Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPECTRUM PHARMACEUTICALS INC | form8-k.htm |

Spectrum

Pharmaceuticals

Rajesh C. Shrotriya, MD

Chairman and Chief Executive Officer

Investor Presentation

January 2017

Safe Harbor Statement

This presentation contains forward-looking statements regarding future events and the future performance of

Spectrum Pharmaceuticals that involve risks and uncertainties that could cause actual results to differ

materially. These statements are based on management’s current beliefs and expectations. These statements

include but are not limited to statements that relate to our business and its future, our strategy, the success of

our drug candidates, the safety and efficacy of our drug products, product approvals, market potential, product

sales, revenue, development, regulatory and approval timelines, product launches, product acquisitions, capital

resources and any statements that relate to the intent, belief, plans or expectations of Spectrum or its

management, or that are not a statement of historical fact.

Risks that could cause actual results to differ include the possibility that our existing and new drug candidates

may not prove safe or effective, the possibility that our existing and new drug candidates may not receive

approval from the FDA and other regulatory agencies in a timely manner or at all, the possibility that our

existing and new drug candidates, if approved, may not be more effective, safer or more cost efficient than

competing drugs, the possibility that price and other competitive pressures may make the marketing and sale of

our drugs not commercially feasible, the possibility that our efforts to acquire or in-license and develop

additional drug candidates may fail, our lack of sustained revenue history, our limited experience in establishing

strategic alliances, our limited marketing experience, our customer concentration, the possibility for fluctuations

in customer orders, evolving market dynamics, our dependence on third parties for clinical trials, manufacturing,

distribution, information and quality control and other risks that are described in further detail in the Company's

reports filed with the Securities and Exchange Commission. We do not plan to update any such forward-

looking statements and expressly disclaim any duty to update the information contained in this presentation

except as required by law.

2

Poziotinib

A promising

Phase 2

pan-HER

inhibitor

3

ROLONTIS

TM

Late-stage drug

targeting blockbuster

market

QAPZOLA

TM

Late-stage drug

targeting unmet

need in bladder

cancer

Spectrum Advancing Three Strong

Oncology Focused Drugs

4

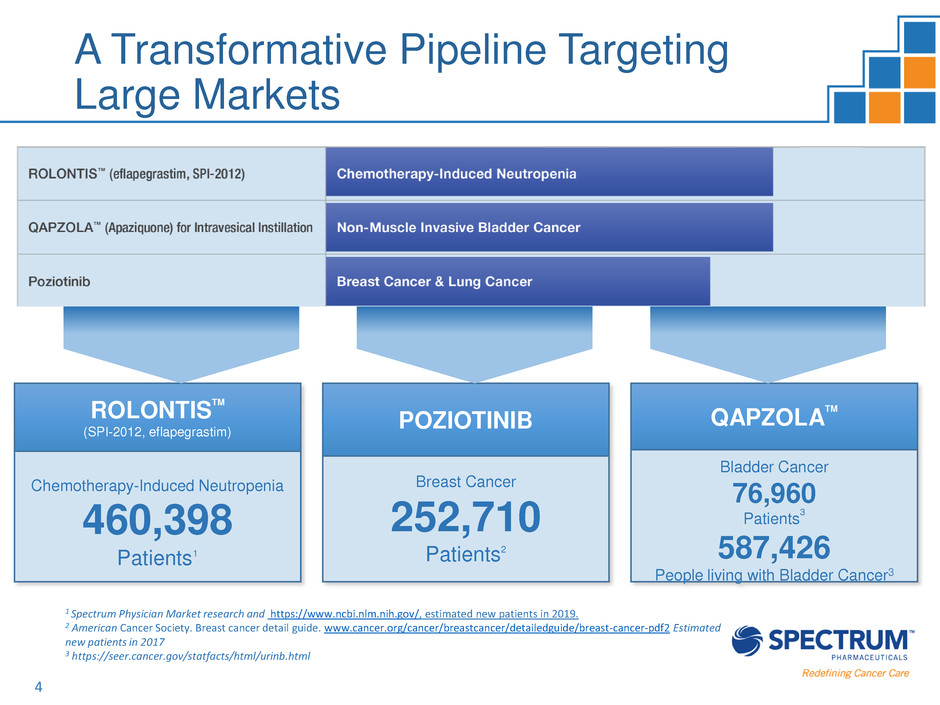

ROLONTIS

TM

(SPI-2012, eflapegrastim)

Chemotherapy-Induced Neutropenia

460,398

Patients1

POZIOTINIB

Breast Cancer

252,710

Patients2

QAPZOLA

TM

Bladder Cancer

76,960

Patients

3

587,426

People living with Bladder Cancer3

A Transformative Pipeline Targeting

Large Markets

1 Spectrum Physician Market research and https://www.ncbi.nlm.nih.gov/, estimated new patients in 2019.

2 American Cancer Society. Breast cancer detail guide. www.cancer.org/cancer/breastcancer/detailedguide/breast-cancer-pdf2 Estimated

new patients in 2017

3 https://seer.cancer.gov/statfacts/html/urinb.html

ROLONTISTM (eflapegrastim):

A Long-Acting Granulocyte-Colony Stimulating

Factor (G-CSF)

5

• Phase 3

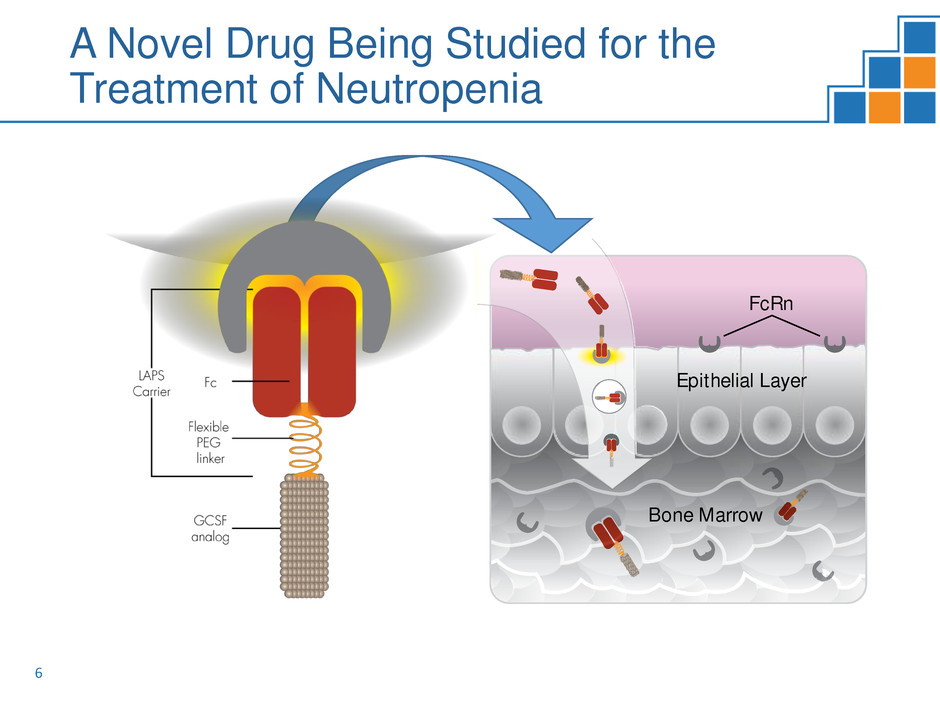

GCSF

Analog

Fc

FcRn

Flexible

PEG

Linker

LAPS

Carrier

FcRn

Bone Marrow

Epithelial Layer

A Novel Drug Being Studied for the

Treatment of Neutropenia

6

0

5

10

15

20

25

30

35

40

0 5 10 15 20

A

N

C

(1

0

9

/L

)

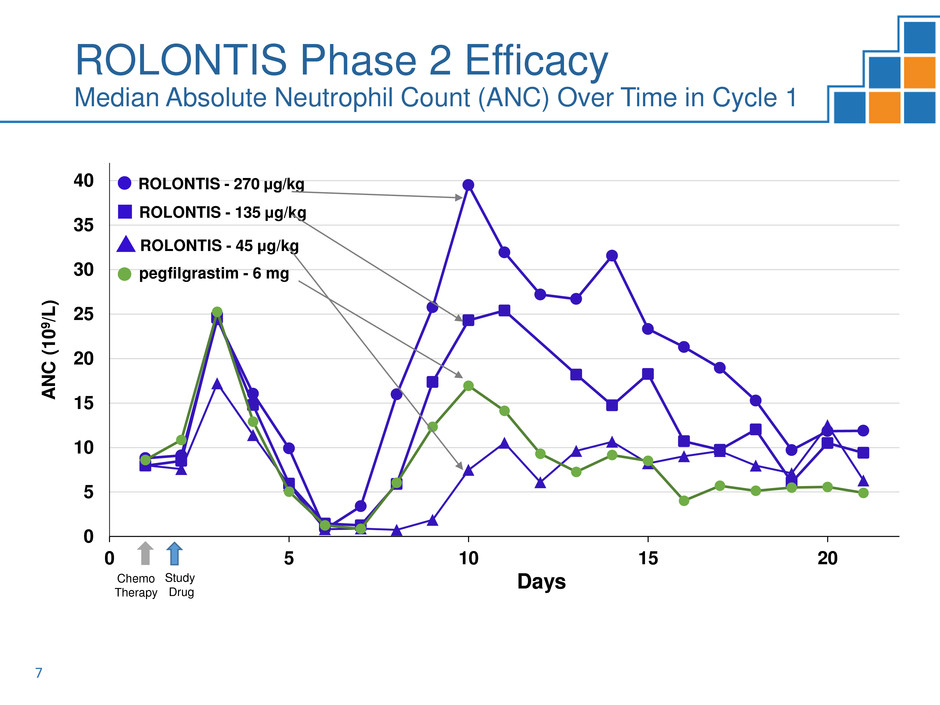

Days

ROLONTIS - 270 μg/kg

ROLONTIS - 45 μg/kg

ROLONTIS - 135 μg/kg

pegfilgrastim - 6 mg

Study

Drug

Chemo

Therapy

7

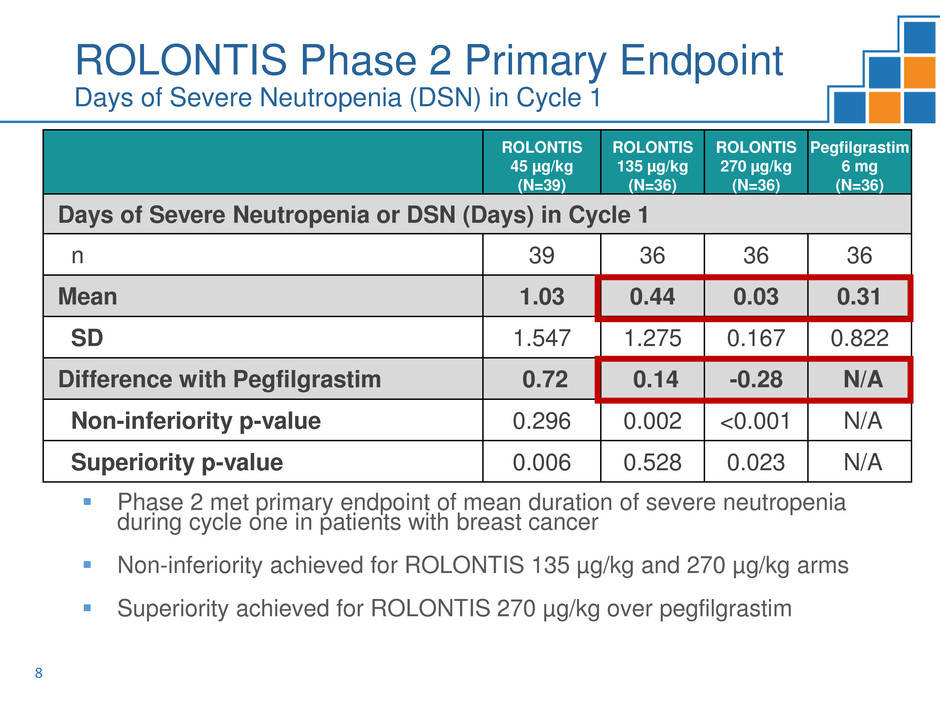

ROLONTIS Phase 2 Efficacy

Median Absolute Neutrophil Count (ANC) Over Time in Cycle 1

Phase 2 met primary endpoint of mean duration of severe neutropenia

during cycle one in patients with breast cancer

Non-inferiority achieved for ROLONTIS 135 µg/kg and 270 µg/kg arms

Superiority achieved for ROLONTIS 270 µg/kg over pegfilgrastim

ROLONTIS

45 µg/kg

(N=39)

ROLONTIS

135 µg/kg

(N=36)

ROLONTIS

270 µg/kg

(N=36)

Pegfilgrastim

6 mg

(N=36)

Days of Severe Neutropenia or DSN (Days) in Cycle 1

n 39 36 36 36

Mean 1.03 0.44 0.03 0.31

SD 1.547 1.275 0.167 0.822

Difference with Pegfilgrastim 0.72 0.14 -0.28 N/A

Non-inferiority p-value 0.296 0.002 <0.001 N/A

Superiority p-value 0.006 0.528 0.023 N/A

8

ROLONTIS Phase 2 Primary Endpoint

Days of Severe Neutropenia (DSN) in Cycle 1

Screening

Period

End of Treatment

Visit

30

Days

R

a

ndomi

z

atio

n

Treatment Period Four 21-day Cycles

Day 1 Day 2

Pegfilgrastim

ROLONTIS

(eflapegrastim)

Docetaxel +

Cyclophosphamide

~30 Days

after the end

of cycle 4

2 Randomized, Non-inferiority studies with duration of severe neutropenia

(DSN) as primary endpoint

ADVANCE is conducted under SPA from the FDA

RECOVER to enroll patients primarily from Europe

Pegfilgrastim sales in 2015 were $3.9 billion in US and $.8 billion in ROW

9

ROLONTIS Phase 3 Program:

Expected to File BLA in 2018

Poziotinib: A Novel, pan-HER Inhibitor

10

• Breast Cancer Phase 2

• Non-Small Cell Lung Cancer (NSCLC)

Phase 1

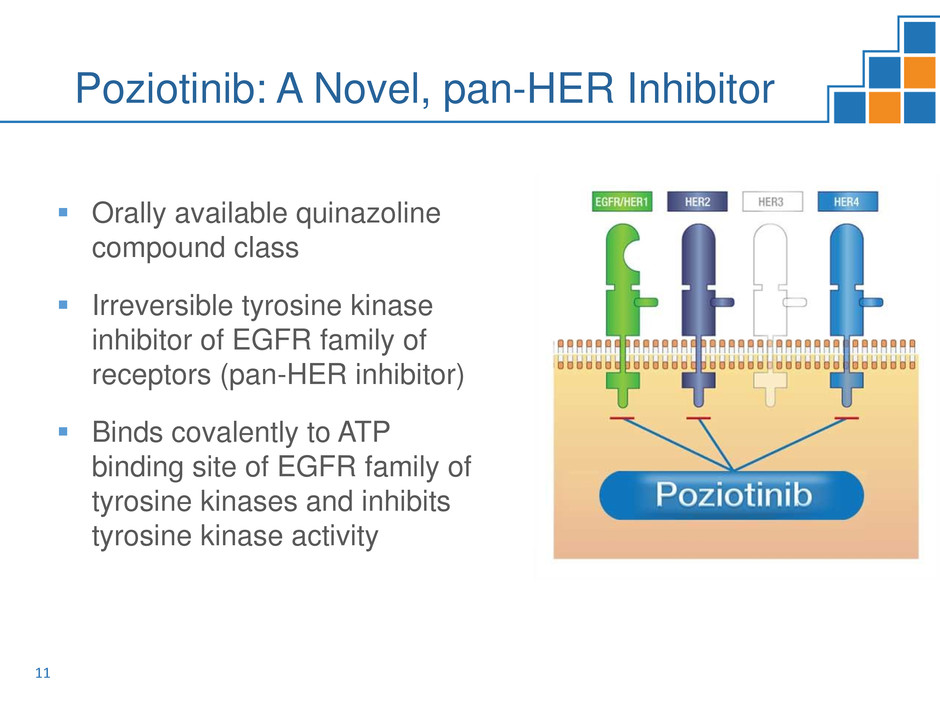

Orally available quinazoline

compound class

Irreversible tyrosine kinase

inhibitor of EGFR family of

receptors (pan-HER inhibitor)

Binds covalently to ATP

binding site of EGFR family of

tyrosine kinases and inhibits

tyrosine kinase activity

11

Poziotinib: A Novel, pan-HER Inhibitor

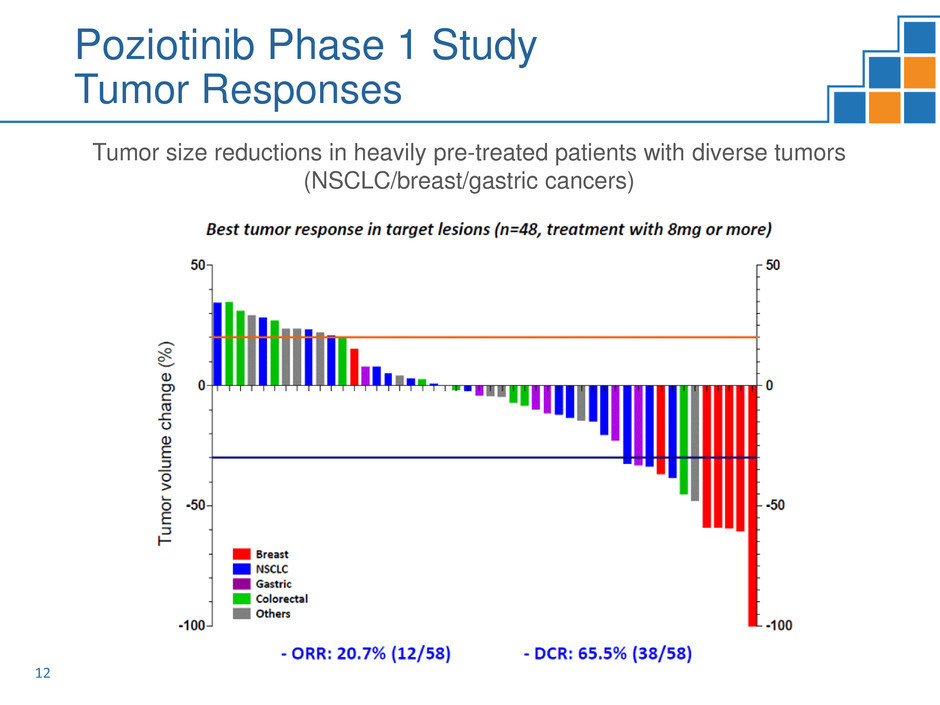

Poziotinib Phase 1 Study

Tumor Responses

Tumor size reductions in heavily pre-treated patients with diverse tumors

(NSCLC/breast/gastric cancers)

12

13

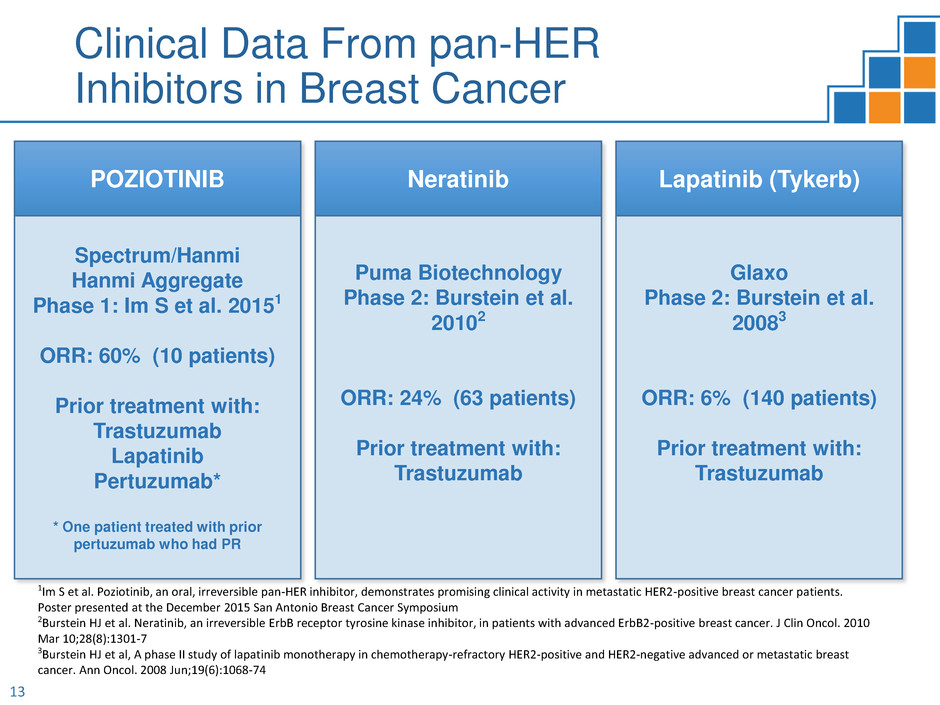

Clinical Data From pan-HER

Inhibitors in Breast Cancer

POZIOTINIB

Spectrum/Hanmi

Hanmi Aggregate

Phase 1: Im S et al. 20151

ORR: 60% (10 patients)

Prior treatment with:

Trastuzumab

Lapatinib

Pertuzumab*

* One patient treated with prior

pertuzumab who had PR

Neratinib

Puma Biotechnology

Phase 2: Burstein et al.

20102

ORR: 24% (63 patients)

Prior treatment with:

Trastuzumab

Lapatinib (Tykerb)

Glaxo

Phase 2: Burstein et al.

20083

ORR: 6% (140 patients)

Prior treatment with:

Trastuzumab

1Im S et al. Poziotinib, an oral, irreversible pan-HER inhibitor, demonstrates promising clinical activity in metastatic HER2-positive breast cancer patients.

Poster presented at the December 2015 San Antonio Breast Cancer Symposium

2Burstein HJ et al. Neratinib, an irreversible ErbB receptor tyrosine kinase inhibitor, in patients with advanced ErbB2-positive breast cancer. J Clin Oncol. 2010

Mar 10;28(8):1301-7

3Burstein HJ et al, A phase II study of lapatinib monotherapy in chemotherapy-refractory HER2-positive and HER2-negative advanced or metastatic breast

cancer. Ann Oncol. 2008 Jun;19(6):1068-74

Phase 2, Open Label

Indication: HER2-positive, recurrent, metastatic breast cancer

who have received at least 2 prior HER2-directed treatment

regimens.

Primary objective is to evaluate the Objective Response Rate

(ORR) of poziotinib in patients with human epidermal growth

factor receptor 2 (HER2)-positive MBC.

Approximately 70 patients

14

Poziotinib Phase 2 Design in

Breast Cancer

15

Poziotinib: Promising Activity in Non-

Small Cell Lung Cancer (NSCLC)

Lung cancer is by far the leading cause of cancer death

among both men and women, estimated 155,870 deaths in

20171

Existing therapies have very limited activity in NSCLC Exon 20

mutations

MD Anderson Cancer Center has screened multiple EGFR

inhibitors in preclinical models and has found poziotinib to be a

highly potent inhibitor of Exon 20 mutations

Data were presented in December 2016 at the World

Conference on Lung Cancer in Vienna

Investigator sponsored trial of poziotinib and EGFR/HER2

Exon 20 insertions scheduled to begin at MD Anderson

Cancer Center in first half of 2017

1http://www.cancer.org/cancer/lungcancer-non-smallcell/detailedguide/non-small-cell-lung-cancer-key-statistics

16

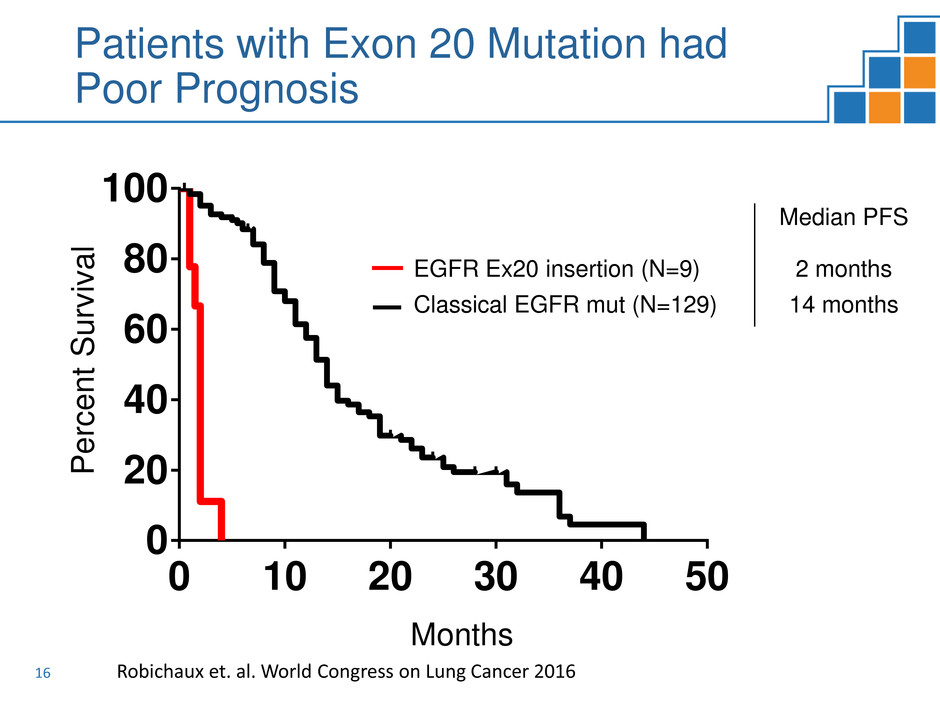

Patients with Exon 20 Mutation had

Poor Prognosis

Median PFS

EGFR Ex20 insertion (N=9) 2 months

Classical EGFR mut (N=129) 14 months

0 10 20 30 40 50

0

20

40

60

80

100

Time (Months)

Pr

og

re

ss

io

n

fre

e

su

rv

iv

al

(%

o

f p

at

ie

nt

s)

Classical EGFR mutations (n=129)

EGFR exon 20 insertions (n=9)

Median PFS (mo)

Classical EGFR Mutaions 14

EGFR exon 20 insertions 2

P<0.0001 (Log-rank)

P

e

rcen

t

S

u

rviv

a

l

Months

Robichaux et. al. World Congress on Lung Cancer 2016

0.001 0.01 0.1 1 10 100

0

25

50

75

100

125

EGFR Exon20 Insertion Mutations

log[Inhibitor], µM

%

V

ia

bi

lit

y AZD9291

EGF816

CO-1686

Afatinib

Erlotinib

Poziotinib

0.001 0.01 0.1 1 10 100

0

25

50

75

100

125

EGFR Exon20 Insertion Mutations

log[Inhibitor], µM

%

V

ia

b

il

it

y

AZD9291

EGF816

CO-1686

Afatinib

Erlotinib

Poziotinib

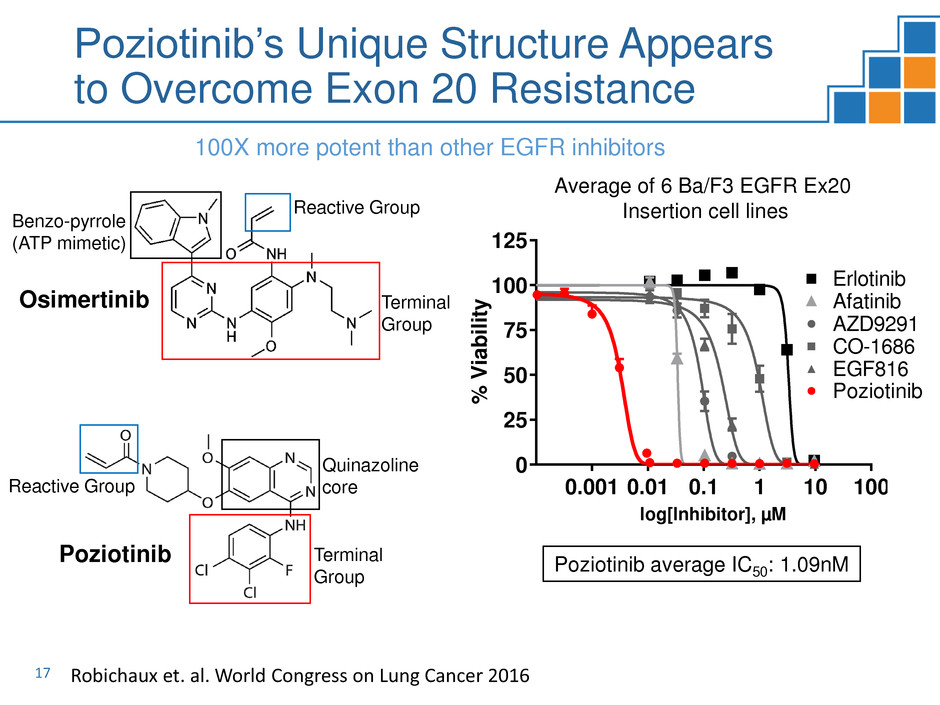

Average of 6 Ba/F3 EGFR Ex20

Insertion cell lines

0.001 0.01 0.1 1 10 100

0

25

50

75

100

125

EGFR Exon20 Insertion Mutations

log[Inhibitor], µM

% Viability

AZD9291

EGF816

CO-1686

fatinib

Erlotinib

Poziotinib average IC50: 1.09nM

Poziotinib

Reactive Group

Quinazoline

core

Terminal

Group

Osimertinib Terminal

Group

Benzo-pyrrole

(ATP mimetic)

Reactive Group EGFR A763insFQEA

0.01 0.1 1 10 100

0

25

50

75

100

125 Erlotinib

Gefitinib

log[Inhibitor], µM

%

V

i

a

b

i

l

i

t

y

Robichaux et. al. World Congress on Lung Cancer 2016 17

Poziotinib’s Unique Structure Appears

to Overcome Exon 20 Resistance

100X more potent than other EGFR inhibitors

18

Poziotinib Summary

Orally available, Irreversible pan-

EGFR/HER inhibitor

Phase 2 Breast Cancer Study ongoing

Investigator sponsored trial of

poziotinib and EGFR/HER2 Exon 20

insertions scheduled to begin at MD

Anderson Cancer Center in first half of

2017

Hanmi studies in gastric and colorectal

continuing

QAPZOLATM (apaziquone) for

Intravesical Installation:

A potent tumor-activated drug for non-

muscle invasive bladder cancer

19

20

NMIBC

Non-muscle invasive bladder cancer remains an unmet

medical need with no new drugs approved in the last 25 years

QAPZOLA demonstrated activity in previous studies

Safety profile shows that QAPZOLA is well-tolerated

QAPZOLATM Targets Surface Tumors

in the Bladder

21

Spectrum is in Discussions with FDA

on New Study Design for QAPZOLA

Seeking SPA for proposed Phase 3 study design

New study design incorporates learnings from previous studies

Study Design

• Approximately 500 patients with non-muscle-invasive bladder

cancer (NMIBC)

• Single dose: 8mg

• Intravesical installation at 30 – 90 minutes post TURBT

• Double blind, placebo controlled Phase 3 study with 2:1

randomization to either QAPZOLA or placebo

• Primary endpoint: time to disease recurrence

Currently Marketing 6 Niche Anti-Cancer Drugs

Contributing to a Pipeline Targeting Large Markets

22

Proven Track Record to Pave the

Path to the Future

23

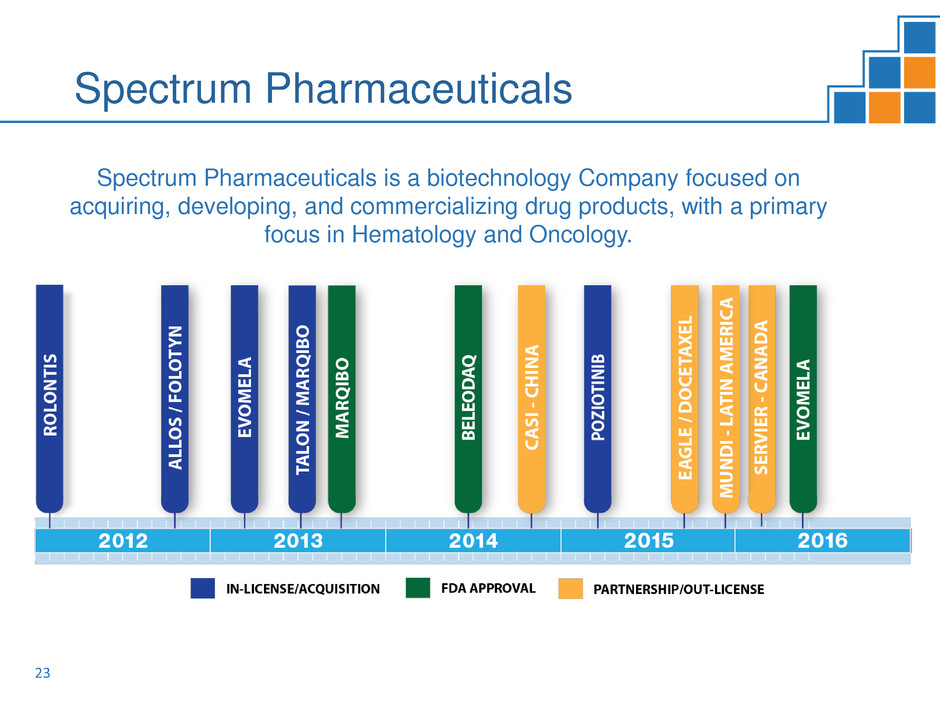

Spectrum Pharmaceuticals

Spectrum Pharmaceuticals is a biotechnology Company focused on

acquiring, developing, and commercializing drug products, with a primary

focus in Hematology and Oncology.

24

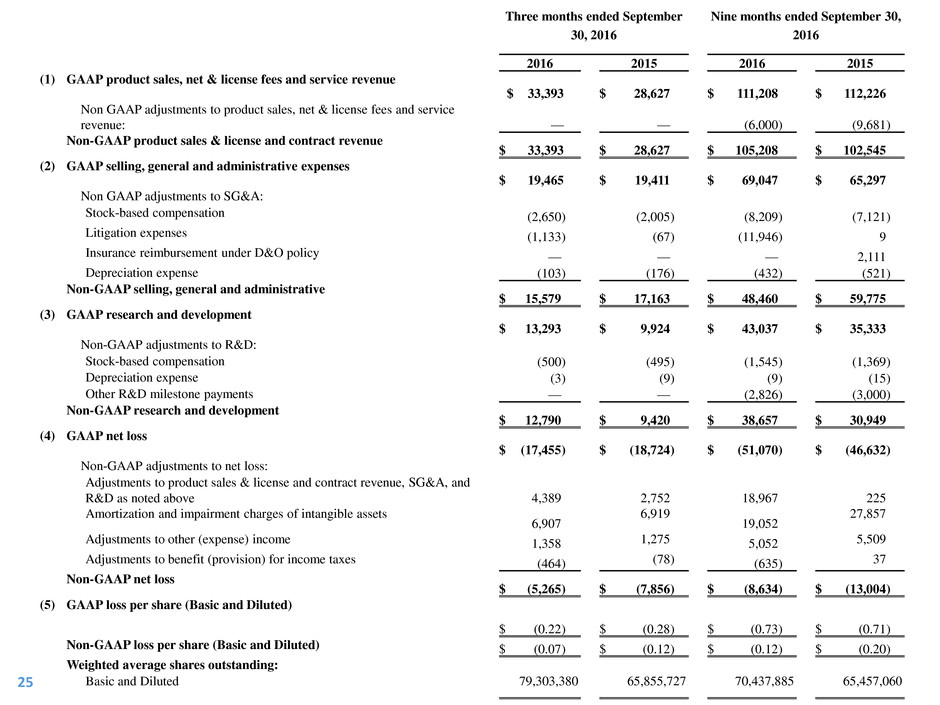

Three months ended September

30, 2016

Nine months ended September 30,

2016

2016 2015 2016 2015

(1) GAAP product sales, net & license fees and service revenue

$ 33,393

$ 28,627

$ 111,208

$ 112,226

Non GAAP adjustments to product sales, net & license fees and service

revenue: —

—

(6,000 ) (9,681 )

Non-GAAP product sales & license and contract revenue

$ 33,393

$ 28,627

$ 105,208

$ 102,545

(2) GAAP selling, general and administrative expenses

$ 19,465

$ 19,411

$ 69,047

$ 65,297

Non GAAP adjustments to SG&A:

Stock-based compensation (2,650 ) (2,005 ) (8,209 ) (7,121 )

Litigation expenses (1,133 ) (67 ) (11,946 ) 9

Insurance reimbursement under D&O policy — — — 2,111

Depreciation expense (103 ) (176 ) (432 ) (521 )

Non-GAAP selling, general and administrative

$ 15,579

$ 17,163

$ 48,460

$ 59,775

(3) GAAP research and development

$ 13,293

$ 9,924

$ 43,037

$ 35,333

Non-GAAP adjustments to R&D:

Stock-based compensation (500 ) (495 ) (1,545 ) (1,369 )

Depreciation expense (3 ) (9 ) (9 ) (15 )

Other R&D milestone payments — — (2,826 ) (3,000 )

Non-GAAP research and development

$ 12,790

$ 9,420

$ 38,657

$ 30,949

(4) GAAP net loss

$ (17,455 ) $ (18,724 ) $ (51,070 ) $ (46,632 )

Non-GAAP adjustments to net loss:

Adjustments to product sales & license and contract revenue, SG&A, and

R&D as noted above 4,389

2,752

18,967

225

Amortization and impairment charges of intangible assets

6,907

6,919

19,052

27,857

Adjustments to other (expense) income 1,358 1,275 5,052 5,509

Adjustments to benefit (provision) for income taxes (464 ) (78 ) (635 ) 37

Non-GAAP net loss

$ (5,265 ) $ (7,856 ) $ (8,634 ) $ (13,004 )

(5)

GAAP loss per share (Basic and Diluted)

$ (0.22 ) $ (0.28 ) $ (0.73 ) $ (0.71 )

Non-GAAP loss per share (Basic and Diluted) $ (0.07 ) $ (0.12 ) $ (0.12 ) $ (0.20 )

Weighted average shares outstanding:

Basic and Diluted 79,303,380

65,855,727

70,437,885

65,457,060 25

26

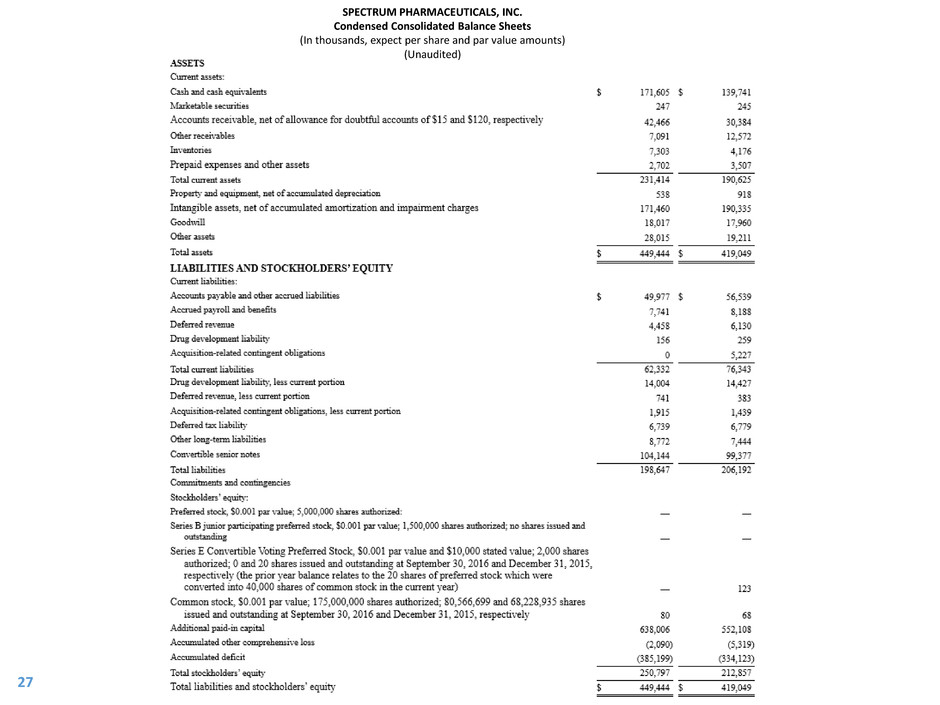

SPECTRUM PHARMACEUTICALS, INC.

Condensed Consolidated Balance Sheets

(In thousands, expect per share and par value amounts)

(Unaudited)

27