Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LendingClub Corp | pressreleaseddated102516.htm |

| 8-K - 8-K - LendingClub Corp | form8-kon102516money2020.htm |

Scott Sanborn, President & CEO

Safe Harbor

Some of the statements in this presentation are "forward-looking statements." The words "anticipate," "believe,"

"estimate," "expect," "intend," "may," “outlook,” "plan," "predict," "project," "will," "would" and similar expressions

may identify forward-looking statements, although not all forward-looking statements contain these identifying

words. The Company may not actually achieve the plans, intentions or expectations disclosed in forward-looking

statements, and you should not place undue reliance on forward-looking statements. Actual results or events

could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. The

Company does not assume any obligation to update any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by law.

Information in this presentation is not an offer to sell securities or the solicitation of an offer to buy securities, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of such jurisdiction.

Additional information about Lending Club is available in the prospectus for Lending Club’s notes, which can be

obtained on Lending Club’s website at https://www.lendingclub.com/info/prospectus.action.

P2P Loans Gaining

Traction. Lending Club

Goes Nationwide

Posted Dec. 13, 2007

TechCrunch

2007

Scalability Credit

Performance

Regulatory

Risk

Bank

Competition

Material questions loomed…

Lending Club

Other Online

$0 B

$5 B

$10 B

$15 B

$20 B

2010 2011 2012 2013 2014 2015

Source: TransUnion, Lending Club analysis. Chart represents marketplace lending as a percentage of U.S. personal loans (24% in 2015). Bar graph reflects Lending Club as a portion of

personal loans facilitated through marketplace lenders.

24%

of US personal loans

#1 Provider

35%

lower

$1,000

saved

Based on approximated $1,030 avg. annual savings, calculated based on approximated $13,500 avg.

loan size (as of December 31, 2015, standard program borrowers only), and 760 basis points average

savings. Average savings based on responses from 12,728 borrowers in a survey of 66,493 randomly

selected borrowers conducted by Lending Club from January 1, 2015 – January 1, 2016. Borrowers

who received a loan to consolidate existing debt or pay off their credit card balance reported that the

interest rate on outstanding debt or credit cards was 20.7% and average interest rate on loans via

Lending Club is 13.8%. Unsecured loans via Lending Club feature rates from 5.99% to 35.89% APR

and origination fees from 1% to 6%. Average origination fee is 5.13% as of Q2 2016. Best APR is

available to borrowers with excellent credit. All loans originated and issued by WebBank, member FDIC.

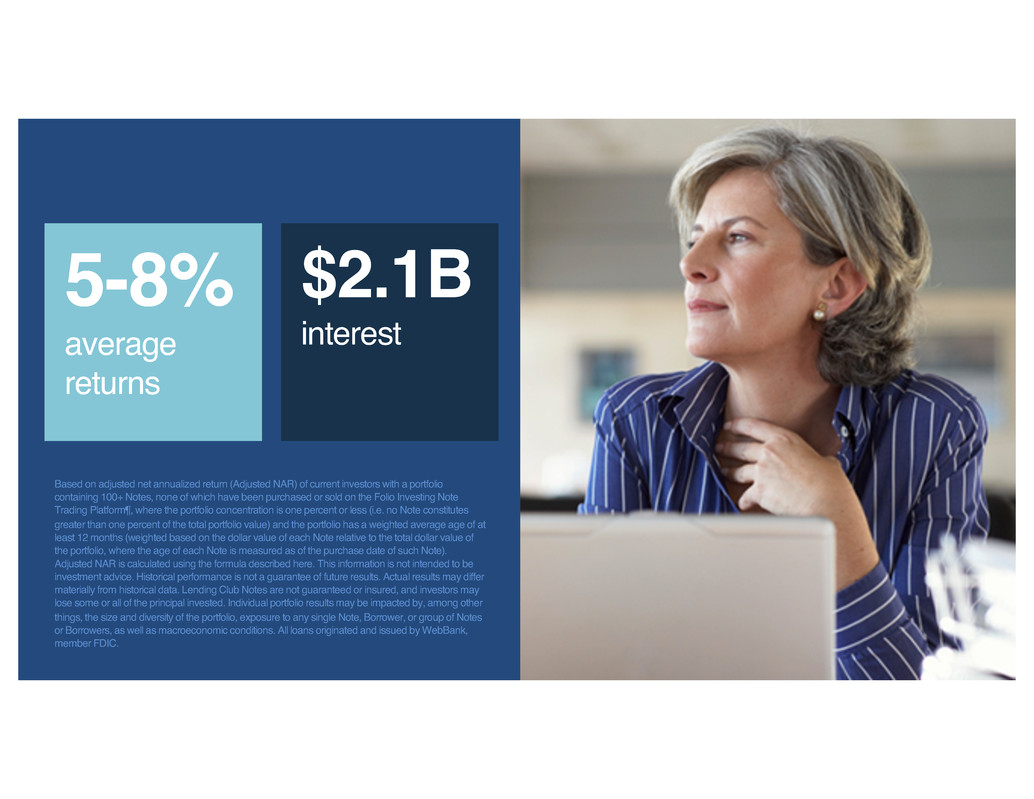

5-8%

average

returns

$2.1B

interest

Based on adjusted net annualized return (Adjusted NAR) of current investors with a portfolio

containing 100+ Notes, none of which have been purchased or sold on the Folio Investing Note

Trading Platform¶, where the portfolio concentration is one percent or less (i.e. no Note constitutes

greater than one percent of the total portfolio value) and the portfolio has a weighted average age of at

least 12 months (weighted based on the dollar value of each Note relative to the total dollar value of

the portfolio, where the age of each Note is measured as of the purchase date of such Note).

Adjusted NAR is calculated using the formula described here. This information is not intended to be

investment advice. Historical performance is not a guarantee of future results. Actual results may differ

materially from historical data. Lending Club Notes are not guaranteed or insured, and investors may

lose some or all of the principal invested. Individual portfolio results may be impacted by, among other

things, the size and diversity of the portfolio, exposure to any single Note, Borrower, or group of Notes

or Borrowers, as well as macroeconomic conditions. All loans originated and issued by WebBank,

member FDIC.

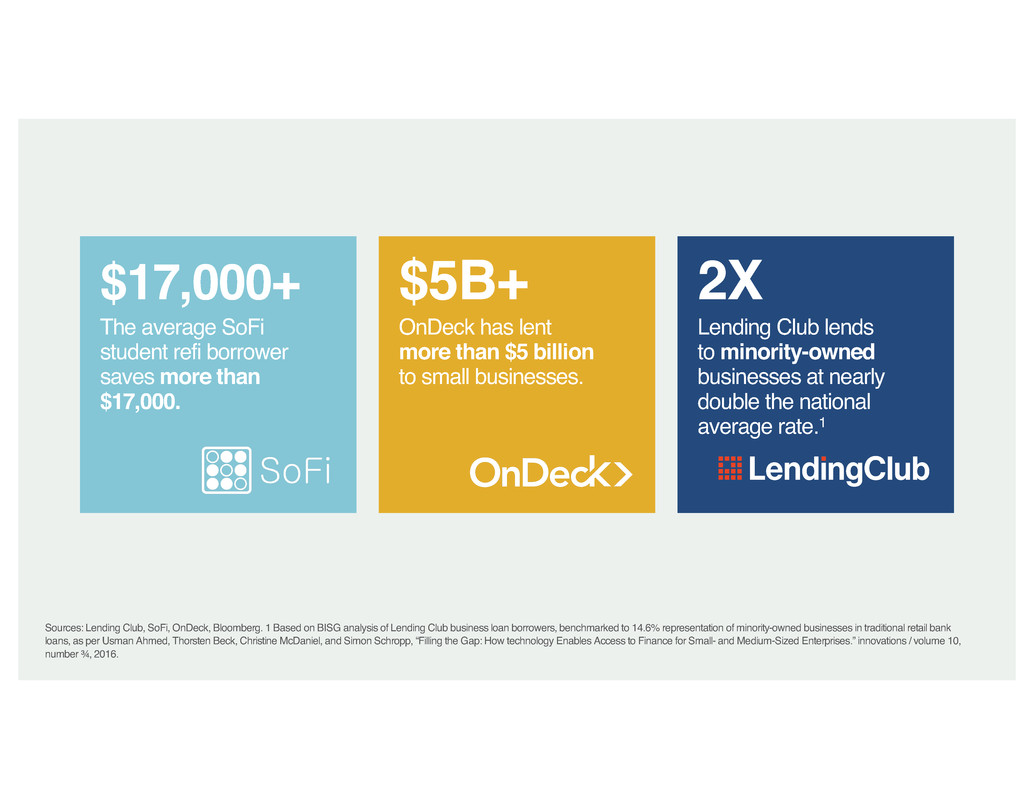

Sources: Lending Club, SoFi, OnDeck, Bloomberg. 1 Based on BISG analysis of Lending Club business loan borrowers, benchmarked to 14.6% representation of minority-owned businesses in traditional retail bank

loans, as per Usman Ahmed, Thorsten Beck, Christine McDaniel, and Simon Schropp, “Filling the Gap: How technology Enables Access to Finance for Small- and Medium-Sized Enterprises.” innovations / volume 10,

number ¾, 2016.

$17,000+

The average SoFi

student refi borrower

saves more than

$17,000.

$5B+

OnDeck has lent

more than $5 billion

to small businesses.

2X

Lending Club lends

to minority-owned

businesses at nearly

double the national

average rate.1

Regulation Downturn

Readiness

Consumers

expect more

from their

technology...

and their

banks.

VIDEO RENTAL MUSIC TRAVEL BANKING

?

13

$1.1T

Unsecured

Consumer

Credit

$0.3T

Small

Business

$1.2T

Auto

Loans

$1.3T

Student

Loans

$8.6T

Mortgages

Source: Federal Reserve

14

15

16

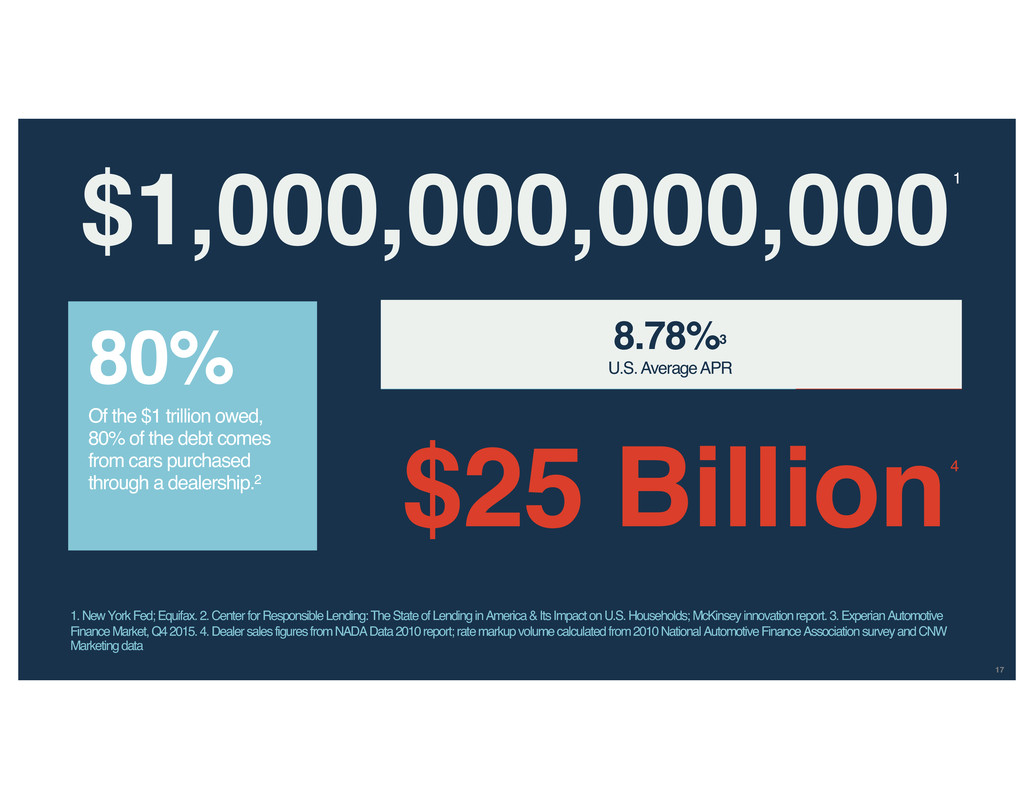

$1,000,000,000,000

80%

Of the $1 trillion owed,

80% of the debt comes

from cars purchased

through a dealership.2

6.78%

Base APR

1-3%

Dealer Markup3

1. New York Fed; Equifax. 2. Center for Responsible Lending: The State of Lending in America & Its Impact on U.S. Households; McKinsey innovation report. 3. Dealer sales figures

from NADA Data 2010 report; rate markup volume calculated from 2010 National Automotive Finance Association survey and CNW Marketing data. 4. Dealer sales figures from NADA

Data 2010 report; rate markup volume calculated from 2010 National Automotive Finance Association survey and CNW Marketing data.

1

$25 Billion 4

17

$1,000,000,000,000

80%

Of the $1 trillion owed,

80% of the debt comes

from cars purchased

through a dealership.2

6.78%

Base APR

1-3%

Dealer Markup3

1. New York Fed; Equifax. 2. Center for Responsible Lending: The State of Lending in America & Its Impact on U.S. Households; McKinsey innovation report. 3. Experian Automotive

Finance Market, Q4 2015. 4. Dealer sales figures from NADA Data 2010 report; rate markup volume calculated from 2010 National Automotive Finance Association survey and CNW

Marketing data

1

$25 Billion 4

8.78%3

U.S. Average APR

19

1-3%

Lower APR on

new auto loans

through Lending

Club.1

Real

Savings

A 2.5% interest

rate reduction could

translate to $1,350

in savings on the life

of the loan.1

1. Based on analysis of 300,000 consumer accounts from Q4 2012 to Q3 2013 using credit bureau data. Assumes the consumer refinances with the lowest rate for which they are eligible and does not extend the term of

the loan. Savings figure is based on a refinance from an average APR of 11.45% to an average APR of 8.2% and 60 months remaining on the term of the loan. Your actual savings may be different. A representative

example of payment terms are as follows: an Amount Financed of $18,000 with an APR of 8.20% and a term of 60 months would have a monthly payment of $366.70. All loans made by WebBank, member FDIC. APR is

the Annual Percentage Rate. A borrower’s actual rate depends upon individual credit score and other key financing characteristics, including but not limited to the amount financed, term, a loan-to-value (LTV) ratio and

other vehicle characteristics. Best APR is available to borrowers with excellent credit. APRs range from 2.49% - 19.99%.

Value.

40+

Fields

VIN number

Current loan balance

And more!

21

Takes less than 1 minute to apply,

with no impact to your credit score.1

2

3

Instantly receive offers you

qualify for and see the savings.

Complete the process online

from virtually anywhere.

No application fees, origination

fees, or prepayment penalties.4

Lender 1

Lender 2

22

For investors

Stable

Secured

Asset

23

S&P U.S. Auto Loan ABS Tracker: October 2013, http://morningconsult.com/opinions/columns-subprime-auto-loans/. Historical performance is not a guarantee of future results. Actual results may differ materially from

historical data.

0%

1%

2%

3%

4%

5%

6%

Apr-2006 Feb-2007 Dec-2007 Oct-2008 Aug-2009 Jun-2010 Apr-2011 Feb-2012 Dec-2012 Oct-2013 Aug-2014 Jun-2015 Apr-2016

S&P/Experian Consumer Loan Default Index

S&P/Experian First Mortgage Default Index

S&P/Experian Auto Default Index

24

For investors

Stable

Secured

Asset

Access to an

In-Demand

Asset Class

25

Consumer

Credit ?

?

?

Auto

Small

Business

Credit

3%

Average

estimated

return

26

For investors

Huge

Opportunity

Stable

Secured

Asset

Access to an

In-Demand

Asset Class

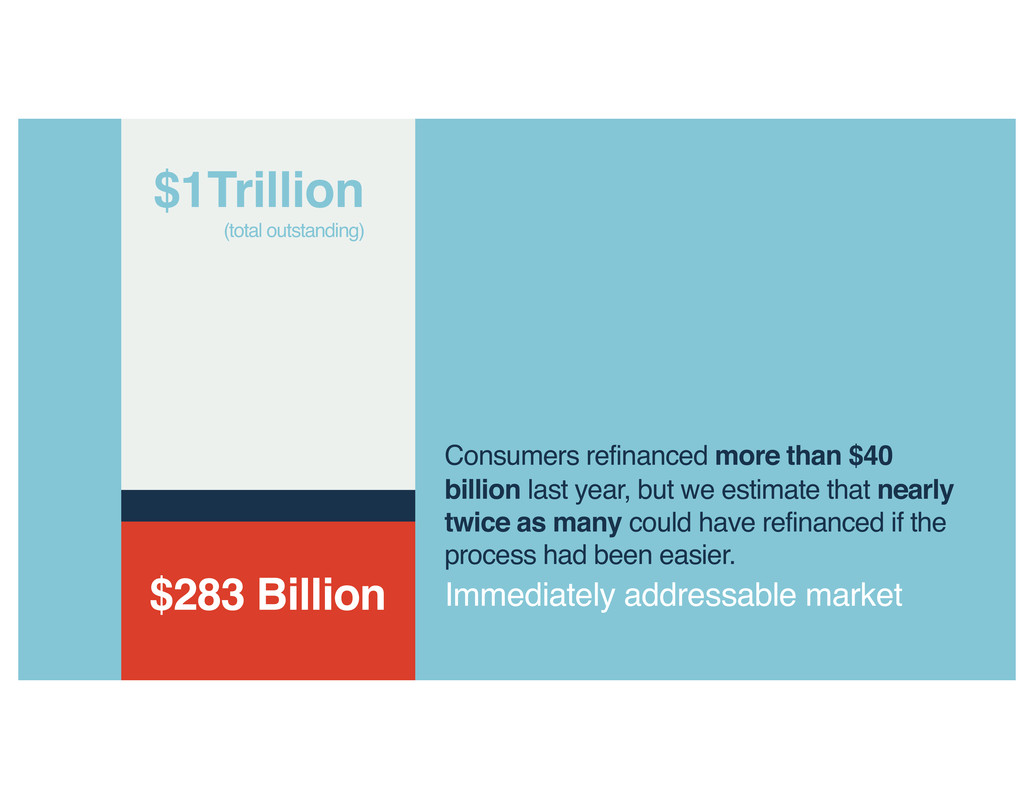

$1Trillion

(total outstanding)

$283 Billion Immediately addressable market

Consumers refinanced more than $40

billion last year, but we estimate that nearly

twice as many could have refinanced if the

process had been easier.

28

Value. Ease. Fairness.

Personal

Loans

Patient

Finance

Small

Business Auto

All loans originated and issued by WebBank, member FDIC.

Marketplace Lending

is just getting started.

29