Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EDGEWATER TECHNOLOGY INC/DE/ | d548765d8k.htm |

Combination of Alithya Group and Edgewater Technology A New North American Digital Technology Transformation Leader Exhibit 99.1

DISCLOSURE This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed transaction will be submitted to the shareholders of each of Alithya Group Inc. ("Alithya") and Edgewater Technology, Inc. ("Edgewater") for their consideration. A newly formed holding company (“New Alithya") will prepare and file a Registration Statement on Form F-4 that will include a prospectus/proxy statement for Edgewater’s shareholders, which will be jointly prepared by Alithya and Edgewater. Alithya plans to mail its shareholders a management proxy circular in connection with the proposed transaction. Edgewater, Alithya and New Alithya may also file other documents with the Securities and Exchange Commission (the “SEC”) regarding the proposed transaction. INVESTORS AND SECURITYHOLDERS ARE URGED TO READ THE PROSPECTUS/PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and securityholders may obtain free copies of the prospectus/proxy statement and other documents containing important information about New Alithya, Alithya and Edgewater once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Edgewater will be available free of charge on Edgewater’s website at http://www.edgewater.com/ under the tab “Investor Relations” and then through the link titled “SEC Filings” or by contacting Edgewater by e-mail at ir@edgewater.com, or by phone at (781) 246-3343. New Alithya, Alithya and Edgewater and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Edgewater in connection with the proposed transaction. Information about the directors and executive officers of Edgewater is set forth in the proxy statement on Schedule 14A for Edgewater’s 2017 annual meeting of shareholders, which was filed with the SEC on April 25, 2017. That document can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the prospectus/proxy statement and other relevant materials to be filed with the SEC when they become available.

DISCLOSURE FORWARD LOOKING STATEMENT This presentation contains forward-looking statements, which are protected as forward-looking statements under the Private Securities Litigation Reform Act of 1995, that are not limited to historical facts, but reflect Alithya’s and Edgewater’s current beliefs, expectations or intentions regarding future events. Words such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursuant,” “target,” “continue,” and similar expressions are intended to identify such forward-looking statements. The statements in this press release that are not historical statements, including statements regarding the expected timetable for completing the proposed transaction, benefits and synergies of the proposed transaction, the tax treatment of the proposed transaction, costs and other anticipated financial impacts of the proposed transaction, the combined company’s plans, objectives, future opportunities for the combined company, future financial performance and operating results and any other statements regarding Alithya's and Edgewater’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance, are forward-looking statements within the meaning of the federal securities laws. These statements are subject to numerous risks and uncertainties, many of which are beyond Alithya's or Edgewater’s control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: failure to obtain the required votes of Alithya's and/or Edgewater’s shareholders; the timing to consummate the proposed transaction; conditions to closing of the proposed transaction may not be satisfied or that the closing of the proposed transaction otherwise does not occur; the risk that a regulatory or court approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Alithya and Edgewater; the effects of the business combination of Alithya and Edgewater following the consummation of the proposed transaction, including the combined company’s future financial condition, results of operations, strategy and plans; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; expected synergies and other benefits from the proposed transaction and the ability of the combined company to realize such synergies and other benefits; expectations regarding regulatory approval, if required, of the transaction; results of litigation, settlements and investigations; actions by third parties, including governmental agencies; global economic conditions; difficulty in integrating acquisitions; weather; loss of, or reduction in business with, key customers; legal proceedings; ability to effectively identify and enter new markets; governmental regulation; and ability to retain management and field personnel. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in Edgewater's SEC filings. Edgewater's filings may be obtained by contacting Edgewater or the SEC or through Edgewater’s web site at http://www.edgewater.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. The foregoing list of risk factors is not exhaustive. These risks, as well as other risks associated with the proposed transaction will be more fully discussed in the prospectus/proxy statement that will be included in the Registration Statement on Form F-4 that will be filed with the SEC in connection with the proposed transaction. Each of Alithya and Edgewater does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation may refer to non-IFRS or non-GAAP financial measures, including EBITDA and Adjusted EBITDA, that are not prepared in accordance with the International Financial Reporting Standards or the accounting principles generally accepted in the United States and that may be different from non-IFRS or non-GAAP financial measures used by other companies. Reconciliations of these non-IFRS or non-GAAP financial measures to the most directly comparable IFRS or GAAP financial measures, as the case may be, are included elsewhere in this presentation.

Presenters Paul Raymond President and CEO Alithya Group Jeffrey Rutherford Interim President, CEO AND Chairman Edgewater Technology

A New North American leader in THE Digital TECHNOLOGY Industry Alithya and Edgewater combine to create a North American Digital Technology Transformation Leader with over 2,000 professionals under the leadership of Paul Raymond, current ceo of alithya group

A New North American leader in THE Digital TECHNOLOGY Industry ANNOUNCEMENT OVERVIEW Alithya and Edgewater have entered into an arrangement agreement to create a North American digital technology transformation leader Alithya is a leading Canadian digital technology firm with more than US$150M (1) in revenue and 1,600 professionals (2) Edgewater is a US-based digital technology firm with more than US$100M (3) in revenue and 400 professionals (2) operating through its wholly-owned business units, Edgewater Fullscope and Edgewater Ranzal The combined businesses will retain the name of Alithya Group Inc. and is expected to be listed on NASDAQ and the TSX Paul Raymond, the CEO of Alithya, and Pierre Turcotte, the Chairman of the Board of Alithya, will, respectively, become the CEO and the Chairman of the Board of New Alithya The transaction is expected to close in the third calendar quarter of 2018 Compelling strategic rationale The combination of Alithya, Edgewater Fullscope and Edgewater Ranzal creates a North American digital technology leader with expertise across many high growth ecosystems and end verticals In connection with the transaction, Edgewater anticipates selling its Classic Consulting Business Unit and eliminating a majority of Edgewater Corporate expenses For calendar year 2017, Alithya’s Adjusted EBITDA was US$7.3M (1, 4) For calendar year 2017, Edgewater Fullscope and Edgewater Ranzal reported Adjusted Business Unit EBITDA of US$11.8M (3, 5) Last twelve months ended December 31, 2017 As at December 31, 2017 Fiscal-Year 2017 ended December 31, 2017 Reconciliation from Net Income to Adjusted EBITDA included in the Appendix to this presentation Reconciliation from Operating Income to Adjusted Business Unit EBITDA included in the Appendix to this presentation; Amounts represent the combined revenue and Adjusted Business Unit EBITDA of Edgewater Fullscope and Edgewater Ranzal, excluding Classic Consulting and Corporate Alithya financials were prepared under IFRS. Edgewater financials were prepared under U.S. GAAP. Accordingly, the financial results of the two entities reflected in this presentation may not be directly comparable. Average exchange rate for 2017 applied: C$ = 0.77 US$. All numbers in US$.

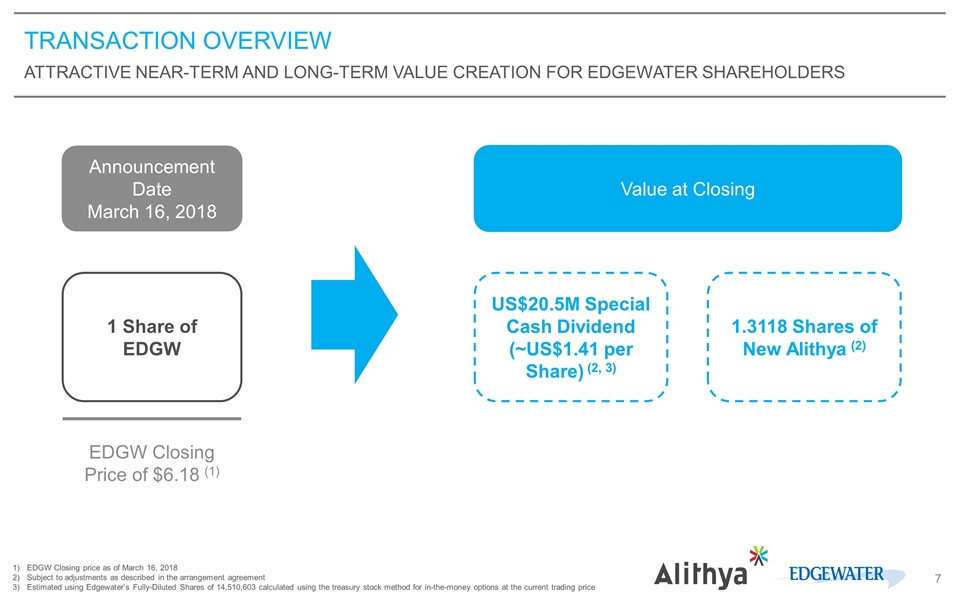

EDGW Closing price as of March 16, 2018 Subject to adjustments as described in the arrangement agreement Estimated using Edgewater’s Fully-Diluted Shares of 14,510,603 calculated using the treasury stock method for in-the-money options at the current trading price TRANSACTION OVERVIEW ATTRACTIVE Near-Term and Long-Term Value Creation for Edgewater Shareholders Announcement Date March 16, 2018 Value at Closing 1 Share of EDGW EDGW Closing Price of $6.18 (1) US$20.5M Special Cash Dividend (~US$1.41 per Share) (2, 3) 1.3118 Shares of New Alithya (2)

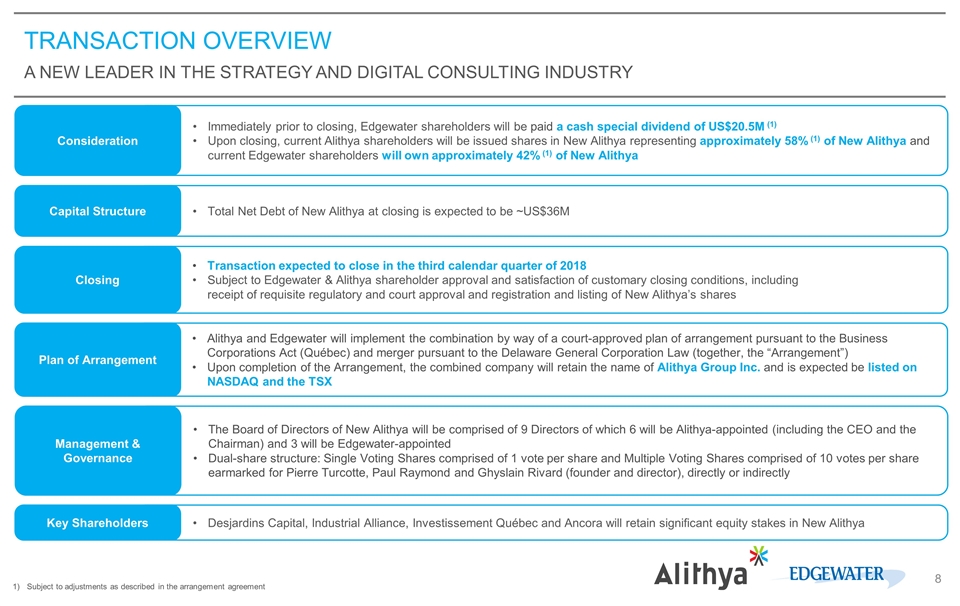

TRANSACTION OVERVIEW A New leader in the Strategy and Digital Consulting Industry Immediately prior to closing, Edgewater shareholders will be paid a cash special dividend of US$20.5M (1) Upon closing, current Alithya shareholders will be issued shares in New Alithya representing approximately 58% (1) of New Alithya and current Edgewater shareholders will own approximately 42% (1) of New Alithya Consideration Total Net Debt of New Alithya at closing is expected to be ~US$36M Capital Structure Alithya and Edgewater will implement the combination by way of a court-approved plan of arrangement pursuant to the Business Corporations Act (Québec) and merger pursuant to the Delaware General Corporation Law (together, the “Arrangement”) Upon completion of the Arrangement, the combined company will retain the name of Alithya Group Inc. and is expected be listed on NASDAQ and the TSX Plan of Arrangement Transaction expected to close in the third calendar quarter of 2018 Subject to Edgewater & Alithya shareholder approval and satisfaction of customary closing conditions, including receipt of requisite regulatory and court approval and registration and listing of New Alithya’s shares Closing Desjardins Capital, Industrial Alliance, Investissement Québec and Ancora will retain significant equity stakes in New Alithya Key Shareholders Subject to adjustments as described in the arrangement agreement The Board of Directors of New Alithya will be comprised of 9 Directors of which 6 will be Alithya-appointed (including the CEO and the Chairman) and 3 will be Edgewater-appointed Dual-share structure: Single Voting Shares comprised of 1 vote per share and Multiple Voting Shares comprised of 10 votes per share earmarked for Pierre Turcotte, Paul Raymond and Ghyslain Rivard (founder and director), directly or indirectly Management & Governance

A New North American leader in THE Digital TECHNOLOGY Industry HIGHLY COMPELLING STRATEGIC RATIONALE Seasoned management team with track record of successful organic and inorganic growth 3 BROAD OFFERING ACROSS MULTIPLE VERTICALS AND PARTNERS 1 Significant cost synergies stemming from the optimization of corporate functions 4 IDEALLY POSITIONED CONSOLIDATOR IN A HIGHLY FRAGMENTED INDUSTRY 2 + North American Digital Technology Transformation LEADER Potential revenue synergies Through cross Selling opportunities and combined growth platform 5 =

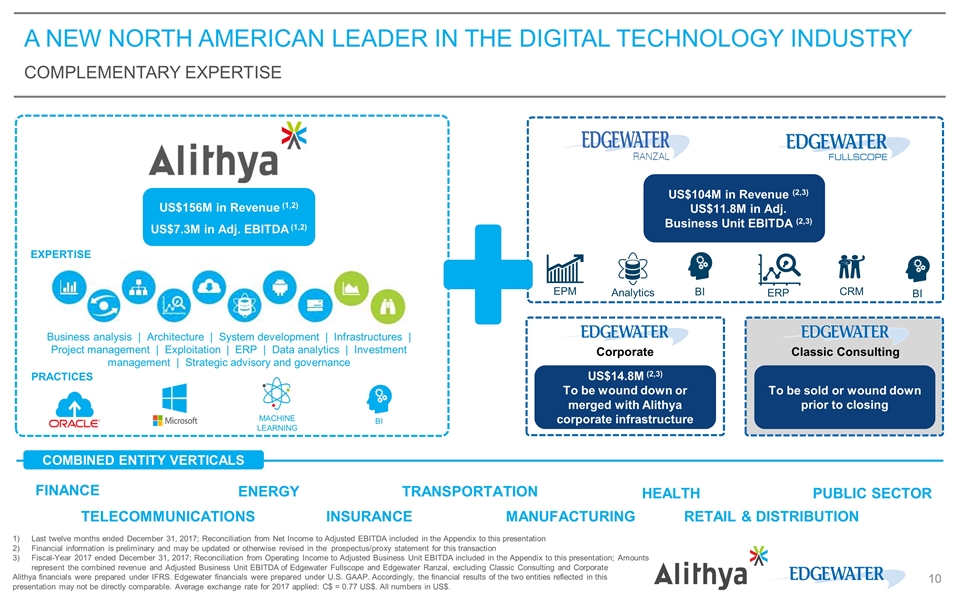

COMPLEMENTARY EXPERTISE A New North American leader in THE Digital TECHNOLOGY Industry Last twelve months ended December 31, 2017; Reconciliation from Net Income to Adjusted EBITDA included in the Appendix to this presentation Financial information is preliminary and may be updated or otherwise revised in the prospectus/proxy statement for this transaction Fiscal-Year 2017 ended December 31, 2017; Reconciliation from Operating Income to Adjusted Business Unit EBITDA included in the Appendix to this presentation; Amounts represent the combined revenue and Adjusted Business Unit EBITDA of Edgewater Fullscope and Edgewater Ranzal, excluding Classic Consulting and Corporate Alithya financials were prepared under IFRS. Edgewater financials were prepared under U.S. GAAP. Accordingly, the financial results of the two entities reflected in this presentation may not be directly comparable. Average exchange rate for 2017 applied: C$ = 0.77 US$. All numbers in US$. BI Machine Learning Business analysis | Architecture | System development | Infrastructures | Project management | Exploitation | ERP | Data analytics | Investment management | Strategic advisory and governance US$156M in Revenue (1,2) US$7.3M in Adj. EBITDA (1,2) PRACTICES EXPERTISE FINANCE HEALTH ENERGY PUBLIC SECTOR INSURANCE TELECOMMUNICATIONS MANUFACTURING RETAIL & DISTRIBUTION TRANSPORTATION COMBINED ENTITY VERTICALS ERP CRM BI EPM Analytics BI US$14.8M (2,3) To be wound down or merged with Alithya corporate infrastructure Corporate Classic Consulting To be sold or wound down prior to closing US$104M in Revenue (2,3) US$11.8M in Adj. Business Unit EBITDA (2,3)

A New North American leader in THE Digital TECHNOLOGY Industry BROAD OFFERING ACROSS MULTIPLE VERTICALS AND PARTNERS MICROSOFT Leader in ERP and CRM cloud solutions Comprised of both Edgewater Fullscope and Alithya’s Microsoft practice Consumer Packaged Goods Life Sciences Chemicals Manufacturing Professional Services Distribution Technology Financial Services Alithya’s Canadian platform Expansion in the West Multiple Levers of Growth Diversified Verticals 11x 20+ Microsoft Partner Awards 3x Cloud Partner of the Year Microsoft Canada Impact Award Winner 1 Offering Enterprise Resource Planning (ERP) Business Intelligence (BI) Customer Relationship Management (CRM)

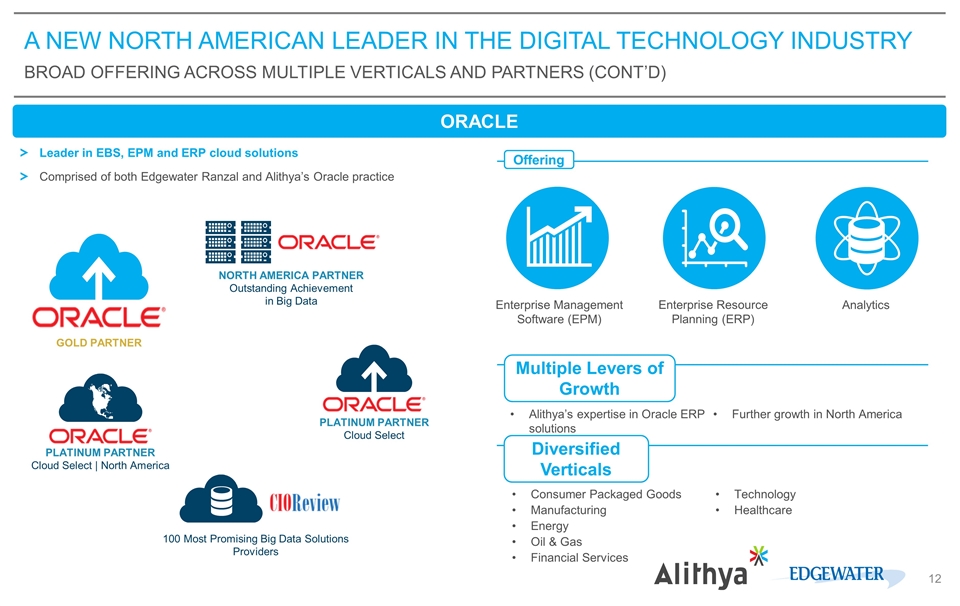

Enterprise Management Software (EPM) Enterprise Resource Planning (ERP) A New North American leader in THE Digital TECHNOLOGY Industry BROAD OFFERING ACROSS MULTIPLE VERTICALS AND PARTNERS (CONT’D) ORACLE Leader in EBS, EPM and ERP cloud solutions Comprised of both Edgewater Ranzal and Alithya’s Oracle practice Consumer Packaged Goods Manufacturing Energy Oil & Gas Financial Services Technology Healthcare Alithya’s expertise in Oracle ERP solutions Further growth in North America Multiple Levers of Growth Diversified Verticals Offering Analytics North America Partner Outstanding Achievement in Big Data 100 Most Promising Big Data Solutions Providers Platinum Partner Cloud Select GOLD Partner Platinum Partner Cloud Select | North America

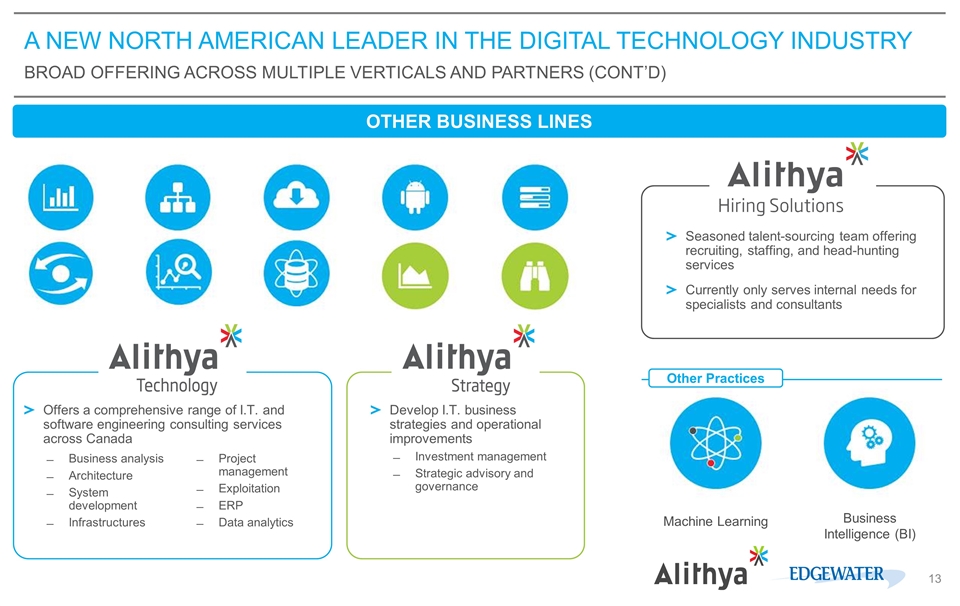

A New North American leader in THE Digital TECHNOLOGY Industry BROAD OFFERING ACROSS MULTIPLE VERTICALS AND PARTNERS (CONT’D) Other Practices Seasoned talent-sourcing team offering recruiting, staffing, and head-hunting services Currently only serves internal needs for specialists and consultants OTHER BUSINESS LINES Business Intelligence (BI) Machine Learning Develop I.T. business strategies and operational improvements Investment management Strategic advisory and governance Offers a comprehensive range of I.T. and software engineering consulting services across Canada Business analysis Architecture System development Infrastructures Project management Exploitation ERP Data analytics

A New North American leader in THE Digital TECHNOLOGY Industry IDEALLY POSITIONED CONSOLIDATOR IN A HIGHLY FRAGMENTED INDUSTRY 1992 CIA founded by ex-Desjardins employees PROFESSIONAL SERVICES Alithya has achieved ~550% revenue growth and significant margin expansion since 2012 2011 - 2013 Paul Raymond joins Alithya Acquisition of SYNAPSE, virtually doubling Alithya’s size and expanding its services offering to the public sector as well as technology strategy and architecture Rebranding to Alithya 2015 Acquisition of TELUS Professional Services, adding 94 professionals to Alithya‘s headcount Acquisition of OSI Group Conseil, bringing the total number of consultants to 1,200 2016 Acquisition of Pro2p, an expert in integration and customized development of Oracle solutions Added new segment with significant growth opportunities 2017 Acquisition of SWI, a full-service software and engineering consulting firm operating primarily in the financial, energy and transportation sectors 2018 Combination with Edgewater, an expert in both Microsoft Dynamics and Oracle enterprise solutions Expected to generate significant cross-selling opportunities as well as further geographical diversification 1999-2005 Acquisitions of 11 smaller competitors in Canada and France

A New North American leader in THE Digital TECHNOLOGY Industry Seasoned management team with track record of successful organic and inorganic growth Oversees strategy, organizational development and accelerated growth at Alithya Recipient of 2016 Entrepreneur of the Year Award from EY Québec in the I.T. category Held several key senior management positions in major I.T. firms Member of OIQ and Institute of Corporate Directors President of the Québec Technology Association Strong operational expertise and background in information technology Leads all business units of Alithya including Québec, Canada and internationally Held a series of key executive positions at national telecommunication companies Responsible for execution of Alithya’s strategic plan and manages the Company’s finances Strong financial experience and background operating diversified industries both in Canada and internationally Held many senior roles including CFO at both LG-Ericsson and Canadian Steamship Lines Group Worked in various roles of increasing responsibility at Nortel in Toronto, Montréal, U.S. and France Responsible for Human Resources at Alithya Strong expertise in the management and development of high performance teams in technology, construction, aviation and engineering sectors Led many human resource initiatives across numerous countries in both private and public company environments Responsible for digital technology, integration of acquisitions and real estate Held various senior management positions for a large IT consulting firm Was in charge of the operations for a large US-based unit of an IT consulting firm Led the Oracle ERP Cloud implementation at Alithya Responsible for all legal matters pertaining to business and labor law as well as to transactions and their financings Held several positions with the Government of Québec, including Director of the Legal Department of the Ministry of Culture and Communications and Committee Clerk at the National Assembly Served as Vice-President of Legal Affairs and Secretary of Videotron Paul Raymond President and CEO 30+ Years of Experience Claude Rousseau Chief Operating Officer 30+ Years of Experience Mathieu Lupien Chief Financial Officer 25+ Years of Experience MARC CANTIN Chief Legal Officer 40+ Years of Experience MARIE-FRANCE PARISÉ SENIOR VICE PRESIDENT, HUMAN CAPITAL 15+ Years of Experience ROBERT LAMARRE Chief DIGITAL Officer 25+ Years of Experience

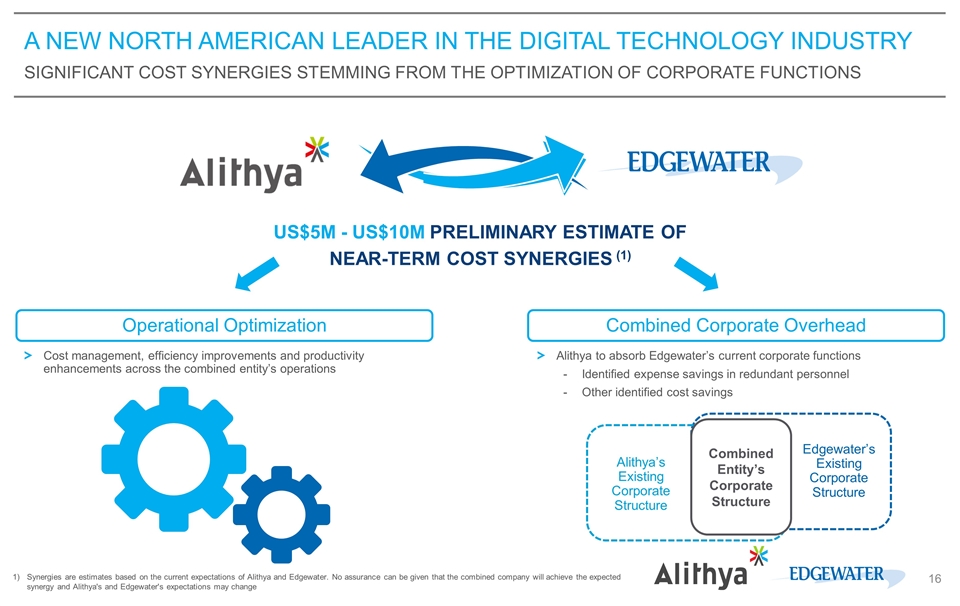

A New North American leader in THE Digital TECHNOLOGY Industry Significant cost synergies stemming from the optimization of corporate functions Combined Corporate Overhead US$5M - US$10M PRELIMINARY ESTIMATE OF NEAR-TERM COST SYNERGIES (1) Operational Optimization Alithya to absorb Edgewater’s current corporate functions Identified expense savings in redundant personnel Other identified cost savings Combined Entity’s Corporate Structure Alithya’s Existing Corporate Structure Edgewater’s Existing Corporate Structure Cost management, efficiency improvements and productivity enhancements across the combined entity’s operations Synergies are estimates based on the current expectations of Alithya and Edgewater. No assurance can be given that the combined company will achieve the expected synergy and Alithya's and Edgewater's expectations may change

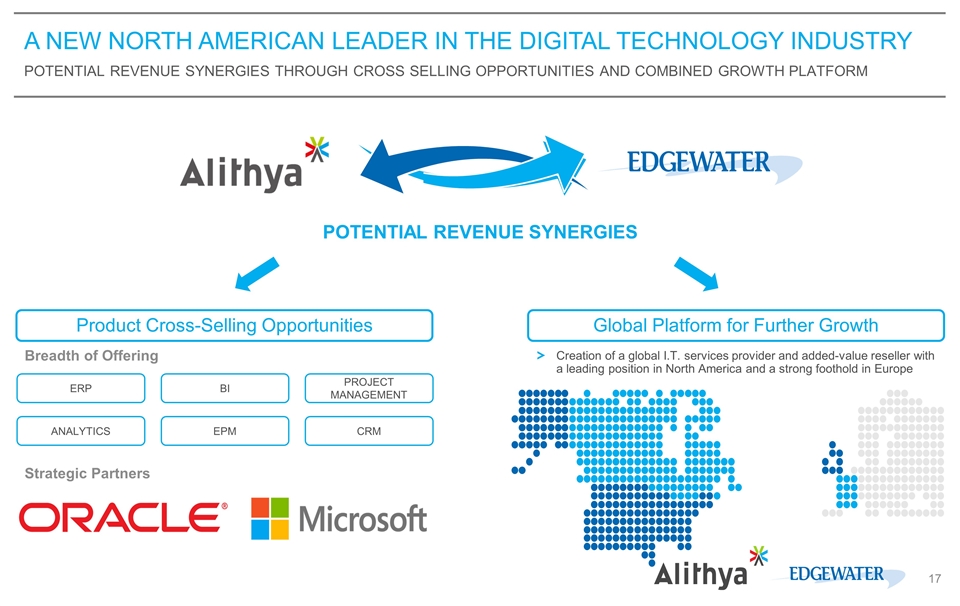

A New North American leader in THE Digital TECHNOLOGY Industry Potential revenue synergies Through cross Selling opportunities and combined growth platform Global Platform for Further Growth Product Cross-Selling Opportunities ERP CRM EPM ANALYTICS BI Strategic Partners Breadth of Offering Creation of a global I.T. services provider and added-value reseller with a leading position in North America and a strong foothold in Europe POTENTIAL REVENUE SYNERGIES PROJECT MANAGEMENT

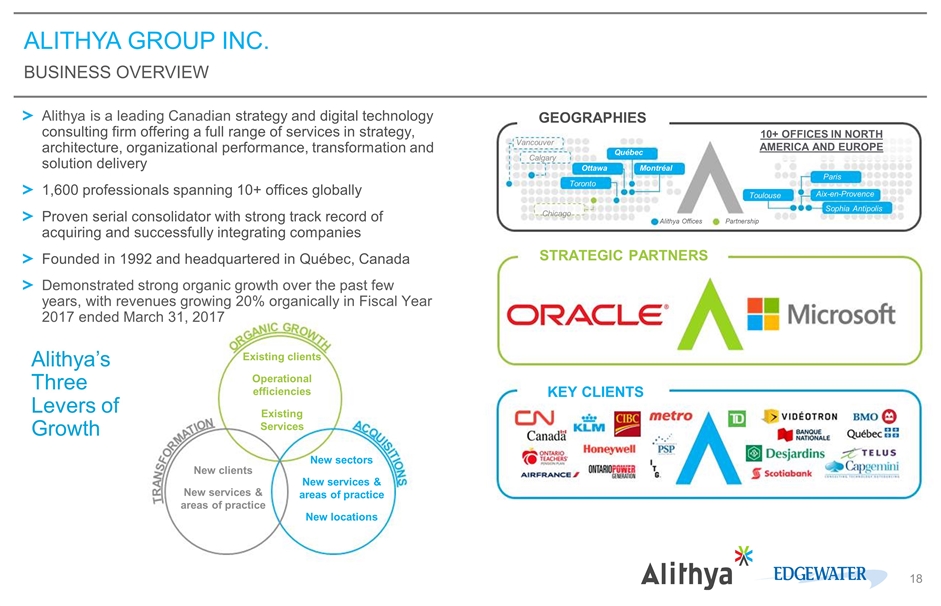

ALITHYA GROUP INC. BUSINESS OVERVIEW KEY CLIENTS STRATEGIC PARTNERS GEOGRAPHIES Alithya Offices Partnership Alithya is a leading Canadian strategy and digital technology consulting firm offering a full range of services in strategy, architecture, organizational performance, transformation and solution delivery 1,600 professionals spanning 10+ offices globally Proven serial consolidator with strong track record of acquiring and successfully integrating companies Founded in 1992 and headquartered in Québec, Canada Demonstrated strong organic growth over the past few years, with revenues growing 20% organically in Fiscal Year 2017 ended March 31, 2017 Alithya’s Three Levers of Growth New clients New services & areas of practice New sectors New services & areas of practice New locations Existing clients Operational efficiencies Existing Services Montréal Québec Ottawa Toronto Vancouver Chicago Aix-en-Provence Paris Toulouse Sophia Antipolis 10+ OFFICES IN NORTH AMERICA AND EUROPE Calgary

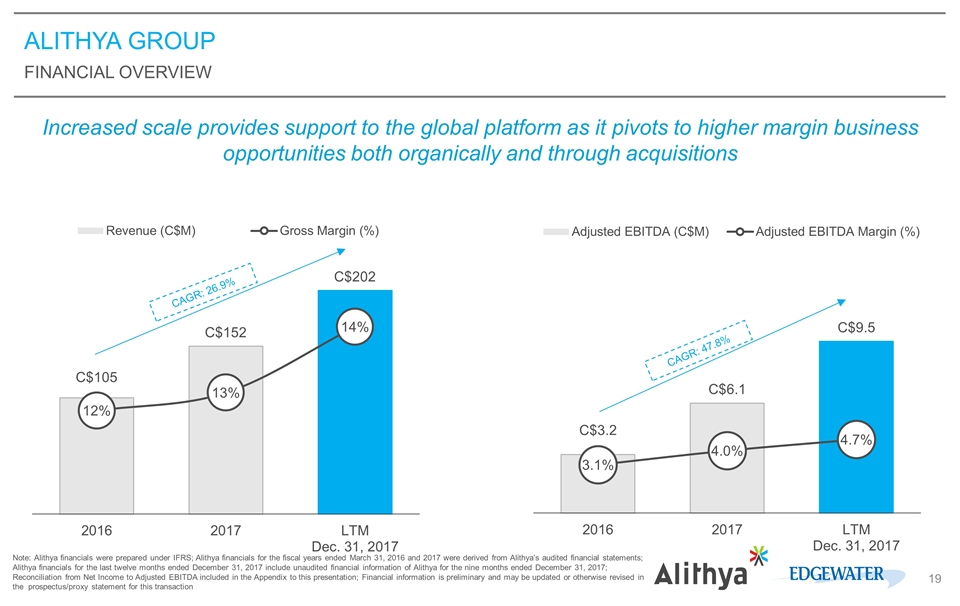

ALITHYA GROUP FINANCIAL OVERVIEW CAGR: 47.8% Increased scale provides support to the global platform as it pivots to higher margin business opportunities both organically and through acquisitions CAGR: 26.9% Note: Alithya financials were prepared under IFRS; Alithya financials for the fiscal years ended March 31, 2016 and 2017 were derived from Alithya’s audited financial statements; Alithya financials for the last twelve months ended December 31, 2017 include unaudited financial information of Alithya for the nine months ended December 31, 2017; Reconciliation from Net Income to Adjusted EBITDA included in the Appendix to this presentation; Financial information is preliminary and may be updated or otherwise revised in the prospectus/proxy statement for this transaction

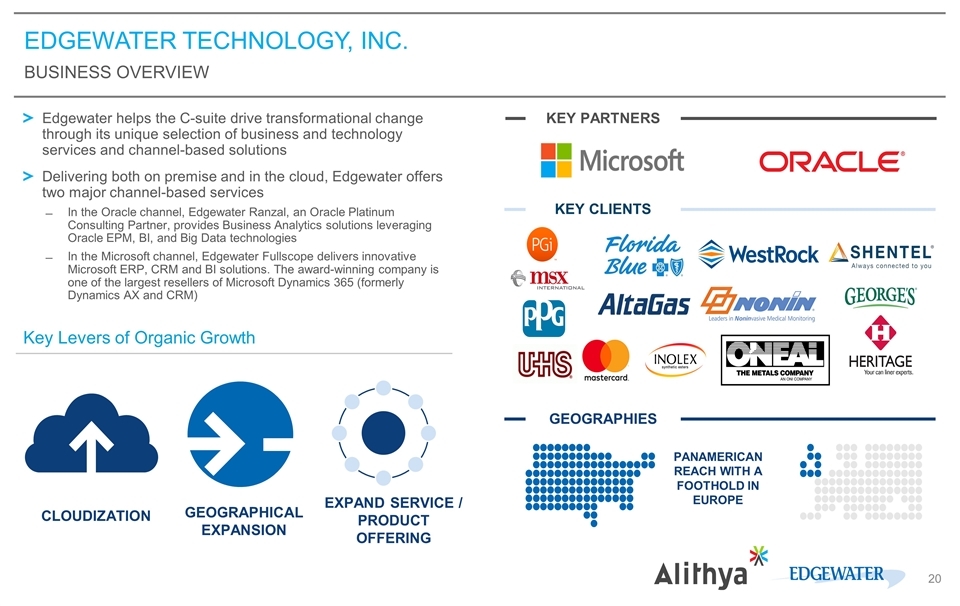

EDGEWATER TECHNOLOGY, INC. BUSINESS OVERVIEW Edgewater helps the C-suite drive transformational change through its unique selection of business and technology services and channel-based solutions Delivering both on premise and in the cloud, Edgewater offers two major channel-based services In the Oracle channel, Edgewater Ranzal, an Oracle Platinum Consulting Partner, provides Business Analytics solutions leveraging Oracle EPM, BI, and Big Data technologies In the Microsoft channel, Edgewater Fullscope delivers innovative Microsoft ERP, CRM and BI solutions. The award-winning company is one of the largest resellers of Microsoft Dynamics 365 (formerly Dynamics AX and CRM) Key Levers of Organic Growth PANAMERICAN REACH WITH A FOOTHOLD IN EUROPE KEY PARTNERS KEY CLIENTS CLOUDIZATION GEOGRAPHICAL EXPANSION EXPAND SERVICE / PRODUCT OFFERING GEOGRAPHIES

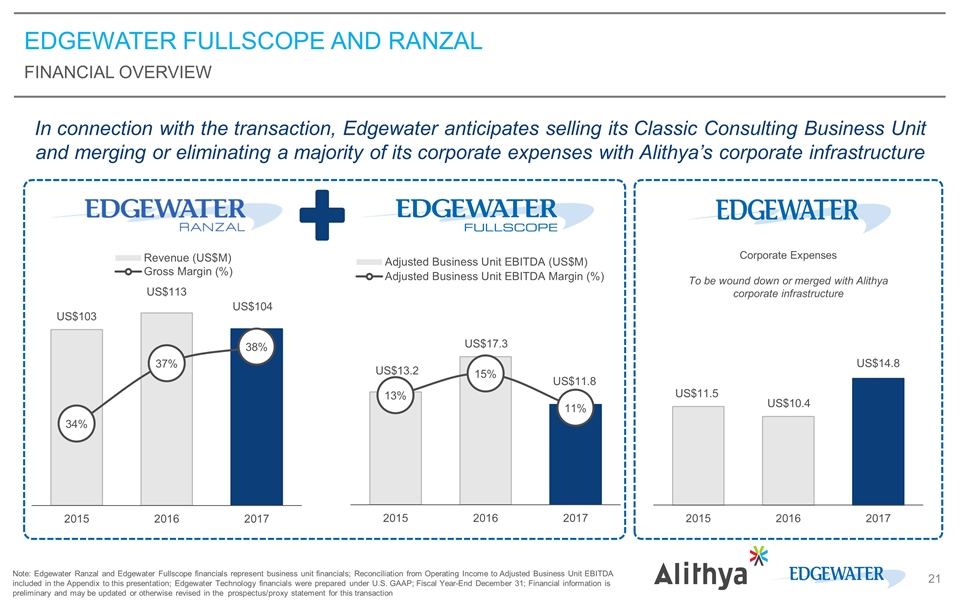

EDGEWATER FULLSCOPE AND RANZAL FINANCIAL OVERVIEW In connection with the transaction, Edgewater anticipates selling its Classic Consulting Business Unit and merging or eliminating a majority of its corporate expenses with Alithya’s corporate infrastructure Note: Edgewater Ranzal and Edgewater Fullscope financials represent business unit financials; Reconciliation from Operating Income to Adjusted Business Unit EBITDA included in the Appendix to this presentation; Edgewater Technology financials were prepared under U.S. GAAP; Fiscal Year-End December 31; Financial information is preliminary and may be updated or otherwise revised in the prospectus/proxy statement for this transaction Corporate Expenses To be wound down or merged with Alithya corporate infrastructure 4 4

Q&A

APPENDIX

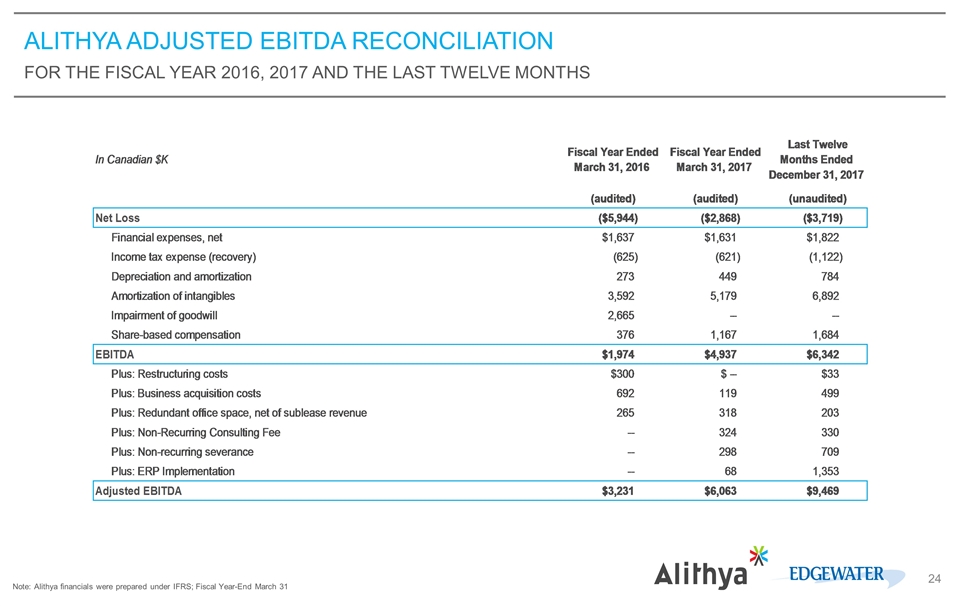

ALITHYA ADJUSTED EBITDA RECONCILIATION FOR THE FISCAL YEAR 2016, 2017 AND THE LAST TWELVE MONTHS Note: Alithya financials were prepared under IFRS; Fiscal Year-End March 31

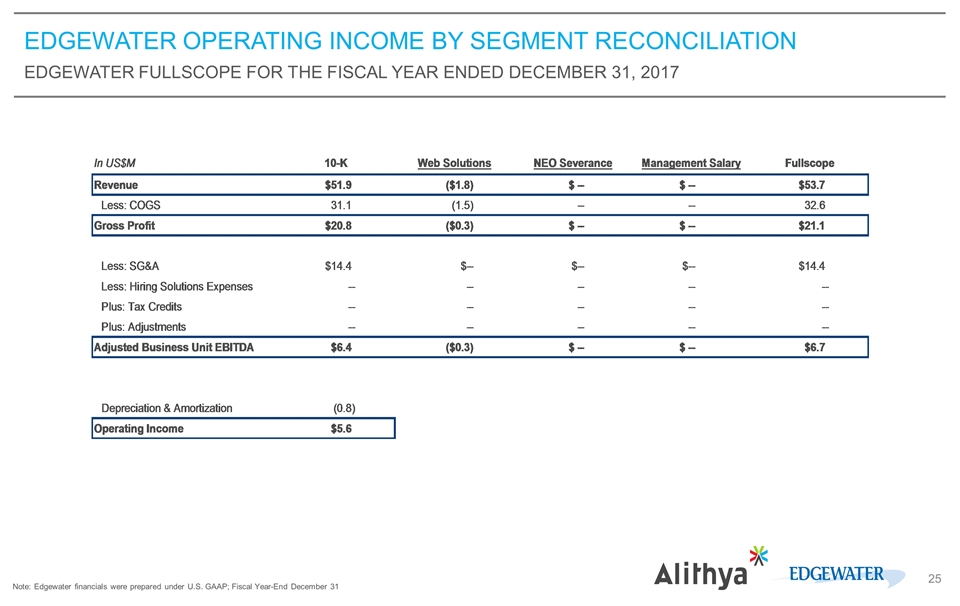

EDGEWATER OPERATING INCOME BY SEGMENT RECONCILIATION EDGEWATER FULLSCOPE FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 Note: Edgewater financials were prepared under U.S. GAAP; Fiscal Year-End December 31

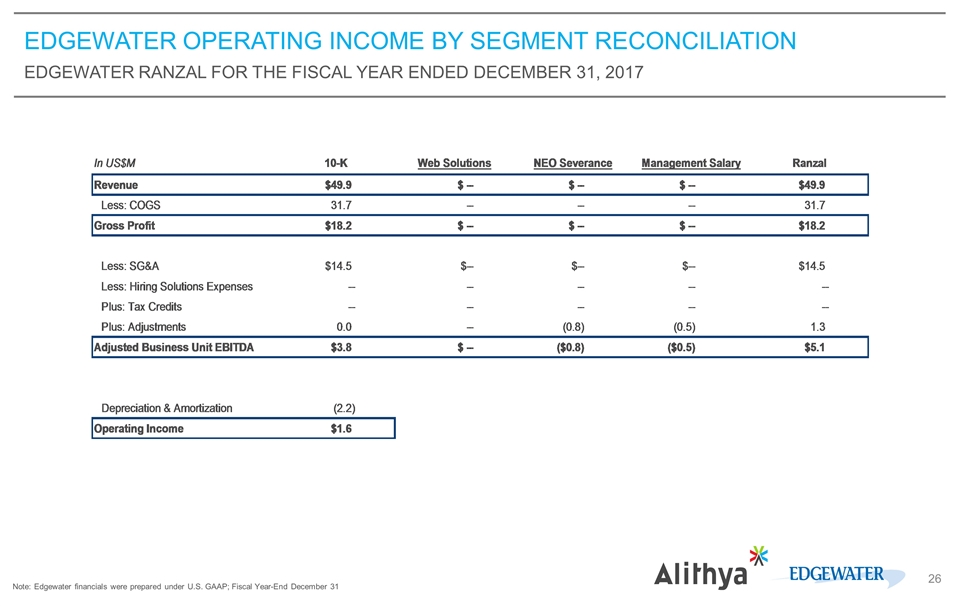

EDGEWATER OPERATING INCOME BY SEGMENT RECONCILIATION EDGEWATER RANZAL FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 Note: Edgewater financials were prepared under U.S. GAAP; Fiscal Year-End December 31

Combination of Alithya Group and Edgewater Technology A New North American Digital Technology Transformation Leader