Attached files

| file | filename |

|---|---|

| EX-10.3 - EXHIBIT 10.3 - Resolute Forest Products Inc. | rfp-2017930xex103.htm |

| EX-32.2 - EXHIBIT 32.2 - Resolute Forest Products Inc. | rfp-2017930xex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Resolute Forest Products Inc. | rfp-2017930xex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Resolute Forest Products Inc. | rfp-2017930xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Resolute Forest Products Inc. | rfp-2017930xex311.htm |

| EX-10.2 - EXHIBIT 10.2 - Resolute Forest Products Inc. | rfp-2017930xex102.htm |

| EX-10.1 - EXHIBIT 10.1 - Resolute Forest Products Inc. | rfp-2017930xex101.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2017

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 001-33776

RESOLUTE FOREST PRODUCTS INC.

(Exact name of registrant as specified in its charter)

Delaware | 98-0526415 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) |

111 Duke Street, Suite 5000; Montréal, Quebec; Canada H3C 2M1 |

(Address of principal executive offices) (Zip Code) |

(514) 875-2160 |

(Registrant’s telephone number, including area code) |

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer þ | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |

Emerging growth company ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes þ No ¨

As of October 31, 2017, there were 89,798,406 shares of Resolute Forest Products Inc. common stock, $0.001 par value, outstanding.

RESOLUTE FOREST PRODUCTS INC.

TABLE OF CONTENTS

Page Number | ||

PART I. FINANCIAL INFORMATION | ||

Item 1. Financial Statements: | ||

PART II. OTHER INFORMATION | ||

PART I. | FINANCIAL INFORMATION |

ITEM 1. | FINANCIAL STATEMENTS |

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except per share amounts)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||||

Sales | $ | 885 | $ | 888 | $ | 2,615 | $ | 2,656 | |||||||||

Costs and expenses: | |||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | 624 | 681 | 1,936 | 2,026 | |||||||||||||

Depreciation and amortization | 52 | 51 | 153 | 157 | |||||||||||||

Distribution costs | 110 | 109 | 328 | 331 | |||||||||||||

Selling, general and administrative expenses | 43 | 37 | 123 | 115 | |||||||||||||

Closure costs, impairment and other related charges | 10 | — | 82 | 37 | |||||||||||||

Net gain on disposition of assets | (2 | ) | — | (2 | ) | (2 | ) | ||||||||||

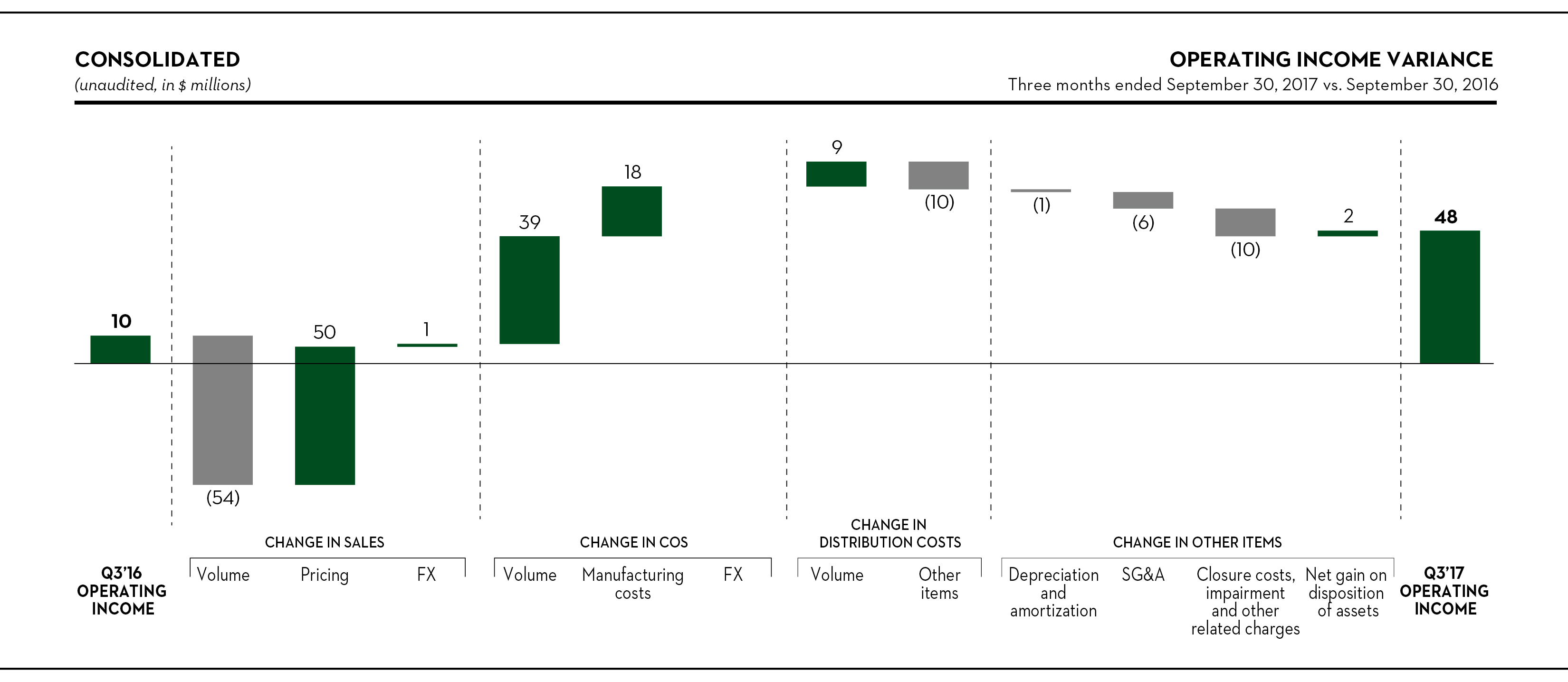

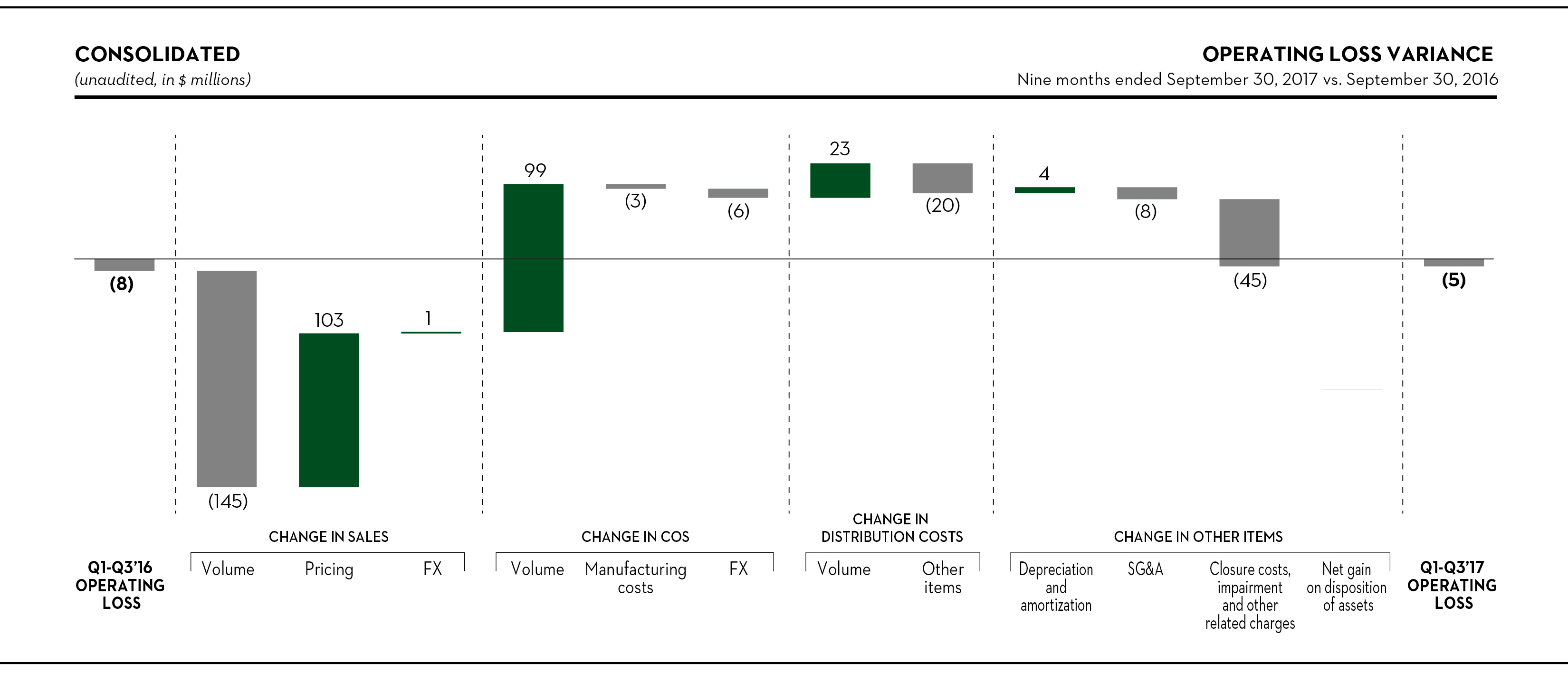

Operating income (loss) | 48 | 10 | (5 | ) | (8 | ) | |||||||||||

Interest expense | (13 | ) | (10 | ) | (36 | ) | (29 | ) | |||||||||

Other income, net | 6 | 1 | 11 | 14 | |||||||||||||

Income (loss) before income taxes | 41 | 1 | (30 | ) | (23 | ) | |||||||||||

Income tax (provision) benefit | (15 | ) | 14 | (63 | ) | (9 | ) | ||||||||||

Net income (loss) including noncontrolling interests | 26 | 15 | (93 | ) | (32 | ) | |||||||||||

Net income attributable to noncontrolling interests | (2 | ) | (1 | ) | (4 | ) | (4 | ) | |||||||||

Net income (loss) attributable to Resolute Forest Products Inc. | $ | 24 | $ | 14 | $ | (97 | ) | $ | (36 | ) | |||||||

Net income (loss) per share attributable to Resolute Forest Products Inc. common shareholders: | |||||||||||||||||

Basic | $ | 0.27 | $ | 0.16 | $ | (1.07 | ) | $ | (0.40 | ) | |||||||

Diluted | 0.26 | 0.15 | (1.07 | ) | (0.40 | ) | |||||||||||

Weighted-average number of Resolute Forest Products Inc. common shares outstanding: | |||||||||||||||||

Basic | 90.5 | 89.9 | 90.4 | 89.8 | |||||||||||||

Diluted | 91.6 | 90.4 | 90.4 | 89.8 | |||||||||||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

1

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited, in millions)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||||

Net income (loss) including noncontrolling interests | $ | 26 | $ | 15 | $ | (93 | ) | $ | (32 | ) | |||||||

Other comprehensive (loss) income: | |||||||||||||||||

Unamortized prior service credits | |||||||||||||||||

Change in unamortized prior service credits | (5 | ) | (4 | ) | (12 | ) | (12 | ) | |||||||||

Income tax provision | — | — | — | — | |||||||||||||

Change in unamortized prior service credits, net of tax | (5 | ) | (4 | ) | (12 | ) | (12 | ) | |||||||||

Unamortized actuarial losses | |||||||||||||||||

Change in unamortized actuarial losses | (2 | ) | 12 | 25 | 36 | ||||||||||||

Income tax provision | (3 | ) | (3 | ) | (8 | ) | (9 | ) | |||||||||

Change in unamortized actuarial losses, net of tax | (5 | ) | 9 | 17 | 27 | ||||||||||||

Foreign currency translation | 1 | (1 | ) | 1 | — | ||||||||||||

Other comprehensive (loss) income, net of tax | (9 | ) | 4 | 6 | 15 | ||||||||||||

Comprehensive income (loss) including noncontrolling interests | 17 | 19 | (87 | ) | (17 | ) | |||||||||||

Comprehensive income attributable to noncontrolling interests | (2 | ) | (1 | ) | (4 | ) | (4 | ) | |||||||||

Comprehensive income (loss) attributable to Resolute Forest Products Inc. | $ | 15 | $ | 18 | $ | (91 | ) | $ | (21 | ) | |||||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

2

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited, in millions, except per share amount)

September 30, 2017 | December 31, 2016 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 38 | $ | 35 | ||||

Accounts receivable, net: | ||||||||

Trade | 377 | 358 | ||||||

Other | 72 | 83 | ||||||

Inventories, net | 555 | 570 | ||||||

Other current assets | 53 | 35 | ||||||

Total current assets | 1,095 | 1,081 | ||||||

Fixed assets, less accumulated depreciation of $1,568 and $1,415 as of September 30, 2017 and December 31, 2016, respectively | 1,737 | 1,842 | ||||||

Amortizable intangible assets, less accumulated amortization of $20 and $16 as of September 30, 2017 and December 31, 2016, respectively | 66 | 70 | ||||||

Goodwill | 81 | 81 | ||||||

Deferred income tax assets | 1,090 | 1,039 | ||||||

Other assets | 163 | 164 | ||||||

Total assets | $ | 4,232 | $ | 4,277 | ||||

Liabilities and equity | ||||||||

Current liabilities: | ||||||||

Accounts payable and accrued liabilities | $ | 449 | $ | 466 | ||||

Current portion of long-term debt | — | 1 | ||||||

Total current liabilities | 449 | 467 | ||||||

Long-term debt, net of current portion | 832 | 761 | ||||||

Pension and other postretirement benefit obligations | 1,249 | 1,281 | ||||||

Deferred income tax liabilities | 9 | 2 | ||||||

Other liabilities | 64 | 55 | ||||||

Total liabilities | 2,603 | 2,566 | ||||||

Commitments and contingencies | ||||||||

Equity: | ||||||||

Resolute Forest Products Inc. shareholders’ equity: | ||||||||

Common stock, $0.001 par value. 117.8 shares issued and 89.8 shares outstanding as of September 30, 2017 and December 31, 2016 | — | — | ||||||

Additional paid-in capital | 3,783 | 3,775 | ||||||

Deficit | (1,307 | ) | (1,207 | ) | ||||

Accumulated other comprehensive loss | (749 | ) | (755 | ) | ||||

Treasury stock at cost, 28.0 shares as of September 30, 2017 and December 31, 2016 | (120 | ) | (120 | ) | ||||

Total Resolute Forest Products Inc. shareholders’ equity | 1,607 | 1,693 | ||||||

Noncontrolling interests | 22 | 18 | ||||||

Total equity | 1,629 | 1,711 | ||||||

Total liabilities and equity | $ | 4,232 | $ | 4,277 | ||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

3

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Unaudited, in millions)

Nine Months Ended September 30, 2017 | ||||||||||||||||||||||||||||

Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non-controlling Interests | Total Equity | ||||||||||||||||||||||

Balance as of December 31, 2016 | $ | — | $ | 3,775 | $ | (1,207 | ) | $ | (755 | ) | $ | (120 | ) | $ | 18 | $ | 1,711 | |||||||||||

Share-based compensation costs for equity-classified awards | — | 8 | — | — | — | — | 8 | |||||||||||||||||||||

Net (loss) income | — | — | (97 | ) | — | — | 4 | (93 | ) | |||||||||||||||||||

Cumulative-effect adjustment upon deferred tax charge elimination (Note 10) | — | — | (3 | ) | — | — | — | (3 | ) | |||||||||||||||||||

Other comprehensive income, net of tax | — | — | — | 6 | — | — | 6 | |||||||||||||||||||||

Balance as of September 30, 2017 | $ | — | $ | 3,783 | $ | (1,307 | ) | $ | (749 | ) | $ | (120 | ) | $ | 22 | $ | 1,629 | |||||||||||

Nine Months Ended September 30, 2016 | ||||||||||||||||||||||||||||

Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non- controlling Interests | Total Equity | ||||||||||||||||||||||

Balance as of December 31, 2015 | $ | — | $ | 3,765 | $ | (1,126 | ) | $ | (587 | ) | $ | (120 | ) | $ | 13 | $ | 1,945 | |||||||||||

Share-based compensation costs for equity-classified awards | — | 8 | — | — | — | — | 8 | |||||||||||||||||||||

Net (loss) income | — | — | (36 | ) | — | — | 4 | (32 | ) | |||||||||||||||||||

Other comprehensive income, net of tax | — | — | — | 15 | — | — | 15 | |||||||||||||||||||||

Balance as of September 30, 2016 | $ | — | $ | 3,773 | $ | (1,162 | ) | $ | (572 | ) | $ | (120 | ) | $ | 17 | $ | 1,936 | |||||||||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

4

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

Nine Months Ended September 30, | ||||||||

2017 | 2016 | |||||||

Cash flows from operating activities: | ||||||||

Net loss including noncontrolling interests | $ | (93 | ) | $ | (32 | ) | ||

Adjustments to reconcile net loss including noncontrolling interests to net cash provided by operating activities: | ||||||||

Share-based compensation | 8 | 8 | ||||||

Depreciation and amortization | 153 | 157 | ||||||

Closure costs, impairment and other related charges | 68 | 36 | ||||||

Inventory write-downs related to closures | 24 | 5 | ||||||

Deferred income taxes | 60 | 5 | ||||||

Net pension contributions and other postretirement benefit payments | (94 | ) | (102 | ) | ||||

Net gain on disposition of assets | (2 | ) | (2 | ) | ||||

Gain on translation of foreign currency denominated deferred income taxes | (80 | ) | (53 | ) | ||||

Loss on translation of foreign currency denominated pension and other postretirement benefit obligations | 65 | 44 | ||||||

Gain on disposition of equity method investment | — | (5 | ) | |||||

Net planned major maintenance payments | (6 | ) | (6 | ) | ||||

Changes in working capital: | ||||||||

Accounts receivable | (6 | ) | 21 | |||||

Inventories | (6 | ) | (27 | ) | ||||

Other current assets | (8 | ) | (3 | ) | ||||

Accounts payable and accrued liabilities | 12 | 7 | ||||||

Other, net | 4 | (2 | ) | |||||

Net cash provided by operating activities | 99 | 51 | ||||||

Cash flows from investing activities: | ||||||||

Cash invested in fixed assets | (136 | ) | (177 | ) | ||||

Disposition of assets | 3 | 5 | ||||||

Increase in countervailing duty cash deposits on supercalendered paper | (17 | ) | (17 | ) | ||||

Increase in countervailing and anti-dumping duty cash deposits on softwood lumber | (18 | ) | — | |||||

Increase in restricted cash, net | (2 | ) | — | |||||

Decrease in deposit requirements for letters of credit, net | 2 | — | ||||||

Net cash used in investing activities | (168 | ) | (189 | ) | ||||

Cash flows from financing activities: | ||||||||

Net borrowings under revolving credit facilities | 70 | 90 | ||||||

Issuance of long-term debt | — | 46 | ||||||

Payments of debt | (1 | ) | (1 | ) | ||||

Payments of financing and credit facility fees | — | (1 | ) | |||||

Net cash provided by financing activities | 69 | 134 | ||||||

Effect of exchange rate changes on cash and cash equivalents | 3 | 1 | ||||||

Net increase (decrease) in cash and cash equivalents | 3 | (3 | ) | |||||

Cash and cash equivalents: | ||||||||

Beginning of period | 35 | 58 | ||||||

End of period | $ | 38 | $ | 55 | ||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

5

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 1. Organization and Basis of Presentation

Nature of operations

Resolute Forest Products Inc. (with its subsidiaries and affiliates, either individually or collectively, unless otherwise indicated, referred to as “Resolute Forest Products,” “we,” “our,” “us,” “Parent” or the “Company”) is incorporated in Delaware. We are a global leader in the forest products industry with a diverse range of products, including market pulp, tissue, wood products, newsprint and specialty papers, which are marketed in over 70 countries. We own or operate some 40 manufacturing facilities, as well as power generation assets, in the United States and Canada.

Financial statements

Our interim consolidated financial statements and related notes (“Consolidated Financial Statements”) are unaudited and have been prepared in accordance with the requirements of the U.S. Securities and Exchange Commission (the “SEC”) for interim reporting. Under those rules, certain footnotes and other financial information that are normally required by U.S. generally accepted accounting principles (“GAAP”) may be condensed or omitted. In our opinion, all adjustments (consisting of normal recurring adjustments) necessary for the fair statement of the unaudited interim Consolidated Financial Statements have been made. All amounts are expressed in U.S. dollars, unless otherwise indicated. The results for the interim period ended September 30, 2017, are not necessarily indicative of the results to be expected for the full year. These unaudited interim Consolidated Financial Statements should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 1, 2017. Certain prior period amounts in our footnotes have been reclassified to conform to the 2017 presentation.

New accounting pronouncements adopted

In October 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-16, “Intra-Entity Transfers of Assets Other Than Inventory,” which eliminates the deferral of the tax effects of intra-entity asset transfers other than inventory until the transferred assets are sold to a third party or recovered through use. This update is effective on a modified retrospective approach for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. As early adoption is permitted as of the beginning of an annual period, we adopted this ASU on January 1, 2017. For additional information, see Note 10, “Income Taxes.”

Accounting pronouncements not yet adopted

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts from Customers,” which provides a framework that replaces existing revenue recognition guidance in GAAP. In March 2016, April 2016, May 2016, and December 2016, the FASB also issued ASU 2016-08, “Principal versus Agent Considerations (Reporting Revenue Gross versus Net),” ASU 2016-10, “Identifying Performance Obligations and Licensing,” ASU 2016-12, “Narrow-Scope Improvements and Practical Expedients,” and ASU 2016-20, “Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers,” respectively, which further affect the guidance of ASU 2014-09. These updates are effective for fiscal years beginning after December 15, 2017. We plan to adopt these standards on January 1, 2018 using the modified retrospective approach.

We are making progress in our assessment of the impact of these standards on our results of operations and financial position. Our current assessment is subject to change as we continue our analysis. Our preliminary findings are as follows:

• | The majority of our revenue arises from contracts with customers in which the sale of goods is generally expected to be the main performance obligation. Accordingly, we expect to recognize revenue for most of our revenue streams at a point in time when control of the asset is transferred to the customer, generally upon delivery of the goods, consistent with our current practice. However, we continue to review our current contracts with customers for the identification of any additional performance obligations, which could be treated differently and affect our preliminary assessment. |

• | Certain of our contracts with customers provide incentive offerings, including special pricing agreements, and other volume-based incentives. Currently, we recognize revenue from the sale of goods measured at the fair value of the consideration received or receivable, net of provisions for customer incentives. If revenue cannot be reliably measured, revenue recognition is deferred until the uncertainty is resolved. Such contract provisions give rise to variable consideration under ASU 2014-09, and will be required to be estimated at contract inception. ASU 2014-09 requires the estimated variable consideration to be constrained to prevent the over-recognition of revenue. We continue to assess individual contracts to determine the estimated variable consideration and related constraint. |

6

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

• | ASU 2014-09 provides presentation and disclosure requirements, which are more detailed than under current GAAP. We are therefore in the process of developing procedures to collect the required information to comply with the additional required financial statement disclosures. |

In March 2017, the FASB issued ASU 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost,” which requires employers that present a measure of operating income in their statements of earnings to disaggregate and present only the service cost component of net periodic benefit cost in operating expenses (together with other employee compensation costs arising during the period). The other components of the net periodic benefit cost are to be reported separately outside any subtotal of operating income. This update is effective retrospectively for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years, with early adoption permitted for fiscal years beginning after December 31, 2016. We plan to adopt this ASU on January 1, 2018. The adoption of this accounting guidance will impact the presentation of our results of operations, the effect of which cannot be reasonably estimated due to the inherent uncertainties with respect to the variations in assumptions used to determine the net periodic benefit cost, and could be material.

Note 2. Closure Costs, Impairment and Other Related Charges

Closure costs, impairment and other related charges for the three and nine months ended September 30, 2017, were comprised of the following:

(Unaudited, in millions) | Impairment of Assets | Accelerated Depreciation | Pension and OPEB Plan Curtailments and Other | Severance and Other Costs | Total | |||||||||||||||

Pulp mill in Coosa Pines, Alabama (1) | ||||||||||||||||||||

Third quarter | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

First nine months | 55 | — | — | — | 55 | |||||||||||||||

Permanent closures | ||||||||||||||||||||

Paper machine in Catawba, South Carolina | ||||||||||||||||||||

Third quarter | — | — | 2 | — | 2 | |||||||||||||||

First nine months | 5 | — | 2 | 4 | 11 | |||||||||||||||

Paper machines in Calhoun, Tennessee | ||||||||||||||||||||

Third quarter | — | 6 | — | 2 | 8 | |||||||||||||||

First nine months | — | 6 | — | 2 | 8 | |||||||||||||||

Paper mill in Mokpo, South Korea | ||||||||||||||||||||

Third quarter | — | — | — | — | — | |||||||||||||||

First nine months | — | — | — | 7 | 7 | |||||||||||||||

Other | ||||||||||||||||||||

Third quarter | — | — | — | — | — | |||||||||||||||

First nine months | — | — | — | 1 | 1 | |||||||||||||||

Total | ||||||||||||||||||||

Third quarter | $ | — | $ | 6 | $ | 2 | $ | 2 | $ | 10 | ||||||||||

First nine months | 60 | 6 | 2 | 14 | 82 | |||||||||||||||

(1) | As a result of the continued deterioration of actual and projected cash flows, we recorded long-lived asset impairment charges of $55 million for the nine months ended September 30, 2017, to reduce the carrying value of the assets to their estimated fair value, which was determined using the market approach, by reference to market transaction prices for similar assets. The fair value measurement is considered a Level 3 measurement due to the significance of its unobservable inputs. |

7

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Closure costs, impairment and other related charges for the three and nine months ended September 30, 2016, were comprised of the following:

(Unaudited, in millions) | Accelerated Depreciation | Severance and Other Costs | Total | |||||||||

Permanent closure | ||||||||||||

Paper machine in Augusta, Georgia | ||||||||||||

Third quarter | $ | — | $ | — | $ | — | ||||||

First nine months | 32 | 4 | 36 | |||||||||

Other | ||||||||||||

Third quarter | — | — | — | |||||||||

First nine months | 1 | — | 1 | |||||||||

Total | ||||||||||||

Third quarter | $ | — | $ | — | $ | — | ||||||

First nine months | 33 | 4 | 37 | |||||||||

Note 3. Other Income, Net

Other income, net for the three and nine months ended September 30, 2017 and 2016, was comprised of the following:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

(Unaudited, in millions) | 2017 | 2016 | 2017 | 2016 | |||||||||||||

Foreign exchange gain | $ | 7 | $ | — | $ | 10 | $ | 3 | |||||||||

Gain on disposition of equity method investment (1) | — | — | — | 5 | |||||||||||||

Miscellaneous (expense) income | (1 | ) | 1 | 1 | 6 | ||||||||||||

$ | 6 | $ | 1 | $ | 11 | $ | 14 | ||||||||||

(1) | On February 1, 2016, we sold for total consideration of $5 million our interest in Produits Forestiers Petit-Paris Inc., an unconsolidated entity located in Saint-Ludger-de-Milot, Quebec, in which we had a 50% interest, resulting in a gain on disposition of $5 million. |

8

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 4. Accumulated Other Comprehensive Loss

The change in our accumulated other comprehensive loss by component (net of tax) for the nine months ended September 30, 2017, was as follows:

(Unaudited, in millions) | Unamortized Prior Service Credits | Unamortized Actuarial Losses | Foreign Currency Translation | Total | ||||||||||||

Balance as of December 31, 2016 | $ | 67 | $ | (819 | ) | $ | (3 | ) | $ | (755 | ) | |||||

Other comprehensive (loss) income before reclassifications | — | (15 | ) | 1 | (14 | ) | ||||||||||

Amounts reclassified from accumulated other comprehensive loss (1) | (12 | ) | 32 | — | 20 | |||||||||||

Net current period other comprehensive (loss) income | (12 | ) | 17 | 1 | 6 | |||||||||||

Balance as of September 30, 2017 | $ | 55 | $ | (802 | ) | $ | (2 | ) | $ | (749 | ) | |||||

(1) | See the table below for details about these reclassifications. |

The reclassifications out of accumulated other comprehensive loss for the nine months ended September 30, 2017, were comprised of the following:

(Unaudited, in millions) | Amounts Reclassified From Accumulated Other Comprehensive Loss | Affected Line in the Consolidated Statements of Operations | |||

Unamortized Prior Service Credits | |||||

Amortization of prior service credits | $ | (11 | ) | Cost of sales, excluding depreciation, amortization and distribution costs (1) | |

Curtailment gain | (1 | ) | Closure costs, impairment and other related charges (1) | ||

— | Income tax (provision) benefit | ||||

$ | (12 | ) | Net of tax | ||

Unamortized Actuarial Losses | |||||

Amortization of actuarial losses | $ | 38 | Cost of sales, excluding depreciation, amortization and distribution costs (1) | ||

Curtailment loss | 1 | Closure costs, impairment and other related charges (1) | |||

Settlement loss | 1 | Cost of sales, excluding depreciation, amortization and distribution costs (1) | |||

(8 | ) | Income tax (provision) benefit | |||

$ | 32 | Net of tax | |||

Total Reclassifications | $ | 20 | Net of tax | ||

(1) | These items are included in the computation of net periodic benefit cost related to our pension and other postretirement benefit (“OPEB”) plans summarized in Note 9, “Employee Benefit Plans.” |

9

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 5. Net Income (Loss) Per Share

The reconciliation of the basic and diluted net income (loss) per share for the three and nine months ended September 30, 2017 and 2016, was as follows:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

(Unaudited, in millions, except per share amounts) | 2017 | 2016 | 2017 | 2016 | |||||||||||||

Numerator: | |||||||||||||||||

Net income (loss) attributable to Resolute Forest Products Inc. | $ | 24 | $ | 14 | $ | (97 | ) | $ | (36 | ) | |||||||

Denominator: | |||||||||||||||||

Basic weighted-average number of Resolute Forest Products Inc. common shares outstanding | 90.5 | 89.9 | 90.4 | 89.8 | |||||||||||||

Dilutive impact of nonvested stock unit awards | 1.1 | 0.5 | — | — | |||||||||||||

Diluted weighted-average number of Resolute Forest Products Inc. common shares outstanding | 91.6 | 90.4 | 90.4 | 89.8 | |||||||||||||

Net income (loss) per share attributable to Resolute Forest Products Inc. common shareholders: | |||||||||||||||||

Basic | $ | 0.27 | $ | 0.16 | $ | (1.07 | ) | $ | (0.40 | ) | |||||||

Diluted | $ | 0.26 | $ | 0.15 | $ | (1.07 | ) | $ | (0.40 | ) | |||||||

The weighted-average number of outstanding stock options and nonvested equity-classified restricted stock units, deferred stock units and performance stock units (collectively, “stock unit awards”) that were excluded from the calculation of diluted net income (loss) per share, as the impact would have been antidilutive, for the three and nine months ended September 30, 2017 and 2016, was as follows:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||

(Unaudited, in millions) | 2017 | 2016 | 2017 | 2016 | |||||||||

Stock options | 1.4 | 1.5 | 1.4 | 1.5 | |||||||||

Stock unit awards | — | — | 4.3 | 2.2 | |||||||||

Note 6. Inventories, Net

Inventories, net as of September 30, 2017 and December 31, 2016, were comprised of the following:

(Unaudited, in millions) | September 30, 2017 | December 31, 2016 | ||||||

Raw materials | $ | 111 | $ | 126 | ||||

Work in process | 36 | 45 | ||||||

Finished goods | 205 | 183 | ||||||

Mill stores and other supplies | 203 | 216 | ||||||

$ | 555 | $ | 570 | |||||

During the three months ended September 30, 2017, we recorded charges for write-downs of mill stores and other supplies of $11 million, primarily related to the permanent closure of two paper machines in Calhoun. During the nine months ended September 30, 2017, we also recorded charges of $13 million for write-downs of mill stores and other supplies primarily related to the permanent closures of a paper machine at our Catawba paper mill and our Mokpo paper mill. During the nine months ended September 30, 2016, we recorded charges of $5 million for write-downs of mill stores and other supplies primarily as a result of the permanent closure of a newsprint machine at our Augusta mill. These charges were included in “Cost of sales, excluding depreciation, amortization and distribution costs” in our Consolidated Statements of Operations.

10

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 7. Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities as of September 30, 2017 and December 31, 2016, were comprised of the following:

(Unaudited, in millions) | September 30, 2017 | December 31, 2016 | ||||||

Trade accounts payable | $ | 325 | $ | 346 | ||||

Payroll, bonuses and severance payable | 56 | 51 | ||||||

Accrued interest | 14 | 5 | ||||||

Pension and other postretirement benefit obligations | 18 | 17 | ||||||

Book overdrafts | — | 13 | ||||||

Income and other taxes payable | 9 | 7 | ||||||

Environmental liabilities | 2 | 5 | ||||||

Other | 25 | 22 | ||||||

$ | 449 | $ | 466 | |||||

Note 8. Long-Term Debt

Overview

Long-term debt, including current portion, as of September 30, 2017 and December 31, 2016, was comprised of the following:

(Unaudited, in millions) | September 30, 2017 | December 31, 2016 | ||||||

5.875% senior notes due 2023: | ||||||||

Principal amount | $ | 600 | $ | 600 | ||||

Deferred financing costs | (5 | ) | (6 | ) | ||||

Unamortized discount | (4 | ) | (4 | ) | ||||

Total senior notes due 2023 | 591 | 590 | ||||||

Term loan due 2025 | 46 | 46 | ||||||

Borrowings under revolving credit facilities | 195 | 125 | ||||||

Capital lease obligation | — | 1 | ||||||

Total debt | 832 | 762 | ||||||

Less: Current portion of long-term debt | — | (1 | ) | |||||

Long-term debt, net of current portion | $ | 832 | $ | 761 | ||||

2023 Notes

We issued $600 million in aggregate principal amount of 5.875% senior notes due 2023 (the “2023 Notes”) on May 8, 2013. Upon their issuance, the notes were recorded at their fair value of $594 million, which reflected a discount of $6 million that is being amortized to “Interest expense” in our Consolidated Statements of Operations using the interest method over the term of the notes, resulting in an effective interest rate of 6%. Interest on the notes is payable semi-annually on May 15 and November 15, until their maturity date of May 15, 2023. In connection with the issuance of the notes, we incurred financing costs of approximately $9 million, which were deferred and recorded as a reduction of the notes. These deferred financing costs are being amortized to “Interest expense” in our Consolidated Statements of Operations using the interest method over the term of the notes. The fair value of the 2023 Notes was $595 million and $543 million as of September 30, 2017 and December 31, 2016, respectively, and was determined by reference to over-the-counter prices (Level 1).

Senior Secured Credit Facility

On September 7, 2016, we entered into a senior secured credit facility (the “Senior Secured Credit Facility”) for up to $185 million. The Senior Secured Credit Facility provides a term loan of $46 million with a maturity date of September 7, 2025 (“Term Loan”), and a revolving credit facility of up to $139 million with a maturity date of September 7, 2022 (“Revolving Credit Facility”). As of September 30, 2017, we had $33 million of availability under the Revolving Credit Facility, net of $106 million of borrowings. The fair values of the Term Loan and Revolving Credit Facility approximated their carrying values

11

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

as of September 30, 2017, as the variable interest rates reflect current interest rates for financial instruments with similar characteristics and maturities (Level 2). We repaid $3 million of borrowings under the Revolving Credit Facility in the first 40 days of the fourth quarter of 2017.

ABL Credit Facility

On May 22, 2015, we entered into a senior secured asset-based revolving credit facility (the “ABL Credit Facility”), with an aggregate lender commitment of up to $600 million at any time outstanding, subject to borrowing base availability based on specified advance rates, eligibility criteria and customary reserves. The ABL Credit Facility will mature on May 22, 2020. As of September 30, 2017, we had $329 million of availability under the ABL Credit Facility, net of $89 million of borrowings and $40 million of ordinary course letters of credit outstanding. The fair value of the ABL Credit Facility approximated its carrying value as of September 30, 2017, as the variable interest rates reflect current interest rates for financial instruments with similar characteristics and maturities (Level 2). We repaid $27 million of borrowings under the ABL Credit Facility in the first 40 days of the fourth quarter of 2017.

Capital lease obligation

We have a capital lease obligation for a warehouse with a maturity date of December 1, 2017, which can be renewed for 20 years at our option. Minimum monthly payments are determined by an escalatory price clause.

Note 9. Employee Benefit Plans

Pension and OPEB plans

The components of net periodic benefit cost relating to our pension and OPEB plans for the three and nine months ended September 30, 2017 and 2016, were as follows:

Pension Plans:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

(Unaudited, in millions) | 2017 | 2016 | 2017 | 2016 | |||||||||||||

Service cost | $ | 6 | $ | 5 | $ | 15 | $ | 15 | |||||||||

Interest cost | 51 | 54 | 149 | 161 | |||||||||||||

Expected return on plan assets | (66 | ) | (62 | ) | (190 | ) | (185 | ) | |||||||||

Amortization of actuarial losses | 14 | 13 | 42 | 40 | |||||||||||||

Amortization of prior service credits | — | — | — | (1 | ) | ||||||||||||

Net periodic benefit cost before special events | 5 | 10 | 16 | 30 | |||||||||||||

Curtailment, settlement and other losses | 3 | — | 4 | — | |||||||||||||

$ | 8 | $ | 10 | $ | 20 | $ | 30 | ||||||||||

OPEB Plans:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

(Unaudited, in millions) | 2017 | 2016 | 2017 | 2016 | |||||||||||||

Service cost | $ | — | $ | 1 | $ | 1 | $ | 1 | |||||||||

Interest cost | 2 | 2 | 5 | 6 | |||||||||||||

Amortization of actuarial gains | (1 | ) | (1 | ) | (4 | ) | (4 | ) | |||||||||

Amortization of prior service credits | (4 | ) | (4 | ) | (11 | ) | (11 | ) | |||||||||

Net periodic benefit cost before special events | (3 | ) | (2 | ) | (9 | ) | (8 | ) | |||||||||

Curtailment gain | (1 | ) | — | (1 | ) | — | |||||||||||

$ | (4 | ) | $ | (2 | ) | $ | (10 | ) | $ | (8 | ) | ||||||

12

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Defined contribution plans

Our expense for the defined contribution plans totaled $5 million and $6 million for the three months ended September 30, 2017 and 2016, respectively, and $16 million for both the nine months ended September 30, 2017 and 2016.

Canadian pension funding

On March 31, 2017, we reached an agreement with the province of Ontario with respect to the additional solvency deficit reduction contributions required for past capacity reductions in Ontario, as provided by the terms of the undertakings in connection with the funding relief regulations, stipulating that we are no longer required to make additional contributions for capacity reductions that occurred in Ontario after April 15, 2014. As a result, our requirement to make additional contributions to our material Canadian registered pension plans was reduced by Cdn $16 million for 2017 and Cdn $8 million for 2018. The expiration of the original 2010 undertaking in December 2015 did not eliminate the obligations already incurred under the terms of that undertaking prior to its expiration.

Note 10. Income Taxes

The income tax (provision) benefit attributable to income (loss) before income taxes differs from the amounts computed by applying the U.S. federal statutory income tax rate of 35% for the three and nine months ended September 30, 2017 and 2016, as a result of the following:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

(Unaudited, in millions) | 2017 | 2016 | 2017 | 2016 | |||||||||||||

Income (loss) before income taxes | $ | 41 | $ | 1 | $ | (30 | ) | $ | (23 | ) | |||||||

Income tax (provision) benefit: | |||||||||||||||||

Expected income tax (provision) benefit | (14 | ) | — | 11 | 8 | ||||||||||||

Changes resulting from: | |||||||||||||||||

Valuation allowance (1) | (19 | ) | (20 | ) | (94 | ) | (65 | ) | |||||||||

Enactment of change in foreign tax rate | — | — | (12 | ) | — | ||||||||||||

Adjustments for unrecognized tax benefits | — | 37 | — | 37 | |||||||||||||

Foreign exchange | 8 | (5 | ) | 9 | (2 | ) | |||||||||||

State income taxes, net of federal income tax benefit | 1 | 2 | 7 | 5 | |||||||||||||

Foreign tax rate differences | 7 | 4 | 15 | 11 | |||||||||||||

Research and development tax incentives | 1 | — | 1 | — | |||||||||||||

Other, net | 1 | (4 | ) | — | (3 | ) | |||||||||||

$ | (15 | ) | $ | 14 | $ | (63 | ) | $ | (9 | ) | |||||||

(1) | We recorded a valuation allowance of $19 million and $20 million for the three months ended September 30, 2017 and 2016, respectively, and $94 million and $65 million for the nine months ended September 30, 2017 and 2016, respectively, primarily related to our U.S. operations where we recognize a full valuation allowance against our net deferred income tax assets. |

Deferred tax charge

On January 1, 2017, we adopted ASU 2016-16, “Intra-Entity Transfers of Assets Other Than Inventory,” which eliminates the deferral of the tax effects of intra-entity asset transfers other than inventory until the transferred assets are sold to a third party or recovered through use. Accordingly, the deferred tax charge recognized in 2015 as a result of a gain on an intercompany asset transfer in connection with an operating company realignment was eliminated, resulting in a decrease in “Other assets” of $35 million and an increase in deferred tax assets of $32 million, with a cumulative-effect adjustment of $3 million to “Deficit” in our Consolidated Balance Sheet as of January 1, 2017.

13

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 11. Commitments and Contingencies

Legal matters

We become involved in various legal proceedings and other disputes in the normal course of business, including matters related to contracts, commercial and trade disputes, taxes, environmental issues, activists’ damages, employment and workers’ compensation claims, Aboriginal claims and other matters. Although the final outcome is subject to many variables and cannot be predicted with any degree of certainty, we regularly assess the status of the matters and establish provisions (including legal costs expected to be incurred) when we believe an adverse outcome is probable, and the amount can be reasonably estimated. Except as described below and for claims that cannot be assessed due to their preliminary nature, we believe that the ultimate disposition of these matters outstanding or pending as of September 30, 2017, will not have a material adverse effect on our Consolidated Financial Statements.

Countervailing and anti-dumping duty investigations on softwood lumber products

On November 25, 2016, countervailing and anti-dumping duty petitions were filed with the U.S. Department of Commerce (“Commerce”) and the U.S. International Trade Commission (“ITC”) by certain U.S. softwood lumber producers and forest landowners, requesting that the U.S. government impose countervailing and anti-dumping duties on Canadian-origin softwood lumber products exported to the U.S. One of our subsidiaries was identified in the petition as being a Canadian exporting producer of softwood lumber products to the U.S. and was selected as a mandatory respondent to be investigated by Commerce in both the countervailing and anti-dumping duty investigations.

On April 24, 2017, Commerce announced its preliminary determinations in the countervailing duty investigation, and, as a result, beginning April 28, 2017, we were required to pay cash deposits to the U.S. at a rate of 12.82% for estimated countervailing duties on our imports to the U.S. of softwood lumber products produced at our Canadian sawmills. The preliminary rate remained in effect until August 26, 2017, and we have not been required to pay countervailing duty deposits since then. On November 2, 2017, Commerce announced its final determinations in the countervailing duty investigation, including an estimated countervailing duty rate of 14.7% for our softwood lumber product imports to the U.S. from our Canadian sawmills. We will be required to pay cash deposits to the U.S. at that rate if and when the ITC publishes an affirmative final determination. If as a result of the ITC final determination, Commerce issues an order that we are subject to countervailing duty deposit requirements on any of our softwood lumber product imports to the U.S., then we will be required to resume making cash deposits at the 14.7% rate until Commerce sets a duty rate in a subsequent administrative review. Through September 30, 2017, our cash deposits totaled $15 million, and based on the 14.7% rate and our current operating parameters, could be as high as $65 million per year.

On June 26, 2017, Commerce announced its preliminary determinations in the anti-dumping duty investigation, and, as a result, since June 30, 2017, we have been required to pay cash deposits to the U.S. at a rate of 4.59% for estimated anti-dumping duties on our imports to the U.S. of softwood lumber products produced at our Canadian sawmills. On November 2, 2017, Commerce announced its final determinations in the investigation, including an estimated anti-dumping duty rate of 3.2% for our softwood lumber product imports to the U.S. from our Canadian sawmills. As a result, since November 8, 2017, we have been paying cash deposits for estimated anti-dumping duties at the 3.2% rate. Through September 30, 2017, our cash deposits totaled $3 million, and based on the 3.2% rate and our current operating parameters, could be as high as $15 million per year. If the ITC does not publish its final determination before the date that is six months from the preliminary determination date, we would not be required to pay anti-dumping duty deposits until the ITC publishes its final determination. If as a result of the ITC final determination, Commerce issues an order that we are subject to anti-dumping duty deposit requirements on any of our softwood lumber product imports to the U.S., then we would be required to resume making cash deposits at the 3.2% rate until Commerce sets a duty rate in a subsequent administrative review. Based on the preliminary 4.59% rate until November 7, 2017, and the 3.2% rate thereafter, and our current operating parameters, cash deposits on our imports of the affected softwood lumber products to the U.S. would be approximately $8 million for the initial six-month period of the anti-dumping duty investigation.

In addition, before Commerce issues any countervailing or anti-dumping duty order, the ITC must determine whether any alleged subsidization or dumping threatens injury to the U.S. softwood lumber industry or causes current injury. If the ITC determines that there is a threat of injury or no injury, rather than current injury, then all deposits paid between Commerce’s preliminary determination and the publication of the ITC’s final determination, would be returned.

We are not presently able to determine the ultimate resolution of these matters, but we believe it is not probable that we will ultimately be assessed with significant duties on our Canadian-produced softwood lumber products that are exported to the U.S. Accordingly, no contingent loss was recorded in respect of these petitions in our Consolidated Statement of Operations for the

14

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

nine months ended September 30, 2017, and our cash deposits were recorded in “Other assets” in our Consolidated Balance Sheets.

Countervailing duty investigation on SC paper

On February 26, 2015, a countervailing duty petition was filed with Commerce and the ITC by certain U.S. supercalendered (“SC”) paper producers requesting that the U.S. government impose countervailing duties on Canadian-origin SC paper exported to the U.S. market. One of our subsidiaries was identified in the petition as being a Canadian exporting producer of SC paper to the U.S. and was selected as a mandatory respondent to be investigated by Commerce. As a result of that investigation, since August 3, 2015, we have been required to pay cash deposits to the U.S. for estimated countervailing duties on our imports to the U.S. of SC paper produced at our Canadian mills. Between August 3, 2015 and October 15, 2015, we were required to make cash deposits at a rate of 2.04%. On October 15, 2015, that rate increased to 17.87%, 17.10% of which was not based on any countervailable subsidy we received, but rather on a punitive application of “adverse facts available.” We are required to continue making cash deposits at the 17.87% rate until Commerce sets a countervailing duty rate in an administrative review. We were selected as a mandatory respondent in the first administrative review, which Commerce commenced on February 13, 2017. Our countervailing duty rate for our SC paper exported to the U.S. market in 2015, if any, will be based on Commerce’s determination in this administrative review as to whether we received countervailable subsidies that benefited our Canadian production of SC paper during the relevant period. Following the initial administrative review, which may not be finalized in 2017, we may remain subject to annual administrative reviews until December 2020, or possibly later, and the duty rate, if any, applicable to our SC paper exported to the U.S. market during periods subsequent to December 31, 2015, will be based on Commerce’s determinations in such future administrative reviews. The decision in each administrative review is subject to appeal. To the extent the countervailing duty rate set by Commerce is lower than 17.87%, we will recover excess deposits, plus interest. If the countervailing duty rate set by Commerce is at or above 17.87%, the deposits and any deficiency will be converted into actual countervailing duties.

Following Commerce’s rate determination in 2015, we appealed that determination to a bi-national panel under the North American Free Trade Agreement (the “Panel”). On April 13, 2017, the Panel issued its decision, remanding the matter to Commerce and upholding several of Commerce’s determinations, including among others its application of adverse facts available in setting our 17.87% subsidy rate. Notwithstanding the Panel’s decision, Commerce’s prior determination of adverse facts available does not apply in an administrative review. In addition, the Panel’s decision can be challenged by the Canadian government, although not until the conclusion of the remand process. The Canadian government has already filed a separate World Trade Organization challenge to Commerce’s countervailing duty determination in the SC paper investigation, including Commerce’s use of adverse facts available against us.

Through September 30, 2017, our cumulative cash deposits totaled $44 million, and based on our current operating parameters, could be as high as $25 million in 2017. We are not presently able to determine the ultimate resolution of this matter, but we believe it is not probable that we will ultimately be assessed with significant countervailing duties on our Canadian-produced SC paper. Accordingly, no contingent loss was recorded in respect of this petition in our Consolidated Statement of Operations for the nine months ended September 30, 2017. These cash deposits were recorded in “Other assets” in our Consolidated Balance Sheets.

Jedson Case

On March 9, 2017, Jedson Engineering, Inc. and Jedson C.M., Inc. (the “Jedson plaintiffs”) filed a complaint against our subsidiary, Resolute FP US Inc., and other defendants in state court in Tennessee. The complaint alleged breach of contract and violation of Tennessee's Prompt Pay Act for failure to pay for services in connection with the design and construction of our Calhoun tissue project, and sought a recovery of, and enforcement of mechanic’s liens for, approximately $10 million, plus interest and cost of litigation. On April 17, 2017, Resolute filed an answer and counterclaim alleging, among other things, breach of contract and professional negligence by the Jedson plaintiffs and seeking recovery for, among other things, resulting costs on the project. On April 4, 2017, the Jedson plaintiffs also filed a motion for an injunction under the Prompt Pay Act seeking immediate payment of monies claimed and, on April 20, 2017, a motion to abate Resolute FP US Inc.’s counterclaim, both of which we opposed and have not been heard by the court. On August 25, 2017, the Jedson plaintiffs amended their complaint. As amended, the complaint includes allegations of fraud, intentional and negligent misrepresentation, unjust enrichment, and a claim for punitive damages in an amount of up to approximately $20 million. The Company disputes the Jedson plaintiffs’ allegations, and intends to vigorously defend the action. The lawsuit is at a preliminary stage. Accordingly, we are not presently able to determine the ultimate resolution of this matter or to reasonably estimate the potential impact on our Consolidated Financial Statements.

15

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Modification of U.S. OPEB plan

Effective January 1, 2015, we modified our U.S. OPEB plan so that unionized participants, upon reaching Medicare eligibility, are provided Medicare coverage via a Medicare Exchange program rather than via a Company-sponsored medical plan. On March 2, 2016, a proposed class action lawsuit (Reynolds, et al v. Resolute Forest Products Inc., Resolute FP US Inc., Resolute FP US Health and Resolute Welfare Benefit Plan) was filed in the United States District Court for the Eastern District of Tennessee (“District Court”) on behalf of certain Medicare-eligible retirees who were previously unionized employees of our Calhoun, Catawba, and Coosa Pines mills, and their spouses and dependents (the “proposed class”). The plaintiffs allege that the modifications described above breach the collective bargaining agreements and plan covering the members of the proposed class in the lawsuit. Plaintiffs seek reinstatement of the health care benefits as in effect before January 1, 2015, for the proposed class in the lawsuit. On May 23, 2016, the Company filed a motion to dismiss the complaint. The motion to dismiss was denied by the District Court on March 1, 2017. On June 28, 2017, a settlement agreement in principle was reached between the parties to the lawsuit. Because the settlement will resolve the claims of the proposed class, court approval of the settlement will be required. A final settlement order issued by the court would result in an amendment of our U.S. OPEB plan and a corresponding increase to both “Pension and other postretirement benefit obligations” and “Accumulated other comprehensive loss” in our Consolidated Balance Sheet, with any such increase to be recorded at the date the plan amendment is adopted. We do not expect that the resulting increase would have a material impact on our Consolidated Financial Statements.

Fibrek acquisition

Effective July 31, 2012, we completed the final step of the transaction pursuant to which we acquired the remaining 25.4% of the outstanding Fibrek Inc. (“Fibrek”) shares, following the approval of Fibrek’s shareholders on July 23, 2012, and the issuance of a final order of the Quebec Superior Court in Canada approving the arrangement on July 27, 2012. Certain former shareholders of Fibrek exercised (or purported to exercise) rights of dissent in respect of the transaction, asking for a judicial determination of the fair value of their claim under the Canada Business Corporations Act. No consideration has to date been paid to the former Fibrek shareholders who exercised (or purported to exercise) rights of dissent. Any such consideration will only be paid out upon settlement or judicial determination of the fair value of their claims and will be paid entirely in cash. Accordingly, we cannot presently determine the amount that ultimately will be paid to former holders of Fibrek shares in connection with the proceedings, but we have accrued approximately Cdn $14 million ($11 million, based on the exchange rate in effect on September 30, 2017) for the eventual payment of those claims. The hearing in this matter is expected to begin in 2019.

Partial wind-ups of pension plans

On June 12, 2012, we filed a motion for directives with the Quebec Superior Court, the court with jurisdiction in the creditor protection proceedings under the Companies’ Creditors Arrangement Act (Canada) (the “CCAA Creditor Protection Proceedings”), seeking an order to prevent pension regulators in each of Quebec, New Brunswick, and Newfoundland and Labrador from declaring partial wind-ups of pension plans relating to employees of former operations in New Brunswick, and Newfoundland and Labrador, or a declaration that any claim for accelerated reimbursements of deficits arising from a partial wind-up is a barred claim under the CCAA Creditor Protection Proceedings. We contend, among other things, that any such declaration, if issued, would be inconsistent with the Quebec Superior Court’s sanction order confirming the CCAA debtors’ CCAA Plan of Reorganization and Compromise, as amended, and the terms of our emergence from the CCAA Creditor Protection Proceedings. A partial wind-up would likely shorten the period in which any deficit within those plans, which could reach up to Cdn $150 million ($120 million, based on the exchange rate in effect on September 30, 2017), would have to be funded if we do not obtain the relief sought. No hearing date has been set to date.

Environmental matters

We are subject to a variety of federal or national, state, provincial and local environmental laws and regulations in the jurisdictions in which we operate. We believe our operations are in material compliance with current applicable environmental laws and regulations. Environmental regulations promulgated in the future could require substantial additional expenditures for compliance and could have a material impact on us, in particular, and the industry in general.

We may be a “potentially responsible party” with respect to four hazardous waste sites that are being addressed pursuant to the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (commonly known as Superfund) or the Resource Conservation and Recovery Act corrective action authority. We believe we will not be liable for any significant amounts at any of these sites.

We have recorded $8 million of environmental liabilities as of both September 30, 2017 and December 31, 2016, primarily related to environmental remediation related to closed sites. The amount of these liabilities represents management’s estimate of

16

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

the ultimate settlement based on an assessment of relevant factors and assumptions and could be affected by changes in facts or assumptions not currently known to management for which the outcome cannot be reasonably estimated at this time. These liabilities are included in “Accounts payable and accrued liabilities” or “Other liabilities” in our Consolidated Balance Sheets.

We have also recorded $24 million and $23 million of asset retirement obligations as of September 30, 2017 and December 31, 2016, respectively, primarily consisting of liabilities associated with landfills, sludge basins and the dismantling of retired assets. These liabilities are included in “Accounts payable and accrued liabilities” or “Other liabilities” in our Consolidated Balance Sheets.

Other matters

On October 30, 2014, we received a notice from the Ministry of Natural Resources and Forestry of Ontario (the “MNRF”) directing us to repay a conditional amount of Cdn $23 million ($18 million, based on the exchange rate in effect on September 30, 2017) offered to us in 2007 toward the construction of an electricity-producing turbine, should we fail to restart our Fort Frances, Ontario, pulp and paper mill or otherwise implement an alternative remedy acceptable to the MNRF. Several extensions of the deadline to implement an alternative remedy were granted to us by the MNRF, the last of which extended the remedy date to June 30, 2017. However, as a result of an agreement reached on June 29, 2017, we will not be required to repay this amount.

17

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 12. Segment Information

We manage our business based on the products we manufacture. Accordingly, our reportable segments correspond to our principal product lines: market pulp, tissue, wood products, newsprint and specialty papers.

None of the income or loss items following “Operating income (loss)” in our Consolidated Statements of Operations are allocated to our segments, since those items are reviewed separately by management. For the same reason, closure costs, impairment and other related charges, inventory write-downs related to closures, start-up costs, gains and losses on disposition of assets, certain components of pension and OPEB costs and credits as well as other discretionary charges or credits are not allocated to our segments. We allocate depreciation and amortization expense to our segments, although the related fixed assets and amortizable intangible assets are not allocated to segment assets. Additionally, all selling, general and administrative expenses are allocated to our segments, with the exception of certain discretionary charges and credits, which we present under “corporate and other.”

In the first quarter of 2017, we changed our presentation of segment operating income to reallocate the amortization of prior service credits component of pension and OPEB costs from the reportable segments to “corporate and other.” Current service costs will continue to be allocated to the reportable segments. This approach is consistent with the indicators management uses internally to evaluate performance, including those used by the chief operating decision maker. Prior period amounts have been reclassified to conform to the 2017 presentation.

Information about certain segment data for the three and nine months ended September 30, 2017 and 2016, was as follows:

(Unaudited, in millions) | Market Pulp (1) | Tissue | Wood Products (2) | Newsprint | Specialty Papers | Segment Total | Corporate and Other | Total | ||||||||||||||||||||||||

Sales | ||||||||||||||||||||||||||||||||

Third quarter | ||||||||||||||||||||||||||||||||

2017 | $ | 227 | $ | 21 | $ | 219 | $ | 199 | $ | 219 | $ | 885 | $ | — | $ | 885 | ||||||||||||||||

2016 | 198 | 23 | 168 | 242 | 257 | 888 | — | 888 | ||||||||||||||||||||||||

First nine months | ||||||||||||||||||||||||||||||||

2017 | 649 | 61 | 593 | 626 | 686 | 2,615 | — | 2,615 | ||||||||||||||||||||||||

2016 | 619 | 70 | 432 | 756 | 779 | 2,656 | — | 2,656 | ||||||||||||||||||||||||

Depreciation and amortization | ||||||||||||||||||||||||||||||||

Third quarter | ||||||||||||||||||||||||||||||||

2017 | $ | 8 | $ | 2 | $ | 9 | $ | 16 | $ | 11 | $ | 46 | $ | 6 | $ | 52 | ||||||||||||||||

2016 | 10 | 2 | 7 | 17 | 11 | 47 | 4 | 51 | ||||||||||||||||||||||||

First nine months | ||||||||||||||||||||||||||||||||

2017 | 24 | 4 | 25 | 49 | 34 | 136 | 17 | 153 | ||||||||||||||||||||||||

2016 | 28 | 6 | 23 | 56 | 34 | 147 | 10 | 157 | ||||||||||||||||||||||||

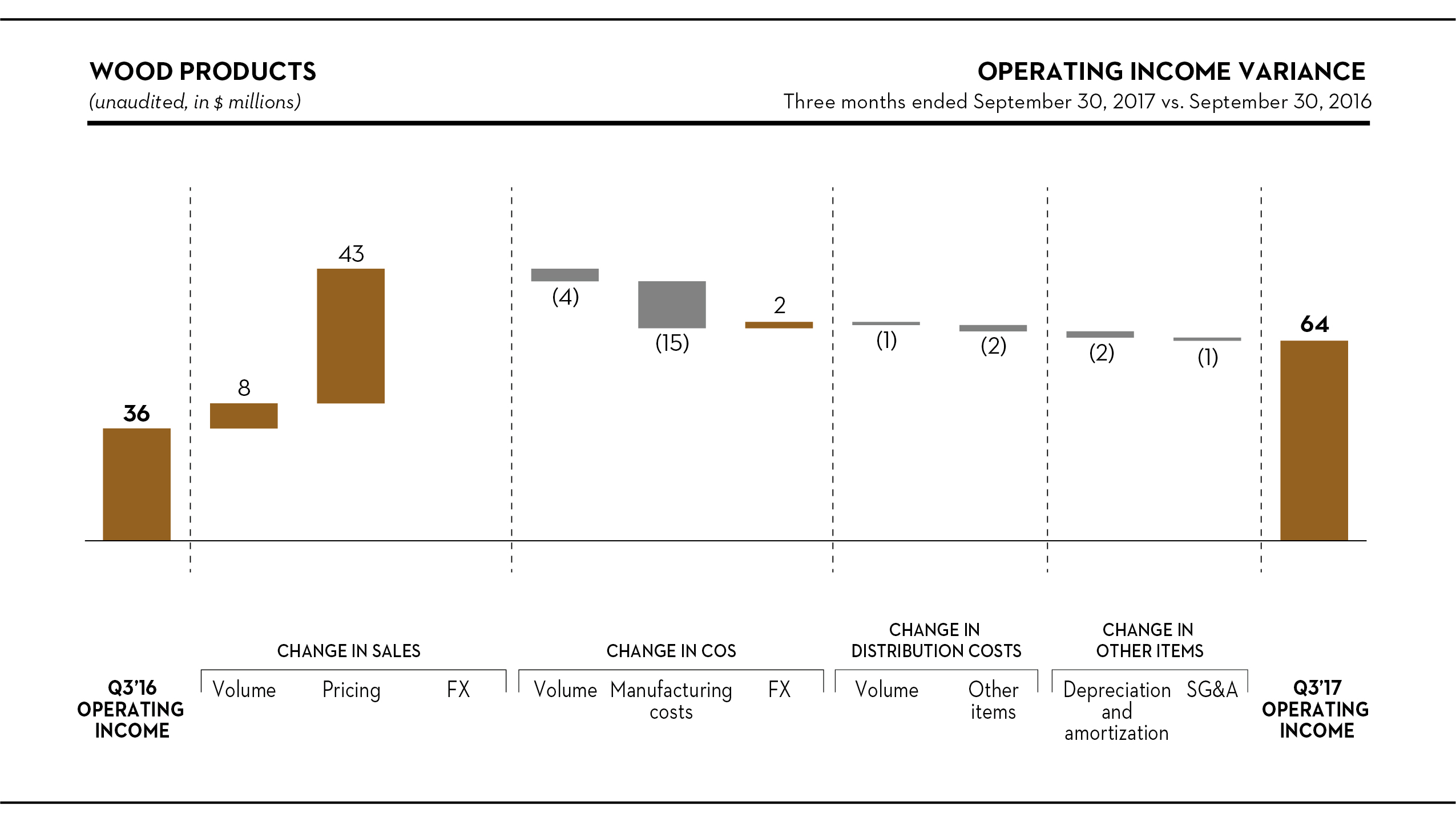

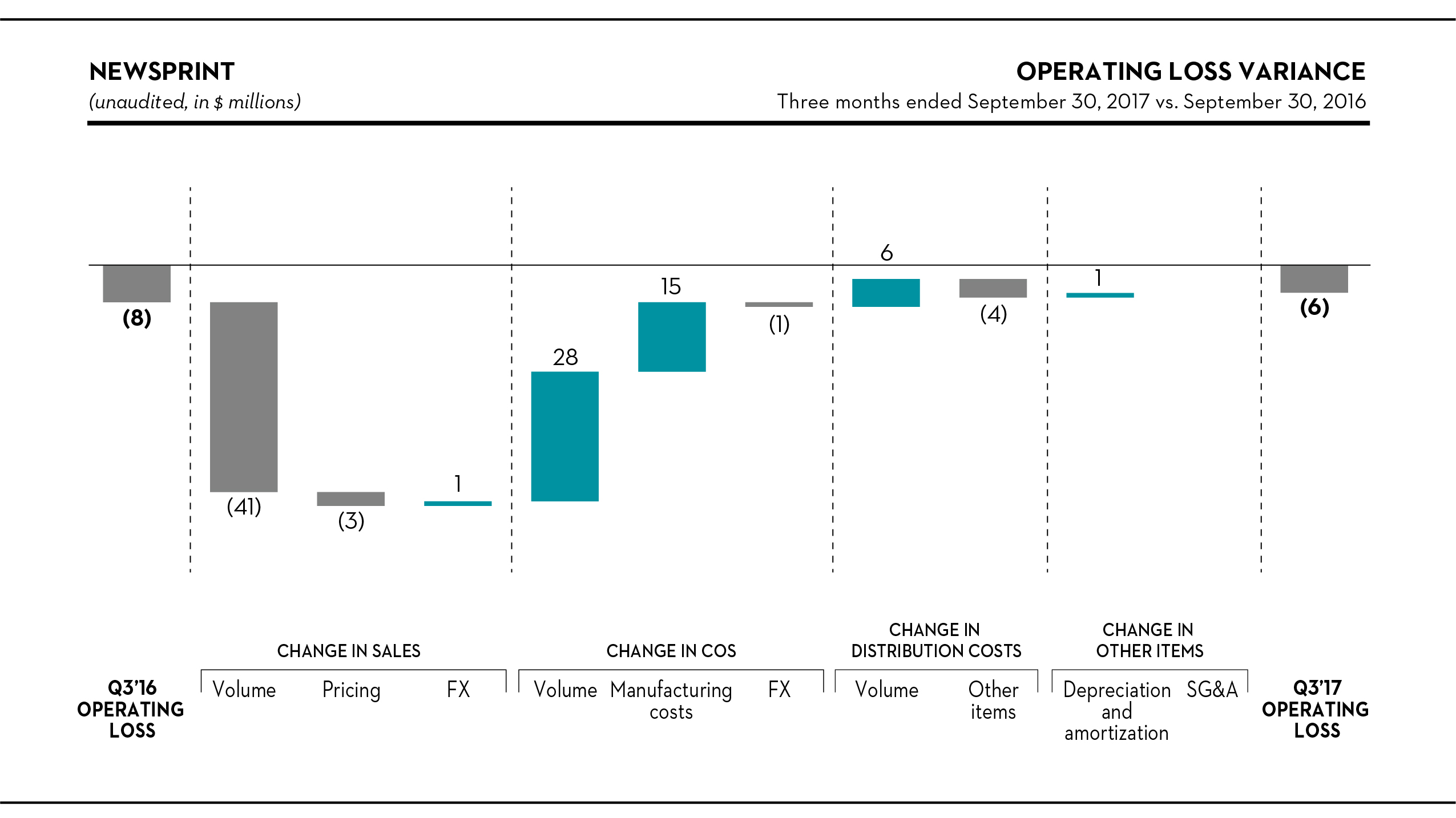

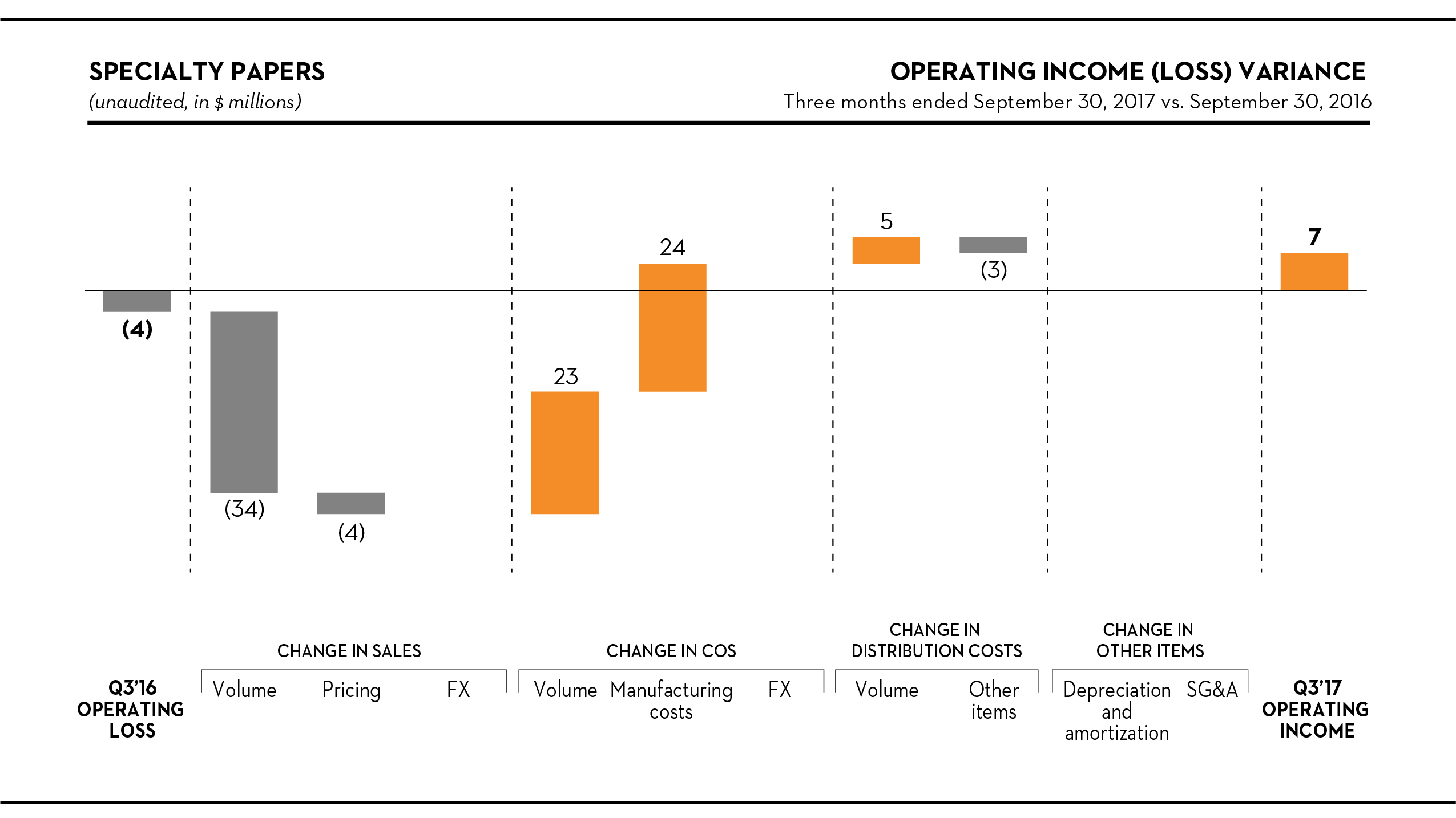

Operating income (loss) | ||||||||||||||||||||||||||||||||

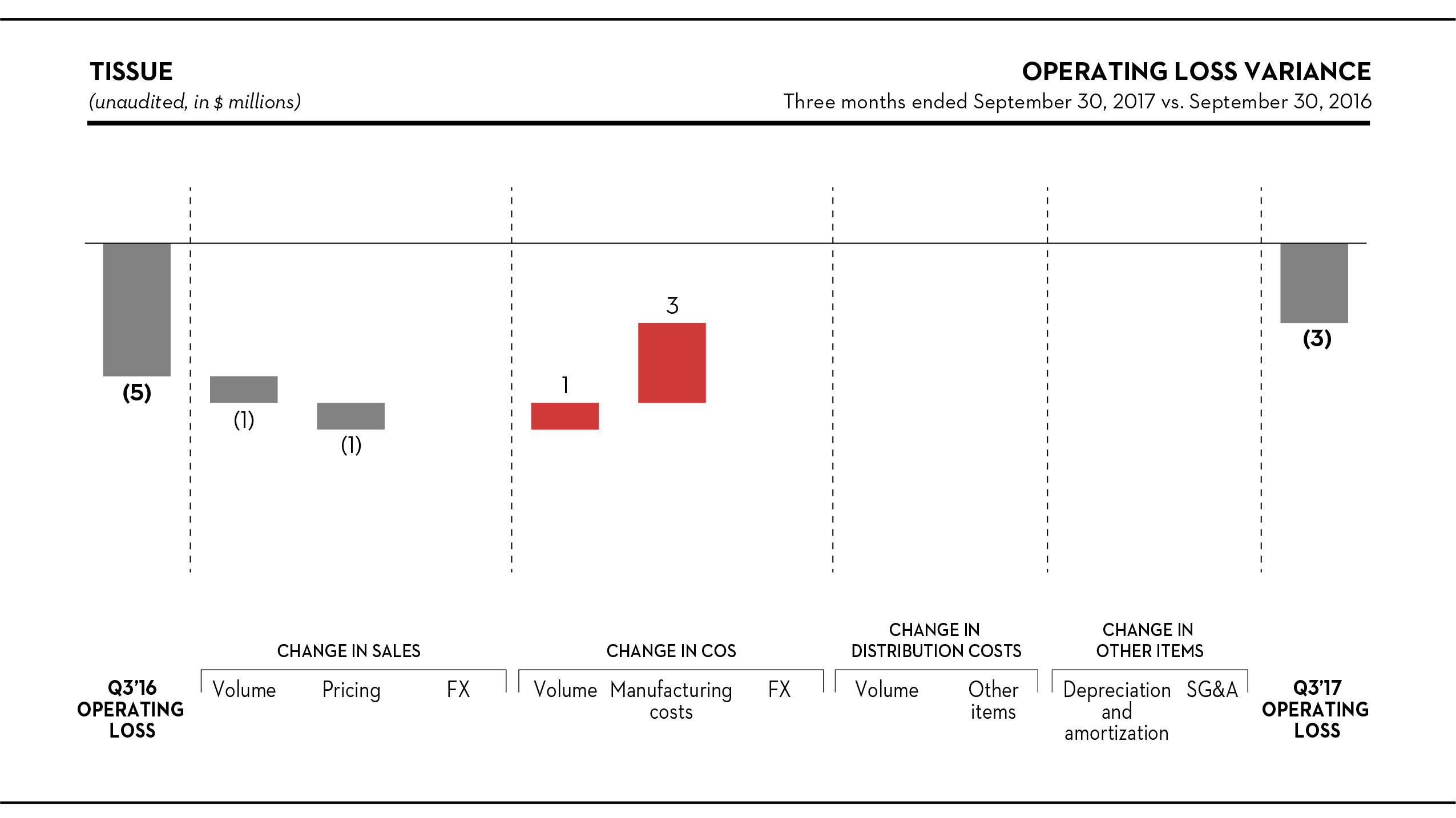

Third quarter | ||||||||||||||||||||||||||||||||

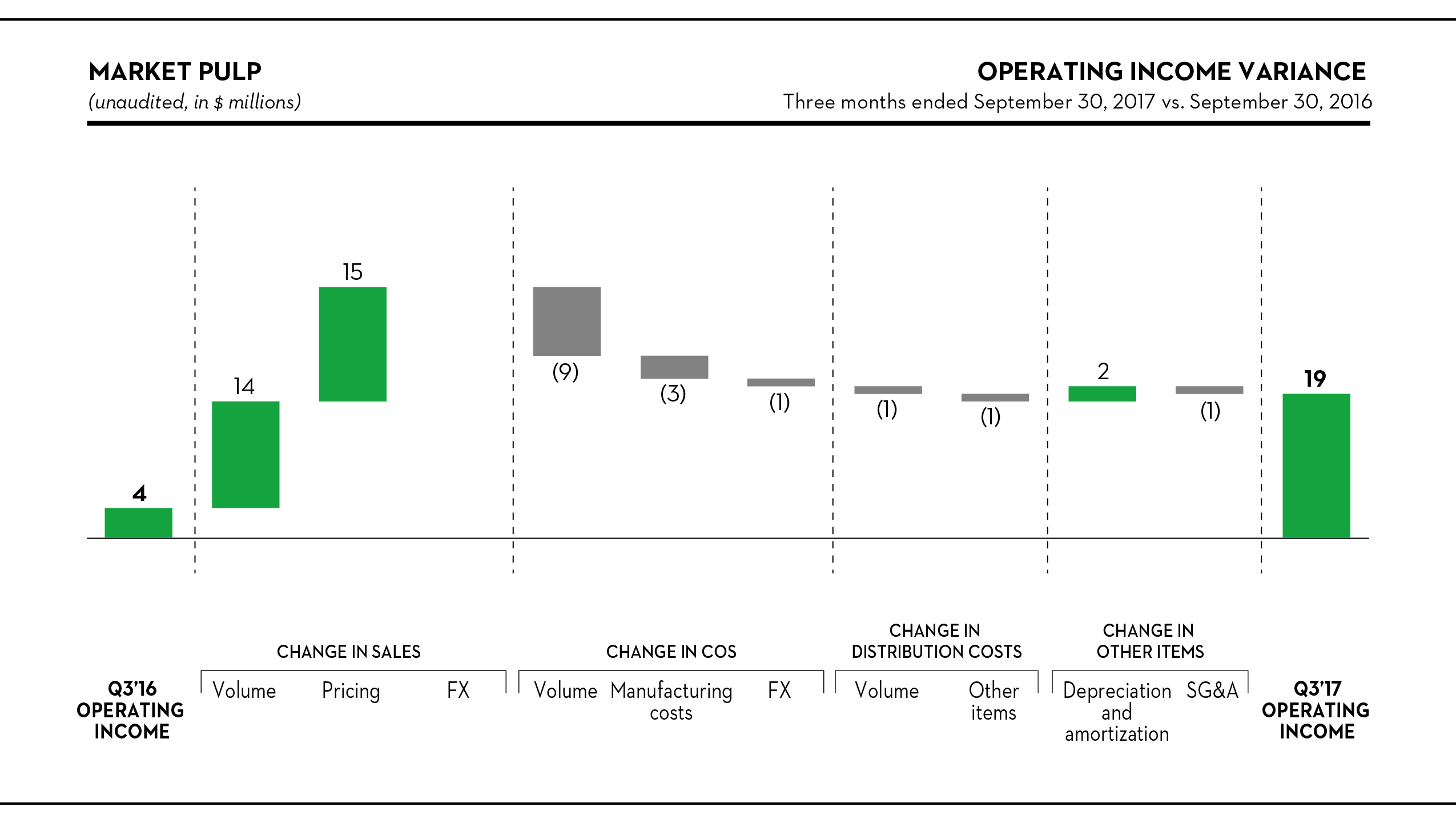

2017 | $ | 19 | $ | (3 | ) | $ | 64 | $ | (6 | ) | $ | 7 | $ | 81 | $ | (33 | ) | $ | 48 | |||||||||||||

2016 | 4 | (5 | ) | 36 | (8 | ) | (4 | ) | 23 | (13 | ) | 10 | ||||||||||||||||||||

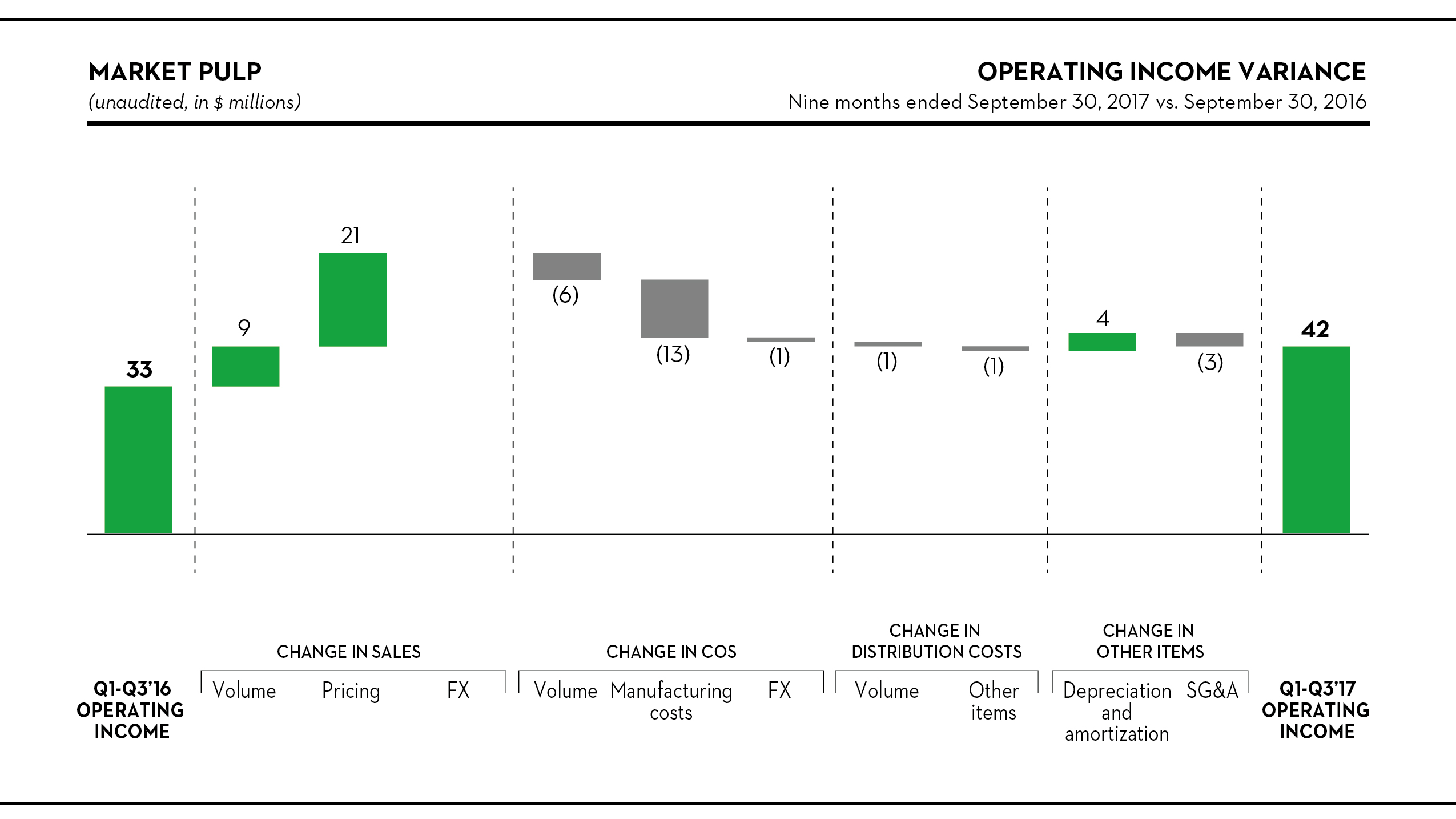

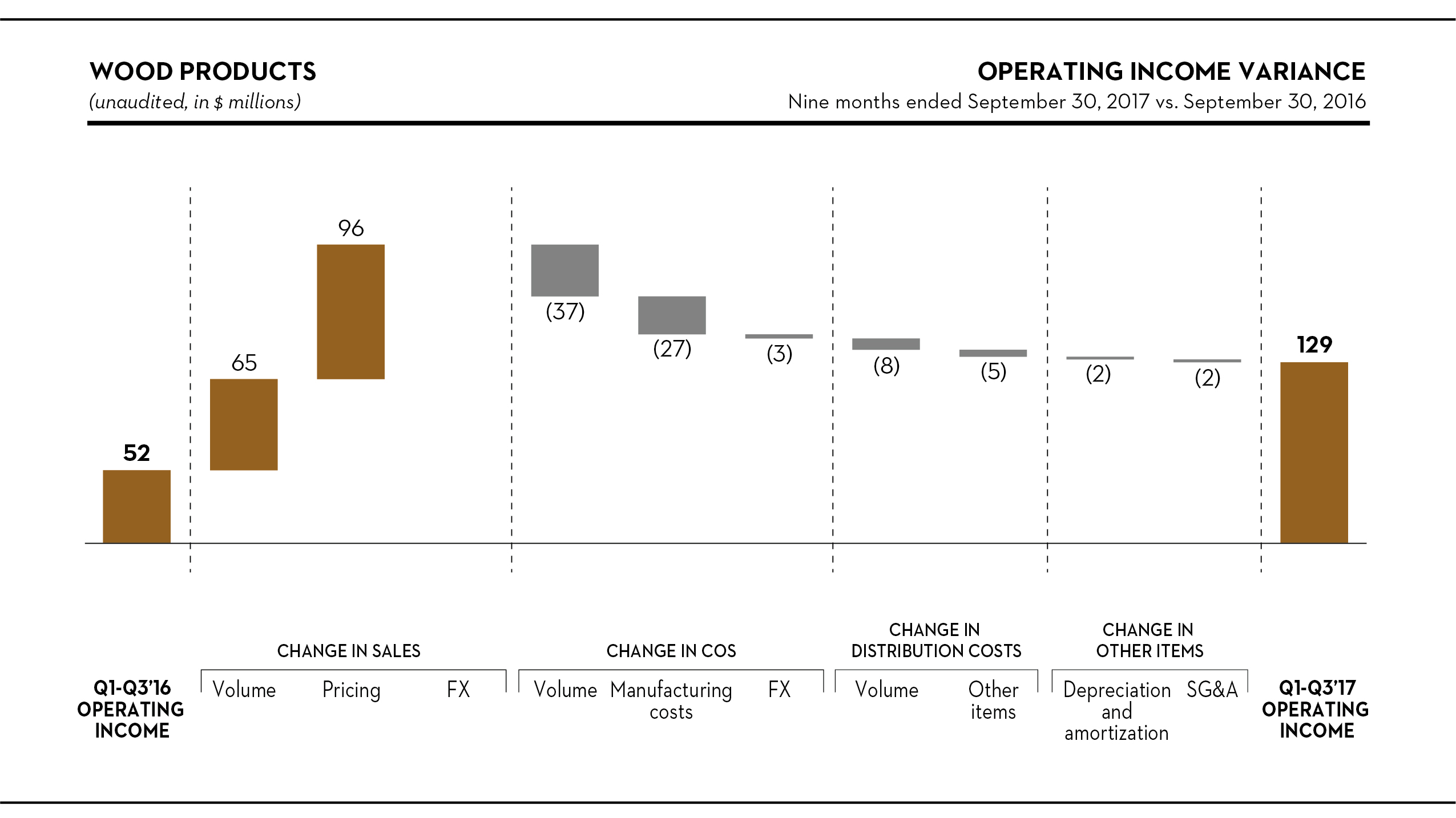

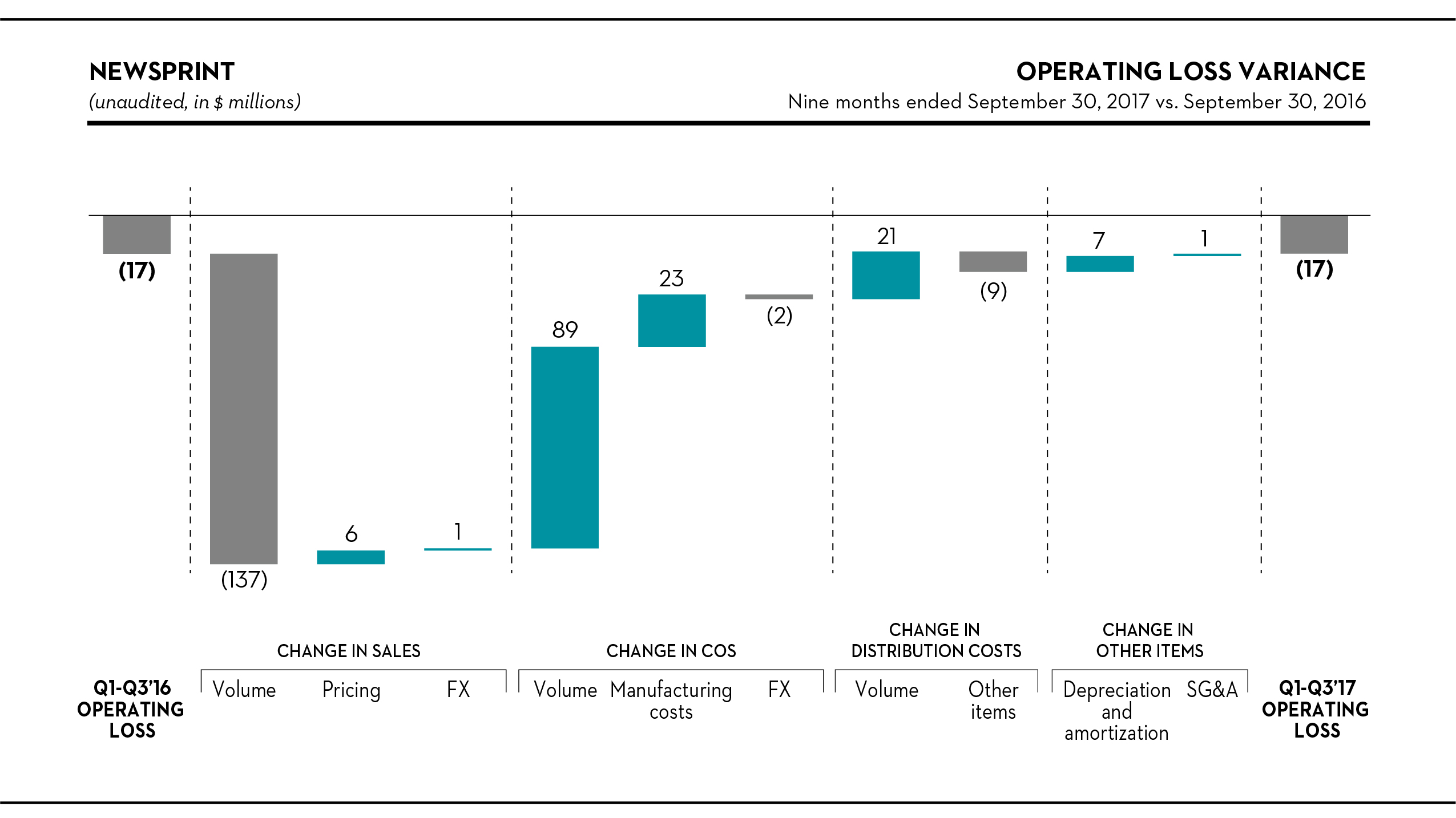

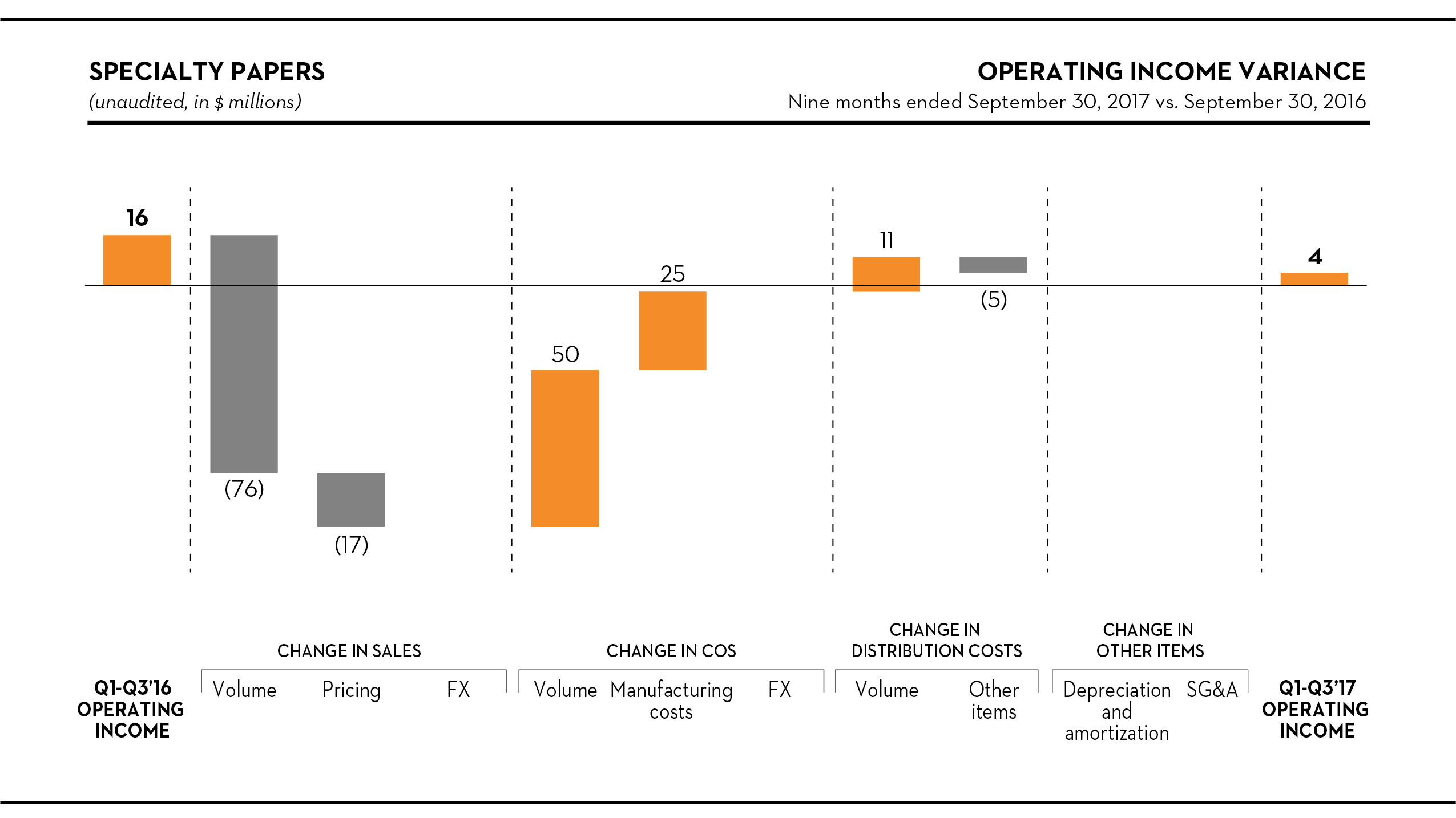

First nine months | ||||||||||||||||||||||||||||||||

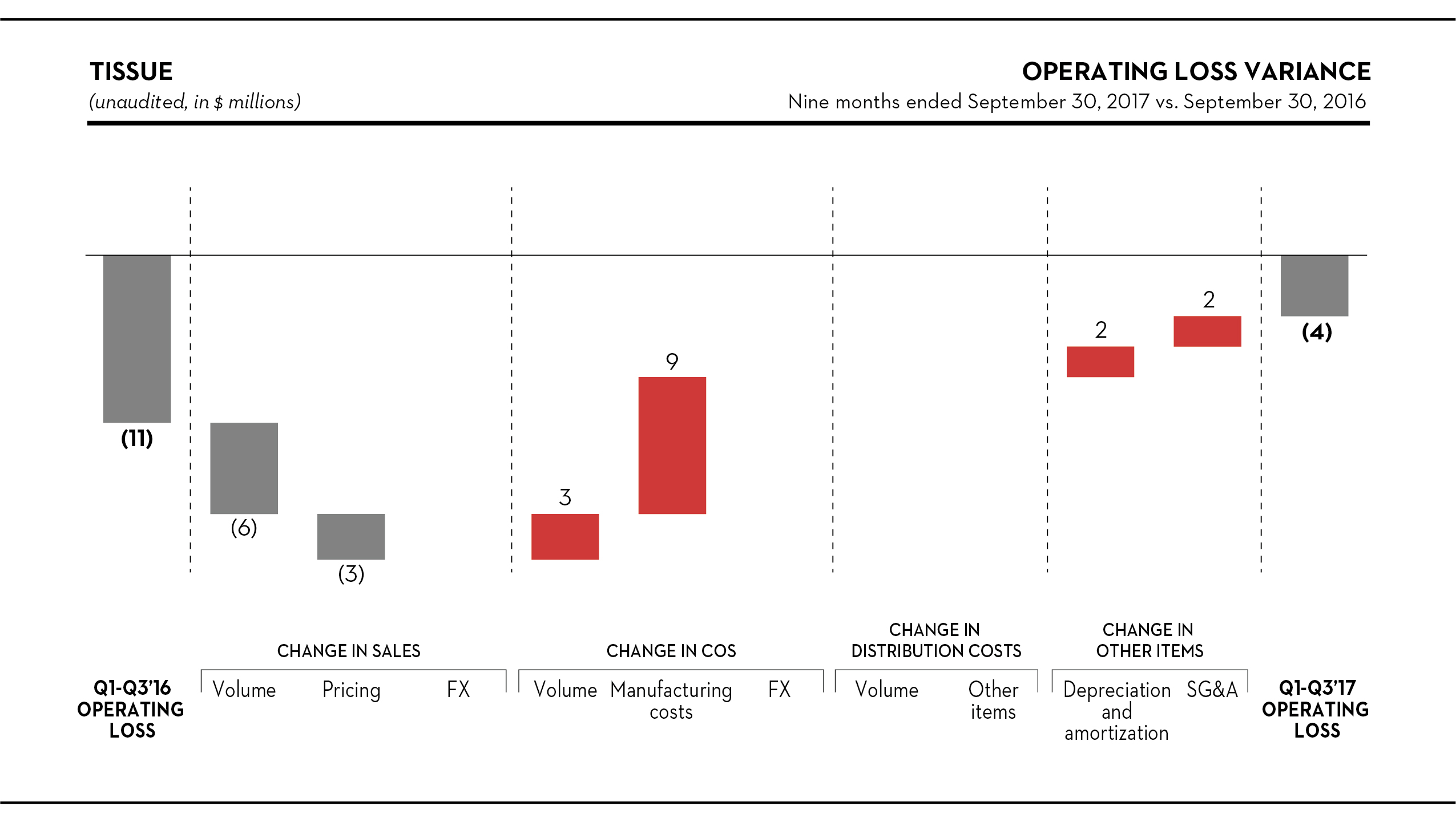

2017 | 42 | (4 | ) | 129 | (17 | ) | 4 | 154 | (159 | ) | (5 | ) | ||||||||||||||||||||

2016 | 33 | (11 | ) | 52 | (17 | ) | 16 | 73 | (81 | ) | (8 | ) | ||||||||||||||||||||

(1) | Inter-segment sales of $9 million and $11 million for the three months ended September 30, 2017 and 2016, respectively, and $28 million and $26 million for the nine months ended September 30, 2017 and 2016, respectively, which are transacted at cost, were excluded from market pulp sales. |

(2) | Wood products sales to our joint ventures, which are transacted at arm’s length negotiated prices, were $6 million and $4 million for the three months ended September 30, 2017 and 2016, respectively, and $16 million and $14 million for the nine months ended September 30, 2017 and 2016, respectively. |

18

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 13. Condensed Consolidating Financial Information

The following information is presented in accordance with Rule 3-10 of Regulation S-X and the public information requirements of Rule 144 promulgated pursuant to the Securities Act of 1933, as amended, in connection with Resolute Forest Products Inc.’s 2023 Notes that are fully and unconditionally guaranteed, on a joint and several basis, by all of our 100% owned material U.S. subsidiaries (the “Guarantor Subsidiaries”). The 2023 Notes are not guaranteed by our foreign subsidiaries (the “Non-guarantor Subsidiaries”).

The following condensed consolidating financial information sets forth the Statements of Operations and Comprehensive Income (Loss) for the three and nine months ended September 30, 2017 and 2016, the Balance Sheets as of September 30, 2017 and December 31, 2016, and the Statements of Cash Flows for the nine months ended September 30, 2017 and 2016 for the Parent, the Guarantor Subsidiaries on a combined basis, and the Non-guarantor Subsidiaries also on a combined basis. The condensed consolidating financial information reflects the investments of the Parent in the Guarantor Subsidiaries and Non-guarantor Subsidiaries, as well as the investments of the Guarantor Subsidiaries in the Non-guarantor Subsidiaries, using the equity method of accounting. The principal consolidating adjustments are entries to eliminate the investments in subsidiaries and intercompany balances and transactions.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) | ||||||||||||||||||||

For the Three Months Ended September 30, 2017 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 716 | $ | 570 | $ | (401 | ) | $ | 885 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 669 | 357 | (402 | ) | 624 | ||||||||||||||

Depreciation and amortization | — | 18 | 34 | — | 52 | |||||||||||||||

Distribution costs | — | 39 | 71 | — | 110 | |||||||||||||||

Selling, general and administrative expenses | 4 | 19 | 20 | — | 43 | |||||||||||||||

Closure costs, impairment and other related charges | — | 10 | — | — | 10 | |||||||||||||||

Net gain on disposition of assets | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Operating (loss) income | (4 | ) | (39 | ) | 90 | 1 | 48 | |||||||||||||

Interest expense | (23 | ) | (3 | ) | (3 | ) | 16 | (13 | ) | |||||||||||

Other income, net | — | 20 | 2 | (16 | ) | 6 | ||||||||||||||

Equity in income (loss) of subsidiaries | 51 | (3 | ) | — | (48 | ) | — | |||||||||||||

Income (loss) before income taxes | 24 | (25 | ) | 89 | (47 | ) | 41 | |||||||||||||

Income tax provision | — | — | (15 | ) | — | (15 | ) | |||||||||||||

Net income (loss) including noncontrolling interests | 24 | (25 | ) | 74 | (47 | ) | 26 | |||||||||||||

Net income attributable to noncontrolling interests | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Net income (loss) attributable to Resolute Forest Products Inc. | $ | 24 | $ | (25 | ) | $ | 72 | $ | (47 | ) | $ | 24 | ||||||||

Comprehensive income (loss) attributable to Resolute Forest Products Inc. | $ | 15 | $ | (41 | ) | $ | 79 | $ | (38 | ) | $ | 15 | ||||||||

19

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME | ||||||||||||||||||||

For the Nine Months Ended September 30, 2017 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 2,131 | $ | 1,660 | $ | (1,176 | ) | $ | 2,615 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 2,028 | 1,084 | (1,176 | ) | 1,936 | ||||||||||||||

Depreciation and amortization | — | 55 | 98 | — | 153 | |||||||||||||||

Distribution costs | — | 119 | 210 | (1 | ) | 328 | ||||||||||||||

Selling, general and administrative expenses | 18 | 53 | 52 | — | 123 | |||||||||||||||

Closure costs, impairment and other related charges | — | 74 | 8 | — | 82 | |||||||||||||||

Net gain on disposition of assets | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Operating (loss) income | (18 | ) | (198 | ) | 210 | 1 | (5 | ) | ||||||||||||

Interest expense | (65 | ) | (7 | ) | (9 | ) | 45 | (36 | ) | |||||||||||

Other income, net | — | 53 | 3 | (45 | ) | 11 | ||||||||||||||

Equity in loss of subsidiaries | (14 | ) | (2 | ) | — | 16 | — | |||||||||||||

(Loss) income before income taxes | (97 | ) | (154 | ) | 204 | 17 | (30 | ) | ||||||||||||

Income tax provision | — | (1 | ) | (62 | ) | — | (63 | ) | ||||||||||||

Net (loss) income including noncontrolling interests | (97 | ) | (155 | ) | 142 | 17 | (93 | ) | ||||||||||||

Net income attributable to noncontrolling interests | — | — | (4 | ) | — | (4 | ) | |||||||||||||

Net (loss) income attributable to Resolute Forest Products Inc. | $ | (97 | ) | $ | (155 | ) | $ | 138 | $ | 17 | $ | (97 | ) | |||||||

Comprehensive (loss) income attributable to Resolute Forest Products Inc. | $ | (91 | ) | $ | (173 | ) | $ | 162 | $ | 11 | $ | (91 | ) | |||||||

20

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) | ||||||||||||||||||||

For the Three Months Ended September 30, 2016 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 722 | $ | 538 | $ | (372 | ) | $ | 888 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 684 | 366 | (369 | ) | 681 | ||||||||||||||

Depreciation and amortization | — | 19 | 32 | — | 51 | |||||||||||||||

Distribution costs | — | 43 | 66 | — | 109 | |||||||||||||||

Selling, general and administrative expenses | 5 | 14 | 18 | — | 37 | |||||||||||||||

Operating (loss) income | (5 | ) | (38 | ) | 56 | (3 | ) | 10 | ||||||||||||

Interest expense | (20 | ) | — | (3 | ) | 13 | (10 | ) | ||||||||||||

Other income, net | — | 11 | 3 | (13 | ) | 1 | ||||||||||||||

Equity in income of subsidiaries | 39 | 11 | — | (50 | ) | — | ||||||||||||||

Income (loss) before income taxes | 14 | (16 | ) | 56 | (53 | ) | 1 | |||||||||||||

Income tax benefit | — | — | 13 | 1 | 14 | |||||||||||||||

Net income (loss) including noncontrolling interests | 14 | (16 | ) | 69 | (52 | ) | 15 | |||||||||||||

Net income attributable to noncontrolling interests | — | — | (1 | ) | — | (1 | ) | |||||||||||||

Net income (loss) attributable to Resolute Forest Products Inc. | $ | 14 | $ | (16 | ) | $ | 68 | $ | (52 | ) | $ | 14 | ||||||||

Comprehensive income (loss) attributable to Resolute Forest Products Inc. | $ | 18 | $ | (19 | ) | $ | 75 | $ | (56 | ) | $ | 18 | ||||||||

21

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME | ||||||||||||||||||||

For the Nine Months Ended September 30, 2016 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 2,193 | $ | 1,591 | $ | (1,128 | ) | $ | 2,656 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 2,067 | 1,084 | (1,125 | ) | 2,026 | ||||||||||||||

Depreciation and amortization | — | 62 | 95 | — | 157 | |||||||||||||||

Distribution costs | — | 126 | 205 | — | 331 | |||||||||||||||

Selling, general and administrative expenses | 15 | 46 | 54 | — | 115 | |||||||||||||||

Closure costs, impairment and other related charges | — | 37 | — | — | 37 | |||||||||||||||

Net gain on disposition of assets | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Operating (loss) income | (15 | ) | (145 | ) | 155 | (3 | ) | (8 | ) | |||||||||||

Interest expense | (59 | ) | — | (9 | ) | 39 | (29 | ) | ||||||||||||

Other income, net | — | 46 | 7 | (39 | ) | 14 | ||||||||||||||

Equity in income (loss) of subsidiaries | 38 | (11 | ) | — | (27 | ) | — | |||||||||||||

(Loss) income before income taxes | (36 | ) | (110 | ) | 153 | (30 | ) | (23 | ) | |||||||||||

Income tax provision | — | (1 | ) | (9 | ) | 1 | (9 | ) | ||||||||||||

Net (loss) income including noncontrolling interests | (36 | ) | (111 | ) | 144 | (29 | ) | (32 | ) | |||||||||||

Net income attributable to noncontrolling interests | — | — | (4 | ) | — | (4 | ) | |||||||||||||

Net (loss) income attributable to Resolute Forest Products Inc. | $ | (36 | ) | $ | (111 | ) | $ | 140 | $ | (29 | ) | $ | (36 | ) | ||||||

Comprehensive (loss) income attributable to Resolute Forest Products Inc. | $ | (21 | ) | $ | (120 | ) | $ | 164 | $ | (44 | ) | $ | (21 | ) | ||||||

22

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING BALANCE SHEET | ||||||||||||||||||||

As of September 30, 2017 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Assets | ||||||||||||||||||||

Current assets: | ||||||||||||||||||||

Cash and cash equivalents | $ | — | $ | 4 | $ | 34 | $ | — | $ | 38 | ||||||||||

Accounts receivable, net | — | 301 | 148 | — | 449 | |||||||||||||||

Accounts receivable from affiliates | 1 | 505 | 632 | (1,138 | ) | — | ||||||||||||||

Inventories, net | — | 260 | 306 | (11 | ) | 555 | ||||||||||||||

Note, advance and interest receivable from parent | — | 536 | — | (536 | ) | — | ||||||||||||||

Notes and interest receivable from affiliates | — | 47 | — | (47 | ) | — | ||||||||||||||

Other current assets | — | 23 | 30 | — | 53 | |||||||||||||||

Total current assets | 1 | 1,676 | 1,150 | (1,732 | ) | 1,095 | ||||||||||||||

Fixed assets, net | — | 698 | 1,039 | — | 1,737 | |||||||||||||||

Amortizable intangible assets, net | — | 13 | 53 | — | 66 | |||||||||||||||

Goodwill | — | 81 | — | — | 81 | |||||||||||||||

Deferred income tax assets | — | — | 1,087 | 3 | 1,090 | |||||||||||||||

Note receivable from parent | — | 318 | — | (318 | ) | — | ||||||||||||||

Note receivable from affiliate | — | 117 | — | (117 | ) | — | ||||||||||||||

Investments in consolidated subsidiaries and affiliates | 3,907 | 2,066 | — | (5,973 | ) | — | ||||||||||||||

Other assets | — | 89 | 74 | — | 163 | |||||||||||||||

Total assets | $ | 3,908 | $ | 5,058 | $ | 3,403 | $ | (8,137 | ) | $ | 4,232 | |||||||||

Liabilities and equity | ||||||||||||||||||||

Current liabilities: | ||||||||||||||||||||

Accounts payable and accrued liabilities | $ | 14 | $ | 186 | $ | 249 | $ | — | $ | 449 | ||||||||||

Accounts payable to affiliates | 505 | 632 | 1 | (1,138 | ) | — | ||||||||||||||

Note, advance and interest payable to subsidiaries | 536 | — | — | (536 | ) | — | ||||||||||||||

Notes and interest payable to affiliate | — | — | 47 | (47 | ) | — | ||||||||||||||

Total current liabilities | 1,055 | 818 | 297 | (1,721 | ) | 449 | ||||||||||||||

Long-term debt, net of current portion | 591 | 241 | — | — | 832 | |||||||||||||||

Note payable to subsidiary | 318 | — | — | (318 | ) | — | ||||||||||||||

Note payable to affiliate | — | — | 117 | (117 | ) | — | ||||||||||||||

Pension and other postretirement benefit obligations | — | 381 | 868 | — | 1,249 | |||||||||||||||

Deferred income tax liabilities | — | 2 | 7 | — | 9 | |||||||||||||||

Other liabilities | 2 | 24 | 38 | — | 64 | |||||||||||||||

Total liabilities | 1,966 | 1,466 | 1,327 | (2,156 | ) | 2,603 | ||||||||||||||

Total equity | 1,942 | 3,592 | 2,076 | (5,981 | ) | 1,629 | ||||||||||||||

Total liabilities and equity | $ | 3,908 | $ | 5,058 | $ | 3,403 | $ | (8,137 | ) | $ | 4,232 | |||||||||

23

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING BALANCE SHEET | ||||||||||||||||||||

As of December 31, 2016 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Assets | ||||||||||||||||||||

Current assets: | ||||||||||||||||||||

Cash and cash equivalents | $ | — | $ | 2 | $ | 33 | $ | — | $ | 35 | ||||||||||

Accounts receivable, net | — | 283 | 158 | — | 441 | |||||||||||||||

Accounts receivable from affiliates | — | 479 | 395 | (874 | ) | — | ||||||||||||||

Inventories, net | — | 259 | 323 | (12 | ) | 570 | ||||||||||||||

Note, advance and interest receivable from parent | — | 373 | — | (373 | ) | — | ||||||||||||||