Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-54685

CNL Healthcare Properties, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland |

|

27-2876363 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

CNL Center at City Commons |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (407) 650-1000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

|

Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of common stock of the registrant outstanding as of October 31, 2017 was 174,687,796.

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

INDEX

|

|

|

Page |

||

|

PART I. FINANCIAL INFORMATION |

|

|

||

|

|

|

|

||

|

Item 1. |

|

Condensed Consolidated Financial Information (unaudited): |

|

|

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

Condensed Consolidated Statements of Stockholders’ Equity and Redeemable Noncontrolling Interest |

|

5 |

|

|

|

|

6 |

|

|

|

|

|

7 |

|

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

24 |

|

Item 3. |

|

|

44 |

|

|

Item 4. |

|

|

45 |

|

|

|

|

|

||

|

|

|

|||

|

|

|

|

||

|

Item 1. |

|

|

45 |

|

|

Item 1A. |

|

|

45 |

|

|

Item 2. |

|

|

45 |

|

|

Item 3. |

|

|

47 |

|

|

Item 4. |

|

|

47 |

|

|

Item 5. |

|

|

47 |

|

|

Item 6. |

|

|

47 |

|

|

|

|

|

||

|

|

48 |

|||

|

|

49 |

|||

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands, except per share data)

|

|

|

September 30, |

|

|

December 31, |

|

||

|

ASSETS |

|

2017 |

|

|

2016 |

|

||

|

Real estate assets: |

|

|

|

|

|

|

|

|

|

Real estate investment properties, net (including VIEs $216,181 and $112,929, respectively) |

|

$ |

2,496,885 |

|

|

$ |

2,419,815 |

|

|

Real estate under development, including land (including VIEs $0 and $80,473, respectively) |

|

|

4,856 |

|

|

|

97,164 |

|

|

Total real estate assets, net |

|

|

2,501,741 |

|

|

|

2,516,979 |

|

|

Intangibles, net (including VIEs $2,129 and $2,891, respectively) |

|

|

106,752 |

|

|

|

130,609 |

|

|

Cash (including VIEs $2,660 and $916, respectively) |

|

|

72,470 |

|

|

|

58,517 |

|

|

Deferred rent and lease incentives (including VIEs $5,421 and $3,061, respectively) |

|

|

40,956 |

|

|

|

31,045 |

|

|

Other assets (including VIEs $2,547 and $1,130, respectively) |

|

|

23,633 |

|

|

|

24,470 |

|

|

Assets held for sale, net |

|

|

52,469 |

|

|

|

53,351 |

|

|

Restricted cash (including VIEs $56 and $20, respectively) |

|

|

9,493 |

|

|

|

12,721 |

|

|

Total assets |

|

$ |

2,807,514 |

|

|

$ |

2,827,692 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Mortgages and other notes payable, net (including VIEs $151,785 and $104,890, respectively) |

|

$ |

1,035,114 |

|

|

$ |

936,723 |

|

|

Credit facilities |

|

|

619,835 |

|

|

|

641,989 |

|

|

Accounts payable and accrued liabilities (including VIEs $3,946 and $16,830, respectively) |

|

|

48,408 |

|

|

|

51,752 |

|

|

Other liabilities (including VIEs $1,426 and $976, respectively) |

|

|

29,160 |

|

|

|

38,946 |

|

|

Due to related parties (including VIEs $113 and $107, respectively) |

|

|

4,090 |

|

|

|

3,465 |

|

|

Total liabilities |

|

|

1,736,607 |

|

|

|

1,672,875 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

399 |

|

|

|

472 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value per share, 200,000 shares authorized; none issued or outstanding |

|

― |

|

|

― |

|

||

|

Excess shares, $0.01 par value per share, 300,000 shares authorized; none issued or outstanding |

|

― |

|

|

― |

|

||

|

Common stock, $0.01 par value per share, 1,120,000 shares authorized, 183,374 and 180,188 shares issued, and 174,688 and 175,070 shares outstanding, respectively |

|

|

1,747 |

|

|

|

1,751 |

|

|

Capital in excess of par value |

|

|

1,524,804 |

|

|

|

1,528,435 |

|

|

Accumulated loss |

|

|

(209,208 |

) |

|

|

(182,813 |

) |

|

Accumulated distributions |

|

|

(243,954 |

) |

|

|

(186,551 |

) |

|

Accumulated other comprehensive loss |

|

|

(4,077 |

) |

|

|

(7,863 |

) |

|

Total stockholders' equity |

|

|

1,069,312 |

|

|

|

1,152,959 |

|

|

Noncontrolling interest |

|

|

1,196 |

|

|

|

1,386 |

|

|

Total equity |

|

|

1,070,907 |

|

|

|

1,154,817 |

|

|

Total liabilities and equity |

|

$ |

2,807,514 |

|

|

$ |

2,827,692 |

|

|

|

|

|

|

|

|

|

|

|

|

The abbreviation VIEs above means variable interest entities. |

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements

2

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except per share data)

|

|

|

Quarter Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income from operating leases |

|

$ |

32,039 |

|

|

$ |

31,047 |

|

|

$ |

97,382 |

|

|

$ |

92,742 |

|

|

Resident fees and services |

|

|

64,548 |

|

|

|

59,271 |

|

|

|

182,557 |

|

|

|

174,594 |

|

|

Other revenues |

|

|

5,100 |

|

|

|

5,193 |

|

|

|

15,226 |

|

|

|

15,176 |

|

|

Total revenues |

|

|

101,687 |

|

|

|

95,511 |

|

|

|

295,165 |

|

|

|

282,512 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses |

|

|

49,978 |

|

|

|

47,163 |

|

|

|

142,944 |

|

|

|

139,637 |

|

|

General and administrative |

|

|

3,529 |

|

|

|

2,705 |

|

|

|

9,811 |

|

|

|

9,653 |

|

|

Acquisition fees and expenses |

|

― |

|

|

|

126 |

|

|

― |

|

|

|

277 |

|

||

|

Asset management fees |

|

|

7,562 |

|

|

|

6,240 |

|

|

|

22,197 |

|

|

|

18,606 |

|

|

Property management fees |

|

|

4,832 |

|

|

|

4,800 |

|

|

|

14,110 |

|

|

|

13,965 |

|

|

Financing coordination fees |

|

|

2,748 |

|

|

― |

|

|

|

2,748 |

|

|

― |

|

||

|

Contingent purchase price consideration adjustments |

|

― |

|

|

|

528 |

|

|

|

77 |

|

|

|

(222 |

) |

|

|

Loss on lease terminations |

|

― |

|

|

― |

|

|

― |

|

|

|

785 |

|

|||

|

Depreciation and amortization |

|

|

26,768 |

|

|

|

30,289 |

|

|

|

81,054 |

|

|

|

94,428 |

|

|

Total operating expenses |

|

|

95,417 |

|

|

|

91,851 |

|

|

|

272,941 |

|

|

|

277,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

6,270 |

|

|

|

3,660 |

|

|

|

22,224 |

|

|

|

5,383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income (expense) |

|

|

(450 |

) |

|

|

9 |

|

|

|

(348 |

) |

|

|

54 |

|

|

Interest expense and loan cost amortization |

|

|

(17,059 |

) |

|

|

(15,820 |

) |

|

|

(48,453 |

) |

|

|

(43,857 |

) |

|

Equity in earnings of unconsolidated entity |

|

|

98 |

|

|

|

194 |

|

|

|

230 |

|

|

|

108 |

|

|

Total other expense |

|

|

(17,411 |

) |

|

|

(15,617 |

) |

|

|

(48,571 |

) |

|

|

(43,695 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

|

(11,141 |

) |

|

|

(11,957 |

) |

|

|

(26,347 |

) |

|

|

(38,312 |

) |

|

Income tax expense |

|

|

(90 |

) |

|

|

(66 |

) |

|

|

(344 |

) |

|

|

(241 |

) |

|

Net loss |

|

|

(11,231 |

) |

|

|

(12,023 |

) |

|

|

(26,691 |

) |

|

|

(38,553 |

) |

|

Less: Net loss attributable to noncontrolling interest |

|

|

(61 |

) |

|

|

(31 |

) |

|

|

(296 |

) |

|

|

(47 |

) |

|

Net loss attributable to common stockholders |

|

$ |

(11,170 |

) |

|

$ |

(11,992 |

) |

|

$ |

(26,395 |

) |

|

$ |

(38,506 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share of common stock (basic and diluted) |

|

$ |

(0.06 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.22 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares of common stock outstanding (basic and diluted) |

|

|

175,190 |

|

|

|

175,033 |

|

|

|

175,229 |

|

|

|

175,068 |

|

|

Distributions declared per share of common stock |

|

$ |

0.1164 |

|

|

$ |

0.1058 |

|

|

$ |

0.3280 |

|

|

$ |

0.3174 |

|

See accompanying notes to condensed consolidated financial statements.

3

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (UNAUDITED)

(in thousands)

|

|

|

Quarter Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Net loss |

|

$ |

(11,231 |

) |

|

$ |

(12,023 |

) |

|

$ |

(26,691 |

) |

|

$ |

(38,553 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on derivative financial instruments, net |

|

|

1,183 |

|

|

|

4,000 |

|

|

|

3,607 |

|

|

|

(5,914 |

) |

|

Reclassification of cash flow hedges upon derecognition |

|

|

132 |

|

|

|

― |

|

|

|

186 |

|

|

|

― |

|

|

Reclassification of cash flow hedges due to ineffectiveness |

|

|

(7 |

) |

|

|

(23 |

) |

|

|

(7 |

) |

|

|

(1 |

) |

|

Unrealized loss on derivative financial instruments of equity method investments |

|

|

― |

|

|

|

― |

|

|

|

― |

|

|

|

(1 |

) |

|

Total other comprehensive income (loss) |

|

|

1,308 |

|

|

|

3,977 |

|

|

|

3,786 |

|

|

|

(5,916 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss |

|

|

(9,923 |

) |

|

|

(8,046 |

) |

|

|

(22,905 |

) |

|

|

(44,469 |

) |

|

Less: Comprehensive loss attributable to noncontrolling interest |

|

|

(61 |

) |

|

|

(31 |

) |

|

|

(296 |

) |

|

|

(47 |

) |

|

Comprehensive loss attributable to common stockholders |

|

$ |

(9,862 |

) |

|

$ |

(8,015 |

) |

|

$ |

(22,609 |

) |

|

$ |

(44,422 |

) |

See accompanying notes to condensed consolidated financial statements.

4

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND REDEEMABLE NONCONTROLLING INTEREST

NINE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016 (UNAUDITED)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Redeemable |

|

|

Common Stock |

|

|

Capital in |

|

|

|

|

|

|

|

|

|

|

Other |

|

|

Total |

|

|

Non- |

|

|

|

|

|

||||||||||

|

|

|

Noncontrolling |

|

|

Number |

|

|

Par |

|

|

Excess of |

|

|

Accumulated |

|

|

Accumulated |

|

|

Comprehensive |

|

|

Stockholders' |

|

|

controlling |

|

|

Total |

|

||||||||||

|

|

|

Interest |

|

|

of Shares |

|

|

Value |

|

|

Par Value |

|

|

Loss |

|

|

Distributions |

|

|

Income (Loss) |

|

|

Equity |

|

|

Interest |

|

|

Equity |

|

||||||||||

|

Balance at December 31, 2016 |

|

$ |

472 |

|

|

|

175,070 |

|

|

$ |

1,751 |

|

|

|

1,528,435 |

|

|

$ |

(182,813 |

) |

|

$ |

(186,551 |

) |

|

$ |

(7,863 |

) |

|

$ |

1,152,959 |

|

|

$ |

1,386 |

|

|

$ |

1,154,817 |

|

|

Subscriptions received for common stock through reinvestment plan |

|

― |

|

|

|

3,186 |

|

|

|

32 |

|

|

|

31,957 |

|

|

― |

|

|

― |

|

|

― |

|

|

|

31,989 |

|

|

― |

|

|

|

31,989 |

|

|||||

|

Redemptions of common stock |

|

― |

|

|

|

(3,568 |

) |

|

|

(36 |

) |

|

|

(35,588 |

) |

|

― |

|

|

― |

|

|

― |

|

|

|

(35,624 |

) |

|

― |

|

|

|

(35,624 |

) |

|||||

|

Net loss |

|

|

(73 |

) |

|

― |

|

|

― |

|

|

― |

|

|

|

(26,395 |

) |

|

― |

|

|

― |

|

|

|

(26,395 |

) |

|

|

(223 |

) |

|

|

(26,691 |

) |

|||||

|

Other comprehensive income |

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

3,786 |

|

|

|

3,786 |

|

|

― |

|

|

|

3,786 |

|

|||||||

|

Distribution to holder of noncontrolling interest |

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(27 |

) |

|

|

(27 |

) |

||||||||

|

Cash distributions declared ($0.3280 per share) |

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(57,403 |

) |

|

― |

|

|

|

(57,403 |

) |

|

― |

|

|

|

(57,403 |

) |

|||||||

|

Contribution from noncontrolling interests |

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

60 |

|

|

|

60 |

|

||||||||

|

Balance at September 30, 2017 |

|

$ |

399 |

|

|

|

174,688 |

|

|

$ |

1,747 |

|

|

$ |

1,524,804 |

|

|

$ |

(209,208 |

) |

|

$ |

(243,954 |

) |

|

$ |

(4,077 |

) |

|

$ |

1,069,312 |

|

|

$ |

1,196 |

|

|

$ |

1,070,907 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2015 |

|

$ |

551 |

|

|

|

174,430 |

|

|

$ |

1,744 |

|

|

$ |

1,528,781 |

|

|

$ |

(151,146 |

) |

|

$ |

(112,543 |

) |

|

$ |

(9,747 |

) |

|

$ |

1,257,089 |

|

|

$ |

1,462 |

|

|

$ |

1,259,102 |

|

|

Subscriptions received for common stock through reinvestment plan |

|

― |

|

|

|

3,281 |

|

|

|

33 |

|

|

|

31,957 |

|

|

― |

|

|

― |

|

|

― |

|

|

|

31,990 |

|

|

― |

|

|

|

31,990 |

|

|||||

|

Redemptions of common stock |

|

― |

|

|

|

(2,656 |

) |

|

|

(26 |

) |

|

|

(25,819 |

) |

|

― |

|

|

― |

|

|

― |

|

|

|

(25,845 |

) |

|

― |

|

|

|

(25,845 |

) |

|||||

|

Net income (loss) |

|

|

(52 |

) |

|

― |

|

|

― |

|

|

― |

|

|

|

(38,506 |

) |

|

― |

|

|

― |

|

|

|

(38,506 |

) |

|

|

5 |

|

|

|

(38,553 |

) |

|||||

|

Other comprehensive loss |

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(5,916 |

) |

|

|

(5,916 |

) |

|

― |

|

|

|

(5,916 |

) |

|||||||

|

Distribution to holder of noncontrolling interest |

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(29 |

) |

|

|

(29 |

) |

||||||||

|

Distributions to holders of promoted interest |

|

― |

|

|

― |

|

|

― |

|

|

|

(6,650 |

) |

|

― |

|

|

― |

|

|

― |

|

|

|

(6,650 |

) |

|

― |

|

|

|

(6,650 |

) |

|||||||

|

Cash distributions declared ($0.3174 per share) |

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

― |

|

|

|

(55,488 |

) |

|

― |

|

|

|

(55,488 |

) |

|

― |

|

|

|

(55,488 |

) |

|||||||

|

Balance at September 30, 2016 |

|

$ |

499 |

|

|

|

175,055 |

|

|

$ |

1,751 |

|

|

$ |

1,528,269 |

|

|

$ |

(189,652 |

) |

|

$ |

(168,031 |

) |

|

$ |

(15,663 |

) |

|

$ |

1,156,674 |

|

|

$ |

1,438 |

|

|

$ |

1,158,611 |

|

See accompanying notes to condensed consolidated financial statements.

5

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in thousands)

|

|

|

Nine Months Ended |

|

|||||

|

|

|

September 30, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

Operating activities: |

|

|

|

|

|

|

|

|

|

Net cash flows provided by operating activities |

|

$ |

56,942 |

|

|

$ |

58,111 |

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

Acquisition of unimproved land |

|

|

(1,050 |

) |

|

― |

|

|

|

Development of properties |

|

|

(46,254 |

) |

|

|

(60,820 |

) |

|

Issuance of note receivable |

|

|

(443 |

) |

|

― |

|

|

|

Capital expenditures |

|

|

(7,789 |

) |

|

|

(5,825 |

) |

|

Payment of leasing costs |

|

|

(1,121 |

) |

|

|

(2,423 |

) |

|

Collection of contingent purchase price consideration |

|

|

407 |

|

|

― |

|

|

|

Deposits on real estate |

|

― |

|

|

|

275 |

|

|

|

Net cash used in investing activities |

|

|

(56,250 |

) |

|

|

(68,793 |

) |

|

|

|

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

Payment of stock issuance and offering costs |

|

― |

|

|

|

(32 |

) |

|

|

Distributions to stockholders, net of distribution reinvestments |

|

|

(25,415 |

) |

|

|

(23,498 |

) |

|

Distributions to holders of promoted interest |

|

|

(2,000 |

) |

|

|

(4,650 |

) |

|

Contributions from noncontrolling interest |

|

|

60 |

|

|

― |

|

|

|

Distributions to holder of noncontrolling interest |

|

|

(27 |

) |

|

|

(29 |

) |

|

Redemptions of common stock |

|

|

(31,984 |

) |

|

|

(20,298 |

) |

|

Draws under credit facilities |

|

|

42,000 |

|

|

|

80,113 |

|

|

Repayments on credit facilities |

|

|

(64,863 |

) |

|

|

(90,250 |

) |

|

Proceeds from mortgage and other notes payable |

|

|

164,548 |

|

|

|

111,309 |

|

|

Principal payments on mortgage and other notes payable |

|

|

(66,098 |

) |

|

|

(48,947 |

) |

|

Payment of contingent purchase price consideration |

|

|

(3,645 |

) |

|

|

(2,770 |

) |

|

Purchase of interest rate cap |

|

|

(59 |

) |

|

|

(587 |

) |

|

Lender deposits |

|

― |

|

|

|

(15 |

) |

|

|

Payment of loan costs |

|

|

(2,484 |

) |

|

|

(1,615 |

) |

|

Payment on extinguishment of debt |

|

― |

|

|

|

(1,127 |

) |

|

|

Net cash flows provided by (used in) financing activities |

|

|

10,033 |

|

|

|

(2,396 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and restricted cash |

|

|

10,725 |

|

|

|

(13,078 |

) |

|

Cash and restricted cash at beginning of period |

|

|

71,238 |

|

|

|

79,209 |

|

|

Cash and restricted cash at end of period |

|

$ |

81,963 |

|

|

$ |

66,131 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

Amounts incurred but not paid (including amounts due to related parties): |

|

|

|

|

|

|

|

|

|

Accrued development costs |

|

$ |

648 |

|

|

$ |

21,336 |

|

|

Redemptions payable |

|

$ |

14,037 |

|

|

$ |

8,285 |

|

|

Contingent purchase price consideration |

|

$ |

1,000 |

|

|

$ |

4,867 |

|

|

Distribution to holder of promoted interest |

|

$ |

— |

|

|

$ |

2,000 |

|

See accompanying notes to condensed consolidated financial statements.

6

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

1. |

Organization |

CNL Healthcare Properties, Inc. (“Company”) was incorporated on June 8, 2010 and elected to be taxed as a real estate investment trust (“REIT”) for United States (“U.S.”) federal income tax purposes beginning with the year ended December 31, 2012. The Company is externally advised by CNL Healthcare Corp. (“Advisor”) and its property manager is CNL Healthcare Manager Corp. (“Property Manager”), each of which is an affiliate of CNL Financial Group, LLC (“Sponsor”). The Sponsor is an affiliate of CNL Financial Group, Inc. (“CNL”) and CNL Securities Corp. (“Managing Dealer”), the managing dealer of the Company’s public offerings (“Offerings”). The Advisor is responsible for managing the Company’s affairs on a day-to-day basis and for identifying and making acquisitions and investments on behalf of the Company pursuant to an advisory agreement among the Company, the CHP Partners, LP (“Operating Partnership”) and the Advisor. Substantially all of the Company’s acquisition, operating, administrative and certain property management services are provided by affiliates of the Advisor and the Property Manager. In addition, third-party sub-property managers have been engaged to provide certain property management services.

The Company contributed the net proceeds from its Offerings to the Operating Partnership in exchange for partnership interests. The Company conducts substantially all of its operations either directly or indirectly through: (1) an operating partnership, CHP Partners, LP, in which the Company is the sole limited partner and its wholly owned subsidiary, CHP GP, LLC, is the sole general partner; (2) a wholly-owned taxable REIT subsidiary (“TRS”), CHP TRS Holding, Inc.; (3) property owner and lender subsidiaries, which are single purpose entities; and (4) investments in joint ventures.

On September 30, 2015, the Company completed its Offerings pursuant to a registration statement on Form S-11 under the Securities Act of 1933 with the Securities and Exchange Commission (“SEC”). In October 2015, the Company deregistered the unsold shares of its common stock under its previous registration statement on Form S-11, except for 20,000,000 shares that the Company concurrently registered on Form S-3 under the Securities Exchange Act of 1933 with the SEC for the sale of additional shares of common stock through its distribution reinvestment plan (“Reinvestment Plan”).

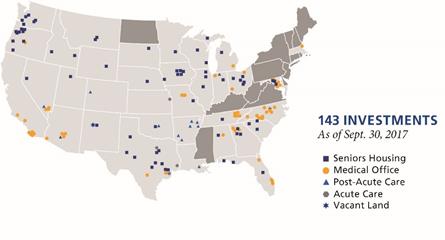

With the completion of the Offerings and substantial completion of its acquisition phase, the Company’s focus is on actively managing a diversified portfolio of healthcare real estate and real estate-related assets within the seniors housing, medical office, post-acute care and acute care asset classes. The types of seniors housing that the Company has acquired include independent and assisted living facilities, continuing care retirement communities, and Alzheimer’s / memory care facilities. The types of medical offices that the Company has acquired include medical office buildings (“MOBs”), specialty medical and diagnostic service facilities, surgery centers, outpatient rehabilitation facilities, and other facilities designed for clinical services. The types of post-acute care facilities that the Company has acquired include skilled nursing facilities and inpatient rehabilitative hospitals. The types of acute care facilities that the Company has acquired include specialty surgical hospitals. The Company views, manages and evaluates its portfolio homogeneously as one collection of healthcare assets with a common goal of maximizing revenues and property income regardless of the asset class or asset type.

The Company has primarily leased its seniors housing properties to wholly owned TRS entities and engaged independent third-party managers under management agreements to operate the properties under the REIT Investment Diversification and Empowerment Act of 2007 (“RIDEA”) structures; however, the Company has also leased its properties to third-party tenants under triple-net or similar lease structures, where the tenant bears all or substantially all of the costs (including cost increases for real estate taxes, utilities, insurance and ordinary repairs). Medical office, post-acute care and acute care properties have been leased on a triple-net, net or modified gross basis to third-party tenants. In addition, most of the Company’s investments have been wholly owned, although, it has invested through partnerships with other entities where it is believed to be appropriate and beneficial. The Company has and continues to invest in existing property developments or properties that have not reached full stabilization.

7

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

2. |

Summary of Significant Accounting Policies |

Basis of Presentation and Consolidation — The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all of the information and note disclosures required by generally accepted accounting principles in the United States (“GAAP”). The unaudited condensed consolidated financial statements reflect all normal recurring adjustments, which, in the opinion of management, are necessary for the fair statement of the Company’s results for the interim period presented. Operating results for the quarter and nine months ended September 30, 2017 may not be indicative of the results that may be expected for the year ending December 31, 2017. Amounts as of December 31, 2016 included in the unaudited condensed consolidated financial statements have been derived from audited consolidated financial statements as of that date but do not include all disclosures required by GAAP. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 (“Annual Report”).

The accompanying unaudited condensed consolidated financial statements include the Company’s accounts, the accounts of wholly owned subsidiaries or subsidiaries for which the Company has a controlling interest, the accounts of variable interest entities (“VIEs”) in which the Company is the primary beneficiary and the accounts of other subsidiaries over which the Company has a controlling financial interest. All material intercompany accounts and transactions have been eliminated in consolidation.

In accordance with the guidance for the consolidation of VIEs, the Company analyzes its variable interests, including loans, leases, guarantees, and equity investments, to determine if the entity in which it has a variable interest is a VIE. The Company’s analysis includes both quantitative and qualitative reviews. The Company bases its quantitative analysis on the forecasted cash flows of the entity, and its qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and financial agreements. The Company also uses its quantitative and qualitative analyses to determine if it is the primary beneficiary of the VIE, and if such determination is made, it includes the accounts of the VIE in its consolidated financial statements.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the consolidated financial statements, the reported amounts of revenues and expenses during the reporting periods and the disclosure of contingent liabilities. For example, significant assumptions are made in the allocation of purchase price, the analysis of real estate impairments, the valuation of contingent assets and liabilities, and the valuation of restricted stock shares issued to the Advisor or Property Manager. Accordingly, actual results could differ from those estimates.

Adopted Accounting Pronouncements — In August 2016, the Financial Accounting Standards Board (“FASB”) issued ASU 2016-15, “Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments,” which made eight targeted changes to how cash receipts and cash payments are presented and classified in the statement of cash flows. The ASU further clarified how the predominance principle should be applied to cash receipts and payments relating to more than one class of cash flows. The ASU is effective for annual reporting periods, and interim periods within those annual periods, beginning after December 15, 2017. The ASU is to be applied retrospectively for each period presented. Subsequently, in November 2016, the FASB issued ASU 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash,” which modifies the presentation of the statement of cash flows and requires reconciliation to the overall change in the total of cash, cash equivalents, restricted cash and restricted cash equivalents. As a result, the statement of cash flows will no longer present transfers between cash and cash equivalents and restricted cash and restricted cash equivalents. The ASU is effective for annual reporting periods, and interim periods within those annual periods, beginning after December 15, 2017. The ASU is to be applied retrospectively for each period presented.

8

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

2. |

Summary of Significant Accounting Policies (continued) |

The Company early adopted both ASU 2016-15 and ASU 2016-18 on January 1, 2017; the adoption of which impacted the Company’s presentation of its statement of cash flows, but did not have a material impact on the Company’s consolidated balance sheet or consolidated results of operations. Accordingly, the Company has retrospectively adjusted the presentation of its consolidated statement of cash flows for all periods presented. The following table provides additional details by financial statement line item of the adjusted presentation in the Company’s condensed consolidated statement of cash flows for the nine months ended September 30, 2016 (in thousands):

|

|

|

As Filed |

|

|

|

|

|

|

Adjusted |

|

||

|

|

|

September 30, |

|

|

|

|

|

|

September 30, |

|

||

|

|

|

2016 |

|

|

Adjustments |

|

|

2016 |

|

|||

|

Operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on extinguishment of debt |

|

$ |

368 |

|

|

$ |

1,127 |

|

|

$ |

1,495 |

|

|

Net cash provided by operating activities |

|

$ |

56,984 |

|

|

$ |

1,127 |

|

|

$ |

58,111 |

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in restricted cash |

|

$ |

(1,225 |

) |

|

$ |

1,225 |

|

|

$ |

— |

|

|

Net cash used in investing activities |

|

$ |

(70,018 |

) |

|

$ |

1,225 |

|

|

$ |

(68,793 |

) |

|

Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment on extinguishment of debt |

|

$ |

— |

|

|

$ |

(1,127 |

) |

|

$ |

(1,127 |

) |

|

Net cash used in financing activities |

|

$ |

(1,269 |

) |

|

$ |

(1,127 |

) |

|

$ |

(2,396 |

) |

|

Net decrease in cash and restricted cash |

|

$ |

(14,303 |

) |

|

$ |

1,225 |

|

|

$ |

(13,078 |

) |

|

Cash and restricted cash at beginning of period |

|

|

68,922 |

|

|

|

10,287 |

|

|

|

79,209 |

|

|

Cash and restricted cash at end of period |

|

$ |

54,619 |

|

|

$ |

11,512 |

|

|

$ |

66,131 |

|

In October 2016, the FASB issued ASU 2016-17, “Consolidation (Topic 810): Interests Held Through Related Parties that are under Common Control,” which requires an entity to consider its indirect interests held by related parties that are under common control on a proportionate basis when evaluating whether the entity is a primary beneficiary of a VIE. The ASU is effective for annual reporting periods, and interim periods within those annual periods, beginning after December 15, 2016. The Company has adopted ASU 2016-17 on January 1, 2017; the adoption of which did not have a material impact to its consolidated financial position, results of operations or cash flows.

In January 2017, the FASB issued ASU 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a Business,” which clarifies the definition of a business and provides a framework by which to evaluate whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The ASU is effective for annual reporting periods, and interim periods within those annual periods, beginning after December 15, 2017. The ASU is to be applied prospectively for each period presented. The Company early adopted ASU 2017-01 on January 1, 2017; the adoption of which did not have a material impact to its consolidated financial position, results of operations or cash flows.

Recent Accounting Pronouncements — In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers,” as a new ASC topic (Topic 606). The core principle of this ASU is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The ASU further provides guidance for any entity that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets, unless those contracts are within the scope of other standards (for example, lease contracts). The FASB subsequently issued ASU 2015-14 to defer the effective date of ASU 2014-09 until annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period, with earlier adoption permitted.

9

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

2. |

Summary of Significant Accounting Policies (continued) |

In addition, in December 2016, the FASB issued ASU 2016-20, which provides technical corrections and improvements to ASC 606 based on questions that stakeholders have raised while working through the implementation. ASC 606 can be adopted using one of two retrospective transition methods: (i) retrospectively to each prior reporting period presented or (ii) as a cumulative-effect adjustment as of the date of adoption. The Company continues to execute on its implementation plan for ASC 606; specifically, as it relates to the allocation of consideration to different revenue streams within a given contract and the impact adoption of ASC 606 could have on the Company’s financial statement disclosures. The Company expects to use the modified retrospective approach as its transition method once it adopts this ASU and the Company expects the adoption of this ASU will not have a material impact on the amount or timing of its revenue recognition.

In February 2016, the FASB issued ASU 2016-02, “Leases (Topic 842): Accounting for Leases,” which sets out the principles for the recognition, measurement, presentation and disclosure of leases for both parties to a contract (i.e. lessees and lessors). The ASU requires lessees to recognize assets and liabilities on the balance sheet for the rights and obligations created by all leases with terms of more than 12 months. The ASU further modifies lessors’ classification criteria for leases and the accounting for sales-type and direct financing leases. The ASU will also require qualitative and quantitative disclosures designed to give financial statement users additional information on the amount, timing, and uncertainty of cash flows arising from leases. The ASU is effective for annual reporting periods, and interim periods within those annual periods, beginning after December 15, 2018 with early adoption permitted. The ASU is to be applied using a modified retrospective approach. The Company continues to execute on its implementation plan for ASC 842 and expects to adopt this ASU on January 1, 2019. The Company expects that adoption will impact the Company’s consolidated financial statements and related financial statement disclosures; specifically, (1) the Company’s consolidated financial position as it relates to the required presentation for arrangements such as ground and air rights leases in which the Company is the lessee, and (2) the allocation of consideration between lease and non-lease components for arrangements in which the Company is the lessor. However, the Company does not expect the adoption of this ASU to have a material impact on the Company’s consolidated results of operations or cash flows.

In August 2017, the FASB issued ASU 2017-12 “Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities,” which amended the hedge accounting model to better reflect an entity’s risk management activities. The ASU expands an entities ability to hedge nonfinancial and financial risk components as well as reduce the complexity related to fair value hedges of interest rate risk. The ASU further eliminates the requirement to separately measure and report hedge ineffectiveness and generally requires the entire change in the fair value of a hedging instrument to be presented in the same income statement line as the hedged item. The ASU is effective for annual reporting periods, and interim periods within those annual periods, beginning after December 15, 2018. The Company expects to early adopt this ASU on January 1, 2018 and does not expect the adoption of this ASU to have a material impact on the Company’s consolidated results of operations or cash flows.

10

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

3. |

Real Estate Assets, net |

The gross carrying amount and accumulated depreciation of the Company’s real estate assets as of September 30, 2017 and December 31, 2016 are as follows (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2017 |

|

|

2016 |

|

||

|

Land and land improvements |

|

$ |

251,659 |

|

|

$ |

235,543 |

|

|

Building and building improvements |

|

|

2,409,656 |

|

|

|

2,306,071 |

|

|

Furniture, fixtures and equipment |

|

|

79,933 |

|

|

|

64,939 |

|

|

Less: accumulated depreciation |

|

|

(244,363 |

) |

|

|

(186,738 |

) |

|

Real estate investment properties, net |

|

|

2,496,885 |

|

|

|

2,419,815 |

|

|

Real estate under development, including land |

|

|

4,856 |

|

|

|

97,164 |

|

|

Total real estate assets, net |

|

$ |

2,501,741 |

|

|

$ |

2,516,979 |

|

Depreciation expense on the Company’s real estate investment properties, net was approximately $19.8 million and $58.6 million for the quarter and nine months ended September 30, 2017, respectively, and approximately $20.2 million and $60.1 million for the quarter and nine months ended September 30, 2016.

The following development properties and expansion projects were completed during the nine months ended September 30, 2017 and as such the related asset values are included in real estate investment properties, net in the accompanying condensed consolidated balance sheet as of September 30, 2017:

|

Property Name |

|

Location |

|

Substantial Completion Date |

|

|

|

Development Properties |

|

|

|

|

|

|

|

Welbrook Transitional Care Grand Junction |

|

Grand Junction, CO |

|

|

March 2017 |

|

|

Waterstone on Augusta |

|

Greenville, SC |

|

|

March 2017 |

|

|

Wellmore of Lexington |

|

Lexington, SC |

|

|

June 2017 |

|

|

Dogwood Forest of Grayson |

|

Grayson, GA |

|

|

June 2017 |

|

|

|

|

|

|

|

|

|

|

Expansion Projects |

|

|

|

|

|

|

|

Brookridge Heights Assisted Living & Memory Care |

|

Marquette, MI |

|

|

June 2017 |

|

As of September 30, 2017, one of the Company’s seniors housing communities has a real estate expansion project with a third-party developer as follows (in thousands):

|

Property Name (and Location) |

|

Developer |

|

Real Estate Development Costs Incurred (1) |

|

Remaining Development Budget (2) |

|

||

|

Tranquillity at Fredericktowne (Frederick, MD) |

|

Capital Health Partners |

|

$ |

4,856 |

|

$ |

2,029 |

|

_____________

FOOTNOTES:

|

(1) |

This amount represents total capitalized costs for GAAP purposes for the development and construction of the seniors housing community as of September 30, 2017. Amounts include investment services fees, asset management fees, interest expense and other costs capitalized during the development period. |

|

(2) |

This amount includes preleasing and marketing costs, which will be expensed as incurred. |

The development budgets generally include the cost of the land, construction costs, development fees, financing costs, start-up costs and initial operating deficits of the respective properties. Generally, the Company has delegated to an affiliate of the developer of the respective community the management and administration of the development and construction. In most cases, the developer is generally responsible for cost overruns beyond the approved development budget for the applicable project pursuant to a cost overrun guarantee.

11

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

4. |

Intangibles, net |

The gross carrying amount and accumulated amortization of the Company’s intangible assets and liabilities as of September 30, 2017 and December 31, 2016 are as follows (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2017 |

|

|

2016 |

|

||

|

In-place lease intangibles |

|

$ |

223,854 |

|

|

$ |

223,854 |

|

|

Above-market lease intangibles |

|

|

13,974 |

|

|

|

13,974 |

|

|

Below-market ground lease intangibles |

|

|

12,470 |

|

|

|

12,470 |

|

|

Less: accumulated amortization |

|

|

(143,546 |

) |

|

|

(119,689 |

) |

|

Intangible assets, net |

|

$ |

106,752 |

|

|

$ |

130,609 |

|

|

|

|

|

|

|

|

|

|

|

|

Below-market lease intangibles |

|

$ |

(12,060 |

) |

|

$ |

(12,060 |

) |

|

Above-market ground lease intangibles |

|

|

(3,488 |

) |

|

|

(3,488 |

) |

|

Less: accumulated amortization |

|

|

5,362 |

|

|

|

4,247 |

|

|

Intangible liabilities, net (1) |

|

$ |

(10,186 |

) |

|

$ |

(11,301 |

) |

____________

FOOTNOTE:

|

(1) |

Intangible liabilities, net are included in other liabilities in the accompanying condensed consolidated balance sheets. |

Amortization on the Company’s intangible assets was approximately $7.4 million and $24.0 million for the quarter and nine months ended September 30, 2017, of which approximately $0.4 million and $1.3 million, respectively, were treated as a reduction of rental income from operating leases, approximately $0.1 million and $0.2 million, respectively, were treated as an increase of property operating expenses and approximately $6.9 million and $22.4 million, respectively, were included in depreciation and amortization. Amortization on the Company’s intangible assets was approximately $10.7 million and $36.0 million for the quarter and nine months ended September 30, 2016, of which approximately $0.5 million and $1.5 million, respectively, were treated as a reduction of rental income from operating leases, approximately $0.1 million and $0.2 million, respectively, were treated as an increase of property operating expenses and approximately $10.1 million and $34.3 million, respectively, were included in depreciation and amortization.

Amortization on the Company’s intangible liabilities was approximately $0.4 million and $1.1 million for the quarter and nine months ended September 30, 2017, of which approximately $0.3 million and $1.0 million, respectively, were treated as an increase of rental income from operating leases and approximately $0.02 million and $0.07 million, respectively, were treated as a reduction of property operating expenses. For the quarter and nine months ended September 30, 2016, amortization on the Company’s intangible liabilities was approximately $0.4 million and $1.3 million, of which approximately $0.4 million and $1.2 million, respectively, were treated as an increase of rental income from operating leases and approximately $0.02 million and $0.07 million were treated as a reduction of property operating expenses.

12

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

5. |

Variable Interest Entities |

The aggregate carrying amount and major classifications of the consolidated assets that can be used to settle obligations of the VIEs and liabilities of the consolidated VIEs that are non-recourse to the Company as of September 30, 2017 and December 31, 2016 are as follows (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

|||

|

|

|

2017 |

|

|

2016 |

|

|||

|

Assets: |

|

|

|

|

|

|

|

|

|

|

Real estate investment properties, net |

|

$ |

216,181 |

|

|

$ |

112,929 |

|

|

|

Real estate under development, including land |

|

$ |

― |

|

|

$ |

80,473 |

|

|

|

Intangibles, net |

|

$ |

2,129 |

|

|

$ |

2,891 |

|

|

|

Cash |

|

$ |

2,660 |

|

|

$ |

916 |

|

|

|

Deferred rent and lease incentives |

|

$ |

5,421 |

|

|

$ |

3,061 |

|

|

|

Other assets |

|

$ |

2,547 |

|

|

$ |

1,130 |

|

|

|

Restricted cash |

|

$ |

56 |

|

|

$ |

20 |

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

Mortgages and other notes payable, net |

|

$ |

151,785 |

|

|

$ |

104,890 |

|

|

|

Accounts payable and accrued liabilities |

|

$ |

3,197 |

|

|

$ |

1,461 |

|

|

|

Accrued development costs |

|

$ |

749 |

|

|

$ |

15,369 |

|

|

|

Other liabilities |

|

$ |

1,426 |

|

|

$ |

976 |

|

|

|

Due to related parties |

|

$ |

113 |

|

|

$ |

107 |

|

|

The Company’s maximum exposure to loss as a result of its involvement with these VIEs is limited to its net investment in these entities which totaled approximately $70.0 million as of September 30, 2017. The Company’s exposure is limited because of the non-recourse nature of the borrowings of the VIEs.

As of September 30, 2017 and December 31, 2016, the Company had 10 subsidiaries which are classified as VIEs due to the following factors and circumstances:

|

• |

Three of these subsidiaries are single property entities, designed to own and lease their respective properties to multiple tenants, which are subject to either a ground lease or an air rights lease that include buy-out and put options held by either the tenant or landlord under the applicable lease. |

|

• |

Four of these subsidiaries are entities with completed developments in which there is insufficient equity at risk due to the development nature of each entity. |

|

• |

Two of these subsidiaries are joint ventures with recently completed real estate under development in which there is insufficient equity at risk due to the development nature of each joint venture. |

|

• |

One of these subsidiaries is a joint venture with equity interest that consists of non-substantive protective voting rights, but not any participating or kick-out rights. |

The Company determined it is the primary beneficiary and holds a controlling financial interest in each of the aforementioned property and development entities due to its power to direct the activities that most significantly impact the economic performance of the entities, as well as its obligation to absorb the losses and its right to receive benefits from these entities that could potentially be significant to these entities. As such, the transactions and accounts of these VIEs are included in the accompanying condensed consolidated financial statements.

13

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

6. |

Contingent Purchase Price Consideration |

The following table provides a roll-forward of the fair value of the Company’s aggregate contingent purchase price consideration for the quarter and nine months ended September 30, 2017 and 2016 (in thousands):

|

|

|

Quarter Ended September 30, 2017 |

|

|||||||||||||

|

Property |

|

Beginning asset (liability) as of June 30, 2017 |

|

|

Contingent Consideration Payment |

|

|

Change in Fair Value |

|

|

Ending asset (liability) as of September 30, 2017 |

|

||||

|

Superior Residences of Panama City |

|

$ |

(2,000 |

) |

|

$ |

1,000 |

|

|

$ |

— |

|

|

$ |

(1,000 |

) |

|

Center One |

|

|

798 |

|

|

|

(203 |

) |

|

― |

|

|

|

595 |

|

|

|

|

|

$ |

(1,202 |

) |

|

$ |

797 |

|

|

$ |

— |

|

|

$ |

(405 |

) |

|

|

|

Quarter Ended September 30, 2016 |

|

|||||||||||||

|

Property |

|

Beginning asset (liability) as of June 30, 2016 |

|

|

Contingent Consideration Payment |

|

|

Change in Fair Value |

|

|

Ending asset (liability) as of September 30, 2016 |

|

||||

|

Superior Residences of Panama City |

|

$ |

(3,000 |

) |

|

$ |

— |

|

|

$ |

(1,000 |

) |

|

$ |

(4,000 |

) |

|

Siena Pavilion VI |

|

|

(3,750 |

) |

|

|

2,770 |

|

|

|

113 |

|

|

|

(867 |

) |

|

Center One |

|

|

843 |

|

|

|

(99 |

) |

|

|

359 |

|

|

|

1,103 |

|

|

|

|

$ |

(5,907 |

) |

|

$ |

2,671 |

|

|

$ |

(528 |

) |

|

$ |

(3,764 |

) |

|

|

|

Nine Months Ended September 30, 2017 |

|

|||||||||||||

|

Property |

|

Beginning asset (liability) as of December 31, 2016 |

|

|

Contingent Consideration Payment |

|

|

Change in Fair Value |

|

|

Ending asset (liability) as of September 30, 2017 |

|

||||

|

Superior Residences of Panama City |

|

$ |

(4,000 |

) |

|

$ |

3,000 |

|

|

$ |

— |

|

|

$ |

(1,000 |

) |

|

Siena Pavilion VI |

|

|

(645 |

) |

|

|

645 |

|

|

― |

|

|

― |

|

||

|

Center One |

|

|

1,079 |

|

|

|

(407 |

) |

|

|

(77 |

) |

|

|

595 |

|

|

|

|

$ |

(3,566 |

) |

|

$ |

3,238 |

|

|

$ |

(77 |

) |

|

$ |

(405 |

) |

|

|

|

Nine Months Ended September 30, 2016 |

|

|||||||||||||

|

Property |

|

Beginning asset (liability) as of December 31, 2015 |

|

|

Contingent Consideration Payment |

|

|

Change in Fair Value |

|

|

Ending asset (liability) as of September 30, 2016 |

|

||||

|

Superior Residences of Panama City |

|

$ |

(3,000 |

) |

|

$ |

— |

|

|

$ |

(1,000 |

) |

|

$ |

(4,000 |

) |

|

The Shores of Lake Phalen |

|

|

(750 |

) |

|

― |

|

|

|

750 |

|

|

― |

|

||

|

Siena Pavilion VI |

|

|

(3,750 |

) |

|

|

2,770 |

|

|

|

113 |

|

|

|

(867 |

) |

|

Center One |

|

|

1,019 |

|

|

|

(275 |

) |

|

|

359 |

|

|

|

1,103 |

|

|

|

|

$ |

(6,481 |

) |

|

$ |

2,495 |

|

|

$ |

222 |

|

|

$ |

(3,764 |

) |

The fair value of the contingent purchase price consideration is based on a then-current income approach that is primarily determined based on the present value and probability of future cash flows using internal underwriting models. The income approach further includes estimates of risk-adjusted rate of return, capitalization rates for the respective property and/or lease-up assumptions. Since these estimates include inputs that are less observable by the public and are not necessarily reflected in active markets, the measurements of the estimated fair value related to the Company’s contingent purchase price consideration are categorized as Level 3 on the three-level fair value hierarchy. There were no transfers into and out of fair value measurement levels during the quarter and nine months ended September 30, 2017.

14

CNL HEALTHCARE PROPERTIES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS ENDED SEPTEMBER 30, 2017 (UNAUDITED)

|

7. |

Indebtedness |

The following table provides details of the Company’s indebtedness as of September 30, 2017 and December 31, 2016 (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2017 |

|

|

2016 |

|

||

|

Mortgages payable and other notes payable: |

|

|

|

|

|

|

|

|

|

Fixed rate debt |

|

$ |

412,159 |

|

|

$ |

382,129 |

|

|

Variable rate debt (1)(5) |

|

|

630,294 |

|

|

|

561,874 |

|

|

Mortgages and other notes payable (2) |

|

|

1,042,453 |

|

|

|

944,003 |

|

|

Premium (discount), net (3) |

|

|

109 |

|

|

|

(67 |

) |

|

Loan costs, net |

|

|

(7,448 |

) |

|

|

(7,213 |

) |

|

Total mortgages and other notes payable, net |

|

|

1,035,114 |

|

|

|

936,723 |

|

|

Credit facilities: |

|

|

|

|

|

|

|

|

|

Revolving Credit Facility (4) (5) |

|

|

172,000 |

|

|

|

194,863 |

|

|

First Term Loan Facility (1) |

|

|

175,000 |

|

|

|

175,000 |

|

|

Second Term Loan Facility (5) |

|

|

275,000 |

|

|

|

275,000 |

|

|

Loan costs, net related to Term Loan Facilities |

|

|

(2,165 |

) |

|

|

(2,874 |

) |

|

Total credit facilities, net |

|

|

619,835 |

|

|

|

641,989 |

|

|

Total indebtedness, net |

|

$ |

1,654,949 |

|

|

$ |

1,578,712 |

|

_____________

FOOTNOTES:

|

(1) |

As of September 30, 2017 and December 31, 2016, the Company had entered into interest rate swaps with notional amounts of approximately $515.3 million and $521.5 million, respectively, which settle on a monthly basis. Refer to Note 9. “Derivative Financial Instruments” for additional information. |

|

(2) |

As of September 30, 2017 and December 31, 2016, the Company’s mortgages and other notes payable are collateralized by 76 and 75 properties, respectively, with total carrying value of approximately $1.6 billion and $1.6 billion, respectively. |

|

(3) |