Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Benefit Street Partners Realty Trust, Inc. | v448399_8k.htm |

Exhibit 99.1

2 nd Quarter 2016 Webinar Series

Financing the Growth of Commercial Real Estate Second Quarter 2016 Investor Presentation Note: This program does not own the properties pictured. The properties serve as the underlying collateral for mezzanine loan s h eld by RFT. Platform Advisor To Investment Programs

Realty Finance Trust, Inc. 3 IMPORTANT INFORMATION Risk Factors Investing in and owning our common stock involves a high degree of risk . See the section entitled “Risk Factors” in our Form 10 - K filed March 11 , 2016 for a discussion of these risks . Forward - Looking Statements Certain statements included in this presentation are forward - looking statements . Those statements include statements regarding the intent, belief or current expectations of Realty Finance Trust and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions . Actual results may differ materially from those contemplated by such forward - looking statements . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law .

Realty Finance Trust, Inc. 4 INVESTMENT OBJECTIVES Our primary investment objectives are: • Preserve and protect capital; • Provide attractive and stable cash distributions; and • Increase the value of assets in order to generate capital appreciation.

Realty Finance Trust, Inc. 5 Our focus on originating and acquiring commercial real estate debt investments emphasizes the payment of current returns to investors and preservation of invested capital as our primary objectives. We also seek to realize appreciation in the value of our investments. RFT’s advisor has experience in originating, managing and disposing of commercial real estate debt investments similar to RFT’s targeted loans and investments. RFT will seek to: □ Invest in loans expected to be realized within one to ten years; □ Maximize current income; □ Lend to creditworthy borrowers; □ Lend on properties leased to high - quality tenants; □ Maintain a portfolio of loans secured by core property types and diversified by geographic location, tenancy and borrower; and □ Source off - market transactions. FOCUSED INVESTMENT STRATEGY

Realty Finance Trust, Inc. 6 6 Asset Type Geographic Location Rate Type Portfolio as of June 30, 2016. PORTFOLIO DIVERSIFICATION Fixed 7.7% Floating 92.3% Office 26% Hospitality 21% Multifamily 24.4% Industrial 4.4% Retail 14% Mixed Use 10.2% New England 3.2% Mideast 16.7% Great Lakes 19.1% Plains 5.5% Southeast 18.0% Southwest 16.3% Rocky Mountain 7.1% Far West 14.1%

Realty Finance Trust, Inc. 7 7 PORTFOLIO PERFORMANCE □ As part of the Company's process for monitoring the credit quality of its loans, it performs a quarterly loan portfolio assessment and assigns risk ratings to each of its loans. □ As of June 30, 2016, the Company assessed the portfolio as performing consistent with expectations and expects a full return of principal and interest with trends and risk factors rated as neutral to favorable. □ The Company does not have any loans that are past due on their payments, in non - accrual status or impaired.

Realty Finance Trust, Inc. 8 8 WELL SECURED PORTFOLIO • RFT has a high concentration in senior loans. • As of June 30, 2016 RFT’s portfolio effective yield was 6.1% with a loan to value of 73.0% 72.3% 17.4% 10.3% First Lien Loans Credit Loans CMBS Portfolio as of June 30, 2016.

Realty Finance Trust, Inc. 9 Summary Number of Investments 91 Carrying Value of Commercial Mortgage Loans $1,128.7 Fair Value of Real Estate Securities (CMBS) 126.0 Total Real Estate Assets $1,254.7 Current Future Funding 113.1 Total Committed Balance $1,367.8 Total Real Estate Assets $1,253.4 Total Portfolio Leverage (668.7) Total Invested Equity $584.7 Leverage as a % of Total Real Estate Assets (3) 52.0% Wtd Avg LTV Ratio (at Origination) (1) 73.0% Weighted Average Coupon (1),(2) 6.1% Weighted Average Life (1) 2.3 Years (1) Excluding CMBS investments (2) Weighted by Position Balance, not Equity Amount (3) Ratio is Total Portfolio Leverage divided by Total Real Estate Assets Portfolio Growth 2015 2016 ($ in millions) Q1 Q2 Q3 Q4 Q1 Q2 Senior $342.9 $538.7 $657.8 $894.1 $901.3 $913.6 Mezzanine 206.9 244.2 271.9 221.0 216.1 205.1 Subordinated 10.0 10.0 10.0 10.0 10.0 10.0 Total Loans 559.8 792.9 $939.7 $1,125.1 $1,127.4 $1,128.7 CMBS $58.4 $93.2 $101.0 $130.7 $124.9 $126.0 Total Portfolio $618.1 $886.1 $1,040.7 $1,255.8 $1,252.3 $1,254.7 Figures in millions where applicable. Portfolio as of June 30, 2016. FINANCIAL PERFORMANCE

Realty Finance Trust, Inc. 10 □ We continue to maintain a diversified portfolio of commercial real estate (CRE) debt investments . □ Our origination strategy is focused on senior and mezzanine CRE loans throughout the country . □ Obtaining a fully levered portfolio to maximize the earnings potential of our capital is our goal . To accomplish this we will : - Maximize the use of our current warehouse facilities - Seek to secure additional financing lines to grow the portfolio - Evaluate the opportunity to execute a second Collateralized Loan Obligation (CLO) □ RFT’s estimated net asset value (“NAV”) per share of the Company’s common stock is $ 25 . 27 as of September 30 , 2015 . STRATEGIC INITIATIVES

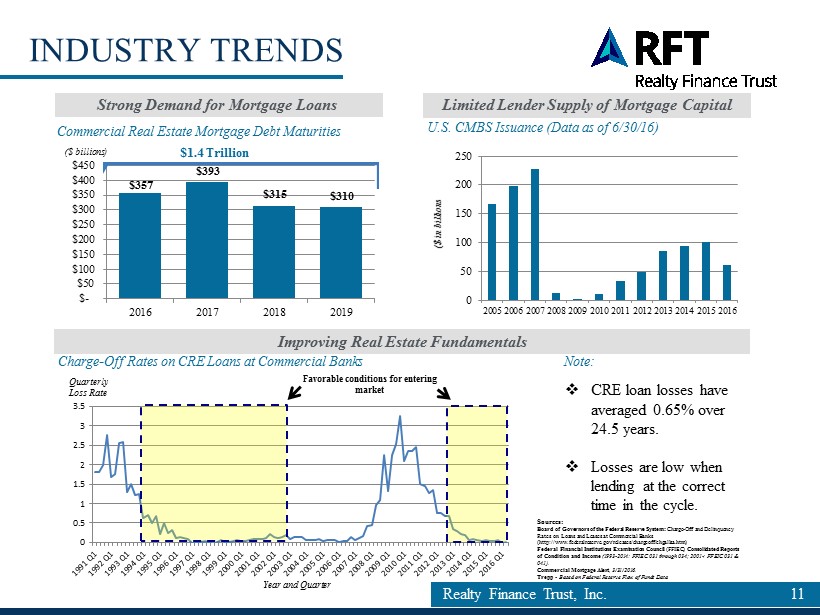

Realty Finance Trust, Inc. 11 11 Strong Demand for Mortgage Loans Improving Real Estate Fundamentals Limited Lender Supply of Mortgage Capital INDUSTRY TRENDS Commercial Real Estate Mortgage Debt Maturities U.S. CMBS Issuance (Data as of 6/30/16) Charge - Off Rates on CRE Loans at Commercial Banks Note: □ CRE loan losses have averaged 0.65% over 24.5 years. □ Losses are low when lending at the correct time in the cycle. Quarterly Loss Rate Year and Quarter Favorable conditions for entering market 0 0.5 1 1.5 2 2.5 3 3.5 $357 $393 $315 $310 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 2016 2017 2018 2019 ($ billions) $1.4 Trillion 0 50 100 150 200 250 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 ($ in billions Sources: Board of Governors of the Federal Reserve System: Charge - Off and Delinquency Rates on Loans and Leases at Commercial Banks (http://www.federalreserve.gov/releases/chargeoff/chgallsa.htm) Federal Financial Institutions Examination Council (FFIEC) Consolidated Reports of Condition and Income (1993 - 2014: FFIEC 031 through 034; 2001 - : FFEIC 031 & 041). Commercial Mortgage Alert , 3/31/2016. Trepp - Based on Federal Reserve Flow of Funds Data

Realty Finance Trust, Inc. 12 EXPERIENCED BOARD AND MANAGEMENT TEAM Peter M. Budko CEO and Interim President Nick Radesca CFO, Secre tary and Treasurer Boris Korotkin Executive Vice President RFT is led by seasoned professionals with extensive and dynamic experience in real estate Elizabeth Tuppeny Lead Independent Director Audit Committee Chair Peter McDonough Independent Director Peter M. Budko Chairman Board of Directors Leadership

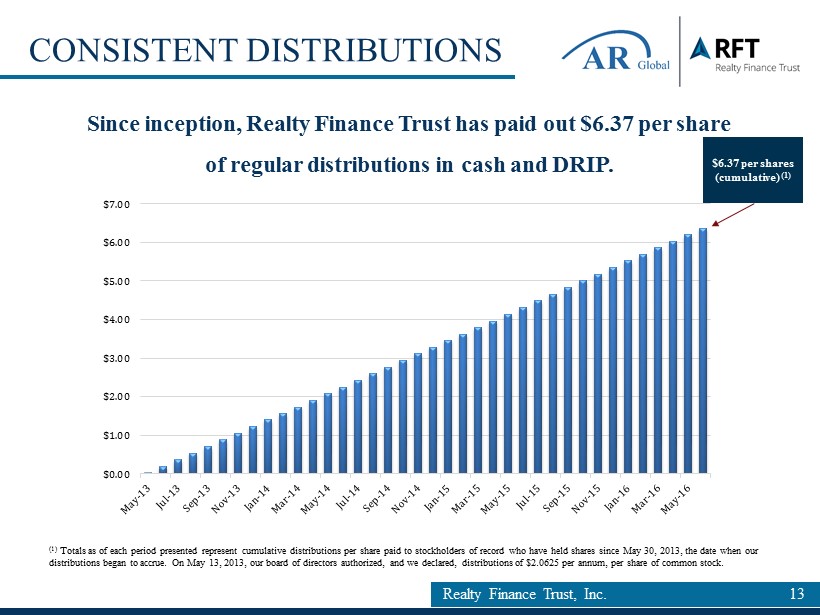

Realty Finance Trust, Inc. 13 Since inception, Realty Finance Trust has paid out $6.37 per share of regular distributions in cash and DRIP. CONSISTENT DISTRIBUTIONS (1) Totals as of each period presented represent cumulative distributions per share paid to stockholders of record who have held sh ares since May 30, 2013, the date when our distributions began to accrue. On May 13, 2013, our board of directors authorized, and we declared, distributions of $2.0625 per annum, per share of common stock. $6.37 per shares (cumulative) (1) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00

Realty Finance Trust, Inc. 14 RISK FACTORS Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Rep ort on Form 10 - K for the year ended December 31, 2015. The following are some of the risks and uncertainties, although not all risks an d uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements: □ We rely on short - term secured borrowings which creates refinancing risk and the risk that a lender may call for additional colla teral, each of which could significantly impact our liquidity position. □ We have a limited operating history and Realty Finance Advisors, LLC, our affiliated advisor (the "Advisor"), has limited exp eri ence operating a public company. This inexperience makes our future performance difficult to predict. □ All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in American Fi nance Advisors, LLC (our "Advisor") or other entities under common control with AR Global Investments, LLC (the successor business to AR Capital, LLC, "A R Global"), the parent of our sponsor, American Realty Capital VIII, LLC (the "Sponsor"). As a result, our executive officers, our Advisor an d i ts affiliates face conflicts of interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment pro grams advised by affiliates of AR Global and conflicts in allocating time among these entities and us, which could negatively impact our operating result s. □ We terminated our primary offering in January 2016 and therefore, absent raising capital from other sources, will have less c ash from financing activities with which to make investments, repay indebtedness, fund our operations or pay distributions. □ No public trading market currently exists, or may ever exist, for shares of our common stock and our shares are, and may cont inu e to be, illiquid. □ Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions to our sto ckholders. □ If we and our Advisor are unable to find sufficient suitable investments, then we may not be able to achieve our investment o bje ctives or pay distributions. □ We may be unable to pay or maintain cash distributions or increase distributions over time. Our board of directors may decide th at maintaining cash distributions at current levels is not in our best interests given investment opportunities or for other reasons. □ We are obligated to pay substantial fees to our Advisor and its affiliates. □ We may fail to continue to qualify to be treated as a real estate investment trust ("REIT") for U.S. federal income tax purpo ses . □ We may be deemed to be an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Ac t") , and thus subject to regulation under the Investment Company Act.

Financing the Growth of Commercial Real Estate www.RealtyFinanceTrust.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com