Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Pattern Energy Group Inc. | exhibit991.htm |

| 8-K - 8-K - Pattern Energy Group Inc. | redwhitepaper8kapril2017.htm |

Investing in Development

Understanding the Risk-Reward Profile | 2017

PATTERN ENERGY GROUP INC.

PAGE

Renewable energy is an essential

part of today’s energy mix and

is poised to become the major

source of new energy supply in

this century. Global investment

in renewable generation reached

$265 billion in 2015, nearly double

the $130 billion investment in new

fossil fuel generation1.

Pattern Energy Group Inc.

(“Pattern Energy” or the

“Company”) is committed to

capturing a significant share of the

growth in the renewable market

and has set a goal, as part of its

Pattern 2020 vision, to double

its portfolio to more than five

gigawatts (“GW”) by 2020. The

primary method of this growth

will be through acquisitions from

Pattern Development2.

Executive Summary

1 Source: Bloomberg New Energy Finance & Frankfurt School-UNEP, “Global Trends in Renewable Energy Investment 2016.”

2 In this White Paper, Pattern Energy Group LP is referred to as “Pattern Development” for the period and events prior to December

2016, and Pattern Energy Group LP (“Pattern Development 1.0”) and Pattern Energy Group 2 LP (“Pattern Development 2.0”) are

together referred to as “Pattern Development” for the period post December 2016.

In addition to acquiring high-

quality assets from Pattern

Development, Pattern Energy also

believes it can potentially improve

shareholder returns through

a modest initial investment

in Pattern Development 2.0,

securing a captive interest in

development assets at a materially

lower cost than buying operating

assets from third parties. A

modest investment of under

$100 million would be one that

is appropriate for both Pattern

Energy’s size and retained cash

flow and allows Pattern Energy

to maintain its dividend, low risk

profile and stable cash flows.

EXECUTIVE SUMMARY

1

PATTERN ENERGY GROUP INC.

PAGE

Primary reasons for considering an investment

in development

A Proven Platform

Since 2009, Pattern Development has built a reputation as one of the

top developers in the renewable industry, successfully developing

more than four GW of high-quality operating wind farms and delivering

private equity returns to its investors. The management team has

successfully completed more than 40 projects, raised more than $8

billion in capital from more than 40 institutions and purchased more

than $3.5 billion of wind turbines from top manufacturers.

A Strong Investment Thesis

A disciplined, experienced development business offers one of the best

risk-reward opportunities in the renewable energy value chain. The key

drivers that support the thesis for investing in development are:

» Strong returns – Targeted total pre-tax returns at the development

business level of more than 15% and a multiple of invested capital

(“MOIC”) of approximately 2.0x;

» Yield compression - Significant de-risking of projects through

long-term offtake contracts and other arrangements so that, during

the construction phase, projects can be sold at a significant yield

compression. For example, building assets at a 6-8x multiple of

cash available for distribution (“CAFD”) and selling the assets at a

10-12x multiple; and

» Managed capital – Managing capital in a disciplined manner,

including 1) selecting good opportunities to invest in, 2) minimizing

the capital at risk during the early development stages, and 3)

minimizing the duration of the relatively higher capital outlays that

are required once a project has achieved an advanced stage.

EXECUTIVE SUMMARY

2

PATTERN ENERGY GROUP INC.

PAGE

Given Pattern Energy’s interest in potentially investing in the

development business, the Company has prepared this White Paper

as an introduction for investors not familiar with renewable power

development. The White Paper addresses two core subjects and

includes a number of actual project examples.

1. The Business Model and Investment Thesis

2. Renewable Energy Development Phases – a description of the

various phases of development and what happens in each one

This White Paper defines the renewable energy development

business as the process of advancing renewable energy projects

from identifying a “greenfield” site through the start of construction.

Development encompasses all the activities within this time frame,

including permitting, real estate acquisition, resource assessment,

interconnection and transmission, community and political engagement,

power marketing, financing and equipment procurement.

EXECUTIVE SUMMARY

3

Pattern Development is active in wind, solar and transmission

development in the United States (“U.S.”), Canada, Mexico, Chile

and Japan, and each type of power development is different (e.g.

solar tends to have lower barriers to entry compared to wind, while

transmission tends to have comparatively higher barriers to entry). In

order to more succinctly present the development process, this White

Paper focuses solely on wind energy development in North America.

PATTERN ENERGY GROUP INC.

PAGE

Development Business Model

A Strong Investment Thesis

DEVELOPMENT BUSINESS MODEL

When done right, renewable energy development offers one of the

most compelling risk-reward trade-offs in the energy value chain.

However, not all companies are able to consistently create the right mix

of capital access, disciplined capital management, and development

expertise to create value from a rapidly evolving industry. For those

with the right mix, the development business model offers strong

returns.

At the core of this model is to “de-risk” projects. This is done through

effective contracting, engineering, and operational management,

so that a fully developed project can be constructed and put into

operation with a significantly higher fair market value than what it cost

to fully develop the project. Or, in other words, it could be “sold down”

at a significant profit.

The key elements to achieving this goal which are discussed below are:

» Returns and yield compression

» Capital management

4

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT BUSINESS MODEL

Construction03

Developer

Equity

Profits &

Distribution

Origination & Early

Development

01

Development

Overhead

Early Stage

Capital

Recycled/

Repaid Capital

Pre-construction

& Financing

02

Pre-Finance

CapEx

Sale of

Project

04

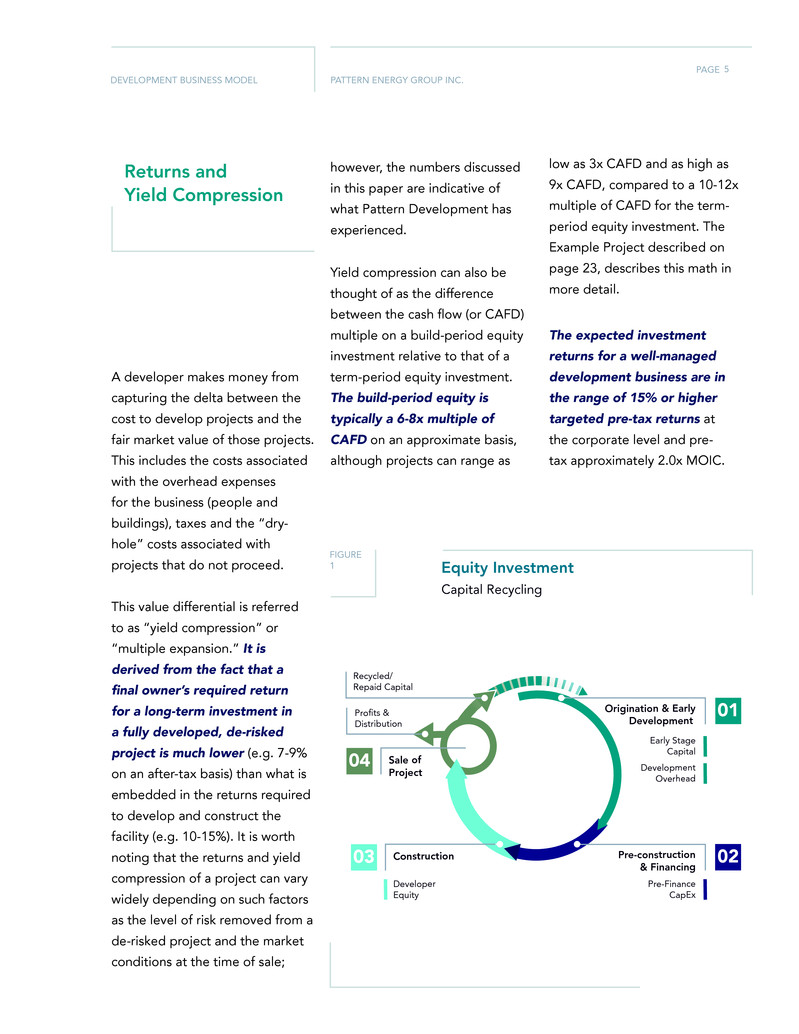

A developer makes money from

capturing the delta between the

cost to develop projects and the

fair market value of those projects.

This includes the costs associated

with the overhead expenses

for the business (people and

buildings), taxes and the “dry-

hole” costs associated with

projects that do not proceed.

This value differential is referred

to as “yield compression” or

“multiple expansion.” It is

derived from the fact that a

final owner’s required return

for a long-term investment in

a fully developed, de-risked

project is much lower (e.g. 7-9%

on an after-tax basis) than what is

embedded in the returns required

to develop and construct the

facility (e.g. 10-15%). It is worth

noting that the returns and yield

compression of a project can vary

widely depending on such factors

as the level of risk removed from a

de-risked project and the market

conditions at the time of sale;

FIGURE

1 Equity Investment

Capital Recycling

however, the numbers discussed

in this paper are indicative of

what Pattern Development has

experienced.

Yield compression can also be

thought of as the difference

between the cash flow (or CAFD)

multiple on a build-period equity

investment relative to that of a

term-period equity investment.

The build-period equity is

typically a 6-8x multiple of

CAFD on an approximate basis,

although projects can range as

low as 3x CAFD and as high as

9x CAFD, compared to a 10-12x

multiple of CAFD for the term-

period equity investment. The

Example Project described on

page 23, describes this math in

more detail.

The expected investment

returns for a well-managed

development business are in

the range of 15% or higher

targeted pre-tax returns at

the corporate level and pre-

tax approximately 2.0x MOIC.

Returns and

Yield Compression

5

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT BUSINESS MODEL

For example, an investment of

$10 million in a development

business that obtains a 2.0x MOIC

would generate $20 million in

net receipts before tax. If it took

four years from the date of that

$10 million investment until the

capital and profits were returned,

it would generate approximately

19% pre-tax return on investment.

The Example Project section

describes how this typically works

for a representative project. It

outlines that for a 100 megawatt

(“MW”) project, the developer

invests approximately $16 million

in “pre-construction” capital.

Upon de-risking the project by

closing financing and starting

construction, and assuming

that the developer holds the

investment during construction,

the investment level may rise

to $40 million of construction

equity (i.e., the equity portion

of the project’s build cost), and

produce a profit upon sale of

approximately $20 million after

return of capital. A developer

may be able to manage down the

construction equity to one-half

the project-level investment, or

approximately $20 million in this

case, via the use of non-recourse

“holdco” or “back-leverage”

financing, while still achieving

approximately the same amount

of profit. Similarly, if the developer

can sell the project upon the start

of construction, the $20 million

profit (subject to a small time-

value-of-money discount) might

be realized while having only

invested the $16 million of pre-

construction capital.

Accounting implications

A minority investor in a

development business would

typically account for its

interest in that business as an

unconsolidated investment

using the equity method of

accounting. It would initially

reflect the investment at cost

in the balance sheet on the

line item “unconsolidated

investments.” The investment

would increase or decrease

by additional contributions or

distributions, as well as by its

proportional interest in the

earnings (losses). In addition, the

proportional recognition of the

interest in earnings (losses) would

be reflected in the statement

of operations in the line item

“earnings of unconsolidated

investments.”

Under normal circumstances,

the holder of such an interest

would recognize CAFD from

the distributions received from

the development business, and

it would reduce its adjusted

earnings before interest, tax,

depreciation and amortization.

6

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT BUSINESS MODEL

Capital Management

At the heart of development

is the business of capital and

risk management. At the project

level, the developer allocates

capital based on risk limits defined

by project-specific factors, such

as environmental, transmission

and land issues. At the corporate

level, the developer manages

a large portfolio of early stage,

higher-risk, low-cost opportunities

(referred to as the pipeline) and a

smaller number of late stage, high

value, lower-risk projects (referred

to as advanced stage projects).

Successful development is thus

defined by the ability of the

developer to prudently allocate

resources (capital and human) to

projects where an execution path

to completion is clear and well

defined.

The most critical element

to achieving a profitable

development business is the

ability to manage capital,

which includes choosing good

opportunities to invest in,

minimizing the capital at risk

during the early development

stages, and minimizing the

duration of the relatively higher

capital outlays required once a

project has achieved an advanced

stage. The other factors that

contribute to disciplined capital

management include: limiting

the number of “dry holes,”

diversification of the development

portfolio and the recycling of

capital.

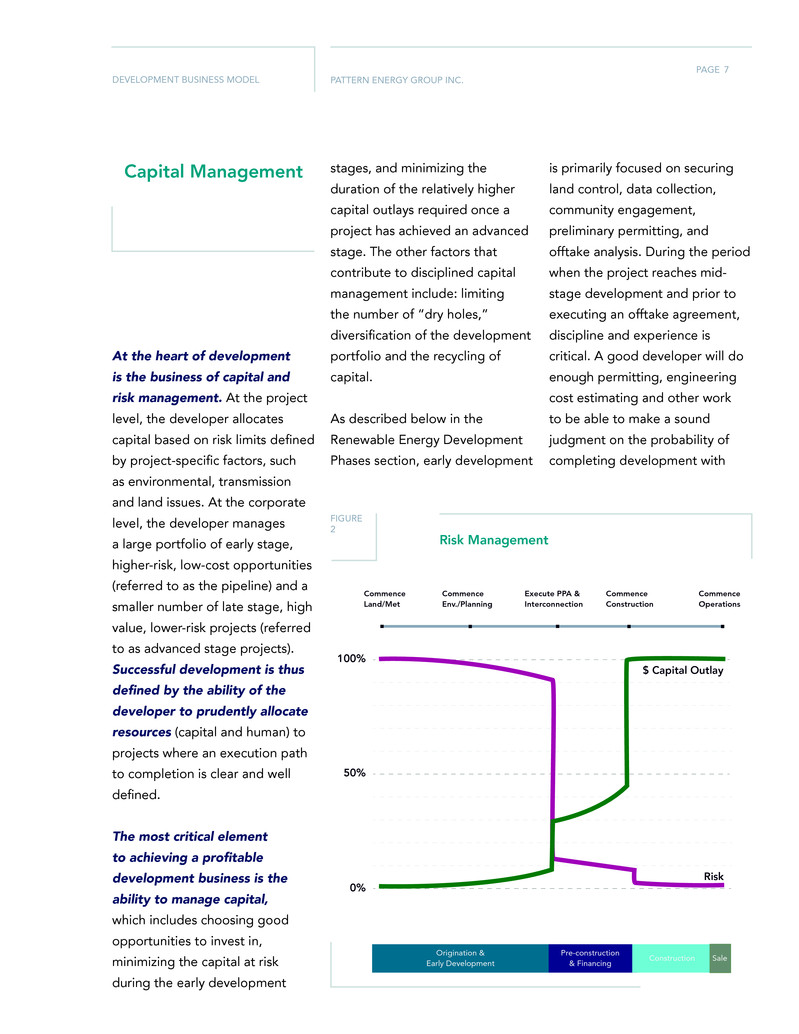

As described below in the

Renewable Energy Development

Phases section, early development

100%

50%

Risk

Origination &

Early Development

Pre-construction

& Financing Construction Sale

$ Capital Outlay

0%

Commence

Land/Met

Commence

Env./Planning

Execute PPA &

Interconnection

Commence

Construction

Commence

Operations

FIGURE

2

Risk Management

is primarily focused on securing

land control, data collection,

community engagement,

preliminary permitting, and

offtake analysis. During the period

when the project reaches mid-

stage development and prior to

executing an offtake agreement,

discipline and experience is

critical. A good developer will do

enough permitting, engineering

cost estimating and other work

to be able to make a sound

judgment on the probability of

completing development with

7

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT BUSINESS MODEL

limited capital outlays. Less

successful developers can often

get caught up in their optimism

for a particular project, which can

result in less disciplined spending

during this period, resulting in

higher risk and lower returns.

As shown in Figure 2, the green

line indicates low spending on

a project prior to a committed

power purchase agreement

(“PPA”), then significant capital

is usually required to secure an

appropriately structured PPA

and interconnection to the grid.

At this point, the probability of

completing the project for a good

developer is high. Since there is

significant capital at risk, the role

of the developer is to complete

the rest of the development in

as short a time as possible. This

reduces the duration of capital

used and improves returns.

Diversification

Successful developers manage

the risk associated with individual

projects, as well as risk across

the portfolio as a whole. Large

developers allocate capital

across a broad set of diverse

development projects that have

different characteristics

(e.g., located in different

geographies, contracted

with different offtakers and

possessing different transmission

characteristics). This level of

diversification, as well as the

economies of scale that larger

developers can take advantage

of, provide another mechanism

to manage risk and improve yield

compression across a portfolio of

uncorrelated projects.

Use of debt

Pattern Energy’s management

believes a development

business should be funded with

equity and that debt should

only be utilized in relation to

developed assets. For example,

once a development project

has progressed to the point

of construction financing, the

project risk has been substantially

reduced and the project is ready

to obtain non-recourse debt.

Equity “back-leverage”

financings may be attractive

to the developer because

such financings can usually be

obtained at rates well below the

marginal cost of funds of the

developer. Under this structure,

the development business is able

to minimize the capital it allocates

to the project in a cost-effective

manner. This in turn increases

the MOIC of, and returns on,

the development business. The

Example Project described on

page 23 assumes construction

equity is approximately $40

million. The developer uses “back-

leverage” to finance much of the

construction equity – a good rule

of thumb is 50% of construction

equity (or $20 million in the

example). Additionally, a project

could be sold at this stage to free

up additional capital to re-invest

in the business.

Self-funded

Capital can either be injected into

the development business up-

front or over time, but depending

on the strategy and portfolio,

a well-managed development

business could start to return

capital to its owners within two

to three years and potentially

become self-funding, thereby

achieving a steady-state business,

within four to five years of its

formation.

Failed projects

For well-managed development

businesses, write-offs associated

with unsuccessful projects are

modest (e.g. less than 10% of

equity capital supporting the busi-

ness) and typically can be accom-

modated within the expectations

for overall return, capital recycling

and payback. As a result, once

a development business is fully

capitalized, new capital injections

may not be required, subject to

dividend distribution policies.

8

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT BUSINESS MODEL

During the pre-construction and financing phase, the developer seeks construction financing,

usually on a non-recourse basis. Under “non-recourse” project financings, lenders provide

funds based solely on the value of the project’s assets and projected future cash flows, with

limited or no support from the owner beyond its equity funding commitment. The high standard

to meet for securing non-recourse funding requires that final permits are obtained and not

Raising Non-Recourse Financing

subject to appeal; land rights are finalized; interconnection and transmission rights are secured;

construction-related agreements are executed; operating agreements are finalized; and revenue

arrangements for the sale of energy and renewable credits (if applicable) are entered into with

offtakers. This type of financing will generally support 70-90% of the project construction cost.

The balance of funding is provided by the project sponsor or the developer as equity in the

project and typically is funded at the beginning of construction.

At the same time, the construction lenders require the developer to secure critical post-

construction capital funding for the project. This means long-term debt (usually a term-out of the

construction debt), or tax equity funding for a U.S. project using production tax credits (“PTCs”),

is lined up at the close of construction financing. For the developer, at the point of the close of

construction financing, both the construction and term equity required are known and defined.

The end of pre-construction is often the point of maximum business exposure on a project (see

Figure 2), but not necessarily the point of maximum capital at risk, and completion of the project

should also be at the lowest risk. As a result, capital is managed to specific milestones to ensure

capital exposure and risks line up. The costs typically incurred at this stage include:

» Interconnection deposits to reserve firm transmission capacity;

» PPA security deposits to secure the offtake agreement;

» Equipment supply orders to reserve manufacturing space or lock in price;

» Engineering or pre-construction work to hold schedule; and

» Legal and other soft costs associated with securing the financing.

The developer will also derive the final bank “underwriting” set of financial forecasts that is the

basis for the large investment required to commence construction. The objective is generally to

maximize the project’s net present value (“NPV”) while keeping capital at risk low. Successfully

bringing a project to the point of closing non-recourse financing is an achievement that creates

significant value as those projects are highly attractive to investors with a desire for low-risk,

financially secure renewable energy facilities.

9

PATTERN ENERGY GROUP INC.

PAGE

Successful renewable energy development requires a highly skilled

and experienced team capable of managing each of the development

phases. This requires strong origination, negotiation, political and

community engagement, permitting, scientific and strategic analysis

capabilities, together with a rigorous focus on development risk

management. Developers must also establish and maintain effective

relationships with key contractors, financial institutions and offtake

counterparties. These skills are essential to cultivating a broad portfolio

of development projects.

Renewable Energy Development Phases

DEVELOPMENT PHASES

10

Blade Signing Event in Curry County - Broadview Wind Project

PATTERN ENERGY GROUP INC.

PAGE

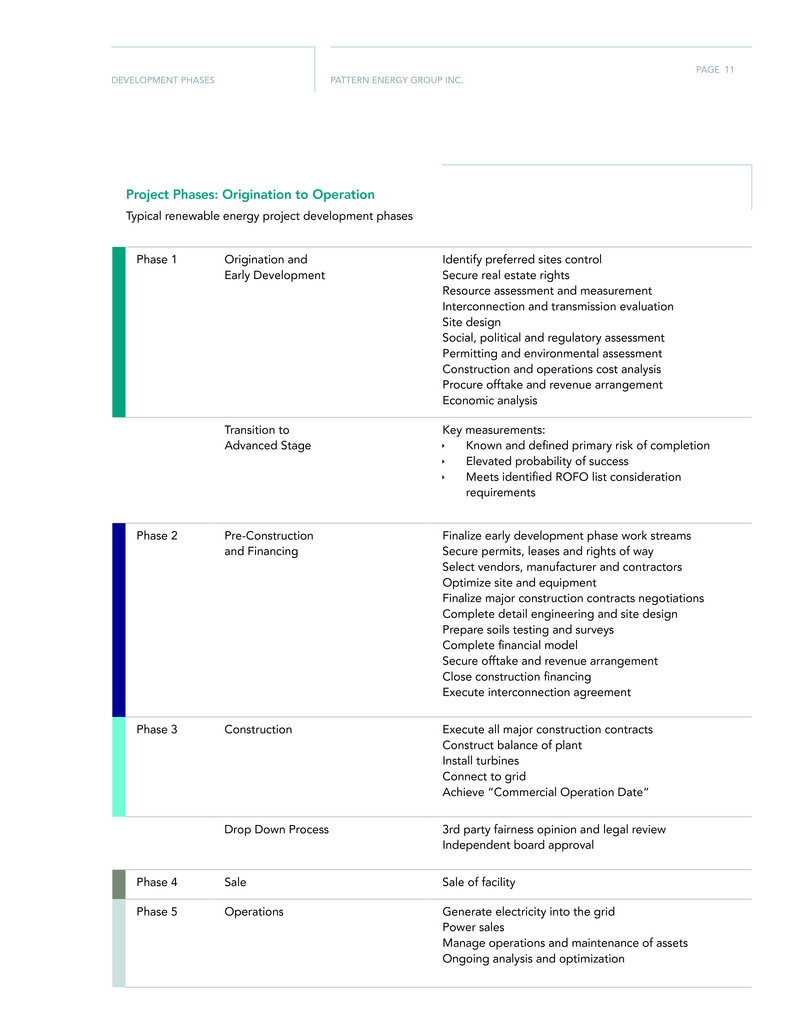

Phase 1 Origination and

Early Development

Identify preferred sites control

Secure real estate rights

Resource assessment and measurement

Interconnection and transmission evaluation

Site design

Social, political and regulatory assessment

Permitting and environmental assessment

Construction and operations cost analysis

Procure offtake and revenue arrangement

Economic analysis

Transition to

Advanced Stage

Key measurements:

Ì Known and defined primary risk of completion

Ì Elevated probability of success

Ì Meets identified ROFO list consideration

requirements

Phase 2 Pre-Construction

and Financing

Finalize early development phase work streams

Secure permits, leases and rights of way

Select vendors, manufacturer and contractors

Optimize site and equipment

Finalize major construction contracts negotiations

Complete detail engineering and site design

Prepare soils testing and surveys

Complete financial model

Secure offtake and revenue arrangement

Close construction financing

Execute interconnection agreement

Phase 3 Construction Execute all major construction contracts

Construct balance of plant

Install turbines

Connect to grid

Achieve “Commercial Operation Date”

Drop Down Process 3rd party fairness opinion and legal review

Independent board approval

Phase 4 Sale Sale of facility

Phase 5 Operations Generate electricity into the grid

Power sales

Manage operations and maintenance of assets

Ongoing analysis and optimization

Project Phases: Origination to Operation

Typical renewable energy project development phases

DEVELOPMENT PHASES

11

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES

Origination and

Early Development

During the origination and early

development stage, projects

are screened for the strength

of renewable energy resources

(wind speeds in this case); social,

political, regulatory and market

risks; availability in terms of

the requisite interconnection

transmission, land, permits

and revenue agreements, and

constructability. Projects that pass

the screening process are either

acquired or self-sourced, and

development begins.

Each project has a unique set

of attributes which drive its

development. The key success

factor for the development of one

project may be securing a permit

(e.g. building on public land). In

another project, securing permits

may be relatively straightforward

(e.g. when building on private

land in low land use regulation

states), but resolving other issues,

such as access to transmission,

may be the key success factor.

In every project, however,

development and origination will

PHASE 1

require the developer to deal with

the same basic set of scientific

analysis, contractual rights and

permits. A description of each is

set out below.

Real estate control

Site control that reflects the

long-term nature of renewable

energy projects is obtained

either through acquisition of the

underlying real estate or, more

often, a lease or right of use of the

property. The developer typically

secures an option to receive the

necessary rights with minimal

payments made during the

development period prior to the

commencement of construction.

Resource assessment

Information is collected from

on-site meteorological towers

(“met masts”), light detection

and ranging sensors (“LIDARs”)

and sonic detection and

ranging sensors (“SODARS”),

as well as from other statistically

significant macro or long-term

off-site reference sources, such

as airports or weather stations.

This information is used to refine

estimates of site productivity

and to identify potential turbine

locations in order to optimize

production. This assessment

requires strong meteorological

expertise to undertake analyses

of on-site and reference weather

data, site suitability, physical

structures, power conversion of

the technology and the impact of

the equipment on itself (i.e. how

upstream turbines can impact

downstream production). These

analyses are an essential tool for

turbine selection, site suitability

and forecasting. Data gathering

periods range from one to five

years or more depending on the

complexity of the site and quality

of the data. It is a sophisticated

12

Less

Energetic

More

Energetic

Wind Resource Map - Meikle Wind

Wind Flow

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES

process that has evolved to

include the use of multiple models

that estimate the long-term

performance of different turbine

technologies on a specific site. For

example, in the past, an average

long-term (20+ years) expected

wind speed would be estimated

and the single best turbine

for that wind speed would be

selected. Today, meteorologists

can model each individual tower

location and make adjustments

for the specific turbine to be used,

including different blade lengths

or hub heights. These scientists

can model the interaction of each

turbine’s location and its effect on

other turbines on the site.

Social, political and regulatory

assessment

A project becomes a long-term

part of the community where it

is located, and each community

has its own unique concerns and

opportunities for helping the

community. In the early stages

of development, it is important

to identify any policies at the

state, provincial or local level

that could be relevant to the

project and how those policies

may change over time. It is

equally important to identify key

stakeholders, ranging from local

and state permitting authorities

and elected officials to business

owners and interested citizens,

and determine what they care

about and how best to engage

with them. This requires direct and

indirect forms of communication,

such as creating project materials

and a website, media briefings,

town hall meetings, and one-

on-one meetings. Often specific

community benefits or design

features are incorporated into the

project. Working respectfully and

transparently with all stakeholders

is not only the right thing to do

but is also good business practice.

Interconnection evaluation

Developers undertake

comprehensive analyses of the

requirements to interconnect

a project to the transmission

system, and assuming the analyses

have a positive outcome, apply

for interconnection. Numerous

studies are required to confirm

the ability to safely inject power

into the system and to understand

the impact of the project on the

transmission system.

Developers are required to

identify if the facilities and system

require upgrades, as well as the

projected cost and schedule for

the construction of those facilities

and upgrades. Developers must

also assess the potential for

congestion or curtailment on

the transmission system that

could limit generation or create

economic burdens on transferring

power across the system. Working

within the constraints of utility

regulations, the developer often

works closely with the relevant

utility on the impact assessment of

the power facility.

Permitting and environmental

assessment

While there are numerous types

of federal, state and local permits

with varying requirements, many

of the major permits associated

with renewable energy projects

require rigorous environmental

impact assessments. Permit

preparation typically involves

siting and environmental studies,

stakeholder engagement

processes, and in many cases,

management, mitigation and

monitoring plans. Threatened

and endangered species, cultural

resources, and visual impacts

are carefully assessed and

mitigation plans are developed

in coordination with the relevant

stakeholders.

13

PATTERN ENERGY GROUP INC.

PAGE

PERMITTING CASE STUDY

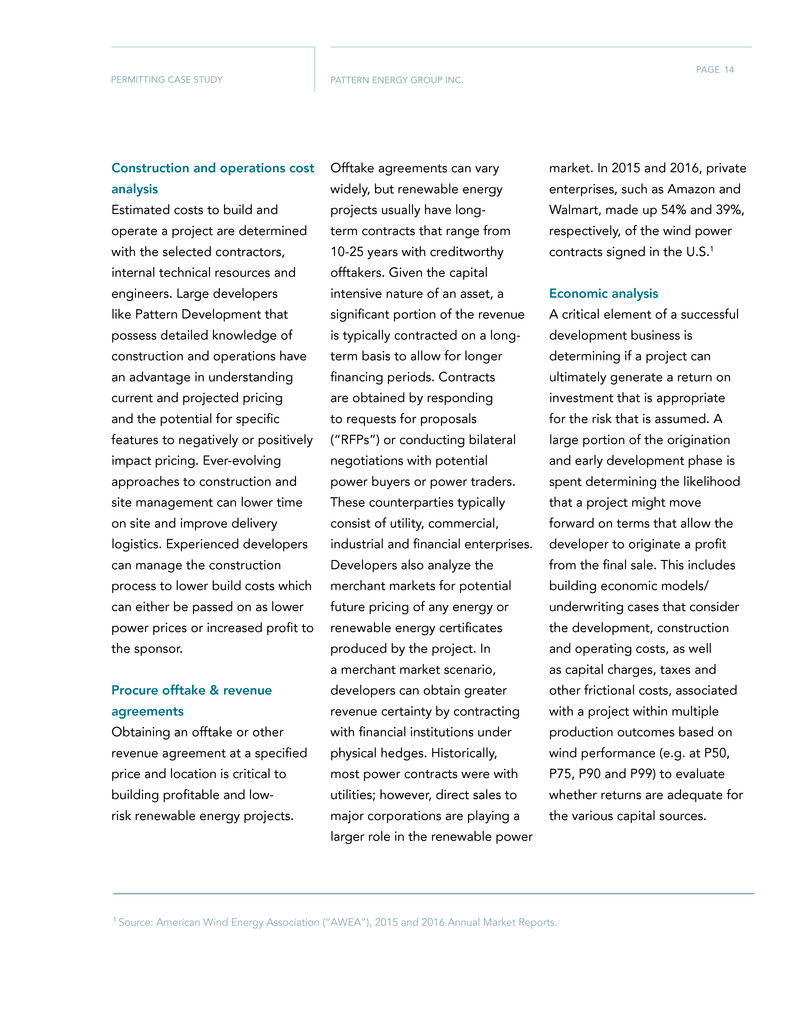

Construction and operations cost

analysis

Estimated costs to build and

operate a project are determined

with the selected contractors,

internal technical resources and

engineers. Large developers

like Pattern Development that

possess detailed knowledge of

construction and operations have

an advantage in understanding

current and projected pricing

and the potential for specific

features to negatively or positively

impact pricing. Ever-evolving

approaches to construction and

site management can lower time

on site and improve delivery

logistics. Experienced developers

can manage the construction

process to lower build costs which

can either be passed on as lower

power prices or increased profit to

the sponsor.

Procure offtake & revenue

agreements

Obtaining an offtake or other

revenue agreement at a specified

price and location is critical to

building profitable and low-

risk renewable energy projects.

1 Source: American Wind Energy Association (“AWEA”), 2015 and 2016 Annual Market Reports.

Offtake agreements can vary

widely, but renewable energy

projects usually have long-

term contracts that range from

10-25 years with creditworthy

offtakers. Given the capital

intensive nature of an asset, a

significant portion of the revenue

is typically contracted on a long-

term basis to allow for longer

financing periods. Contracts

are obtained by responding

to requests for proposals

(“RFPs”) or conducting bilateral

negotiations with potential

power buyers or power traders.

These counterparties typically

consist of utility, commercial,

industrial and financial enterprises.

Developers also analyze the

merchant markets for potential

future pricing of any energy or

renewable energy certificates

produced by the project. In

a merchant market scenario,

developers can obtain greater

revenue certainty by contracting

with financial institutions under

physical hedges. Historically,

most power contracts were with

utilities; however, direct sales to

major corporations are playing a

larger role in the renewable power

market. In 2015 and 2016, private

enterprises, such as Amazon and

Walmart, made up 54% and 39%,

respectively, of the wind power

contracts signed in the U.S.1

Economic analysis

A critical element of a successful

development business is

determining if a project can

ultimately generate a return on

investment that is appropriate

for the risk that is assumed. A

large portion of the origination

and early development phase is

spent determining the likelihood

that a project might move

forward on terms that allow the

developer to originate a profit

from the final sale. This includes

building economic models/

underwriting cases that consider

the development, construction

and operating costs, as well

as capital charges, taxes and

other frictional costs, associated

with a project within multiple

production outcomes based on

wind performance (e.g. at P50,

P75, P90 and P99) to evaluate

whether returns are adequate for

the various capital sources.

14

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES

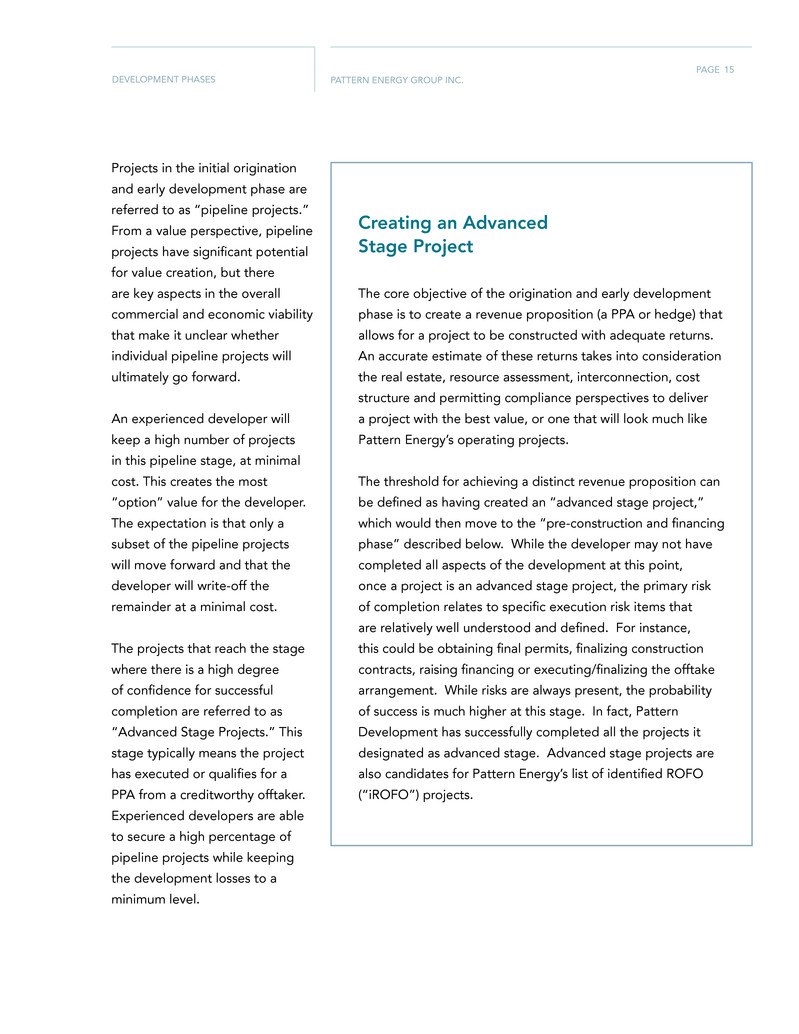

Creating an Advanced

Stage Project

The core objective of the origination and early development

phase is to create a revenue proposition (a PPA or hedge) that

allows for a project to be constructed with adequate returns.

An accurate estimate of these returns takes into consideration

the real estate, resource assessment, interconnection, cost

structure and permitting compliance perspectives to deliver

a project with the best value, or one that will look much like

Pattern Energy’s operating projects.

The threshold for achieving a distinct revenue proposition can

be defined as having created an “advanced stage project,”

which would then move to the “pre-construction and financing

phase” described below. While the developer may not have

completed all aspects of the development at this point,

once a project is an advanced stage project, the primary risk

of completion relates to specific execution risk items that

are relatively well understood and defined. For instance,

this could be obtaining final permits, finalizing construction

contracts, raising financing or executing/finalizing the offtake

arrangement. While risks are always present, the probability

of success is much higher at this stage. In fact, Pattern

Development has successfully completed all the projects it

designated as advanced stage. Advanced stage projects are

also candidates for Pattern Energy’s list of identified ROFO

(“iROFO”) projects.

15

Projects in the initial origination

and early development phase are

referred to as “pipeline projects.”

From a value perspective, pipeline

projects have significant potential

for value creation, but there

are key aspects in the overall

commercial and economic viability

that make it unclear whether

individual pipeline projects will

ultimately go forward.

An experienced developer will

keep a high number of projects

in this pipeline stage, at minimal

cost. This creates the most

“option” value for the developer.

The expectation is that only a

subset of the pipeline projects

will move forward and that the

developer will write-off the

remainder at a minimal cost.

The projects that reach the stage

where there is a high degree

of confidence for successful

completion are referred to as

“Advanced Stage Projects.” This

stage typically means the project

has executed or qualifies for a

PPA from a creditworthy offtaker.

Experienced developers are able

to secure a high percentage of

pipeline projects while keeping

the development losses to a

minimum level.

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES - CASE STUDY

Project

Case Study

Broadview Energy Projects

The Broadview Energy projects were part of a development acquisition

that lacked sufficient meteorological towers for Pattern Development

to obtain the necessary confidence in the productivity of the projects.

Consequently, soon after obtaining control of the development

projects, Pattern Development added an incremental six met

masts and a remote sensing device to more accurately define the

horizontal and vertical gradient of the wind resource across the

projects. In order to further characterize the long-term wind regime,

the met masts were correlated to a long-term wind speed reference

that extended the total wind data collection period to 16 years.

Pattern Development undertook an extensive wind flow modeling

exercise (using model types including linear, computational fluid

dynamics, and weather-driven mesoscale) to map the sites’ wind

potential. The meteorological team further took advantage of the

newly installed met masts by utilizing modeling tools to create a more

comprehensive picture of the available wind resource than otherwise

available using the prior meteorological data.

By combining the modeling campaign results with new site layout

optimization tools that accounted for both energy generation and the

build costs, the meteorological team created the lowest “levelized cost

of energy” (or the lowest cost to produce the energy) while maximizing

energy generation. The tool factored costs to topographic features

16

Wind Resource Data Analysis - Broadview Wind Projects

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES - CASE STUDY

as part of the calculation. The layout also underwent a quality-control

process that applied learnings from observed operational tendencies

of the layout performance of similar projects in the Pattern Energy

fleet. By applying operational data considerations during development,

Pattern Development leveraged proprietary data to build the

Broadview Energy projects better and more efficient.

The layout design process also incorporated the concept of

“overbuilding” by using additional turbines so the actual project

capacity exceeds the maximum capacity allowed to be injected into

the grid. During periods when total energy production is less than the

maximum capacity allowed to be injected into the grid, the additional

turbines included in the overbuild enable the project to generate more

energy than the project would generate with fewer turbines.

The meteorological team used a new time-series based energy-capture

technique to model the effect of the production cap on an hourly basis.

Then working with third parties to evaluate turbine performance using

data from Pattern Energy’s operational facilities, Pattern Development

ensured stakeholders such as lenders were comfortable with the

production estimates.

Project

Case Study

Meikle Wind

The Meikle Wind project, acquired by Pattern Development as an

early-stage development opportunity in 2013, demonstrates many

of the concepts described above. Immediately after acquiring the

project, Pattern Development focused on optimizing and improving its

economic viability. Utilizing its meteorological capabilities to optimize

17

forecast production, Pattern Development efficiently exploited differing

terrain and wind conditions by selecting and locating different types of

turbines on the project site.

Pattern Development also worked closely with BC Hydro, the PPA

offtaker for the project, to develop a mutually acceptable arrangement,

balancing BC Hydro’s needs for cost-effective energy and maintaining

a viable project for Pattern Development. Additionally, the project’s

comparatively long-term (25-year) PPA and strong fundamentals

enabled the project to receive non-recourse project construction to

term financing with a long-term (22-year) amortization profile and a

fixed-rate swap.

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES - CASE STUDY

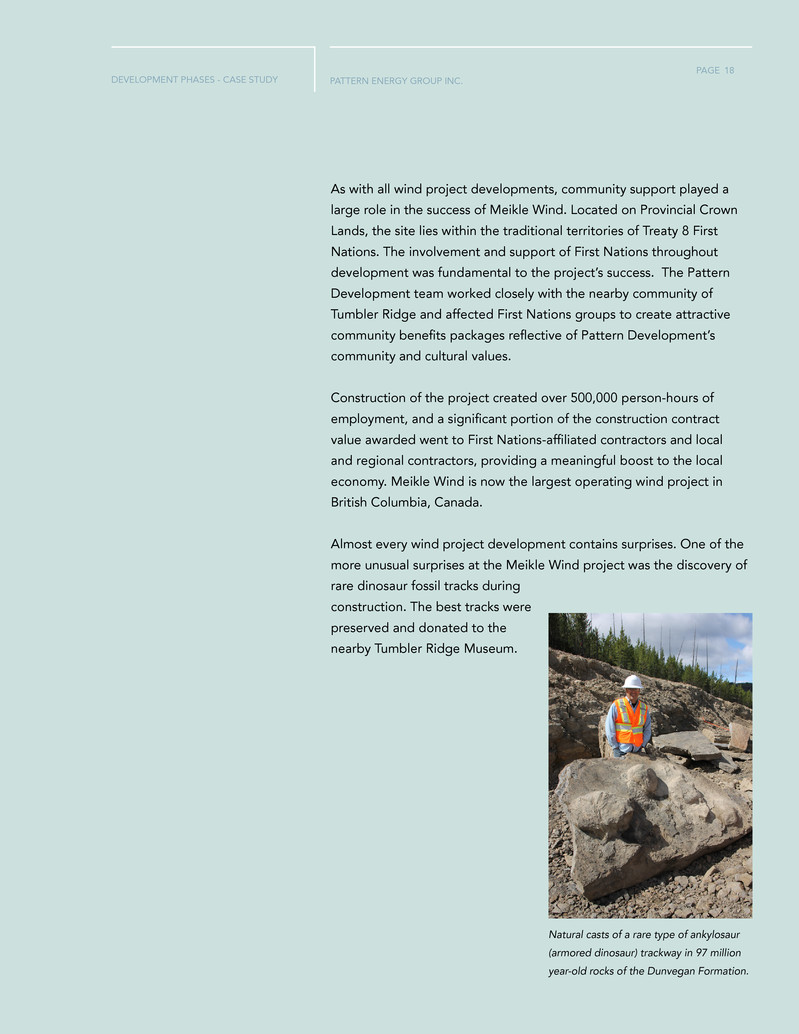

Natural casts of a rare type of ankylosaur

(armored dinosaur) trackway in 97 million

year-old rocks of the Dunvegan Formation.

rare dinosaur fossil tracks during

construction. The best tracks were

preserved and donated to the

nearby Tumbler Ridge Museum.

As with all wind project developments, community support played a

large role in the success of Meikle Wind. Located on Provincial Crown

Lands, the site lies within the traditional territories of Treaty 8 First

Nations. The involvement and support of First Nations throughout

development was fundamental to the project’s success. The Pattern

Development team worked closely with the nearby community of

Tumbler Ridge and affected First Nations groups to create attractive

community benefits packages reflective of Pattern Development’s

community and cultural values.

Construction of the project created over 500,000 person-hours of

employment, and a significant portion of the construction contract

value awarded went to First Nations-affiliated contractors and local

and regional contractors, providing a meaningful boost to the local

economy. Meikle Wind is now the largest operating wind project in

British Columbia, Canada.

Almost every wind project development contains surprises. One of the

more unusual surprises at the Meikle Wind project was the discovery of

18

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES

Once a project transitions

to the advanced stage, pre-

construction and financing

activities commence. Managing

this stage of development

involves completing activities

required to build the project

without material risk of loss

of the project and managing

schedule delays or changes to the

economic parameters established

in the revenue proposition. At

this stage, all aspects of the

origination and early development

stage work streams are finalized.

Final contracts are executed and

detailed engineering and plant

drawings are completed.

Large developers execute the

engineering, procurement and

construction work together with

Pre-Construction

& Financing

PHASE 2

1 BOP contracts relate to civil and electrical work (outside the turbines), such as roads, turbine foundations, met mast foundations,

monitoring systems, cable networks, and buildings/facilities.

experienced contractors.

The developer manages the

interface between the balance of

plant (“BOP”)1 contractors, turbine

vendor and the other contractors.

The developer typically procures

the turbines and towers directly

from the equipment vendors and

executes the construction of the

facility under fixed-priced, fixed-

schedule contracts with credible

construction contractors. Under

the terms of these contracts, it

is the construction contractors

and the vendors that bear nearly

all the risk for the completion

of construction rather than the

developer.

19

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES

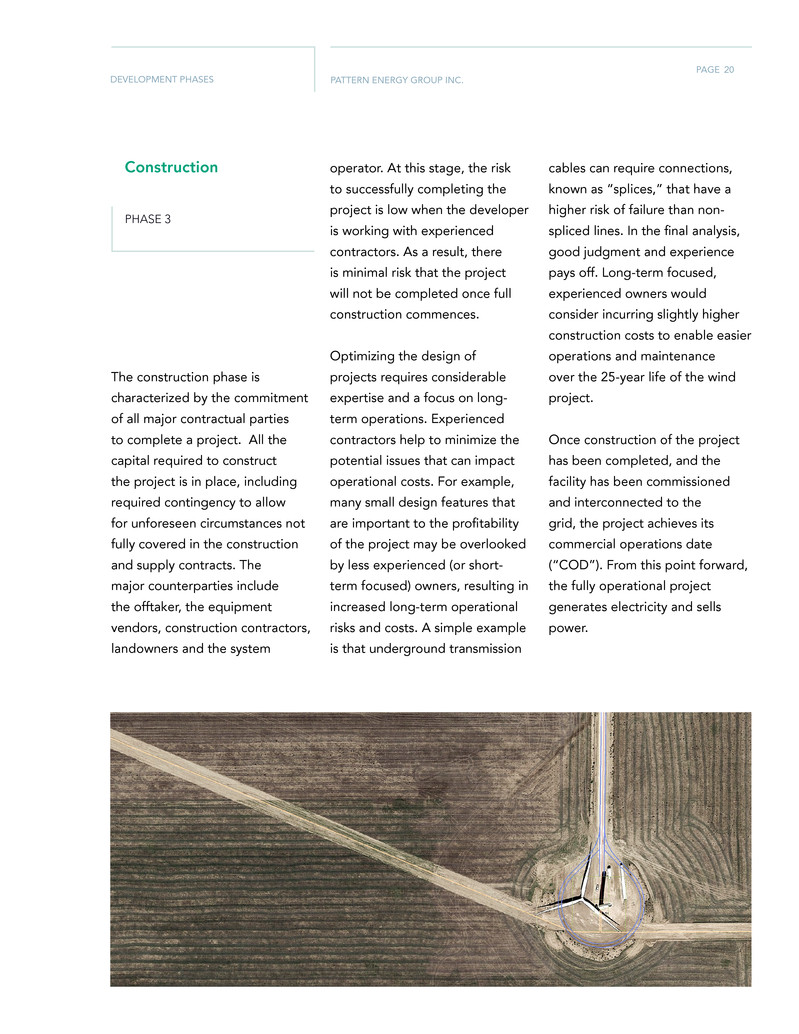

Construction

PHASE 3

The construction phase is

characterized by the commitment

of all major contractual parties

to complete a project. All the

capital required to construct

the project is in place, including

required contingency to allow

for unforeseen circumstances not

fully covered in the construction

and supply contracts. The

major counterparties include

the offtaker, the equipment

vendors, construction contractors,

landowners and the system

operator. At this stage, the risk

to successfully completing the

project is low when the developer

is working with experienced

contractors. As a result, there

is minimal risk that the project

will not be completed once full

construction commences.

Optimizing the design of

projects requires considerable

expertise and a focus on long-

term operations. Experienced

contractors help to minimize the

potential issues that can impact

operational costs. For example,

many small design features that

are important to the profitability

of the project may be overlooked

by less experienced (or short-

term focused) owners, resulting in

increased long-term operational

risks and costs. A simple example

is that underground transmission

cables can require connections,

known as “splices,” that have a

higher risk of failure than non-

spliced lines. In the final analysis,

good judgment and experience

pays off. Long-term focused,

experienced owners would

consider incurring slightly higher

construction costs to enable easier

operations and maintenance

over the 25-year life of the wind

project.

Once construction of the project

has been completed, and the

facility has been commissioned

and interconnected to the

grid, the project achieves its

commercial operations date

(“COD”). From this point forward,

the fully operational project

generates electricity and sells

power.

20

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES

Since the formation of Pattern Development, the Pattern Development construction team has

successfully managed construction of 19 wind and solar projects (with gross capacity of over 2.8

GW) and brought all to completion within budget and on schedule.1

Pattern Development Construction Track Record

Project Rated Capacity MW

Within

Budget

On

Schedule

Hatchet Ridge 101 �3 �3

St. Joseph 138 �3 �3

Spring Valley 152 �3 �3

Santa Isabel 101 �3 �3

Ocotillo 265 �3 �3

El Arrayan 115 �3 �3

South Kent 270 �3 �3

Grand Renewable 149 �3 �3

Panhandle 1 218 �3 �3

Panhandle 2 182 �3 �3

K2 270 �3 �3

Armow 180 �3 �3

Logan’s Gap 200 �3 �3

Amazon Fowler Ridge 150 �3 �3

Conejo Solar1 104 �3

Meikle 180 �3 �3

Futtsu Solar 42 �3 �3

Kanagi Solar 14 �3 �3

Broadview 324 �3 �3

Ohorayama 33 in construction

Belle River 100 in construction

Mont Sainte-Marguerite 147 in construction

2

Pattern Development Construction Projects

3

1 Conejo Solar was two months delayed.

2”Within budget” means within the board-approved budget (including contingency).

3”On schedule” means achieved commercial operations prior to the term conversion deadline under the project

construction credit facilities.

21

PATTERN ENERGY GROUP INC.

PAGE

DEVELOPMENT PHASES - CASE STUDY

In 2009 and 2010, Pattern Development was constructing its first

project in Canada, the St. Joseph Wind Farm in southern Manitoba.

This project is located in an ancient lakebed that has silted in over the

centuries. As a result, below the surface is 150 feet of mud that has

virtually no structural support to sustain a wind turbine. Additionally,

the Red River flows through its northern boundary which makes it prone

to flooding.

To overcome the design challenges associated with the soil conditions,

Pattern Development worked with various design firms to create an

innovative foundation of pipe piling and integrated concrete cap, which

provided the necessary support for the wind turbines. To overcome

the effects of potential flooding, Pattern Development worked with

the BOP firm and turbine supplier to ensure that the entire electrical

infrastructure was either capable of being submerged in water or

sufficiently elevated well above historical averages.

All of the design effort and planning were tested during its

construction, as the project suffered four different significant weather

events that flooded the region to historic levels, including a 100-year

flood. In order to properly sequence and plan the work around the

affected areas, these events required daily collaboration with the BOP

contractor and the wind turbine supplier. Pattern Development and

the construction contractors successfully delivered the St. Joseph Wind

Farm project without delay and within the original budget.

Project

Case Study

St. Joseph Wind Farm

22

PATTERN ENERGY GROUP INC.

PAGE

EXAMPLE PROJECT

This section expands on the example introduced in the Development

Business Model description of the economics of a project as it moves

through the stages of development. The example below is a generic

project as each project can have slightly different attributes, but it

is highly indicative and comparable to actual projects completed

by Pattern Development. In this scenario, the economics relate to

a 100 MW project that has a development period of 24 months,

a construction period of 12 months, and an all-in total projected

cost to construct of $160 million, inclusive of all hard and soft costs,

contingency costs, interest during construction, fees and other

expenses. Once the project achieves commercial operations, it has a

fair market value of $180 million and generates CAFD of approximately

$5.5 million per year.

Project at a Glance

Project Size 100 MW

All-in project cost

to construct

$160 million

$120 million non recourse financing

$40 million developer’s equity

Time to COD 36 months

Development 24 months

Construction 12 months

Fair market value

of asset

$180 million

CAFD per annum $5.5 million

An Example Project

23

PATTERN ENERGY GROUP INC.

PAGE

EXAMPLE PROJECT

Origination and early

development phase

capital structure

In the early stages of develop-

ment, assumed to be 24 months,

limited capital is expended to

advance the project. To take

projects from this phase to the

point of construction financing,

“at-risk” development expenses

may total less than $1 million on

the low end to $5-10 million on

the high end. Assume that the ex-

ample project incurs expenses of

approximately $2 million during a

two-year development period pri-

or to the pre-construction stage.

This $2 million investment would

be all equity funded.

Pre-construction phase

capital structure

In the pre-construction and

financing stage, the developer

will take the project to readiness

for construction financing by

closing out general development

activities and receiving a PPA and

interconnection rights. Typically,

PPAs and interconnection

agreements require developers

to post Letters of Credit (“LCs”)

in support of project obligations.

These LCs are usually supported

by cash deposits. The total

capital deployed to advance

projects from project origination

through pre-construction capital

expenditure, including letter

of credit exposure, varies from

construction period as proceeds

are needed to pay for the project

costs. Limited or non-recourse

financing, or “back-leverage,”

reduce the equity capital further

and ultimately result in less than

$20 million in net investment

during construction.

Developer return analysis

In the example, as a multiple

of CAFD, the project’s equity

value is $40 million ÷ $5.5 million

= 7.3x on an “as built” basis

and $60 million ÷ $5.5 million

= 10.9x on a fair market value

basis. Alternatively, the $160

million investment that yields

$5.5 million in CAFD per year for

a period of a 25-year asset life

will result in a levered after-tax

IRR of approximately 13.9% from

the commercial operations date.

project to project. However,

based on Pattern Development’s

experience, a reasonable estimate

is approximately 10% of the built

cost on average, or $16 million in

this scenario.

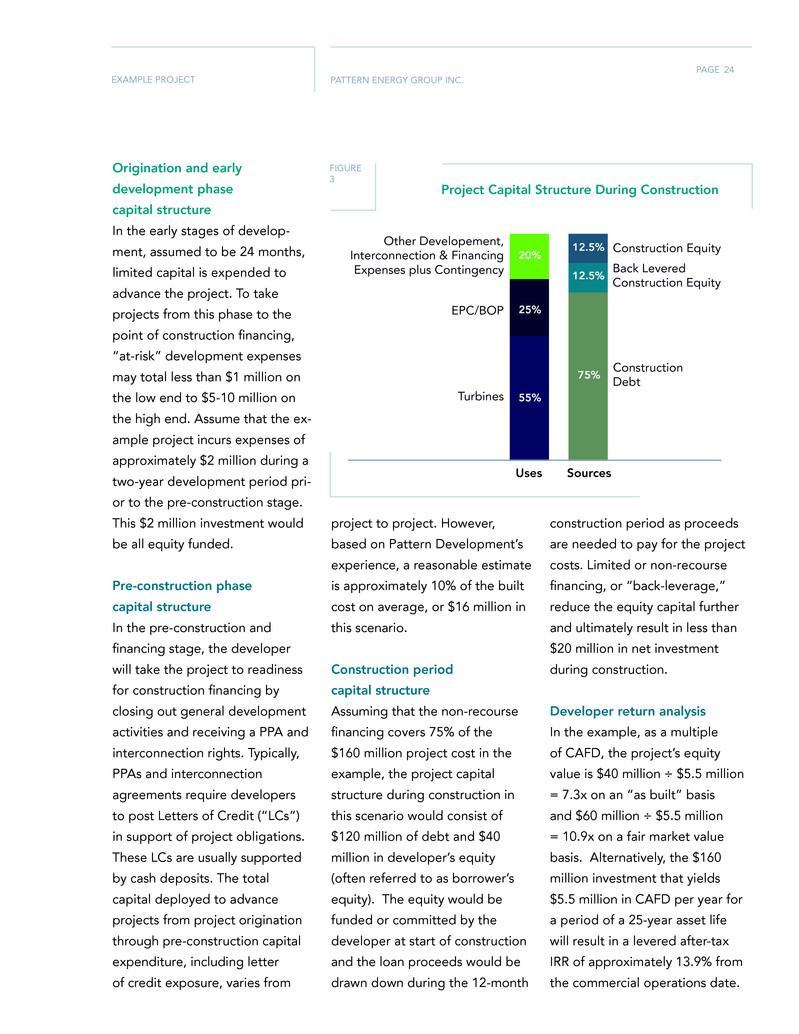

Construction period

capital structure

Assuming that the non-recourse

financing covers 75% of the

$160 million project cost in the

example, the project capital

structure during construction in

this scenario would consist of

$120 million of debt and $40

million in developer’s equity

(often referred to as borrower’s

equity). The equity would be

funded or committed by the

developer at start of construction

and the loan proceeds would be

drawn down during the 12-month

Uses Sources

Construction

Debt

Back Levered

Construction Equity

Construction Equity20% 12.5%

12.5%

75%

25%

55%

Other Developement,

Interconnection & Financing

Expenses plus Contingency

EPC/BOP

Turbines

FIGURE

3

Project Capital Structure During Construction

24

PATTERN ENERGY GROUP INC.

PAGE

SUMMATION

On sell-down at the commercial

operations date, assuming the

$180 million purchase price, the

levered after-tax IRR would be

approximately 8.1%, generating

5.8% (or 580 basis points) of “yield

compression.”

Per-share accretion analysis

Assume a company with $1.8

billion market capitalization, 6%

yield and 80% targeted payout

ratio, invested $60 million to buy

the example project using funds

from an equity raise, corporate

debt and a portion of existing

CAFD. If the investment produced

incremental CAFD of $5.5 million

($4.5 million after servicing

corporate debt), accretion arising

from that investment would be

around 1.8%. Assuming the same

facts, except that the company

invested $40 million to develop,

build and own the example

project, accretion arising from

that investment would be around

2.8%, which represents more than

a 50% increase from buying the

developed project.

In summation, renewable energy development offers ever-growing

opportunities both domestically and abroad. Although the process

has certain risks associated with it, an experienced, disciplined team

can effectively manage those risks to generate high quality assets and

attractive returns for its investors. Should you have any questions,

please don’t hesitate to contact us at:

Pattern Energy Group Inc.

Investor Relations

ir@patternenergy.com

Economic Conclusions

In summary, the following conclusions can be drawn:

» A well-managed project can progress through the early

development and origination phases, which are typically

the longer duration and higher risk periods for an individual

project, on a limited amount of capital – less than 2% of

build cost.

» The point of maximum business risk exposure, typically

approximately 10% of build cost, is usually during the pre-

construction stage immediately prior to the beginning of

construction.

» The point of maximum capital at risk is usually upon close

of construction financing and full commencement of

construction – typically approximately 40% of build cost.

While the capital is higher at this stage than during the pre-

construction stage, this capital is lower risk in nature. The

primary risks at this stage relate to construction completion

and sell-down price of the equity interest.

Summation

Disclaimer

Any investment in Pattern Development 2.0 would be subject to approval by Pattern Energy’s Conflicts Committee and Board of

Directors. The content provided in this White Paper is intended solely for general information purposes. The case studies, hypotheticals

and other information in the White Paper do not constitute estimates, forecasts or assurances that similar future circumstances will result

in similar results. The White Paper in no way constitutes the provision of investment advice. Pattern Energy does not accept liability for

direct or indirect losses resulting from using, relying or acting upon information in the White Paper.

25