Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VISTEON CORP | d395458d8k.htm |

Visteon Citi Global Technology Conference September 2017 Markus Schupfner Chief Technology Officer Exhibit 99.1

Forward-looking Information This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various factors, risks and uncertainties that could cause our actual results to differ materially from those expressed in these forward-looking statements, including, but not limited to: conditions within the automotive industry, including (i) the automotive vehicle production volumes and schedules of our customers, (ii) the financial condition of our customers and the effects of any restructuring or reorganization plans that may be undertaken by our customers, including work stoppages at our customers, and (iii) possible disruptions in the supply of commodities to us or our customers due to financial distress, work stoppages, natural disasters or civil unrest; our ability to execute on our transformational plans and cost-reduction initiatives in the amounts and on the timing contemplated; our ability to satisfy future capital and liquidity requirements; including our ability to access the credit and capital markets at the times and in the amounts needed and on terms acceptable to us; our ability to comply with financial and other covenants in our credit agreements; and the continuation of acceptable supplier payment terms; our ability to satisfy pension and other post-employment benefit obligations; our ability to access funds generated by foreign subsidiaries and joint ventures on a timely and cost effective basis; general economic conditions, including changes in interest rates and fuel prices; the timing and expenses related to internal restructurings, employee reductions, acquisitions or dispositions and the effect of pension and other post-employment benefit obligations; increases in raw material and energy costs and our ability to offset or recover these costs, increases in our warranty, product liability and recall costs or the outcome of legal or regulatory proceedings to which we are or may become a party; and those factors identified in our filings with the SEC (including our Annual Report on Form 10-K for the fiscal year ended December 31, 2016). Caution should be taken not to place undue reliance on our forward-looking statements, which represent our view only as of the date of this presentation, and which we assume no obligation to update. New business wins, re-wins and backlog do not represent firm orders or firm commitments from customers, but are based on various assumptions, including the timing and duration of product launches, vehicle productions levels, customer price reductions and currency exchange rates.

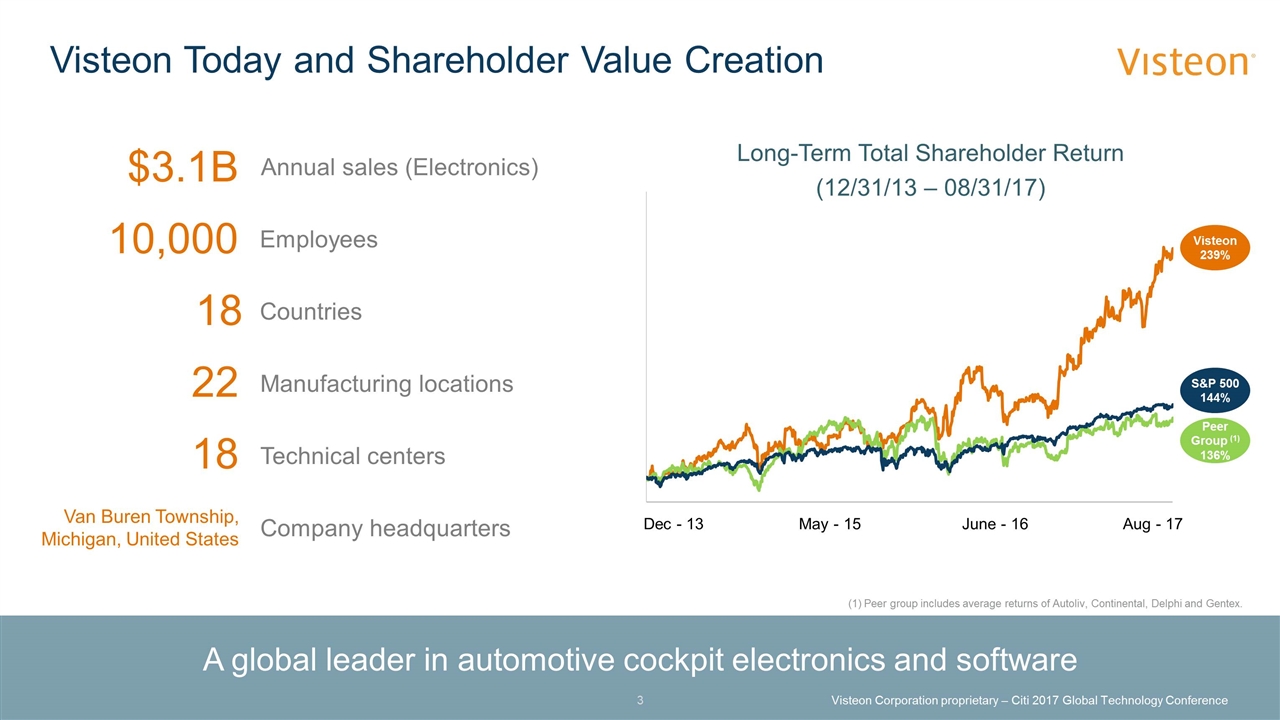

Visteon Today and Shareholder Value Creation A global leader in automotive cockpit electronics and software Long-Term Total Shareholder Return (12/31/13 – 08/31/17) Visteon 239% S&P 500 144% Peer Group (1) 136% (1) Peer group includes average returns of Autoliv, Continental, Delphi and Gentex. Manufacturing locations 22 10,000 Employees 18 Countries Technical centers 18 $3.1B Annual sales (Electronics) Company headquarters Van Buren Township, Michigan, United States Dec - 13 May - 15 June - 16 Aug - 17 Visteon Corporation proprietary – Citi 2017 Global Technology Conference

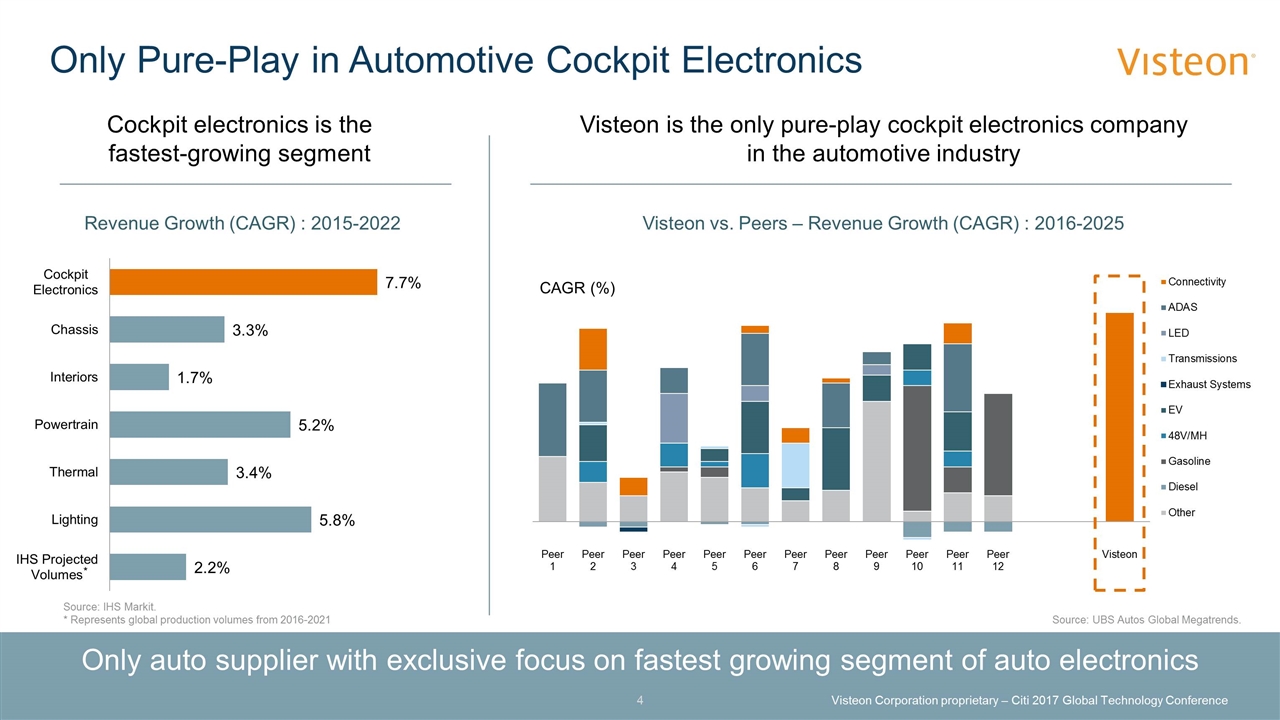

Only Pure-Play in Automotive Cockpit Electronics Only auto supplier with exclusive focus on fastest growing segment of auto electronics Source: IHS Markit. * Represents global production volumes from 2016-2021 Revenue Growth (CAGR) : 2015-2022 Visteon vs. Peers – Revenue Growth (CAGR) : 2016-2025 Cockpit electronics is the fastest-growing segment Visteon is the only pure-play cockpit electronics company in the automotive industry Source: UBS Autos Global Megatrends. * Visteon Corporation proprietary – Citi 2017 Global Technology Conference CAGR (%)

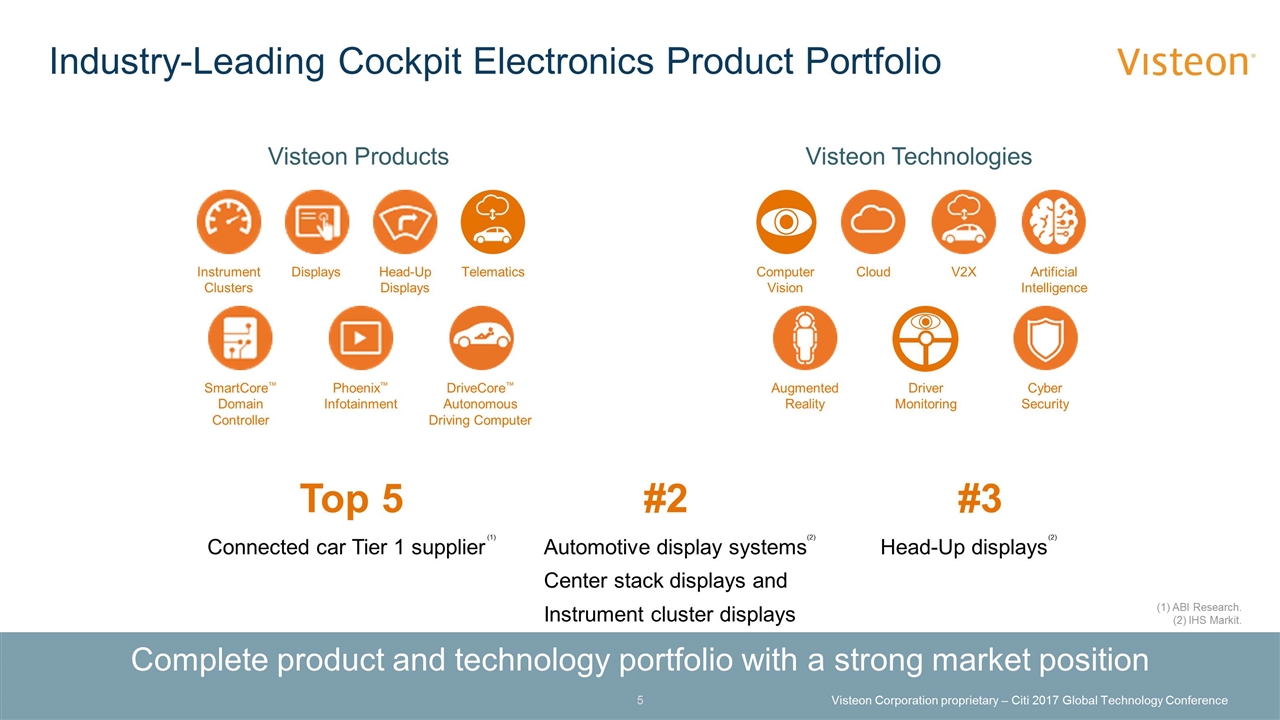

Industry-Leading Cockpit Electronics Product Portfolio Complete product and technology portfolio with a strong market position #2 Automotive display systems Center stack displays and Instrument cluster displays #3 Head-Up displays Top 5 Connected car Tier 1 supplier (2) (1) (2) Visteon Corporation proprietary – Citi 2017 Global Technology Conference Telematics DriveCore™ Autonomous Driving Computer SmartCore™ Domain Controller Head-Up Displays Instrument Clusters Displays Phoenix™ Infotainment Visteon Products Cloud Driver Monitoring Artificial Intelligence Cyber Security Augmented Reality V2X Computer Vision Visteon Technologies (1) ABI Research. (2) IHS Markit.

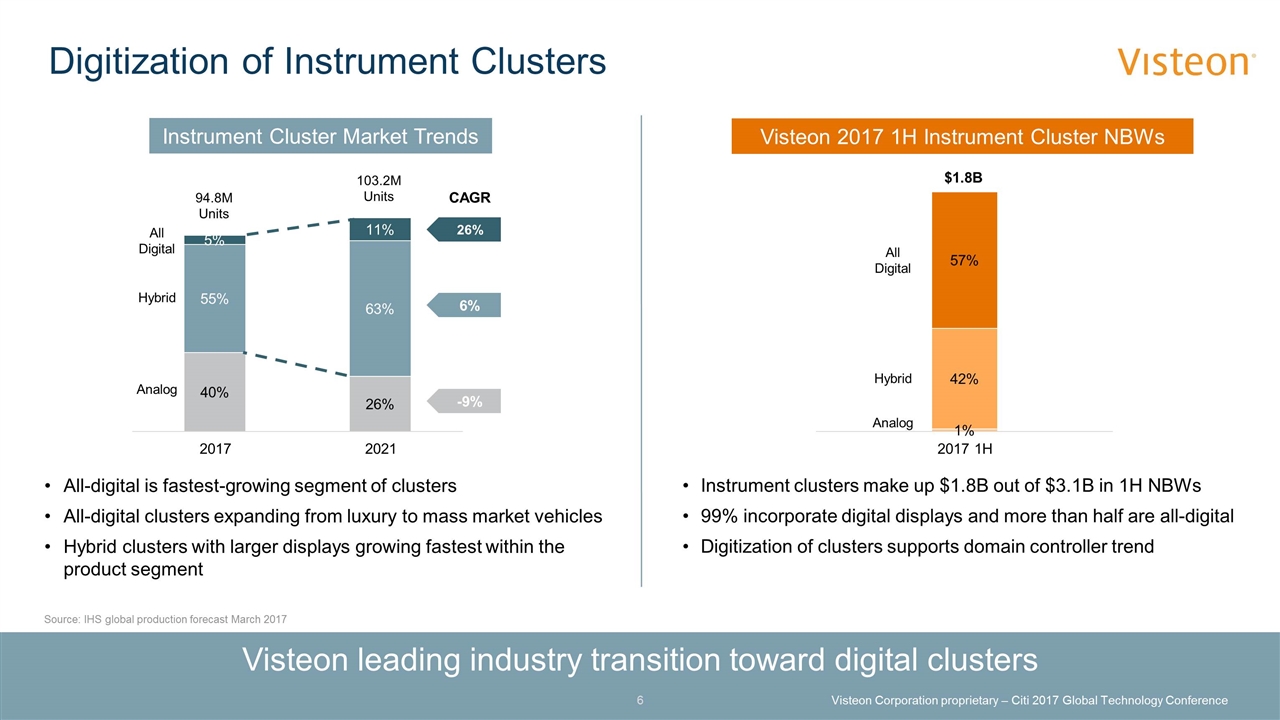

Digitization of Instrument Clusters Visteon leading industry transition toward digital clusters Source: IHS global production forecast March 2017 Instrument Cluster Market Trends Visteon 2017 1H Instrument Cluster NBWs $1.8B All-digital is fastest-growing segment of clusters All-digital clusters expanding from luxury to mass market vehicles Hybrid clusters with larger displays growing fastest within the product segment Instrument clusters make up $1.8B out of $3.1B in 1H NBWs 99% incorporate digital displays and more than half are all-digital Digitization of clusters supports domain controller trend All Digital Hybrid Analog CAGR 2021 2017 26% 6% -9% Hybrid Analog All Digital 94.8M Units 103.2M Units 2017 1H Visteon Corporation proprietary – Citi 2017 Global Technology Conference

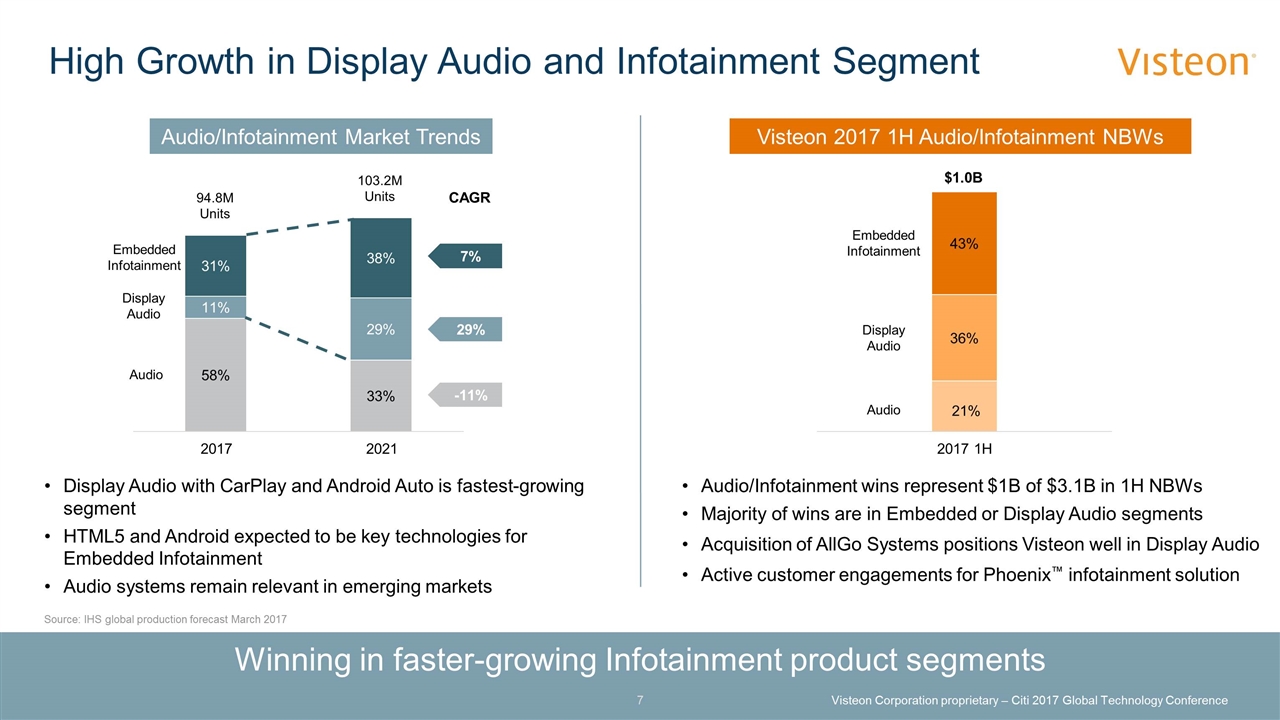

High Growth in Display Audio and Infotainment Segment Winning in faster-growing Infotainment product segments Source: IHS global production forecast March 2017 Audio/Infotainment Market Trends Visteon 2017 1H Audio/Infotainment NBWs Display Audio with CarPlay and Android Auto is fastest-growing segment HTML5 and Android expected to be key technologies for Embedded Infotainment Audio systems remain relevant in emerging markets Embedded Infotainment Display Audio Audio Audio/Infotainment wins represent $1B of $3.1B in 1H NBWs Majority of wins are in Embedded or Display Audio segments Acquisition of AllGo Systems positions Visteon well in Display Audio Active customer engagements for Phoenix™ infotainment solution CAGR 2021 2017 7% 29% -11% 94.8M Units 103.2M Units Display Audio Audio Embedded Infotainment 2017 1H $1.0B Visteon Corporation proprietary – Citi 2017 Global Technology Conference

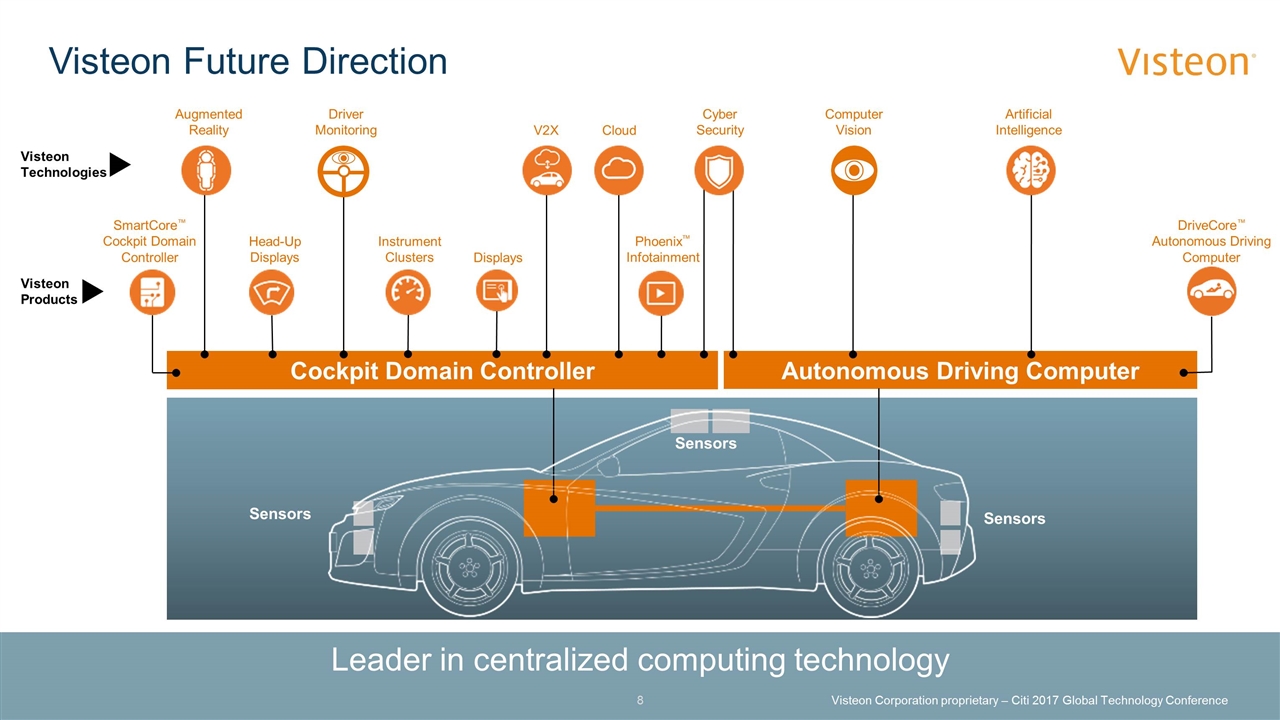

Visteon Future Direction Leader in centralized computing technology Autonomous Driving Computer Cockpit Domain Controller Sensors Sensors Sensors Cloud DriveCore™ Autonomous Driving Computer Artificial Intelligence SmartCore™ Cockpit Domain Controller Augmented Reality V2X Head-Up Displays Instrument Clusters Displays Phoenix™ Infotainment Visteon Technologies Visteon Products Computer Vision Cyber Security Driver Monitoring Visteon Corporation proprietary – Citi 2017 Global Technology Conference

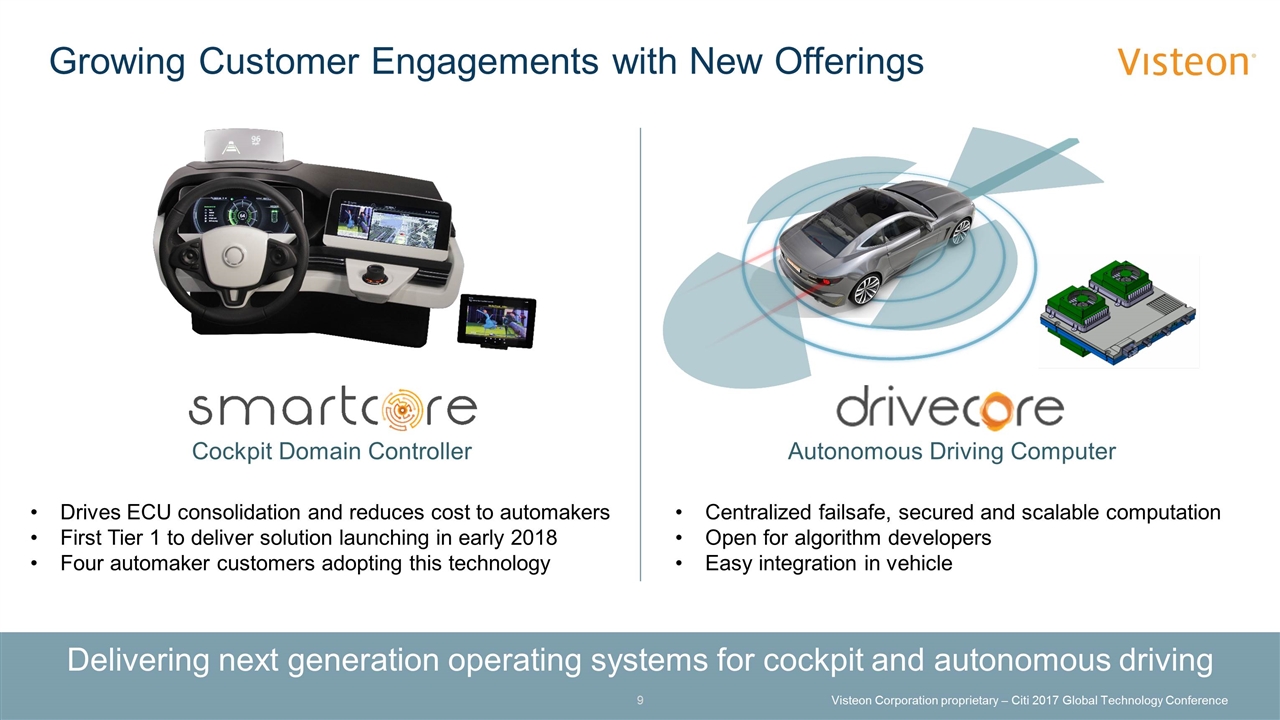

Growing Customer Engagements with New Offerings Delivering next generation operating systems for cockpit and autonomous driving Drives ECU consolidation and reduces cost to automakers First Tier 1 to deliver solution launching in early 2018 Four automaker customers adopting this technology Autonomous Driving Computer Cockpit Domain Controller Centralized failsafe, secured and scalable computation Open for algorithm developers Easy integration in vehicle Visteon Corporation proprietary – Citi 2017 Global Technology Conference

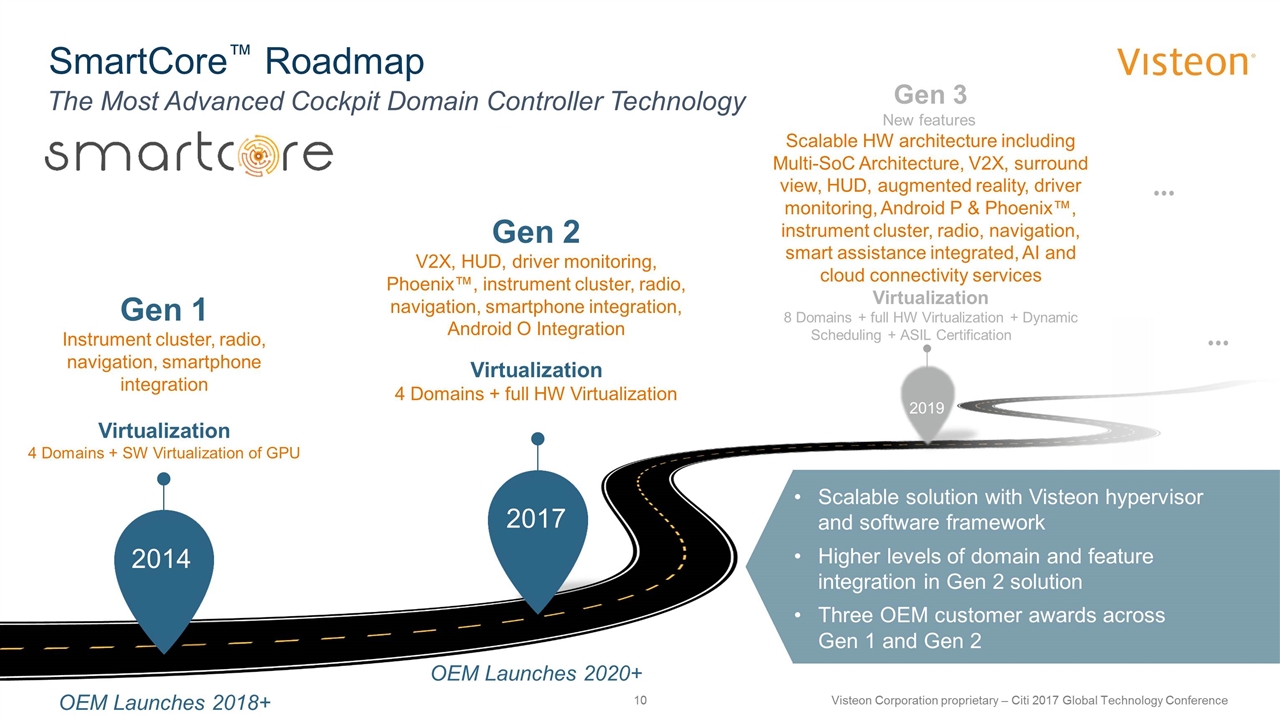

SmartCore™ Roadmap Gen 1 Instrument cluster, radio, navigation, smartphone integration Virtualization 4 Domains + SW Virtualization of GPU 2014 2017 Gen 3 New features … Scalable HW architecture including Multi-SoC Architecture, V2X, surround view, HUD, augmented reality, driver monitoring, Android P & Phoenix™, instrument cluster, radio, navigation, smart assistance integrated, AI and cloud connectivity services Virtualization 8 Domains + full HW Virtualization + Dynamic Scheduling + ASIL Certification …… OEM Launches 2018+ OEM Launches 2020+ 2019 Scalable solution with Visteon hypervisor and software framework Higher levels of domain and feature integration in Gen 2 solution Three OEM customer awards across Gen 1 and Gen 2 The Most Advanced Cockpit Domain Controller Technology Gen 2 V2X, HUD, driver monitoring, Phoenix™, instrument cluster, radio, navigation, smartphone integration, Android O Integration Virtualization 4 Domains + full HW Virtualization Visteon Corporation proprietary – Citi 2017 Global Technology Conference

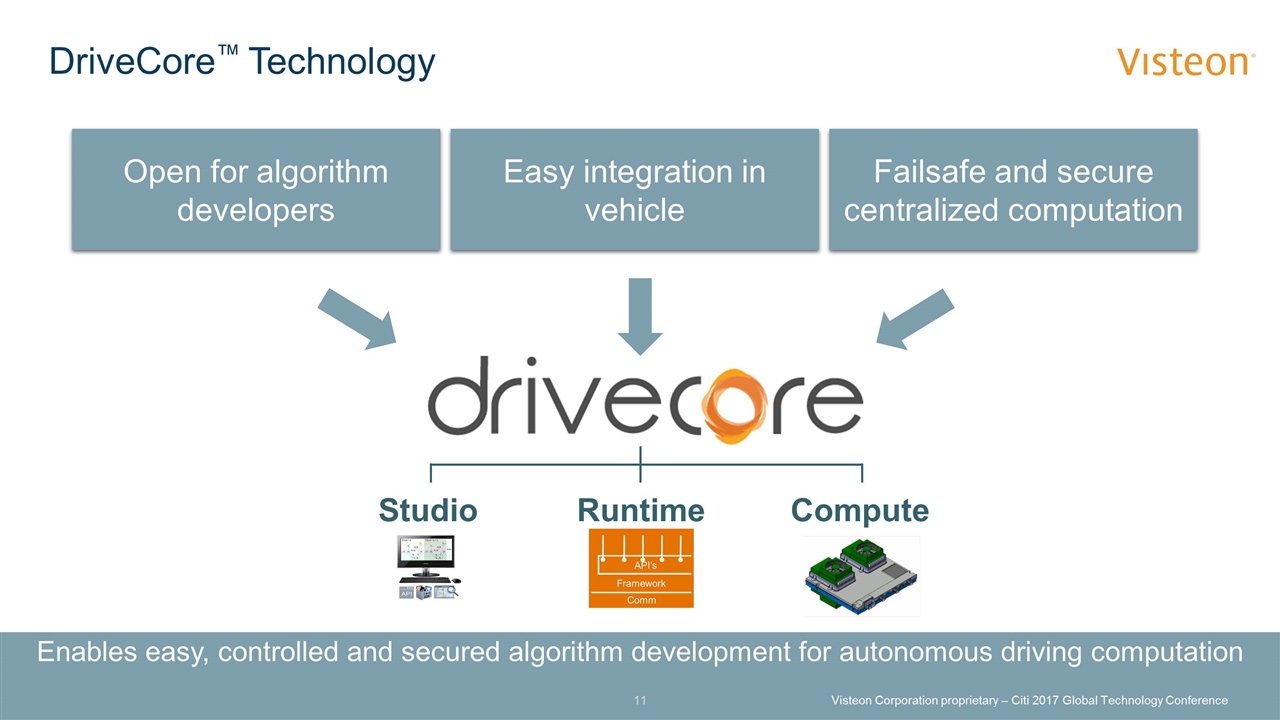

DriveCore™ Technology Failsafe and secure centralized computation Open for algorithm developers Easy integration in vehicle Runtime Studio Compute Enables easy, controlled and secured algorithm development for autonomous driving computation Visteon Corporation proprietary – Citi 2017 Global Technology Conference

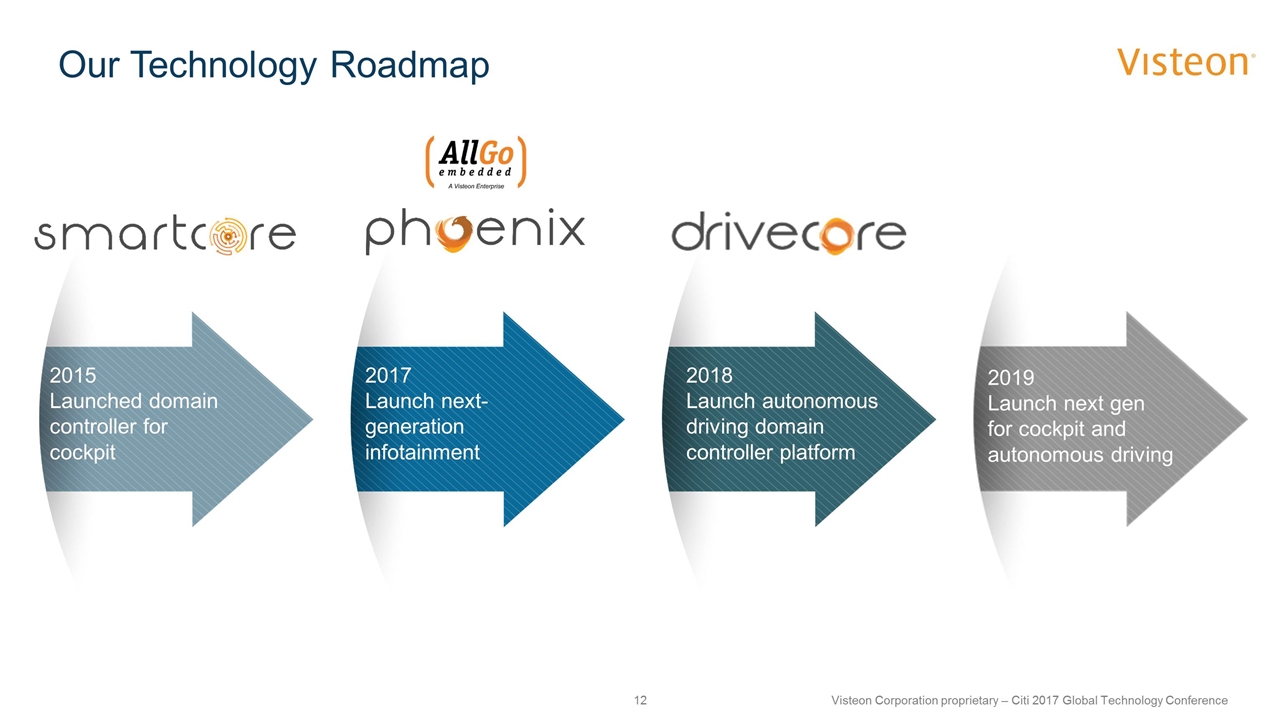

Our Technology Roadmap 2015 Launched domain controller for cockpit 2017 Launch next-generation infotainment 2018 Launch autonomous driving domain controller platform Visteon Corporation proprietary – Citi 2017 Global Technology Conference 2019 Launch next gen for cockpit and autonomous driving

Appendix Citi Global Technology Conference

Use of Non-GAAP Financial Information Because not all companies use identical calculations, adjusted EBITDA, free cash flow and adjusted free cash flow used throughout this presentation may not be comparable to other similarly titled measures of other companies. In order to provide the forward-looking non-GAAP financial measures for full-year 2016 and 2017, the Company is providing reconciliations to the most directly comparable GAAP financial measures on the subsequent slides. The provision of these comparable GAAP financial measures is not intended to indicate that the Company is explicitly or implicitly providing projections on those GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this presentation and the adjustments that management can reasonably predict.

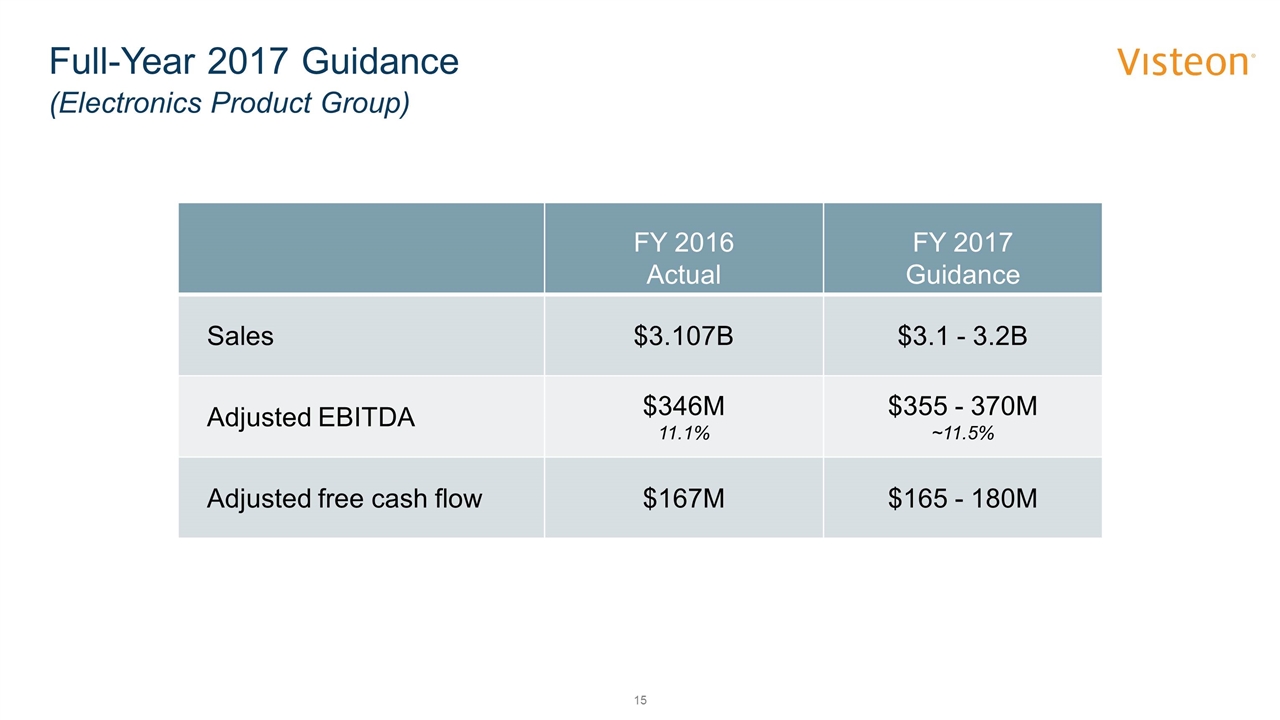

Full-Year 2017 Guidance (Electronics Product Group) FY 2016 Actual FY 2017 Guidance Sales $3.107B $3.1 - 3.2B Adjusted EBITDA $346M 11.1% $355 - 370M ~11.5% Adjusted free cash flow $167M $165 - 180M

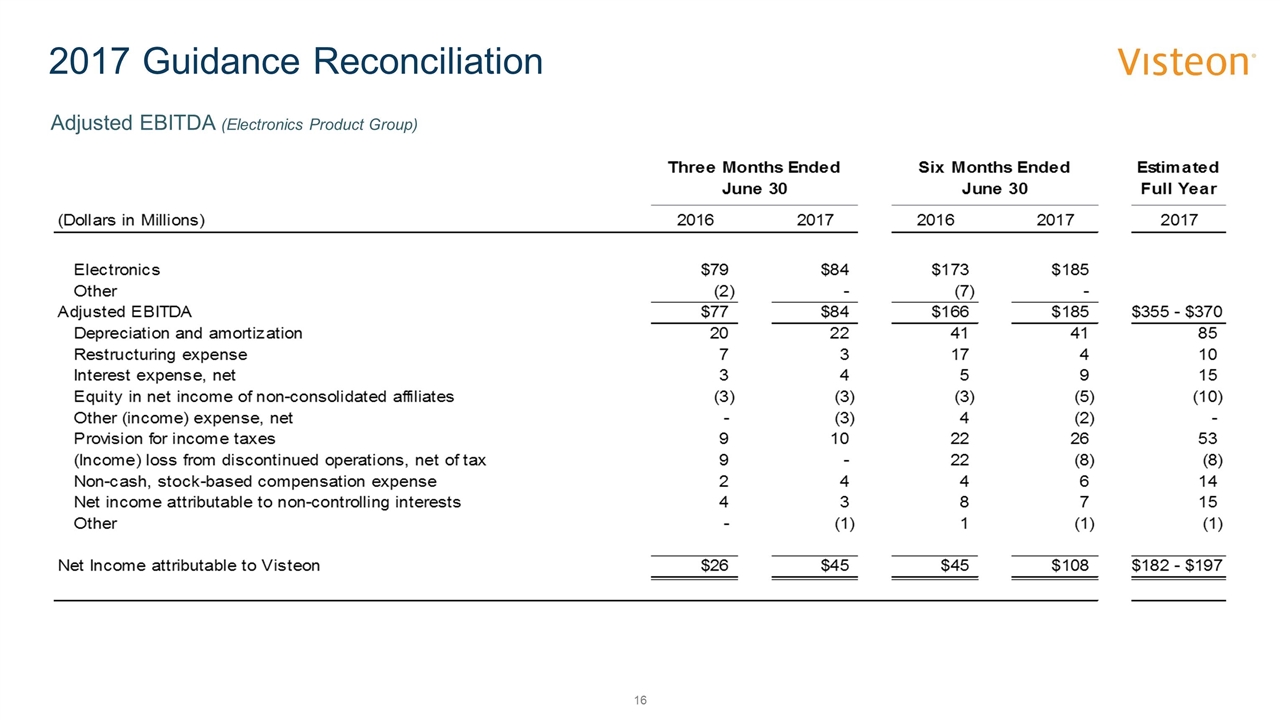

2017 Guidance Reconciliation Adjusted EBITDA (Electronics Product Group)

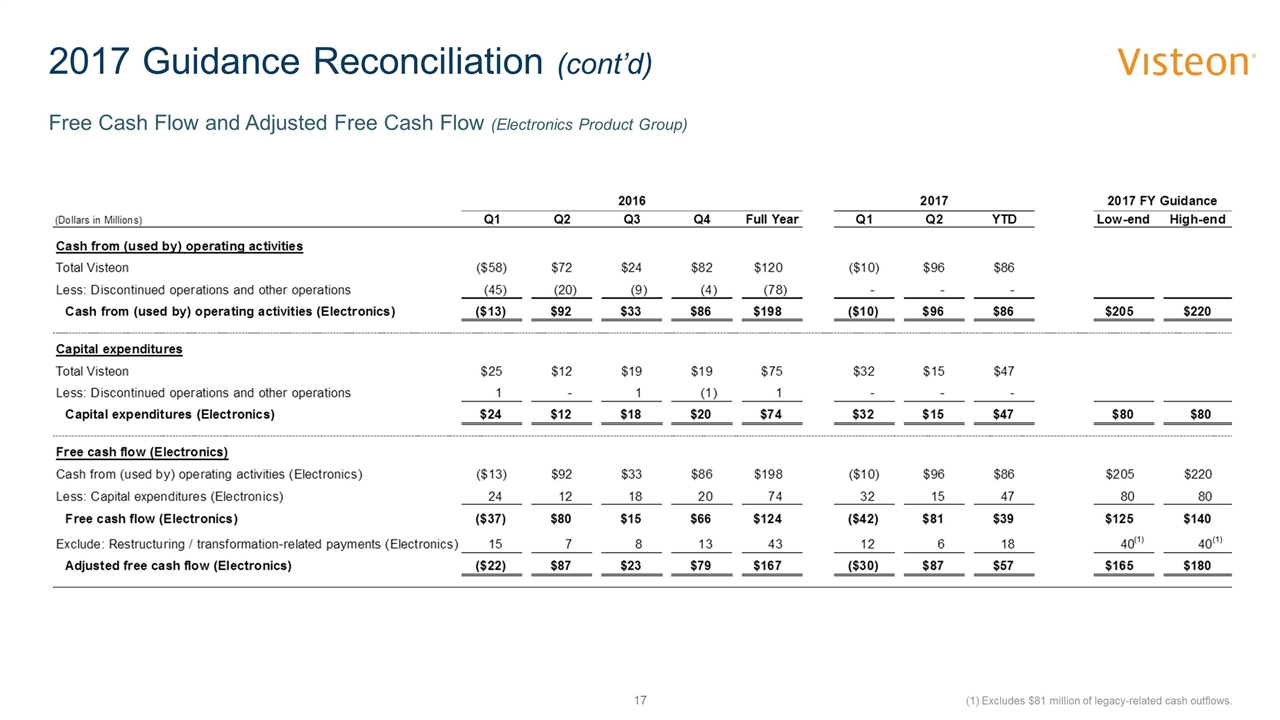

2017 Guidance Reconciliation (cont’d) Free Cash Flow and Adjusted Free Cash Flow (Electronics Product Group) (1) (1) Excludes $81 million of legacy-related cash outflows. (1)