Attached files

Exhibit 99.2

February 13, 2017

Dear Fellow Shareholder:

We are pleased to share with you the results of our 2016 estimated net asset valuation per share (NAV) for CNL Healthcare Properties, as well as other portfolio highlights. Below is a snapshot of what you should know about your investment:

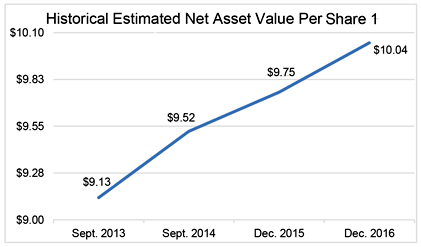

| 1. | Our estimated NAV increased to $10.04 per share, from $9.75 per share – our third consecutive annual increase. |

| 2. | The Distribution Reinvestment Plan (DRP) and Distribution Policy remain unchanged at this time, with the exception of the purchase price for shares under the DRP will now be our new NAV – $10.04 per share. The first quarter distribution remains $0.4215 per share, which represents an annualized distribution rate of 4.2 percent based on the updated NAV. First quarter distributions will be paid in mid-March. |

| 3. | In 2016, the portfolio performed quite well as we continued to actively manage our holdings to maximize shareholder value. |

| 4. | Looking ahead, we will remain focused on completing our current construction and expansion projects and continuing to lease up targeted assets to further position the portfolio to the point when we can begin the process of studying options for shareholder liquidity. |

2016 Estimated Net Asset Value

Following a unanimous recommendation from the valuation committee, the board of directors unanimously determined $10.041 as the estimated NAV per share of our common stock as of December 31, 2016. As you can see in the graph below, this is our third consecutive NAV increase, with our previous estimated NAV per share being $9.75 as of December 31, 2015.

Our estimated NAV per share was positively impacted by several factors, including an increase in net operating income due to improved property performance, the continued stabilization of our newly developed and lease-up properties, and slight declines in market-based discount and capitalization rates. To arrive at our 2016 NAV, we engaged CBRE, Capital Advisors, Inc., an independent appraisal firm, to provide a valuation analysis of the company. CBRE has conducted our three previous annual valuation analyses and is one of the world’s largest commercial real estate services and investment firms (in terms of 2016 revenue).

If you are interested in more in-depth information on our valuation, we also invite you to review our 8-K and valuation presentations; both are available at cnlhealthcareproperties.com. While we are pleased with the trajectory of our estimated NAV per share, keep in mind that this value is as of a specific date and may not necessarily be indicative of the value that could be realized when we pursue future strategies for shareholder liquidity.

Distribution Reinvestment Plan and Distribution Policy

The purchase price for shares under the DRP will be $10.04 per share. Additionally, monthly distributions remain unchanged during the first quarter at $0.4215 per share. Expressed as a percentage of the estimated NAV, the distribution represents 4.2 percent annually. The company will pay first quarter distributions on or about March 13, 2017.

Portfolio Highlights

Reflecting back on 2016, we continued to actively manage our portfolio to best position the company and shareholders for success. Here are some highlights:

| • | We have a healthcare portfolio with an appraised value of more than $3 billion. It is comprised of well-positioned seniors housing communities, medical office buildings, acute care and post-acute care facilities, representing 144 investments across 34 states. |

| • | In 2016, we expanded our geographic footprint to Louisiana with the acquisition of a newly constructed inpatient rehabilitation facility in New Orleans. |

| • | We completed the construction of Watercrest at Katy, a 210-unit seniors housing community in Texas. This is our fifth ground-up seniors’ housing development, which opened in May of last year and has enjoyed a strong lease-up period. |

| • | In November of last year, we sold Dogwood Forest of Acworth – a seniors housing community in the Atlanta, Georgia area that we developed and opened to residents in mid-2014. Sixteen months later, we were presented a unique opportunity to sell it for $34.3 million, recording a net gain on the sale of approximately $15.4 million. |

While we approach ownership of the properties in our portfolio with a longer-term view, we expect to strategically evaluate select opportunities to sell assets if it is consistent with our portfolio strategy of maximizing shareholder value.

Looking Ahead

As our company and portfolio continue to mature, we are intently focused on completing our six current development and value-add expansion projects. Ultimately, we expect to turn our attention to the process of beginning to evaluate potential options for shareholder liquidity. In the meantime, we look forward to updating you further in our upcoming 2016 annual report.

We are pleased with our progress and as always, appreciate your confidence in us and the opportunity to be stewards of your investment. Should you have questions, please contact your financial advisor or CNL Client Services at 866-650-0650, option 3.

| Sincerely, | ||

|

Thomas K. Sittema |

Stephen H. Mauldin | |

| Chairman of the Board | President and Chief Executive Officer |

cc: Financial advisors

| 1 | The estimated NAV per share is only an estimate and is based on a number of assumptions and estimates which may not be correct. The NAV is based on numerous assumptions with respect to industry, business, economic and regulatory conditions, all of which are subject to changes. Throughout the valuation process, the valuation committee, our advisor and senior members of management reviewed, confirmed and approved the processes and methodologies and their consistency with real estate industry standards and best practices. |

For the nine months ended Sept. 30, 2016, approximately 96 percent of cash distributions were covered by operating cash flow and 4 percent were funded by other sources, which could include borrowings and/or proceeds from the Distribution Reinvestment Plan. The REIT’s distribution is subsidized by expense waivers that will be reimbursed to the advisor in the form of restricted stock. The REIT has experienced losses that are anticipated to be temporary and due to several properties under development. For the years ended Dec. 31, 2015, 2014 and 2013, approximately 45, 34 and 13 percent, respectively, of total distributions were covered by operating cash flow and approximately 55, 66 and 87 percent, respectively, were funded by offering proceeds. For the years ended Dec. 31, 2012 and 2011, the REIT’s first two years of operations, distributions were not covered by operating cash flow and were 100 percent funded by offering proceeds.

Cautionary Note Regarding Forward-Looking Statements

Forward-looking statements are based on current expectations and may be identified by words such as “believes,” “anticipates,” “expects,” “may,” “could” and terms of similar substance, and speak only as of the date made. Actual results could differ materially due to risks and uncertainties that are beyond the company’s ability to control or accurately predict, including the amount and timing of anticipated future distributions, estimated per share net asset value of the company’s stock and/or other matters. The company’s forward-looking statements are not guarantees of future performance. Shareholders and financial advisors should not place undue reliance on forward-looking statements.