Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - PIONEER ENERGY SERVICES CORP | exhibit3224q2016.htm |

| EX-32.1 - EXHIBIT 32.1 - PIONEER ENERGY SERVICES CORP | exhibit3214q2016.htm |

| EX-31.2 - EXHIBIT 31.2 - PIONEER ENERGY SERVICES CORP | exhibit3124q2016.htm |

| EX-31.1 - EXHIBIT 31.1 - PIONEER ENERGY SERVICES CORP | exhibit3114q2016.htm |

| EX-23.1 - EXHIBIT 23.1 - PIONEER ENERGY SERVICES CORP | exhibit231-consentq42016.htm |

| EX-21.1 - EXHIBIT 21.1 - PIONEER ENERGY SERVICES CORP | exhibit211-subsidiariesq42.htm |

| EX-12.1 - EXHIBIT 12.1 - PIONEER ENERGY SERVICES CORP | exhibit121-fixedchargesrat.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K |

(Mark one)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-8182

PIONEER ENERGY SERVICES CORP.

(Exact name of registrant as specified in its charter)

_____________________________________________

TEXAS | 74-2088619 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

1250 N.E. Loop 410, Suite 1000 San Antonio, Texas | 78209 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (855) 884-0575

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.10 par value | NYSE | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer þ | |||

Non-accelerated filer o | (Do not check if a smaller reporting company) | Smaller reporting company o | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the registrant’s common stock held by nonaffiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter (based on the closing sales price on the New York Stock Exchange (NYSE) on June 30, 2016) was approximately $291 million.

As of January 31, 2017, there were 77,278,844 shares of common stock, par value $0.10 per share, of the registrant issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement related to the registrant’s 2017 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

PART I

INTRODUCTORY NOTE

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

From time to time, our management or persons acting on our behalf make forward-looking statements to inform existing and potential security holders about our company. These statements may include projections and estimates concerning the timing and success of specific projects and our future backlog, revenues, income and capital spending. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “plan,” “intend,” “seek,” “will,” “should,” “goal” or other words that convey the uncertainty of future events or outcomes. Forward-looking statements speak only as of the date on which they are first made, which in the case of forward-looking statements made in this report is the date of this report. Sometimes we will specifically describe a statement as being a forward-looking statement and refer to this cautionary statement.

In addition, various statements contained in this Annual Report on Form 10-K, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. Such forward-looking statements appear in Item 1—“Business” and Item 3—“Legal Proceedings” in Part I of this report; in Item 5—“Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities,” Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” Item 7A—“Quantitative and Qualitative Disclosures About Market Risk” and in the Notes to Consolidated Financial Statements we have included in Item 8 of Part II of this report; and elsewhere in this report. Forward-looking statements speak only as of the date of this report. We disclaim any obligation to update these statements, and we caution you not to place undue reliance on them. We base forward-looking statements on our current expectations and assumptions about future events. While our management considers the expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks, contingencies and uncertainties relate to, among other matters, the following:

• | general economic and business conditions and industry trends; |

• | levels and volatility of oil and gas prices; |

• | the continued demand for drilling services or production services in the geographic areas where we operate; |

• | decisions about exploration and development projects to be made by oil and gas exploration and production companies; |

• | the highly competitive nature of our business; |

• | technological advancements and trends in our industry, and improvements in our competitors’ equipment; |

• | the loss of one or more of our major clients or a decrease in their demand for our services; |

• | future compliance with covenants under our senior secured revolving credit facility and our senior notes; |

• | operating hazards inherent in our operations; |

• | the supply of marketable drilling rigs, well servicing rigs, coiled tubing and wireline units within the industry; |

• | the continued availability of drilling rig, well servicing rig, coiled tubing and wireline unit components; |

• | the continued availability of qualified personnel; |

• | the success or failure of our acquisition strategy, including our ability to finance acquisitions, manage growth and effectively integrate acquisitions; |

• | the political, economic, regulatory and other uncertainties encountered by our operations, and |

• | changes in, or our failure or inability to comply with, governmental regulations, including those relating to the environment. |

We believe the items we have outlined above are important factors that could cause our actual results to differ materially from those expressed in a forward-looking statement contained in this report or elsewhere. We have discussed many of these factors in more detail elsewhere in this report. Other unpredictable or unknown factors could also have material adverse effects on actual results of matters that are the subject of our forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, except as required by applicable securities laws and regulations. We advise our security holders that they should (1) recognize that unpredictable or unknown factors not referred to above could affect the accuracy of our forward-looking statements and (2) use caution and common sense when considering our forward-looking statements. Also, please read the risk factors set forth in Item 1A—“Risk Factors.”

1

Item 1. | Business |

Company Overview

Pioneer Energy Services Corp. provides land-based drilling services and production services to a diverse group of independent and large oil and gas exploration and production companies in the United States and internationally in Colombia. We also provide two of our services (coiled tubing and wireline services) offshore in the Gulf of Mexico. Drilling services and production services are fundamental to establishing and maintaining the flow of oil and natural gas throughout the productive life of a well and enable us to meet multiple needs of our clients.

• | Drilling Services Segment— From 1999 to 2011, we significantly expanded our fleet through acquisitions and the construction of new drilling rigs. As our industry changed with the evolution of shale drilling, we began a transformation process in 2011, by selectively disposing of our older, less capable rigs, while we continued to invest in our rig building program to construct more technologically advanced, pad-optimal rigs to meet the changing needs of our clients. |

As of December 31, 2016, our drilling rig fleet is 100% pad-capable. We offer the latest advancements in pad drilling with our fleet of 16 AC rigs in the US and eight SCR rigs in Colombia, all of which have 1,500 horsepower or greater drawworks. The removal of older, less capable rigs from our fleet and the recent investments in the construction of new drilling rigs has transformed our fleet into a highly capable, pad optimal fleet focused on the horizontal drilling market. We believe this positions us to compete well, grow our presence in the significant shale basins in the US, and improve profitability as the recovery of our industry continues.

In addition to our drilling rigs, we provide the drilling crews and most of the ancillary equipment needed to operate our drilling rigs. We obtain our contracts for drilling oil and natural gas wells either through competitive bidding or through direct negotiations with existing or potential clients. Our drilling contracts generally provide for compensation on a daywork basis, and sometimes on a turnkey basis. Contract terms generally depend on the complexity and risk of operations, the on-site drilling conditions, the type of equipment used, and the anticipated duration of the work to be performed. The drilling rigs in our fleet are currently assigned to the following divisions:

Drilling Division | Rig Count | ||

South Texas | 1 | ||

West Texas | 7 | ||

North Dakota | 2 | ||

Appalachia | 6 | ||

Colombia | 8 | ||

24 | |||

• | Production Services Segment— In 2008, we acquired two production services companies which significantly expanded our service offerings to include well servicing and wireline services. At the end of 2011, we acquired a coiled tubing services business to further expand our production services offerings. Since the acquisitions of these businesses, we continued to invest in their organic growth and significantly expanded all our production services fleets. However, we temporarily suspended organic growth of our production services fleets during the recent downturn, and continue to selectively update our fleets. |

Our Production Services Segment provides a range of services to a diverse group of exploration and production companies, with our operations concentrated in the major United States onshore oil and gas producing regions in the Mid-Continent and Rocky Mountain states and in the Gulf Coast, both onshore and offshore. The primary production services we offer are the following:

• | Well Servicing. A range of services are required in order to establish production in newly-drilled wells and to maintain production over the useful lives of active wells. We use our well servicing rig fleet to provide these necessary services, including the completion of newly-drilled wells, maintenance and workover of active wells, and plugging and abandonment of wells at the end of their useful lives. As of December 31, 2016, we have a fleet of 114 rigs with 550 horsepower and 11 rigs with 600 horsepower with operations in 10 locations, mostly in the Gulf Coast states, as well as in Arkansas and North Dakota. |

2

• | Wireline Services. Oil and gas exploration and production companies require wireline services to better understand the reservoirs they are drilling or producing, and use logging services to accurately characterize reservoir rocks and fluids. To complete a cased-hole well, the production casing must be perforated to establish a flow path between the reservoir and the wellbore. We use our fleet of wireline units to provide these important logging and perforating services in addition to a range of other mechanical services that are needed in order to place equipment in or retrieve equipment or debris from the wellbore, install bridge plugs and control pressure. As of December 31, 2016, we have a fleet of 114 wireline units in 17 operating locations in the Gulf Coast, Mid-Continent and Rocky Mountain states. |

• | Coiled Tubing Services. Coiled tubing is also an important element of the well servicing industry that allows operators to continue production during service operations on a well under pressure without shutting in the well, thereby reducing the risk of formation damage. Coiled tubing services involve the use of a continuous metal pipe spooled on a large reel for oil and natural gas well applications, such as wellbore clean-outs, nitrogen jet lifts, through-tubing fishing, formation stimulation utilizing acid, chemical treatments and fracturing. Coiled tubing is also used for a number of horizontal well applications such as milling temporary plugs between frac stages. As of December 31, 2016, our coiled tubing business consists of 12 onshore and five offshore coiled tubing units which are deployed through three locations in Texas and Louisiana. |

Pioneer Energy Services Corp. (formerly called “Pioneer Drilling Company”) was incorporated under the laws of the State of Texas in 1979 as the successor to a business that had been operating since 1968. Over the last 15 years, we have significantly expanded and transformed our business through acquisitions and organic growth. We conduct our operations through two operating segments: our Drilling Services Segment and our Production Services Segment. Financial information about our operating segments is included in Note 10, Segment Information, of the Notes to Consolidated Financial Statements, included in Part II, Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Pioneer Energy Services Corp.’s corporate office is located at 1250 NE Loop 410, Suite 1000, San Antonio, Texas 78209. Our phone number is (855) 884-0575 and our website address is www.pioneeres.com. We make available free of charge through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (SEC). Information on our website is not incorporated into this report or otherwise made part of this report.

Industry Overview

Demand for oilfield services offered by our industry is a function of our clients’ willingness to make operating expenditures and capital expenditures to explore for, develop and produce hydrocarbons, which is primarily driven by current and expected oil and natural gas prices.

Our business is influenced substantially by both operating and capital expenditures by exploration and production companies. Exploration and production spending is generally categorized as either a capital expenditure or an operating expenditure.

Capital expenditures by oil and gas exploration and production companies tend to be relatively sensitive to volatility in oil or natural gas prices because project decisions are tied to a return on investment spanning a number of months or years. As such, capital expenditure economics often require the use of commodity price forecasts which may prove inaccurate over the amount of time necessary to plan and execute a capital expenditure project (such as a drilling program for a number of wells in a certain area). When commodity prices are depressed for longer periods of time, capital expenditure projects are routinely deferred until prices are forecasted to return to an acceptable level.

In contrast, both mandatory and discretionary operating expenditures are more stable than capital expenditures for exploration as these expenditures are less sensitive to commodity price volatility. Mandatory operating expenditure projects involve activities that cannot be avoided in the short term, such as regulatory compliance, safety, contractual obligations and certain projects to maintain the well and related infrastructure in operating condition. Discretionary operating expenditure projects may not be critical to the short-term viability of a lease or field and are generally evaluated according to a simple short-term payout criterion that is less dependent on commodity price forecasts.

3

Capital expenditures by exploration and production companies for the drilling of exploratory wells or new wells in proven areas are more directly influenced by current and expected oil and natural gas prices and generally reflect the volatility of commodity prices. In contrast, operating expenditures by exploration and production companies for the maintenance of existing wells, for which a range of production services are required in order to maintain production, are relatively more stable and predictable.

Drilling and production services have historically trended similarly in response to fluctuations in commodity prices. However, because exploration and production companies often adjust their budgets for exploratory drilling first in response to a shift in commodity prices, the demand for drilling services is generally impacted first and to a greater extent than the demand for production services which is more dependent on ongoing expenditures that are necessary to maintain production. Additionally, within the range of production services businesses, those that derive more revenue from production related activity, as opposed to completion of a new well, tend to be less affected by fluctuations in commodity prices and temporary reductions in industry activity.

However, in a severe downturn that is prolonged, both operating and capital expenditures are significantly reduced, and the demand for all our service offerings is significantly impacted.

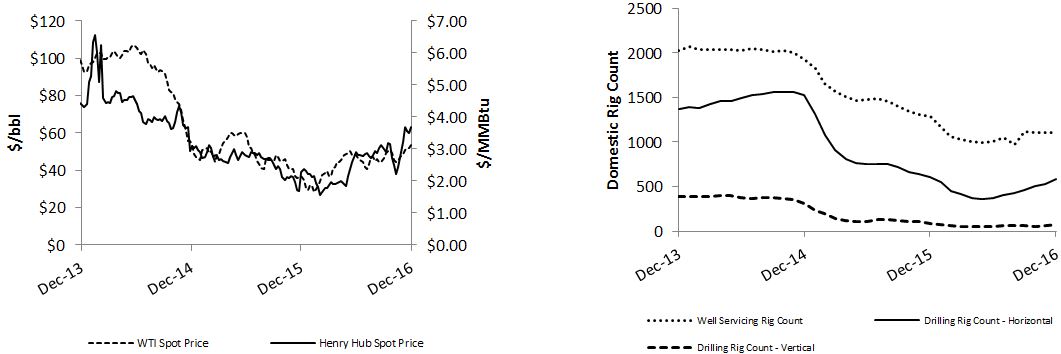

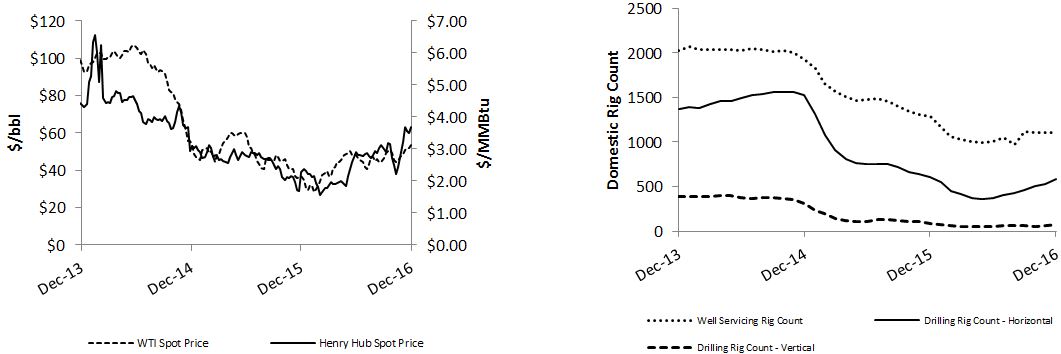

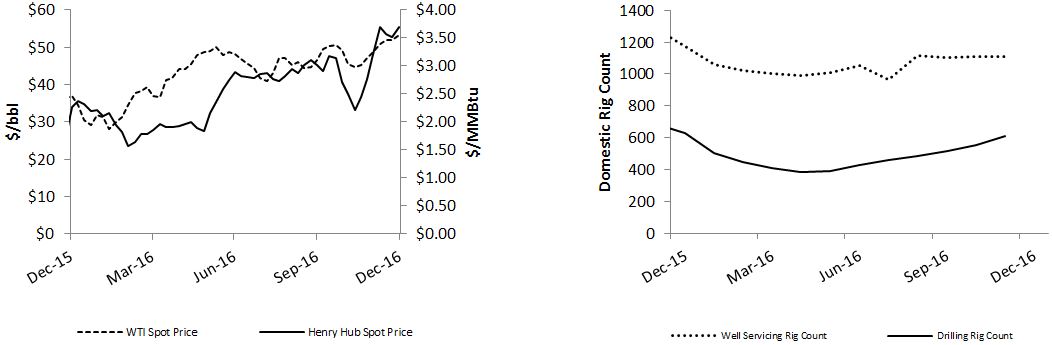

The trends in spot prices of WTI crude oil and Henry Hub natural gas, and the resulting trends in domestic land rig counts (per Baker Hughes) and domestic well servicing rig counts (per Guiberson/Association of Energy Service Companies) over the last three years are illustrated in the graphs below.

As shown in the charts above, the trends in industry rig counts are influenced primarily by fluctuations in oil prices, which affect the levels of capital and operating expenditures made by our clients.

Colombian oil prices have historically trended in line with West Texas Intermediate (WTI) oil prices. Demand for drilling and production services in Colombia is largely dependent upon its national oil company’s long-term exploration and production programs, and to a lesser extent, additional activity from other producers in the region.

Technological advancements and trends in our industry also affect the demand for certain types of equipment, and can affect the overall demand for equipment in our industry. For several years, prior to late 2014, higher oil prices drove industry equipment utilization and revenue rates up, particularly in oil-producing regions and certain shale regions. However, advancements in technology improved the efficiency of drilling rigs and overall demand remained steady, while the demand for certain drilling rigs decreased, particularly in vertical well markets. The decline was a result of higher demand for drilling rigs that are able to drill horizontally and the increased use of “pad drilling” which enables a series of horizontal wells to be drilled in succession by walking or skidding a drilling rig at a single pad-site location, thereby improving the productivity of exploration and production activities. This trend, then coupled with the downturn, resulted in significantly reduced demand for drilling rigs that do not have the ability to walk or skid and to drill horizontal wells.

For additional information concerning the effects of the volatility in oil and gas prices and the effects of technological advancements and trends in our industry, see Item 1A – “Risk Factors” in Part I of this Annual Report on Form 10-K.

4

Competitive Strengths

Our competitive strengths include:

• | High Quality Assets. As of December 31, 2016, our drilling rig fleet is 100% pad-capable. We offer the latest advancements in pad drilling with our fleet of 16 AC rigs in the US and eight SCR rigs in Colombia, all of which have 1,500 horsepower or greater drawworks. Our well servicing fleet is 100% tall-masted, 550 to 600 horsepower rigs, and 75% of our onshore coiled tubing units offer larger diameter coil. We also currently have commitments to purchase four new wireline units and 20 new-model well servicing rigs, for which we will trade in 20 of our older well servicing rigs. We believe that our modern and well maintained fleet allows us to realize higher utilization and pricing because we are able to offer our clients technologically advanced equipment that allows them to operate with less downtime and greater efficiency. |

• | One of the Leading Providers in the Prominent Domestic Regions. Our drilling and production services fleets operate in many of the most attractive producing regions in the United States, including the Marcellus, Eagle Ford, Permian Basin and the Bakken. Our drilling rigs are currently located in four divisions throughout the United States and Colombia. We believe the varied capabilities of our drilling rigs make them particularly well suited to these areas where the optimal rig configuration is dictated by local geology and market conditions. In addition, the expansion of our production services fleets has been focused on those regions with the most opportunity for growth. All our fleet equipment is mobile between domestic regions, diversifying our geographic exposure and limiting the impact of any regional slowdown. |

• | Provide Services Throughout the Well Life Cycle. By offering our clients both drilling and production services, we capture revenue throughout the life cycle of a well and diversify our business. Our Drilling Services Segment performs work prior to initial production, and our Production Services Segment provides services such as logging, completion, perforation, workover and maintenance throughout the productive life of a well. We also provide certain end-of-well-life activities such as plugging and abandonment. Drilling and production services activity have historically exhibited different degrees of demand fluctuation, and we believe the diversity of our services reduces our exposure to decreases in demand for any single service activity. Further, the diversity of our service offerings enables us to cross-sell our services, which has allowed us to generate more business from existing clients and increase our profits as we expand our services within existing markets. |

• | Industry-Leading Safety Record. Our safety program called “LiveSafe” focuses on creating an environment where everyone is committed to and recognizes the possibility of always working without incident or injury. The commitment to LiveSafe helps keep our employees safe and reduces our business risk. In 2015, we were recognized by the International Association of Drilling Contractors as the safest land contract driller of the 15 busiest contractors with a total recordable incident rate 46% lower than the industry average, and our 2016 lost time incident rate is the lowest in company history, which was also the third year in a row with improving rates. Our excellent safety record and reputation are critical to winning new business and expanding our relationships with existing clients. |

• | Skilled Management Team. We believe that an important competitive factor in achieving long-term client relationships includes having an experienced and skilled management team, with a focus on the growth and development of our leadership team, maintaining employee continuity and effective succession planning. Our CEO, Wm. Stacy Locke, joined Pioneer in 1995 as President and has over 35 years of industry experience. Our management team has operated through numerous oilfield services cycles and provides us with valuable long-term experience and a detailed understanding of client requirements. We seek to minimize employee turnover, invest in the growth of our employees, and recruit new talent through our focus on employee training and development, safety and competitive compensation. |

• | Longstanding and Diversified Clients. We maintain long-standing, high quality client relationships with a diverse group of large independent oil and gas exploration and production companies including Apache Corporation, Whiting Petroleum Corporation, and PDC Energy. Our largest two clients, Apache Corporation and Whiting Petroleum Corporation, accounted for approximately 12% and 10%, respectively, of our 2016 consolidated revenues. We believe our relationships with our clients are strong and the diversity of our client base offers numerous opportunities for growth as our industry continues to improve. |

5

Strategy

Our strategy has been to become a premier land drilling and production services company through steady and disciplined growth, which we executed through the acquisition and building of our high quality drilling rig fleet and production services businesses. In 2011, we shifted our approach to accommodate changes in the industry, which resulted in a period of combined growth and rejuvenation through the disposition of assets which use older technology. Today, we provide drilling and production services in many of the most attractive drilling markets throughout the United States, and provide drilling services in Colombia.

With the decline in oil prices that began in 2014 and the resulting reductions in our utilization and revenue rates, our near-term efforts have been focused on:

• | Cost Reductions. Since the beginning of 2015, we have reduced our total headcount by over 50%, reduced wage rates for our operations personnel, reduced incentive compensation, eliminated certain employment benefits and closed ten field offices to reduce overhead and reduce associated lease payments. In 2016, we lowered our capital expenditures by 77%, limiting our capital spending to primarily routine expenditures to maintain our equipment and deferring discretionary upgrades and additions except those that we committed to in 2014 before the market slowdown. We continue to evaluate opportunities to lower our cost structure in response to reduced revenues and to improve profitability. |

• | Liquidating Nonstrategic Assets. Since the beginning of 2015, we have sold 35 drilling rigs and other drilling equipment for aggregate net proceeds of $65.5 million. As of December 31, 2016, we have six additional domestic mechanical and SCR drilling rigs held for sale, along with other drilling equipment, 13 wireline units, 20 older well servicing rigs that will be traded in for 20 new-model rigs in the first quarter of 2017, and certain coiled tubing equipment. We will continue to evaluate our domestic and international fleets for additional drilling rigs or equipment for which a near term sale would be favorable. |

• | Maintaining Liquidity and Financial Flexibility. We most recently amended our revolving credit facility on June 30, 2016, to maintain access to capital but with more flexible financial covenants. In December 2016, we sold 12,075,000 shares of common stock in a public offering, and applied the net proceeds to reduce our outstanding debt under our revolving credit facility. Since the beginning of 2015, we have paid down $105.3 million of debt through January 2017. We currently have availability for equity or debt offerings up to $234.6 million under our shelf registration statement, subject to the limitations imposed by our Revolving Credit Facility and Senior Notes, as well as our Restated Articles of Incorporation which currently limits our issuance of common stock to 100 million shares. |

• | Performance of our Core Businesses. We continue to focus on maintaining our relationships with our clients and vendors through the downturn, and remain committed to our safety and service quality goals. In 2015, we were recognized by the International Association of Drilling Contractors as the safest land contract driller of the 15 busiest contractors, and our 2016 lost time incident rate is the lowest in company history, which was also the third year in a row with improving rates. With the expectation of a modest recovery ahead, we are allocating our resources to the markets with the best opportunities for increased activity and reactivating units in those areas with increasing demand. |

We continue to evaluate our business and look for opportunities to further achieve these goals, which we believe will position us to take advantage of future business opportunities and maintain our long-term growth strategy.

Our long-term strategy as a leading land drilling and production services company is to further leverage our relationships with existing clients, expand our client base in the areas where we currently operate and further enhance our geographic diversification through selective expansion. The key elements of this long-term strategy are focused on our:

• | Investments in Our Business. We have historically invested in the growth and technological advancement of our business by engaging in select rig building opportunities and acquisitions, strategically upgrading our existing assets and disposing of assets which use older technology. |

6

Since the beginning of 2010, we have added significant capacity to our production services offerings through the addition of 51 wireline units, 51 well servicing rigs and 17 coiled tubing units. From 2011 to 2015, we constructed 15 walking AC drilling rigs, five of which were completed in 2015. During 2015 and 2016, we removed all 31 of our mechanical and lower horsepower electric drilling rigs from our fleet, which were the most negatively impacted by the industry downturn, as well as all 12 domestic SCR rigs in our fleet. We achieved this by selling a total of 35 drilling rigs, retiring two, and placing the remaining six as held for sale.

As of December 31, 2016, our drilling rig fleet is 100% pad-capable. We offer the latest advancements in pad drilling with our fleet of 16 AC rigs in the US and eight SCR rigs in Colombia, all of which have 1,500 horsepower or greater drawworks. The removal of older, less capable rigs from our fleet and the recent investments in the construction of new drilling rigs has transformed our fleet into a highly capable, pad optimal fleet focused on the horizontal drilling market. We believe this positions us to compete well, grow our presence in the significant shale basins in the US, and improve profitability as the recovery of our industry continues.

• | Competitive Position in the Prominent Domestic Markets. Shale plays and non-shale oil or liquid rich environments are increasingly important to domestic hydrocarbon production, and not all drilling rigs are capable of successfully drilling in these unconventional opportunities. Our pad-optimal domestic fleet was designed for operation in the Marcellus, Eagle Ford, Permian Basin and the Bakken. Additionally, the added capacity in our production services fleets was focused on increasing our presence in those regions where demand benefits from shale development. |

• | Exposure to Oil and Liquids Rich Natural Gas Drilling Activity. We believe that our flexible drilling and production services fleets allow us to pursue varied opportunities, enabling us to focus on a favorable mix of natural gas, oil and liquids rich natural gas activity. When natural gas prices fell to low levels, we increased our exposure to oil-related activities by redeploying certain of our assets into predominately oil-producing regions. As our industry continues to recover from the downturn that began in late 2014, we believe our fleets are highly capable and well positioned for deployment to whichever markets offer the most opportunity. |

Overview of Our Segments and Services

Drilling Services Segment

A land drilling rig consists of power generation system(s), a hoisting system, a rotating system, pumps and related equipment to circulate and clean drilling fluid, blowout preventers, and other related equipment. Generally, our land drilling rigs operate with crews of five to six persons, and 100% of our drilling rigs have the ability to drill multiple well bores from a single surface location as discussed in more detail below.

There are numerous factors that differentiate land drilling rigs such as the type of power used, drilling depth capabilities or drawworks horsepower, mud pump pressure rating, and the ability to drill multiple well bores from a single surface location or pad.

Regarding the type of power used, mechanical rigs are generally less expensive than their electric counterparts. Mechanical rigs use torque converters, clutches, chains, belts, and transmissions to couple engines directly to various types of equipment. Mechanical rigs are considered less efficient and less precise as the main drives are more challenging to control. SCR rigs and AC rigs are considered electric rigs. Both generate electrical power through one or more engine generator sets. SCR rigs utilize direct current to supply and control DC motors coupled to the various drilling equipment, while AC rigs utilize alternating current and AC motors. Both types of electric rigs are considered safer, more reliable, and more efficient than mechanical rigs. AC rigs are considered to be more energy efficient and provide more precise control of equipment than their SCR counterparts which enhances rig safety and reduces drilling time.

The following table summarizes our current rig fleet composition:

Multi-well, Pad-capable | |||||

SCR rigs | AC rigs | Total | |||

Domestic rigs | — | 16 | 16 | ||

Colombia rigs | 8 | — | 8 | ||

24 | |||||

7

Technological advancements and trends in our industry affect the demand for certain types of equipment. Every drilling rig in our fleet is equipped with at least 1,500 horsepower drawworks, a top drive, an iron roughneck, an automatic catwalk, and a walking or skidding system. This equipment, which is described in more detail below, provides our clients with drilling rigs that have more varied capabilities for drilling in unconventional plays, and improves our efficiency and safety.

In horizontal well drilling, operators can utilize top drives to reach formations that may not be accessible with conventional rotary drilling. Top drives provide maximum torque and rotational control, improved well control and better hole conditioning. An iron roughneck is a remotely operated pipe handling feature on the rig floor, which is used to help reduce the occurrence of repetitive motion injuries and decrease drill pipe tripping time. An automated catwalk is a drill pipe handling feature used to raise drill pipe, drill collars, casing, and other necessary items to the drilling rig floor. Its function has significant safety advantages and can reduce the overall time required to complete the well.

In recent years, oil and gas exploration and production companies have increased the use of “pad drilling” whereby a series of horizontal wells are drilled in succession by walking or skidding a drilling rig at a single pad-site location. Walking systems increase efficiency by allowing multiple wells to be drilled on the same pad site and permitting the drilling rig to move between wells while drill pipe remains in the derrick and ancillary systems such as engines and mud tanks remain stationary, thus reducing move times and costs. Our omnidirectional walking systems enable the drilling rig to move forward, backward, and side to side which affords the operator additional flexibility.

The following table sets forth historical information regarding utilization for our drilling rig fleet:

Year ended December 31, | ||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||

Average number of operating rigs for the period | 30.9 | 39.1 | 62.0 | 68.2 | 65.0 | |||||||||

Average utilization rate | 43 | % | 63 | % | 87 | % | 84 | % | 87 | % | ||||

The utilization of our AC fleet was 74% during both of the years ended December 31, 2016 and 2015.

As our industry changed with the evolution of shale drilling, we began a transformation process in 2011, by selectively disposing of our older, less capable rigs, while we continued to invest in our rig building program to construct more technologically advanced, pad-optimal rigs to meet the changing needs of our clients. From 2011 to 2015, we constructed 15 walking AC drilling rigs, five of which were completed in 2015. During 2015 and 2016, we removed all 31 of our mechanical and lower horsepower electric drilling rigs from our fleet, which were the most negatively impacted by the industry downturn, as well as all 12 domestic SCR rigs in our fleet. We achieved this by selling a total of 35 drilling rigs, retiring two, and placing the remaining six as held for sale. The removal of older, less capable rigs from our fleet and the recent investments in the construction of new drilling rigs has transformed our fleet into a highly capable, pad optimal fleet focused on the horizontal drilling market.

We believe that our drilling rigs and other related equipment are in good operating condition. Our employees perform periodic maintenance and minor repair work on our drilling rigs. We rely on various oilfield service companies for major repair work and overhaul of our drilling equipment when needed. We also engage in periodic improvement and upgrades of our drilling equipment. In the event of major breakdowns or mechanical problems, our rigs could be subject to significant idle time and a resulting loss of revenue if the necessary repair services are not immediately available.

In addition to our drilling rigs, we provide the drilling crews and most of the ancillary equipment needed to operate our drilling rigs. We obtain our contracts for drilling oil and natural gas wells either through competitive bidding or through direct negotiations with existing or potential clients. Our drilling contracts generally provide for compensation on a daywork basis, and sometimes on a turnkey basis. Contract terms generally depend on the complexity and risk of operations, the on-site drilling conditions, the type of equipment used, and the anticipated duration of the work to be performed. Spot market contracts generally provide for the drilling of a single well and typically permit the client to terminate on short notice. We typically enter into longer-term drilling contracts for our newly constructed rigs and/or during periods of high rig demand.

Our business and the profitability of our operations depend on the level of drilling activity by oil and gas exploration and production companies operating in the geographic markets where we operate. The oil and gas exploration and production industry is a historically cyclical industry characterized by significant changes in the levels of exploration and development activities. During periods of reduced drilling activity or excess rig capacity, price competition tends

8

to increase and the profitability of daywork contracts tends to decrease, and in such a competitive price environment, we may be more inclined to enter into turnkey contracts that expose us to greater risk of loss but which offer higher potential contract profitability.

During the last three fiscal years, our drilling contracts have primarily been for daywork drilling. The following table presents, by type of contract, information about the total number of wells we completed for our clients during each of the last three fiscal years.

Year ended December 31, | ||||||||

Types of Contracts | 2016 | 2015 | 2014 | |||||

Daywork | 300 | 448 | 1,001 | |||||

Turnkey | 1 | 17 | 106 | |||||

Total number of wells | 301 | 465 | 1,107 | |||||

Daywork Contracts. Under daywork drilling contracts, we provide a drilling rig and required personnel to our client who supervises the drilling of the well. We are paid based on a negotiated fixed rate per day while the rig is used. Daywork drilling contracts specify the equipment to be used, the size of the hole and the depth of the well. Under a daywork drilling contract, the client bears a large portion of the out-of-pocket drilling costs and we generally bear no part of the usual risks associated with drilling, such as time delays and unanticipated costs.

Turnkey Contracts. Under a typical turnkey drilling contract, we agree to drill a well for our client to a specified depth and under specified conditions for a fixed price. We provide technical expertise and engineering services, as well as most of the equipment and drilling supplies required to drill the well. We often subcontract for related services, such as the provision of casing crews, cementing and well logging. Under typical turnkey drilling arrangements, we do not receive progress payments and are paid by our client only after we have performed the terms of the drilling contract in full.

For these reasons, the risk to us under a turnkey drilling contract is substantially greater than for a well drilled on a daywork basis because we must assume most of the risks associated with drilling operations that the operator generally assumes under a daywork contract, including the risks of blowout, loss of hole, stuck drill pipe, machinery breakdowns, abnormal drilling conditions and risks associated with subcontractors’ services, supplies, cost escalations and personnel. We believe that our experienced management team, our knowledge of geologic formations in our areas of operations, the condition of our drilling equipment and our experienced crews have previously enabled us to make reasonable cost estimates and complete contracts according to our drilling plan. While we do bear the risk of loss for cost overruns and other events that are not specifically provided for in our initial cost estimates, our pricing of turnkey contracts takes such risks into consideration, and we maintain insurance coverage against some, but not all, drilling hazards. During periods of reduced demand for drilling rigs, our overall profitability on turnkey contracts has historically exceeded our profitability on daywork contracts.

Production Services Segment

Our Production Services Segment provides a range of services to a diverse group of exploration and production companies, with our operations concentrated in the major United States onshore oil and gas producing regions in the Mid-Continent and Rocky Mountain states and in the Gulf Coast, both onshore and offshore. As of December 31, 2016, our production services fleets are as follows:

Production Services Fleets | ||||||

550 HP | 600 HP | Total | ||||

Well servicing rigs, by horsepower (HP) rating | 114 | 11 | 125 | |||

Offshore | Onshore | Total | ||||

Wireline units | 6 | 108 | 114 | |||

Coiled tubing units | 5 | 12 | 17 | |||

Well Servicing. Our well servicing rig fleet provides a range of services, including the completion of newly-drilled wells, maintenance and workover of existing wells, and plugging and abandonment of wells at the end of their useful lives.

9

Newly drilled wells require completion services to prepare the well for production. Well servicing rigs are frequently used to complete newly drilled wells to minimize the use of higher cost drilling rigs in the completion process. The completion process may involve selectively perforating the well casing in the productive zones to allow oil or gas to flow into the well bore, stimulating and testing these zones and installing the production string and other downhole equipment. The completion process typically requires a few days to several weeks, depending on the nature and type of the completion, and generally requires additional auxiliary equipment. Accordingly, completion services require less well-to-well mobilization of equipment and can provide higher operating margins than regular maintenance work. The demand for completion services is directly related to drilling activity levels, which are sensitive to changes in oil and gas prices.

Regular maintenance is required throughout the life of a well to sustain optimal levels of oil and gas production. Common maintenance services include repairing inoperable pumping equipment in an oil well and replacing defective tubing in a gas well. Our maintenance services involve relatively low-cost, short-duration jobs which are part of normal well operating costs. The need for maintenance does not directly depend on the level of drilling activity, although it is somewhat impacted by short-term fluctuations in oil and gas prices. Accordingly, maintenance services generally experience relatively stable demand; however, when oil or gas prices are too low to justify additional expenditures, operating companies may choose to temporarily shut in producing wells rather than incur additional maintenance costs.

In addition to periodic maintenance, producing oil and gas wells occasionally require major repairs or modifications called workovers, which are typically more complex and more time consuming than maintenance operations. Workover services include extensions of existing wells to drain new formations either through perforating the well casing to expose additional productive zones not previously produced, deepening well bores to new zones or the drilling of lateral well bores to improve reservoir drainage patterns. Our well servicing rigs are also used to convert former producing wells to injection wells through which water or carbon dioxide is then pumped into the formation for enhanced oil recovery operations. Workovers also include major subsurface repairs such as repair or replacement of well casing, recovery or replacement of tubing and removal of foreign objects from the well bore. These extensive workover operations are normally performed by a well servicing rig with additional specialized auxiliary equipment, which may include rotary drilling equipment, mud pumps, mud tanks and fishing tools, depending upon the particular type of workover operation. All of our well servicing rigs are designed to perform complex workover operations. A workover may require a few days to several weeks and generally requires additional auxiliary equipment. The demand for workover services is sensitive to oil and gas producers’ intermediate and long-term expectations for oil and gas prices.

Well servicing rigs are also used in the process of permanently closing oil and gas wells no longer capable of producing in economic quantities. Many well operators bid this work on a “turnkey” basis, requiring the service company to perform the entire job, including the sale or disposal of equipment salvaged from the well as part of the compensation received, and complying with state regulatory requirements. Plugging and abandonment work can provide favorable operating margins and is less sensitive to oil and gas pricing than drilling and workover activity since well operators must plug a well in accordance with state regulations when it is no longer productive. We perform plugging and abandonment work throughout our core areas of operation in conjunction with equipment provided by other service companies.

We typically bill clients for our well servicing on an hourly basis during the period that the rig is actively working. We operate through 10 locations, mostly in the Gulf Coast states, as well as in Arkansas and North Dakota. We believe that our fleet is among the newest in the industry, consisting entirely of tall-masted rigs with at least 550 horsepower, capable of working at depths of 20,000 feet. These specifications allow us to operate in areas with deeper well depths and perform jobs that rigs with lesser capabilities cannot. In late 2016, we committed to trade in 20 of our older 550 horsepower well servicing rigs for 20 new-model rigs to be delivered in the first quarter of 2017, further improving the quality of our rig fleet, enhancing our ability to recruit crew talent and competitively positioning us for new service opportunities as the market improves. Our well servicing utilization rates for the years ended December 31, 2016 and 2015 were 41% and 65%, respectively, based on total fleet count.

Wireline Services. Wireline trucks, like well servicing rigs, are utilized throughout the life of a well. Wireline trucks are often used in place of a well servicing rig when there is no requirement to remove tubulars from the well in order to make repairs.

Wireline services typically utilize a single truck equipped with a spool of wireline that is used to lower and raise a variety of specialized tools in and out of the wellbore. Electric wireline contains a conduit that allows signals to be transmitted to or from tools located in the well. These tools can be used to measure pressures and temperatures as well

10

as the condition of the casing and the cement that holds the casing in place. In order for oil and gas exploration and production companies to better understand the reservoirs they are drilling or producing, they require logging services to accurately characterize reservoir rocks and fluids. We provide both open and cased-hole logging services.

Other applications for wireline tools include placing equipment in or retrieving equipment (or debris) from the wellbore, installing bridge plugs, perforating the casing in order to prepare the well for production, or cutting off pipe that is stuck in the well so that the free section can be recovered.

Our wireline operations are deployed through 17 locations in Texas, Kansas, Colorado, Montana, North Dakota, Louisiana, Oklahoma and Wyoming. We are currently actively marketing approximately 65% of our wireline fleet.

Coiled Tubing Services. Coiled tubing is also an important element of the well servicing industry that allows operators to continue production during service operations on a well under pressure without shutting in the well, thereby reducing the risk of formation damage. Coiled tubing services involve the use of a continuous metal pipe spooled on a large reel for oil and natural gas well applications, such as wellbore clean-outs, nitrogen jet lifts, through-tubing fishing, formation stimulation utilizing acid, chemical treatments and fracturing. Coiled tubing is also used for a number of horizontal well applications such as milling temporary plugs between frac stages.

Our coiled tubing operations are deployed through three locations in Texas and Louisiana. Our coiled tubing utilization rates for the years ended December 31, 2016 and 2015 were 22% and 27%, respectively, based on total fleet count.

Seasonality

All our production services operations are impacted by seasonal factors. Our business can be negatively impacted during the winter months due to inclement weather, fewer daylight hours, and holidays. Because our well servicing rigs, wireline units and coiled tubing units are mobile, during periods of heavy snow, ice or rain, we may not be able to move our equipment between locations.

Clients

We provide drilling and production services to numerous independent and large oil and gas exploration and production companies that are active in the geographic areas in which we operate. The following table shows our three largest clients as a percentage of our total revenue for each of our last three fiscal years.

Total Revenue Percentage | ||

Fiscal year ended December 31, 2016 | ||

Apache Corporation | 11.9 | % |

Whiting Petroleum Corporation | 10.1 | % |

PDC Energy, Inc | 4.4 | % |

Fiscal year ended December 31, 2015 | ||

Whiting Petroleum Corporation | 17.8 | % |

Ecopetrol | 6.1 | % |

Apache Corporation | 4.6 | % |

Fiscal year ended December 31, 2014 | ||

Whiting Petroleum Corporation | 11.9 | % |

Ecopetrol | 9.9 | % |

Penn Virginia Oil & Gas, LP | 6.0 | % |

Competition

We encounter substantial competition from other drilling contractors and other oilfield service companies. Our primary market areas are highly fragmented and competitive. The fact that drilling and production services equipment are mobile and can be moved from one market to another in response to market conditions heightens the competition in the industry and may result in an oversupply of equipment in an area. Contract drilling companies and other oilfield service companies compete primarily on a regional basis, and the intensity of competition may vary significantly from

11

region to region at any particular time. If demand for drilling or production services improves in a region where we operate, our competitors might respond by moving in suitable rigs and production services equipment from other regions. An influx of equipment from other regions could rapidly intensify competition, reduce profitability and make any improvement in demand for our services short-lived.

Most drilling services contracts and production services contracts are awarded on the basis of competitive bids, which also results in price competition. In addition to pricing and equipment availability, we believe the following factors are also important to our clients in determining which drilling services or production services provider to select:

• | the type, capability and condition of each of the competing drilling rigs, well servicing rigs, wireline units and coiled tubing units; |

• | the mobility and efficiency of the equipment; |

• | the quality of service and experience of the crews; |

• | the reputation and safety record of the company providing the services; |

• | the offering of ancillary services; and |

• | the ability to provide drilling and production services equipment adaptable to, and personnel familiar with, new technologies and drilling and production techniques. |

While we must be competitive in our pricing, our competitive strategy generally emphasizes the quality of our equipment, our safety record, our ability to offer ancillary services, the experience of our crews and the quality of service we provide to differentiate us from our competitors. This strategy is less effective when lower demand for drilling and production services intensifies price competition and makes it more difficult for us to compete on the basis of factors other than price. In all of the markets in which we compete, an oversupply of drilling rigs or production services equipment generally causes greater price competition and reduced profitability.

We believe that an important competitive factor in establishing and maintaining long-term client relationships is having an experienced, skilled and well-trained work force. In recent years, many of our larger clients have placed increased emphasis on the safety performance and quality of the crews, equipment and services provided by their contractors. We have devoted, and will continue to devote, substantial resources toward employee safety and training programs. Although we believe clients consider all of these factors, price is generally the primary factor in determining which service provider is awarded the work. However, we believe that many clients are willing to pay a slight premium for the quality and safe, efficient service we provide.

The drilling contracts we compete for are usually awarded on the basis of competitive bids. Our principal drilling competitors are Helmerich & Payne, Inc., Precision Drilling Corporation, Patterson-UTI Energy, Inc. and Nabors Industries, Ltd.

The largest well servicing providers that we compete with are Key Energy Services, Basic Energy Services, C&J Energy Services, Superior Energy Services, Inc. and CC Forbes. As compared to the other large competitors in this industry, we believe our fleet is one of the youngest, most uniform fleets, which in addition to our safety performance and service quality, has historically allowed us to operate at utilization and hourly rates that are among the highest of our peers.

The wireline market in the United States is dominated by a small number of companies, including ourselves. These competitors include Allied-Horizontal Wireline Services, Renegade Services, C&J Energy Services, KLX Energy Services and Archer Ltd. Additional competitors include Schlumberger Ltd., Halliburton Company and other independents. The market for wireline services is very competitive, but historically we have competed effectively with our competitors because of the diversified services we provide, our performance and strong client service.

The market for coiled tubing has expanded within the oilfield services market over recent years due to technological advances which increased the number of applications for the coiled tubing unit, and the increase in deep well and horizontal drilling. Our primary competitors in the coiled tubing services market currently include C&J Energy Services, Superior Energy Services, Key Energy Services and RPC Inc.

In addition, there are numerous smaller companies that compete in all of our services markets. Some of our competitors have greater financial, technical and other resources than we do. Their greater capabilities in these areas may enable them to:

• | better withstand industry downturns; |

• | compete more effectively on the basis of price and technology; |

• | retain skilled personnel; and |

12

• | build new rigs or acquire and refurbish existing rigs and place them into service more quickly than us in periods of high drilling demand. |

The need for our services fluctuates primarily in relation to the price (or anticipated price) of oil and natural gas, which in turn is driven by the supply of and demand for oil and natural gas. The level of our revenues, earnings and cash flows are substantially dependent upon, and affected by, the level of domestic and international oil and gas exploration and development activity, as well as the equipment capacity in any particular region. For a more detailed discussion, see Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Raw Materials

The materials and supplies we use in our drilling and production services operations include fuels to operate our equipment, drilling mud, drill pipe, drill collars, drill bits, cement and other job materials such as explosives, perforating guns and coiled tubing. We do not rely on a single source of supply for any of these items. While we are not currently experiencing any shortages, from time to time there have been shortages of drilling and production services equipment and supplies during periods of high demand. Shortages could result in increased prices for equipment or supplies that we may be unable to pass on to clients. In addition, during periods of shortages, the delivery times for equipment and supplies can be substantially longer. Any significant delays in our obtaining equipment or supplies could limit our operations and jeopardize our relations with clients. In addition, shortages of equipment or supplies could delay and adversely affect our ability to obtain new contracts for our rigs, which could have a material adverse effect on our financial condition and results of operations.

Operating Risks and Insurance

Our operations are subject to the many hazards inherent in exploration and production activity, including the risks of:

• | blowouts; |

• | cratering; |

• | fires and explosions; |

• | loss of well control; |

• | collapse of the borehole; |

• | damaged or lost drilling equipment; and |

• | damage or loss from natural disasters. |

Any of these hazards can result in substantial liabilities or losses to us from, among other things:

• | suspension of operations; |

• | damage to, or destruction of, our property and equipment and that of others; |

• | personal injury and loss of life; |

• | damage to producing or potentially productive oil and gas formations through which we drill; and |

• | environmental damage. |

We seek to protect ourselves from some but not all operating hazards through insurance coverage. However, some risks are either not insurable or insurance is available only at rates that we consider uneconomical. Those risks include, among other things, pollution liability in excess of relatively low limits. Depending on competitive conditions and other factors, we attempt to obtain contractual protection against uninsured operating risks from our clients. However, clients who provide contractual indemnification protection may not in all cases maintain adequate insurance or otherwise have the financial resources necessary to support their indemnification obligations. Our insurance or indemnification arrangements may not adequately protect us against liability or loss from all the hazards of our operations. The occurrence of a significant event that we have not fully insured or indemnified against or the failure of a client to meet its indemnification obligations to us could materially and adversely affect our results of operations and financial condition. Furthermore, we may be unable to maintain adequate insurance in the future at rates we consider reasonable.

Our current insurance coverage includes property insurance on our rigs, drilling equipment, production services equipment and real property. Our insurance coverage for property damage to our rigs, drilling equipment and production services equipment is based on our estimates of the cost of comparable used equipment to replace the insured property. The policy provides for a deductible of no more than $750,000 per drilling rig and a deductible on production services equipment of $250,000 per occurrence. Our third-party liability insurance coverage is $101 million per occurrence and

13

in the aggregate, with a deductible of $250,000 per occurrence. We also carry insurance coverage for pollution liability up to $20 million with a deductible of $500,000. We believe that we are adequately insured for public liability and property damage to others with respect to our operations. However, such insurance may not be sufficient to protect us against liability for all consequences of well disasters, extensive fire damage or damage to the environment.

In addition, we generally carry insurance coverage to protect against certain hazards inherent in our turnkey contract drilling operations. This insurance covers “control-of-well,” including blowouts above and below the surface, redrilling, seepage and pollution. This policy provides coverage of $3 million to $20 million, subject to a deductible of $150,000 or $250,000, depending on the area in which the well is drilled and its target depth. This policy also provides care, custody and control insurance, with a limit of $1 million, subject to a $100,000 deductible.

Employees

We have approximately 1,800 employees, which is down by over 50% from the beginning of 2015. The majority of our employees work in operations for our Drilling Services Segment and Production Services Segment and are primarily compensated on an hourly basis. The number of employees in operations fluctuates depending on the utilization of our drilling rigs, well servicing rigs, wireline units and coiled tubing units at any particular time. None of our employment arrangements are subject to collective bargaining arrangements.

Our operations require the services of employees having the technical training and experience necessary to achieve proper operational standards. As a result, our operations depend, to a considerable extent, on the continuing availability of such personnel. Although we have not encountered material difficulty in hiring and retaining employees in our operations, shortages of qualified personnel have occurred in our industry. If we should suffer any material loss of personnel to competitors or be unable to employ additional or replacement personnel with the requisite level of training and experience to adequately operate our equipment, our operations could be materially and adversely affected. While we believe our wage rates are competitive and our relationships with our employees are satisfactory, a significant increase in the wages paid by other employers could result in a reduction in our workforce, increases in wage rates, or both. The occurrence of either of these events for a significant period of time could have a material adverse effect on our financial condition and results of operations.

Facilities

We lease our corporate office facilities located at 1250 N.E. Loop 410, Suite 1000 San Antonio, Texas 78209. We conduct our business operations through 53 other real estate locations, of which we own 12, in the United States (Texas, Oklahoma, Colorado, Montana, North Dakota, Pennsylvania, Wyoming, Mississippi, Arkansas, Louisiana and Kansas) and internationally in Colombia. These real estate locations are primarily used for regional offices and storage and maintenance yards.

Governmental Regulation

Many aspects of our operations are subject to various federal, state and local laws and governmental regulations, including laws and regulations governing:

• | environmental quality; |

• | pollution control; |

• | remediation of contamination; |

• | preservation of natural resources; |

• | transportation; and |

• | worker safety. |

Our operations are subject to stringent federal, state and local laws, rules and regulations governing the protection of the environment and human health and safety. Some of those laws, rules and regulations relate to the disposal of hazardous substances, oilfield waste and other waste materials and restrict the types, quantities and concentrations of those substances that can be released into the environment. Several of those laws also require removal and remedial action and other cleanup under certain circumstances, commonly regardless of fault. Our operations routinely involve the handling of significant amounts of waste materials, some of which are classified as hazardous substances. Planning, implementation and maintenance of protective measures are required to prevent accidental discharges. Spills of oil, natural gas liquids, drilling fluids and other substances may subject us to penalties and cleanup requirements. Handling, storage and disposal of both hazardous and non-hazardous wastes are also subject to these regulatory requirements. In addition, our operations are often conducted in or near ecologically sensitive areas, such as wetlands, which are subject

14

to special protective measures and which may expose us to additional operating costs and liabilities for accidental discharges of oil, gas, drilling fluids, contaminated water or other substances, or for noncompliance with other aspects of applicable laws and regulations.

Environmental laws and regulations are complex and subject to frequent change. Failure to comply with governmental requirements or inadequate cooperation with governmental authorities could subject a responsible party to administrative, civil or criminal action. We may also be exposed to environmental or other liabilities originating from businesses and assets which we acquired from others. Our compliance with amended, new or more stringent requirements, stricter interpretations of existing requirements or the future discovery of contamination or regulatory noncompliance may require us to make material expenditures or subject us to liabilities that we currently do not anticipate.

There are a variety of regulatory developments, proposals or requirements and legislative initiatives that have been introduced in the United States and international regions in which we operate that are focused on restricting the emission of carbon dioxide, methane and other greenhouse gases.

Hydraulic fracturing of wells and subsurface water disposal are also under public and governmental scrutiny due to concerns regarding potential environmental and physical impacts, including groundwater and drinking water impacts, as well as whether such activities may cause earthquakes. Increased regulation and attention given to the hydraulic fracturing process could lead to greater opposition, including litigation, to oil and gas production activities using hydraulic fracturing techniques. Additional legislation or regulation could also lead to operational delays or increased operating costs in the production of oil and natural gas, including from the developing shale plays, incurred by our clients. The adoption of any federal, state or local laws or the implementation of regulations or ordinances restricting or increasing the costs of hydraulic fracturing could cause a decrease in the completion of new oil and natural gas wells and an associated decrease in demand for our drilling and well servicing activities, any or all of which could adversely affect our financial position, results of operations and cash flows.

Our wireline operations involve the use of radioactive isotopes along with other nuclear, electrical, acoustic, and mechanical devices. Our activities involving the use of isotopes are regulated by the U.S. Nuclear Regulatory Commission and specified agencies of certain states. Additionally, we use high explosive charges for perforating casing and formations, and we use various explosive cutters to assist in wellbore cleanout. Such operations are regulated by the U.S. Department of Justice, Bureau of Alcohol, Tobacco, Firearms, and Explosives and require us to obtain licenses or other approvals for the use of densitometers as well as explosive charges. We have obtained these licenses and approvals when necessary and believe that we are in substantial compliance with these federal requirements.

In addition, our business depends on the demand for land drilling and production services from the oil and gas industry and, therefore, is affected by tax, environmental and other laws relating to the oil and gas industry generally, by changes in those laws and by changes in related administrative regulations. It is possible that these laws and regulations may in the future add significantly to our operating costs or those of our clients, or otherwise directly or indirectly affect our operations.

Among the services we provide, we operate as a motor carrier for the transportation of our own equipment and therefore are subject to regulation by the U.S. Department of Transportation and by various state agencies. These regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations and regulatory safety. There are additional regulations specifically relating to the trucking industry, including testing and specification of equipment and product handling requirements. The trucking industry is subject to possible regulatory and legislative changes that may affect the economics of the industry by requiring changes in operating practices or by changing the demand for common or contract carrier services or the cost of providing truckload services. Some of these possible changes include increasingly stringent environmental regulations, changes in the hours of service regulations which govern the amount of time a driver may drive in any specific period, onboard black box recorder devices or limits on vehicle weight and size.

Interstate motor carrier operations are subject to safety requirements prescribed by the U.S. Department of Transportation. To a large degree, intrastate motor carrier operations are subject to state safety regulations that mirror federal regulations. Such matters as weight and dimension of equipment are also subject to federal and state regulations.

From time to time, various legislative proposals are introduced, including proposals to increase federal, state, or local taxes, including taxes on motor fuels, which may increase our costs or adversely impact the recruitment of drivers. We cannot predict whether, or in what form, any increase in such taxes applicable to us will be enacted.

15

See Item 1A—“Risk Factors” in Part I of this Annual Report on Form 10-K for a detailed discussion of risks we face concerning laws and governmental regulations.

Available Information

Our Website address is www.pioneeres.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, are available free of charge through our Website as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the Securities and Exchange Commission. The public may read and copy these materials at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. For additional information on the operations of the Securities and Exchange Commission’s Public Reference Room, please call 1-800-SEC-0330. In addition, the Securities and Exchange Commission maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically. We have also posted on our Website our: Charters for the Audit, Compensation, and Nominating and Corporate Governance Committees of our Board; Code of Business Conduct and Ethics; Corporate Governance Guidelines; and Company Contact Information. Information on our website is not incorporated into this report or otherwise made part of this report.

Item 1A. | Risk Factors |

The information set forth in this Item 1A should be read in conjunction with the rest of the information included in this report, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and the financial statements and related notes this report contains. While we attempt to identify, manage and mitigate risks and uncertainties associated with our business to the extent practical under the circumstances, some level of risk and uncertainty will always be present. Additional risks and uncertainties that are not presently known to us or that we currently believe are immaterial also may negatively impact our business, financial condition or operating results.

Set forth below are various risks and uncertainties that could adversely impact our business, financial condition, results of operations and cash flows.

Risks Relating to the Oil and Gas Industry

We derive all our revenues from companies in the oil and gas exploration and production industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and gas prices.

As a provider of contract land drilling services and oil and gas production services, our business depends on the level of exploration and production activity in the geographic markets where we operate. The oil and gas exploration and production industry is a historically cyclical industry characterized by significant changes in the levels of exploration and development activities.

Oil and gas prices, and market expectations of potential changes in those prices, significantly affect the levels of those activities. Oil and gas prices have been volatile historically and, we believe, will continue to be so in the future. Worldwide political, economic, and military events as well as natural disasters have contributed to oil and gas price volatility historically, and are likely to continue to do so in the future. Many factors beyond our control affect oil and gas prices, including:

• | the worldwide supply and demand for oil and gas; |

• | the cost of exploring for, producing and delivering oil and gas; |

• | the discovery rate of new oil and gas reserves; |

• | the rate of decline of existing and new oil and gas reserves; |

• | available pipeline and other oil and gas transportation capacity; |

• | the levels of oil and gas storage; |

• | the ability of oil and gas exploration and production companies to raise capital; |

• | economic conditions in the United States and elsewhere; |

• | actions by the Organization of Petroleum Exporting Countries, which we refer to as OPEC; |

• | political instability in the Middle East and other major oil and gas producing regions; |

16