Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Green Plains Inc. | d197923dex991.htm |

| EX-10.1I - EX-10.1I - Green Plains Inc. | d197923dex101i.htm |

| EX-10.1H - EX-10.1H - Green Plains Inc. | d197923dex101h.htm |

| EX-10.1G - EX-10.1G - Green Plains Inc. | d197923dex101g.htm |

| EX-10.1F - EX-10.1F - Green Plains Inc. | d197923dex101f.htm |

| EX-10.1E - EX-10.1E - Green Plains Inc. | d197923dex101e.htm |

| EX-10.1D - EX-10.1D - Green Plains Inc. | d197923dex101d.htm |

| EX-10.1C - EX-10.1C - Green Plains Inc. | d197923dex101c.htm |

| EX-10.1B - EX-10.1B - Green Plains Inc. | d197923dex101b.htm |

| EX-10.1A - EX-10.1A - Green Plains Inc. | d197923dex101a.htm |

| EX-2.1 - EX-2.1 - Green Plains Inc. | d197923dex21.htm |

| 8-K - 8-K - Green Plains Inc. | d197923d8k.htm |

Acquisition of Fleischmann’s Vinegar Company October 3, 2016 Exhibit 99.2

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Statements that do not relate strictly to historical or current facts are forward-looking, and include words such as “anticipates,” “believes,” “estimates,” “expects,” “goal,” “intends,” “plans,” “potential,” “predicts,” “should,” “will,” and other words with similar meanings in connection with future operating or financial performance of Green Plains Inc. (NASDAQ: GPRE) and its subsidiaries, including Green Plains Partners LP (NASDAQ: GPP). Such statements are based on the management's current expectations, which are subject to various factors, risks and uncertainties that may cause actual results, outcomes, timing and performance to differ materially from those expressed or implied. Green Plains may experience significant fluctuations in future operating results due to a number of economic conditions, including competition in the industries in which Green Plains operates; commodity market risks, including those resulting from current weather conditions; financial market risks; counterparty risks; risks associated with changes to federal policy or regulation. As a result of these risks, uncertainties and other factors, actual results could differ materially from those referred to in the forward-looking statements. Factors that may cause actual results to differ from the forward-looking statements contained in this presentation include, but are not limited to, risks relating to Green Plains’ ability to realize the anticipated benefits of the Fleischmann’s Vinegar Company acquisition and other risks detailed in Green Plains' reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2015, and subsequent filings with the SEC. Forward-looking statements do not guarantee future performance or results nor are they necessarily accurate indicators that such performance or results will be achieved. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Green Plains is not obligated to update, and does not intend to update, its forward-looking statements at any time unless it is required by applicable securities laws. Forward-Looking Statements

Purchase price of $250 million, including working capital, subject to certain post closing adjustments Transaction closed October 3, 2016 Management team will continue to run the business Acquired on a forward sub-10x EBITDA multiple before any synergies Acquisition will be immediately accretive to earnings Financed with $135 million of debt with the balance paid from cash on hand A group of lenders led by Maranon Capital L.P. provided a $130 million term loan and a $15 million revolving line of credit for this business unit Summary of Fleischmann’s Vinegar Transaction Fleischmann’s Vinegar Company (FVC)

Summary of Fleischmann’s Vinegar Acquisition STRATEGIC RATIONALE Takes advantage of our platform and expertise – the primary raw material in vinegar production is food-grade ethanol Consistent with our strategy for moving into adjacencies that leverage our capabilities Broadens our reach into food ingredient markets, building higher-margin production capabilities, adding value to our end products Opportunity for ongoing consolidation of a relatively fragmented vinegar market Support expansion into developing markets outside of food; pharma, food preservation, agriculture etc. VALUE PROPOSITION Stable and predictable earnings stream Non-cyclical end markets allow the Company to maintain stable margins in volatile commodity markets Above average growth capability for highly valued on-trend “clean-label” products (organic, non-GMO all natural, etc.) Nationwide supplier of concentrated and specialty vinegars Consistent earnings growth rate, well above industry average due to scale and scope of operation

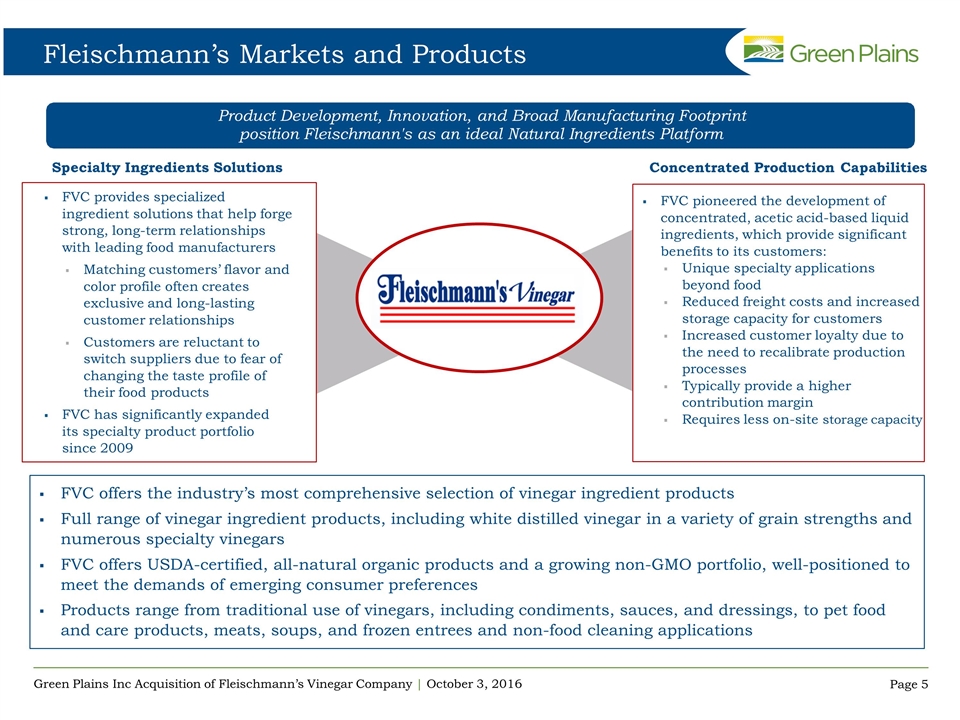

FVC pioneered the development of concentrated, acetic acid-based liquid ingredients, which provide significant benefits to its customers: Unique specialty applications beyond food Reduced freight costs and increased storage capacity for customers Increased customer loyalty due to the need to recalibrate production processes Typically provide a higher contribution margin Requires less on-site storage capacity Fleischmann’s Markets and Products Concentrated Production Capabilities Specialty Ingredients Solutions Product Development, Innovation, and Broad Manufacturing Footprint position Fleischmann's as an ideal Natural Ingredients Platform FVC provides specialized ingredient solutions that help forge strong, long-term relationships with leading food manufacturers Matching customers’ flavor and color profile often creates exclusive and long-lasting customer relationships Customers are reluctant to switch suppliers due to fear of changing the taste profile of their food products FVC has significantly expanded its specialty product portfolio since 2009 FVC offers the industry’s most comprehensive selection of vinegar ingredient products Full range of vinegar ingredient products, including white distilled vinegar in a variety of grain strengths and numerous specialty vinegars FVC offers USDA-certified, all-natural organic products and a growing non-GMO portfolio, well-positioned to meet the demands of emerging consumer preferences Products range from traditional use of vinegars, including condiments, sauces, and dressings, to pet food and care products, meats, soups, and frozen entrees and non-food cleaning applications

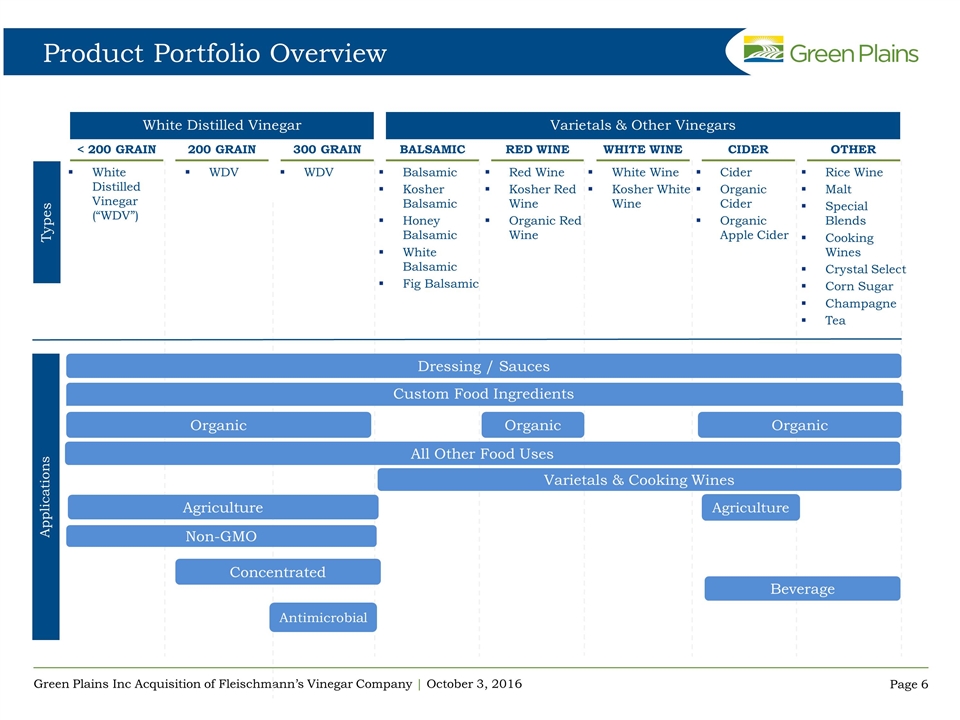

Product Portfolio Overview White Distilled Vinegar Varietals & Other Vinegars Applications Types < 200 Grain 200 Grain 300 Grain Balsamic White wine Other Red Wine Cider White Distilled Vinegar (“WDV”) WDV WDV Balsamic Kosher Balsamic Honey Balsamic White Balsamic Fig Balsamic Red Wine Kosher Red Wine Organic Red Wine White Wine Kosher White Wine Cider Organic Cider Organic Apple Cider Rice Wine Malt Special Blends Cooking Wines Crystal Select Corn Sugar Champagne Tea Non-GMO Concentrated All Other Food Uses Dressing / Sauces Agriculture Agriculture Organic Organic Organic Antimicrobial Varietals & Cooking Wines Custom Food Ingredients Beverage

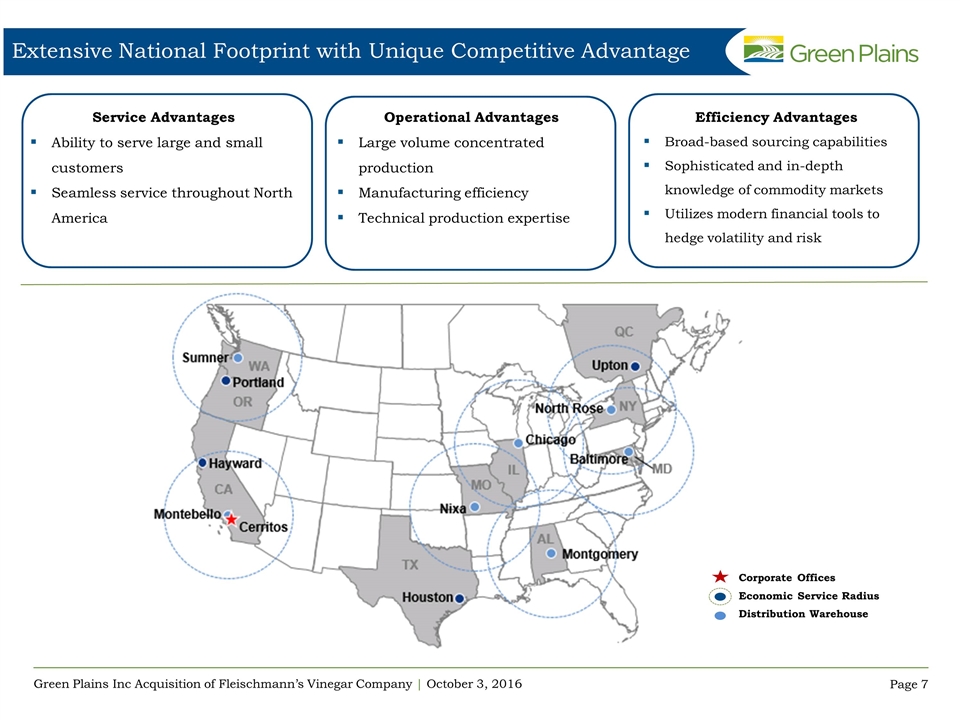

Corporate Offices Economic Service Radius Distribution Warehouse Extensive National Footprint with Unique Competitive Advantage Service Advantages Ability to serve large and small customers Seamless service throughout North America Operational Advantages Large volume concentrated production Manufacturing efficiency Technical production expertise Efficiency Advantages Broad-based sourcing capabilities Sophisticated and in-depth knowledge of commodity markets Utilizes modern financial tools to hedge volatility and risk

Fleischmann’s Vinegar Customer Base FVC has built a reputation for product quality and excellence for nearly 100 years Company benefits from a customer base comprised of major food industry participants Leading branded food companies Private label food manufacturers Companies serving the foodservice channel Longstanding relationships with a diverse, blue-chip base of approximately 1,000 customers Average relationship with its top ten customers exceeds 25 years Numerous relationships extend 40+ years Top tier customers continue to grow brands and thus vinegar consumption. FVC’s national production and sourcing capabilities allow it to meet demand, even for large customers of organic products Dedicated R&D team, with extensive experience in food science and agriculture FVC can develop innovative products and technology to meet the needs of customers for this specialized end-market

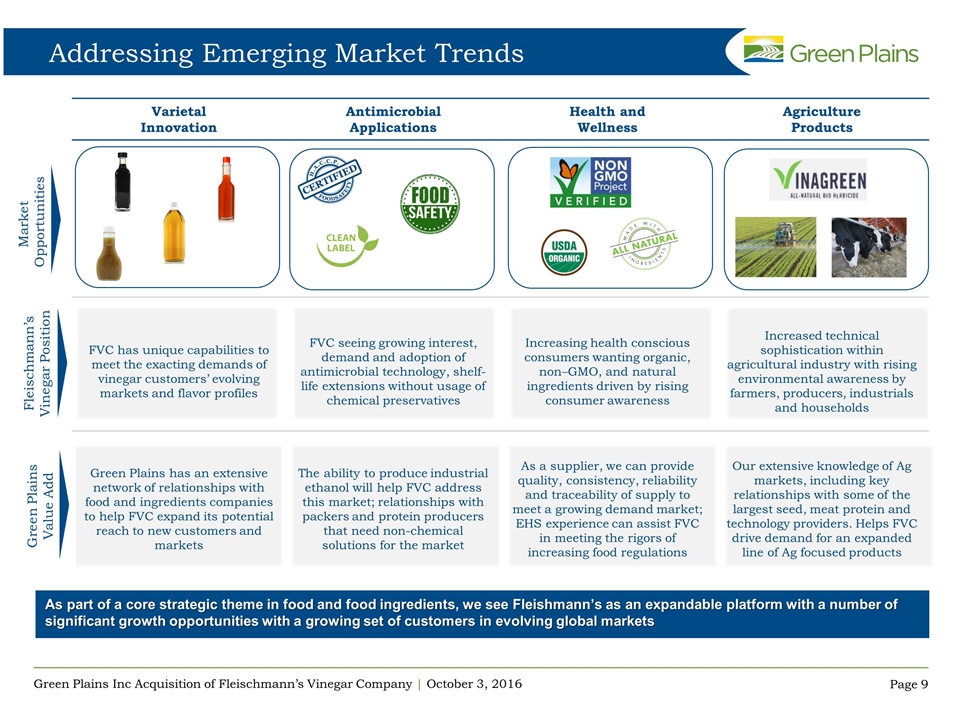

Varietal Innovation Antimicrobial Applications Health and Wellness Agriculture Products FVC has unique capabilities to meet the exacting demands of vinegar customers’ evolving markets and flavor profiles FVC seeing growing interest, demand and adoption of antimicrobial technology, shelf-life extensions without usage of chemical preservatives Increasing health conscious consumers wanting organic, non–GMO, and natural ingredients driven by rising consumer awareness Increased technical sophistication within agricultural industry with rising environmental awareness by farmers, producers, industrials and households Green Plains has an extensive network of relationships with food and ingredients companies to help FVC expand its potential reach to new customers and markets The ability to produce industrial ethanol will help FVC address this market; relationships with packers and protein producers that need non-chemical solutions for the market As a supplier, we can provide quality, consistency, reliability and traceability of supply to meet a growing demand market; EHS experience can assist FVC in meeting the rigors of increasing food regulations Our extensive knowledge of Ag markets, including key relationships with some of the largest seed, meat protein and technology providers. Helps FVC drive demand for an expanded line of Ag focused products Addressing Emerging Market Trends As part of a core strategic theme in food and food ingredients, we see Fleishmann’s as an expandable platform with a number of significant growth opportunities with a growing set of customers in evolving global markets Green Plains Value Add Fleischmann’s Vinegar Position Market Opportunities

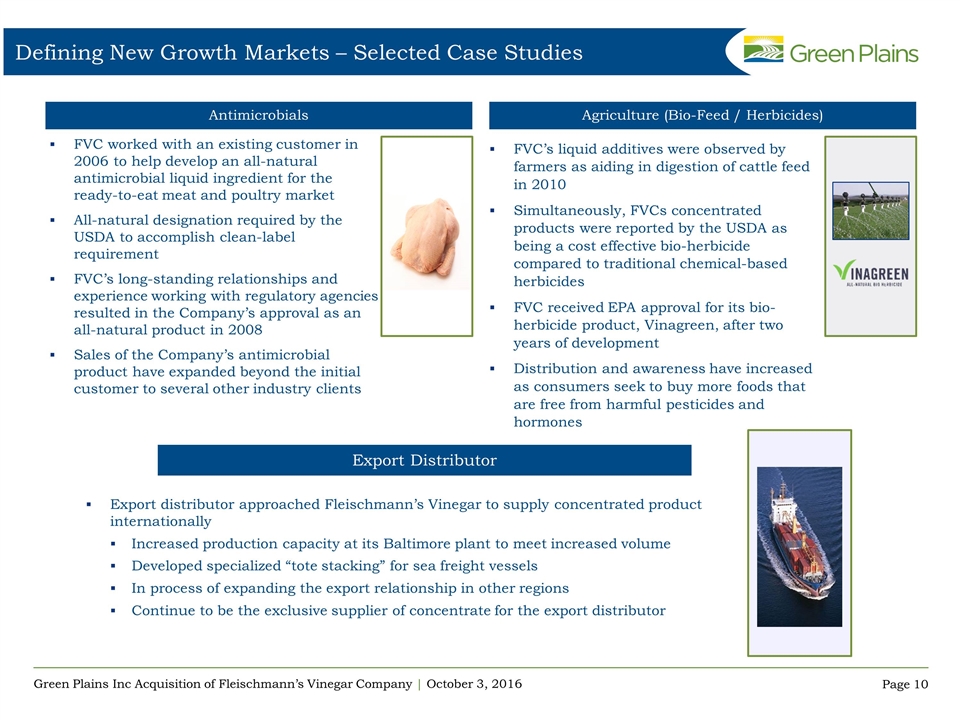

Defining New Growth Markets – Selected Case Studies Antimicrobials Agriculture (Bio-Feed / Herbicides) FVC worked with an existing customer in 2006 to help develop an all-natural antimicrobial liquid ingredient for the ready-to-eat meat and poultry market All-natural designation required by the USDA to accomplish clean-label requirement FVC’s long-standing relationships and experience working with regulatory agencies resulted in the Company’s approval as an all-natural product in 2008 Sales of the Company’s antimicrobial product have expanded beyond the initial customer to several other industry clients FVC’s liquid additives were observed by farmers as aiding in digestion of cattle feed in 2010 Simultaneously, FVCs concentrated products were reported by the USDA as being a cost effective bio-herbicide compared to traditional chemical-based herbicides FVC received EPA approval for its bio-herbicide product, Vinagreen, after two years of development Distribution and awareness have increased as consumers seek to buy more foods that are free from harmful pesticides and hormones Export Distributor Export distributor approached Fleischmann’s Vinegar to supply concentrated product internationally Increased production capacity at its Baltimore plant to meet increased volume Developed specialized “tote stacking” for sea freight vessels In process of expanding the export relationship in other regions Continue to be the exclusive supplier of concentrate for the export distributor

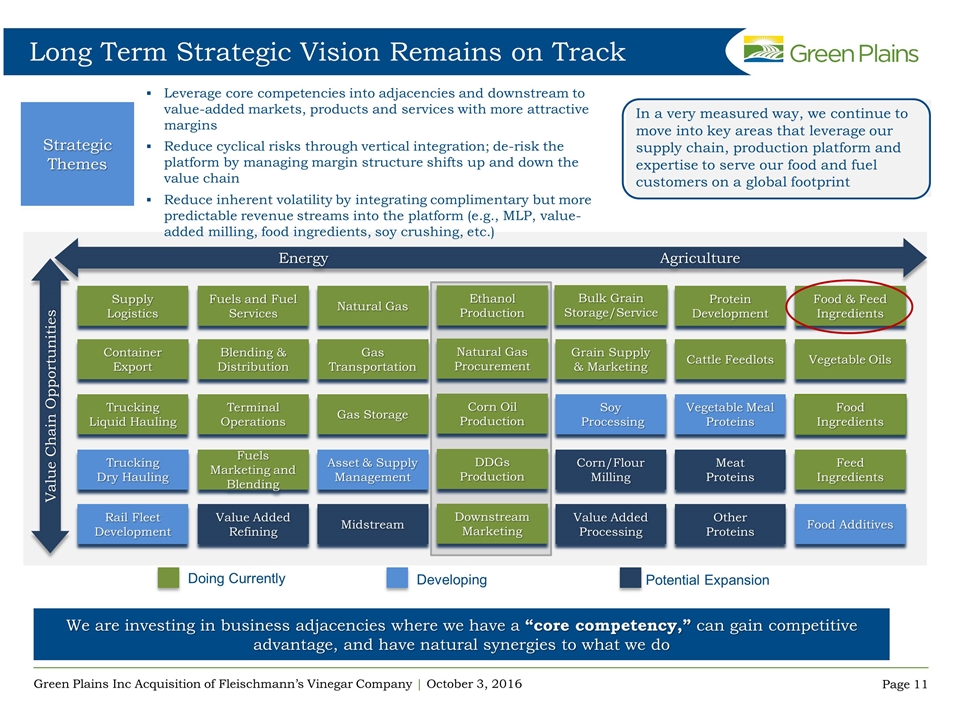

Long Term Strategic Vision Remains on Track Asset & Supply Management Rail Fleet Development Trucking Dry Hauling Terminal Operations Energy Agriculture Natural Gas Food & Feed Ingredients Feed Ingredients Supply Logistics Gas Transportation Midstream Trucking Liquid Hauling Blending & Distribution Food Additives Bulk Grain Storage/Service Grain Supply & Marketing Corn/Flour Milling Container Export Fuels and Fuel Services Value Added Refining Potential Expansion Vegetable Oils Protein Development Cattle Feedlots Meat Proteins Vegetable Meal Proteins Value Chain Opportunities Soy Processing Other Proteins Value Added Processing Fuels Marketing and Blending We are investing in business adjacencies where we have a “core competency,” can gain competitive advantage, and have natural synergies to what we do Food Ingredients Doing Currently Developing Gas Storage In a very measured way, we continue to move into key areas that leverage our supply chain, production platform and expertise to serve our food and fuel customers on a global footprint Natural Gas Procurement Ethanol Production Corn Oil Production DDGs Production Downstream Marketing Strategic Themes Leverage core competencies into adjacencies and downstream to value-added markets, products and services with more attractive margins Reduce cyclical risks through vertical integration; de-risk the platform by managing margin structure shifts up and down the value chain Reduce inherent volatility by integrating complimentary but more predictable revenue streams into the platform (e.g., MLP, value-added milling, food ingredients, soy crushing, etc.)

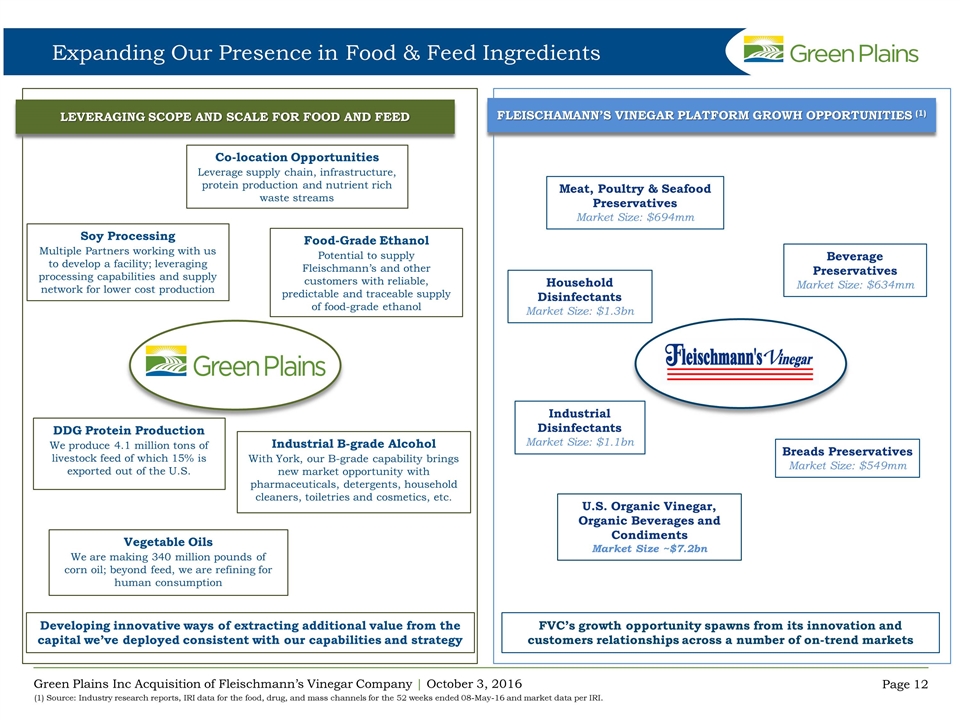

FLEISCHAMANN’S VINEGAR PLATFORM GROWH OPPORTUNITIES (1) Soy Processing Multiple Partners working with us to develop a facility; leveraging processing capabilities and supply network for lower cost production Industrial B-grade Alcohol With York, our B-grade capability brings new market opportunity with pharmaceuticals, detergents, household cleaners, toiletries and cosmetics, etc. Food-Grade Ethanol Potential to supply Fleischmann’s and other customers with reliable, predictable and traceable supply of food-grade ethanol Vegetable Oils We are making 340 million pounds of corn oil; beyond feed, we are refining for human consumption Co-location Opportunities Leverage supply chain, infrastructure, protein production and nutrient rich waste streams Meat, Poultry & Seafood Preservatives Market Size: $694mm Breads Preservatives Market Size: $549mm Beverage Preservatives Market Size: $634mm Household Disinfectants Market Size: $1.3bn Industrial Disinfectants Market Size: $1.1bn FVC’s growth opportunity spawns from its innovation and customers relationships across a number of on-trend markets U.S. Organic Vinegar, Organic Beverages and Condiments Market Size ~$7.2bn Developing innovative ways of extracting additional value from the capital we’ve deployed consistent with our capabilities and strategy LEVERAGING SCOPE AND SCALE FOR FOOD AND FEED DDG Protein Production We produce 4.1 million tons of livestock feed of which 15% is exported out of the U.S. Expanding Our Presence in Food & Feed Ingredients (1) Source: Industry research reports, IRI data for the food, drug, and mass channels for the 52 weeks ended 08-May-16 and market data per IRI.

Transaction Highlights Attractive Industry Dynamics ü Value-Added Ingredients Provider ü Proven Track Record of Innovation ü Significant Scale ü Attractive and Recession Resistant Financial Profile ü Tangible Growth Opportunities ü Longstanding, Diverse, Blue-Chip Customer Base ü Fleischmann’s is a food ingredients company with a focus on natural, good-for-you products in the Food & Agriculture sector

Green Plains Inc. | NASDAQ: GPRE | www.gpreinc.com Green Plains Partners LP | NASDAQ: GPP | www.greenplainspartners.com Questions & Answers