Attached files

| file | filename |

|---|---|

| EX-99.6 - EX-99.6 - iHeartCommunications, Inc. | d531688dex996.htm |

| EX-99.5 - EX-99.5 - iHeartCommunications, Inc. | d531688dex995.htm |

| EX-99.3 - EX-99.3 - iHeartCommunications, Inc. | d531688dex993.htm |

| EX-99.2 - EX-99.2 - iHeartCommunications, Inc. | d531688dex992.htm |

| EX-99.1 - EX-99.1 - iHeartCommunications, Inc. | d531688dex991.htm |

| 8-K - 8-K - iHeartCommunications, Inc. | d531688d8k.htm |

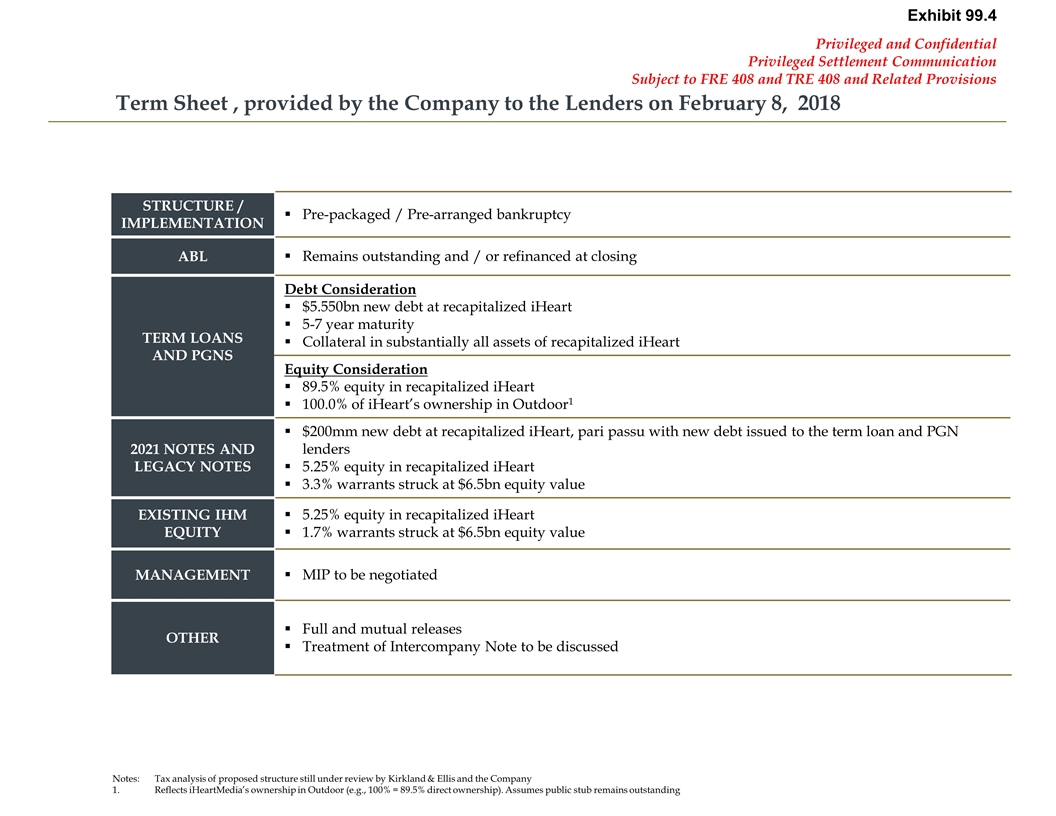

Term Sheet , provided by the Company to the Lenders on February 8, 2018 STRUCTURE / IMPLEMENTATION Pre-packaged / Pre-arranged bankruptcy ABL Remains outstanding and / or refinanced at closing TERM LOANS AND PGNS Debt Consideration $5.550bn new debt at recapitalized iHeart 5-7 year maturity Collateral in substantially all assets of recapitalized iHeart Equity Consideration 89.5% equity in recapitalized iHeart 100.0% of iHeart’s ownership in Outdoor1 2021 NOTES AND LEGACY NOTES $200mm new debt at recapitalized iHeart, pari passu with new debt issued to the term loan and PGN lenders 5.25% equity in recapitalized iHeart 3.3% warrants struck at $6.5bn equity value EXISTING IHM EQUITY 5.25% equity in recapitalized iHeart 1.7% warrants struck at $6.5bn equity value MANAGEMENT MIP to be negotiated OTHER Full and mutual releases Treatment of Intercompany Note to be discussed Notes:Tax analysis of proposed structure still under review by Kirkland & Ellis and the Company Reflects iHeartMedia’s ownership in Outdoor (e.g., 100% = 89.5% direct ownership). Assumes public stub remains outstanding Exhibit 99.4