Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - GigPeak, Inc. | ex99_1.htm |

| 8-K - GIGPEAK INC 8-K 2-13-2017 - GigPeak, Inc. | form8k.htm |

Exhibit 99.2

Welcome to GigPeak PeopleFebruary, 2017

Cautionary Note Regarding Forward Looking Statements This presentation contains forward-looking statements, including, but not limited to, statements related to the anticipated consummation of the acquisition of GigPeak, Inc. (“GigPeak”) and the timing, benefits and financing thereof, Integrated Device Technology, Inc.’s (“IDT”) strategy, plans, objectives, expectations (financial or otherwise) and intentions, future financial results and growth potential, anticipated product portfolio, development programs, patent terms and other statements that are not historical facts. These forward-looking statements are based on IDT’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to IDT’s ability to complete the transaction on the proposed terms and schedule; whether IDT or GigPeak will be able to satisfy their respective closing conditions related to the transaction; whether sufficient stockholders of GigPeak tender their shares of GigPeak common stock in the transaction; whether IDT will obtain financing for the transaction on the expected timeline and terms; the outcome of legal proceedings that may be instituted against GigPeak and/or others relating to the transaction; the possibility that competing offers will be made; risks associated with acquisitions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the transaction will not occur; risks related to future opportunities and plans for the acquired company and its products, including uncertainty of the expected financial performance of the acquired company and its products; disruption from the proposed transaction, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; the calculations of, and factors that may impact the calculations of, the acquisition price in connection with the proposed merger and the allocation of such acquisition price to the net assets acquired in accordance with applicable accounting rules and methodologies; and the possibility that if the acquired company does not achieve the perceived benefits of the proposed transaction as rapidly or to the extent anticipated by financial analysts or investors, the market price of IDT’s shares could decline, as well as other risks related to IDT’s and GigPeak’s businesses detailed from time-to-time under the caption “Risk Factors” and elsewhere in IDT’s and the GigPeak’s respective SEC filings and reports, including the Annual Report of GigPeak on Form 10-K for the year ended December 31, 2015 and the Annual Report of IDT on Form 10-K for the year ended April 3, 2016. IDT undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or changes in its expectations.

Additional Information and Where to Find It This presentation related to IDT’s acquisition of GigPeak. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. The tender offer for the outstanding shares of GigPeak’s common stock described in this presentation has not commenced. At the time the tender offer is commenced, IDT will file or cause to be filed a Tender Offer Statement on Schedule TO with the SEC and GigPeak will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to GigPeak’s stockholders at no expense to them by the information agent to the tender offer, which will be announced. In addition, all of those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

What We Just Announced Integrated Device Technology to acquire GigPeakApproved by both Management teams and Board of DirectorsProcess started for government approvals and acquiring shares (tender offer)Expected to close during the 2nd calendar quarter of 2017We intend to grow GigPeak’s business, and are interested in all of itFrom an IDT perspective, GigPeak isn’t a new strategyIt accelerates our current strategyWe can now provide ultra-high speed interconnect using electrons, radio, and photons – a unique and valuable position !

5 Questions You May Have Will there be job loss?We’re very impressed with GigPeak peopleYes, there will be some but very little, and mainly in G&A. IDT will actively help everyone in this process No R&D change. Marketing / bus-dev and sales is also complimentary to our ownWill IDT invest to grow our business?Yes. We expect commitment to grow along with new investment. We wouldn’t be doing this if we didn’t think we could grow faster togetherWho will my boss(es) be?Pretty much the same ones you know already This will be run as a standalone business, led by Raluca Dinu who will report to Sean Fan, head of IDT Computing & Communications DivisionThere’s a lot of opportunity to leverage GigPeak IP and knowledge into other IDT businesses too – we’ll figure those out together

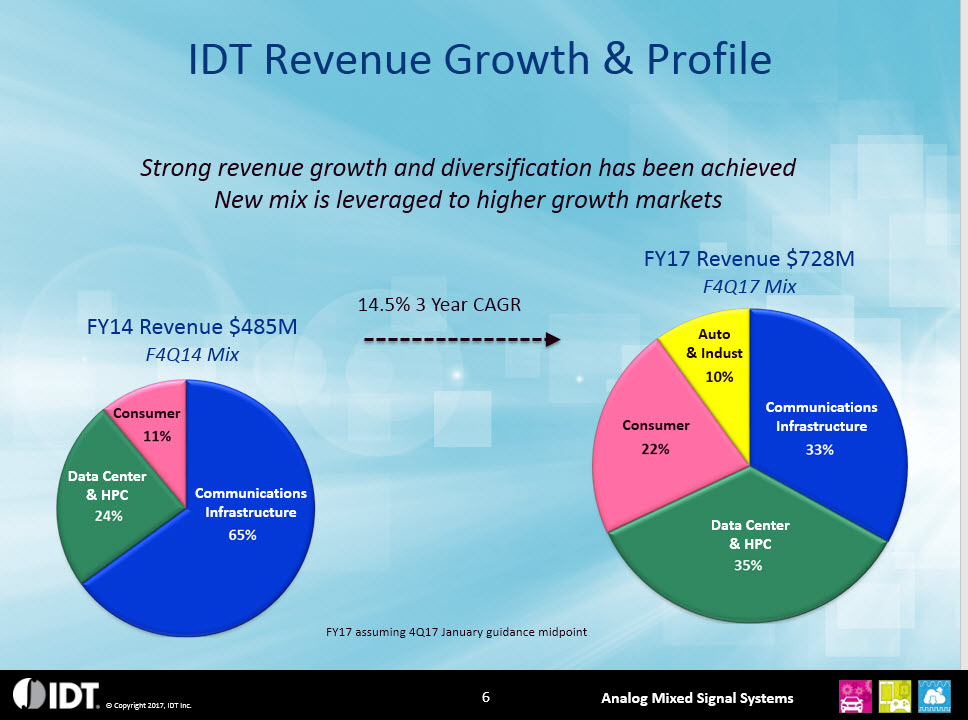

IDT Revenue Growth & Profile FY14 Revenue $485MF4Q14 Mix FY17 Revenue $728MF4Q17 Mix 14.5% 3 Year CAGR Strong revenue growth and diversification has been achievedNew mix is leveraged to higher growth markets FY17 assuming 4Q17 January guidance midpoint CommunicationsInfrastructure Data Center& HPC Consumer CommunicationsInfrastructure Data Center& HPC Consumer Auto& Indust 6

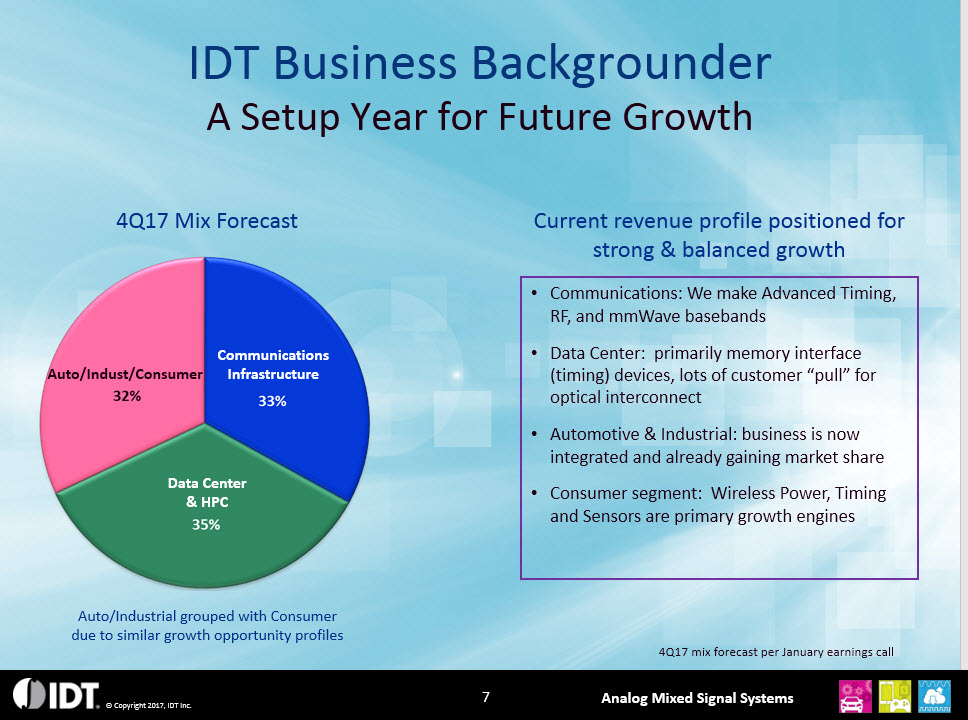

Communications: We make Advanced Timing, RF, and mmWave basebands Data Center: primarily memory interface (timing) devices, lots of customer “pull” for optical interconnectAutomotive & Industrial: business is now integrated and already gaining market shareConsumer segment: Wireless Power, Timing and Sensors are primary growth engines IDT Business BackgrounderA Setup Year for Future Growth CommunicationsInfrastructure Data Center& HPC Auto/Indust/Consumer 4Q17 Mix Forecast 4Q17 mix forecast per January earnings call Auto/Industrial grouped with Consumer due to similar growth opportunity profiles Current revenue profile positioned for strong & balanced growth 7

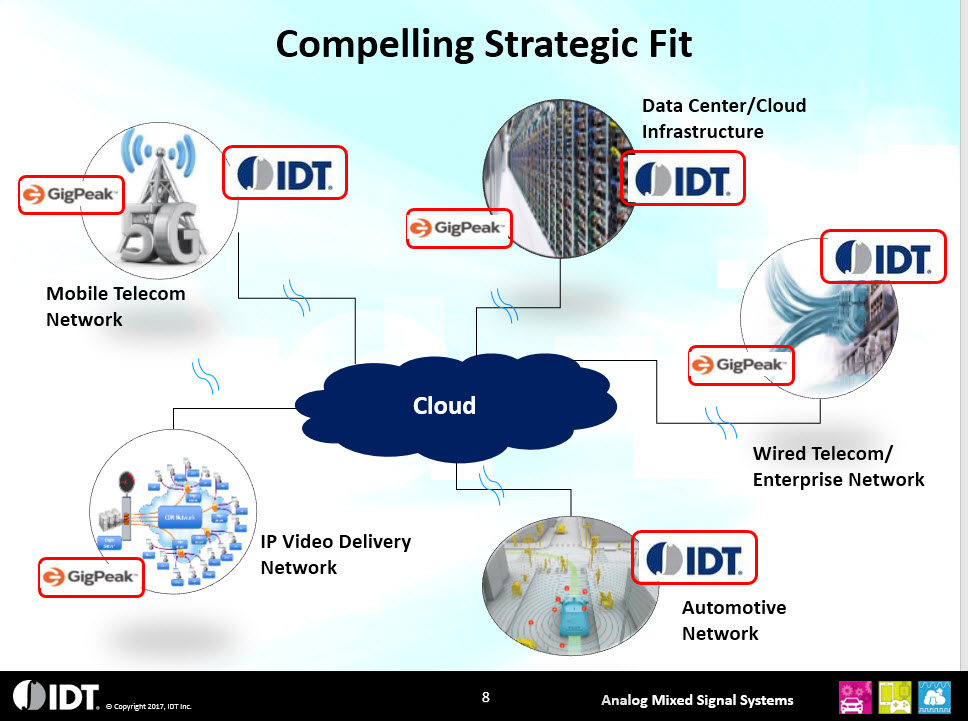

Compelling Strategic Fit 8 Cloud Mobile Telecom Network Wired Telecom/Enterprise Network IP Video DeliveryNetwork Data Center/CloudInfrastructure Automotive Network

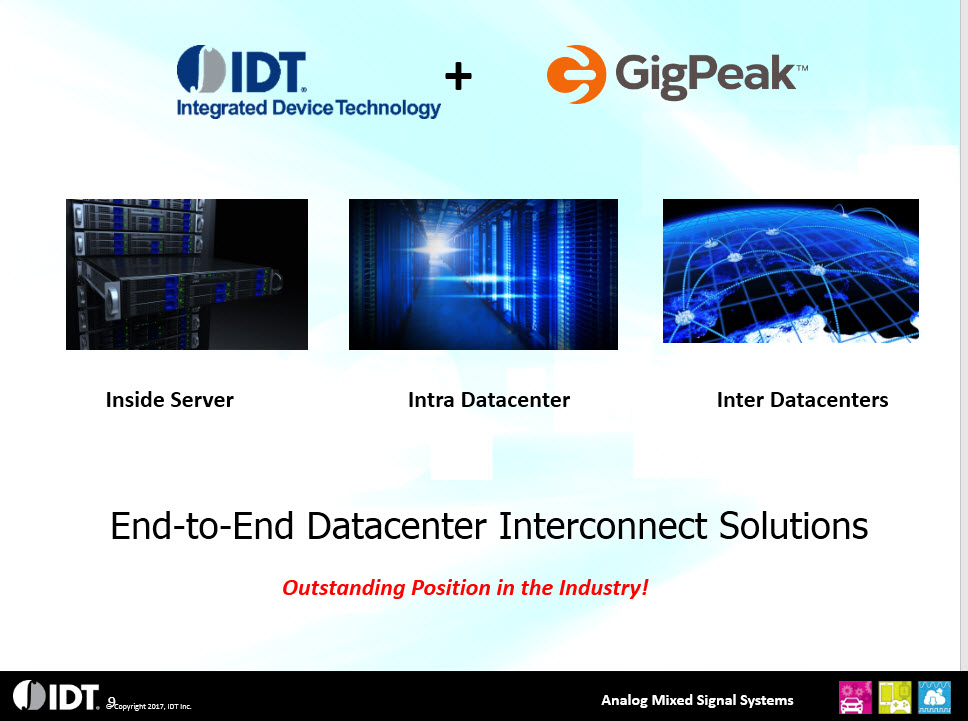

End-to-End Datacenter Interconnect Solutions 9 Inside Server Intra Datacenter Inter Datacenters Outstanding Position in the Industry! +

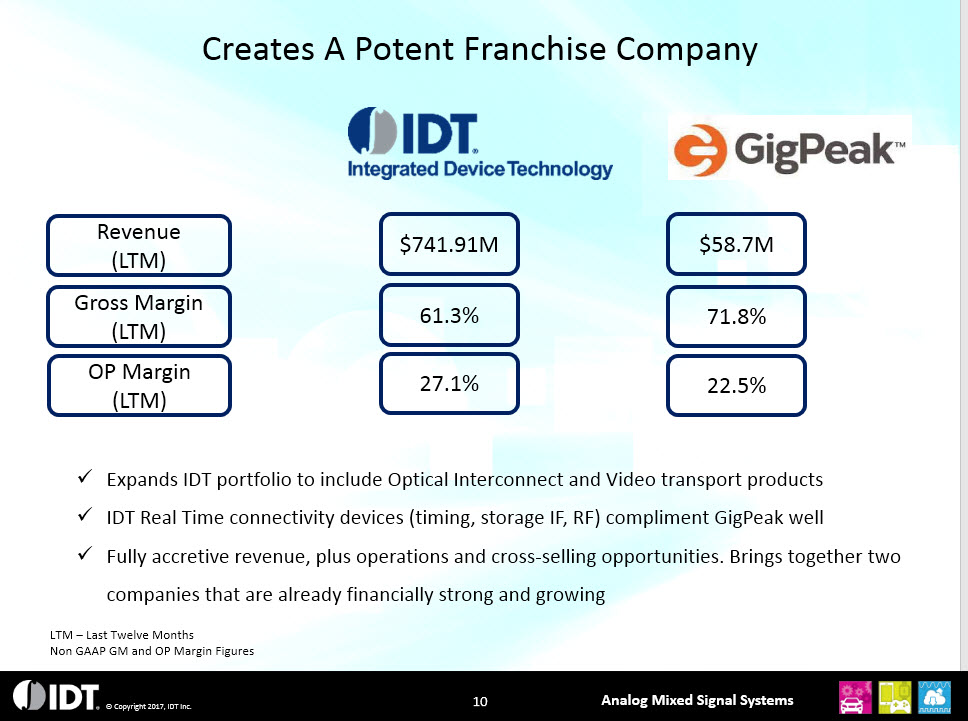

Creates A Potent Franchise Company 10 Revenue (LTM) Gross Margin (LTM) OP Margin (LTM) $741.91M $58.7M 61.3% 71.8% 27.1% 22.5% Expands IDT portfolio to include Optical Interconnect and Video transport productsIDT Real Time connectivity devices (timing, storage IF, RF) compliment GigPeak wellFully accretive revenue, plus operations and cross-selling opportunities. Brings together two companies that are already financially strong and growing LTM – Last Twelve MonthsNon GAAP GM and OP Margin Figures

11 Cloud Concept Goes Beyond DatacentersSignificantly Increases IDT Content Cloud InfrastructureStuff that We Do

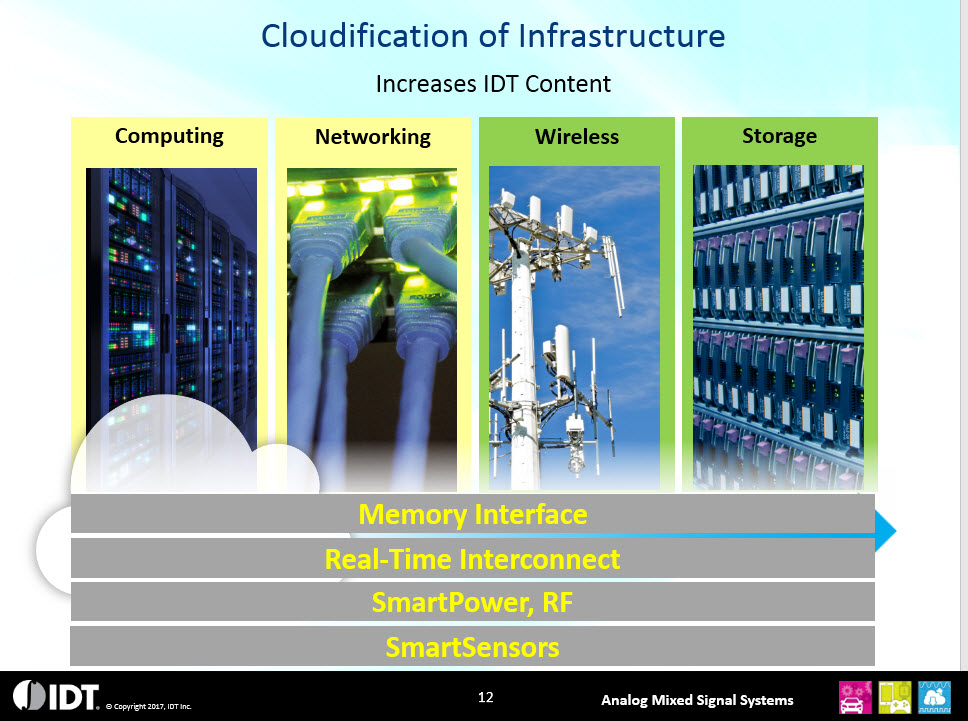

Networking Computing Storage Wireless 12 Cloudification of InfrastructureIncreases IDT Content Memory Interface Real-Time Interconnect SmartPower, RF SmartSensors

Real-Time Cloud Services Connecting People to Machines and Machines to Machines 13 RoboticsAutonomous VehiclesIndustrial DronesHealth ServicesImage RecognitionMachine Learning Real-Time InterconnectNew RF & SpectrumIntelligent Sensing

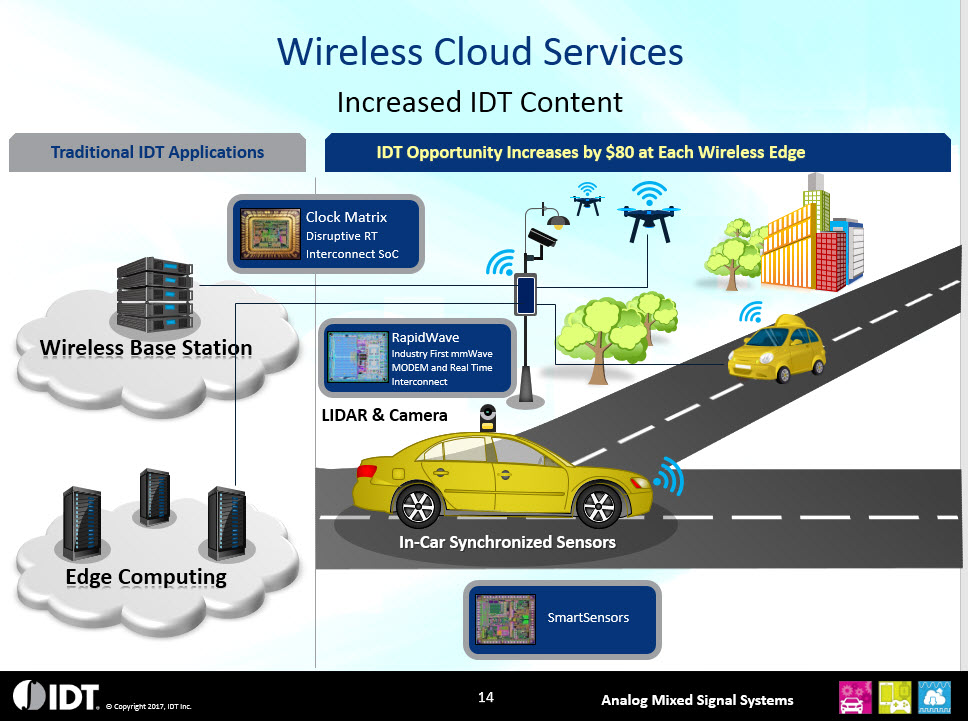

Wireless Base Station Edge Computing Traditional IDT Applications LIDAR & Camera IDT Opportunity Increases by $80 at Each Wireless Edge In-Car Synchronized Sensors Wireless Cloud ServicesIncreased IDT Content RapidWaveIndustry First mmWave MODEM and Real Time Interconnect SmartSensors Clock MatrixDisruptive RT Interconnect SoC 14

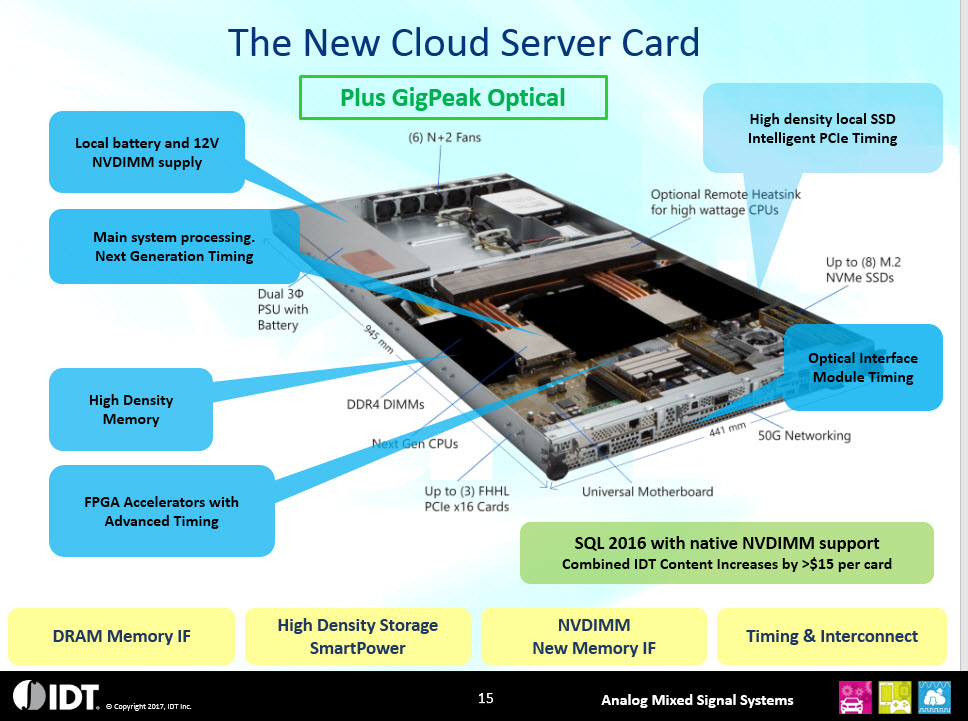

The New Cloud Server Card Local battery and 12V NVDIMM supply High Density Memory High density local SSD Intelligent PCIe Timing SQL 2016 with native NVDIMM supportCombined IDT Content Increases by >$15 per card Main system processing. Next Generation Timing FPGA Accelerators with Advanced Timing Optical Interface Module Timing DRAM Memory IF High Density StorageSmartPower NVDIMMNew Memory IF Timing & Interconnect 15 15 Plus GigPeak Optical

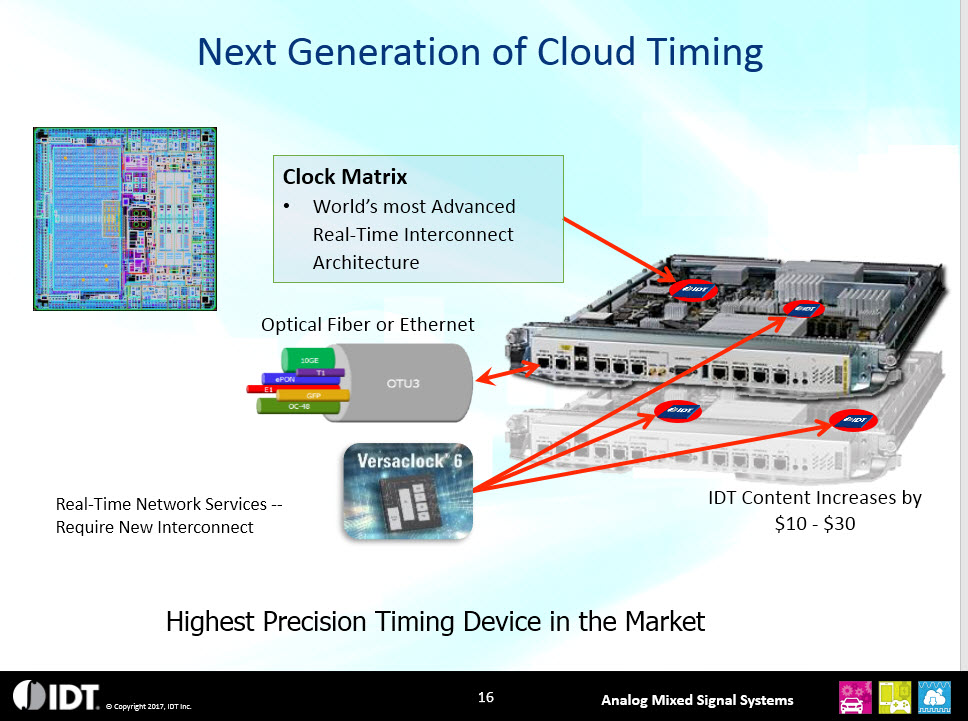

Next Generation of Cloud Timing 16 Optical Fiber or Ethernet Real-Time Network Services -- Require New Interconnect IDT Content Increases by $10 - $30 Clock MatrixWorld’s most Advanced Real-Time Interconnect Architecture Highest Precision Timing Device in the Market

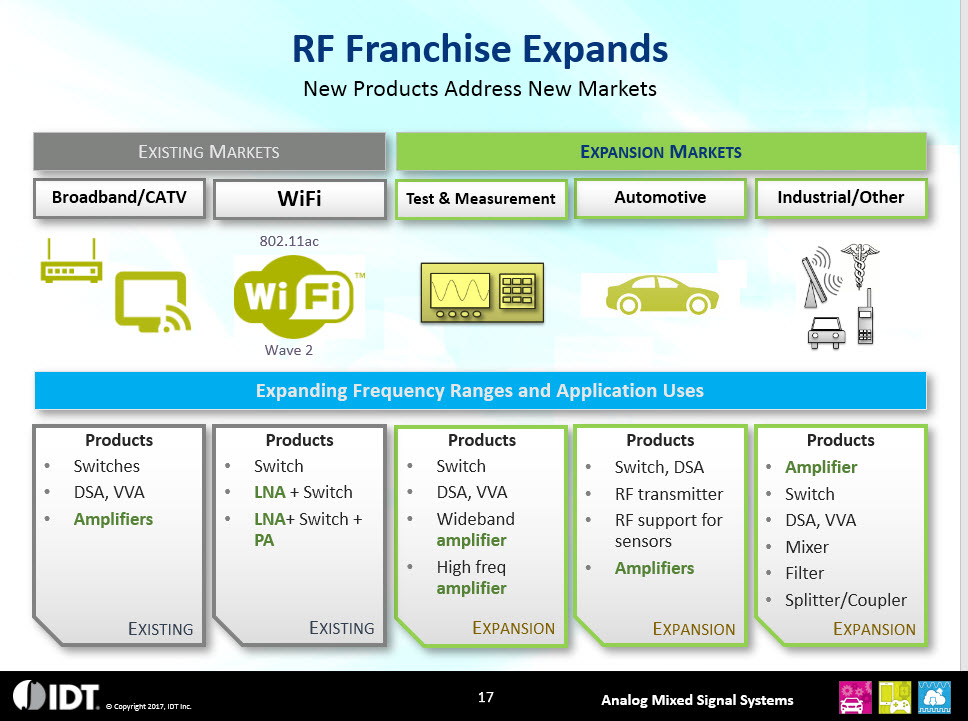

RF Franchise ExpandsNew Products Address New Markets 17 Broadband/CATV Industrial/Other ProductsSwitchesDSA, VVAAmplifiers ProductsSwitchLNA + SwitchLNA+ Switch + PA ProductsSwitch, DSARF transmitterRF support for sensorsAmplifiers ProductsAmplifierSwitchDSA, VVAMixerFilterSplitter/Coupler Expanding Frequency Ranges and Application Uses Existing Existing Expansion Expansion Expansion ProductsSwitchDSA, VVAWideband amplifierHigh freq amplifier WiFi Automotive Test & Measurement Existing Markets Expansion Markets 802.11ac Wave 2

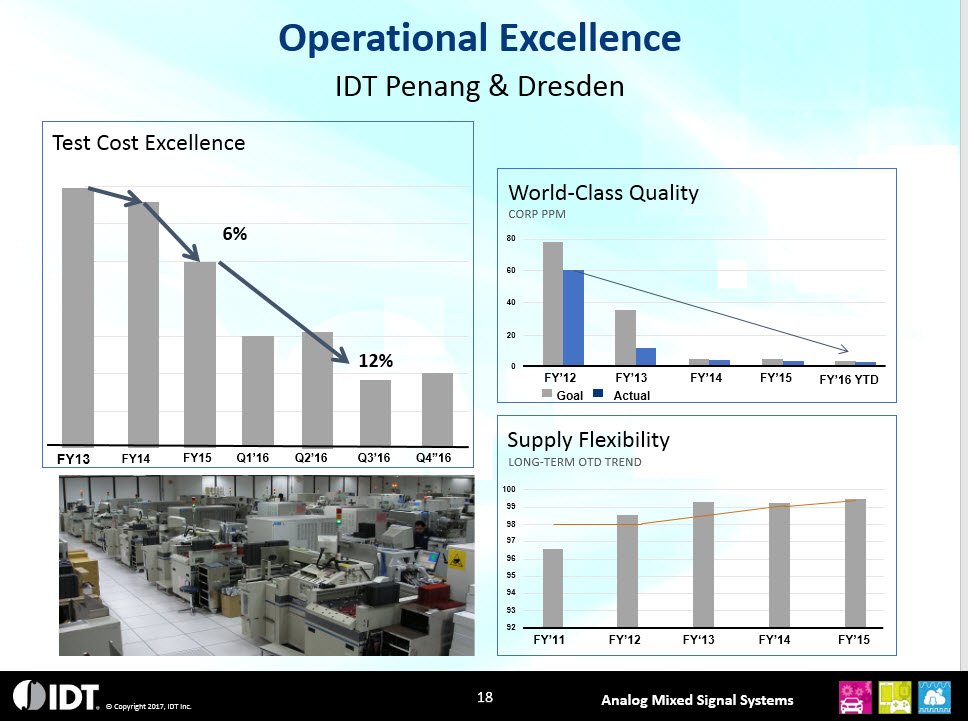

Operational Excellence World-Class Quality Supply Flexibility IDT Penang & Dresden Test Cost Excellence FY13 FY14 FY15 Q1’16 Q2’16 Q3’16 Q4”16 6% 12% 80 60 40 20 0 FY’12 FY’13 FY’14 FY’15 FY’16 YTD CORP PPM Goal Actual FY’11 FY’12 FY‘13 FY’14 FY’15 100 99 98 97 96 95 94 93 92 LONG-TERM OTD TREND 18

Discussion