Attached files

| file | filename |

|---|---|

| 8-K - 8-K - R1 RCM INC. | a1-108xk.htm |

35th Annual J.P. Morgan

Healthcare Conference

January 12, 2017

Exhibit 99.1

2

Safe Harbor Statement and Non-GAAP Financial Measures

This presentation contains forward-looking statements, including statements regarding future growth, plans and performance. All forward-

looking statements contained in this presentation involve risks and uncertainties. The Company’s actual results and outcomes could differ

materially from those anticipated in these forward-looking statements as a result of various factors, including the factors set forth under the

heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 10, 2016. The

words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “vision,” “would,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying

words. The Company has based these forward-looking statements on its current expectations and projections about future events. Although

the Company believes that the expectations underlying any of its forward-looking statements are reasonable, these expectations may prove to

be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize,

or should underlying assumptions, projections, or expectations prove incorrect, actual results, performance, financial condition, or events may

vary materially and adversely from those anticipated, estimated, or expected.

All forward-looking statements included in this presentation are expressly qualified in their entirety by these cautionary statements. The

Company cautions readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to

recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ

materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described

above, as well as others that the Company may consider immaterial or does not anticipate at this time. Although the Company believes that

the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations may prove

correct. The Company’s expectations reflected in its forward-looking statements can be affected by inaccurate assumptions it might make or

by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not

exclusive, and further information concerning the Company and its business, including factors that potentially could materially affect its

financial results or condition or relationships with customers and potential customers, may emerge from time to time. The Company assumes

no, and it specifically disclaims any, obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in

factors or assumptions affecting such forward-looking statements. The Company advises investors, however, to consult any further disclosures

it makes on related subjects in our periodic reports that it files with or furnishes to the SEC.

This presentation includes the following non-GAAP financial measures on a projected basis: Gross Cash Generated and Net Cash Generated

from Customer Contracting Activities (only for 2016), Adjusted EBITDA and Free Cash Flow. Please refer to the supplemental information

located at the end of this presentation for a reconciliation of these projected non-GAAP financial measures to the most directly comparable

projected GAAP financial measures and other important information.

3

The trusted partner to manage

client revenue built on strong

relationships with the confidence

to commit to results

Your one revenue partner across payment model,

engagement model or settings of care fueled by a values

driven organization

The first in the market with the most

experience, leading performance, one

partner to manage all aspects of

revenue cycle

4

Company Overview

Comprehensive Provider of Technology-Enabled RCM Services

Operating Experience Critical to Enabling Growth

of Outsourced RCM Offering

Joe Flanagan – President & CEO

Joined June 2013; CEO since Q2’16

Extensive experience building technology

driven, scalable commercial infrastructure in

industrial and services sectors

New Management Team Significant Footprint Under Contract

• $65B of gross billings

• 16.5M patient annual encounters

• 132 hospital sites/ 17 states

Seasoned Human Capital

• 5K employees growing to 12K with current

contracted business

• Strong mix of innovation & execution

Global Shared Services

• Full coverage of all core processes

• Captive & integrated India operations

• Higher performance vs. local ops

Proprietary Technology

• Built for purpose from best in class

operations

• Exception-based & integrated

• Agnostic to EMR

Chris Ricaurte – CFO & Treasurer

Experienced Executive Team

With new investment and a strong, stable

platform, rebuilt Sr. Exec Team in 2016

Functional competency in scaling combined with

deep domain expertise

Joined August 2013 as SVP of Shared Services;

CFO since Q2’16

15 years CFO experience in 5 industries

alongside CEO

5

Investment Highlights

RCM market continues to be underdeveloped with high-growth

potential

Significant investments made since 2013 to strengthen and re-establish

leadership position

Only pure-play RCM provider with a comprehensive technology-

enabled solution

Compelling growth story underpinned by strong fundamentals

Financial Guidance ($M) 2016 2017 2020

Revenue1 205-210 400-425 700-900

GAAP Operating Income 295-300 (25)-(30) 75-105

Adj. EBITDA1 (24)-(27) 0-5 105-135

Free Cash Flow2 (100) – (105) (25)-(30) 75-105

Note1: For 2016 only, Revenue = Non-GAAP Gross Cash Generated from Customer Contracting Activities; Adjusted EBITDA = Non-GAAP Net Cash

Generated from Customer Contracting Activities.

Note2: Free Cash Flow, a non-GAAP measure, includes changes in customer deposits and accrued service costs: 2016 ~($50); 2017 ~($15)

6

Significant Improvement Since 2013

Driven by Consistent Focus Across 5 Key Areas

Simplified pricing improves customer alignment

Expanded engagement model

Commercial Model

1

Adopted new architecture

Doubled IT development spend

Technology Platform

3

Overhauled Shared Services

Created operating system

Operational Framework

2

Overhauled organization and increased investment

Addressed internal control framework

Compliance

5

CFO customer satisfaction up 94% since 2013

Contract KPI’s on average up 78% since 2013

Customer Performance

4

Significant Investment Made to Enable Scaling

7

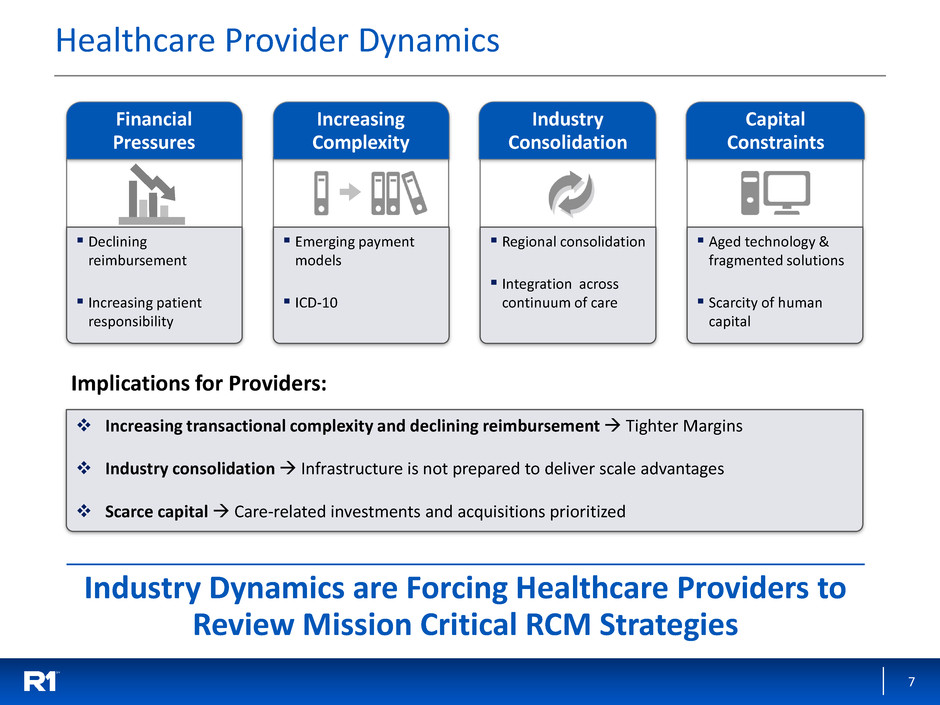

Healthcare Provider Dynamics

Increasing transactional complexity and declining reimbursement Tighter Margins

Industry consolidation Infrastructure is not prepared to deliver scale advantages

Scarce capital Care-related investments and acquisitions prioritized

Financial

Pressures

Increasing

Complexity

Declining

reimbursement

Increasing patient

responsibility

Emerging payment

models

ICD-10

Regional consolidation

Integration across

continuum of care

Aged technology &

fragmented solutions

Scarcity of human

capital

Industry Dynamics are Forcing Healthcare Providers to

Review Mission Critical RCM Strategies

Implications for Providers:

Industry

Consolidation

Capital

Constraints

8

Market Dynamics

Structural Growth with Shift to External Services Providers

Source: CMS NHE Projections, KPMG, R1 estimates

2015: $51.6B

In-House RCM Spend

External RCM Spend

Outsourced RCM Services

External RCM Apps / Software

52.2

8.8

7.7

16.5

Estimated Hospital Revenue Cycle Spend

43.3

4.5

3.8

8.3

15% CAGR

2020: $68.7B

9

Market Dynamics Impacting Traditional Approaches

Historical way market is served has not evolved to meet industry needs

− Consulting, point-solution technologies, transactional outsourcing

− Providers on the hook to get right outcome from fragmented solutions

− 70% of providers are expected to change approach over next 4 years

− Significant customer dissatisfaction

Market forces drive the need for a strong commercial partner

− Fatigue with lack of results from historical approach

− Provider consolidation increases pressure to deliver scale advantage

− Healthcare reform drives increasing reimbursement complexity

Holistic, High Performance Solution has the Potential to Drive

Growth Higher than Current Market Projections

10

Our Approach . . .

Holistic and Differentiated Relative to the Market

One Trusted Partner to Optimize the Revenue Cycle

Acute (serves 89 hospitals, >$20B

contracted NPR)

Physician (experience with 3,500+

physicians and >$1.8B NPR)

CARE SETTING

Order to Intake

Care to Claim

Claim to Payment

REVENUE CYCLE PHASES

Payor-based

− Fee for Service, Risk-based

Patient-based

− Insured/uninsured

PAYMENT MODELS

+ Comprehensive Coverage of Provider Requirements +

Flexible

Delivery Models

CO-MANAGED

Embedded managers,

processes & technologies in

the organization

OPERATING PARTNER

Full, risk-sharing

infrastructure partners

MODULAR

Targeted components of

revenue cycle

1

2

3

PERFORMANCE STACKSM

Robust and Proven

Operating Model

11

. . . Drives Meaningful Financial Improvement for

Customers . . .

Income

Statement

Bad Debt Expense

Denials

Bad Debt write-offs

Uncompensated Care (Bad

Debt + Charity)

Insured Patient Yield

Uninsured Patient Yield

Balance

Sheet

Discharged Not Final Billed

Total Gross AR Days

Credit AR Days

AR Days > 180

Customer

Service

Average Speed to Answer

Call Abandonment Rate

Data sourced from independent

3rd Party

− Validated for payment and

service level agreement (SLA)

service

This translates into real financial

impact. For typical $3B customer

achieved over 3 year period….

− $100M Income Statement

improvement

− $125M Balance Sheet working

capital improvement

Performance Metric Improvement >10% >25% >100%

R1 vs. Customer Internal (same customer) Summary of Impact

+

+

12

. . . And Outperforms Comparatives

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

Provider 1

Provider 2

Provider 3

Ascension -

R1

Better Performance Drives Superior Overall Economics For Providers

AR Days1 Performance – % Increase/(Decrease) from FY 2011

2011 2012 2013 2014 2015

% Change – Decrease is Favorable

(16.7%)

+ 9.8%

+ 22.9%

+ 25.7%

% Incr. / (Decr.)

from 2011

Source: Definitive Healthcare Note1: Gross Accounts Receivable divided by average daily Gross Revenue

Comparison of a blinded cohort of

$10Bn+ systems that are served by

mature E2E RCM Providers

13

Growth Roadmap

Ascension Contract + 2016 Investments Provide

Confidence for Growth

Ascension Rollout Provides Growth Visibility Through 2020

Incremental New Business Wins

Expansion of Capabilities

Drive Margin Expansion

Strong execution of Ascension contracted business

Maximize growth potential inside of Ascension (Physician/Acquisitions)

Leverage brand launch & Ascension/TowerBrook partnership to expand pipeline

Invest in commercial organization capability & capacity; increase external focus

Maximize installed base to expand with full suite of R1 offerings (PAS, Technology)

Utilize healthy balance sheet to develop M&A pipeline

Commit capacity & technology to driving next wave of productivity

Utilize 2016 investments to drive scaling benefits

14

Financial Highlights

2016 investments drive confidence to scale with leverage

Expect doubling top line and returning to profitability in 2017

High visibility in long range forecast

− Contracted customers with high recurring revenue

Healthy balance sheet: strong cash balance, no debt

Adopting new revenue recognition in 2017 to simplify GAAP reporting

Contracted Revenue and 2016 Investments Drive

Confidence in Future Profitability

15

Capital Structure

~$180 million in cash and equivalents, as of 12/31/16

No Debt

Ascension/TowerBrook investment vehicle has warrants to acquire 60

million common shares at $3.50 per share

Can be exercised on a cash or cashless basis

Warrants

Cash and Debt

$200 million investment by Ascension/TowerBrook in February 2016

Equivalent to 80 million common shares issued, with 8% annual dividend

payable in kind on a quarterly basis for 7 years, and cash thereafterConvertible

Preferred Stock Common-equivalent share count progression (M shares)

Feb. 2016 Dec. 2017 Dec. 2020

80.0 91.0 115.4

107 million shares outstanding as of 12/31/16Common Stock

16

Market Offerings and Financial Impact

Three Compelling Offerings that Meet our Customers' Needs

Revenue EBITDA contribution

Year 1 Year 5

70-80

120-150

30-40

$M

~(12)

5-15

30-50

15-20

~(2.0)

10-20

3-12

$M $M

10-20

3-12

Co-ManagedOperating Partner Modular

Illustrative Revenue and EBITDA contribution based on typical $3B NPR

Year 1 Year 5 Year 1 Year 5

17

Financial Model for Operating Partner Offering

Evolution of Contribution of $3B NPR

Profitability Trends Up as Model is Fully Deployed

Growth

Deploy transition resources

Perform financial assessment

Invest in infrastructure

Implement technology

Finalize employee transitions

Transfers to Shared Services

Complete standardization

Steady state org structure

Continuous optimization:

− KPI metric improvement

− Technology advancement

− Productivity improvement

Financial Impact – $M

Mid-Point of

Range

Revenue 120

EBITDA contribution 17

EBITDA contribution % 14%

0 – 12 Months 12 – 36 Months 36+ Months

Launch Steady State

Financial Impact – $M

Mid-Point

of Range

Revenue 75

EBITDA contribution (12)

EBITDA contribution % (16%)

Financial Impact – $M

Mid-Point

of Range

Revenue 135

EBITDA contribution 35

EBITDA contribution % 26%

Illustrative

18

Long Term Outlook

Accelerating Growth 2017 to 2020

Positioned to Drive 2017 Profitability & Meet 2020 Projections

2017 Outlook & Improvement from 2016

High visibility to 2020 projections

Currently contracted business delivers 90%+ of the low end of the 2020 projection

Expect to turn cash flow positive in 2H 2017

Highlights

$M 2016 2017 2020

Revenue1 205-210 400-425 700-900

GAAP Operating Income 295-300 (25)-(30) 75-105

Adj. EBITDA1 (24)-(27) 0-5 105-135

Free Cash Flow2 (100) – (105) (25)-(30) 75-105

Note1: For 2016 only, Revenue = Non-GAAP Gross Cash Generated from Customer Contracting Activities; Adjusted EBITDA = Non-GAAP Net Cash

Generated from Customer Contracting Activities.

Note2: Free Cash Flow, a non-GAAP measure, includes changes in customer deposits and accrued service costs: 2016 ~($50); 2017 ~($15)

19

Investment Summary

RCM market continues to be underdeveloped with high-growth

potential

Significant investments made since 2013 to strengthen and re-establish

leadership position

Only pure-play RCM provider with a comprehensive technology-

enabled solution

Compelling growth story underpinned by strong fundamentals

20

Use of Non-GAAP Financial Measures

In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational

decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial measures, which

are included in this presentation on a projected basis. These include Gross Cash Generated from Customer Contracting Activities, Net Cash

Generated from Customer Contracting Activities , Free Cash Flow, and adjusted EBITDA. Our Board and management team use these non-

GAAP measures as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against

such expectations; and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation

programs, as well as for incentive compensation plans for employees.

Gross Cash Generated from Customer Contracting Activities is defined as GAAP net services revenue, plus the change in deferred customer

billings. Accordingly, Gross Cash Generated from Customer Contracting Activities is the sum of (i) invoiced or accrued net operating fees, (ii)

cash collections on incentive fees and (iii) other services fees. Net Cash Generated from Customer Contracting Activities reflects non-GAAP

adjusted EBITDA and the change in deferred customer billings. The Company anticipates that it will no longer report Gross Cash Generated

from Customer Contracting Activities and Net Cash Generated from Customer Contracting Activities once it adopts the new revenue

recognition accounting standard in 2017.

Adjusted EBITDA is defined as net income before net interest income (expense), income tax provision, depreciation and amortization

expense, share-based compensation, transaction-related expenses, reorganization-related expenses and certain other items. The use of

adjusted EBITDA to measure operating and financial performance is limited by our revenue recognition criteria, pursuant to which GAAP

net services revenue is recognized at the end of a contract or other contractual agreement event. Adjusted EBITDA does not adequately

match corresponding cash flows from customer contracting activities. As a result, the Company uses Gross and Net Cash Generated from

Customer Contracting Activities to better compare cash flows to operating performance.

Free Cash Flow is defined as cash flow from operations, less capital expenditures. For 2017 and 2020 the Company expects Free Cash Flow

to be approximately equal to GAAP Operating Income provided on slide 21 and, therefore, no reconciliation is provided.

Deferred customer billings include the portion of both (i) invoiced or accrued net operating fees and (ii) cash collections of incentive fees, in

each case, that have not met our revenue recognition criteria. Deferred customer billings are included in the detail of our customer

liabilities balance in the consolidated balance sheet available in the Company’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2016.

These adjusted measures are non-GAAP and should be considered in addition to, but not as a substitute for, the information prepared in

accordance with GAAP.

21

Reconciliation of GAAP to Non-GAAP Financial Measures

($M) 2016

GAAP Revenue 589-594

Change in deferred customer billings ~(384)

Gross Cash Generated from Customer Contracting Activities 205-210

Reconciliation of GAAP Revenue Guidance to Non-GAAP Gross Cash Generated from

Customer Contracting Activities

Reconciliation of GAAP Operating Income Guidance to Non-GAAP Adjusted EBITDA Guidance

($M) 2016 2017 2020

GAAP Operating Income Guidance 295-300 (25) - (30) 75 - 105

Plus: Change in deferred customer billings ~(384) 0 0

Depreciation and amortization expense ~10 ~15 10 - 15

Share-based compensation expense ~28 ~13 10 - 15

Transaction costs, severance and other ~22 ~5 ~5

Adjusted EBITDA Guidance (24) - (27) 0 - 5 105 - 135

1

Note1: For 2016, Adjusted EBITDA = Non-GAAP Net Cash generated from customer contracting activities.

($M) 2016

GAAP Operating Income 295 - 300

Adjustments to reconcile Operating Income to Fee Cash Flow:

Change in customer liabilities ~(434)

Change in other assets and liabilities ~5

Depreciation and amortization expense ~10

Share-based compensation expense ~28

Capital expenditures ~(14)

Free Cash Flow (100) - (105)

Reconciliation of 2016 GAAP Operating Income to Free Cash Flow