Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Benefit Street Partners Realty Trust, Inc. | v470674_8k.htm |

Exhibit 99.1

Financing the Growth of Commercial Real Estate Note: This program does not own the properties pictured. The properties serve as the underlying collateral for mezzanine loan s h eld by BSP Realty Trust. Benefit Street Partners Realty Trust 2017 Annual Meeting Presentation

2 IMPORTANT INFORMATION Risk Factors Investing in and owning our common stock involves a high degree of risk . See the section entitled “Risk Factors” in our Form 10 - K filed March 29 , 2017 for a discussion of these risks . Forward - Looking Statements Certain statements included in this presentation are forward - looking statements . Those statements include statements regarding the intent, belief or current expectations of Benefit Street Partners Realty Trust, Inc . (“BSP Realty Trust”, “we”, “our” or the “Company”) and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions . Actual results may differ materially from those contemplated by such forward - looking statements . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law . Additional Important Information The summary information provided in this presentation does not purport to be complete and no obligation to update or otherwise revise such information is being assumed . Nothing shall be relied upon as a promise or representation as to the future performance of BSP Realty Trust . This summary is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted . This summary is not advice, a recommendation or an offer to enter into any transaction with BSP Realty Trust or any of their affiliated funds . There is no guarantee that any of the goals, targets or objectives described in this summary will be achieved . The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, ERISA or tax advice or investment recommendations . Investors should also seek advice from their own independent tax, accounting, financial, ERISA, investment and legal advisors to properly assess the merits and risks associated with their investment in light of their own financial condition and other circumstances . The information contained herein will be superseded by, and is qualified in its entirety by reference to, BSP Realty Trust's Annual Report and Form 10 - K, which will contain information about the investment objective, terms and conditions of an investment in BSP Realty Trust . Investors should consider the investment objectives, risks, and charges and expenses of BSP Realty Trust carefully before investing . BSP Realty Trust's Annual Report and Form 10 - K contain this and other information about the company . You may obtain a copy of the most recent Annual or Semi - Annual Report by calling ( 844 ) 785 - 4393 and/or visiting www . bsprealtytrust . com . Past performance is not indicative of future results . There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved . Any references herein to any of BSP Realty Trust's past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only . It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments . There can be no guarantee that the investment objective of BSP Realty Trust will be achieved . Any investment entails a risk of loss . An investor could lose all or substantially all of his or her investment . Please refer to BSP Realty Trust's Annual Report on Form 10 - K for a more complete list of risk factors . AUM refers to the assets under management for funds and separately managed accounts managed by Providence Equity Partners L . L . C . , Providence Equity Capital Markets L . L . C . (“PECM”), Benefit Street Partners L . L . C . (“Benefit Street”) and Merganser Capital Management, LLC (collectively, “Providence”) . For private debt funds and other drawdown funds and separately managed accounts, AUM generally represents the sum of the total investments at fair value plus available capital (undrawn commitments plus distributions subject to recall) . For hedge funds, non - drawdown funds and separately managed accounts, AUM represents the NAV (net asset value) of each fund or separately managed account . For CLOs, AUM represents the total amount of the debt tranches and subordinated notes (equity) at closing . For long - only liquid accounts, AUM represents the gross asset value of the investments managed by Providence . AUM amounts are as of 2 / 28 / 2017 . Certain amounts are preliminary and remain subject to change .

3 Richard J. Byrne Chief Executive Officer and President of BSP Realty Trust TODAY’S SPEAKER Richard Byrne is president of Benefit Street Partners and is based in BSP’s New York office . Mr . Byrne is also Chairman and Chief Executive Officer of Business Development Corporation of America . Prior to joining BSP in 2013 , Mr . Byrne was chief executive officer of Deutsche Bank Securities Inc . He was also the global head of capital markets at Deutsche Bank as well as a member of the global banking executive committee and the global markets executive committee . Before joining Deutsche Bank, Mr . Byrne was global co - head of the leveraged finance group and global head of credit research at Merrill Lynch . He was also a perennially top - ranked credit analyst . Mr . Byrne earned a Masters of Business Administration from the Kellogg School of Management at Northwestern University and a Bachelor of Arts from Binghamton University .

4 TABLE OF CONTENTS Section I Fund Snapshot Section II Strategic Initiatives Section III Proxy Overview Section IV Voting Information

5 EXECUTIVE SUMMARY ▪ For the quarter ending 3/31/2017 , Adjusted Net Income was $ 0.24 per share or $7.6 million, vs. $ 0.21 per share or $ 6.6 million for the quarter ending 12/31/2016 . ▪ Our dividend remained unchanged at $0.51 per share quarterly or $16.1 million. ▪ Book Value was $19.62 per share at 3/31/2017 vs. $19.87 per share at 12/31/2016. ▪ The Company’s portfolio consisted of 67 loans and 2 CMBS investments as of 3/31/17, as compared to 71 loans and 6 CMBS investments as of 12/31/16 . ▪ There were no investments on non - accrual as of 03/31/17 and as of 12/31/16. ▪ The weighted average yield on portfolio was 6.8% vs 6.4% last quarter ▪ As of the May dividend reinvestment plan (“DRIP”), the DRIP price is now $19.62 per share ▪ Robust pipeline of investments at attractive yields Source: SEC filings as of 5/12/17. Note: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS O F E NTIRE INVESTMENT . Views expressed are those of BSP.

6 Section I – Fund Snapshot

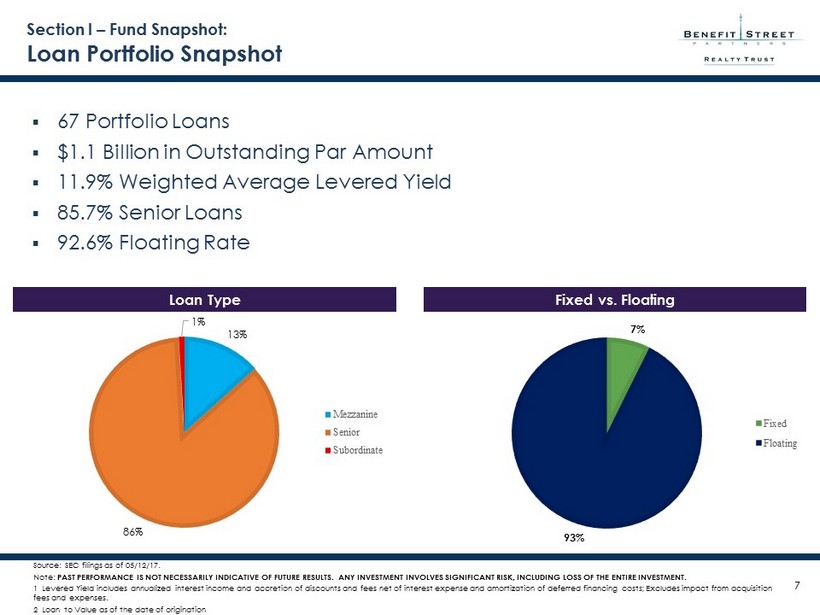

7 Section I – Fund Snapshot: Loan Portfolio Snapshot ▪ 67 Portfolio Loans ▪ $1.1 Billion in Outstanding Par Amount ▪ 11.9% Weighted Average Levered Yield ▪ 85.7% Senior Loans ▪ 92.6% Floating Rate Loan Type Fixed vs. Floating Source: SEC filings as of 05/12/17. Note: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS O F T HE ENTIRE INVESTMENT. 1 Levered Yield includes annualized interest income and accretion of discounts and fees net of interest expense and amortization of deferred financing costs; Excludes impact from acquisition fees and expenses. 2 Loan to Value as of the date of origination 7% 93% Fixed Floating 13% 86% 1% Mezzanine Senior Subordinate

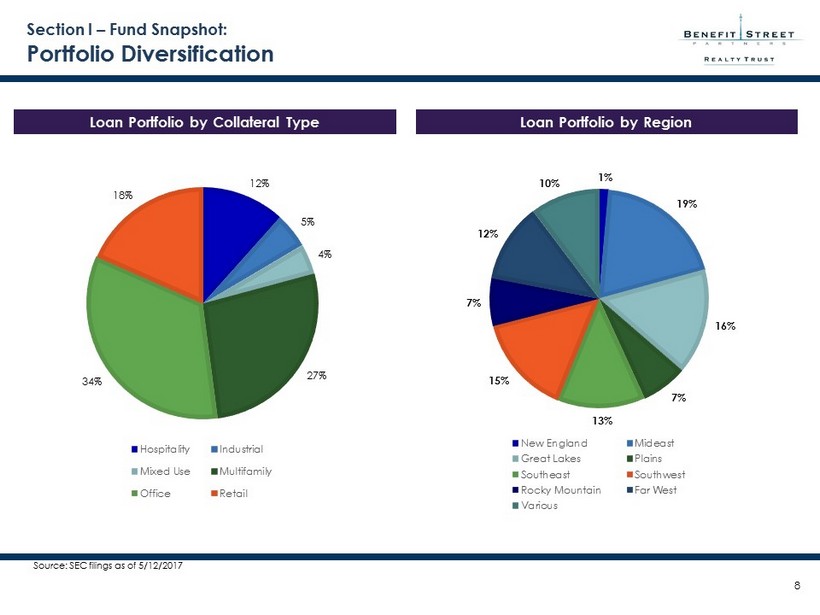

8 Section I – Fund Snapshot : Portfolio Diversification Loan Portfolio by Collateral Type Loan Portfolio by Region Source: SEC filings as of 5/12/2017 12% 5% 4% 27% 34% 18% Hospitality Industrial Mixed Use Multifamily Office Retail 1% 19% 16% 7% 13% 15% 7% 12% 10% New England Mideast Great Lakes Plains Southeast Southwest Rocky Mountain Far West Various

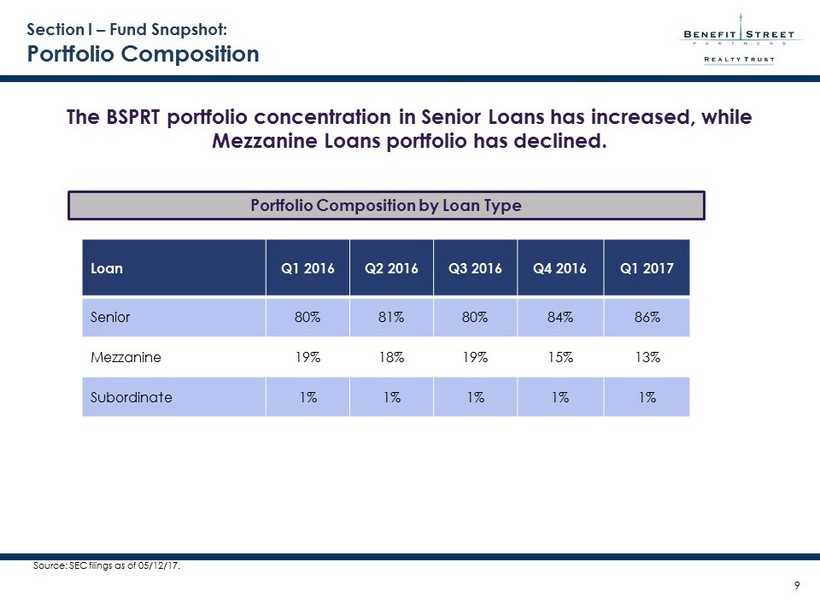

9 Section I – Fund Snapshot: Portfolio Composition The BSPRT portfolio concentration in Senior Loans has increased, while Mezzanine Loans portfolio has declined. Portfolio Composition by Loan Type Source: SEC filings as of 05/12/17. Loan Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Senior 80% 81% 80% 84% 86% Mezzanine 19% 18% 19% 15% 13% Subordinate 1% 1% 1% 1% 1%

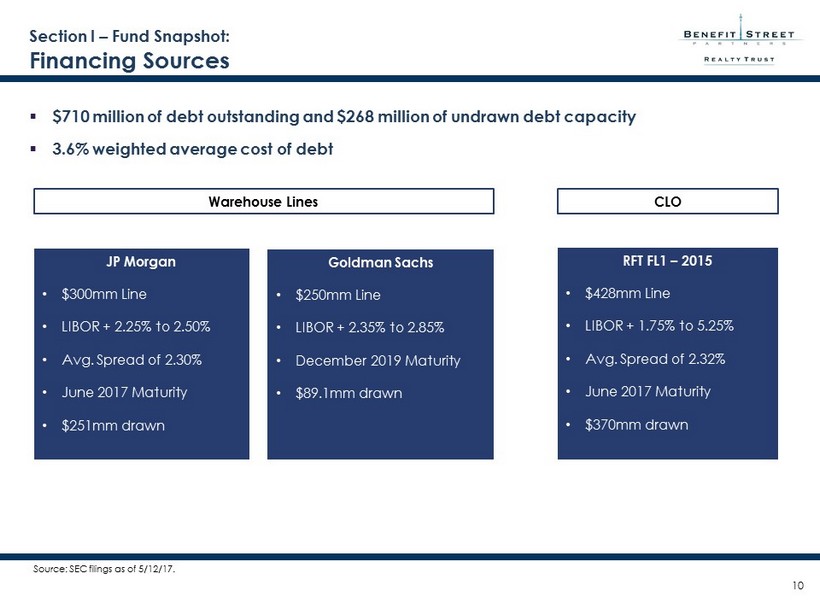

10 Section I – Fund Snapshot: Financing Sources JP Morgan • $300mm Line • Libor + 225 to 250 • Avg. Spread of 230 • June 2017 Maturity • $257mm drawn Goldman Sachs • $250mm Line • Libor + 235 to 285 • Avg. Spread of 260 • December 2019 Maturity • $0.0mm drawn RFT FL1 – 2015 • $428mm Line • LIBOR + 1.75% to 5.25% • Avg. Spread of 2.32% • June 2017 Maturity • $370mm drawn ▪ $710 million of debt outstanding and $ 268 million of undrawn debt capacity ▪ 3.6% weighted average cost of debt CLO Warehouse Lines JP Morgan • $300mm Line • LIBOR + 2.25% to 2.50% • Avg. Spread of 2.30% • June 2017 Maturity • $ 251mm drawn Goldman Sachs • $250mm Line • LIBOR + 2.35% to 2.85% • December 2019 Maturity • $89.1mm drawn Source: SEC filings as of 5/12/17.

11 Section II – Strategic Initiatives

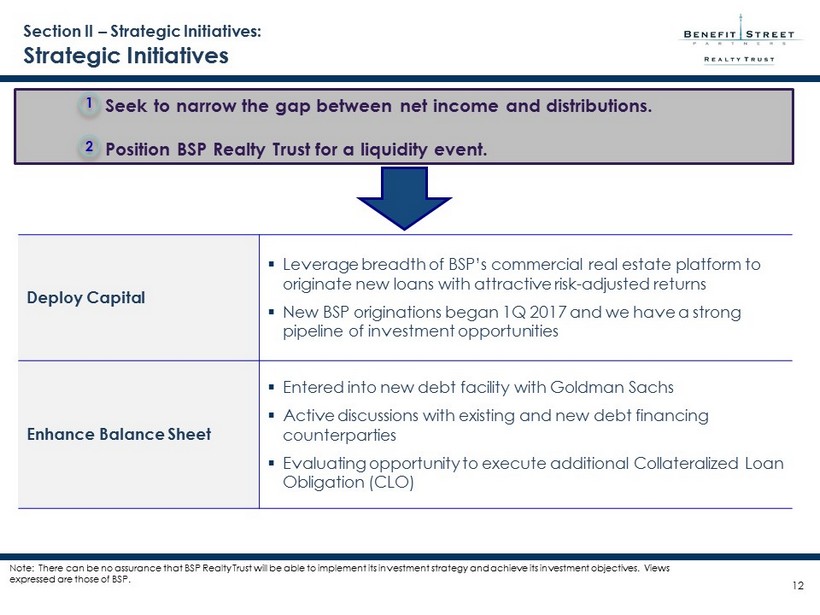

12 Note: There can be no assurance that BSP Realty Trust will be able to implement its investment strategy and achieve its investment objectives. Views expressed are those of BSP . Deploy Capital ▪ Leverage breadth of BSP’s commercial real estate platform to originate n ew loans with attractive risk - adjusted returns ▪ New BSP originations began 1Q 2017 and we have a strong pipeline of investment opportunities Enhance Balance Sheet ▪ Entered into new debt facility with Goldman Sachs ▪ Active discussions with existing and new debt financing counterparties ▪ Evaluating opportunity to execute additional Collateralized Loan Obligation (CLO) Seek to narrow the gap between net income and distributions . Position BSP Realty Trust for a liquidity event . 1 2 Section II – Strategic Initiatives: Strategic Initiatives

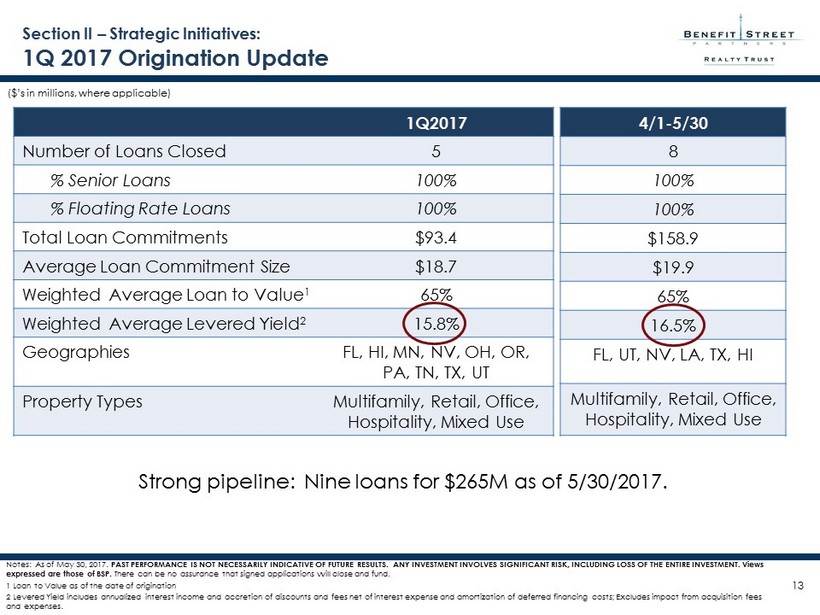

13 Notes: As of May 30, 2017. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS O F T HE ENTIRE INVESTMENT. Views expressed are those of BSP . There can be no assurance that signed applications will close and fund. 1 Loan to Value as of the date of origination 2 Levered Yield includes annualized interest income and accretion of discounts and fees net of interest expense and amortization of def err ed financing costs; Excludes impact from acquisition fees and expenses. 1Q2017 Number of Loans Closed 5 % Senior Loans 100% % Floating Rate Loans 100% Total Loan Commitments $93.4 Average Loan Commitment Size $18.7 Weighted Average Loan to Value 1 65% Weighted Average Levered Yield 2 15.8% Geographies FL, HI, MN, NV, OH, OR, PA, TN, TX, UT Property Types Multifamily, Retail, Office, Hospitality, Mixed Use Section II – Strategic Initiatives: 1Q 2017 Origination Update ($’s in millions, where applicable) 4/1 - 5/30 8 100% 100% $158.9 $19.9 65% 16.5% FL, UT, NV, LA, TX, HI Multifamily, Retail, Office, Hospitality, Mixed Use Strong pipeline: Nine loans for $265M as of 5/30/2017.

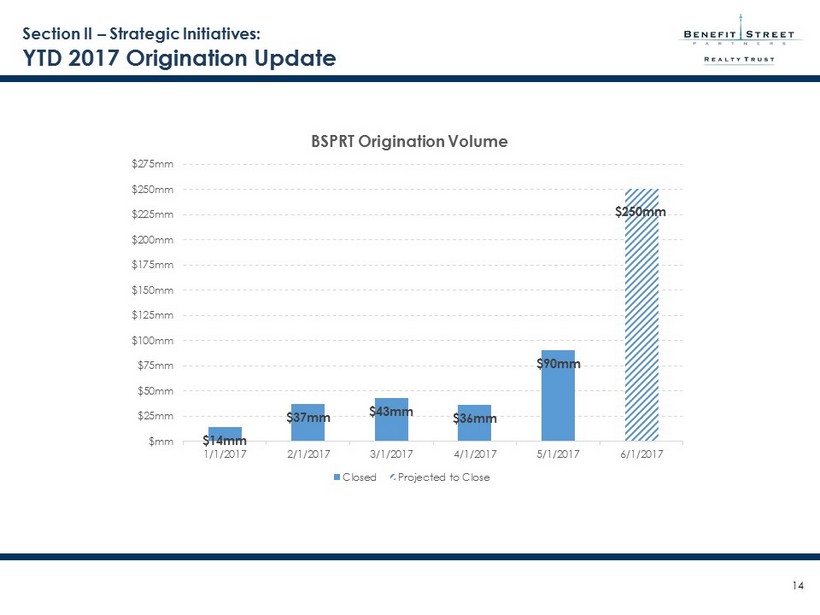

14 Section II – Strategic Initiatives: YTD 2017 Origination Update $14mm $37mm $43mm $36mm $90mm $250mm $mm $25mm $50mm $75mm $100mm $125mm $150mm $175mm $200mm $225mm $250mm $275mm 1/1/2017 2/1/2017 3/1/2017 4/1/2017 5/1/2017 6/1/2017 BSPRT Origination Volume Closed Projected to Close

15 Section III – Proxy Overview

16 Section III – Proxy Overview Proxy Details ▪ Benefit Street Partners Realty Trust, Inc. (“BSPRT”) Board of Director’s has fixed the close of business on March 27, 2017 as the record date for shareholders entitled to vote at the Annual Meeting . ▪ BSPRT filed the Proxy Statement on March 30, 2017 . This Proxy Statement, the proxy card, Notice of Annual Meeting and our 2016 Annual Report have been mailed to you and made available on the Internet. ▪ The reconvened Annual Meeting will be held on July 25, 2017, commencing at 4:00 PM (EST) at the offices of Hogan Lovells , New York, New York. ▪ The full Proxy Statement, the Notice of Annual Meeting and our 2016 Annual Report are available at: www.proxyvote.com/BSPRT.

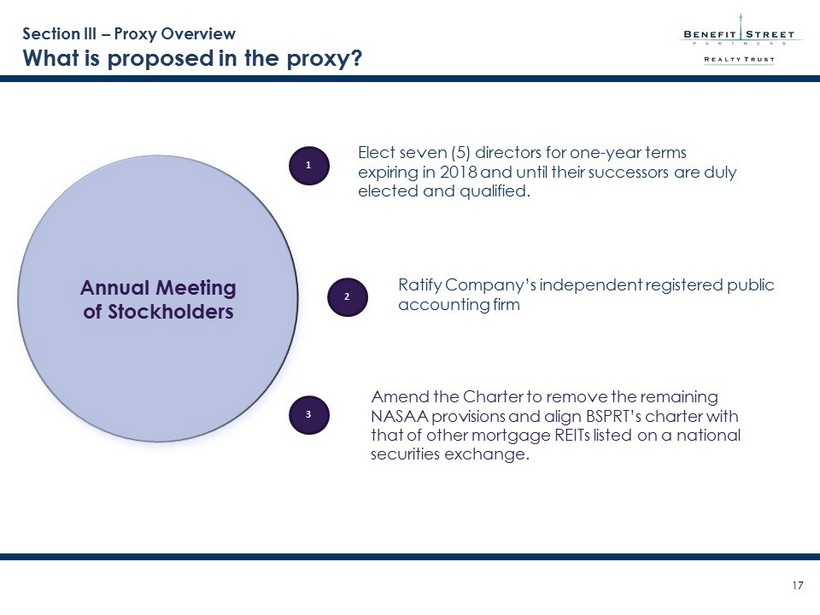

17 Section III – Proxy Overview What is proposed in the proxy? Annual Meeting of Stockholders 2 1 3 Elect seven (5) directors for one - year terms expiring in 2018 and until their successors are duly elected and qualified. Ratify Company’s independent registered public accounting firm Amend the Charter to remove the remaining NASAA provisions and align BSPRT’s charter with that of other mortgage REITs listed on a national securities exchange.

18 Section III – Proxy Overview Proposal 1 & 2 ▪ On May 31, 2017 the Benefit Street Partners Realty Trust Annual Meeting of Shareholders was held ▪ Proposal 1: The Board of Directors proposal passed, which elected the existing five directors to another one year term ▪ Proposal 2: The Company’s independent auditors were ratified ▪ The Annual M eeting was adjourned for insufficient votes on Proposals 3 - 9, which are proposals relating to the changes to the Company’s charter

19 Section III – Proxy Overview Proposals 3 - 9 Description of Proposal and Rationale ▪ BSPRT is no longer conducting a 50 - state offering and we are no longer required to have certain charter provisions set forth in the Omnibus Guidelines published by NASAA. ▪ Management is recommending that BSPRT further amend the charter to remove the remaining NASAA provisions and align BSPRT’s charter with that of other publicly traded REIT’s incorporated in Maryland. ▪ These charter amendment proposals are common in the non - traded REIT and non - traded BDC sector once the capital raising phase is complete. ▪ Charter amendments are an important first step in preparing BSPRT for a listing on a national securities exchange.

20 Section III – Proxy Overview Proposals 3 - 9 ▪ Many Non - Traded REIT’s and Non - Traded BDC’s included similar charter amendment proposals in their proxies including: – Corporate Capital Trust (KKR) – CNL Healthcare Properties – Smartstop Self Storage – American Realty Capital Healthcare Trust III – American Realty Capital Global Net Lease II – FS Investment (Blackstone / GSO) – Phillips Edison Grocery Center REIT – Carter Validus Mission Critical REIT – American Realty Capital New York City REIT – American Realty Capital Hospitality Trust

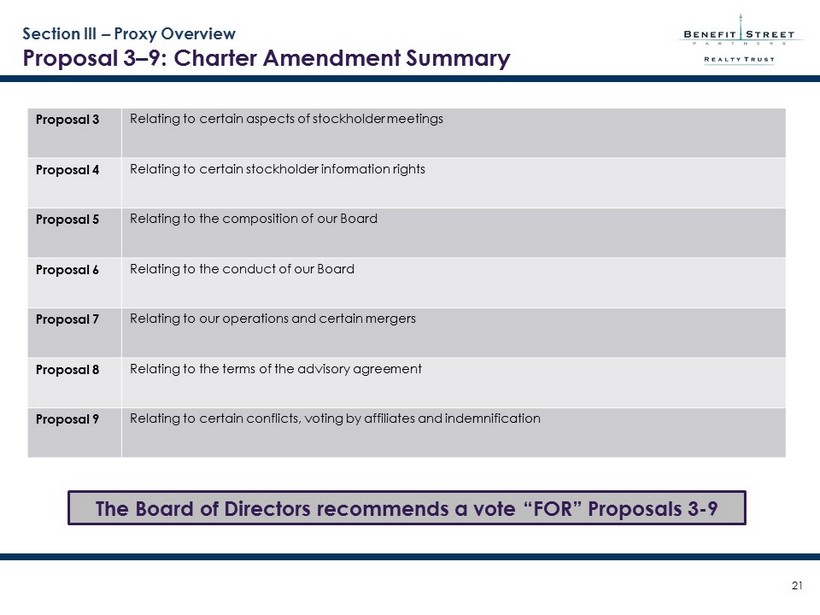

21 Section III – Proxy Overview Proposal 3 – 9: Charter Amendment Summary Proposal 3 Relating to certain aspects of stockholder meetings Proposal 4 Relating to certain s tockholder information rights Proposal 5 Relating to the c omposition of our Board Proposal 6 Relating to the conduct of our Board Proposal 7 Relating to our operations and certain mergers Proposal 8 Relating to the terms of the advisory agreement Proposal 9 Relating to certain conflicts, voting by affiliates and indemnification The Board of Directors recommends a vote “FOR” Proposals 3 - 9

22 Section IV – Voting Information

23 Section IV – Voting Information Important Numbers/Website If you have questions about the proposals or would like additional copies of the proxy statement, please contact our proxy solicitor, Broadridge Investor Communication Solutions, Inc. (“ Broadridge ”) at (855) 601 - 2252 . VOTING OPTIONS MAIL : Stockholders may submit their votes by mail by completing, signing, dating and returning their proxy card in the pre - paid envelope sent in the Proxy Statement. PHONE : By calling (800) 690 - 6903 with your control number available. INTERNET : www.proxyvote.com/B SPRT. Enter your control number and follow the prompts.

24 RISK FACTORS Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Rep ort on Form 10 - K for the year ended December 31, 2016. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements: □ We rely on short - term secured borrowings which creates refinancing risk and the risk that a lender may call for additional colla teral, each of which could significantly impact our liquidity position. □ All of our executive officers are also officers or managers Benefit Street Partners L.L.C. (our " Adviser "). As a result, our executive officers, our Adviser and its affiliates face conflicts of interest, including significant conflicts created by our Adviser's compensation arrangements with us and conflicts in allocating time among these entities and us, which could negatively impact our operating results. □ We terminated our primary offering in January 2016 and therefore, absent raising capital from other sources, will have less c ash from financing activities with which to make investments, repay indebtedness, fund our operations or pay distributions. □ No public trading market currently exists, or may ever exist, for shares of our common stock and our shares are, and may cont inu e to be, illiquid. □ Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions to our sto ckholders. □ If we and our Adviser are unable to find sufficient suitable investments, then we may not be able to achieve our investment objectives or pay distr ibu tions. □ We may be unable to pay or maintain cash distributions or increase distributions over time. Our board of directors may decide th at maintaining cash distributions at current levels is not in our best interests given investment opportunities or for other reasons. □ We are obligated to pay substantial fees to our Adviser and its affiliates. □ We may fail to continue to qualify to be treated as a real estate investment trust ("REIT") for U.S. federal income tax purpo ses . □ We may be deemed to be an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Ac t") , and thus subject to regulation under the Investment Company Act. □ We update our estimated net asset value per share annually and such estimate may change significantly between these annual ca lcu lations.

Financing the Growth of Commercial Real Estate www.bsprealtytrust.com ▪ Investor and Financial Advisors can call (844) 785 - 4393 for account information, balances and the status of submitted paperwork ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.bsprealtytrust.com