Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VISTEON CORP | d288201d8k.htm |

| Exhibit 99.1

|

Visteon Corporation

Baird Industrial Conference

November 10, 2016

Sachin Lawande

President and CEO

Christian Garcia

Executive Vice President and CFO

Visteon Confidential

|

|

Forward-looking information

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- looking statements are not guarantees of future results and conditions but rather are subject to various factors, risks and uncertainties that could cause our actual results to differ materially from those expressed in these forward-looking statements, including, but not limited to: conditions within the automotive industry, including (i) the automotive vehicle production volumes and schedules of our customers, (ii) the financial condition of our customers and the effects of any restructuring or reorganization plans that may be undertaken by our customers, including work stoppages at our customers, and (iii) possible disruptions in the supply of commodities to us or our customers due to financial distress, work stoppages, natural disasters or civil unrest; our ability to execute on our transformational plans and cost-reduction initiatives in the amounts and on the timing contemplated; our ability to satisfy future capital and liquidity requirements; including our ability to access the credit and capital markets at the times and in the amounts needed and on terms acceptable to us; our ability to comply with financial and other covenants in our credit agreements; and the continuation of acceptable supplier payment terms; our ability to satisfy pension and other post-employment benefit obligations; our ability to access funds generated by foreign subsidiaries and joint ventures on a timely and cost effective basis; general economic conditions, including changes in interest rates and fuel prices; the timing and expenses related to internal restructurings, employee reductions, acquisitions or dispositions and the effect of pension and other post-employment benefit obligations; increases in raw material and energy costs and our ability to offset or recover these costs, increases in our warranty, product liability and recall costs or the outcome of legal or regulatory proceedings to which we are or may become a party; and those factors identified in our filings with the SEC (including our Annual Report on Form 10-K for the fiscal year ended December 31, 2015). Caution should be taken not to place undue reliance on our forward-looking statements, which represent our view only as of the date of this presentation, and which we assume no obligation to update. The financial results presented herein are preliminary and unaudited; final financial results will be included in the company’s Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2016. New business wins, re-wins and backlog do not represent firm orders or firm commitments from customers, but are based on various assumptions, including the timing and duration of product launches, vehicle productions levels, customer price reductions and currency exchange rates.

2

|

|

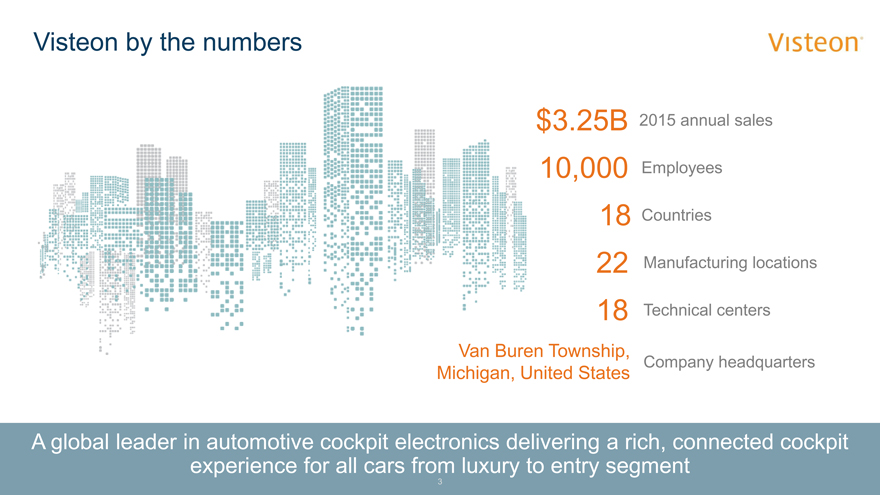

Visteon by the numbers

$3.25B 2015 annual sales 10,000 Employees

18 Countries

22 Manufacturing locations

18 Technical centers

Township,

Company headquarters

Michigan, United States

A global leader in automotive cockpit electronics delivering a rich, connected cockpit experience for all cars from luxury to entry segment

3

|

|

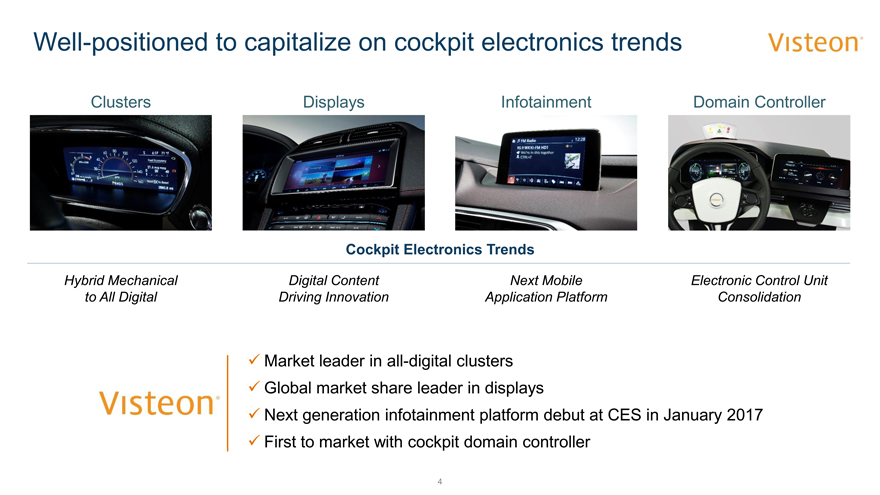

Well-positioned to capitalize on cockpit electronics trends

Clusters Displays Infotainment Domain Controller

Cockpit Electronics Trends

Hybrid Mechanical Digital Content Next MobileElectronic Control Unit

to All Digital Driving Innovation Application PlatformConsolidation

Market leader in all-digital clusters

Global market share leader in displays

Next generation infotainment platform debut at CES inJanuary2017

First to market with cockpit domain controller

4

|

|

Next-generation solutions

Next generation infotainment PhoenixTM

Our approach to autonomous driving

App developer Highly FullyFail-safeOpen frameworkNeural

friendly secure upgradeablecentralizeddesigned fornetworks

domainalgorithmic

hardwaredevelopers

5

|

|

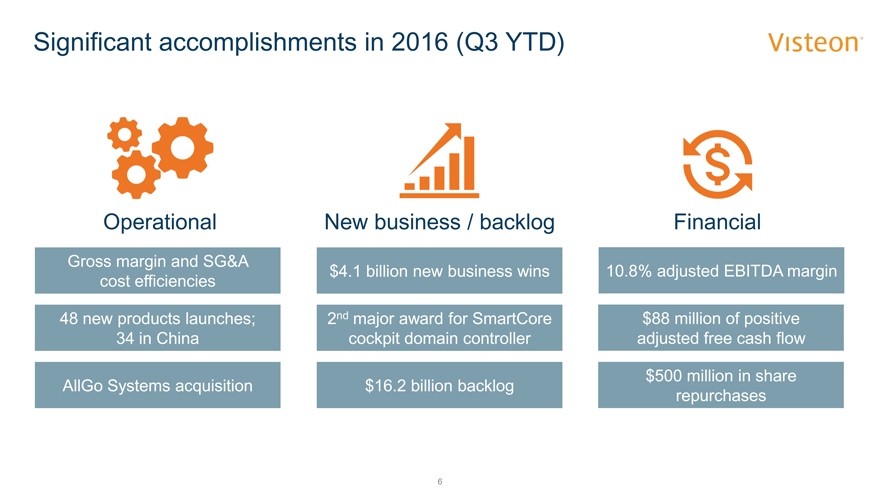

Significant accomplishments in 2016 (Q3 YTD)

Operational New business / backlog Financial

Gross margin and SG&A $4.1 billion new business wins10.8% adjusted EBITDA margin

cost efficiencies

48 new products launches; 2nd major award for SmartCore$88 million of positive

34 in China cockpit domain controller adjusted free cash flow

$500 million in share

AllGo Systems acquisition $16.2 billion backlog repurchases

6

|

|

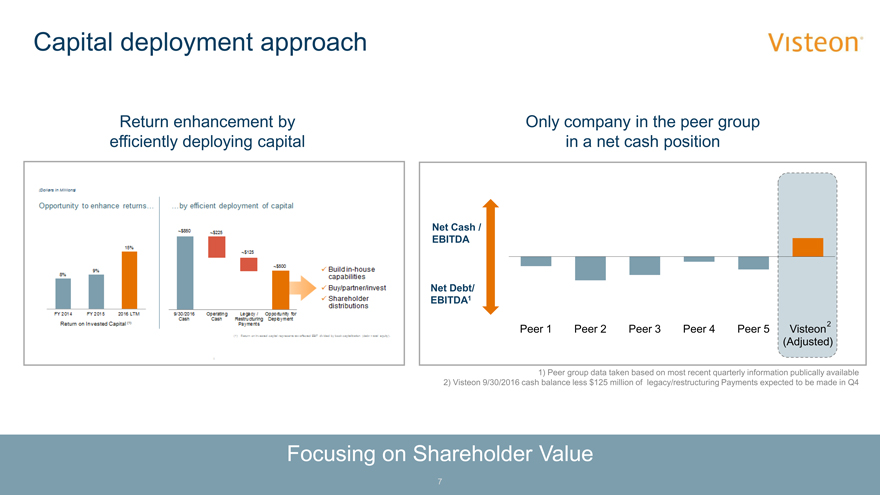

Capital deployment approach

Return enhancement by Only company in the peer group efficiently deploying capital in a net cash position

Net Cash / EBITDA

Net Debt/ EBITDA1

Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Visteon2 (Adjusted)

1) Peer group data taken based on most recent quarterly information publically available

2) Visteon 9/30/2016 cash balance less $125 million of legacy/restructuring Payments expected to be made in Q4

Focusing on Shareholder Value

7

|

|

Investment themes

Long-Term Growth Through Margin Expansion / Return Enhancement

Technology Leadership Cash Flow Generation Through Capital Deployment

Positioned for leadership in Driving higher EBITDA margin Healthy balance sheet with net

next-generation infotainment and and delivering consistent free cash position

advanced driver assistance cash flow through operational

systems (ADAS) improvements Deploy cash with focus on

shareholder value

A global leader in automotive cockpit electronics delivering a rich, connected cockpit experience for all cars from luxury to entry segment

8

|

|

Appendix

Visteon Corporation

Baird Global Industrial Conference

|

|

Use of non-GAAP financial information

Because not all companies use identical calculations, adjusted EBITDA, free cash flow and adjusted free cash flow used throughout this presentation may not be comparable to other similarly titled measures of other companies. In order to provide the forward-looking non-GAAP financial measures for full-year 2016, the Company is providing reconciliations to the most directly comparable GAAP financial measures on the subsequent slides. The provision of these comparable GAAP financial measures is not intended to indicate that the Company is explicitly or implicitly providing projections on those GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this presentation and the adjustments that management can reasonably predict.

10

|

|

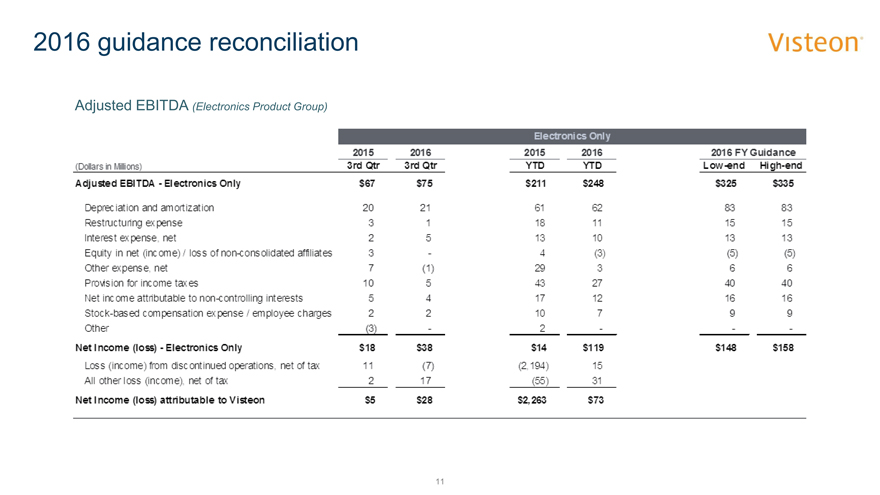

2016 guidance reconciliation

Adjusted EBITDA (Electronics Product Group)

Electronics Only

2015 2016201520162016 FY Guidance

(Dollars in Millions) 3rd Qtr 3rd QtrYTDYTDLow-endHigh-end

Adjusted EBITDA—Electronics Only $67 $75$211$248$325$335

Depreciation and amortization 20 2161628383

Restructuring expense 3 118111515

Interest expense, net 2 513101313

Equity in net (income) / loss of non-consolidated affiliates 3 -4(3)(5)(5)

Other expense, net 7 (1)29366

Provision for income taxes 10 543274040

Net income attributable to non-controlling interests 5 417121616

Stock-based compensation expense / employee charges 2 210799

Other (3) -2---

Net Income (loss)—Electronics Only $18 $38$14$119$148$158

Loss (income) from discontinued operations, net of tax 11 (7)(2,194)15

All other loss (income), net of tax 2 17(55)31

Net Income (loss) attributable to Visteon $5 $28$2,263$73

11

|

|

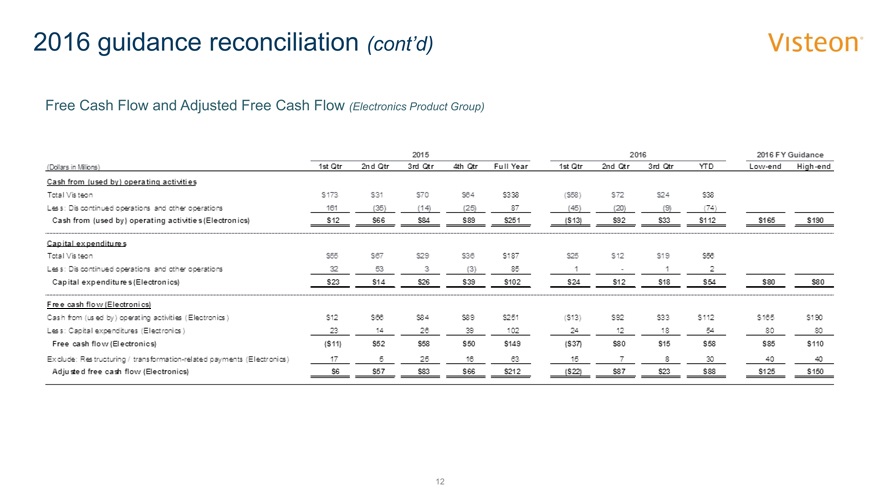

2016 guidance reconciliation (cont’d)

Free Cash Flow and Adjusted Free Cash Flow (Electronics Product Group)

201520162016 FY Guidance

(Dollars in Millions) 1st Qtr 2nd Qtr3rd Qtr4th QtrFull Year1st Qtr2nd Qtr3rd QtrYTDLow-endHigh-end

Cash from (used by) operating activities

Total Visteon $173 $31$70$64$338($58)$72$24$38

Less: Discontinued operations and other operations 161 (35)(14)(25)87(45)(20)(9)(74)

Cash from (used by) operating activities (Electronics) $12 $66$84$89$251($13)$92$33$112$165$190

Capital expenditures

Total Visteon $55 $67$29$36$187$25$12$19$56

Less: Discontinued operations and other operations 32 533(3)851-12

Capital expenditures (Electronics) $23 $14$26$39$102$24$12$18$54$80$80

Free cash flow (Electronics)

Cash from (used by) operating activities (Electronics) $12 $66$84$89$251($13)$92$33$112$165$190

Less: Capital expenditures (Electronics) 23 142639102241218548080

Free cash flow (Electronics) ($11) $52$58$50$149($37)$80$15$58$85$110

Exclude: Restructuring / transformation-related payments (Electronics) 17 52516631578304040

Adjusted free cash flow (Electronics) $6 $57$83$66$212($22)$87$23$88$125$150

12

|

|

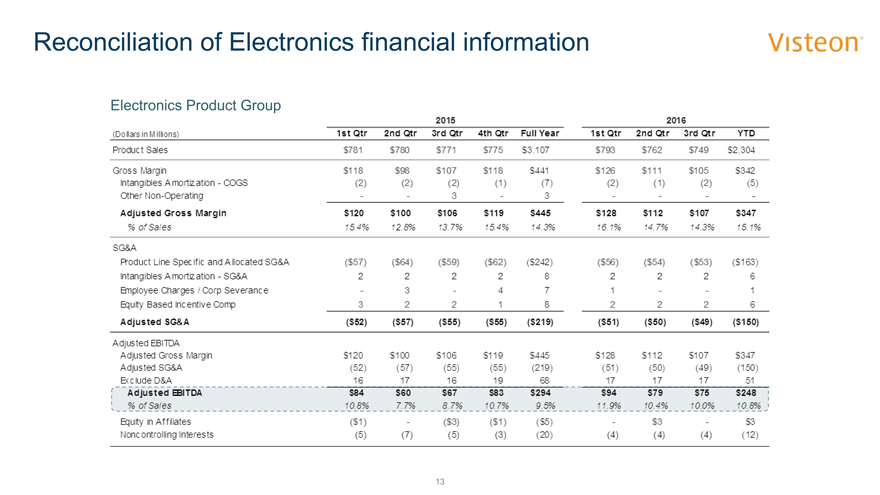

Reconciliation of Electronics financial information

Electronics Product Group

20152016

(Dollars in Millions) 1st Qtr 2nd Qtr3rd Qtr4th QtrFull Year1st Qtr2nd Qtr3rd QtrYTD

Product Sales $781 $780$771$775$3,107$793$762$749$2,304

Gross Margin $118 $98$107$118$441$126$111$105$342

Intangibles Amortization—COGS (2) (2)(2)(1)(7)(2)(1)(2)(5)

Other Non-Operating - -3-3----

Adjusted Gross Margin $120 $100$106$119$445$128$112$107$347

% of Sales 15.4% 12.8%13.7%15.4%14.3%16.1%14.7%14.3%15.1%

SG&A

Product Line Specific and Allocated SG&A ($57) ($64)($59)($62)($242)($56)($54)($53)($163)

Intangibles Amortization—SG&A 2 22282226

Employee Charges / Corp Severance - 3-471--1

Equity Based Incentive Comp 3 22182226

Adjusted SG&A ($52) ($57)($55)($55)($219)($51)($50)($49)($150)

Adjusted EBITDA

Adjusted Gross Margin $120 $100$106$119$445$128$112$107$347

Adjusted SG&A (52) (57)(55)(55)(219)(51)(50)(49)(150)

Exclude D&A 16 1716196817171751

Adjusted EBITDA $84 $60$67$83$294$94$79$75$248

% of Sales 10.8% 7.7%8.7%10.7%9.5%11.9%10.4%10.0%10.8%

Equity in Affiliates ($1) -($3)($1)($5)-$3-$3

Noncontrolling Interests (5) (7)(5)(3)(20)(4)(4)(4)(12)

13

|

|

VISTEON