Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Benefit Street Partners Realty Trust, Inc. | v441400_8k.htm |

Exhibit 99.1

Financing the Growth of Commercial Real Estate First Quarter 2016 Investor Presentation Realty Finance Trust, Inc. Publicly Registered Non - Traded Real Estate Investment Trust Note: This program does not own the properties pictured. The properties serve as the underlying collateral for mezzanine loans held by RFT.

Realty Finance Trust, Inc. 2 IMPORTANT INFORMATION Risk Factors Investing in and owning our common stock involves a high degree of risk . See the section entitled “Risk Factors ” in our Form 10 - K filed March 11 , 2016 for a discussion of these risks . Forward - Looking Statements Certain statements included in this presentation are forward - looking statements . Those statements include statements regarding the intent, belief or current expectations of Realty Finance Trust and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions . Actual results may differ materially from those contemplated by such forward - looking statements . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law .

Realty Finance Trust, Inc. 3 RISK FACTORS Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Rep ort on Form 10 - K for the year ended December 31, 2015. The following are some of the risks and uncertainties, although not all risks an d uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements: □ We rely on short - term secured borrowings which creates refinancing risk and the risk that a lender may call for additional collateral, each of which could significantly impact our liquidity position. □ We have a limited operating history and Realty Finance Advisors, LLC, our affiliated advisor (the "Advisor"), has limited experi enc e operating a public company. This inexperience makes our future performance difficult to predict. □ All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in American Fin anc e Advisors, LLC (our "Advisor") or other entities under common control with AR Global Investments, LLC (the successor business to AR Capital, LLC, "A R Global"), the parent of our sponsor, American Realty Capital VIII, LLC (the "Sponsor"). As a result, our executive officers, our Advisor an d i ts affiliates face conflicts of interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment pro grams advised by affiliates of AR Global and conflicts in allocating time among these entities and us, which could negatively impact our operating result s. □ We terminated our primary offering in January 2016 and therefore, absent raising capital from other sources, will have less cash fr om financing activities with which to make investments, repay indebtedness, fund our operations or pay distributions. □ No public trading market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continu e t o be, illiquid. □ Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions to our stockholde rs. □ If we and our Advisor are unable to find sufficient suitable investments, then we may not be able to achieve our investment obje cti ves or pay distributions. □ We may be unable to pay or maintain cash distributions or increase distributions over time. Our board of directors may decide th at maintaining cash distributions at current levels is not in our best interests given investment opportunities or for other reasons . □ We are obligated to pay substantial fees to our Advisor and its affiliates. □ We may fail to continue to qualify to be treated as a real estate investment trust ("REIT") for U.S. federal income tax purpo ses . □ We may be deemed to be an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Ac t") , and thus subject to regulation under the Investment Company Act.

Realty Finance Trust, Inc. 4 Our focus on originating and acquiring commercial real estate debt investments emphasizes the payment of current returns to investors and preservation of invested capital as our primary objectives . We also seek to realize appreciation in the value of our investments. RFT’s advisor has experience in originating, managing and disposing of commercial real estate debt investments similar to RFT’s targeted loans and investments. RFT will seek to: □ Invest in loans expected to be realized within one to ten years; □ Maximize current income; □ L end to creditworthy borrowers; □ L end on properties leased to high - quality tenants; □ Maintain a portfolio of loans secured by core property types and diversified by geographic location, tenancy and borrower; and □ S ource off - market transactions. FOCUSED INVESTMENT STRATEGY

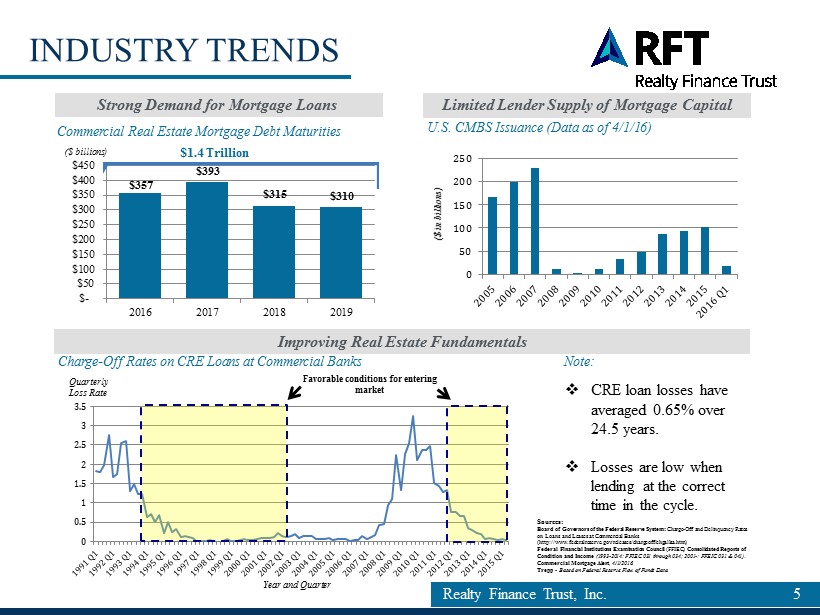

Realty Finance Trust, Inc. 5 5 Strong Demand for Mortgage Loans Improving Real Estate Fundamentals Limited Lender Supply of Mortgage Capital INDUSTRY TRENDS Commercial Real Estate Mortgage Debt Maturities U.S. CMBS Issuance (Data as of 4/1/16) Charge - Off Rates on CRE Loans at Commercial Banks Note: □ CRE loan losses have averaged 0.65% over 24.5 years. □ Losses are low when lending at the correct time in the cycle. Quarterly Loss Rate Year and Quarter Favorable conditions for entering market 0 0.5 1 1.5 2 2.5 3 3.5 $357 $393 $315 $310 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 2016 2017 2018 2019 ($ billions) $ 1.4 Trillion ($ in billions) Sources: Board of Governors of the Federal Reserve System: Charge - Off and Delinquency Rates on Loans and Leases at Commercial Banks (http:// www.federalreserve.gov/releases/chargeoff/chgallsa.htm) Federal Financial Institutions Examination Council (FFIEC) Consolidated Reports of Condition and Income (1993 - 2014: FFIEC 031 through 034; 2001 - : FFEIC 031 & 041). Commercial Mortgage Alert , 4/1/2016. Trepp - Based on Federal Reserve Flow of Funds Data 0 50 100 150 200 250

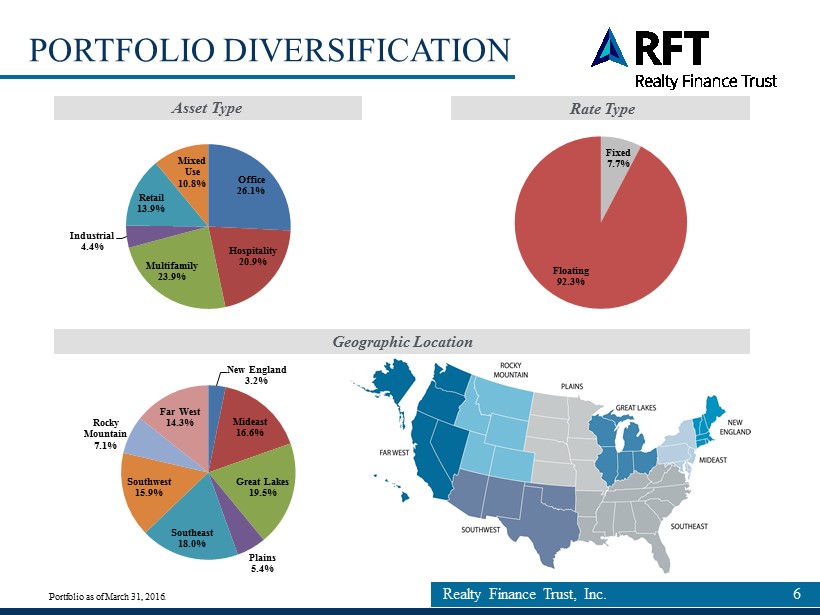

Realty Finance Trust, Inc. 6 6 Asset Type Geographic Location Rate Type Portfolio as of March 31, 2016. PORTFOLIO DIVERSIFICATION Fixed 7.7% Floating 92.3% Office 26.1% Hospitality 20.9% Multifamily 23.9% Industrial 4.4% Retail 13.9% Mixed Use 10.8% New England 3.2% Mideast 16.6% Great Lakes 19.5% Plains 5.4% Southeast 18.0% Southwest 15.9% Rocky Mountain 7.1% Far West 14.3%

Realty Finance Trust, Inc. 7 7 PORTFOLIO PERFORMANCE □ As part of the Company's process for monitoring the credit quality of its loans, it performs a quarterly loan portfolio assessment and assigns risk ratings to each of its loans. □ As of March 31, 2016, the Company assessed the portfolio as performing consistent with expectations and expects a full return of principal and interest with trends and risk factors rated as neutral to favorable. □ The Company does not have any loans that are past due on their payments, in non - accrual status or impaired.

Realty Finance Trust, Inc. 8 8 Portfolio as of March 31, 2016. WELL SECURED PORTFOLIO • RFT has a high concentration in senior loans . • As of March 31, 2016 RFT’s portfolio effective yield was 6.4% with a loan to value of 73.1% 72% 18% 10% First Lien Loans Credit Loans CMBS

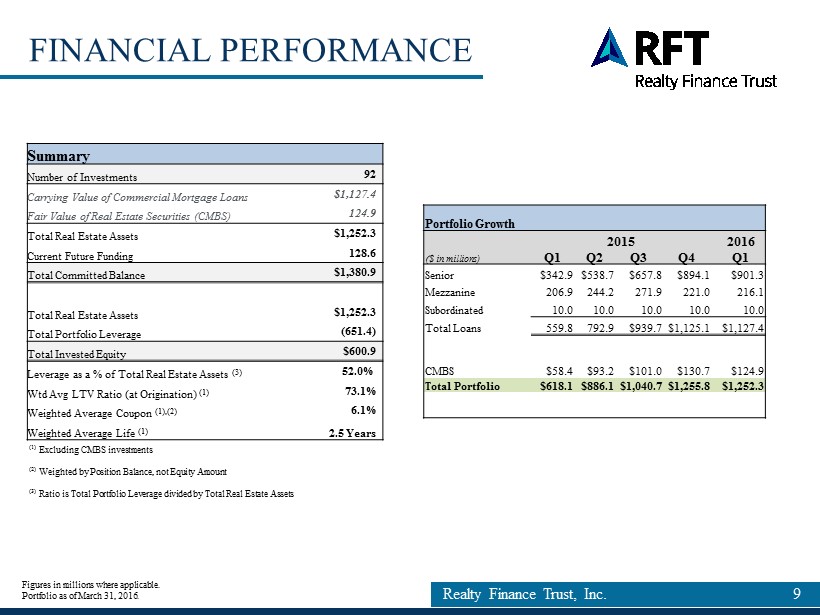

Realty Finance Trust, Inc. 9 Summary Number of Investments 92 Carrying Value of Commercial Mortgage Loans $1,127.4 Fair Value of Real Estate Securities (CMBS) 124.9 Total Real Estate Assets $1,252.3 Current Future Funding 128.6 Total Committed Balance $1,380.9 Total Real Estate Assets $1,252.3 Total Portfolio Leverage (651.4) Total Invested Equity $600.9 Leverage as a % of Total Real Estate Assets (3) 52.0% Wtd Avg LTV Ratio (at Origination ) (1) 73.1% Weighted Average Coupon (1 ),(2) 6.1% Weighted Average Life (1) 2.5 Years (1) Excluding CMBS investments (2) Weighted by Position Balance, not Equity Amount (3) Ratio is Total Portfolio Leverage divided by Total Real Estate Assets Portfolio Growth 2015 2016 ($ in millions) Q1 Q2 Q3 Q4 Q1 Senior $342.9 $538.7 $657.8 $894.1 $901.3 Mezzanine 206.9 244.2 271.9 221.0 216.1 Subordinated 10.0 10.0 10.0 10.0 10.0 Total Loans 559.8 792.9 $939.7 $1,125.1 $1,127.4 CMBS $58.4 $93.2 $101.0 $130.7 $124.9 Total Portfolio $618.1 $886.1 $1,040.7 $1,255.8 $1,252.3 Figures in millions where applicable. Portfolio as of March 31, 2016. FINANCIAL PERFORMANCE

Realty Finance Trust, Inc. 10 Since inception, Realty Finance Trust has paid out $5.94 per share of regular distributions in cash and DRIP . CONSISTENT DISTRIBUTIONS $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 5/1/13 6/1/13 7/1/13 8/1/13 9/1/13 10/1/13 11/1/13 12/1/13 1/1/14 2/1/14 3/1/14 4/1/14 5/1/14 6/1/14 7/1/14 8/1/14 9/1/14 10/1/14 11/1/14 12/1/14 1/1/15 2/1/15 3/1/15 4/1/15 5/1/15 6/1/15 7/1/15 8/1/15 9/1/15 10/1/15 11/1/15 12/1/15 1/1/16 2/1/16 3/1/16

Realty Finance Trust, Inc. 11 □ We continue to maintain a diversified portfolio of commercial real estate (CRE) debt investments . □ Our origination strategy is focused on senior and mezzanine CRE loans throughout the country . □ Obtaining a fully levered portfolio to maximize the earnings potential of our capital is our goal . To accomplish this we will : - Maximize the use of our current warehouse facilities - Seek to secure additional financing lines to grow the portfolio - Evaluate the opportunity to execute a second Collateralized Loan Obligation (CLO) □ RFT’s estimated net asset value (“NAV”) per share of the Company’s common stock is $ 25 . 27 as of September 30 , 2015 . STRATEGIC INITIATIVES

Financing the Growth of Commercial Real Estate www.RealtyFinanceTrust.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com