Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Resolute Forest Products Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT - Resolute Forest Products Inc. | rfp-2014630xex321.htm |

| EX-32.2 - EXHIBIT - Resolute Forest Products Inc. | rfp-2014630xex322.htm |

| EX-31.1 - EXHIBIT - Resolute Forest Products Inc. | rfp-2014630xex311.htm |

| EX-31.2 - EXHIBIT - Resolute Forest Products Inc. | rfp-2014630xex312.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2014

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 001-33776

RESOLUTE FOREST PRODUCTS INC.

(Exact name of registrant as specified in its charter)

Delaware | 98-0526415 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) |

111 Duke Street, Suite 5000; Montréal, Québec; Canada H3C 2M1 |

(Address of principal executive offices) (Zip Code) |

(514) 875-2515 |

(Registrant’s telephone number, including area code) |

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes þ No ¨

As of July 31, 2014, there were 94,590,405 shares of Resolute Forest Products Inc. common stock, $0.001 par value, outstanding.

RESOLUTE FOREST PRODUCTS INC.

TABLE OF CONTENTS

Page Number | |

PART I FINANCIAL INFORMATION | |

Item 1. Financial Statements: | |

PART II OTHER INFORMATION | |

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except per share amounts)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

2014 | 2013 | 2014 | 2013 | ||||||||||||||

Sales | $ | 1,091 | $ | 1,107 | $ | 2,107 | $ | 2,181 | |||||||||

Costs and expenses: | |||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | 812 | 859 | 1,633 | 1,715 | |||||||||||||

Depreciation and amortization | 62 | 61 | 124 | 121 | |||||||||||||

Distribution costs | 134 | 130 | 254 | 253 | |||||||||||||

Selling, general and administrative expenses | 41 | 44 | 77 | 88 | |||||||||||||

Closure costs, impairment and other related charges | 52 | 12 | 62 | 52 | |||||||||||||

Net gain on disposition of assets | (2 | ) | (2 | ) | (2 | ) | (2 | ) | |||||||||

Operating (loss) income | (8 | ) | 3 | (41 | ) | (46 | ) | ||||||||||

Interest expense | (11 | ) | (13 | ) | (23 | ) | (27 | ) | |||||||||

Other income (expense), net | 20 | (65 | ) | 7 | (47 | ) | |||||||||||

Income (loss) before income taxes | 1 | (75 | ) | (57 | ) | (120 | ) | ||||||||||

Income tax (provision) benefit | (1 | ) | 31 | 7 | 71 | ||||||||||||

Net loss including noncontrolling interests | — | (44 | ) | (50 | ) | (49 | ) | ||||||||||

Net (income) loss attributable to noncontrolling interests | (2 | ) | 1 | (2 | ) | 1 | |||||||||||

Net loss attributable to Resolute Forest Products Inc. | $ | (2 | ) | $ | (43 | ) | $ | (52 | ) | $ | (48 | ) | |||||

Net loss per share attributable to Resolute Forest Products Inc. common shareholders: | |||||||||||||||||

Basic | $ | (0.02 | ) | $ | (0.45 | ) | $ | (0.55 | ) | $ | (0.51 | ) | |||||

Diluted | (0.02 | ) | (0.45 | ) | (0.55 | ) | (0.51 | ) | |||||||||

Weighted-average number of Resolute Forest Products Inc. common shares outstanding: | |||||||||||||||||

Basic | 94.6 | 94.8 | 94.6 | 94.8 | |||||||||||||

Diluted | 94.6 | 94.8 | 94.6 | 94.8 | |||||||||||||

See accompanying notes to unaudited interim consolidated financial statements.

1

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited, in millions)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

2014 | 2013 | 2014 | 2013 | ||||||||||||||

Net loss including noncontrolling interests | $ | — | $ | (44 | ) | $ | (50 | ) | $ | (49 | ) | ||||||

Other comprehensive income (loss): | |||||||||||||||||

Change in unamortized prior service credits, net of tax of $17 and $34 for the three and six months ended June 30, 2014, respectively, and $5 for both the three and six months ended June 30, 2013 | 28 | (13 | ) | 52 | (14 | ) | |||||||||||

Change in unamortized actuarial losses, net of tax of $2 and $3 for the three and six months ended June 30, 2014, respectively, and $11 and $13 for the three and six months ended June 30, 2013, respectively | (2 | ) | 20 | (1 | ) | 24 | |||||||||||

Foreign currency translation | 1 | (3 | ) | — | (5 | ) | |||||||||||

Other comprehensive income, net of tax | 27 | 4 | 51 | 5 | |||||||||||||

Comprehensive income (loss) including noncontrolling interests | 27 | (40 | ) | 1 | (44 | ) | |||||||||||

Comprehensive (income) loss attributable to noncontrolling interests | (2 | ) | 1 | (2 | ) | 1 | |||||||||||

Comprehensive income (loss) attributable to Resolute Forest Products Inc. | $ | 25 | $ | (39 | ) | $ | (1 | ) | $ | (43 | ) | ||||||

See accompanying notes to unaudited interim consolidated financial statements.

2

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited, in millions, except per share amount)

June 30, 2014 | December 31, 2013 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 263 | $ | 322 | ||||

Accounts receivable, net: | ||||||||

Trade | 521 | 536 | ||||||

Other | 89 | 98 | ||||||

Inventories, net | 579 | 529 | ||||||

Deferred income tax assets | 32 | 32 | ||||||

Other current assets | 62 | 45 | ||||||

Total current assets | 1,546 | 1,562 | ||||||

Fixed assets, net | 2,184 | 2,289 | ||||||

Amortizable intangible assets, net | 64 | 66 | ||||||

Deferred income tax assets | 1,237 | 1,266 | ||||||

Other assets | 216 | 202 | ||||||

Total assets | $ | 5,247 | $ | 5,385 | ||||

Liabilities and equity | ||||||||

Current liabilities: | ||||||||

Accounts payable and accrued liabilities | $ | 556 | $ | 533 | ||||

Current portion of long-term debt | 1 | 2 | ||||||

Deferred income tax liabilities | 32 | 32 | ||||||

Total current liabilities | 589 | 567 | ||||||

Long-term debt, net of current portion | 597 | 597 | ||||||

Pension and other postretirement benefit obligations | 1,146 | 1,294 | ||||||

Deferred income tax liabilities | 25 | 26 | ||||||

Other long-term liabilities | 48 | 62 | ||||||

Total liabilities | 2,405 | 2,546 | ||||||

Commitments and contingencies | ||||||||

Equity: | ||||||||

Resolute Forest Products Inc. shareholders’ equity: | ||||||||

Common stock, $0.001 par value. 117.1 shares issued and 94.6 shares outstanding as of June 30, 2014; 117.0 shares issued and 94.5 shares outstanding as of December 31, 2013 | — | — | ||||||

Additional paid-in capital | 3,753 | 3,751 | ||||||

Deficit | (644 | ) | (592 | ) | ||||

Accumulated other comprehensive loss | (220 | ) | (271 | ) | ||||

Treasury stock at cost, 22.5 shares as of June 30, 2014 and December 31, 2013 | (61 | ) | (61 | ) | ||||

Total Resolute Forest Products Inc. shareholders’ equity | 2,828 | 2,827 | ||||||

Noncontrolling interests | 14 | 12 | ||||||

Total equity | 2,842 | 2,839 | ||||||

Total liabilities and equity | $ | 5,247 | $ | 5,385 | ||||

See accompanying notes to unaudited interim consolidated financial statements.

3

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Unaudited, in millions)

Six Months Ended June 30, 2014 | ||||||||||||||||||||||||||||

Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non- controlling Interests | Total Equity | ||||||||||||||||||||||

Balance as of December 31, 2013 | $ | — | $ | 3,751 | $ | (592 | ) | $ | (271 | ) | $ | (61 | ) | $ | 12 | $ | 2,839 | |||||||||||

Share-based compensation costs for equity-classified awards | — | 2 | — | — | — | — | 2 | |||||||||||||||||||||

Net (loss) income | — | — | (52 | ) | — | — | 2 | (50 | ) | |||||||||||||||||||

Other comprehensive income, net of tax | — | — | — | 51 | — | — | 51 | |||||||||||||||||||||

Balance as of June 30, 2014 | $ | — | $ | 3,753 | $ | (644 | ) | $ | (220 | ) | $ | (61 | ) | $ | 14 | $ | 2,842 | |||||||||||

Six Months Ended June 30, 2013 | ||||||||||||||||||||||||||||

Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Retained Earnings (Deficit) | Accumulated Other Comprehensive Loss | Treasury Stock | Non- controlling Interests | Total Equity | ||||||||||||||||||||||

Balance as of December 31, 2012 | $ | — | $ | 3,730 | $ | 47 | $ | (614 | ) | $ | (61 | ) | $ | 23 | $ | 3,125 | ||||||||||||

Share-based compensation costs for equity-classified awards | — | 4 | — | — | — | — | 4 | |||||||||||||||||||||

Net loss | — | — | (48 | ) | — | — | (1 | ) | (49 | ) | ||||||||||||||||||

Contribution of capital from noncontrolling interest (net of tax of $3) | — | — | — | — | — | 5 | 5 | |||||||||||||||||||||

Acquisition of noncontrolling interest (Note 3) | — | 14 | — | — | — | (14 | ) | — | ||||||||||||||||||||

Other comprehensive income, net of tax | — | — | — | 5 | — | — | 5 | |||||||||||||||||||||

Balance as of June 30, 2013 | $ | — | $ | 3,748 | $ | (1 | ) | $ | (609 | ) | $ | (61 | ) | $ | 13 | $ | 3,090 | |||||||||||

See accompanying notes to unaudited interim consolidated financial statements.

4

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

Six Months Ended June 30, | ||||||||

2014 | 2013 | |||||||

Cash flows from operating activities: | ||||||||

Net loss including noncontrolling interests | $ | (50 | ) | $ | (49 | ) | ||

Adjustments to reconcile net loss including noncontrolling interests to net cash provided by operating activities: | ||||||||

Share-based compensation | 2 | 4 | ||||||

Depreciation and amortization | 124 | 121 | ||||||

Closure costs, impairment and other related charges | 54 | 46 | ||||||

Inventory write-downs related to closures | 4 | 5 | ||||||

Deferred income taxes | (8 | ) | (71 | ) | ||||

Net pension contributions and other postretirement benefit payments | (74 | ) | (35 | ) | ||||

Net gain on disposition of assets | (2 | ) | (2 | ) | ||||

Loss on translation of foreign currency denominated deferred income taxes | 6 | 80 | ||||||

Gain on translation of foreign currency denominated pension and other postretirement benefit obligations | (6 | ) | (78 | ) | ||||

Gain on forgiveness of note payable | — | (12 | ) | |||||

Net loss on extinguishment of debt | — | 59 | ||||||

Net planned major maintenance payments | (6 | ) | (7 | ) | ||||

Dividends received from equity method investees in excess of income | — | 3 | ||||||

Changes in working capital: | ||||||||

Accounts receivable | 36 | (5 | ) | |||||

Inventories | (55 | ) | 14 | |||||

Other current assets | (9 | ) | (2 | ) | ||||

Accounts payable and accrued liabilities | 5 | (16 | ) | |||||

Other, net | 1 | (7 | ) | |||||

Net cash provided by operating activities | 22 | 48 | ||||||

Cash flows from investing activities: | ||||||||

Cash invested in fixed assets | (82 | ) | (86 | ) | ||||

Disposition of assets | 2 | 3 | ||||||

Proceeds from insurance settlements | — | 4 | ||||||

Decrease in restricted cash | 1 | 3 | ||||||

(Increase) decrease in deposit requirements for letters of credit, net | (1 | ) | 1 | |||||

Net cash used in investing activities | (80 | ) | (75 | ) | ||||

Cash flows from financing activities: | ||||||||

Issuance of long-term debt | — | 594 | ||||||

Premium paid on extinguishment of debt | — | (84 | ) | |||||

Payments of debt | (1 | ) | (497 | ) | ||||

Payments of financing and credit facility fees | (1 | ) | (9 | ) | ||||

Contribution of capital from noncontrolling interest | — | 8 | ||||||

Net cash (used in) provided by financing activities | (2 | ) | 12 | |||||

Effect of exchange rate changes on cash and cash equivalents | 1 | — | ||||||

Net decrease in cash and cash equivalents | (59 | ) | (15 | ) | ||||

Cash and cash equivalents: | ||||||||

Beginning of period | 322 | 263 | ||||||

End of period | $ | 263 | $ | 248 | ||||

See accompanying notes to unaudited interim consolidated financial statements.

5

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 1. Organization and Basis of Presentation

Nature of operations

Resolute Forest Products Inc. (with its subsidiaries and affiliates, either individually or collectively, unless otherwise indicated, referred to as “Resolute Forest Products,” “we,” “our,” “us,” “Parent” or the “Company”) is incorporated in Delaware. We are a global leader in the forest products industry, with a diverse range of products, including newsprint, specialty papers, market pulp and wood products, which are marketed in close to 90 countries. We own or operate nearly 40 pulp and paper mills and wood products facilities in the United States, Canada and South Korea, and power generation assets in Canada.

Financial statements

Our interim consolidated financial statements are unaudited and have been prepared in accordance with the requirements of the United States Securities and Exchange Commission (the “SEC”) for interim reporting. Under those rules, certain footnotes and other financial information that are normally required by United States generally accepted accounting principles (“U.S. GAAP”) may be condensed or omitted. In our opinion, all adjustments (consisting of normal recurring adjustments) necessary for the fair statement of the unaudited interim consolidated financial statements have been made. All amounts are expressed in U.S. dollars, unless otherwise indicated. The results for the interim period ended June 30, 2014 are not necessarily indicative of the results to be expected for the full year. These unaudited interim consolidated financial statements should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on March 3, 2014 (the “2013 Annual Report”). Certain prior period amounts in our footnotes have been reclassified to conform to the 2014 presentation.

New accounting pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update 2014-09, “Revenue from Contracts from Customers” (“ASU 2014-09”). ASU 2014-09 provides a framework that replaces existing revenue recognition guidance in U.S. GAAP. This standard is effective for fiscal years beginning after December 15, 2016 and early adoption is prohibited. We do not expect the adoption of this accounting guidance to impact our results of operations or financial position.

6

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 2. Closure Costs, Impairment and Other Related Charges

Closure costs, impairment and other related charges for the three and six months ended June 30, 2014 were comprised of the following:

(Unaudited, in millions) | Impairment of Assets (1) | Accelerated Depreciation | Severance and Other Costs | Total | ||||||||||||

Permanent closures: | ||||||||||||||||

Paper machine in Catawba, South Carolina (2) | ||||||||||||||||

Second quarter | $ | — | $ | 45 | $ | — | $ | 45 | ||||||||

First six months | — | 45 | 1 | 46 | ||||||||||||

Kraft mill and paper machine in Fort Frances, Ontario (3) | ||||||||||||||||

Second quarter | — | — | 2 | 2 | ||||||||||||

First six months | — | — | 8 | 8 | ||||||||||||

Paper machine in Iroquois Falls, Ontario (4) | ||||||||||||||||

Second quarter | — | — | — | — | ||||||||||||

First six months | — | 3 | — | 3 | ||||||||||||

Other | ||||||||||||||||

Second quarter | 5 | — | — | 5 | ||||||||||||

First six months | 6 | — | (1 | ) | 5 | |||||||||||

Total | ||||||||||||||||

Second quarter | $ | 5 | $ | 45 | $ | 2 | $ | 52 | ||||||||

First six months | 6 | 48 | 8 | 62 | ||||||||||||

(1) | We recorded long-lived asset impairment charges of $4 million and $5 million for the three and six months ended June 30, 2014 related to our recycling assets to reduce the carrying value of the assets to fair value less costs to sell. |

(2) | On May 22, 2014, we announced the permanent closure of the previously idled paper machine in Catawba. |

(3) | On May 6, 2014, we announced the permanent closure of our previously idled pulp mill and paper machine in Fort Frances. We are exploring opportunities to continue to operate the biomass boiler and electricity-producing turbine. |

(4) | In April 2014, we permanently closed a paper machine in Iroquois Falls, following the announcement made on October 24, 2013. |

7

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Closure costs, impairment and other related charges for the three and six months ended June 30, 2013 were comprised of the following:

(Unaudited, in millions) | Accelerated Depreciation | Pension Plan Settlement Gain | Severance and Other Costs | Total | ||||||||||||

Indefinite idlings: | ||||||||||||||||

Paper machine in Calhoun, Tennessee (1) | ||||||||||||||||

Second quarter | $ | 9 | $ | — | $ | 3 | $ | 12 | ||||||||

First six months | 44 | — | 5 | 49 | ||||||||||||

Kraft mill and paper machine in Fort Frances (2) | ||||||||||||||||

Second quarter | — | — | — | — | ||||||||||||

First six months | — | — | 4 | 4 | ||||||||||||

Other | ||||||||||||||||

Second quarter | — | — | — | — | ||||||||||||

First six months | — | (1 | ) | — | (1 | ) | ||||||||||

Total | ||||||||||||||||

Second quarter | $ | 9 | $ | — | $ | 3 | $ | 12 | ||||||||

First six months | 44 | (1 | ) | 9 | 52 | |||||||||||

(1) | Following our acquisition of the noncontrolling interest in Calhoun Newsprint Company (“CNC”), we indefinitely idled a paper machine at the Calhoun mill on March 12, 2013, resulting in accelerated depreciation charges to reduce the carrying value of the assets to reflect their revised estimated remaining useful lives. In 2014, we restarted the paper machine. For additional information regarding our acquisition of the noncontrolling interest in CNC, see Note 3, “Other Income (Expense), Net.” |

(2) | On May 6, 2014, we announced the permanent closure of our previously idled pulp mill and paper machine in Fort Frances. We are exploring opportunities to continue to operate the biomass boiler and electricity-producing turbine. |

Note 3. Other Income (Expense), Net

Other income (expense), net for the three and six months ended June 30, 2014 and 2013 was comprised of the following:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

(Unaudited, in millions) | 2014 | 2013 | 2014 | 2013 | |||||||||||||

Foreign exchange gain (loss) | $ | 17 | $ | (7 | ) | $ | 3 | $ | (12 | ) | |||||||

Net loss on extinguishment of debt (Note 7) | — | (59 | ) | — | (59 | ) | |||||||||||

Gain on forgiveness of note payable (1) | — | — | — | 12 | |||||||||||||

Gain on liquidation settlement (2) | — | — | — | 9 | |||||||||||||

Miscellaneous income | 3 | 1 | 4 | 3 | |||||||||||||

$ | 20 | $ | (65 | ) | $ | 7 | $ | (47 | ) | ||||||||

(1) | On March 11, 2013, we acquired the noncontrolling interest in CNC, which was previously owned 51% by us and included in our consolidated financial statements on a fully consolidated basis. As a result, CNC became a wholly-owned subsidiary of ours. In connection with this transaction, we recognized a gain on the forgiveness of a $12 million note issued by CNC. The acquisition of the noncontrolling interest in CNC was accounted for as an equity transaction. |

(2) | On February 2, 2010, Bridgewater Paper Company Limited (“BPCL”), a subsidiary of ours, filed for administration in the United Kingdom pursuant to the United Kingdom Insolvency Act 1986, as amended. As a result, we became a creditor of BPCL and lost control over their operations. In connection with our claims, we received a liquidation settlement of $9 million in March 2013. |

8

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 4. Accumulated Other Comprehensive Loss

The change in our accumulated other comprehensive loss by component (net of tax) for the six months ended June 30, 2014 was as follows:

(Unaudited, in millions) | Unamortized Prior Service Credits (1) | Unamortized Actuarial Losses (1) | Foreign Currency Translation | Total | ||||||||||||

Balance as of December 31, 2013 | $ | 18 | $ | (290 | ) | $ | 1 | $ | (271 | ) | ||||||

Other comprehensive income (loss) before reclassifications | 55 | (2 | ) | — | 53 | |||||||||||

Amounts reclassified from accumulated other comprehensive loss (2) | (3 | ) | 1 | — | (2 | ) | ||||||||||

Net current period other comprehensive income (loss) | 52 | (1 | ) | — | 51 | |||||||||||

Balance as of June 30, 2014 | $ | 70 | $ | (291 | ) | $ | 1 | $ | (220 | ) | ||||||

(1) | During the six months ended June 30, 2014, we modified our U.S. other postretirement benefit (“OPEB”) plan, whereby unionized post-65 participants will be provided comparable Medicare coverage via a Medicare exchange program available under the U.S. Affordable Care Act, effective January 1, 2015. As a result of this plan amendment, “Pension and other postretirement benefit obligations” and “Accumulated other comprehensive loss” in our Consolidated Balance Sheet as of June 30, 2014, were decreased by $84 million and $51 million (net of tax of $33 million), respectively, and consisted of $55 million (net of tax of $36 million) of unamortized prior service credits offset by $4 million (net of tax of $3 million) of unamortized actuarial losses. |

(2) | See the table below for details about these reclassifications. |

The reclassifications out of accumulated other comprehensive loss for the six months ended June 30, 2014 were comprised of the following:

(Unaudited, in millions) | Amounts Reclassified From Accumulated Other Comprehensive Loss | Affected Line in the Consolidated Statements of Operations | |||

Unamortized Prior Service Credits | |||||

Amortization of prior service credits | $ | (5 | ) | Cost of sales, excluding depreciation, amortization and distribution costs (1) | |

2 | Income tax (provision) benefit | ||||

$ | (3 | ) | Net of tax | ||

Unamortized Actuarial Losses | |||||

Amortization of actuarial losses | $ | 1 | Cost of sales, excluding depreciation, amortization and distribution costs (1) | ||

— | Income tax (provision) benefit | ||||

$ | 1 | Net of tax | |||

Total Reclassifications | $ | (2 | ) | Net of tax | |

(1) | These items are included in the computation of net periodic benefit cost related to our pension and OPEB plans summarized in Note 8, “Employee Benefit Plans.” |

9

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 5. Net Loss Per Share

The weighted-average number of common shares outstanding used to calculate the basic and diluted net loss per share attributable to Resolute Forest Products Inc. common shareholders for the three and six months ended June 30, 2014 and 2013 was as follows:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

(Unaudited, in millions) | 2014 | 2013 | 2014 | 2013 | |||||||||

Basic weighted-average number of common shares outstanding | 94.6 | 94.8 | 94.6 | 94.8 | |||||||||

Diluted weighted-average number of common shares outstanding | 94.6 | 94.8 | 94.6 | 94.8 | |||||||||

No adjustments to net loss attributable to Resolute Forest Products Inc. common shareholders were necessary to calculate basic and diluted net loss per share for all periods presented.

The weighted-average number of share options and equity-classified restricted stock units (“RSUs”) and deferred stock units (“DSUs”) outstanding for the three and six months ended June 30, 2014 and 2013 was as follows:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

(Unaudited, in millions) | 2014 | 2013 | 2014 | 2013 | |||||||||

Share options | 1.8 | 1.5 | 1.8 | 1.5 | |||||||||

RSUs and DSUs | 1.0 | 0.8 | 1.0 | 0.8 | |||||||||

These share options and RSUs and DSUs were excluded from the calculation of diluted net loss per share as the impact would have been antidilutive for all periods presented.

Note 6. Inventories, Net

Inventories, net as of June 30, 2014 and December 31, 2013 were comprised of the following:

(Unaudited, in millions) | June 30, 2014 | December 31, 2013 | ||||||

Raw materials and work in process | $ | 130 | $ | 153 | ||||

Finished goods | 260 | 195 | ||||||

Mill stores and other supplies | 189 | 181 | ||||||

$ | 579 | $ | 529 | |||||

During the three months ended June 30, 2014, we recorded charges of $3 million for write-downs of mill stores and other supplies as a result of the permanent closure of our previously idled paper machine in Catawba. During the six months ended June 30, 2014, we also recorded charges for write-downs of mill stores and other supplies of $1 million primarily related to the permanent closure of a paper machine in Iroquois Falls. During the three months ended June 30, 2013, we recorded charges of $1 million for write-downs of mill stores and other supplies as a result of the indefinite idling of a paper machine in Fort Frances. During the six months ended June 30, 2013, we also recorded charges for write-downs of mill stores and other supplies of $4 million as a result of the indefinite idling of a paper machine in Calhoun. These charges were included in “Cost of sales, excluding depreciation, amortization and distribution costs” in our Consolidated Statements of Operations.

10

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 7. Long-Term Debt

Overview

Long-term debt, including current portion, as of June 30, 2014 and December 31, 2013 was comprised of the following:

(Unaudited, in millions) | June 30, 2014 | December 31, 2013 | ||||||

5.875% senior notes due 2023: | ||||||||

Principal amount | $ | 600 | $ | 600 | ||||

Unamortized discount | (5 | ) | (5 | ) | ||||

Total senior notes due 2023 | 595 | 595 | ||||||

Other debt: | ||||||||

PSIF – Investissement Québec loan | 1 | 1 | ||||||

Capital lease obligation | 2 | 3 | ||||||

Total other debt | 3 | 4 | ||||||

Total debt | 598 | 599 | ||||||

Less: Current portion of long-term debt | (1 | ) | (2 | ) | ||||

Long-term debt, net of current portion | $ | 597 | $ | 597 | ||||

5.875% senior notes due 2023

We issued $600 million in aggregate principal amount of 5.875% senior notes (the “2023 Notes”) on May 8, 2013. Interest is payable semi-annually on May 15 and November 15 of each year, until their maturity date of May 15, 2023. The fair value of the 2023 Notes was $596 million and $554 million as of June 30, 2014 and December 31, 2013, respectively, and was determined by reference to over-the-counter prices (Level 1).

On May 8, 2013, we used the proceeds of the sale of the 2023 Notes to purchase $496 million aggregate principal amount of the 10.25% senior secured notes due 2018 (the “2018 Notes”), or 99% of the outstanding amount, which was then fully redeemed on October 8, 2013. Aggregate consideration for the purchase was $584 million, including accrued and unpaid interest of $4 million. Accordingly, we recorded a loss on extinguishment of debt of $59 million (net of $25 million write-down of unamortized premium) in “Other Income (Expense), Net” in our Consolidated Statements of Operations for the three and six months ended June 30, 2013.

On May 27, 2014, in accordance with the registration rights agreement of May 8, 2013, we completed an exchange offer whereby we: (i) exchanged the 2023 Notes for registered notes (which we refer to as the “exchange notes”), with substantially the same terms as the 2023 Notes; and (ii) exchanged the guarantees related to the 2023 Notes for registered guarantees relating to the exchange notes, with substantially the same terms as the original guarantees.

11

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

ABL Credit Facility

Our senior secured asset-based revolving credit facility (the “ABL Credit Facility”), as amended, matures October 28, 2016 and provides an aggregate lender commitment of up to $665 million at any time outstanding, subject to borrowing base limitations. As of June 30, 2014, we had no borrowings and $38 million of letters of credit outstanding under the ABL Credit Facility. As of June 30, 2014, we had $567 million of availability under the ABL Credit Facility, which was comprised of $329 million for the “U.S. Borrowers” (Resolute Forest Products Inc., Resolute FP US Inc. and AbiBow Recycling LLC) and $238 million for the Canadian borrower (Resolute FP Canada Inc.).

The ABL Credit Facility was amended as of February 25, 2014, to, among other things:

• | release the liens securing the ABL Credit Facility on that portion of the assets of the U.S. Borrowers and certain of our material U.S. subsidiaries that had secured the 2018 Notes on a first priority basis, primarily consisting of real property, equipment, intellectual property and the equity of our subsidiaries, with the ability to re-implement those liens with a second lien priority should we issue new secured debt that is to be secured by a second lien on our accounts receivable and inventory and other assets that continue to secure the ABL Credit Facility; |

• | reduce the excess availability thresholds that trigger a minimum consolidated fixed charge coverage ratio to the greater of: (i) $50 million and (ii) 10% of the lesser of (A) the total commitments and (B) the borrowing base then in effect; |

• | increase the uncommitted incremental loan facility to $200 million; |

• | increase our borrowing capacity by expanding our ability to create liens if the debt incurrence test is met and by increasing minimum baskets for unsecured and secured debt to $500 million each, subject to certain conditions; and |

• | increase the borrowing base by including 90% of eligible international accounts receivable and 100% of cash deposits, limited to $100 million and subject to certain conditions. |

PSIF – Investissement Québec

On February 23, 2007, Investissement Québec granted Fibrek Inc. (“Fibrek”) a Cdn$6 million interest-free loan through the Soutien à l’industrie forestière program (“PSIF”), payable in monthly installments over a maximum of four years, starting December 31, 2010. As of June 30, 2014, the fair value of the loan approximated its carrying value of $1 million. The fair value was determined by discounting the cash flows using a current interest rate (4.4%) for financial instruments with similar characteristics and maturities (Level 3).

Capital lease obligation

We have a capital lease obligation for a warehouse, which can be renewed for 20 years at our option. Minimum payments are determined by an escalatory price clause.

12

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 8. Employee Benefit Plans

Pension and OPEB plans

The components of net periodic benefit cost relating to our pension and OPEB plans for the three and six months ended June 30, 2014 and 2013 were as follows:

Pension Plans:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

(Unaudited, in millions) | 2014 | 2013 | 2014 | 2013 | |||||||||||||

Service cost | $ | 7 | $ | 8 | $ | 14 | $ | 16 | |||||||||

Interest cost | 69 | 70 | 138 | 140 | |||||||||||||

Expected return on plan assets | (76 | ) | (77 | ) | (151 | ) | (155 | ) | |||||||||

Amortization of actuarial losses | 2 | 6 | 3 | 12 | |||||||||||||

Amortization of prior service credits | (1 | ) | — | (1 | ) | (1 | ) | ||||||||||

Net periodic benefit cost before special events | 1 | 7 | 3 | 12 | |||||||||||||

Settlement | — | — | — | (1 | ) | ||||||||||||

$ | 1 | $ | 7 | $ | 3 | $ | 11 | ||||||||||

OPEB Plans:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

(Unaudited, in millions) | 2014 | 2013 | 2014 | 2013 | |||||||||||||

Service cost | $ | — | $ | 1 | $ | 1 | $ | 2 | |||||||||

Interest cost | 3 | 4 | 6 | 8 | |||||||||||||

Amortization of actuarial gains | (1 | ) | — | (2 | ) | — | |||||||||||

Amortization of prior service credits | (2 | ) | — | (4 | ) | — | |||||||||||

$ | — | $ | 5 | $ | 1 | $ | 10 | ||||||||||

Defined contribution plans

The expense for our defined contribution plans totaled $5 million for both the three months ended June 30, 2014 and 2013, and $11 million for both the six months ended June 30, 2014 and 2013.

Canadian pension funding

The provinces of Québec and Ontario adopted, as of April 9, 2014 and April 15, 2014, respectively, the funding relief regulations contemplated in Note 14, “Pension and Other Postretirement Benefit Plans - Canadian pension funding,” to our consolidated financial statements for the year ended December 31, 2013 to implement the revised framework parameters concerning the funding of the aggregate solvency deficits in our material Canadian registered pension plans, which we refer to as the “affected plans”.

The principal amendments to the funding relief regulations include, among other things:

• | an increase in the annual basic contribution in respect of the solvency deficits in the affected plans from Cdn$50 million to Cdn$80 million for each year from 2013 through 2020; and |

• | the elimination of the conditional additional contribution feature based on a measure of free cash flow (as determined in accordance with the regulations), which would have applied as of 2013 below a certain solvency threshold. |

As originally adopted, the funding relief regulations provided that corrective measures would be required if the aggregate solvency ratio in the affected plans fell below a prescribed level under the targets specified by the regulations as of December 31 in any year through 2014. This requirement was definitively removed with the amendments to the regulations. But according

13

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

to the Ontario regulations, the corresponding 2011 and 2012 amounts in respect of Ontario plans (approximately $100 million) have been deferred to after the expiration of the funding relief regulations in 2020, and will then be payable over 5 years in equal monthly installments starting on December 31, 2021, but only up to the elimination of the then remaining deficit, if any.

In connection with the establishment of the original regulations, our principal Canadian operating subsidiary had undertaken to make an additional solvency deficit reduction contribution of Cdn$75 to its affected plans, payable over four years, for each metric ton of capacity reduced in Québec or Ontario, in the event of downtime of more than six consecutive months or nine cumulative months over a period of 18 months. As part of the amendments to the funding relief regulations, it was determined that no additional contribution would be made in respect of any capacity reduction in Québec before April 13, 2013. The application of this undertaking in respect of capacity reductions in Ontario has yet to be settled.

Note 9. Income Taxes

The income tax (provision) benefit attributable to income (loss) before income taxes differs from the amounts computed by applying the United States federal statutory income tax rate of 35% for the three and six months ended June 30, 2014 and 2013 as a result of the following:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

(Unaudited, in millions) | 2014 | 2013 | 2014 | 2013 | |||||||||||||

Income (loss) before income taxes | $ | 1 | $ | (75 | ) | $ | (57 | ) | $ | (120 | ) | ||||||

Income tax (provision) benefit: | |||||||||||||||||

Expected income tax benefit | — | 26 | 20 | 42 | |||||||||||||

Changes resulting from: | |||||||||||||||||

Valuation allowance (1) | (12 | ) | (1 | ) | (20 | ) | 33 | ||||||||||

Foreign exchange | 4 | — | (2 | ) | (1 | ) | |||||||||||

State income taxes and foreign tax rate differences | 9 | 7 | 11 | 4 | |||||||||||||

Other, net | (2 | ) | (1 | ) | (2 | ) | (7 | ) | |||||||||

$ | (1 | ) | $ | 31 | $ | 7 | $ | 71 | |||||||||

(1) | During the three and six months ended June 30, 2014, we increased our valuation allowance by $12 million and $20 million, respectively, primarily related to our U.S operations, where we do not recognize deferred income tax assets. During the six months ended June 30, 2013, we reversed $33 million of valuation allowance, primarily related to available U.S. capital losses that will be utilized as a result of the 2013 acquisition of the noncontrolling interest in CNC. |

14

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 10. Commitments and Contingencies

Legal matters

We become involved in various legal proceedings and other disputes in the normal course of business, including matters related to contracts, commercial disputes, taxes, environmental issues, employment and workers’ compensation claims, Aboriginal claims and other matters. Although the final outcome is subject to many variables and cannot be predicted with any degree of certainty, we regularly assess the status of the matters and establish provisions (including legal costs expected to be incurred) when we believe an adverse outcome is probable, and the amount can be reasonably estimated. We believe that the ultimate disposition of these matters outstanding or pending as of June 30, 2014, will not have a material adverse effect on our consolidated financial statements.

Effective July 31, 2012, we completed the second step transaction pursuant to which we acquired the remaining 25.4% of the outstanding Fibrek shares, following the approval of Fibrek’s shareholders on July 23, 2012, and the issuance of a final order of the Québec Superior Court in Canada approving the arrangement on July 27, 2012. Certain former shareholders of Fibrek exercised (or purported to exercise) rights of dissent in respect of the transaction, asking for a judicial determination of the fair value of their claim under the Canada Business Corporations Act. No consideration has to date been paid to the former Fibrek shareholders who exercised (or purported to exercise) rights of dissent. Any such consideration will only be paid out upon settlement or judicial determination of the fair value of their claims and will be paid entirely in cash. Accordingly, we cannot presently determine the amount that ultimately will be paid to former holders of Fibrek shares in connection with the proceedings, but we have accrued approximately Cdn$14 million ($13 million, based on the exchange rate in effect on June 30, 2014) for the eventual payment of those claims.

On June 12, 2012, we filed a motion for directives with the Québec Superior Court, the court with the jurisdiction in the creditor protection proceedings from which our predecessor entity and all but one of its affiliates emerged in 2010, seeking an order to prevent pension regulators in each of Québec, New Brunswick, and Newfoundland and Labrador from declaring partial wind-ups of pension plans relating to employees of former operations in New Brunswick and Newfoundland and Labrador, or a declaration that any claim for accelerated reimbursements of deficits arising from a partial wind-up is a barred claim under the creditor protection proceedings. These plans are subject to the funding relief regulations described in Note 14, “Pension and Other Postretirement Benefit Plans - Canadian pension funding,” to our consolidated financial statements for the year ended December 31, 2013 and we contend, among other things, that any such declaration, if issued, would be inconsistent with the court’s sanction order confirming the plan of reorganization and the terms of our emergence from the creditor protection proceedings. A partial wind-up would likely shorten the period in which any deficit within those plans, which could reach up to Cdn$150 million ($141 million based on the exchange rate in effect on June 30, 2014), would have to be funded if we do not obtain the relief sought. No hearing date has been set to date.

Environmental matters

We are subject to a variety of federal, state, provincial and local environmental laws and regulations in the jurisdictions in which we operate. We believe our operations are in material compliance with current applicable environmental laws and regulations. Environmental regulations promulgated in the future could require substantial additional expenditures for compliance and could have a material impact on us, in particular, and the industry in general. We may be a “potentially responsible party” with respect to four hazardous waste sites that are being addressed pursuant to the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“Superfund”) or the Resource Conservation and Recovery Act (“RCRA”) corrective action authority. We believe we will not be liable for any significant amounts at any of these sites.

We have recorded $9 million of environmental liabilities as of both June 30, 2014 and December 31, 2013, which represents management’s estimate based on an assessment of relevant factors and assumptions of the ultimate settlement amounts for environmental liabilities. The amount of these liabilities could be affected by changes in facts or assumptions not currently known to management. These liabilities are included in “Accounts payable and accrued liabilities” or “Other long-term liabilities” in our Consolidated Balance Sheets.

Other representations, warranties and indemnifications

In the normal course of our business, we make representations and warranties, and offer indemnities to counterparties in connection with commercial transactions such as asset sales and other commercial agreements. Indemnification obligations generally are related to contingencies that are not expected to occur at the time of the agreement. We cannot predict with any degree of certainty the potential maximum exposure in respect of these indemnification obligations, but we believe that it is unlikely that we will be required to make material payments thereunder. Accordingly, we have recognized no material liabilities in this respect in our consolidated financial statements.

15

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 11. Segment Information

We manage our business based on the products we manufacture. Accordingly, our reportable segments correspond to our primary product lines: newsprint, specialty papers, market pulp and wood products.

None of the income or loss items following “Operating (loss) income” in our Consolidated Statements of Operations are allocated to our segments, since those items are reviewed separately by management. For the same reason, closure costs, impairment and other related charges, inventory write-downs related to closures, start-up costs, net gain on disposition of assets, transaction costs, as well as other discretionary charges or credits are not allocated to our segments. We allocate depreciation and amortization expense to our segments, although the related fixed assets and amortizable intangible assets are not allocated to segment assets. Additionally, all selling, general and administrative expenses, excluding severance costs and certain discretionary charges and credits, are allocated to our segments.

Information about certain segment data for the three and six months ended June 30, 2014 and 2013 was as follows:

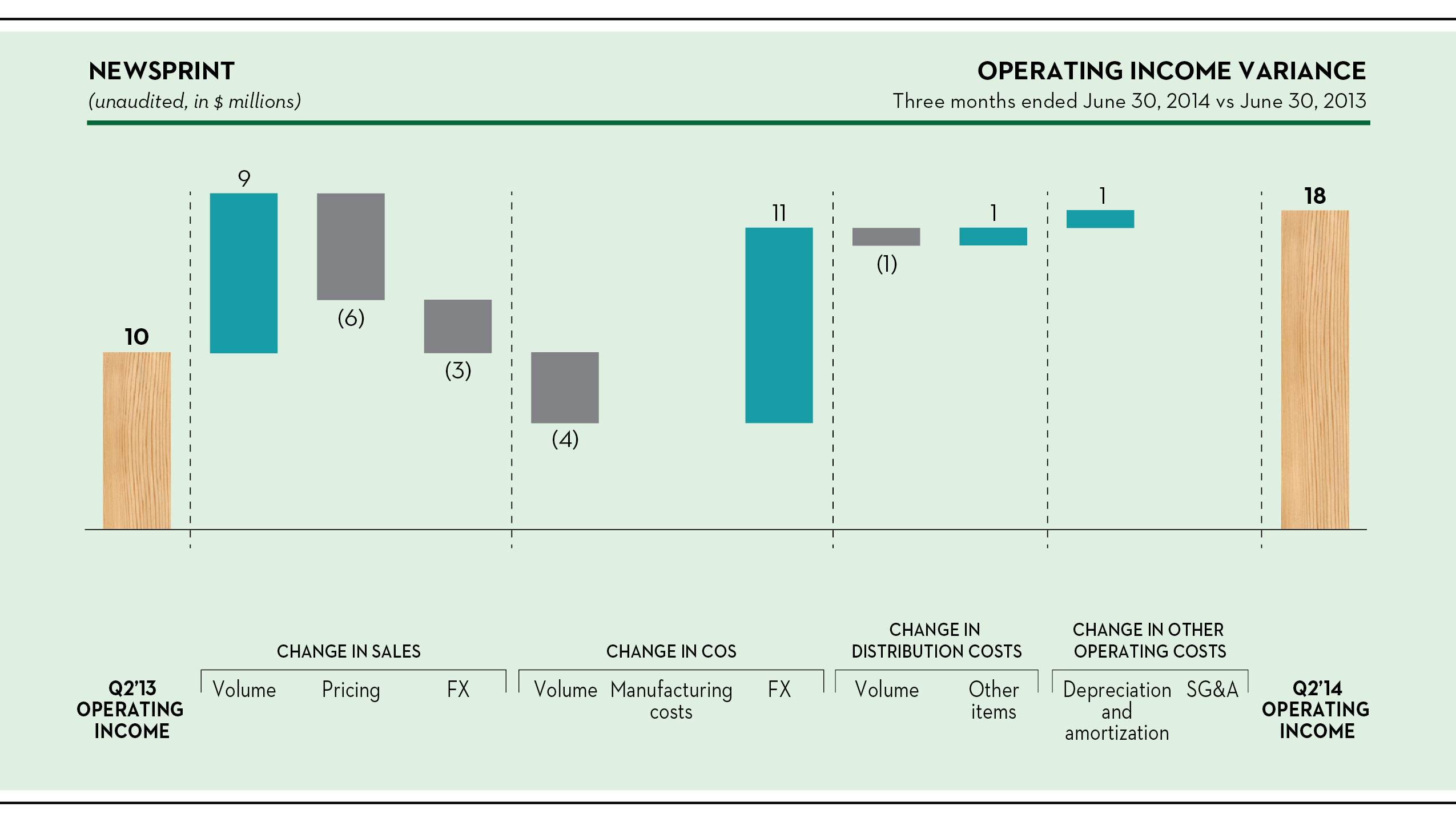

(Unaudited, in millions) | Newsprint | Specialty Papers | Market Pulp (1) | Wood Products | Corporate and Other | Consolidated Total | ||||||||||||||||||

Sales | ||||||||||||||||||||||||

Second quarter 2014 | $ | 364 | $ | 325 | $ | 241 | $ | 161 | $ | — | $ | 1,091 | ||||||||||||

Second quarter 2013 | 364 | 338 | 263 | 142 | — | 1,107 | ||||||||||||||||||

First six months 2014 | 710 | 626 | 475 | 296 | — | 2,107 | ||||||||||||||||||

First six months 2013 | 720 | 678 | 503 | 280 | — | 2,181 | ||||||||||||||||||

Depreciation and amortization | ||||||||||||||||||||||||

Second quarter 2014 | $ | 17 | $ | 22 | $ | 13 | $ | 8 | $ | 2 | $ | 62 | ||||||||||||

Second quarter 2013 | 18 | 19 | 13 | 9 | 2 | 61 | ||||||||||||||||||

First six months 2014 | 35 | 44 | 26 | 16 | 3 | 124 | ||||||||||||||||||

First six months 2013 | 36 | 38 | 26 | 18 | 3 | 121 | ||||||||||||||||||

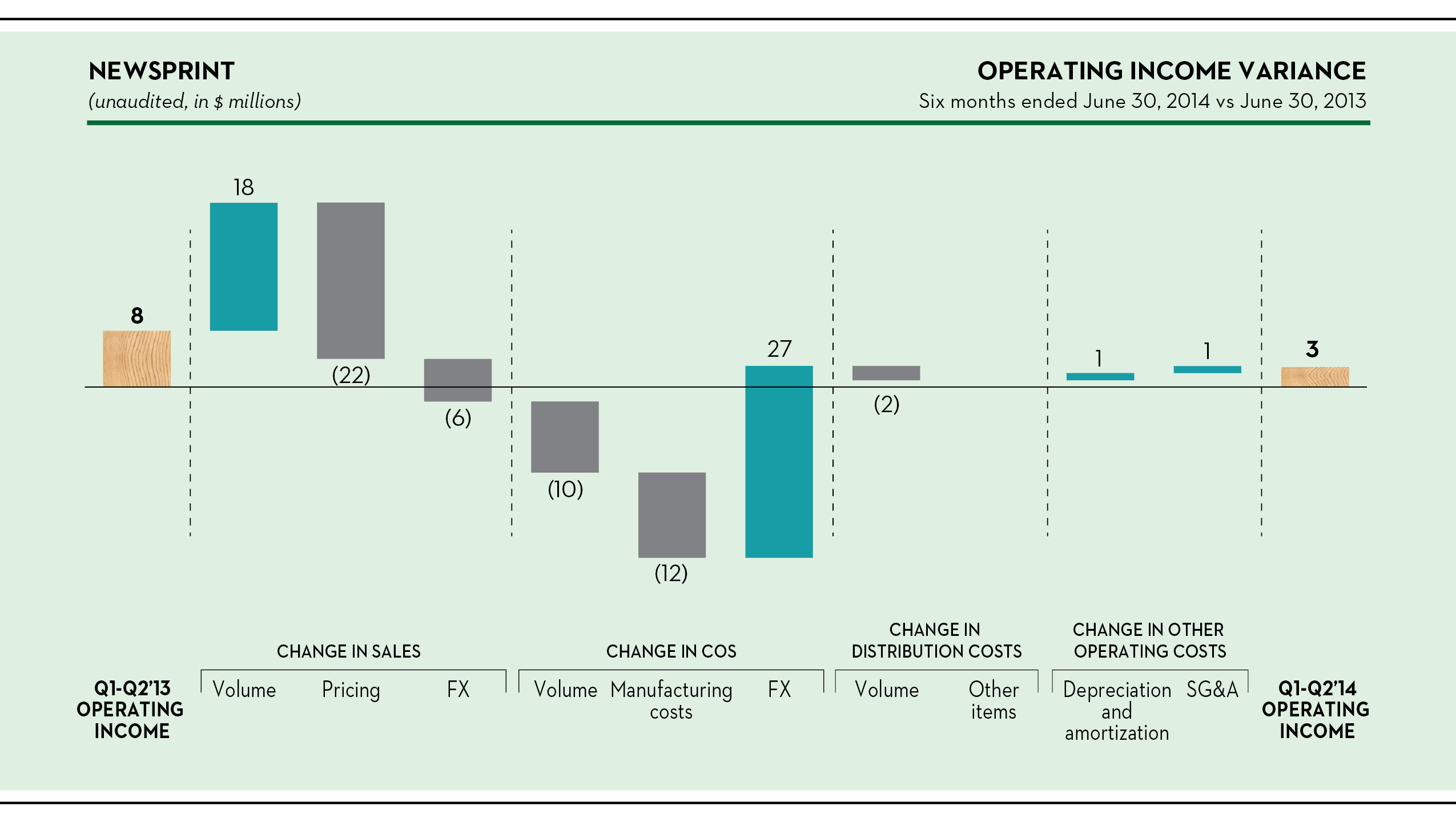

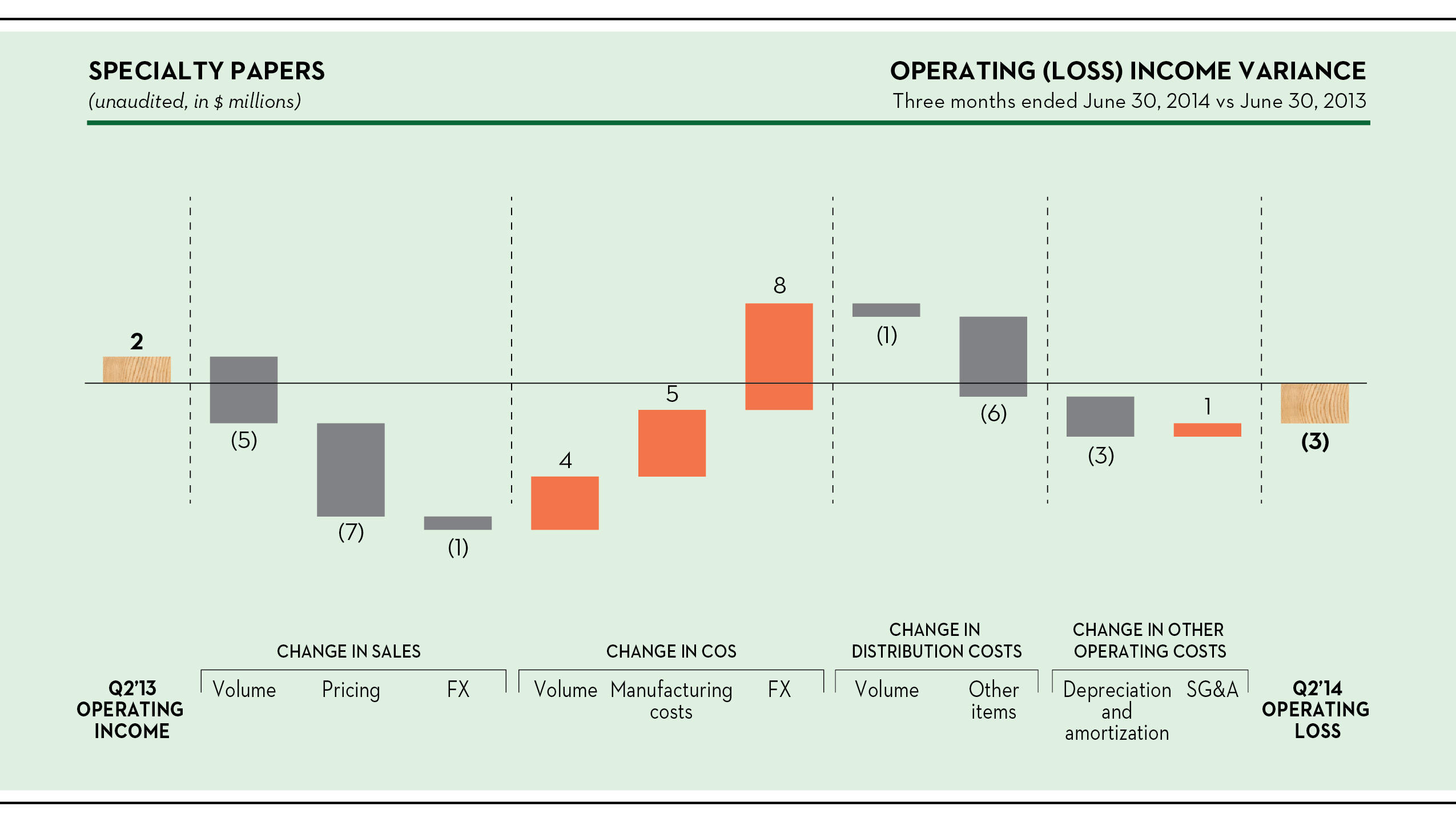

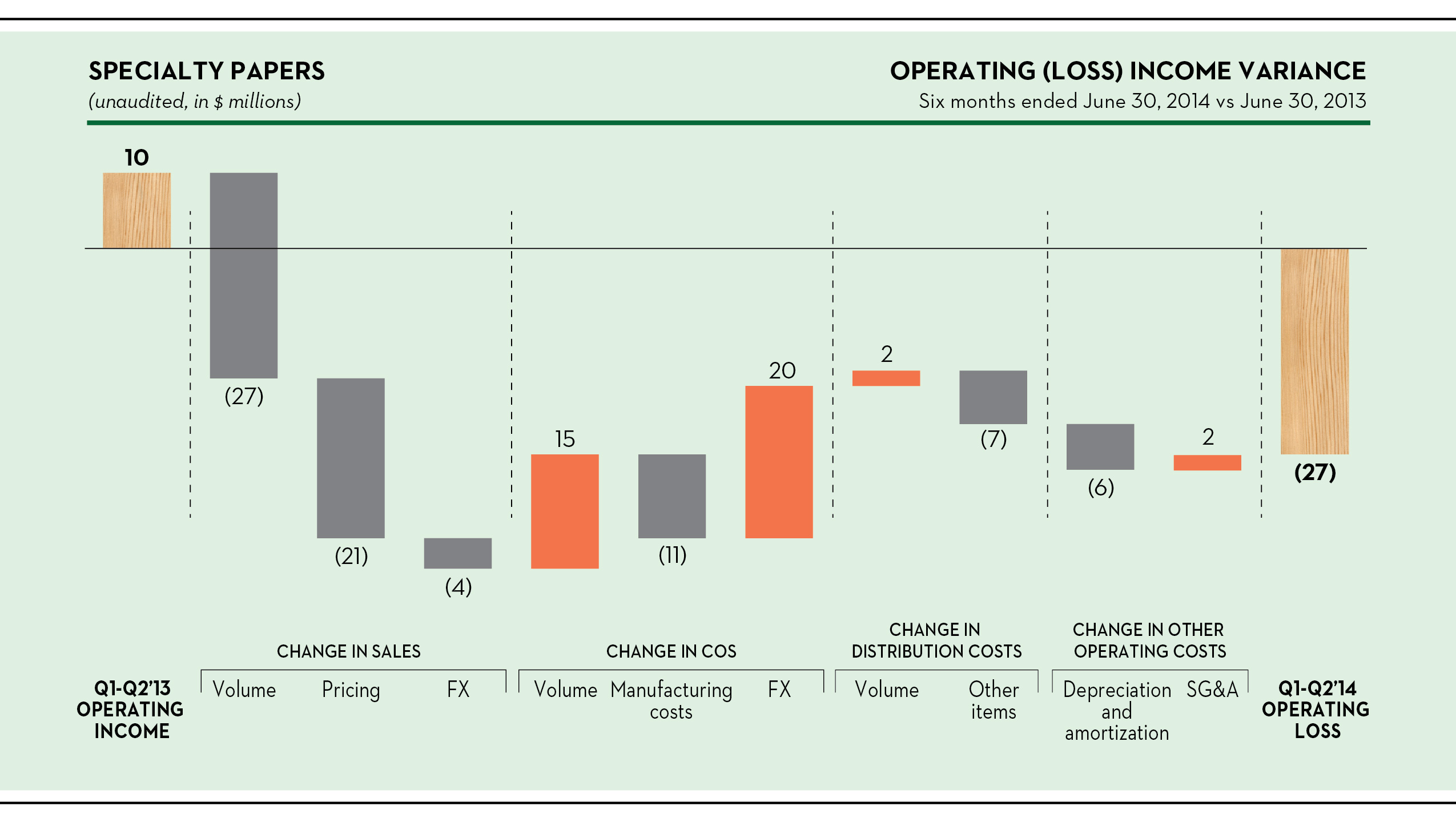

Operating income (loss) (2) | ||||||||||||||||||||||||

Second quarter 2014 | $ | 18 | $ | (3 | ) | $ | 24 | $ | 15 | $ | (62 | ) | $ | (8 | ) | |||||||||

Second quarter 2013 | 10 | 2 | 10 | 16 | (35 | ) | 3 | |||||||||||||||||

First six months 2014 | 3 | (27 | ) | 32 | 27 | (76 | ) | (41 | ) | |||||||||||||||

First six months 2013 | 8 | 10 | 5 | 32 | (101 | ) | (46 | ) | ||||||||||||||||

(1) | Market pulp sales excluded inter-segment sales of $7 million and $3 million for the three months ended June 30, 2014 and 2013, respectively, and $10 million and $8 million for the six months ended June 30, 2014 and 2013, respectively. |

(2) | Corporate and other operating loss for the three and six months ended June 30, 2014 and 2013 included the following significant items: |

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

(Unaudited, in millions) | 2014 | 2013 | 2014 | 2013 | |||||||||||||

Net gain on disposition of assets | $ | 2 | $ | 2 | $ | 2 | $ | 2 | |||||||||

Closure costs, impairment and other related charges | (52 | ) | (12 | ) | (62 | ) | (52 | ) | |||||||||

Inventory write-downs related to closures | (3 | ) | (1 | ) | (4 | ) | (5 | ) | |||||||||

Transaction costs | — | (2 | ) | — | (5 | ) | |||||||||||

Start-up costs | (1 | ) | (13 | ) | (1 | ) | (28 | ) | |||||||||

$ | (54 | ) | $ | (26 | ) | $ | (65 | ) | $ | (88 | ) | ||||||

16

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 12. Condensed Consolidating Financial Information

The following information is presented in accordance with Rule 3-10 of Regulation S-X and the public information requirements of Rule 144 promulgated pursuant to the Securities Act of 1933 in connection with Resolute Forest Products Inc.’s 2023 Notes that are fully and unconditionally guaranteed, on a joint and several basis, by all of our 100% owned material U.S. subsidiaries (the “Guarantor Subsidiaries”). The 2023 Notes are not guaranteed by our foreign subsidiaries and our less than 100% owned U.S. subsidiaries (the “Non-guarantor Subsidiaries”).

The following condensed consolidating financial information sets forth the Statements of Operations and Comprehensive Income (Loss) for the three and six months ended June 30, 2014 and 2013, the Balance Sheets as of June 30, 2014 and December 31, 2013 and the Statements of Cash Flows for the six months ended June 30, 2014 and 2013 for the Parent, the Guarantor Subsidiaries on a combined basis, and the Non-guarantor Subsidiaries on a combined basis. The condensed consolidating financial information reflects the investments of the Parent in the Guarantor Subsidiaries and Non-guarantor Subsidiaries, as well as the investments of the Guarantor Subsidiaries in the Non-guarantor Subsidiaries, using the equity method of accounting. The principal consolidating adjustments are elimination entries to eliminate the investments in subsidiaries and intercompany balances and transactions.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) | ||||||||||||||||||||

For the Three Months Ended June 30, 2014 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 892 | $ | 732 | $ | (533 | ) | $ | 1,091 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 830 | 507 | (525 | ) | 812 | ||||||||||||||

Depreciation and amortization | — | 23 | 39 | — | 62 | |||||||||||||||

Distribution costs | — | 42 | 93 | (1 | ) | 134 | ||||||||||||||

Selling, general and administrative expenses | 4 | 13 | 24 | — | 41 | |||||||||||||||

Closure costs, impairment and other related charges | — | 48 | 4 | — | 52 | |||||||||||||||

Net gain on disposition of assets | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Operating (loss) income | (4 | ) | (64 | ) | 67 | (7 | ) | (8 | ) | |||||||||||

Interest expense | (18 | ) | (1 | ) | (1 | ) | 9 | (11 | ) | |||||||||||

Other income, net | 1 | 8 | 20 | (9 | ) | 20 | ||||||||||||||

Parent’s equity in income of subsidiaries | 19 | — | — | (19 | ) | — | ||||||||||||||

(Loss) income before income taxes | (2 | ) | (57 | ) | 86 | (26 | ) | 1 | ||||||||||||

Income tax benefit (provision) | — | 15 | (18 | ) | 2 | (1 | ) | |||||||||||||

Net (loss) income including noncontrolling interests | (2 | ) | (42 | ) | 68 | (24 | ) | — | ||||||||||||

Net income attributable to noncontrolling interests | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Net (loss) income attributable to Resolute Forest Products Inc. | $ | (2 | ) | $ | (42 | ) | $ | 66 | $ | (24 | ) | $ | (2 | ) | ||||||

Comprehensive income (loss) attributable to Resolute Forest Products Inc. | $ | 25 | $ | (16 | ) | $ | 67 | $ | (51 | ) | $ | 25 | ||||||||

17

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME | ||||||||||||||||||||

For the Six Months Ended June 30, 2014 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 1,737 | $ | 1,433 | $ | (1,063 | ) | $ | 2,107 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 1,650 | 1,039 | (1,056 | ) | 1,633 | ||||||||||||||

Depreciation and amortization | — | 48 | 76 | — | 124 | |||||||||||||||

Distribution costs | — | 79 | 177 | (2 | ) | 254 | ||||||||||||||

Selling, general and administrative expenses | 8 | 22 | 47 | — | 77 | |||||||||||||||

Closure costs, impairment and other related charges | — | 50 | 12 | — | 62 | |||||||||||||||

Net gain on disposition of assets | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Operating (loss) income | (8 | ) | (112 | ) | 84 | (5 | ) | (41 | ) | |||||||||||

Interest expense | (35 | ) | (2 | ) | (4 | ) | 18 | (23 | ) | |||||||||||

Other income, net | — | 19 | 6 | (18 | ) | 7 | ||||||||||||||

Parent’s equity in loss of subsidiaries | (9 | ) | — | — | 9 | — | ||||||||||||||

(Loss) income before income taxes | (52 | ) | (95 | ) | 86 | 4 | (57 | ) | ||||||||||||

Income tax benefit (provision) | — | 30 | (24 | ) | 1 | 7 | ||||||||||||||

Net (loss) income including noncontrolling interests | (52 | ) | (65 | ) | 62 | 5 | (50 | ) | ||||||||||||

Net income attributable to noncontrolling interests | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Net (loss) income attributable to Resolute Forest Products Inc. | $ | (52 | ) | $ | (65 | ) | $ | 60 | $ | 5 | $ | (52 | ) | |||||||

Comprehensive (loss) income attributable to Resolute Forest Products Inc. | $ | (1 | ) | $ | (15 | ) | $ | 61 | $ | (46 | ) | $ | (1 | ) | ||||||

18

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME | ||||||||||||||||||||

For the Three Months Ended June 30, 2013 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 935 | $ | 732 | $ | (560 | ) | $ | 1,107 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 859 | 558 | (558 | ) | 859 | ||||||||||||||

Depreciation and amortization | — | 25 | 36 | — | 61 | |||||||||||||||

Distribution costs | — | 42 | 89 | (1 | ) | 130 | ||||||||||||||

Selling, general and administrative expenses | 5 | 15 | 24 | — | 44 | |||||||||||||||

Closure costs, impairment and other related charges | — | 12 | — | — | 12 | |||||||||||||||

Net gain on disposition of assets | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Operating (loss) income | (5 | ) | (18 | ) | 27 | (1 | ) | 3 | ||||||||||||

Interest expense | (23 | ) | (1 | ) | (2 | ) | 13 | (13 | ) | |||||||||||

Other (expense) income, net | (59 | ) | 11 | (4 | ) | (13 | ) | (65 | ) | |||||||||||

Parent’s equity in income of subsidiaries | 11 | — | — | (11 | ) | — | ||||||||||||||

(Loss) income before income taxes | (76 | ) | (8 | ) | 21 | (12 | ) | (75 | ) | |||||||||||

Income tax benefit (provision) | 33 | 5 | (7 | ) | — | 31 | ||||||||||||||

Net (loss) income including noncontrolling interests | (43 | ) | (3 | ) | 14 | (12 | ) | (44 | ) | |||||||||||

Net loss attributable to noncontrolling interests | — | — | 1 | — | 1 | |||||||||||||||

Net (loss) income attributable to Resolute Forest Products Inc. | $ | (43 | ) | $ | (3 | ) | $ | 15 | $ | (12 | ) | $ | (43 | ) | ||||||

Comprehensive (loss) income attributable to Resolute Forest Products Inc. | $ | (39 | ) | $ | 14 | $ | 2 | $ | (16 | ) | $ | (39 | ) | |||||||

19

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME | ||||||||||||||||||||

For the Six Months Ended June 30, 2013 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 1,782 | $ | 1,420 | $ | (1,021 | ) | $ | 2,181 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 1,633 | 1,094 | (1,012 | ) | 1,715 | ||||||||||||||

Depreciation and amortization | — | 50 | 71 | — | 121 | |||||||||||||||

Distribution costs | — | 85 | 171 | (3 | ) | 253 | ||||||||||||||

Selling, general and administrative expenses | 10 | 27 | 51 | — | 88 | |||||||||||||||

Closure costs, impairment and other related charges | — | 49 | 3 | — | 52 | |||||||||||||||

Net gain on disposition of assets | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Operating (loss) income | (10 | ) | (62 | ) | 32 | (6 | ) | (46 | ) | |||||||||||

Interest expense | (55 | ) | (1 | ) | (4 | ) | 33 | (27 | ) | |||||||||||

Other (expense) income, net | (59 | ) | 45 | — | (33 | ) | (47 | ) | ||||||||||||

Parent’s equity in income of subsidiaries | 32 | — | — | (32 | ) | — | ||||||||||||||

(Loss) income before income taxes | (92 | ) | (18 | ) | 28 | (38 | ) | (120 | ) | |||||||||||

Income tax benefit (provision) | 44 | 40 | (14 | ) | 1 | 71 | ||||||||||||||

Net (loss) income including noncontrolling interests | (48 | ) | 22 | 14 | (37 | ) | (49 | ) | ||||||||||||

Net loss attributable to noncontrolling interests | — | — | 1 | — | 1 | |||||||||||||||

Net (loss) income attributable to Resolute Forest Products Inc. | $ | (48 | ) | $ | 22 | $ | 15 | $ | (37 | ) | $ | (48 | ) | |||||||

Comprehensive (loss) income attributable to Resolute Forest Products Inc. | $ | (43 | ) | $ | 40 | $ | 2 | $ | (42 | ) | $ | (43 | ) | |||||||

20

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING BALANCE SHEET | ||||||||||||||||||||

As of June 30, 2014 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Assets | ||||||||||||||||||||

Current assets: | ||||||||||||||||||||

Cash and cash equivalents | $ | — | $ | 55 | $ | 208 | $ | — | $ | 263 | ||||||||||

Accounts receivable, net | — | 437 | 173 | — | 610 | |||||||||||||||

Accounts receivable from affiliates | — | 367 | 161 | (528 | ) | — | ||||||||||||||

Inventories, net | — | 259 | 332 | (12 | ) | 579 | ||||||||||||||

Deferred income tax assets | — | — | 32 | — | 32 | |||||||||||||||

Note and interest receivable from parent | — | 282 | — | (282 | ) | — | ||||||||||||||

Notes receivable from affiliates | — | 354 | — | (354 | ) | — | ||||||||||||||

Note receivable from subsidiary | 8 | — | — | (8 | ) | — | ||||||||||||||

Other current assets | — | 32 | 30 | — | 62 | |||||||||||||||

Total current assets | 8 | 1,786 | 936 | (1,184 | ) | 1,546 | ||||||||||||||

Fixed assets, net | — | 777 | 1,407 | — | 2,184 | |||||||||||||||

Amortizable intangible assets, net | — | — | 64 | — | 64 | |||||||||||||||

Deferred income tax assets | — | 28 | 1,206 | 3 | 1,237 | |||||||||||||||

Note receivable from parent | — | 376 | — | (376 | ) | — | ||||||||||||||

Notes receivable from affiliates | — | 170 | — | (170 | ) | — | ||||||||||||||

Investments in consolidated subsidiaries and affiliates | 4,776 | 1,999 | — | (6,775 | ) | — | ||||||||||||||

Other assets | 8 | 114 | 94 | — | 216 | |||||||||||||||

Total assets | $ | 4,792 | $ | 5,250 | $ | 3,707 | $ | (8,502 | ) | $ | 5,247 | |||||||||

Liabilities and equity | ||||||||||||||||||||

Current liabilities: | ||||||||||||||||||||

Accounts payable and accrued liabilities | $ | 5 | $ | 204 | $ | 347 | $ | — | $ | 556 | ||||||||||

Current portion of long-term debt | — | — | 1 | — | 1 | |||||||||||||||

Accounts payable to affiliates | 370 | 158 | — | (528 | ) | — | ||||||||||||||

Deferred income tax liabilities | — | 32 | — | — | 32 | |||||||||||||||

Note and interest payable to subsidiary | 282 | — | — | (282 | ) | — | ||||||||||||||

Notes payable to affiliates | — | — | 354 | (354 | ) | — | ||||||||||||||

Note payable to parent | — | — | 8 | (8 | ) | — | ||||||||||||||

Total current liabilities | 657 | 394 | 710 | (1,172 | ) | 589 | ||||||||||||||

Long-term debt, net of current portion | 595 | 2 | — | — | 597 | |||||||||||||||

Long-term debt due to subsidiary | 376 | — | — | (376 | ) | — | ||||||||||||||

Long-term debt due to affiliate | — | — | 170 | (170 | ) | — | ||||||||||||||

Pension and other postretirement benefit obligations | — | 244 | 902 | — | 1,146 | |||||||||||||||

Deferred income tax liabilities | — | 1 | 24 | — | 25 | |||||||||||||||

Other long-term liabilities | 1 | 26 | 21 | — | 48 | |||||||||||||||

Total liabilities | 1,629 | 667 | 1,827 | (1,718 | ) | 2,405 | ||||||||||||||

Total equity | 3,163 | 4,583 | 1,880 | (6,784 | ) | 2,842 | ||||||||||||||

Total liabilities and equity | $ | 4,792 | $ | 5,250 | $ | 3,707 | $ | (8,502 | ) | $ | 5,247 | |||||||||

21

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING BALANCE SHEET | ||||||||||||||||||||

As of December 31, 2013 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Assets | ||||||||||||||||||||

Current assets: | ||||||||||||||||||||

Cash and cash equivalents | $ | — | $ | 165 | $ | 157 | $ | — | $ | 322 | ||||||||||

Accounts receivable, net | — | 433 | 201 | — | 634 | |||||||||||||||

Accounts receivable from affiliates | — | 335 | 135 | (470 | ) | — | ||||||||||||||

Inventories, net | — | 211 | 326 | (8 | ) | 529 | ||||||||||||||

Deferred income tax assets | — | — | 32 | — | 32 | |||||||||||||||

Interest receivable from parent | — | 14 | — | (14 | ) | — | ||||||||||||||

Note receivable from affiliate | — | 350 | — | (350 | ) | — | ||||||||||||||

Note receivable from subsidiary | 13 | — | — | (13 | ) | — | ||||||||||||||

Other current assets | — | 18 | 27 | — | 45 | |||||||||||||||

Total current assets | 13 | 1,526 | 878 | (855 | ) | 1,562 | ||||||||||||||

Fixed assets, net | — | 847 | 1,442 | — | 2,289 | |||||||||||||||

Amortizable intangible assets, net | — | — | 66 | — | 66 | |||||||||||||||

Deferred income tax assets | — | 28 | 1,236 | 2 | 1,266 | |||||||||||||||

Notes receivable from parent | — | 627 | — | (627 | ) | — | ||||||||||||||

Notes receivable from affiliates | — | 170 | — | (170 | ) | — | ||||||||||||||

Investments in consolidated subsidiaries and affiliates | 4,734 | 2,085 | — | (6,819 | ) | — | ||||||||||||||

Other assets | 8 | 112 | 82 | — | 202 | |||||||||||||||

Total assets | $ | 4,755 | $ | 5,395 | $ | 3,704 | $ | (8,469 | ) | $ | 5,385 | |||||||||

Liabilities and equity | ||||||||||||||||||||

Current liabilities: | ||||||||||||||||||||

Accounts payable and accrued liabilities | $ | 5 | $ | 190 | $ | 338 | $ | — | $ | 533 | ||||||||||

Current portion of long-term debt | — | 1 | 1 | — | 2 | |||||||||||||||

Accounts payable to affiliates | 352 | 118 | — | (470 | ) | — | ||||||||||||||

Deferred income tax liabilities | — | 32 | — | — | 32 | |||||||||||||||

Interest payable to subsidiaries | 14 | — | — | (14 | ) | — | ||||||||||||||

Note payable to affiliate | — | — | 350 | (350 | ) | — | ||||||||||||||

Note payable to parent | — | — | 13 | (13 | ) | — | ||||||||||||||

Total current liabilities | 371 | 341 | 702 | (847 | ) | 567 | ||||||||||||||

Long-term debt, net of current portion | 595 | 2 | — | — | 597 | |||||||||||||||

Long-term debt due to subsidiaries | 627 | — | — | (627 | ) | — | ||||||||||||||

Long-term debt due to affiliate | — | — | 170 | (170 | ) | — | ||||||||||||||

Pension and other postretirement benefit obligations | — | 340 | 954 | — | 1,294 | |||||||||||||||

Deferred income tax liabilities | — | 1 | 25 | — | 26 | |||||||||||||||

Other long-term liabilities | — | 26 | 36 | — | 62 | |||||||||||||||

Total liabilities | 1,593 | 710 | 1,887 | (1,644 | ) | 2,546 | ||||||||||||||

Total equity | 3,162 | 4,685 | 1,817 | (6,825 | ) | 2,839 | ||||||||||||||

Total liabilities and equity | $ | 4,755 | $ | 5,395 | $ | 3,704 | $ | (8,469 | ) | $ | 5,385 | |||||||||

22

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS | ||||||||||||||||||||

For the Six Months Ended June 30, 2014 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Net cash (used in) provided by operating activities | $ | — | $ | (70 | ) | $ | 92 | $ | — | $ | 22 | |||||||||

Cash flows from investing activities: | ||||||||||||||||||||

Cash invested in fixed assets | — | (38 | ) | (44 | ) | — | (82 | ) | ||||||||||||

Disposition of assets | — | — | 2 | — | 2 | |||||||||||||||

Decrease in restricted cash | — | — | 1 | — | 1 | |||||||||||||||

Increase in deposit requirements for letters of credit, net | — | — | (1 | ) | — | (1 | ) | |||||||||||||

Net cash used in investing activities | — | (38 | ) | (42 | ) | — | (80 | ) | ||||||||||||

Cash flows from financing activities: | ||||||||||||||||||||

Payments of debt | — | (1 | ) | — | — | (1 | ) | |||||||||||||

Payments of financing and credit facility fees | — | (1 | ) | — | — | (1 | ) | |||||||||||||

Net cash used in financing activities | — | (2 | ) | — | — | (2 | ) | |||||||||||||

Effect of exchange rate changes on cash and cash equivalents | — | — | 1 | — | 1 | |||||||||||||||

Net (decrease) increase in cash and cash equivalents | — | (110 | ) | 51 | — | (59 | ) | |||||||||||||

Cash and cash equivalents: | ||||||||||||||||||||

Beginning of period | — | 165 | 157 | — | 322 | |||||||||||||||

End of period | $ | — | $ | 55 | $ | 208 | $ | — | $ | 263 | ||||||||||

23

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS | ||||||||||||||||||||

For the Six Months Ended June 30, 2013 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Net cash (used in) provided by operating activities | $ | — | $ | (7 | ) | $ | 55 | $ | — | $ | 48 | |||||||||

Cash flows from investing activities: | ||||||||||||||||||||

Cash invested in fixed assets | — | (29 | ) | (57 | ) | — | (86 | ) | ||||||||||||

Disposition of assets | — | — | 3 | — | 3 | |||||||||||||||

Proceeds from insurance settlements | — | — | 4 | — | 4 | |||||||||||||||

Decrease in restricted cash | — | — | 3 | — | 3 | |||||||||||||||

Decrease in deposit requirements for letters of credit, net | — | — | 1 | — | 1 | |||||||||||||||

Advances (to) from affiliates | (10 | ) | 10 | — | — | — | ||||||||||||||

Net cash used in investing activities | (10 | ) | (19 | ) | (46 | ) | — | (75 | ) | |||||||||||

Cash flows from financing activities: | ||||||||||||||||||||

Issuance of long-term debt | 594 | — | — | — | 594 | |||||||||||||||

Premium paid on extinguishment of debt | (84 | ) | — | — | — | (84 | ) | |||||||||||||

Payments of debt | (496 | ) | — | (1 | ) | — | (497 | ) | ||||||||||||

Payments of financing and credit facility fees | (9 | ) | — | — | — | (9 | ) | |||||||||||||

Contribution of capital from noncontrolling interest | — | 8 | — | — | 8 | |||||||||||||||

Net cash provided by (used in) financing activities | 5 | 8 | (1 | ) | — | 12 | ||||||||||||||

Net (decrease) increase in cash and cash equivalents | (5 | ) | (18 | ) | 8 | — | (15 | ) | ||||||||||||

Cash and cash equivalents: | ||||||||||||||||||||

Beginning of period | 5 | 171 | 87 | — | 263 | |||||||||||||||

End of period | $ | — | $ | 153 | $ | 95 | $ | — | $ | 248 | ||||||||||

24

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following management’s discussion and analysis is intended to help the reader understand Resolute Forest Products, our results of operations, cash flows and financial condition. The discussion is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the accompanying notes contained in Item 1 – Financial Statements.

When we refer to “Resolute Forest Products,” “we,” “our,” “us” or the “Company,” we mean Resolute Forest Products Inc. with its subsidiaries and affiliates, either individually or collectively, unless otherwise indicated.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION AND USE OF THIRD-PARTY DATA

Statements in this quarterly report on Form 10-Q that are not reported financial results or other historical information of Resolute Forest Products are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. They include, for example, statements relating to our: efforts to continue to reduce costs and increase revenues and profitability, including our cost-reduction initiatives; business and operating outlook; assessment of market conditions; prospects, growth strategies and the industry in which we operate; and strategies for achieving our goals generally. Forward-looking statements may be identified by the use of forward-looking terminology such as the words “should,” “would,” “could,” “will,” “may,” “expect,” “believe,” “anticipate,” “attempt,” “project” and other terms with similar meaning indicating possible future events or potential impact on our business or Resolute Forest Products’ shareholders.

The reader is cautioned not to place undue reliance on these forward-looking statements, which are not guarantees of future performance. These statements are based on management’s current assumptions, beliefs and expectations, all of which involve a number of business risks and uncertainties that could cause actual results to differ materially. The potential risks and uncertainties that could cause our actual future financial condition, results of operations and performance to differ materially from those expressed or implied in this quarterly report on Form 10-Q include, but are not limited to, the potential risks and uncertainties set forth under Part I, Item 1A, “Risk Factors,” of our annual report of Form 10-K for the year ended December 31, 2013, filed with the U.S. Securities and Exchange Commission, or the “SEC”, on March 3, 2014 (the “2013 annual report”).

All forward-looking statements in this quarterly report on Form 10-Q are expressly qualified by the cautionary statements contained or referred to in this section and in our other filings with the SEC and the Canadian securities regulatory authorities. We disclaim any obligation to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

Market and industry data

The information on industry and general economic conditions in this quarterly report on Form 10-Q was derived from third-party sources and trade publications we believe to be widely accepted and accurate. We have not independently verified the information and cannot assure you of its accuracy.

OVERVIEW

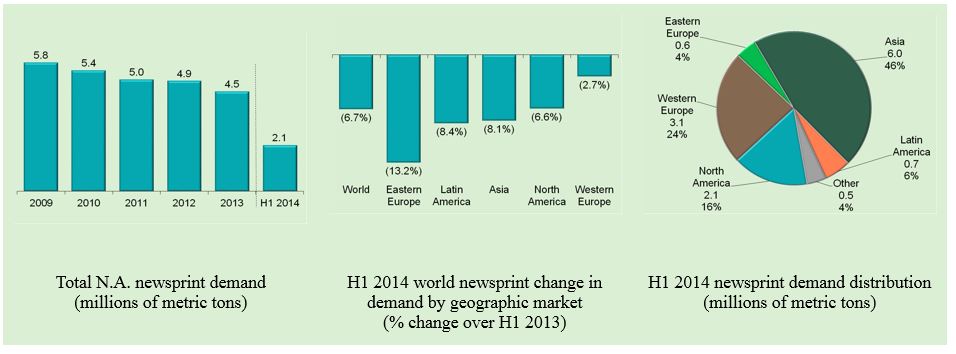

Resolute Forest Products is a global leader in the forest products industry, with a diverse range of products, including newsprint, specialty papers, market pulp and wood products, which are marketed in close to 90 countries. We own or operate nearly 40 pulp and paper mills and wood products facilities in the U.S., Canada and South Korea, and power generation assets in Canada. By capacity, we are the number one producer of newsprint in the world, the largest producer of uncoated mechanical papers in North America and the largest Canadian producer of wood products east of the Rockies. We are also a significant North American producer of coated mechanical papers and market pulp.

We report our activities in four business segments: newsprint, specialty papers, market pulp and wood products.

We are guided by our vision and values, focusing on safety, profitability, accountability, sustainability and teamwork. These are the elements that we believe best define us:

• | Competitive cost structure - as a result of aggressive cost reductions and mill rationalizations, today we compete as a leading, lower-cost North American producer. Maintaining this competitive advantage is our key focus. By challenging ourselves to optimize assets - maximizing the utilization of our most cost-effective mills and streamlining production to adapt to changing market dynamics - we seek to remain an industry cost leader and to maximize shareholder value and earnings power. |

25

• | Synergistic and diversified asset base - our harvesting rights and extensive network of Canadian sawmills not only make us a significant lumber producer in eastern North America, but also give us the fiber management advantage of integration from the harvested log through the finished pulp or paper product at more than half of our facilities. In the U.S., we source primarily from the lower-cost southeastern fiber basket. The diversified and complimentary nature of our asset base also provides earnings from multiple products. |

• | Financial strength - we make disciplined capital management a priority; we believe in maintaining a flexible and conservative capital structure. |

Our Business

For information relating to our business, including our products, strategy, sustainable performance and development, and power generation assets, refer to our 2013 annual report.

Second Quarter Overview

Three months ended June 30, 2014 vs. June 30, 2013

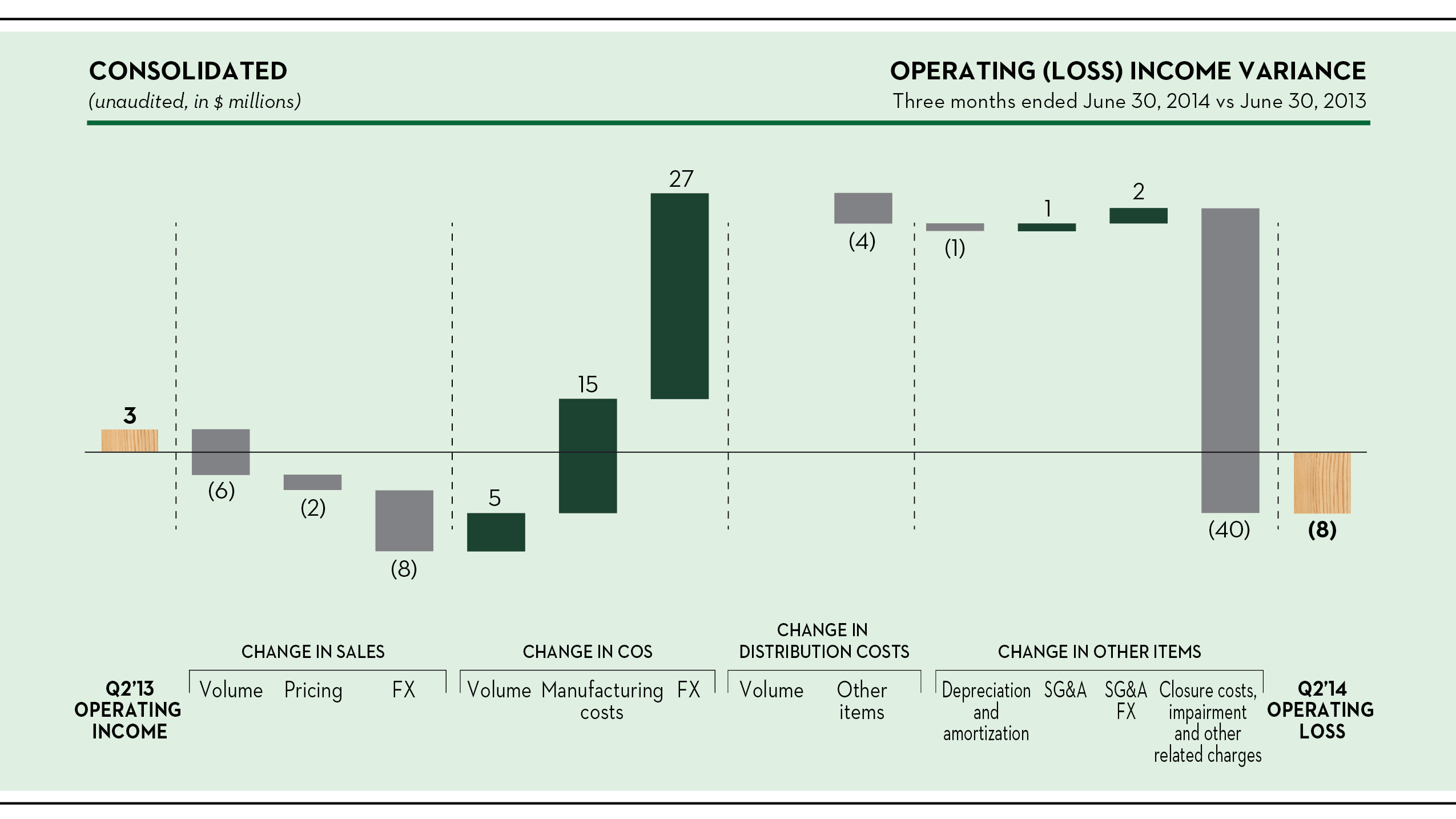

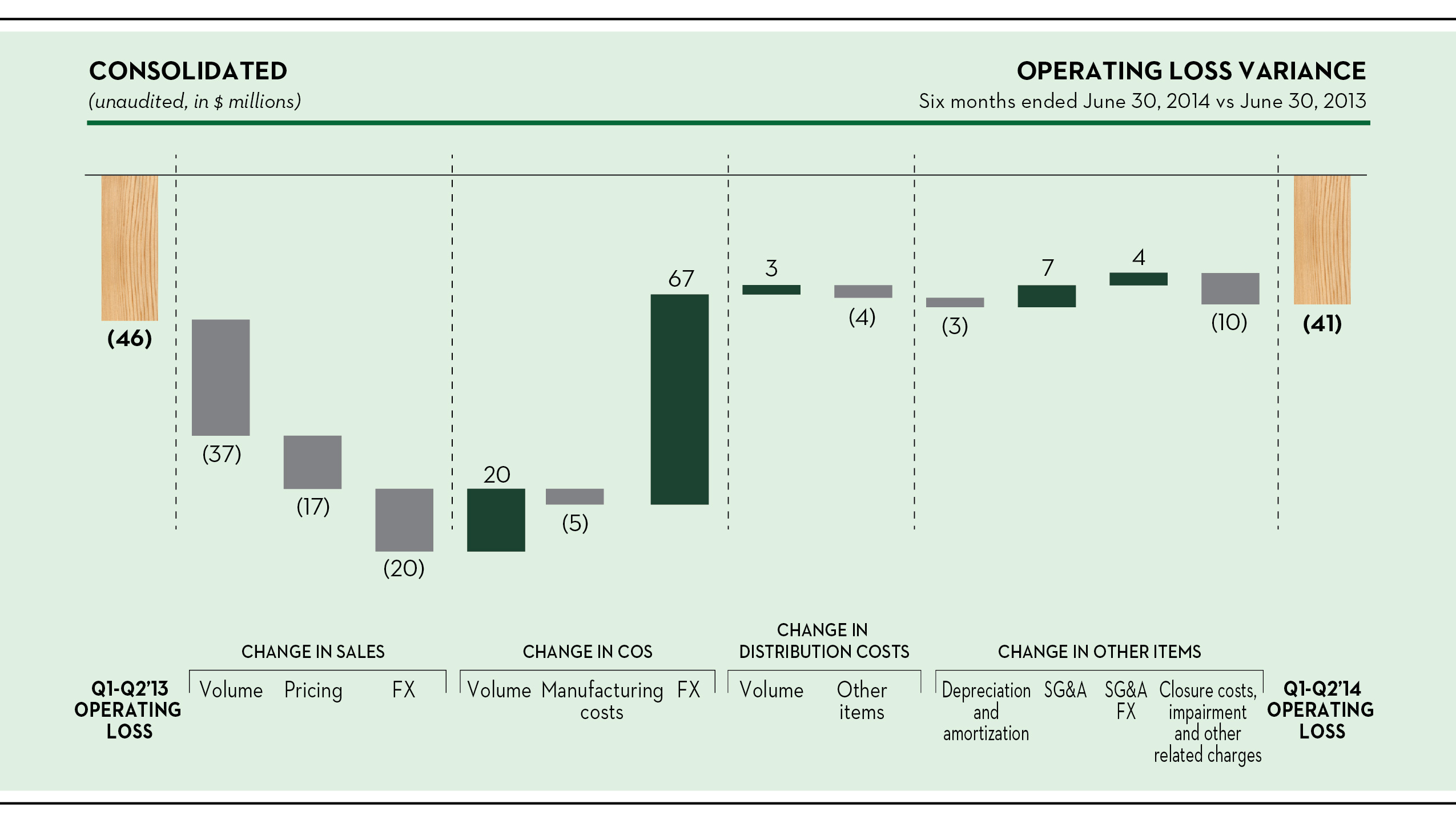

Excluding special items, we generated operating income of $46 million, compared to $29 million in the year-ago period. Unadjusted for special items, the operating loss was $8 million in the second quarter, compared to operating income of $3 million in the year-ago period. The special items are described below.

Our net income in the quarter, excluding special items, was $19 million, or $0.20 per share, up from net income, excluding special items, of $18 million, or $0.19 per share, in the second quarter of 2013. Unadjusted for special items, our net loss in the quarter was $2 million, compared to $43 million in the year-ago period. Sales were $1.1 billion in the quarter, down $16 million from the second quarter of 2013.

Three Months Ended June 30, 2014 | Operating Income (Loss) | Net Income (Loss) | EPS | |||||||||

(unaudited, in millions, except per share amounts) | ||||||||||||

GAAP, as reported | $ | (8 | ) | $ | (2 | ) | $ | (0.02 | ) | |||

Adjustments for special items (1): | ||||||||||||

Foreign exchange translation gain | — | (17 | ) | (0.18 | ) | |||||||

Closure costs, impairment and other related charges | 52 | 52 | 0.55 | |||||||||

Inventory write-downs related to closures | 3 | 3 | 0.03 | |||||||||

Start-up costs | 1 | 1 | 0.01 | |||||||||

Net gain on disposition of assets | (2 | ) | (2 | ) | (0.02 | ) | ||||||

Other income, net | — | (3 | ) | (0.03 | ) | |||||||

Income tax effect of special items | — | (13 | ) | (0.14 | ) | |||||||

GAAP, as adjusted for special items | $ | 46 | $ | 19 | $ | 0.20 | ||||||

26

Three Months Ended June 30, 2013 | Operating Income (Loss) | Net Income (Loss) | EPS | |||||||||

(unaudited, in millions, except per share amounts) | ||||||||||||

GAAP, as reported | $ | 3 | $ | (43 | ) | $ | (0.45 | ) | ||||

Adjustments for special items (1): | ||||||||||||

Foreign exchange translation loss | — | 7 | 0.07 | |||||||||

Closure costs, impairment and other related charges | 12 | 12 | 0.13 | |||||||||

Inventory write-downs related to closures | 1 | 1 | 0.01 | |||||||||

Start-up costs | 13 | 13 | 0.14 | |||||||||

Net gain on disposition of assets | (2 | ) | (2 | ) | (0.02 | ) | ||||||

Net loss on extinguishment of debt | — | 59 | 0.62 | |||||||||

Transaction costs | 2 | 2 | 0.02 | |||||||||

Other income, net | — | (1 | ) | (0.01 | ) | |||||||

Income tax effect of special items | — | (30 | ) | (0.32 | ) | |||||||

GAAP, as adjusted for special items | $ | 29 | $ | 18 | $ | 0.19 | ||||||