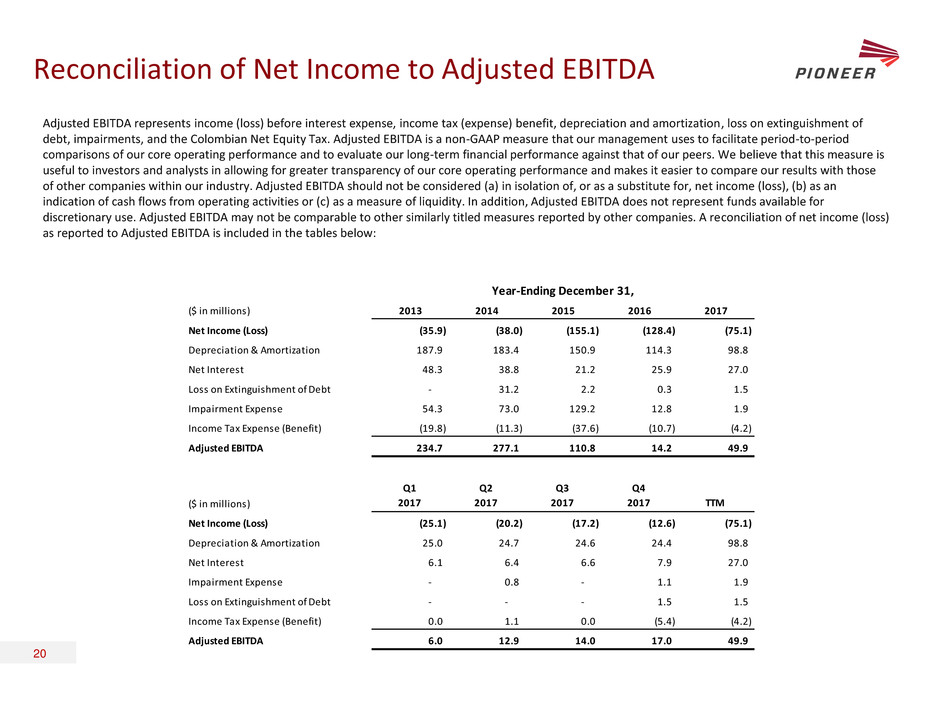

Reconciliation of Net Income to Adjusted EBITDA

Adjusted EBITDA represents income (loss) before interest expense, income tax (expense) benefit, depreciation and amortization, loss on extinguishment of

debt, impairments, and the Colombian Net Equity Tax. Adjusted EBITDA is a non-GAAP measure that our management uses to facilitate period-to-period

comparisons of our core operating performance and to evaluate our long-term financial performance against that of our peers. We believe that this measure is

useful to investors and analysts in allowing for greater transparency of our core operating performance and makes it easier to compare our results with those

of other companies within our industry. Adjusted EBITDA should not be considered (a) in isolation of, or as a substitute for, net income (loss), (b) as an

indication of cash flows from operating activities or (c) as a measure of liquidity. In addition, Adjusted EBITDA does not represent funds available for

discretionary use. Adjusted EBITDA may not be comparable to other similarly titled measures reported by other companies. A reconciliation of net income (loss)

as reported to Adjusted EBITDA is included in the tables below:

20

($ in millions) 2013 2014 2015 2016 2017

Net Income (Loss) (35.9) (38.0) (155.1) (128.4) (75.1)

Depreciation & Amortization 187.9 183.4 150.9 114.3 98.8

Net Interest 48.3 38.8 21.2 25.9 27.0

Loss on Extinguishment of Debt - 31.2 2.2 0.3 1.5

Impairment Expense 54.3 73.0 129.2 12.8 1.9

Income Tax Expense (Benefit) (19.8) (11.3) (37.6) (10.7) (4.2)

Adjusted EBITDA 234.7 277.1 110.8 14.2 49.9

($ in millions)

Q1

2017

Q2

2017

Q3

2017

Q4

2017 TTM

N t Inco e (Lo s) (25.1) (20.2) (17.2) (12.6) (75.1)

Depr ciation & Amortization 25.0 24.7 24.6 24.4 98.8

Net Interest 6.1 6.4 6.6 7.9 27.0

Impairment Expense - 0.8 - 1.1 1.9

Loss on Extinguishment of Debt - - - 1.5 1.5

Income Tax Expense (Benefit) 0.0 1.1 0.0 (5.4) (4.2)

Adjusted EBITDA 6.0 12.9 14.0 17.0 49.9

Year-Ending December 31,

ibdroot\Projects\IBD-NY\thaw2016\595552_1\06. Road Show\PES Company Presentation GS EQUITY v02.pptx