Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - JOHNSON OUTDOORS INC | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - JOHNSON OUTDOORS INC | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - JOHNSON OUTDOORS INC | ex31_1.htm |

| EX-23 - EXHIBIT 23 - JOHNSON OUTDOORS INC | ex23.htm |

| EX-21 - EXHIBIT 21 - JOHNSON OUTDOORS INC | ex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 30, 2016

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______ to ______

Commission file number 0-16255

JOHNSON OUTDOORS INC.

(Exact name of registrant as specified in its charter)

|

Wisconsin

|

39-1536083

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

555 Main Street, Racine, Wisconsin 53403

(Address of principal executive offices, including zip code)

(262) 631-6600

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class

|

Name of Exchange on Which Registered

|

|

Class A Common Stock, $.05 par value per share

|

NASDAQ Global MarketSM

|

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10‑K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large Accelerated Filer

|

☐

|

||

|

Accelerated Filer

|

☒

|

||

|

Non-Accelerated Filer

|

☐

|

(do not check if a smaller reporting company)

|

|

|

Smaller Reporting Company

|

☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 27, 2016, 8,778,028 shares of Class A and 1,212,006 shares of Class B common stock of the registrant were outstanding. The aggregate market value of voting and non-voting common stock of the registrant held by nonaffiliates of the registrant was approximately $105,000,000 on April 1, 2016 (the last business day of the registrant’s most recently completed fiscal second quarter) based on approximately 4,760,000 shares of Class A common stock held by nonaffiliates as of such date. For purposes of this calculation only, shares of all voting stock are deemed to have a market value of $22.07 per share, the closing price of the Class A common stock as reported on the NASDAQ Global MarketSM on April 1, 2016 (the last trading day of the registrant’s most recently completed fiscal second quarter). Shares of common stock held by any executive officer or director of the registrant (including all shares beneficially owned by the Johnson Family, as defined herein) have been excluded from this computation because such persons may be deemed to be affiliates. This determination of affiliate status is not a conclusive determination for other purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2017 Annual Meeting of the Shareholders of the Registrant are incorporated by reference into Part III of this report.

As used in this report, the terms “we,” “us,” “our,” “Johnson Outdoors” and the “Company” mean Johnson Outdoors Inc. and its subsidiaries collectively, unless the context indicates another meaning.

|

Page

|

|

|

4

|

|

|

10

|

|

|

16

|

|

|

16

|

|

|

17

|

|

|

18

|

|

|

19

|

|

|

22

|

|

|

23

|

|

|

33

|

|

|

33

|

|

|

33

|

|

|

33

|

|

|

34

|

|

|

34

|

|

|

34

|

|

|

35

|

|

|

35

|

|

|

35

|

|

|

35

|

|

|

37

|

|

|

39

|

|

|

F-1

|

Forward Looking Statements

Certain matters discussed in this Form 10-K are “forward-looking statements,” and the Company intends these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of those safe harbor provisions. These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “confident,” “could,” “expect,” “intend,” “may,” “planned,” “potential,” “should,” “will,” “would” or the negative of those terms or other words of similar meaning. Similarly, statements that describe the Company’s future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which could cause actual results or outcomes to differ materially from those currently anticipated.

Factors that could affect actual results or outcomes include the matters described under the caption “Risk Factors” in Item 1A of this report and the following: changes in economic conditions, consumer confidence levels and discretionary spending patterns in key markets; the Company’s success in implementing its strategic plan, including its targeted sales growth platforms and focus on innovation; litigation costs related to actions of and disputes with third parties, including competitors; the Company’s continued success in working capital management and cost-structure reductions; the Company’s ongoing success in meeting financial covenants in its credit agreements with its lenders; the Company’s success in integrating strategic acquisitions; the risk of future writedowns of goodwill or other long-lived assets; the ability of the Company's customers to meet payment obligations; movements in foreign currencies, interest rates or commodity costs; fluctuations in the prices of raw materials or the availability of raw materials used by the Company; the success of the Company’s suppliers and customers; the ability of the Company to deploy its capital successfully; unanticipated outcomes related to outsourcing certain manufacturing processes; unanticipated outcomes related to litigation matters; and adverse weather conditions. Shareholders, potential investors and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included herein are only made as of the date of this filing. The Company assumes no obligation, and disclaims any obligation, to update such forward-looking statements to reflect subsequent events or circumstances.

Trademarks

We have registered the following trademarks, which may be used in this report: Minn Kota®, Cannon®, Humminbird®, LakeMaster®, Silva®, Eureka!®, Jetboil®, Old Town®, Ocean Kayakä, Necky®, Extrasport®, Carlisle® and SCUBAPRO®.

PART I

Johnson Outdoors is a leading global manufacturer and marketer of branded seasonal, outdoor recreation products used primarily for fishing from a boat, diving, paddling, hiking and camping. The Company’s portfolio of well-known consumer brands has attained leading market positions due to continuous innovation, marketing excellence, product performance and quality. Company values and culture support innovation in all areas, promoting and leveraging best practices and synergies within and across its subsidiaries to advance the Company’s strategic vision set by executive management and approved by the Board of Directors. The Company is controlled by Helen P. Johnson-Leipold (Chairman and Chief Executive Officer), members of her family and related entities.

The Company was incorporated in Wisconsin in 1987 as successor to various businesses.

Marine Electronics

The Company’s Marine Electronics segment key brands are: Minn Kota battery-powered fishing motors for quiet trolling or primary propulsion, marine battery chargers and shallow water anchors; Humminbird sonar and GPS equipment for fishfinding, navigation and marine cartography; and Cannon downriggers for controlled-depth fishing.

Marine Electronics’ brands and related accessories are sold across the globe, with the majority of sales coming from North America through large outdoor specialty retailers, such as Bass Pro Shops and Cabela’s; large retail store chains; marine products distributors; original equipment manufacturers (OEM) of boat brands such as Tracker, Skeeter and Ranger; and internet retailers and distributors. Markets outside of North America are accessed through a network of international distributors.

Marine Electronics has achieved market share gains by focusing on product innovation, quality products and effective marketing. Such consumer marketing and promotion activities include: product placements on fishing-related television shows; print advertising and editorial coverage in outdoor, general interest and sport magazines; professional angler and tournament sponsorships; packaging and point-of-purchase materials and offers to increase consumer appeal and sales; the Minn Kota, Humminbird and Cannon brand websites; social media networks; and online promotions.

During the year ended September 30, 2016, the Company acquired substantially all of the assets of Northport Systems, Inc., a company specializing in the development and application of unique digital cartography technologies and web, e-commerce and data solutions for fishing and marine markets. See “Note 17 – Acquisitions” of our consolidated financial statements included elsewhere in this report for additional information.

Outdoor Equipment

The Company’s Outdoor Equipment segment key brands are: Eureka! consumer, commercial and military tents and accessories, sleeping bags, camping furniture and other recreational camping products; Jetboil portable outdoor cooking systems; and Silva field compasses.

Eureka! consumer tents, sleeping bags, camping furniture, camping stoves and other recreational camping products are mid- to high-price range products sold in the U.S. and Canada through independent sales representatives, primarily to camping and backpacking specialty stores, sporting goods stores, catalog and mail order houses, internet retailers and the Eureka! brand website. Marketing of the Company’s tents, sleeping bags and other recreational camping products is focused on building the Eureka! brand name and establishing the Company as a leader in tent design and innovation. The Company’s consumer camping tents and sleeping bags are produced by third party manufacturing sources in Asia. Eureka! camping products are sold under license in Japan, Australia and Europe.

Eureka! commercial tents include party tents and accessories, sold primarily to general rental stores, and other commercial tents and accessories sold directly to tent erectors. The Company’s commercial tent products range from 10’x10’ canopies to 120’ wide pole tents and other large scale frame structures and are primarily manufactured by the Company at the Company’s Binghamton, New York location.

Eureka! also designs and manufactures large, heavy-duty tents and lightweight backpacking tents primarily for the U.S. military at its Binghamton, New York location. Tents produced for military use in the last twelve months include modular general purpose tents, rapid deployment shelters and various lightweight one and two person tents. The Company manufactures military tent accessories like fabric floors and insulated thermal liners and is also a subcontract manufacturer for other providers of military tents.

Jetboil portable outdoor cooking systems are sold in the U.S. and Canada through independent sales representatives, primarily to camping and backpacking specialty stores, sporting goods stores, catalog and mail order houses, internet retailers, and the Jetboil brand website. Marketing of Jetboil systems is focused on building brand awareness and leadership in product features and innovation. Jetboil products are produced at both the Company’s operating location in Manchester, New Hampshire and by third party manufacturing sources in Asia. Jetboil products are sold in approximately 30 countries around the world. Markets outside of North America are accessed through a network of international distributors.

Silva field compasses are manufactured by the Company under an exclusive Silva North America trademark right and marketed in the U.S. and Canada through independent sales representatives, primarily to camping and backpacking specialty stores, sporting goods stores, catalog and mail order houses, internet retailers, and the Silva brand website.

Watercraft

The Company’s Watercraft segment designs and markets Necky high performance sea touring kayaks; sit on top Ocean Kayaks; and Old Town canoes and kayaks for family recreation, touring, angling and tripping and pedal-driven and Minn Kota motor-driven kayaks. With the exception of Necky fiberglass boats and Old Town wooden canoes, these brands are manufactured at the Company’s facility in Old Town, Maine.

The Company uses a rotational molding process for manufacturing mid- to high-end polyethylene kayaks and canoes. The Company uses a thermoform molding process in the manufacturing of lower priced models. The Company’s United States warehouse and distribution center for all of its Watercraft brands is also located in Old Town, Maine.

Watercraft accessory brands, including Extrasport personal flotation devices and Carlisle branded paddles, are produced primarily by third party sources located in North America and Asia.

The Company’s kayaks, canoes and accessories are sold through multiple channels in the U.S., Europe and the Pacific Basin with an emphasis on independent specialty retailers and large outdoor retailers such as REI, L.L. Bean, Academy and Cabela’s. The Company has a network of distributors who sell Company products outside of North America.

The Company’s Watercraft business competes in the mid- to high-end of the product category by introducing product innovations, creating quality products and by focusing on the product-specific needs of each marketing channel. Consumer marketing and promotion activities include: print advertising and editorial coverage in outdoor, general interest and sport magazines; direct marketing; and using the Carlisle and Extrasport brand websites and social media networks.

Diving

The Company manufactures and markets underwater diving products for recreational divers, which it sells and distributes under the SCUBAPRO brand name.

The Company markets a complete line of underwater diving and snorkeling equipment, including regulators, buoyancy compensators, dive computers and gauges, wetsuits, masks, fins, snorkels and accessories. SCUBAPRO diving equipment is marketed to the premium segment and high performance technical diving market. Products are sold via select distribution to independent specialty dive stores worldwide. These specialty dive stores sell the Company’s products over the counter as well as through their own websites. In addition, they generally provide a wide range of services to divers, including regular maintenance, product repair, diving education and travel programs. The Company also sells diving gear to dive training centers, resorts, public safety units and armed forces around the world.

The Company’s consumer communication focuses on building brand awareness and highlighting exclusive product features and consumer benefits of its product lines. The Company’s communication and distribution strategies reinforce the SCUBAPRO brand’s position as the industry’s quality and innovation leader. The Company markets its equipment in diving magazines, via websites, through social media and through information and displays in dive specialty stores.

The Company manufactures regulators, dive computers, gauges, and instruments at its Italian and Indonesian facilities. The Company sources buoyancy compensators, neoprene goods, plastic products, proprietary materials, and other components from third parties.

During the year ended September 30, 2016, the Company acquired the outstanding common stock of SeaBear GmbH, a company specializing in the development of underwater instrumentation through the unique application of existing, new and emerging technologies. See “Note 17 – Acquisitions” of our consolidated financial statements included elsewhere in this report for additional information.

Financial Information for Business Segments

As noted above, the Company has four reportable business segments. See Note 12 to the consolidated financial statements included elsewhere in this report for financial information concerning each business segment.

International Operations

See Note 12 to the consolidated financial statements included elsewhere in this report for financial information regarding the Company’s domestic and international operations. See Note 1, subheading “Foreign Operations and Related Derivative Financial Instruments,” to the consolidated financial statements included elsewhere in this report for information regarding risks related to the Company’s foreign operations.

Research and Development

The Company commits significant resources to new product research and development in each of its business segments. Marine Electronics conducts its product research, design, engineering and software development activities at its locations in Mankato and Little Falls, Minnesota; Alpharetta, Georgia; Toronto, Canada; and Eufaula, Alabama. Diving maintains research and development facilities in Zurich, Switzerland; Graz, Austria; and Casarza Ligure, Italy. Research and development activities for Watercraft are performed in Old Town, Maine. Product research, design and innovation for Outdoor Equipment products are conducted at the Company's Binghamton, New York and Manchester, New Hampshire locations.

The Company expenses research and development costs as incurred, except for software development for new electronics products and bathymetry data collection and processing. These costs are capitalized once technological feasibility is established and then amortized over the expected useful life of the software or database. The amounts expensed by the Company in connection with research and development activities for each of the last three fiscal years are set forth in the Company’s Consolidated Statements of Operations included elsewhere in this report.

Industry and Competitive Environment

The Company believes its products compete favorably on the basis of product innovation, product performance and marketing support and, to a lesser extent, price.

Marine Electronics: Minn Kota’s main competitors in the electric trolling motors business are Motor Guide®, owned by Brunswick Corporation, and private label branded motors sourced primarily from manufacturers in Asia. Competition in this business is focused on technological innovation, product quality and durability as well as product benefits and features for fishing.

The primary competitors in the marine battery charging business are Dual Pro™, owned by Pro Charging Systems, and various Pro Mariner™ products, owned by Power Products, LLC. Competition in this business is based on charging time, reliability and battery protection. The primary competitor in shallow water anchors is Power Pole®, owned by JL Marine Systems. Competition in this business is based on secure positioning, speed of deployment and quiet operation.

Humminbird’s main competitors in the market for on-boat electronics are GarminTM, LowranceTM and Simrad, owned by Navico (an Altor private equity holding), and Raymarine®, owned by FLIR Systems. Competition in this business is primarily focused on the quality of sonar imaging and display, easy to use graphical interfaces as well as the integration of mapping and GPS technology. Humminbird products contain marine cartography features. Competitors offering marine cartography products include Navionics®, and C-Map, owned by Digital Marine Solutions (an Altor private equity holding). Competition in this business focuses primarily on quality of data and quantity of available charts for inland lakes and ocean shoreline.

Cannon’s main competitors in the downrigger market are Big Jon Sports®, Walker and Scotty®. Competition in this business primarily focuses on ease of operation, speed and durability.

Outdoor Equipment: The Company’s outdoor equipment brands and products compete in the sporting goods and specialty segments of the outdoor equipment market. Competitive brands with a strong position in the sporting goods channel include Coleman® and private label brands. The Company also competes with specialty companies such as Kelty®, The North Face®, Marmot® and Big Agnes® on the basis of materials and innovative designs for consumers who want performance products priced at a value.

The Company’s portable outdoor cooking systems compete in the specialty and higher end performance backpacking and camping markets. The primary competitor in portable outdoor cooking systems is MSR® which is owned by Cascade Designs®. Competition in this market is based on product size and weight, ease of use, reliability and performance.

The Company’s competitors in the commercial tent market include Anchor Industries® and Aztec Tents for tension, frame and canopy tents. Competition in the commercial tent business is based on price, quality, structure, styling, ease of installation and technical support.

The Company sells military tents to the United States government via third party distributors who hold supply contracts primarily with the U.S. Government, as well as to international governments. Such supply contracts can be for commercial off-the-shelf products in addition to products required to be built to unique specifications. Competitors in the military tent business include HDT®, Alaska Structures®, Camel, Outdoor Venture, and Diamond Brand.

Watercraft: The Company primarily competes in this segment in the kayak and canoe product categories of the paddlesports market. The Company’s main competitors in this market are Confluence Outdoor, Hobie Cat®, Wenonah Canoe, Jackson Kayak and Legacy Paddlesports™, each of which competes on the basis of their product’s design, performance, quality and price.

Diving: The main competitors in the Diving segment include Aqua Lung®, Suunto®, Atomic Aquatics, Oceanic, Cressi and Mares®. Competitive advantage in the life support product category of this segment, which consists of regulators, dive computers, and buoyancy compensators, is a function of product innovation, performance, quality and safety.

Competition in the general diving product category of fins, masks, snorkels and wetsuits is characterized by low barriers to entry and numerous competitors who compete on the basis of product innovation, performance, quality and price.

Backlog

Unfilled orders for future delivery of products totaled approximately $62 million at September 30, 2016. For the majority of its products, the Company’s businesses do not receive significant orders in advance of expected shipment dates.

Employees

At September 30, 2016, the Company had approximately 1,200 regular, full-time employees. The Company considers its employee relations to be excellent. Temporary employees are utilized primarily to manage peaks in the seasonal manufacturing of products.

Patents, Trademarks and Proprietary Rights

The Company holds patents for various of the products it sells and regularly files applications for patents. The Company has numerous trademarks and trade names which it considers important to its business, many of which are noted in this report. Historically, the Company has vigorously defended its intellectual property rights and expects to continue to do so.

Supply Chain and Sourcing of Materials

The Company manufactures some products that use parts or materials that, due to geographical distance, limited supplier capacity or availability or competing demands for such parts or materials, are only available in a cost effective manner from a single vendor or require the Company to place orders several months in advance of required delivery.

The Company attempts to mitigate product availability and these supply chain risks when possible through the purchase of safety stock, use of forecast-based supply contracts, and, to a lesser extent, with just in time inventory deliveries or supplier-owned inventory located close to the Company’s manufacturing locations. The Company strives to balance the businesses’ need to maintain adequate inventory levels with the cost of holding such inventory by manufacturing to forecast for high volume products, utilizing build-to-order strategies wherever possible, and by having contract-manufactured products delivered to customers directly from the supplier. The Company also seeks to manage its inventory through on-going product design and logistical initiatives with its suppliers to reduce lead times.

As most military contracts require utilization of domestic suppliers, the Company is limited to key vendors for materials used in its military tent business.

Seasonality

The Company’s products are warm-weather, outdoor recreation-related, which results in seasonal variations in sales and profitability. This seasonal variability is due to customers’ increasing their inventories in the quarters ending March and June, the primary selling season for the Company’s outdoor recreation products, with lower inventory volumes during the quarters ending September and December. The Company mitigates the seasonality of its businesses somewhat by encouraging customers to purchase and take delivery of products more evenly through the year. The following table shows, for the past three fiscal years, the total net sales and operating profit or loss of the Company for each quarter, as a percentage of the total year.

|

Fiscal Year

|

||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

||||||||||||||||||||||

|

Quarter Ended

|

Net

Sales

|

Operating

Profit

|

Net

Sales

|

Operating

Profit

|

Net

Sales

|

Operating

Profit

|

||||||||||||||||||

|

December

|

20

|

%

|

-4

|

%

|

16

|

%

|

-41

|

%

|

19

|

%

|

-17

|

%

|

||||||||||||

|

March

|

31

|

%

|

66

|

%

|

31

|

%

|

43

|

%

|

29

|

%

|

69

|

%

|

||||||||||||

|

June

|

32

|

%

|

59

|

%

|

33

|

%

|

92

|

%

|

32

|

%

|

56

|

%

|

||||||||||||

|

September

|

17

|

%

|

-21

|

%

|

20

|

%

|

6

|

%

|

20

|

%

|

-8

|

%

|

||||||||||||

|

100

|

%

|

100

|

%

|

100

|

%

|

100

|

%

|

100

|

%

|

100

|

%

|

|||||||||||||

Environment and Climate Change

The Company is subject to various supranational, federal, state and local environmental laws, ordinances, regulations, and other requirements of governmental authorities. We believe we comply with such laws and regulations. Expenditures on environmental compliance have not had, and we believe in the future, will not have, a material effect on the Company’s capital expenditures, earnings or competitive position. We do not believe that any direct or indirect consequences of legislation related to climate change will have a material effect on our operating costs, facilities or products.

Available Information

The Company maintains a website at www.johnsonoutdoors.com. On its website, the Company makes available, free of charge, its Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as soon as reasonably practical after the reports have been electronically filed or furnished to the Securities and Exchange Commission. In addition, the Company makes available on its website, free of charge, its (a) proxy statement for its annual meeting of shareholders; (b) Code of Business Conduct; (c) Code of Ethics for its Chief Executive Officer and Senior Financial and Accounting Officers; and (d) the charters for the following committees of the Board of Directors: Audit; Compensation; Executive; and Nominating and Corporate Governance. Except as specifically provided herein, the Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Annual Report on Form 10-K. This report includes all material information about the Company that is included on the Company’s website and is otherwise required to be included in this report. Copies of any materials the Company files with the Securities and Exchange Commission (SEC) can also be obtained free of charge through the SEC’s website at www.sec.gov. The SEC’s Public Reference Room can be contacted at 100 F Street, N.E., Washington, D.C. 20549, or by calling 1 (800) 732-0330.

The risks described below are not the only risks we face. Additional risks that we do not yet know of or that we currently think are immaterial may also impair our future business operations. If any of the events or circumstances described in the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected. In such cases, the trading price of our common stock could decline.

Our net sales and profitability depend on our ability to continue to conceive, design and market products that appeal to our consumers.

Our business depends on our ability to continue to conceive, design, manufacture and market new products and upon continued market acceptance of our product offering. Rapidly changing consumer preferences and trends make it difficult to predict how long consumer demand for our existing products will continue or what new products will be successful. A decline in consumer demand for our products, our failure to develop new products on a timely basis in anticipation of changing consumer preferences or the failure of our new products to achieve and sustain consumer acceptance could reduce our net sales and profitability.

Competition and consolidation in our markets could reduce our net sales and profitability.

We operate in highly competitive markets. We compete with several large domestic and foreign companies such as Brunswick, Navico, Garmin, Confluence Outdoor and Aqua Lung International, with private label products sold by many of our retail customers and with other producers of outdoor recreation products. Some of our competitors have longer operating histories, stronger brand recognition and greater financial, technical, marketing and other resources than us. In addition, we may face competition from new participants in our markets because some of the outdoor recreation product industries have limited barriers to entry. We experience price competition for our products, and competition for shelf space at retailers, all of which may increase in the future. Consolidation of our retail markets, such as a recently announced combination of outdoor sporting goods retailers, could result in fewer but larger retail customers, which may further result in lower selling prices or reduced sales volumes of our products. If we cannot compete in our product markets successfully in the future, our net sales and profitability will likely decline.

General economic conditions affect the Company’s results.

Our revenues are affected by economic conditions and consumer confidence worldwide, but especially in the United States and Europe. In times of economic uncertainty, consumers tend to defer expenditures for discretionary items, which affects demand for our products. Moreover, our businesses are cyclical in nature, and their success is impacted by general economic conditions and specific economic conditions affecting the regions and markets we serve, the overall level of consumer confidence in the economy and discretionary income levels. Any substantial deterioration in general economic conditions that diminishes consumer confidence or discretionary income can reduce our sales and adversely affect our financial results. Moreover, declining economic conditions create the potential for future impairments of goodwill and other intangible and long-lived assets that may negatively impact our financial condition and results of operations. The impact of weak consumer credit markets, corporate restructurings, layoffs, prolonged high unemployment rates, declines in the value of investments and residential real estate, higher fuel prices and increases in federal and state taxation all can negatively affect our operating results.

Intellectual property disputes relating to our products could increase our costs.

Our industry is susceptible to litigation regarding patent infringement and infringement of other intellectual property rights. We could be either a plaintiff or a defendant in trademark, patent and/or other intellectual property infringement or misappropriation claims and claims of breach of license from time to time. The prosecution or defense of any intellectual property litigation is both costly and disruptive of the time and resources of our management and product development teams, even if the claim or defense against us is without merit. The scope of any patent or other intellectual property to which we have or may obtain rights also may not prevent others from developing and selling competing products. The validity and breadth of claims covered in patents and other intellectual property involve complex legal and factual questions, and the resolution of such claims may be highly uncertain, lengthy and expensive. In addition, our patents or other intellectual property may be held invalid upon challenge, or others may claim that we have improperly or invalidly sought patent or other intellectual property protection for our technology, thus exposing us to direct or counter claims in any patent or intellectual property proceeding. We could also be required to pay substantial damages or settlement costs to resolve intellectual property litigation.

Furthermore, we may rely on trade secret law to protect technologies and proprietary information that we cannot or have chosen not to patent. Trade secrets, however, are difficult to protect. Although we attempt to maintain protection through confidentiality agreements with necessary personnel, contractors and consultants, we cannot guarantee that such contracts will not be breached. In the event of a breach of a confidentiality agreement or the divulgence of proprietary information, we may not have adequate legal remedies to maintain our trade secret protection. Litigation to determine the scope of intellectual property rights, even if ultimately successful, could be costly and could divert management’s attention away from the Company’s business. Any of these negative events could adversely affect our profitability or operating results.

Product recalls and other claims could affect our financial position and results of operations.

As a manufacturer and distributor of consumer products, we could be required to repurchase or recall one or more of our products if they are found to be unsafe or defective. A repurchase or recall of our products could be costly to us and could damage the reputation of our brands. If we were required to remove, or we voluntarily removed, our products from the market, our reputation could be tarnished and we might have large quantities of finished products that we could not sell. As a result, product recalls could have a material adverse effect on our business, results of operations and financial condition.

Impairment charges could impact our future financial position and results of operations.

We test our goodwill and other long-lived assets for impairment on an annual basis or when an event occurs that might reduce the fair value of the reporting unit or applicable asset or group of assets below its carrying value. Various uncertainties, including significant adverse changes in business climate, adverse actions by regulators, unanticipated competition, loss of key customers, a downturn in the economy or in discretionary income levels or changes in consumer preferences could impact the expected cash flows to be generated by an asset or group of assets, and may result in an impairment of those assets. Although any such impairment charge would be a non-cash expense, any impairment of our assets could materially increase our expenses and reduce our profitability. We recorded impairment charges totaling $6,197 in the year ended September 30, 2016 and $8,475 in the year ended October 3, 2014.

Sales of our products are seasonal, which causes our operating results to vary from quarter to quarter.

Sales of our products are seasonal. Historically, our net sales and profitability have peaked in our second and third fiscal quarters due to the buying patterns of our customers for our products. Seasonal variations in operating results may also cause us to increase our debt levels and interest expense primarily in the second and third fiscal quarters as we fund our working capital requirements.

The trading price of shares of our common stock fluctuates and investors in our common stock may experience substantial losses.

The trading price of our common stock has been volatile and may continue to be volatile in the future. The trading price of our common stock could decline or fluctuate in response to a variety of factors, including:

| · |

the timing of our announcements or those of our competitors concerning significant product developments, acquisitions or financial performance;

|

| · |

fluctuation in our quarterly operating results;

|

| · |

substantial sales of our common stock;

|

| · |

general stock market conditions; or

|

| · |

other economic or external factors.

|

You may be unable to sell your stock at or above your purchase price.

A limited number of our shareholders can exert significant influence over the Company.

As of November 27, 2016, Helen P. Johnson-Leipold, members of her family and related entities (hereinafter the Johnson Family), held approximately 77% of the voting power of both classes of our common stock taken as a whole. This voting power would permit these shareholders, if they chose to act together, to exert significant influence over the outcome of shareholder votes, including votes concerning the election of directors, by-law amendments, possible mergers, corporate control contests and other significant corporate transactions. Moreover, certain members of the Johnson Family have entered into a voting trust agreement covering approximately 96% of our outstanding class B common shares. This voting trust agreement permits these shareholders, if they continue to choose to act together, to exert significant influence over the outcome of shareholder votes, including votes concerning the election of directors, by-law amendments, possible mergers, corporate control contests and other significant corporate transactions.

We may experience difficulties in integrating strategic acquisitions.

We have, as part of our strategy, historically pursued strategic acquisitions. The pursuit of future growth through acquisitions, involves significant risks that could have a material adverse effect on our business. Risks associated with integrating strategic acquisitions include:

| · |

the acquired business may experience losses which could adversely affect our profitability;

|

| · |

unanticipated costs relating to the integration of acquired businesses may increase our expenses and reduce our profitability;

|

| · |

the possible failure to obtain any necessary consents to the transfer of licenses or other material agreements of the acquired company;

|

| · |

the possible failure to maintain customer, licensor and other relationships of the acquired company after the closing of the transaction with the acquired company;

|

| · |

difficulties in achieving planned cost savings and synergies may increase our expenses;

|

| · |

diversion of our management’s attention could impair their ability to effectively manage our other business operations;

|

| · |

unanticipated management or operational problems or liabilities may adversely affect our profitability and financial condition; and/or

|

| · |

breaches of the representations or warranties or other violations of the contractual obligations required by the acquisition agreement of other parties to the acquisition transaction and any contractual remedies related thereto may not adequately protect or compensate us.

|

We are dependent upon certain key members of management.

Our success will depend to a significant degree on the abilities and efforts of our senior management. Moreover, our success depends on our ability to attract, retain and motivate qualified management, marketing, technical and sales personnel. These people are in high demand and often have competing employment opportunities. The labor market for skilled employees is highly competitive and we may lose key employees or be forced to increase their compensation to retain these people. Employee turnover could significantly increase our recruitment, training and other related employee costs. The loss of key personnel, or the failure to attract qualified personnel, could have a material adverse effect on our business, financial condition or results of operations.

Sources of and fluctuations in market prices of raw materials can affect our operating results.

The primary raw materials we use in manufacturing our products are metals, resins and packaging materials. These materials are generally available from a number of suppliers, but we have chosen to concentrate our sourcing with a limited number of vendors for each commodity or purchased component. We believe our sources of raw materials are reliable and adequate for our needs. However, the development of future sourcing issues related to the availability of these materials as well as significant fluctuations in the market prices of these materials may have an adverse effect on our financial results.

Our profitability is also affected by significant fluctuations in the prices of the raw materials we use in our products, including the effect of fluctuations in foreign currency exchange rates on raw materials and purchased components. We may not be able to pass along any price increases in our raw materials or other component costs to our customers. As a result, an increase in the cost of raw materials, labor or other costs associated with the manufacturing of our products could increase our costs of sales and reduce our gross margins.

Financial distress in supply chain and shortage of raw materials or components of supply.

Deteriorating industry conditions can adversely affect our supply base. Lower production levels at our major suppliers and volatility in certain raw material and energy costs may result in severe financial distress among many companies within our supply base. Financial distress within our supply base and/or our suppliers’ inability to obtain credit from lending institutions could lead to commercial disputes and possible supply chain interruptions to our business. In addition, potential adverse industry conditions may require us to provide financial assistance or other measures to ensure uninterrupted production of key components or materials used in the production of our products which could have a material adverse effect on our existing and future revenues and net income.

Additionally, in the event of catastrophic acts of nature such as fires, tsunamis, hurricanes and earthquakes or a rapid increase in production demands, either we, or our suppliers may experience supply shortages of raw materials or components. This could be caused by a number of factors, including a lack of production line capacity or manpower or working capital constraints. In order to manage and reduce the costs of purchased goods and services, we, and others within our industry have been rationalizing and consolidating our supply base. As a result, there is greater dependence on fewer sources of supply for certain components and materials used in our products, which could increase the possibility of a supply shortage of any particular component. If we or one of our own suppliers experience a supply shortage, we may become unable to produce the affected products if we cannot procure the components from another source. Such production interruptions could impede a ramp-up in production and could have a material adverse effect on our business, results of operations and financial condition.

We consider the production capacities and financial condition of suppliers in our selection process, and expect that they will meet our delivery requirements. However, there can be no assurance that strong demand, capacity limitations, shortages of raw materials, labor disputes or other problems will not result in any shortages or delays in the supply of components to us.

Currency exchange rate fluctuations could adversely affect the Company’s results.

We have significant foreign operations, for which the functional currencies are denominated primarily in euros, Swiss francs, Hong Kong dollars, Japanese yen and Canadian dollars. As the values of the currencies of the foreign countries in which we have operations increase or decrease relative to the U.S. dollar, the sales, expenses, profits, losses, assets and liabilities of our foreign operations, as reported in our consolidated financial statements, increase or decrease, accordingly. Approximately 17% of our revenues for the year ended September 30, 2016 were denominated in currencies other than the U.S. dollar. Approximately 7% were denominated in euros and approximately 6% were denominated in Canadian dollars with the remaining 4% denominated in various other foreign currencies. We may mitigate a portion of the impact of fluctuations in certain foreign currencies on our operations through the purchase of foreign currency swaps, forward contracts and options to hedge known commitments denominated in foreign currencies or to reduce the risk of changes in foreign currency exchange rates on foreign currency borrowings.

Because we rely on foreign suppliers and we sell products in foreign markets, we are susceptible to numerous international business risks that could increase our costs or disrupt the supply of our products.

Our international operations subject us to risks, including:

| · |

economic and political instability;

|

| · |

restrictive actions by foreign governments;

|

| · |

opportunity costs and reputational damage related to the presence of counterfeit versions of the Company’s products in such foreign markets;

|

| · |

greater difficulty enforcing intellectual property rights and weaker laws protecting intellectual property rights;

|

| · |

changes in import duties or import or export restrictions;

|

| · |

timely shipping of product and unloading of product, including the timely rail/truck delivery to our warehouses and/or a customer’s warehouse of our products;

|

| · |

complications in complying with the laws and policies of the United States affecting the importation of goods, including duties, quotas and taxes;

|

| · |

required compliance with U.S. laws that impact the Company’s operations in foreign jurisdictions that do not impact local operating companies; and

|

| · |

complications in complying with trade and foreign tax laws.

|

Any of these risks, including the cost of compliance with trade and foreign tax laws, could disrupt the supply of our products or increase our expenses. In particular, the uncertainty regarding the ability of certain European countries to continue to service their sovereign debt obligations and the related financial restructuring efforts by European governments, as well as the decision of the United Kingdom to withdraw from the European Union, may cause the value of several European currencies, including the euro, to fluctuate, which may adversely affect our non-U.S. dollar sales and earnings. As we have manufacturing operations in Italy, a significant disruption of the political or financial systems there could put these manufacturing operations at risk, which could ultimately adversely affect our profitability or operating results.

We may be subject to disruptions or failures in our information technology systems and network infrastructures that could have a material adverse effect on our business.

We rely on the efficient and uninterrupted operation of complex information technology systems and network infrastructures to operate our business. We also hold data in various company-owned and third party data center facilities upon which our business depends. A disruption, infiltration or failure of these information technology systems or any of these data centers as a result of software or hardware malfunctions, system implementations or upgrades, computer viruses, third-party security breaches, employee error, theft or misuse, malfeasance, power disruptions, natural disasters or accidents could cause breaches of data security, loss of intellectual property and critical data and the release and misappropriation of sensitive competitive information. Any of these events could result in the loss of key information, impair our production and supply chain processes, harm our competitive position, damage our reputation with customers, cause us to incur significant costs to remedy any damages and ultimately materially and adversely affect our business, results of operations and financial condition. While we have implemented a number of protective measures, such measures may not be adequate or implemented properly to prevent or fully address the adverse effect of such events.

Our failure to adequately protect personal information could have a material adverse effect on our business.

A wide variety of local, state, national, and international laws, directives and regulations apply to the collection, use, retention, protection, disclosure, transfer, and other processing of personal data. These data protection and privacy-related laws and regulations continue to evolve and may result in ever-increasing regulatory and public scrutiny and escalating levels of enforcement and sanctions and increased costs of compliance. Certain safe-harbor exemptions upon which the Company relies for data transfers have been challenged and may no longer be available to us in the future. Our failure to comply with applicable laws and regulations, or to protect such data, could result in enforcement actions against us, including fines, imprisonment of company officials and public censure, claims for damages by end-customers and other affected individuals, damage to our reputation and loss of goodwill (both in relation to existing end-customers and prospective end-customers), any of which could have a material adverse effect on our operations, financial performance, and business. Changing definitions of personal data and personal information, within the European Union, the United States, and elsewhere may limit or inhibit our ability to operate or expand our business, including limiting strategic partnerships that may involve the sharing of data. The evolving data protection regulatory environment may require significant management attention and financial resources to analyze and modify our information technology infrastructure to meet these changing requirements all of which could reduce our operating margins and impact our operating results and financial condition.

Future terror attacks, war, natural disasters or other catastrophic events beyond our control could negatively impact our business.

Terror attacks, war or other civil disturbances, natural disasters and other catastrophic events could lead to economic instability and decreased demand for our products, which could negatively impact our business, financial condition, results of operations and cash flows. In the past, terrorist attacks have caused instability in global financial markets and the industries in which we compete and have negatively affected spending on consumer discretionary products. In addition, our facilities are located throughout the world and could be subject to damage from terrorism incidents or from fires, floods, earthquakes or other natural or man-made disasters. Terrorist incidents could also lead to increased border security which could in turn negatively impact our global supply chain by causing shipping delays or shortages in key materials or components, increasing the cost of such goods or requiring us to keep greater inventories, any of which may adversely impact our business, results of operations, financial condition or cash flows.

The inability to successfully defend claims asserted by taxing authorities could adversely affect our financial condition, results of operations and cash flows.

We conduct business in many countries, which requires us to interpret the income tax laws and rulings in each of those taxing jurisdictions. Due to the subjectivity of tax laws in or between those jurisdictions, as well as the subjectivity of factual interpretations, our estimates of income tax liabilities may differ from actual payments or assessments. Claims from taxing authorities related to these differences could have an adverse impact on our financial condition, results of operations and cash flows.

We are subject to environmental, safety and human rights regulations.

We are subject to supranational, federal, state, local and foreign laws and other legal requirements related to the generation, storage, transport, treatment and disposal of materials as a result of our manufacturing and assembly operations. These laws include the Resource Conservation and Recovery Act (as amended), the Clean Air Act (as amended) and the Comprehensive Environmental Response, Compensation and Liability Act (as amended). Risk of environmental liability and changes associated with maintaining compliance with environmental laws is inherent in the nature of our business and there is no assurance that material liabilities or changes would not arise.

The Company is also subject to the requirement of Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and SEC rules related thereto to conduct due diligence and disclose and report on whether certain minerals and metals, known as “conflict minerals,” are contained in the Company’s products and whether they originate from the Democratic Republic of Congo (“DRC”) and adjoining countries. Among other things, compliance with this rule could adversely affect the sourcing, availability and pricing of such materials if they are found to be used in the manufacture of the Company’s products, and this in turn could affect the costs associated with the Company’s products. As there may be only a limited number of suppliers offering “conflict free” conflict minerals, we cannot be sure that going forward we will be able to obtain the necessary conflict minerals from such suppliers in sufficient quantities or at competitive prices. Moreover, since the Company’s supply chain structure is complex, management may have difficulty verifying the origin of these materials in the future and if they exist within the Company’s products and, as a result, the Company may be unable to certify that its products are DRC conflict mineral free. Also, we may face reputational challenges if we determine that certain of our products contain minerals not determined to be conflict free or if we are unable to sufficiently verify the origins of all conflict minerals used in our products through the procedures we implement.

We rely on our credit facilities to provide us with sufficient working capital to operate our business.

Historically, we have relied upon our existing credit facilities to provide us with adequate working capital to operate our business. If our lenders reduce or terminate our access to amounts under our credit facilities, we may not have sufficient capital to fund our working capital needs and/or we may need to secure additional capital or financing to fund our working capital requirements or to repay outstanding debt under our credit facilities. We can make no assurance that we will be successful in ensuring our availability of amounts under our credit facilities or in connection with raising additional capital and that any amount, if raised, will be sufficient to meet our cash flow requirements. If we are not able to maintain our borrowing availability under our credit facilities and/or raise additional capital when needed, we may be forced to sharply curtail our efforts to manufacture and promote the sale of our products or to curtail our operations. Ultimately, we may be forced to cease operations.

Our debt covenants may limit our ability to complete acquisitions, incur debt, make investments, sell assets, merge or complete other significant transactions.

Our credit facilities and certain other of our debt instruments include limitations on a number of our activities, including our ability to:

| · |

incur additional debt;

|

| · |

create liens on our assets or make guarantees;

|

| · |

make certain investments or loans;

|

| · |

pay dividends; or

|

| · |

dispose of or sell assets, make acquisitions above certain amounts or enter into a merger or similar transaction.

|

Our credit facilities also contain a number of financial covenants. The restrictive covenants in our credit facilities may limit our ability to engage in acts that may be in our best long term interests. A breach of any of the restrictive covenants in our credit facilities could result in a default under these facilities. If a default occurs, the lenders under our credit facilities may elect to declare all outstanding borrowings, together with accrued interest, to be immediately due and payable, to terminate any commitments they have to provide further borrowings and to exercise any other rights they have under the facilities or applicable law.

Our shares of common stock are thinly traded and our stock price may be volatile.

Because our common stock is thinly traded, its market price may fluctuate significantly more than the stock market in general or the stock prices of similar companies, which are exchanged, listed or quoted on NASDAQ. We believe there are approximately 4,760,000 shares of our Class A common stock held by non-affiliates as of November 27, 2016. Thus, our common stock will be less liquid than the stock of companies with broader public ownership, and as a result, the trading price for our shares of common stock may be more volatile. Among other things, trading of a relatively small volume of our common stock may have a greater impact on the trading price for our stock than would be the case if our public float were larger.

Our business is susceptible to adverse weather conditions or events.

Our success is in part affected by adverse weather conditions, including fires, floods, tornados, severe cold and other natural disasters. Such events have the tendency to create fluctuations in demand for our products which may impact our borrowing costs, increase our expenses and reduce our profitability. Moreover, our profitability is affected by our ability to successfully manage our inventory levels and demand for our products, which, in part depends upon the efficient operation of our production and delivery systems. These systems are vulnerable to damage or interruption from the aforementioned natural disasters. Such natural disasters could adversely impact our ability to meet delivery requirements of our customers, which may result in our need to incur extra costs to expedite production and delivery of product to meet customer demand. Any of these events could negatively impact our profitability.

Not Applicable

The Company maintains leased and owned manufacturing, warehousing, distribution and office facilities throughout the world. The Company believes that its facilities are well maintained and have capacity adequate to meet its current needs.

See Note 5 to the consolidated financial statements included elsewhere in this report for a discussion of the Company’s lease obligations.

As of September 30, 2016, the Company’s principal manufacturing (identified with an asterisk) and other locations are:

Alpharetta, Georgia (Marine Electronics)

Antibes, France (Diving)

Barcelona, Spain (Diving)

Batam, Indonesia* (Diving and Outdoor Equipment)

Binghamton, New York* (Outdoor Equipment)

Brussels, Belgium (Diving)

Burlington, Ontario, Canada (Marine Electronics, Outdoor Equipment, Watercraft)

Casarza Ligure, Italy* (Diving)

Chai Wan, Hong Kong (Diving)

Chatswood, Australia (Diving)

El Cajon, California (Diving)

Eufaula, Alabama* (Marine Electronics)

Graz, Austria (Diving)

Little Falls, Minnesota* (Marine Electronics)

Manchester, New Hampshire* (Outdoor Equipment)

Mankato, Minnesota* (Marine Electronics)

Mexicali, Mexico* (Marine Electronics)

Old Town, Maine* (Watercraft)

Toronto, Canada (Marine Electronics)

Wendelstein, Germany (Diving)

Yokahama, Japan (Diving)

Zurich, Switzerland (Diving)

The Company’s corporate headquarters is located in a facility in Racine, Wisconsin.

In the normal course of business, we may be involved in various legal proceedings from time to time. Except as noted below, we are not involved in any litigation involving amounts deemed to be material to the business or financial condition of the Company.

In the Matter of Certain Marine Sonar Imaging Systems, Products Containing the Same and Components Thereof (ITC Investigation No. 337-TA-926).

On July 18, 2014, the Company and Johnson Outdoors Marine Electronics, Inc. filed a complaint with the United States International Trade Commission (“ITC”), Investigation No. 337-TA-926, against Respondents Garmin International Inc., Garmin USA, Inc. and Garmin Corporation (collectively “Garmin”) alleging a violation of Section 337 of the Tariff Act of 1930, as amended, to block the importation of one or more side scan imaging products that are believed to infringe U.S. Patents 7,652,952 (“the ‘952 patent”); 7,710,825 (“the ‘825 patent”); and 7,755,974 (“the ‘974 patent”). The inventions of these asserted patents are used in certain Humminbird® fishfinders.

On July 13, 2015, an Administrative Law Judge (“ALJ”) at the ITC determined that Garmin violated Section 337 of the Tariff Act of 1930, as amended, by importing and selling SideVü sonars, which the judge found infringed the ‘974 patent. The ALJ also found that all three of the asserted patents are valid and enforceable.

On November 18, 2015, the full ITC affirmed the initial determination by the ALJ. The ITC affirmed that all three patents asserted by Johnson Outdoors are valid and enforceable and that numerous models of Garmin’s SideVü sonars directly infringe six Johnson Outdoors patent claims. The ITC also issued a limited exclusion order barring Garmin’s infringing SideVü sonar systems and components thereof which are manufactured overseas from import into the United States and a cease and desist order prohibiting Garmin from selling or distributing any infringing product or component thereof from its inventory. The orders went into effect on January 19, 2016.

On January 15, 2016, the Company and Johnson Outdoors Marine Electronics, Inc. filed a notice of appeal with the Court of Appeals for the Federal Circuit on all issues appealable in the case, including the Commission’s final determination to affirm the finding of no Section 337 violation in connection with the asserted claims of the ‘952 and ‘825 patents, and asserted claim 25 of the ‘974 patent.

Johnson Outdoors Inc. and Johnson Outdoors Marine Electronics, Inc. v. Garmin International Inc. and Garmin USA, Inc. (Civil Action No.: 2:14-cv-683).

On July 1, 2014, the Company and Johnson Outdoors Marine Electronics, Inc. filed a parallel patent infringement lawsuit (similar in nature to the ITC proceeding noted above) against Garmin in the United States District Court for the Middle District of Alabama, Northern Division, Civil Action No.: 2:14-cv-683. This lawsuit has been stayed by the District Court pending a final resolution of the above ITC proceeding.

Pursuant to a confidential settlement agreement entered into between the parties on May 5, 2016, these cases have been dismissed with prejudice.

None.

PART II

| ITEM 5. |

Market Information

Certain information with respect to this item is included in Notes 9 and 10 to the Company’s consolidated financial statements included elsewhere in this report. The Company’s Class A common stock is traded on the NASDAQ Global MarketSM under the symbol: JOUT. There is no public market for the Company’s Class B common stock. However, the Class B common stock is convertible at all times at the option of the holder into shares of Class A common stock on a share for share basis. As of November 27, 2016, the Company had 620 holders of record of its Class A common stock and 25 holders of record of its Class B common stock. We believe the number of beneficial owners of our Class A common stock on that date was substantially greater.

A summary of the high and low closing prices for the Company’s Class A common stock during each quarter of the years ended September 30, 2016, October 2, 2015 and October 3, 2014 is as follows:

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

|||||||||||||||||||||||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

2016

|

2015

|

2014

|

2016

|

2015

|

2014

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||||||||||||||

|

Stock prices:

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

High

|

$

|

24.24

|

$

|

31.74

|

$

|

28.70

|

$

|

22.99

|

$

|

34.66

|

$

|

28.37

|

$

|

26.75

|

$

|

34.86

|

$

|

26.36

|

$

|

36.62

|

$

|

26.95

|

$

|

27.10

|

||||||||||||||||||||||||

|

Low

|

21.43

|

25.60

|

25.26

|

19.69

|

28.35

|

21.57

|

20.79

|

20.43

|

19.82

|

26.09

|

20.50

|

22.47

|

||||||||||||||||||||||||||||||||||||

Dividends

The Company’s Articles of Incorporation provide that no dividend, other than a dividend payable in shares of the Company’s common stock, may be declared or paid upon the Class B common stock unless such dividend is declared or paid upon both classes of common stock. Whenever a dividend (other than a dividend payable in shares of Company common stock) is declared or paid upon any shares of Class B common stock, at the same time there must be declared and paid a dividend on the shares of Class A common stock equal in value to 110% of the amount per share of the dividend declared and paid on the shares of Class B common stock. Whenever a dividend is payable in shares of Company common stock, such dividend must be declared or paid at the same rate on the Class A common stock and the Class B common stock.

Pursuant to the Company’s revolving credit agreement dated September 16, 2013, the Company is limited in the amount of restricted payments (primarily dividends and repurchases of common stock) made during each fiscal year. The Company may declare, and pay, dividends in accordance with historical practices, but in no event may the aggregate amount of all dividends or repurchases of common stock exceed $10 million in any fiscal year.

Quarterly dividends declared in each of the first three quarters of 2016 were $0.08 per share of Class A common stock and $0.073 per share of Class B common stock. Beginning with the dividend declared on September 28, 2016, the Company increased the dividend to $0.09 per share of Class A common stock and $0.082 per share of Class B common stock. Total dividends declared in 2016 were $3,269. Cash dividends paid in 2016 totaled $3,170 and dividends payable of $890 were included in current liabilities at September 30, 2016.

While the Board of Directors of the Company presently intends to continue the payment of regular quarterly cash dividends on the Company’s common stock, they monitor and evaluate the Company’s dividend payment practice quarterly and may elect to increase, decrease or not pay a dividend at any time. The Company’s ability to pay dividends could be affected by future business performance, liquidity, capital needs, alternative investment opportunities and debt covenants in its loan agreements.

Issuer Purchases of Equity Securities

The following table summarizes the Company’s monthly Class A common stock purchases during the quarter ended September 30, 2016, which were made solely in connection with the Company’s repurchase of all shares of the Class A common stock formerly held by the Johnson Outdoors Inc. Retirement and Savings Plan (the “401(k) Plan”) and its elimination of the Class A common stock as an investment option under the 401(k) Plan for the participants in such plan.

|

Average Price

Paid per Share

|

Total Number of

Shares Purchased

|

Total Number of

Shares Purchased

part of Publicly

Announced Plans

or Programs

|

Maximum Number

of Shares that May

Yet be Purchased

Under the Plan

or Programs

|

|||||||||||||

|

September 1, 2016

|

$

|

33.13

|

31,100

|

-

|

-

|

|||||||||||

|

Total

|

$

|

33.13

|

31,100

|

-

|

-

|

|||||||||||

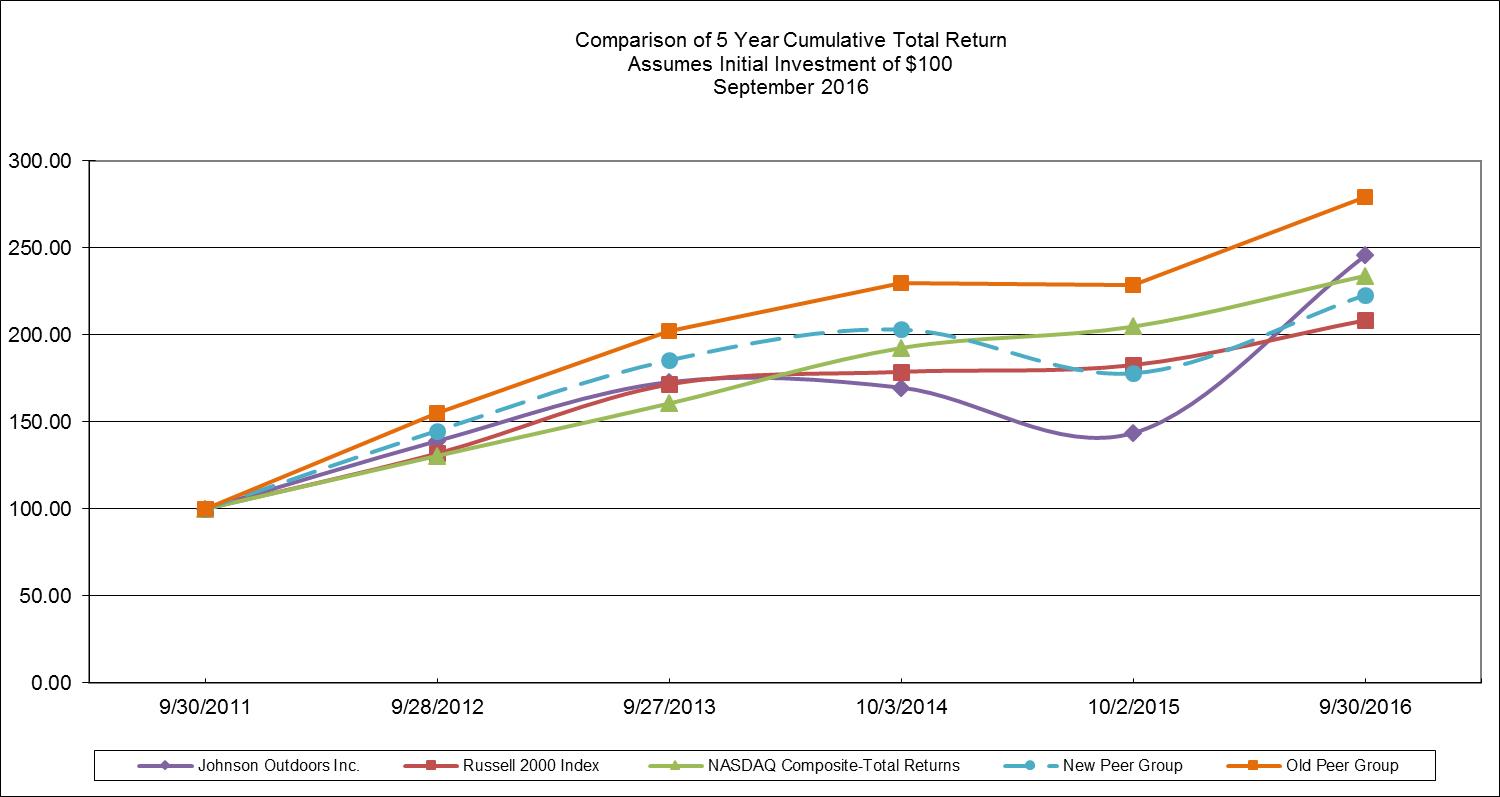

Total Shareholder Return

The graph below compares on a market cap weighted cumulative basis the yearly percentage change since September 30, 2011 in the total return (assuming reinvestment of dividends) to shareholders on the Class A common stock with (a) the total return (assuming reinvestment of dividends) on The NASDAQ Stock Market-U.S. Index; (b) the total return (assuming reinvestment of dividends) on the Russell 2000 Index; and (c) the total return (assuming reinvestment of dividends) on a self-constructed peer group index. The Company updated its peer group index to reflect the removal of Jarden Corp. The Company’s new peer group consists of Arctic Cat Inc., Black Diamond Inc., Brunswick Corporation, Callaway Golf Company, Escalade Inc., Garmin Ltd., Marine Products Corporation, and Nautilus, Inc. The graph assumes $100 was invested on September 30, 2011 in the Company’s Class A common stock, The NASDAQ Stock Market-U.S. Index, the Russell 2000 Index and the new and old peer group indices.

* $100 invested on September 30, 2011 in stock or index, including reinvestment of dividends.

Indexes calculated on a mid-month basis.

|

9/30/2011

|

9/28/2012

|

9/27/2013

|

10/3/2014

|

10/2/2015

|

9/30/2016

|

|||||||||||||||||||

|

Johnson Outdoors Inc.

|

$

|

100.0

|

$

|

139.1

|

$

|

173.0

|

$

|

169.7

|

$

|

143.7

|

$

|

245.6

|

||||||||||||

|

NASDAQ Composite

|

100.0

|

130.5

|

160.7

|

192.5

|

204.9

|

234.0

|

||||||||||||||||||

|

Russell 2000 Index

|

100.0

|

131.9

|

171.6

|

178.8

|

182.8

|

208.4

|

||||||||||||||||||

|

New Peer Group

|

100.0

|

145.0

|

185.5

|

203.2

|

178.0

|

223.0

|

||||||||||||||||||

|

Old Peer Group

|

100.0

|

155.0

|

202.2

|

229.8

|

228.5

|

279.1

|

||||||||||||||||||

The information in this section titled “Total Shareholder Return” shall not be deemed to be “soliciting material” or “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C promulgated by the Securities and Exchange Commission or subject to the liabilities of section 18 of the Securities Exchange Act of 1934, as amended, and this information shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The following table presents selected consolidated financial data, which should be read along with the Company’s consolidated financial statements and the notes to those statements and with “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in or referred to elsewhere in this report. The operating results for the years ended September 30, 2016, October 2, 2015 and October 3, 2014 and the balance sheet data as of September 30, 2016 and October 2, 2015, are derived from the Company’s audited consolidated financial statements included elsewhere herein. The operating results for the years ended September 27, 2013 and September 28, 2012, and the balance sheet data as of October 3, 2014, September 27, 2013 and September 28, 2012 are derived from the Company’s audited consolidated financial statements which are not included in this report. The historical results are not necessarily indicative of results to be expected for future periods.

|

(thousands, except per share data)

|

September 30

2016 |

October 2

2015 |

October 3

2014 |

September 27

2013 |

September 28

2012 |

|||||||||||||||

|

OPERATING RESULTS

|

||||||||||||||||||||

|

Net sales

|

$

|

433,727

|

$

|

430,489

|

$

|

425,410

|

$

|

426,461

|

$

|

412,292

|

||||||||||

|

Gross profit

|

176,462

|

171,733

|

168,613

|

171,049

|

164,322

|

|||||||||||||||

|

Impairment losses

|

6,197

|

-

|

8,475

|

-

|

-

|

|||||||||||||||

|

Operating expenses

|

147,371

|

153,880

|

143,447

|

145,458

|

142,909

|

|||||||||||||||

|

Operating profit

|

22,894

|

17,853

|

16,691

|

25,591

|

21,413

|

|||||||||||||||

|

Interest expense

|

727

|

865

|

788

|

1,285

|

2,258

|

|||||||||||||||

|

Other (income) expense, net

|

(1,488