Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Ruths Hospitality Group, Inc. | ruth-ex992_43.htm |

| 8-K - 8-K - Ruths Hospitality Group, Inc. | ruth-8k_20180108.htm |

RUTH’S HOSPITALITY GROUP

WINTER UPDATE 2018

RUTH’S HOSPITALITY GROUP

Abdiel Aleman, VP of Culinary Development – 1997 Culinary Institute of America

Exhibit 99.1

DISCLAIMER: THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995.

This presentation contains “forward-looking statements” that reflect, when made, the Company’s expectations or beliefs concerning future events that involve risks and uncertainties. Forward-looking statements frequently are identified by the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “targeting,” “will be,” “will continue,” “will likely result,” or other similar words and phrases. Similarly, statements here in that describe the Company’s objectives, plans or goals, including with respect to new restaurant openings, strategy, financial outlook, capital expenditures, the reduction in our effective tax rate and the expected benefits of the Hawaii franchisee acquisition also are forward-looking statements. Actual results could differ materially from those projected, implied or anticipated by the Company’s forward-looking statements. Some of the factors that could cause actual results to differ include: reductions in the availability of, or increases in the cost of, USDA Prime grade beef, fish and other food items; changes in economic conditions and general trends; the loss of key management personnel; the effect of market volatility on the Company’s stock price; health concerns about beef or other food products; the effect of competition in the restaurant industry; changes in consumer preferences or discretionary spending; labor shortages or increases in labor costs; the impact of federal, state or local government regulations relating to Company employees, the sale or preparation of food, the sale of alcoholic beverages and the opening of new restaurants; harmful actions taken by the Company’s franchisees; a material failure, interruption or security breach of the Company’s information technology network; repeal or reduction of the federal FICA tip credit; unexpected expenses incurred as a result of the sale of the Mitchell’s Restaurants; the Company’s ability to protect its name and logo and other proprietary information; an impairment in the financial statement carrying value of our goodwill, other intangible assets or property; the impact of litigation; the restrictions imposed by the Company’s Credit Agreement; changes in, or the discontinuation of, the Company’s quarterly cash dividend payments or share repurchase program; unanticipated transaction costs for the Hawaii franchisee acquisition; and the Company’s inability to successfully integrate the Hawaii franchisee restaurants into its operations. For a discussion of these and other risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 25, 2016, which is available on the SEC’s website at www.sec.gov. All forward-looking statements are qualified in their entirety by this cautionary statement, and the Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. You should not assume that material events subsequent to the date of this presentation have not occurred.

Unless the context otherwise indicates, all references in this report to the “Company,” “Ruth’s,” “we,” “us”, “our” or similar words are to Ruth’s Hospitality Group, Inc. and its subsidiaries. Ruth’s Hospitality Group, Inc. is a Delaware corporation formerly known as Ruth’s Chris Steak House, Inc., and was founded in 1965.

|

|

RUTH’S HOSPITALITY GROUP |

A COMPELLING LONG-TERM INVESTMENT OPPORTUNITY

Proven, differentiated business model with a history of success

Record of consistent performance driven by operational excellence

Cash flow supports multiple levers to drive total shareholder returns

|

|

RUTH’S HOSPITALITY GROUP |

RUTH’S CHRIS STEAK HOUSE: A BRAND WITH STAYING POWER

From our beginnings in New Orleans back in 1965, founder Ruth Fertel’s simple and timeless formula of always offering the highest quality food, beverage and service in a warm and inviting atmosphere has resonated strongly with guests.

|

|

RUTH’S HOSPITALITY GROUP |

PROVEN BUSINESS MODEL – HAS GROWN TO 134 U.S. LOCATIONS

Domestic company-owned count includes six locations in Hawaii (not pictured) and locations in Cherokee, NC & Tulsa, OK operating under contractual agreements.

Domestic franchise-owned count includes one location in Puerto Rico (not pictured).

79 Company / 55 Franchise

|

|

RUTH’S HOSPITALITY GROUP |

PROVEN BUSINESS MODEL – AND 21 INTERNATIONAL LOCATIONS

|

▪ Chengdu, China ▪ Shanghai, China ▪ Taipei, Taiwan ▪ Taipei, Taiwan (Dai Zhi) ▪ Taichung, Taiwan ▪ Kaohsiung, Taiwan ▪ Kowloon, Hong Kong ▪ Queensway, Hong Kong ▪ Tokyo, Japan ▪ Marina Square, Singapore ▪ Dubai, UAE ▪ Jakarta, Indonesia ▪ Palm Beach, Aruba ▪ Panama City, Panama ▪ Cabo San Lucas, Mexico ▪ Cancun, Mexico ▪ Toronto, Canada ▪ Mississauga, Canada ▪ Niagara Falls, Canada ▪ Edmonton, Canada ▪ Calgary, Canada |

|

|

OVER 60% GROWTH INTERNATIONALLY SINCE 2008

|

|

RUTH’S HOSPITALITY GROUP |

BROAD APPEAL ACROSS MULTIPLE CUSTOMER GROUPS

SPECIAL OCCASIONS

Holiday offerings

Birthdays

Anniversaries

BUSINESS / CORPORATE

Onsite event managers

Extensive private dining and off-site catering

HD Satellite broadcast for multi-location events

CORE CUSTOMERS

Innovation: three prix fixe menu launches each year

Sizzle, Swizzle & Swirl Happy Hour

Core menu evolution

MAKING MEMORIES ON 500 DEGREE SIZZLING PLATES

|

|

RUTH’S HOSPITALITY GROUP |

MAINTAIN HEALTHY CORE

Grow sales through same store sales initiatives

Ruth’s 2.0 menu updates

Ruth’s 2.0 restaurant remodels

CONTINUE DISCIPLINED GROWTH

Three to five new restaurants per year for both franchise and Company

Acquire franchise territory at attractive prices

RETURN EXCESS CAPITAL

Strong FCF allows significant return of capital through:

1.Dividend payments

2.Share repurchases

3.Debt Repayment

|

|

RUTH’S HOSPITALITY GROUP |

THE SECRET BEHIND THE SIZZLE; MAINTAIN A HEALTHY CORE

Grow sales through same store sales initiatives

Ruth’s 2.0 menu updates

Ruth’s 2.0 restaurants remodels

|

|

RUTH’S HOSPITALITY GROUP |

OUR PEOPLE, OUR FOOD, OUR ATMOSPHERE

OUR PEOPLE

Expert, tenured restaurant team

Rigorous investment in annual recertification for corporate and franchise team members

OUR FOOD

Only the best will do – USDA prime steak, fresh seafood and local produce

Industry-leading bar menu featuring fresh-squeezed, handcrafted, mixology-driven cocktail list

OUR ATMOSPHERE

Classic American steak house with contemporary touches of whimsy

All locations uniquely designed to reflect individual market characteristics and local tastes

|

|

RUTH’S HOSPITALITY GROUP |

|

|

|

RUTH'S 2.0 A marketing and operational initiative to evolve our menu, infrastructure and design elements. MENU Adding new menu items that appeal to guests without adding operational complexity. DEPLOYMENT Menu design changes completed in 2016. Multi-year initiative on infrastructure and design changes. |

Chilled Seafood Tower

|

|

RUTH’S HOSPITALITY GROUP |

|

|

|

|

|

|

Cowboy Ribeye

Spicy Shrimp

Crab Stack

|

|

RUTH’S HOSPITALITY GROUP |

RUTH'S 2.0 RESTAURANT REMODELS

|

|

|

RUTH'S 2.0 A marketing and operational initiative to evolve our menu, infrastructure and design elements. DESIGN All new Company and Franchise restaurants will reflect updated infrastructure & design elements. REMODELS Multiyear initiative that will align portions of new design and infrastructure elements. Targeting 6-10 remodels annually.

|

WEEHAWKEN, NJ

|

|

RUTH’S HOSPITALITY GROUP |

COMPLETED APRIL 2016

|

|

|

|

|

|

RUTH’S HOSPITALITY GROUP |

THE SECRET BEHIND THE SIZZLE: CONTINUE DISCIPLINED GROWTH • Three to five new restaurants per year for both franchise and Company • Acquire franchise territory at attractive prices

THE SECRET BEHIND THE SIZZLE: CONTINUE DISCIPLINED GROWTH

Three to five new restaurants per year for both franchise and Company

Acquire franchise territory at attractive prices

|

|

RUTH’S HOSPITALITY GROUP |

DISCIPLINED GROWTH – COMPANY - OWNED

|

|

|

COMPANY– OWNED GROWTH ▪ Looking to grow 3 – 5 units per year ▪ Focused solely on U.S. Markets ▪ Leverage existing management infrastructure ▪ One opening in 2018: Jersey City, NJ (3Q18) ▪ Continuing to work on additional opportunities for late 2018 and 2019 |

EL PASO, TX

|

|

RUTH’S HOSPITALITY GROUP |

DISCIPLINED GROWTH – FRANCHISE - OWNED

|

|

|

FRANCHISE–OWNED GROWTH ▪ Allows system growth without additional Company capital ▪ Looking to grow 3 – 5 units per year ▪ Two openings in 2018: Fort Wayne, IN (2Q18), Markham, Ontario (3Q18) |

INDIANAPOLIS, IN

|

|

RUTH’S HOSPITALITY GROUP |

FRANCHISE ACQUISITION IS ALSO A VEHICLE FOR GROWTH

|

|

|

▪ Looking to acquire franchise territory at attractive prices ▪ Recently completed the acquisition of six restaurants in Hawaii from longtime franchise partner, Desert Island Restaurants ▪ Honolulu ▪ Kauai ▪ Lahaina (Maui) ▪ Mauna Lani (Big Island) ▪ Waikiki (Oahu) ▪ Wailea (Maui) |

LAHAINA, MAUI

|

|

RUTH’S HOSPITALITY GROUP |

COMPANY–OWNED TARGET UNIT ECONOMICS

|

|

|

TARGET UNITS 3 – 5 units per year TARGET SIZE 8,000 – 10,000 square feet TYPICAL DEMOGRAPHICS Medium and large markets; DMA population > 1 million SALES TARGET $4MM – $6MM NET CASH INVESTMENT $2.5MM – $3.5 MM RESTAURANT LEVEL MARGINS > 20% |

WALTHAM, MA

|

|

RUTH’S HOSPITALITY GROUP |

THE SECRET BEHIND THE SIZZLE: RETURN EXCESS CAPITAL

Strong FCF allows significant return of capital through:

1. Dividend payments

2. Share repurchases

3. Debt Repayment

|

|

RUTH’S HOSPITALITY GROUP |

CONSISTENT AVERAGE UNIT VOLUME GROWTH

Company-Owned Comparable Restaurant AUV Trends ($MM) $5.7 2007 Comp Sales% $5.1 2008 -10.3% $4.1 2009 -19.5% $4.3 2010 +4.0% $4.5 2011 +5.4% $4.8 20121 +5.2% $5.0 2013 +5.3% 5.2 2014 +3.7% $5.3 2015 +3.4% $5.5 2016 +1.6% $5.5 2017 3Q LTM Full Year Total Location Count Company 66 64 64 63 64 63 65 67 68 70 1. FY 2012 excludes 53rd week

|

|

RUTH’S HOSPITALITY GROUP |

FRANCHISEES ARE THE HEART AND SOUL OF OUR BUSINESS

|

▪ |

Unique franchise business model provides annuity stream. |

|

▪ |

Provides $16 million to $17 million in annual royalty fees |

|

▪ |

76 locations/29 franchisees, many of whom date back to our founder, Ruth Fertel. |

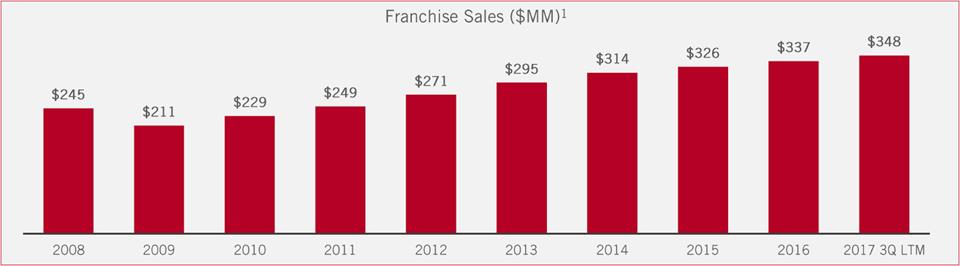

Franchise Sales ($MM)1 $245 $211 $229 $249 $271 $295 $314 $326 $337 $348 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 3Q LTM

1. Franchise sales include sales related to the Hawaii-based restaurants acquired from longtime franchise partner, Desert Island Restaurants, in December of 2017.

|

|

RUTH’S HOSPITALITY GROUP |

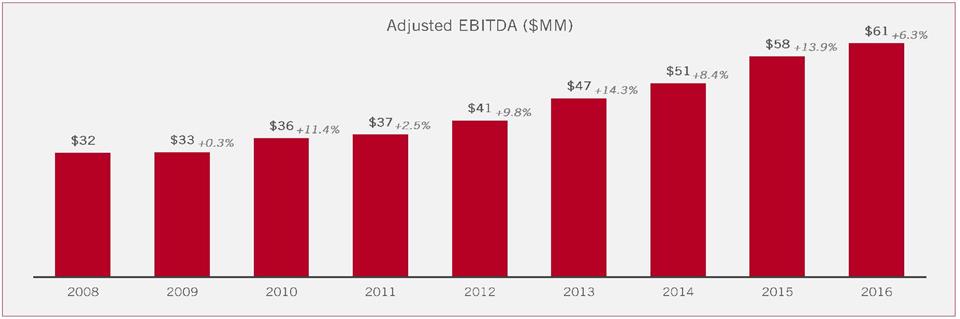

Adjusted EBITDA ($MM) $32 $33 +0.3% $36 +11.4% $37 +2.5% $41 +9.8% $47 +14.3% $51 +14.3% $58 +13.9% $61 +6.3% 2008 2009 2010 2011 2012 2013 2014 2015 2016

Adjusted EBITDA, a non-GAAP financial measure, excludes interest, taxes, depreciation, amortization, gain/loss on assets, losses on impairment, restructuring benefits/expenses, loss/income on discontinued operations and additional items not listed here. For a reconciliation of adjusted EBITDA to net income, see the reconciliation table furnished as Exhibit 99.2 to our Current Report on Form 8-K.

|

|

RUTH’S HOSPITALITY GROUP |

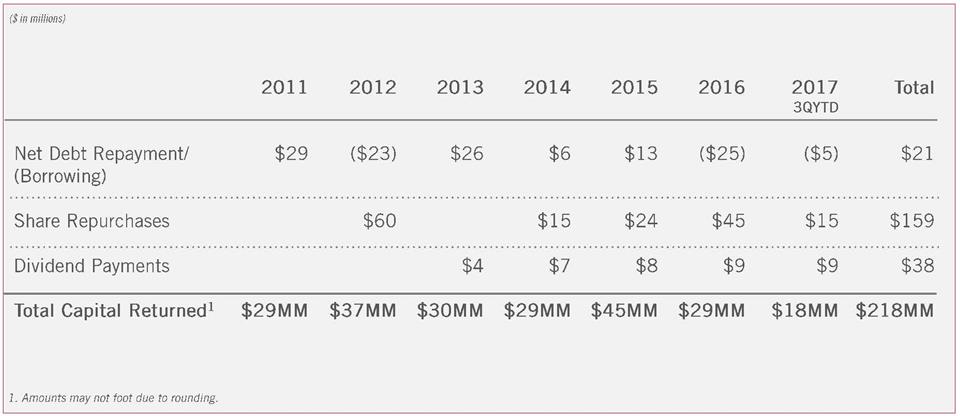

RETURNING CAPITAL TO DRIVE SHAREHOLDER RETURNS

($in millions) Net Debt Repayment/ (Borrowing) Share Repurchases Dividend Payments Total Capital Returned 1 2011 $29 $29MM 2012 ($23) $60 $37MM 2013 $26 $4 $30MM 2014 $6 $15 $7 $29MM 2015 $13 $24 $8 $45MM 2016 ($25) $45 $9 $29MM 2017 3QYTD ($5) $15 $9 $18MM Total $21 $159 $38 $218MM 1. Amounts may not foot due to rounding.

|

|

RUTH’S HOSPITALITY GROUP |

|

|

|

PROVEN BUSINESS MODEL WITH A LONG HISTORY OF SUCCESS ▪ High-end fine-dining steak experience remains timeless after 53 years. RECORD OF CONSISTENT PERFORMANCE DRIVEN BY OPERATIONAL EXCELLENCE ▪ Consistent traffic, revenue, net income EBITDA and EPS growth. STRONG CASH FLOW SUPPORTS MULTIPLE LEVERS TO DRIVE SHAREHOLDER RETURN ▪ Maintaining a healthy core, growing in a disciplined fashion, returning excess capital to shareholders through dividends, share repurchases and debt repayment. ▪ Returned over $215MM to shareholders since 2011

|

|

|

RUTH’S HOSPITALITY GROUP |

2 NASDAQ: RUTH

2 NASDAQ: RUTH

3 NASDAQ: RUTH

3 NASDAQ: RUTH 4 NASDAQ: RUTH

4 NASDAQ: RUTH 5 NASDAQ: RUTH

5 NASDAQ: RUTH

6 NASDAQ: RUTH

6 NASDAQ: RUTH 7 NASDAQ: RUTH

7 NASDAQ: RUTH 8 NASDAQ: RUTH

8 NASDAQ: RUTH

9 NASDAQ: RUTH

9 NASDAQ: RUTH 10 NASDAQ: RUTH

10 NASDAQ: RUTH

11 NASDAQ: RUTH

11 NASDAQ: RUTH

12 NASDAQ: RUTH

12 NASDAQ: RUTH

13 NASDAQ: RUTH

13 NASDAQ: RUTH

14 NASDAQ: RUTH

14 NASDAQ: RUTH 15 NASDAQ: RUTH

15 NASDAQ: RUTH

16 NASDAQ: RUTH

16 NASDAQ: RUTH

17 NASDAQ: RUTH

17 NASDAQ: RUTH

18 NASDAQ: RUTH

18 NASDAQ: RUTH

19 NASDAQ: RUTH

19 NASDAQ: RUTH

20 NASDAQ: RUTH

20 NASDAQ: RUTH 21 NASDAQ: RUTH

21 NASDAQ: RUTH 22 NASDAQ: RUTH

22 NASDAQ: RUTH 23 NASDAQ: RUTH

23 NASDAQ: RUTH 24 NASDAQ: RUTH

24 NASDAQ: RUTH

25 NASDAQ: RUTH

25 NASDAQ: RUTH