Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Education Realty Trust, Inc. | a8-kcitiinvestorpresentati.htm |

1

2

Key Themes

Recent Updates

Deep Experienced Management Team

Best-in-Class Portfolio

Stable Industry With Growth Potential

Investment Strategy for Value Creation

Capital Structure to Support Growth

Superior Historical Shareholder Returns

3

Recent Updates

Recent Updates

On-Campus – ONE Plans

• Awarded 7 on-campus deals since start of 2017:

• Lehigh – ONE Plan – ~425 beds – targeting delivery in 2019

• Mississippi State – ONE Plan – ~650 beds – targeting delivery in 2019

• Cornell East Hill Village – ONE Plan - ~470 beds targeting delivery in 2020

• South Carolina – Third-party – ~3,700 beds – targeting deliveries in 2020 – 2024

• Univ. of South FL – St. Petersburg – Third-party – ~550 beds – 2019 or 2020 delivery

• Sacramento State – possible ONE Plan - ~1,100 beds – targeting delivery in 2021

• Umass Dartmouth – Third-party - ~1,200 beds – targeting delivery in 2020

• 82% of ONE Plan assets and 77% of our total portfolio, including active developments,

are at Ivy League and Power 5 conference schools.

Developments and Acquisitions

• Grew collegiate housing assets by 16% in 2017, with $128 million in acquisitions and

delivery of 6 owned developments totaling $281 million.

• Accelerated anticipated delivery of Hawaii development from 2019 to summer 2018.

• Active development pipeline, 7,464 beds for $900 million, represents prefunded growth

in collegiate housing assets of 32% over 12/31/2017.

• Anticipate 2019 development pipeline to be between $117 and $150 million.

4

Recent Updates

Recent Updates

Capital Structure

• Amended revolver, increasing capacity by $100 million to $600 million and extending

maturity for 5 years to 2023.

• Debt to gross assets, net of ATM forward equity, was 21% at 12/31/17 and 27%

forward looking after funding active developments.

• First debt maturity not until 2021.

• $190 million of unsettled ATM forward equity shares available to fund developments.

• Pursuing the disposition of $150 - $225 million of assets in 2018.

2018 New Supply in EdR’s Markets

• Supply growth is expected to outpace enrollment growth by ~60 bps compared to an

average of 64 bps over the last 5 years.

• Six EdR markets are anticipated to be challenging due to three year cumulative supply

in excess of 10%.

• 75% of NOI is from markets where purpose built off-campus student housing is below

the national average of 25% of enrollment, indicating further room for modernization.

• 71% of NOI comes from markets where cumulative supply over the last 3 years was

less than 6% of enrollment or on average less than 2% per year.

5

Recent Updates

Recent Updates

Guidance

• 2018 Core FFO per share/unit guidance range of $1.81 to $1.91, a 2% decline at the

midpoint from 2017.

• Guidance includes no third-party development fees, driving a decline in third-party fees

that equates to an $0.08 decline in Core FFO from 2017.

• Anticipate full year same-community revenue, expense, and NOI growth at the

midpoint to be 1.3%, 3.5% and flat, respectively.

• Projected 2018/2019 leasing results include revenue growth of 2.0% to 4.0% for the

same-leasing portfolio (all communities leased for this and last leasing cycle) and 1.5%

to 3.0% for the 2018 financial same-community portfolio.

• Capital needs during 2018 are projected to be $426 million and are expected to be

funded with $190 million of sold but unsettled ATM forward equity shares, $225 million

of disposition proceeds and the remainder with the revolver.

• Year end leverage is expected to be approximately 26%.

See following page for a comparison of 2018 Core FFO per share/unit guidance at the

midpoint to the results for 2017.

6

Recent Updates

Recent Updates

Guidance (cont.)

The following compares the midpoint of 2018 Core FFO per share/unit guidance to the

results for 2017 (in millions, except per share/unit amounts):

Core FFO

Core FFO per

Share/Unit

Weighted

Average

Shares/Units

Total

Shares/Units

Outstanding

Full Year 2017 $ 141.5 $ 1.90 74.5 76.4

Impact of difference in weighted average shares and shares outstanding

at 12/31/2017 — (0.05) 1.9 —

Increase in community NOI 25.4 0.33 — —

Decrease in third-party fee revenue (6.2) (0.08) — —

Decrease in general and administrative expense 4.3 0.06 — —

Increase in interest expense, net (16.9) (0.22) — —

All other, net 0.2 — — —

Midpoint of 2018 Core FFO guidance without Capital Transactions $ 148.3 $ 1.94 76.4 76.4

Decrease in NOI from asset dispositions (10.4) (0.14) — —

Net impact on interest expense and share count from anticipated

dispositions and settling 4.8 million already sold ATM forward

equity shares 7.0 0.06 1.5 4.8

Midpoint of 2018 Core FFO Guidance with Capital Transactions $ 144.9 $ 1.86 77.9 81.2

7

Deep Experienced Management Team

Deep Experienced Management Team

Executives

Randy Churchey CEO & Chairman 8

Tom Trubiana President 28

Chris Richards COO 16

Bill Brewer CFO 4

Operations

Matt Fulton SVP 19

Frank Witt Regional VP 25

16 Other VPs and Regional Directors 10

Years of Tenure At EdR

Senior Development / Acq 7

Senior Finance and Other 9

Board of Directors (5) – Includes 3 current/former public REIT CEOs, former

CEO of public hospitality company and a former “big 4” audit partner.

8

9

Portfolio Snapshot

Best-in-Class Portfolio

December 31, 2017

Including

Announced

Transactions

Owned communities 70 74

University markets 41 44

Beds 36,420 39,684

Median distance to campus 0.1 miles 0.1 miles

Average distance to campus 0.3 miles 0.3 miles

% of NOI on or pedestrian to campus 90% 92%

% NOI on campus 34% 30%

Average full-time enrollment 27,275 26,675

Average rental rate $816 $ 872

Average age 7 years 7 years

NOTE: Enrollment is based on 2016 full-time enrollment from common data sets. The last column includes announced developments and excludes

anticipated dispositions, with the exception of the recently awarded Cornell – East Hill Village and Sacramento State, which are in preliminary stages.

10

Portfolio Characteristics

Best-in-Class Portfolio

HIGH DEMAND

UNIVERSITIES

1.8x

APPLICATION

TO ADMITTANCE

RATIO

(1) Represents our communities’ relative position in their respective market, based on a comparison of average rents to local

competitors. Includes only open and operating communities.

81%

OF BEDS SERVE

UNIVERSITIES

WITH >20,000

ENROLLMENT

12%

56%

33%

R

e

n

t

s

R

e

l

a

t

i

v

e

t

o

C

o

m

p

s

.

Well Positioned(1)

Low End Average

High End

44%

28%

23%

5%

Diverse Product

Mid-Rise High-Rise

Garden2 Cottage2

11

Strong Operating Performance

Best-in-Class Portfolio

Source: Respective financial supplements.

$397

$783

2010 2017

Same-Community NAR

per Occupied Bed

51%

60%

2010 2017

Same-Community

Margins

12

Market Leading Internal Growth

Best-in-Class Portfolio

Source: Respective company’s disclosures. EdR’s proprietary leasing system, PILOT, which tracks market trends and

leasing velocity by unit type, gives EdR the tools to produce consistent and market leading leasing results.

Market-Leading

Leasing Results in

3 of Last 5

Years

3.3% 3.4%

2.7%

3.0%

Revenue NOI

EdR ACC

Same-Community Growth

Seven-Year CAGR Through December 2017

13

14

Stable Demand

Stable Industry With Growth Potential

Projected Full-Time Enrollment Growth

Projected Average % Growth 2016-2025 = 1.4%

Sources: National Center for Education Statistics (NCES) report titled “Projections of Education Statistics to 2025, Forty-fourth edition" (Sept 2017),

Pew Research - Social & Demographic Trends: The Rising Cost of Not Going to College, February 11, 2014, Moody’s Investors Service, Special

Comment: More US Colleges Face Stagnating Enrollment and Tuition Revenue, According to Moody’s Survey, Jan. 10, 2013.

Enrollment Drivers

• Earnings gap between high school and college

graduates has stretched to its widest level in nearly a

half century

• US high school graduates will increase by an

average annual rate of 0.6% between 2016 and 2025

• Students seek the highest value education

• There is a correlation between university size and

enrollment trends, with the highest median

enrollment growth experienced at large, program-

diversified universities.

• Enrollment at public four-year institutions has out

performed four-year private and for-profit institutions

as well as two-year institutions

1.3%

2.3% 2.0%

1.5%

1.1% 1.3%

1.2% 1.3% 1.1%

0.4%

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

15

2016 Enrollment Growth

Stable Industry With Growth Potential

2016 enrollment at post-secondary institutions

declined 1.4%, driven mainly by a large drop at

for-profit and 2-year institutions.

• Decline at 4-Year Private institutions mainly

isolated to small schools with <3,000 students

• 4-year public schools experienced enrollment

growth

Sources: Wall Street Journal article titled "College Enrollment Drops 1.4% as Adults Head Back to Work" (Dec. 2016), National Student Clearinghouse Research

Center. Enrollment growth for EdR markets comes from either university common data sets or IPEDS.

• Average enrollment across EdR portfolio is

over 27,000

• Enrollment at EdR universities served is

consistent with prior years and outpaces the

average

• International students represent

approximately 5% of all university students

EdR's focus on larger tier 1 universities produces stronger enrollment growth.

-1.4%

-14.5%

-2.6%

-0.6%

0.2% 1.1%

All Institutions For-Profit 2-Year 4-Year Private 4-Year Public EdR Markets

E

n

r

o

l

l

m

e

n

t

G

r

o

w

t

h

Growth by Market

16

Manageable Supply

Stable Industry With Growth Potential

EdR Markets – Supply, Enrollment and Revenue Growth

Note: Source is Company and AXIOMetrics data. 2013 through 2017 data represents the portfolio as it was in each respective year.

(1) Data includes the existing portfolio plus 2017 developments. The estimated enrollment growth is based on the 3-year enrollment CAGR through 2016 for the included

communities.

(2) The estimated enrollment growth is based on the 3-year enrollment CAGR through 2016 for the included communities.

(3) Represents the midpoint of 2018/2019 leasing guidance.

(14%) (23%) (22%)

2013 2014 2015 2016 2017(1) 2018 Est(2)

EdR Markets:

New supply as % of enrollment 2.2% 2.2% 2.0% 1.8% 2.1% 1.9%

Enrollment growth 1.3% 1.4% 1.5% 1.5% 1.4% 1.3%

Difference 0.9% 0.8% 0.5% 0.3% 0.7% 0.6%

Same-community leasing results:

Occupancy increase/(decrease) 3.0% 2.0% 0.4% (1.1)% (1.2)%

Rate increase 2.0% 2.0% 3.4% 3.4 % 3.0%

Total leasing revenue growth 5.0% 4.0% 3.8% 2.3 % 1.8% 3.0%(3)

• 2018 supply to enrollment gap improved

compared to last 5 years.

• Averaged 3.4% revenue growth over

last 5 years.

•Favorable environment for future muted supply

▪ Increasing land and construction costs

▪ Tighter construction lending market

17

Modernization

Stable Industry With Growth Potential

Modernization is in full swing with new purpose-built housing

supply replacing older duplexes, single-family homes, etc.

Source: Company and AXIOMetrics data. Represents EdR’s markets.

Other Housing

49%On‐Campus

Housing 27%

Off‐Campus

Purpose Built

24%

18

Consistent and Stable Revenue Growth

Stable Industry With Growth Potential

Student Housing - 52 consecutive quarters with same store revenue growth.

Source: SNL Financial and Goldman Sachs Global Investment Research

3.0%

Average

3.5%

Average

-6%

-4%

-2%

0%

2%

4%

6%

8%

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

S

a

m

e

S

t

o

r

e

R

e

v

e

n

u

e

G

r

o

w

t

h

,

y

/

y

Student Housing Apartment

19

20

2018 – 2019 development deliveries $900mm

Median distance to campus 0.1 miles

Average distance to campus 0.3 miles

Average full-time enrollment 26,675

Average development yields 6.5% - 7.0%

32%

GROWTH IN

COLLEGIATE

HOUSING

ASSETS FROM 2017

29%OF

DEVELOPMENTS

ARE ON-CAMPUS

Embedded External Growth

Investment Strategy for Value Creation

Note: Does not include the University or Cornell – East Hill Village and Sacramento State developments as

details are not yet finalized.

21

Quality Development Pipeline

Investment Strategy for Value Creation

29%

ON-CAMPUS(1)

96%

ADJACENT TO

OR

ON-CAMPUS (1)

(1) Includes announced developments.

22

5.00%

5.00%

1.50% - 1.75%

0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00%

Development Yields

Market Cap Rates

Acquisition Cap Rates Development Premium

Development Premiums Drive Growth

Investment Strategy for Value Creation

Yield Premium For Low-Risk Developments(1)

(1) Current market cap rates for adjacent to campus assets in EdR type markets range from 4.50 to 5.25%.

30% Premium

23

Development

Year

Percentage

On-Campus

Budgeted

Total Cost

EdR’s

Economic

Ownership

Cost

Market

Value(1)

Additional

AV Creation

Incremental

NAV per

Share

2018 Deliveries 18% $783 $648 $843 $195 $1.93

2019 Deliveries 100% $118 $118 $180 $62 $0.62

Total Active

Developments 29% $901 $766 $1,023 $257 $2.55

Value Creation from Announced Developments

Investment Strategy for Value Creation

(1) Based on a 6.5% average project yield and cap rates of 4.25% for on-campus and 5.25% for off-campus developments.

in Millions, except

per share data

34% Value Creation

24

EdR’s

Share of

Cost

(in millions)

First Year

Occupancy

Second Year

Occupancy

First-Year

Economic

Yield

2017 Deliveries $271 87.9% N / A 6.5% - 7%(1)

2016 Deliveries $158 91.1% 92.6% 7.3%

2015 Deliveries $180 94.1% 99.1% 7.5%

2014 Deliveries $263 94.4% 95.0% 7.7%

2013 Deliveries $192 92.4% 98.9% 7.4%

2012 Deliveries $91 96.7% 99.3% 9.1%

Total / Average $1,155 92.3% 96.5% 7.8%

Note: Excludes any unconsolidated joint ventures.

(1) Represents average proforma first-year economic yields

EdR developments have opened with average first year occupancy of 92.3% and first-year economic yields above 7%

Student Housing Developments Less Risky

• Delivering to stable market demand

• Campuses expand but don’t move

• Construction risk passed to general

contractor

• Developments on or adjacent to campus

Successful Development Delivery

Investment Strategy for Value Creation

25

Investment Strategy for Value Creation

26

On-Campus Market Context

Investment Strategy for Value Creation

University Market Trends

▪ Reduction in state funding

▪ Demographic shifts

▪ Significant deferred maintenance

▪ Increasing competitiveness for

students

▪ On-campus students perform better

Main Reasons Universities Pursue P3s

▪ Funding shortfalls

▪ Risk transfer

▪ Operational efficiencies

▪ Project efficiencies

▪ Debt control

Enrollment

Growth

7.2%

State

Appropriations

(14.6%)

Source: Center on Budget & Policy Priorities, Aon Infrastructure Solutions and P3C Conference Survey Report.

(‘07 to ’14)

(‘07 to ’14)

27

Public REITs Dominate Equity P3s

Investment Strategy for Value Creation

NOTE: Combined public company results from company financial supplements.

$0.3

Billion

$1.8

Billion

2009 2017

Delivered On-Campus

Equity Developments

Significant Competitive Advantages

Proven on-campus development and

management expertise

Well-capitalized balance sheet

Size and depth of resources

Public company transparency

Long-term owner of assets

28

ONE Plan History

Investment Strategy for Value Creation

• Best risk-adjusted return

• Currently 34% NOI from on-campus

assets

• Recently awarded Lehigh University,

Mississippi State and second

development at Cornell

• Robust pipeline of opportunities

(1) Based on average economic yield of 6.5% and cap rate of 4.25%

(2) Current and announced ONE Plan investments, except for the recently awarded developments at Cornell – East Hill Village and Sacramento State as

details are not yet finalized.

$26 $81 $111

$204

$342

$443

$527

$718

$833

$951

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

ONE Plan investments

Market Value(1)

$1,454

Year-End Cumulative Cost

in Millions

(2)

49%

CAGR

29

On-Campus Market Continues to Grow

Investment Strategy for Value Creation

Boise State University Honors Housing

Northern Michigan University

30+ Active on-campus opportunities

New housing growth: South / West

Replacement housing: Midwest / Northeast

Growth in university systems

Growth in top tier privates

30

31

Approach to Funding Capital Commitments

Capital Structure to Support Growth

• Investment Grade Rated Balance Sheet (recent upgrade to Baa2 by Moody’s)

• Capital commitments include developments and acquisitions we are contractually

obligated to complete

• Maintain forward looking debt to gross asset target range of 25% - 30%

• Capital sources include cash on hand, cash from operations, sold but unsettled

ATM forward equity shares, current debt facilities, capital recycling and equity

issuance depending on market conditions and economics

• ATM is most efficient source of equity due to low execution cost and ability to do

over time as capital is needed. Forward option on ATM protects against current

dilution.

• Sold $505 million in assets since 2010, representing 73% of the assets owned at

the beginning of 2010

• Every incremental development or acquisition commitment requires equity

funding or capital recycling of 70% - 75% to maintain debt to gross asset range

32

Capital Commitments and Funding

Capital Structure to Support Growth

Estimated Capital Commitments:

Total Project

Development

Cost

Acquisition or

Development Costs

funded by EdR

(Excludes Partner

Contributions)

Cost Incurred to

Date

Remaining Capital

Needs

2018 Development deliveries $ 783 $ 743 $ 371 $ 372

2019 Development deliveries 118 118 2 116

Total Capital Commitments $ 901 $ 861 $ 373 $ 488

Estimated Capital Funding: 2018 Thereafter Capital Sources

Disposition proceeds $ 225 $ — $ 225

Equity proceeds, available from ATM forward sales 190 — 190

Additional debt, including draws on Line of Credit 11 62 73

Total Capital Funding $ 426 $ 62 $ 488

12/31/2017

Pro Forma for

Funding Needs

Through

12/31/2018

Pro Forma for

Funding Needs

Through 12/31/2019

Debt to Gross Assets(1) 28% 26% 27%

Note: Capital Commitments include EdR’s share of announced and active developments. See the Fourth Quarter 2017 Financial Supplement for further details.

(1) Debt to gross assets is defined as total debt, excluding deferred financing costs, divided by gross assets, or total assets excluding accumulated depreciation on real estate assets.

33

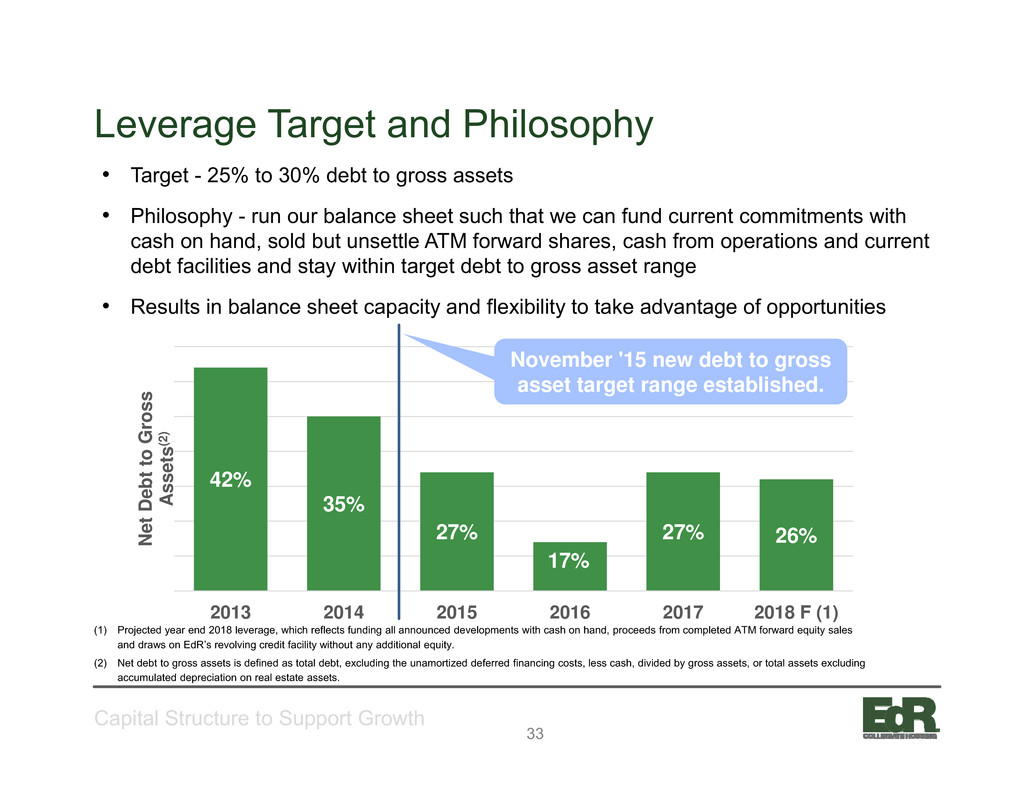

Leverage Target and Philosophy

Capital Structure to Support Growth

• Target - 25% to 30% debt to gross assets

• Philosophy - run our balance sheet such that we can fund current commitments with

cash on hand, sold but unsettle ATM forward shares, cash from operations and current

debt facilities and stay within target debt to gross asset range

• Results in balance sheet capacity and flexibility to take advantage of opportunities

(1) Projected year end 2018 leverage, which reflects funding all announced developments with cash on hand, proceeds from completed ATM forward equity sales

and draws on EdR’s revolving credit facility without any additional equity.

(2) Net debt to gross assets is defined as total debt, excluding the unamortized deferred financing costs, less cash, divided by gross assets, or total assets excluding

accumulated depreciation on real estate assets.

42%

35%

27%

17%

27% 26%

2013 2014 2015 2016 2017 2018 F (1)

N

e

t

D

e

b

t

t

o

G

r

o

s

s

A

s

s

e

t

s

(

2

)

November '15 new debt to gross

asset target range established.

34

Debt Metrics as of December 31, 2017

Capital Structure to Support Growth

Source: Company financial supplements and KeyBanc Corp; Debt includes any outstanding preferred equity

(1) Net debt to gross assets is defined as total debt, excluding the unamortized deferred financing costs, less cash, divided by gross assets, or total assets excluding accumulated depreciation on

real estate assets.

(2) Adjusted EBITDA is defined as GAAP net income excluding: (1) straight line adjustment for ground leases; (2) acquisition costs; (3) depreciation and amortization; (4) loss on impairment of

collegiate housing assets; (5) gain on sale of collegiate housing properties; (6) interest expense, net of capitalized interest and interest income; (7) amortization of deferred financing costs; (8)

income tax expense (benefit); (9) non-controlling interests; (10) other operating expense related to noncash adjustments; (11) loss on extinguishment of debt and (12) other non-operating

expense (income).

(3) Interest coverage is adjusted EBITDA divided by interest expense.

27%

38%

48%

Net Debt To

Gross Assets(1)

6.0X

6.8X 6.8X

Debt to EBITDA(2)

5.3X

4.2X

3.1X

Interest

Coverage(3)

35

Current Capital Structure

Capital Structure to Support Growth

• Conservative Leverage Levels

• Debt to Gross Assets: 21%, net of

unsettled ATM forward equity

• Net Debt to Adjusted EBITDA: 3.3x

• No Secured Debt

• Strong Coverage Levels

• Interest Coverage Ratio: 5.3x

• Well-staggered debt maturities

• $600 million unsecured Credit Facility

expandable to $1 billion(1)

• $190 million sold but not yet settled ATM

forward equity

• Attractive dividend(2)

• Dividend Yield: 5.0%

(1) In February 2018, the unsecured revolving credit facility was amended to extend the maturity until February 2023 and to expand the maximum availability to $600 million.

(2) Based on current annual dividend of $1.56 and stock price of $31.05 on February 27, 2018.

$123

$65

$250

$349

$150

2018 2019 2020 2021 2022 2023 2024 2025+

Debt Maturities as of December 31,

2017 (in Millions)

Unsecured Private Placement Notes

Unsecured revolving credit facility (1)

Unsecured Senior Notes

Unsecured Term Loan - Fixed Rate

Construction Loans - Variable Rate

36

37

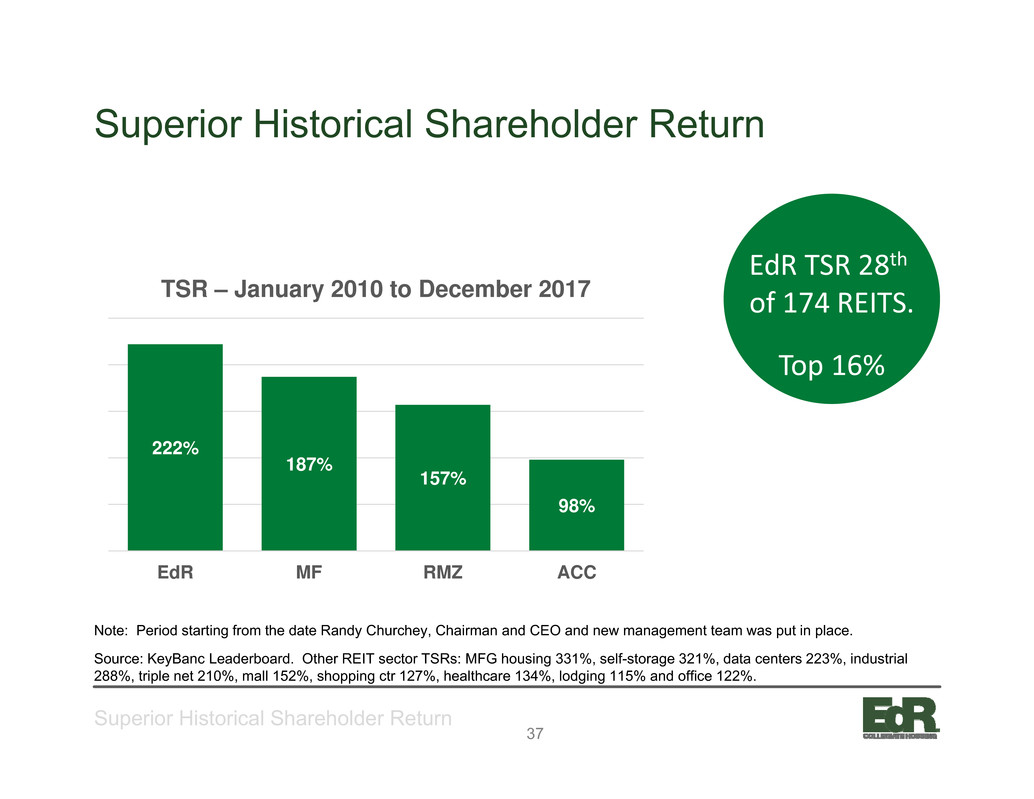

Superior Historical Shareholder Return

Superior Historical Shareholder Return

Note: Period starting from the date Randy Churchey, Chairman and CEO and new management team was put in place.

Source: KeyBanc Leaderboard. Other REIT sector TSRs: MFG housing 331%, self-storage 321%, data centers 223%, industrial

288%, triple net 210%, mall 152%, shopping ctr 127%, healthcare 134%, lodging 115% and office 122%.

222%

187%

157%

98%

EdR MF RMZ ACC

TSR – January 2010 to December 2017

EdR TSR 28th

of 174 REITS.

Top 16%

39

Safe Harbor Statement

Statements about the Company’s business that are not historical facts are “forward-looking

statements,” which relate to expectations, beliefs, projections, future plans and strategies,

anticipated events or trends, and similar expressions. In some cases, you can identify forward-

looking statements by the use of forward-looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or the

negative of these words and phrases or similar words or phrases which are predictions of or

indicate future events or trends and which do not relate solely to historical matters. Forward-

looking statements are based on current expectations. You should not rely on our forward-looking

statements because the matters that they describe are subject to known and unknown risks and

uncertainties that could cause the Company’s business, financial condition, liquidity, results of

operations, Core FFO, FFO and prospects to differ materially from those expressed or implied by

such statements. Such risks are set forth under the captions “Risk Factors,” “Forward-Looking

Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” (or similar captions) in our most recent Annual Report on Form 10-K and our quarterly

reports on Form 10-Q, and as described in our other filings with the Securities and Exchange

Commission. Forward-looking statements speak only as of the date on which they are made, and,

except as otherwise may be required by law, the Company undertakes no obligation to update

publicly or revise any guidance or other forward-looking statement, whether as a result of new

information, future developments, or otherwise, except as required by law.