Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Benefit Street Partners Realty Trust, Inc. | v450073_8k.htm |

Exhibit 99.1

Financing the Growth of Commercial Real Estate Note: This program does not own the properties pictured. The properties serve as the underlying collateral for mezzanine loan s h eld by RFT. Peter M. Budko Partner AR Global Investments, LLC Jerry Baglien Chief Financial Officer Realty Finance Trust Richard J. Byrne Chief Executive Officer and President Realty Finance Trust

Realty Finance Trust, Inc. 2 IMPORTANT INFORMATION Risk Factors Investing in and owning our common stock involves a high degree of risk . See the section entitled “Risk Factors” in our Form 10 - K filed March 11 , 2016 for a discussion of these risks . Forward - Looking Statements Certain statements included in this presentation are forward - looking statements . Those statements include statements regarding the intent, belief or current expectations of Realty Finance Trust and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions . Actual results may differ materially from those contemplated by such forward - looking statements . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law .

Realty Finance Trust, Inc. 3 WHAT IS HAPPENING? WHY NOW? Enhanced Opportunities for RFT and its Stockholders □ On September 29 , 2016 , Realty Finance Trust, Inc . (“RFT” or the “Company”) announced that Benefit Street Partners L . L . C . (“Benefit Street”) was appointed as the new adviser to RFT . □ Over the past three years, RFT stockholders have enjoyed consistent performance delivered by Realty Finance Adviser, LLC (“the Adviser”) and its personnel . The Adviser believes that to achieve optimal results going forward, it would need to draw upon additional resources . □ After a competitive process and in consideration of what would provide the best foundation for future success, the Board of Directors appointed Benefit Street as RFT’s new adviser . Benefit Street is affiliated with Providence Equity Partners L . L . C . (“Providence Equity”) . □ Our Board has assessed Benefit Street’s capabilities and historical performance and believes that stockholders will benefit from Benefit Street’s institutional presence, larger existing origination and investment management teams and sophisticated infrastructure . Benefit Street’s credit capabilities and expertise are further strengthened by Providence Equity’s global reach .

Realty Finance Trust, Inc. 4 TRANSACTION HIGHLIGHTS Broader Resources and Best Foundation for Success Economies of Scale New Advisory Agreement Institutional Quality Ownership of the New Adviser □ Benefit Street Partners L.L.C. (“Benefit Street”) and its affiliate, Providence Equity Partners L.L.C. (“Providence Equity”) have the resources and expertise necessary in order to attain our core objectives and to successfully achieve the liquidity we expect to realize within the next several years. □ The n ew advisory agreement provides stockholders with substantially improved terms as compared to the previous advisory agreement in several key areas, including: □ computing the management fee based on stockholder’s equity instead of assets; □ revising the annual performance fee to more closely align with stockholder interests; □ eliminating acquisition fees after $600 million of new investments; and □ eliminating disposition fees. □ The Company expects that these changes to the advisory agreement will result in significant savings for stockholders. □ Our Board has assessed Benefit Street ’s capabilities and historical performance and believes that stockholders will benefit from Benefit Street ’s larger existing origination and investment management teams and sophisticated infrastructure. □ Benefit Street ’s capabilities and expertise are further strengthened by Providence’s global reach. □ RFT benefits from Benefit Street’s existing 34 - person real estate team. □ RFT will have access to the accounting, finance, legal and compliance resources of Benefit Street’s larger platform, including experienced compliance personnel of Benefit Street and its affiliates.

Realty Finance Trust, Inc. 5 WHO IS BENEFIT STREET PARTNERS? □ Benefit Street is a leading credit - focused alternative asset management firm with over $ 14 . 0 billion in assets under management . □ Benefit Street was formed in 2008 as the credit investment platform of Providence Equity, a leading global private equity firm with more than $ 47 billion in assets under management . □ Benefit Street manages funds for institutions and high - net - worth investors globally across various credit funds and strategies including private debt, long - short liquid credit, long - only credit and commercial real estate debt . □ Benefit Street’s commercial real estate team has closed approximately $ 1 . 8 billion in fixed and floating rate loans over the past two years . □ Benefit Street has over 115 professionals, including a 34 - person team dedicated to the firm’s real estate platform . As of September 29, 2016

Realty Finance Trust, Inc. 6 Richard J. Byrne President, Benefit Street Partners Richard Byrne is president of Benefit Street Partners and is based in our New York office. Prior to joining BSP in 2013, Mr. Byrne was chief executive officer of Deutsche Bank Securities Inc. He was also the global head of capital markets at Deutsche Bank as well as a member of the global banking executive committee and the global markets executive committee. Before joining Deutsche Bank, Mr. Byrne was global co - head of the leveraged finance group and global head of credit research at Merrill Lynch. He was also a perennially top - ranked credit analyst. Mr. Byrne earned a Masters of Business Administration from the Kellogg School of Management at Northwestern University and a Bachelor of Arts from Binghamton University. Jerome S. Baglien Chief Financial Officer, Commercial Real Estate, Benefit Street Partners Jerry Baglien is chief financial officer and a vice president with Benefit Street Partners in our New York office, where he focuses on commercial real estate. Prior to joining BSP in 2016, Mr. Baglien was director of fund finance for GTIS Partners LP, where he oversaw all finance and operations for GTIS funds. Previously, he was an accounting manager at iStar Inc. with oversight of loans and special investments. Mr. Baglien received a Master of Business Administration from Kellstadt Graduate School of Business at DePaul University and a Bachelor of Science in Accounting from the University of Oregon. WHO IS BENEFIT STREET PARTNERS?

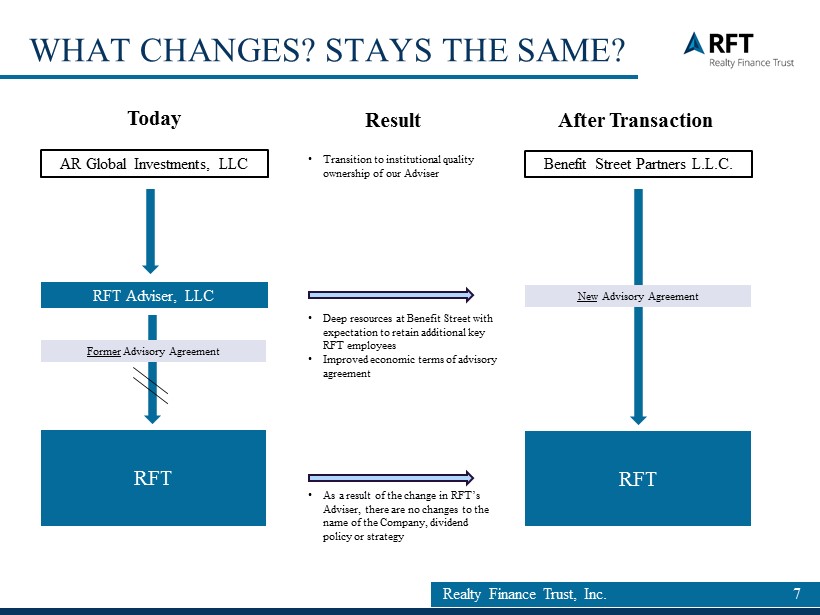

Realty Finance Trust, Inc. 7 RFT WHAT CHANGES? STAYS THE SAME? RFT Adviser, LLC Today • Transition to institutional quality ownership of our Adviser After Transaction Benefit Street Partners L.L.C. Former Advisory Agreement RFT AR Global Investments, LLC New Advisory Agreement Result • Deep resources at Benefit Street with expectation to retain additional key RFT employees • Improved economic terms of advisory agreement • As a result of the change in RFT’s Adviser, there are no changes to the name of the Company, dividend policy or strategy

Realty Finance Trust, Inc. 8 WHAT ARE SOME KEY BENEFITS OF THE TRANSACTION? □ The transition to institutional quality ownership of the Adviser will provide greater opportunities for RFT and its stockholders to achieve on attractive liquidity event . □ Lower fees under the new advisory agreement . □ As part of the Benefit Street platform, we expect to realize an increase in deal flow and commercial mortgage loan originations and strengthen the capital structure of RFT . □ The Adviser will be well capitalized and able to attract and retain personnel necessary to provide quality advisory services to RFT by being a part of a larger platform . □ The Adviser will have access to the accounting, finance, legal and compliance resources of Benefit Street’s larger platform . □ RFT will benefit from Benefit Street’s larger existing teams and sophisticated infrastructure . Benefit Street’s credit capabilities and expertise are further strengthened by Providence Equity’s global reach .

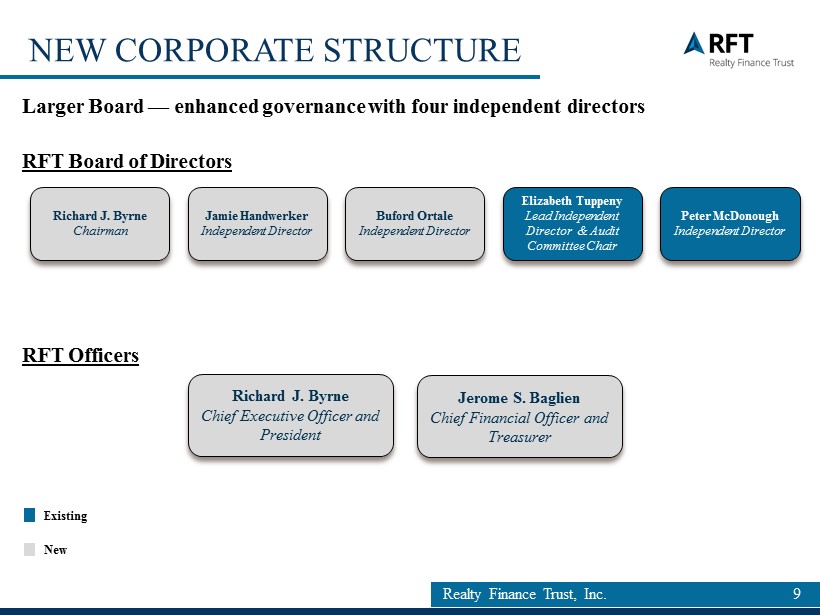

Realty Finance Trust, Inc. 9 NEW CORPORATE STRUCTURE Richard J. Byrne Chief Executive Officer and President Jerome S. Baglien Chief Financial Officer and Treasurer Elizabeth Tuppeny Lead Independent Director & Audit Committee Chair Peter McDonough Independent Director Richard J. Byrne Chairman RFT Board of Directors RFT Officers Existing New Jamie Handwerker Independent Director Buford Ortale Independent Director Larger Board — enhanced governance with four independent directors

Realty Finance Trust, Inc. 10 MONTHLY DISTRIBUTIONS □ Our current distribution is approximately $ 2 . 063 per share on an annualized basis . □ There is no current intention to change our distribution policy . Our distributions may exceed earnings . As a result, a portion of the distributions you receive may be considered a return of capital for U . S . federal income tax purposes . The amount of our distributions, if any, will continue to be determined by our Board . Existing Dividend Policy

Realty Finance Trust, Inc. 11 WHEN WILL RFT PROVIDE LIQUIDITY FOR STOCKHOLDERS? □ The anticipated holding period for RFT shares is three to six years from the close of the initial public, non - listed offering of securities, which occurred in January of 2016 . □ The Board feels that Benefit Street, as a highly respected institutional investment manager, is well positioned to optimize RFT’s portfolio performance and expense structure and has the requisite access to institutional capital and relationships that could produce such an outcome .

Realty Finance Trust, Inc. 12 RISK FACTORS Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Rep ort on Form 10 - K for the year ended December 31, 2015. The following are some of the risks and uncertainties, although not all risks an d uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements: □ We rely on short - term secured borrowings which creates refinancing risk and the risk that a lender may call for additional colla teral, each of which could significantly impact our liquidity position. □ All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in Benefit Str eet Partners L.L.C. (our "Advisor"). As a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including signifi can t conflicts created by our Advisor's compensation arrangements with us and conflicts in allocating time among these entities and us, which could negativ ely impact our operating results. □ We terminated our primary offering in January 2016 and therefore, absent raising capital from other sources, will have less c ash from financing activities with which to make investments, repay indebtedness, fund our operations or pay distributions. □ No public trading market currently exists, or may ever exist, for shares of our common stock and our shares are, and may cont inu e to be, illiquid. □ Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions to our sto ckholders. □ If we and our Advisor are unable to find sufficient suitable investments, then we may not be able to achieve our investment o bje ctives or pay distributions. □ We may be unable to pay or maintain cash distributions or increase distributions over time. Our board of directors may decide th at maintaining cash distributions at current levels is not in our best interests given investment opportunities or for other reasons. □ We are obligated to pay substantial fees to our Advisor and its affiliates. □ We may fail to continue to qualify to be treated as a real estate investment trust ("REIT") for U.S. federal income tax purpo ses . □ We may be deemed to be an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Ac t") , and thus subject to regulation under the Investment Company Act. □ We update our estimated net asset value per share annually and such estimate may change significantly between these annual ca lcu lations.

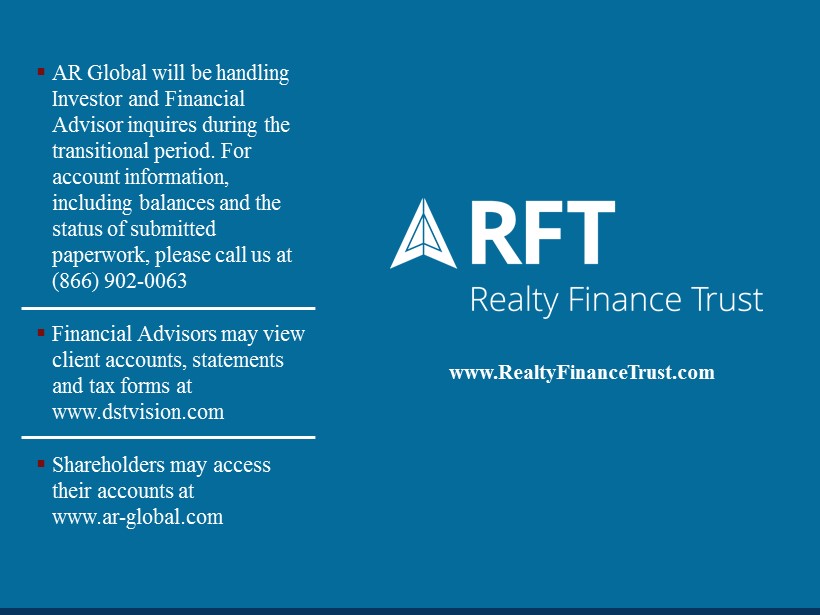

Financing the Growth of Commercial Real Estate www.RealtyFinanceTrust.com ▪ AR Global will be handling Investor and Financial Advisor inquires during the transitional period. For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com