Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RACKSPACE HOSTING, INC. | rax8k_8816xearningsreleasesl.htm |

Q2 2016

Earnings Slides

August 8, 2016

2

Forward Looking Statements, Non-GAAP Financial Measures,

and Trademarks and Service Marks

Forward-Looking Statements

We have made forward-looking statements in this presentation that are subject to risks and uncertainties. Forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, are subject to the “safe harbor” created by those sections.

The forward-looking statements in this presentation are based on our management’s beliefs and assumptions and on information currently available to our management.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “aspires,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will” or “would” or the negative of these terms and similar expressions intended to identify forward-looking

statements. These statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance, time frames or

achievements to be materially different from any future results, performance, time frames or achievements expressed or implied by the forward-looking statements. We

discuss many of these risks, uncertainties and other factors in greater detail under the heading “Risk Factors” in our Form 10-K/A for the year ended December 31, 2015

and may add additional risks in our future filings with the Securities and Exchange Commission, including in our Form 10-Q for the quarter ended June 30, 2016. We

believe it is important to communicate our expectations to our investors. However, there may be events in the future that we are not able to predict accurately or over which

we have no control.

Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements

represent our estimates and assumptions only as of August 8, 2016 (the date on which we publicly presented this presentation). You should read this document completely

along with our earnings press release and the Form 10-Q for the period ended June 30, 2016, which will be filed with the Securities and Exchange Commission no later

than August 9, 2016, and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify our forward-looking

statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the

reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Non-GAAP Financial Measures

This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA, Non-GAAP EPS, Free Cash Flow, Return on Capital, and revenue growth

adjusted for foreign currency and asset divestiture. We believe that those metrics may be useful to investors as a measure of comparative operating performance between

time periods and among companies, however these measures should be considered only as a supplement to, and not as a substitute for or as a superior measure to,

financial measures prepared in accordance with GAAP, nor should they be considered in isolation or as an alternative to such GAAP measures. In addition, we note that

other companies may calculate similar non-GAAP measures differently, limiting their usefulness as a comparative measure. This presentation contains reconciliations of

the non-GAAP financial measures used to the most directly comparable GAAP financial measures. With respect to our third quarter of 2016 and full year 2016

expectations, reconciliations of revenue growth adjusted for foreign currency and asset divestiture to net revenue are included within this presentation. A reconciliation of

Adjusted EBITDA margin to net income margin cannot be provided without unreasonable efforts due to high variability in net non-operating foreign currency exchange gains

or losses and the inability to predict future acquisitions, dispositions, and certain other items that arise from time to time, the impact of which is excluded from Adjusted

EBITDA margin. The Company is unable to address the probable significance of the unavailable information.

Trademarks and Service Marks

Rackspace®, and Fanatical Support® are service marks of Rackspace US, Inc. registered in the United States and other countries. OpenStack® is either a registered

trademark or trademark of OpenStack, LLC in the United States and/or other countries. Other trademarks and tradenames appearing in this report are the property of their

respective holders. We do not intend our use or display of other companies’ tradenames, trademarks, or service marks to imply a relationship with, or endorsement or

sponsorship of us by, these other companies.

3

Continued Growth, Consistent Profitability, Decreasing CapEx

Intensity, and Increasing Cash Generation

$441

$489

$524

Q2 2014 Q2 2015 Q2 2016

Quarterly Revenue ($M)

$141

$160

$187

Q2 2014 Q2 2015 Q2 2016

Adjusted EBITDA1 ($M)

25.5%

31.0%

15.7%

Q2 2014 Q2 2015 Q2 2016

Capital Expenditures (%

of Revenue)

$24

$37

$98

Q2 2014 Q2 2015 Q2 2016

Free Cash Flow (FCF1)

($M)

1. Reference the Appendix for reconciliation of non-GAAP financial measures

$22

$28

$36

Q2 2014 Q2 2015 Q2 2016

Net Income ($M)

$125 $123

$165

Q2 2014 Q2 2015 Q2 2016

Cash Flow from Ops (CFO)

($M)

4

$489

$524

Q2 2015 Q2 2016

$530

$3 Jungle

Disk

Contribution

32.8%

35.8%

5.8% 6.8%

Q2 2015 Q2 2016

Adj. EBITDA Margin

Net Income Margin

Summary Q2 Financials

• GAAP Revenue of $524M

• Growth of 7.0% YoY

• Normalized growth1 of 8.9% YoY

• Net income margin of 6.8%

• Adjusted EBITDA margin2 of 35.8%

• GAAP/Non-GAAP2 EPS of $0.28/$0.38

• 40.0%/31.0% higher YoY

• CapEx as % of revenue 15.7%

• CFO/Free Cash Flow2 of $165M/$98M

Revenue ($M)

1. Normalized growth excludes the impact of asset divestiture and FX

headwinds. Reference the Appendix for reconciliation of non-GAAP

financial measures

2. Reference the Appendix for reconciliation of non-GAAP financial

measures

$6 FX

headwind

1

Adjusted EBITDA and Net Income

Margin2

5

Sales and Marketing Update - Good progress, more work to be done

• Improvements made in 1H 2016

– Strengthened sales leadership ranks

– Improved go-to market approach for Sales teams

– Enhanced training and certification programs

Pipeline has improved 2 quarters in a row

New enterprise/mid-market logos signed in 1H 2016 almost doubled YoY

• Priorities for 2H 2016

– Cross-sell high-growth offerings to current customers

– Grow partner network and expand channel sales

– Increase brand awareness and help customers understand our value add

6

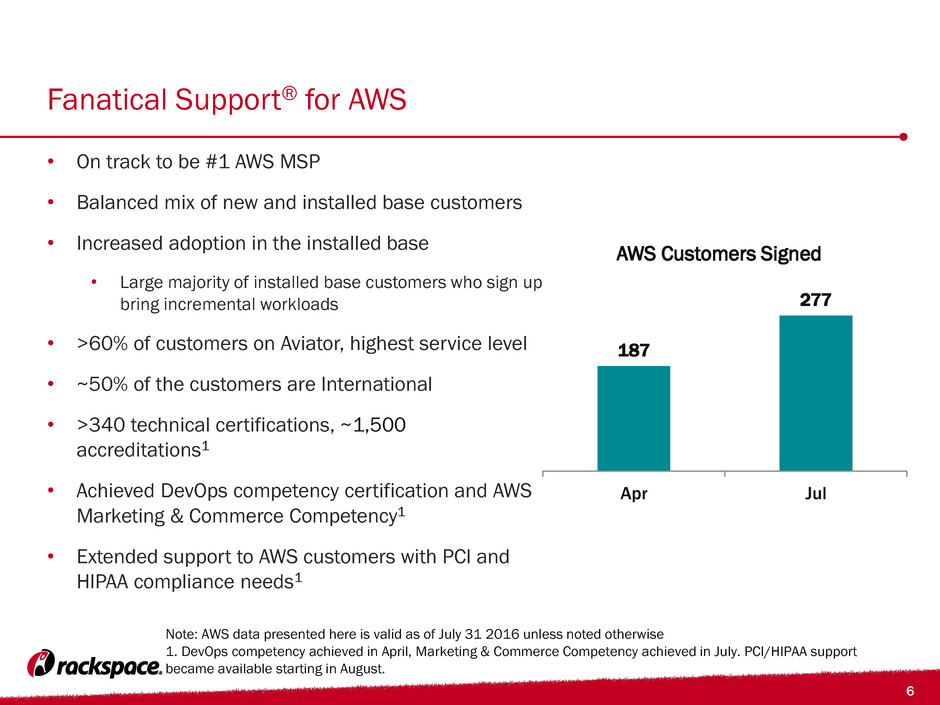

Fanatical Support® for AWS

• On track to be #1 AWS MSP

• Balanced mix of new and installed base customers

• Increased adoption in the installed base

• Large majority of installed base customers who sign up

bring incremental workloads

• >60% of customers on Aviator, highest service level

• ~50% of the customers are International

• >340 technical certifications, ~1,500

accreditations1

• Achieved DevOps competency certification and AWS

Marketing & Commerce Competency1

• Extended support to AWS customers with PCI and

HIPAA compliance needs1

Note: AWS data presented here is valid as of July 31 2016 unless noted otherwise

1. DevOps competency achieved in April, Marketing & Commerce Competency achieved in July. PCI/HIPAA support

became available starting in August.

187

277

Apr Jul

AWS Customers Signed

7

Microsoft Cloud

178

211

Apr Jul

Microsoft Customers Signed

Note: Microsoft Cloud data presented here is valid as of July 31 2016 unless noted otherwise

• Signed 211 Microsoft Cloud customers since

launch

• Microsoft Private Cloud demand is driven by mid-

market and large enterprises

• Increased traction for Microsoft Azure since

offering refresh in May

• Broadened channel reach with Fanatical Support

for Microsoft Azure and Office 365 Reseller and

Referral Program

• One of less than 10 hosting providers globally

enabled for 2-Tier distribution across entire

Microsoft suite

8

OpenStack Private Cloud

• Focus is on larger, multi-cloud

customers

• Complex enterprise deployments are

leading to longer time to deployment

• Major wins:

• One of the world’s largest industrial

conglomerates

• One of the world’s largest auto

manufacturers

9

2016 Key Focus Areas

• Optimizing mature parts of our business and increasing cost savings

• Investing in high growth areas and expanding our position as the #1 managed

cloud provider

• Increasing cash generation

– Almost $100M of FCF generated this quarter

• Completed $500M share buyback commitment

– Incremental buyback capacity of up to $500M authorized till August 2017

10

Financial and Operational

Information

11

Summary Financial Results

Q 2 2 01 6 Q 2 2 01 5 Q 1 2 01 6

A C T U A L S G U I D A N C E 1 A C T U A L S A C T U A L S

R E V E N U E $524M $519M-$524M $489M $518M

YoY Growth 7.0% 6%-7% 11.0% 7.9%

YoY Growth (Normalized) 2 8.9% 8%-9% 13.7% 9.9%

QoQ Growth 1.1% N/A 1.9% -0.9%

QoQ Growth (Normalized) 2 0.9% 0.2%-1.2% 1.8% 0.7%

Net Income Margin 6.8% N/A 5.8% 9.4%

Adjusted EBITDA Margin2 35.8% 33.0% - 35.0% 32.8% 34.5%

GAAP Diluted EPS $0.28 N/A $0.20 $0.37

Non-GAAP Diluted EPS2 $0.38 N/A $0.29 $0.34

Capital Expenditure as % of Revenue 15.7% N/A 31.0% 15.2%

Cash Flow from Operations $165M N/A $123M $156M

FCF2 $98M N/A $37M $89M

Return on Assets 7.1% N/A 6.4% 9.7%

Return On Capital2 16.4% N/A 11.8% 14.4%

1. Q2 16 guidance provided on 9 May. 2016

2. Reference the Appendix for reconciliation of non-GAAP financial measures

12

Updated Free Cash Flow methodology1

Free Cash Flow (New methodology)

Net cash provided by operating activities

Less: Cash purchases of property and

equipment

Plus: Excess tax benefits from share-

based compensation arrangements

____________________________________

Free cash flow

Adjusted EBITDA

Plus: Non-cash deferred rent

Less: Total capital expenditures

Less: Cash payments for interest, net of

interest received

Less: Cash payments for income taxes,

net of refunds

______________________________________

Adjusted free cash flow

Adjusted Free Cash Flow (Old methodology)

1. The company has stopped using “Adjusted Free Cash Flow” and is now using “Free Cash Flow” in order

to be in line with updated SEC guidelines.

13

Brexit Update

Current impact

• 20-25% of revenue exposed to UK/Europe

• Muted margin impact due to local cost structure

• Minimal impact in Q2 2016 due to late June timing of Brexit

2H16 impact

• Gartner forecasting significant slowdown in 2016 UK IT spending

• Seeing signs of elevated, but contained, churn

• YoY FX headwinds of ~250 bps/~$50M affecting 2016 GAAP revenue growth

14

Leverage and Buyback Update

LEVERAGE CALCULATION

Credit facility $0M

Senior Notes $500M

Capital Leases $1M

LTM Adj. EBITDA1 (Q2 16) $724M

Gross Leverage 0.69x

Equity Raised/Returned in $M

Since 2008 IPO

Raised (IPO & Employee

Stock Purchases)

$345M

Returned to Shareholders

through share repurchases

$700M

• Current Leverage

• 0.69x Last twelve months (LTM) Adj. EBITDA1

excluding off-balance sheet liabilities, close to

target leverage of 0.75x2

• Buyback

• $500M commitment completed (through open

market & 10b5-1 plan purchases)

• Incremental capacity under our authorized share

repurchase plan to buy back additional $500M of

shares by August 2017

1. Reference the Appendix for reconciliation of non-GAAP financial measures

2. 0.75x target leverage is equivalent to the ~1.5x target leverage including off balance sheet leases.

15

Server Consolidation Update

• Continued server decommissioning

• ~2,900 servers decommissioned due to

legacy public cloud migration to

OpenStack public cloud

– Majority of servers used for >3 years

– Expect continued migration and improved

server utilization over 2016 and early 2017

• ~500 servers decommissioned as a part

of Cloud Sites server consolidation

• GAAP average revenue per server up

2.8% QoQ

• Normalized average revenue per server

up 2.6% QoQ

$1,472 $1,510

Q1 2016 Q2 2016

Normalized Average Revenue per

Server1

$3 FX QoQ

tailwind

$1 Jungle

Disk

impact

$1,513

1. Reference the Appendix for reconciliation of non-GAAP financial measures

16

Guidance for Q3 16

Q3 16 Guidance

Revenue (GAAP, $M) $510 - $515

GAAP growth YoY 0.2% - 1.2%

Normalized growth YoY (a) 4.9% - 5.9%

GAAP growth QoQ (2.6)% - (1.6)%

Normalized growth QoQ (a) (0.2)% - 0.7%

Adj. EBITDA Margin 33% - 35%

Notes:

(a) Excludes ~470/240 bps of negative YoY/QoQ impact from currency movements (370 bps YoY/

180 bps QoQ) and asset divestiture (100 bps YoY/60 bps QoQ)

17

Guidance for 2016

2016 Guidance

Revenue (GAAP, $M) $2,060 - $2,080

GAAP growth YoY 3% - 4%

Normalized growth YoY (a) 6.5% -7.5%

Adj. EBITDA Margin (b) 33% - 35%

Effective tax rate 35%

Capital expenditure as % of Revenue 16% - 18%

Notes:

(a) Excludes ~350 bps ($70M) of negative impact from currency movements (~250 bps, ~$50M)

and asset divestiture (~100 bps, ~$20M)

(b) Excludes future asset divestiture-related gain and one-time impacts

18

Appendix

(Reconciliation of Non-GAAP Financial

Measures)

19

Reconciliation of Non-GAAP Financial Measures

Revenue Growth Adjusted for FX and Asset Divestiture

(In millions) Net Revenue

Foreign

Currency

Translation

Asset

Divestiture

Adjustment

Revenue Growth Adjusted

for Foreign Currency and

Asset Divestiture

June 30, 2016 $523.6 $6.1 $ - $529.7

June 30, 2015 489.4 - (3.0) 486.4

Dollar Change $34.2 $43.3

Percent Change 7.0 % 8.9 %

June 30, 2016 $523.6 $(1.1) $ - $522.5

March 31, 2016 518.1 - (0.2) 517.9

Dollar Change 5.5 4.6

Percent Change 1.1 % 0.9 %

June 30, 2015 $489.4 $12.1 - $501.5

June 30, 2014 441.2 - - 441.2

Dollar Change 48.2 60.3

Percent Change 11.0 % 13.7 %

20

Reconciliation of Non-GAAP Financial Measures

Revenue Growth Adjusted for FX and Asset Divestiture

(In millions) Net Revenue

Foreign

Currency

Translation

Asset

Divestiture

Adjustment

Revenue Growth Adjusted

for Foreign Currency and

Asset Divestiture

June 30, 2015 $489.4 $(0.7) - $488.7

March 31, 2015 480.2 - - 480.2

Dollar Change $9.2 $8.5

Percent Change 1.9 % 1.8 %

March 31, 2016 $518.1 $6.4 $(0.2) $524.3

March 31, 2015 480.2 - (3.0) 477.2

Dollar Change 37.9 47.1

Percent Change 7.9 % 9.9 %

March 31, 2016 $518.1 $5.7 $(0.2) $523.6

December 31, 2015 522.8 - (2.9) 519.9

Dollar Change (4.7) 3.7

Percent Change (0.9) % 0.7 %

21

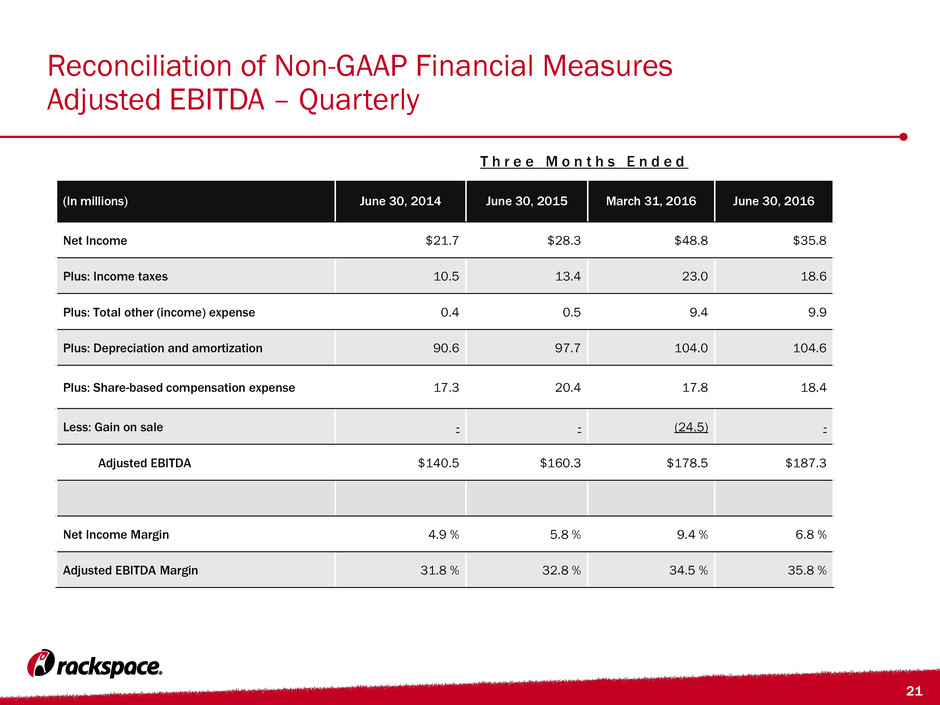

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA – Quarterly

T h r e e M o n t h s E n d e d

(In millions) June 30, 2014 June 30, 2015 March 31, 2016 June 30, 2016

Net Income $21.7 $28.3 $48.8 $35.8

Plus: Income taxes 10.5 13.4 23.0 18.6

Plus: Total other (income) expense 0.4 0.5 9.4 9.9

Plus: Depreciation and amortization 90.6 97.7 104.0 104.6

Plus: Share-based compensation expense 17.3 20.4 17.8 18.4

Less: Gain on sale - - (24.5) -

Adjusted EBITDA $140.5 $160.3 $178.5 $187.3

Net Income Margin 4.9 % 5.8 % 9.4 % 6.8 %

Adjusted EBITDA Margin 31.8 % 32.8 % 34.5 % 35.8 %

22

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA LTM

T h r e e M o n t h s E n d e d

(In millions)

September 30,

2015

December

31, 2015

March 31, 2016 June 30, 2016 LTM

Net Income $35.5 $31.1 $48.8 $35.8 $151.2

Plus: Income taxes 15.6 23.1 23.0 18.6 80.3

Plus: Total other (income) expense 3.9 5.7 9.4 9.9 28.9

Plus: Depreciation and amortization 101.3 104.0 104.0 104.6 413.9

Plus: Share-based compensation

expense

19.6 18.1 17.8 18.4 73.9

Less: Gain on sale - - (24.5) - (24.5)

Adjusted EBITDA $175.9 $182.0 $178.5 $187.3 $723.7

23

Reconciliation of Non-GAAP Financial Measures

Free Cash Flow

T h r e e M o n t h s E n d e d

(In millions) June 30, 2014 June 30, 2015 March 31, 2016 June 30, 2016

Net cash provided by operating activities $124.5 $122.9 $156.2 $164.9

Less: Cash purchases of property and equipment (114.0) (104.7) (82.9) (76.7)

Plus: Excess tax benefits from share-based

compensation arrangements

13.2 18.6 15.8 10.2

Free cash flow $23.7 $36.8 $89.1 $98.4

24

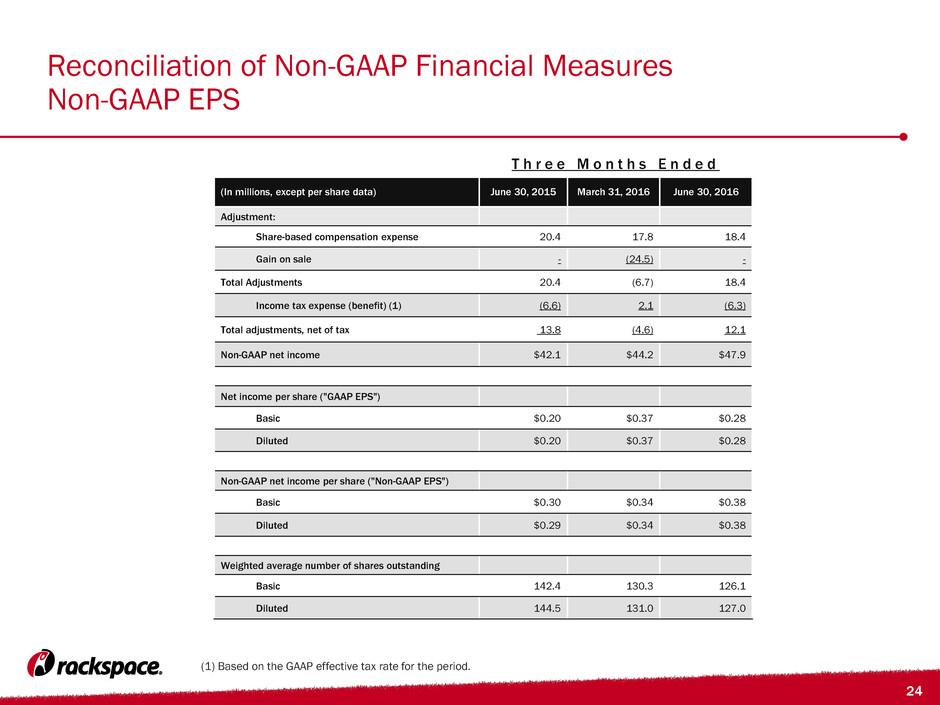

Reconciliation of Non-GAAP Financial Measures

Non-GAAP EPS

(1) Based on the GAAP effective tax rate for the period.

T h r e e M o n t h s E n d e d

(In millions, except per share data) June 30, 2015 March 31, 2016 June 30, 2016

Adjustment:

Share-based compensation expense 20.4 17.8 18.4

Gain on sale - (24.5) -

Total Adjustments 20.4 (6.7) 18.4

Income tax expense (benefit) (1) (6.6) 2.1 (6.3)

Total adjustments, net of tax 13.8 (4.6) 12.1

Non-GAAP net income $42.1 $44.2 $47.9

Net income per share ("GAAP EPS")

Basic $0.20 $0.37 $0.28

Diluted $0.20 $0.37 $0.28

Non-GAAP net income per share ("Non-GAAP EPS")

Basic $0.30 $0.34 $0.38

Diluted $0.29 $0.34 $0.38

Weighted average number of shares outstanding

Basic 142.4 130.3 126.1

Diluted 144.5 131.0 127.0

25

Reconciliation of Non-GAAP Financial Measures

Return on Capital

T h r e e M o n t h s E n d e d

(In millions) June 30, 2015 March 31, 2016 June 30, 2016

Income from operations $42.2 $81.2 $64.3

Adjustment for gain on sale - (24.5) -

Adjustment for build-to-suit lease impact (1) (0.4) (2.2) (2.6)

Income from operations, adjusted $41.8 $54.5 $61.7

Effective tax rate 32.2 % 32.1 % 34.0 %

Net operating profit after tax (NOPAT) $28.4 $37.0 $40.7

Total assets at period end $1,826.6 $2,025.4 $1,996.8

Add: Unamortized debt issuance costs (2) - 7.4 7.2

Less: Excess cash (3) (258.4) (472.0) (481.5)

Less: Accounts payable and accrued expenses, accrued

compensation and benefits, and income and other taxes

payable

(256.4) (213.0) (219.1)

Less: Deferred revenue (current and non-current) (29.7) (29.0) (30.2)

Less: Other non-current liabilities, deferred income taxes,

deferred rent, and finance lease obligations for build-to-

suit leases

(299.7)

(313.6)

(296.4)

Capital base $982.4 $1,005.2 $976.8

Average total assets $1,756.0 $2,019.8 $2,011.1

Average capital base $961.2 $1,026.6 $991.0

Return on assets (annualized) 6.4 % 9.7 % 7.1 %

Return on capital (annualized) 11.8 % 14.4 % 16.4 %

(1) Reflects additional expense we would have

expected to record if our build-to-suit lease

arrangements had been deemed operating leases

instead of finance lease obligations for build-to-suit

leases. Calculated as the excess of estimated

straight-line rent expense over actual depreciation

expense for completed real estate projects under

build-to-suit lease arrangements.

(2) Amount recorded as a direct deduction from the

carrying value of the long-term debt liability in the

consolidated balance sheets.

(3) Defined as the amount of cash and cash

equivalents that exceeds our operating cash

requirements, which is calculated as three percent of

our annualized net revenue for the three months

prior to the period end.

26

Reconciliation of Non-GAAP Financial Measures

Average Revenue per Server

Three Months Ended

(In millions, except server count

and avg revenue per server)

March 31,

2016

June 30,

2016

Net Revenue $518.1 $523.6

Foreign currency translation - (1.1)

Asset Divestiture adjustment (0.2) -

Net Revenue in Constant

Currency, adjusted for Asset

Divestiture

$517.9 $522.5

Beginning of quarter server

count

118,177 116,507

End of quarter server count 116,507 114,231

Average server count 117,342 115,369

Average monthly net revenue

per average server

$1,472 $1,513

Average monthly net revenue

in Constant Currency, adjusted

for Asset Divestiture, per

average server

$1,471 $1,510

27

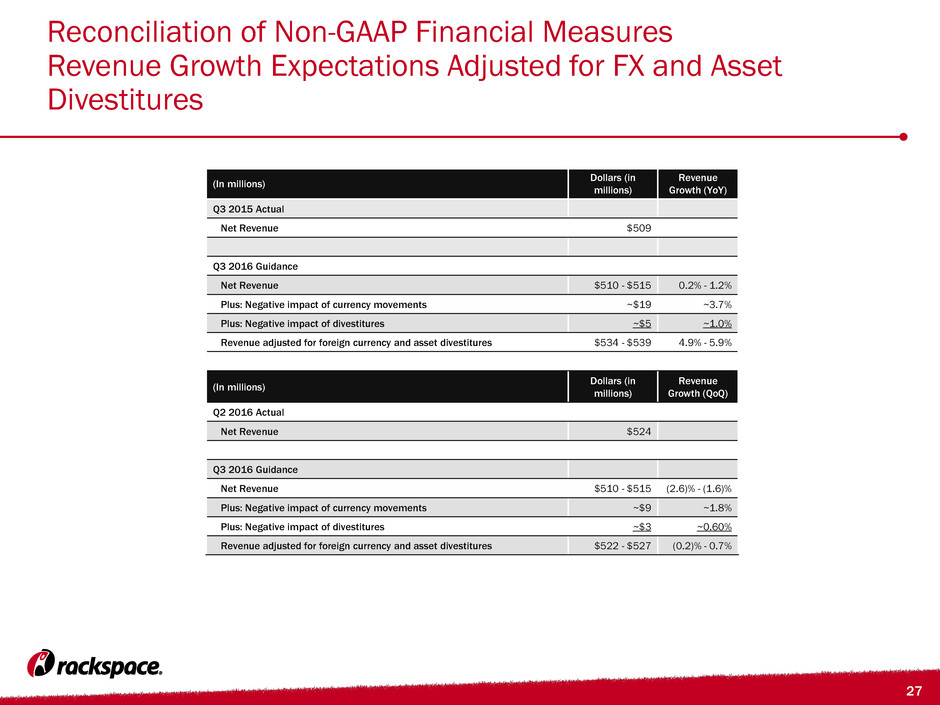

Reconciliation of Non-GAAP Financial Measures

Revenue Growth Expectations Adjusted for FX and Asset

Divestitures

(In millions)

Dollars (in

millions)

Revenue

Growth (YoY)

Q3 2015 Actual

Net Revenue $509

Q3 2016 Guidance

Net Revenue $510 - $515 0.2% - 1.2%

Plus: Negative impact of currency movements ~$19 ~3.7%

Plus: Negative impact of divestitures ~$5 ~1.0%

Revenue adjusted for foreign currency and asset divestitures $534 - $539 4.9% - 5.9%

(In millions)

Dollars (in

millions)

Revenue

Growth (QoQ)

Q2 2016 Actual

Net Revenue $524

Q3 2016 Guidance

Net Revenue $510 - $515 (2.6)% - (1.6)%

Plus: Negative impact of currency movements ~$9 ~1.8%

Plus: Negative impact of divestitures ~$3 ~0.60%

Revenue adjusted for foreign currency and asset divestitures $522 - $527 (0.2)% - 0.7%

28

Reconciliation of Non-GAAP Financial Measures

Revenue Growth Expectations Adjusted for FX and Asset

Divestitures

(In millions) Dollars (in millions)

Revenue

Growth

(YoY)

2015 Actual

Net Revenue $2,001

2016 Guidance

Net Revenue $2,060 - $2,080 3.0% - 4.0%

Plus: Negative impact of currency movements ~$50 ~2.5%

Plus: Negative impact of divestitures ~$20 ~1.0%

Revenue adjusted for foreign currency and asset divestitures $2,130 - $2,150 6.5% - 7.5%