Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Roadrunner Transportation Systems, Inc. | rrts-20180205x8xk2ndamendt.htm |

EXECUTION VERSION

SECOND AMENDMENT TO CREDIT AGREEMENT

SECOND AMENDMENT TO CREDIT AGREEMENT (this “Second Amendment”) dated as of

January 30, 2018 among ROADRUNNER TRANSPORTATION SYSTEMS, INC., a Delaware

corporation (the “Company”), each of the Subsidiaries of the Company identified as “Subsidiary

Guarantors” on the signature pages to the Credit Agreement (the “Subsidiary Guarantors”), the Lenders

(as defined below) party hereto and BMO HARRIS BANK N.A., as Administrative Agent (the

“Administrative Agent”), each of which is a party to the Existing Credit Agreement (as defined below).

WHEREAS, Company, the Subsidiary Guarantors, the financial institutions from time to time

party thereto as lenders (the “Lenders”) and the Administrative Agent are parties to that certain Credit

Agreement dated as of July 21, 2017 (as amended, supplemented, or otherwise modified from time to

time prior to this Second Amendment and as in effect immediately prior to the effectiveness of this

Second Amendment, the “Existing Credit Agreement”, and as amended by this Second Amendment and

as may be further amended, supplemented or otherwise modified and in effect from time to time, the

“Amended Credit Agreement”).

WHEREAS, the Company and the Subsidiary Guarantors request that the Lenders and the

Administrative Agent amend the Existing Credit Agreement in certain respects, and the Lenders party

hereto and the Administrative Agent are willing to so amend the Existing Credit Agreement.

WHEREAS, these recitals shall be construed as part of this Second Amendment.

NOW THEREFORE, in consideration of the foregoing and for other good and valuable

consideration, the receipt of which is hereby acknowledged, the parties hereto hereby agree as follows:

Section 1. Definitions. Except as otherwise defined in this Second Amendment, terms defined in

the Amended Credit Agreement are used herein as defined therein.

Section 2. Amendments to the Existing Credit Agreement. From and after the Second

Amendment Effective Date, the Existing Credit Agreement shall be amended as follows:

2.01. References Generally. References in the Existing Credit Agreement (including

references to the Existing Credit Agreement as amended hereby) to “this Agreement” (and indirect

references such as “hereunder”, “hereby”, “herein” and “hereof”) and each reference to the Existing

Credit Agreement in the other Loan Documents (and indirect references such as “thereunder”, “thereby”,

“therein” and “thereof”) shall be deemed to be references to the Existing Credit Agreement as amended

hereby.

2.02. Amended Language.

(a) The Existing Credit Agreement is amended by (i) deleting the definition of

“Investment Agreement” in Section 1.01 of the Existing Credit Agreement and (ii) replacing each

remaining reference to “Investment Agreement” with “Existing Investment Agreement”.

(b) Section 1.01 of the Existing Credit Agreement is amended by adding the

following defined terms in appropriate alphabetical order as follows:

“Existing Investment Agreement” means that certain Investment Agreement

dated as of May 1, 2017, by and among the Company, Elliott Associates, L.P., a

AmericasActive:11640079.8

2

Delaware limited partnership, and Brockdale Investments LP, a Delaware limited

partnership.

“Second Amendment Effective Date” means January 30, 2018.

“Second Amendment Investment Agreement” means the Investment Agreement

by and among the Company, Elliott Associates, L.P., a Delaware limited partnership, and

Brockdale Investments LP, a Delaware limited partnership entered into within 30 days of

the Second Amendment Effective Date on the terms described in paragraphs 1 and 2 of

that certain commitment letter dated as of the Second Amendment Effective Date by and

among the Company, Elliott Associates, L.P., a Delaware limited partnership, and

Brockdale Investments LP, a Delaware limited partnership and otherwise on terms

reasonably acceptable to the Administrative Agent.

“Second Amendment Series E Preferred Stock” means the “Series E Preferred

Stock” as defined in, and issued pursuant to, the Second Amendment Investment

Agreement; provided that (A) the aggregate amount of such Preferred Stock shall not

exceed $52,500,000, (B) such Preferred Stock shall be issued in increments of not less

than $8,750,000, (C) the Net Cash Proceeds of each issuance of such Preferred Stock

shall be applied to prepay Term Loans pursuant to Section 2.06(b)(i)(E) and (D) such

Preferred Stock is issued within six months of the Second Amendment Effective Date.

(c) Section 1.01 of the Existing Credit Agreement is amended by amending and

restating the following defined terms in appropriate alphabetical order as follows:

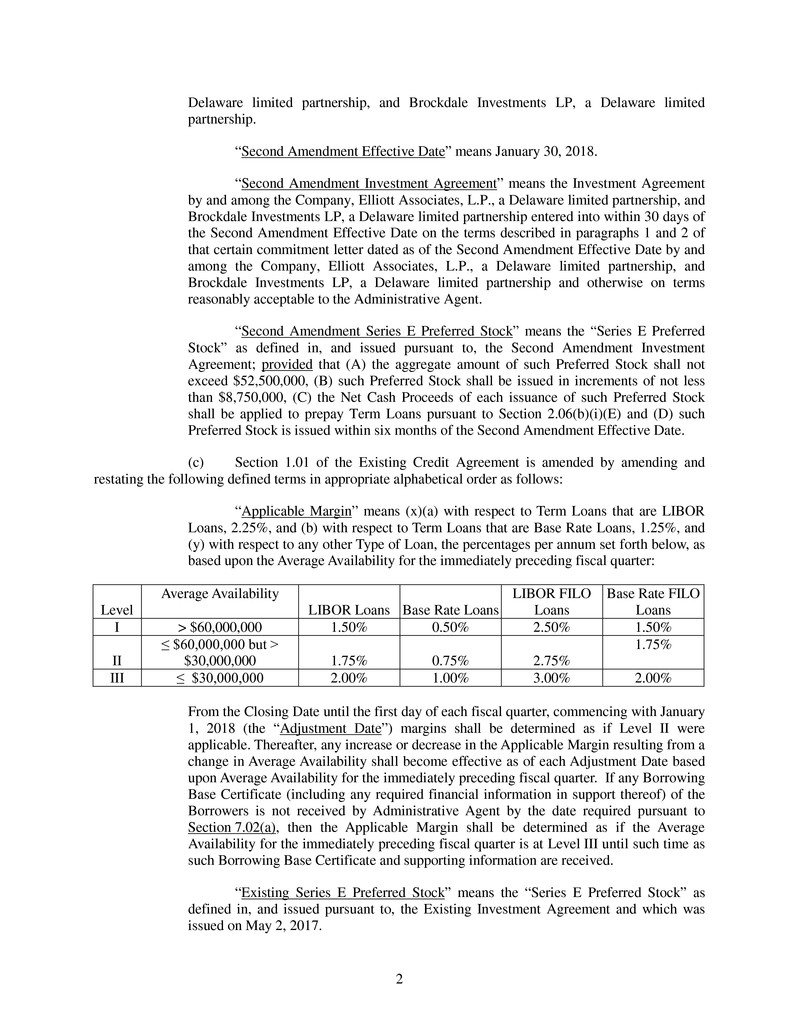

“Applicable Margin” means (x)(a) with respect to Term Loans that are LIBOR

Loans, 2.25%, and (b) with respect to Term Loans that are Base Rate Loans, 1.25%, and

(y) with respect to any other Type of Loan, the percentages per annum set forth below, as

based upon the Average Availability for the immediately preceding fiscal quarter:

Level

Average Availability

LIBOR Loans Base Rate Loans

LIBOR FILO

Loans

Base Rate FILO

Loans

I > $60,000,000 1.50% 0.50% 2.50% 1.50%

II

≤ $60,000,000 but >

$30,000,000 1.75% 0.75% 2.75%

1.75%

III ≤ $30,000,000 2.00% 1.00% 3.00% 2.00%

From the Closing Date until the first day of each fiscal quarter, commencing with January

1, 2018 (the “Adjustment Date”) margins shall be determined as if Level II were

applicable. Thereafter, any increase or decrease in the Applicable Margin resulting from a

change in Average Availability shall become effective as of each Adjustment Date based

upon Average Availability for the immediately preceding fiscal quarter. If any Borrowing

Base Certificate (including any required financial information in support thereof) of the

Borrowers is not received by Administrative Agent by the date required pursuant to

Section 7.02(a), then the Applicable Margin shall be determined as if the Average

Availability for the immediately preceding fiscal quarter is at Level III until such time as

such Borrowing Base Certificate and supporting information are received.

“Existing Series E Preferred Stock” means the “Series E Preferred Stock” as

defined in, and issued pursuant to, the Existing Investment Agreement and which was

issued on May 2, 2017.

3

(d) The definition of Disqualified Equity Interest in Section 1.01 of the Existing

Credit Agreement is amended by amending and restating the parenthetical in clause (b)(ii) thereof as

follows:

(other than Preferred Stock under the Existing Investment Agreement existing on

the Closing Date and the Second Amendment Series E Preferred Stock (but excluding

any reissuance thereof))

(e) Section 2.06(b)(i) of the Existing Credit Agreement is amended by adding a new

clause (E) to the end thereof to read as follows:

(E) Second Amendment Series E Preferred Stock Issuances. The Borrowers shall

prepay an aggregate principal amount of Term Loans equal to (i) with respect to the first

$17,500,000 (based on the aggregate gross purchase price) of issued Second Amendment

Series E Preferred Stock, 10% of the aggregate gross purchase price thereof immediately

upon receipt thereof, (ii) with respect to the second $17,500,000 (based on the aggregate

gross purchase price) of issued Second Amendment Series E Preferred Stock, 20% of the

aggregate gross purchase price thereof immediately upon receipt thereof, and (iii) with

respect to the any remaining issued Second Amendment Series E Preferred Stock, 30% of

the aggregate gross purchase price thereof immediately upon receipt thereof, each such

prepayment to be applied in inverse order of maturity and allocated among the Lenders in

accordance with their respective Applicable Percentage in respect of the Term Loans.

(f) Section 7.03(m) of the Existing Credit Agreement is amended and restated in its

entirety as follows:

(m) promptly after the furnishing thereof, copies of any material requests or

notices received by any Borrower or Subsidiary (other than in the ordinary course of

business or to the extent duplicative of notices provided hereunder) and copies of any

material statement or report furnished to any lender or holder of any “Preferred Stock”

under the Existing Investment Agreement or the Second Amendment Investment

Agreement (including executed copies of the Second Amendment Investment Agreement

and the certificate of designation related thereto promptly after execution or filing

thereof, as applicable), Permitted Term Debt or Subordinated Debt; and

(g) Section 8.06(f) of the Existing Credit Agreement is amended by replacing the

words “Investment Agreement” with “Existing Investment Agreement or Second Amendment Investment

Agreement, as applicable”:

(h) Section 8.11 of the Existing Credit Agreement is amended by adding a new

clause (c) to read as follows:

(c) Amend, modify or change in any manner any term or condition of the

Existing Investment Agreement, the Second Amendment Investment Agreement or the

preferred stock certificates of designation related thereto, in each case so that the terms

and conditions thereof are less favorable in any material respect to the Administrative

Agent and the Lenders than the terms thereof (i) in the case of the Existing Investment

Agreement and the preferred stock certificates of designation related thereto, as of the

Closing Date and (ii) in the case of the Second Amendment Investment Agreement and

the preferred stock certificate of designation related thereto, as of the date of execution or

filing thereof, as applicable.

4

(i) Schedule 8.01 of the Existing Credit Agreement is amended by replacing

reference to the Preferred Stock issued pursuant to the Investment Agreement in clause 1 thereof with

“[Reserved]”.

Section 3. Representations and Warranties of the Loan Parties. The Loan Parties represent and

warrant to the Administrative Agent and the Lenders that as of the Second Amendment Effective Date:

3.01. each of the representations and warranties set forth in the Amended Credit Agreement

and in the other Loan Documents are true and correct in all respects (or in all material respects for such

representations and warranties that are not by their terms already qualified as to materiality) as of the date

hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in

which case they shall be true and correct in all respects (or in all material respects for such representations

and warranties that are not by their terms already qualified as to materiality) as of such earlier date, and

except that for purposes of this Section 3.01, (i) the representations and warranties contained in

Section 6.05(a) and (c) of the Amended Credit Agreement shall be deemed to refer to the most recent

statements furnished pursuant to clause (a) of Section 7.01 of the Amended Credit Agreement and (ii) the

representations and warranties contained in Section 6.05(b) of the Amended Credit Agreement shall be

deemed to refer to the most recent statements furnished pursuant to clause (b) of Section 7.01 of the

Amended Credit Agreement; and

3.02. both immediately before and after giving effect to this Second Amendment and the

transactions contemplated hereby, no Default shall have occurred and be continuing, or would result

therefrom.

Section 4. Conditions Precedent. The amendments to the Existing Credit Agreement set forth in

Section 2 above shall become effective as of the date (the “Second Amendment Effective Date”), upon

which each of the following conditions precedent shall be satisfied or waived:

4.01. Execution. The Administrative Agent shall have received counterparts of this Second

Amendment and the fee letter dated the date hereof, executed by the Loan Parties, the Administrative

Agent and the Lenders.

4.02. Preferred Stock Consent. The Administrative Agent shall have received confirmation

that the holders of the “Preferred Stock” under the Investment Agreement have consented to the Second

Amendment in form and substance satisfactory to the Administrative Agent.

4.03. Fees. The Company shall have paid to the Administrative Agent and the Lenders the

fees described in that certain fee letter agreement dated the date hereof.

4.04. Costs and Expenses. The Company shall have paid all reasonable and documented out-

of-pocket costs and expenses of the Administrative Agent in connection with this Second Amendment

payable pursuant to Section 11.04 of the Amended Credit Agreement.

Section 5. Reference to and Effect Upon the Existing Credit Agreement.

5.01. Except as specifically amended or waived above, the Existing Credit Agreement and the

other Loan Documents shall remain unchanged and in full force and effect and are hereby ratified and

confirmed.

5.02. The execution, delivery and effectiveness of this Second Amendment shall not operate as

a waiver of any right, power or remedy of the Administrative Agent or any Lender under the Existing

5

Credit Agreement or any Loan Document, nor constitute a waiver of any provision of the Existing Credit

Agreement or any Loan Document, except as specifically set forth herein.

Section 6. Ratification of Liability. As of the Second Amendment Effective Date, the Company

and the other Loan Parties, as debtors, grantors, pledgors, guarantors, assignors, or in other similar

capacities in which such parties grant liens or security interests in their properties or otherwise act as

accommodation parties or guarantors, as the case may be, under the Loan Documents to which they are a

party, hereby ratify and reaffirm all of their payment and performance obligations and obligations to

indemnify, contingent or otherwise, under each of such Loan Documents to which they are a party, and

ratify and reaffirm their grants of liens on or security interests in their properties pursuant to such Loan

Documents to which they are a party, respectively, as security for the Obligations, and as of the Second

Amendment Effective Date, each such Person hereby confirms and agrees that such liens and security

interests hereafter secure all of the Obligations, including, without limitation, all additional Obligations

hereafter arising or incurred pursuant to or in connection with this Second Amendment, the Credit

Agreement or any other Loan Document. As of the Second Amendment Effective Date, the Company and

the other Loan Parties further agree and reaffirm that the Loan Documents to which they are parties now

apply to all Obligations as defined in the Credit Agreement (including, without limitation, all additional

Obligations hereafter arising or incurred pursuant to or in connection with this Second Amendment, the

Credit Agreement or any other Loan Document). As of the Second Amendment Effective Date, the

Company and the other Loan Parties (a) further acknowledge receipt of a copy of this Second

Amendment, (b) consent to the terms and conditions of same, and (c) agree and acknowledge that each of

the Loan Documents to which they are a party remain in full force and effect and is hereby ratified and

confirmed.

Section 7. Miscellaneous. Except as herein provided, the Existing Credit Agreement shall

remain unchanged and in full force and effect. This Second Amendment is a Loan Document for all

purposes of the Amended Credit Agreement. This Second Amendment may be executed in any number of

counterparts, and by different parties hereto on separate counterpart signature pages, and all such

counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of a

counterpart signature page by facsimile transmission or by e-mail transmission of an Adobe portable

document format file (also known as a “PDF” file) shall be effective as delivery of a manually executed

counterpart signature page. Section headings used in this Second Amendment are for reference only and

shall not affect the construction of this Second Amendment.

Section 8. GOVERNING LAW. THIS SECOND AMENDMENT, AND THE RIGHTS AND

DUTIES OF THE PARTIES HERETO, SHALL BE GOVERNED BY, AND CONSTRUED IN

ACCORDANCE WITH, THE LAWS OF THE STATE OF ILLINOIS.

Section 9. Release and Waiver. The Loan Parties each do hereby release the Administrative

Agent and each of the Lenders and each of their officers, directors, employees, agents, attorneys, personal

representatives, successors, predecessors and assigns from all manner of actions, cause and causes of

action, suits, deaths, sums of money, accounts, reckonings, bonds, bills, specialties, covenants,

controversies, agreements, promises, variances, trespasses, damages, judgments, executions, claims and

demands, whatsoever, in law or in equity, and particularly, without limiting the generality of the

foregoing, in connection with the Credit Agreement and the other Loan Documents and any agreements,

documents and instruments relating to the Credit Agreement and the other Loan Documents and the

administration of the Credit Agreement and the other Loan Documents, all indebtedness, obligations and

liabilities of the Loan Parties to the Administrative Agent or any Lender and any agreements, documents

and instruments relating to the Credit Agreement and the other Loan Documents (collectively, the

“Claims”), which the Loan Parties now have against the Administrative Agent or any Lender or ever had,

or which might be asserted by their heirs, executors, administrators, representatives, agents, successors, or

6

assigns based on any Claims which exist on or at any time prior to the date of this Second Amendment.

The Loan Parties expressly acknowledge and agree that they have been advised by counsel in connection

with this Second Amendment and that they each understand that this Section 9 constitutes a general

release of the Administrative Agent and the Lenders and that they each intend to be fully and legally

bound by the same. The Loan Parties further expressly acknowledge and agree that this general release

shall have full force and effect notwithstanding the occurrence of a breach of the terms of this Second

Amendment or an Event of Default or Default under the Credit Agreement.

[signature pages follow]