Attached files

| file | filename |

|---|---|

| EX-10.7 - EXHIBIT 10.7 - CION Investment Corp | v467817_ex10-7.htm |

| EX-10.6 - EXHIBIT 10.6 - CION Investment Corp | v467817_ex10-6.htm |

| EX-10.4 - EXHIBIT 10.4 - CION Investment Corp | v467817_ex10-4.htm |

| EX-10.3 - EXHIBIT 10.3 - CION Investment Corp | v467817_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - CION Investment Corp | v467817_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - CION Investment Corp | v467817_ex10-1.htm |

| 8-K - FORM 8-K - CION Investment Corp | v467817_8k.htm |

Exhibit 10.5

|

The Bond Market Association |

International Securities Market Association |

2000 VERSION

TBMA/ISMA

GLOBAL MASTER REPURCHASE AGREEMENT

Dated as of MAY 15, 2017

| Between: | |

| UBS AG | (“Party A”) |

| and | |

| MURRAY HILL FUNDING, LLC | (“Party B”) |

| 1. | Applicability |

| (a) | From time to time the parties hereto may enter into transactions in which one party, acting through a Designated Office, (“Seller”) agrees to sell to the other, acting through a Designated Office, (“Buyer”) securities and financial instruments (“Securities”) (subject to paragraph 1(c), other than equities and Net Paying Securities) against the payment of the purchase price by Buyer to Seller, with a simultaneous agreement by Buyer to sell to Seller Securities equivalent to such Securities at a date certain or on demand against the payment of the repurchase price by Seller to Buyer. |

| (b) | Each such transaction (which may be a repurchase transaction (“Repurchase Transaction”) or a buy and sell back transaction (“Buy/Sell Back Transaction”)) shall be referred to herein as a “Transaction” and shall be governed by this Agreement, including any supplemental terms or conditions contained in Annex I hereto, unless otherwise agreed in writing. |

| (c) | If this Agreement may be applied to - |

| (i) | Buy/Sell Back Transactions, this shall be specified in Annex I hereto, and the provisions of the Buy/Sell Back Annex shall apply to such Buy/Sell Back Transactions; |

| (ii) | Net Paying Securities, this shall be specified in Annex I hereto and the provisions of Annex I, paragraph 1(b) shall apply to Transactions involving Net Paying Securities. |

| (d) | If Transactions are to be effected under this Agreement by either party as an agent, this shall be specified in Annex I hereto, and the provisions of the Agency Annex shall apply to such Agency Transactions. |

| 2. | Definitions |

| (a) | “Act of Insolvency” shall occur with respect to any party hereto upon - |

| (i) | its making a general assignment for the benefit of, entering into a reorganisation, arrangement, or composition with creditors; or |

| (ii) | its admitting in writing that it is unable to pay its debts as they become due; or |

| (iii) | its seeking, consenting to or acquiescing in the appointment of any trustee, administrator, receiver or liquidator or analogous officer of it or any material part of its property; or |

| (iv) | the presentation or filing of a petition in respect of it (other than by the counterparty to this Agreement in respect of any obligation under this Agreement) in any court or before any agency alleging or for the bankruptcy, winding-up or insolvency of such party (or any analogous proceeding) or seeking any reorganisation, arrangement, composition, re-adjustment, administration, liquidation, dissolution or similar relief under any present or future statute, law or regulation, such petition (except in the case of a petition for winding-up or any analogous proceeding, in respect of which no such 30 day period shall apply) not having been stayed or dismissed within 30 days of its filing; or |

| (v) | the appointment of a receiver, administrator, liquidator or trustee or analogous officer of such party or over all or any material part of such party’s property; or |

| (vi) | the convening of any meeting of its creditors for the purposes of considering a voluntary arrangement as referred to in section 3 of the Insolvency Act 1986 (or any analogous proceeding); |

| (b) | “Agency Transaction”, the meaning specified in paragraph 1 of the Agency Annex; |

| (c) | “Appropriate Market”, the meaning specified in paragraph 10; |

| (d) | “Base Currency”, the currency indicated in Annex I hereto; |

| - 2 - |

| (e) | “Business Day” - |

| (i) | in relation to the settlement of any Transaction which is to be settled through Clearstream or Euroclear, a day on which Clearstream or, as the case may be, Euroclear is open to settle business in the currency in which the Purchase Price and the Repurchase Price are denominated; |

| (ii) | in relation to the settlement of any Transaction which is to be settled through a settlement system other than Clearstream or Euroclear, a day on which that settlement system is open to settle such Transaction; |

| (iii) | in relation to any delivery of Securities not falling within (i) or (ii) above, a day on which banks are open for business in the place where delivery of the relevant Securities is to be effected; and |

| (iv) | in relation to any obligation to make a payment not falling within (i) or (ii) above, a day other than a Saturday or a Sunday on which banks are open for business in the principal financial centre of the country of which the currency in which the payment is denominated is the official currency and, if different, in the place where any account designated by the parties for the making or receipt of the payment is situated (or, in the case of a payment in euro, a day on which TARGET operates); |

| (f) | “Cash Margin”, a cash sum paid to Buyer or Seller in accordance with paragraph 4; |

| (g) | “Clearstream”, Clearstream Banking, société anonyme, (previously Cedelbank) or any successor thereto; |

| (h) | “Confirmation”, the meaning specified in paragraph 3(b); |

| (i) | “Contractual Currency”, the meaning specified in paragraph 7(a); |

| (j) | “Defaulting Party”, the meaning specified in paragraph 10; |

| (k) | “Default Market Value”, the meaning specified in paragraph 10; |

| (l) | “Default Notice”, a written notice served by the non-Defaulting Party on the Defaulting Party under paragraph 10 stating that an event shall be treated as an Event of Default for the purposes of this Agreement; |

| (m) | “Default Valuation Notice”, the meaning specified in paragraph 10; |

| (n) | “Default Valuation Time”, the meaning specified in paragraph 10; |

| (o) | “Deliverable Securities”, the meaning specified in paragraph 10; |

| (p) | “Designated Office”, with respect to a party, a branch or office of that party which is specified as such in Annex I hereto or such other branch or office as may be agreed to by the parties; |

| - 3 - |

| (q) | “Distributions”, the meaning specified in sub-paragraph (w) below; |

| (r) | “Equivalent Margin Securities”, Securities equivalent to Securities previously transferred as Margin Securities; |

| (s) | “Equivalent Securities”, with respect to a Transaction, Securities equivalent to Purchased Securities under that Transaction. If and to the extent that such Purchased Securities have been redeemed, the expression shall mean a sum of money equivalent to the proceeds of the redemption; |

| (t) | Securities are “equivalent to” other Securities for the purposes of this Agreement if they are: (i) of the same issuer; (ii) part of the same issue; and (iii) of an identical type, nominal value, description and (except where otherwise stated) amount as those other Securities, provided that - |

| (A) | Securities will be equivalent to other Securities notwithstanding that those Securities have been redenominated into euro or that the nominal value of those Securities has changed in connection with such redenomination; and |

| (B) | where Securities have been converted, subdivided or consolidated or have become the subject of a takeover or the holders of Securities have become entitled to receive or acquire other Securities or other property or the Securities have become subject to any similar event, the expression “equivalent to” shall mean Securities equivalent to (as defined in the provisions of this definition preceding the proviso) the original Securities together with or replaced by a sum of money or Securities or other property equivalent to (as so defined) that receivable by holders of such original Securities resulting from such event; |

| (u) | “Euroclear”, Morgan Guaranty Trust Company of New York, Brussels office, as operator of the Euroclear System or any successor thereto; |

| (v) | “Event of Default”, the meaning specified in paragraph 10; |

| (w) | “Income”, with respect to any Security at any time, all interest, dividends or other distributions thereon, but excluding distributions which are a payment or repayment of principal in respect of the relevant securities (“Distributions”); |

| (x) | “Income Payment Date”, with respect to any Securities, the date on which Income is paid in respect of such Securities or, in the case of registered Securities, the date by reference to which particular registered holders are identified as being entitled to payment of Income; |

| (y) | “LIBOR”, in relation to any sum in any currency, the one month London Inter Bank Offered Rate in respect of that currency as quoted on page 3750 on the Bridge Telerate Service (or such other page as may replace page 3750 on that service) as of 11:00 a.m., London time, on the date on which it is to be determined; |

| - 4 - |

| (z) | “Margin Ratio”, with respect to a Transaction, the Market Value of the Purchased Securities at the time when the Transaction was entered into divided by the Purchase Price (and so that, where a Transaction relates to Securities of different descriptions and the Purchase Price is apportioned by the parties among Purchased Securities of each such description, a separate Margin Ratio shall apply in respect of Securities of each such description), or such other proportion as the parties may agree with respect to that Transaction; |

| (aa) | “Margin Securities”, in relation to a Margin Transfer, Securities reasonably acceptable to the party calling for such Margin Transfer; |

| (bb) | “Margin Transfer”, any, or any combination of, the payment or repayment of Cash Margin and the transfer of Margin Securities or Equivalent Margin Securities; |

| (cc) | “Market Value”, with respect to any Securities as of any time on any date, the price for such Securities at such time on such date obtained from a generally recognised source agreed to by the parties (and where different prices are obtained for different delivery dates, the price so obtainable for the earliest available such delivery date) (provided that the price of Securities that are suspended shall (for the purposes of paragraph 4) be nil unless the parties otherwise agree and (for all other purposes) shall be the price of those Securities as of close of business on the dealing day in the relevant market last preceding the date of suspension) plus the aggregate amount of Income which, as of such date, has accrued but not yet been paid in respect of the Securities to the extent not included in such price as of such date, and for these purposes any sum in a currency other than the Contractual Currency for the Transaction in question shall be converted into such Contractual Currency at the Spot Rate prevailing at the relevant time; |

| (dd) | “Net Exposure”, the meaning specified in paragraph 4(c); |

| (ee) | the “Net Margin” provided to a party at any time, the excess (if any) at that time of (i) the sum of the amount of Cash Margin paid to that party (including accrued interest on such Cash Margin which has not been paid to the other party) and the Market Value of Margin Securities transferred to that party under paragraph 4(a) (excluding any Cash Margin which has been repaid to the other party and any Margin Securities in respect of which Equivalent Margin Securities have been transferred to the other party) over (ii) the sum of the amount of Cash Margin paid to the other party (including accrued interest on such Cash Margin which has not been paid by the other party) and the Market Value of Margin Securities transferred to the other party under paragraph 4(a) (excluding any Cash Margin which has been repaid by the other party and any Margin Securities in respect of which Equivalent Margin Securities have been transferred by the other party) and for this purpose any amounts not denominated in the Base Currency shall be converted into the Base Currency at the Spot Rate prevailing at the relevant time; |

| - 5 - |

| (ff) | “Net Paying Securities”, Securities which are of a kind such that, were they to be the subject of a Transaction to which paragraph 5 applies, any payment made by Buyer under paragraph 5 would be one in respect of which either Buyer would or might be required to make a withholding or deduction for or on account of taxes or duties or Seller might be required to make or account for a payment for or on account of taxes or duties (in each case other than tax on overall net income) by reference to such payment; |

| (gg) | “Net Value”, the meaning specified in paragraph 10; |

| (hh) | “New Purchased Securities”, the meaning specified in paragraph 8(a); |

| (ii) | “Price Differential”, with respect to any Transaction as of any date, the aggregate amount obtained by daily application of the Pricing Rate for such Transaction to the Purchase Price for such Transaction (on a 360 day basis or 365 day basis in accordance with the applicable ISMA convention, unless otherwise agreed between the parties for the Transaction), for the actual number of days during the period commencing on (and including) the Purchase Date for such Transaction and ending on (but excluding) the date of calculation or, if earlier, the Repurchase Date; |

| (jj) | “Pricing Rate”, with respect to any Transaction, the per annum percentage rate for calculation of the Price Differential agreed to by Buyer and Seller in relation to that Transaction; |

| (kk) | “Purchase Date”, with respect to any Transaction, the date on which Purchased Securities are to be sold by Seller to Buyer in relation to that Transaction; |

| (ll) | “Purchase Price”, on the Purchase Date, the price at which Purchased Securities are sold or are to be sold by Seller to Buyer; |

| (mm) | “Purchased Securities”, with respect to any Transaction, the Securities sold or to be sold by Seller to Buyer under that Transaction, and any New Purchased Securities transferred by Seller to Buyer under paragraph 8 in respect of that Transaction; |

| (nn) | “Receivable Securities”, the meaning specified in paragraph 10; |

| (oo) | “Repurchase Date”, with respect to any Transaction, the date on which Buyer is to sell Equivalent Securities to Seller in relation to that Transaction; |

| (pp) | “Repurchase Price”, with respect to any Transaction and as of any date, the sum of the Purchase Price and the Price Differential as of such date; |

| (qq) | “Special Default Notice”, the meaning specified in paragraph 14; |

| (rr) | “Spot Rate”, where an amount in one currency is to be converted into a second currency on any date, unless the parties otherwise agree, the spot rate of exchange quoted by Barclays Bank PLC in the London inter-bank market for the sale by it of such second currency against a purchase by it of such first currency; |

| - 6 - |

| (ss) | “TARGET”, the Trans-European Automated Real-time Gross Settlement Express Transfer System; |

| (tt) | “Term”, with respect to any Transaction, the interval of time commencing with the Purchase Date and ending with the Repurchase Date; |

| (uu) | “Termination”, with respect to any Transaction, refers to the requirement with respect to such Transaction for Buyer to sell Equivalent Securities against payment by Seller of the Repurchase Price in accordance with paragraph 3(f), and reference to a Transaction having a “fixed term” or being “terminable upon demand” shall be construed accordingly; |

| (vv) | “Transaction Costs”, the meaning specified in paragraph 10; |

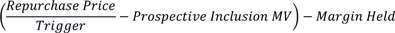

| (ww) | “Transaction Exposure”, with respect to any Transaction at any time during the period from the Purchase Date to the Repurchase Date (or, if later, the date on which Equivalent Securities are delivered to Seller or the Transaction is terminated under paragraph 10(g) or 10(h)), the difference between (i) the Repurchase Price at such time multiplied by the applicable Margin Ratio (or, where the Transaction relates to Securities of more than one description to which different Margin Ratios apply, the amount produced by multiplying the Repurchase Price attributable to Equivalent Securities of each such description by the applicable Margin Ratio and aggregating the resulting amounts, the Repurchase Price being for this purpose attributed to Equivalent Securities of each such description in the same proportions as those in which the Purchase Price was apportioned among the Purchased Securities) and (ii) the Market Value of Equivalent Securities at such time. If (i) is greater than (ii), Buyer has a Transaction Exposure for that Transaction equal to that excess. If (ii) is greater than (i), Seller has a Transaction Exposure for that Transaction equal to that excess; and |

| (xx) | except in paragraphs 14(b)(i) and 18, references in this Agreement to “written” communications and communications “in writing” include communications made through any electronic system agreed between the parties which is capable of reproducing such communication in hard copy form. |

| 3. | Initiation; Confirmation; Termination |

| (a) | A Transaction may be entered into orally or in writing at the initiation of either Buyer or Seller. |

| (b) | Upon agreeing to enter into a Transaction hereunder Buyer or Seller (or both), as shall have been agreed, shall promptly deliver to the other party written confirmation of such Transaction (a “Confirmation”). |

| - 7 - |

The Confirmation shall describe the Purchased Securities (including CUSIP or ISIN or other identifying number or numbers, if any), identify Buyer and Seller and set forth -

| (i) | the Purchase Date; |

| (ii) | the Purchase Price; |

| (iii) | the Repurchase Date, unless the Transaction is to be terminable on demand (in which case the Confirmation shall state that it is terminable on demand); |

| (iv) | the Pricing Rate applicable to the Transaction; |

| (v) | in respect of each party the details of the bank account[s] to which payments to be made hereunder are to be credited; |

| (vi) | where the Buy/Sell Back Annex applies, whether the Transaction is a Repurchase Transaction or a Buy/Sell Back Transaction; |

| (vii) | where the Agency Annex applies, whether the Transaction is an Agency Transaction and, if so, the identity of the party which is acting as agent and the name, code or identifier of the Principal; and |

| (viii) | any additional terms or conditions of the Transaction; |

and may be in the form of Annex II hereto or may be in any other form to which the parties agree.

The Confirmation relating to a Transaction shall, together with this Agreement, constitute prima facie evidence of the terms agreed between Buyer and Seller for that Transaction, unless objection is made with respect to the Confirmation promptly after receipt thereof. In the event of any conflict between the terms of such Confirmation and this Agreement, the Confirmation shall prevail in respect of that Transaction and those terms only.

| (c) | On the Purchase Date for a Transaction, Seller shall transfer the Purchased Securities to Buyer or its agent against the payment of the Purchase Price by Buyer. |

| (d) | Termination of a Transaction will be effected, in the case of on demand Transactions, on the date specified for Termination in such demand, and, in the case of fixed term Transactions, on the date fixed for Termination. |

| (e) | In the case of on demand Transactions, demand for Termination shall be made by Buyer or Seller, by telephone or otherwise, and shall provide for Termination to occur after not less than the minimum period as is customarily required for the settlement or delivery of money or Equivalent Securities of the relevant kind. |

| - 8 - |

| (f) | On the Repurchase Date, Buyer shall transfer to Seller or its agent Equivalent Securities against the payment of the Repurchase Price by Seller (less any amount then payable and unpaid by Buyer to Seller pursuant to paragraph 5). |

| 4. | Margin Maintenance |

| (a) | If at any time either party has a Net Exposure in respect of the other party it may by notice to the other party require the other party to make a Margin Transfer to it of an aggregate amount or value at least equal to that Net Exposure. |

| (b) | A notice under sub-paragraph (a) above may be given orally or in writing. |

| (c) | For the purposes of this Agreement a party has a Net Exposure in respect of the other party if the aggregate of all the first party’s Transaction Exposures plus any amount payable to the first party under paragraph 5 but unpaid less the amount of any Net Margin provided to the first party exceeds the aggregate of all the other party’s Transaction Exposures plus any amount payable to the other party under paragraph 5 but unpaid less the amount of any Net Margin provided to the other party; and the amount of the Net Exposure is the amount of the excess. For this purpose any amounts not denominated in the Base Currency shall be converted into the Base Currency at the Spot Rate prevailing at the relevant time. |

| (d) | To the extent that a party calling for a Margin Transfer has previously paid Cash Margin which has not been repaid or delivered Margin Securities in respect of which Equivalent Margin Securities have not been delivered to it, that party shall be entitled to require that such Margin Transfer be satisfied first by the repayment of such Cash Margin or the delivery of Equivalent Margin Securities but, subject to this, the composition of a Margin Transfer shall be at the option of the party making such Margin Transfer. |

| (e) | Any Cash Margin transferred shall be in the Base Currency or such other currency as the parties may agree. |

| (f) | A payment of Cash Margin shall give rise to a debt owing from the party receiving such payment to the party making such payment. Such debt shall bear interest at such rate, payable at such times, as may be specified in Annex I hereto in respect of the relevant currency or otherwise agreed between the parties, and shall be repayable subject to the terms of this Agreement. |

| (g) | Where Seller or Buyer becomes obliged under sub-paragraph (a) above to make a Margin Transfer, it shall transfer Cash Margin or Margin Securities or Equivalent Margin Securities within the minimum period specified in Annex I hereto or, if no period is there specified, such minimum period as is customarily required for the settlement or delivery of money, Margin Securities or Equivalent Margin Securities of the relevant kind. |

| - 9 - |

| (h) | The parties may agree that, with respect to any Transaction, the provisions of subparagraphs (a) to (g) above shall not apply but instead that margin may be provided separately in respect of that Transaction in which case - |

| (i) | that Transaction shall not be taken into account when calculating whether either party has a Net Exposure; |

| (ii) | margin shall be provided in respect of that Transaction in such manner as the parties may agree; and |

| (iii) | margin provided in respect of that Transaction shall not be taken into account for the purposes of sub-paragraphs (a) to (g) above. |

| (i) | The parties may agree that any Net Exposure which may arise shall be eliminated not by Margin Transfers under the preceding provisions of this paragraph but by the repricing of Transactions under sub-paragraph (j) below, the adjustment of Transactions under sub-paragraph (k) below or a combination of both these methods. |

| (j) | Where the parties agree that a Transaction is to be repriced under this sub-paragraph, such repricing shall be effected as follows - |

| (i) | the Repurchase Date under the relevant Transaction (the “Original Transaction”) shall be deemed to occur on the date on which the repricing is to be effected (the “Repricing Date”); |

| (ii) | the parties shall be deemed to have entered into a new Transaction (the “Repriced Transaction”) on the terms set out in (iii) to (vi) below; |

| (iii) | the Purchased Securities under the Repriced Transaction shall be Securities equivalent to the Purchased Securities under the Original Transaction; |

| (iv) | the Purchase Date under the Repriced Transaction shall be the Repricing Date; |

| (v) | the Purchase Price under the Repriced Transaction shall be such amount as shall, when multiplied by the Margin Ratio applicable to the Original Transaction, be equal to the Market Value of such Securities on the Repricing Date; |

| (vi) | the Repurchase Date, the Pricing Rate, the Margin Ratio and, subject as aforesaid, the other terms of the Repriced Transaction shall be identical to those of the Original Transaction; |

| (vii) | the obligations of the parties with respect to the delivery of the Purchased Securities and the payment of the Purchase Price under the Repriced Transaction shall be set off against their obligations with respect to the delivery of Equivalent Securities and payment of the Repurchase Price under the Original Transaction and accordingly only a net cash sum shall be paid by one party to the other. Such net cash sum shall be paid within the period specified in sub-paragraph (g) above. |

| - 10 - |

| (k) | The adjustment of a Transaction (the “Original Transaction”) under this sub-paragraph shall be effected by the parties agreeing that on the date on which the adjustment is to be made (the “Adjustment Date”) the Original Transaction shall be terminated and they shall enter into a new Transaction (the “Replacement Transaction”) in accordance with the following provisions - |

| (i) | the Original Transaction shall be terminated on the Adjustment Date on such terms as the parties shall agree on or before the Adjustment Date; |

| (ii) | the Purchased Securities under the Replacement Transaction shall be such Securities as the parties shall agree on or before the Adjustment Date (being Securities the aggregate Market Value of which at the Adjustment Date is substantially equal to the Repurchase Price under the Original Transaction at the Adjustment Date multiplied by the Margin Ratio applicable to the Original Transaction); |

| (iii) | the Purchase Date under the Replacement Transaction shall be the Adjustment Date; |

| (iv) | the other terms of the Replacement Transaction shall be such as the parties shall agree on or before the Adjustment Date; and |

| (v) | the obligations of the parties with respect to payment and delivery of Securities on the Adjustment Date under the Original Transaction and the Replacement Transaction shall be settled in accordance with paragraph 6 within the minimum period specified in sub-paragraph (g) above. |

| 5. | Income Payments |

Unless otherwise agreed -

| (i) | where the Term of a particular Transaction extends over an Income Payment Date in respect of any Securities subject to that Transaction, Buyer shall on the date such Income is paid by the issuer transfer to or credit to the account of Seller an amount equal to (and in the same currency as) the amount paid by the issuer; |

| (ii) | where Margin Securities are transferred from one party (“the first party”) to the other party (“the second party”) and an Income Payment Date in respect of such Securities occurs before Equivalent Margin Securities are transferred by the second party to the first party, the second party shall on the date such Income is paid by the issuer transfer to or credit to the account of the first party an amount equal to (and in the same currency as) the amount paid by the issuer; |

| - 11 - |

and for the avoidance of doubt references in this paragraph to the amount of any Income paid by the issuer of any Securities shall be to an amount paid without any withholding or deduction for or on account of taxes or duties notwithstanding that a payment of such Income made in certain circumstances may be subject to such a withholding or deduction.

| 6. | Payment and Transfer |

| (a) | Unless otherwise agreed, all money paid hereunder shall be in immediately available freely convertible funds of the relevant currency. All Securities to be transferred hereunder (i) shall be in suitable form for transfer and shall be accompanied by duly executed instruments of transfer or assignment in blank (where required for transfer) and such other documentation as the transferee may reasonably request, or (ii) shall be transferred through the book entry system of Euroclear or Clearstream, or (iii) shall be transferred through any other agreed securities clearance system or (iv) shall be transferred by any other method mutually acceptable to Seller and Buyer. |

| (b) | Unless otherwise agreed, all money payable by one party to the other in respect of any Transaction shall be paid free and clear of, and without withholding or deduction for, any taxes or duties of whatsoever nature imposed, levied, collected, withheld or assessed by any authority having power to tax, unless the withholding or deduction of such taxes or duties is required by law. In that event, unless otherwise agreed, the paying party shall pay such additional amounts as will result in the net amounts receivable by the other party (after taking account of such withholding or deduction) being equal to such amounts as would have been received by it had no such taxes or duties been required to be withheld or deducted. |

| (c) | Unless otherwise agreed in writing between the parties, under each Transaction transfer of Purchased Securities by Seller and payment of Purchase Price by Buyer against the transfer of such Purchased Securities shall be made simultaneously and transfer of Equivalent Securities by Buyer and payment of Repurchase Price payable by Seller against the transfer of such Equivalent Securities shall be made simultaneously. |

| (d) | Subject to and without prejudice to the provisions of sub-paragraph 6(c), either party may from time to time in accordance with market practice and in recognition of the practical difficulties in arranging simultaneous delivery of Securities and money waive in relation to any Transaction its rights under this Agreement to receive simultaneous transfer and/or payment provided that transfer and/or payment shall, notwithstanding such waiver, be made on the same day and provided also that no such waiver in respect of one Transaction shall affect or bind it in respect of any other Transaction. |

| (e) | The parties shall execute and deliver all necessary documents and take all necessary steps to procure that all right, title and interest in any Purchased Securities, any Equivalent Securities, any Margin Securities and any Equivalent Margin Securities shall pass to the party to which transfer is being made upon transfer of the same in accordance with this Agreement, free from all liens, claims, charges and encumbrances. |

| - 12 - |

| (f) | Notwithstanding the use of expressions such as “Repurchase Date”, “Repurchase Price”, “margin”, “Net Margin”, “Margin Ratio” and “substitution”, which are used to reflect terminology used in the market for transactions of the kind provided for in this Agreement, all right, title and interest in and to Securities and money transferred or paid under this Agreement shall pass to the transferee upon transfer or payment, the obligation of the party receiving Purchased Securities or Margin Securities being an obligation to transfer Equivalent Securities or Equivalent Margin Securities. |

| (g) | Time shall be of the essence in this Agreement. |

| (h) | Subject to paragraph 10, all amounts in the same currency payable by each party to the other under any Transaction or otherwise under this Agreement on the same date shall be combined in a single calculation of a net sum payable by one party to the other and the obligation to pay that sum shall be the only obligation of either party in respect of those amounts. |

| (i) | Subject to paragraph 10, all Securities of the same issue, denomination, currency and series, transferable by each party to the other under any Transaction or hereunder on the same date shall be combined in a single calculation of a net quantity of Securities transferable by one party to the other and the obligation to transfer the net quantity of Securities shall be the only obligation of either party in respect of the Securities so transferable and receivable. |

| (j) | If the parties have specified in Annex I hereto that this paragraph 6(j) shall apply, each obligation of a party under this Agreement (other than an obligation arising under paragraph 10) is subject to the condition precedent that none of those events specified in paragraph 10(a) which are identified in Annex I hereto for the purposes of this paragraph 6(j) (being events which, upon the serving of a Default Notice, would be an Event of Default with respect to the other party) shall have occurred and be continuing with respect to the other party. |

| 7. | Contractual Currency |

| (a) | All the payments made in respect of the Purchase Price or the Repurchase Price of any Transaction shall be made in the currency of the Purchase Price (the “Contractual Currency”) save as provided in paragraph 10(c)(ii). Notwithstanding the foregoing, the payee of any money may, at its option, accept tender thereof in any other currency, provided, however, that, to the extent permitted by applicable law, the obligation of the payer to pay such money will be discharged only to the extent of the amount of the Contractual Currency that such payee may, consistent with normal banking procedures, purchase with such other currency (after deduction of any premium and costs of exchange) for delivery within the customary delivery period for spot transactions in respect of the relevant currency. |

| - 13 - |

| (b) | If for any reason the amount in the Contractual Currency received by a party, including amounts received after conversion of any recovery under any judgment or order expressed in a currency other than the Contractual Currency, falls short of the amount in the Contractual Currency due and payable, the party required to make the payment will, as a separate and independent obligation, to the extent permitted by applicable law, immediately transfer such additional amount in the Contractual Currency as may be necessary to compensate for the shortfall. |

| (c) | If for any reason the amount in the Contractual Currency received by a party exceeds the amount of the Contractual Currency due and payable, the party receiving the transfer will refund promptly the amount of such excess. |

| 8. | Substitution |

| (a) | A Transaction may at any time between the Purchase Date and Repurchase Date, if Seller so requests and Buyer so agrees, be varied by the transfer by Buyer to Seller of Securities equivalent to the Purchased Securities, or to such of the Purchased Securities as shall be agreed, in exchange for the transfer by Seller to Buyer of other Securities of such amount and description as shall be agreed (“New Purchased Securities”) (being Securities having a Market Value at the date of the variation at least equal to the Market Value of the Equivalent Securities transferred to Seller). |

| (b) | Any variation under sub-paragraph (a) above shall be effected, subject to paragraph 6(d), by the simultaneous transfer of the Equivalent Securities and New Purchased Securities concerned. |

| (c) | A Transaction which is varied under sub-paragraph (a) above shall thereafter continue in effect as though the Purchased Securities under that Transaction consisted of or included the New Purchased Securities instead of the Securities in respect of which Equivalent Securities have been transferred to Seller. |

| (d) | Where either party has transferred Margin Securities to the other party it may at any time before Equivalent Margin Securities are transferred to it under paragraph 4 request the other party to transfer Equivalent Margin Securities to it in exchange for the transfer to the other party of new Margin Securities having a Market Value at the time of transfer at least equal to that of such Equivalent Margin Securities. If the other party agrees to the request, the exchange shall be effected, subject to paragraph 6(d), by the simultaneous transfer of the Equivalent Margin Securities and new Margin Securities concerned. Where either or both of such transfers is or are effected through a settlement system in circumstances which under the rules and procedures of that settlement system give rise to a payment by or for the account of one party to or for the account of the other party, the parties shall cause such payment or payments to be made outside that settlement system, for value the same day as the payments made through that settlement system, as shall ensure that the exchange of Equivalent Margin Securities and new Margin Securities effected under this sub-paragraph does not give rise to any net payment of cash by either party to the other. |

| - 14 - |

| 9. | Representations |

Each party represents and warrants to the other that -

| (a) | it is duly authorised to execute and deliver this Agreement, to enter into the Transactions contemplated hereunder and to perform its obligations hereunder and thereunder and has taken all necessary action to authorise such execution, delivery and performance; |

| (b) | it will engage in this Agreement and the Transactions contemplated hereunder (other than Agency Transactions) as principal; |

| (c) | the person signing this Agreement on its behalf is, and any person representing it in entering into a Transaction will be, duly authorised to do so on its behalf; |

| (d) | it has obtained all authorisations of any governmental or regulatory body required in connection with this Agreement and the Transactions contemplated hereunder and such authorisations are in full force and effect; |

| (e) | the execution, delivery and performance of this Agreement and the Transactions contemplated hereunder will not violate any law, ordinance, charter, by-law or rule applicable to it or any agreement by which it is bound or by which any of its assets are affected; |

| (f) | it has satisfied itself and will continue to satisfy itself as to the tax implications of the Transactions contemplated hereunder; |

| (g) | in connection with this Agreement and each Transaction - |

| (i) | unless there is a written agreement with the other party to the contrary, it is not relying on any advice (whether written or oral) of the other party, other than the representations expressly set out in this Agreement; |

| (ii) | it has made and will make its own decisions regarding the entering into of any Transaction based upon its own judgment and upon advice from such professional advisers as it has deemed it necessary to consult; |

| (iii) | it understands the terms, conditions and risks of each Transaction and is willing to assume (financially and otherwise) those risks; and |

| (h) | at the time of transfer to the other party of any Securities it will have the full and unqualified right to make such transfer and that upon such transfer of Securities the other party will receive all right, title and interest in and to those Securities free of any lien, claim, charge or encumbrance. |

| - 15 - |

On the date on which any Transaction is entered into pursuant hereto, and on each day on which Securities, Equivalent Securities, Margin Securities or Equivalent Margin Securities are to be transferred under any Transaction, Buyer and Seller shall each be deemed to repeat all the foregoing representations. For the avoidance of doubt and notwithstanding any arrangements which Seller or Buyer may have with any third party, each party will be liable as a principal for its obligations under this Agreement and each Transaction.

| 10. | Events of Default |

| (a) | If any of the following events (each an “Event of Default”) occurs in relation to either party (the “Defaulting Party”, the other party being the “non-Defaulting Party”) whether acting as Seller or Buyer - |

| (i) | Buyer fails to pay the Purchase Price upon the applicable Purchase Date or Seller fails to pay the Repurchase Price upon the applicable Repurchase Date, and the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| (ii) | if the parties have specified in Annex I hereto that this sub-paragraph shall apply, Seller fails to deliver Purchased Securities on the Purchase Date or Buyer fails to deliver Equivalent Securities on the Repurchase Date, and the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| (iii) | Seller or Buyer fails to pay when due any sum payable under sub-paragraph (g) or (h) below, and the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| (iv) | Seller or Buyer fails to comply with paragraph 4 and the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| (v) | Seller or Buyer fails to comply with paragraph 5 and the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| (vi) | an Act of Insolvency occurs with respect to Seller or Buyer and (except in the case of an Act of Insolvency which is the presentation of a petition for winding-up or any analogous proceeding or the appointment of a liquidator or analogous officer of the Defaulting Party in which case no such notice shall be required) the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| (vii) | any representations made by Seller or Buyer are incorrect or untrue in any material respect when made or repeated or deemed to have been made or repeated, and the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| (viii) | Seller or Buyer admits to the other that it is unable to, or intends not to, perform any of its obligations hereunder and/or in respect of any Transaction and the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| - 16 - |

| (ix) | Seller or Buyer is suspended or expelled from membership of or participation in any securities exchange or association or other self regulating organisation, or suspended from dealing in securities by any government agency, or any of the assets of either Seller or Buyer or the assets of investors held by, or to the order of, Seller or Buyer are transferred or ordered to be transferred to a trustee by a regulatory authority pursuant to any securities regulating legislation and the non-Defaulting Party serves a Default Notice on the Defaulting Party; or |

| (x) | Seller or Buyer fails to perform any other of its obligations hereunder and does not remedy such failure within 30 days after notice is given by the non-Defaulting Party requiring it to do so, and the non-Defaulting Party serves a Default Notice on the Defaulting Party; |

then sub-paragraphs (b) to (f) below shall apply.

| (b) | The Repurchase Date for each Transaction hereunder shall be deemed immediately to occur and, subject to the following provisions, all Cash Margin (including interest accrued) shall be immediately repayable and Equivalent Margin Securities shall be immediately deliverable (and so that, where this sub-paragraph applies, performance of the respective obligations of the parties with respect to the delivery of Securities, the payment of the Repurchase Prices for any Equivalent Securities and the repayment of any Cash Margin shall be effected only in accordance with the provisions of sub-paragraph (c) below). |

| (c) | (i) | The Default Market Values of the Equivalent Securities and any Equivalent Margin Securities to be transferred, the amount of any Cash Margin (including the amount of interest accrued) to be transferred and the Repurchase Prices to be paid by each party shall be established by the non-Defaulting Party for all Transactions as at the Repurchase Date; and |

| (ii) | on the basis of the sums so established, an account shall be taken (as at the Repurchase Date) of what is due from each party to the other under this Agreement (on the basis that each party’s claim against the other in respect of the transfer to it of Equivalent Securities or Equivalent Margin Securities under this Agreement equals the Default Market Value therefor) and the sums due from one party shall be set off against the sums due from the other and only the balance of the account shall be payable (by the party having the claim valued at the lower amount pursuant to the foregoing) and such balance shall be due and payable on the next following Business Day. For the purposes of this calculation, all sums not denominated in the Base Currency shall be converted into the Base Currency on the relevant date at the Spot Rate prevailing at the relevant time. |

| - 17 - |

| (d) | For the purposes of this Agreement, the “Default Market Value” of any Equivalent Securities or Equivalent Margin Securities shall be determined in accordance with sub-paragraph (e) below, and for this purpose - |

| (i) | the “Appropriate Market” means, in relation to Securities of any description, the market which is the most appropriate market for Securities of that description, as determined by the non-Defaulting Party; |

| (ii) | the “Default Valuation Time” means, in relation to an Event of Default, the close of business in the Appropriate Market on the fifth dealing day after the day on which that Event of Default occurs or, where that Event of Default is the occurrence of an Act of Insolvency in respect of which under paragraph 10(a) no notice is required from the non-Defaulting Party in order for such event to constitute an Event of Default, the close of business on the fifth dealing day after the day on which the non-Defaulting Party first became aware of the occurrence of such Event of Default; |

| (iii) | “Deliverable Securities” means Equivalent Securities or Equivalent Margin Securities to be delivered by the Defaulting Party; |

| (iv) | “Net Value” means at any time, in relation to any Deliverable Securities or Receivable Securities, the amount which, in the reasonable opinion of the non-Defaulting Party, represents their fair market value, having regard to such pricing sources and methods (which may include, without limitation, available prices for Securities with similar maturities, terms and credit characteristics as the relevant Equivalent Securities or Equivalent Margin Securities) as the non-Defaulting Party considers appropriate, less, in the case of Receivable Securities, or plus, in the case of Deliverable Securities, all Transaction Costs which would be incurred in connection with the purchase or sale of such Securities; |

| (v) | “Receivable Securities” means Equivalent Securities or Equivalent Margin Securities to be delivered to the Defaulting Party; and |

| (vi) | “Transaction Costs” in relation to any transaction contemplated in paragraph 10(d) or (e) means the reasonable costs, commission, fees and expenses (including any mark-up or mark-down) that would be incurred in connection with the purchase of Deliverable Securities or sale of Receivable Securities, calculated on the assumption that the aggregate thereof is the least that could reasonably be expected to be paid in order to carry out the transaction; |

| (e) | (i) | If between the occurrence of the relevant Event of Default and the Default Valuation Time the non-Defaulting Party gives to the Defaulting Party a written notice (a “Default Valuation Notice”) which - |

| (A) | states that, since the occurrence of the relevant Event of Default, the non-Defaulting Party has sold, in the case of Receivable Securities, or purchased, in the case of Deliverable Securities, Securities which form part of the same issue and are of an identical type and description as those Equivalent Securities or Equivalent Margin Securities, and that the non-Defaulting Party elects to treat as the Default Market Value - |

| - 18 - |

| (aa) | in the case of Receivable Securities, the net proceeds of such sale after deducting all reasonable costs, fees and expenses incurred in connection therewith (provided that, where the Securities sold are not identical in amount to the Equivalent Securities or Equivalent Margin Securities, the non-Defaulting Party may either (x) elect to treat such net proceeds of sale divided by the amount of Securities sold and multiplied by the amount of the Equivalent Securities or Equivalent Margin Securities as the Default Market Value or (y) elect to treat such net proceeds of sale of the Equivalent Securities or Equivalent Margin Securities actually sold as the Default Market Value of that proportion of the Equivalent Securities or Equivalent Margin Securities, and, in the case of (y), the Default Market Value of the balance of the Equivalent Securities or Equivalent Margin Securities shall be determined separately in accordance with the provisions of this paragraph 10(e) and accordingly may be the subject of a separate notice (or notices) under this paragraph 10(e)(i)); or |

| (bb) | in the case of Deliverable Securities, the aggregate cost of such purchase, including all reasonable costs, fees and expenses incurred in connection therewith (provided that, where the Securities purchased are not identical in amount to the Equivalent Securities or Equivalent Margin Securities, the non-Defaulting Party may either (x) elect to treat such aggregate cost divided by the amount of Securities sold and multiplied by the amount of the Equivalent Securities or Equivalent Margin Securities as the Default Market Value or (y) elect to treat the aggregate cost of purchasing the Equivalent Securities or Equivalent Margin Securities actually purchased as the Default Market Value of that proportion of the Equivalent Securities or Equivalent Margin Securities, and, in the case of (y), the Default Market Value of the balance of the Equivalent Securities or Equivalent Margin Securities shall be determined separately in accordance with the provisions of this paragraph 10(e) and accordingly may be the subject of a separate notice (or notices) under this paragraph 10(e)(i)); |

| - 19 - |

| (B) | states that the non-Defaulting Party has received, in the case of Deliverable Securities, offer quotations or, in the case of Receivable Securities, bid quotations in respect of Securities of the relevant description from two or more market makers or regular dealers in the Appropriate Market in a commercially reasonable size (as determined by the non-Defaulting Party) and specifies - |

| (aa) | the price or prices quoted by each of them for, in the case of Deliverable Securities, the sale by the relevant market marker or dealer of such Securities or, in the case of Receivable Securities, the purchase by the relevant market maker or dealer of such Securities; |

| (bb) | the Transaction Costs which would be incurred in connection with such a transaction; and |

| (cc) | that the non-Defaulting Party elects to treat the price so quoted (or, where more than one price is so quoted, the arithmetic mean of the prices so quoted), after deducting, in the case of Receivable Securities, or adding, in the case of Deliverable Securities, such Transaction Costs, as the Default Market Value of the relevant Equivalent Securities or Equivalent Margin Securities; or |

| (C) | states - |

| (aa) | that either (x) acting in good faith, the non-Defaulting Party has endeavoured but been unable to sell or purchase Securities in accordance with sub-paragraph (i)(A) above or to obtain quotations in accordance with sub-paragraph (i)(B) above (or both) or (y) the non-Defaulting Party has determined that it would not be commercially reasonable to obtain such quotations, or that it would not be commercially reasonable to use any quotations which it has obtained under sub-paragraph (i)(B) above; and |

| (bb) | that the non-Defaulting Party has determined the Net Value of the relevant Equivalent Securities or Equivalent Margin Securities (which shall be specified) and that the non-Defaulting Party elects to treat such Net Value as the Default Market Value of the relevant Equivalent Securities or Equivalent Margin Securities, |

then the Default Market Value of the relevant Equivalent Securities or Equivalent Margin Securities shall be an amount equal to the Default Market Value specified in accordance with (A), (B)(cc) or, as the case may be, (C)(bb) above.

| (ii) | If by the Default Valuation Time the non-Defaulting Party has not given a Default Valuation Notice, the Default Market Value of the relevant Equivalent Securities or Equivalent Margin Securities shall be an amount equal to their Net Value at the Default Valuation Time; provided that, if at the Default Valuation Time the non-Defaulting Party reasonably determines that, owing to circumstances affecting the market in the Equivalent Securities or Equivalent Margin Securities in question, it is not possible for the non-Defaulting Party to determine a Net Value of such Equivalent Securities or Equivalent Margin Securities which is commercially reasonable, the Default Market Value of such Equivalent Securities or Equivalent Margin Securities shall be an amount equal to their Net Value as determined by the non-Defaulting Party as soon as reasonably practicable after the Default Valuation Time. |

| - 20 - |

| (f) | The Defaulting Party shall be liable to the non-Defaulting Party for the amount of all reasonable legal and other professional expenses incurred by the non-Defaulting Party in connection with or as a consequence of an Event of Default, together with interest thereon at LIBOR or, in the case of an expense attributable to a particular Transaction, the Pricing Rate for the relevant Transaction if that Pricing Rate is greater than LIBOR. |

| (g) | If Seller fails to deliver Purchased Securities to Buyer on the applicable Purchase Date Buyer may - |

| (i) | if it has paid the Purchase Price to Seller, require Seller immediately to repay the sum so paid; |

| (ii) | if Buyer has a Transaction Exposure to Seller in respect of the relevant Transaction, require Seller from time to time to pay Cash Margin at least equal to such Transaction Exposure; |

| (iii) | at any time while such failure continues, terminate the Transaction by giving written notice to Seller. On such termination the obligations of Seller and Buyer with respect to delivery of Purchased Securities and Equivalent Securities shall terminate and Seller shall pay to Buyer an amount equal to the excess of the Repurchase Price at the date of Termination over the Purchase Price. |

| (h) | If Buyer fails to deliver Equivalent Securities to Seller on the applicable Repurchase Date Seller may - |

| (i) | if it has paid the Repurchase Price to Buyer, require Buyer immediately to repay the sum so paid; |

| (ii) | if Seller has a Transaction Exposure to Buyer in respect of the relevant Transaction, require Buyer from time to time to pay Cash Margin at least equal to such Transaction Exposure; |

| (iii) | at any time while such failure continues, by written notice to Buyer declare that that Transaction (but only that Transaction) shall be terminated immediately in accordance with sub-paragraph (c) above (disregarding for this purpose references in that sub-paragraph to transfer of Cash Margin and delivery of Equivalent Margin Securities and as if references to the Repurchase Date were to the date on which notice was given under this subparagraph). |

| - 21 - |

| (i) | The provisions of this Agreement constitute a complete statement of the remedies available to each party in respect of any Event of Default. |

| (j) | Subject to paragraph 10(k), neither party may claim any sum by way of consequential loss or damage in the event of a failure by the other party to perform any of its obligations under this Agreement. |

| (k) | (i) | Subject to sub-paragraph (ii) below, if as a result of a Transaction terminating before its agreed Repurchase Date under paragraphs 10(b), 10(g)(iii) or 10(h)(iii), the non-Defaulting Party, in the case of paragraph 10(b), Buyer, in the case of paragraph 10(g)(iii), or Seller, in the case of paragraph 10(h)(iii), (in each case the “first party”) incurs any loss or expense in entering into replacement transactions, the other party shall be required to pay to the first party the amount determined by the first party in good faith to be equal to the loss or expense incurred in connection with such replacement transactions (including all fees, costs and other expenses) less the amount of any profit or gain made by that party in connection with such replacement transactions; provided that if that calculation results in a negative number, an amount equal to that number shall be payable by the first party to the other party. |

| (ii) | If the first party reasonably decides, instead of entering into such replacement transactions, to replace or unwind any hedging transactions which the first party entered into in connection with the Transaction so terminating, or to enter into any replacement hedging transactions, the other party shall be required to pay to the first party the amount determined by the first party in good faith to be equal to the loss or expense incurred in connection with entering into such replacement or unwinding (including all fees, costs and other expenses) less the amount of any profit or gain made by that party in connection with such replacement or unwinding; provided that if that calculation results in a negative number, an amount equal to that number shall be payable by the first party to the other party. |

| (l) | Each party shall immediately notify the other if an Event of Default, or an event which, upon the serving of a Default Notice, would be an Event of Default, occurs in relation to it. |

| 11. | Tax Event |

| (a) | This paragraph shall apply if either party notifies the other that - |

| (i) | any action taken by a taxing authority or brought in a court of competent jurisdiction (regardless of whether such action is taken or brought with respect to a party to this Agreement); or |

| - 22 - |

| (ii) | a change in the fiscal or regulatory regime (including, but not limited to, a change in law or in the general interpretation of law but excluding any change in any rate of tax), |

has or will, in the notifying party’s reasonable opinion, have a material adverse effect on that party in the context of a Transaction.

| (b) | If so requested by the other party, the notifying party will furnish the other with an opinion of a suitably qualified adviser that an event referred to in sub-paragraph (a)(i) or (ii) above has occurred and affects the notifying party. |

| (c) | Where this paragraph applies, the party giving the notice referred to in sub-paragraph may, subject to sub-paragraph (d) below, terminate the Transaction with effect from a date specified in the notice, not being earlier (unless so agreed by the other party) than 30 days after the date of the notice, by nominating that date as the Repurchase Date. |

| (d) | If the party receiving the notice referred to in sub-paragraph (a) so elects, it may override that notice by giving a counter-notice to the other party. If a counter-notice is given, the party which gives the counter-notice will be deemed to have agreed to indemnify the other party against the adverse effect referred to in sub-paragraph (a) so far as relates to the relevant Transaction and the original Repurchase Date will continue to apply. |

| (e) | Where a Transaction is terminated as described in this paragraph, the party which has given the notice to terminate shall indemnify the other party against any reasonable legal and other professional expenses incurred by the other party by reason of the termination, but the other party may not claim any sum by way of consequential loss or damage in respect of a termination in accordance with this paragraph. |

| (f) | This paragraph is without prejudice to paragraph 6(b) (obligation to pay additional amounts if withholding or deduction required); but an obligation to pay such additional amounts may, where appropriate, be a circumstance which causes this paragraph to apply. |

| 12. | Interest |

To the extent permitted by applicable law, if any sum of money payable hereunder or under any Transaction is not paid when due, interest shall accrue on the unpaid sum as a separate debt at the greater of the Pricing Rate for the Transaction to which such sum relates (where such sum is referable to a Transaction) and LIBOR on a 360 day basis or 365 day basis in accordance with the applicable ISMA convention, for the actual number of days during the period from and including the date on which payment was due to, but excluding, the date of payment.

| - 23 - |

| 13. | Single Agreement |

Each party acknowledges that, and has entered into this Agreement and will enter into each Transaction hereunder in consideration of and in reliance upon the fact that all Transactions hereunder constitute a single business and contractual relationship and are made in consideration of each other. Accordingly, each party agrees (i) to perform all of its obligations in respect of each Transaction hereunder, and that a default in the performance of any such obligations shall constitute a default by it in respect of all Transactions hereunder, and (ii) that payments, deliveries and other transfers made by either of them in respect of any Transaction shall be deemed to have been made in consideration of payments, deliveries and other transfers in respect of any other Transactions hereunder.

| 14. | Notices and Other Communications |

| (a) | Any notice or other communication to be given under this Agreement - |

| (i) | shall be in the English language, and except where expressly otherwise provided in this Agreement, shall be in writing; |

| (ii) | may be given in any manner described in sub-paragraphs (b) and (c) below; |

| (iii) | shall be sent to the party to whom it is to be given at the address or number, or in accordance with the electronic messaging details, set out in Annex I hereto. |

| (b) | Subject to sub-paragraph (c) below, any such notice or other communication shall be effective - |

| (i) | if in writing and delivered in person or by courier, at the time when it is delivered; |

| (ii) | if sent by telex, at the time when the recipient’s answerback is received; |

| (iii) | if sent by facsimile transmission, at the time when the transmission is received by a responsible employee of the recipient in legible form (it being agreed that the burden of proving receipt will be on the sender and will not be met by a transmission report generated by the sender’s facsimile machine); |

| (iv) | if sent by certified or registered mail (airmail, if overseas) or the equivalent (return receipt requested), at the time when that mail is delivered or its delivery is attempted; |

| (v) | if sent by electronic messaging system, at the time that electronic message is received; |

| - 24 - |

except that any notice or communication which is received, or delivery of which is attempted, after close of business on the date of receipt or attempted delivery or on a day which is not a day on which commercial banks are open for business in the place where that notice or other communication is to be given shall be treated as given at the opening of business on the next following day which is such a day.

| (c) | lf- |

| (i) | there occurs in relation to either party an event which, upon the service of a Default Notice, would be an Event of Default; and |

| (ii) | the non-Defaulting Party, having made all practicable efforts to do so, including having attempted to use at least two of the methods specified in sub-paragraph (b)(ii), (iii) or (v), has been unable to serve a Default Notice by one of the methods specified in those sub-paragraphs (or such of those methods as are normally used by the non-Defaulting Party when communicating with the Defaulting Party), |

the non-Defaulting Party may sign a written notice (a “Special Default Notice”) which -

| (aa) | specifies the relevant event referred to in paragraph 10(a) which has occurred in relation to the Defaulting Party; |

| (bb) | states that the non-Defaulting Party, having made all practicable efforts to do so, including having attempted to use at least two of the methods specified in sub-paragraph (b)(ii), (iii) or (v), has been unable to serve a Default Notice by one of the methods specified in those sub-paragraphs (or such of those methods as are normally used by the non-Defaulting Party when communicating with the Defaulting Party); |

| (cc) | specifies the date on which, and the time at which, the Special Default Notice is signed by the non-Defaulting Party; and |

| (dd) | states that the event specified in accordance with sub-paragraph (aa) above shall be treated as an Event of Default with effect from the date and time so specified. |

On the signature of a Special Default Notice the relevant event shall be treated with effect from the date and time so specified as an Event of Default in relation to the Defaulting Party, and accordingly references in paragraph 10 to a Default Notice shall be treated as including a Special Default Notice. A Special Default Notice shall be given to the Defaulting Party as soon as practicable after it is signed.

| - 25 - |

| (d) | Either party may by notice to the other change the address, telex or facsimile number or electronic messaging system details at which notices or other communications are to be given to it. |

| 15. | Entire Agreement; Severability |

This Agreement shall supersede any existing agreements between the parties containing general terms and conditions for Transactions. Each provision and agreement herein shall be treated as separate from any other provision or agreement herein and shall be enforceable notwithstanding the unenforceability of any such other provision or agreement.

| 16. | Non-assignability; Termination |

| (a) | Subject to sub-paragraph (b) below, neither party may assign, charge or otherwise deal with (including without limitation any dealing with any interest in or the creation of any interest in) its rights or obligations under this Agreement or under any Transaction without the prior written consent of the other party. Subject to the foregoing, this Agreement and any Transactions shall be binding upon and shall inure to the benefit of the parties and their respective successors and assigns. |

| (b) | Sub-paragraph (a) above shall not preclude a party from assigning, charging or otherwise dealing with all or any part of its interest in any sum payable to it under paragraph 10(c) or (f) above. |

| (c) | Either party may terminate this Agreement by giving written notice to the other, except that this Agreement shall, notwithstanding such notice, remain applicable to any Transactions then outstanding. |

| (d) | All remedies hereunder shall survive Termination in respect of the relevant Transaction and termination of this Agreement. |

| (e) | The participation of any additional member State of the European Union in economic and monetary union after 1 January 1999 shall not have the effect of altering any term of the Agreement or any Transaction, nor give a party the right unilaterally to alter or terminate the Agreement or any Transaction. |

| 17. | Governing Law |

This Agreement shall be governed by and construed in accordance with the laws of England. Buyer and Seller hereby irrevocably submit for all purposes of or in connection with this Agreement and each Transaction to the jurisdiction of the Courts of England.

Party A hereby appoints the person identified in Annex I hereto as its agent to receive on its behalf service of process in such courts. If such agent ceases to be its agent,

| - 26 - |

Party A shall promptly appoint, and notify Party B of the identity of, a new agent in England.

Party B hereby appoints the person identified in Annex I hereto as its agent to receive on its behalf service of process in such courts. If such agent ceases to be its agent, Party B shall promptly appoint, and notify Party A of the identity of, a new agent in England.

Each party shall deliver to the other, within 30 days of the date of this Agreement in the case of the appointment of a person identified in Annex I or of the date of the appointment of the relevant agent in any other case, evidence of the acceptance by the agent appointed by it pursuant to this paragraph of such appointment.

Nothing in this paragraph shall limit the right of any party to take proceedings in the courts of any other country of competent jurisdiction.

| 18. | No Waivers, etc. |

No express or implied waiver of any Event of Default by either party shall constitute a waiver of any other Event of Default and no exercise of any remedy hereunder by any party shall constitute a waiver of its right to exercise any other remedy hereunder. No modification or waiver of any provision of this Agreement and no consent by any party to a departure herefrom shall be effective unless and until such modification, waiver or consent shall be in writing and duly executed by both of the parties hereto. Without limitation on any of the foregoing, the failure to give a notice pursuant to paragraph 4(a) hereof will not constitute a waiver of any right to do so at a later date.

| 19. | Waiver of Immunity |

Each party hereto hereby waives, to the fullest extent permitted by applicable law, all immunity (whether on the basis of sovereignty or otherwise) from jurisdiction, attachment (both before and after judgment) and execution to which it might otherwise be entitled in any action or proceeding in the Courts of England or of any other country or jurisdiction, relating in any way to this Agreement or any Transaction, and agrees that it will not raise, claim or cause to be pleaded any such immunity at or in respect of any such action or proceeding.

| 20. | Recording |

The parties agree that each may electronically record all telephone conversations between them.

| 21. | Third Party Rights |

No person shall have any right to enforce any provision of this Agreement under the Contracts (Rights of Third Parties) Act 1999.

| - 27 - |

| Party A | PARTY B | |||

| UBS AG | MURRAY HILL FUNDING, LLC | |||

| By: | /s/ Lisa Rosenthal | By: | /s/ Michael A. Reisner | |

| Title: | Executive Director & Counsel | Title: | Co-Chief Executive Officer | |

| Date: | May 19, 2017 | Date: | May 19, 2017 | |

| By: | /s/ Sergio Breton | By: | /s/ Mark Gatto | |

| Title: | Director | Title: | Co-Chief Executive Officer | |

| Date: | May 19, 2017 | Date: | May 19, 2017 |

| - 28 - |

ANNEX I

Supplemental Terms or Conditions

The following terms and conditions supplement and are a part of the Global Master Repurchase Agreement dated the date hereof (the “Agreement”) between UBS AG (“Party A”), a banking corporation organized under the laws of Switzerland, and MURRAY HILL FUNDING, LLC (“Party B”), a Delaware limited liability company. In the event of a conflict between provisions of this Annex I and the Agreement, the provisions of this Annex I shall govern. Capitalized terms used but not defined shall have the meanings ascribed to them in the Agreement.

Paragraph references are to paragraphs in the Agreement.

| 1. | The following elections shall apply: |

| (a) | paragraph 1(c)(i). Buy/Sell Back Transactions may be effected under this Agreement, and accordingly the Buy/Sell Back Annex shall apply. |

| (b) | paragraph 1(c)(ii). Transactions in Net Paying Securities may be effected under this Agreement, and accordingly the provisions of sub-paragraphs (i) to (ii) below shall apply. |

| (i) | The phrase "other than equities and Net Paying Securities" shall be replaced by the phrase "other than equities". |

| (ii) | In the Buy/Sell Back Annex the following words shall be added to the end of the definition of the expression "IR": "and for the avoidance of doubt the reference to the amount of Income for these purposes shall be to an amount paid without withholding or deduction for or on account of taxes or duties notwithstanding that a payment of such Income made in certain circumstances may be subject to such a withholding or deduction". |

| (c) | paragraph 1(d). Agency Transactions may not be effected under this Agreement, and accordingly the Agency Annex shall not apply. |

| (d) | paragraph 1. Transactions in gilt-edged securities may be effected under this Agreement and accordingly the Gilt Annex shall apply. |

| (e) | paragraph 1. Equity Transactions may not be effected under this Agreement and accordingly the Equity Annex shall not apply. |

| (f) | paragraph 1. Transactions in Italian Domestic Purchased Securities may not be effected under this Agreement and accordingly the Italian Annex shall not apply. |

| (g) | Transactions in Japanese Securities may not be effected under this Agreement and accordingly the Japanese Annex shall not apply. |

| (h) | paragraph 2(d). The Base Currency shall be: United States Dollars ("USD"). |

| (i) | paragraph 2(p). Designated Office: | Party A: | London, Stamford and New York | |

| Party B: | New York |

| (j) | paragraph 2(cc). The pricing source for calculation of Market Value shall be: failing agreement, any generally accepted pricing source for the relevant Securities, which in the case of UK gilt-edged securities, shall include “GEMMA” prices published by the UK Debt Management Office. |

| (k) | paragraph 2(rr). Spot Rate to be the rate as provided in paragraph 2(rr). |

| (l) | paragraph 3(b). Both Seller and Buyer to deliver Confirmation. |

| (m) | paragraph 4(f). Interest rate on Cash Margin (including the payment intervals and payment dates) shall be the rate per annum equal to the overnight Federal Funds (Effective) Rate for each day on which cash is held as Margin hereunder, as reported in Federal Reserve Publication H.15-519, unless specifically agreed otherwise between the parties at the time that a margin call is made. |

| - 29 - |

| (n) | paragraph 4(g). Delivery period for Margin Transfers shall be: |

| (1) | in respect of Cash Margin, any Margin Securities or Equivalent Margin Securities denominated in CAD or USD same day if the call is made before 10 am (New York time) and if requested after such time on such Business Day, on the next Business Day; and |

| (2) | in respect of Cash Margin, any Margin Securities or Equivalent Margin Securities denominated in any other currency, next Business Day if the call is made before 10am (New York time), and if requested after such time on such Business Date, on the second next Business Day. |

| (o) | paragraph 6(j). Paragraph 6(j) shall apply and the events specified in paragraph 10(a) identified for the purposes of paragraph 6(j) shall be those as set out in sub-paragraphs (i) and (iii) to (xiii) of paragraph 10(a) of the Agreement, provided, however, and without limiting the rights of a non-Defaulting Party under paragraph 10, a party’s right to suspend payments due to the condition precedent set forth in paragraph 6(j) with respect to an Event of Default (other than an “Exempt Event of Default” as defined below) shall only apply for a period not longer than 60 days after the non-Defaulting Party has received a Termination Request (as defined below) from the Defaulting Party and provided further that the Defaulting Party shall promptly provide the non-Defaulting Party with such material information as it may reasonably request during such period. |

For the purposes herein, an Exempt Event of Default shall mean an Event of Default referenced in paragraph 10(a), subparagraphs (i), (iii), (iv), (v), (vi), (xi), (xii) and (xiii), unless the Defaulting Party has demonstrated to the reasonable satisfaction of the non-Defaulting Party that such default under Sections subparagraphs (xi), (xii) or (xiii) was caused solely by an event, condition or circumstance other than a failure to pay money or deliver an asset.

For the purposes herein, a Termination Request shall mean a notice requesting that the non-Defaulting Party suspend its payment or delivery obligations for no longer than 60 days. A Termination Request may only be made and shall only be applicable at a time when the non-Defaulting Party is otherwise entitled to send a Default Notice under paragraph 10 of this Agreement, and nothing herein shall limit the non-Defaulting Party's right to send such Default Notice. Such Termination Request may only be delivered to the non-Defaulting Party after the non-Defaulting Party does not make a payment or delivery when due under this Agreement by reason of the condition precedent set forth in paragraph 6(j) not being satisfied. The Termination Request shall not be effective unless delivered in the manner set forth in paragraph 14 of the Agreement as if it was a notice under paragraph 10.

| (p) | paragraph 10(a)(ii). paragraph 10(a)(ii) shall not apply. |

| (q) | paragraph 14. For the purposes of paragraph 14 of this Agreement - |

| (i) | Address for notices and other communications for Party A when acting through its London Branch: |

| Address: | 5 Broadgate, London EC2M 2QS |

| Attention: | Documentation Unit / Legal Department |

| Telephone: | +44 20 7567 8000 |

| Facsimile: | +44 20 7567 4406 / +44 20 7568 9257 |

| - 30 - |

| (ii) | Address for notices and other communications for Party A when acting through its Stamford or New York Branch: |

| Address: | 1285 Avenue of the Americas, New York, NY |

| Attention: | Documentation Unit / Legal Department |

| Email: | SH-UBSLegalNotices-Amer@ubs.com |