Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 906 - TENNANT CO | exhibit_32-2.htm |

| EX-32.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 906 - TENNANT CO | exhibit_32-1.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - TENNANT CO | exhibit_31-2.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - TENNANT CO | exhibit_31-1.htm |

| EX-23.1 - INDEPENDENT AUDITOR'S CONSENT - TENNANT CO | exhibit_23-1.htm |

| EX-21 - SUBSIDIARIES OF THE REGISTRANT - TENNANT CO | exhibit_21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[ü] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 |

OR | |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________. |

Commission File Number 001-16191

TENNANT COMPANY

(Exact name of registrant as specified in its charter)

Minnesota | 41-0572550 | |

State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization | Identification No.) | |

701 North Lilac Drive, P.O. Box 1452 Minneapolis, Minnesota 55440 |

(Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code 763-540-1200

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of exchange on which registered | |

Common Stock, par value $0.375 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None | ||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. | ü | Yes | No | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | ü | No | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ü | Yes | No | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | ü | Yes | No | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | [ü] | |||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. | |||||

Large accelerated filer | ü | Accelerated filer | |||

Non-accelerated filer | (Do not check if a smaller reporting company) | Smaller reporting company | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes | ü | No | |

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2016, was $929,372,459. | ||||

As of February 10, 2017, there were 17,695,327 shares of Common Stock outstanding. | ||||

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2017 annual meeting of shareholders (the “2017 Proxy Statement”) are incorporated by reference in Part III.

Tennant Company

Form 10–K

Table of Contents

PART I | Page | ||||

PART II | |||||

PART III | |||||

PART IV | |||||

2

TENNANT COMPANY

2016

ANNUAL REPORT

Form 10–K

(Pursuant to Securities Exchange Act of 1934)

PART I

ITEM 1 – Business

General Development of Business

Tennant Company, a Minnesota corporation founded in 1870 and incorporated in 1909, is a world leader in designing, manufacturing and marketing solutions that empower customers to achieve quality cleaning performance, significantly reduce environmental impact and help create a cleaner, safer, healthier world. Tennant is committed to creating and commercializing breakthrough, sustainable cleaning innovations to enhance its broad suite of products, including: floor maintenance and outdoor cleaning equipment, detergent-free and other sustainable cleaning technologies, aftermarket parts and consumables, equipment maintenance and repair service, specialty surface coatings and asset management solutions. Tennant products are used in many types of environments including: Retail establishments, distribution centers, factories and warehouses, public venues such as arenas and stadiums, office buildings, schools and universities, hospitals and clinics, parking lots and streets, and more. Customers include contract cleaners to whom organizations outsource facilities maintenance, as well as businesses that perform facilities maintenance themselves. The Company reaches these customers through the industry's largest direct sales and service organization and through a strong and well-supported network of authorized distributors worldwide.

Segment and Geographic Area Financial Information

The Company has one reportable business segment. Sales to customers geographically located in the United States were $525.3 million, $517.9 million and $479.5 million for the years ended December 31, 2016, 2015 and 2014, respectively. Long-lived assets located in the United States were $109.2 million and $92.2 million as of the years ended December 31, 2016 and 2015, respectively. Additional financial information on the Company’s segment and geographic areas is provided throughout Item 8 and Note 19 to the Consolidated Financial Statements.

Principal Products, Markets and Distribution

The Company offers products and solutions consisting of mechanized cleaning equipment, detergent-free and other sustainable cleaning technologies, aftermarket parts and consumables, equipment maintenance and repair service, specialty surface coatings, and business solutions such as financing, rental and leasing programs, and machine-to-machine asset management solutions. The Company markets and sells the following brands: Tennant®, Nobles®, Green Machines™, Alfa Uma Empresa Tennant™, IRIS® and Orbio®. Orbio Technologies, which markets and sells Orbio-branded products and solutions, is a group created by the Company to focus on expanding the opportunities for the emerging category of On-Site Generation (OSG). OSG technologies create and dispense effective cleaning and antimicrobial solutions on site within a facility.

As of January 31, 2016, we closed on the sale of our Green Machines outdoor city cleaning line to Green Machines International GmbH and affiliates, subsidiaries of M&F Management and Financing GmbH, which is also parent company of the master distributor of our products in Central Eastern Europe, Middle East and Africa, TCS EMEA GmbH. Therefore, as of February 2016, Green Machines is no longer a Company-owned brand. Further details regarding the sale of our Green Machines outdoor city cleaning line are discussed in Note 4 and Note 6 to the Consolidated Financial Statements.

The Company's principal markets include targeted vertical industries such as retail, manufacturing/warehousing, education, healthcare and hospitality, among others. The Company sells products directly in 15 countries and through distributors in more than 80 countries. The Company serves customers in these geographies via three geographically aligned business units: The Americas, which consists of North America and Latin America, EMEA, which consists of Europe, the Middle East and Africa, and APAC, which consists of the Asia Pacific region.

Raw Materials

The Company has not experienced any significant or unusual problems in the availability of raw materials or other product components. The Company has sole-source vendors for certain components. A disruption in supply from such vendors may disrupt the Company’s operations. However, the Company believes that it can find alternate sources in the event there is a disruption in supply from such vendors.

Intellectual Property

Although the Company considers that its patents, proprietary technologies and trade secrets, customer relationships, licenses, trademarks, trade names and brand names in the aggregate constitute a valuable asset, it does not regard its business as being materially dependent upon any single item or category of intellectual property. We take appropriate measures to protect our intellectual property to the extent such intellectual property can be protected.

Seasonality

Although the Company’s business is not seasonal in the traditional sense, the percentage of revenues in each quarter typically ranges from 22% to 28% of the total year. The first quarter tends to be at the low end of the range reflecting customers’ initial slow ramp up of capital purchases and the Company’s efforts to close out orders at the end of each year. The second and fourth quarters tend to be towards the high end of the range and the third quarter is typically in the middle of the range.

Working Capital

The Company funds operations through a combination of cash and cash equivalents and cash flows from operations. Wherever possible, cash management is centralized and intercompany financing is used to provide working capital to subsidiaries as needed. In addition, credit facilities are available for additional working capital needs or investment opportunities.

Major Customers

The Company sells its products to a wide variety of customers, none of which are of material importance in relation to the business as a whole. The customer base includes several governmental entities which generally have terms similar to other customers.

Backlog

The Company processes orders within two weeks, on average. Therefore, no significant backlogs existed at December 31, 2016 and 2015.

3

Competition

While there is no publicly available industry data concerning market share, the Company believes, through its own market research, that it is a world-leading manufacturer of floor maintenance and cleaning equipment. Several global competitors compete with Tennant in virtually every geography in the world. However, small regional competitors also exist who vary by country, vertical market, product category or channel. The Company competes primarily on the basis of offering a broad line of high-quality, innovative products supported by an extensive sales and service network in major markets.

Research and Development

The Company strives to be an industry leader in innovation and is committed to investing in research and development. The Company’s Global Innovation Center in Minnesota and engineers throughout its global locations are dedicated to various activities, including researching new technologies to create meaningful product differentiation, development of new products and technologies, improvements of existing product design or manufacturing processes and exploring new product applications with customers. In 2016, 2015 and 2014, the Company spent $34.7 million, $32.4 million and $29.4 million on research and development, respectively.

Environmental Compliance

Compliance with Federal, State and local provisions which have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, has not had, and the Company does not expect it to have, a material effect upon the Company’s capital expenditures, earnings or competitive position.

Employees

The Company employed 3,236 people in worldwide operations as of December 31, 2016.

Available Information

The Company makes available free of charge, through the Investor Relations website at investors.tennantco.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable when such material is filed electronically with, or furnished to, the Securities and Exchange Commission (“SEC”).

ITEM 1A – Risk Factors

The following are significant factors known to us that could materially adversely affect our business, financial condition or operating results.

We may encounter financial difficulties if the United States or other global economies experience an additional or continued long-term economic downturn, decreasing the demand for our products and negatively affecting our sales growth.

Our product sales are sensitive to declines in capital spending by our customers. Decreased demand for our products could result in decreased revenues, profitability and cash flows and may impair our ability to maintain our operations and fund our obligations to others. In the event of a continued long-term economic downturn in the U.S. or other global economies, our revenues could decline to the point that we may have to take cost-saving measures, such as restructuring actions. In addition, other fixed costs would have to be reduced to a level that is in line with a lower level of sales. A long-term economic downturn that puts downward pressure on sales could also negatively affect investor perception relative to our publicly stated growth targets.

We are subject to competitive risks associated with developing innovative products and technologies, including but not limited to, not expanding as rapidly or aggressively in the global market as our competitors, our customers not continuing to pay for innovation and competitive challenges to our products, technology and the underlying intellectual property.

Our products are sold in competitive markets throughout the world. Competition is based on product features and design, brand recognition, reliability, durability, technology, breadth of product offerings, price, customer relationships and after-sale service. Although we believe that the performance and price characteristics of our products will produce competitive solutions for our customers’ needs, our products are generally priced higher than our competitors’ products. This is due to our dedication to innovation and continued investments in research and development. We believe that customers will pay for the innovations and quality in our products. However, in the current economic environment, it may be difficult for us to compete with lower priced products offered by our competitors and there can be no assurance that our customers will continue to choose our products over products offered by our competitors. If our products, markets and services are not competitive, we may experience a decline in sales volume, an increase in price discounting and a loss of market share, which adversely impacts revenues, margin and the success of our operations.

Competitors may also initiate litigation to challenge the validity of our patents or claims, allege that we infringe upon their patents, violate our patents or they may use their resources to design comparable products that avoid infringing our patents. Regardless of whether such litigation is successful, such litigation could significantly increase our costs and divert management’s attention from the operation of our business, which could adversely affect our results of operations and financial condition.

Our ability to effectively operate our Company could be adversely affected if we are unable to attract and retain key personnel and other highly skilled employees, provide employee development opportunities and create effective succession planning strategies.

Our continued success will depend on, among other things, the skills and services of our executive officers and other key personnel. Our ability to attract and retain highly qualified managerial, technical, manufacturing, research, sales and marketing personnel also impacts our ability to effectively operate our business. As the economy recovers and companies grow and increase their hiring activities, there is an inherent risk of increased employee turnover and the loss of valuable employees in key positions, especially in emerging markets. We believe the increased loss of key personnel within a concentrated region could adversely affect our sales growth.

In addition, there is a risk that we may not have adequate talent acquisition resources and employee development resources to support our future hiring needs and provide training and development opportunities to all employees. This, in turn, could impede our workforce from embracing change and leveraging the improvements we have made in technology and other business process enhancements.

We may consider acquisition of suitable candidates to accomplish our growth objectives. We may not be able to successfully integrate the businesses we acquire to achieve operational efficiencies, including synergistic and other benefits of acquisition.

We may consider, as part of our growth strategy, supplementing our organic growth through acquisitions of complementary businesses or products. We have engaged in acquisitions in the past and believe future acquisitions may provide meaningful opportunities to grow our business and improve profitability. Acquisitions allow us to enhance the breadth of our product offerings and expand the market and geographic participation of our products and services.

4

However, our success in growing by acquisition is dependent upon identifying businesses to acquire, integrating the newly acquired businesses with our existing businesses and complying with the terms of our credit facilities. We may incur difficulties in the realignment and integration of business activities when assimilating the operations and products of an acquired business or in realizing projected efficiencies, cost savings, revenue synergies and profit margins. Acquired businesses may not achieve the levels of revenue, profit, productivity or otherwise perform as expected. We are also subject to incurring unanticipated liabilities and contingencies associated with an acquired entity that are not identified or fully understood in the due diligence process. Current or future acquisitions may not be successful or accretive to earnings if the acquired businesses do not achieve expected financial results.

In addition, we may record significant goodwill or other intangible assets in connection with an acquisition. We are required to perform impairment tests at least annually and whenever events indicate that the carrying value may not be recoverable from future cash flows. If we determine that any intangible asset values need to be written down to their fair values, this could result in a charge that may be material to our operating results and financial condition.

We may not be able to effectively manage organizational changes which could negatively impact our operating results or financial condition.

We are continuing to implement global standardized processes in our business despite lean staffing levels. We continue to consolidate and reallocate resources as part of our ongoing efforts to optimize our cost structure in the current economy. Our operating results may be negatively impacted if we are unable to implement new processes and manage organizational changes. In addition, if we do not effectively realize and sustain the benefits that these transformations are designed to produce, we may not fully realize the anticipated savings of these actions or they may negatively impact our ability to serve our customers or meet our strategic objectives.

We may not be able to upgrade and evolve our information technology systems as quickly as we wish and we may encounter difficulties as we upgrade and evolve these systems, which could adversely impact our abilities to accomplish anticipated future cost savings, better serve our customers and protect against information system disruption, corruption or intrusions.

We have many information technology systems that are important to the operation of our business and are in need of upgrading in order to effectively implement our growth strategy. Given our greater emphasis on customer-facing technologies, we may not have adequate resources to upgrade our systems at the pace which the current business environment demands. This could increase the risk that the Information Technology infrastructure, such as access and cybersecurity, is not adequately designed to protect critical data and systems from theft, corruption, unauthorized usage, viruses, sabotage or unintentional misuse. Additionally, significantly upgrading and evolving the capabilities of our existing systems could lead to inefficient or ineffective use of our technology due to lack of training or expertise in these evolving technology systems. These factors could lead to significant expenses, adversely impacting our results of operations and hinder our ability to offer better technology solutions to our customers.

Inadequate funding or insufficient innovation of new technologies may result in an inability to develop and commercialize new innovative products and services.

We strive to develop new and innovative products and services to differentiate ourselves in the marketplace. New product development relies heavily on our financial and resource investments in both the short term and long term. If we fail to adequately fund product development projects or fund a project which ultimately does not gain the market acceptance we anticipated, we risk not meeting our customers' expectations, which could result in decreased revenues, declines in margin and loss of market share.

We are subject to product liability claims and product quality issues that could adversely affect our operating results or financial condition.

Our business exposes us to potential product liability risks that are inherent in the design, manufacturing and distribution of our products. If products are used incorrectly by our customers, injury may result leading to product liability claims against us. Some of our products or product improvements may have defects or risks that we have not yet identified that may give rise to product quality issues, liability and warranty claims. Quality issues may also arise due to changes in parts or specifications with suppliers and/or changes in suppliers. If product liability claims are brought against us for damages that are in excess of our insurance coverage or for uninsured liabilities and it is determined we are liable, our business could be adversely impacted. Any losses we suffer from any liability claims, and the effect that any product liability litigation may have upon the reputation and marketability of our products, may have a negative impact on our business and operating results. We could experience a material design or manufacturing failure in our products, a quality system failure, other safety issues, or heightened regulatory scrutiny that could warrant a recall of some of our products. Any unforeseen product quality problems could result in loss of market share, reduced sales and higher warranty expense.

Increases in the cost of, quality, or disruption in the availability of, raw materials and components that we purchase to manufacture our products could negatively impact our operating results or financial condition.

Our sales growth, expanding geographical footprint and continued use of sole source vendors (concentration risk), coupled with suppliers’ potential credit issues, could lead to an increased risk of a breakdown in our supply chain. There is an increased risk of defects due to the highly configured nature of our purchased component parts that could result in quality issues, returns or production slow-downs. In addition, modularization may lead to more sole sourced products and as we seek to outsource the design of certain key components, we risk loss of proprietary control and becoming more reliant on a sole source. There is also a risk that the vendors we choose to supply our parts and equipment fail to comply with our quality expectations, thus damaging our reputation for quality and negatively impacting sales.

The SEC has adopted rules regarding disclosure of the use of “conflict minerals” (commonly referred to as tin, tantalum, tungsten and gold) which are mined from the Democratic Republic of the Congo in products we manufacture or contract to manufacture. These rules have required and will continue to require due diligence and disclosure efforts. There are and will continue to be costs associated with complying with this disclosure requirement, including costs to determine which of our products are subject to the rules and the source of any "conflict minerals" used in these products. Since our supply chain is complex, ultimately we may not be able to sufficiently discover the origin of the conflict minerals used in our products through the due diligence procedures that we implement. If we are unable to, or choose not to certify that our products are conflict mineral free, customers may choose not to purchase our products. Alternatively, if we choose to use only suppliers offering conflict free minerals, we cannot be sure that we will be able to obtain metals, if necessary, from such suppliers in sufficient quantities or at competitive prices. Any one or a combination of these various factors could harm our business, reduce market demand for our products, and adversely affect our profit margins, net sales, and overall financial results.

5

Foreign currency exchange rate fluctuations, particularly the strengthening of the U.S. dollar against other major currencies, could result in declines in our reported net sales and net earnings.

We earn revenues, pay expenses, own assets and incur liabilities in countries using functional currencies other than the U.S. dollar. Because our consolidated financial statements are presented in U.S. dollars, we translate revenues and expenses into U.S. dollars at the average exchange rate during each reporting period, as well as assets and liabilities into U.S. dollars at exchange rates in effect at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against other major currencies will affect our net revenues, net earnings, earnings per share and the value of balance sheet items denominated in foreign currencies as we translate them into the U.S. dollar reporting currency. We use derivative financial instruments to hedge our estimated transactional or translational exposure to certain foreign currency-denominated assets and liabilities as well as our foreign currency denominated revenue. While we actively manage the exposure of our foreign currency market risk in the normal course of business by utilizing various foreign exchange financial instruments, these instruments involve risk and may not effectively limit our underlying exposure from foreign currency exchange rate fluctuations or minimize the effects on our net earnings and the cash volatility associated with foreign currency exchange rate changes. Fluctuations in foreign currency exchange rates, particularly the strengthening of the U.S. dollar against major currencies, could materially affect our financial results, such as it did in 2015 and to a lesser extent in 2016.

We may be unable to conduct business if we experience a significant business interruption in our computer systems, manufacturing plants or distribution facilities for a significant period of time.

We rely on our computer systems, manufacturing plants and distribution facilities to efficiently operate our business. If we experience an interruption in the functionality in any of these items for a significant period of time for any reason, including unauthorized access to our systems, we may not have adequate business continuity planning contingencies in place to allow us to continue our normal business operations on a long-term basis. In addition, the increase in customer facing technology raises the risk of a lapse in business operations. Therefore, significant long-term interruption in our business could cause a decline in sales, an increase in expenses and could adversely impact our financial results.

Our global operations are subject to laws and regulations that impose significant compliance costs and create reputational and legal risk.

Due to the international scope of our operations, we are subject to a complex system of commercial, tax and trade regulations around the world. Recent years have seen an increase in the development and enforcement of laws regarding trade, tax compliance, labor and safety and anti-corruption, such as the U.S. Foreign Corrupt Practices Act, and similar laws from other countries. Our numerous foreign subsidiaries and affiliates are governed by laws, rules and business practices that differ from those of the U.S., but because we are a U.S. based company, oftentimes they are also subject to U.S. laws which can create a conflict. Despite our due diligence, there is a risk that we do not have adequate resources or comprehensive processes to stay current on changes in laws or regulations applicable to us worldwide and maintain compliance with those changes. Increased compliance requirements may lead to increased costs and erosion of desired profit margin. As a result, it is possible that the activities of these entities may not comply with U.S. laws or business practices or our Business Ethics Guide. Violations of the U.S. or local laws may result in severe criminal or civil sanctions, could disrupt our business, and result in an adverse effect on our reputation, business and results of operations or financial condition. We cannot predict the nature, scope or effect of future regulatory requirements to which our operations might be subject or the manner in which existing laws might be administered or interpreted.

We have identified material weaknesses in our internal control over financial reporting. If our remedial measures are insufficient to address the material weaknesses, or if additional material weaknesses or significant deficiencies in our internal control over financial reporting are discovered or occur in the future, our consolidated financial statements may contain material misstatements, which could adversely affect our stock price and could negatively impact our results of operations.

As of December 31, 2016, we concluded that there were material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. See Item 9A in Part II of this Annual Report on Form 10-K for details.

While we are committed to remediating the control deficiencies that gave rise to the material weaknesses, there can be no assurances that our remediation efforts will be successful or that we will be able to prevent future control deficiencies (including material weaknesses) from happening that could cause us to incur unforeseen costs, negatively impact our results of operations, cause our consolidated financial results to contain material misstatements, cause the market price of our common stock to decline, damage our reputation or have other potential material adverse consequences.

ITEM 1B – Unresolved Staff Comments

None.

ITEM 2 – Properties

The Company’s corporate offices are owned by the Company and are located in the Minneapolis, Minnesota, metropolitan area. Manufacturing facilities located in Minneapolis, Minnesota; Holland, Michigan; Chicago, Illinois; and Uden, the Netherlands are owned by the Company. Manufacturing facilities located in Louisville, Kentucky; São Paulo, Brazil; and Shanghai, China are leased to the Company. Sales offices, warehouse and storage facilities are leased in various locations in North America, Europe, Japan, China, Australia, New Zealand and Latin America. The Company’s facilities are in good operating condition, suitable for their respective uses and adequate for current needs. Further information regarding the Company’s property and lease commitments is included in the Contractual Obligations section of Item 7 and in Note 15 to the Consolidated Financial Statements.

Effective with the sale of our Green Machines outdoor city cleaning line in January 2016, we sub-leased our former manufacturing facility in Falkirk, United Kingdom to the buyer of the Green Machines business. Further details regarding the sale of our Green Machines outdoor city cleaning line are discussed in Note 6 to the Consolidated Financial Statements.

ITEM 3 – Legal Proceedings

There are no material pending legal proceedings other than ordinary routine litigation incidental to the Company’s business.

ITEM 4 – Mine Safety Disclosures

Not applicable.

6

PART II

ITEM 5 – Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

MARKET INFORMATION – Tennant's common stock is traded on the New York Stock Exchange, under the ticker symbol TNC. As of February 10, 2017, there were 348 shareholders of record. The common stock price was $71.10 per share on February 10, 2017. The accompanying chart shows the high and low sales prices for the Company’s shares for each full quarterly period over the past two years as reported by the New York Stock Exchange:

2016 | 2015 | ||||||||||||||

High | Low | High | Low | ||||||||||||

First Quarter | $ | 55.71 | $ | 45.92 | $ | 72.52 | $ | 63.14 | |||||||

Second Quarter | 56.33 | 49.97 | 70.12 | 62.59 | |||||||||||

Third Quarter | 66.54 | 52.51 | 66.38 | 54.00 | |||||||||||

Fourth Quarter | 76.80 | 60.21 | 62.92 | 54.39 | |||||||||||

DIVIDEND INFORMATION – Cash dividends on Tennant’s common stock have been paid for 72 consecutive years. Tennant’s annual cash dividend payout increased for the 45th consecutive year to $0.81 per share in 2016, an increase of $0.01 per share over 2015. Dividends are generally declared each quarter. On February 15, 2017, the Company announced a quarterly cash dividend of $0.21 per share payable March 15, 2017, to shareholders of record on March 2, 2017.

DIVIDEND REINVESTMENT OR DIRECT DEPOSIT OPTIONS – Shareholders have the option of reinvesting quarterly dividends in additional shares of Company stock or having dividends deposited directly to a bank account. The Transfer Agent should be contacted for additional information.

TRANSFER AGENT AND REGISTRAR – Shareholders with a change of address or questions about their account may contact:

Wells Fargo Bank, N.A.

Shareowner Services

P.O. Box 64874

St. Paul, MN 55164-0854

(800) 468-9716

EQUITY COMPENSATION PLAN INFORMATION – Information regarding equity compensation plans required by Regulation S-K Item 201(d) is incorporated by reference in Item 12 of this annual report on Form 10-K from the 2017 Proxy Statement.

SHARE REPURCHASES – On October 31, 2016, the Board of Directors authorized the repurchase of an additional 1,000,000 shares of our common stock. This was in addition to the 395,049 shares remaining under our prior repurchase program as of December 31, 2016. Share repurchases are made from time to time in the open market or through privately negotiated transactions, primarily to offset the dilutive effect of shares issued through our share-based compensation programs. Our Amended and Restated Credit Agreement and Shelf Agreement restrict the payment of dividends or repurchasing of stock if, after giving effect to such payments, our leverage ratio is greater than 2.00 to 1, in such case limiting such payments to an amount ranging from $50.0 million to $75.0 million during any fiscal year. If our leverage ratio is greater than 3.25 to 1, our Amended and Restated Credit Agreement and Shelf Agreement restrict us from paying any dividends or repurchasing stock, after giving effect to such payments.

For the Quarter Ended December 31, 2016 | Total Number of Shares Purchased (1) | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | |||||||

October 1–31, 2016 | 106 | 63.88 | — | 1,395,049 | |||||||

November 1–30, 2016 | 1,228 | 64.25 | — | 1,395,049 | |||||||

December 1–31, 2016 | 157 | 52.42 | — | 1,395,049 | |||||||

Total | 1,491 | $62.98 | — | 1,395,049 | |||||||

(1) | Includes 1,491 shares delivered or attested to in satisfaction of the exercise price and/or tax withholding obligations by employees who exercised stock options or restricted stock under employee share-based compensation plans. |

7

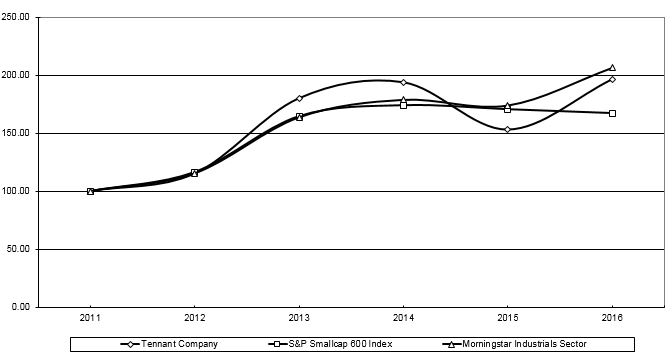

STOCK PERFORMANCE GRAPH – The following graph compares the cumulative total shareholder return on Tennant’s common stock to two indices: S&P SmallCap 600 and Morningstar Industrials Sector. The graph below compares the performance for the last five fiscal years, assuming an investment of $100 on December 31, 2011, including the reinvestment of all dividends.

5-YEAR CUMULATIVE TOTAL RETURN COMPARISON

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||

Tennant Company | $100 | $115 | $180 | $194 | $153 | $196 | |||||

S&P SmallCap 600 | $100 | $116 | $164 | $174 | $170 | $167 | |||||

Morningstar Industrials Sector | $100 | $115 | $164 | $179 | $174 | $206 | |||||

8

ITEM 6 – Selected Financial Data

(In thousands, except shares and per share data)

Years Ended December 31 | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||||||

Financial Results: | ||||||||||||||||||||||||

Net Sales | $ | 808,572 | $ | 811,799 | $ | 821,983 | $ | 752,011 | $ | 738,980 | ||||||||||||||

Cost of Sales | 456,977 | 462,739 | 469,556 | 426,103 | 413,684 | (3) | ||||||||||||||||||

Gross Margin - % | 43.5 | 43.0 | 42.9 | 43.3 | 44.0 | |||||||||||||||||||

Research and Development Expense | 34,738 | 32,415 | 29,432 | 30,529 | 29,263 | |||||||||||||||||||

% of Net Sales | 4.3 | 4.0 | 3.6 | 4.1 | 4.0 | |||||||||||||||||||

Selling and Administrative Expense | 248,210 | 252,270 | (1) | 250,898 | 232,976 | (2) | 234,114 | (3) | ||||||||||||||||

% of Net Sales | 30.7 | 31.1 | 30.5 | 31.0 | 31.7 | |||||||||||||||||||

Loss (Gain) on Sale of Business | 149 | — | — | — | (784 | ) | (3) | |||||||||||||||||

% of Net Sales | — | — | — | — | (0.1 | ) | ||||||||||||||||||

Impairment of Long-Lived Assets | — | 11,199 | — | — | — | |||||||||||||||||||

% of Net Sales | — | 1.4 | — | — | — | |||||||||||||||||||

Profit from Operations | 68,498 | 53,176 | (1) | 72,097 | 62,403 | (2) | 62,703 | (3) | ||||||||||||||||

% of Net Sales | 8.5 | 6.6 | 8.8 | 8.3 | 8.5 | |||||||||||||||||||

Total Other Expense, Net | (2,007 | ) | (2,752 | ) | (2,559 | ) | (2,525 | ) | (2,813 | ) | ||||||||||||||

Profit Before Income Taxes | 66,491 | 50,424 | (1) | 69,538 | 59,878 | (2) | 59,890 | (3) | ||||||||||||||||

% of Net Sales | 8.2 | 6.2 | 8.5 | 8.0 | 8.1 | |||||||||||||||||||

Income Tax Expense | 19,877 | 18,336 | (1) | 18,887 | 19,647 | (2) | 18,306 | (3) | ||||||||||||||||

Effective Tax Rate - % | 29.9 | 36.4 | 27.2 | 32.8 | 30.6 | |||||||||||||||||||

Net Earnings | 46,614 | 32,088 | (1) | 50,651 | 40,231 | (2) | 41,584 | (3) | ||||||||||||||||

% of Net Sales | 5.8 | 4.0 | 6.2 | 5.3 | 5.6 | |||||||||||||||||||

Per Share Data: | ||||||||||||||||||||||||

Basic Net Earnings | $ | 2.66 | $ | 1.78 | (1) | $ | 2.78 | $ | 2.20 | (2) | $ | 2.24 | (3) | |||||||||||

Diluted Net Earnings | $ | 2.59 | $ | 1.74 | (1) | $ | 2.70 | $ | 2.14 | (2) | $ | 2.18 | (3) | |||||||||||

Diluted Weighted Average Shares | 17,976,183 | 18,493,447 | 18,740,858 | 18,833,453 | 19,102,016 | |||||||||||||||||||

Cash Dividends | $ | 0.81 | $ | 0.80 | $ | 0.78 | $ | 0.72 | $ | 0.69 | ||||||||||||||

Financial Position: | ||||||||||||||||||||||||

Total Assets | $ | 470,037 | $ | 432,295 | $ | 486,932 | $ | 456,306 | $ | 420,760 | ||||||||||||||

Total Debt | 36,194 | 24,653 | 28,137 | 31,803 | 32,323 | |||||||||||||||||||

Total Shareholders’ Equity | 278,543 | 252,207 | 280,651 | 263,846 | 235,054 | |||||||||||||||||||

Current Ratio | 2.2 | 2.2 | 2.4 | 2.4 | 2.2 | |||||||||||||||||||

Debt-to-Capital Ratio | 11.5 | % | 8.9 | % | 9.1 | % | 10.8 | % | 12.1 | % | ||||||||||||||

Cash Flows: | ||||||||||||||||||||||||

Net Cash Provided by Operations | $ | 57,878 | $ | 45,232 | $ | 59,362 | $ | 59,814 | $ | 47,566 | ||||||||||||||

Capital Expenditures, Net of Disposals | (25,911 | ) | (24,444 | ) | (19,292 | ) | (14,655 | ) | (14,595 | ) | ||||||||||||||

Free Cash Flow | 31,967 | 20,788 | 40,070 | 45,159 | 32,971 | |||||||||||||||||||

Other Data: | ||||||||||||||||||||||||

Depreciation and Amortization | $ | 18,300 | $ | 18,031 | $ | 20,063 | $ | 20,246 | $ | 20,872 | ||||||||||||||

Number of employees at year-end | 3,236 | 3,164 | 3,087 | 2,931 | 2,816 | |||||||||||||||||||

The results of operations from our 2011 acquisition have been included in the Selected Financial Data presented above since its acquisition date.

(1) | 2015 includes restructuring charges of $3,744 pre-tax ($3,095 after-tax or $0.17 per diluted share) and a non-cash Impairment of Long-Lived Assets of $11,199 pre-tax ($10,822 after-tax or $0.58 per diluted share). |

(2) | 2013 includes restructuring charges of $3,017 pre-tax ($2,938 after-tax or $0.15 per diluted share) and a tax benefit of $582 (or $0.03 per diluted share) related to the retroactive reinstatement of the 2012 U.S. Federal Research and Development ("R&D") Tax Credit. |

(3) | 2012 includes a gain on sale of business of $784 pre-tax ($508 after-tax or $0.03 per diluted share), a restructuring charge of $760 pre-tax ($670 after-tax or $0.04 per diluted share) and tax benefits from an international entity restructuring of $2,043 (or $0.11 per diluted share). |

9

ITEM 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Tennant Company is a world leader in designing, manufacturing and marketing solutions that empower customers to achieve quality cleaning performance, significantly reduce environmental impact and help create a cleaner, safer, healthier world. Tennant is committed to creating and commercializing breakthrough, sustainable cleaning innovations to enhance its broad suite of products, including: floor maintenance and outdoor cleaning equipment, detergent-free and other sustainable cleaning technologies, aftermarket parts and consumables, equipment maintenance and repair service, specialty surface coatings and asset management solutions. Tennant products are used in many types of environments including: Retail establishments, distribution centers, factories and warehouses, public venues such as arenas and stadiums, office buildings, schools and universities, hospitals and clinics, parking lots and streets, and more. Customers include contract cleaners to whom organizations outsource facilities maintenance, as well as businesses that perform facilities maintenance themselves. The Company reaches these customers through the industry's largest direct sales and service organization and through a strong and well-supported network of authorized distributors worldwide.

Net Sales in 2016 totaled $808.6 million, down 0.4% from $811.8 million in the prior year primarily due to an unfavorable impact from foreign currency exchange of approximately 1.0%, an unfavorable net impact of 0.5% resulting from the sale of our Green MachinesTM outdoor city cleaning line, partially offset by the acquisition of the Florock® Polymer Flooring brand ("Florock"), and lower sales of commercial equipment, particularly within the Asia Pacific ("APAC") region. These impacts were more than offset by strong sales of industrial equipment and sales of new products, particularly in the Americas region. 2016 organic sales growth, which excludes the impact of foreign currency exchange and acquisitions and divestitures, was up approximately 1.1% from 2015 with growth in the Americas and Europe, Middle East and Africa ("EMEA") geographical regions. 2016 Gross Profit margin increased 50 basis points to 43.5% from 43.0% in 2015 primarily due to a more favorable product mix (with relatively higher sales of industrial equipment and lower sales of commercial equipment). This was somewhat offset by manufacturing productivity challenges in North America. Selling and Administrative Expense (“S&A Expense”) decreased 1.6% to $248.2 million in 2016 from $252.3 million in 2015, which included the third and fourth quarter restructuring charges we recorded in 2015 of $3.7 million that did not repeat in 2016. Further details regarding the 2015 restructuring actions are discussed in Note 2 to the Consolidated Financial Statements. Operating Profit was $68.5 million in 2016, as compared to Operating Profit of $53.2 million in the prior year which included $11.2 million for the pre-tax non-cash Impairment of Long-Lived Assets as a result of the classification of our Green Machines assets as held for sale and also the $3.7 million pre-tax restructuring charges recorded in 2015. Operating Profit margin increased 190 basis points to 8.5% in 2016 from 6.6% in 2015. 2016 Operating Profit was also favorably impacted by higher Gross Profit despite the lower Net Sales in 2016 as compared to 2015. Due to the overall strengthening of the U.S. dollar relative to other currencies in 2016, foreign currency exchange reduced Operating Profit by approximately $1.2 million.

Net Earnings of $46.6 million for 2016 were $14.5 million greater than 2015. 2015 Net Earnings were impacted by the $11.2 million pre-tax non-cash Impairment of Long-Lived Assets as a result of the classification of our Green Machines assets as held for sale as well as the $3.7 million pre-tax restructuring charges that did not repeat in 2016.

Net Sales in 2015 totaled $811.8 million, down from $822.0 million in the prior year primarily due to an unfavorable impact from foreign currency exchange of approximately 5.5%, lower sales of outdoor equipment and sales declines to our Master Distributor for Russia. These impacts were partially offset by robust sales to strategic accounts in North America and global sales of new products and also selling list price increases. 2015 organic sales growth, which excludes the impact of foreign currency exchange (and acquisitions and divestitures when applicable), was up approximately 4.3% from 2014 with growth in the Americas and APAC geographical regions. 2015 Gross Profit margin increased 10 basis points to 43.0% from 42.9% in 2014 primarily due to improved operating efficiencies in both the direct service organization and manufacturing operations. This was somewhat offset by foreign currency headwinds that unfavorably impacted gross margin by approximately 80 basis points. S&A Expense increased 0.5% from $250.9 million in 2014 to $252.3 million in 2015 primarily due to our 2015 third and fourth quarter restructuring charges, described in Note 3 to the Consolidated Financial Statements, of $3.7 million, or 50 basis points as a percentage of Net Sales. This was somewhat offset by continued cost controls and improved operating efficiencies that favorably impacted S&A Expense in 2015. Operating Profit of $53.2 million in 2015 was down from $72.1 million in the prior year and Operating Profit margin decreased 220 basis points to 6.6% in 2015 from 8.8% in 2014. Operating Profit during 2015 was unfavorably impacted by $14.9 million, or 180 basis points as a percentage of Net Sales, for the non-cash Impairment of Long-Lived Assets and the third and fourth quarter restructuring charges. Operating Profit was also unfavorably impacted by higher R&D Expense of $3.0 million as compared to 2014. Due to the strength of the U.S. dollar in 2015, foreign currency exchange reduced Operating Profit by approximately $13.0 million. Net Earnings for 2015 were unfavorably impacted by the $11.2 million pre-tax, or $0.58 per diluted share after-tax, non-cash Impairment of Long-Lived Assets as a result of the classification of our Green Machines assets as held for sale in the third quarter of 2015. There were also two restructuring charges included in the 2015 S&A Expense of $3.7 million pre-tax, or $0.17 per diluted share after-tax, to reduce our infrastructure costs.

Tennant continues to invest in innovative product development with 4.3% of 2016 Net Sales spent on R&D. During 2016, we continued to invest in developing innovative new products for our traditional core business, as well as advancing a suite of sustainable cleaning technologies. New products are a key driver of sales growth. There were 10 new products and product variants launched in 2016 including three models of emerging market floor machines, two models of the M17 battery-powered sweeper-scrubber, three large next-generation cleaning machines: the M20 and M30 integrated sweeper-scrubbers, and the T20 heavy-duty industrial rider scrubber, and two models of the commercial dryer/air mover.

We ended 2016 with a Debt-to-Capital ratio of 11.5%, $58.0 million in Cash and Cash Equivalents compared to $51.3 million at the end of 2015, and Shareholders’ Equity of $278.5 million. During 2016, we generated operating cash flows of $57.9 million, paid a total of $14.3 million in cash dividends and repurchased $12.8 million of common stock. Total debt increased to $36.2 million as of December 31, 2016, compared to $24.7 million at the end of 2015, due primarily to the 2016 acquisitions.

10

Historical Results

The following table compares the historical results of operations for the years ended December 31, 2016, 2015 and 2014 in dollars and as a percentage of Net Sales (in thousands, except per share amounts and percentages):

2016 | % | 2015 | % | 2014 | % | |||||||||||||||

Net Sales | $ | 808,572 | 100.0 | $ | 811,799 | 100.0 | $ | 821,983 | 100.0 | |||||||||||

Cost of Sales | 456,977 | 56.5 | 462,739 | 57.0 | 469,556 | 57.1 | ||||||||||||||

Gross Profit | 351,595 | 43.5 | 349,060 | 43.0 | 352,427 | 42.9 | ||||||||||||||

Operating Expense: | ||||||||||||||||||||

Research and Development Expense | 34,738 | 4.3 | 32,415 | 4.0 | 29,432 | 3.6 | ||||||||||||||

Selling and Administrative Expense | 248,210 | 30.7 | 252,270 | 31.1 | 250,898 | 30.5 | ||||||||||||||

Impairment of Long-Lived Assets | — | — | 11,199 | 1.4 | — | — | ||||||||||||||

Loss on Sale of Business | 149 | — | — | — | — | — | ||||||||||||||

Total Operating Expense | 283,097 | 35.0 | 295,884 | 36.4 | 280,330 | 34.1 | ||||||||||||||

Profit from Operations | 68,498 | 8.5 | 53,176 | 6.6 | 72,097 | 8.8 | ||||||||||||||

Other Income (Expense): | ||||||||||||||||||||

Interest Income | 330 | — | 172 | — | 302 | — | ||||||||||||||

Interest Expense | (1,279 | ) | (0.2 | ) | (1,313 | ) | (0.2 | ) | (1,722 | ) | (0.2 | ) | ||||||||

Net Foreign Currency Transaction Losses | (392 | ) | — | (954 | ) | (0.1 | ) | (690 | ) | (0.1 | ) | |||||||||

Other Expense, Net | (666 | ) | (0.1 | ) | (657 | ) | (0.1 | ) | (449 | ) | (0.1 | ) | ||||||||

Total Other Expense, Net | (2,007 | ) | (0.2 | ) | (2,752 | ) | (0.3 | ) | (2,559 | ) | (0.3 | ) | ||||||||

Profit Before Income Taxes | 66,491 | 8.2 | 50,424 | 6.2 | 69,538 | 8.5 | ||||||||||||||

Income Tax Expense | 19,877 | 2.5 | 18,336 | 2.3 | 18,887 | 2.3 | ||||||||||||||

Net Earnings | $ | 46,614 | 5.8 | $ | 32,088 | 4.0 | $ | 50,651 | 6.2 | |||||||||||

Net Earnings per Diluted Share | $ | 2.59 | $ | 1.74 | $ | 2.70 | ||||||||||||||

Consolidated Financial Results

Net Earnings for 2016 were $46.6 million, or $2.59 per diluted share, compared to $32.1 million, or $1.74 per diluted share, for 2015. Net Earnings were impacted by:

• | A decrease in Net Sales of 0.4% primarily due to an unfavorable impact from foreign currency exchange of approximately 1.0%, an unfavorable net impact of 0.5% resulting from the sale of our Green Machines outdoor city cleaning line, partially offset by the acquisition of Florock, and lower sales of commercial equipment, particularly within the APAC region. These impacts were more than offset by strong sales of industrial equipment and sales of new products, particularly in the Americas region. 2016 organic sales growth, which excludes the impact of foreign currency exchange and acquisitions and divestitures, was up approximately 1.1% from 2015 with growth in the Americas and Europe, Middle East and Africa ("EMEA") geographical regions. |

• | A 50 basis point increase in Gross Profit margin due to a more favorable product mix (with relatively higher sales of industrial equipment and lower sales of commercial equipment). This was somewhat offset by manufacturing productivity challenges in North America. |

• | A decrease in S&A Expense as a percentage of Net Sales of 40 basis points compared to 2015 which included the third and fourth quarter restructuring charges we recorded in 2015 of $3.7 million and there were no restructuring charges recorded in 2016. Further details regarding the 2015 restructuring actions are discussed in Note 2 to the Consolidated Financial Statements. In addition, there was a net favorable impact to S&A Expense in 2016 as a result of disciplined spending control more than offsetting investments in key growth initiatives. |

• | A pre-tax non-cash impact of $11.2 million in 2015 due to the Impairment of Long-Lived Assets as a result of the classification of our Green Machines assets as held for sale that did not repeat in 2016. |

• | A favorable impact of $0.6 million with Net Foreign Currency Transaction Losses of $0.4 million in 2016 as compared to $1.0 million in 2015. |

Net Earnings for 2015 were $32.1 million, or $1.74 per diluted share, compared to $50.7 million, or $2.70 per diluted share, for 2014. Net Earnings were impacted by:

• | A decrease in Net Sales of 1.2% primarily due to an unfavorable impact from foreign currency exchange of approximately 5.5%, lower sales of outdoor equipment and sales declines to our Master Distributor for Russia. These impacts were partially offset by robust sales to strategic accounts in North America and global sales of new products, such as the T12 and T17 rider scrubbers and the T300 walk behind scrubber, and also selling list price increases. |

• | A 10 basis point increase in Gross Profit margin due to improved operating efficiencies in both the direct service organization and manufacturing operations, somewhat offset by foreign currency headwinds that unfavorably impacted gross margin by approximately 80 basis points. |

• | An increase in S&A Expense as a percentage of Net Sales of 60 basis points primarily due to our 2015 third and fourth quarter restructuring charges of $3.7 million, described in Note 2 to the Consolidated Financial Statements. This was somewhat offset by continued cost controls and improved operating efficiencies that favorably impacted S&A Expense. |

• | An unfavorable impact of 130 basis points, as a percentage of Net Sales, net of tax, for the non-cash Impairment of Long-Lived Assets. |

• | An unfavorable direct foreign currency exchange impact to Net Earnings of 110 basis points, as a percentage of Net Sales. |

Profit Before Income Taxes for 2016 was $66.5 million compared to $50.4 million for 2015 and $69.5 million in 2014.

The breakdown of Profit Before Income Taxes between U.S. and foreign operations for each year ended December 31 were as follows:

2016 | % | 2015 | % | 2014 | % | ||||||||

U.S. operations | $ | 54,018 | 81.2 | $ | 51,189 | 101.5 | $ | 52,315 | 75.2 | ||||

Foreign operations | 12,473 | 18.8 | (765 | ) | (1.5 | ) | 17,223 | 24.8 | |||||

Total | $ | 66,491 | 100.0 | $ | 50,424 | 100.0 | $ | 69,538 | 100.0 | ||||

11

Profit Before Income Taxes from foreign operations increased by $13.2 million in 2016 compared to 2015. The increase resulted primarily from the $11.2 million non-cash Impairment of Long-Lived Assets included in 2015 as a result of our decision to hold the assets and liabilities of our Green Machines outdoor city cleaning line for sale that did not repeat in 2016. We further describe this decision in Note 6 to the Consolidated Financial Statements. This impairment affected the results of operations in our EMEA region. In addition, 2015 Profit Before Income Taxes in our EMEA and APAC subsidiaries included an additional expense of $1.9 million and $0.7 million, respectively, as a result of two worldwide restructuring actions, which are more fully described in Note 2 to the Consolidated Financial Statements. Profit Before Income Taxes in our Latin America subsidiaries increased approximately $0.6 million in 2016 primarily due to sales increases. Profit Before Income Taxes in our APAC subsidiaries decreased by $1.3 million primarily due to lower sales resulting from economic slowdowns in the region and fewer large deals.

Profit Before Income Taxes from foreign operations decreased by $18.0 million in 2015 compared to 2014. The decrease was partially due to the $11.2 million non-cash Impairment of Long-Lived Assets recorded in 2015 as a result of our decision to hold the assets and liabilities of our Green Machines outdoor city cleaning line for sale. We further describe this decision in Note 6 to the Consolidated Financial Statements. This impairment affects the results of operations in our EMEA region. In addition, Profit Before Income Taxes in our EMEA subsidiaries decreased by an additional $1.9 million as a result of two worldwide restructuring actions, which are more fully described in Note 3 to the Consolidated Financial Statements. These restructuring actions also unfavorably impacted Profit Before Income Taxes in our APAC subsidiaries by an additional $0.7 million. Furthermore, Profit Before Income Taxes in our EMEA subsidiaries decreased by an additional $2.9 million in 2015 compared to 2014 primarily due to a 15.6% decrease in Net Sales as a result of foreign exchange devaluations and the difficult economic conditions in the European region. Profit Before Income Taxes in our Latin America subsidiaries decreased by approximately $2.8 million in 2015 primarily due to a 26% decrease in net sales due to the devaluation of the Brazilian real and difficult economic conditions in the Latin American countries. Profit Before Income Taxes in our APAC subsidiaries increased by $1.3 million primarily due to lower intercompany interest expense as a result of new intercompany financing agreements and lower intercompany allocations as a result of a legal entity reorganization in 2014.

Other Comprehensive Loss Changes

Foreign Currency Translation Adjustments – For the year ended December 31, 2016, we recorded a pre-tax foreign currency translation gain of $0.1 million. For the years ended December 31, 2015 and 2014, we recorded pre-tax foreign currency translation losses of $12.5 million and $10.1 million, respectively, in Other Comprehensive Loss. These adjustments resulted from translating the financial statements of our non-U.S. dollar functional currency subsidiaries into our reporting currency, which is the U.S. dollar, as well as other adjustments permitted by ASC 830 – Foreign Currency Matters.

During 2016, we recorded translation gains of $3.4 million relating to the Brazilian real, and translation losses of $1.3 million for the Euro, $1.0 million for the Chines renminbi, $0.9 million for the British pound and $0.1 million for various other currencies. These adjustments were caused by the appreciation of the U.S. dollar against these currencies of between 3% and 17%, and the strengthening of the Brazilian real of 22% in 2016.

During 2015, we recorded translation losses of $6.5 million relating to the Brazilian real, $5.3 million for the Euro, $0.6 million for the Chinese renminbi and $0.1 million for various other currencies. These adjustments were caused by the appreciation of the U.S. dollar against these currencies of between 5% and 32% in 2015.

During 2014, we recorded translation losses of $7.0 million relating to the Euro, $1.7 million for the Brazilian real, $1.1 million for the British pound and $0.3 million for various other currencies. These adjustments were caused by the appreciation of the U.S. dollar against these currencies of between 5% and 15% in 2014.

Pension and Retiree Medical Benefits – For the years ended December 31, 2016 and 2015, we recorded pre-tax pension and postretirement liability adjustments consisting of losses of $2.2 million and gains of $4.1 million, respectively, in other comprehensive loss as further disclosed in Note 13 to the Company's Consolidated Financial Statements. For the year ended December 31, 2014, we recorded a loss of $5.4 million in other comprehensive loss for these items.

The summarized changes in Accumulated Other Comprehensive Loss for the three years ended December 31 were as follows:

Pension and Postretirement Medical Benefits | |||||||||

2016 | 2015 | 2014 | |||||||

Net actuarial loss (gain) | $ | 2,357 | $ | (2,940 | ) | $ | 5,931 | ||

Amortization of prior service cost | (41 | ) | (67 | ) | (37 | ) | |||

Amortization of net actuarial loss | (68 | ) | (1,114 | ) | (512 | ) | |||

Total recognized in other comprehensive loss (income) | $ | 2,248 | $ | (4,121 | ) | $ | 5,382 | ||

The $2.2 million loss in 2016 was primarily due to a $2.4 million net actuarial loss relating to an increase of $3.2 million in the projected benefit obligation resulting from a 16 basis point decrease in the U.S. pension discount rate, a 95 basis point decrease in the non-U.S. discount rate and a 12 basis point decrease in the postretirement discount rate. There was an approximate $0.6 million decrease in the pension benefit obligation in 2016 relating to demographic experience and other changes, as well as a $0.2 million decrease due to a higher than expected actual return on assets. The net actuarial loss was partially offset by a $0.1 million credit relating to amortization of accumulated actuarial losses and prior service costs.

The $4.1 million gain in 2015 was primarily due to a $2.9 million net actuarial gain relating to a decrease of $2.4 million in the projected benefit obligation resulting from a 32 basis point increase in the U.S. Pension discount rate, a 21 basis point increase in the non-U.S. discount rate and a 31 basis point increase in the postretirement discount rate. There was an approximate $3.3 million decrease in the pension benefit obligation in 2015 relating to demographic experience and other changes, as well as a $3.0 million increase due to a lower than expected actual return of assets. The net actuarial gain was supplemented by a $1.2 million credit relating to amortization of accumulated losses and prior service costs.

The $5.4 million loss in 2014 was primarily due to a $5.9 million net actuarial loss relating to an increase of $2.1 million in the projected benefit obligation from adopting a new mortality table in 2014, as well as an increase of $6.6 million in the projected benefit obligation resulting from an 87 basis point decease in the U.S. pension discount rate, a 95 basis point decrease in the non-U.S. discount rate and a 71 basis point decrease in the postretirement discount rate. There was an approximate $0.8 million decrease in the pension benefit obligation in 2014 relating to demographic experience and other changes, as well as a $2.0 million decrease due to higher than expected actual return on assets. The net actuarial loss was partially offset by a $0.5 million credit relating to amortization of accumulated actuarial losses and prior service costs.

Net Sales

In 2016, consolidated Net Sales were $808.6 million, a decrease of 0.4% as compared to 2015. Consolidated Net Sales were $811.8 million in 2015, a decrease of 1.2% as compared to 2014.

12

The components of the consolidated Net Sales change for 2016 as compared to 2015, and 2015 as compared to 2014, were as follows:

Growth Elements | 2016 v. 2015 | 2015 v. 2014 | |

Organic Growth: | |||

Volume | 1.1% | 3.3% | |

Price | —% | 1.0% | |

Organic Growth | 1.1% | 4.3% | |

Foreign Currency | (1.0%) | (5.5%) | |

Acquisitions & Divestiture | (0.5%) | —% | |

Total | (0.4%) | (1.2%) | |

The 0.4% decrease in consolidated Net Sales for 2016 as compared to 2015 was primarily due to the following:

• | An unfavorable impact from foreign currency exchange of approximately 1.0%. |

• | An unfavorable net impact of 0.5% resulting from the sale of our Green Machines outdoor city cleaning line, partially offset by the acquisition of the Florock brand. |

• | An organic sales increase of approximately 1.1% which excludes the effects of foreign currency exchange and acquisitions and divestitures, due to an approximate 1.1% volume increase. The volume increase was primarily due to strong sales of industrial equipment and sales of new products, particularly in the Americas region, being somewhat offset by lower sales of commercial equipment, particularly within the APAC region. Sales of new products introduced within the past three years totaled 37% of equipment revenue in 2016. This compares to 26% of equipment revenue in 2015 from sales of new products introduced within the past three years. There was essentially no price increase in 2016 due to no significant new selling list price increases since prior year selling list price increases with an effective date of February 1, 2015. |

The 1.2% decrease in consolidated Net Sales for 2015 as compared to 2014 was primarily due to an unfavorable impact from foreign currency exchange of approximately 5.5%, lower sales of outdoor equipment and sales declines to our Master Distributor in Russia. These impacts were partially offset by robust sales to strategic accounts in North America and global sales of new products, such as the T12 and T17 rider scrubbers and the T300 walk behind scrubber. Sales of new products introduced within the past three years totaled 26% of equipment revenue in 2015. The 1 percent price increase was the result of selling list price increases, typically in the range of 2 percent to 4 percent in most geographies, with an effective date of February 1, 2015.

The following table sets forth annual Net Sales by geographic area and the related percentage change from the prior year (in thousands, except percentages):

2016 | % | 2015 | % | 2014 | |||||||||||||

Americas | $ | 607,026 | 2.6 | $ | 591,405 | 3.9 | $ | 569,004 | |||||||||

Europe, Middle East and Africa | 129,046 | (7.7 | ) | 139,834 | (15.6 | ) | 165,686 | ||||||||||

Asia Pacific | 72,500 | (10.0 | ) | 80,560 | (7.7 | ) | 87,293 | ||||||||||

Total | $ | 808,572 | (0.4 | ) | $ | 811,799 | (1.2 | ) | $ | 821,983 | |||||||

Americas – In 2016, Americas Net Sales increased 2.6% to $607.0 million as compared with $591.4 million in 2015. The primary drivers of the increase in Net Sales were strong sales of industrial equipment, sales of new products and robust sales in Latin America. The direct impact of the Florock acquisition favorably impacted Net Sales by approximately 0.7%. An unfavorable direct impact of foreign currency translation exchange effects within the Americas impacted Net Sales by approximately 0.5% in 2016. As a result, organic sales increased approximately 2.4% in 2016 within the Americas.

In 2015, Americas Net Sales increased 3.9% to $591.4 million as compared with $569.0 million in 2014. The primary driver of the increase in Net Sales was attributable to robust sales to strategic accounts in North America and sales of newly introduced products, including the T12 and T17 rider scrubbers and the T300 walk behind scrubber. The direct impact of foreign currency translation exchange effects within the Americas unfavorably impacted Net Sales by approximately 2.5%. As a result, organic sales increased approximately 6.4% in 2015.

Europe, Middle East and Africa – EMEA Net Sales in 2016 decreased 7.7% to $129.0 million as compared to 2015 Net Sales of $139.8 million. In 2016, organic sales growth was achieved in all regions except the UK and the Central Eastern Europe, Middle East and Africa markets primarily due to Brexit and challenging economic conditions, respectively. In 2016, there was an unfavorable impact on Net Sales of approximately 5.9% as a result of the sale of our Green Machines outdoor city cleaning line in January 2016. In addition, the direct impact of foreign currency exchange effects within EMEA unfavorably impacted Net Sales by approximately 2.0% in 2016. As a result, organic sales increased approximately 0.2% in 2016 within EMEA.

EMEA Net Sales in 2015 decreased 15.6% to $139.8 million as compared to 2014 Net Sales of $165.7 million. Organic sales decreased approximately 2.1% in 2015, which reflected a fragile European economy resulting in lower sales of outdoor equipment and sales declines to our Master Distributor for Russia, somewhat offset by higher sales to strategic accounts and through distribution in Western Europe. Unfavorable direct foreign currency exchange effects decreased EMEA Net Sales by approximately 13.5% in 2015.

Asia Pacific – APAC Net Sales in 2016 decreased 10.0% to $72.5 million as compared to 2015 Net Sales of $80.6 million. Organic sales decreased approximately 10.0% in 2016 with lower sales of commercial and industrial equipment. Organic sales declines in all of our Asian markets were primarily due to economic slowdowns in the region and fewer large deals. Direct foreign currency translation exchange effects had essentially no impact on Net Sales in 2016 within APAC.

APAC Net Sales in 2015 decreased 7.7% to $80.6 million as compared to 2014 Net Sales of $87.3 million. Organic sales increased approximately 1.3% in 2015 due primarily to organic sales growth in China and Australia, more than offsetting the slower economy in other Asian countries. Unfavorable direct foreign currency exchange effects decreased Net Sales by approximately 9.0% in 2015.

Gross Profit

Gross Profit margin was 43.5% in 2016, an increase of 50 basis points as compared to 2015. Gross Profit margin in 2016 was favorably impacted by product mix (with relatively higher sales of industrial equipment and lower sales of commercial equipment), partially offset by manufacturing productivity challenges in North America.

Gross Profit margin was 43.0% in 2015, an increase of 10 basis points as compared to 2014. Gross Profit margin in 2015 was favorably impacted by operating efficiencies in both the direct service organization and manufacturing operations. This was somewhat offset by foreign currency headwinds that unfavorably impacted gross margin by approximately 80 basis points.

13

Operating Expenses

Research and Development Expense – Research and Development ("R&D") Expense increased $2.3 million, or 7.2%, in 2016 as compared to 2015. As a percentage of Net Sales, 2016 R&D Expense increased 30 basis points compared to the prior year. We continue to invest in developing innovative new products for our traditional core business, as well as advancing a suite of sustainable cleaning technologies. New products are a key driver of sales growth. There were 10 new products and product variants launched in 2016 including three models of emerging market floor machines, two models of the M17 battery-powered sweeper-scrubber, three large next-generation cleaning machines: the M20 and M30 integrated sweeper-scrubbers, and the T20 heavy-duty industrial rider scrubber, and two models of the commercial dryer/air mover.

R&D Expense increased $3.0 million, or 10.1%, in 2015 as compared to 2014. As a percentage of Net Sales, 2015 R&D Expense increased 40 basis points to 4.0% in 2015 from 3.6% in the prior year primarily due to an increase in the number of R&D employees and the timing of new product development projects. We continued to invest in developing innovative new products and technologies.

Selling and Administrative Expense – S&A Expense decreased by $4.1 million, or 1.6%, in 2016 compared to 2015. As a percentage of Net Sales, 2016 S&A Expense decreased 40 basis points to 30.7% from 31.1% in 2015 due to two restructuring charges totaling $3.7 million we recorded in 2015 to reduce our infrastructure costs that did not repeat in 2016. In addition, there was a net favorable impact to S&A Expense in 2016 as a result of disciplined spending control more than offsetting investments in key growth initiatives.

S&A Expense increased by $1.4 million, or 0.5%, in 2015 compared to 2014. As a percentage of Net Sales, 2015 S&A Expense increased 60 basis points to 31.1% from 30.5% in 2014 due to continued investments in direct sales and marketing to build organic sales. There were also two restructuring charges totaling $3.7 million, or 50 basis points as a percentage of Net Sales, to reduce our infrastructure costs. These were somewhat offset by strong cost controls and improved operating efficiencies that favorably impacted S&A Expense.

Other Income (Expense)

Interest Income – Interest Income was $0.3 million in 2016, an increase of $0.1 million from 2015. The increase between 2016 and 2015 was due to higher levels of cash deposits.

Interest Income was $0.2 million in 2015, a decrease of $0.1 million from 2014. The decrease between 2015 and 2014 was due to lower levels of cash deposits.

Interest Expense – Interest Expense was $1.3 million in 2016 and 2015.

Interest Expense was $1.3 million in 2015 as compared to $1.7 million in 2014. This decrease was primarily due to a lower level of debt.

Net Foreign Currency Transaction Losses – Net Foreign Currency Transaction Losses were $0.4 million in 2016 as compared to $1.0 million in 2015. The favorable change in the impact from foreign currency transactions in 2016 was due to fluctuations in foreign currency rates and settlements of transactional hedging activity in the normal course of business.

Net Foreign Currency Transaction Losses were $1.0 million in 2015 as compared to $0.7 million in 2014. The unfavorable change in the impact from foreign currency transactions in 2015 was due to fluctuations in foreign currency rates and settlements of transactional hedging activity in the normal course of business.

Income Taxes

The overall effective income tax rate was 29.9%, 36.4% and 27.2% in 2016, 2015 and 2014, respectively.

The tax expense for 2015 included a $0.4 million tax benefit associated with an $11.2 million Impairment of Long-Lived Assets and a $0.6 million tax benefit associated with restructuring charges of $3.7 million. We are not able to recognize a tax benefit on the impairment charge until the assets are sold due to a tax valuation allowance. Excluding these items, the 2015 overall effective tax rate would have been 29.6%.

The increase in the overall effective tax rate to 29.9% in 2016 as compared to 29.6% in the prior year, excluding the effect of the 2015 one-time charges, was primarily related to the mix in expected full year taxable earnings by country.

There were no special items that affected the tax rate in 2014.

We do not have any plans to repatriate the undistributed earnings of non-U.S. subsidiaries. Any repatriation from foreign subsidiaries that would result in incremental U.S. taxation is not being considered. It is management's belief that reinvesting these earnings outside the U.S. is the most efficient use of capital.

Liquidity and Capital Resources

Liquidity – Cash and Cash Equivalents totaled $58.0 million at December 31, 2016, as compared to $51.3 million as of December 31, 2015. Cash and Cash Equivalents held by our foreign subsidiaries totaled $19.0 million as of December 31, 2016, as compared to $14.9 million as of December 31, 2015. Wherever possible, cash management is centralized and intercompany financing is used to provide working capital to subsidiaries as needed. Our current ratio was 2.2 as of December 31, 2016 and 2015, and our working capital was $165.1 million and $160.4 million, respectively.

Our Debt-to-Capital ratio was 11.5% as of December 31, 2016, compared with 8.9% as of December 31, 2015. Our capital structure was comprised of $36.2 million of Debt and $278.5 million of Shareholders’ Equity as of December 31, 2016.

Cash Flow Summary – Cash provided by (used in) our operating, investing and financing activities is summarized as follows (in thousands):

2016 | 2015 | 2014 | |||||||||

Operating Activities | $ | 57,878 | $ | 45,232 | $ | 59,362 | |||||

Investing Activities: | |||||||||||

Purchases of Property, Plant and Equipment, Net of Disposals | (25,911 | ) | (24,444 | ) | (19,292 | ) | |||||

Acquisitions of Businesses, Net of Cash Acquired | (12,933 | ) | — | — | |||||||

Issuance of Long-Term Note Receivable | (2,000 | ) | — | — | |||||||

Proceeds from Sale of Business | 285 | 1,185 | 1,416 | ||||||||

Decrease (Increase) in Restricted Cash | 116 | (322 | ) | 6 | |||||||

Financing Activities | (9,558 | ) | (61,405 | ) | (28,038 | ) | |||||

Effect of Exchange Rate Changes on Cash and Cash Equivalents | (1,144 | ) | (1,908 | ) | (1,476 | ) | |||||

Net Increase (Decrease) in Cash and Cash Equivalents | $ | 6,733 | $ | (41,662 | ) | $ | 11,978 | ||||

14