Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - TECH DATA CORP | d263203dex991.htm |

| EX-2.2 - REORGANIZATION AGREEMENT - TECH DATA CORP | d263203dex22.htm |

| EX-2.1 - INTEREST PURCHASE AGREEMENT - TECH DATA CORP | d263203dex21.htm |

| 8-K - FORM 8-K - TECH DATA CORP | d263203d8k.htm |

Exhibit 99.2

1

Tech Data’s

Acquisition of Avnet Technology Solutions techdata.com

September 19, 2016

Creating a Premier Global IT Distributor: From the Data Center to the Living Room

2

Forward-Looking

Statements Safe Harbor

Certain statements in this communication may contain “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements, including statements regarding Tech Data’s plans, objectives, expectations and intentions relating to the proposed acquisition of Avnet’s technology solutions business

(“Acquisition”), the proposed Acquisition’s expected contribution to Tech Data’s results, financing and closing of the proposed Acquisition, the expected timing and benefits of the proposed Acquisition, Tech Data’s,

Avnet’s and the Acquired Business’ financial results and estimates and/or business prospects involve a number of risks and uncertainties and actual results could differ materially from those projected. These forward-looking statements are

based on current expectations, estimates, forecasts, and projections about the proposed Acquisition and the operating environment, economies and markets in which Tech Data and the Acquired Business operate and the beliefs and assumptions of our

management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,”

variationsof such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of Tech Data or the Acquired Business’ future financial performance, our

anticipated growth and trends in our businesses, and other characterizations of future events or circumstances, are forward-looking statements. These forward-looking statements are only predictions and are subject to risks, uncertainties, and

assumptions. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements.

For additional information with

respect to risks and other factors which could occur, see Tech Data’s Annual Report on Form 10-K filed on January 31, 2016, including Part I, Item 1A, “Risk Factors” therein, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K

and other securities filings with the Securities and Exchange Commission (the “SEC”) that are available at the SEC’s website at www.sec.gov and other securities regulators. Readers are cautioned not to place undue reliance upon any

such forward-looking statements, which speak only as of the date made. Many of these factors are beyond Tech Data’s control. Unless otherwise required by applicable securities laws, Tech Data disclaims any intention or obligation to update or

revise any forward-looking statements, whether as a result of new information, future events or otherwise. Tech Data undertakes no duty to update any forward-looking statements contained herein to reflect actual results or changes in Tech

Data’s expectations.

3

Tech Data’s

Acquisition of Avnet Technology Solutions

Tech Data is acquiring Avnet’s Technology Solutions business for approximately $2.6 billion in a cash and stock

transaction

The combination of Tech Data and Technology Solutions creates a premier global IT distributor with the most diverse end-to-end solutions from the data

center to the living room

The acquisition will be financed through $300 million of cash, $2.1 billion of new debt and approximately 2.785 million shares of Tech

Data common stock

4

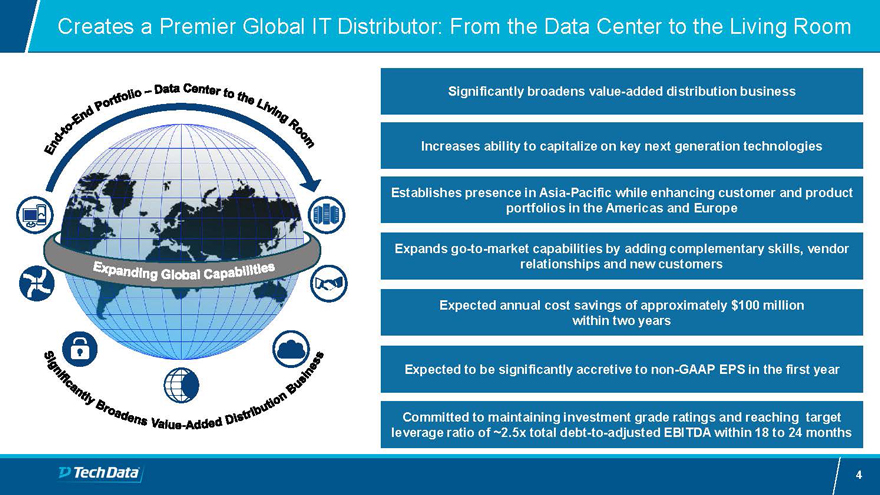

Creates a Premier

Global IT Distributor: From the Data Center to the Living Room Significantly broadens value-added distribution business

Increases ability to capitalize on key next

generation technologies

Expands go-to-market capabilities by adding complementary skills, vendor relationships and new customers

Expected annual cost savings of approximately $100 million

within two years

Expected to be significantly accretive to non-GAAP EPS in the first year

Establishes presence

in Asia-Pacific while enhancing customer and product portfolios in the Americas and Europe

Committed to maintaining investment grade ratings and reaching target

leverage ratio of ~2.5x total debt-to-adjusted EBITDA within 18 to 24 months

5

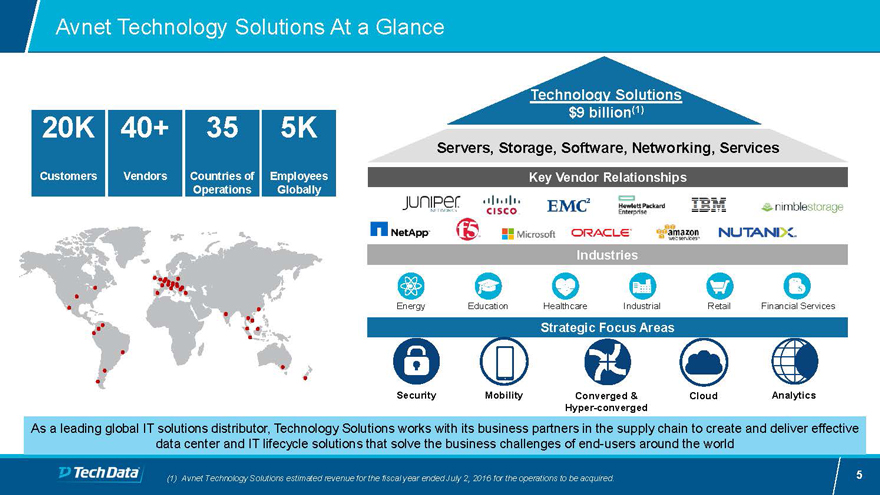

Avnet Technology

Solutions At a Glance

(1) Avnet Technology Solutions estimated revenue for the fiscal year ended July 2, 2016 for the operations to be acquired.

Servers, Storage, Software, Networking, Services

Converged & Hyper-converged

Security

Analytics

Cloud

Technology Solutions

$9 billion(1)

Strategic Focus Areas

Key Vendor Relationships

Industries

Energy

Education

Healthcare

Industrial

Retail

Financial Services

Mobility

As a leading global IT solutions distributor, Technology Solutions works with its

business partners in the supply chain to create and deliver effective data center and IT lifecycle solutions that solve the business challenges of end-users around the world 20K 40+ 35 5K

Customers Vendors Countries of Operations Employees Globally

6

New Forces in IT

Disrupting the Channel: Third Platform Technologies

Hardware

Software

Services

Big Data

Converged & Hyper-converged Infrastructure

Information Security

Mobility

Cloud

7

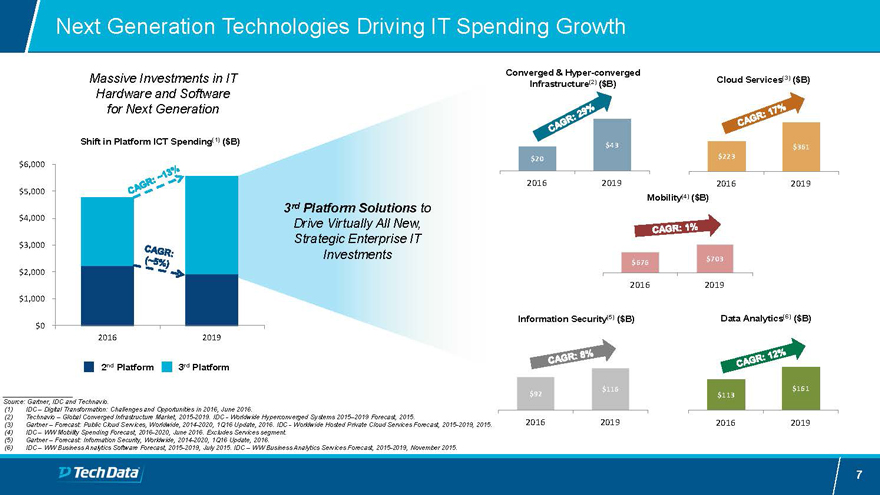

Next Generation

Technologies Driving IT Spending Growth $20 $43 20162019$676 $703 20162019

Converged & Hyper-converged Infrastructure(2) ($B)

3rd Platform Solutions to Drive Virtually All New, Strategic Enterprise IT Investments

Cloud

Services(3) ($B) $223 $361 20162019

Data Analytics(6) ($B) $113 $161 20162019

$92 $116 20162019

Information Security(5) ($B)

Mobility(4) ($B) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 20162019

Shift in Platform ICT

Spending(1) ($B)

Massive Investments in IT Hardware and Software for Next Generation

2nd Platform

3rd Platform Source: Gartner, IDC and Technavio.

(1)IDC – Digital Transformation: Challenges and Opportunities in 2016, June 2016.

(2)Technavio – Global Converged Infrastructure Market, 2015-2019. IDC -Worldwide Hyperconverged Systems 2015–2019 Forecast, 2015.

(3)Gartner – Forecast: Public Cloud Services, Worldwide, 2014-2020, 1Q16 Update, 2016. IDC -Worldwide Hosted Private Cloud Services Forecast, 2015-2019, 2015.

(4)IDC –WW Mobility Spending Forecast, 2016-2020, June 2016. Excludes Services segment.

(5)Gartner – Forecast: Information Security, Worldwide, 2014-2020, 1Q16 Update, 2016.

(6)IDC – WW Business Analytics Software Forecast, 2015-2019, July 2015. IDC – WW Business Analytics Services Forecast, 2015-2019, November 2015.

8

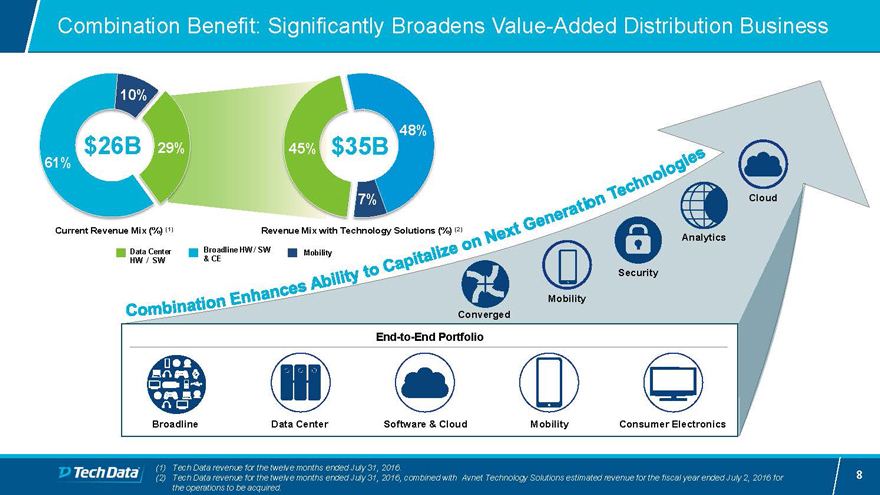

Combination Benefit:

Significantly Broadens Value-Added Distribution Business

45%

48%

7%

29%

61% 10%

Current Revenue Mix (%) (1)

Revenue Mix with Technology Solutions (%) (2)

$26B

$35B

Broadline HW / SW & CE

Data Center HW / SW

Mobility

End-to-End Portfolio

Broadline

Data Center

Software & Cloud

Mobility

Consumer Electronics

Converged

Security

Analytics

Cloud

Mobility

(1)Tech Data revenue for the twelve months ended July 31, 2016.

(2)Tech Data revenue for the twelve months ended July 31, 2016, combined with Avnet Technology Solutions estimated revenue for the fiscal year ended July 2, 2016 for the operations

to be acquired.

9

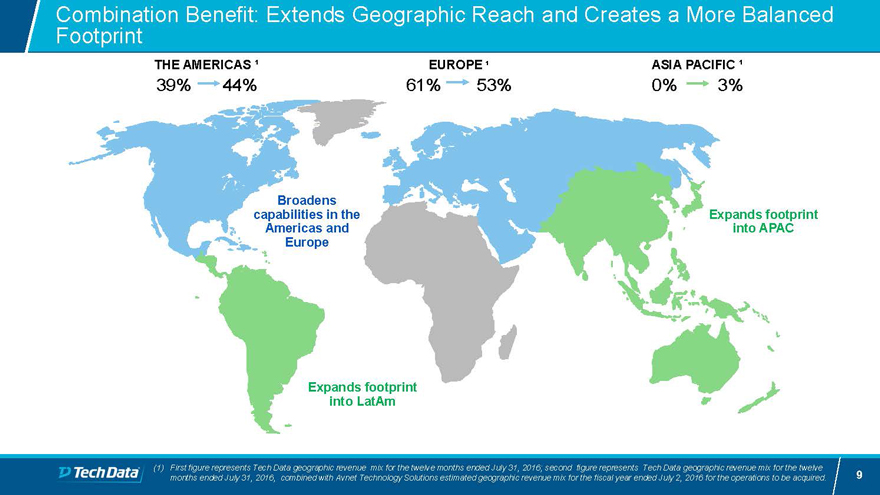

Expands footprint into

APAC

Broadens capabilities in the Americas and Europe THE AMERICAS ¹ 39% 44%

EUROPE ¹

61% 53%

ASIA PACIFIC ¹

0% 3% Expands footprint into LatAm

Combination Benefit: Extends Geographic Reach and Creates a More Balanced Footprint

(1)First

figure represents Tech Data geographic revenue mix for the twelve months ended July 31, 2016; second figure represents Tech Data geographic revenue mix for the twelve months ended July 31, 2016, combined with Avnet Technology Solutions estimated

geographic revenue mix for the fiscal year ended July 2, 2016 for the operations to be acquired.

10

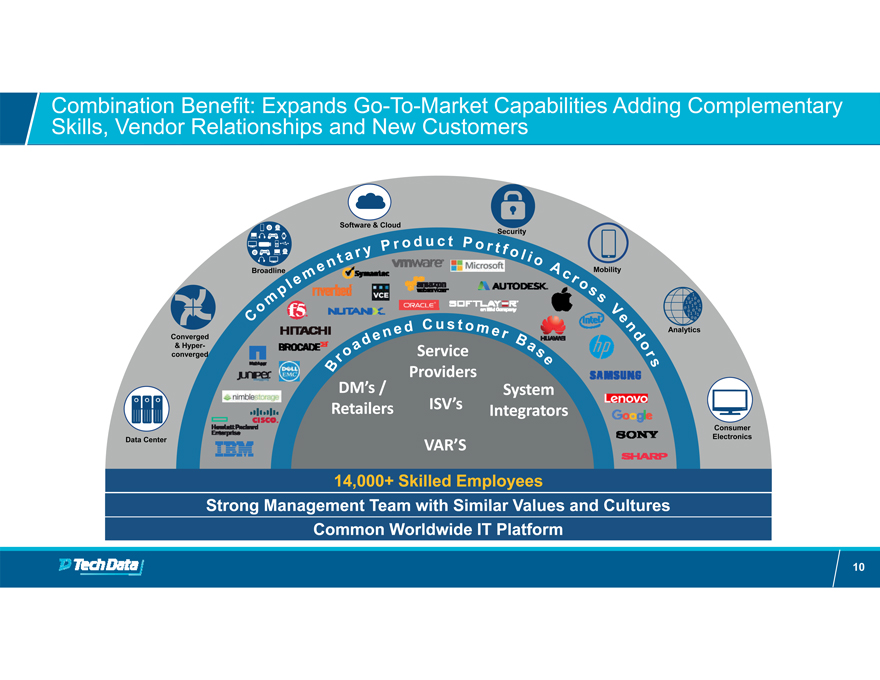

Combination Benefit:

Expands Go-To-Market Capabilities Adding Complementary Skills, Vendor Relationships and New Customers

14,000+ Skilled Employees

Strong Management Team with Similar Values and Cultures Software & Cloud

Data Center

Consumer Electronics

Converged & Hyper-converged

Security

Analytics

Broadline

Mobility

VAR’S

DM’s / Retailers

Service Providers

System Integrators

ISV’s

Common Worldwide IT Platform

11

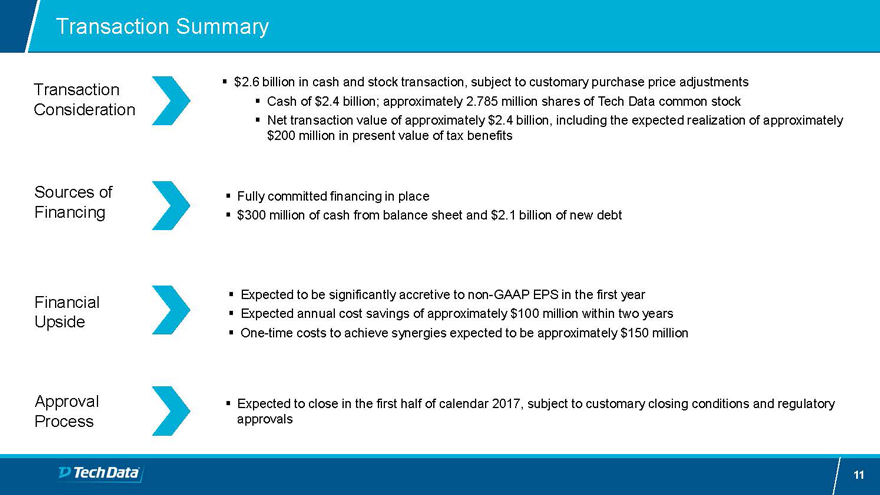

Transaction Summary

Transaction Consideration

Sources of Financing

Financial Upside

Approval Process

$2.6 billion in cash and stock transaction, subject to customary purchase price adjustments Cash of $2.4 billion; approximately 2.785 million shares of Tech Data common stock

Net transaction value of approximately $2.4 billion, including the expected realization of approximately $200 million in present value of tax benefits

Fully committed financing in place

$300 million of cash from balance sheet and $2.1 billion of

new debt

Expected to close in the first half of calendar 2017, subject to customary closing conditions and regulatory approvals

Expected to be significantly accretive to non-GAAP EPS in the first year

Expected annual cost

savings of approximately $100 million within two years

One-time costs to achieve synergies expected to be approximately $150 million

12

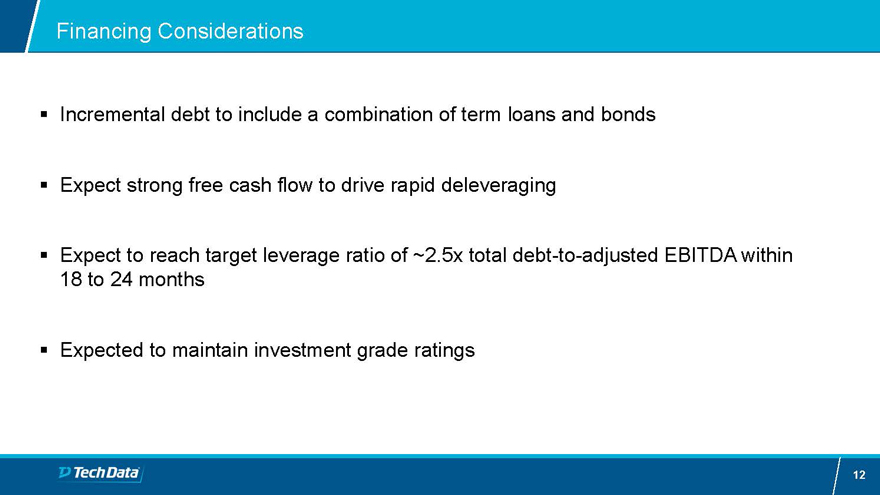

Financing

Considerations

Incremental debt to include a combination of term loans and bonds

Expect strong free cash flow to drive rapid deleveraging

Expect to reach target leverage ratio

of ~2.5x total debt-to-adjusted EBITDA within 18 to 24 months

Expected to maintain investment grade ratings

13

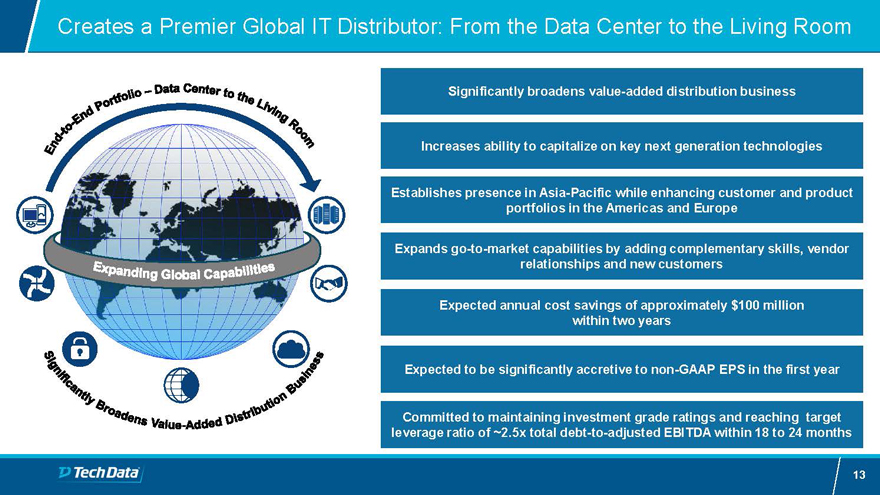

Creates a Premier

Global IT Distributor: From the Data Center to the Living Room

Significantly broadens value-added distribution business

Increases ability to capitalize on key next generation technologies Expands go-to-market capabilities by adding complementary skills, vendor relationships and new customers

Expected annual cost savings of approximately $100 million within two years Expected to be significantly accretive to non-GAAP EPS in the first year Establishes presence in Asia-Pacific while enhancing customer and product portfolios in the Americas

and Europe Committed to maintaining investment grade ratings and reaching target leverage ratio of ~2.5x total debt-to-adjusted EBITDA within 18 to 24 months