Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Evolve Transition Infrastructure LP | spp-20160516ex99194ad0a.htm |

| 8-K - 8-K - Evolve Transition Infrastructure LP | spp-20160516x8k.htm |

|

|

Legal Disclaimers Forward-Looking Statements This presentation contains, and the officers and representatives of the Partnership and its general partner may from time to time make, statements that are considered forward–looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about our: business strategy; acquisition strategy; financial strategy; ability to make, maintain and grow distributions; the ability of our customers to meet their drilling and development plans on a timely basis or at all and perform under gathering and processing agreements; future operating results, including our forecast of Adjusted EBITDA and Distributable Cash Flow; future capital expenditures; and plans, objectives, expectations, forecasts, outlook and intentions. All of these types of statements, other than statements of historical fact included in this presentation, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this presentation are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. Management cautions all readers that the forward-looking statements contained in this presentation are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the “Risk Factors” section in our filings with the U.S. Securities and Exchange Commission (“SEC”) and elsewhere in those filings. The forward-looking statements speak only as of the date made, and other than as required by law, we do not intend to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. Oil and Gas Reserves The SEC requires oil and gas companies, in filings with the SEC, to disclose “proved oil and gas reserves” (i.e., quantities of oil and gas that are estimated with reasonable certainty to be economically producible) and permits oil and gas companies to disclose “probable reserves” (i.e., quantities of oil and gas that are as likely as not to be recovered) and “possible reserves” (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable reserves). Investors are urged to consider closely the disclosure in Sanchez Production Partners’ Annual Report on Form 10-K for the most recent fiscal year. 2 |

|

|

Overview |

|

|

SPP’s Transformation (1) See Slide 12 (2) Reflects anticipated contribution to 2016 base case Adjusted EBITDA forecast (as updated 3/30/2016) before G&A expenses; See Slide 23 “SOG” refers to Sanchez Oil & Gas Corporation; “SN” refers to Sanchez Energy Corporation (NYSE: SN); “SEPI” refers to Sanchez Energy Partners I, LP, a SOG-operated private company The New Sanchez Production Partners Challenge: Orphan MLP with no sponsor Significant leverage with no ability to grow Asset base: Legacy PDP production Dominated by dry gas assets acquired in the 2007-08 timeframe Distributions: Suspended in 2009 Steps of the Transformation The Old SPP / Constellation Energy Partners EV: ~ $70 MM (1) (As of 6/30/2013) Established Relationship With SOG (Aug-13) Closed First Production Transaction With SN (Mar-15) Closed First Midstream Transaction With SN (Oct-15) Adjusted EBITDA Adjusted EBITDA (2) Converted from LLC to LP (Mar-15) ROFO on Significant, Identified Acquisition Inventory 4 Challenge met: Sponsored partnership Shared Services Agreement with SP Holdings, LLC; supported by the SOG operating platform ROFO on significant, identified acquisition inventory Executed transactions with SEPI and SN to deleverage and grow cash flows Asset base: Fixed fee gathering and processing assets with long-term minimum volume commitments Eagle Ford EWI and other Gulf Coast production assets Other legacy production assets (Mid-Continent) Distributions: An initial quarterly distribution per unit (“DPU”) of $0.4000 was paid in November 2015 A DPU of $0.4121, a 1.5% increase over the prior quarter (the Partnership’s second consecutive increase of 1.5%), will be paid in May 2016 Production 100% Production 44% Midstream 56% EV: ~ $500 MM (1) (As of 3/31/2016) Production 40% Midstream 60% |

|

|

2016 Forecast 5 See also SPP Hedging Program, Slide 22; Non-GAAP Financial Measures, Slide 23 Low Midpoint High Adjusted EBITDA 54.0 $ 57.0 $ 60.0 $ Distributable Cash Flow (2) 13.5 $ 16.5 $ 19.5 $ Common Unit Distributions 7.0 $ 7.0 $ 7.0 $ Distribution Coverage Ratio 1.9x 2.3x 2.8x NOTES: (1) Developed using the following key assumptions: - Hedges in place and forward prices as of 12/31/2015 - Excludes contribution of the Mid-Continent assets, which have been targeted for divestiture - No incremental asset acquisitions or divestitures - No additional common unit repurchases (2) Adjusted EBITDA, less: - Cash interest expense of $3.1 MM; - Distributions on Class B Preferred Units of $35.0 MM; and - Maintenance capital of $2.4 MM Base Case ($MM) (1) |

|

|

Investment Highlights |

|

|

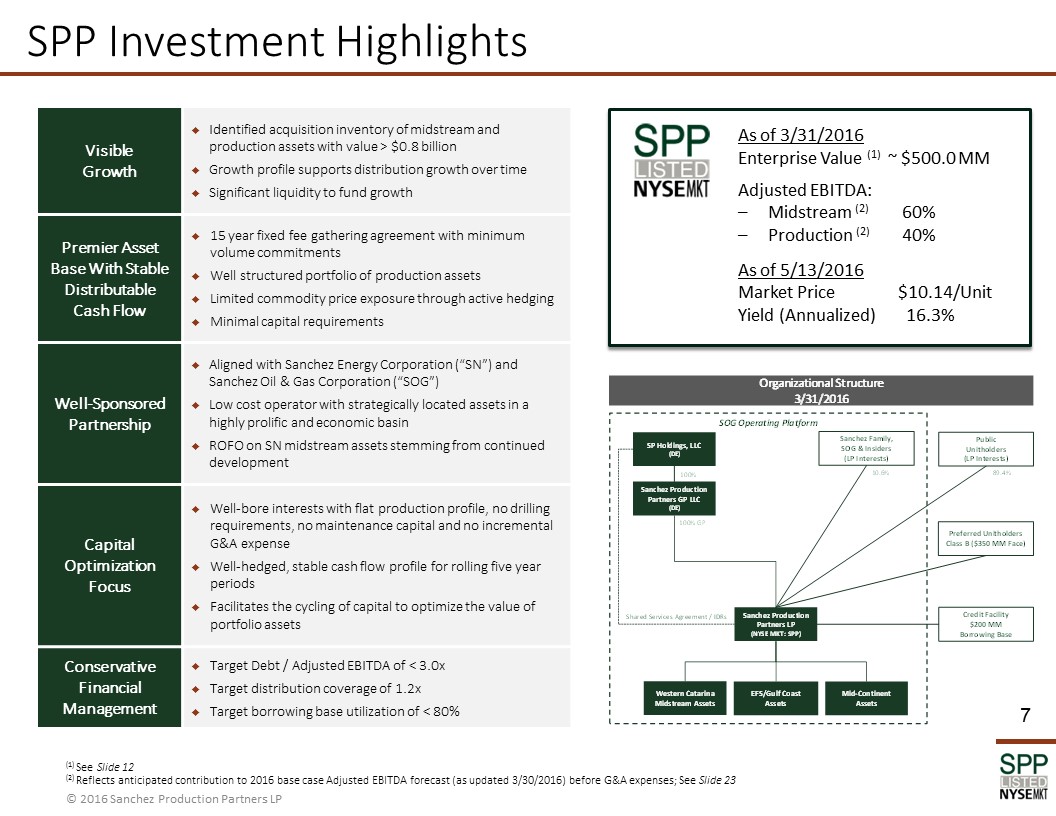

Visible Growth Identified acquisition inventory of midstream and production assets with value > $0.8 billion Growth profile supports distribution growth over time Significant liquidity to fund growth Premier Asset Base With Stable Distributable Cash Flow 15 year fixed fee gathering agreement with minimum volume commitments Well structured portfolio of production assets Limited commodity price exposure through active hedging Minimal capital requirements Well-Sponsored Partnership Aligned with Sanchez Energy Corporation (“SN”) and Sanchez Oil & Gas Corporation (“SOG”) Low cost operator with strategically located assets in a highly prolific and economic basin ROFO on SN midstream assets stemming from continued development Capital Optimization Focus Well-bore interests with flat production profile, no drilling requirements, no maintenance capital and no incremental G&A expense Well-hedged, stable cash flow profile for rolling five year periods Facilitates the cycling of capital to optimize the value of portfolio assets Conservative Financial Management Target Debt / Adjusted EBITDA of < 3.0x Target distribution coverage of 1.2x Target borrowing base utilization of < 80% As of 3/31/2016 Enterprise Value (1) ~ $500.0 MM Adjusted EBITDA: – Midstream (2) 60% – Production (2) 40% As of 5/13/2016 Market Price $10.14/Unit Yield (Annualized) 16.3% (1) See Slide 12 (2) Reflects anticipated contribution to 2016 base case Adjusted EBITDA forecast (as updated 3/30/2016) before G&A expenses; See Slide 23 |

|

|

Second quarterly DPU increase of 1.5% to $0.4121/unit (May-16) NYSE MKT: SPP (IPO Dec-06 as “CEP”) NYSE: SN (IPO Dec-11) Visible Growth CEP Acquires Gulf Coast Assets from SEP I, LP* (Aug-13) SN acquires Catarina assets from Shell (May-14) LLC-LP conversion implemented with the overwhelming support of SPP’s unitholders (Mar-15) SPP acquires Palmetto EWI assets from SN (Mar-15) * Sanchez Energy Partners I, LP, a SOG-operated private company SN grows its Eagle Ford asset base, through the drill bit and acquisitions Development/Growth 2012 2013 2014 Business development relationship between SPP and SOG, a committed sponsor, initiated 2016 and Beyond CEP asset base managed without a sponsor; significant leverage with no ability to grow Yield/Distributions Other targets with value > $0.8 B identified by SN (Ongoing) SPP acquires Western Catarina Midstream assets from SN (Oct-15) Ongoing Eagle Ford development expected to lead to growth and enhanced performance Cash Flowing Assets Monetized Proceeds Reinvested Additional Stable Cash Flows Shared Services Agreements executed and implemented; CEP (public LLC) is rebranded “SPP” 8 Quarterly DPU initiated at $0.4000/unit (Nov-15) 2015 |

|

|

Sanchez Production Partners LP Asset Base Midstream Production % Adjusted EBITDA (1) 60% 40% Total Proved Reserves (2) N/A 15,327 MBOE* EFS / Gulf Coast Assets (2) 5,252 MBOE (95% PDP)* Mid-Continent Assets (2) 10,075 MBOE (36% PDP)* Houston, Texas Headquarters (1) Reflects anticipated contribution to 2016 base case Adjusted EBITDA forecast (as updated 3/30/2016) before G&A expenses; See Slide 23 (2) As of 12/31/2015 based on forward prices Premier Asset Base Western Catarina Midstream Assets Located in a dedication area covering approximately 35,000 net acres in Dimmit and Webb Counties, TX Includes over 150 miles of gathering lines (4” to 12” diameter), compressors, tanks, vessels and other miscellaneous production equipment Supports production activities across SN’s Catarina asset Long-term fee-based throughput and gathering agreement with SN SPP Production Assets Gulf Coast non-operated assets acquired from Sanchez Energy Partners I, LP in 2013 Eagle Ford Shale (“EFS”) assets acquired from SN in 2015 Mid-Continent assets: Cherokee Basin operated and non-operated assets Other non-operated assets, including Woodford Shale assets and Central Kansas Uplift assets 9 Targeted for Divestiture |

|

|

Well-Sponsored Partnership Sanchez Oil & Gas Corporation (“SOG”) 1972 Private operating platform with ~ 200 employees Experienced management Technical and operational expertise Active business development Shared Services and Business Development Relationships (1) Sanchez Energy Corporation (2) (NYSE: SN) 2011 (IPO) Structure: Public C-Corp Enterprise Value: ~ $2.2 billion Asset Focus: Oil resource focus Eagle Ford Shale Tuscaloosa Marine Shale 1P Reserves: 128 MMBOE (at 12/31/2015) Production: ~ 56.500 BOE/D (16Q1 Average) Net Acres: ~ 200,000 Acquired $1.1 billion in assets since IPO Credit Rating (Sr. Unsecured): B / Caa2 Sanchez Production Partners (NYSE MKT: SPP) 2006 (IPO) Structure: Publicly-traded limited partnership Enterprise Value: ~ $500 MM (3) Asset Focus: Stable cash producing assets Gathering and processing midstream assets Escalating working interests Integrated approach to visible growth Initial quarterly DPU of $0.4000 was paid in November 2015 A DPU of $0.4121, a 1.5% increase over the prior quarter, will be paid in May 2016 Development / Growth Yield / Distributions Operations and Technical Support (1) Covers operational and technical support and business development activities; includes allocation of G&A (2) Source: SN Corporate Presentation – May 2016; SN market data as of 2/23/2016 (3) See Slide 12 Right of First Offer 10 |

|

|

Capital Optimization Focus Growth at SPP generates currency for SN’s future growth SN invests capital in development drilling and acquisitions Produces growth in production, infrastructure and cash flow Assets sold to SPP Large inventory of mature cash producing assets fit best in the MLP model Cash flows at SPP valued on yield Ability to pay market price to SN while capturing economic uplift for SPP Ability to show accretion 4 1 2 3 Perpetuates Growth Platform Capital Deployed Assets Divested Accelerates Cash Proceeds to SN Transaction Value Exchanged Provides Stable Cash Flows To SPP Optimizes Cost of Capital Initial Cash Flow to SN Development/Growth Yield/Distributions Improves Credit Metrics 11 |

|

|

Conservative Financial Management 12 (1) Quarter-end preceding SPP’s acquisition of Gulf Coast non-operated assets from Sanchez Energy Partners I, LP (2) Based on ~2.4 MM units outstanding at an $18.80/unit closing price of SPP on NYSE MKT (adjusted for the 1:10 reverse split effective 8/4/2015) as of 6/30/2013 (3) Based on ~4.2 MM units outstanding at a $11.60/unit closing price of SPP on NYSE MKT as of 3/31/2016 (4) Par value ($ in 000’s unless noted) 6/30/2013 (1) 3/31/2016 Cash & Cash Equivalents 9,541 $ 5,936 $ Borrowing Capacity 21,000 $ 91,000 $ = Borrowing Base 55,000 200,000 - Debt Outstanding 34,000 109,000 Total Liquidity 30,541 $ 96,936 $ = Borrowing Capacity 21,000 91,000 + Cash & Equivalents 9,541 5,936 Net Debt 24,459 $ 103,064 $ = Debt Outstanding 34,000 109,000 - Cash & Equivalents 9,541 5,936 Enterprise Value 69,054 $ 501,295 $ = Market Capitalization, Common Units (2),(3) 44,595 48,231 + Class B Preferred Units (4) - 350,000 + Net Debt 24,459 103,064 Net Debt / Enterprise Value 35% 21% |

|

|

Appendix I Escalating Working Interest Advantage |

|

|

From the Seller’s perspective, monetization of a portion of the well’s stable cash flow in an EWI structure enhances realized rates of return and provides capital for redeployment in the asset base In this example, the sale of the EWI results in: NPV $4.1 MM (unchanged) IRR 89% Eagle Ford wells are characterized by fast payback during a period of steep decline followed by a longer period of stable cash flow and low decline for the remaining life of the well Years 0 - 2 = ~ 40% of production and 60% of present value Years 2+ = ~ 60% of production and 40% of present value In this example, over the full life of the well the developer expects: NPV $4.1 MM IRR 67% EWI Case Study: Repeatable “Win/Win” Structure(1) Typical Eagle Ford Well EWI – Seller’s Perspective EWI – MLP Buyer’s Perspective (1) Assumes initial well cost of $4.5 MM; Three year EWI sold in Year 2 at PV10; Flat price deck of $55/BBL and $3.50/MCFE; 25% NGL realization; Catarina type curve EWI Seller Achieves Payback, Monetizes FCF For Redeployment, and Enhances IRR EWI Buyer Achieves Stable Cash Flow, Which Supports Distributions PV10 CF t=0 Mo. $4.1 MM From the MLP Buyer’s perspective, the purchase of an EWI, together with hedging (at closing) of the resulting “levelized” production from the asset, provides stable cash flow to support distributions over time while mitigating the need for maintenance capital 14 Cash Flow Cash Flow Cash Flow Months Months Months $ 0.0 $ 1.0 $ 2.0 $ 3.0 $ 4.0 $ 5.0 $ 6.0 0 12 24 36 48 60 72 84 96 108 120 Remaining PV ($mm) Months $ 0.0 $ 1.0 $ 2.0 $ 3.0 $ 4.0 $ 5.0 $ 6.0 0 12 24 36 48 60 72 84 96 108 120 Remaining PV ($mm) Months $ 0.0 $ 1.0 $ 2.0 $ 3.0 $ 4.0 $ 5.0 $ 6.0 0 12 24 36 48 60 72 84 96 108 120 Remaining PV ($mm) Months |

|

|

SPP Eagle Ford Acquisition Illustrated below, the SPP Eagle Ford Acquisition was structured to offset natural production declines, minimize maintenance capital requirements, and maintain more stable cash flows over the life of the asset for SPP The escalating working interests acquired from SN are expected to “levelize” production to SPP in years one through five Hedges covering a high percentage of production in years one through five, executed by SN, were novated to SPP at closing Escalating Working Interest Purchased From SN By SPP SN Retains EWI Year = * * Factors shown exclude natural gas liquids production Stable Cash Flow, Low Decline In this EWI structure (closed in Mar-15), SPP’s WI increases annually which, when applied to the production total, yields flat SPP production in EWI Years 1 - 5 SPP Owns 15 - 200 400 600 800 1,000 1,200 1 2 3 4 5 MBOE Per Year SPP PDP PDP Total SPP Receives: 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024+ Avg. Working Interest 18.2% 26.1% 33.5% 40.6% 47.5% 47.5% 47.5% 47.5% 47.5% 47.5% Avg. Net Revenue Interest 13.2% 18.9% 24.2% 29.4% 34.3% 34.3% 34.3% 34.3% 34.3% 34.3% % PDP Total Shown Above 33.1% 50.7% 66.2% 80.9% 95.0% 95.0% 95.0% 95.0% 95.0% 95.0% Hedges as a % of Acquired Interests* 95.0% 90.0% 85.0% 85.0% 80.0% |

|

|

SPP Eagle Ford Acquisition (Closed March 2015) Source: Graphics from the SN Corporate Presentation – December 2014; Transaction details provided by SN and verified by SPP Note: All data shown is as of 3/31/2015, the date of transaction closing EURs (MBOE) 450 – 750 % Oil / Liquids 75% / 89% Palmetto Well Characteristics Trend Eagle Ford Shale Field Palmetto Location (County) Gonzales County, TX Type Wellbore Interests Operator Marathon Well (Reserve) Type Producing (PDP Only) Well Count 59 Transaction Structure Escalating Working Interests Avg. WI / NRI – Year 1 18.3% / 13.2% Avg. WI / NRI – Years 5+ 47.5% / 34.3% Forecast Net Production , 2015 through 2019 ~1,000 BOE/D Producing Horizons Upper Eagle Ford, Lower Eagle Ford Asset Mix, 2015-19 84.2% Oil/Liquids, 15.8% Natural Gas Asset Mix, Life Cycle 83.9% Oil/Liquids, 16.1% Natural Gas % PV10 Value Years 1 – 5 63.3% Assets Included In Transaction Producing Horizon Trend Field Type Curve Geology 16 LEF BUDA UEF |

|

|

Appendix II Western Catarina Midstream Transaction |

|

|

18 Catarina Overview Upper Eagle Ford 150+ Potential Locations 7 wells in stacked pilots drilled to date High oil yields of 250 Bbl/MMcf 500+ potential Locations Large Stacked Pay Application Production in line with LEF Type Curve Middle Eagle Ford 700+ Potential Locations 600-1200 Mboe EUR Extension into South Central Lower Eagle Ford Source: SN Corporate Presentation – May 2016 |

|

|

Gathering and processing assets originally constructed by Royal Dutch Shell as part of the infrastructure for the development of the Catarina Field Development and construction of the assets were promulgated under rights embedded in the lease agreement Pipeline capacity can be easily expanded through small compression projects at nominal costs (~$1 MM/year in growth capital planned) Western Catarina Midstream Asset Overview Asset Details Asset Overview Western Catarina Dedicated Acreage (1) Covers ~ 85,000 net development acres 19 Dedicated Acreage ~ 35,000 acres (1) Pipeline Assets ~ 150 miles of gathering lines (ranging in diameter from 4” to 12”) Facilities Four main gathering and processing facilities, which include: Eight stabilizers (5,000 BBL/D) ~ 25,000 BBL storage capacity NGL pressurized storage ~ 18,000hp compression ~ 300 MMCF/D dehydration capacity Interconnections Crude oil: Plains All American Pipeline header system delivered to Gardendale Terminal Connectivity to all four takeaway pipelines to Corpus Christi Natural gas: Southcross Energy Kinder Morgan Energy Transfer Enterprise Products Targa Resources Interconnections located at each of the four main processing facilities Capacity Condensate: 40,000 BBL/D Natural Gas: 200 MMCF/D |

|

|

Western Catarina Midstream Transaction Buyer: Sanchez Production Partners LP (“SPP”) Seller: SN Catarina, LLC, a wholly-owned subsidiary of Sanchez Energy Corp. (“SN”) Purchase Price: ~ $345 MM Effective Date: 10/14/2015 Closed: 10/14/2015 Assets: All of the issued and outstanding membership interests in Catarina Midstream, LLC, which owns ~ 150 miles of gathering lines, compressors, tanks, vessels and other gathering and processing infrastructure in Dimmit and Webb Counties, TX Transaction Agreement: Purchase and Sale Agreement; includes right of first offer on additional midstream asset sales by SN Gathering Agreement: Effective upon closing; 15 year term with fixed rates and a five year “Minimum Quarterly Quantity” Dedicated Acreage: ~ 35,000 acres in Western Catarina, SN’s most active development area Operations: Managed with the support of SOG since SN’s June 2014 acquisition Financing Overview: Financed through a preferred equity raise with Stonepeak Infrastructure Partners and available cash with incremental new debt capacity reserved for future growth 20 |

|

|

Appendix III Other Information |

|

|

SPP Hedging Program (1) As of 3/31/2016 (2) NYMEX swaps NOTE: The Partnership accounts for derivatives using the mark-to-market accounting method SPP intends to hedge a high percentage of PDP for up to five years SPP’s hedge strategy primarily utilizes swaps and costless collars, as warranted by market conditions Hedges executed with SPP’s lenders and subject to limitations in SPP’s Credit Facility Hedges in place result in the following fixed price positions, which were in-the-money ~ $28 MM as of 3/31/2016: 22 Hedge Positions (1) 2016 2017 2018 2019 Natural Gas Hedges (2) $/MMbtu 4.14 3.52 3.58 3.62 MMbtu 3,009,867 296,048 295,683 277,888 Crude Hedges (2) $/Bbl 73.93 64.80 65.40 65.65 Bbl 320,234 213,003 212,555 199,768 |

|

|

Non-GAAP Financial Measures Use of Non-GAAP Financial Measures – Historic Financials: EBITDA and Adjusted EBITDA are non-GAAP financial measures that are reconciled to their most comparable GAAP financial measure under Reconciliation of Non-GAAP Financial Measures in this presentation. The reconciliations are only intended to be reviewed in conjunction with the presentation to which they relate. EBITDA is defined as net income (loss) adjusted by interest (income) expense, net; income tax expense (benefit); depreciation, depletion and amortization; asset impairments; and accretion expense. Adjusted EBITDA is defined as EBITDA adjusted by (gain) loss on sale of assets; (gain) loss from equity investment; unit-based compensation programs; unit-based asset management fees; (gain) loss from mark-to-market activities; and (gain) loss on embedded derivative. Distributable Cash Flow is defined as Adjusted EBITDA less cash interest expense; distributions on preferred units; and maintenance capital. These financial measures are used as quantitative standards by our management and by external users of our financial statements such as investors, research analysts and others to assess the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; the ability of our assets to generate cash sufficient to pay interest costs and support our indebtedness; and our operating performance and return on capital as compared to those of other companies in our industry, without regard to financing or capital structure. These financial measures are not intended to represent cash flows for the period, nor are they presented as a substitute for net income, operating income, cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Use of Non-GAAP Financial Measures – Forecast Financials: In addition to Adjusted EBITDA, we provide a forecast of Distributable Cash Flow in this presentation. Distributable Cash Flow is defined as Adjusted EBITDA less cash interest expense; distributions on preferred units; and maintenance capital. We are unable to reconcile our forecast range of Adjusted EBITDA or Distributable Cash Flow to GAAP net income, operating income or net cash flow provided by operating activities because we do not predict the future impact of adjustments to net income (loss), such as (gains) losses from mark-to-market activities and equity investments or asset impairments due to the difficulty of doing so, and we are unable to address the probable significance of the unavailable reconciliation, in significant part due to ranges in our forecast impacted by changes in oil and natural gas prices and reserves which affect certain reconciliation items. Summary of Non-GAAP Financial Measures : 23 Non-GAAP Measure Slide(s) Where Used in Presentation Most Comparable GAAP Measure Slide Containing Reconciliations Adjusted EBITDA, EBITDA 5, 24 Net Income 25 |

|

|

Recent Financial Results 24 (1) Includes lease operating expenses, cost of sales and production taxes (2) Includes loss (gain) on asset sale and loss on embedded derivative, which are non-cash items (3) Includes accretion expense and asset impairments, which are non-cash items (4) Includes employee severance charges of $4.4 MM, transaction charges of $0.6 MM, conversion charges of $0.3 MM, and litigation charges of less than $0.1 MM in 15Q1 See Reconciliation Items, Slide 25 16Q1 vs. 15Q4 16Q1 vs. 15Q1 ($ in 000’s unless noted) 16Q1 15Q4 16Q1 15Q1 Production (MBOE) 303 336 303 324 Oil and gas sales 12,398 $ 11,264 $ 12,398 $ 12,656 $ Midstream sales 13,875 11,725 13,875 - Gain (loss) on mark-to-market activities (3,104) 3,109 (3,104) (732) Revenue 23,169 $ 26,098 $ 23,169 $ 11,924 $ Operating expenses, production (1) 5,324 5,058 5,324 5,475 Operating expenses, midstream 3,054 2,176 3,054 - General and administrative expenses 6,157 5,440 6,157 9,547 Other (income) expense (2) (6,354) 9,264 (6,354) 4 EBITDA 14,988 $ 4,160 $ 14,988 $ (3,102) $ DD&A (3) 8,812 46,865 8,812 86,238 Interest expense, net 899 1,767 899 646 Income tax expense - 52 - - Net income (loss) 5,277 $ (44,524) $ 5,277 $ (89,986) $ Adjusted EBITDA, As Reported 13,521 $ 11,961 $ 13,521 $ (437) $ Add Back: Non-Recurring Items (4) - - - 5,318 Equals: Adjusted EBITDA Excluding Non-Recurring Items 13,521 $ 11,961 $ 13,521 $ 4,881 $ |

|

|

Reconciliation Items 25 (1) Includes accretion expense and asset impairments (2) Includes employee severance charges of $4.4 MM, transaction charges of $0.6 MM, conversion charges of $0.3 MM, and litigation charges of less than $0.1 MM in 15Q1; Excluding these non-recurring items in the quarterly results shown, 15Q1 Adjusted EBITDA was $4.9 MM Reconciliation of Net Income (Loss) to Adjusted EBITDA ($ in 000s) 15Q1 15Q4 16Q1 Net income (loss) (89,986) $ (44,524) $ 5,277 $ Interest expense, net 646 1,767 899 Income tax expense - 52 - DD&A (1) 86,238 46,865 8,812 EBITDA (3,102) $ 4,160 $ 14,988 $ (Gain) on sale of assets (59) - - Unit-based compensation programs 1,992 (9) 438 Unit-based asset management fees - 937 1,285 (Gain) loss on mark-to-market activities 732 (3,109) 3,104 (Gain) loss on embedded derivative - 9,982 (6,294) Adjusted EBITDA (1),(2) (437) $ 11,961 $ 13,521 $ |