Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - EDGEWATER TECHNOLOGY INC/DE/ | d546769dex32.htm |

| EX-31.2 - EX-31.2 - EDGEWATER TECHNOLOGY INC/DE/ | d546769dex312.htm |

| EX-31.1 - EX-31.1 - EDGEWATER TECHNOLOGY INC/DE/ | d546769dex311.htm |

| EXCEL - IDEA: XBRL DOCUMENT - EDGEWATER TECHNOLOGY INC/DE/ | Financial_Report.xls |

| EX-10.1 - EX-10.1 - EDGEWATER TECHNOLOGY INC/DE/ | d546769dex101.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | Quarterly report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2013

or

| ¨ | Transition report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 |

for the transition period from to

Commission file number: 000-20971

EDGEWATER TECHNOLOGY, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 71-0788538 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

| 200 Harvard Mill Square, Suite 210 Wakefield, MA |

01880-3209 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (781) 246-3343

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares of Common Stock of the Registrant, par value $.01 per share, outstanding at July 31, 2013 was 10,829,920.

Table of Contents

FORM 10-Q FOR THE QUARTER ENDED JUNE 30, 2013

INDEX

2

Table of Contents

PART I – FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS |

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands, Except Per Share Data)

| June 30, 2013 |

December 31, 2012 |

|||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 11,467 | $ | 16,651 | ||||

| Accounts receivable, net of allowance of $250 |

23,846 | 18,281 | ||||||

| Prepaid expenses and other current assets |

1,605 | 1,418 | ||||||

|

|

|

|

|

|||||

| Total current assets |

36,918 | 36,350 | ||||||

| Property and equipment, net |

1,714 | 1,949 | ||||||

| Intangible assets, net |

1,155 | 1,194 | ||||||

| Goodwill |

12,049 | 12,049 | ||||||

| Other assets |

244 | 247 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 52,080 | $ | 51,789 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 2,338 | $ | 593 | ||||

| Accrued liabilities |

12,817 | 14,280 | ||||||

| Deferred revenue |

3,028 | 2,969 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

18,183 | 17,842 | ||||||

| Other liabilities |

978 | 1,272 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

19,161 | 19,114 | ||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $.01 par value; 2,000 shares authorized, no shares issued or outstanding |

— | — | ||||||

| Common stock, $.01 par value; 48,000 shares authorized, 29,736 shares issued as of June 30, 2013 and December 31, 2012, 10,795 and 10,897 shares outstanding as of June 30, 2013 and December 31, 2012, respectively |

297 | 297 | ||||||

| Paid-in capital |

212,382 | 213,238 | ||||||

| Treasury stock, at cost, 18,941 and 18,839 shares at June 30, 2013 and December 31, 2012, respectively |

(125,210 | ) | (125,806 | ) | ||||

| Accumulated other comprehensive loss |

(144 | ) | (123 | ) | ||||

| Retained deficit |

(54,406 | ) | (54,931 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

32,919 | 32,675 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 52,080 | $ | 51,789 | ||||

|

|

|

|

|

|||||

See notes to the unaudited condensed consolidated financial statements.

3

Table of Contents

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In Thousands, Except Per Share Data)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Revenue: |

||||||||||||||||

| Service revenue |

$ | 21,599 | $ | 21,587 | $ | 41,295 | $ | 43,383 | ||||||||

| Software revenue |

4,331 | 3,622 | 6,308 | 5,006 | ||||||||||||

| Reimbursable expenses |

1,970 | 1,978 | 3,773 | 4,079 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

27,900 | 27,187 | 51,376 | 52,468 | ||||||||||||

| Cost of revenue: |

||||||||||||||||

| Project and personnel costs |

13,456 | 13,052 | 26,766 | 26,706 | ||||||||||||

| Software costs |

2,433 | 2,697 | 3,656 | 3,658 | ||||||||||||

| Reimbursable expenses |

1,970 | 1,978 | 3,773 | 4,079 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

17,859 | 17,727 | 34,195 | 34,443 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

10,041 | 9,460 | 17,181 | 18,025 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

8,110 | 8,551 | 15,641 | 16,502 | ||||||||||||

| Depreciation and amortization |

308 | 448 | 623 | 890 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

8,418 | 8,999 | 16,264 | 17,392 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

1,623 | 461 | 917 | 633 | ||||||||||||

| Other expense, net |

69 | 196 | 173 | 105 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

1,554 | 265 | 744 | 528 | ||||||||||||

| Tax provision |

140 | 131 | 219 | 219 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 1,414 | $ | 134 | $ | 525 | $ | 309 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income: |

||||||||||||||||

| Currency translation adjustments |

(23 | ) | (3 | ) | (22 | ) | (12 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive income |

$ | 1,391 | $ | 131 | $ | 503 | $ | 297 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share: |

||||||||||||||||

| Basic net income per share of common stock |

$ | 0.13 | $ | 0.01 | $ | 0.05 | $ | 0.03 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted net income per share of common stock |

$ | 0.12 | $ | 0.01 | $ | 0.05 | $ | 0.03 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in computing basic net income per share of common stock |

10,791 | 11,288 | 10,834 | 11,319 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in computing diluted net income per share of common stock |

11,428 | 11,836 | 11,447 | 11,682 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to the unaudited condensed consolidated financial statements.

4

Table of Contents

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

| Six Months Ended June 30, |

||||||||

| 2013 | 2012 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||||

| Net income |

$ | 525 | $ | 309 | ||||

| Adjustments to reconcile net income to net cash used in operating activities: |

||||||||

| Depreciation and amortization |

804 | 932 | ||||||

| Share-based compensation expense |

838 | 706 | ||||||

| Deferred income taxes |

17 | — | ||||||

| Fair value adjustment of contingent earnout consideration |

— | 15 | ||||||

| Changes in operating accounts: |

||||||||

| Accounts receivable |

(5,581 | ) | (4,432 | ) | ||||

| Prepaid expenses and other current assets |

(188 | ) | (509 | ) | ||||

| Accounts payable |

1,745 | (703 | ) | |||||

| Accrued liabilities and other liabilities |

(1,770 | ) | 696 | |||||

| Deferred revenue |

59 | 2,478 | ||||||

|

|

|

|

|

|||||

| Net cash used in operating activities |

(3,551 | ) | (508 | ) | ||||

|

|

|

|

|

|||||

| CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||||

| Acquisition of intellectual property |

(200 | ) | — | |||||

| Capitalization of product development costs |

(152 | ) | (205 | ) | ||||

| Purchases of property and equipment |

(179 | ) | (199 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(531 | ) | (404 | ) | ||||

|

|

|

|

|

|||||

| CASH FLOW FROM FINANCING ACTIVITES: |

||||||||

| Payments on capital leases |

— | (52 | ) | |||||

| Purchases of treasury stock |

(1,513 | ) | (710 | ) | ||||

| Proceeds from employee stock plans and stock option exercises |

416 | 240 | ||||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(1,097 | ) | (522 | ) | ||||

|

|

|

|

|

|||||

| Effects of exchange rates on cash |

(5 | ) | (6 | ) | ||||

|

|

|

|

|

|||||

| Net decrease in cash and cash equivalents |

(5,184 | ) | (1,440 | ) | ||||

| CASH AND CASH EQUIVALENTS, beginning of period |

16,651 | 10,333 | ||||||

|

|

|

|

|

|||||

| CASH AND CASH EQUIVALENTS, end of period |

$ | 11,467 | $ | 8,893 | ||||

|

|

|

|

|

|||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: |

||||||||

| Cash paid for income taxes |

$ | 66 | $ | 278 | ||||

|

|

|

|

|

|||||

| Issuance of restricted stock awards |

$ | 1,051 | $ | — | ||||

|

|

|

|

|

|||||

See notes to the unaudited condensed consolidated financial statements.

5

Table of Contents

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 1. | ORGANIZATION: |

Edgewater Technology, Inc. (“Edgewater” or the “Company”) is a strategic consulting firm that brings a synergistic blend of specialty services to drive transformational change that (1) improves process, (2) reduces costs and (3) increases revenue. Our solutions are tailored to the C-level executives in the upper mid-market and Global 2000. Headquartered in Wakefield, Massachusetts, we work with customers to reduce costs, improve process and increase revenue through the judicious use of technology.

In this Quarterly Report on Form 10-Q (the “Form 10-Q”), we use the terms “Edgewater,” “Edgewater Technology,” “we,” “our Company,” “the Company,” “our” and “us” to refer to Edgewater Technology, Inc. and its wholly-owned subsidiaries, which are described in our 2012 Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (the “SEC”) on March 8, 2013 (the “2012 Form 10-K”).

| 2. | BASIS OF PRESENTATION: |

The accompanying unaudited condensed consolidated financial statements have been prepared by Edgewater pursuant to the rules and regulations of the SEC regarding interim financial reporting. Certain information and note disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to those rules and regulations, although we believe that the disclosures made are adequate to ensure the information presented is not misleading.

The accompanying unaudited condensed consolidated financial statements reflect all adjustments (which were of a normal, recurring nature) that, in the opinion of management, are necessary to present fairly our financial position, results of operations and cash flows as of and for the interim periods presented. All intercompany transactions have been eliminated in the accompanying unaudited condensed consolidated financial statements. These financial statements should be read in conjunction with the audited financial statements and notes thereto included in our 2012 Form 10-K.

The results of operations for the three and six months ended June 30, 2013 are not necessarily indicative of the results to be expected for any future period or the full fiscal year. Our revenue and earnings may fluctuate from quarter-to-quarter based on factors within and outside our control, including variability in demand for information technology professional services, the length of the sales cycle associated with our service offerings, the number, size and scope of our projects and the efficiency with which we utilize our employees. Substantially all of our revenue is generated within North America.

Other comprehensive income consists of net income plus or minus any periodic currency translation adjustments.

| 3. | REVENUE RECOGNITION: |

Our Company generates revenue primarily through the provision of consulting services and the resale of third-party, off-the-shelf software and maintenance.

We generate revenue by providing consulting services under written service contracts with our customers. The service contracts we enter into generally fall into three specific categories: time and materials, fixed-price and retainer.

We consider amounts to be earned once evidence of an arrangement has been obtained, services are delivered, fees are fixed or determinable and collectability is reasonably assured. We establish billing terms at the time at which the project deliverables and milestones are agreed. Our standard payment terms are 30 days from invoice date. Out-of-pocket reimbursable expenses charged to customers are reflected as revenue.

When a customer enters into a time and materials, fixed-price or a periodic retainer-based contract, the Company recognizes revenue in accordance with its evaluation of the deliverables in each contract. If the deliverables represent separate units of accounting, the Company then measures and allocates the consideration from the arrangement to the separate units, based on vendor specific objective evidence (“VSOE”) of the value for each deliverable.

The revenue under time and materials contracts is recognized as services are rendered and performed at contractually agreed upon rates. Revenue pursuant to fixed-price contracts is recognized under the proportional performance method of accounting. We routinely evaluate whether revenue and profitability should be recognized in the current period.

6

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 3. | REVENUE RECOGNITION: (Continued) |

We estimate the proportional performance on our fixed-price contracts on a monthly basis utilizing hours incurred to date as a percentage of total estimated hours to complete the project. This method is used because reasonably dependable estimates of costs and revenue earned can be made, based on historical experience and milestones identified in any particular contract. If we do not have a sufficient basis to measure progress toward completion, revenue is recognized upon completion of performance, subject to any warranty provisions or other project management assessments as to the status of work performed.

Estimates of total project costs are continuously monitored during the term of an engagement. There are situations where the number of hours to complete projects may either exceed (or be less than) our original estimate, as a result of an increase (or decrease) in project scope, unforeseen events that arise, or the inability of the client or the delivery team to fulfill their responsibilities. Accordingly, recorded revenues and costs are subject to revision throughout the life of a project based on current information and historical trends. Such revisions may result in increases or decreases to revenue and income and are reflected in the consolidated financial statements in the periods in which they are first identified.

If our initial estimates of the resources required or the scope of work to be performed on a contract are inaccurate, or we do not manage the project properly within the planned time period, a provision for estimated losses on incomplete projects is made. Any known or probable losses on projects are charged to operations in the period in which such losses are determined. A formal project review process takes place quarterly, although projects are evaluated on an ongoing basis. Management reviews the estimated total direct costs on each contract to determine if the estimated amounts are accurate, and estimates are adjusted as needed in the period revised estimates are made. No losses were recognized on fixed price contracts during the three- or six-month periods ended June 30, 2013 or 2012.

We also perform services on a periodic retainer basis under infrastructure service contracts, which include monthly hosting and support services. Revenue under periodic retainer-based contracts is recognized ratably over the contract period, as outlined within the respective contract. In the event additional services are required, above the minimum retained or contracted amount, then such services are billed on a time and materials basis.

Typically, the Company provides warranty services on its fixed-price contracts related to providing customers with the ability to have any “design flaws” remedied and/or have our Company “fix” routine defects. The warranty services, as outlined in the respective contracts, are provided for a specific period of time after a project is complete. The Company values the warranty services based upon historical labor hours incurred for similar services at standard billing rates. Revenue related to the warranty provisions within our fixed-price contracts is recognized as the services are performed or the revenue is earned. The warranty period is typically for a 30-60 day period after the project is complete.

Customer prepayments, even if nonrefundable, are deferred (classified as deferred revenue on the condensed consolidated balance sheets) and recognized over future periods as services are performed.

Software revenue represents the resale of certain third-party off-the-shelf software and maintenance and is recorded on a gross basis provided we act as a principal in the transaction, which we have determined based upon several factors, including, but not limited to, the fact that we have credit risk and we set the price to the end user. In the event we do not meet the requirements to be considered a principal in the software sale transaction and act as an agent, software revenue will be recorded on a net basis.

The majority of the software sold by the Company is delivered electronically. For software that is delivered electronically, we consider delivery to have occurred when the customer either (a) takes possession of the software via a download (that is, when the customer takes possession of the electronic data on its hardware), or (b) has been provided with access codes that allow the customer to take immediate possession of the software on its hardware pursuant to an agreement or purchase order for the software.

7

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 3. | REVENUE RECOGNITION: (Continued) |

The Company enters into multiple element arrangements which typically include software, post-contract support (or maintenance), and consulting services. Consistent with the software described above, maintenance that is in the form of a pass through transaction is recognized upon delivery of the software, as all related warranty and maintenance is performed by the primary software vendor and not the Company. Maintenance fee revenue for the Company’s software products, which is inconsequential in all years presented, is recognized ratably over the term of the arrangements, which are generally for a one-year period. The Company has established VSOE with respect to the services provided based on the price charged when the services are sold separately. The Company has established VSOE for maintenance based upon the stated renewal rate.

In June 2012, Microsoft Corporation agreed to purchase Edgewater Fullscope’s Process Industries 2 (“PI2”) software and intellectual property along with certain services. The sale of PI2 is a significant multiple element contract. This contract includes $3.25 million of license consideration and subsequent development and training services. We have determined that the license does not have stand-alone value without the services, and thus the license and services are being accounted for as one unit. The license revenue is being recognized as revenue over the period the services are being performed. We recognized $934 thousand and $1.4 million of revenue, reported as Software revenue in our Consolidated Statement of Comprehensive Income (loss), during the three- and six-month periods ended June 30, 2013, respectively. No PI2-related revenue was recognized during the three- or six-month periods ended June 30, 2012.

We perform routine periodic reviews of our current and expected performance against the service contracts in connection with our PI2 revenue recognition procedures. During the three months ended June 30, 2013, in conjunction with our periodic review, the Company revised its estimate to complete certain work under the training services agreement. As a result of our revised estimates, we recognized software revenue related to the PI2 transaction of $934 thousand during the second quarter of 2013, which amount is higher than what we have recognized on a recurring quarterly basis since entering the transaction in the second quarter of 2012. We recognized $1.4 million in PI2-related software revenue during the six months ended June 30, 2013. No PI2-related software revenue was recognized during the three- or six-month periods ended June 30, 2012.

| 4. | SHARE-BASED COMPENSATION: |

Share-based compensation expense under all of the Company’s share-based plans was $346 thousand and $838 thousand for the three- and six-month periods ended June 30, 2013, respectively. Share-based compensation expense under all of the Company’s share-based plans was $359 thousand and $706 thousand for the three- and six-month periods ended June 30, 2012, respectively.

Cash received from the employee stock purchase plan (“ESPP”) and through stock option exercises was $273 thousand and $416 thousand during the three- and six-month periods ended June 30, 2013, respectively. Cash received from ESPP and stock option exercises was $115 thousand and $240 thousand during the three- and six-month periods ended June 30, 2012, respectively.

As of June 30, 2013, unrecognized compensation expense, net of estimated forfeitures, related to the unvested portion of all share-based compensation arrangements was approximately $2.2 million and is expected to be recognized over a weighted-average period of 1.4 years.

The Company intends to use previously purchased treasury shares for shares issued for options, restricted share awards and ESPP purchases. Shares may also be issued from authorized but unissued share reserves.

8

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 5. | INCOME TAXES: |

The Company recorded a tax provision of $140 thousand and $219 thousand for the three- and six-month periods ended June 30, 2013, respectively. The Company recorded a tax provision of $131 thousand and $219 thousand for the three- and six-month periods ended June 30, 2012, respectively. The reported tax expense for the three- and six-month periods ended June 30, 2013, is based upon an estimated annual effective tax rate of 9.0% and 29.4%, respectively, related to our combined federal and state income tax rates, foreign income tax provisions and the recognition of U.S. deferred tax liabilities for differences between the book and tax basis of goodwill. The reported estimated annual effective tax rate is lower than an anticipated statutory rate due to a full valuation allowance being provided against our deferred tax assets, which includes significant federal net operating loss carryforwards. The reported tax expense for the three- and six-month periods ended June 30, 2012 is based upon an estimated annual effective tax rate of 49.4% and 41.5%, respectively.

Our policy is to classify interest and penalties related to unrecognized tax benefits as income tax expense. This policy has been consistently applied in all periods. During the three- and six-month periods ended June 30, 2013, we recognized, as part of income tax expense, $22 thousand and $43 thousand, respectively, in interest and penalties related to our unrecognized tax benefits. During the three- and six-month periods ended June 30, 2012, we recognized, as part of income tax expense, $21 thousand and $43 thousand, respectively, in interest and penalties related to our unrecognized tax benefits. We have reviewed the tax positions taken, or to be taken, in our tax returns for all tax years currently open to examination by a taxing authority. As of June 30, 2013, the gross amount of unrecognized tax benefits exclusive of interest and penalties was $140 thousand. Other than certain unrecognized tax benefits for which the statute of limitations will expire during the third quarter of 2013, we have identified no other uncertain tax positions for which it is reasonably possible that the total amount of unrecognized tax benefits will significantly increase or decrease within the twelve months ending June 30, 2014. We remain subject to examination until the statute of limitations expires for each respective tax jurisdiction.

We have deferred tax assets that have arisen primarily as a result of timing differences, net operating loss carryforwards and tax credits. Our ability to realize a deferred tax asset is based on our ability to generate sufficient future taxable income within the applicable carryforward period and subject to any applicable limitations. We assess, on a routine periodic basis, the estimated future realizability of the gross carrying value of our deferred tax assets on a more likely than not basis. Our periodic assessments take into consideration both positive evidence (future profitability projections for example) and negative evidence (recent and historical financial performance for example) as it relates to evaluating the future recoverability of our deferred tax assets.

We have a full valuation allowance against our deferred tax assets at June 30, 2013. The establishment of a full valuation allowance against the gross carrying value of our deferred tax assets does not prohibit or limit the Company’s ability to realize a tax benefit in future periods. All existing deferred tax assets, net operating loss carryforwards and credits will be available, subject to possible statutory limitations, to reduce certain future federal and state income tax obligations.

| 6. | FAIR VALUE MEASUREMENT: |

We utilize the following valuation hierarchy for disclosure of the inputs to valuation used to measure fair value. This hierarchy prioritizes the inputs into three broad levels as follows:

| • | Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| • | Level 2 inputs are quoted prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability, either directly or indirectly through market corroboration, for substantially the full term of the financial instrument. |

| • | Level 3 inputs are unobservable inputs based on our own assumptions used to measure assets and liabilities at fair value. |

A financial asset or liability’s classification within the hierarchy is determined based upon the lowest level input that is significant to the fair value measurement.

9

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 6. | FAIR VALUE MEASUREMENT: (Continued) |

As of June 30, 2013, the Company’s only financial assets and liabilities required to be measured on a recurring basis were our money market investments. As of December 31, 2012, the Company’s only financial assets and liabilities required to be measured on a recurring basis were our money market investments and the accrued contingent earnout consideration payable in connection with the Company’s acquisition of Meridian Consulting International (“Meridian”).

The following table represents the Company’s fair value hierarchy for its financial assets and liabilities required to be measured on a recurring basis:

| Basis of Fair Value Measurements | ||||||||||||||||

| Balance | Quoted Prices in Active Markets for Identical Items (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

|||||||||||||

| (In Thousands) | ||||||||||||||||

| Balance at June 30, 2013: |

||||||||||||||||

| Financial assets: |

||||||||||||||||

| Money market investment |

$ | 4,084 | $ | 4,084 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total financial assets |

$ | 4,084 | $ | 4,084 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at December 31, 2012: |

||||||||||||||||

| Financial assets: |

||||||||||||||||

| Money market investment |

$ | 4,084 | $ | 4,084 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total financial assets |

$ | 4,084 | $ | 4,084 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Company had historically classified its liability for contingent earnout consideration relating to its acquisition of Meridian within Level 3 of the fair value hierarchy because the fair value is determined using significant unobservable inputs, which includes probability weighted cash flows. The former Meridian stockholders’ third and final twelve-month earnout period concluded in May 2013. None of the minimum financial performance measures necessary to earn additional contingent earnout consideration were achieved.

A reconciliation of the beginning and ending Level 3 net liabilities is as follows:

| Fair Value Measurements Using Significant Unobservable Inputs (Level 3) |

||||

| (In Thousands) | ||||

| Balance at January 1, 2012 |

$ | 231 | ||

| Change in fair value related to Meridian contingent earnout consideration |

(231 | ) | ||

|

|

|

|||

| Balance at December 31, 2012 |

— | |||

| Change in fair value related to Meridian contingent earnout consideration |

— | |||

|

|

|

|||

| Ending balance at June 30, 2013 |

$ | — | ||

|

|

|

|||

The Company routinely examined, on a periodic basis, actual results in comparison to the performance measurements utilized in the earnout calculation and assesses the carrying value of the contingent earnout consideration. No adjustment was made to fair value during the three- or six-month periods ended June 30, 2013. During the three- and six-month periods ended June 30, 2012, the Company increased the estimated accrual of contingent earnout consideration earned by the former Meridian stockholders by $8 thousand and $15 thousand, respectively.

10

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 6. | FAIR VALUE MEASUREMENT: (Continued) |

No financial instruments were transferred into or out of Level 3 classification during the three- or six-month period ended June 30, 2013.

As of June 30, 2013 and December 31, 2012, the fair values of our other financial instruments, which include cash and cash equivalents, accounts receivable and accounts payable, approximate the carrying amounts of the respective asset and/or liability due to the short-term nature of these financial instruments.

| 7. | GOODWILL AND INTANGIBLE ASSETS: |

There has been no change in the Company’s recorded goodwill balance during the three- or six-month periods ended June 30, 2013 or 2012. Our annual goodwill and intangible assets measurement date is December 2.

We amortize our intangible assets that have finite lives using either the straight-line method or based on estimated future cash flows to approximate the pattern in which the economic benefit of the asset will be utilized. Amortization expense was $101 thousand and $209 thousand during the three- and six-month periods ended June 30, 2013, respectively. Amortization expense was $241 thousand and $482 thousand during the three- and six-month periods ended June 30, 2012, respectively. This amortization expense relates to certain non-competition covenants, trade names and customer lists, which expire between 2012 and 2016.

The Company recorded amortization from capitalized internally developed software (intellectual property)(reported as part of our software expense) of $116 thousand and $181 thousand during the three- and six-month periods ended June 30, 2013, respectively. The Company recorded amortization from capitalized internally developed software (reported as part of our software expense) of $25 thousand and $42 thousand during the three- and six-month periods ended June 30, 2012, respectively.

Estimated annual amortization expense (including amortization expense associated with capitalized software costs) for the current year and the following four years ending December 31, is as follows:

| Amortization Expense |

||||

| (In Thousands) | ||||

| 2013 |

$ | 764 | ||

| 2014 |

$ | 445 | ||

| 2015 |

$ | 198 | ||

| 2016 |

$ | 136 | ||

| 2017 |

$ | — | ||

11

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 8. | ACCRUED LIABILITIES: |

Accrued liabilities as of June 30, 2013 and December 31, 2012 consisted of the following:

| June 30, 2013 |

December 31, 2012 |

|||||||

| (In Thousands) | ||||||||

| Accrued vacation |

$ | 2,449 | $ | 1,838 | ||||

| Accrued bonuses |

2,324 | 2,245 | ||||||

| Accrued commissions |

1,583 | 2,229 | ||||||

| Accrued payroll related liabilities |

1,171 | 1,364 | ||||||

| Income tax related accruals |

639 | 498 | ||||||

| Short-term portion of lease abandonment accrual |

580 | 580 | ||||||

| Deferred rent |

548 | 526 | ||||||

| Accrued software expense |

279 | 1,668 | ||||||

| Accrued sales and use tax |

713 | 1,482 | ||||||

| Other accrued expenses |

2,531 | 1,850 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 12,817 | $ | 14,280 | ||||

|

|

|

|

|

|||||

Other long-term liabilities as of June 30, 2013 and December 31, 2012 consisted of the following:

| June 30, 2013 |

December 31, 2012 |

|||||||

| (In Thousands) | ||||||||

| Long-term portion of lease abandonment accrual |

$ | 875 | $ | 1,179 | ||||

| Long-term portion of deferred tax liability |

103 | 93 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 978 | $ | 1,272 | ||||

|

|

|

|

|

|||||

| 9. | NET INCOME PER SHARE: |

A reconciliation of net income and weighted average shares used in computing basic and diluted net income per share is as follows:

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| (In Thousands, Except Per Share Data) | ||||||||||||||||

| Basic net income per share: |

||||||||||||||||

| Net income applicable to common shares |

$ | 1,414 | $ | 134 | $ | 525 | $ | 309 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding |

10,791 | 11,288 | 10,834 | 11,319 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic net income per share of common stock |

$ | 0.13 | $ | 0.01 | $ | 0.05 | $ | 0.03 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted net income per share: |

||||||||||||||||

| Net income applicable to common shares |

$ | 1,414 | $ | 134 | $ | 525 | $ | 309 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding |

10,791 | 11,288 | 10,834 | 11,319 | ||||||||||||

| Dilutive effects of stock options |

637 | 548 | 612 | 363 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares, assuming dilutive effect of stock options |

11,428 | 11,836 | 11,447 | 11,682 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted net income per share of common stock |

$ | 0.12 | $ | 0.01 | $ | 0.05 | $ | 0.03 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

12

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 9. | NET INCOME PER SHARE: (Continued) |

Share-based awards, inclusive of all grants made under the Company’s equity plans, for which either the stock option exercise price or the fair value of the restricted share award exceeds the average market price over the period, have an anti-dilutive effect on earnings per share, and accordingly, are excluded from the diluted computations for all periods presented. Had such shares been included, shares for the diluted computation would have increased by approximately 1.6 million and 1.7 million in the three- and six-month periods ended June 30, 2013, respectively. The diluted computation would have increased by approximately 813 thousand and 959 thousand, respectively, in the three- and six-month periods ended June 30, 2012. As of June 30, 2013 and 2012, there were approximately 4.3 million and 3.9 million share-based awards outstanding, respectively, under the Company’s equity plans.

| 10. | STOCK REPURCHASE PROGRAM: |

In December 2007, our Board of Directors (the “Board”) authorized a stock repurchase program for up to $5.0 million of common stock on the open market or through privately negotiated transactions from time to time through December 31, 2008 (the “Stock Repurchase Program”). The Board subsequently amended the Stock Repurchase Program, authorizing both an increase to and an extension of the Stock Repurchase Program. The Stock Repurchase Program, as amended, had a maximum purchase value of shares of $13.5 million (the “Purchase Authorization”) and was scheduled to expire on September 21, 2012 (the “Repurchase Period”). In September 2012, the Board approved both a $2.6 million increase to the Purchase Authorization, to $16.1 million, and an extension of the Repurchase Period to September 20, 2013. As of June 30, 2013, there was $3.0 million of remaining Purchase Authorization under the Stock Repurchase Program.

The timing and amount of the purchases will be based upon market conditions, securities law considerations and other factors. The Stock Repurchase Program does not obligate the Company to acquire a specific number of shares in any period and may be modified, suspended, extended or discontinued at any time, without prior notice.

The Company repurchased a total of 201 thousand and 365 thousand shares of common stock during the three and six- month periods ended June 30, 2013, respectively, at an aggregate purchase price of $852 thousand and $1.5 million, respectively. The Company repurchased a total of 118 thousand and 187 thousand shares of common stock during the three- and six-month periods ended June 30, 2012, respectively, at an aggregate purchase price of $468 thousand and $728 thousand, respectively.

| 11. | FULLSCOPE EMBEZZLEMENT: |

During the second quarter of 2010, the Company discovered embezzlement activities at Fullscope, one of its wholly-owned subsidiaries, which was acquired by the Company in December 2009 (the “Fullscope Embezzlement Issue”). Based upon the results of forensic accounting procedures, we identified that the embezzlement activities occurred for an extended period prior to our acquisition of Fullscope and also during the first and second quarter of 2010. Additionally, based upon the procedures performed, we concluded that the embezzlement activities that occurred during the first and second quarters of 2010 did not have a material impact upon our previously issued financial statements.

We have completed our investigation as it relates to the embezzlement activities that occurred during 2010. In total, we identified approximately $116 thousand of embezzlement during 2010.

Embezzlement-related expenses incurred in the three- and six-month periods ended June 30, 2013 were not material. However, future expenses may be incurred in connection with the Fullscope Embezzlement Issue. During the second quarter of 2012, the Company increased the previously recorded accrual for pre-acquisition sales and use tax exposure by $550 thousand.

We incurred a majority of our embezzlement expenses during fiscal 2010 in connection with our identification and investigation of the embezzlement activity. We anticipate that we may continue to incur additional expenses associated with the Fullscope Embezzlement Issue as we intend to aggressively pursue recovery through a claim against the escrow account established in connection with the acquisition of Fullscope, Inc. (“Fullscope Acquisition”). We anticipate that we will be able to recover some, if not all, of the receivable amounts embezzled during 2010, the professional service expenses we have incurred to-date, or will incur in the future, addressing this situation, and any amounts paid to settle any of the identified sales and use tax liability amounts. Amounts recovered, if any, will be recorded during the period in which settlement is determined to be probable.

13

Table of Contents

EDGEWATER TECHNOLOGY, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 11. | FULLSCOPE EMBEZZLEMENT: (Continued) |

As of June 30, 2013, the accrual for pre-acquisition sales and use tax exposure was $643 thousand. The potential sales and use tax-related liability was created by the methods employed by a former employee of Fullscope to conceal the discovered fraudulent activity. While the Company has accounted for this liability as a period expense, we believe that any amounts actually paid to resolve this issue will be recoverable from an existing, fully funded escrow account which was established in connection with our acquisition of Fullscope. Future amounts recovered, if any, will be recorded by the Company in the period in which the amounts are determined to be probable of recovery from escrow. In connection with the Fullscope Acquisition, an escrow account was established with $1.3 million, or 10% of the initial upfront purchase price consideration. Subsequent to that time, the Company transferred an additional $700 thousand to the escrow account in connection with the release of a pre-acquisition Fullscope escrow account that was established in June 2009 in connection with Fullscope’s sale of Dynamics AX add-on software modules to Microsoft. Further, in the fourth quarter of 2011, the Company funded the escrow account with $2.6 million in settlement of the contingent consideration obligation. As of June 30, 2013, the combined value of the two escrow accounts was approximately $4.6 million. The escrow accounts, as per the merger agreement, were established to ensure the satisfactory resolution of all potential claims during the earnout period. These amounts will remain unsettled until our claim of recovery for the above matters is resolved.

During the fourth quarter of 2012, the Company began to file tax returns and pay sales and use tax liabilities related to the Fullscope Embezzlement. The Company, as of June 30, 2013 has made payments totaling $858 thousand associated with the sales and use tax liabilities. We expect to continue to make payments associated with these liabilities during the third quarter of 2013. The Company fully expects to be reimbursed for payments made in relation to amended sales and use tax returns; however, reimbursement from escrow is not expected until resolution is reached on all outstanding embezzlement-related sales and use tax amounts. Amounts recovered, if any, will be recorded during the period in which settlement is determined to be probable of recovery from escrow.

| 12. | PURCHASE OF INTELLECTUAL PROPERTY: |

In March 2013, the Company purchased Trade Program Management (“TPM”) software assets. The purchase price for the TPM intellectual property was $200 thousand, payable in installments. The Company has recorded this asset within intangible assets on the condensed consolidated balance sheet as of June 30, 2013 (and will begin to amortize the purchase price, over a three-year period (the expected period of benefit), once development is complete and the product is commercially available).

14

Table of Contents

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following information should be read in conjunction with the information contained in the Unaudited Condensed Consolidated Financial Statements and notes thereto appearing elsewhere in this Quarterly Report on Form 10-Q. This Quarterly Report on Form 10-Q contains forward-looking statements that involve risks and uncertainties. See “Risk Factors” and “Special Note Regarding Forward-Looking Statements” included elsewhere herein. We use the terms “we,” “our,” “us,” “Edgewater” and “the Company” in this report to refer to Edgewater Technology, Inc. and its wholly-owned subsidiaries.

Edgewater is a strategic consulting firm that brings a synergistic blend of specialty services to drive transformational change that (1) improves process, (2) reduces costs and (3) increases revenue. Our solutions are tailored to the C-level executives in the upper mid-market and Global 2000.

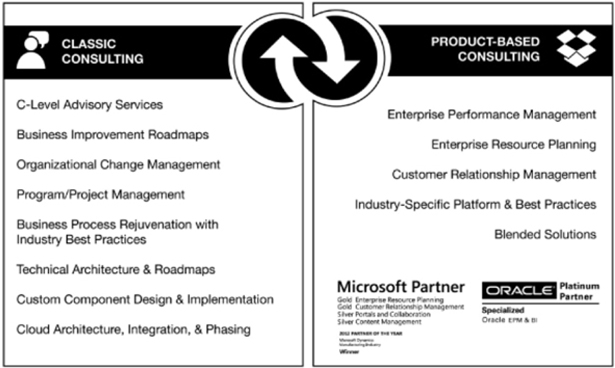

We deliver our services across a broad range of industries. We work onsite with our clients, providing a full spectrum of services in the following areas: classic consulting and product-based consulting, primarily in enterprise performance management (“EPM”) and enterprise resource planning (“ERP”).

Our Services

Edgewater offers a full spectrum of services and expertise to ensure the success of our engagement. Our consulting services are consolidated into two major synergistic offerings: (1) Classic Consulting and (2) Product-Based Consulting.

The following diagram illustrates these offerings:

Edgewater has the proven expertise to plan, deliver and manage integration services that improve performance and maximize business results. We focus on deploying new systems and unlocking the value of the existing corporate assets. This proven expertise enables us to bring complex technologies and systems together while minimizing risk, leveraging our clients’ technology investments and delivering tailored solutions.

15

Table of Contents

The following are Edgewater’s service categories with sample services:

Classic consulting services

| • | CFO advisory services |

| • | Business improvement roadmaps |

| • | Organizational change management |

| • | Program/project management |

| • | Business process rejuvenation with best practices |

| • | Specialized operational, due diligence and technology management expertise to mergers and acquisitions, private equity and venture capital |

| • | Strategic advice, costing, estimates to complete, failing or failed programs or project initiatives |

| • | Independent package selection and Request for Information or Proposal process design and implementation |

| • | Technical architecture and roadmaps |

| • | CIO advisory services |

| • | Strategic technology selections |

| • | Technical evaluation and design |

| • | Custom component design and implementation |

| • | Customer intelligence solutions using web/mobile analytics combined with social intelligence |

| • | Cloud architecture, integration and phasing solutions |

| • | On-going support services |

| • | Infrastructure optimization and redesign, disaster recovery and business continuity specialized design and assistance |

Product-based consulting services

| • | Effect business transformation through the use of packaged software solutions |

| • | Enterprise performance management with Oracle budgeting, planning, consolidation and strategic finance |

| • | Enterprise resource planning with Microsoft Dynamics AX targeted in process and discrete manufacturing verticals such as CPG, IEM, Chemical, and Pharmaceuticals |

| • | Customer relationship management with Microsoft Dynamics CRM |

| • | Industry specific platform and best practice solutions |

| • | Blended solutions; Microsoft CRM/XRM and specialized custom solutions |

| • | Business intelligence analytics |

| • | Design, develop and introduce IP that helps “verticalize” channel product stacks |

| • | Support and training services |

In addition to the above services, the Company also provides synergistic services in the area of data management and analytics. Examples of such services include the following:

Enterprise information management services

| • | Provide for data related matters: master data management, data governance, logical and physical data base design, data warehouse strategies and design |

| • | Provide practical data architectures and roadmaps to support transactional systems and enterprise performance management through advanced analytics |

| • | Provide forms of data manipulation, transformation and quality services |

16

Table of Contents

Analytics services

| • | Lead derivation of key financial and operational performance indicators and correlate their measurement, visualization and action for a given organization |

| • | Advise on opportunities for the use of predictive techniques, external data and benchmarks to improve business performance measurement and forecasting |

| • | Advise on the creation and adoption of analytics architectures, roadmaps and supporting organizations |

| • | Advise, design and roadmap analytics-based near real-time to real-time alerting strategies and implementations |

Our consultants are expected to travel and to be onsite with the customer to provide the highest level of service and support in all of these endeavors. We provide varying degrees of customer project assistance and will incorporate customer resources for technology transfer or cost optimization purposes. Independent teams and proper project process and delineation provide conflict-free transition points among all key service offerings as well as independent entry points. Leads for all offerings are internally driven with assistance from the respective vendors for software product solutions.

Factors Influencing Our Results of Operations

Revenue. The Company derives its service revenue from time and materials-based contracts, fixed-price contracts and retainer-based arrangements. Time and materials-based contracts represented 92.6% and 92.3% of service revenue for the three- and six-month periods ended June 30, 2013, respectively. Time and materials-based contracts represented 95.4% and 95.5% of service revenue for the three- and six-month periods ended June 30, 2012, respectively. Revenue under time and materials contracts is recognized as services are rendered and performed at contractually agreed upon rates. Fixed-price contracts represented 4.4% and 4.6% of service revenue for the three- and six-month periods ended June 30, 2013, respectively. Fixed-price contracts represented 1.9% and 1.9% of service revenue for the three- and six-month periods ended June 30, 2012, respectively. Revenue pursuant to fixed-price contracts is recognized under the proportional performance method of accounting. Retainer-based contracts represented 3.0% and 3.1% of service revenue during the three- and six-month periods ended June 30, 2013, respectively. Retainer-based contracts represented 2.7% and 2.6% of service revenue during the three- and six- month periods ended June 30, 2012, respectively. Revenue under retainer-based contracts is recognized ratably over the contract period, as outlined within the respective contract.

Estimates of total project costs are continuously monitored during the term of an engagement. There are situations where the number of hours to complete projects may exceed (or be less than) our original estimate, as a result of an increase (or decrease) in project scope, unforeseen events that arise, or the inability of the client or the delivery team to fulfill their responsibilities. Accordingly, recorded revenues and costs are subject to revision throughout the life of a project based on current information and historical trends. Such revisions may result in increases or decreases to revenue and income and are reflected in the consolidated financial statements in the periods in which they are first identified.

We anticipate that software revenue will continue to be a significant portion of our revenues. Our reported software revenue represents the resale of certain third-party off-the-shelf software and related maintenance (primarily relates to the resale of Microsoft Dynamics AX product) and is recorded on a gross basis provided we act as principal in the transaction, whereby we have credit risk and we set the price to the end user. In the event we do not meet the requirements to be considered a principal in the software sale transaction and act as an agent, software revenue will be recorded on a net basis.

Software revenue is recognized upon delivery, except in the infrequent situation where the Company provides maintenance services, in which case the related maintenance is recognized ratably over the maintenance period (while the software revenue is recognized upon delivery). Software revenue is expected to fluctuate between quarters, dependent on our customers’ demand for such third-party off-the-shelf software. Fluctuations in software revenue may have an impact upon our periodic operating performance, including gross margin.

Prior to the second quarter of 2013, we recorded the majority of our software resale revenue on a gross basis (reporting all of the revenue and cost from the transaction in our statement of operations). However, during the second quarter of 2013, due to changes in the nature of the terms of certain of our Microsoft Dynamics AX software resale arrangements, we began to recognize an increasing portion of our software resale revenue on a net basis (reporting only the net profit from the transaction as revenue in our statement of operations). We expect this trend to continue and also anticipate that the number of new software resale arrangements subject to these terms will increase in future periods. Additionally, the changes in the terms of the resale arrangements will also, in certain situations, extend the timing of the recognition period (from full, immediate recognition of the gross margin on the transaction to recognition of the gross margin on the transaction spread evenly over a three-year period) and reduce the amount of the software gross margin to be recognized by the Company.

17

Table of Contents

Operating Expenses. The largest portion of our operating expenses consists of cash and non-cash compensation and benefits associated with our project consulting personnel and related expenses. Non-cash compensation includes share-based compensation expense arising from restricted stock and option grants to employees. Project personnel expenses also consist of payroll costs and related benefits associated with our professional staff. Other related expenses include travel, subcontracting costs, third-party vendor payments and non-billable expenses associated with the delivery of services to our customers. We consider the relationship between project personnel expenses and service revenue to be an important measure of our operating performance. The relationship between project personnel expenses and service revenue is driven largely by the chargeability of our consultant base, the prices we charge our customers and the non-billable costs associated with securing new customer engagements and developing new service offerings. The remainder of our recurring operating expense is composed of expenses associated with the development of our business and the support of our customer-serving professionals, such as professional development and recruiting, marketing and sales, and management and administrative support. Professional development and recruiting expenses consist primarily of recruiting and training content development and delivery costs. Marketing and sales expenses consist primarily of the costs associated with the development and maintenance of our marketing materials and programs. Management and administrative support expenses consist primarily of the costs associated with operations, including finance, information systems, human resources, facilities (including the rent of office space) and other administrative support for project personnel.

We regularly review our fees for services, professional compensation and overhead costs to ensure that our services and compensation are competitive within the industry and that our overhead costs are balanced with our revenue levels. In addition, we monitor the progress of customer projects with customer senior management. We manage the activities of our professionals by closely monitoring engagement schedules and staffing requirements. However, a rapid decline in the demand for the professional services that we provide could result in lower utilization of our professionals than we planned. In addition, because most of our customer engagements are terminable by our customers without penalty, an unanticipated termination of a customer project could require us to maintain underutilized employees. While professional staff levels must be adjusted to reflect active engagements, we must also maintain a sufficient number of consulting professionals to oversee existing customer engagements and to participate in sales activities to secure new customer assignments.

Adjustments to Fair Value of Contingent Consideration. During the three- and six-month periods ended June 30, 2012, we made adjustments to the estimated fair value of certain acquisition-related contingent consideration liabilities. We remeasure the estimated carrying value of contingent consideration each quarter, with any changes (income or expense) in the estimated fair value recorded as an operating expense. Changes in the carrying value of contingent consideration liabilities may fluctuate significantly in future periods depending on changes in estimates, including probabilities associated with achieving the milestones and the period in which we estimate these milestones will be achieved.

Fullscope Embezzlement Expenses. During fiscal 2010 and continuing through the six-month period ended June 30, 2013, we incurred certain non-routine professional service-related expenses associated with our identification of embezzlement activities at Fullscope, one of our wholly-owned subsidiaries (the “Fullscope Embezzlement Issue”). We incurred a majority of our embezzlement-related expenses during fiscal 2010 in connection with our identification and investigation of the embezzlement activity.

During the second quarter of 2012, the Company increased the previously recorded accrual for pre-acquisition sales and use tax exposure by $550 thousand. As of June 30, 2013, the adjusted accrual for pre-acquisition sales and use tax exposure was $643 thousand. The potential sales and use tax-related liability was created by the methods employed by a former employee of Fullscope to conceal the discovered fraudulent activity. While the Company has accounted for this liability as a period expense, we believe that any amounts actually paid to resolve this issue will be recoverable from an existing, fully funded escrow account in the amount of $4.6 million, which was established in connection with our acquisition of Fullscope. Future amounts recovered, if any, will be recorded by the Company in the period in which the amounts are determined to be probable of recovery from escrow.

We anticipate that we may continue to incur additional expenses associated with the Fullscope Embezzlement Issue as we intend to aggressively pursue recovery through all possible avenues, including a claim against the escrow account established in connection with the Fullscope Acquisition. We anticipate that we will be able to recover some, if not all, of the receivable amounts embezzled during 2010, the professional service expenses we have incurred to-date, or will incur in the future, addressing this situation, and any amounts paid to settle any of the identified sales and use tax liability amounts. Amounts recovered, if any, will be recorded during the period in which settlement is determined to be probable of recovery from escrow.

18

Table of Contents

During the fourth quarter of 2012, the Company began to file tax returns and pay sales and use tax liabilities related to the Fullscope Embezzlement. As of June 30, 2013, the Company has made payments totaling $858 thousand associated with the sales and use tax liabilities. We expect to continue to make payments associated with these liabilities during the third quarter of 2013. The Company fully expects to be reimbursed for payments made in relation to amended sales and use tax returns. However, reimbursement from escrow is not expected until resolution is reached on all outstanding embezzlement-related sales and use tax amounts. Amounts recovered, if any, will be recorded during the period in which settlement is determined to be probable of recovery from escrow.

Company Performance Measurement Systems and Metrics. The Company’s management monitors and assesses its operating performance by evaluating key metrics and indicators on an ongoing basis. For example, we regularly review performance information related to annualized revenue per billable consultant, periodic consultant utilization rates, gross profit margins, average bill rates and billable employee headcount. Edgewater has also developed internal Enterprise Performance Management systems which aid us in measuring our operating performance and consultant utilization rates. The matching of sales opportunities to available skill sets in our consultant base is one of our greatest challenges and therefore, we monitor consultant utilization closely. These metrics, along with other operating and financial performance metrics, are used in evaluating management’s overall performance. These metrics and indicators are discussed in more detail under “Results for the Three and Six Months Ended June 30, 2013, Compared to Results for the Three and Six Months Ended June 30, 2012,” included elsewhere in this Quarterly Report on Form 10-Q.

Results for the Three and Six Months Ended June 30, 2013, Compared to Results for the Three and Six Months Ended June 30, 2012

The financial information that follows has been rounded in order to simplify its presentation. The amounts and percentages below have been calculated using the detailed financial information contained in the unaudited condensed consolidated financial statements, the notes thereto, and the other financial data included in this Quarterly Report on Form 10-Q.

The following table sets forth the percentage of total revenue of items included in our unaudited condensed consolidated statements of operations:

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Revenue: |

||||||||||||||||

| Service revenue |

77.4 | % | 79.4 | % | 80.4 | % | 82.7 | % | ||||||||

| Software revenue |

15.5 | % | 13.3 | % | 12.3 | % | 9.5 | % | ||||||||

| Reimbursable expenses |

7.1 | % | 7.3 | % | 7.3 | % | 7.8 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||

| Cost of revenue: |

||||||||||||||||

| Project and personnel costs |

48.2 | % | 48.0 | % | 52.1 | % | 50.8 | % | ||||||||

| Software costs |

8.7 | % | 9.9 | % | 7.2 | % | 7.0 | % | ||||||||

| Reimbursable expenses |

7.1 | % | 7.3 | % | 7.3 | % | 7.8 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

64.0 | % | 65.2 | % | 66.6 | % | 65.6 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

36.0 | % | 34.8 | % | 33.4 | % | 34.4 | % | ||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

29.1 | % | 31.5 | % | 30.4 | % | 31.5 | % | ||||||||

| Depreciation and amortization |

1.1 | % | 1.6 | % | 1.2 | % | 1.7 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

30.2 | % | 33.1 | % | 31.6 | % | 33.2 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

5.8 | % | 1.7 | % | 1.8 | % | 1.2 | % | ||||||||

| Other expense, net |

0.2 | % | 0.7 | % | 0.4 | % | 0.2 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

5.6 | % | 1.0 | % | 1.4 | % | 1.0 | % | ||||||||

| Income tax provision |

0.5 | % | 0.5 | % | 0.4 | % | 0.4 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

5.1 | % | 0.5 | % | 1.0 | % | 0.6 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

19

Table of Contents

Revenue. Total revenue increased by $713 thousand, or 2.6%, to $27.9 million during the three-month period ended June 30, 2013, compared to total revenue of $27.2 million in the three-month period ended June 30, 2012. Total revenue decreased by $(1.1) million, or (2.1)%, to $51.4 million during the six-month period ended June 30, 2013, compared to total revenue of $52.5 million in the six-month period ended June 30, 2012. With respect to the comparative changes in year-over-year total revenue, service revenue remained at $21.6 million during the comparative 2013 and 2012 quarterly periods, while service revenue during the six-month period ended June 30, 2013 decreased $(2.1) million, or (4.8)%, to $41.3 million, compared to service revenue of $43.4 million during the six-month period ended June 30, 2012. Software revenue represented $4.3 million, or 15.5% of total revenues, during the three-month period ended June 30, 2013, compared to $3.6 million during the second quarter of 2012 and was $6.3 million, or 12.3% of total revenues, during the six-month period ended June 30, 2013, compared to $5.0 million during the first six months of 2012.

On a sequential quarterly basis, service revenue in the second quarter of 2013 increased by $1.9 million, or 9.7%, compared to the first quarter of 2013. The sequential quarterly improvement in service revenue is reflective of the improved sales pipeline activity and project closures we experienced in the latter half of the first quarter of 2013. The timing of the closures, along with continued positive pipeline activity during the second quarter of 2013, combined to provide sufficient delivery backlog to drive sequential quarterly service revenue growth. Both our EPM and Classic Consulting offerings posted strong sequential service revenue growth, while our ERP offering had strong sales closures, benefiting from the cyclical reloading of the Dynamics AX delivery pipeline in connection with Microsoft’s June 30th fiscal year end.

The addition of intellectual property (IP) design and build capabilities to our strategic offerings mix has had a positive impact on our lead generation and overall sales activity. We plan to build out intellectual property in the healthcare, insurance and manufacturing space in future periods.

We believe that our second quarter pipeline closures and current pipeline activity will provide us with sufficient momentum to generate sequential quarterly service revenue growth in the third quarter of 2013, as compared to the second quarter of 2013.

Utilization, which is the rate at which we are able to generate revenue from our consultants, increased to 75.0% during the second quarter of 2013, compared to 73.2% during the second quarter of 2012. Further, billable headcount, including contractors, increased by 12 during the second quarter of 2013, compared to the second quarter of 2012. Second quarter 2013 utilization, on a sequential quarterly basis, improved from 69.0% during the first quarter of 2013 essentially as a result of the relative strength of the delivery pipeline entering the second quarter of 2013, compared to the delivery pipeline entering the first quarter of 2013.

Annualized service revenue per billable consultant, as adjusted for utilization, was $355 thousand and $350 thousand during the three- and six-month periods ended June 30, 2013, which is relatively consistent with our reported annualized service revenue per billable consultant of $362 thousand and $357 thousand during the comparative 2012 three- and six-month periods.

During the three- and six-month periods ended June 30, 2013, software revenue totaled $4.3 million and $6.3 million, or 15.5% and 12.3% of total revenue, respectively, compared to software revenue of $3.6 million and $5.0 million, or 13.3% and 9.5%, respectively, in the three- and six-month periods ended June 30, 2012. Our software revenue is primarily related to our resale of Microsoft Dynamics AX ERP software and maintenance. Software revenue is expected to fluctuate on annual period to period basis dependent upon our customers’ demand for such third-party off-the-shelf software. We anticipate that software revenue will continue to be a significant component of annual revenues in future years. Because of this, we believe that periodic fluctuations in the amount of software revenue recognized by the Company may have a material impact upon our gross margins.

Prior to the second quarter of 2013, we recorded the majority of our software resale revenue on a gross basis (reporting all of the revenue and cost from the transaction in our statement of operations). However, during the second quarter of 2013, due to changes in the nature of the terms of certain of our Microsoft Dynamics AX software resale arrangements, we began to recognize an increasing portion of our software resale revenue on a net basis (reporting only the net profit from the transaction as revenue in our statement of operations). We expect this trend to continue and also anticipate that the number of new software resale arrangements subject to these terms will increase in future periods. Additionally, the changes in the terms of the resale arrangements will also, in certain situations, extend the timing of the recognition period (from full, immediate recognition of the gross margin on the transaction to recognition of the gross margin on the transaction spread evenly over a three-year period) and reduce the amount of the software gross margin to be recognized by the Company.

20

Table of Contents

A significant amount of our 2013 three- and six-month software revenue is associated with the recognition of PI2 license revenue. In June 2012, Microsoft purchased the Company’s internally developed PI2 software and intellectual property (the “PI2 Solution”) for an aggregate purchase price of $3.25 million. The sale of the PI2 Solution was a significant multiple element contract. This contract includes $3.25 million of license consideration and subsequent development and training services. At the time of the sale, we determined that the license did not have stand-alone value without the services, and accordingly we accounted for the license and related services as one unit. Since June 2012, we have recognized the license revenue over the period the expected services are to be performed.

We perform routine periodic reviews of our current and expected performance against the service contracts in connection with our PI2 revenue recognition procedures. During the three months ended June 30, 2013, in conjunction with our periodic review, the Company revised its estimate to complete certain work under the training services agreement. As a result of our revised estimates, we recognized software revenue related to the PI2 transaction of $934 thousand during the second quarter of 2013, which amount is higher than what we have recognized on a recurring quarterly basis since entering the transaction in the second quarter of 2012. We recognized $1.4 million in PI2-related software revenue during the six months ended June 30, 2013. No PI2-related software revenue was recognized during the three- or six-month periods ended June 30, 2012.

Generally, we are reimbursed for our out-of-pocket expenses incurred in connection with our customers’ consulting projects. Reimbursed expense revenue remained consistent, at $2.0 million for the three-month periods ended June 30, 2013 and 2012, respectively. Reimbursed expense revenue decreased $306 thousand, to $3.8 million for the six-month period ended June 30, 2013, as compared to $4.1 million in the comparative 2012 year-to-date period. The aggregate amount of reimbursed expenses will fluctuate from period-to-period depending on the number of billable consultants as well the location of our customers, the general fluctuation of travel costs, such as airfare, and the number of our projects that require travel.

The number of customers the Company served during the six-month period ended June 30, 2013 totaled 314, as compared to 326 customers during the six-month period ended June 30, 2012. During the first six months of 2013, we secured first-time engagements with a total of 46 new customers, compared to 54 new customer engagements during the first six months of 2012.