Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - RITCHIE BROS AUCTIONEERS INC | v460013_ex99-1.htm |

| EX-32.2 - EXHIBIT 32.2 - RITCHIE BROS AUCTIONEERS INC | v460013_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - RITCHIE BROS AUCTIONEERS INC | v460013_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - RITCHIE BROS AUCTIONEERS INC | v460013_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - RITCHIE BROS AUCTIONEERS INC | v460013_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - RITCHIE BROS AUCTIONEERS INC | v460013_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - RITCHIE BROS AUCTIONEERS INC | v460013_ex21-1.htm |

| EX-10.50 - EXHIBIT 10.50 - RITCHIE BROS AUCTIONEERS INC | v460013_ex10-50.htm |

| EX-10.45 - EXHIBIT 10.45 - RITCHIE BROS AUCTIONEERS INC | v460013_ex10-45.htm |

| EX-10.20 - EXHIBIT 10.20 - RITCHIE BROS AUCTIONEERS INC | v460013_ex10-20.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

Commission file number: 001-13425

Ritchie Bros. Auctioneers Incorporated

(Exact Name of Registrant as Specified in its Charter)

| Canada | N/A | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 9500 Glenlyon Parkway | ||

| Burnaby, British Columbia, Canada V5J 0C6 | (778) 331-5500 | |

| (Address of Principal Executive Offices) | (Registrant’s Telephone Number, including Area Code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange on Which Registered | |

| Common Shares | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference on Part III of this Form 10-K or any amendment to this Form10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, accelerated filer, and smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

At June 30, 2016 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s common shares held by non-affiliates of the registrant (assuming for these purposes, but without conceding, that all executive officers and Directors are "affiliates" of the registrant) was approximately $3,575,313,844. The number of common shares of the registrant outstanding as of February 17, 2017, was 106,822,475.

Documents Incorporated by Reference

Certain portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission (“SEC”) pursuant to Regulation 14A not later than 120 days after the registrant's fiscal year ended December 31, 2016, in connection with the registrant’s 2017 Annual and Special Meeting of Shareholders, are incorporated herein by reference into Part III of this Annual Report on Form 10-K.

RITCHIE BROS. AUCTIONEERS INCORPORATED

FORM 10-K

For the year ended December 31, 2016

INDEX

Cautionary Note Regarding Forward-Looking Statements

The information discussed in this Annual Report on Form 10-K of Ritchie Bros. Auctioneers Incorporated (“Ritchie Bros.”, the “Company”, “we” or “us”) includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) and Canadian securities laws. These statements are based on our current expectations and estimates about our business and markets, and include, among others, statements relating to:

| · | our future strategy, objectives, targets, projections, performance, and key enablers; |

| · | our ability to drive shareholder value; |

| · | market opportunities; |

| · | our ability to attract bidders and sellers from different markets to our auctions; |

| · | our internet initiatives and the level of participation in our auctions by internet bidders, and the success of EquipmentOne and our other online marketplaces; |

| · | our ability to grow our core auction business, including our ability to increase our market share among traditional customer groups, including those in the used equipment market, and do more business with new customer groups in new sectors; |

| · | the impact of our initiatives, services, investments, and acquisitions on us and our customers; |

| · | the acquisition or disposition of properties; |

| · | our ability to integrate our acquisitions; |

| · | potential future mergers and acquisitions, including the planned merger of Ritchie Bros. and IronPlanet Holdings, Inc.; |

| · | ability for the planned merger of Ritchie Bros. and IronPlanet Holdings, Inc. to add multi-channel solutions for equipment sellers, add scale and sales volume to our core auction business, bolster the scope and offering of our business and increase our earnings and growth; |

| · | potential future strategic alliances, including the planned alliance between Ritchie Bros., IronPlanet, Inc., and Caterpillar Inc. |

| · | ability for the planned alliance among Ritchie Bros., IronPlanet, Inc., and Caterpillar Inc. to significantly strengthen our relationship with Caterpillar dealers; |

| · | our ability to add new business and information solutions, including, among others, our ability to maximize and integrate technology to enhance our existing services and support additional value-added service offerings; |

| · | the supply trend of equipment in the market and the anticipated price environment for late model equipment, as well as the resulting effect on our business and Gross Auction Proceeds (“GAP”) (as defined under “Part I, Item 1: Business” of this Annual Report on Form 10-K); |

| · | the growth potential of Ritchie Bros. Financial Services, as well as expectations towards and significance of its service offerings and geographical expansion in the near future; |

| · | fluctuations in our quarterly revenues and operating performance resulting from the seasonality of our business; |

| · | our ability to implement new performance measurement metrics to gauge our effectiveness and progress; |

| · | our compliance with all laws, rules regulations and requirements that affect our business; |

| · | the relative percentage of GAP represented by straight commission or underwritten (guarantee and inventory) contracts, and its impact on revenues and profitability; |

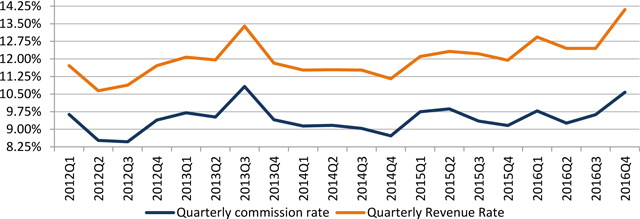

| · | our Revenue Rates (as described under “Part II, Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K), the sustainability of those rates, the impact of our commission rate and fee changes, and the seasonality of GAP and revenues; |

| · | our future capital expenditures and returns on those expenditures; |

| Ritchie Bros. | 1 |

| · | the proportion of our revenues, operating expenses, and operating income denominated in currencies other than the United States (“U.S.”) dollar or the effect of any currency exchange and interest rate fluctuations on our results of operations; |

| · | financing available to us, our ability to refinance borrowings, and the sufficiency of our working capital to meet our financial needs; and |

| · | our ability to satisfy our present operating requirements and fund future growth through existing working capital and credit facilities. |

Forward-looking statements are typically identified by such words as “aim”, “anticipate”, “believe”, “could”, “continue”, “estimate”, “expect”, “intend”, “may”, “ongoing”, “plan”, “potential”, “predict”, “will”, “should”, “would”, “could”, “likely”, “generally”, “future”, “period to period”, “long-term”, or the negative of these terms, and similar expressions intended to identify forward-looking statements. Our forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict.

While we have not described all potential risks related to our business and owning our common stock, the important factors listed under “Part I, Item 1A: Risk Factors” of this Annual Report on Form 10-K are among those that we consider may affect our performance materially or could cause our actual financial and operational results to differ significantly from our expectations. Except as required by applicable securities law and regulations of relevant securities exchanges, we do not intend to update publicly any forward-looking statements, even if our expectations have been affected by new information, future events or other developments. You should consider our forward-looking statements in light of the factors listed or referenced under “Risk Factors” herein and other relevant factors.

| Ritchie Bros. | 2 |

| ITEM 1: | BUSINESS |

Company Overview

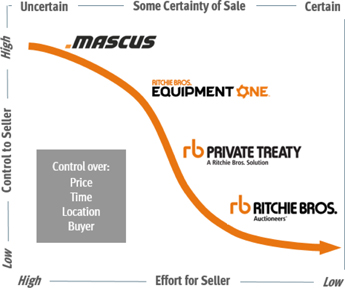

We are one of the world’s largest industrial auctioneers and used equipment distributors, selling more than $4.3 billion of used equipment and other assets during 2016. Our expertise, global reach, market insight and trusted brand provide us with a unique position in the used equipment market. We primarily sell used equipment for our customers through live unreserved auctions at 45 auction sites worldwide, which are simulcast online to reach a global bidding audience. During 2013, we added to our sales channels by launching EquipmentOne, an online-only used equipment marketplace, in order to reach a broader customer base. These two complementary used equipment brand solutions provide different value propositions to equipment owners and allow us to meet the needs and preferences of a wide spectrum of equipment sellers. In the past two years, we have also added a private brokerage service (Ritchie Bros. Private Treaty) and an online listing service (Mascus).

Through our unreserved auctions, online marketplaces, and private brokerage services, we sell a broad range of used and unused equipment, including trucks and other assets. Construction and heavy machinery comprise the majority of the equipment sold through our multiple brand solutions. Customers selling equipment through our sales channels include end users (such as construction companies), equipment dealers, and other equipment owners (such as rental companies). Our customers participate in a variety of sectors, including heavy construction, transportation, agriculture, energy, and mining.

Our Gross Auction Proceeds1 (“GAP”) represents the total proceeds from all items sold at our auctions and online marketplaces. Our GAP was $4.3 billion for the year ended December 31, 2016, representing a 2% increase from 2015. Approximately half of what we sold during 2016, transacted online; through either online simulcast auction participation, or through EquipmentOne. In 2016, of the $4.3 billion of all items sold by us, $2.1 billion were sold to online buyers through these online solutions.

We operate worldwide with locations in more than 15 countries, including the United States, Canada, Australia, the United Arab Emirates, and the Netherlands, and employ more than 1,700 full time employees worldwide.

Our corporate information

Our corporate headquarters are located near Vancouver, Canada: at 9500 Glenlyon Parkway, Burnaby, British Columbia, Canada V5J 0C6, and our telephone number is (778) 331-5500. We maintain a customer website at www.rbauction.com and an investor website at investor.ritchiebros.com. None of the information on our websites is incorporated into this Annual Report on Form 10-K by this or any other reference.

Ritchie Bros. Auctioneers Incorporated was amalgamated on December 12, 1997 under, and is governed by, the Canada Business Corporation Act. Our articles were amended on May 2, 2000 to permit our directors to set the number of directors on our Board of Directors (our “Board”) by resolution of the Board, subject to the limits set out in our articles, and to permit our directors to appoint one or more additional directors to our Board between shareholder meetings, provided that the total number of directors appointed does not exceed 1⁄3 of the number of directors elected at the previous annual general meeting. Our articles were further amended on April 19, 2004 to subdivide each of our common shares outstanding on May 4, 2004 into two common shares. On April 11, 2008 the shareholders approved a further amendment to our articles to subdivide each of our common shares outstanding on April 24, 2008 into three common shares.

1 GAP is not a measure of financial performance, liquidity, or revenue, and is not presented in our consolidated financial statements.

| Ritchie Bros. | 3 |

Multi-channel sales solutions and complementary services

We offer a variety of sales solutions and complementary services that position us as one of the world’s largest industrial auctioneers and used equipment distributors.

Our multi-channel sales solutions allow sellers to choose the method of sale best for them, based on their specific needs and preferences for control over the sales process, efficiency and surety of sale, ability to select the buyer, and equipment transportation constraints. Our vision is to position appropriate solutions at each point of the seller journey, which is illustrated as follows, and connect them with quality buyers from a global marketplace:

Each of the channels offered through our multi-channel sales solutions reaches a different segment of customers.

Integrated on site/online auctions:

Ritchie Bros. Auctioneers

Our core business, Ritchie Bros. Auctioneers, operates unreserved auctions; meaning that auction items are sold during live on site auctions without a minimum or “reserve” price. Each asset is sold to the highest bidder on auction day, regardless of what their highest bid was. In unreserved auctions, we do not allow consignors or their agents to bid on or buy back or in any way influence the selling price of their own equipment. This type of auction ensures the sale of goods on the day of the auction at the global market price. Our adherence to the unreserved auction process is one of our founding principles and we believe one of our most significant competitive advantages.

GAP, the total value of assets sold through our auction and other sales channels, is driven by four primary influences:

| · | Number of lots consigned: increasing the number of lots sold can bolster GAP. |

| · | Mix of categories of assets sold: The proportion of higher-valued items sold at each auction relative to smaller goods impacts the auction proceeds generated. |

| · | Pricing environment: A strong pricing environment will enhance market values of equipment sold at auctions. |

| · | Mix of equipment age: Newer equipment generally has a higher market value compared to older machinery. |

Our bidders participate in our auctions in person, by proxy, or through real-time online bidding. Annual online participation in our auctions has increased steadily since that option was introduced in 2002. Some online bidders still visit our auction sites prior to the auction, in order to test and inspect the equipment being sold.

| Ritchie Bros. | 4 |

Over 60% of our core auction GAP goes to buyers from outside the region of sale. Our ability to consistently draw significant numbers of local and international bidders from many different markets to our auctions, most of whom are end users rather than resellers, is appealing to sellers of used equipment and trucks and helps us to attract consignments to our auctions. Higher consignment volumes attract more bidders, which in turn attract more consignments, and so on in a self-reinforcing process that has helped us to achieve a history of significant growth and momentum in our business which is reflected in our core auction GAP growth.

Consignment volumes at our auctions are affected by a number of factors, including regular fleet upgrades and reconfigurations, financial pressure, retirements, and inventory reductions, as well as by the timing of the completion of major construction and other projects. We generally cannot influence the decision of an equipment owner whether to sell, but once they have made the decision to sell, our sales team’s opportunity is to demonstrate the Ritchie Bros. Auctioneers value proposition and have the equipment contributed to one of our unreserved auctions.

Revenues from our core auction business are comprised of seller commissions earned, where we act as an agent for consignors of equipment and other assets, as well as administrative fees and fees from value-added services.

Commissions: The majority of our commissions are earned as a pre-negotiated fixed rate of the gross selling price, while other commissions are earned through underwritten transactions:

| o | Straight commission: Consignors contract to sell their equipment through one of our unreserved auctions. We earn a pre-determined percentage of the selling price as commission. |

| o | Underwritten commission: Our underwritten commissions consist of: |

| § | Guaranteed contracts: Consignors are guaranteed a pre-determined amount for their equipment, regardless of the final selling price at the auction. A stepped commission fee is negotiated, accounting for the additional risk we assume. |

| § | Inventory contracts: We may choose to purchase equipment outright, obtaining title of the piece to sell at an upcoming auction. Net revenues from the gain on inventory sales are booked as revenue. |

Administrative fees and value-added services: We also charge equipment buyers an administrative fee for purchases made at our auctions. Further, we provide additional services to assist with the sale and purchase of equipment, including appraisal services, insurance services, refurbishment and logistics services which supplement revenue generation (see “Support businesses”).

Our commission and fee revenues, in thousands of U.S. dollars, over the last three years are as follows:

| Year ended December 31, | 2016 | 2015 | 2014 | |||||||||

| Commissions | $ | 424,128 | $ | 405,308 | $ | 379,340 | ||||||

| Fees | 142,267 | 110,567 | 101,757 | |||||||||

| $ | 566,395 | $ | 515,875 | $ | 481,097 | |||||||

During 2016, Ritchie Bros. acquired Petrowsky Auctioneers and Kramer Auctions, both regional auction companies, to grow our customer reach in both the US Northeast region and the Canadian Agricultural sector. Auctions held by Petrowsky and Kramer are currently branded as such, though simulcast live on Ritchie Bros.’ retail website and considered part of Ritchie Bros. Auctioneers’ business segment.

Online marketplace

EquipmentOne

Ritchie Bros. launched EquipmentOne to cater to a complementary segment of the used equipment transaction market that prefers to retain control over the sales process, while potentially taking on more effort. Through EquipmentOne, equipment sellers are able to list their equipment on the online marketplace, receive and accept offers, and complete and settle their sale. This brand solution also effectively meets the needs of large fleet owners who want to transact when they want, and only if a certain price point is achieved.

| Ritchie Bros. | 5 |

EquipmentOne is a secure online marketplace that equipment sellers can navigate independently, while still leveraging our trusted brand and transaction processing. EquipmentOne facilitates the completion of sales through a settlement process managed by EquipmentOne that protects both the seller and the buyer. In February 2016, we expanded our EquipmentOne offering from the United States into Canada.

Opposite from our auction model, revenue from EquipmentOne is generated from a buyer’s premium and a smaller portion of revenue is generated from equipment, listing and transaction fees from sellers.

Online listing service

Mascus

Acquired by Ritchie Bros. in 2016, Mascus is an online equipment listing service for used heavy machinery and trucks, with a global presence and a leading market position in Europe. Mascus offers subscriptions to equipment dealers, brokers, exporters and equipment manufacturers to list equipment available for sale at a listed price. Through Mascus, we provide online advertising services, business tools and solutions to many of the world’s leading equipment dealerships and equipment manufacturers. Unlike other solutions provided by Ritchie Bros., Mascus does not transact sales (does not generate GAP), and instead earns revenue through listing fees for the equipment it lists on its site.

Brokerage channel for highly specialized assets

Ritchie Bros. Private Treaty

In 2015, Ritchie Bros. launched our private brokerage service, wherein we act as a private sales agent/broker, leveraging our global customer base and extensive heavy industry knowledge to conduct negotiated sales of specialized and high-value equipment items between buyers and sellers. Under this service offering, the seller sets the price and the completion timeline. To earn our commission from rendering private brokerage services, we manage the sales process in accordance with the seller’s terms, including marketing the equipment to a global audience and settling the sale. With over 50 years of experience, Ritchie Bros. has the connections and expertise to identify and target the most qualified buyers from around the world for sellers’ assets.

Support businesses

In addition to the multiple sales channels we offer customers, we also offer several support services to facilitate equipment transactions and auction services:

Ritchie Bros. Financial Services (“RBFS”)

RBFS originates loans for equipment buyers in the United States and Canada, including Ritchie Bros. auctions and other sales formats. This business acts as a loan originator via a brokerage model, matching loan applicants with appropriate financial lending institutions (we do not act as a lender or otherwise utilize our balance sheet for RBFS loans). The RBFS business generates revenue through both brokerage fees (the net present value of the spread between wholesale rates offered to us and the retail rates provided to customers) and administrative fees.

Xcira

In 2015, we purchased a 75% stake in Xcira, a leading online auction simulcast technology provider. Xcira had been a long-time supplier to Ritchie Bros., and the platform is an integral part of our auction services. Xcira also licenses its technology solutions and platforms to other (non-industrial) auction companies, such as Christies and Insurance Auto Auctions. Xcira’s revenue is generated through contracts for services with these and many other auction companies.

Equipment Refurbishment

Through Ritchie Bros.’ network of refurbishment facilities, located at most permanent auction sites, equipment sellers and buyers can choose to have equipment repaired and/or repainted. This work is conducted by third party suppliers contracted by Ritchie Bros., to facilitate better marketability of equipment being sold, and to refurbish used equipment purchased at our auctions. Ritchie Bros. charges a fee to conduct these services.

| Ritchie Bros. | 6 |

Ritchie Bros. Logistical Services (“RBLS”)

Currently only piloted in Europe, RBLS offers end-to-end transportation and customs clearance solutions for equipment sellers and buyers with shipping needs. Ritchie Bros. oversees the transport process, through the use of selected shipping service providers, to ease the transportation and logistical needs of customers during the equipment sales and purchase process.

History and development of our business

Ritchie Bros. was founded in 1958 in Kelowna, British Columbia, Canada. We held our first major industrial auction in 1963, selling over $600,000 worth of construction equipment in Radium, British Columbia. While our early auction sales were held primarily in Western Canada, Ritchie Bros. expanded eastward in Canada through the 1960s.

By 1970, we had established operations in the United States and held our first American sale in Beaverton, Oregon. Throughout the 1970s and 1980s, we held auctions in additional locations across Canada and an increasing number of U.S. states. In 1987, we held our first European auctions in Liverpool, United Kingdom and Rotterdam, The Netherlands. Our first Australian auction was held in 1990, and this was followed by expansion into Asia, with subsequent sales in Japan, the Philippines, Hong Kong, Thailand and Singapore. We held our first Mexican auction in 1995 and our first auction in the Middle East in Dubai, United Arab Emirates, in 1997.

In 1994, we introduced our prototype auction facility, opening new permanent auction sites in Fort Worth, Texas and Olympia, Washington that represented significant improvements over the facilities being used at the time by other industrial equipment auctioneers. We have since constructed similar facilities in various locations in Canada, the United States, Mexico, Europe, Australia, Asia and the Middle East. We have 45 permanent and regional auction sites at the date of this Annual Report on Form 10-K.

In March 1998, we completed an initial public offering of our common shares. Our common shares trade on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange (“TSX”) under the ticker symbol “RBA”.

On May 15, 2012, we purchased AssetNation, an online marketplace and solutions provider for surplus and salvage assets based in the United States. Leveraging AssetNation’s technology and e-commerce expertise in early 2013 we commercially launched our new online marketplace, EquipmentOne.

On November 4, 2015, we acquired a 75% interest in Xcira, a proven leader in simulcast auction technology that provides a seamless customer experience for integrated on site and online auctions. Through this acquisition, we secured Xcira’s bidding technology, which represents a significant and growing portion of all bidding conducted at our auctions.

On February 19, 2016, we acquired 100% of the equity interests in Mascus International Holding B.V. (“Mascus”). Mascus is an Amsterdam-based company that operates a global online listing service to advertise equipment and other assets for sale. Unlike other sales channels offered by Ritchie Bros., Mascus does not currently transact through its website. Sales facilitated through Mascus are conducted directly between the seller and buyer.

On July 12, 2016, Ritchie Bros. acquired the minority interest of Ritchie Bros. Financial Services – providing Ritchie Bros. with full ownership of this growing business. RBFS provides loans to equipment purchasers, as a brokerage business, through several bank relationships. RBFS does not leverage Ritchie Bros. balance sheet for the loans it originates.

On August 2, 2016, Ritchie Bros. acquired Petrowsky Auctioneers – a leading regional industrial auctioneer in the U.S. Northeast. Similar to Ritchie Bros. Auctioneers, Petrowsky Auctioneers offers live on site and simulcast live online auctions.

| Ritchie Bros. | 7 |

On August 29, 2016, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which Ritchie Bros. agreed to acquire a 100% interest in IronPlanet Holdings, Inc. (“IronPlanet”). IronPlanet is a leading online industrial auctioneer and marketplace, with several complementary brands and solutions catering to the needs of equipment owners. The acquisition of IronPlanet (the “Acquisition” or “Merger”) is currently under regulatory review in the United States. We expect that the U.S. Department of Justice (“DoJ”) will complete its review of the transaction by the end of the second quarter of 2017. While the closing of the transaction is subject to the DoJ review and customary closing conditions, assuming approval is provided at that time, we believe the acquisition will likely close shortly thereafter (see “Acquisition of IronPlanet”).

On August 29, 2016, we entered into a Strategic Alliance and Remarketing Agreement (the “Alliance”) with IronPlanet, Inc. (“IronPlanet subsidiary”) and Caterpillar Inc. (“Caterpillar”). The Alliance is subject to, contingent upon, and will not be effective until consummation of the IronPlanet acquisition.

On November 15, 2016, we acquired substantially all of the assets of Kramer Auctions Ltd. And Kramer Auctions — Real Estate Division Inc. (together, ‘‘Kramer’’), a Canadian agricultural auction company with strong customer relationships in central Canada. Operating for more than 65 years, Kramer operates in Saskatchewan, Alberta and Manitoba as a premier agricultural auctioneer, offering both on-the-farm and on site live auctions for customers selling equipment, livestock and real-estate in the agricultural sector.

Acquisition of IronPlanet

On August 29, 2016, Ritchie Bros. entered into an agreement to acquire IronPlanet Holdings, Inc. and its subsidiaries (the ‘‘Acquisition’’ or the “Merger”). IronPlanet is a leading online marketplace for selling and buying used equipment and other assets in the United States and internationally. IronPlanet operates online equipment sales platforms under a number of brands, including: IronPlanet, Cat Auction Services, Kruse Energy, GovPlanet and TruckPlanet.

Over the last several years, Ritchie Bros. has undertaken a meaningful strategic transformation, through both organic and acquisitive growth initiatives, to broaden our service offerings and the value propositions we provide to different segments of the used equipment transaction market. Our stated M&A objectives were:

(1) adding multi-channel solutions for equipment sellers;

(2) adding scale and sales volume to our core auction business; and

(3) securing a ‘‘needle-moving’’ transaction that could significantly bolster the scope and offering of our business.

We believe the IronPlanet Acquisition will accelerate this strategy and meet these objectives. Specifically, this Acquisition represents a ‘‘needle-moving’’ transaction and presents a unique opportunity for us to strengthen our multi-channel platform and equipment disposition solutions. It will also allow us to better serve customers globally by enabling customers with varying preferences to choose from a variety of channels and formats to meet their varying needs and preferences. We believe this Acquisition will provide us with increased earnings and growth through:

| · | the global expansion of IronPlanet’s unique online brand solutions; |

| · | the Cat Auction Services brand combined with the Caterpillar Agreement (see below) |

| · | IronPlanet’s brand offering of multiple formats, including weekly online unreserved auctions, online reserved marketplace formats and buy-it-now formats — which appeal to a different set of sellers and buyers than our core business; |

| · | the ability to appeal to equipment sellers who do not want to move their equipment to an auction site, and the ability to provide additional comfort to online equipment buyers through the IronClad Assurance buyer protection program; |

| · | increased access to sectors Ritchie Bros. has not traditionally targeted, such as government surplus and energy; and, |

| · | our ability to expand our financial services business (RBFS) to a broader customer base. |

| Ritchie Bros. | 8 |

Related to the acquisition of IronPlanet, Ritchie Bros. has entered into an agreement with Caterpillar Inc., contingent on the acquisition closing, to become Caterpillar’s preferred used equipment auction vendor. The Caterpillar Agreement provides that upon consummation of the Acquisition, Caterpillar will designate us as a ‘‘preferred’’ but nonexclusive provider for online and on site auctions and marketplaces (including those of IronPlanet) in the countries where we do business in exchange for preferred rates and access to certain data and information.

The Used Equipment Market Opportunity

Ritchie Bros. is one of the world’s largest industrial auctioneers and used equipment distributors. Our scale is a competitive advantage, as we reach a vast audience of targeted equipment bidders and buyers. As we sell large volumes of used equipment, we attract more interested buyers. This in turn attracts more equipment sellers. This cycle continues to bolster our growth, which is demonstrated by our long history of expansion.

We recently updated our estimate of the annual global used equipment market, through a review of the construction, transportation and agricultural used equipment markets. Based on this review, we believe the global used equipment market is valued at more than $300 billion. The market is highly fragmented and fluid between sales channels; however, we believe our multi-channel sales solutions can meet a broad range of customer preferences and needs. We compete with other sellers of used equipment on the basis of breadth, brand reputation, security, and global reach of our services, as well as in the variety of contracts and methods and channels of selling equipment.

The volume of used equipment transactions is affected by the ongoing production of new equipment and trucks, the demand for equipment, the rate of equipment utilization and the motivations of equipment owners to realign and replace their fleets. Our goal is to capture a greater proportion of the transactions through our multi-channel strategy. Most of our businesses generate revenue based on a percent of the selling price of goods sold through our sales channels. As such, influences on used equipment pricing can affect corporate performance. Factors such as regional or global economic and construction activity, the supply of good quality used equipment, availability of low-cost financing and changes to regional regulations can affect the demand for, and therefore price of, equipment sold through our auctions and our online marketplace.

Competitive Advantages

Our key strengths provide distinct competitive advantages and have enabled us to achieve significant and profitable growth over the long term. Our GAP has grown at a compound annual growth rate of 9.45% over the last 25 years, as illustrated below.

| Ritchie Bros. | 9 |

Global platform

Our business is a leader of equipment disposition services, with global reach, including 45 auction sites in more than 15 countries, including the United States, Canada, Australia, the United Arab Emirates, and the Netherlands. Our global presence ensures we generate global market pricing for our equipment sellers, as we reach international buyers and equipment demand, helping to deliver strong price realization through our sales channels. This global reach provides us and our selling customers with the ability to transcend local market conditions.

In our core auction business, Ritchie Bros. Auctioneers, we believe our network of auction sites has allowed us to achieve economies of scale by holding more frequent and larger auctions at our existing facilities, thereby taking advantage of our considerable operating capacity without incurring significant incremental costs. In addition, many of our auction sites are equipped with state-of-the-art painting and refurbishing facilities which, together with purpose-built auction theatres and equipment display yards, allow us to deliver a uniquely high level of service to our customers. Our secure yards enable our bidders to inspect, test and compare assets available for sale at our auctions, and give them confidence that the assets on which they are bidding exist and will be in the same condition when they pick them up as they were when they purchased them.

An industry leader in a highly fragmented market

We believe there is a global market opportunity in excess of $300 billion per year, including an opportunity in the United States of over $50 billion per year. While our business is a global market leader for the sale of used equipment, Ritchie Bros. currently has only 1.4% of the estimated global used equipment market, based on GAP during 2016. The United States represents a key area for growth with positive industrial tailwinds around infrastructure and construction.

Multi-channel product offering

Our multi-channel sales solutions provide a wide range of brand solutions for used industrial equipment, which appeal to a variety of personal preferences for sellers and buyers. We continue to build on our strong brand equity and loyal customer base by providing many value-added services to equipment sellers and buyers, including financing

and leasing solutions, appraisal services, insurance services, refurbishment and logistics services. We continue to look for even more ways to support the equipment industry and serve the various needs of equipment owners.

| Ritchie Bros. | 10 |

Technological capability

Ritchie Bros. continues to use and develop leading auction and marketplace technology, which has facilitated approximately half of our GAP through online sales during 2016. During the year, we developed and deployed our first mobile bidding app for smartphones and tablets, invested in the development of next-generation auction bidding platforms through Xcira, and enhanced Wi-Fi access at many of our auction sites.

Diverse sector coverage

Our sales solutions cater to the needs of end users, dealers and other equipment sellers across a variety of sectors, such as construction, transportation, agriculture, energy and mining. This diversity of sectors mitigates sector-specific exposure, and enables the sale of equipment with cross-sector applications regardless of sector-specific cyclicality.

Experienced management team

Our experienced management team continues to capitalize on the strength of our core on site auction offering, while expanding our online offering through multiple acquisitions to better serve our existing customers and to attract new customers. Ritchie Bros. executives have served as officers of a number of well-known global public companies, and have developed a deep understanding of the used equipment market and customer base.

Data and sector intelligence

Ritchie Bros. transacted more than 430,000 assets through its sales channels in 2016, had more than 660,000 people register to bid, and had more than 910,000 average monthly users of www.rbauction.com in 2016. The volume of transactions and customer interactions we have provide us with a unique, proprietary database of information. This information provides us with some of the world’s best information to identify market trends and estimate used equipment values.

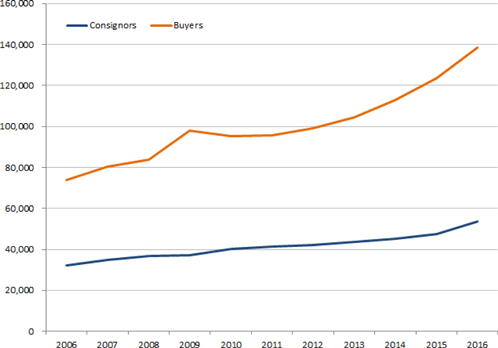

These competitive advantages have enabled us to hold successful auctions that are appealing to both buyers and consignors, as evidenced by the growth in the number of buyers and consignors participating in our auctions, set out in the graph below, and the resulting growth in our GAP over the last decade.

Industrial Auction Metrics: 2006 – 2016

| Ritchie Bros. | 11 |

We believe that this momentum, together with our reputation, size and financial resources, gives our customers confidence in our auction services, which should contribute to our growth over the long term.

Digital Capabilities

An increasing portion of sales transactions through Ritchie Bros.’ solutions are conducted online, as illustrated in the graph below. As such, digital technologies and capabilities have become an increasing important component of our strategy and service offering.

Internet services

Online bidding at live auctions

We believe that our extensive internet presence and the tools available on our website are valuable to buyers and sellers of equipment and represent a distinct competitive advantage for Ritchie Bros. Our online bidding service, provided by Xcira, a business under the Ritchie Bros. family of companies, has enhanced our ability to transcend local market conditions and offer international scope to equipment buyers and sellers at our auctions. It has also increased the number of bidders participating in our auctions, which we believe has led to higher selling prices.

Through the use of Xcira’s online bidding technology, we launched our internet bidding service in 2002. Internet bidders and buyers at our auctions have continued to trend higher on an annual basis since 2002, with just over half of our core auction GAP in 2016 generated from online transactions. In 2016, we sold over $1.9 billion of equipment to users of this core auction service. In 2016, customers bidding in our live industrial auctions over the internet accounted for 66% of total industrial auction registrations. Our internet bidding service gives our auction customers the choice of how they want to do business with us and access to both live and online auction participation. Our online bidding technology is available in nine languages.

| Ritchie Bros. | 12 |

The average number of registered bidders, both online and on-site, participating in our industrial auctions has increased 118% to 2,356 registered bidders in 2016 from 1,080 bidders in 2001, prior to the implementation our internet bidding service.

Online sales through a secure and trusted marketplace

In 2013, we launched our online equipment marketplace, EquipmentOne (www.equipmentone.com), which provides equipment sellers with control over the selling price and the sales process. EquipmentOne appeals to equipment sellers who want to manage the process, decide if and when to sell, and negotiate a selling price. This optionality appeals to companies and equipment owners who would prefer to sell only under certain conditions. During 2016, $148.0 million of online transactions were completed on EquipmentOne.

Search engine optimization

In 2010 we launched our new 22-language Ritchie Bros. website, with enhanced features such as high quality zoomable photos, watch lists and other valuable features. The website (www.rbauction.com) now enables customers to interact with us more easily, as well as search for and purchase the equipment they need, and we believe it is a powerful tool for attracting new non-English speaking customers.

In 2011 we launched our detailed equipment information program, in which we provide free of charge on our website to all customers much more detailed information and photos about the equipment to be sold at our auctions. We believe this program is allowing customers to shop with greater ease and bid with more confidence, and has made our auctions more appealing to a broader range of equipment owners.

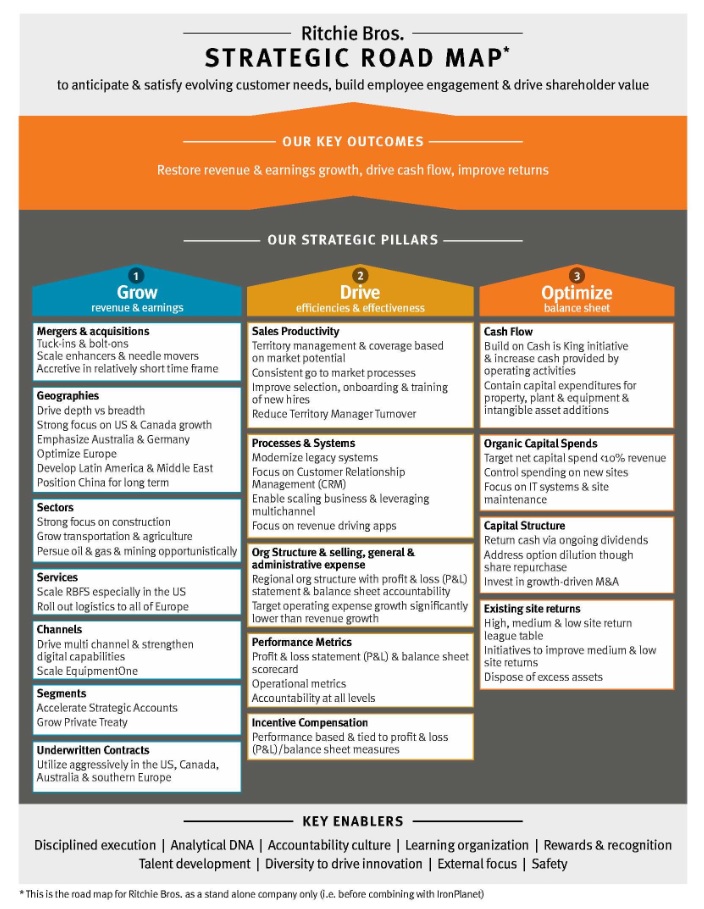

Strategy

Over the past several years our strategy has continued to evolve. At the beginning of 2015 we formalized a new strategy, that outlines the following objectives, strategic pillars and key enablers:

| Ritchie Bros. | 13 |

| Ritchie Bros. | 14 |

There are three main drivers to our strategy and roadmap to generate shareholder value:

GROW Revenue and Earnings

We are committed to pursuing growth initiatives that will further enhance our sector reach, drive geographic depth, meet a broader set of customer needs, and add scale to our operations. EquipmentOne is a key part of a full-service offering to provide our customers with a menu of options that cater to their needs at different points of their asset disposition journey. The strategy of offering EquipmentOne and other sales channels alongside our core auction service is a key step in developing a truly multi-channel offering to our market. The addition of Ritchie Bros. Private Treaty and Mascus (our listing service), as well as the acquisition of the minority interest in Ritchie Bros. Financial Services, will also contribute to revenue and earnings growth for the Company. We will also continue to focus on accelerating our strategic accounts growth and improving the overall performance and use of our underwritten contracts.

DRIVE Efficiencies and Effectiveness

We plan to take advantage of opportunities to improve the overall effectiveness of our organization by enhancing sales productivity, modernizing and integrating our legacy IT systems and optimizing business processes. We are also implementing formal performance measurement metrics to gauge our effectiveness and progress, and will better align our executive compensation plans with our new strategy and key targets. We also continue to evaluate ways to most effectively structure our organization to enhance the agility of our business, and speed up our decision making processes, to better serve our customers.

OPTIMIZE our Balance Sheet

Our business model provides us with the ability to generate strong cash flows. Cash flow represents our ability to convert revenue into cash, and provides a meaningful indication of the strength of our business. We will focus not only on profit growth but also further enhancing cash flow, reviewing contract structures and auction site returns to improve the cash flow and asset returns of our core auction segment. During 2016 we also adjusted our capital structure, taking on more debt (through a new syndicated credit facility and issuance of senior unsecured notes) to improve our average cost of capital, and continued to be prudent with our organic capital expenditures.

The announced acquisition of IronPlanet is considered a transformational transaction, and one that will increase both the scale and scope of our Company. The enhanced scale of our combined business is expected to drive further operating leverage from our unique business model, and provide new opportunities to operate more efficiently by utilizing a more digital service offering.

Segmented Information

Segmented information is disclosed in the consolidated financial statements and the notes thereto included in “Part II, Item 8: Financial Statements and Supplementary Data” presented elsewhere in this Annual Report on Form 10-K.

Operations

Transaction volume and Gross Auction Proceeds

Equipment sales are transacted through our core auction business, Ritchie Bros. Auctioneers, and our online marketplace, EquipmentOne. During 2016, $4.2 billion, or 97% of total GAP, was generated through Ritchie Bros. Auctioneers, while $148.0 million, or 3% of total GAP was sold through EquipmentOne.

Ritchie Bros. Auctioneers

In 2016, approximately 87% of our GAP was attributable to auctions held on one of our 45 permanent auction sites and regional auction sites, compared to 85% in 2015. Please see further discussion below under “Part II, Item 2: Properties – international network of auction sites” for a discussion of our properties. In 2016, 10% of our GAP came from “off-site” auctions, compared to 12% in 2015 and 2014. Off-site auctions are typically held on rented or consignor-owned land. The decision as to whether to hold a particular auction at one of our sites instead of at an off-site location is influenced by the nature, amount and location of the equipment to be sold. The majority of our agricultural auctions are held at off-site locations, usually on the consignor’s farm.

| Ritchie Bros. | 15 |

During 2016, the Company acquired Petrowsky Auctioneers and Kramer Auctions. Transactions from both Petrowsky and Kramer branded auctions are now allocated to GAP reported for Ritchie Bros. Auctioneers. Equipment transactions and revenue generated through Ritchie Bros. Private Treaty are also allocated to our Core Auction reportable segment.

EquipmentOne

GAP generated through EquipmentOne, also referred to as Gross Transaction Value (“GTV”) represents total proceeds from all items sold at our online marketplaces, as well as a buyers’ premium component applicable only to our online marketplace transactions.

Seasonality

Our Core Auction reportable segment GAP and associated revenues are affected by the seasonal nature of our business. Core auction GAP and revenues tend to increase during the second and fourth calendar quarters, during which time we generally conduct more business than in the first and third calendar quarters. Given the operating leverage inherent in our business model, the second and fourth quarter also tend to produce higher operating margins, given the higher volume and revenue generated in those quarters.

Some of the key elements of our auction and marketplace process include:

Attracting bidders

We believe our proprietary customer database, which contains over 610,900 customer names from approximately 190 countries, significantly enhances our ability to market our auctions effectively. We typically send tens of thousands of digital and print direct marketing materials to strategically selected customers from our database as part of our comprehensive auction marketing service. We also conduct targeted regional and industry-specific advertising and marketing campaigns and use social media to generate awareness. In addition, we present information about the majority of the consigned equipment at upcoming auctions on our website so that potential bidders can review equipment descriptions and view photographs of many of the items to be sold. We had over 549,000 bidder registrations at our industrial auctions in 2016.

Attracting equipment

We solicit equipment consignments ranging from single pieces of equipment consigned by local owner-operators to large equipment fleets offered by multi-national consortiums upon the completion of major construction projects.

For larger consignments, our service typically begins with an equipment appraisal that gives the prospective consignor a credible estimate of the value of the appraised equipment. We believe that consignors choose to sell their equipment through Ritchie Bros. sales solutions as we reach an exceptionally large audience of qualified equipment buyers, which helps equipment sellers realize higher sales prices.

Our willingness to take consignment of a customer’s full equipment fleet, including ancillary assets such as inventories, parts, tools, attachments and construction materials, rather than only accepting selected items, is another valuable service that we offer to consignors that sets us apart from most of our competitors.

Attractive contract options

We offer consignors several contract options to meet their individual needs and sale objectives. Through our auction offerings, options include a straight commission contract, where the consignor receives the gross proceeds from the sale less a pre-negotiated commission rate, as well as alternate arrangements including guarantee contracts (where the consignor receives a guaranteed minimum amount plus an additional amount if proceeds exceed a specified level) or inventory contracts (where we purchase the equipment temporarily for resale). We refer to guarantee and inventory contracts as underwritten contracts, which accounted for approximately 25% of our GAP in 2016, compared to 29% in 2015 and 31% in 2014.

| Ritchie Bros. | 16 |

In order to assist customers with their equipment transactions and to build our business and position ourselves in the marketplace, in a minority of cases, we will strategically present proposals to customers that include underwritten contracts. In making the decision to strategically use an underwritten proposal, we consider a multitude of factors, including, the size and the mix of the equipment in the proposal, the condition of the equipment, the timing of the contract in relation to a particular auction and its impact on attracting additional consignments, the competitive environment, the used equipment pricing environment and our relationship with the customer. We have a rigorous approach to appraising and evaluating the items included in a potential underwritten deal and have a well-developed, strict internal approval process for entering into underwritten contracts.

Further, the choice by equipment owners between straight commission, guarantee, or inventory contracts, if presented by us, depends on the owner’s risk tolerance and sale objectives. We work with our customers to provide them with the contract option that best suits their needs at that point in time. As a result, the mix of contracts in a particular quarter or year fluctuates and is not necessarily indicative of the mix in future periods. The composition of our auction commissions and our Revenue Rate are affected by the mix and performance of contracts entered into with consignors in the particular period and fluctuates from period to period.

Equipment sellers with larger packages of equipment will also often be provided with a proposal to sell their assets across multiple Ritchie Bros. sales channels – including EquipmentOne and Ritchie Bros. Private Treaty. Our proposals are structured to provide sellers with the best possible outcome, given their specific and unique needs and preferences.

Value-added services

We provide a wide array of services to make the auction process convenient for buyers and sellers of equipment. Examples of these services include:

| · | conducting title searches, where registries are commercially available, to ensure equipment is sold free and clear of all liens and encumbrances (if we are not able to deliver clear title, we provide a full refund up to the purchase price to the buyer); |

| · | making equipment available for inspection, testing and comparison by prospective buyers; |

| · | displaying high-quality, zoomable photographs of equipment on our website; |

| · | providing free detailed equipment information on our website for most equipment; |

| · | providing financing services through RBFS, as well as insurance and powertrain warranty products; |

| · | providing access at our auctions to transportation companies, customs brokerages and other service providers, and online through our partner, uShip, and Ritchie Bros. Logistics; |

| · | providing facilities for on-site cleaning, painting, and refurbishment of equipment; and |

| · | handling all pre-auction marketing, as well as collection and disbursement of proceeds. |

Online bidding and equipment marketplace purchase metrics

We continue to see an increase in the use and popularity of both our online bidding system and our online equipment marketplace. During 2016, we attracted record online bidder registrations and sold approximately $2.1 billion of equipment, trucks and other assets to online auction bidders and EquipmentOne customers. This represents an 8% increase over the $1.9 billion of assets sold online in 2015, and an annual online sales record.

Competition

The global used industrial equipment market is highly fragmented and often fluid between sales channels. We compete for potential purchasers and sellers of industrial equipment with other companies, including non-auction competitors such as equipment manufacturers, distributors and dealers, used equipment brokers, equipment rental companies, and other online marketplaces. We also compete with private sales – often securing new business from equipment owners who had previously tried selling their equipment privately.

| Ritchie Bros. | 17 |

Governmental regulations and environmental laws

Our operations are subject to a variety of federal, provincial, state and local laws, rules and regulations throughout the world relating to, among other things, the auction business, imports and exports of equipment, worker health and safety, privacy of customer information and the use, storage, discharge and disposal of environmentally sensitive materials. In addition, our development or expansion of auction sites depends upon the receipt of required licenses, permits and other governmental authorizations, and we are subject to various local zoning requirements with regard to the location of our auction sites, which vary among jurisdictions.

Under some of the laws regulating the use, storage, discharge and disposal of environmentally sensitive materials, an owner or lessee of, or other person involved in, real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances located on or in, or emanating from, such property, as well as related costs of investigation and property damage. These laws often impose liability without regard to whether the owner or lessee or other person knew of, or was responsible for, the presence of such hazardous or toxic substances.

We typically obtain Phase I environmental assessment reports prepared by independent environmental consultants in connection with our site acquisitions and leases. A Phase I environmental assessment consists of a site visit, historical record review, interviews and reports, with the purpose of identifying potential environmental conditions associated with the subject property. There can be no assurance, however, that acquired or leased sites have been operated in compliance with environmental laws and regulations or that future uses or conditions will not result in the imposition of environmental liability upon us or expose us to third-party actions such as tort suits. Although we have insurance to protect us from such liability, there can also be no assurance that it will cover any or all potential losses.

There are restrictions in the United States and Europe that may affect the ability of equipment owners to transport certain equipment between specified jurisdictions. One example of these restrictions is environmental certification requirements in the United States, which prevent non-certified equipment from being entered into commerce in the United States. In addition, engine emission standards in some jurisdictions limit the operation of certain trucks and equipment in those markets. We expect these emission standards to be implemented in additional jurisdictions or to be strengthened in existing jurisdictions in the future.

We are committed to contributing to the protection of the natural environment by preventing and reducing adverse impacts of our operations. As part of our commitment, we aim to:

| · | empower our employees to identify and address environmental issues; |

| · | consider environmental impacts as part of all business decisions; |

| · | conduct business in compliance with applicable regulations and legislation, and where appropriate, adopt the most stringent standards as our global benchmark; |

| · | use resources wisely and efficiently to minimize our environmental impact; |

| · | communicate transparently with our shareholders about environmental matters; |

| · | conduct ongoing assessments to ensure compliance and good stewardship; and |

| · | hold management accountable for providing leadership on environmental matters, achieving targets, and providing education to employees. |

We believe that by following these principles, we will be able to achieve our objective to be in compliance with applicable environmental laws and make a positive contribution to the protection of the natural environment.

Our operational and marketing activities are subject to various types of regulations, including laws relating to the protection of personal information, consumer protection and competition. For example, the Canadian Anti-Spam Law (“CASL”) came into force on July 1, 2014. CASL prohibits the transmission of commercial electronic messages to an email address without consent and it also requires certain formalities to be complied with, including the ability to unsubscribe easily from subsequent messages.

| Ritchie Bros. | 18 |

We believe that we are in compliance in all material respects with all laws, rules, regulations and requirements that affect our business, and that compliance with such laws, rules, regulations and requirements does not impose a material impediment on our ability to conduct our business.

Available Information

The information contained on or accessible through our website is not part of this Annual Report on Form 10-K. We file required reports on Form 10-K, Form 10-Q, Form 8-K, proxy materials and other filings required under the Exchange Act. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

We maintain a website at www.rbauction.com and copies of our reports on Form 10-K, Form 10-Q and Form 8-K, proxy materials and other filings required under the Exchange Act, are available on our website, free of charge, as soon as reasonably practicable after we electronically file such reports with, or furnish those reports to, the SEC.

We maintain a Code of Business Conduct and Ethics for our directors, officers and employees (“Code of Conduct”). A copy of our Code of Conduct may be found on our website in the Corporate Governance section.

Additional information related to Ritchie Bros. is also available on SEDAR at www.sedar.com.

Geographical Information

Geographical information about our revenues is disclosed in “Part II, Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K, under the subsection “Results of Operations”.

The distribution of our long-lived assets according to the country in which they are located, is as follows:

| Outside of | United | |||||||||||||||||||

| Canada | Canada | States | Europe | Other | ||||||||||||||||

| Long-lived assets distribution | ||||||||||||||||||||

| December 31, 2016 | 21 | % | 79 | % | 55 | % | 14 | % | 10 | % | ||||||||||

| December 31, 2015 | 20 | % | 80 | % | 55 | % | 15 | % | 10 | % | ||||||||||

| December 31, 2014 | 22 | % | 78 | % | 52 | % | 16 | % | 10 | % | ||||||||||

| Ritchie Bros. | 19 |

| ITEM 1A: | RISK FACTORS |

An investment in our common stock involves a high degree of risk. In addition to the other information included in this Annual Report on Form 10-K, you should carefully consider each of the risks described below before purchasing our common shares. The risk factors set forth below are not the only risks that may affect our business. Our business could also be affected by additional risks not currently known to us or that we currently deem to be immaterial. If any of the following risks actually occur, our business, financial condition and results of operations could materially suffer. As a result, the trading price of our common shares could decline, and you may lose all or part of your investment. Information in this section may be considered “forward-looking statements.” See “Cautionary Note Regarding Forward-Looking Statements” for a discussion of certain qualifications regarding such statements.

Damage to our reputation for fairness, transparency and integrity could harm our business.

One of our founding principles is that our core auctions are fair and transparent and we believe this is one of our most significant competitive advantages. Closely related to this is our reputation for fairness and honesty in our dealings with our customers.

Our ability to continue to develop our brand strength, attract new customers and continue to do business with existing customers could be harmed if our reputation for fairness, transparency and integrity was damaged. If we are unable to maintain our reputation, we could lose business and our financial condition and results of operations could be adversely affected.

The IronPlanet Merger is subject to conditions and may not be completed or may not be completed as described.

Although we believe that the Merger will be completed as described herein, there can be no assurances that this will be the case. The consummation of the Merger pursuant to the Merger Agreement is subject to the terms and conditions set out therein, including (i) the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (ii) the absence of a material adverse change with respect to IronPlanet since the date of the Merger Agreement, as described in the Merger Agreement; and (iii) the United States Committee on Foreign Investment in the United States having provided a written notice to the effect that review of the transactions contemplated by the Merger Agreement has been concluded and has terminated all action under the Section 721 of the Defense Production Act of 1950, as amended. The Merger will not be consummated until such clearances are received and such conditions are satisfied, which may take several months or longer. Furthermore, there can be no assurance that such clearances are received and such conditions are satisfied. Alternatively, the relevant antitrust authorities may authorize clearance of the Merger but demand that we implement certain remedies, such as undertakings or divestitures as a condition to close the Merger. Any such remedies would likely make the Merger less attractive and limit the size of the business we acquire and our ability to deliver the anticipated synergies and other benefits. We cannot assure you that we will be permitted to undertake the Merger in a timely fashion, without remedies, or at all.

If the Merger is not consummated on or before October 31, 2017 or the Merger Agreement is terminated prior to such date, we will be required to redeem all of the outstanding Notes at a redemption price equal to 100% of the original offering price of the Notes, plus accrued and unpaid interest to, but excluding, the date of such mandatory redemption. Moreover, the Merger is expected to be consummated in accordance with the terms of the Merger Agreement, and the Merger Agreement may be modified, amended and waived at any time by the parties thereto, without the consent of the holders of the Notes. Furthermore, modifications and amendments made to the Merger Agreement may make the Merger less attractive. The redemption of the outstanding Notes, and/or any amendment made to the Merger Agreement may adversely affect our business, financial condition, and results of operations.

| Ritchie Bros. | 20 |

We could experience delays or impediments to executing our acquisition strategy and expanding our business due to antitrust laws.

The Merger is, and other proposed business acquisitions and dispositions may be, subject to the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, as well as potentially the obtaining of certain other antitrust clearances. The relevant regulatory and antitrust authorities focus on the effects on competition, including the structure of the relevant markets and the pro-competitive benefits of the transaction. Any delay, prohibition or modification required by regulatory and antitrust authorities could adversely affect the terms of a proposed acquisition or could require us to modify or abandon an otherwise attractive acquisition opportunity.

Significant costs have been incurred and are expected to be incurred in connection with the consummation of the Merger and the integration of IronPlanet with Ritchie Bros. into a combined company, including legal, accounting, financial advisory and other costs.

We expect to incur one-time costs in connection with integrating our operations, products and personnel with those of IronPlanet into a combined company, in addition to costs related directly to completing the Merger. We would expect similar costs to be incurred in connection with any future acquisition. These costs may include expenditures for:

| · | reorganization or closures of facilities; |

| · | employee redeployment, relocation or severance; and |

| · | integration of operations and information systems. |

In addition, we expect to incur a number of non-recurring costs associated with combining our operations with those of IronPlanet. Additional unanticipated costs may yet be incurred as we integrate our business with IronPlanet. Although we expect that the elimination of duplicative costs, as well as the realization of other efficiencies related to the integration of our operations with IronPlanet, may offset incremental transaction and transaction-related costs over time, this net benefit may not be achieved in the near term.

We may not realize the anticipated benefits of, and synergies from, the Merger and may become responsible for certain liabilities and integration costs as a result.

Business acquisitions involve the integration of new businesses that have previously operated independently from us. The integration of our operations with those of IronPlanet is expected to result in financial and operational benefits, as well as operating synergies we expect to capture through corporate expense reduction including elimination of duplicate corporate administrative costs, auction site rationalization as a result of a larger digital footprint, and integration of operations and systems. There can be no assurance, however, regarding when or the extent to which we will be able to realize these and other benefits. Integration may also be difficult, unpredictable, and subject to delay because of possible company culture conflicts and different opinions on future business development. We may be required to integrate or, in some cases, replace, numerous systems, including those involving management information, purchasing, accounting and finance, sales, billing, employee benefits, payroll and regulatory compliance, many of which may be dissimilar. Difficulties associated with the integration of acquired businesses could have a material adverse effect on our business.

Even if we are able to successfully integrate the operations of Ritchie Bros. and IronPlanet, we may not realize the full benefits that we anticipate. If we achieve the expected benefits, they may not be achieved within the anticipated time frame. Also, the benefits from the Merger may be offset by costs incurred in integrating Ritchie Bros. and IronPlanet, increases in other expenses, operating losses or problems in the business unrelated to the Merger. As a result, there can be no assurance that such synergies or other benefits will be achieved.

In addition, in connection with the Merger, we have assumed, and may assume in connection with future acquisitions, certain potential liabilities. To the extent such liabilities are not identified by us or to the extent indemnifications obtained from third parties are insufficient to cover such liabilities, these liabilities could have a material adverse effect on our business.

| Ritchie Bros. | 21 |

Additionally, we entered into the Caterpillar Agreement under which Caterpillar will designate us, upon consummation of the Merger, as a “preferred” but nonexclusive provider for online and on site auctions and marketplaces (including, those of IronPlanet) in the countries where we do business in exchange for preferred rates and access to certain data and information. If the Merger has not been consummated by June 29, 2017, subject to an extension to September 29, 2017 to satisfy certain conditions related to regulatory clearances, or the Merger is approved by any regulatory authority on the condition that Ritchie Bros. make any changes to its business (structure, process or otherwise), the Caterpillar Agreement will become null and void. If the Caterpillar Agreement becomes null and void, or is otherwise modified, it could adversely affect our anticipated benefits from the Merger.

Integrating our business with IronPlanet may divert our management’s attention away from operations.

Successful integration of IronPlanet’s operations, products and personnel with ours may place a significant burden on our management and other internal resources. The diversion of management’s attention, and any difficulties encountered in the transition and integration process, could adversely affect our business, financial condition and operating results.

IronPlanet identified material weaknesses in its internal control over financial reporting.

IronPlanet and its independent auditor identified material weaknesses in IronPlanet’s internal control over financial reporting for the years ended December 31, 2014 and 2015. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of financial statements will not be prevented or detected on a timely basis. Specifically, IronPlanet had a lack of resources to enable effective review over complex accounting areas and non-routine transactions in accordance with GAAP, and it did not perform effective reconciliations over certain accounts related to seller transactions.

IronPlanet has taken numerous steps to strengthen its internal controls, including hiring additional financial reporting personnel with technical accounting and financial reporting experience and enhancing its internal review procedures during the financial statement close process. The actions that they have taken are subject to ongoing management review as well as audit committee oversight. IronPlanet plans to complete the remediation process as quickly as possible. However, upon consummation of the Merger, we may conclude that these remedial measures were insufficient, or we may identify additional material weaknesses or significant deficiencies in IronPlanet’s internal control over financial reporting, which, in either case, may result in IronPlanet’s or our business and financial condition being adversely impacted.

We are incurring substantial indebtedness in connection with the Merger, and the degree to which we will be leveraged following the completion of the Merger may materially and adversely affect our business, financial condition and results of operations.

We are incurring substantial indebtedness in connection with the Merger. As of December 31, 2016, we have $619.6 million of total debt outstanding, consisting of $123.8 million under a new five-year credit agreement (the “Credit Agreement”) with a syndicate of lenders entered into on October 27, 2016 (the “New Facilities”), and $500.0 million aggregate principal amount of 5.375% senior unsecured notes issued December 21, 2016 (the “Notes”), partially reduced by $4.2 million of unamortized debt issue costs, as well as $863.6 million of availability under the New Facilities.

Our ability to make payments on and to refinance our indebtedness, including the debt incurred pursuant to the Merger as well as any future debt that we may incur, will depend on our ability to generate cash in the future from operations, financings or asset sales. Our ability to generate cash is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. We may not generate sufficient funds to service our debt and meet our business needs, such as funding working capital or the expansion of our operations. If we are not able to repay or refinance our debt as it becomes due, we may be forced to take certain actions, including reducing spending on marketing, advertising and new product innovation, reducing future financing for working capital, capital expenditures and general corporate purposes, selling assets or dedicating an unsustainable level of our cash flow from operations to the payment of principal and interest on our indebtedness. In addition, our ability to withstand competitive pressures and to react to changes in our industry, including both the live and online auction industry, could be impaired.

| Ritchie Bros. | 22 |

The lenders who hold our debt could also accelerate amounts due in the event that we default, which could potentially trigger a default or acceleration of the maturity of our other debt.

In addition, our substantial leverage could put us at a competitive disadvantage compared to our competitors that are less leveraged. These competitors could have greater financial flexibility to pursue strategic acquisitions and secure additional financing for their operations. Our substantial leverage could also impede our ability to withstand downturns in our industry or the economy in general.