Attached files

| file | filename |

|---|---|

| EX-10.12.1 - EXHIBIT 10.12.1 - VISTEON CORP | ex-10121201710xk.htm |

| EX-32.2 - EXHIBIT 32.2 - VISTEON CORP | ex-322201710xk.htm |

| EX-32.1 - EXHIBIT 32.1 - VISTEON CORP | ex-321201710xk.htm |

| EX-31.2 - EXHIBIT 31.2 - VISTEON CORP | ex-312201710xk.htm |

| EX-31.1 - EXHIBIT 31.1 - VISTEON CORP | ex-311201710xk.htm |

| EX-24.1 - EXHIBIT 24.1 - VISTEON CORP | ex-241201710xk.htm |

| EX-23.1 - EXHIBIT 23.1 - VISTEON CORP | ex-231201710xk.htm |

| EX-21.1 - EXHIBIT 21.1 - VISTEON CORP | ex-211201710xk.htm |

| EX-14.1 - EXHIBIT 14.1 - VISTEON CORP | ex141201710k.htm |

| EX-12.1 - EXHIBIT 12.1 - VISTEON CORP | ex-121201710xk.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number 001-15827

VISTEON CORPORATION

(Exact name of registrant as specified in its charter)

State of Delaware | 38-3519512 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

One Village Center Drive, Van Buren Township, Michigan | 48111 |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (800)-VISTEON

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on which Registered |

Common Stock, par value $0.01 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

Warrants, each exercisable for 1.3 shares of Common Stock at an exercise price of $0.01 (expiring October 1, 2020) (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ü No __

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes __ No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No__

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ü No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ü

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer," "accelerated filer” and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ü Accelerated filer __ Non-accelerated filer __ Smaller reporting company __ Emerging growth company __

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. __

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No ü

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2017 (the last business day of the most recently completed second fiscal quarter) was approximately $3.2 billion.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ü No__

As of February 15, 2018, the registrant had outstanding 30,919,267 shares of common stock.

Document Incorporated by Reference

Document | Where Incorporated |

2018 Proxy Statement | Part III (Items 10, 11, 12, 13 and 14) |

1

Visteon Corporation and Subsidiaries

Index

Page | ||

2

Part I

Item 1. | Business |

Description of Business

Visteon Corporation (the "Company" or "Visteon") is a global automotive supplier that designs, engineers and manufactures innovative electronics products for nearly every original equipment vehicle manufacturer ("OEM") worldwide including Ford, Mazda, Renault/Nissan, General Motors, Jaguar/Land Rover, Honda, Volkswagen, BMW and Daimler. Visteon is headquartered in Van Buren Township, Michigan, and has an international network of manufacturing operations, technical centers and joint venture operations, supported by approximately 10,000 employees, dedicated to the design, development, manufacture and support of its product offerings and its global customers. The Company's manufacturing and engineering footprint is principally located outside of the U.S., with a heavy concentration in low-cost geographic regions.

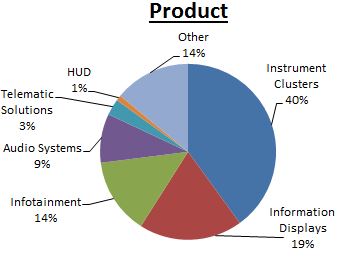

Visteon provides value for its customers and stockholders through its technology-focused vehicle cockpit electronics business, by delivering a rich, connected cockpit experience for every car from luxury to entry. The Company's cockpit electronics business is one of the broadest portfolios in the industry and includes instrument clusters, information displays, infotainment systems, audio systems, telematics solutions, and head-up displays. The Company's vehicle cockpit electronics business comprises and is reported under the Electronics segment. In addition to the Electronics segment, the Company had residual operations in South America and Europe previously associated with the Interiors and Climate businesses, sold or exited by December 31, 2016, but not subject to discontinued operations classification that comprised Other.

The Company’s History

The Company was incorporated in Delaware in January 2000 as a wholly owned subsidiary of Ford Motor Company (“Ford” or “Ford Motor Company”). Subsequently, Ford transferred the assets and liabilities comprising its automotive components and systems business to Visteon. The Company separated from Ford in June 2000 when all of the Company’s common stock was distributed by Ford to its shareholders. After filing for bankruptcy in 2009 as a result of the recession, the Company emerged from bankruptcy in 2010, and in 2012 implemented a comprehensive shareholder value creation plan that involved the transformation milestones below.

Transformation Milestones

The Company previously operated Climate, Interiors, and Electronics product lines. Over the last five years, the Company has transformed the business operations into a pure-play supplier of automotive cockpit electronics and connected car solutions.

A summary of the milestones completing the transformation are summarized below:

• | Exit of Climate Business - On June 9, 2015, Visteon Corporation and its wholly owned subsidiary, VIHI, LLC (collectively, “Visteon”) completed the sale of its shares of Halla Visteon Climate Control Corporation, a Korean corporation (“HVCC”) (the “Climate Transaction”). The Company received net cash proceeds of approximately $2.7 billion and recognized a pretax gain of approximately $2.3 billion in connection with the closing of the Climate Transaction in the second quarter of 2015. |

During the fourth quarter of 2016, the Company sold its South Africa climate operations with 2015 annual sales of $9 million for proceeds of $2 million, and recorded a loss of $11 million related to foreign currency translation amounts recorded in accumulated other comprehensive loss.

In connection with the Climate Transaction, the Company completed the repurchase of the electronics operations located in India during the first quarter of 2017 for $47 million, recognizing a $7 million gain on the settlement of purchase commitment contingencies.

• | Exit of Interiors Business - During 2014, the Company divested the majority of its global Interiors business (the "Interiors Divestiture"). Subsequently, Visteon completed the sale of its Interiors operations in Thailand on February 2, 2015. On December 1, 2016, the Company completed the sale of its Interiors operations in Argentina and Brazil, incurring a loss of $19 million representing the final working capital cash contribution and related contractual obligations, marking the completion of the Interiors Divestiture. |

3

On December 1, 2015, Visteon completed the sale and transfer of its equity ownership in Visteon Deutschland GmbH, which operated the Berlin, Germany interiors plant ("Germany Interiors Divestiture"). The Company contributed cash of approximately $141 million, assets of $27 million, and liabilities of $198 million including pension related liabilities. The Company made a final contribution payment of approximately $35 million during December 2017 upon the fulfillment of certain buyer contractual commitments, that had been included in the Company's consolidated balance sheet as "Other current liabilities" as of December 31, 2016.

• | Enhance Shareholder Returns - In connection with the Climate Transaction, the Company returned approximately $2.75 billion of cash to shareholders from 2015 through 2016 via a series of actions including share buybacks and special distributions. |

During 2015, the Company entered an accelerated stock buyback ("ASB") program for an aggregate purchase price of $500 million. Under this program the Company repurchased 4,771,262 shares of common stock for an average settlement price of $104.79.

On December 9, 2015, the Company declared a special distribution of $43.40 per share of its common stock outstanding as of January 15, 2016, or approximately $1.75 billion in the aggregate. On January 22, 2016 approximately $1.74 billion was distributed to shareholders. An additional amount of $14 million will be paid upon vesting and settlement of restricted stock units and performance-based share units previously granted to the Company's employees. The special cash distribution was funded from the Climate Transaction proceeds.

During 2016, Visteon entered into stock buyback programs with a third-party financial institution to purchase shares of common stock for an aggregate purchase price of $500 million. Under these programs, Visteon purchased 7,190,506 shares at an average price of $69.48.

The Company's strategic priorities going forward are outlined in Item 7 "Executive Summary" of this Report.

The Company’s Industry

The Company operates in the automotive industry, which is cyclical and highly sensitive to general economic conditions. The Company believes that future success in the automotive industry is, in part, dependent on alignment with customers to support their efforts to effectively meet the challenges associated with the following significant trends and developments in the global automotive industry.

• | Electronic content and connectivity - The electronic content of vehicles continues to increase due to various regulatory requirements and consumer demand for increased vehicle performance and functionality. The use of electronic components can reduce weight, expedite assembly, enhance fuel economy, improve emissions, increase safety and enhance vehicle performance. Additionally, digital and portable technologies have dramatically influenced the lifestyle of today’s consumers, who expect products that enable such a lifestyle. This requires increased electronic and technical content such as in-vehicle communication, navigation and entertainment capabilities. While OEMs are taking different paths to connect their vehicles to high-speed broadband internet connections in the short-term, future vehicles are expected to be built with vehicle-to-vehicle connectivity systems. There is momentum by OEMs to integrate discrete electronic control units into a multi-core domain controller to increase efficiency and reduce power consumption, cost and weight. Vehicle cockpits are becoming increasingly digitized. |

• | Advanced driver assistance systems ("ADAS") and autonomous driving - The industry continues to advance toward semi-autonomous and autonomous vehicles. The Society of Automotive Engineers has defined five levels of autonomy ranging from levels one and two with driver-assist functions whereby the driver is responsible for monitoring the environment, to level five with full autonomy under all conditions. Levels one and two are already popular in the market while levels three and above require multiple sensors, radars, camera and LiDARs, requiring sensor fusion and machine learning technologies, as the system assumes the role of monitoring the environment. Level three includes features such as highway pilot and parking assist technology, for which a high market penetration rate is expected over the next several years. |

• | Safety and security - Governments continue to focus regulatory efforts on safer transportation. Accordingly, OEMs are working to improve occupant and pedestrian safety by incorporating more safety-oriented technology in their vehicles. Additionally, in-vehicle connectivity has increased the need for robust cybersecurity systems to protect data, applications and associated infrastructure. Security features are evolving with advances in sensors and silicon. Suppliers must enable the security/safety initiatives of their customers including the development of new technologies. |

4

• | Vehicle standardization - OEMs continue to standardize vehicle platforms on a global basis, resulting in a lower number of individual vehicle platforms, design cost savings and further scale of economies through the production of a greater number of models from each platform. Having operations in the geographic markets in which OEMs produce global platforms enables suppliers to meet OEMs’ needs more economically and efficiently, thus making global coverage a source of significant competitive advantage for suppliers with a diversified global footprint. Additionally, OEMs are looking to suppliers for increased collaboration to lower costs, reduce risks and decrease overall time to market. Suppliers that can provide fully engineered solutions, systems and pre-assembled combinations of component parts are positioned to leverage the trend toward system sourcing. As vehicles become more connected and cockpits more digitized, suppliers that can deliver modular hardware architectures, “open” software architectures and a software platform approach will be poised to help OEMs achieve greater reuse of validated hardware circuitry, design scalability and faster development cycles. |

Financial Information about Segments

The Company’s current reportable segment is Electronics. The Company's Electronics segment provides vehicle cockpit electronics products to customers, including instrument clusters, information displays, infotainment systems, audio systems, telematics solutions, and head-up displays. Prior to 2017, the Company also had Other operations consisting primarily of South Africa and South America climate operations substantially exited during the fourth quarter of 2016. Future impacts of such legacy operations will be included with the Company's continuing Electronics operations.

Refer to Note 22 “Segment Information” in Item 8 of this Report for more information about the Company’s reportable segment.

The Company’s Products

The Company designs and manufactures vehicle cockpit electronics components, modules and systems further described as follows:

Instrument Clusters

The Company offers a full line of instrument clusters, from standard analog gauge clusters to high-resolution, all-digital, fully reconfigurable, 2-D and 3-D display-based devices. The Company uses a platform approach to accelerate development and manage multiple vehicle variants. These clusters can use a wide range of display technologies, graphic capabilities and decorative elements, including organic light-emitting diode ("OLED"), free-form and curved displays. Premium clusters support complex 3-D graphics and feature embedded functionality such as driver monitoring, camera inputs and ambient lighting.

Information Displays

The Company offers a range of information displays for various applications within the cockpit, incorporating a sleek profile, craftsmanship and touch sensors, designed to deliver high performance for the automotive market. These displays can integrate a range of user interface technologies and graphics management capabilities, such as 3-D, dual view, cameras, optics, haptic feedback, light effects and dual (OLED) displays.

Infotainment/Audio Systems

The Company offers a range of infotainment solutions, including Phoenix™ display audio and embedded infotainment platform, and Android embedded infotainment - an open-source system based on Android Automotive. Visteon’s Phoenix™ display audio entry offering is designed to allow vehicle occupants to easily connect their mobile devices to the system and safely access phone functions, listen to music, stream media and enable mobile connectivity applications through Apple CarPlay®, Android Auto and Baidu CarLife. Phoenix™ embedded infotainment enables third-party developers to create apps easily through a software development kit and software simulation of the target hardware system. The Phoenix™ platform delivers built-in security and over-the-air updates. It consists of Phoenix InfoCore™ - in-vehicle middleware that maximizes software reuse and upgrades, and Phoenix Studio 2.0 - a PC-based development tool for apps.

5

Telematics Solutions

The Company provides a cost-optimized, high-speed telematics control unit to enable secure connected car services, software updates and data. The Company’s telematics solution uses a single hardware and flexible software architecture to support regional telematics service providers and mobile networks. The Company’s wireless gateway platform is designed to meet future connectivity requirements including 4G, V2X, Wi-Fi® and next-generation mobile standards such as 5G. The Company also offers a hands-free telephone unit that provides Bluetooth® and Universal Serial Bus ("USB") connectivity.

Head-Up Displays

The Company provides a complete line of head-up displays ("HUD") that present critical information to the driver in a convenient location and at a comfortable focal distance. Combiner HUD projects a virtual image in front of the driver using a compact, transparent screen mounted on top of the instrument panel. Windshield HUD projects the image directly on the vehicle windscreen. The Company has demonstrated an augmented reality system that overlays graphics in the driver’s line of sight to represent objects in the vehicle’s path; provide navigation guidance; and display relevant information, such as a lane departure warning.

SmartCore™ Domain Controller

The Company offers an automotive-grade, integrated domain controller approach, called SmartCore™, which can independently operate the infotainment system, instrument cluster, head-up display and potentially other features on a single, multi-core chip to improve efficiency and reduce power consumption and cost. Included are: SmartCore™ Runtime, middleware, enabling communication between domains and apps to be shown on any display; and SmartCore™ Studio, a PC-based configuration tool to generate hypervisor configurations.

DriveCore™ Autonomous Driving Controller

DriveCore™ is a complete technology platform consisting of the hardware, middleware and frameworks to develop machine learning algorithms for autonomous driving applications of Level 3 and above. It provides an open platform for the development of sensor-based solutions for the auto industry - through three main components:

• | Compute - A modular and scalable computing hardware platform designed to be adapted to all levels of automated driving |

• | Runtime - In-vehicle middleware that provides a secure framework enabling applications and algorithms to communicate in a real time, high-performance environment |

• | Studio - A PC-based development environment that enables automakers to create an ecosystem of developers for rapid algorithm development. |

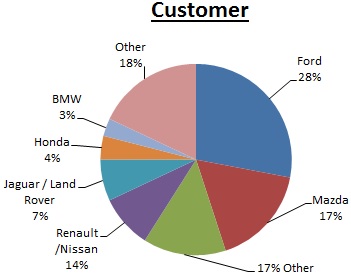

The Company’s Customers

The Company's ultimate customers are global vehicle manufacturers including Ford, Mazda, Renault/Nissan, General Motors, Jaguar / Land Rover, Honda, Volkswagen, BMW and Daimler. Ford, Mazda and Renault/Nissan are the Company's largest customers and in 2017 accounted for sales of approximately 28%, 17% and 14%, respectively. In 2016 and 2015, Ford accounted for 30% and 34% of sales, respectively, Mazda accounted for 17% and 16% of sales in 2016 and 2015, respectively and Renault/Nissan accounted for 15% and 14% of sales for 2016 and 2015, respectively.

The Company records revenue when persuasive evidence of an arrangement exists, delivery occurs, the sales price or fee is fixed or determinable and collectibility is reasonably assured. Price reductions are typically negotiated on an annual basis between suppliers and OEMs. Such reductions are intended to take into account expected annual reductions in the overall cost to the supplier of providing products and services to the customer, through such factors as manufacturing productivity enhancements, material cost-reductions and design-related cost improvements. The Company has an aggressive cost-reduction program that focuses on reducing its total costs, which are intended to offset customer price reductions. However, there can be no assurance that the Company’s cost-reduction efforts will be sufficient to fully offset such price reductions. The Company records price reductions when probable and reasonably estimable.

6

The Company’s Competition

The automotive sector is concentrated, but operates under highly competitive conditions resulting from the globalized nature of the industry, high fixed costs and the resulting need for scale economies, market dynamics including share in mature economies and positioning in emerging economies, and the low cost of switching for the end consumer. Accordingly, OEMs rigorously evaluate suppliers on the basis of financial viability, product quality, price competitiveness, technical expertise and development capability, new product innovation, reliability and timeliness of delivery, product design and manufacturing capability and flexibility, customer service and overall management. The Company's primary independent competitors include but are not limited to Alpine Electronics, Aptiv PLC, Continental AG, Denso Corporation, Harman International, LG Corporation, Nippon Seiki, Panasonic Corporation, Pioneer Corporation, and Robert Bosch GmbH.

The Company’s Product Sales Backlog

The Company defines backlog as cumulative remaining awarded life-of-program expected booked sales, to be delivered in future periods. The Company’s Electronics segment backlog was $19.4 billion as of December 31, 2017, compared with $16.5 billion as of December 31, 2016, reflecting an increase of 18%. The Company’s estimated net sales may be impacted by various assumptions, including new program vehicle production levels, customer price reductions, currency exchange rates and program launch timing. In addition, the Company typically enters into customer agreements at the beginning of a vehicle life cycle with the intent to fulfill purchasing requirements for the entire vehicle production life cycle. These agreements may be terminated by customers at any time and, accordingly, expected net sales information does not represent firm orders or firm commitments.

The Company’s Business is Seasonal and Cyclical

Historically, the Company’s business has been moderately seasonal because its largest North American customers typically cease production for approximately two weeks in July for model year changeovers and approximately one week in December during the winter holidays. Customers in Europe historically shut down vehicle production during a portion of August and one week in December. In China, customers typically shut down approximately one week in early October and one week in January or February. Additionally, third-quarter automotive production traditionally is lower as new vehicle models enter production.

The Company’s Workforce and Employee Relations

The Company’s workforce as of December 31, 2017 included approximately 10,000 persons, of which approximately 5,000 were salaried employees and 5,000 were hourly workers. Many of the Company’s employees are members of industrial trade unions and confederations within their respective countries, including Europe, Asia and South America. Many of these organizations operate under collectively bargained contracts that are not specific to any one employer. The Company constantly works to establish and maintain positive, cooperative relations with its unions and work representatives around the world and believes that its relationships with unionized employees are satisfactory.

The Company’s Product Research and Development

The Company’s research and development efforts are intended to maintain leadership positions in core products and provide the Company with a competitive edge as it seeks additional business with new and existing customers. The Company also works with technology development partners, including customers, to develop technological capabilities and new products and applications. Total research and development expenses, net of recoveries, were approximately $253 million, $295 million and $294 million in 2017, 2016 and 2015, respectively.

The Company’s Intellectual Property

The Company owns significant intellectual property, including a number of patents, copyrights, proprietary tools and technologies and trade secrets and is involved in numerous licensing arrangements. Although the Company’s intellectual property plays an important role in maintaining its competitive position, no single patent, copyright, proprietary tool or technology, trade secret or license, or group of related patents, copyrights, proprietary tools or technologies, trade secrets or licenses is, in the opinion of management, of such value to the Company that its business would be materially affected by the expiration or termination thereof. The Company’s general policy is to apply for patents on an ongoing basis, in appropriate countries, on its patentable developments that are considered to have commercial significance.

The Company also views its name and mark as significant to its business as a whole. In addition, the Company holds rights in a number of other trade names and marks applicable to certain of its businesses and products that it views as important to such businesses and products.

7

The Company’s Raw Materials and Suppliers

Raw materials used by the Company in the manufacture of its products include electronics components, resins, copper, and precious metals. All of the materials used are generally available from numerous sources. In general, the Company does not carry inventories of raw materials in excess of those reasonably required to meet production and shipping schedules. As of December 31, 2017, the Company had not experienced significant shortages of raw materials. The Company monitors its supply base and endeavors to work with suppliers and customers to attempt to mitigate the impact of potential material shortages and supply disruptions. While the Company does not anticipate any significant interruption in the supply of raw materials, there can be no assurance that sufficient sources or amounts of all necessary raw materials will be available in the future.

The automotive supply industry is subject to inflationary pressures with respect to raw materials, which have historically placed operational and financial burdens on the entire supply chain. Accordingly, the Company continues to take actions with its customers and suppliers to mitigate the impact of these inflationary pressures in the future. Actions to mitigate inflationary pressures with customers include collaboration on alternative product designs and material specifications, contractual price escalation clauses and negotiated customer recoveries. Actions to mitigate inflationary pressures with suppliers include aggregation of purchase requirements to achieve optimal volume benefits, negotiation of cost-reductions and identification of more cost competitive suppliers. While these actions are designed to offset the impact of inflationary pressures, the Company cannot provide assurance that it will be successful in fully offsetting increased costs resulting from inflationary pressures.

8

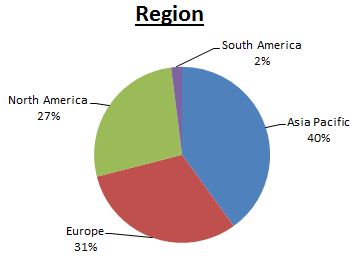

The Company’s International Operations

Financial information about sales and net property by major geographic region can be found in Note 22, Segment Information, included in Item 8 “Financial Statements and Supplementary Data” of this Report. The attendant risks of the Company’s international operations are primarily related to currency fluctuations, changes in local economic and political conditions, and changes in laws and regulations. The following table presents the Company’s sales and net property and equipment by geographic region as a percentage of such consolidated total amounts.

Sales (a) | Property and Equipment, Net | |||||||||||||

Year Ended December 31 | December 31 | |||||||||||||

2017 | 2016 | 2015 | 2017 | 2016 | ||||||||||

United States | 25 | % | 26 | % | 26 | % | 3 | % | 4 | % | ||||

Mexico | 2 | % | 2 | % | 2 | % | 14 | % | 14 | % | ||||

Total North America | 27 | % | 28 | % | 28 | % | 17 | % | 18 | % | ||||

Portugal | 16 | % | 14 | % | 13 | % | 20 | % | 18 | % | ||||

Slovakia | 9 | % | 8 | % | 8 | % | 10 | % | 8 | % | ||||

Tunisia | 3 | % | 4 | % | 6 | % | 3 | % | 3 | % | ||||

France | 3 | % | 4 | % | 4 | % | 2 | % | 6 | % | ||||

Germany | — | % | — | % | 3 | % | 1 | % | 1 | % | ||||

Other Europe | 1 | % | 2 | % | 3 | % | 3 | % | 2 | % | ||||

Intra-region eliminations | — | % | (1 | )% | (2 | )% | — | % | — | % | ||||

Total Europe | 32 | % | 31 | % | 35 | % | 39 | % | 38 | % | ||||

China | 23 | % | 23 | % | 21 | % | 23 | % | 22 | % | ||||

Japan | 16 | % | 16 | % | 15 | % | 6 | % | 5 | % | ||||

Thailand | 3 | % | 3 | % | 3 | % | 3 | % | 3 | % | ||||

India | 3 | % | 2 | % | 2 | % | 6 | % | 7 | % | ||||

Korea | — | % | 1 | % | 1 | % | — | % | — | % | ||||

Intra-region eliminations | (5 | )% | (5 | )% | (5 | )% | — | % | — | % | ||||

Total Asia | 40 | % | 40 | % | 37 | % | 38 | % | 37 | % | ||||

South America | 2 | % | 3 | % | 4 | % | 6 | % | 7 | % | ||||

Inter-region eliminations | (1 | )% | (2 | )% | (4 | )% | — | % | — | % | ||||

100 | % | 100 | % | 100 | % | 100 | % | 100 | % | |||||

(a) Company sales based on geographic region where sale originates and not where customer is located. | ||||||||||||||

The Company’s Website and Access to Available Information

The Company’s current and periodic reports filed with the United States Securities and Exchange Commission (“SEC”), including amendments to those reports, may be obtained through its internet website at www.visteon.com free of charge as soon as reasonably practicable after the Company files these reports with the SEC. A copy of the Company’s code of business conduct and ethics for directors, officers and employees of Visteon and its subsidiaries, entitled “Ethics and Integrity Policy,” the Corporate Governance Guidelines adopted by the Company’s Board of Directors and the charters of each committee of the Board of Directors are also available on the Company’s website. A printed copy of the foregoing documents may be requested by contacting the Company’s Investor Relations department in writing at One Village Center Drive, Van Buren Township, MI 48111; by phone (734) 710-8349; or via email at investor@visteon.com.

9

Item 1A. | Risk Factors |

The risks and uncertainties described below are not the only ones facing the Company. Risks attributable to all registrants are not included below. Additional risks and uncertainties, including those not presently known or that the Company believes to be immaterial, also may adversely affect the Company’s results of operations and financial condition. Should any such risks and uncertainties develop into actual events, these developments could have material adverse effects on the Company’s business and financial results.

The Company’s substantial international operations make it vulnerable to risks associated with doing business in foreign countries.

The Company has manufacturing and distribution facilities in many foreign countries, including Mexico and countries in Europe, South America and Asia. International operations are subject to certain risks inherent in doing business abroad, including:

• | changes to international trade agreements; |

• | local economic conditions, expropriation and nationalization, foreign exchange rate fluctuations and currency controls; |

• | withholding, border, and other taxes on remittances and other payments by subsidiaries; |

• | investment restrictions or requirements; |

• | export and import restrictions, including increases in border tariffs; and |

• | increases in working capital requirements related to long supply chains. |

In particular, if the United States withdraws from or materially modifies the North American Free Trade Agreement, or any other international trade agreement with one of the countries in which the Company operates, or implements increases in border tariffs, there could be a significantly adverse effect on the Company's financial condition, operating results and cash flows.

The Company has and is expected to continue to invest significantly in joint ventures with other parties to conduct business in China and elsewhere in Asia. These investments may include manufacturing operations and technical centers as well as research and development activities to support anticipated growth in the region. If the Company is not able to strengthen existing relationships, secure additional customers and develop market-relevant advanced driver assistance and autonomous vehicle technologies, it may fail to realize expected rates of return on these investments. The Company’s ability to repatriate funds from these joint ventures depends not only upon their uncertain cash flows and profits, but also upon the terms of particular agreements with the Company’s joint venture partners and maintenance of the legal and political status quo. As a result, the Company’s exposure to the risks described above is substantial. The likelihood of such occurrences and its potential effect on the Company vary from country to country and are unpredictable. However, any such occurrences could be harmful to the Company’s business and the Company’s profitability and financial condition.

The Company must continue to develop, introduce and achieve market acceptance of new and enhanced products in order to grow its sales in the future.

The growth of the Company's business will be dependent on the demand for innovative automotive electronics products, including but not limited to advanced driver assistance and autonomous vehicle technologies. In order to increase sales in current markets and gain entry into new markets, the Company must innovate to maintain and improve existing products, including software, while successfully developing and introducing distinctive new and enhanced products that anticipate changing customer and consumer preferences and capitalize upon emerging software technologies. However, the Company may experience difficulties that delay or prevent the development, introduction or market acceptance of its new or enhanced products, or undiscovered software errors, bugs and defects in its products may injure the Company's reputation. Furthermore, these new technologies have also attracted increased competition from outside the traditional automotive industry, and any of these competitors may develop and introduce technologies that gain greater customer or consumer acceptance, which could adversely affect the future growth of the Company.

The Company’s ability to effectively operate could be hindered if it fails to attract and retain key personnel.

The Company’s ability to operate its business and implement its strategies effectively depends, in part, on the efforts of its executive officers and other key employees. In addition, the Company’s future success will depend on, among other factors, the ability to attract and retain qualified personnel, particularly engineers and other employees with critical expertise and skills that support key customers and products or in emerging regions. The loss of the services of any key employees or the failure to attract or retain other qualified personnel could have a material adverse effect on the Company’s business.

10

Warranty claims, product liability claims and product recalls could harm the Company’s business, results of operations and financial condition.

The Company faces the inherent business risk of exposure to warranty and product liability claims in the event that its products fail to perform as expected or such failure results, or is alleged to result, in bodily injury or property damage (or both). In addition, if any of the Company’s designed products are defective or are alleged to be defective, the Company may be required to participate in a recall campaign. As suppliers become more integrally involved in the vehicle design process and assume more of the vehicle assembly functions, automakers are increasingly expecting them to warrant their products and are increasingly looking to suppliers for contributions when faced with product liability claims or recalls. A successful warranty or product liability claim against the Company in excess of its available insurance coverage and established reserves, or a requirement that the Company participate in a product recall campaign, could have materially adverse effects on the Company’s business, results of operations and financial condition.

Developments or assertions by or against the Company relating to intellectual property rights could materially impact its business.

The Company owns significant intellectual property, including a number of patents, trademarks, copyrights and trade secrets, and is involved in numerous licensing arrangements. The Company’s intellectual property plays an important role in maintaining its competitive position in a number of the markets served. The Company may utilize intellectual property in its products that requires a license from a third-party. While the Company believes that such licenses generally can be obtained, there is no assurance that the necessary licenses can be obtained on commercially acceptable terms or at all. Failure to obtain the right to use third-party intellectual property could preclude the Company from selling certain products and have materially adverse effects on the Company’s business, results of operations and financial condition. Developments or assertions by or against the Company relating to intellectual property rights could materially impact the Company’s business. Recently, the Company has seen an increase in patent claims related to connectivity-enabled products where other patent-holding companies are seeking royalties and often enter into litigation based on patent infringement allegations. Significant technological developments by others also could materially and adversely affect the Company’s business and results of operations and financial condition.

The discontinuation or loss of business, or lack of commercial success, with respect to a particular vehicle model for which the Company is a significant supplier could reduce the Company’s sales and harm its profitability.

Although the Company has purchase orders from many of its customers, these purchase orders generally provide for the supply of a customer’s annual requirements for a particular vehicle model and assembly plant, or in some cases, for the supply of a customer’s requirements for the life of a particular vehicle model, rather than for the purchase of a specific quantity of products. In addition, it is possible that customers could elect to manufacture components internally that are currently produced by outside suppliers, such as the Company. The discontinuation of, the loss of business with respect to or a lack of commercial success of a particular vehicle model for which the Company is a significant supplier, could reduce the Company’s sales and harm the Company’s profitability.

The automotive industry is cyclical and significant declines in the production levels of the Company’s major customers could reduce the Company’s sales and harm its profitability.

Demand for the Company’s products is directly related to the automotive vehicle production of the Company’s major customers. Automotive sales and production are cyclical and can be affected by general economic or industry conditions, labor relations issues, fuel prices, regulatory requirements, government initiatives, trade agreements, the cost and availability of credit and other factors.

A disruption in the Company's information technology systems could adversely affect its business and financial performance.

The Company relies on the accuracy, capacity and security of its information technology systems as well as those of its customers, suppliers, partners, and service providers to conduct its business. Despite the security and risk-prevention measures the Company has implemented, the Company's systems could be breached, damaged or otherwise interrupted by a system failure, cyber attack, malicious computer software (malware), unauthorized physical or electronic access or other natural or man-made incidents or disasters. The Company is also susceptible to security breaches that may go undetected. Such a breach or interruption could result in business disruption, theft of the Company intellectual property or trade secrets and unauthorized access to personnel information. To the extent that business is interrupted or data is lost, destroyed or inappropriately used or disclosed, such disruptions could adversely affect the Company’s competitive position, relationships with customers, financial condition, operating results and cash flows.

11

The Company is highly dependent on Ford Motor Company and decreases in this customer’s vehicle production volumes would adversely affect the Company.

Ford is one of the Company’s largest ultimate customers and accounted for 28%, 30% and 34% of sales in 2017, 2016 and 2015, respectively. Accordingly, any change in Ford's vehicle production volumes may have a significant impact on the Company’s sales volume and profitability.

The Company's inability to effectively manage the timing, quality and costs of new program launches could adversely affect its financial performance.

In connection with the award of new business, the Company often obligates itself to deliver new products and services that are subject to its customers’ timing, performance and quality standards. Additionally, as a Tier 1 supplier, the Company must effectively coordinate the activities of numerous suppliers in order to launch programs successfully. Given the complexity of new program launches, especially involving new and innovative technologies, the Company may experience difficulties managing product quality, timeliness and associated costs. In addition, new program launches require a significant ramp up of costs; however, the sales related to these new programs generally are dependent upon the timing and success of the introduction of new vehicles by the Company's customers. The Company's inability to effectively manage the timing, quality and costs of these new program launches could adversely affect its financial condition, operating results and cash flows.

The Company’s pension expense and funding levels of pension plans could materially deteriorate or the Company may be unable to generate sufficient excess cash flow to meet increased pension benefit obligations.

The Company’s assumptions used to calculate pension obligations as of the annual measurement date directly impact the expense to be recognized in future periods. While the Company’s management believes that these assumptions are appropriate, significant differences in actual experience or significant changes in these assumptions may materially affect the Company’s pension obligations and future expense. For more information on sensitivities to changing assumptions, please see “Critical Accounting Estimates” in Item 7 and Note14 “Employee Benefit Plans” in Item 8 of this report.

The Company’s expected annual effective tax rate could be volatile and could materially change as a result of changes in mix of earnings and other factors.

Changes in the Company’s debt and capital structure, among other items, may impact its effective tax rate. The Company is in a position whereby losses incurred in certain tax jurisdictions generally provide no current financial statement benefit. In addition, certain jurisdictions have statutory rates greater than or less than the United States statutory rate. As such, changes in the mix and source of earnings between jurisdictions could have a significant impact on the Company’s overall effective tax rate in future periods. Changes in tax law and rates, changes in rules related to accounting for income taxes or adverse outcomes from tax audits that regularly are in process in any of the jurisdictions in which the Company operates could also have a significant impact on the Company’s overall effective rate in future periods.

The Company may not be able to fully utilize its U.S. net operating losses and other tax attributes.

Visteon's emergence from bankruptcy in 2010 resulted in a change of ownership within the meaning of Internal Revenue Code (“IRC”) Sections 382 and 383, causing the use of Visteon's pre-emergence U.S. federal net operating loss (“NOL”) and various other tax attributes to be limited in the post-emergence period. However, NOLs and other tax attributes generated in the post-emergence period are generally not limited by the emergence from bankruptcy, but could be limited if there is a subsequent change of ownership. If the Company were to have another change of ownership within the meaning of IRC Sections 382 and 383, its post-emergence NOL and other tax attributes could be limited to an amount equal to its market capitalization at the time of the subsequent ownership change multiplied by the federal long-term tax exempt rate. The Company cannot provide any assurance that such an ownership change will not occur, in which case the availability of the Company's NOLs and other tax attributes could be significantly limited or possibly eliminated. Certain tax benefit preservation provisions of its corporate documents could delay or prevent a change of control, even if that change would be beneficial to stockholders.

Recent changes in the U.S. federal income tax rules could adversely affect us and our shareholders.

On December 22, 2017, the Tax Cuts and Jobs Act of 2017 (the “Act”) was signed into law, making significant changes to the U.S. Internal Revenue Code. Changes include, but are not limited to, a corporate income tax rate decrease from 35% to 21% effective for tax years beginning after December 31, 2017, the migration from a worldwide tax system to a territorial tax system with a one-time transition tax on cumulative post-1986 foreign earnings, a modification of the characterization and treatment of certain intercompany transactions, and the creation of a new U.S. corporate minimum tax on certain earnings of foreign subsidiaries.

12

The Company has reflected the necessary impact of the Act in our financial statements for 2017, the year of enactment. The Company continues to examine the impact the Act may have on its business. The impact the Act may have on holders of Visteon common stock is uncertain and could be adverse. The Company urges its shareholders to consult with their legal and tax advisors with respect to the Act and the potential tax consequences of investing in our common stock.

Privacy and security concerns relating to the Company's current or future products and services could damage its reputation and deter current and potential users from using them.

The Company may gain access to sensitive, confidential or personal data or information that is subject to privacy and security laws, regulations and customer-imposed controls. Concerns about the Company's practices with regard to the collection, use, disclosure, or security of personal information or other privacy related matters, even if unfounded, could damage its reputation and adversely affect its operating results.

Furthermore, regulatory authorities around the world are considering a number of legislative and regulatory proposals concerning cybersecurity and data protection. In addition, the interpretation and application of consumer and data protection laws in the U.S., Europe and elsewhere are often uncertain and in flux. Complying with these various laws could cause the Company to incur substantial costs.

Escalating price pressures from customers may adversely affect the Company’s business.

Downward pricing pressures by automotive manufacturers, while characteristic of the automotive industry, are increasing. Virtually all automakers have implemented aggressive price-reduction initiatives and objectives each year with their suppliers, and such actions are expected to continue in the future. In addition, estimating such amounts is subject to risk and uncertainties because any price reductions are a result of negotiations and other factors. Accordingly, suppliers must be able to reduce their operating costs in order to maintain profitability. The Company has taken steps to reduce its operating costs and other actions to offset customer price reductions; however, price reductions have impacted the Company’s sales and profit margins and are expected to continue to do so in the future. If the Company is unable to offset customer price reductions in the future through improved operating efficiencies, new manufacturing processes, sourcing alternatives and other cost-reduction initiatives, the Company’s results of operations and financial condition will likely be adversely affected.

The Company could be negatively impacted by the distress of its supplier or other shortages.

In an effort to manage and reduce the costs of purchased goods and services, the Company, like many suppliers and automakers, has been consolidating its supply base. In addition, certain materials and components used by the Company are in high demand but of limited availability. As a result, the Company is dependent on single or limited sources of supply for certain components used in the manufacture of its products. The Company selects its suppliers based on total value (including price, delivery and quality), taking into consideration production capacities and financial condition. However, there can be no assurance that strong demand, capacity limitations or other problems experienced by the Company’s suppliers will not result in occasional shortages or delays in the supply of components. If the Company were to experience a significant or prolonged shortage of critical components from any of its suppliers, particularly those who are sole sources, and could not procure the components from other sources, the Company would be unable to meet its production schedules for some of its key products or to ship such products to its customers in a timely fashion, which would adversely affect sales, margins, and customer relations. Furthermore, unfavorable economic or industry conditions could result in financial distress within the Company's supply base, thereby increasing the risk of supply disruption. Although market conditions generally have improved in recent years, uncertainty remains and another economic downturn or other unfavorable industry conditions in one or more of the regions in which the Company operates could cause a supply disruption and thereby adversely affect the Company's financial condition, operating results and cash flows.

Work stoppages and similar events could significantly disrupt the Company’s business.

Because the automotive industry relies heavily on just-in-time delivery of components during the assembly and manufacture of vehicles, a work stoppage at one or more of the Company’s manufacturing and assembly facilities could have material adverse effects on the business. Similarly, if one or more of the Company’s customers were to experience a work stoppage, that customer would likely halt or limit purchases of the Company’s products, which could result in the shutdown of the related manufacturing facilities. A significant disruption in the supply of a key component due to a work stoppage at one of the Company’s suppliers or any other supplier could have the same consequences, and accordingly, have a material adverse effect on the Company’s financial results.

13

The Company may incur significant restructuring charges.

The Company has taken, and expects to take, restructuring actions to realign and resize its production capacity and cost structure to meet current and projected operational and market requirements. Charges related to these actions could have a material adverse effect on the Company's financial condition, operating results and cash flows. Moreover, there can be no assurances that any future restructuring will be completed as planned or achieve the desired results.

The Company is involved from time to time in legal proceedings and commercial or contractual disputes, which could have an adverse effect on its business, results of operations and financial position.

The Company is involved in legal proceedings and commercial or contractual disputes that, from time to time, are significant. These are typically claims that arise in the normal course of business including, without limitation, commercial or contractual disputes (including disputes with suppliers), intellectual property matters, personal injury claims and employment matters. No assurances can be given that such proceedings and claims will not have a material adverse impact on the Company’s profitability and financial position.

The Company is subject to significant foreign currency risks and foreign exchange exposure.

As a result of Visteon's global presence, a significant portion of the Company's revenues and expenses is denominated in currencies other than the U.S. dollar. The Company is therefore subject to foreign currency risks and foreign exchange exposure. The Company's primary exposures are to the Euro, Japanese Yen, and Chinese Renminbi. While the Company employs financial instruments to hedge transactional foreign exchange exposure, including multi-year contracts, exchange rates are difficult to predict and such actions may not insulate the Company' completely from those exposures. As a result, volatility in certain exchange rates could adversely impact Visteon financial results and comparability of results from period to period.

Item 1B. | Unresolved Staff Comments |

None

Item 2. Properties

The Company's principal executive offices are located in Van Buren Township, Michigan. At December 31, 2017, the Company and its consolidated subsidiaries owned or leased approximately:

• | 34 corporate offices, technical and engineering centers and customer service centers in eleven countries around the world, of which 33 were leased and 1 was owned. |

• | 15 Electronics manufacturing and/or assembly facilities in Mexico, Portugal, Russia, Slovakia, Tunisia, India, Japan, South Korea, China, Thailand and Brazil, of which 12 were leased and 3 were owned. |

In addition, the Company's non-consolidated affiliates operate approximately 6 manufacturing and/or assembly locations, primarily in the Asia Pacific region. The Company considers its facilities to be adequate for its current uses.

Item 3. | Legal Proceedings |

Certain legal proceedings in which the Company is involved are discussed in Note 21 - "Commitments and Contingencies" of Part II, Item 8 "Financial Statements and Supplementary Data" and should be considered an integral part of Part I, Item 3 "Legal Proceedings."

Item 4. | Mine Safety Disclosures |

None

14

Item 4A. Executive Officers and Key Employees

The following table shows information about the executive officers of the Company and other key employees. Ages are as of February 1, 2018:

Name | Age | Position | ||

Sachin S. Lawande | 50 | Director, President and Chief Executive Officer | ||

Christian A. Garcia | 54 | Executive Vice President and Chief Financial Officer | ||

Sunil K. Bilolikar | 56 | Senior Vice President, Operations and Procurement | ||

Matthew M. Cole | 48 | Senior Vice President, Product Development Engineering | ||

Brett D. Pynnonen | 49 | Senior Vice President and General Counsel | ||

Markus J. Schupfner | 48 | Senior Vice President and Chief Technology Officer | ||

Robert R. Vallance | 57 | Senior Vice President, Customer Business Groups | ||

Stephanie S. Marianos | 49 | Vice President and Chief Accounting Officer | ||

Sachin S. Lawande has been Visteon’s Chief Executive Officer, President and a director of the Company since June 29, 2015. Before joining Visteon, Mr. Lawande served as Executive Vice President and President, Infotainment Division of Harman International Industries, Inc., an automotive supplier, from July 2013 to June 2015. From July 2011 to June 2013, he served as Executive Vice President and President of Harman’s Lifestyle Division, and from July 2010 to June 2011 as Executive Vice President and Co-President, Automotive Division. Prior to that he served as Harman’s Executive Vice President and Chief Technology Officer since February 2009. Mr. Lawande joined Harman International in 2006, following senior roles at QNX Software Systems and 3Com Corporation. He also serves on the board of directors of DXC Technology Company

Christian A. Garcia has been Visteon’s Executive Vice President and Chief Financial Officer since October 2016. Prior to joining the Company, Mr. Garcia served as Senior Vice President, Finance and Interim Chief Financial Officer of Halliburton Company, a global provider of products and services to the energy sector, from January 2015 to August 2016. From January 2014 to December 2015, he served as Halliburton’s Chief Accounting Officer and from September 2011 to December 2014 as Halliburton’s Treasurer. Prior to that, he was Senior Vice President, Investor Relations of Halliburton from January 2011 to August 2011. He also held a series of senior financial positions with Landmark Graphics, a software and consulting provider that was acquired by Halliburton. Prior to joining Landmark Graphics, he worked at Bell and Howell and San Miguel Corp. in the Philippines in various roles. Mr. Garcia also serves on the board of directors of Keane Group, Inc.

Sunil K. Bilolikar has been Visteon’s Senior Vice President, Operations and Purchasing since December 2016. Prior to that, he was Group Vice President, Operations and Purchasing since July 2014, Global Director, Operations and Purchasing from January 2012 to June 2014, and Global Director, Operations from 2005 to 2012. During his career with Visteon and Ford Motor Company, he has held several engineering and operations leadership positions in the U.S., Canada, India, Portugal and Germany.

Matthew M. Cole has been Visteon’s Senior Vice President, Product Development since December 2016. Prior to that, he was Vice President, Product Development upon rejoining the Company in July 2014. From July 2011 to June 2014, he served as Vice President, Engineering at Johnson Controls, Inc., an automotive supplier. From July 2010 to June 2011, he served as Johnson Controls' Vice President, Product Management. Prior to that, he spent 19 years at Ford Motor Company and Visteon in product development, engineering and leadership positions in the U.S. and Asia.

Brett D. Pynnonen has been Visteon’s Senior Vice President and General Counsel since December 2016. Prior to that, he was Vice President and General Counsel since joining the Company in March 2016. Before joining Visteon he was Senior Vice President, General Counsel and Corporate Secretary of Federal-Mogul Holdings Corporation, a global automotive supplier, from November 2007 to March 2016. Prior to that, he was General Counsel and Secretary of Covansys Corporation, a technology services company, and an attorney at the law firm of Butzel Long.

Markus J. Schupfner has been Visteon’s Senior Vice President and Chief Technology Officer since December 2016. Prior to that, he was Vice President and Chief Technology Officer since joining the Company in April 2016. Before joining Visteon he was Executive Vice President of Operations at Elektrobit Automotive GmbH, a supplier of embedded software solutions and services, since February 2014, and from November 2009 to January 2014, he was Elektrobit’s Vice President, Infotainment Solutions. Prior to that, he served as Vice President of Navigation for the Infotainment Division of Harman International Industries and held director-level roles at Siemens VDO and Siemens.

15

Robert R. Vallance has been Visteon’s Senior Vice President, Customer Business Groups since December 2016. Prior to that, he was Vice President, Customer Business Groups upon rejoining the Company in July 2014. From February 2008 to June 2015, he served as Vice President, Electronics Business Group of Johnson Controls, Inc., an automotive supplier. Prior to that, he spent 23 years at Ford Motor Company and Visteon in product development, program and commercial management, strategy and planning, product marketing and manufacturing.

Stephanie S. Marianos has been Visteon’s Vice President and Chief Accounting Officer since February 2017. Prior to that, she was Chief Accounting Officer since June 2015; Assistant Corporate Controller since July 2014; Associate Director, Corporate Finance since May 2012; Associate Director, Corporate Accounting since April 2008; and Senior Manager, Corporate Accounting since joining the Company in September 2005. Before joining Visteon, she was an independent accounting consultant serving manufacturing, insurance and health care companies. Ms. Marianos began her career at Ernst & Young LLP and is a certified public accountant.

16

Part II

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

On December 14, 2017, the Company's Board of Directors (the "Board") approved the Company to be voluntarily delisted from The New York Stock Exchange (“NYSE”) at the close of trading on December 26, 2017 and transfer the listing of its common stock to The NASDAQ Stock Market (“NASDAQ”) to commence trading on December 27, 2017. Visteon’s common stock will continue to trade under the stock symbol “VC”.

As of February 15, 2018, the Company had 30,919,267 shares of its common stock, $0.01 par value per share, outstanding, which were owned by 4,261 shareholders of record. The table below shows the high and low sales prices per share for the Company’s common stock as reported by the stock exchange for each quarterly period for the last two years.

2017 | |||||||

First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||

High | $101.12 | $103.58 | $125.46 | $132.42 | |||

Low | $80.94 | $92.37 | $101.27 | $121.99 | |||

2016 | |||||||

First Quarter* | Second Quarter | Third Quarter | Fourth Quarter | ||||

High | $80.85 | $81.04 | $73.13 | $84.48 | |||

Low | $54.71 | $64.11 | $63.04 | $64.95 | |||

*The Company paid a special distribution of $43.40 per share of common stock on January 22, 2016. The stock price before the distribution has been adjusted to proforma distribution as of January 1, 2016.

No dividends were paid by the Company on its common stock during the years ended December 31, 2017 and 2016. The Company’s Board evaluates the Company’s dividend policy based on all relevant factors. The Company’s credit agreements limit the amount of cash payments for dividends that may be made. Additionally, the ability of the Company’s subsidiaries to transfer assets is subject to various restrictions, including regulatory requirements and governmental restraints. Refer to Note 17, “Stockholders’ Equity and Non-controlling Interests,” in Item 8 of this Report.

The following table summarizes information relating to purchases made by or on behalf of the Company, or an affiliated purchaser, of shares of the Company’s common stock during the fourth quarter of 2017.

Period | Total Number of Shares (or Units) Purchased (1) | Average Price Paid per Share (or Unit) | Total Number of Shares (or units) Purchased as Part of Publicly Announced Plans or Programs (2) | Approximate Dollar Value of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs (3) | |||||

Oct. 1, 2017 to Oct. 31, 2017 | — | $0.00 | — | $0.00 | |||||

Nov. 1, 2017 to Nov. 30, 2017 | 98,283 | $125.10 | — | $0.00 | |||||

Dec. 1, 2017 to Dec. 31, 2017 | 138,101 | $128.37 | — | $0.00 | |||||

Total | 236,384 | $127.01 | — | $0.00 | |||||

(1) | This column includes 219 shares surrendered to the Company by employees to satisfy tax withholding obligations in connection with the vesting of restricted stock units made pursuant to the Visteon Corporation 2010 Incentive Plan. |

(2) | On January 9, 2017, the Company's Board of Directors authorized $400 million of share repurchases. As of December 31, 2017, there is $200 million remaining on this authorization. Additional repurchases of common stock, if any, may occur at the discretion of the Company. |

(3) | On January 15, 2018, the Company's Board authorized an additional $500 million share repurchases to be completed through 2020. |

The following information in Item 5 is not deemed to be “soliciting material” or be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 (“Exchange Act”) or to the liabilities of Section 18 of the Exchange Act, and

17

will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, except to the extent the Company specifically incorporates it by reference into such a filing.

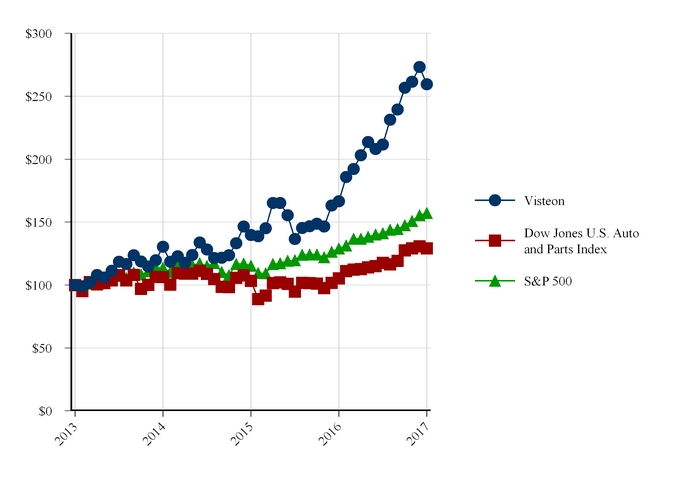

Performance Graph

The following graph compares the cumulative total stockholder return from December 31, 2013, through December 31, 2017, for Visteon's existing common stock, the S&P 500 Index and the Dow Jones U.S. Auto Parts Index. The graph below assumes that $100 was invested on December 31, 2013, in each of the Company's common stock, the stocks comprising the S&P 500 Index and the stocks comprising the Dow Jones U.S. Auto Parts Index, and that all that dividends have been reinvested.

December 31, 2013 | December 31, 2014 | December 31, 2015 | December 31, 2016 | December 31, 2017 | |

Visteon Corporation | $100.00 | $130.49 | $139.82 | $166.65 | $259.58 |

Dow Jones U.S. Auto & Parts Index | $100.00 | $106.36 | $103.44 | $105.35 | $129.22 |

S&P 500 | $100.00 | $113.68 | $115.24 | $129.02 | $157.17 |

The above comparisons are required by the Securities and Exchange Commission and are not intended to forecast or be indicative of possible future performance of the Company's common stock or the referenced indices.

18

Item 6. | Selected Financial Data |

The following statement of operations, statement of cash flows and balance sheet data were derived from the Company's consolidated financial statements for the years ended December 31, 2017, 2016, 2015, 2014 and 2013. This information should be read in conjunction with Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data” in this Report.

Year Ended December 31 | Year Ended December 31 | Year Ended December 31 | Year Ended December 31 | Year Ended December 31 | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

(Dollars in Millions, Except Per Share Amounts) | |||||||||||||||||||

Statement of Operations Data: | |||||||||||||||||||

Net sales | $ | 3,146 | $ | 3,161 | $ | 3,245 | $ | 2,586 | $ | 1,724 | |||||||||

Net income (loss) from continuing operations | 175 | 131 | 42 | (75 | ) | 555 | |||||||||||||

Net income (loss) from discontinued operations, net of tax | 17 | (40 | ) | 2,286 | (131 | ) | 220 | ||||||||||||

Net income (loss) attributable to Visteon Corporation | $ | 176 | $ | 75 | $ | 2,284 | $ | (295 | ) | $ | 690 | ||||||||

Basic earnings (loss) per share | |||||||||||||||||||

Continuing operations | $ | 5.03 | $ | 3.28 | $ | 0.52 | $ | (2.14 | ) | $ | 11.10 | ||||||||

Discontinued operations | 0.54 | (1.14 | ) | 53.48 | (4.30 | ) | 2.70 | ||||||||||||

Basic earnings (loss) attributable to Visteon Corporation | $ | 5.57 | $ | 2.14 | $ | 54.00 | $ | (6.44 | ) | $ | 13.80 | ||||||||

Diluted earnings (loss) per share | |||||||||||||||||||

Continuing operations | $ | 4.94 | $ | 3.25 | $ | 0.51 | $ | (2.14 | ) | $ | 10.86 | ||||||||

Discontinued operations | 0.53 | (1.13 | ) | 52.12 | (4.30 | ) | 2.64 | ||||||||||||

Diluted earnings (loss) attributable to Visteon Corporation | $ | 5.47 | $ | 2.12 | $ | 52.63 | $ | (6.44 | ) | $ | 13.50 | ||||||||

Balance Sheet Data: | |||||||||||||||||||

Total assets | $ | 2,304 | $ | 2,373 | $ | 4,681 | $ | 5,323 | $ | 6,027 | |||||||||

Total debt, excluding held for sale | $ | 393 | $ | 382 | $ | 383 | $ | 616 | $ | 399 | |||||||||

Total Visteon Corporation stockholders' equity | $ | 637 | $ | 586 | $ | 1,057 | $ | 865 | $ | 1,920 | |||||||||

Statement of Cash Flows Data: | |||||||||||||||||||

Cash provided from operating activities | $ | 217 | $ | 120 | $ | 338 | $ | 284 | $ | 312 | |||||||||

Cash (used by) provided from investing activities | $ | (175 | ) | $ | 302 | $ | 2,358 | $ | (740 | ) | $ | 698 | |||||||

Cash used by financing activities | $ | (233 | ) | $ | (2,262 | ) | $ | (774 | ) | $ | (359 | ) | $ | (141 | ) | ||||

Year Ended December 31, 2017

On December 1, 2017, the Company completed an asset sale related to an Electronics facility in France to a third party (the "France Transaction"). In connection with the France Transaction, the Company recorded pre-tax losses of approximately $33 million including a cash contribution of $13 million, long-lived asset impairment charges of $13 million and other working capital and transaction related impacts of $7 million.

Year Ended December 31, 2016

On December 1, 2016, the Company completed the sale of its Interiors operations in Argentina and Brazil, incurring a loss of $19 million representing the final working capital cash contribution and related contractual obligations, completing the Interiors Divestiture.

During the fourth quarter of 2016, the Company sold its South Africa climate operations and recorded a loss of $11 million related to foreign currency translation amounts previously recorded in accumulated other comprehensive loss.

On December 9, 2015, the Company declared a special distribution of $43.40 per share of its common stock outstanding as of January 15, 2016, or approximately $1.75 billion in the aggregate. On January 22, 2016 approximately $1.74 billion was paid.

19

Year Ended December 31, 2015

On June 9, 2015, Visteon completed the sale of all of its shares of Halla Visteon Climate Control Corporation, a Korean corporation (“HVCC”). The Company received net cash proceeds of approximately $2.7 billion and recognized a pretax gain of approximately $2.3 billion in connection with the closing of the Climate Transaction in the second quarter of 2015.

On December 1, 2015, Visteon completed the Germany Interiors Divestiture. The Company recognized a pretax loss on divestiture of $105 million during the year ended December 31, 2015, related to foreign currency translation and pension benefit plan amounts previously recorded in accumulated other comprehensive loss in 2015. Although the divestiture represented a continuation of the Company’s exit from the Interiors business, the divestiture was not considered a strategic shift given the size of the operations representing $86 million in 2015 sales. Therefore, the operations did not qualify for discontinued operations presentation and operating results prior to the sale were classified within Other as continuing operations.

Year Ended December 31, 2014

During 2014, the Company divested the majority of its global Interiors business (the "Interiors Divestiture"). The Company recorded losses totaling $326 million during the year ended December 31, 2014. The operating results of Interiors businesses subject to the Interiors Divestiture have been reclassified to Net income (loss) from discontinued operations, net of tax for all periods presented. These losses included an asset impairment loss of $190 million recorded during the second quarter of 2014 pursuant to execution of the Purchase Agreement and additional losses of $136 million during the fourth quarter of 2014 pursuant to the Master Closing on November 1, 2014 and the completion of the sale of an Interiors operation in India on December 1, 2014. The operating results of Interiors businesses subject to the Interiors Divestiture were reclassified to Net income (loss) from discontinued operations, net of tax for all periods presented.

On July 1, 2014, the Company completed the acquisition of substantially all of the global automotive electronics business of Johnson Controls Inc. for an aggregate purchase price of $299 million, including $31 million of cash and equivalents at the acquired business. The Company commenced consolidation of the acquired business from date of acquisition.

20

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

Management’s Discussion and Analysis (“MD&A”) is intended to help the reader understand the results of operations, financial condition and cash flows of Visteon Corporation (“Visteon” or the “Company”). MD&A is provided as a supplement to, and should be read in conjunction with, the Company’s consolidated financial statements and related notes appearing in Item 8 “Financial Statements and Supplementary Data” of this Report.

Description of Business

Visteon Corporation (the "Company" or "Visteon") is a global automotive supplier that designs, engineers and manufactures innovative electronics products for nearly every original equipment vehicle manufacturer ("OEM") worldwide including Ford, Mazda, Renault/Nissan, General Motors, Jaguar / Land Rover, Honda, Volkswagen, BMW and Daimler. Visteon is headquartered in Van Buren Township, Michigan, and has an international network of manufacturing operations, technical centers and joint venture operations, supported by approximately 10,000 employees, dedicated to the design, development, manufacture and support of its product offerings and its global customers. The Company's manufacturing and engineering footprint is principally located outside of the United States.

Visteon provides value for its customers and stockholders through its technology-focused vehicle cockpit electronics business, by delivering a rich, connected cockpit experience for every car from luxury to entry. The Company's cockpit electronics business is one of the broadest portfolios in the industry and includes instrument clusters, information displays, infotainment systems, audio systems, telematics solutions, and head-up displays. The Company's vehicle cockpit electronics business comprises and is reported under the Electronics segment. Prior to 2017, the Company also had Other operations consisting primarily of South Africa and South America climate operations substantially exited during the fourth quarter of 2016. As the Company ceased Other operations in 2016, future impacts of such legacy operations will be included with the Company's continuing Electronics operations.

Executive Summary

Strategic Priorities

Visteon is a technology-focused, pure-play supplier of automotive cockpit electronics. The cockpit electronics business is growing faster than underlying vehicle production, expected to grow by more than 1.5 times over the next five years. Key drivers of the growth include connected car, advanced driver assistance systems ("ADAS") and electrification technologies.

The Company has laid out the following strategic priorities:

• | Long-Term Growth and Margin Expansion - Visteon offers technology and related manufacturing operations for instrument clusters, information displays, infotainment systems, audio systems, telematics solutions, and head-up displays. Backlog, defined as cumulative remaining life of program booked sales, is approximately $19.4 billion as of December 31, 2017, or 6.1 times the last twelve months of sales, reflecting a strong booked sales base on which to launch future growth. This is $2.9 billion higher than the $16.5 billion backlog as of December 31, 2016. |

2017 new business wins included the third and fourth awards of SmartCore™ cockpit technology which represents the industry-first automotive grade cockpit domain controller, consolidating separate cockpit electronics products on a single, multi-core chip, accessible through integrated human machine interface ("HMI") technology.