Attached files

| file | filename |

|---|---|

| EX-99.3 - PRESS RELEASE - AVADEL PHARMACEUTICALS PLC | sharerepurchaseannouncemen.htm |

| EX-99.1 - EARNINGS RELEASE - AVADEL PHARMACEUTICALS PLC | ex991earningsreleaseq4_2016.htm |

| 8-K - PRESS RELEASE - AVADEL PHARMACEUTICALS PLC | form8-kq4_2016.htm |

Year-End 2016

Earnings Conference Call

March 7, 2017

2

Safe Harbor

This presentation may include "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements herein that are not clearly historical in nature are forward-looking, and the words

"anticipate," "assume," "believe," "expect," "estimate," "plan," "will," "may," and the negative of these and similar

expressions generally identify forward-looking statements. All forward-looking statements involve risks, uncertainties

and contingencies, many of which are beyond Avadel’s control and could cause actual results to differ materially from

the results contemplated in such forward-looking statements. These risks, uncertainties and contingencies include the

risks relating to: our dependence on a small number of products and customers for the majority of our revenues; the

possibility that our Bloxiverz®, Vazculep® and Akovaz® products, which are not patent protected, could face substantial

competition resulting in a loss of market share or forcing us to reduce the prices we charge for those products; the

possibility that we could fail to successfully complete the research and development for the pipeline product we are

evaluating for potential application to the FDA pursuant to our "unapproved-to-approved" strategy, or that competitors

could complete the development of such product and apply for FDA approval of such product before us; our

dependence on the performance of third parties in partnerships or strategic alliances for the commercialization of some

of our products; the possibility that our products may not reach the commercial market or gain market acceptance; our

need to invest substantial sums in research and development in order to remain competitive; our dependence on

certain single providers for development of several of our drug delivery platforms and products; our dependence on a

limited number of suppliers to manufacture our products and to deliver certain raw materials used in our products; the

possibility that our competitors may develop and market technologies or products that are more effective or safer than

ours, or obtain regulatory approval and market such technologies or products before we do; the challenges in

protecting the intellectual property underlying our drug delivery platforms and other products; our dependence on key

personnel to execute our business plan; the amount of additional costs we will incur to comply with U.S. securities laws

as a result of our ceasing to qualify as a foreign private issuer; and the other risks, uncertainties and contingencies

described in the Company's filings with the U.S. Securities and Exchange Commission, including our annual report on

Form 10-K for the year ended December 31, 2015, all of which filings are also available on the Company's website.

Avadel undertakes no obligation to update its forward-looking statements as a result of new information, future events

or otherwise, except as required by law.

3

Call Outline

• Share Repurchase Program

• REST-ON Trial

• Special Protocol Assessment

• Timeline

• Patent Landscape

• Base Business Overview

• Akovaz®

• Vazculep®

• Bloxiverz®

• R&D Pipeline

• Non-GAAP Financial Results

• GAAP Financial Results

• Product Sales

• Cash Flow

• 2017 Guidance

4

Share Repurchase Program

Board of Directors authorized share repurchase program of up

to $25 million

Strong cash position allows flexibility to allocate money for share repurchase

Provides opportunity to purchase shares and return cash to shareholders

Repurchases may be made in open-market transactions, block transactions on or off

the exchange, in privately negotiated transactions, or through other means as

determined by management

5

REST-ON Phase III Trial

• Reached protocol agreement with FDA via Special Protocol

Assessment in Q4

• Upfront agreement from FDA on powering and trial design

• Endpoints: Excessive Daytime Sleepiness (EDS) and Cataplexy

• Initiated patient enrollment and dosing in Q4

• Active enrollment in Europe and Canada

• US site initiations ongoing

• Enrollment completion goal of year end 2017

Progress to Date

6

Sodium Oxybate Patent Landscape

1st generic approved with separate REMS from Xyrem®

Generic litigation of patent surrounding concomitant use with valproate sodium

slated for May 2017

• Potential settlement prior to trial

• Patent holds – generics likely delayed until 2026

• Patent falls – potential generic entry 2H 2017

AVDL’s plans to file 5050(b)(2) NDA for FT218

• Patients taking forms of valproate sodium excluded from REST-ON study

– FDA is aware of this exclusion criteria

• NDA not subject to label requirements of ANDA filers, even though NDA

will reference existing safety information of RLD

• FT218 will have a different label than competing 2x nightly products

7

Hospital Products

• Akovaz® successfully launched in August Q3

• Exited 2016 with approximately 27% market share

( ~7.5 million vials / year)

• 1 competitor in 2016

• 2 competitors in 2017

• Expect to garner and retain ~ 30% of overall market

• Vazculep® had 100% share of 5mL & 10mL markets

• 40% market share across 3 vial sizes

• Expect another competitor mid-year 2017

• Bloxiverz® retained ~ 40% share during 2016 in 3

player market

• Sugammadex, neostigmine alternative, reduced the

overall neostigmine market by ~20% during 2016

• Expect another competitor mid-year 2017

8

Internal Development Pipeline

Indication: CNS

Indication: Psychiatric

Indication: Pediatric

Indication: Pediatric

• Numerous internal development opportunities under evaluation

• Expect to file 4th NDA for AV001 by year end 2017

• Evaluating more unapproved marketed drugs (UMD) for potential development

beginning in 2017

9

Non-GAAP Financial Results

*Reconciliations from GAAP to Non-GAAP can be found in the appendix

(in 000s)

12/31/16 09/30/16 12/31/15 12/31/16 12/31/15

Sales 43,085$ 32,087$ 44,568$ 150,246$ 173,009$

Cost of products and services sold 3,610 2,844 2,937 12,742 11,410

Research and development expenses 13,476 8,143 5,161 34,611 25,608

Selling, general and admin expenses 10,688 12,740 6,808 44,179 21,712

Intangible asset amortization - - - - -

Operating expenses 27,774 23,727 14,906 91,532 58,730

Contingent consideration payments and accruals 7,645 5,884 8,158 26,966 32,081

Operating income (loss) 7,666 2,476 21,504 31,748 82,198

Interest and other expense (net) 294 226 65 672 1,236

Other Expense - changes in fair value of related party payable (1,018) (785) (1,123) (3,636) (4,414)

Income (loss) before income taxes 6,942 1,917 20,446 28,784 79,020

Income tax provision 6,875 5,416 9,687 31,373 37,290

Net income (loss) 67$ (3,499)$ 10,759$ (2,589)$ 41,730$

Diluted earnings (loss) per share -$ (0.08)$ 0.25$ (0.06)$ 0.96$

Three Months Ended Twelve Months Ended

10

GAAP Financial Results

(in 000s)

12/31/16 09/30/16 12/31/15 12/31/16 12/31/15

Sales 43,085$ 32,087$ 44,568$ 150,246$ 173,009$

Cost of products and services sold 2,591 2,844 2,937 13,248 11,410

Research and development expenses 13,476 8,143 5,161 34,611 25,608

Selling, general and admin expenses 10,688 12,740 6,808 44,179 21,712

Intangible asset amortization 2,970 3,702 3,141 13,888 12,564

Operating expenses 29,725 27,429 18,047 105,926 71,294

Fair value adjustments of contingent consideration (3,704) 20,848 (51,079) 49,285 30,957

Operating income (loss) 17,064 (16,190) 77,600 (4,965) 70,758

Interest and other expense (net) 1,429 1,475 2,563 1,795 11,830

Other Expense - changes in fair value of related party payable (413) (1,828) 4,746 (6,548) (4,883)

Income (loss) before income taxes 18,080 (16,543) 84,909 (9,718) 77,705

Income tax provision 13,346 3,451 11,391 31,558 35,907

Net income (loss) 4,734$ (19,994)$ 73,518$ (41,276)$ 41,798$

Diluted earnings (loss) per share 0.11$ (0.48)$ 1.69$ (1.00)$ 0.96$

Three Months Ended Twelve Months Ended

11

Product Sales

in $000's

Q1 2016 Q2 2016 Q3 2016 Q4 2016

Full Year

2016

Full Year

2015

Bloxiverz 24,747$ 25,620$ 15,591$ 16,938$ 82,896$ 150,083$

Vazculep 9,406 10,421 9,340 10,629 39,796 20,151

Akovaz - - 5,568 11,263 16,831 -

Other 1,200 2,124 841 3,534 7,699 2,054

Total product sales and services 35,353$ 38,165$ 31,340$ 42,364$ 147,222$ 172,288$

License and research revenue 863$ 693$ 747$ 721$ 3,024$ 721$

Total revenues 36,216$ 38,858$ 32,087$ 43,085$ 150,246$ 173,009$

12

Cash Flow Summary

in $000's

2016 2015

TOTAL Cash and Marketable Securities

Beginning Balance 144,802$ 92,834$

Operating Cash Flows (excl tax and earnout payments) 68,801$ 126,414

Tax Payments (27,180)$ (42,121)

Earnout/Royalty Payments (30,837)$ (27,897)

Capital Spending (1,201)$ (1,629)

Repayment of Debt (277)$ (5,658)

Issuance of Ordinary Shares and Warrants 440$ 6,990

FX (166)$ (3,508)

Other (187)$ (623)

Change in Total 9,393$ 51,968

Ending Balance 154,195$ 144,802$

Twelve Months Ended December 31,

13

Full Year 2017 Guidance - Reaffirmed

2017 Guidance

Sales $170M - $200M

Diluted EPS (Adjusted) $0.20 - $0.35

14

APPENDIX

15

GAAP to NON-GAAP Reconciliations

Three Months Ended December 31, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Cross-border

merger impacts

Purchase

accounting

adjustments -

FSC

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 42,364$ -$ -$ -$ -$ -$ -$ -$ 42,364$

License and research revenue 721 - - - - - - - 721

Total revenue 43,085 - - - - - - - 43,085

Cost of products and services sold 2,591 - - - 1,019 - - 1,019 3,610

Research and development expenses 13,476 - - - - - - - 13,476

Selling, general and administrative expenses 10,688 - - - - - - - 10,688

Intangible asset amortization 2,970 (2,970) - - - - - (2,970) -

Changes in fair value of related party contingent

consideration (3,704) - - - - 3,704 7,645 11,349 7,645

Total operating expenses 26,021 (2,970) - - 1,019 3,704 7,645 9,398 35,419

Operating income (loss) 17,064 2,970 - - (1,019) (3,704) (7,645) (9,398) 7,666

Investment Income 555 - - - - - - - 555

Interest Expense (261) - - - - - - - (261)

Other Expense - changes in fair value of related party

payable (413) - - - - 413 (1,018) (605) (1,018)

Foreign exchange gain (loss) 1,135 - (1,135) - - - - (1,135) -

Income (loss) before income taxes 18,080 2,970 (1,135) - (1,019) (3,291) (8,663) (11,138) 6,942

Income tax provision 13,346 1,066 - (6,754) (366) 82 (499) (6,471) 6,875

Income Tax Rate 74% 36% - - 36% (2%) 6% 58% 99%

Net Loss 4,734$ 1,904$ (1,135)$ 6,754$ (653)$ (3,373)$ (8,164)$ (4,667)$ 67$

Net loss per share - Diluted 0.11$ 0.04$ (0.03)$ 0.16$ (0.02)$ (0.08)$ (0.19)$ (0.11)$ -$

Weighted average number of shares outstanding - Diluted 42,808 42,808 42,808 42,808 42,808 42,808 42,808 42,808 42,808

Adjustments

Exclude

16

GAAP to NON-GAAP Reconciliations

Three Months Ended September 30, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 31,340$ -$ -$ -$ -$ -$ 31,340$

License and research revenue 747 - - - - - 747

Total revenue 32,087 - - - - - 32,087

Cost of products and services sold 2,844 - - - - - 2,844

Research and development expenses 8,143 - - - - - 8,143

Selling, general and administrative expenses 12,740 - - - - - 12,740

Intangible asset amortization 3,702 (3,702) - - - (3,702) -

Changes in fair value of related party contingent

consideration 20,848 - - (20,848) 5,884 (14,964) 5,884

Total operating expenses 48,277 (3,702) - (20,848) 5,884 (18,666) 29,611

Operating income (loss) (16,190) 3,702 - 20,848 (5,884) 18,666 2,476

Investment Income 490 - - - - - 490

Interest Expense (264) - - - - - (264)

Other Expense - changes in fair value of related party

payable (1,828) - - 1,828 (785) 1,043 (785)

Foreign exchange gain (loss) 1,249 - (1,249) - - (1,249) -

Income (loss) before income taxes (16,543) 3,702 (1,249) 22,676 (6,669) 18,460 1,917

Income tax provision 3,451 1,329 - 1,022 (386) 1,965 5,416

Income Tax Rate (21%) 36% - 5% 6% 11% 283%

Net Loss (19,994)$ 2,373$ (1,249)$ 21,654$ (6,283)$ 16,495$ (3,499)$

Net loss per share - Diluted (0.48)$ 0.06$ (0.03)$ 0.53$ (0.15)$ 0.40$ (0.08)$

Weighted average number of shares outstanding - Diluted 41,241 41,241 41,241 41,241 41,241 41,241 41,241

Adjustments

Exclude

17

GAAP to NON-GAAP Reconciliations

Three Months Ended December 31, 2015:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 43,847$ -$ -$ -$ -$ -$ 43,847$

License and research revenue 721 - - - - - 721

Total revenue 44,568 - - - - - 44,568

Cost of products and services sold 2,937 - - - - - 2,937

Research and development expenses 5,161 - - - - - 5,161

Selling, general and administrative expenses 6,808 - - - - - 6,808

Intangible asset amortization 3,141 (3,141) - - - (3,141) -

Changes in fair value of related party contingent

consideration (51,079) - - 51,079 8,158 59,237 8,158

Total operating expenses (33,032) (3,141) - 51,079 8,158 56,096 23,064

Operating income (loss) 77,600 3,141 - (51,079) (8,158) (56,096) 21,504

Investment Income 65 - - - - - 65

Interest Expense - - - - - - -

Other Expense - changes in fair value of related party

payable 4,746 - - (4,746) (1,123) (5,869) (1,123)

Foreign exchange gain (loss) 2,498 - (2,498) - - (2,498) -

Income (loss) before income taxes 84,909 3,141 (2,498) (55,825) (9,281) (64,463) 20,446

Income tax provision 11,391 1,099 (749) (1,661) (393) (1,704) 9,687

Income Tax Rate 13% 35% 30% 3% 4% 3% 47%

Net Loss 73,518$ 2,042$ (1,749)$ (54,164)$ (8,888)$ (62,759)$ 10,759$

Net loss per share - Diluted 1.69$ 0.05$ (0.04)$ (1.25)$ (0.20)$ (1.45)$ 0.25$

Weighted average number of shares outstanding - Diluted 43,430 43,430 43,430 43,430 43,430 43,430 43,430

Adjustments

Exclude

18

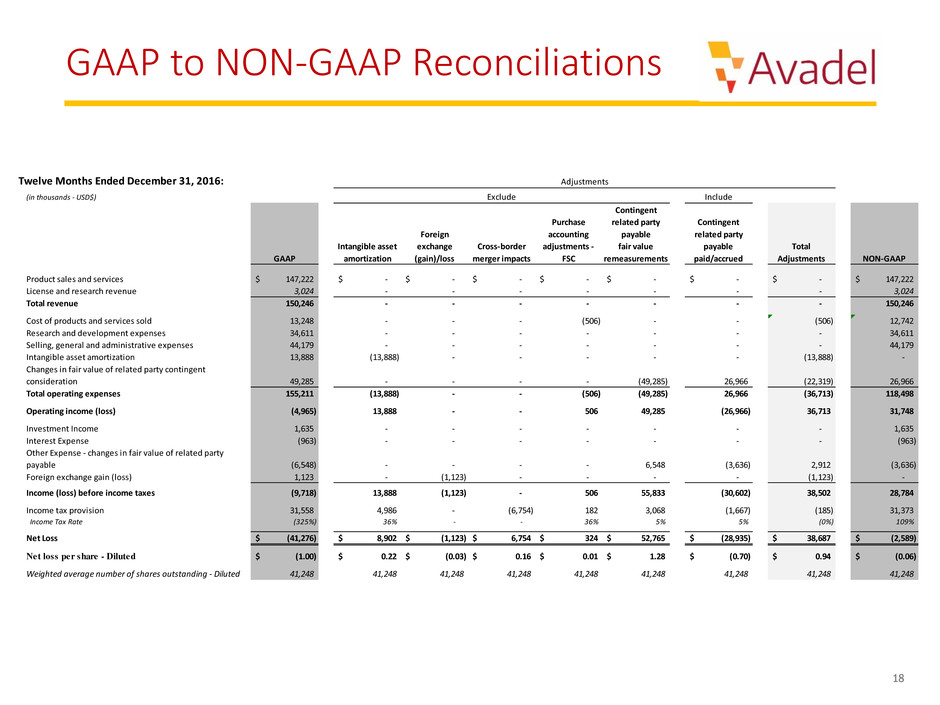

GAAP to NON-GAAP Reconciliations

Twelve Months Ended December 31, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Cross-border

merger impacts

Purchase

accounting

adjustments -

FSC

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 147,222$ -$ -$ -$ -$ -$ -$ -$ 147,222$

License and research revenue 3,024 - - - - - - - 3,024

Total revenue 150,246 - - - - - - - 150,246

Cost of products and services sold 13,248 - - - (506) - - (506) 12,742

Research and development expenses 34,611 - - - - - - - 34,611

Selling, general and administrative expenses 44,179 - - - - - - - 44,179

Intangible asset amortization 13,888 (13,888) - - - - - (13,888) -

Changes in fair value of related party contingent

consideration 49,285 - - - - (49,285) 26,966 (22,319) 26,966

Total operating expenses 155,211 (13,888) - - (506) (49,285) 26,966 (36,713) 118,498

Operating income (loss) (4,965) 13,888 - - 506 49,285 (26,966) 36,713 31,748

Investment Income 1,635 - - - - - - - 1,635

Interest Expense (963) - - - - - - - (963)

Other Expense - changes in fair value of related party

payable (6,548) - - - - 6,548 (3,636) 2,912 (3,636)

Foreign exchange gain (loss) 1,123 - (1,123) - - - - (1,123) -

Income (loss) before income taxes (9,718) 13,888 (1,123) - 506 55,833 (30,602) 38,502 28,784

Income tax provision 31,558 4,986 - (6,754) 182 3,068 (1,667) (185) 31,373

Income Tax Rate (325%) 36% - - 36% 5% 5% (0%) 109%

Net Loss (41,276)$ 8,902$ (1,123)$ 6,754$ 324$ 52,765$ (28,935)$ 38,687$ (2,589)$

Net loss per share - Diluted (1.00)$ 0.22$ (0.03)$ 0.16$ 0.01$ 1.28$ (0.70)$ 0.94$ (0.06)$

Weighted average number of shares outstanding - Diluted 41,248 41,248 41,248 41,248 41,248 41,248 41,248 41,248 41,248

Adjustments

Exclude

19

GAAP to NON-GAAP Reconciliations

Twelve Months Ended December 31, 2015:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 172,288$ -$ -$ -$ -$ -$ 172,288$

License and research revenue 721 - - - - - 721

Total revenue 173,009 - - - - - 173,009

Cost of products and services sold 11,410 - - - - - 11,410

Research and development expenses 25,608 - - - - - 25,608

Selling, general and administrative expenses 21,712 - - - - - 21,712

Intangible asset amortization 12,564 (12,564) - - - (12,564) -

Changes in fair value of related party contingent

consideration 30,957 - - (30,957) 32,081 1,124 32,081

Total operating expenses 102,251 (12,564) - (30,957) 32,081 (11,440) 90,811

Operating income (loss) 70,758 12,564 - 30,957 (32,081) 11,440 82,198

Investment Income 1,236 - - - - - 1,236

Interest Expense - - - - - - -

Other Expense - changes in fair value of related party

payable (4,883) - - 4,883 (4,414) 469 (4,414)

Foreign exchange gain (loss) 10,594 - (10,594) - - (10,594) -

Income (loss) before income taxes 77,705 12,564 (10,594) 35,840 (36,495) 1,315 79,020

Income tax provision 35,907 4,397 (3,178) 1,709 (1,545) 1,383 37,290

Income Tax Rate 46% 35% 30% 5% 4% 105% 47%

Net Loss 41,798$ 8,167$ (7,416)$ 34,131$ (34,950)$ (68)$ 41,730$

Net loss per share - Diluted 0.96$ 0.19$ (0.17)$ 0.78$ (0.80)$ -$ 0.96$

Weighted average number of shares outstanding - Diluted 43,619 43,619 43,619 43,619 43,619 43,619 43,619

Adjustments

Exclude