Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - TIAA REAL ESTATE ACCOUNT | ex99293017.htm |

| 8-K - 8-K - TIAA REAL ESTATE ACCOUNT | tiaarealestate8-k93017.htm |

TIAA Retirement Annuity Accounts | Exhibit 99.1 | |||||||||||||||

TIAA Real Estate Account | ||||||||||||||||

Real Estate | As of 09/30/17 | |||||||||||||||

Portfolio Net Assets $24.8 Billion | Inception Date 10/2/1995 | Symbol QREARX | Estimated Annual Expenses1 2 0.85% | |||||||||||||

Portfolio Strategies | Performance | |||||||||||||||

This variable annuity account seeks favorable long-term returns primarily through rental income and appreciation of real estate and real estate-related investments owned by the Account. The Account will also invest in non-real estate-related publicly traded securities and short-term higher quality liquid investments that are easily converted to cash to enable the Account to meet participant redemption requests, purchase or improve properties or cover other expense needs. The Account intends to have between 75% and 85% of its net assets invested directly in real estate or real estate-related assets with the goal of producing favorable long-term returns. The Account’s principal strategy is to purchase direct ownership interests in income-producing real estate, primarily office, industrial, retail and multi-family residential properties. The Account may also make foreign real estate investments. Under the Account’s investment guidelines, investments in direct foreign real estate, together with foreign real estate-related securities and foreign non-real estate-related liquid investments may not comprise more than 25% of the Account’s net assets. The Account will invest the remaining portion of its assets (targeted between 15% and 25% of net assets) in publicly traded, liquid investments. | Total Return | Average Annual Total Return | ||||||||||||||

3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | ||||||||||

TIAA Real Estate Account | 1.08% | 3.04% | 4.34% | 6.74% | 8.04% | 2.58% | 6.36% | |||||||||

The returns quoted represent past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org, or call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower. | ||||||||||||||||

1 The total annual expense deduction, which includes investment management, administration, and distribution expenses, mortality and expense risk charges, and the liquidity guarantee, is estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Historically, adjustments have been small. | ||||||||||||||||

2 The Account’s total annual expense deduction appears in the Account’s prospectus, and may be different than that shown herein due to rounding. Please refer to the prospectus for further details. | ||||||||||||||||

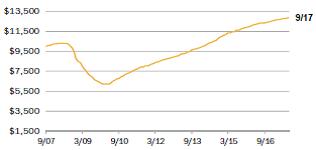

Learn More | Hypothetical Growth of $10,000 | |||||||||||||||

For more information please contact: 800-842-2252 Weekdays, 8 a.m. to 10 p.m. (ET), Saturdays, 9 a.m. to 6 p.m. (ET), or visit TIAA.org | ||||||||||||||||

The chart illustrates the performance of a hypothetical $10,000 investment on September 30, 2007 and redeemed on September 30, 2017. |  | |||||||||||||||

$ | 12,900 | |||||||||||||||

— TIAA Real Estate Account | ||||||||||||||||

The total returns are not adjusted to reflect sales charges, the effects of taxation or redemption fees, but are adjusted to reflect actual ongoing expenses, and assume reinvestment of dividends and capital gains, net of all recurring costs. | ||||||||||||||||

Properties by Type | As of 09/30/17 | Properties by Region | As of 09/30/17 | |||||||||||||

% of Real Estate Investments3 4 | % of Real Estate Investments4 | |||||||||||||||

Office | 42.4 | % | West | 40.0 | % | |||||||||||

Apartment | 21.7 | % | East | 36.3 | % | |||||||||||

Retail | 18.9 | % | South | 21.5 | % | |||||||||||

Industrial | 14.0 | % | Midwest | 2.2 | % | |||||||||||

Other | 3.0 | % | ||||||||||||||

| 3 Other properties represents interest in Storage Portfolio investment and a fee interest encumbered by a ground lease real estate investment. | |||||||||||||||

4 Wholly-owned properties are represented at fair value and gross of any debt, while joint venture properties are represented at the net equity value. | ||||||||||||||||

TIAA Retirement Annuity Accounts | ||||||||||||||||

TIAA Real Estate Account | ||||||||||||||||

Real Estate | As of 09/30/17 | |||||||||||||||

Portfolio Composition | As of 09/30/17 | Market Recap | ||||||||||||||

Investments by Type | % of Net Assets | Hurricanes Disrupt Economic Data, but Real Estate Market Conditions Remain Stable | ||||||||||||||

Real Estate Properties (Net Of Debt) | 53.7 | % | The Bureau of Labor Statistics reported that the U.S. economy added 274,000 jobs during the third quarter of 2017 as compared to 562,000 jobs during the second quarter of 2017. Several hurricanes were partially responsible for the moderation in job growth during the quarter. Labor market conditions in Florida and Texas were particularly impacted, which contributed to a loss of 33,000 jobs nationally in September. The unemployment rate continued to trend lower, ending the third quarter at 4.2%, down from 4.4% in the second quarter. Finance and professional and business services are the primary drivers of office space demand. In the third quarter, job growth moderated, but remained healthy in each sector. The financial services sector added 29,000 jobs as compared to 41,000 in the second quarter of 2017, while the professional and business services sector added 99,000 jobs as compared to 140,000 previously. CB Richard Ellis Econometric Advisors (“CBRE-EA”) reported that job growth was strong enough to support a decline in the national office vacancy rate to 12.9% in the third quarter, as compared to 13.0% in the second quarter. Vacancy rates declined in 38 of the 63 markets tracked by CBRE-EA. The national industrial availability rate edged down to 7.7% during the third quarter from 7.8% in the second quarter. CBRE-EA noted that the decline was largely driven by strong demand, and net absorption continued to outpace completions. Overall, availability rates decreased in 33 of the 64 industrial markets tracked by CBRE-EA. The national apartment vacancy rate increased for the sixth consecutive quarter on a year-over-year basis to 4.6%, as compared to 4.5% during third quarter 2016. (Year-over-year comparisons are necessary due to seasonal leasing patterns.) CBRE-EA data indicates that vacancy rates increased in 39 of the 65 apartment markets tracked, while three markets went unchanged. Market conditions are expected to continue to soften as new supply delivers nationwide. Over the next year, the supply pipeline is expected to peak and market conditions should begin to stabilize as a result. Preliminary data from the U.S. Census Bureau indicate that retail sales excluding motor vehicles and parts increased 1.0% from second quarter 2017 and 4.1% over third quarter 2016 sales. Retail market conditions have been challenged by bankruptcies and store closings, but national availability rates have generally held steady or modestly declined since 2011. However, CBRE-EA data indicate that the national retail availability rate ticked up to 10.2% in the third quarter from 10.1% previously. Note: Data subject to revision | |||||||||||||

Real Estate Joint Venture And Limited Partnerships | 23.4 | % | ||||||||||||||

Short-Term Investments | 17.3 | % | ||||||||||||||

Marketable Securities Real Estate-Related | 4.5 | % | ||||||||||||||

Loans Receivable | 1.2 | % | ||||||||||||||

Other (Net Receivable/Liability) | (0.1 | )% | ||||||||||||||

Top 10 Holdings5 | As of 09/30/17 | |||||||||||||||

% of Total Investments6 | ||||||||||||||||

Fashion Show | 3.1 | % | ||||||||||||||

1001 Pennsylvania Avenue | 3.0 | % | ||||||||||||||

The Florida Mall | 2.8 | % | ||||||||||||||

DDR | 2.3 | % | ||||||||||||||

Fourth and Madison | 1.9 | % | ||||||||||||||

501 Boylston Street | 1.9 | % | ||||||||||||||

99 High Street | 1.9 | % | ||||||||||||||

425 Park Avenue | 1.7 | % | ||||||||||||||

780 Third Avenue | 1.6 | % | ||||||||||||||

Ontario Industrial Portfolio | 1.5 | % | ||||||||||||||

5 | The top 10 holdings are subject to change and may not be representative of the Account’s current or future investments. The holdings listed only include the Account’s long-term investments. Money market instruments and/or futures contracts, if applicable, are excluded. The holdings do not include the Account’s entire investment portfolio and should not be considered a recommendation to buy or sell a particular security. | |||||||||||||||

6 | Fair Value as reported in the September 30, 2017 Consolidated Schedule of Investments. Investments owned 100% by the Account are reported based on fair value. Investments in joint ventures are reported at the net equity value on a fair value basis, and are presented at the Account’s ownership interest. | |||||||||||||||

Fashion Show is held in a joint venture with General Growth Properties, in which the Account holds a 50% interest, and is presented net of debt. As of September 30, 2017, this debt had a fair value of $431.5 million. 1001 Pennsylvania Avenue is presented gross of debt. The value of the Account's interest less the fair value of leverage is $475.4 million. The Florida Mall is held in a joint venture with Simon Property Group, L.P., in which the Account holds a 50% interest, and is presented net of debt. As of September 30, 2017, this debt had a fair value of $175.6 million. DDR Joint Venture, in which the Account holds an 85% interest, and consists of 24 retail properties located in 11 states and is presented net of debt. As of September 30, 2017, this debt had a fair value of $606.5 million. Fourth and Madison is presented gross of debt. The value of the Account's interest less the fair value of leverage is $324.8 million. 501 Boylston Street is presented gross of debt. The value of the Account's interest less the fair value of leverage is $292.5 million. 780 Third Avenue is presented gross of debt. The value of the Account’s interest less the fair value of leverage is $258.4 million. | ||||||||||||||||

Real estate investment portfolio turnover rate was 1.3% for the year ended 12/31/2016. Real estate investment portfolio turnover rate is calculated by dividing the lesser of purchases or sales of real estate property investments (including contributions to, or return of capital distributions received from, existing joint venture and limited partnership investments) by the average value of the portfolio of real estate investments held during the period. Marketable securities portfolio turnover rate was 3.5% for the year ended 12/31/2016. Marketable securities portfolio turnover rate is calculated by | ||||||||||||||||

Continued on next page… | ||||||||||||||||

TIAA Retirement Annuity Accounts | |||||||||||||||

TIAA Real Estate Account | |||||||||||||||

Real Estate | As of 09/30/17 | ||||||||||||||

dividing the lesser of purchases or sales of securities, excluding securities having maturity dates at acquisition of one year or less, by the average value of the portfolio securities held during the period. | |||||||||||||||

This material is for informational or educational purposes only and does not constitute a recommendation or investment advice in connection with a distribution, transfer or rollover, a purchase or sale of securities or other investment property, or the management of securities or other investments, including the development of an investment strategy or retention of an investment manager or advisor. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made in consultation with an investor's personal advisor based on the investor's own objectives and circumstances. | |||||||||||||||

Teachers Insurance and Annuity Association of America (TIAA), New York, NY, issues annuity contracts and certificates. | |||||||||||||||

TIAA-CREF Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., Members FINRA and SIPC, distribute securities products. | |||||||||||||||

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity and may lose value. | |||||||||||||||

THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS FOR THE TIAA REAL ESTATE ACCOUNT. PLEASE CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES, AND EXPENSES BEFORE INVESTING AND CAREFULLY READ THE PROSPECTUS. ADDITIONAL COPIES OF THE PROSPECTUS CAN BE OBTAINED BY CALLING 877-518-9161. | |||||||||||||||

A Note About Risks | |||||||||||||||

In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. | |||||||||||||||

The risks associated with investing in the Real Estate Account include the risks associated with real estate ownership including among other things fluctuations in property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. | |||||||||||||||

©2017 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 | |||||||||||||||

C272788 | |||||||||||||||