Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - PetroShare Corp. | ex32.htm |

| EX-31.1 - EXHIBIT 31.1 - PetroShare Corp. | ex31x1.htm |

| EX-31.2 - EXHIBIT 31.2 - PetroShare Corp. | ex31x2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ to ___

Commission File Number 333-198881

PETROSHARE CORP.

(Exact name of registrant as specified in its charter)

|

Colorado

(State or other jurisdiction of incorporation or organization)

|

46-1454523

(I.R.S. Employer

Identification No.) |

7200 S. Alton Way, Suite B-220

Centennial, Colorado 80112

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number including area code: (303) 500-1160

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§203.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference into Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ý

As of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, there were 10,998,191 shares outstanding and held by non-affiliates of the registrant. As of that date, there was no public trading market for the registrant’s common stock.

Indicate the number of shares outstanding of each of the Registrant’s classes of common equity, as of the latest practicable date:

|

Class

|

Outstanding as of March 28, 2016

|

|

|

Common Stock, $0.001 par value per share

|

21,728,191

|

Documents incorporated by reference: None

TABLE OF CONTENTS

|

PART I

|

||

|

|

|

|

|

|

|

|

|

PART II

|

||

|

|

|

|

|

|

|

|

|

PART III

|

||

|

|

|

|

|

|

|

|

|

PART IV

|

||

|

|

|

|

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENTS SCHEDULES | 65 |

2

PART I

Please see Cautionary Language Regarding Forward-Looking Statements on page 20 of this report for important information contained herein.

Please see page 33 for a glossary of certain terms used in this report.

ITEM 1. BUSINESS

History and Organization

PetroShare Corp. (“we,” “our,” or “us”) is an independent oil and natural gas company, which was organized to investigate, acquire and develop crude oil and natural gas properties in the Rocky Mountain or mid-continent region of the United States and produce oil, liquids and/or natural gas from those properties. Currently, all of our properties are located in Colorado. As of March 29, 2016, we had an interest in two gross (0.5 net) wells and 3,099 gross (651 net) acres of oil and gas properties, most of which was undeveloped.

We completed our initial public offering (“IPO”) in November 2015 at $1.00 per share and received gross proceeds of $4,174,000. We raised additional capital pursuant to a private placement of our common stock in December 2015 and January 2016 for gross proceeds of $120,000. We used the initial IPO and private placement funds to acquire additional acreage in our Todd Creek Farms prospect, pay our general and administrative costs, and increase our working capital. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for more information.

We were incorporated under the laws of the State of Colorado on September 4, 2012. We maintain a website at www.petrosharecorp.com. We became an SEC reporting company in February 2015, when a registration statement for our common stock was declared effective. You may access and read our SEC filings through the SEC’s website at www.sec.gov.

Our executive and administrative offices are currently located at 7200 South Alton Way, Suite B-220, Centennial, CO 80112, where we lease approximately 1,400 square feet.

Developments During 2015

During the fiscal year ended December 31, 2015, we continued to execute our plans to grow the Company by acquiring an acreage position in our Todd Creek farms prospect, on which we expect to begin drilling operations in the first quarter of 2017. We also completed our IPO, raising $4,600,000 before offering expenses and commissions and shares of our common stock began trading on the OCTQB of OTCLink under the symbol “PRHR.” Our offering provided us capital for drilling and leasing activity as well as our general and administrative expenses. During the latter half of 2015, we conducted additional fracture stimulation of our Buck Peak wells. However, the fracture stimulation thus far has not provided the increased production we had hoped for and we took both wells off-line for the winter on December 15, 2015, with the expectation of bringing both wells on-line in the second quarter of 2016.

Oil and Gas Properties

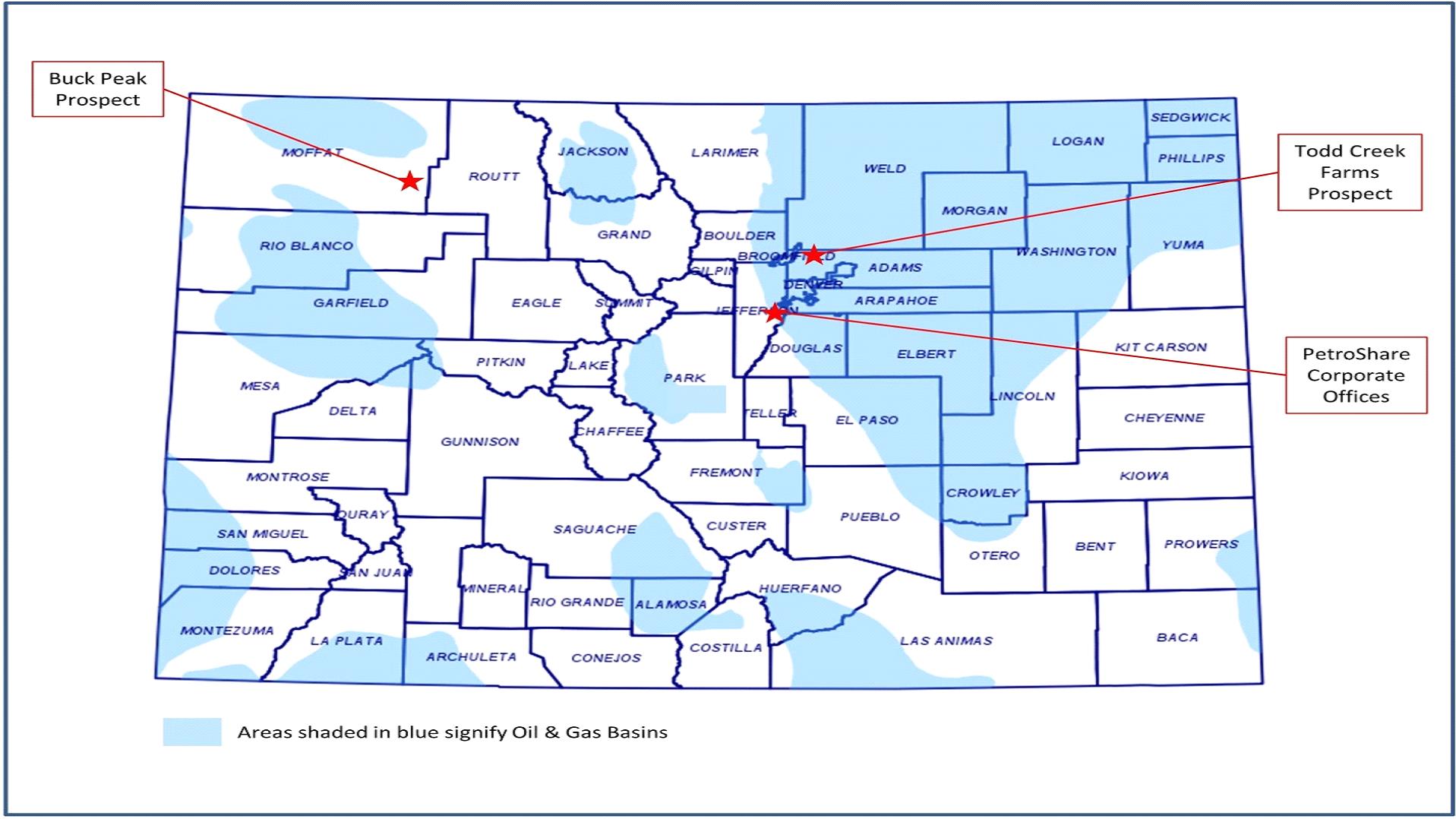

We currently have interests in two crude oil and natural gas prospects: (i) our prospect in Moffatt County, Colorado, in the northwest portion of the State, which we refer to as the Buck Peak prospect, and (ii) our prospect in Adams County, Colorado in the northeast portion of the State, which we refer to as the Todd Creek Farms prospect. The Todd Creek Farms prospect is located within the Wattenberg Field, which is a part of the Denver-Julesburg Basin (“DJ Basin”). The DJ Basin generally extends from the Denver metropolitan area throughout northeast Colorado into parts of Wyoming, Nebraska, and Kansas. Below is a map depicting the location of our prospects, as well as our corporate headquarters:

3

Our primary target in both prospects is the Niobrara formation. The Niobrara formation is a calcareous shale rock formation varying from approximately 200 to 1,500 feet in thickness and extending from Canada to New Mexico, but the vast majority of the oil and natural gas concentration is in Colorado and Wyoming. The formation generally slopes downward from east to west, from Kansas to western Colorado, from depths of approximately 1,500 feet to 12,000 feet below the surface. In our Todd Creek Farms prospect, we also intend to target the Codell formation, which is an oil and natural gas producing tight sandstone formation generally found at depths of approximately 7,000 to 8,000 feet below the surface and is located at the base of the Niobrara – Fort Hays limestone member. Oil and natural gas companies have been producing resources from the Niobrara and Codell formations for over 40 years, but horizontal drilling techniques and hydraulic fracturing have only recently opened up increased production opportunities in the Niobrara and Codell formations.

The Wattenberg Field is located in the DJ Basin and covers more than 2,000 square miles in Colorado between the cities of Denver and Greeley. The majority of the Wattenberg Field lies in Weld County, but reaches into Adams, Arapahoe, Boulder, Broomfield, Denver, and Larimer Counties. Discovered in 1970, and historically a gas field, the Wattenberg Field now produces both crude oil and natural gas primarily from the Niobrara and Codell formations. Advanced horizontal drilling techniques and hydraulic fracturing have unlocked increased production potential within the Wattenberg Field’s tight sands. According to the Colorado Oil and Gas Commission’s records, the Wattenberg Field had in excess of 24,000 producing wells operating in 2015, producing 89,964,666 barrels of oil and 515,953,429 Mcf of gas for the year. According to the U.S. Energy Information Administration’s statistics, the Wattenberg Field ranked fourth in the top U.S. oil fields and ninth in the top U.S. gas fields as of December 31, 2013.

A majority of our leaseholds are held under “paid-up” fee leases. All of the acreage is held by oil and natural gas leases with varying expiration dates, some with options to extend ranging from one to five years, and landowner and other royalties and burdens ranging from 20 to 22-1/2%. A majority of our Buck Peak leases are held by current production and/or drilling and completion efforts and are burdened with total royalties of approximately 21%.

4

Our leases can be held indefinitely by commercial production. Unless production is established within the area covering our undeveloped acreage, the leases for such acreage eventually will expire. Our leases not held by production are scheduled to expire, including potential extensions, from 2016 until 2020. If our leases expire in an area we intend to explore, we or our working interest partners will have to negotiate the price and terms of lease renewals with the lessors. The cost to renew such leases may increase significantly and we may not be able to renew the lease on commercially reasonable terms, or at all.

As of December 31, 2015, we had no proved reserves.

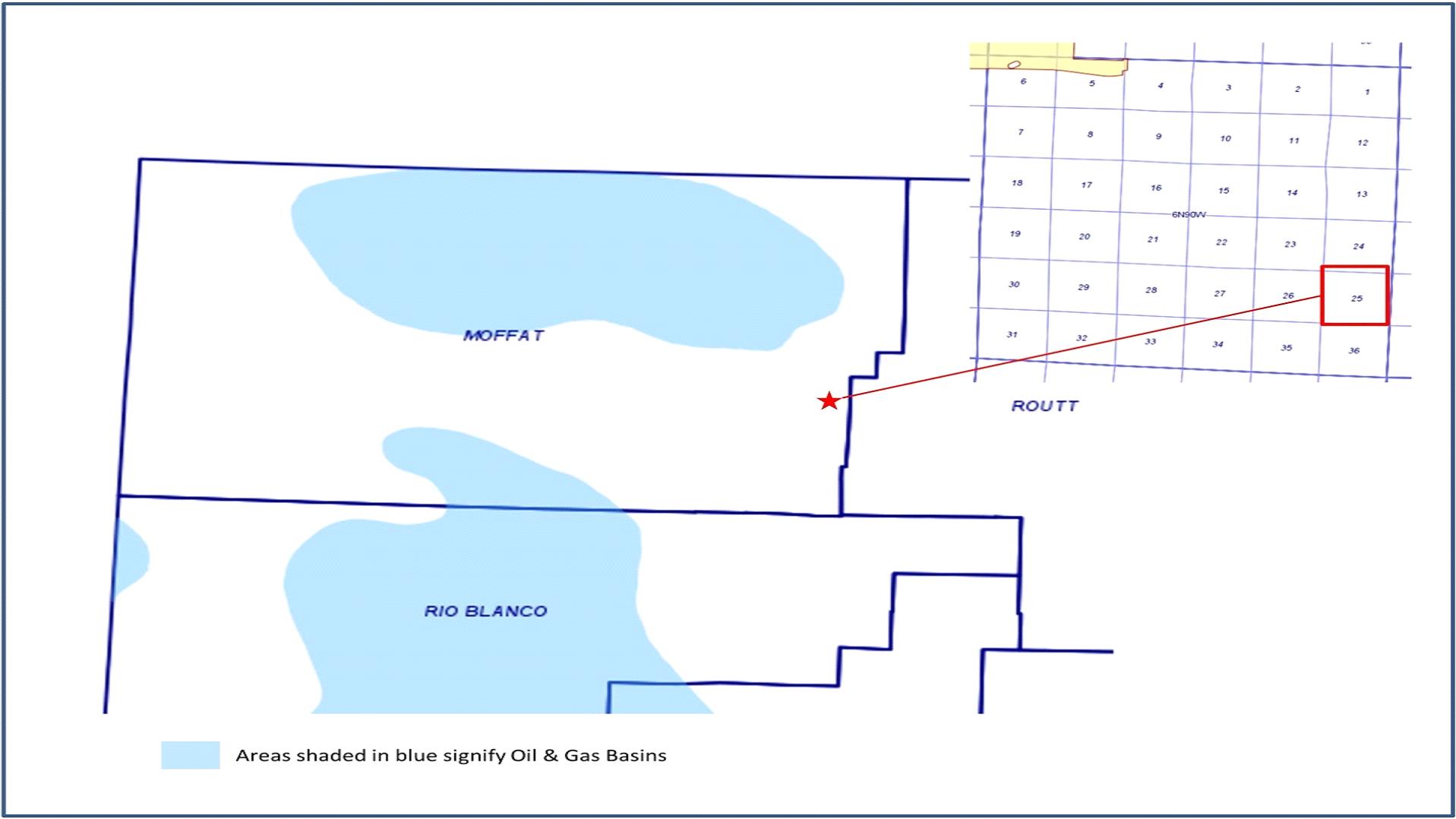

Buck Peak Prospect

On April 30, 2013, we completed the acquisition of our Buck Peak prospect. The prospect consists of interests in various parcels totaling approximately 7,500 gross acres, of which we acquired approximately 1,000 net acres. We paid $565,310 in cash and issued 67,000 shares of our common stock valued at $67,000 for this acreage. We paid the entire purchase price from our working capital. Our largest working interest position is concentrated in one 672-acre section located at what we believe to be the crest of the Buck Peak Field structural feature. That is where the two drilled wells, described below, are located.

Below is a map depicting the location of our Buck Peak prospect:

5

In 2013 and 2014, we successfully drilled, cased, and completed two wells on the Buck Peak prospect. In an effort to diversify our risk and preserve working capital, we sold a majority of the working interest in those wells and currently own a 25% working interest. We are the operator of the wells pursuant to participation agreements and standard form AAPL Form 610 Operating Agreement with our working interest partners. Three other companies, not affiliated with us, own the remaining working interests.

After completing fracture stimulation on some of the lower Niobrara zones, we placed the first well on production on November 26, 2014 and put the second well on production on December 12, 2014. We have completed the installation of permanent surface production facilities for both wells and have weatherproofed the pipes and equipment. During the third quarter of 2015, we fracture stimulated the upper zones of both wells. As of December 2015, one well was producing at a rate of approximately four bbls of oil per day and we were still analyzing the post-fracture stimulation results of the other well. To date, the fracture stimulations have not led to better production or improved operations.

On December 15, 2015, we took the Buck Peak wells offline for the winter months in order to avoid paying excessive operating costs. We expect to bring the wells back on-line during the second quarter of 2016, weather permitting. As of December 31, 2015, we have generated only nominal revenue related to the sale of oil from the Buck Peak prospect.

Oil produced from the Buck Peak wells is stored in tank batteries located onsite and transported by truck for sale at existing spot prices. The availability of a ready market for our oil and gas depends upon numerous factors beyond our control, including the extent of domestic production and importation of oil and gas, the relative status of the domestic and international economies, the proximity of our properties to gas pipeline systems, the capacity of those systems, the marketing of other competitive fuels, fluctuations in seasonal demand, and governmental regulation of production, refining, transportation, and pricing of oil, gas, and other fuels.

Currently, management has determined that further exploration in the Buck Peak prospect area is uneconomic because of the downturn in oil prices over the past several quarters and the nominal production rate of the initial two wells. However, we will maintain the majority of our interests in the prospect area through the terms of the existing leases and will continue to monitor oil prices and the production rates of our wells to determine their impact on further potential exploratory and drilling activities in that area.

We have additional minor working interests (less than 10%) in acreage that is governed by a joint operating agreement designating Southwestern Energy as successor to Quicksilver Resources, Inc. and/or SWEPI LP as the operator. We expect that most, if not all, of these leases will be allowed to expire. Under the provisions of this agreement, Southwestern is the operator and is permitted to propose one or more wells on the acreage covered by the agreement, following which we would be permitted to participate at our election on any acreage which we retain. If we elect to participate, we would be required to pay our proportionate share of the costs and expenses, and would be entitled to a proportionate share of any production from those wells. No wells have been proposed by Southwestern under this agreement as of the date of this report.

Todd Creek Farms Prospect

In November 2014, we entered into a services agreement with Kingdom Resources, LLC (“Kingdom”), a local lease broker affiliated with a local mineral interest owner. This agreement led to our acquisition in May 2015 of an oil and gas lease covering 1,280 gross (333 net) undeveloped acres, which we refer to as the Kingdom Lease, in the Wattenberg Field of northeast Colorado. This property is located approximately five miles northeast of Thornton, Colorado. The Kingdom Lease covers a primary term of five years, beginning on November 24, 2014 and required us to pay to Kingdom $785,630. Kingdom conveyed to us an 80% net revenue interest in the acreage after accounting for landowner and other royalties.

6

Below is a map depicting the location of our Todd Creek Farms prospect:

Also, in May 2015, we entered into a participation agreement with Providence Energy Operators, LLC (“Providence”). The participation agreement assigned Providence the option to acquire a 50% interest in the Kingdom Lease and permits Providence to acquire and participate in any oil and gas development on the Kingdom Lease and other potential leases that may be acquired within an area of mutual interest at its pro rata interest (the “AMI”). The AMI covers an area in Adams County, Colorado containing all of Township 1 South, Range 67 West, consisting of approximately 23,100 gross acres with an additional one mile border around the defined AMI area, plus any other mutually agreeable areas. Upon Providence’s election to participate in a lease acquisition, it is obligated to pay its pro rata share of any lease acquisition costs, including those for the Kingdom Lease, and any expenses necessary to maintain the lease, less a one-time credit extended by us in the amount of $105,000. The participation agreement also contemplates that we would enter into a joint operating agreement with Providence and any proposed operator of the acreage to develop the Kingdom Lease and any additional acreage we acquire in the AMI. The participation agreement grants to Providence the option to participate in any well drilled on the Kingdom Lease on a pro rata basis. Providence exercised its option under the participation agreement to acquire a 50% interest in the Kingdom Lease, effective June 1, 2015, which had the effect of reducing our position in the Kingdom Lease to approximately 171 net acres.

In connection with our acquisition of the Kingdom Lease, we expect to participate as a working interest partner with Providence and owners of other interests in various drilling spacing units, as we intend to retain no more than a 50% working interest in any wells drilled in the Todd Creek Farms prospect. In October 2015, we initiated permitting activities for all of Section 10 on our Todd Creek Farms prospect. Submission of permits are pending receipt of a final surface use schedule from landowners. In October 2015 we submitted an application to space the West half of Section 10 on the Todd Creek Farms prospect. Since that time we have received approval for that 320 acre spacing unit. In January 2016 we submitted an application for spacing on the 400 acres on the east half of Section 10 and a minor portion of Section 3. This application for spacing has subsequently been approved. Upon final permitting approval, we intend to operate the initial wells drilled on this acreage.

7

We also have begun preliminary discussions with entities we believe would be interested in becoming working interest partners with us with the hope of commencing drilling activities in the first quarter of 2017. We expect to pay for the future drilling program through existing working capital, proceeds from our public and private offerings, our line of credit, and/or the sale of additional working interests.

We are currently in negotiation with an independent third party pursuant to a non-binding letter of intent executed on January 16, 2016 to acquire approximately 300 net acres and one producing well within the east half of Section 10 in our Todd Creek Farms prospect area.

Competitive Advantages

We believe we have certain competitive advantages that set us apart from our competitors in the oil and gas industry, including:

Experienced management and technical team. Our management team has significant experience in finding and developing oil and natural gas. We believe that the strength of our team is its unique relationships with real estate land developers in our areas of focus and our singular geographic focus.

Advanced seismic image processing. Commercial improvements in 3-D seismic data imaging and the development of advanced processing algorithms, including pre-stack depth, beam, and reverse time migration have allowed the industry to better distinguish hydrocarbon traps and identify previously unknown prospects. Specifically, advanced processing techniques improve the definition of the seismic data from a scale of time to a scale of depth, thus correctly locating the images in three dimensions. Our technical team has significant experience utilizing advanced seismic image processing techniques in our area of concentration.

Long-term relationships with industry leading E&P companies. Our management has long-term relationships with multiple exploration and production (“E&P”) companies we believe may have an interest in participating with us, or selling us properties by direct purchase or through farm-in or farm-out arrangements of future wells to be drilled. The reputation of our management team and the compelling characteristics of our prospects in terms of size, geology and potential for attractive economic returns in the current commodity price environment, should present opportunities for jointly exploiting our prospects with industry leading E&P companies.

Lease and Acquisition Strategy

Our prospect identification and analytical approach is based on a thorough understanding of the geologic trends within our focus areas. Our exploration, development and production efforts have been focused in areas where lease acquisition opportunities are available. Our industry network and experience coupled with integration of existing geologic and engineering understanding provides us with unique perspectives on existing producing areas and underexplored formations prospective for hydrocarbon production.

We have acquired leases covering approximately 3,099 gross acres (approximately 651 net acres) and we will evaluate additional sources of growth opportunities with companies that hold active leases in our focus area. Our leases have a 5 year primary term, expiring between 2016 and 2020. We intend to acquire additional leases by lease sale, farm-in, or purchase. As is consistent with a prudent and successful exploitation and development approach, we believe that additional seismic acquisition, processing, and/or interpretation may become highly advantageous, in order to more precisely define the most optimal drillable location(s).

Drilling and Other Exploratory and Development Strategies

Our plan is to initiate operations on our own property base and attempt to enter into farm-in and farm-out arrangements with other oil and gas companies with established operating capabilities. Our goal is to diversify risk and minimize capital exposure to development, drilling and completion costs. In any drilling, we expect that our retained working interest will be adjusted based upon factors such as well costs and geologic and engineering risk.

8

Early monetization of a discovered asset or a portion of a discovered asset is an option for us as a means to fund development or additional exploitation projects as an alternative to potential equity or debt offerings. However, if a reasonable value were not received from the market at the discovery stage, then we may elect to retain (subject to lease terms) the discovery asset undeveloped, until a reasonable offer is received in line with our perceived market value of the asset, or we may elect to seek development partners on a promoted basis in order to substantially reduce capital development requirements. We may also evaluate and seek to acquire producing properties that have a strategic relationship to our focus area.

We expect that any drilling activities on our Todd Creek Farms prospect will not commence until the first quarter of 2017, at the earliest and is subject to the Company receiving all the necessary drilling and construction permits.

Governmental Regulation

The production and sale of oil and gas is subject to various federal, state, and local governmental regulations, which may be changed from time to time in response to economic or political conditions. Matters subject to regulation include discharge permits for drilling operations, drilling bonds, reports concerning operations, the spacing of wells, noise, unitization and pooling of properties, taxation and environmental protection. Many laws and regulations govern the location of wells, the method of drilling and casing wells, the plugging and abandoning of wells, the restoration of properties upon which wells are drilled, temporary storage tank operations, air emissions from flaring, compression, the construction and use of access roads, and the disposal of fluids used in connection with operations. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. Changes in these regulations could have a material adverse effect on our company.

The failure to comply with any such laws and regulations can result in substantial penalties. In addition, the effect of all these laws and regulations may limit the amount of oil and gas we can produce from our wells and may limit the number of wells or the locations at which we can drill. Although we believe we are in substantial compliance with current applicable laws and regulations relating to our oil and natural gas operations, we are unable to predict the future cost or impact of complying with such laws and regulations because such laws and regulations are frequently amended or reinterpreted.

As the operator of Buck Peak prospect and the proposed operator of the Todd Creek Farms prospect, we are responsible for obtaining all permits and government permission necessary to operate the property. We must obtain permits for any new well sites and wells that are drilled.

In February 2013, the Colorado Oil & Gas Conservation Commission (“COGCC”) passed extensive rule changes providing perhaps the most stringent oil and gas regulations in the country, including statewide requirements, commonly known as setbacks, from wells and production facilities, to various structures. In addition, certain Colorado cities, including Fort Collins, Boulder, and Lafayette, have voted to ban hydraulic fracturing but most of these local ordinances have been overturned by the district courts. Currently, two cases brought by the Colorado Oil and Gas Association (COGA) are pending before the Colorado Supreme Court challenging the drilling ban in Lafayette, Colorado and the hydraulic fracturing moratorium in Fort Collins, Colorado.

At one time in 2014, there were several proposed ballot initiatives that could have subjected the oil and gas industry to even greater restrictions and regulatory uncertainty and these initiatives may be revived in the future. The ballot initiatives included statewide setback distances greater than those currently mandated by the COGCC, as well as proposals for local government control of oil and gas operations. In exchange for an agreement withdrawing these potential ballot initiatives, Governor John Hickenlooper appointed an oil and gas task force to study the issues and make recommendations regarding any additional regulation. The recommendations from the task force included proposals to give local governments more input into decisions of the COGCC. On January 25, 2016, the COGCC approved new rules enhancing local government participation in locating and planning for large scale oil and gas operations. The COGCC defined large scale facilities as (i) any location that proposes eight new horizontal, directional, or vertical wells, or (ii) cumulative hydrocarbon storage capacity of 4,000 bbls or more, which are located within an urban mitigation area as defined by COGCC rules. The new COGCC rules also include additional notice and consultation requirements for operators when planning such large scale facilities.

9

Management does not believe that these new large scale facilities regulations will impact us during the year ended December 31, 2016 because our current well sites do not meet the definitions of large scale facilities and we do not anticipate having more than eight wells or storage capacity of greater than 4,000 bbls prior to the end of the current fiscal year.

Three proposed ballot initiatives for the 2016 ballot, and aimed at oil and gas production, currently remained filed with the Colorado Secretary of State. These ballot initiatives include proposals for a mandatory setback of 2,500 feet for new oil and gas facilities from occupied structures and provide local governments with the primary authority over oil and gas operations within their boundaries.

On March 22, 2016, the Adams County Board of County Commissioners approved amendments to the county’s oil and gas regulatory process, which ended a temporary drilling moratorium previously imposed. The new regulations include an enhanced administrative review process for operators that share a Memorandum of Understanding (MOU) with Adams County, including a site-specific review of any oil and gas permit application. The regulations also require compliance with an Administrative Use by Special Review (“USR”) approval process for oil and gas facilities governed by an MOU between the operator and Adams County. This approval process includes increased notice and submittal requirements. The USR process will consist of a six-week administrative review of the application by the county and appropriate agencies. The application can be approved, approved with conditions, denied or referred to the Board of County Commissioners for a public hearing. If denied, the applicant can appeal to the Board of County Commissioners. Effective March 23, 2016, we have instructed our permitting agent to commence the application for a USR.

The above newly enacted regulations in Adams County and any additional regulations that may result from the referenced ballot initiative efforts may delay our drilling activities and increase our costs of development and production and limit the quantity of oil and gas that we can economically produce to the extent that we use hydraulic fracturing.

Competition

The oil and natural gas industry is highly competitive. Our competitors and potential competitors include major oil companies and independent producers of varying sizes which are engaged in the acquisition of producing properties and the exploration and development of prospects. The majority of our competitors have greater financial, personnel and other resources than we do and therefore have greater leverage with respect to acquiring prospects and producing oil and natural gas. We believe a high degree of competition in this industry will continue for the foreseeable future.

Intense competition in the industry is not limited to the acquisition of oil and natural gas properties but also extends to the technical expertise to find, advance, and operate such properties, the labor to operate the properties, and the capital for the purpose of funding such properties. Our inability to compete with other companies for these resources may have a material adverse effect on our results of operation and business.

Employees

We currently have four employees, including our Chief Executive Officer, President, and Chief Operating Officer. Our Chief Financial Officer serves in his role as an independent contractor. We also engage a number of other independent contractors and consultants to supplement the services of our employees, including geologic, reservoir and facilities engineers, drilling contractors, attorneys, and accountants. We believe our relations with our employees and vendors are outstanding.

Company Facilities

Our executive and administrative offices are currently located at 7200 South Alton Way, Suite B-220, Centennial, CO 80112, where we lease approximately 1,400 square feet. Rent is payable at the rate of $2,151 per month for a term which extends until June 2016. We believe this space is adequate for our needs for the foreseeable future.

10

ITEM 1A. RISK FACTORS

Risks Related to Our Business and Financial Condition

Since we are a new business with limited operating history, investors have no basis to evaluate our ability to operate profitability. We were incorporated in September 2012 and have generated only nominal revenue related to the sale of crude oil collected during our testing and production efforts to date. Our activities to date have been limited to organizational efforts, assembling a management team, raising capital, researching, and developing our business plan, completing the acquisition of our two properties, and commencing our first drilling program. We face all of the risks commonly encountered by other new businesses, including the lack of an established operating history, need for additional capital and personnel, and competition. There is no assurance that our business will be successful or that we can ever operate profitably. We may not be able to effectively manage the demands required of a new business in our industry, such that we may be unable to successfully implement our business plan or achieve profitability.

We have essentially no cash flow and are dependent on achieving profitable operations and receipt of additional working capital to fund continued development and implementation of our business plan, and our failure to obtain this capital may cause the partial or total loss of your investment. Significant amounts of capital are required for companies to participate in the business of exploration for and development of oil and natural gas resources, and many companies that are engaged in this business are significantly better capitalized than us. In addition to funds required for the acquisition and development of additional acreage, we will require additional capital to pay our administrative expenses, including salary and rent. Adverse developments in our business or general economic conditions may require us to raise additional financing at prices or on terms that are disadvantageous to existing shareholders. We may not be able to obtain additional capital at all and may be forced to curtail or cease our operations. We will continue to rely on equity or debt financing and the sale of working interests to finance operations until such time, if ever, that we are profitable. The inability to obtain necessary financing may adversely impact our ability to develop our properties and to expand our business operations.

Since we have no reserves at this time, our shareholders cannot be assured that we will have any cash flow in the future. As of December 31, 2015, we had no proved reserves expected to be recovered from our Buck Peak prospect, where we historically invested our capital resources, and are still in the early development stage of our Todd Creek Farms prospect. Even with new technology such as 3D seismic and other exploration techniques, oil and natural gas exploration is a high risk undertaking. As a result, investors have no assurance that we will have any cash flow.

We may be unable to meet our obligations under our line of credit and any default by us may cause us to forfeit all or a portion of our properties. In May 2015, we entered into a line of credit agreement with a third-party creditor, under which we are permitted to borrow up to $5,000,000. The line of credit is secured by certain of our assets and oil and gas interests, including the Kingdom Lease. We are required to pay the entire balance of any amounts borrowed, including accrued interest, no later than June 1, 2018. As of March 28, 2016, we have approximately $1.1 million plus accrued interest outstanding against our line of credit. Our ability to repay the line of credit is dependent on our ability to generate sufficient revenue from operations. If we are unable to make payments in accordance with the terms of the line of credit, our creditor may declare the loan in default, which may result in the loss of some or all of our properties.

Our line of credit contains various covenants which, if not complied with, could accelerate our repayment obligations, thereby materially and adversely affect our liquidity, financial condition, and ability to remain in business. The agreement governing our line of credit requires us to comply with certain financial and operational covenants so long as the loan is outstanding. These covenants prohibit us from, among other things, incurring additional indebtedness or making loans to any third party, other than trade debt incurred in the ordinary course of business and selling, leasing, or otherwise disposing of any material assets in excess of $100,000 in any calendar year. Our continued compliance with these covenants depends on many factors and could be impacted by current or future economic conditions, and thus there are no assurances that we will continue to comply with these covenants. Failure to comply with these covenants could result in a default which, if we were unable to obtain a waiver from our creditor, could accelerate our repayment obligations under the line of credit and thereby have a material adverse impact on our liquidity, financial condition, and ability to remain in business.

11

Our substantial investment in a limited number of prospects and lack of diversification will increase the risk to investors that we may not be profitable. Our investment in the Buck Peak and Todd Creek Farms prospects and the capital required to pay our share of drilling and production costs increases the risk that the operation of our business may not be profitable, as we will not be able to spread the risk of investment and operation over a number of different assets until we become profitable or receive additional investment. If one or both of the wells at the Buck Peak prospect is not successful in producing commercially viable amounts of oil and/or natural gas, or if the Todd Creek Farms prospect is not economic, our business may suffer and you may lose all or part of your investment.

If the Todd Creek Farms and Buck Peak prospects are not commercially productive of oil or natural gas, any funds spent on exploration and production may be lost. All of our current capital investment is tied up in the Todd Creek Farms and Buck Peak prospects. Since the Buck Peak prospect is in the early production stage and has had very limited production to date and our Todd Creek Farms prospect is not yet drilled, we are dependent on establishing sufficient reserves in these prospects for additional cash flow and a return of our investment. If the prospects are not economic, all of the funds that we have invested will be lost. In addition, the failure of the prospects to produce commercially may make it more difficult for us to raise additional funds in the form of additional sale of our equity securities or working interests in other property in which we may acquire an interest.

Our proposed development of the Todd Creek Farms prospect will be costly and there is no assurance the Todd Creek Farms prospect will be profitable. A significant portion of the proceeds we have received from our public and private offerings have been budgeted for paying our share of an anticipated drilling program on the Todd Creek Farms prospect. Any drilling program likely will involve multiple horizontal wells, which are expensive to drill. Our business plan is dependent on, among other things, developing sufficient reserves at the Todd Creek Farms prospect to generate cash flow and provide a return on investment. If we are not successful in producing economically viable amounts of oil and/or gas from the Todd Creek Farms prospect, our business may suffer and you may lose all or part of your investment.

There is no assurance that we will be successful in identifying or acquiring other oil and natural gas prospects. Investigating and locating suitable property for acquisition is expensive and time consuming. If we are successful in identifying one or more additional properties for acquisition, there is no assurance that we can obtain such property at reasonable prices or that sufficient working capital will be available to finance the acquisition.

Our ability to sell any production and/or receive market prices for our production may be adversely affected by lack of transportation, capacity constraints and interruptions. The marketability of any production from the Buck Peak prospect, Todd Creek Farms prospect, or any other interests that we may acquire depends in part upon the availability, proximity and capacity of third-party refineries, natural gas gathering systems and processing facilities. We expect to deliver any oil and natural gas produced from our properties through trucking services and pipelines that we do not own. The lack of availability or capacity of these systems and facilities could reduce the price offered for any production or result in the shut-in of producing wells or the delay or discontinuance of development plans for properties.

We are an “emerging growth company” and as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our common stock may be less attractive to investors. As an “emerging growth company,” as defined in the JOBS Act, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to the following:

12

| · | reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and |

| · | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and from holding a vote for stockholder approval of any golden parachute payments not previously approved. |

We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

We are required to evaluate our internal controls under Section 404 of the Sarbanes-Oxley Act of 2002 and any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have a material adverse effect on the price of our common stock. Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we are required to furnish a report by our management on internal controls. Such a report must contain, among other matters, an assessment of the effectiveness of our internal controls over financial reporting, including a statement as to whether or not our internal controls are effective. This assessment must include disclosure of any material weaknesses in our internal controls over financial reporting identified by our management. If we are unable to maintain and to assert that our internal controls over financial reporting are effective, or if we disclose significant deficiencies or material weaknesses in our internal controls, investors could lose confidence in the accuracy and completeness of our financial reports, which would have a material adverse effect on our stock price.

We are not required to obtain an opinion from our independent registered public accounting firm on the effectiveness of our internal controls over financial reporting under Section 404(b) of the Sarbanes-Oxley Act of 2002 until we are no longer an emerging growth company. For so long as we remain an emerging growth company as defined in the JOBS Act, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to public companies that are not emerging growth companies, including, but not limited to, not being required to obtain the auditor attestation of our assessment of our internal controls. Once we are no longer an emerging growth company or, if prior to such date, we opt to no longer take advantage of the applicable exemption, we will be required to include an opinion from our independent registered public accounting firm on the effectiveness of our internal controls over financial reporting. We will remain an “emerging growth company” until the earliest to occur of (1) the last day of the fiscal year during which our total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (2) the last day of the fiscal year during which occurs the fifth anniversary of our initial public offering, (3) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt, or (4) the date on which we are deemed a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Once we are no longer an emerging growth company, compliance with Section 404(b) will be costly.

Our financial statements may not be comparable to other public companies. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, if the PCAOB adopts new or revised accounting standards and we decide to delay adoption of such changes, our financial statements may not be comparable to companies that comply with public company effective dates and the price of our common stock may be adversely affected.

We are currently not required to register our common stock under the Exchange Act, which reduces the disclosure we are required to provide to our investors compared to other public companies and may adversely affect the price of our stock. Our securities are not currently registered under the Exchange Act, and we may not be required or may not choose to register under that Act in the future. Registration under the Exchange Act would be required if we meet certain minimum asset and shareholder requirements or if any of our securities were to be listed on a national securities exchange. Since we do not believe that we currently meet the minimum requirements for mandatory registration, and we do not expect that our common stock will be listed on a national securities exchange in the foreseeable future, we will not be subject to certain reporting requirements imposed by that Act. Among other consequences, we will not be required to comply with the proxy solicitation rules of the Exchange Act and our directors and officers will not be required to file reports of their trading activity in our stock under Section 16 of the Exchange Act. As a result, there will be less information available to the public regarding our corporate affairs and insider transactions in our common stock than other companies that have registered under the Exchange Act.

13

Our business is substantially dependent on our senior executive officers and the loss of service of any of these individuals would adversely affect our business. Stephen J. Foley is our Chief Executive Officer and is responsible for overseeing our business, developing our business plan and the strategic vision of our company. Frederick Witsell is our President and is responsible for identifying and managing our properties. Paul Maniscalco is our Chief Financial Officer and is responsible for the oversight of our day-to-day accounting operations as well as our periodic financial reporting. Bill Lloyd is our Chief Operating Officer and is responsible for the management of engineering and operating activities including, coordination of permitting, drilling and completion activities. Each of these individuals is critical to the perceived success of our business. The loss of service of any of these individuals would adversely affect our business, as we have very limited personnel and expect to rely on contractors for a majority of services that we require. There is no assurance we would be able to replace any of such individuals, or if so, on terms that were acceptable to our company. We have no key man life insurance on any of these individuals.

Because we do not have an audit or compensation committee, shareholders will have to rely on our Board of Directors, which includes only one “independent” director as defined by a national securities exchange, to perform these functions. We do not presently maintain an audit or compensation committee. These functions are performed by our Board of Directors as a whole and only one of the members of our Board meets the definition of “independent” under the rules of any national securities exchange. Since two of our current Board members are also part of our management team, there is a potential conflict where these individuals participate in discussions concerning management compensation and audit issues that may affect management decisions. This lack of independence may adversely affect our corporate governance and the operation of our business.

Colorado law and our Articles of Incorporation may protect our directors from certain types of lawsuits at the expense of the shareholders. The laws of the State of Colorado provide that directors of a corporation shall not be liable to the corporation or its shareholders for monetary damages for all but limited types of conduct. Our Articles of Incorporation permit us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing shareholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances.

Risks Relating to the Energy Production and/or Distribution Industry

Oil and natural gas exploration and development are affected by fluctuations in oil and natural gas prices, and low prices could have a material adverse effect on the future of our business. If exploration efforts are successful in identifying economic amounts of oil and natural gas, our future success will depend largely on the prices received for any oil or natural gas production. Prices received also will affect the amount of future cash flow available for capital expenditures and may affect the ability to raise additional capital. Lower prices may also affect the amount of oil and natural gas that can be commercially produced from reserves either discovered or acquired. Lower prices may also make it uneconomical to drill in certain areas.

Prices for oil and natural gas fluctuate widely. For example, the price of West Texas Intermediate (WTI) Crude Oil, as quoted on NYMEX, has ranged from a high of $65.73 per barrel to a low of $29.85 per barrel in the twelve months ended March 28, 2016. The price of WTI on March 28, 2016, was $39.39 per barrel. Factors that can cause price fluctuations include:

| · | The level of consumer product demand; |

| · | The domestic and foreign supply of oil and natural gas; |

| · | Weather conditions; |

14

| · | Domestic and foreign governmental regulations; |

| · | Actions by other producers, including the Organization of the Petroleum Exporting Countries (OPEC); |

| · | The price and availability of alternative fuels; |

| · | Political and ethnic conflicts in oil and natural gas producing regions; |

| · | The price of foreign imports; and |

| · | Overall economic conditions. |

The following table shows the high and low quarterly price per barrel of West Texas Intermediate (WTI) Crude Oil for 2015, as quoted on NYMEX:

|

Year Ended December 31, 2015

|

High

|

Low

|

||||||

|

Fourth Quarter

|

$

|

49.63

|

$

|

34.73

|

||||

|

Third Quarter

|

56.96

|

38.24

|

||||||

|

Second Quarter

|

61.43

|

49.14

|

||||||

|

First Quarter

|

54.56

|

43.46

|

||||||

The cost of oil and natural gas exploration is extremely volatile and may adversely affect our operations. The costs of oil and natural gas exploration, such as the costs of drilling rigs, casing, cement, and pumps, and the fuel and parts necessary to keep the rigs and pumps operating and the costs of the oil field service crews have been volatile over the past few years in direct proportion to the amount of ongoing oil and natural gas exploration. As with most other companies involved in resource exploration and development, we may be adversely affected by future increases in the costs of conducting exploration, development and resource extraction that may not be fully offset by increases in the price received on sales of oil or natural gas.

Our operations are subject to health, safety and environmental laws and regulations which may expose us to significant costs and liabilities and which may not be covered by insurance. Our oil and natural gas exploration will be subject to stringent and complex federal, state and local laws and regulations governing health and safety aspects of our operations, the discharge of materials into the environment and the protection of the environment. These laws and regulations may impose on our operations numerous requirements, including the obligation to obtain a permit before conducting drilling or underground injection activities; restrictions on the types, quantities and concentration of materials that may be released into the environment; limitations or prohibitions of drilling activities on certain lands lying within wilderness, wetlands and other protected areas; specific health and safety criteria to protect workers; and the responsibility for cleaning up any pollution resulting from operations. Numerous governmental authorities such as the U.S. Environmental Protection Agency, or the EPA, and analogous state agencies have the power to enforce compliance with these laws and regulations and the permits issued under them, oftentimes requiring difficult and costly actions. Failure to comply with these laws and regulations may result in the assessment of administrative, civil or criminal penalties; the imposition of investigatory or remedial obligations; the issuance of injunctions limiting or preventing some or all of our proposed operations; and delays in granting permits and cancellation of leases.

There is an inherent risk of incurring significant environmental costs and liabilities in the performance of our operations, some of which may be material, due to our handling of petroleum hydrocarbons and wastes, our emissions to air and water, the underground injection or other disposal of our wastes, the use of hydraulic fracturing fluids and historical industry operations and waste disposal practices. Under certain environmental laws and regulations, we may be liable regardless of whether we were at fault for the full cost of removing or remediating contamination, even when multiple parties contributed to the release and the contaminants were released in compliance with all applicable laws. In addition, accidental spills or releases on our properties may expose us to significant liabilities that could have a material adverse effect on our financial condition or results of operations and which may not be covered by insurance. Aside from government agencies, the owners of properties where our wells are located, the operators of facilities where our petroleum hydrocarbons or wastes are expected to be taken for reclamation or disposal and other private parties may be able to sue us to enforce compliance with environmental laws and regulations, collect penalties for violations or obtain damages for any related personal injury or property damage. Some sites are located near current or former third-party oil and natural gas operations or facilities, and there is a risk that contamination has migrated from those sites to ours. Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent or costly material handling, emission, waste management or cleanup requirements could require us to make significant expenditures to attain and maintain compliance or may otherwise have a material adverse effect on our own results of operations, competitive position or financial condition. We may not be able to recover some or any of these costs from insurance.

15

Federal, state, and local legislative and regulatory initiatives relating to hydraulic fracturing, as well as government reviews of such activities, could result in increased costs, additional operating restrictions or delays, and adversely affect our production and/or ability to book future reserves. Hydraulic fracturing involves the injection of water, sand or other proppants, and chemical additives under pressure into a targeted subsurface formation. The water and pressure create fractures in the rock formations, which are held open by the proppant, enabling the oil or natural gas to flow to the wellbore. The process is typically regulated by state oil and natural gas commissions; however, the EPA asserted federal regulatory authority over certain hydraulic-fracturing activities involving diesel fuel under the Safe Drinking Water Act. In addition, the COGCC has adopted (and other states have adopted or are considering adopting) regulations that impose more stringent permitting, disclosure and well construction requirements on hydraulic fracturing operations. Further, on February 23, 2014, Colorado’s Air Quality Control Commission fully adopted EPA’s Standards of Performance for Crude Oil and Natural Gas Production, Transmission, and Distribution; adopted corresponding revisions to its emissions reporting and permitting framework; and adopted complimentary oil and gas control measures. These regulations will affect our operations, increase our costs of exploration and production and limit the quantity of oil and natural gas that we can economically produce to the extent that we use hydraulic fracturing.

Certain cities in Colorado have implemented bans or moratoriums on hydraulic fracturing, some of which are subject to lawsuits currently pending before the Colorado Supreme Court. In addition, several ballot initiatives were proposed and subsequently withdrawn in Colorado in 2014 seeking to impose additional restrictions on hydraulic fracturing and oil and natural gas development. Proposals of similar ballot initiatives may occur in 2016. Three proposed ballot initiatives for the 2016 ballot, and aimed at oil and gas production, currently remained filed with the Colorado Secretary of State. These ballot initiatives include proposals for a mandatory setback of 2,500 feet for new oil and gas facilities from occupied structures and provide local governments with the primary authority over oil and gas operations within their boundaries.

Effective March 22, 2016, Adams County adopted new amendments to the county’s oil and gas regulatory process. The new regulations include an enhanced administrative review process, which may increase our costs or delay our drilling program. In the event that additional regulations or legal restrictions at the federal, state or local level is adopted related to hydraulic fracturing or other development activities in the areas in which we currently or in the future plan to operate, we may incur additional costs to comply with such requirements that may be significant in nature, and also could become subject to additional permitting and siting requirements and cause us to experience added delays or curtailment in the pursuit of exploration, development, or production activities. Furthermore, these additional costs may put us at a competitive disadvantage compared to larger companies in the industry which can spread such additional costs over a greater number of wells and larger operating staff.

Competition in the oil and natural gas industry is intense and many of our competitors have resources that are substantially greater than ours. We operate in the highly competitive environment to acquire producing prospects and productive properties, marketing oil and natural gas and securing equipment and trained personnel. As a small oil and natural gas company, most competitors, including major and large independent oil and natural gas companies, possess and employ financial, technical and personnel resources substantially greater than ours. Those companies may be able to develop and acquire more prospects and productive properties than our financial or personnel resources permit. Our ability to acquire additional prospects and discover reserves in the future will depend on our ability to evaluate and select suitable properties and consummate transactions in a highly competitive environment. Also, there is substantial competition for capital available for investment in the oil and natural gas industry. Larger competitors may be better able to withstand sustained periods of unsuccessful drilling and absorb the burden of changes in laws and regulations more easily than we can, which would adversely affect our competitive position. We may not be able to compete successfully in the future in acquiring prospective properties, developing reserves, marketing hydrocarbons, attracting and retaining quality personnel and raising additional capital.

16

We may incur losses as a result of title deficiencies. We own working and revenue interests in oil and natural gas leasehold interests. The existence of a material title deficiency can render a lease worthless and can adversely affect our results of operations and financial condition. Title insurance covering mineral leaseholds is not generally available and, in all instances, we forego the expense of retaining lawyers to examine the title to the mineral interest to be placed under lease or already placed under lease until the drilling block is assembled and ready to be drilled. As is customary in our industry, we rely upon the judgment of oil and natural gas lease brokers, in-house landmen or independent landmen who perform the field work in examining records in the appropriate governmental offices and abstract facilities before attempting to acquire or place under lease a specific mineral interest. We do not always perform curative work to correct deficiencies in the marketability of the title to us. In cases involving serious title problems, the amount paid for affected oil and natural gas leases can be lost, and the target area can become undrillable. We may be subject to litigation from time to time as a result of title issues.

The oil and natural gas business involves many operating risks that can cause substantial losses. The oil and natural gas business involves a variety of operating risks, including:

| · | Fires; |

| · | Explosions; |

| · | Blow-outs and surface cratering; |

| · | Uncontrollable flows of underground natural gas, oil or formation water; |

| · | Natural disasters; |

| · | Pipe and cement failures; |

| · | Casing collapses; |

| · | Embedded oilfield drilling and service tools; |

| · | Abnormal pressure formations; and |

| · | Environmental hazards such as natural gas leaks, oil spills, pipeline ruptures or discharges of toxic gases. |

If any of these events occur, we could incur substantial losses as a result of:

| · | Injury or loss of life; |

| · | Severe damage to and destruction of property, natural resources or equipment; |

| · | Pollution and other environmental damage; |

| · | Clean-up responsibilities; |

| · | Regulatory investigation and penalties; |

| · | Suspension of our operations; or |

| · | Repairs necessary to resume operations. |

17

If we were to experience any of these problems, it could affect well bores, gathering systems and processing facilities, any one of which could adversely affect our ability to conduct operations. We may be affected by any of these events more than larger companies, since we have limited working capital. We currently have general liability insurance with a combined single limit per occurrence of not less than $1,000,000 for bodily injury and property damage and a combined occurrence limit of $2,000,000, an excess umbrella liability policy for up to $5,000,000, and control of well insurance with limits of $5,000,000 for any one occurrence. For other risks, however, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. In addition, pollution and environmental risks generally are not fully insurable. If a significant accident or other event occurs and is not fully covered by insurance, it could adversely affect operations and/or our financial condition. Moreover, we cannot assure shareholders that we will be able to maintain adequate insurance in the future at rates considered reasonable.

Extensive state and federal regulation may be costly to comply with and result in significant fines and penalties. Companies that explore for and develop, produce and sell oil and natural gas in the United States are subject to extensive federal, state, local and tribal laws and regulations, including complex tax and environmental laws and the corresponding regulations, and are required to obtain various permits and approvals from federal, state, local and tribal agencies and authorities. Our ability to obtain, sustain and renew the necessary permits and approvals from federal, state, local and tribal agencies and authorities on acceptable terms and without unfavorable restrictions or conditions is subject to a change in regulations and policies and to the discretion of the applicable governmental agencies or authorities, among other factors. Possible regulation related to global warming and climate change could have an adverse effect on our operations and demand for oil and natural gas.

Risks Related to Our Common Stock

Our stock price has been and may continue to be volatile and as a result you could lose all or part of your investment. In addition to volatility associated with over-the-counter securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

| · | failure to successfully implement our business plan; |

| · | failure to meet our revenue or profit goals or operating budget; |

| · | decline in demand for our common stock; |

| · | sales of additional amounts of common stock; |

| · | downward revisions in securities analysts’ estimates or changes in general market conditions; |

| · | investor perception of our industry or our prospects; and |

| · | general economic trends. |

In addition, stock markets have experienced extreme price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common stock. As a result, investors may be unable to resell their shares at a fair price.

The sale of a substantial number of shares of our common stock may cause the price of our common stock to decline. We registered a total of 9,426,003 shares for sale by our shareholders commensurate with our IPO. Our common stock is currently extremely thinly-traded and it is likely that market sales of large amounts of common stock (or the potential for those sales even if they do not actually occur) could cause the market price of our common stock to decline, which may make it difficult to sell our common stock in the future at a time and price which we deem reasonable or appropriate and may also cause you to lose all or a part of your investment.

A small number of existing shareholders own a significant amount of our common stock, which could limit your ability to influence the outcome of any shareholder vote. Our executive officers, directors, and certain beneficial owners beneficially own approximately 58.8% of our common stock as of the date of this report. Under our Articles of Incorporation and Colorado law, the vote of a majority of the shares outstanding is generally required to approve most shareholder action. As a result, these individuals shall strongly influence the outcome of shareholder votes for the foreseeable future, including votes concerning the election of directors, amendments to our Articles of Incorporation or proposed mergers or other significant corporate transactions. We have no existing agreements or plans for mergers or other corporate transactions that would require a shareholder vote at this time. However, shareholders should be aware that they may have limited ability to influence the outcome of any vote in the future.

18

Since our common stock is not presently nor expected to be listed, on a national securities exchange, trading in our shares will likely be subject to rules governing “penny stocks,” which will impair trading activity in our shares. Our common stock is currently subject to rules adopted by the SEC regulating broker-dealer practices in connection with transactions in penny stocks. Those disclosure rules applicable to penny stocks require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized disclosure document required by the SEC. These rules also require a cooling off period before the transaction can be finalized. These requirements may have the effect of reducing the level of trading activity in the secondary market for our common stock. Many brokers may be unwilling to engage in transactions in our common stock because of the added disclosure requirements, thereby making it more difficult for stockholders to dispose of their shares.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock. In addition to the penny stock rules promulgated by the SEC, which are discussed in the immediately preceding risk factor, FINRA rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the ability to buy and sell our stock and have an adverse effect on the market value for our shares.

Issuance of our stock in the future could dilute existing shareholders and adversely affect the market price of our common stock. We have the authority to issue up to 110,000,000 shares of stock, including 100,000,000 shares of common stock and 10,000,000 shares of preferred stock, and to issue options and warrants to purchase shares of our stock without shareholder approval. Because our common stock is not currently listed on a national securities exchange, we are not required to solicit shareholder approval prior to issuing large blocks of our stock. These future issuances could be at values substantially below the price paid for our common stock by investors in this offering. In addition, we could issue large blocks of our stock to fend off unwanted tender offers or hostile takeovers without further shareholder approval. Because the trading volume of our common stock is relatively low, the issuance of our stock may have a disproportionately large impact on its price compared to larger companies.

The issuance of preferred stock in the future could adversely affect the rights of the holders of our common stock. An issuance of preferred stock could result in a class of outstanding securities that would have preferences with respect to voting rights and dividends and in liquidation over the common stock and could, upon conversion or otherwise, have all of the rights of our common stock. Our Board of Directors’ authority to issue preferred stock could discourage potential takeover attempts or could delay or prevent a change in control through merger, tender offer, proxy contest or otherwise by making these attempts more difficult or costly to achieve.

We have never paid dividends on our common stock and we do not anticipate paying any in the foreseeable future. We have not paid dividends on our common stock to date, and we may not be in a position to pay dividends for the foreseeable future. Our ability to pay dividends will depend on our ability to successfully develop our business plan and generate revenue from operations. Further, our initial earnings, if any, will likely be retained to finance our operations. Any future dividends will depend upon our earnings, our then-existing financial requirements and other factors, and will be at the discretion of our Board of Directors.

19

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

In this Annual Report, references to “PetroShare,” the “Company,” “we,” “us,” and “our” refer to PetroShare Corp., the Registrant.

The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “will,” “would,” and similar words or expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. We caution you not to put undue reliance on these statements, which speak only as of the date of this report. Further, the information contained in this document or incorporated herein by reference is a statement of our present intention and is based on present facts and assumptions, and may change at any time and without notice, based on changes in such facts or assumptions. Readers should not place undue reliance on forward-looking statements.

The important factors that could affect the accuracy of forward-looking statements and prevent us from achieving our stated goals and objectives include, but are not limited to:

| · | Changes in the general economy affecting the disposable income of the public; |

| · | Changes in environmental law, including federal, state and local legislation; |

| · | Changes in drilling requirements imposed by state or local laws or regulations; |

| · | Terrorist activities within and outside the United States; |

| · | Technological changes in the crude oil and natural gas industry; |

| · | Acts and omissions of third parties over which we have no control; |

| · | Inflation and the costs of goods or services used in our operation; |

| · | Access and availability of materials, equipment, supplies, labor and supervision, power, and water; |

| · | Interpretation of drill hole results and the uncertainty of reserve estimates; |

| · | The availability of sufficient pipeline and other transportation facilities to carry our production and the impact of these facilities on price; |

| · | The level of demand for the production of crude oil and natural gas; |

| · | Changes in our business strategy; |

| · | Potential failure to achieve production from development drilling projects; and |

| · | Capital expenditures. |

Those factors discussed above and elsewhere in this report are difficult to predict and expressly qualify all subsequent oral and written forward-looking statements attributable to us or persons acting on our behalf. In light of these risks, uncertainties and assumptions, the forward-looking events discussed may not occur. We do not have any intention or obligation to update forward-looking statements included in this report after the date of this report, except as required by law. The preceding outlines some of the risks and uncertainties that may affect our forward-looking statements.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

See Item 1 of this report.

20

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become involved in litigation relating to claims arising out of our operations in the normal course of business. No legal proceedings, government actions, administrative actions, investigations, or claims are currently pending against us or our officers and directors in which we are adverse.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

21

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Beginning November 23, 2015, our common stock was quoted on the OTCQB of OTCLink under the symbol “PRHR.” Prior to that date, there was no trading market for our common stock.

The table below sets forth the high and low bid prices for our common stock on the OTCQB for the last fiscal year:

|

Fiscal Year Ended December 31, 2015

|

High Bid

|

Low Bid

|

||||||

|

Fourth Quarter

|

$

|

3.49

|

$

|

1.10

|

||||

On March 28, 2016, the high and low bid price of our common stock on the OTCQB were $0.67 and $0.65, respectively.

Because our common stock is thinly traded and is not listed on a national securities exchange, the price for our common stock may be highly volatile and may bear no relationship to our actual financial condition or results of operations. Factors that we discuss in this report, including the many risks associated with our stock, may have a significant impact on the market price of our common stock. The market for our common stock will be affected by the offer and sale of our common stock by existing securities holders.

Holders of our Common Stock

As of March 28, 2016, we have outstanding 21,728,191 shares of common stock and approximately 128 holders of record of our common stock.

Penny Stock Rules