Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - BLUCORA, INC. | ex-992earningsreleaseq32017.htm |

| EX-99.1 - EXHIBIT 99.1 - BLUCORA, INC. | ex-991earningsreleaseq32017.htm |

| 8-K - 8-K - BLUCORA, INC. | bcor8-kq32017earningsrelea.htm |

Investor Presentation

October 26, 2017

3Q 2017

2

Forward-Looking Statements

and Non-GAAP Financial Measures

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words "anticipate," "believe," "plan," "project,"

"expect," "future," "intend," "may," "will," "should," “could,” “would,” "estimate," "predict," "potential," "continue," and similar expressions. Actual

results may differ significantly from management's expectations due to various risks and uncertainties including, but not limited to: risks associated

with Blucora, Inc. (“Blucora” or the “Company”) strategic transformation and the successful execution of its strategic initiatives, operating plans and

marketing strategies; general economic, political, industry, and market conditions; the Company’s ability to attract and retain productive advisors;

the Company’s ability to successfully make technology enhancements and introduce new products and services; information technology and

cybersecurity risks; the effect of current, pending and future legislation, regulation and regulatory actions, such as the new Department of Labor

rule and any changes in tax laws; dependence on third parties to distribute products and services; litigation risks; the Company’s ability to hire,

retain and motivate key employees; the Company’s ability to protect its intellectual property; and financing risks, including risks related to the

Company’s existing debt obligations.

A more detailed description of these and certain other factors that could affect actual results is included in Blucora’s most recent Annual Report on

Form 10-K and subsequent reports filed with or furnished to the Securities and Exchange Commission. Readers are cautioned not to place undue

reliance on these forward-looking statements. The Company undertakes no obligation to update any forward-looking statements to reflect events

or circumstances after the date of this presentation.

This presentation contains non-GAAP financial measures relating to our performance. You can find the reconciliation of these measures to the most

directly comparable GAAP financial measure in the Appendix at the end of this presentation. The non-GAAP financial measures disclosed by the

Company should not be considered a substitute for, or superior to, the financial measures prepared in accordance with GAAP. Please refer to the

notes to reconciliation of non-GAAP financial measures in Blucora’s quarterly earnings release for a detailed explanation of the adjustments made

to the comparable GAAP measures, the ways management uses the non-GAAP measures, and the reasons why management believes the non-

GAAP measures provide investors with useful supplemental information.

3

Source: U.S. Bureau of Labor Statistics Empowering people’s goals by optimizing taxes.

We specialize in it.

Americans spend more on taxes than on their

mortgage, groceries and clothing, combined.

Yet few firms focus on tax,

and many avoid it altogether.

4

• Demonstrated revenue, segment income and non-GAAP EPS growth

• Our business portfolio is positioned with significant organic growth opportunities

• Strong cash flow generating business, strengthened balance sheet

• Diversified revenue streams with multiple growth drivers and positive industry tailwinds

• Differentiated business model with competitive advantages

Investment Highlights

5

2016 Overview Blucora’s tax-smart solutions

empower people’s goals by leveraging

one of life’s largest expenses – taxes

$42.7 B

Assets Under

Administration

$12 B

Assets Under

Management

4.3M

Consumer

e-Files

21K

Professional Users

5

Wealth Management

• #1 Tax-Focused Independent Broker Dealer

• We provide advisors with the training,

tools & support to deliver tax-smart

wealth management to clients

4,400

Advisors

345,000

Customers

Leadership: Bob Oros

Led Fidelity’s RIA business (2012-17)

LPL, Charles Schwab

1.7M

Professional

e-Files

• #3 Tax Preparation Service (unit share)

• Online tax software solution for

consumers and professionals that is

simple, affordable, accurate

Tax Preparation

19

Yrs. Revenue Growth

Leadership: Sanjay Baskaran

Led Amazon N. America Credit Card biz (2015-17)

Visa, HSBC

LTM Financial Results

(as of 9/30/17)

Wealth Management

$317M

Tax Preparation

$139M

Advisory

Commission & Trails

Cash sweep

& other

Fees

Consumer

Pro

$129

$150

$23

$14

$130

70% 30%

Revenue $498.5 M

Segment Income $127.8 M

Adjusted EBITDA $105.1 M

Non-GAAP EPS $1.44

About Us

Blucora helps consumers manage

their financial lives and optimize taxes

through two segments:

6

Multi-Year Transformation

Integrated Tax-Smart Platform

Reduced Customer Concentration Increased Recurring Revenue

2014 3Q’17 LTM

Customers Accounting for more than 5% of Revenue

Tax-Optimized

Wealth

Management

Tax Prep

0%

20%

40%

60%

80%

100%

2014 3Q'17 LTM 13% 77%

6.3x

Divested Non-Core Assets

Blucora

InfoSpace

Monoprice

55%

0%

7

2014 2015 2016 2017 E*

$0.70

$0.88

$1.06

$1.36

2014 2015 2016 3Q'17 LTM 2014 2015 2016 3Q'17 LTM

Continued Momentum

Revenue 7% CAGR Adjusted EBITDA 13% CAGR

Non-GAAP EPS 25% CAGR Strengthening Balance Sheet

$76 $82

$94

$105

$409 $437

$456

$499

2015 2016 3Q'17

6.3x

4.0x

2.6x

LTM Free Cash Flow

$72 million

Net Leverage Ratio

Adjusted EBITDA, non-GAAP EPS and Free Cash Flow are not defined under U.S. generally accepted accounting principles (GAAP). The company defines free cash flow as net cash provided by operating activities from continuing operations less purchases of

property and equipment. Please see appendix for reconciliations to nearest GAAP measures. On December 31, 2015, Blucora closed the acquisition of HD Vest . The pro forma information represents the combination of HD Vest, TaxAct, and corporate

expenses as if the acquisition closed on January 1, 2014, and excludes the divested Search and Content and E-Commerce businesses. The Company believes that this presentation most accurately reflects the financial performance of the Company on a go-

forward basis.

8

Wealth Management

• Revenue up 8% y/y

• Assets Under Administration (AUA) +11% y/y to $42.7B

• Assets Under Management (AUM) +17% y/y to $12.0B

Strong Third Quarter

New Record

Tax Preparation

• Revenue up 7% y/y

• Investing & positioning for next tax season

New Record

Blucora Consolidated

Revenue

UP 8%

Year over year

Net leverage

DOWN TO 2.6x

vs. 4.2x year-ago

9

Core Beliefs

• Taxes are one of life’s largest expenses

• Leveraging taxes is not maximizing a once-a-year refund,

but rather helping people achieve their financial goals

• The tax prep industry focuses consumers on maximizing a

once-a-year refund, a reactive approach that ignores the

greater goals of minimizing taxes, increasing cash flow and

enabling better long-term outcomes

• The brokerage and wealth management industries ignore

taxes, making the simplifying assumption that they don’t

exist – because they can’t advise on taxes; instead they

focus consumers on the illusion of investment alpha

We will leverage tax information – along with

trusted brands – to enable people to better

achieve their goals, connecting the dots

across a person’s financial life-cycle,

uncovering opportunity they would

otherwise miss

Taxes are the key to better outcomes

People are seriously underserved

We have a unique opportunity

to disrupt these outdated

approaches

The next innovation in managing finances:

Integrated tax and

wealth management

That frame our growth strategy

10

Purpose and Values

Purpose

Values

Vision

Strategic

Statement

“Tax-smart” leaders, earning world-class customer loyalty and trust

We live by a CREDO…

• Customer obsessed: We serve all customers with passion

• Reliable: We always deliver on our commitments

• Ethical: We respect all others and treat people as they want to be treated

• Driven: We demand excellence and strive to find a better way

• One-Blucora: We will win more together

Objective: High-performing growth company, delivering 15-18% growth in Non-GAAP EPS

Scope: For consumers and small businesses, and their trusted advisors, we enable better financial outcomes

through our tax expertise and insights – across relationship-led and digitally-led channels

Advantage: Leveraging the tax information through our trusted brands enables us to deliver better financial

recommendations and outcomes, across a breadth of demographic and the full consumer life-cycle

Empowering people to exceed their goals through optimizing one of life’s largest expenses – taxes

11

Accelerate Growth

Capture organic growth opportunities

Create clear competitive differentiation and customer value in each business

Deliver on cross-brand migration & synergies, leverage data to offer personalized services

Build Tax-smart

Leadership

Deliver tax-alpha through integrated products and services across brands

Deliver holistic tax-smart solutions, while others offer pieces

Create One Blucora

Enable efficiencies through shared services and expertise across the enterprise

Build high-performing organization that attracts, retains, develops and engages the strongest talent

Drive a shared purpose and common culture

Our Path Forward / How We Win From Here

Deliver Results

Drive continuous improvement, metrics driven organization

Continue to meet our goals and targets; maximize NOL

Blucora Strategy

12

Financial Objectives (Next 3-5 Years)

Revenue

Growth

Adjusted EBITDA

Growth

Non-GAAP

EPS Growth

5-8%

6-9%

15-18%

Near-term Focus

Organic growth requirements

Continued de-levering

Future Considerations

Consolidation & capability M&A

Return of capital (share repurchase)

Capital allocation priorities

2016 2017 2018+

13

Roadmap for Value Creation

Stabilize and Reposition Foundation for Growth Growth Company

Increase profit & grow share

Increase profit & grow AUM

Organic

Reposition TaxAct

HD Vest DOL & capability buildout

Redesign & streamline organization

Integrate HD Vest

Organization

Divestitures

De-lever

Refinance debt

Cap Allocation

Consolidation & capability M&A

Return of capital

De-lever

14

Wealth

Management

15

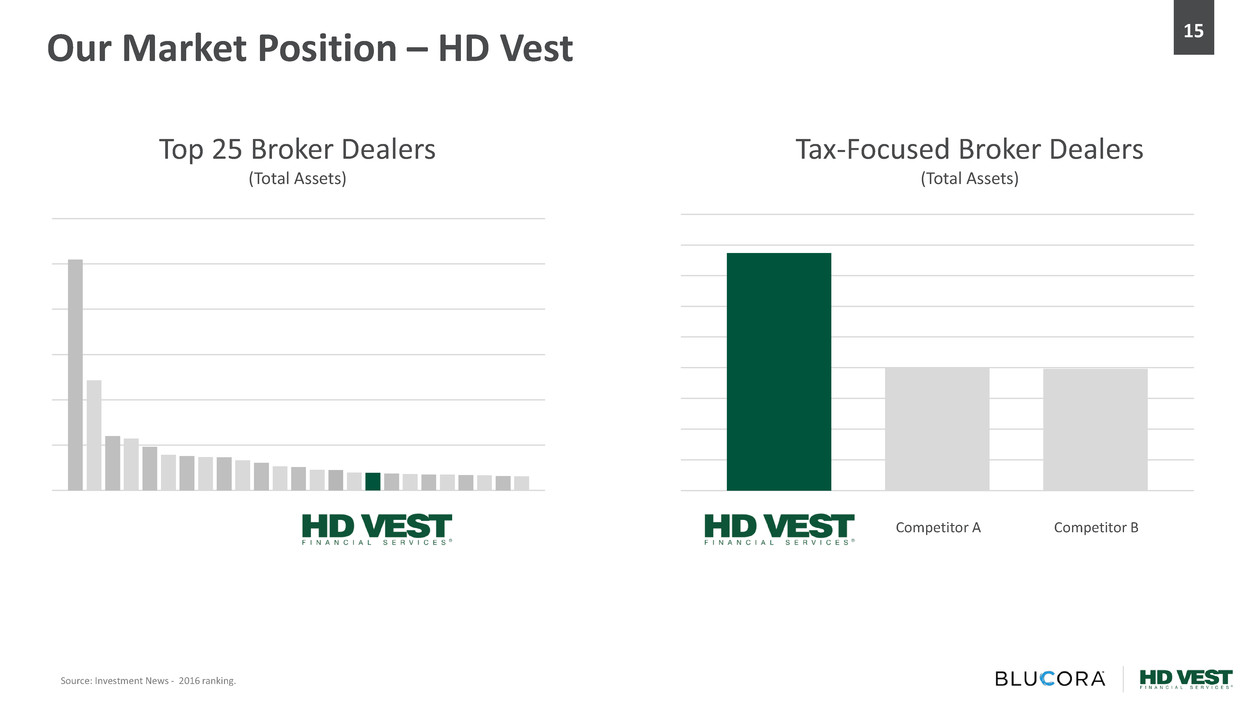

Our Market Position – HD Vest

Source: Investment News - 2016 ranking.

Competitor A

Top 25 Broker Dealers

(Total Assets)

Tax-Focused Broker Dealers

(Total Assets)

Competitor B

16

Financial Performance – HD Vest

Revenue

$40.3 $43.0

$46.3

$50.5

13% 13%

15%

15%

0.06

0.08

0.1

0.12

0.14

0.16

0.18

0

5

10

15

20

25

30

35

40

45

50

55

60

2014 2015 2016 LTM 3Q'17

Segment Income & Margin

40.8%

27.0%

20.5%

11.7%

Other

Fee-based

Transactional

Trails

3Q’17

$273 $286 $280 $297

$32

$33 $37

$41

$305

$320 $317

$338

2014 2015 2016 LTM 3Q'17

Advisor Driven Other

Revenue Mix

17

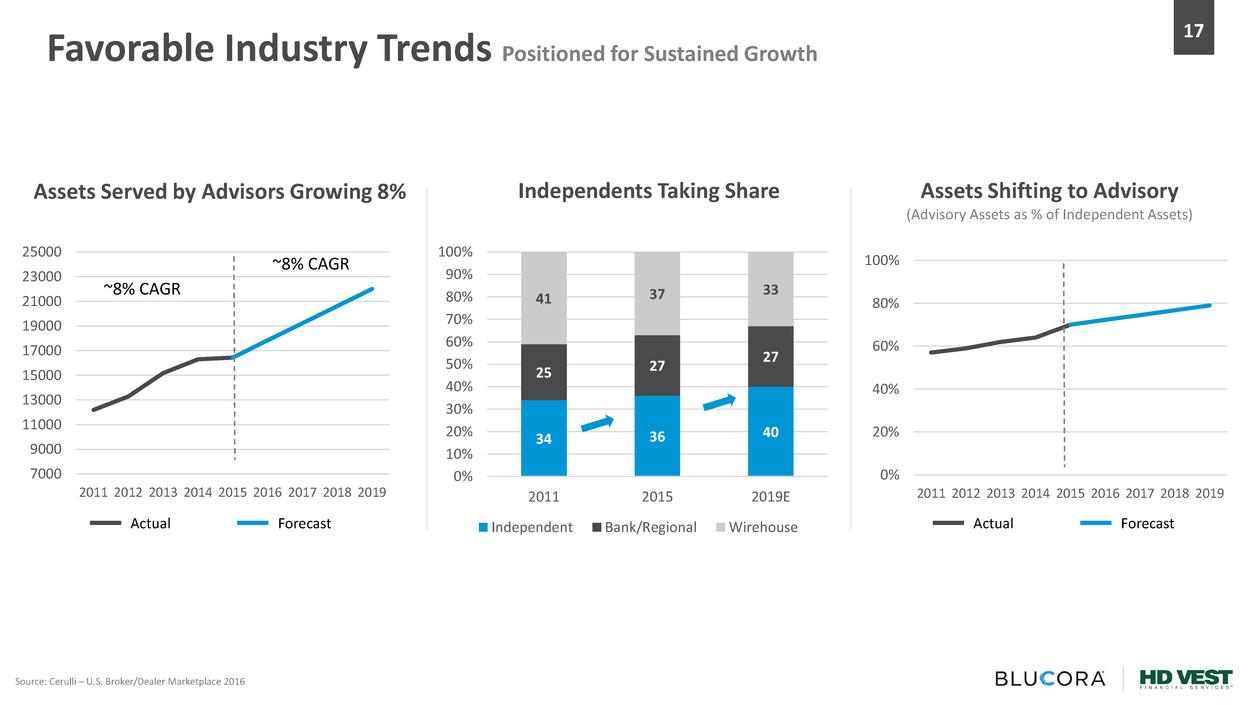

Favorable Industry Trends Positioned for Sustained Growth

Source: Cerulli – U.S. Broker/Dealer Marketplace 2016

7000

9000

11000

13000

15000

17000

19000

21000

23000

25000

2011 2012 2013 2014 2015 2016 2017 2018 2019

~8% CAGR

~8% CAGR

Actual Forecast

Assets Served by Advisors Growing 8%

34 36 40

25 27

27

41 37

33

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2011 2015 2019E

Independent Bank/Regional Wirehouse

Independents Taking Share Assets Shifting to Advisory

(Advisory Assets as % of Independent Assets)

0%

20%

40%

60%

80%

100%

2011 2012 2013 2014 2015 2016 2017 2018 2019

Actual Forecast

18

Differentiated Business Model

1. Recruiting 2. New Customers 3. Tax Focus 4. Teamwork

Train Existing

Tax-Pros to be

Wealth Mgmt.

Advisors

Advisors have

existing client base

…with trusted relationship

Offer Tax-Smart

Investing

…integrated with tax

management

Family Atmosphere:

Chapters, Mentors,

Support Groups

Recruit with

Bonuses, Loans,

Higher Payout

Cold Calls

Avoid Tax

Discussion

Tell clients to speak

with their tax advisor

Everyone for

Themselves

Traditional

IBD

Competitive

Advantage

• Advisor loyalty

• Lower avg. payout

• Limited upfront costs

• Trusted relationship

• Personalized approach

• Comprehensive advice

• Tax alpha

• Share best practices

• Client orientation

Increased Loyalty Higher Conversion More Profitable Improved outcomes

19

Organic Business Opportunities Strong Position with Significant Organic Opportunity

Highest Potential

Advisors Evaluate - Recruit

Technology Upgrades

Significantly

Increase Support

Leverage Proprietary

Tax-Smart Platform

1. Optimize Advisor Success & Productivity 3. Improve End-Client Penetration*

2. Transition to New Clearing Platform

(Scheduled for 3Q 2018)

4. Grow Managed Assets (AUM)

Narrow the Gap

Value Drivers

Grow Assets

(AUA)

Increase

Monetization

(ROCA)

• Better capture of interest income ($2-$3M for each 25bps)

• New technology

• DTF Assets Opportunity ($14B off-platform)

Est. $60-$100 million segment income benefit over 10 years

(equal to incremental 1-2 yrs. @ 3Q’17 run-rate).

Increasing PPA for ½ of second quartile HD Vest advisors to average of first

quartile = $20-$25M annual segment income opportunity.

Productivity Per Advisor (PPA) (Top 25 IBDs by Revenue)

70%

Unserved

Percentage of Advisor

Tax Clients Served

Wallet Share of

Served Clients

Increasing tax practice penetration to 40% could represent $20

million annual segment income opportunity.

Every 5 pts represents up to $5 million incremental recurring

segment income opportunity at existing asset levels.

HD Vest

28%

Best-in-Class*

54%

Managed Assets

% of Total

50%

Unserved

30%

Served

50%

Served

*Best in class among broker dealers

20

Key Takeaways – Wealth Management

• LT Growth in assets served by advisors

• Independents taking share

• Continued shift to fee-based

Favorable Industry Trends

Already strong business with significant organic growth opportunities

Differentiated business model, uniquely positioned

• Optimize advisor success & productivity

• Drive end-client penetration

• New clearing platform

• Grow managed assets

21

Tax Preparation

22

TaxAct Performance

$0

$20

$40

$60

$80

$100

$120

$140

$160

19 Consecutive Years of Growth

$-

$10

$20

$30

$40

$50

$60

$70

$80

$90

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

TY

2011

TY

2012

TY

2013

TY

2014

TY

2015

TY

2016

Preparer Online Segment Income

E-files

(Mil)

Segment Income

($Mil)

• YTD through Sept. 30, 2017

• ARPU – Average revenue per U.S. TaxAct return (e-file)

2014 2015 2016 2017

Revenue ($mil) E-Files & Segment Income ARPU

23

34% 35% 36% 37%

39% 40% 41%

46% 47%

46% 46%

46% 46% 46%

14% 13% 13% 12%

11% 11% 10%

6% 5% 5% 5% 4%

3% 3%

2011 2012 2013 2014 2015 2016 2017

Online

Leader

Online

Leader

Online

Leader

Retail

Leader

Retail

Leader

Retail

Leader

TaxAct TaxAct TaxAct

Other Other Other

0%

20%

40%

60%

80%

100%

2014 (TY13) 2016 (TY15) 2017E (TY16E)

Unit Market Share (DDIY) Consumer Tax Filings by Method

Percentage of U.S. Consumer Returns Processed Annually

Tax Pro DIY Software Paper Store Front

Source: Daymark Consulting, Blucora Estimates

Market Overview

Deductions, Credits & Investments $37.00 $54.99 $79.99 33% - 54%

Business Owner $47.00 $79.99 $114.99 41% - 59%

24

Market Overview (continued)

Savings H&R Block

• DDIY is fastest growing segment of market, but only

commands 12% of industry revenue

• DDIY volumetric leader growing category with focus

on stores

• New entrants targeting ‘free’ segment to sell

customer data

• Any tax reform/simplification expected to benefit DIY

Unit Share

178M Market

Dollar Share

$22B Market

Digital Volumetric Leader

Growing Category

46%

1% CAGR

4% CAGR

Federal Late-Season Pricing *Pricing as of 3/23/17

Tax Filing Market

(U.S. and Canada)

Pros

Stores

DDIY

Paper

69%

$180 ASP

10% 4% CAGR

19%

$225 ASP

40%

5% CAGR

12% $37 ASP

Source: Daymark Consulting, Intuit.

CAGR 2013-2016

ASP – Average Selling Price

Turbo Tax

25

New Entrants: Free

Leader: Free, Stores

Hidden Fees

& Charges

$50++ ‘free’ filings

$30 for copy of return

Varied

Tech: Clunky to Very Good

Support: None to Good

Sell Client Data

Mass Referral

Engine

Backed by True

Financial and

Tax-Expertise

BluVest- Assessment

BluPrint- tax-smart robo

HD Vest – 360o

High Potential

Segments

Pay year 1

Transparent

Excellent Value

Reliable,

Easy to Use

Targeting Pricing Technology & Support

Deepen & Monetize

Relationships

Competitive

Strength

• High long-term value • Loyalty

• Potential ancillary svcs.

• 70% customer retention • Thousands of advisors

• $43B AUA, $12B AUM

Increased LTV Extend Brand Profitable No reason to use others

Others

Differentiated Business Model

26

Win target segments Retain customers,

win-back former customers

• High-potential sub-segments

• High lifetime value • 70% paid retention

• Marketing optimization

• Partnerships

• Distribution

• BluVest™

• Referral to HD Vest Advisor

Business Opportunities

• Cloud migration

• Next-Gen operations &

customer Support

• Artificial Intelligence/Machine

Learning, Cybersecurity

• Marketing optimization

Enhance Winning Capabilities Diversify Revenue

27

Benefitting from secular shift to DDIY

Targeting higher value customer segments

Enhancing platform

Consistent growth in revenue and segment income

Any tax reform/simplification expected to benefit DDIY

Key Takeaways – Tax Preparation

28

Synergies

29

Convert TaxAct professional users to HD Vest financial advisors

• Currently 21,000 TaxAct Pro users vs. 4,400 HD Vest Advisors

Extend financial solutions to TaxAct DDIY tax filers

• Currently 4.3 million TA filers vs. 345,000 HD Vest Customers

• Examples include BluVest, BluPrint, Expert review

Create integrated tax pro software solutions

2018 2019 2020 2021

Business Unit Specific Synergy

While organic growth opportunities are

near-term priority, synergy opportunities

can drive incremental growth.

Synergy Opportunities are Incremental

Blucora Growth Opportunities

(Illustrative)

30

Summary

Completed Multi-Year Business Transformation

Continued Momentum Through Third Quarter

Recently Conducted Growth Strategy Work

Positioned to Execute on Significant Organic Growth Opportunities

Upper-Single-Digit Revenue Growth Across Both Businesses

Strengthened Balance Sheet

Improvement in Key Growth Metrics, Including AUA, AUM

Appendix

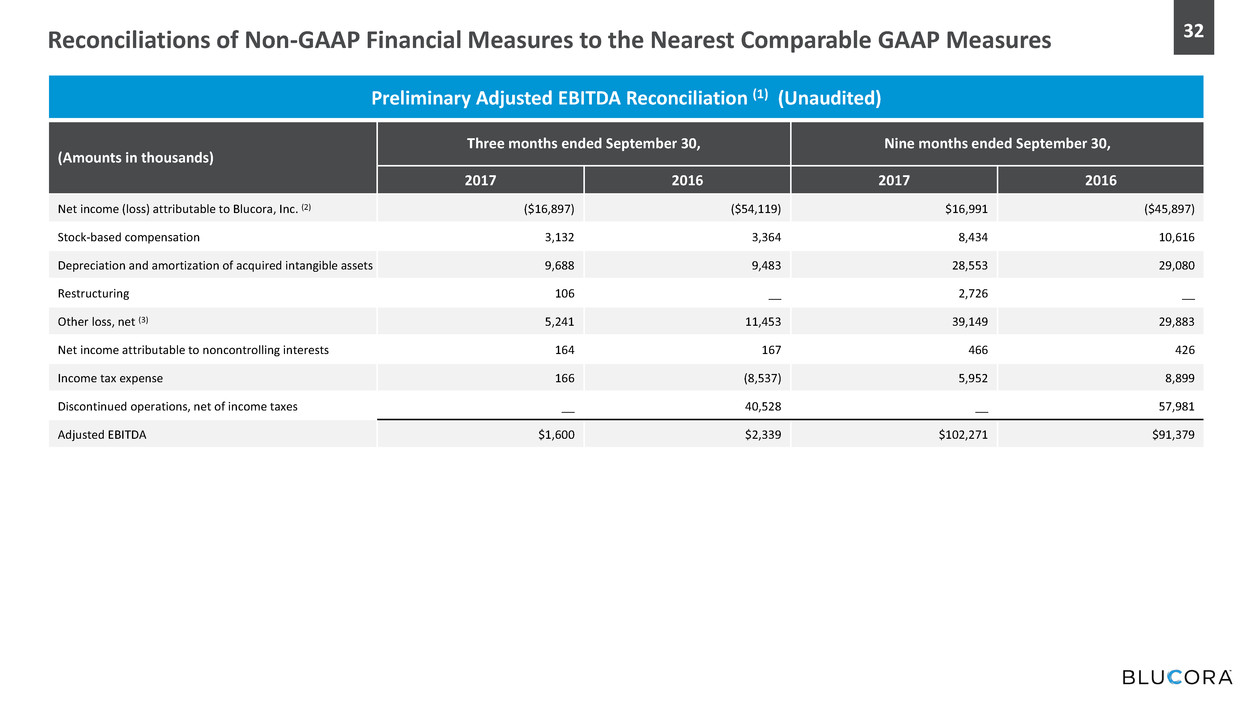

32 Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measures

Preliminary Adjusted EBITDA Reconciliation (1) (Unaudited)

(Amounts in thousands)

Three months ended September 30, Nine months ended September 30,

2017 2016 2017 2016

Net income (loss) attributable to Blucora, Inc. (2) ($16,897) ($54,119) $16,991 ($45,897)

Stock-based compensation 3,132 3,364 8,434 10,616

Depreciation and amortization of acquired intangible assets 9,688 9,483 28,553 29,080

Restructuring 106 __ 2,726 __

Other loss, net (3) 5,241 11,453 39,149 29,883

Net income attributable to noncontrolling interests 164 167 466 426

Income tax expense 166 (8,537) 5,952 8,899

Discontinued operations, net of income taxes __ 40,528 __ 57,981

Adjusted EBITDA $1,600 $2,339 $102,271 $91,379

33

Preliminary Non-GAAP Net Income (Loss) Reconciliation (1) (Unaudited)

(Amounts in thousands,

except per share amounts)

Three months ended September 30, Nine months ended September 30,

2017 2016 2017 2016

Net income (loss) attributable to Blucora, Inc. (2) ($16,897) ($54,119) $16,991 ($45,897)

Discontinued operations, net of income taxes __ 40,528 __ 57,981

Stock-based compensation 3,132 3,364 8,434 10,616

Amortization of acquired intangible assets 8,665 8,346 25,337 25,694

Accretion of debt discount on Convertible Senior

Notes

__ 901 1,567 2,749

Accelerated accretion of debt discount on

Convertible Senior Notes repurchased

__ __ __ 1,628

Gain on Convertible Senior Notes repurchased __ __ __ (7,724)

Write-off of debt discount and debt issuance costs

on terminated Convertible Senior Notes

__ __ 6,715 __

Write-off of debt discount and debt issuance costs

on closed TaxAct - HD Vest 2015 credit facility

__ __ 9,593 __

Acquisition-related costs __ __ __ 391

Restructuring 106 __ 2,726 __

Impact of noncontrolling interests 164 167 466 426

Cash tax impact of adjustments to GAAP net income (928) (17) (3,334) 244

Non-cash income tax expense (1) 224 (9,312) 6,325 6,460

Non-GAAP net income (loss) ($5,534) ($10,142) $74,820 $52,568

Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measures

34

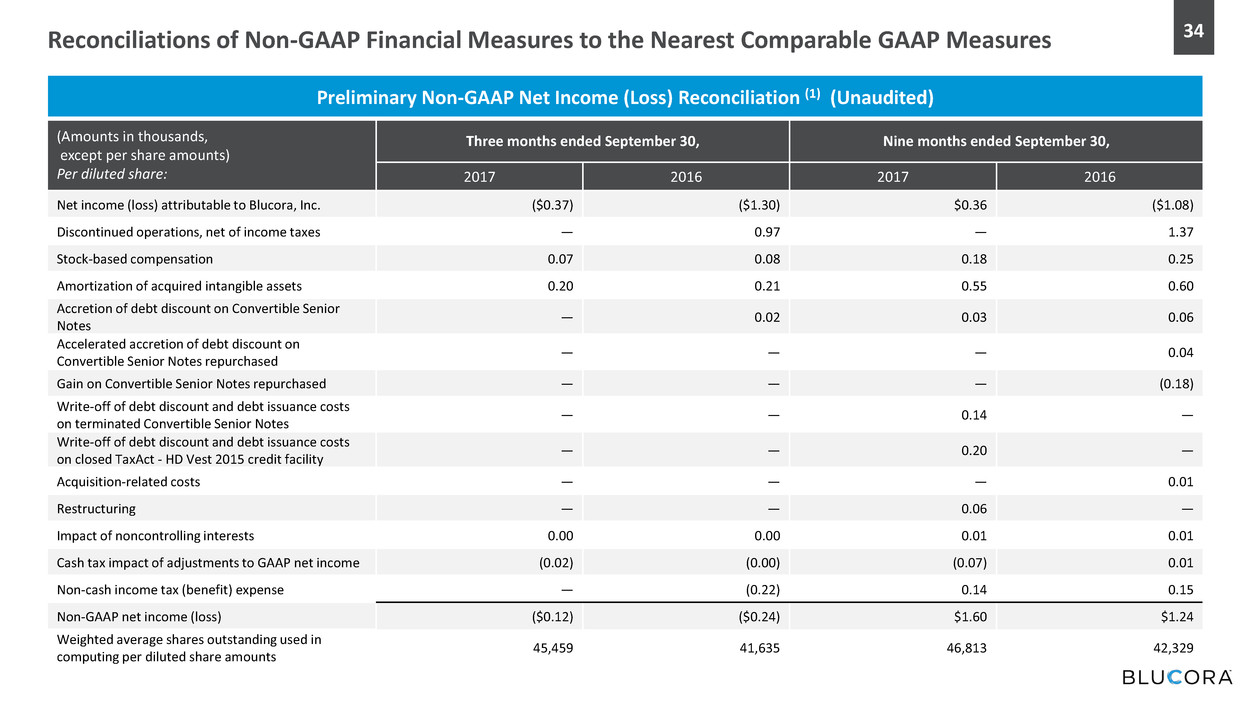

Preliminary Non-GAAP Net Income (Loss) Reconciliation (1) (Unaudited)

(Amounts in thousands,

except per share amounts)

Per diluted share:

Three months ended September 30, Nine months ended September 30,

2017 2016 2017 2016

Net income (loss) attributable to Blucora, Inc. ($0.37) ($1.30) $0.36 ($1.08)

Discontinued operations, net of income taxes — 0.97 — 1.37

Stock-based compensation 0.07 0.08 0.18 0.25

Amortization of acquired intangible assets 0.20 0.21 0.55 0.60

Accretion of debt discount on Convertible Senior

Notes

— 0.02 0.03 0.06

Accelerated accretion of debt discount on

Convertible Senior Notes repurchased

— — — 0.04

Gain on Convertible Senior Notes repurchased — — — (0.18)

Write-off of debt discount and debt issuance costs

on terminated Convertible Senior Notes

— — 0.14 —

Write-off of debt discount and debt issuance costs

on closed TaxAct - HD Vest 2015 credit facility

— — 0.20 —

Acquisition-related costs — — — 0.01

Restructuring — — 0.06 —

Impact of noncontrolling interests 0.00 0.00 0.01 0.01

Cash tax impact of adjustments to GAAP net income (0.02) (0.00) (0.07) 0.01

Non-cash income tax (benefit) expense — (0.22) 0.14 0.15

Non-GAAP net income (loss) ($0.12) ($0.24) $1.60 $1.24

Weighted average shares outstanding used in

computing per diluted share amounts

45,459 41,635 46,813 42,329

Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measures

35 Notes to Reconciliations of Non-GAAP Financial Measures

to the Nearest Comparable GAAP Measures

(1) We define Adjusted EBITDA as net income (loss) attributable to Blucora, Inc., determined in accordance with GAAP, excluding the effects of stock-based compensation, depreciation,

amortization of acquired intangible assets (including acquired technology), restructuring, other loss, net, the impact of noncontrolling interests, income tax expense, the effects of discontinued

operations, and acquisition-related costs. Restructuring costs relate to the move of our corporate headquarters, which was announced in the fourth quarter of 2016. Acquisition-related costs

include professional services fees and other direct transaction costs and changes in the fair value of contingent consideration liabilities related to acquired companies. The SimpleTax acquisition

that was completed in 2015 included contingent consideration, for which the fair value of that liability was revalued in the second quarter of 2016.

We believe that Adjusted EBITDA provides meaningful supplemental information regarding our performance. We use this non-GAAP financial measure for internal management and compensation

purposes, when publicly providing guidance on possible future results, and as a means to evaluate period-to-period comparisons. We believe that Adjusted EBITDA is a common measure used by

investors and analysts to evaluate our performance, that it provides a more complete understanding of the results of operations and trends affecting our business when viewed together with

GAAP results, and that management and investors benefit from referring to this non-GAAP financial measure. Items excluded from Adjusted EBITDA are significant and necessary components to

the operations of our business and, therefore, Adjusted EBITDA should be considered as a supplement to, and not as a substitute for or superior to, GAAP net income (loss). Other companies may

calculate Adjusted EBITDA differently and, therefore, our Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

We define non-GAAP net income (loss) as net income (loss) attributable to Blucora, Inc., determined in accordance with GAAP, excluding the effects of discontinued operations, stock-based

compensation, amortization of acquired intangible assets (including acquired technology), accretion of debt discount and accelerated accretion of debt discount on the Convertible Senior Notes

(the "Notes"), gain on the Notes repurchased, write-off of debt discount and debt issuance costs on the Notes that were redeemed and the terminated TaxAct - HD Vest 2015 credit facility,

acquisition-related costs (described further under Adjusted EBITDA above), restructuring costs (described further under Adjusted EBITDA above), the impact of noncontrolling interests, the related

cash tax impact of those adjustments, and non-cash income taxes. The write-off of debt discount and debt issuance costs on the terminated Notes and the closed TaxAct - HD Vest 2015 credit

facility relates to the debt refinancing that occurred in the second quarter of 2017. We exclude the non-cash portion of income taxes because of our ability to offset a substantial portion of our

cash tax liabilities by using deferred tax assets, which primarily consist of U.S. federal net operating losses. The majority of these net operating losses will expire, if unutilized, between 2020 and

2024.

We believe that non-GAAP net income (loss) and non-GAAP net income (loss) per share provide meaningful supplemental information to management, investors, and analysts regarding our

performance and the valuation of our business by excluding items in the statement of operations that we do not consider part of our ongoing operations or have not been, or are not expected to

be, settled in cash. Additionally, we believe that non-GAAP net income (loss) and non-GAAP net income (loss) per share are common measures used by investors and analysts to evaluate our

performance and the valuation of our business. Non-GAAP net income (loss) should be evaluated in light of our financial results prepared in accordance with GAAP and should be considered as a

supplement to, and not as a substitute for or superior to, GAAP net income (loss). Other companies may calculate non-GAAP net income differently, and, therefore, our non-GAAP net income may

not be comparable to similarly titled measures of other companies.

(2) As presented in the Preliminary Condensed Consolidated Statements of Operations (unaudited)

(3) Other loss, net primarily includes items such as interest income, interest expense, amortization of debt issuance costs, accretion of debt discounts, and gain/loss on debt extinguishment.

36 Blucora Net Leverage Ratio

(In thousands except ratio,

rounding differences may exist)

2015 2016 2017

FY 12/31 1Q 2Q 3Q 4Q

FY 12/31

1Q 2Q 3Q

CASH:

Cash and cash equivalents $55,473 $67,955 $74,273 $71,165 $51,713 $51,713 $74,609 $78,312 $78,558

Available-for-sale investments 11,301 11,642 7,821 4,492 7,101 7,101 160 — —

$66,774 $79,597 $82,094 $75,657 $58,814 $58,814 $74,769 $78,312 $78,558

DEBT:

Senior secured credit facility $ — $ — $ — $ — $ — $ — $ — $360,000 $350,000

TaxAct - HD Vest 2015 credit facility 400,000 360,000 340,000 295,000 260,000 260,000 222,000 — —

Convertible Senior Notes 201,250 172,859 172,859 172,859 172,859 172,859 172,859 — —

Note payable, related party 6,400 6,400 6,400 6,400 3,200 3,200 3,200 3,200 3,200

$607,650 $539,259 $519,259 $474,259 $436,059 $436,059 $398,059 $363,200 $353,200

NET DEBT FROM CONTINUING OPERATIONS ($540,876) ($459,662) ($437,165) ($398,602) ($377,245) ($377,245) ($323,290) ($284,888) ($274,642)

OTHER:

Add: Escrow receivable (1) $20,000 $ — $ — $ — $ — $ — $ — $ — $ —

TOTAL NET DEBT FROM CONTINUING OPERATIONS ($520,876) ($459,662) ($437,165) ($398,602) ($377,245) ($377,245) ($323,290) ($284,888) ($274,642)

Last twelve months (pro forma): (2)

SEGMENT INCOME:

Wealth Management $42,997 $45,256 $44,563 $44,703 $46,296 $46,296 $47,243 $49,725 $50,522

Tax Preparation 56,984 60,412 70,318 68,478 66,897 66,897 72,457 79,176 77,320

99,981 105,668 114,881 113,181 113,193 113,193 119,700 128,901 127,842

Unallocated corporate operating expenses (17,750) (18,073) (17,871) (18,345) (18,999) (18,999) (21,073) (23,076) (22,756)

ADJUSTED EBITDA $82,231 $87,595 $97,010 $94,836 $94,194 $94,194 $98,627 $105,825 $105,086

LEVERAGE RATIO 6.3 5.2 4.5 4.2 4.0 4.0 3.3 2.7 2.6

(1) Amount represents consideration funded to escrow that was contingent upon HD Vest's 2015 earnings performance. The contingent consideration was not achieved;

therefore, the amount was returned to the Company from escrow in 1Q16.

(2) The pro forma information represents the combination of HD Vest, TaxAct, and corporate expenses as if the acquisition closed on January 1, 2014. The Company

believes that this presentation most accurately reflects the financial performance of the Company on a go-forward basis.

37

(In thousands, rounding differences may exist)

2015 2016 2017

FY 12/31 1Q 2Q 3Q 4Q FY 12/31 1Q 2Q 3Q

Net cash provided by operating activities from continuing

operations

$24,308 (2) $68,721 (2) $22,165 ($2,349) ($2,567) $85,970 $52,900 $28,236 ($1,906)

Purchases of property and equipment (1,512) (677) (851) (1,120) (1,164) (3,812) (1,165) (746) (1,898)

Operating free cash flow from continuing operations $22,796 $68,044 $21,314 ($3,469) ($3,731) $82,158 $51,735 $27,490 ($3,804)

(1) We define operating free cash flow from continuing operations as net cash provided by operating activities from continuing operations less purchases of property and equipment. We believe operating

free cash flow is an important liquidity measure that reflects the cash generated by the continuing businesses, after the purchases of property and equipment, that can then be used for, among other

things, strategic acquisitions and investments in the businesses, stock repurchases, and funding ongoing operations.

(2) FY 2015 includes $20.0 million of consideration funded to escrow that was contingent upon HD Vest's 2015 earnings performance. The contingent consideration was not achieved; therefore, the

amount was returned to the Company from escrow in 1Q16.

Blucora Reconciliation of Operating Free Cash Flow from Continuing Operations (1)