Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PetroShare Corp. | a17-23052_18k.htm |

|

|

PetroShare Corp. (“PetroShare”) cautions that this presentation (along with oral commentary that accompanies it) may contain certain forward looking-statements that involve substantial risk and uncertainties and should be read in conjunction with the Company’s filings with the Securities and Exchange Commission . All statements, other than statements of historical facts, contained in this presentation, including statements regarding estimates, forecasts, projections, expectations or beliefs as to future events and results are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “would,” “should,” “plan,” “expect,” “predict,” “could,” “potentially,” or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements and information are necessarily based on a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, technical, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, risks related to receipt of working capital, identification and acquisition of economically desirable properties, fluctuations in the market price of crude oil and natural gas, industry risks, risks related to permitting and the projected timeframes to receive the necessary permits, risks associated with crude oil operations, the construction of crude oil production operations and commencement of production and the projected costs thereof, risks related to litigation, property title, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of crude oil and natural gas resources and reserves and other risks. See PetroShare’s Form 10-K for the year ended December 31, 2016 and other filings with the Securities and Exchange Commission, under the caption “Risk Factors” for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding PetroShare. The forward-looking statements contained in this presentation speak only as of the date of this presentation and are based on information available to us as of such date and/or management’s good faith belief as of such date with respect to future events. Readers should not place undue reliance on forward-looking statements or information included herein. PetroShare undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. All forward-looking statements and information made in this presentation are qualified by this cautionary statement. Forward Looking Statements & Key Statistics Key Statistics Stock Price (10/06/17) $1.50 Shares Outstanding (10/06/17)(1) 23 MM Market Capitalization $34.5 MM Insider & Employee Holdings, est. 41.3% Senior Secured Debt $8.5MM Unsecured Convertible Notes $10MM Total Enterprise Value (09/13/17) $53 MM Proved Reserves (12/31/16) 6.3 MMBOE PV-10 (12/31/16) ~$42.8 MM(2) Excludes approximately 18.9 mm shares issuable upon exercise of options and warrants or upon conversion of convertible notes (if all notes are converted, debt would be reduced by $10 mm) SEC pricing at $42.75/BBL and $2.48/MMBtu – NYMEX 12 months trailing average |

|

|

Focused Core Wattenberg Operator Focused on a Proven Recipe for Success ~33,000 gross acres /~10,000 net core acres in a proven play |

|

|

Focus Area – Southern Wattenberg “Sweet Spot”* *Map is for illustration purposes only, is subject to change and not meant to depict exact formation boundaries and entire leasehold Primary Horizontal Targets Niobrara A Chalk Niobrara B Chalk Niobrara C Chalk Codell SS Primary Targets D&J sand vertical wells Horizontal development potential is under evaluation by other operators |

|

|

Wattenberg Focused Company with Significant Upside Focused operations in one of North America’s most economic oil and liquids rich plays ~33,000 gross acres /~10,000 net acres representing ~250 gross and ~100 net horizontal Niobrara / Codell locations Third-party operators such as PDC, Anadarko, Great Western and Ward Petroleum have proposed or permitted over 140 horizontal wells on acreage in which PetroShare has an interest, of which 17 wells have been completed and on production The majority of these permits are extended-range laterals in which PetroShare expects to participate with various working interest percentages Attractive, Low-Risk Growth Opportunities Ability to lease up additional acreage blocks within current DSU’s at accretive prices to increase working interest Focused plan to acquire acreage with geo-mechanical attributes within targeted areas of the Wattenberg and DJ Basin Vertical wellbores HBP the majority of the current acreage position Long-Standing Partnerships Provide Leasing Advantages Entered into an exclusive oil and gas leasing agreement and/or contractor agreements with land developers who own or have access to various mineral rights in the rural and residential areas allowing PetroShare to leverage its real estate and land development expertise to acquire core Wattenberg leases at attractive prices. Partnered with Providence Energy Operators (Providence), a sophisticated oil and gas industry veteran with a history of successful O&G investments, to acquire assets within the DJ Basin/Wattenberg under a 50/50 participation agreement Supportive Capital Sponsor and Conservative Financial Profile In addition to being large shareholders of PetroShare, owning ~14% of our common stock, Providence and related entities have provided PetroShare with $8.5 million in secured debt for asset development and acquisitions Low G&A with 12 full time employees and disciplined cost controls Experienced Management Team Aligned with Shareholders Members of management and the board of directors were instrumental in starting and growing Synergy Resources Corp into a $1.4 billion market cap Wattenberg player Over 110 years of collective experience in major US basins, particularly the Wattenberg Field Management and board of directors own over 40% of the company’s equity, aligning them with shareholder interests Corporate Highlights |

|

|

11/2015 Company $4.6mm IPO 3/2016 Todd Creek Farms Expansion PRHR expands footprint in Southern Wattenberg Field by leasing and tuck-in acq. 6/2016 PDC Acquisition 12/2016 Contango Acquisition (aka Crimson) 1/2017 $10mm Unsecured Convertible Notes Offering Due 12/31/18 4/2017 Morning Gun Acquisition Corporate Timeline: Track Record of Execution Since Entering the DJ Basin in May 2015 Secured strong technical team with a track record of execution Grown footprint to ~10,000 net acre focused in the Wattenberg Field Completed asset transactions with both public and private operating companies in the DJ Basin 8/2017 Concluded drilling operations on the 14 well Shook Pad Facilities and completion activities scheduled for Q4 |

|

|

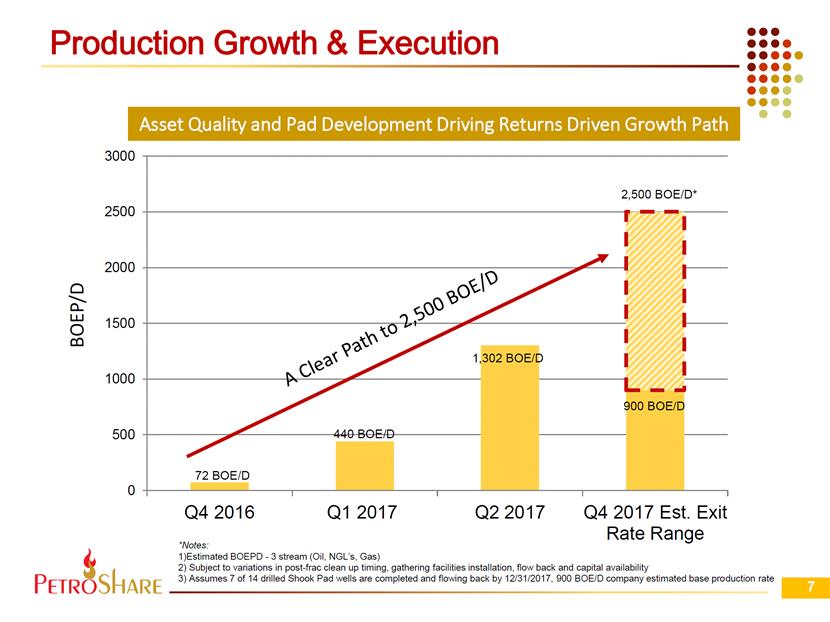

Production Growth & Execution 72 BOE/D 440 BOE/D 2,500 BOE/D* 1,302 BOE/D 900 BOE/D *Notes: 1)Estimated BOEPD - 3 stream (Oil, NGL’s, Gas) 2) Subject to variations in post-frac clean up timing, gathering facilities installation, flow back and capital availability 3) Assumes 7 of 14 drilled Shook Pad wells are completed and flowing back by 12/31/2017, 900 BOE/D company estimated base production rate A Clear Path to 2,500 BOE/D BOEP/D Asset Quality and Pad Development Driving Returns Driven Growth Path 0 500 1000 1500 2000 2500 3000 Q4 2016 Q1 2017 Q2 2017 Q4 2017 Est. Exit Rate Range |

|

|

Summary Financial Results 2Q, 2017* Revenues $4.45MM Production averaged 1,302 BOE/D EBTIDA $2.87MM Operating Income $708k Net Income (loss) ($733k) including non-cash charges *Please refer to the form 10-Q filed with the SEC on 08/14/17 for more complete financial results data for the period ending 6/30/17. |

|

|

Asset Overview |

|

|

The Wattenberg Field in the DJ Basin has emerged as one of the premier horizontal shale plays in the US Stacked Pay and Pad Development ~33,000 gross acres /~10,000 net acres representing ~250 gross and ~100 net horizontal Niobrara / Codell locations Ability to lease up additional acreage blocks within current DSU’s at accretive prices to increase working interest Potential strong returns with possible 25% to over 100% IRRs depending on zone and lateral length using the NYMEX strip(1) NYMEX strip as of 6/30/17 |

|

|

4,512 gross (1,526 net) acres Robust Operated and Non-operated Horizontal Drilling and Permitting Activity Approx. 116 Gross Non-Op WI Locations are Fully Permitted or in the Final Permitting Stages Todd Creek Farms Focus Area – Southern Core Area Ward Riverdale Pad 1 Non-operated Standard-Range Lateral Well In Production (11 Wells Permitted On Pad) Approx. 11% WI net to PetroShare Riverdale #15-2 Codell HZ 542 BOED 90 Day Average Production Rate PetroShare Operated Corcillius Pad 44.0% WI (34.1% NRI) up to 12 Wells Permitted or Proposed – (3) Codell, (3) Niobrara B, (3) Niobrara C, (3) Niobrara A PDC Jacobucci Pad 14 Non-operated Mid-Range Lateral Wells In Production 8% to 27% WI 14 Wells – (6) Codell, (3) Niobrara B, (5) Niobrara C Great Western Marcus / Baseline Pad 2 Non-operated Extended-Range Lateral Wells in Production (24 Wells Permitted or Proposed) 11% to 15% WI net to PetroShare Marcus LL #11-379 Niobrara B bench 639 BOED* Marcus LL #11-380 Niobrara A bench 645 BOED* *90 Day Average Production Rates PetroShare Operated Shook Pad Drilled, Cased & Cemented 45.0% WI (38.0% NRI) 14 Wells Permitted – (6) Codell, (4) Niobrara B, (2) Niobrara C, (2) Niobrara A Great Western Ocho & Kortum Pad Up to 22 Extended-Range Lateral Wells Per Pad |

|

|

South Brighton Focus Area – Southern Core Area PetroShare’s Operated Brighton Lakes Pad ~26% WI Permits Pending 8 Extended-Range Horizontal Wells – (2) Codell, (3) Niobrara B, (2) Niobrara C, (1) Niobrara A Ward Petroleum Anderson Pad #19-1 IP 90 = 542 bopd / 405 mcfd #18-3 IP 90 = 420 bopd / 538 mcfd Great Western 40 Well Pad 5,015 gross (2,030 net) acres Increasing Horizontal Development and Permitting Activity Confluence DJ LLC 10 Well Pad Permitted PRHR ~25% WI Kerr McGee (Anadarko) 20 Well Pad |

|

|

Northern Wattenberg Focus Area Approx. 840 Net Acres with up to 36 potential gross Horizontal Niobrara & Codell Locations (based on 12 wells per XRL drilling spacing unit*) Actively Developing Area by major Wattenberg Operators, including Noble Energy Existing Gathering Infrastructure Thick Niobrara B & C Pay Zones Potential Drilling Spacing Units *The number of net wells will vary depending the size of the drilling spacing units and permits issued |

|

|

Runway Focus Area – Southern Core Area Over 5,000 Net Acres in the Southern DJ Basin Approx. 40 Gross (14 net) Vertical D&J Sand Locations Identified Extensive Hydrocarbon Saturation in Tight Sand Reservoirs Access to New 3D Seismic Data to Determine Additional Low Risk Infill Locations Existing Gathering Infrastructure Horizontal Development Potential Leases mostly Held by Production from Vertical Wells |

|

|

Rates of Return and Capital Expenditures |

|

|

Team Focused on Sensitivity to Service Price & CAPEX Escalation * ROR% based on a $6.50/bbl discount from WTI prices, CIG natural gas value based on 18:1 to WTI, and NGL’s at 40% of WTI Potential IRR Stagnation $50 to $58/bbl WTI Oil < $50/bbl SRL = $3.0 MM D&C MRL’s = $3.5 MM D&C Oil > $50/bbl (20% increase in costs) SRL = $3.6 MM D&C MRL’s = $4.2 MM D&C 0 20 40 60 80 100 120 140 160 180 200 30 35 40 45 50 55 60 65 70 75 ROR (%) NYMEX Oil Price ($/ bbl ) PetroShare Area Horizontal Wells - ROR vs NYMEX Oil Codell Standard Lateral Codell Intermediate Lateral Niobrara Standard Lateral Niobrara Intermediate Lateral |

|

|

Economic Metrics – 2017 Estimated Finding and Development Costs Mono-bores and Longer Laterals are Key to Improving F&D * Reserves estimates are based on historical area averages and spud to rig release drilling times based on actual results of recently completed wells in non-operated drilling programs in which PetroShare has participated & PetroShare’s non-operated Shook Program Standard-Range Laterals (1 Mile) Mid-Range Laterals (1.5 miles) Extended-Range Laterals (2 miles) Target Zone Exposure (feet) 4,400’ 6,900’ 9,000’ Spud to Rig Release 3 to 5 days 4 to 6 days 8 to 12 days CAPEX ($MM) $3.6 $4.2 $5.2 Codell Type Curve EUR (MBOE)* 453 728 907 Codell F&D ($/BOE) $7.95 $5.77 $5.73 Niobrara Type Curve EUR (MBOE)* 333 535 622 Niobrara F&D ($/BOE) $10.81 $7.85 $8.36 |

|

|

Capital Expenditures and Growth Activities 2017* *All non – operated activities are at sole discretion of the well operator, and operated capex is subject to availability of adequate capital Q1 2017 Production began on 14 gross (2.5 net) non-operated mid-range horizontal wells on Jacobucci Pad PetroShare non-op working interest ranging from approx. 8% to 27% Q2 2017 Commenced drilling operations of PetroShare’s operated 14 gross (6.3 net) horizontal well Shook Pad Pursued “tuck-in” acquisition and acreage swaps to consolidate acreage blocks Q3 2017 Pursuing spacing and permitting activities on additional PetroShare operated drilling blocks Evaluate new non-op well proposals as received Participate in additional non-operated horizontal wells in Todd Creek Farms Q4 2017 Re-permitting Corcillius Pad to increase well count to enable more efficient leasehold development Initiate facilities construction and completion activities of PetroShare’s operated 14 gross (6.3 net) horizontal well Shook Pad Evaluate additional non-op well proposals as received Pursue “tuck-in” acquisition and acreage swaps to consolidate acreage blocks Evaluate reserve-backed borrowing base for increased financial flexibility |

|

|

Key Summary Highlights Wattenberg Focused Company with Significant Upside Attractive, Low-Risk Growth Opportunities Long-Standing Partnerships Provide Leasing Advantages Supportive Capital Sponsor and Conservative Financial Profile Experienced Management Team Aligned with Shareholders |

|

|

Appendix |

|

|

Management Team Bill Conrad, Chairman Over 20 years of experience as an executive or director of oil and gas companies Former director of Synergy Resources Corporation, a publicly traded oil and gas company, with securities listed on the NYSE MKT Chairman of the Board of Gold Resource Corporation, (“GORO”) a publicly traded gold mining and exploration company with securities listed on the NYSE MKT Stephen Foley, CEO Mr. Foley has served as the Chief Executive Officer of PetroShare since its inception in 2012 15 years of experience in property investment and real estate development in Colorado 11 seasons as a safety with the Denver Broncos football organization (’76-’86) Frederick Witsell, President Over 35 years of experience in several facets of the oil and gas industry, including geoscience, prospect development, conventional and horizontal drilling and completion operations, project management, gathering and compression systems and marketing and risk management Served as an executive and co-founder of a series of small, privately-funded oil and gas companies with properties in North Dakota, Wyoming, Utah and Colorado William Lloyd, Executive VP of Engineering, Chief Operating Officer Over 35 years of experience, leading operations for extensive drilling and completion programs in the Rocky Mountains, California, Norway and Alaska, which included a record horizontal well, the longest Extended Reach well and the largest ice road construction and exploration drilling program Most recently served as Senior VP of Operations for a successful private Rocky Mountain Oil and Gas Company with divestitures in excess of $500MM |

|

|

Paul Maniscalco, CFO Over 20 years of senior management experience in auditing, accounting and financial reporting Former interim Chief Financial Officer of Earthstone Energy Inc. and former interim Chief Financial Officer of GeoPetro Resources Company William Givan, Executive Vice President of Land Over 35 years of experience, in all facets of land work, administration and business development. Most recently served as Senior Land Manager for a successful private Rocky Mountain Oil and Gas Company with over 1.0 million acres under management Jon Kruljac, Executive Vice President - Capital Markets & Investor Relations 32 years of Wall Street experience, with a focus on small-cap oil and gas companies since 1991 as an institutional salesman, investment banker, and investor relations consultant Most recently served as Vice President of Capital Markets and Investor Relations with Synergy Resources Corporation Management Team |