Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Simulations Plus, Inc. | simulations_8k-022618.htm |

Exhibit 99.1

(NASDAQ:SLP) Annual Shareholders’ Meeting February 26, 2018

• Chairman : Walt Woltosz • Welcome and Introductions • Chairman’s Remarks • Chief Financial Officer: John Kneisel • Discussion of Voting Issues • Financial presentation • John DiBella, President Lancaster Division of Simulations Plus • Ted Grasela, Ph.D., President , Cognigen • Brett Howell, Ph.D President, DILIsym Services (North Carolina) • Questions & Answers • Adjournment of Official Meeting Agenda 2

Safe Harbor Statement With the exception of historical information, the matters discussed in this presentation are forward - looking statements that involve a number of risks and uncertainties . The actual results of the Company could differ significantly from those statements . Factors that could cause or contribute to such differences include, but are not limited to : continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity . Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission . 3

Management & Directors • Board of Directors: – Thaddeus H. “Ted” Grasela, Pharm D., Ph.D ., Director and President and Founder, Cognigen Corporation – John K. Paglia Ph.D., CFA, CPA, Director • Associate Dean; Associate Professor of Finance, Pepperdine University – David Ralph, Ph.D., Director • Chair, Department of Economics, Law & Marketing, Pepperdine University – Daniel L. Weiner, Ph.D., Director • Adjunct Professor University of Maryland and North Carolina and Pharmaceutical Industry Consultant specializing in Model Based Drug Development – Walter S. Woltosz, M.S., M.A.S., Chairman & CEO. • Co - founder, Simulations Plus, Inc. • Senior Management Team – John R. Kneisel, CPA, Chief Financial Officer, Simulations Plus – John DiBella, M.S., President, Lancaster Division of Simulations Plus – Michael B. Bolger, Ph.D., Chief Scientist, Lancaster Division of Simulations Plus – Cindy Walawander, M.A., Vice President, Operations , Cognigen – Jill Fielder - Kelly, M.S., Vice President, Pharmacometric Services , Cognigen – Brett Howell, President DILIsym Services, Inc. North Carolina Division – Scott Siler Ph.D., Chief Scientist DILIsym Services, Inc 4

• Registered Independent Auditors • Rose, Snyder, & Jacobs LLP, Encino, CA • Tax Specialists • Rose, Snyder, & Jacobs LLP, Encino, CA • Legal Counsel • Procopio, Cory, Hargreaves, & Savitch LLP Outside Counsels 5

• Major provider of simulation and modeling software for pharmaceutical research and development • Consulting services for problem drugs and formulations • Leader in Drug Induced Liver Injury (DILI) simulation sciences • Expertise and software tools span from earliest drug discovery through clinical trials and beyond patent life to supporting generic companies • Completed 3 years since our Acquisition of Cognigen Corp. in September 2014 • A cquired DILIsym Services Inc. of North Carolina in June 2017, the leader in Drug Induced Liver Injury simulation and consulting • September 2017, management reorganization by division to better support structure and strategy implementation • Currently distributing dividends at an estimate rated of $0.24/year per share ($0.06/quarter), subject to board approval each quarter. Up from $0.20 prior year. Simulations Plus, Inc. Overview 6

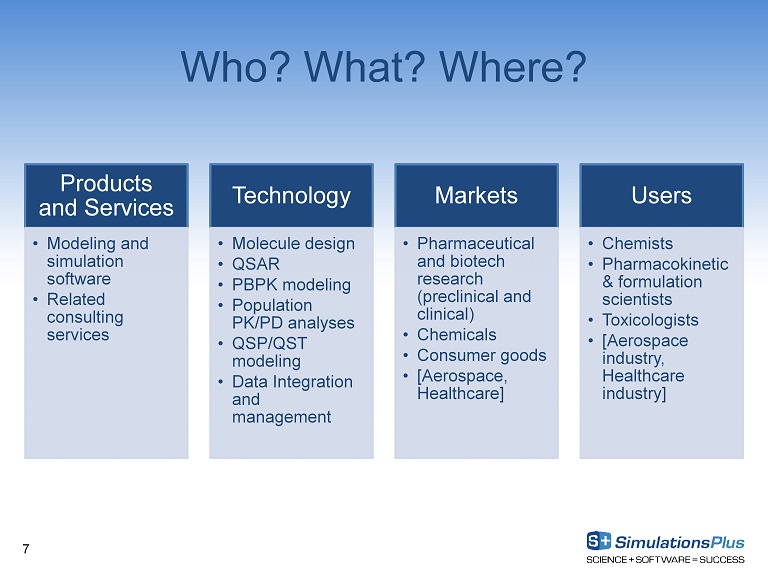

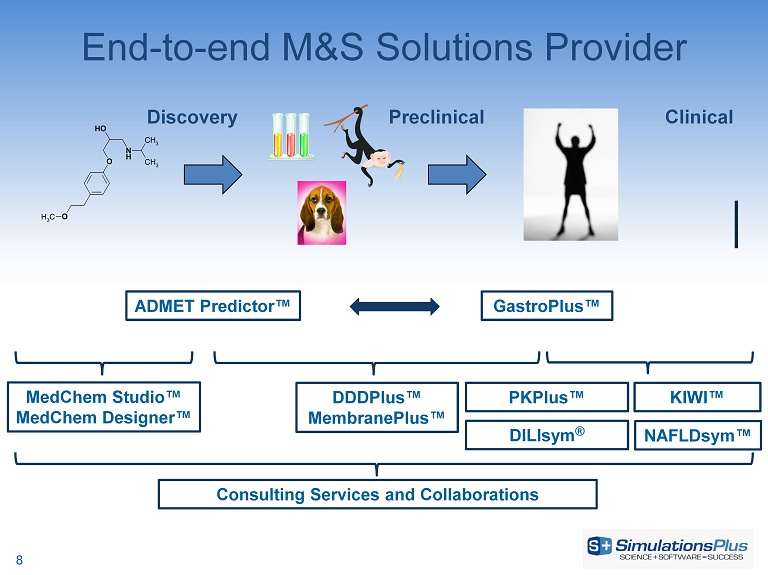

Products and Services • Modeling and simulation software • Related consulting services Technology • Molecule design • QSAR • PBPK modeling • Population PK/PD analyses • QSP/QST modeling • Data Integration and management Markets • Pharmaceutical and biotech research (preclinical and clinical) • Chemicals • Consumer goods • [Aerospace, Healthcare ] Users • Chemists • Pharmacokinetic & formulation scientists • Toxicologists • [Aerospace industry, Healthcare industry] Who? What? Where? 7

N H O OH O CH 3 CH 3 CH 3 ADMET Predictor™ GastroPlus ™ MedChem Studio™ MedChem Designer™ DDDPlus ™ MembranePlus™ Consulting Services and Collaborations Discovery Preclinical Clinical PKPlus™ KIWI™ End - to - end M&S Solutions Provider DILIsym ® NAFLDsym™ 8

• PROXY Resolutions and Results • Financial Presentation John Kneisel, CFO 9

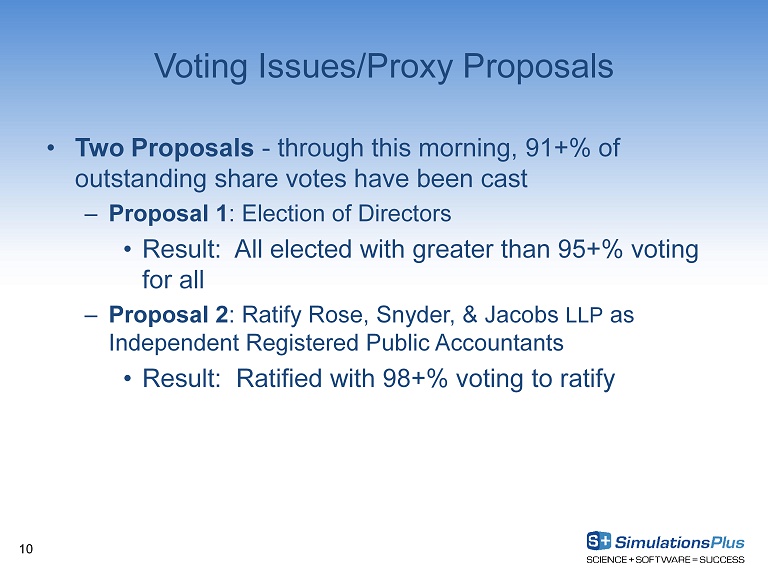

10 • Two Proposals - through this morning, 91+% of outstanding share votes have been cast – Proposal 1 : Election of Directors • Result: All elected with greater than 95+% voting for all – Proposal 2 : Ratify Rose, Snyder, & Jacobs LLP as Independent Registered Public Accountants • Result: Ratified with 98+% voting to ratify Voting Issues/Proxy Proposals

• FY2017 ended August 31, 2017 vs. FY2016 • 1QFY2018 ended November 30, 2017 vs 1QFY2017 • Balance Sheet Highlights • Financial Charts Financial Presentation 11

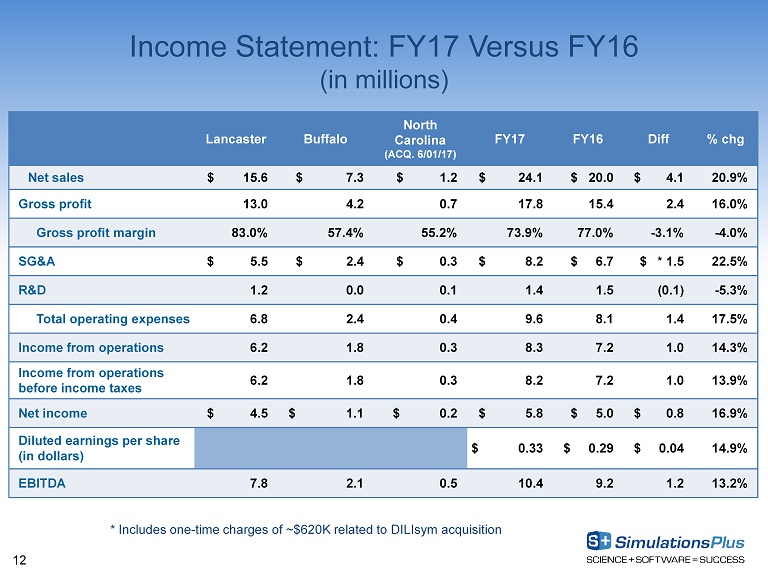

12 Income Statement: FY17 Versus FY16 (in millions) Lancaster Buffalo North Carolina (ACQ. 6/01/17) FY17 FY16 Diff % chg Net sales $ 15.6 $ 7.3 $ 1.2 $ 24.1 $ 20.0 $ 4.1 20.9% Gross profit 13.0 4.2 0.7 17.8 15.4 2.4 16.0% Gross profit margin 83.0% 57.4% 55.2% 73.9% 77.0% - 3.1% - 4.0% SG&A $ 5.5 $ 2.4 $ 0.3 $ 8.2 $ 6.7 $ * 1.5 22.5% R&D 1.2 0.0 0.1 1.4 1.5 (0.1) - 5.3% Total operating expenses 6.8 2.4 0.4 9.6 8.1 1.4 17.5% Income from operations 6.2 1.8 0.3 8.3 7.2 1.0 14.3% Income from operations before income taxes 6.2 1.8 0.3 8.2 7.2 1.0 13.9% Net income $ 4.5 $ 1.1 $ 0.2 $ 5.8 $ 5.0 $ 0.8 16.9% Diluted earnings per share (in dollars) $ 0.33 $ 0.29 $ 0.04 14.9% EBITDA 7.8 2.1 0.5 10.4 9.2 1.2 13.2% * Includes one - time charges of ~$620K related to DILIsym acquisition

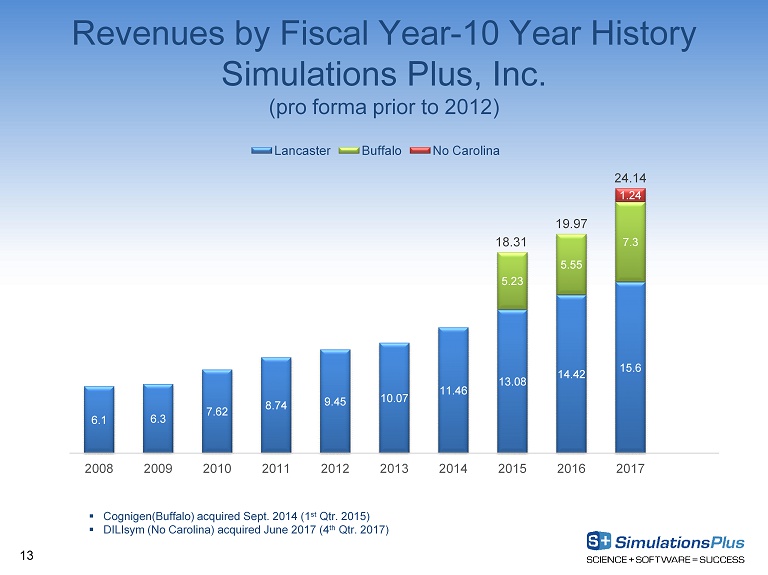

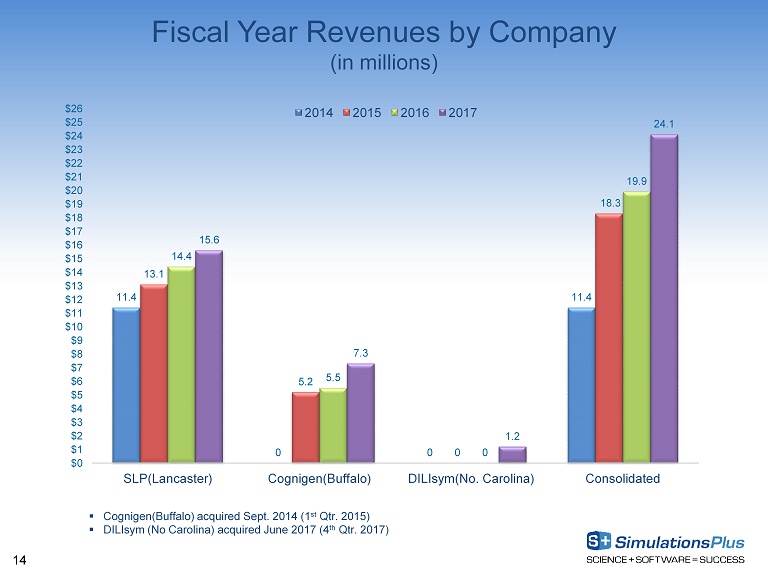

Revenues by Fiscal Year - 10 Year History Simulations Plus, Inc. (pro forma prior to 2012) 6.1 6.3 7.62 8.74 9.45 10.07 11.46 13.08 14.42 15.6 5.23 5.55 7.3 1.24 18.31 19.97 24.14 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Lancaster Buffalo No Carolina 13 ▪ Cognigen(Buffalo) acquired Sept. 2014 (1 st Qtr. 2015) ▪ DILIsym (No Carolina) acquired June 2017 (4 th Qtr. 2017)

14 Fiscal Year Revenues by Company (in millions) 11.4 0 0 11.4 13.1 5.2 0 18.3 14.4 5.5 0 19.9 15.6 7.3 1.2 24.1 $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 $11 $12 $13 $14 $15 $16 $17 $18 $19 $20 $21 $22 $23 $24 $25 $26 SLP(Lancaster) Cognigen(Buffalo) DILIsym(No. Carolina) Consolidated 2014 2015 2016 2017 ▪ Cognigen(Buffalo) acquired Sept. 2014 (1 st Qtr. 2015) ▪ DILIsym (No Carolina) acquired June 2017 (4 th Qtr. 2017)

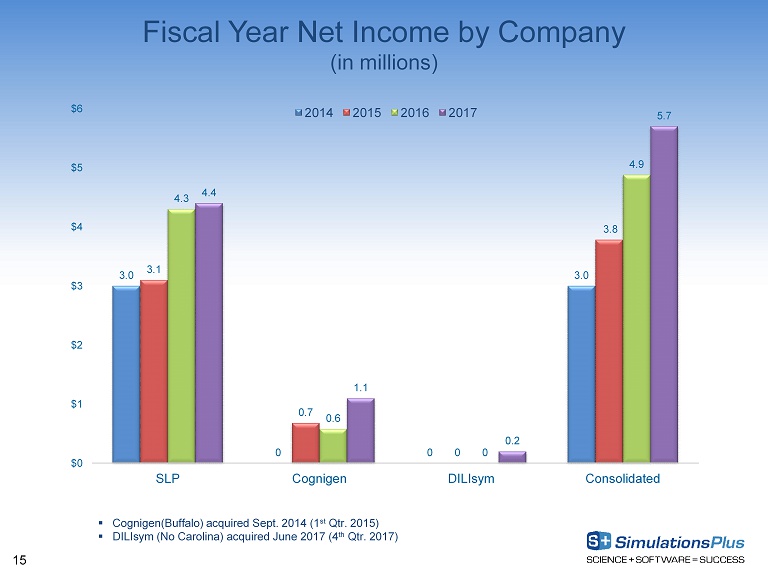

15 Fiscal Year Net Income by Company (in millions) 3.0 0 0 3.0 3.1 0.7 0 3.8 4.3 0.6 0 4.9 4.4 1.1 0.2 5.7 $0 $1 $2 $3 $4 $5 $6 SLP Cognigen DILIsym Consolidated 2014 2015 2016 2017 ▪ Cognigen(Buffalo) acquired Sept. 2014 (1 st Qtr. 2015) ▪ DILIsym (No Carolina) acquired June 2017 (4 th Qtr. 2017)

16 Consolidated Diluted Earnings Per Share $0.18 $0.23 $0.29 $0.33 $ - $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 FY14 FY15 FY16 FY17

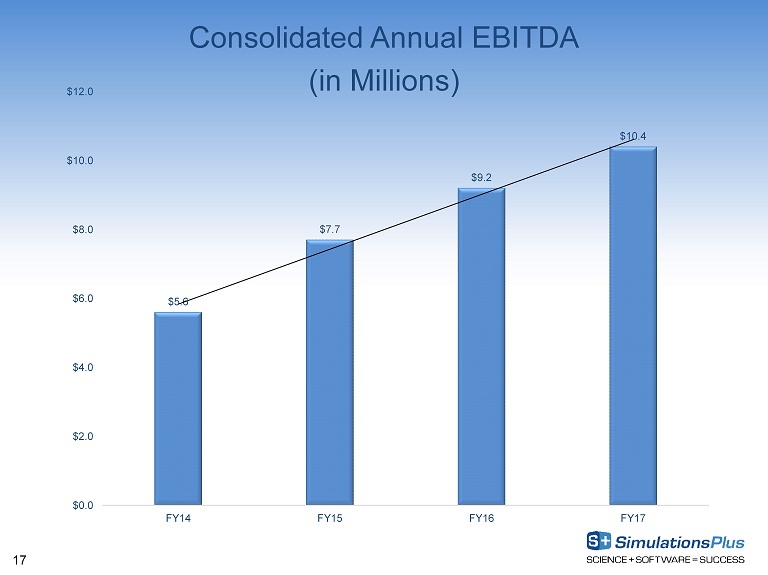

17 Consolidated Annual EBITDA (in Millions) $5.6 $7.7 $9.2 $10.4 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 FY14 FY15 FY16 FY17

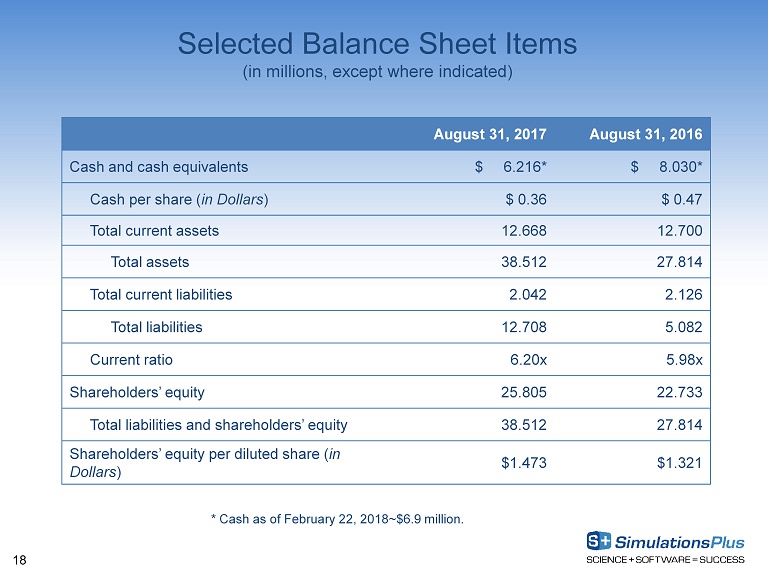

18 Selected Balance Sheet Items (in millions, except where indicated) August 31, 2017 August 31, 2016 Cash and cash equivalents $ 6.216* $ 8.030* Cash per share ( in Dollars ) $ 0.36 $ 0.47 Total current assets 12.668 12.700 Total assets 38.512 27.814 Total current liabilities 2.042 2.126 Total liabilities 12.708 5.082 Current ratio 6.20x 5.98x Shareholders’ equity 25.805 22.733 Total liabilities and shareholders’ equity 38.512 27.814 Shareholders’ equity per diluted share ( in Dollars ) $1.473 $1.321 * Cash as of February 22, 2018~$6.9 million.

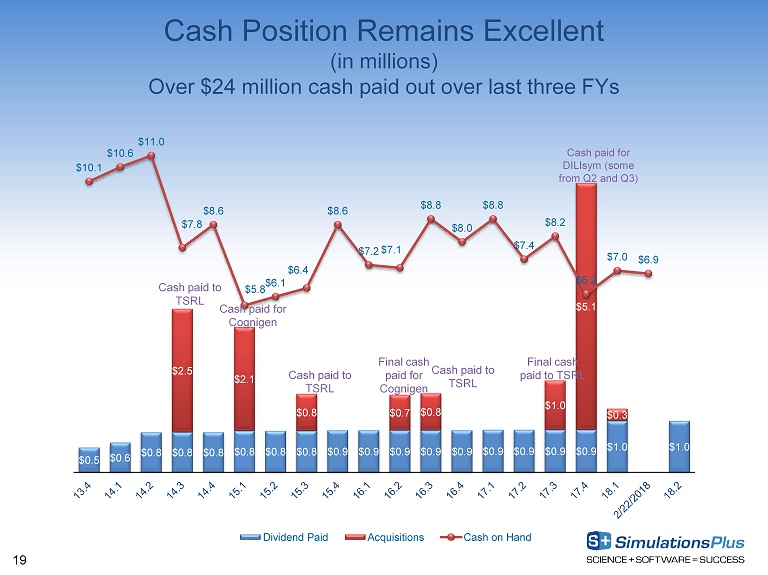

19 Cash Position Remains Excellent (in millions) Over $24 million cash paid out over last three FYs $0.5 $0.6 $0.8 $0.8 $0.8 $0.8 $0.8 $0.8 $0.9 $0.9 $0.9 $0.9 $0.9 $0.9 $0.9 $0.9 $0.9 $1.0 $1.0 $2.5 $2.1 $0.8 $0.7 $0.8 $1.0 $5.1 $0.3 $10.1 $10.6 $11.0 $7.8 $8.6 $5.8 $6.1 $6.4 $8.6 $7.2 $7.1 $8.8 $8.0 $8.8 $7.4 $8.2 $6.2 $7.0 $6.9 Dividend Paid Acquisitions Cash on Hand Cash paid to TSRL Cash paid for Cognigen Final cash paid for Cognigen Cash paid for DILIsym (some from Q2 and Q3) Cash paid to TSRL Cash paid to TSRL Final cash paid to TSRL

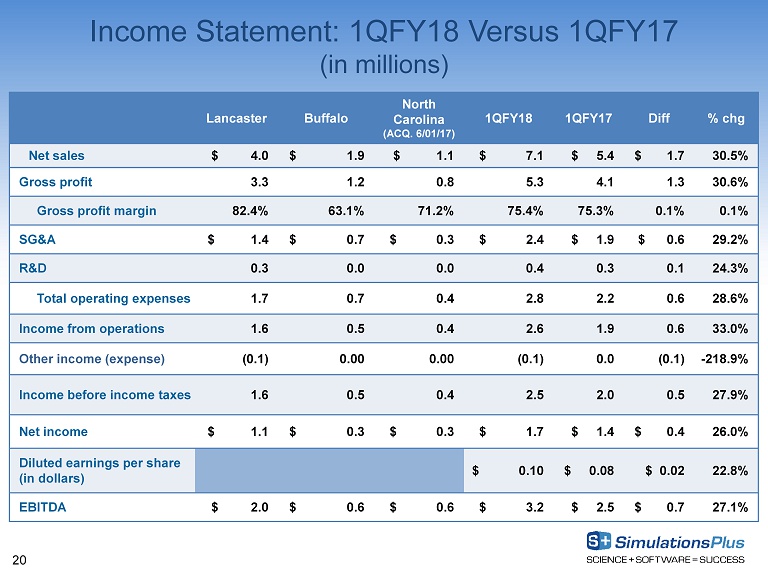

20 Income Statement: 1QFY18 Versus 1QFY17 (in millions) Lancaster Buffalo North Carolina (ACQ. 6/01/17) 1QFY18 1QFY17 Diff % chg Net sales $ 4.0 $ 1.9 $ 1.1 $ 7.1 $ 5.4 $ 1.7 30.5% Gross profit 3.3 1.2 0.8 5.3 4.1 1.3 30.6% Gross profit margin 82.4% 63.1% 71.2% 75.4% 75.3% 0.1% 0.1% SG&A $ 1.4 $ 0.7 $ 0.3 $ 2.4 $ 1.9 $ 0.6 29.2% R&D 0.3 0.0 0.0 0.4 0.3 0.1 24.3% Total operating expenses 1.7 0.7 0.4 2.8 2.2 0.6 28.6% Income from operations 1.6 0.5 0.4 2.6 1.9 0.6 33.0% Other income (expense) (0.1) 0.00 0.00 (0.1) 0.0 (0.1) - 218.9% Income before income taxes 1.6 0.5 0.4 2.5 2.0 0.5 27.9% Net income $ 1.1 $ 0.3 $ 0.3 $ 1.7 $ 1.4 $ 0.4 26.0% Diluted earnings per share (in dollars) $ 0.10 $ 0.08 $ 0.02 22.8% EBITDA $ 2.0 $ 0.6 $ 0.6 $ 3.2 $ 2.5 $ 0.7 27.1%

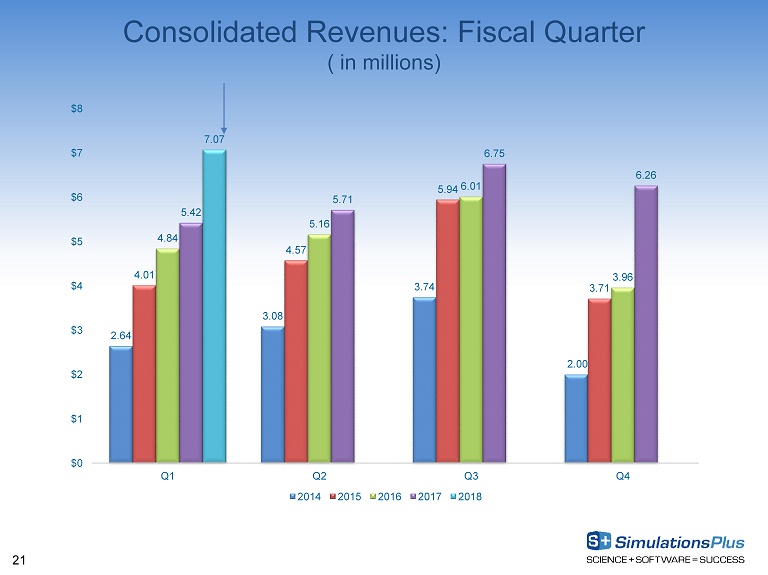

21 Consolidated Revenues: Fiscal Quarter ( in millions) 2.64 3.08 3.74 2.00 4.01 4.57 5.94 3.71 4.84 5.16 6.01 3.96 5.42 5.71 6.75 6.26 7.07 $0 $1 $2 $3 $4 $5 $6 $7 $8 Q1 Q2 Q3 Q4 2014 2015 2016 2017 2018

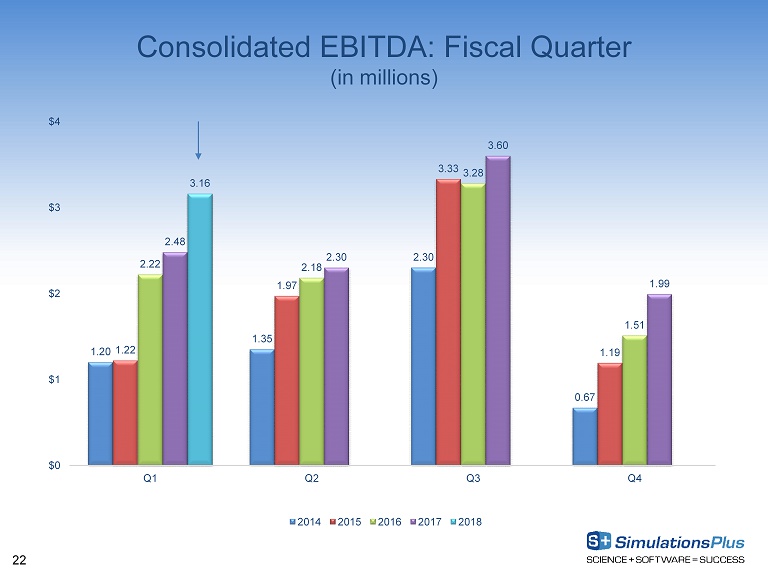

22 Consolidated EBITDA: Fiscal Quarter (in millions) 1.20 1.35 2.30 0.67 1.22 1.97 3.33 1.19 2.22 2.18 3.28 1.51 2.48 2.30 3.60 1.99 3.16 $0 $1 $2 $3 $4 Q1 Q2 Q3 Q4 2014 2015 2016 2017 2018

Lancaster Division of Simulations Plus 23 • Products & Services John DiBella , President

FDA Voice blog: July 7 th , 2017

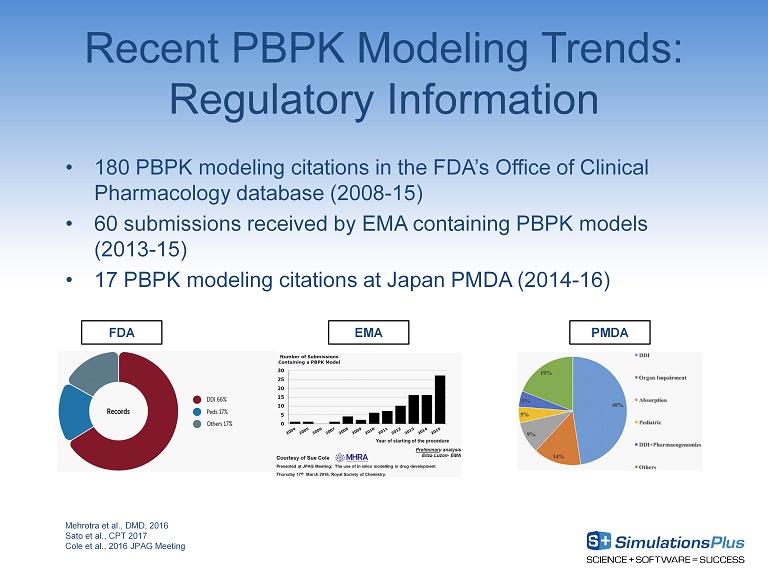

Recent PBPK Modeling Trends: Regulatory Information Mehrotra et al., DMD, 2016 Sato et al., CPT 2017 Cole et al., 2016 JPAG Meeting • 180 PBPK modeling citations in the FDA’s Office of Clinical Pharmacology database (2008 - 15) • 60 submissions received by EMA containing PBPK models (2013 - 15) • 17 PBPK modeling citations at Japan PMDA (2014 - 16) EMA PMDA FDA

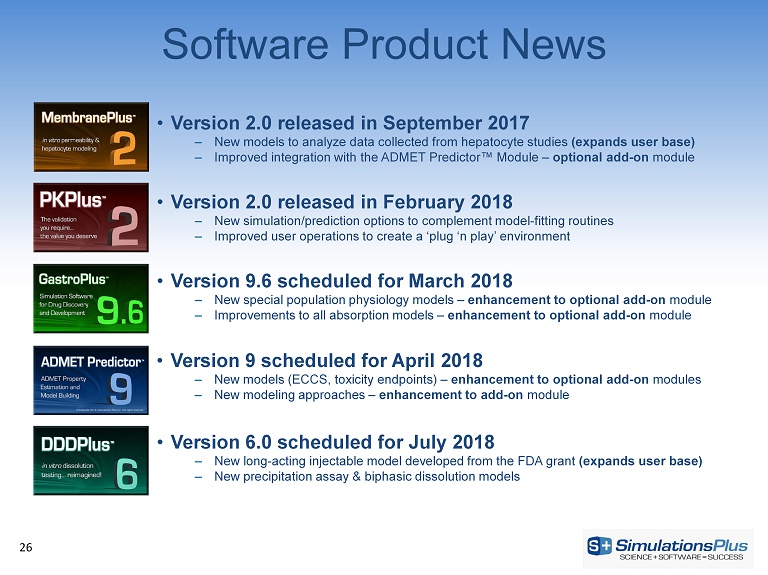

26 • Version 9.6 scheduled for March 2018 ‒ New special population physiology models – enhancement to optional add - on module ‒ Improvements to all absorption models – enhancement to optional add - on module • Version 9 scheduled for April 2018 ‒ New models (ECCS, toxicity endpoints) – enhancement to optional add - on modules ‒ New modeling approaches – enhancement to add - on module Software Product News • Version 6.0 scheduled for July 2018 ‒ New long - acting injectable model developed from the FDA grant (expands user base) ‒ New precipitation assay & biphasic dissolution models • Version 2.0 released in September 2017 ‒ New models to analyze data collected from hepatocyte studies (expands user base) ‒ Improved integration with the ADMET Predictor™ Module – optional add - on module • Version 2.0 released in February 2018 ‒ New simulation/prediction options to complement model - fitting routines ‒ Improved user operations to create a ‘plug ‘n play’ environment

PBPK Consulting Projects • Working on 21 projects + 2 FDA grants: – Formulation optimization – Preclinical development and First - in - Human predictions – Virtual bioequivalence trial simulations – DDI predictions – Non - oral absorption modeling – Food effect/PPI modeling – Pediatric population simulations and dose projections – Mechanistic IVIVCs • 7 model reports submitted to regulatory agencies 27

Marketing Activities Website Content • Designing new menu system and homepage to illustrate 3 divisions • Increased focus on SEO performance/analytics • Continued producing new video content Workshops and Conferences • PBPK modeling workshops scheduled for San Diego, Germany, China, Korea, India, and Japan in 2018 • Attending fewer conferences but presenting at more • Client roadshows – San Diego, Boston, Midwest already scheduled Strategic Digital Marketing Initiatives • Have 8 product webinars scheduled for 2018 • Continuing with active social media campaigns 28

29 Re - imagining the Future of Science - based Research and Development Ted Grasela, PharmD , Ph.D. President , Cognigen

Cognigen Growth • Activities supporting continued growth – Successful recruiting and on - boarding of software engineers and scientists – New marketing initiatives and business/sales models – Increasing synergy and cross - selling between divisions – Accelerating KIWI TM development 30

31 Cognigen Status Report Pharmacometric Services • In FY2018 relationships with 21 companies on 34 drugs, 54 projects – 2 new companies in FY2018 – 14 new projects in FY2018 – 8 projects expanded scope in FY2018 – 3 projects with reduced scope – 37 outstanding proposals with 25 different companies • Expansion in global health initiatives, bridging global regulatory submissions, and embedding pharmacometric services from first - in - human to commercialization of new medicines • In FY2018 presented 5 posters, and 3 peer - reviewed publications – Working on 20 publications and 5 conference abstracts • Most common therapeutic area is oncology, followed by neurology, endocrinology, and infectious disease – ~45% of projects result directly in regulatory interaction.

Leading by Example… 32

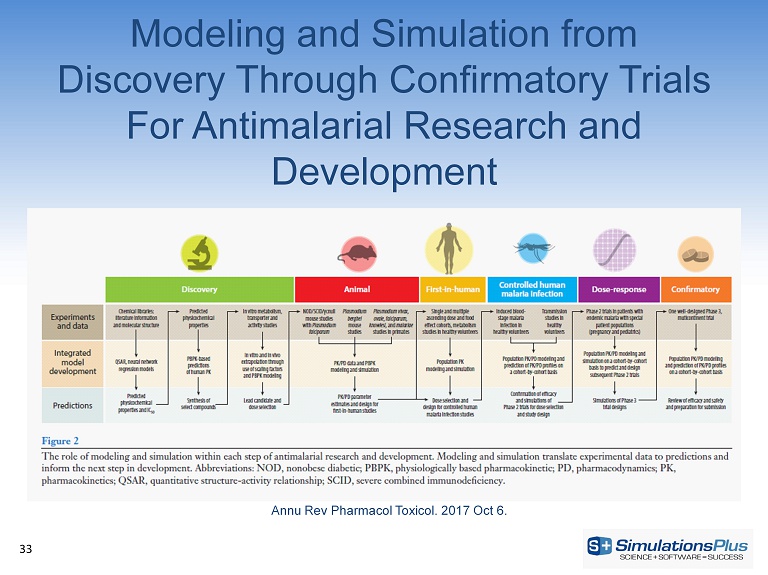

Modeling and Simulation from Discovery Through Confirmatory Trials For Antimalarial Research and Development 33 Annu Rev Pharmacol Toxicol . 2017 Oct 6.

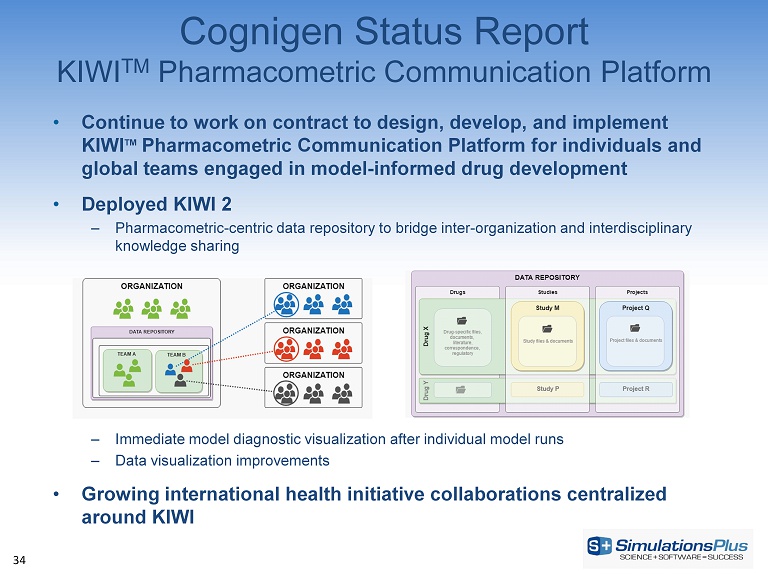

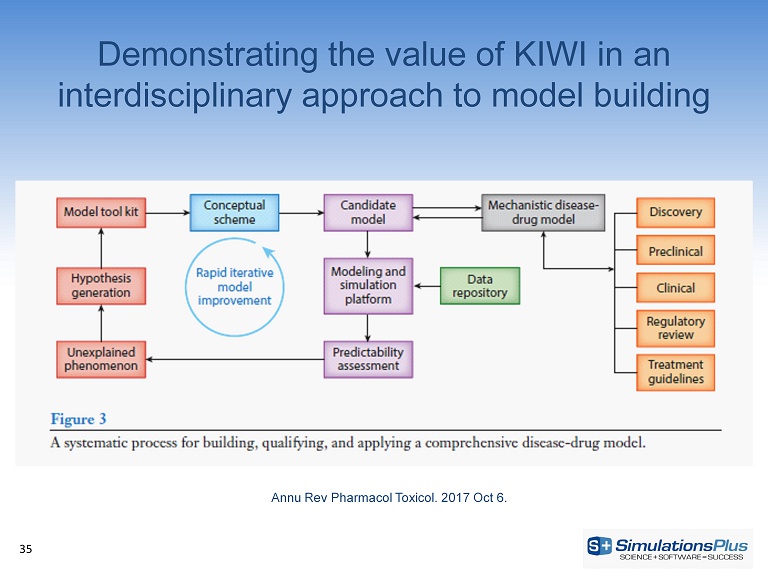

34 • Continue to work on contract to design, develop, and implement KIWI TM Pharmacometric Communication Platform for individuals and global teams engaged in model - informed drug development • Deployed KIWI 2 – Pharmacometric - centric data repository to bridge inter - organization and interdisciplinary knowledge sharing – Immediate model diagnostic visualization after individual model runs – Data visualization improvements • Growing international health initiative collaborations centralized around KIWI Cognigen Status Report KIWI TM Pharmacometric Communication Platform

Demonstrating the value of KIWI in an interdisciplinary approach to model building 35 Annu Rev Pharmacol Toxicol . 2017 Oct 6.

36 • Increased Marketing and Sales • Pharmacometric services continue to expand; healthy pipeline of new projects, including global health initiative projects, bridging global regulatory filings, and embedded client partner opportunities from first - in - human to commercialization of new medicines • Cross - selling opportunities with Simulations Plus and DILIsym creating broader spectrum business models with clients and expanding scientific synergies across company scientists • KIWI TM Pharmacometric Communication Platform design and deployment accelerating; 1 st stage of hiring completed. Cognigen Summary

37 Drug - Induced Liver Injury and Liver Diseases Brett A. Howell, President DILIsym Services, Research Triangle Park, NC

DILIsym Services, Inc. – Our Vision 38 • DILIsym Services, Inc. offers comprehensive program services: – DILIsym software licensing, training, development (DILI - sim Initiative) – DILIsym and NAFLDsym simulation consulting projects – Consulting and data interpretation – in vitro assay experimental design and management “Our vision is safer, effective, more affordable medicines for patients through modeling and simulation.” DILIsym ®

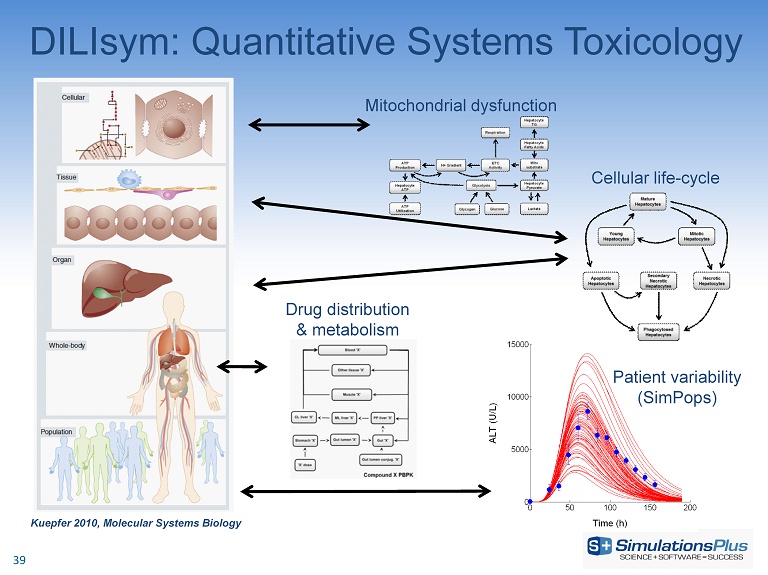

DILIsym: Quantitative Systems Toxicology Kuepfer 2010, Molecular Systems Biology Mitochondrial dysfunction Cellular life - cycle Patient variability ( SimPops ) Drug distribution & metabolism 39

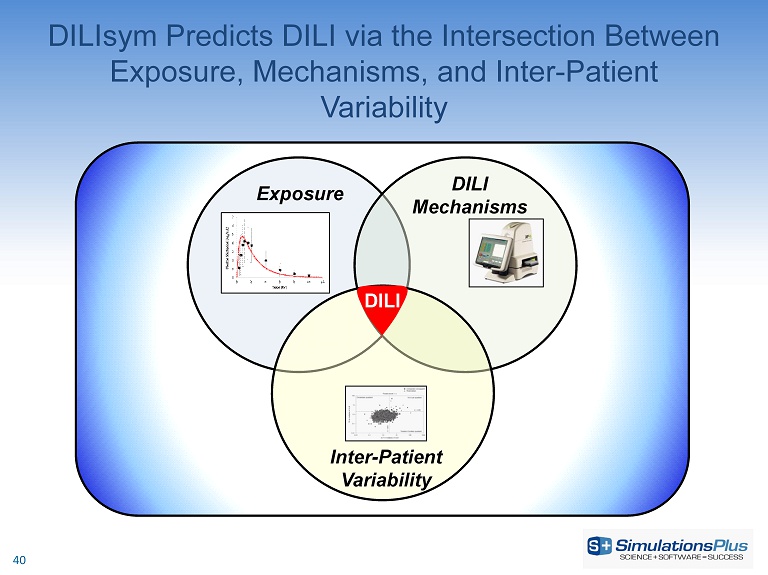

DILIsym Predicts DILI via the Intersection Between Exposure, Mechanisms, and Inter - Patient Variability Exposure DILI Mechanisms Inter - Patient Variability DILI 40

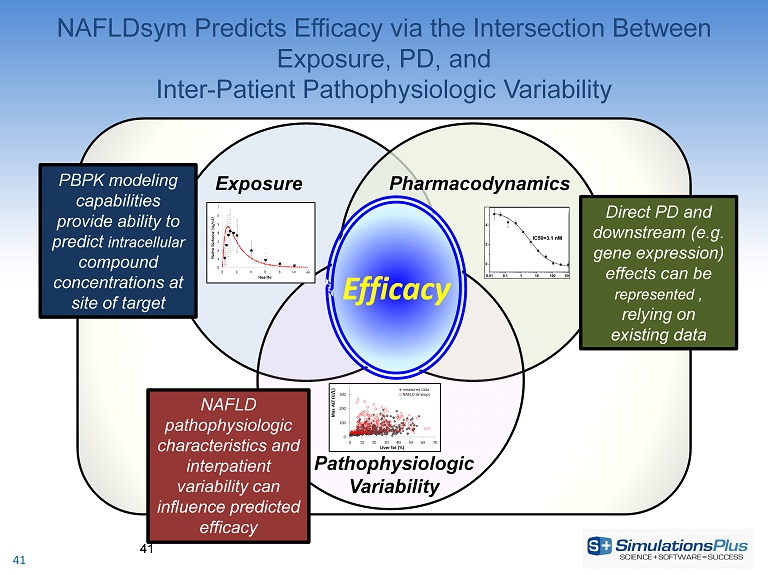

NAFLDsym Predicts Efficacy via the Intersection Between Exposure, PD, and Inter - Patient Pathophysiologic Variability 41 Exposure Pharmacodynamics Pathophysiologic Variability Efficacy PBPK modeling capabilities provide ability to predict intracellular compound concentrations at site of target Direct PD and downstream (e.g. gene expression) effects can be represented , relying on existing data NAFLD pathophysiologic characteristics and interpatient variability can influence predicted efficacy 41

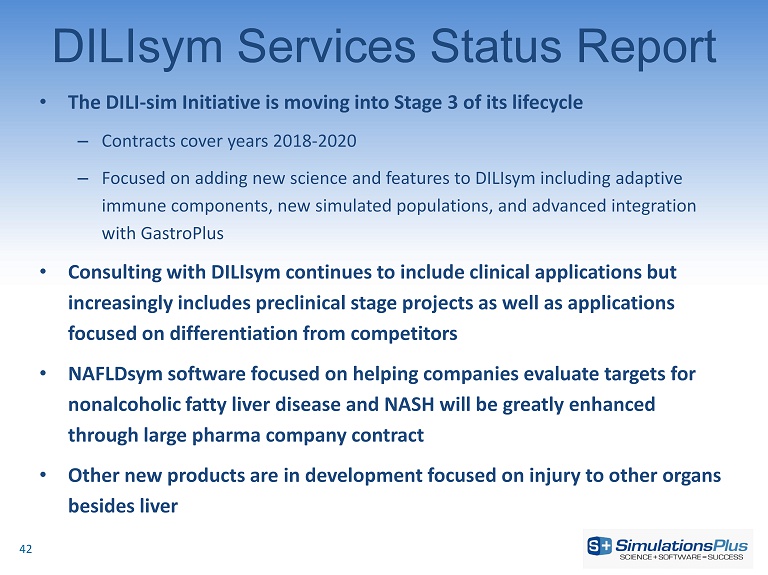

DILIsym Services Status Report • The DILI - sim Initiative is moving into Stage 3 of its lifecycle – Contracts cover years 2018 - 2020 – Focused on adding new science and features to DILIsym including adaptive immune components, new simulated populations, and advanced integration with GastroPlus • Consulting with DILIsym continues to include clinical applications but increasingly includes preclinical stage projects as well as applications focused on differentiation from competitors • NAFLDsym software focused on helping companies evaluate targets for nonalcoholic fatty liver disease and NASH will be greatly enhanced through large pharma company contract • Other new products are in development focused on injury to other organs besides liver 42

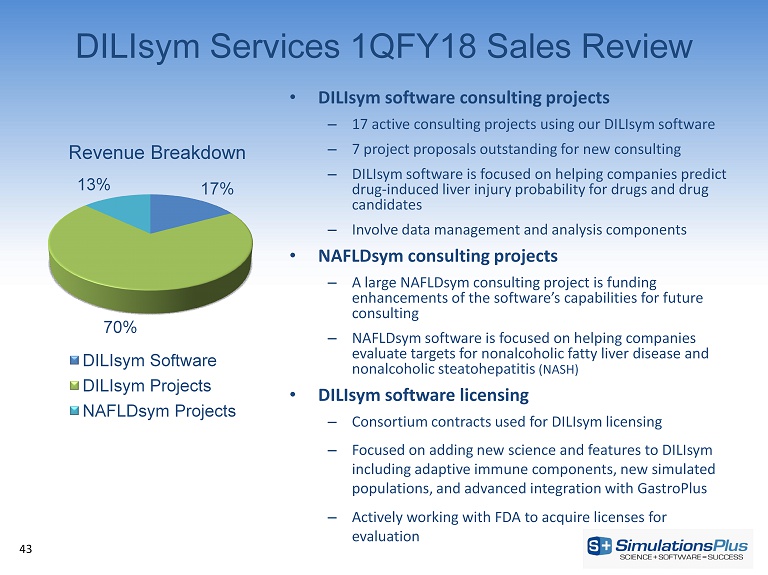

DILIsym Services 1QFY18 Sales Review • DILIsym software consulting projects – 17 active consulting projects using our DILIsym software – 7 project proposals outstanding for new consulting – DILIsym software is focused on helping companies predict drug - induced liver injury probability for drugs and drug candidates – Involve data management and analysis components • NAFLDsym consulting projects – A large NAFLDsym consulting project is funding enhancements of the software’s capabilities for future consulting – NAFLDsym software is focused on helping companies evaluate targets for nonalcoholic fatty liver disease and nonalcoholic steatohepatitis (NASH) • DILIsym software licensing – Consortium contracts used for DILIsym licensing – Focused on adding new science and features to DILIsym including adaptive immune components, new simulated populations, and advanced integration with GastroPlus – Actively working with FDA to acquire licenses for evaluation 43 17% 70% 13% Revenue Breakdown DILIsym Software DILIsym Projects NAFLDsym Projects

DILIsym Services Software Product News • DILIsym version 7A was released on Monday, January 8 th to DILI - sim consortium members for internal software use – Includes large number of expanded features and exemplar drugs • Actively working towards increased communication between DILIsym software and GastroPlus • NAFLDsym development continues through large pharma company sponsorships – Addition of fibrosis and inflammation pathways and additional simulated patients – Available towards end of 2018 for internal consulting use • Submitted a proposal for development of software focused on drug - induced kidney injury to go alongside our liver - related products 44 DILIsym ®

DILIsym Services Summary • Enhanced version of flagship product, DILIsym, just released • Active development across multiple products for expanded applications • Continuing to work with Simulations Plus Lancaster and Cognigen on integrative marketing and other synergies • Number of consulting clients continues to grow; now well over 30 companies with several large proposals outstanding 45

46 Summary & Wrap - up Walt Woltosz, Chairman and CEO

47 Summary • For FY2017: - Financial performance continues our >10 - year profitable trend - Continuing to achieve record revenue and profitability - Continuing to expand our R&D team - Acquired DILIsym Services in June 2017 • Expanding sales team and activities - Greater staff time spent on marketing and sales activities - Expanded training workshops offered around the globe - East Coast sales presence began in 4QFY17 • Simulations Plus is globally recognized as a leader - Outstanding reputation for scientific expertise and innovation - Outstanding reputation for strong customer support • Strong cash position continues - Cash dividends of $0.20/share were distributed in FY2017 - Dividend increased $0.06/share per quarter in FY2018

48 Thank you for your kind attention… Questions?