Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESTERN CAPITAL RESOURCES, INC. | s107867_8k.htm |

Exhibit 99.1

WCR ANDSUBSIDIARIES

DISCLOSURE 2 Some of the statements made in this report are “forward-looking statements,” as that term is defined under Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based upon our current expectations and projections about future events. Whenever used in this report, the words “believe,” “anticipate,” “intend,” “estimate,” “expect” and similar expressions, or the negative of such words and expressions, are intended to identify forward-looking statements, although not all forward-looking statements contain such words or expressions. These forward-looking statements generally relate to our plans, objectives and expectations for future operations and are based upon management’s current estimates and projections of future results or trends. Although we believe that our plans and objectives reflected in or suggested by these forward- looking statements are reasonable, we may not achieve these plans or objectives. You should read this presentation completely and with the understanding that actual future results may be materially different from what we expect. We will not update forward-looking statements even though our situation may change in the future.

A. COMPANY OVERVIEW (WESTERNCAPITALRESOURCES, INC.) 3 ▪ Acquired a controlling interest in 2010 in Western Capital Resources, Inc. (“WCR”), a publicly held company by purchasing the preferred stock and part of the common stock for $5.4 MM - Small, orphan public company operating in a heavily regulated industry - Senior debt at the Company was maturing with limited refinancing options ▪ Reverse Stock split on 1-20 basis reduced outstanding common shares from 60 MM to 3 MM ▪ Preferred Stock converted to common stock in December 2012 ▪ On October 1, 2014 completed merger with AlphaGraphics(subsequently sold AlphaGraphicsto an affiliate of MBE Worldwide on October 3, 2017 for $61.5 MM gross, pre-tax) ▪ On July 1,2015, completed merger of J&P Park Acquisition, Inc. (“JPPA”) and J&P Real Estate, LLC (“JPRE”): JPPA and JPRE are fully owned subsidiaries of WCR - Fund received 2,289,859 shares of stock of WCRS for JPPA and 596,275 shares of stock of WCRS for JPRE ▪ On July 1, 2015, completed merger of Restorer’s Acquisition, Inc. (“RAI”): RAI is a fully owned subsidiary of WCR ▪ Established $12 million credit facility with Fifth Third Bank to fund acquisitions ▪ Reincorporated in state of Delaware ▪ Declared and paid six consecutive quarterly $0.025 dividends beginning in June 2016 ▪ Plan is to: - Continue to strategically grow existing subsidiaries - Diversify earnings with very selective acquisitions

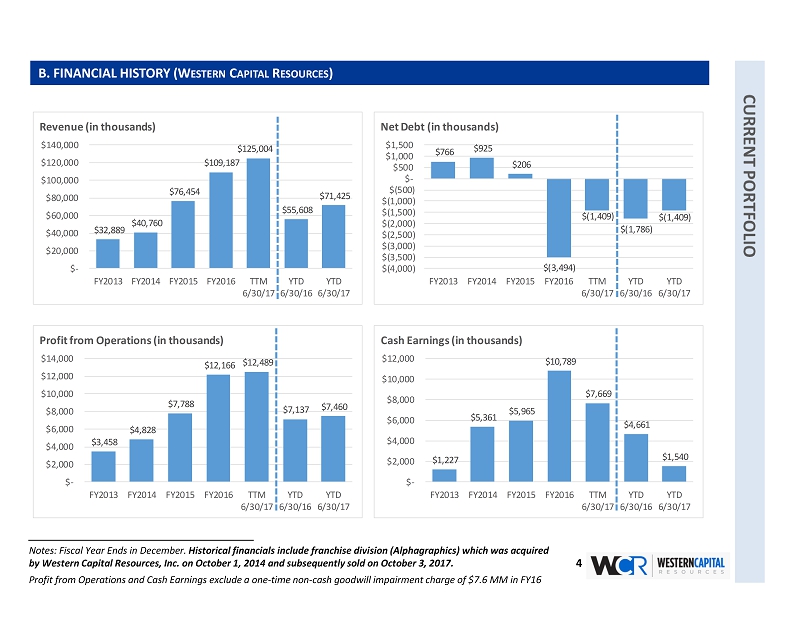

B. FINANCIAL HISTORY (WESTERNCAPITALRESOURCES) 4 Notes: Fiscal Year Ends in December. Historical financials include franchise division (Alphagraphics) which was acquired by Western Capital Resources, Inc. on October 1, 2014 and subsequently sold on October 3, 2017. Profit from Operations and Cash Earnings exclude a one-time non-cash goodwill impairment charge of $7.6 MM in FY16 $32,889 $40,760 $76,454 $109,187 $125,004 $55,608 $71,425 $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 FY2013 FY2014 FY2015 FY2016 TTM 6/30/17 YTD 6/30/16 YTD 6/30/17 Revenue (in thousands) $3,458 $4,828 $7,788 $12,166 $12,489 $7,137 $7,460 $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 FY2013 FY2014 FY2015 FY2016 TTM 6/30/17 YTD 6/30/16 YTD 6/30/17 Profit from Operations (in thousands) $1,227 $5,361 $5,965 $10,789 $7,669 $4,661 $1,540 $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 FY2013 FY2014 FY2015 FY2016 TTM 6/30/17 YTD 6/30/16 YTD 6/30/17 Cash Earnings (in thousands) $766 $925 $206 $(3,494) $(1,409) $(1,786) $(1,409) $(4,000) $(3,500) $(3,000) $(2,500) $(2,000) $(1,500) $(1,000) $(500) $- $500 $1,000 $1,500 FY2013 FY2014 FY2015 FY2016 TTM 6/30/17 YTD 6/30/16 YTD 6/30/17 Net Debt (in thousands)

B. FINANCIAL HISTORY (WESTERNCAPITALRESOURCES) 5 Notes: Fiscal Year Ends in December. Historical financials include franchise division (Alphagraphics) which was acquired by Western Capital Resources, Inc. on October 1, 2014 and subsequently sold on October 3, 2017. Net Income Per share and Cash Earnings Per Share exclude the after-tax impact of a non-cash goodwill impairment charge of $4.7 MM in FY2016 $0.54 $0.64 $0.45 $0.64 $0.66 $0.40 $0.42 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 FY2013 FY2014 FY2015 FY2016 TTM 6/30/17 YTD 6/30/16 YTD 6/30/17 Net Income Per Share $0.41 $1.42 $0.77 $1.14 $0.81 $0.49 $0.16 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 FY2013 FY2014 FY2015 FY2016 TTM 6/30/17 YTD 6/30/16 YTD 6/30/17 Cash Earnings Per Share

A. COMPANY OVERVIEW (PQH WIRELESS, INC.; WYOMINGFINANCIALLENDERS, INC; & EXPRESSPAWN, INC.) 6 ▪ Provider of retail financial services and retail cellular phones to consumers through a network of 307 locations throughout the United States ? Retail Financial Services Division primarily in Midwestern U.S. • 40 payday and installment lending locations and three pawn stores in seven states • Offers non-recourse cash advance loans, installment loans, check cashing and other money services, as well as money transfers and money orders ? Retail Cellular Phone Division operates as a dealer for Cricket Wireless, Inc. • 267 locations in 26 states throughout the United States • Sells cellular phones and accessories and accepts service payments from Cricket customers Retail Cellular Pawn Payday Lending

B. 2017 UPDATE(PQH WIRELESS, INC.; WYOMINGFINANCIALLENDERS, INC; & EXPRESSPAWN, INC.) 7 ▪ Consumer Finance Division - Experienced revenue decline due to closure of six locations - South Dakota voters eliminated payday lending in state effective November 2016 - Pawn revenues and profitability remained flat year-over-year - Consumer Financial Protection Bureau released final rules on payday advance companies in October 2017; projected effective date of new rules is June 2019 - Plan is to: • Prepare for industry consolidation • Collaborate with state associations to introduce installment legislation as alternative product to payday loans ▪ Cricket Division - Acquired 53 Cricket Wireless retail locations in TX, OK, AR, KS - Opened 110 new Cricket locations across the United States - Plan is to: • Improve operational efficiencies with enhanced internally developed management software • Close or sell underperforming stores

C. RESULTS (PQH WIRELESS, INC.; WYOMINGFINANCIALLENDERS, INC; & EXPRESSPAWN, INC.) 8 ▪ Purchased majority interest in the business in April 2010 ▪ Purchase price of $5.4 MM including fees and expenses ? BCP II investment of $3.0 MM ? Bridged the remaining $2.4 MM through Fund’s EagleBankline of credit –now $0 balance ▪ Gross realized cash multiple of 0.4x 31 ? No carried interest paid on this investment to-date; see footnote for additional detail Estimated Shares Remaining Shares Owned Indirectly in WCR of WCRS Value (a) BCP II J&P, LLC (a) 2,876,804 17,548,504$ BCP 2 WCR, LLC (a) 2,306,022 14,066,734$ Total Shares Owned Indirectly in WCR by BCP II (54.8%) 5,182,826 31,615,239$ Total Shares of WCR Outstanding (Including Options) 9,455,997 Stock price of WCR as of 10/20/17 6.10$ (a) Represents the Fund's interest (pre-carried interest)

A. COMPANY OVERVIEW (BCPII J&P, LLC) 9 ▪ Catalog and internet retailer/wholesaler of branded roses, plants, seeds and other horticultural- related products based in Greenwood, SC with three brands: – Jackson & Perkins—Founded 1872; sells premium bare-root roses, live trees and perennials with a strong Q4 gift business – Wayside Gardens—Founded 1920; direct-mail nursery company that distributes exclusive varieties from well-known growers – Park Seed—Founded 1868; direct mail seed business with wholesale and retail divisions Accomplishments ▪ Flattened the org chart (headcount reduction of 33) which achieved $1.2 MM in overhead savings ▪ Exited in-house rose breeding and transitioned to a business focused on marketing and distribution; preserved the Jackson & Perkins research crop for new introductions; saved mother block of roses ▪ Migrated three unstable web platforms to a single web platform and three unstable ERP and accounting systems into one ▪ Improved purchasing and merchandising functions to reduce end of season write-offs and carryover ▪ Partial migration from catalog to online retail by refocusing catalog paper spend to online advertising spend ▪ Gay Burke serving as Chairperson since 2013 (paid by J&P Park Acquisitions, Inc.) ▪ Bill Powers added as Vice Chairperson in January 2017 (paid by J&P Park Acquisitions, Inc.) ▪ On July 1, 2015, became a wholly-owned subsidiary of WCR

B. 2017 UPDATE(BCPII J&P, LLC) 10 ▪ Gains in J&P and Wayside offset by a decline in lower margin Wholesale division ▪ Reduced cancellations and labor while improving fulfillment and inventory (with new technology) ▪ Upgraded phone system and internet to fiber; will save approximately $35k annually ▪ Renovated call center includes expanded training room, relocation of team management to improve customer response, professional environment to focus on customer and reduce turnover Technology ▪ Improved SEO to drive more organic acquisition traffic ▪ Upgraded ERP and web platform to enhance customer experience and deploy advanced features Marketing ▪ Deployed New J&P App in October 2017; provides gardening information in a customer-friendly application based shopping experience; features plant care tips, social sharing, and mobile Commerce ▪ Launched select assortment of gifts, seed and live plant categories on Amazon Marketplace ▪ Developed strategic partnerships with Vogue Magazine, Dr. Jane Goodall, American Heart Association and the US Airforce to introduce exclusive rose varieties in 2017-2018 ▪ Testing new formats and contact strategies to increase buyer conversion from direct mail campaigns ▪ Expanded the use of social influencers, online videos, and new social media ▪ Ramping up new product review platform to increase customer feedback and boost SEO rankings Upcoming Initiatives and Events ▪ Launching new landscape design service to drive sales of roses, perennials, annuals ▪ Migrate J&P holiday business into a year-round gifting business ▪ Add technology to support drop-ship transactions with vendors ▪ Planning to migrate rose growing operations from California to Arizona in 2018

C. RESULTS (BCPII J&P, LLC) 11 ▪ Acquired the business on August 25, 2010 ▪ Purchase price of $8.7 MM inclusive of fees and expenses ? BCP II investment of $6.0 MM ▪ Distributed $3.6 MM from company and $1.8 MM on real estate for a total of $5.4 MM ▪ Since July 1, 2015, JPPA and JPRE are now owned by a wholly-owned subsidiary of WCR ▪ Gross realized cash multiple of 1.3x for Operating Company and 0.6x for Real Estate Company 32 ? No carried interest paid on this investment to-date; see footnote for additional detail Estimated Shares Remaining Shares Owned Indirectly in WCR of WCRS Value (a) BCP II J&P, LLC (a) 2,876,804 17,548,504$ BCP 2 WCR, LLC (a) 2,306,022 14,066,734$ Total Shares Owned Indirectly in WCR by BCP II (54.8%) 5,182,826 31,615,239$ Total Shares of WCR Outstanding (Including Options) 9,455,997 Stock price of WCR as of 10/20/17 6.10$ (a) Represents the Fund's interest (pre-carried interest)

A. COMPANY OVERVIEW (WCRS RESTORERSACQUISITIONCO., LLC) 12 ▪ Catalog and internet retailer of reproduction vintage home restoration and renovation products ▪ Revenue generated through two channels: - Residential –85% - Contractor/Trade –15% ▪ Utilizes third party 3PL for call center, operations, and logistics ▪ Gay Burke serving as Chairperson and Bill Powers serving as President (both paid by Restorers) ▪ On July 1, 2015, RAI became a fully owned subsidiary of WCR

B. 2017 UPDATE(WCRS RESTORERSACQUISITIONCO., LLC) 13 Accomplishments ▪ Gross margin on plan at 53.0% YTD vs. 52.9% last year ▪ SG&A has been reduced to $2.35 million YTD vs. $2.65 million last year ▪ Reduced Inventory to $1.23 million YTD from $1.62 million last year ▪ Merchandising focus on Top 25 Core Vendors; partnering with each to fully utilize resources - Annual Product line review updated “core group” with the latest content, styles and finishes - Consolidated to single freight vendor UPS to reduce service transit time by 2 days at lower cost ▪ Developed and implemented a strategy to shift domestic stock SKU’s to drop ship status - Drop shipment activity has increased to 45% of overall sales allowing for enhanced product offering, reduced backorders and lower inventory levels ▪ Implemented Web platform optimization to improve customer experience and SEO performance - Implemented Responsive Design and updated site to latest software version - Eliminated separate and problematic mobile platform ▪ Expanding Social Media platforms including blog to partner with influencers ▪ Initiatives for 2017 and beyond - Grow through concentrated efforts within core market categories of hardware and wood - Implement customer segmentation with targeted marketing campaigns including newly designed contractor program - Launch Amazon Marketplace offering of Hardware and Decorative Wood during 4 th Quarter - Implement plan to migrate 3PL warehouse to new OMS/WMS software platform - Identify select competitors for bolt on acquisition

EXHIBITB: SUPPLEMENTALFINANCIALINFORMATION

DESCRIPTIONS 15 “NetDebt”isdefinedasFund-Leveldebtandthirdpartydebtincludingcapital leaseobligationslesscash. “ProfitfromOperations”isanon-GAAPmeasure.ProfitfromOperationsequals pre-tax income, plus depreciation and amortization expenses and excludes interestexpense(income),net. “CashEarnings”isanon-GAAPmeasure.CashEarningsequalspre-taxincome plusdepreciationandamortization,minuscapitalexpendituresandplus/minus changesinoperatingassetsandliabilities.Pleaseseeappendixforreconciliation toGAAPamountsforbothProfitfromOperationsandCashEarnings. “Gross”cashmultiplesorIRRsarebeforecarriedinterestandmanagementfees “Net”cashmultiplesorIRRSareaftercarriedinterestandmanagementfees

WESTERNCAPITALRESOURCES, INC. S U P P L E M E N T A L F I N A N C I A L I N F O R M A T I O N 16 (Dollars In Thousands) (Dollars) Western Capital Resources, Inc. FY2013 FY2014 FY2015 FY2016 TTM 6/30/17 YTD 6/30/16 YTD 6/30/17 Revenue 32,889$ 40,760$ 76,454$ 109,187$ 125,004$ 55,608$ 71,425$ Gross Profit 20,762$ 26,058$ 48,144$ 67,514$ 78,358$ 33,903$ 44,748$ Gross Profit Margin 63.1% 63.9% 63.0% 61.8% 62.7% 61.0% 62.6% EBITDA 1 3,458$ 4,828$ 7,788$ 12,166$ 12,489$ 7,137$ 7,460$ Profit from Operations 3,458$ 4,828$ 7,788$ 12,166$ 12,489$ 7,137$ 7,460$ Cash Earnings 2 1,227$ 5,361$ 5,965$ 10,789$ 7,669$ 4,661$ 1,540$ Net Income 2 1,620$ 2,406$ 3,520$ 6,138$ 6,389$ 3,756$ 4,006$ Net Income per Share 2 0.54$ 0.64$ 0.45$ 0.64$ 0.66$ 0.40$ 0.42$ Cash 1,984$ 4,273$ 7,848$ 14,160$ 10,060$ 8,587$ 10,060$ Third-Party Debt and Capital Lease Obligations 2,750$ 5,199$ 8,054$ 10,666$ 8,651$ 6,801$ 8,651$ Net Debt 766$ 925$ 206$ (3,494)$ (1,409)$ (1,786)$ (1,409)$ Pre-Tax Income (GAAP) 2,605$ 3,957$ 6,019$ 9,902$ 10,275$ 5,966$ 6,339$ Interest Expenses / (Income), Net 332$ 314$ 571$ 505$ 304$ 318$ 117$ Depreciation & Amortization 521$ 556$ 1,198$ 1,760$ 1,910$ 854$ 1,004$ Profit from Operations (Non-GAAP) 3,458$ 4,828$ 7,788$ 12,166$ 12,489$ 7,137$ 7,460$ Pre-Tax Income (GAAP) 2,605$ 3,957$ 6,019$ 9,902$ 10,275$ 5,966$ 6,339$ Depreciation & Amortization 521$ 556$ 1,198$ 1,760$ 1,910$ 854$ 1,004$ Capital Expenditures (455)$ (237)$ (767)$ (1,961)$ (2,451)$ (929)$ (1,420)$ Change in Operating Assets and Liabilities (1,443)$ 1,084$ (485)$ 1,089$ (2,065)$ (1,229)$ (4,383)$ Cash Earnings (Non-GAAP) 1,227$ 5,361$ 5,965$ 10,789$ 7,669$ 4,661$ 1,540$ Cash Earnings Per Share (Non-GAAP) 0.41$ 1.42$ 0.77$ 1.14$ 0.81$ 0.49$ 0.16$ 1 InFY2016,excludesaone-timenon-cashgoodwillimpairmentchargeof$7.6MM 2 InFY2016,excludestheafter-taximpactofanon-cashgoodwillimpairmentchargeof$4.7MMor$0.49EPS